Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Vitamin Shoppe, Inc. | d563336dex312.htm |

| EX-31.1 - EX-31.1 - Vitamin Shoppe, Inc. | d563336dex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2017

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to .

Commission file number: 001-34507

VITAMIN SHOPPE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 11-3664322 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(IRS Employer Identification No.) |

300 Harmon Meadow Blvd.

Secaucus, New Jersey 07094

(Addresses of Principal Executive Offices, including Zip Code)

(201) 868-5959

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Name of the exchange on which registered | |

| Common Stock, $0.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||||

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | ||||

| Emerging growth company | ☐ | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant was approximately $274,373,029 as of July 1, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of the common stock on the New York Stock Exchange.

As of January 27, 2018, Vitamin Shoppe, Inc. had 24,203,144 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 2 | ||||

| Item 10. Directors, Executive Officers and Corporate Governance |

2 | |||

| 8 | ||||

| 38 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

41 | |||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

i

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Vitamin Shoppe, Inc., a Delaware corporation (“VSI,” the “Company,” “we,” “us” and “our”), for the fiscal year ended December 30, 2017, originally filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2018 (the “Original Filing”). This Amendment is being filed to (i) amend Part III of the Original Filing to include the information required by and not included in Part III of the Original Filing and to amend the section of the cover page captioned “Documents Incorporated by Reference” to read “None” and (ii) add certain new certifications, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance with Rule 13a-14(a) under the Exchange Act. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events that occurred at a date subsequent to the filing of the Original Filing other than as expressly indicated in this Amendment. Accordingly, this Amendment should be read in conjunction with the Original Filing and our other filings made with the SEC on or subsequent to February 27, 2018.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

Set forth below is certain information regarding our directors as of April 27, 2018.

| Colin Watts Age: 52 Director Since: |

Colin Watts has served as our Chief Executive Officer since April 6, 2015. Prior to joining us, Mr. Watts was President of Weight Watchers Health Solutions from July 2013 to March 2015. He previously served as Senior Vice President, Health Solutions and Global Innovation at Weight Watchers from 2012 through July 2013. Before joining Weight Watchers, Mr. Watts was the Chief Innovation Officer and a member of the executive team at Walgreens from December 2008 through December 2011. Prior to that, he was General Manager of US Soup at Campbell Soup Company from February 2007 to November 2008. Mr. Watts also previously served as Worldwide President of two Johnson & Johnson operating companies: McNeil Nutritionals from 2002 to 2005 and McNeil Consumer Healthcare from 2005 to 2007.

Mr. Watts’ separation from the Company was announced on February 27, 2018; under his separation arrangement, Mr. Watts will continue to be a director and employed as the Chief Executive Officer through no later than May 31, 2018. Skills and Qualifications: Pursuant to Mr. Watts’ employment agreement, the Board selected Mr. Watts as a director because he has a broad range of experience in general management, marketing and innovation from leading consumer, retail and healthcare companies. Each of these professional experiences strengthens the Board’s collective qualifications, skills and experience. | |

| B. Michael Becker Age: 73 Director Since: Independent Committee Memberships: |

B. Michael Becker was a Senior Consultant at Pay Pal, Inc. from August 2008 to November 2009, and from August 2006 to August 2008 had a consulting practice to provide accounting and audit services. Mr. Becker served as an Audit Partner for Ernst & Young LLP from 1979 until his retirement in 2006. Mr. Becker also served as a director and Chairman of the Audit Committee of Tailored Brands, Inc. (formerly The Men’s Wearhouse, Inc.).

Skills and Qualifications: The Board selected Mr. Becker to serve as a director based on his extensive experience in financial and accounting matters and in auditing and reporting on the financial statements and internal control over financial reporting of large publicly held companies, including retail companies. | |

| John D. Bowlin Age: 67 Director Since: Independent Committee Memberships: |

John D. Bowlin served as our non-executive chairman from June 2016 until December 2017 and our Lead Director from December 2015 through June 2016. From January 2008 through December 2011, Mr. Bowlin served as an executive advisor to CCMP Capital Advisors, LLC.

From 1999 until 2003, he served as President and Chief Executive Officer of Miller Brewing Company. Prior to that, Mr. Bowlin was employed by Philip Morris Companies, Inc. in various leadership capacities, including President, Kraft International, Inc. (1996-1999), President and Chief Operating Officer, Kraft Foods North America (1994-1996), President and Chief Operating Officer, Miller Brewing Company (1993-1994), and President, Oscar Mayer Food Corporation (1991-1993).

Mr. Bowlin has served as a director of Generac Holdings, Inc. since 2006. Previously, Mr. Bowlin served as a director of the Pliant Corporation, Chupa Chups, Schwan Food Company and Quiznos, as well as the Non-Executive Chairman of Spectrum Brands.

Skills and Qualifications: The Board selected Mr. Bowlin as a director due to his experience having served on the boards of directors of retailers and in senior leadership positions, including as chief executive officer for consumer products, manufacturing and brand development companies, including retailers. | |

2

| Deborah M. Derby Age: 54 Director Since: Independent Committee Memberships: |

Deborah M. Derby has served as President of the Horizon Group USA since April 2016, prior to which she was a consultant to them since November 2015. She served as Vice Chairman, Executive Vice President of Toys “R” Us from March 2013 to August 2015. Prior to her rejoining Toys “R” Us, she consulted for Kenneth Cole Productions, Inc., beginning in September 2012. She previously served as Chief Administrative Officer for Toys “R” Us from February 2009 to February 2012. Ms. Derby joined Toys “R” Us in 2000 as Vice President, Human Resources and held positions of increasing responsibility during her 11 years there, including Corporate Secretary, Executive Vice President, Human Resources, Legal & Corporate Communications and President, Babies “R” Us.

Prior to joining Toys “R” Us, she spent eight years at Whirlpool Corporation with her last position there as Corporate Director Compensation & Benefits. Ms. Derby also has experience as an attorney specializing in employment law and as a financial analyst with The Goldman Sachs Group, Inc.

Skills and Qualifications: The Board selected Ms. Derby as a director based on her breadth of experience in retailing, human resources, legal and financial analysis, as well as her experience as the Executive Vice President of a large global retailer. | |

| Tracy Dolgin Age: 58 Director Since: Independent |

Tracy Dolgin has served as a Senior Advisor to The Raine Group since July 2017. He served as President, Chief Executive Officer and a board member of YES Network from August 2004 through January 2014, when YES Network was acquired by 21st Century Fox. After the acquisition, Mr. Dolgin remained President and Chief Executive Officer of YES Network through June 2016, at which time he transitioned to the role of Non-Executive Chairman through January 2017 and remains on the board of YES Network. Prior to joining YES Network, Mr. Dolgin served as Managing Director and Co-Head of Houlihan Lokey’s Media, Sports and Entertainment practice in 2003 and 2004. From 2000 through 2003, Mr. Dolgin served as President of FOX Sports Net. Mr. Dolgin came to FOX Sports Net from FOX/Liberty Cable, where he was Chief Operating Officer from 1997-1999. Prior to joining FOX/Liberty, Mr. Dolgin was one of the founders of FOX Sports and served as Executive Vice President of Marketing at FOX Sports from the division’s inception in 1993 until 1997. Previously, Mr. Dolgin was Executive Vice President of Marketing of FOX.

Skills and Qualifications: The Board selected Mr. Dolgin as a director due to his extensive experience serving as an executive officer for over 30 years and his broad general management expertise. | |

| David H. Edwab Age: 63 Director Since: Independent Committee Memberships: |

David H. Edwab served the Company as Lead Director from April 4, 2011 until December 29, 2015. Mr. Edwab has served as an officer and director of Tailored Brands, Inc. (formerly The Men’s Wearhouse, Inc.) for approximately 25 years, starting as Vice President of Finance and Director in 1991, serving as Chief Operating Officer from 1993 to 1997, as President in 1997 and as Executive Vice Chairman.

Mr. Edwab currently serves as Non-Executive Vice Chairman of the Board of Directors of Tailored Brands, Inc. Mr. Edwab also currently serves as a director and member of the audit committee and is chairman of the nomination and governance committee of New York & Company, Inc. Mr. Edwab previously served as lead director and chairman of the audit committee of Aeropostale, Inc. and was a partner with Deloitte & Touche LLP. | |

| Skills and Qualifications: The Board selected Mr. Edwab as a director based on his extensive retail and financial background and his experience having served on the boards of directors of retailers. Mr. Edwab is an inactive CPA and has experience in investment banking and private equity. | ||

3

| Melvin L. Keating Age: 71 Director Since: Independent |

Melvin L. Keating serves as a consultant, providing investment advice and other services to private equity firms, since November 2008. Mr. Keating serves as a director of Agilysys Inc., a leading technology company that provides innovative software for point-of-sale (POS), property management, inventory and procurement, workforce management, analytics, document management and mobile and wireless solutions and services to the hospitality industry, MagnaChip Semiconductor Corp., a designer and manufacturer of analog and mixed-signal semiconductor products for consumer, communication, computing, industrial, automotive and IoT applications (and is chair of its audit committee since August 2016), SPS Commerce, a provider of cloud based supply chain management solutions, and, Harte Hanks, Inc., a provider of multichannel marketing services. During the past five years, Mr. Keating also served on the Boards of Directors of the following public companies: Red Lion Hotels Corporation (2010-2017); API Techonologies Corp.; Crown Crafts Inc. (August 2010 – August 2013) and ModSys International Ltd. (formerly BluePhoenix Solutions Ltd.), a legacy platform modernization provider.

Skills and Qualifications: The Board selected Mr. Keating as a director because of his extensive experience in technology, his successes as an executive and his corporate governance experience developed while serving on the boards of other publicly-traded companies. He is recognized as a financial expert. | |

| Guillermo G. Marmol Age: 65 Director Since: Independent Committee Memberships: |

Guillermo G. Marmol has served as President of Marmol & Associates since March 2007 and, prior to that, from October 2000 to 2003. He served as Division Vice President and a member of the Executive Committee of Electronic Data Systems Corporation from 2003 to 2007, and as a director and Chief Executive Officer of Luminant Worldwide Corporation from 1998 to 2000. He served as Vice President and Chair of the Operating Committee of Perot Systems Corporation from 1995 to 1998. He began his career at McKinsey & Company rising to increasingly senior positions with the firm, including the positions of Director and Senior Partner from 1990 to 1995. Mr. Marmol is a director and chair of the audit committee of Foot Locker Inc., and a director of Principal Solar Inc. and KERA/KXT North Texas Public Broadcasting Inc., and he is a member of the Board of Trustees and Chair of the Finance Committee of the Center for a Free Cuba in Arlington, Virginia. Mr. Marmol was a director of Information Services Group, Inc.

Skills and Qualifications: The Board selected Mr. Marmol as a director because he has a significant background in information technology and systems, and because of his experience having served on the boards of other publicly-traded companies. Through his long tenure as a management consultant focusing on strategic analysis and business processes, Mr. Marmol brings valuable knowledge and expertise to his service on the Board. | |

| Beth M. Pritchard Age: 71 Director Since: Independent Committee Memberships: |

Beth M. Pritchard has served as a principal and strategic advisor for Sunrise Beauty Studio, LLC since 2009. She served as North American Advisor to M.H. Alshaya Co. from 2008-2013. From 2006-2009, Ms. Pritchard was the President and Chief Executive Officer and subsequent Vice Chairman of Dean & DeLuca, Inc. Ms. Pritchard was the President and Chief Executive Officer of Organized Living Inc. from 2004-2005.

From 1991 to 2003, Ms. Pritchard held executive positions with L Brands, Inc. serving as President and Chief Executive Officer of Bath & Body Works, Chief Executive Officer of Victoria’s Secret Beauty and Chief Executive Officer of The White Barn Candle Company. | |

4

| Ms. Pritchard also serves as a director of Loblaw Companies Limited, including as a member of the environmental, health and safety committee.

Previously Ms. Pritchard held director positions with Cabela’s, Inc. (acquired by Bass Pro Shops), Borderfree, Inc. (acquired by Pitney Bowes June 2015), Zale Corp. (acquired by Signet May 2014), Shoppers Drug Mart (acquired by Loblaw Companies Limited March 2014), Ecolab, Crabtree & Evelyn Holdings, Dean & DeLuca, Inc., Albertson’s, Borders Group, Inc. and the nonprofit Bpeace.org.

Skills and Qualifications: The Board selected Ms. Pritchard as a director due to her extensive executive leadership experience as a Chief Executive Officer of multi-store retailers and her experience having served on the boards of directors of retailers. | ||

| Himanshu H. Shah Age: 51 Director Since: Independent |

Himanshu H. Shah has served as Founder, President and Chief Investment Officer of Shah Capital since January 2005, and Managing General Partner of Shah Capital Opportunity Fund LP since July 2006 and, prior to that, Mr. Shah served as Vice President and Senior Portfolio Manager at PMP, UBS Financial Services, Inc. He serves as a Chairman of Marius Pharmaceuticals Inc. since January 2017. He has been the Chairman of UTStarcom Holdings Corp., since June 2014 and Director since November 2013.

Skills and Qualifications: The Board selected Mr. Shah as a director because he has a significant background in capital markets, and because of his extensive experience consulting other companies. | |

| Alexander W. Smith Age: 65 Director Since: |

Alexander W. Smith became our Executive Chairman in February 2018. He previously served as our Non-Executive Chairman since December 2017. From February 2007 until December 2016, Mr. Smith served as President, Chief Executive Officer and a member of the board of Pier 1 Imports, Inc. (“Pier 1 Imports”). Prior to joining Pier 1 Imports, from 1995 until 2007, Mr. Smith was employed by TJX Companies, Inc. where he was instrumental in the development of TJ Maxx in the U.K, and served as Group President, where his responsibilities included Winners in Canada, Home Goods, TJ Maxx and Marshalls, plus a number of corporate functions.

Mr. Smith currently serves as a director of Art Van Furniture, LLC and as a director and member of the Audit Committee of Bluestem Group Inc. From December, 2013 to July 2016, Mr. Smith served as a director of Tumi, Inc., including as chairman of its nominating and governance committee and a member of its audit committee. From June, 2007 to April, 2011 Mr. Smith also served as a director of Papa John’s International, Inc., including as chairman of its compensation committee and as a member of its audit committee.

Skills and Qualifications: The Board selected Mr. Smith as a director due to his experience in retailing and brand management, including his extensive public company experience as a senior executive and director. | |

| Timothy J. Theriault Age: 57 Director Since: Independent Committee Memberships: |

Timothy J. Theriault served as an advisor to the Chief Executive Officer of Walgreens Boots Alliance, Inc. from June 2015 until December 2016 and as executive vice president and global chief information officer from 2014–2015. He served in leadership positions with increasing responsibility at Walgreen Company from 2009 to 2014, including as senior vice president and chief information, innovation and improvement officer from 2012–2014 and as senior vice president and chief information officer from 2009–2012. Additionally, Mr. Theriault served in various executive and management positions at Northern Trust Corporation from 1991 to 2009. Mr. Theriault served as director of end user computing and advanced technologies for S. C. Johnson & Son, Inc., from 1989 to 1991. He currently serves as a director and member of the audit committee of Alliance Data Systems Corporation. | |

5

| Skills and Qualifications: The Board selected Mr. Theriault as a director due to his extensive experience in senior management positions at retailers and his extensive knowledge in operational and information systems. | ||

| Sing Wang Age: 54 Director Since: Independent |

Sing Wang has served as the Chairman of TKK Capital since 2015. He also has served as the Chief Executive Officer and Director of CM Seven Star Acquisition Corporation since February 2018 and Vice General Manager (non-executive) of CMIG Capital Company Limited since May 2017. Previously, he served as the Chief Executive Officer and Executive Director of China Minsheng Financial Holding Corporation Limited from February 2016 to May 2017. From September 2015 until December 2017, he was a Senior Advisor to TPG China, Limited and from 2016 until November 2017, Mr. Wang served as the Chairman of Evolution Media China. He served as a partner at TPG, Co-Chairman of TPG Greater China and the Head of TPG Growth North Asia from May 2006 until August 2015. Prior to joining TPG, Mr. Wang was the Chief Executive Officer and Executive Director of TOM Group Limited from mid-2000 to early 2006. From mid-1993 until mid-2000 he served in various positions at Goldman Sachs Hong Kong / New York.

In July 2017, he was appointed as the Independent Non- Executive Director and member of the Audit Committee of Sands China Limited. Mr. Wang also serves as the Chairman of his personal investment companies including Amerinvest group of companies since 1991 and Texas Kang Kai (TKK) group of companies since 2015. Mr. Wang was the Non-Executive Director of China Renewable Energy Investment Limited (June 2011 - October 2015) and MIE Holdings Corporation (June 2010 - November 2015).

Skills and Qualifications: The Board selected Mr. Wang as a director due to his extensive experience in executive leadership positions at various companies. | |

Executive Officers

The following table sets forth the name, age and principal position of each of our executive officers as of April 27, 2018:

| Name |

Age | Position | ||

| Colin Watts |

52 | Chief Executive Officer | ||

| Brenda Galgano |

49 | Executive Vice President and Chief Financial Officer | ||

| David M. Kastin |

50 | Senior Vice President, General Counsel and Corporate Secretary |

Colin Watts. We provide Mr. Watts’ biography above under “Directors.”

Brenda Galgano, CPA, has served as our Executive Vice President and Chief Financial Officer since March 31, 2011. She previously served as Senior Vice President and Chief Financial Officer for The Great Atlantic & Pacific Tea Company, Inc. from November 2005 through March 2011, and from February 2010 was additionally appointed Treasurer. Ms. Galgano served as Senior Vice President and Corporate Controller, from November 2004 to November 2005, Vice President, Corporate Controller from February 2002 to November 2004, Assistant Corporate Controller from July 2000 to February 2002 and Director of Corporate Accounting from October 1999 to July 2000. Prior to joining The Great Atlantic & Pacific Tea Company, Inc., Ms. Galgano was with PricewaterhouseCoopers LLP as Senior Manager, Assurance and Business Advisory Services.

David M. Kastin has served as our Senior Vice President, General Counsel and Corporate Secretary since August 2015. Mr. Kastin previously served as the Senior Vice President, General Counsel and Corporate Secretary of Town Sports International Holdings, Inc. from August 2007 to July 2015. From March 2007 through July 2007, Mr. Kastin was Senior Associate General Counsel and Corporate Secretary of Sequa Corporation, a diversified manufacturer. From March 2003 through December 2006, Mr. Kastin was in-house counsel at Toys “R” Us, Inc.,

6

most recently as Vice President, Deputy General Counsel. From 1996 through 2003, Mr. Kastin was an associate in the corporate and securities departments at several prominent New York law firms, including Bryan Cave LLP. From September 1992 through October 1996, Mr. Kastin was a Staff Attorney in the Northeast Regional Office of the U.S. Securities and Exchange Commission.

Section 16(A) Beneficial Ownership Reporting Compliance

We believe that all reports for our executive officers, directors and owner of more than 10% of our common stock that were required to be filed under Section 16 of the Exchange Act during 2017 were timely filed.

Code of Ethics for our Senior Financial Employees

We have adopted a Standards of Business Conduct and Code of Ethics for our Senior Financial Employees. A copy of the Standards of Business Conduct and Code of Ethics for our Senior Financial Employees is available on the Investor Relations Section of our website, www.vitaminshoppe.com. If we make any amendment or grant any waiver to this code that applies to our chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions, and that relates to an element of the SEC’s “code of ethics” definition, then we will disclose the nature of the amendment or waiver on the Company’s website.

Audit Committee and Audit Committee Financial Experts

Our Board of Directors (the “Board”) has a separately designated standing Audit Committee. The members of the Audit Committee are B. Michael Becker (chair), John D. Bowlin, David H. Edwab and Timothy J. Theriault. Each member of the Audit Committee is financially literate and has accounting or financial management expertise. The Board has determined that both Mr. Becker and Mr. Edwab has financial management expertise and, based upon their education and experience as a public accountant and experience in advising, auditing and reporting on the financial statements and on internal control over financial reporting of large publicly held companies, including retail companies, the Board has determined that both Mr. Becker and Mr. Edwab are audit committee financial experts as defined in Item 407(d)(5)(ii) and (iii) of Regulation S-K. The Board has also determined that each Audit Committee member is independent under the listing standards of the New York Stock Exchange (the “NYSE”), the Corporate Governance Guidelines and Rule 10A-3 under the Exchange Act.

7

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis explains the compensation principles under which our executive compensation program operates and the key actions taken by the Compensation Committee for fiscal 2017 with respect to the compensation of our named executive officers included in the compensation tables that follow. Under applicable SEC rules, our named executive officers for 2017 are as follows:

| Name |

Title | |

| Colin Watts(1) | Chief Executive Officer | |

| Michael J. Beardall(2) | President, Nutri-Force Nutrition | |

| Brenda Galgano | Executive Vice President and Chief Financial Officer | |

| David M. Kastin | Senior Vice President, General Counsel and Corporate Secretary | |

| Jason Reiser(3) | Former Executive Vice President and Chief Operating Officer |

| (1) | Mr. Watts’ separation from the Company was announced on February 27, 2018; under his separation arrangement, Mr. Watts will continue to be employed as the Chief Executive Officer through no later than May 31, 2018. |

| (2) | Mr. Beardall’s employment with the Company ended as of March 30, 2018. |

| (3) | Mr. Reiser’s employment with the Company ended as of July 11, 2017. |

Executive Summary

Fiscal year 2017 was a challenging year for the Company. We continued to focus on implementing initiatives tied to our turn-around; however, competitive trends such as broader channel availability, particularly for sports protein products, more aggressive competitor pricing and promotional strategies, and significantly increased expenditures in marketing by our competitors continued to intensify. Our operations were impacted, resulting in lower customer traffic, negative same store sales and a reduction in net sales. To combat these headwinds and turn the business around, in 2017, we launched a few key initiatives, which yielded promising results. For example, (i) we increased spending and focus on customer acquisition (digital and grassroots), which resulted in customer acquisition turning positive in Q4 for the first time in Fiscal 2017 and (ii) in August 2017, we launched the “SPARK Auto Delivery™,” a new subscription program, resulting in approximately 400,000 subscriptions by Fiscal 2017 year end.

In addition to the initiatives above, we continued to identify and implement opportunities in key areas to improve efficiencies and reduce costs. In Fiscal 2017, the Company:

| • | Realized incremental year-over-year, cost of goods sold savings of approximately $15.0 million and selling, general and administrative expenses savings of approximately $4.0 million. |

| • | Renegotiated rent expenses with certain landlords resulting in lower occupancy costs of $9.5 million over the remaining lease periods. |

| • | Restructured Nutri-Force, our manufacturing operation. Although the business performance has improved and the Company explored strategic alternatives, it is currently pursuing the sale of the business. |

| • | Opened a new distribution center on the West Coast to better service our stores and customers on the West Coast. We also announced the closure of our North Bergen, New Jersey office and distribution center upon lease expiration in August 2018. Our recent |

8

| financial performance coupled with the rapid change in the customer shopping decision journey made it clear we needed to further improve our omni-channel capabilities. We introduced a number of new initiatives focused on positioning The Vitamin Shoppe as a modern omni-channel retailer with a solid platform to grow through new category innovation, deeper customer personalization and unique business partnerships to help enrich the lives of our customers. |

On February 27, 2018, the Company announced the naming of Alex Smith as Executive Chairman effective immediately and the upcoming departure of its Chief Executive Officer, Colin Watts. Mr. Watts will continue employment with the Company as its Chief Executive Officer through no later than May 31, 2018.

Stockholder Outreach

Communicating with our stockholders and the broader investment community is critically important. We believe that regular, transparent communications along with a proactive stockholder outreach program is essential to our commitment to keeping the investment community and all relevant stockholders informed as to our business performance. We communicate with our stockholders through a variety of means, including in person meetings at our headquarters, the stockholder’s office, or at investor conferences, via phone calls, our website or in print, which includes press releases. During Fiscal year 2017, our management team engaged with institutional investors representing more than 75% of our outstanding shares to discuss our long-term business strategy, financial and operating performance, capital allocation and other issues specific to our industry and Company. In these meetings, we heard many constructive comments on the strategy, our capital allocation plans and stockholder communications. We value the views of our stockholders and other stakeholders, and our outreach efforts provide us with a valuable understanding of our stockholders’ perspectives and an opportunity to exchange views. On at least a quarterly basis the Board receives a report from management on stockholder engagement and investor feedback. In addition to speaking with our institutional investors, we respond to inquiries from our retail investors and other stakeholders.

We also conduct general “off-season” outreach to the governance teams at our top twenty stockholders, representing approximately 85% of our outstanding shares. In our discussions with these teams we sought their input on a variety of corporate governance topics as well as executive compensation practices. Investors’ feedback was generally positive with respect to our corporate governance practices and the structure of our executive compensation plan. This information was also shared with the Board.

Although stockholder outreach is primarily a function of the management team, members of our Board, including the Chairman of the Board and Chair of the Compensation Committee, also participate when appropriate. Our Board believes these meetings are important because they help us better understand and respond to our stockholders’ priorities and perspectives.

As a result of stockholder feedback and an analysis of industry trends and best practices, we took several important actions to enhance the Company’s corporate governance practices.

| What We Heard from Stockholders |

How We Responded | |

| Executive Compensation: Concern that the named executive officer compensation was increasing despite the Company’s lackluster performance | Although CEO target compensation increased for 2017, due to compensation being closely aligned with performance, the pay realized by our named executive officers is substantially lower than their total potential compensation. Refer to discussion under “Target and Realizable Compensation” for full details.

In addition, in 2018, the Company took additional steps to more closely align compensation with the Company’s performance. The Company decreased the total long-term incentive opportunities for our executive officers by 20% and increased the weighting of performance share units (PSUs) from 50% to 75% for the CEO and from 50% to 60% for all other executive officers. |

9

| What We Heard from Stockholders |

How We Responded | |

| Capital Allocation: The Company has not optimized its capital structure, and excess capital should be used to repurchase the Company’s 2.25% Convertible Senior Notes due 2020 (“Senior Notes”) | In 2017, the Board authorized the repurchase of up to an additional $70 million of the Company’s common stock and equity-linked securities, including the Senior Notes. In addition, the previously authorized share repurchase program, of which $66 million remains, was broadened to include the Senior Notes. On March 29, 2018, the Company settled the repurchase of $45.4 million in aggregate principal amount of its Senior Notes for an aggregate purchase price of $34.0 million, which includes accrued interest. |

At our 2017 Annual Meeting of Stockholders, 98% of the votes cast were in favor of our 2017 executive compensation program. Although investors provided us with their overwhelming approval of our compensation program, some investors expressed concerns regarding the continual increase in named executive officer’s compensation despite the Company’s decline in market value.

Recommendations from our compensation consultant were also considered by our Compensation Committee in setting named executive officer compensation for fiscal 2017 and 2018. Important changes were as follows:

Fiscal Year 2017 Changes

| Compensation Program Changes – Plan |

Specific Change |

Rationale | ||

| Management Incentive Plan (MIP) | Aligned Key Performance Indicators (KPI) metrics with 2017 key initiatives | Incent senior management to achieve objectives critical to the execution of our Reinvention Strategy | ||

| Long-Term Incentive Plan (LTIP) | Adjusted equity award allocation: Time Vesting Restricted Stock increased to 50% and eliminated Stock Options; Performance Share Units remain at 50% | Support executive retention and stability of management as we execute on our multi-year Reinvention Strategy and to limit potential stockholder dilution | ||

Fiscal Year 2018 Changes

| Compensation Program Changes – Plan |

Specific Change |

Rationale | ||

| MIP | Aligned KPI metrics with 2018 key initiatives | Incent senior management to achieve objectives critical to the execution of our long-term plan | ||

| LTIP | Increased weighting on PSUs from 50% - 75% for CEO and from 50% - 60% for rest of senior management PSU awards will be based on cumulative Adjusted Operating Income and ROIC at the end of the 3-year performance period |

Takes into consideration decline in stock price More closely align realized compensation with execution of the long-term plan | ||

General Compensation Philosophy and Objectives

We work to attract and retain proven and talented industry executives who we believe will help to place us in the best position to resume growth and to meet our objectives. We seek to recruit executives with retail or other experience that we believe is transferable to our business with the expectation that they will share their knowledge to develop and manage a large and successful retail organization. We seek to provide our named executive officers

10

with a compensation package that is competitive for a given position in our industry and geographic region. In establishing executive compensation, we believe each of the following:

| • | Compensation and benefits should be competitive with peer companies that compete with us for business opportunities and/or executive talent. |

| • | Annual cash incentive and equity awards should (i) reflect progress toward Company-wide financial and strategic objectives and (ii) balance rewards for short-term and long-term performance. |

| • | Our policies should encourage executives to hold stock through long-term equity awards and stock ownership guidelines, thus aligning our executives’ interests with those of our other stockholders. |

We believe our compensation objectives are best pursued through a combination of base salary, annual bonus, equity compensation and other benefits.

We offer a market-competitive base salary that is intended to attract and retain executives and recognize each executive’s position, role, responsibility and experience. We use an annual cash incentive and long-term incentives to directly tie our executives’ realized compensation to achievement of pre-established financial and strategic goals. We also use long-term equity awards that encourage our executives to stay committed to the Company, and, in addition, we maintain minimum stock ownership guidelines and a general insider trading policy that includes various prohibitions that could otherwise misalign the mutual interests of our executives and our stockholders.

Executive Compensation Practices

Summarized below are some of the key executive compensation practices we believe promote good governance and best serve the interest of our stockholders, alongside those practices we do not employ.

| What We Do |

What We Don’t Do | |

| Pay for Performance: A majority of our named executive officer’s compensation is tied to our financial performance. | No Excise Tax Gross-Ups Upon Change–In-Control.

Stock Options: No stock options granted below fair market value and no repricing of underwater stock options. | |

| Double Trigger Equity Acceleration Upon a Change-in-Control: LTIP awards provide for accelerated vesting upon a change-in-control only if the executive is terminated without cause within two years of that change-in-control. | Employment Agreements: Limited use of employment agreements. Severance benefits provided under a standardized Company policy.

No Guaranteed Salary Increases or Guaranteed Annual Incentive Bonuses Under The MIP. | |

| Independent Executive Compensation Consultant: The Compensation Committee is advised by an independent executive compensation consultant on matters surrounding executive pay and governance. The consultant provides no other services to the Company. | ||

11

| What We Do |

What We Don’t Do | |

| Stock Ownership Policy: Named executive officers are expected to hold Company stock worth two to four times their base salary. Until the guideline is met, named executive officers are expected to retain a percentage of the net after-tax shares realized upon the vesting/earn-out of awards or exercise of stock options received in 2017 or thereafter (“Retention Ratio”). The Retention Ratio for the CEO is 75% and for other named executive officers is 50% of the after-tax shares. | ||

| Insider Trading: Prohibit named executive officers from pledging of Company stock, hedging strategies, short sales and entering into any derivative transaction on Company stock. | ||

| Clawback: Include clawback language in equity incentive awards, giving the Board the discretion to seek recoupment of the incentive-based compensation paid or granted to certain executive officers in the event of a material restatement of our financial statements. | ||

| Stockholder Outreach: Maintain ongoing dialogue with our stockholders and incorporate their feedback as appropriate in our compensation programs. | ||

Compensation Committee Process

The Compensation Committee approves all compensation and awards to our named executive officers. Annually, the Compensation Committee reviews the performance and compensation of our Chief Executive Officer and establishes our Chief Executive Officer’s compensation for the subsequent year. Our Chairman and our Chief Executive Officer review with the Compensation Committee the performance of our other named executive officers, but no other named executive officer has any input in executive compensation decisions. Our Chief Executive Officer does not, and in fiscal 2017 did not, participate in the Compensation Committee’s deliberations with regard to his own compensation. The Compensation Committee gives substantial weight to our Chairman’s and our Chief Executive Officer’s evaluations and recommendations because they are particularly able to assess our other named executive officers’ performance and contributions.

The Compensation Committee evaluates all elements of named executive officer compensation each year after a review of achievement of financial and other strategic, non-financial and corporate objectives with respect to the prior year’s results. Additionally, following discussions with our Chairman and our Chief Executive Officer and, when the Compensation Committee determines that it is appropriate, with input from other advisors, the Compensation Committee establishes the compensation for our other named executives for the subsequent year. Early in the calendar year, the Compensation Committee determines the performance objectives for the Company and each named executive officer for that year. The Compensation Committee may, however, review and adjust compensation at other times as the result of new appointments or promotions during the year. In addition to the Compensation Committee members, our Chief Executive Officer, our Chairman, our Chief Financial Officer, our General Counsel/Corporate Secretary, our Senior Vice President of Human Resources and other officers and Board members have provided input to the Compensation Committee from time to time.

12

Compensation Determinations and the Role of Consultants

Compensation Consultants

The Compensation Committee retained FW Cook as its compensation consultant. The compensation consultant reports directly to, and acts solely at the discretion of, the Compensation Committee and the Compensation Committee may replace the compensation consultant or hire additional consultants at any time. A representative of the compensation consultant attends meetings of the Compensation Committee, as requested, and communicates with the Compensation Committee Chair between meetings. Management may use, as needed, other outside consultants to assist with the day-to-day management of our programs and in the development of proposals for review by the Compensation Committee and its compensation consultant. In fiscal 2017, management did not engage a separate consultant.

During fiscal 2017, the compensation consultant performed the following services:

| (i) | Assisted with the design of our MIP and LTIP for fiscal 2017 and 2018; |

| (ii) | Provided assistance with CEO total compensation and compensation for the hire of new senior executives; |

| (iii) | Discussed with the Compensation Committee possible actions to take to retain certain key executives; |

| (iv) | Reviewed drafts and commented on this CD&A and related compensation tables for the proxy statement; |

| (v) | Reviewed and recommended changes to the Company’s Executive Severance Pay Policy; |

| (vi) | Performed a competitive review of non-employee director compensation levels and program structure and assisted with setting compensation for Mr. Smith in his new role of non-executive chairman; and |

| (vii) | Discussed executive compensation trends and regulatory developments. |

Selection of Peer Group

The Compensation Committee recognizes the value of using a peer group to further its understanding of the competitive market for setting executive and non-employee director compensation levels, although we do not attempt to link any single element of compensation to specific peer company percentiles.

For guidance in establishing senior executive and non-employee director compensation levels for fiscal 2017, FW Cook reviewed our peer group to ensure that it continues to serve as an appropriate benchmark and, if appropriate, recommend changes for the Compensation Committee’s consideration. FW Cook applied the following criteria to the Company’s existing peer group and to other companies considered for inclusion: revenue between forty percent and two and one-half times the Company’s and market capitalization between one-fifth and five times the Company, similar business models, including manufacturing and presence in health and wellness space, companies that current peers are using for comparison and companies that consider the Company a peer.

Based upon FW Cook’s analysis, they recommended we remove companies whose business characteristics, product mix and revenue/market capitalization were materially different from the Company.

13

As a result of FW Cook’s review, the following companies were removed from the peer group:

| Company |

Rationale for Removal | |

| The Fresh Market, Inc. | Acquired by Apollo Global Management in April 2016 and not publically listed | |

| Lumber Liquidators Holdings, Inc. | Weak fit in terms of industry and business characteristics | |

| Tailored Brands, Inc. | Weak fit in terms of industry and business characteristics | |

| Ulta Salon, Cosmetics & Fragrance, Inc. | Larger in terms of revenue and market capitalization | |

In addition, in accordance with FW Cook’s recommendation, the following companies were added to the peer group that was used for guidance in establishing senior executive and non-employee director compensation levels for fiscal 2017:

| Company |

Rationale for Addition | |

| Nutrisystem, Inc. | Comparable market capitalization and has a presence in the health and wellness space | |

| Sprouts Farmers Market, Inc. | Comparable market capitalization and is a retailer with a presence in the health and wellness space | |

| Stein Mart, Inc. | Appropriate size with respect to revenue and market capitalization, considers the Company a compensation peer and three current companies in the peer group consider Stein Mart, Inc. a peer | |

| Weight Watchers International, Inc. | Comparable revenue and market capitalization and has a presence in the health and wellness space | |

| Weis Markets, Inc. | Comparable revenue and market capitalization and similar business characteristics – retailer with manufacturing operations | |

Relative to the 15-company peer group, our revenues ranked at the 40th percentile and our market capitalization was below the 25th percentile.

| Company Name |

Revenue (1)$ |

Market Valuation (2)$ |

||||||

| Big 5 Sporting Goods Corporation | $ | 1,009.635 | $ | 162.22 | ||||

| The Buckle, Inc. | 974.873 | 1,159.98 | ||||||

| The Cato Corporation | 956.569 | 398.50 | ||||||

| Finish Line, Inc. | 1,844.393 | 585.93 | ||||||

| GNC Holdings, Inc. | 2,453.000 | 308.36 | ||||||

| Hibbett Sports, Inc. | 973.000 | 389.41 | ||||||

| lululemon athletica inc. | 2,344.392 | 9,870.83 | ||||||

| Nutrisystem, Inc. | 696.957 | 1,562.53 | ||||||

| Pier 1 Imports Inc. | 1,828.400 | 345.06 | ||||||

| Sprouts Farmers Market, Inc. | 4,664.612 | 3,291.36 | ||||||

| Stein Mart, Inc. | 1,360.518 | 55.62 | ||||||

| Village Super Market, Inc. | 1,604.574 | 344.36 | ||||||

| Weight Watchers International, Inc. | 1,306.911 | 2,848.48 | ||||||

| Weis Markets, Inc. | 3,136.720 | 1,113.32 | ||||||

14

| Company Name |

Revenue (1)$ |

Market Valuation (2)$ |

||||||

| Zumiez, Inc. | 836,268 | 525.95 | ||||||

| Vitamin Shoppe, Inc. | 1,178,694 | 105.70 | ||||||

| Vitamin Shoppe, Inc. Percentile Rank(3) | 40 | % | 6.6 | % | ||||

| (1) | As reported in the annual report on Form 10-K for the most recent fiscal year available (in thousands of US dollars). |

| (2) | Based on the closing stock price as of December 29, 2017 and the number of shares of outstanding common stock reported in the latest Form 10-K or, if the fiscal year of a company does not end in December or January, the latest Form 10-Q. (in millions of US dollars). |

| (3) | The percentage of scores that fall at or below the score of the Company. |

No changes were made to the peer group for establishing senior executive and non-employee director compensation levels for fiscal 2018.

Review of External Data

The Compensation Committee may also consider other data, including trends and best practices in executive compensation, proxy data from our peer group and legal and regulatory changes to assess our compensation practices in the businesses and markets in which we compete for executive talent. We have determined, and continue to believe, that our compensation levels should be competitive in our market and that compensation packages should be aligned with our business goals and objectives. However, we strongly believe in engaging the best talent in critical functions, and this can entail negotiations with individual executives who have significant compensation and/or retention packages in place with other employers. As a result, the Compensation Committee may determine to provide compensation outside of our normal practices to certain individuals to achieve attraction and retention objectives. Our named executive officers did not receive compensation outside of normal practice in 2017.

Elements of Total Compensation

Compensation for our named executive officers includes both fixed and performance-based components. Performance-based components are designed so that above-target performance is rewarded with above-target payouts and vice versa. The fixed components of compensation are designed to be competitive and encourage retention.

The following table briefly describes each element of compensation. A detailed explanation of each component is provided in the next section, “Fiscal Year 2017 Compensation.”

| Compensation Component |

Reason to Provide |

Performance Based |

Not- Performance |

Value |

Value Not | |||||

| Management Incentive Plan | Rewards our Named Executive Officers for achieving the annual financial and operational performance goals established by the Compensation Committee. | ✓ | ✓ | |||||||

| Long-term Incentive: PSUs | Granted annually to all Named Executive Officers to drive focus on Vitamin Shoppe’s long-term performance, align their interest with the interest of our stockholders and link to the achievement of long-term value creation. | ✓ | ✓ | |||||||

15

| Compensation Component |

Reason to Provide |

Performance Based |

Not- Performance |

Value |

Value Not | |||||

| Long-term Incentive: RSAs | Granted annually to Named Executive Officers to encourage retention. Although the number of shares earned is fixed, provided the executive is still employed, their value rises and falls with the price of our common stock, adding a performance element. | ✓ | ✓ | |||||||

| Base salary | Paid to all Named Executive Officers; competitive base salaries are necessary to attract and retain qualified, high-performing executives. Prior experience, scope of responsibility and performance are key elements considered in setting base salaries. | ✓ | ✓ | |||||||

| Executive Severance Pay Policy | Applicable to all executive officers, including Named Executive Officers, to encourage retention. | ✓ | ✓ | |||||||

| Benefits & Limited Perquisites | Offered to all Named Executive Officers; competitive benefits and modest perquisites are necessary to attract and retain qualified, high-performing executives. | ✓ | ✓ | |||||||

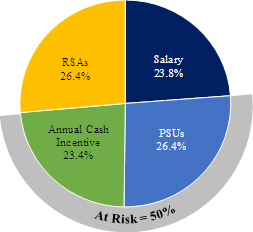

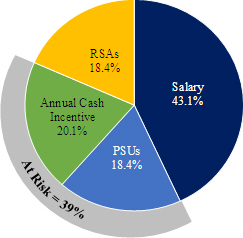

The Compensation Committee believes a substantial portion of an executive’s pay should be comprised of awards that are directly tied to the Company and individual performance. A large percentage of total target compensation is “at risk” through long-term equity awards and annual bonuses. These awards are linked to actual performance and include a substantial portion of equity. The following charts illustrate the weighting of base salary, annual incentive awards and long-term incentive awards at target for the CEO and the other named executive officers during 2017:

Target and Realizable Compensation. Consistent with our pay-for performance philosophy, 50% of our CEO’s and 39% of our other named executive officer’s target compensation is at-risk and performance-based. Accordingly, we believe that the CEO and other named executive officer’s financial incentives are aligned with the Company’s actual operational, financial and stock price performance. Further, the value of realizable compensation can differ substantially from the target compensation in ways that emphasize the practical impact of our pay-for-performance philosophy. The chart below illustrates what percentage of the CEO’s and other named executive officer’s total target compensation in 2017 is at risk and performance based.

16

| Target Total Direct Compensation-CEO |

Target Total Direct Compensation Other NEOs | |

|

|

|

2017 CEO – Total Target and Realizable Compensation

The chart below compares the CEO’s total target compensation in 2017 to the values realized in light of the Company’s performance in a challenging year.

| Total Target Compensation |

Realizable Compensation |

|||||||

| Salary |

$ | 880,000 | (3) | $ | 864,615 | (3) | ||

| PSUs(1) |

974,998 | 149,745 | ||||||

| RSAs(2) |

974,998 | 224,607 | ||||||

| Annual Bonus |

864,615 | 309,100 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 3,684,610 | $ | 1,548,067 | ||||

|

|

|

|

|

|||||

CEO’s Realized Compensation: 42% of Target Total Compensation

| (1) | The amount of PSU-based compensation realized by the CEO was calculated by multiplying the total number of PSUs granted in 2017 (51,047) times the closing stock price on the last trading day of 2017, December 29, 2017 ($4.40), and then multiplying that sum by 66.67% which reflects that the Company missed the threshold financial targets for Adjusted Operating Income and Return on Invested Capital for fiscal 2017 and assumes that 100% of the target performance goals for fiscal 2018 and 2019 will be achieved. |

| (2) | The amount of RSA -based compensation realized by the CEO was calculated by multiplying the total number of RSAs granted in 2017 (51,047) times the closing stock price on the last trading day of 2017, December 29, 2017 ($4.40). |

| (3) | The difference between the CEO’s target salary and realized salary is due to the fact that the CEO received a merit increase to his salary on February 27, 2017 that increased his salary from $800,000 to $ 880,000. |

17

Fiscal Year 2017 Compensation

Base Salary

Base salaries for our named executive officers are determined based on the specific level of the executive, the responsibilities of his or her position, and certain peer group data and labor market factors. Generally, our goal is to provide a salary that is competitive with the salary for similar positions in similar industries. Salaries are reviewed annually to determine whether any change is appropriate. Any increase in salary for our named executive officers is subject to Compensation Committee approval. In addition, base salaries may be adjusted on occasion at the Compensation Committee’s discretion to realign a particular executive’s salary with those prevailing in the market.

The following table provides information concerning the annual base salaries of our named executive officers for the periods specified. The amounts represent the salaries approved by the Compensation Committee.

| Name |

2016 Rate ($) |

2017 Rate ($) |

Increase (%) |

|||||||||

| Colin Watts(1) |

800,000 | 880,000 | 10 | % | ||||||||

| Brenda Galgano |

500,000 | 515,000 | 3 | % | ||||||||

| Michael Beardall(2) |

361,000 | 371,000 | 2.8 | % | ||||||||

| David Kastin |

357,000 | 385,000 | 7.8 | % | ||||||||

| Jason Reiser(3) |

600,000 | 618,000 | 3 | % | ||||||||

| (1) | Mr. Watts’ separation from the Company was announced on February 27, 2018; under his separation arrangement, Mr. Watts will continue to be employed as the Chief Executive Officer through no later than May 31, 2018. |

| (2) | Mr. Beardall’s employment with the Company ended as of March 30, 2018. |

| (3) | Mr. Reiser’s employment with the Company ended as of July 11, 2017. |

In Fiscal 2016, FW Cook completed an assessment of each component of compensation for our named executive officers, including base salary, annual cash incentive and annual long-term incentive equity grants, which included an analysis of compensation within our peer group. FW Cook’s analysis revealed that Mr. Watts’ and Mr. Kastin’s base salaries were below median. In light of Mr. Watts’ maturation as a chief executive officer and the critical nature of his role in the execution of our Reinvention Strategy, the Compensation Committee increased Mr. Watts’ base salary by 10% to bring it closer to the median of the Company’s peer group. In addition, the Compensation Committee reviewed Mr. Kastin’s contributions to the Company, not only as head of the Company’s legal and regulatory function but as a strategic advisor to senior management and head of real estate, and determined that it would be appropriate to raise Mr. Kastin base salary by 7.8%, which brings it closer to the median of the Company’s peer group.

Since our fiscal year 2017 was challenging, we did not increase the base salaries of the named executive officers for fiscal year 2018.

Annual Cash Incentive – Management Incentive Program

Our philosophy is that annual cash incentives are to be used to incent achievement of short-term objectives. Our MIP is a cash-based, pay-for-performance annual incentive plan. The MIP allows for a range of cash awards based on the named executive officer’s base salary and level of employment, and our operating results and/or achievement of Key Performance Indicators (KPI) goals.

Annual cash incentives under the 2017 MIP are based upon a combination of corporate financial targets and KPIs. We believe that focusing on operating income targets, which include depreciation and amortization expense, will encourage disciplined capital investment to fuel profitable growth. Our KPIs are directly linked to our

18

Reinvention Strategy and shared by the named executive officers, which encourages cross-functional teamwork and successful implementation of future business drivers, such as growth of private brands and an enhanced loyalty program.

The Compensation Committee approves the structure of the MIP including the corporate financial targets and the KPI goals. The Committee also retains the discretion to award lesser amounts under the MIP to individuals based upon Company or individual performance, based upon the recommendation of our Chief Executive Officer or such other factors that the Committee deems appropriate. The Compensation Committee Chair, the Audit Committee Chair and our outside auditors generally discuss our audited financial results in connection with the determination of MIP payouts.

Target bonuses are expressed as a percentage of base salary and range from 45% to 100% of salary for our named executive officers (as provided in the table on page 18). The table below describes the target bonus for each named executive officer, which is expressed as a percentage of salary in the fiscal year, and the performance metrics, which make up the target bonus.

Target Bonus Metrics and Weightings

| Adjusted Operating Income |

KPI’s | |||||||||||||||||||||||||||||||||||

| Name |

Vitamin Shoppe |

Nutri- Force Nutrition |

Private Brands Growth |

Customer Engage- ment / Churn Reduction |

Vendor Negotiations |

Brand Defining Store Trans- forma- tions |

Nutri- Force Turn- around |

Supply Chain |

Total | |||||||||||||||||||||||||||

| Colin Watts |

60 | % | 10 | % | 6 | % | 6 | % | 6 | % | 6 | % | 3 | % | 3 | % | 100 | % | ||||||||||||||||||

| Michael J. Beardall |

40 | % | 30 | % | 6 | % | 6 | % | 6 | % | 6 | % | 3 | % | 3 | % | 100 | % | ||||||||||||||||||

| Brenda Galgano |

60 | % | 10 | % | 6 | % | 6 | % | 6 | % | 6 | % | 3 | % | 3 | % | 100 | % | ||||||||||||||||||

| David M. Kastin |

60 | % | 10 | % | 6 | % | 6 | % | 6 | % | 6 | % | 3 | % | 3 | % | 100 | % | ||||||||||||||||||

| Jason Reiser |

60 | % | 10 | % | 6 | % | 6 | % | 6 | % | 6 | % | 3 | % | 3 | % | 100 | % | ||||||||||||||||||

Performance Achievement Percentage Multiplier

As set forth in the chart below, The Vitamin Shoppe Financial Objectives component and The Nutri-Force Nutrition Financial Objectives component are subject to a multiplier based on a Performance Achievement Percentage, which ranges from 25% to 200% of target, based on the level of Adjusted Operating Income achieved in the fiscal year 2017.

| The Vitamin Shoppe | Nutri-Force Nutrition | |||||||||||||||||||||||

| Adjusted Operating Income |

Threshold $93.7 million |

Target $96.8 million |

Maximum $106.5 million |

Threshold $(8.5) million |

Target $(7.9) million |

Maximum $(7.1) million |

||||||||||||||||||

| Performance Achievement Percentage |

25 | % | 100 | % | 200 | % | 25 | % | 100 | % | 200 | % | ||||||||||||

Achievement of less than the threshold level of Adjusted Operating Income results in a multiplier of 0%. In addition, achievement of less than the threshold Adjusted Operating Income results in the maximum award under the KPI component being reduced from 150% to 100%. In addition, The KPI component is subject to a multiplier based on Strategic Performance Percentage, which ranges from 25% to 150% based upon the Company’s performance against the KPIs.

19

Adjusted Operating Income

Adjusted Operating Income for The Vitamin Shoppe represents the Company’s reported operating income (excluding Nutri-Force), along with adjustments for extraordinary, unusual or non-recurring items during the year as determined by the Compensation Committee. Adjusted Operating Income for Nutri-Force represents Nutri-Force’s portion of the Company’s reported operating income, along with adjustments for extraordinary, unusual or non-recurring items during the year as determined by the Compensation Committee.

Key Performance Indicators (KPIs)

For 2016, the Compensation Committee implemented an incentive compensation plan that focused our named executive officers on achieving specific business goals directly supporting the Company’s short and long-term goals. For 2017, the Compensation Committee decided to maintain the same structure used for the 2016 MIP, but changed the KPIs to better align our named executive officers’ compensation with the Company’s strategic goals of revenue growth, margin improvement, cost containment and improved customer experience. The Compensation Committee also decided to continue to apply the same KPIs to each named executive officer in order to foster strong cross-functional support and better align our senior management team with the Company’s corporate goals. The KPIs consisted of five (5) initiatives: (i) Private Brands Growth, (ii) Customer Engagement, (iii) Vendor Negotiations, (iv) Brand Defining Store Transformations, and (v) Nutri-Force and Supply Chain, each of which contained measurable performance metrics which were used to calculate the KPI portion of the MIP bonus for each named executive officer.

MIP Calculation

The following formula provides an illustration of how annual cash incentive awards pursuant to the MIP were calculated for Mr. Watts, Mr. Kastin, Mr. Reiser and Ms. Galgano:

| Step 1: |

Participant’s eligible earnings x Participant’s Target Bonus % = Target Bonus Amount. | |||

| Step 2: |

||||

| • | Target Bonus Amount x 60% = Vitamin Shoppe Financial Objectives Component. | |||

| • | Target Bonus Amount x 10% = Nutri-Force Nutrition Financial Objectives Component. | |||

| • | Target Bonus Amount x 30% = KPI Component. | |||

| Step 3: |

(Vitamin Shoppe Financial Objectives Component x Performance Achievement Percentage Multiplier, capped at 200%) + (Nutri-Force Nutrition Financial Objectives Component x Performance Achievement Percentable Multiplier, capped at 200%) + (KPI Component x Strategic Performance Achievement Percentage Multiplier, capped at 150%) = MIP Award. |

The following formula provides an illustration of how the annual cash incentive award pursuant to the MIP was calculated for Mr. Beardall:

| Step 1: |

Participant’s eligible earnings x Participant’s Target Bonus % = Target Bonus Amount. | |||

| Step 2: |

||||

| • |

Target Bonus Amount x 10% = Vitamin Shoppe Financial Objectives Component. | |||

| • |

Target Bonus Amount x 60% = Nutri-Force Nutrition Financial Objectives Component. | |||

| • |

Target Bonus Amount x 30% = KPI Component. | |||

20

| Step 3: |

(Vitamin Shoppe Financial Objectives Component x Performance Achievement Percentage Multiplier, capped at 200%) + (Nutri-Force Nutrition Financial Objectives Component x Performance Achievement Percentable Multiplier, capped at 200%) + (KPI Component x Strategic Performance Achievement Percentage Multiplier, capped at 150%) = MIP Award. |

MIP Payouts

For fiscal 2017, The Vitamin Shoppe did not achieve our minimum threshold Adjusted Operating Income of $93.7 million, and therefore the Performance Achievement Percentage Multiplier was 0%. However, Nutri-Force exceeded its Adjusted Operating Income target maximum of $(7.1) million, resulting in a Performance Achievement Percentage Multiplier of 200%.

As set forth in the chart below, our named executive officers also achieved a portion of the KPIs, which resulted in a payout to each of the named executive officers of approximately 53% of the KPI portion of their target bonus.

| KPI |

Achievement % |

Weight | Actual Payout % | |||||||||

| Private Brands Growth |

0 | % | 6 | % | 0 | % | ||||||

| Customer Engagement |

0 | % | 6 | % | 0 | % | ||||||

| Vendor Negotiations(1) |

100 | % | 6 | % | 6 | % | ||||||

| Brand Defining Store Transformations(2) |

50 | % | 6 | % | 3 | % | ||||||

| Nutri-Force and Supply Chain(3) |

112 | % | 6 | % | 6.72 | % | ||||||

| Total |

15.72 | % | ||||||||||

| (1) | The 100% payout on this KPI was a direct result of management’s negotiations with vendors that resulted in approximately $15 million in annual savings. |

| (2) | The 50% payout on this KPI was a result of the complete transformation of 10 of The Vitamin Shoppe stores by the end of Q2 2017. |

| (3) | The 112% payout on this KPI was the result of the completion of the new distribution center in Arizona coming in under budget and outbound shipments beginning ahead of schedule. |

The following table shows targeted and actual bonus amounts calculated as described above for our named executive officers for 2017.

| Name |

2017 Target % Salary |

Threshold Payment $(1) |

2017 Target Payment $(2) |

Maximum Payment $(3) |

Actual Bonus $(4) |

Actual Bonus as a % of Target Payment |

||||||||||||||||||

| Colin Watts |

100 | % | 216,154 | 864,615 | 1,599,538 | 309,100 | 36 | % | ||||||||||||||||

| Brenda Galgano |

50 | % | 64,014 | 256,057 | 473,705 | 91,541 | 36 | % | ||||||||||||||||

| Michael Beardall |

45 | % | 41,521 | 166,085 | 307,257 | 225,460 | 136 | % | ||||||||||||||||

| David Kastin |

45 | % | 42,828 | 171,311 | 316,925 | 61,244 | 36 | % | ||||||||||||||||

| Jason Reiser(5) |

65 | % | 56,216 | 224,865 | 416,000 | — | — | |||||||||||||||||

| (1) | The amounts reflected in the chart are based on the assumption that the Company achieved at least the threshold level of Adjusted Operating Income, and that the individual received 100% of the KPI component of the bonus. |

| (2) | The amounts reflected in the chart are based on the assumption that the Company achieved at least the target level of Adjusted Operating Income, and that the individual received 100% of the KPI component of the bonus. |

21

| (3) | The amounts reflected in the chart are based on the assumption that the Company achieved at least the maximum level of Adjusted Operating Income, and that the individual received 150% of the KPI component of the bonus. |

| (4) | The amounts reflected in the chart are based on a The Vitamin Shoppe Performance Achievement Percentage multiplier of 0%, Nutri-Force Performance Achievement Percentage Multiplier of 200%, and achievement of 53% of the potential KPI payout |

| (5) | Mr. Reiser’s employment with the Company ended as of July 11, 2017. |

Long-Term Incentive Compensation

We believe that granting equity that vests over an extended period of time encourages our named executive officers to focus on our future success and aligns their interests with the interests of our stockholders. In addition, we typically employ (x) time-based vesting to retain our named executive officers and (y) performance-based metrics to incentivize them to accomplish our goals. In certain instances, we also use time-based awards as a means for inducing potential employees to join us, as a means of rewarding current employees in connection with a promotion, for taking on new responsibilities, or for retention purposes. All such equity awards are granted under the 2009 Equity Incentive Plan. The total equity granted to recipients is based in part on their position with us and the reason for the grants. All grants to named executive officers require the approval of the Board.

In 2017, we provided our named executive officers with annual grants comprised of 50% Time Vesting Restricted Stock and 50% Performance Share Units to directly tie compensation to achievement of multi-year financial performance and increases in stock price, while supporting our retention objective during execution of our long-term strategy. We believe this mix of equity increases accountability for results and total upside earnings potential.

Time Vesting Restricted Stock

Provided the named executive officer is employed by the Company, the Time Vesting Restricted Stock shall become unrestricted and vested: (i) as to the first 50% of the shares of restricted stock, on the second anniversary of the grant date, and (ii) as to the second 50% of the shares of restricted stock, on the third anniversary of the grant date. If the named executive officer is no longer employed by the Company for any reason (other than death or disability) prior to the vesting of all or any portion of the restricted stock, such unvested portion of the restricted stock shall immediately be cancelled and the named executive officer shall forfeit any rights or interests in and with respect to any such shares of restricted stock; provided, however, in the event the named executive officer’s employment is terminated due to death or disability, the shares of restricted stock shall become unrestricted and vested as of the date of any such termination.

Performance Share Units

The Performance Share Units have a three-year performance period (“Performance Period”) and 50% of the Performance Stock Units shall be eligible to vest at the end of the Performance Period based on the achievement of adjusted operating income growth targets (the “Adjusted Operating Income Units”) and 50% of the Performance Stock Units shall be eligible to vest at the end of the Performance Period based on the achievement of return on invested capital targets (the “ROIC Units”). Performance goals for the Adjusted Operating Income Units and ROIC Units are established at the beginning of the Performance Period. The number of Adjusted Operating Income Units that vest is equal to the target number of Adjusted Operating Income Units multiplied by the Adjusted Operating Income Applicable Percentage. The “Adjusted Operating Income Applicable Percentage” is equal to the average of the Adjusted Operating Income Vesting Percentages, which range from 0% (below threshold) to 150% (outstanding) determined for each year during the Performance Period. The “Adjusted Operating Income Vesting Percentage” for fiscal 2017 is measured against a pre-established range, and a payout percentage, if any, would be calculated, but not paid. The same methodology is repeated for Fiscal 2018 and 2019. At the end of Fiscal 2019, the calculated payout percentages from each of the three years’ performance results are averaged to determine the actual share delivery. If the percentage growth in Adjusted Operating Income for a particular fiscal year falls between the indicated performance levels, the Adjusted Operating Income Vesting Percentage will be determined based on straight-line interpolation. For performance levels below the threshold level, straight-line interpolation will not be applied and the Adjusted Operating Income Vesting Percentage will be 0%.

22

The number of ROIC Units that performance vest as of the end of the Performance Period is equal to the target number of ROIC Units multiplied by the ROIC Applicable Percentage. The “ROIC Applicable Percentage” is equal to the average of the ROIC Vesting Percentages, which range from 0% (below threshold) to 150% (outstanding) determined for each year during the Performance Period. The “ROIC Vesting Percentage” for fiscal 2017 is measured against a pre-established range, and a payout percentage, if any, would be calculated, but not paid. The same methodology is repeated for Fiscal 2018 and 2019. At the end of Fiscal 2019, the calculated payout percentages from each of the three years’ performance results are averaged to determine the actual share delivery. For return on invested capital performance levels that fall between the indicated performance levels, the Vesting Percentage will be determined based on straight-line interpolation. For performance levels below the threshold level, straight-line interpolation will not be applied and the ROIC Vesting Percentage will be 0%.

In the event the participant’s employment with the Company is terminated before the end of the Performance Period due to the participant’s death, disability or retirement, the participant shall be entitled to a pro-rata portion of the Performance Stock Units equal to (x) the percentage of the Performance Period that the Participant was employed by the Company (calculated using the number of days employed during the Performance Period) multiplied by (y) the number of Performance Stock Units that would otherwise have performance vested as of the end of the Performance Period.

Other Benefits and Perquisites

Our named executive officers are provided with basic health and welfare insurance coverage, life insurance, and are eligible to participate in our 401(k) plan. Perquisites may be awarded to our named executive officers on a limited case-by-case basis, subject to Board and/or Compensation Committee approval. The Compensation Committee approved an annual car allowance for Mr. Watts of $20,000 effective March 17, 2017. Except for Mr. Watts’ car allowance, no additional material perquisites are being provided to our named executive officers.

Equity Award Grant Date Policy