Attached files

| file | filename |

|---|---|

| EX-99.4 - RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - SANDRIDGE ENERGY INC | sd3413631-ex994.htm |

| EX-31.4 - SECTION 302 CERTIFICATION-CHIEF FINANCIAL OFFICER - SANDRIDGE ENERGY INC | sd3413631-ex314.htm |

| EX-31.3 - SECTION 302 CERTIFICATION-CHIEF EXECUTIVE OFFICER - SANDRIDGE ENERGY INC | sd3413631-ex313.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 10-K/A

(Amendment No. 1)

_____________________

| (Mark One) | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2017 | |

| OR | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

| Commission File Number: 001-33784 |

| SANDRIDGE ENERGY, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 20-8084793 |

| (State or other jurisdiction | (I.R.S. Employer |

| of incorporation or organization) | Identification No.) |

| 123 Robert S. Kerr Avenue | |

| Oklahoma City, Oklahoma | 73102 |

| (Address of principal executive offices) | (Zip code) |

| (405) 429-5500 | ||

| (Registrant’s telephone number, including area code) | ||

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 par value | New York Stock Exchange | |

| Securities registered pursuant to Section 12(g) of the Act: | ||

| None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☑ | |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☐ | |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of our common stock held by non-affiliates on June 30, 2017 was approximately $586.9 million based on the closing price as quoted on the New York Stock Exchange. As of April 20, 2018 there were 35,402,981 shares of our common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

The purpose of this Amendment No. 1 to SandRidge Energy, Inc’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (this “Report”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 22, 2018 (the “Original Report”), is to amend Part III, Items 10 through 14 of the Original Report to include information previously omitted from the Original Report in reliance on General Instructions G to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy statement filed with the SEC within 120 days after the end of the fiscal year.

We are also amending Part IV, Item 15 of the Original Report to include certain exhibits to be filed with this Amendment No. 1 to the Original Report.

Except as described above, this Amendment No. 1 to the Original Report does not amend, update or change any other items or disclosures in the Original Report and does not purport to reflect information or events subsequent to the filing thereof.

References in this report to the “Company,” “SandRidge,” “we,” “our,” and “us” mean SandRidge Energy, Inc., including its consolidated subsidiaries and variable interest entities of which it is the primary beneficiary.

Item 10. Directors, Executive Officers and Corporate Governance

The names of the members of our Board of Directors (the “Board”) and certain information concerning each of them as of April 30, 2017 are set forth below.

Members of the Board of Directors

| Name | Age | Position | ||

| Sylvia K. Barnes | 61 | Director | ||

| Kenneth H. Beer | 60 | Director | ||

| Michael L. Bennett | 64 | Chairman | ||

| William M. Griffin, Jr. | 58 | Director | ||

| David J. Kornder | 57 | Director |

Sylvia K. Barnes. Ms. Barnes has served as a director since February 2018. Ms. Barnes has over thirty years of oil & gas finance experience and a background in engineering. Since April 2015, Ms. Barnes has been Principal and owner of Tanda Resources LLC, a privately-held oil and gas investment and consulting company. From 2011 to April 2015, Ms. Barnes served as Managing Director and Group Head for KeyBanc Capital Markets Oil & Gas Investment and Corporate Banking Group and was a member of the firm’s Executive Committee. Prior to joining KeyBanc, Ms. Barnes was Head of Energy Investment Banking at Madison Williams from 2009 to 2011, and Managing Director at Merrill Lynch’s energy investment banking practice. She joined Merrill as part of the firm’s acquisition of Petrie Parkman & Co. From 1994 to 2000, Ms. Barnes worked as Managing Director and SVP for Nesbitt Burns, including serving as head of the firm’s U.S. energy investment banking group. Prior to that she worked in various capacities at Nesbitt Burns and its parent company, Bank of Montreal. As a banker Ms. Barnes devoted her career to serving companies in the upstream oil and gas sector and she successfully executed a variety of mergers, acquisitions and divestiture transactions, and advised on public and private equity offerings and private debt and equity placements. Ms. Barnes currently services as a member on the board of directors of Pure Acquisition Corp (NASDAQ: PACQU), where she is Chair of the audit committee and a member of the nominating & governance and compensation committees. Ms. Barnes previously served on the Board of Directors of Halcon Resources Corporation (NYSE: HK) and as a member of its audit and reserves committees. Ms. Barnes began her career as a reservoir engineer for Esso Resources. Ms. Barnes graduated from the University of Manitoba with a Bachelor of Science in Engineering (Dean’s List), was a licensed professional engineer in Alberta and earned a Masters of Business Administration in Finance from York University. She is experienced in advising boards of directors, special committees and executive management on financial decisions with strategic and governance considerations including mergers & acquisitions, being responsible for strategic growth initiatives, budgets and P&L, and raising private and public capital. Ms. Barnes’ experience provides her with valuable insights into corporate strategy, capital allocation, equity and debt financing and the assessment and management of risks faced by energy companies.

The Board believes Ms. Barnes’ extensive financial analysis and transaction experience and knowledge of the oil and gas industry qualifies her to serve on the Board.

Kenneth H. Beer. Mr. Beer has served as a director since April 2018. Mr. Beer has nearly forty years of financial analysis, transactional and managerial experience, as well as knowledge of the oil & gas industry. Since January 2011, Mr. Beer has been the Executive Vice President and Chief Financial Officer of Stone Energy Corporation, an oil and natural gas exploration and production company, prior to which, he served as the Senior Vice President and Chief Financial Officer from August 2005. During this time, he has been responsible for significant financial transactions including equity and debt offerings, investor relations, financial analysis and planning, risk management, marketing, IT and facilities. From 1992 to 2005, Mr. Beer was Partner and Director of Equity Research of Johnson Rice & Company, an energy brokerage and investment bank. From 1986 to 1992, Mr. Beer worked at Howard Weil, a U.S. energy investment business. From 1984 to 1985, Mr. Beer worked at Wood Mackenzie/Gintel, a research and consulting business for global energy, chemicals, metals and mining industries. From 1979 to 1981, Mr. Beer worked at Boston Consulting Group, a global management and strategy consulting firm. Additionally, Mr. Beer has previously served on the board of directors of International Shipholding (NYSE: ISH), including on its audit (chairman), compensation (chairman) and governance committees, and he currently serves as a board member of certain private entities. Mr. Beer has a Master’s of Business Administration from Stanford University and an A.B. in Economics from Dartmouth College.

1

The Board believes that Mr. Beer’s financial analysis, transactional and managerial experience, as well as his knowledge of the oil and gas industry, service on other public company boards and his background in overseeing public company financial management and reporting qualify him to serve on the Board.

Michael L. Bennett. Mr. M. Bennett has served as a director since October 2016. Mr. M. Bennett has over forty years of technical and managerial experience in the petrochemical industry. From 1973 until 2010, Mr. M. Bennett was an employee of Terra Industries Inc., a manufacturer of nitrogen products. During such time he served in a variety of leadership roles, including Executive Vice President and Chief Operating Officer, from February 1997 until April 2001, and President and Chief Executive Officer, from April 2001 until April 2010, when the company was acquired by CF Industries. Since May 2010, Mr. M. Bennett has been a private investor with Albaton Enterprises LLC in Sioux City, Iowa. Mr. M. Bennett currently serves as Chairman of the board of directors of OCI N.V. (NYSE Euronext: OCI), a producer of nitrogen fertilizers, methanol, and other natural gas-based products, serving agricultural and industrial customers from the Americas to Asia. Mr. M. Bennett also serves as Chairman of the board of directors of OCI Partners, L.P. (NYSE: OCIP), which operates OCI Beaumont, the largest integrated ammonia and methanol production complex in the United States. In addition, Mr. M. Bennett previously served on the board of directors of Alliant Energy (NYSE: LNT) and is a past Chairman of the board of The Fertilizer Institute, the Methanol Institute, the Agribusiness Association of Iowa, and Morningside College.

The Board believes Mr. M. Bennett’s senior management experience, his service on other public company boards and his background in overseeing public company financial management and reporting qualifies him to serve on the Board.

William (Bill) M. Griffin. Mr. B. Griffin has served as a director since October 2016 and Interim President and Chief Executive Officer (“CEO”) of SandRidge since February 2018. Mr. B. Griffin has over thirty-five years of technical and leadership experience with active public and privately owned upstream energy organizations in most oil and gas basins throughout the United States and Gulf of Mexico. Mr. B. Griffin most recently served as President and CEO of Petro Harvester Oil & Gas, a private equity based company with oil production and asset development in the Williston Basin and U.S. Gulf Coast from 2012 to August 2015. Mr. B. Griffin founded and served as President of Ironwood Oil & Gas, a privately held upstream organization focused on acquisition and self-development of Texas horizontal natural gas fields and opportunities from 2008 to 2012. From 1999 to 2007, he had full business responsibilities for various U.S. onshore and offshore basins with El Paso Exploration and Production Company, ultimately serving as Sr. Vice President, Onshore U.S. Division. He held various technical and asset management positions, including District Vice President with Sonat Exploration Company, an oil and natural gas exploration and production business from 1990 to 1999 and began his career serving in various petroleum engineering and operations roles during tenure with TXO Production Corp., an oil and natural gas production company from 1981 to 1990. In addition to Petro Harvester Oil & Gas, Mr. B. Griffin previously served on the boards of Black Warrior Methane Corp. and Four Star Oil & Gas Company. Mr. B. Griffin is a registered professional engineer with a B.S. in mechanical engineering from Texas A&M University.

The Board believes Mr. B. Griffin’s senior management experience in the exploration and production industry and his operational/technical experience in the exploration and production industry qualifies him to serve on the Board.

David J. Kornder. Mr. Kornder has served as a director since October 2016. Mr. Kornder has over twenty five years of experience in oil and gas and finance. In November 2016, Mr. Kornder co-founded Sequel Energy Group LLC, a privately held oil and gas company for which he serves as a Managing Director. Sequel Energy Group is financially backed by GSO Capital Partners and is focused on making investments in non-operated drilling joint ventures in proven areas with experienced oil and gas teams. From September 2008 until June 2015, Mr. Kornder served as President and Chief Executive Officer of Cornerstone Natural Resources, LLC, a privately held independent oil and gas company primarily focused on drilling and production in the Williston Basin in North Dakota. Previously, Mr. Kornder served as the Executive Vice President and Chief Financial Officer at BioFuel Energy Corp., a publicly traded ethanol production company, as Senior Vice President and Chief Financial Officer at Petrie, Parkman, LLC, a privately held investment bank focused on the energy sector, and as Executive Vice President, Chief Financial Officer and Director for Patina Oil & Gas Corporation, a publicly traded oil and gas company. Mr. Kornder also worked as the Assistant Vice President – Finance at Gillett Group Management and as a senior accountant with Deloitte, Haskins & Sells. Mr. Kornder presently serves on the boards of 3 Bear Energy, LLC, and Bear Cub Energy, both privately held midstream energy companies, and as a director of the Colorado Oil & Gas Association. Mr. Kornder holds a B.A. in accounting from Montana State University.

2

The Board believes Mr. Kornder’s senior management experience in the exploration and production industry, his prior service on other public company boards, his background in energy-focused investing and capital raising activities and his background in overseeing public company financial management and reporting qualifies him to serve on the Board.

Executive Officers

Set forth below is information regarding each of our executive officers as of April 30, 2018:

| Name | Age | Position | ||

| William (“Bill”) M. Griffin | 58 | President and CEO | ||

| Michael A. Johnson | 52 | Senior Vice President, Chief Financial Officer and Chief Accounting Officer | ||

| John P. Suter | 57 | Executive Vice President and Chief Operating Officer | ||

| Philip T. Warman | 47 | Executive Vice President, General Counsel and Corporate Secretary |

Bill Griffin. Mr. B. Griffin was named President and CEO, effective February 8, 2018 on an interim basis. Biographical information about Mr. B. Griffin can be found above under the heading “Directors, Executive Officers and Corporate Governance —Members of the Board of Directors.”

Michael A. Johnson. Mr. Johnson was named Chief Financial Officer, effective at the close of business on February 22, 2018 on an interim basis. Mr. Johnson joined SandRidge in August 2017 as the Company’s Senior Vice President and Chief Accounting Officer. Prior to that, Mr. Johnson served as Senior Vice President – Accounting, Controller and Chief Accounting Officer at Chesapeake Energy Corporation from 2000 until May 10, 2017 and served as its Vice President of Accounting and Financial Reporting from 1998 to 2000 and as Assistant Controller from 1993 to 1998. From 1991 to 1993, Mr. Johnson served as Project Manager of Phibro Energy Production, Inc. From 1987 to 1991, he served as an Audit Manager of Arthur Andersen & Co. Mr. Johnson is a Certified Public Accountant and graduated from the University of Texas at Austin in 1987.

John P. Suter. Mr. Suter was appointed as Executive Vice President and Chief Operating Officer effective December 1, 2016. Mr. Suter joined SandRidge in April 2015 as Senior Vice President of Mid-Continent Operations, bringing with him extensive experience in the exploration and production sector, including most recently serving as Vice President of the Woodford business unit at American Energy Partners, LP from November 2013 to April 2015. From May 2010 to September 2013, he served as Vice President of Operations for Chesapeake Energy Corporation’s Western Division, and before that, as Chesapeake’s District Manager for the Barnett Shale and Southern Oklahoma assets. Before joining Chesapeake Energy, Mr. Suter served in various operational roles at Continental Resources, Inc., Cabot Oil & Gas Corporation and Petro-Lewis Corporation. He holds a Bachelor of Science degree in Petroleum Engineering from Texas Tech University.

Philip T. Warman. Mr. Warman was appointed as Executive Vice President, General Counsel and Corporate Secretary, effective February 8, 2018, with an expanded role encompassing the people and culture department. Mr. Warman joined SandRidge in August 2010 as Senior Vice President, General Counsel and Corporate Secretary. Prior to joining the Company, Mr. Warman was the Associate General Counsel for SEC and finance matters for Spectra Energy Corporation from January 2007 through July 2010. From 1998 through 2006 he practiced law as a corporate finance attorney with Vinson & Elkins, LLP in Houston, Texas. Mr. Warman earned a Bachelor of Science in Chemical Engineering from the University of Houston in 1993 and graduated from the University of Texas School of Law in 1998.

Section 16(a) Beneficial Ownership Compliance

Section 16(a) of the Exchange Act requires our officers and directors and persons who own more than 10% of the outstanding shares of our common stock to file reports of ownership and changes in ownership concerning their shares of our common stock with the SEC and to furnish us with copies of all Section 16(a) forms they file. We are required to disclose delinquent filings of reports by such persons.

3

Based solely on the copies of such reports and amendments thereto received by us, or written representations that no filings were required, we believe that all Section 16(a) filing requirements applicable to our executive officers and directors and 10% stockholders were met for the fiscal year ended December 31, 2017.

Corporate Governance Guidelines, Code of Business Conduct and Ethics and Financial Code of Ethics

The Board has adopted corporate governance guidelines that define those governance practices of the Board that are not included in our Bylaws. Our Board has also adopted a Code of Business Conduct and Ethics, which contains general guidelines for conducting our business and applies to all of our officers, directors and employees, and a Financial Code of Ethics that applies to our CEO and Senior Vice President, Chief Financial Officer and Chief Accounting Officer. Our corporate governance guidelines and codes can be found in the corporate governance section of our website at http://www.sandridgeenergy.com.

Audit Committee

SandRidge has a separately standing Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee members are Messrs. Kornder (Chairman) and Beer and Ms. Barnes. Each member of the Audit Committee has been determined by our Board to be an “audit committee financial expert” as defined under the rules of the SEC and to satisfy the independence requirements of Audit Committee members required by the Exchange Act and the New York Stock Exchange (the “NYSE”) Listed Company Manual.

Item 11. Executive Compensation

COMPENSATION DISCUSSION & ANALYSIS

The following Compensation Discussion and Analysis (“CD&A”), we describe our compensation philosophy, objectives and practices, our compensation setting process, our executive compensation program components, and the decisions regarding our named executive officers for 2017. Detailed information regarding the compensation earned by named executive officers is set forth in the Summary Compensation Table and other compensation tables contained in this CD&A.

2017 NAMED EXECUTIVE OFFICERS

| Name | Position | |

| James D. Bennett(1) | President & CEO | |

| Julian M. Bott(2) | Executive Vice President and Chief Financial Officer | |

| John P. Suter | Executive Vice President and Chief Operating Officer | |

| Philip T. Warman | Executive Vice President, General Counsel, & Corporate Secretary | |

| Robert S. (“Scott”) Griffin(3) | Senior Vice President, People and Culture | |

| Duane M. Grubert(4) | Executive Vice President, Investor Relations & Strategy |

| (1) |

Mr. J. Bennett departed the Company effective February 8, 2018. |

| (2) |

Mr. Bott departed the Company effective February 22, 2018. |

| (3) |

Mr. S. Griffin departed the Company effective March 1, 2018. |

| (4) |

Mr. Grubert departed the Company effective July 11, 2017. |

4

We present our CD&A in the following sections:

| 1. |

Executive Summary. In this section, we lead with a message from the Compensation Committee, which is followed by a summary of our business strategy and performance, extensive stockholder outreach, and compensation highlights. |

|

| |

| 2. |

Our Executive Compensation and Governance Principles. In this section, we describe the Company’s executive compensation strategy and objectives. |

|

| |

| 3. |

Key 2017 Compensation Program Elements. In this section, we highlight the material elements of the 2017 compensation program for named executive officers. |

|

| |

| 4. |

2017 Executive Compensation. In this section, we explain each of the material elements of the 2017 compensation program for named executive officers established by the Board or the Compensation Committee. |

|

| |

| 5. |

Process for Determining 2017 Executive Compensation. In this section, we describe the process for arriving at compensation decisions for 2017. |

|

| |

| 6. |

Actions Related to 2018 Executive Compensation. In this section, we provide an overview of the Compensation Committee’s compensation decisions made for 2018 including those in connection with the management transition. |

|

| |

| 7. |

Other Executive Compensation Matters. In this section, we provide an overview of policies related to minimum stock ownership, compensation clawbacks, and the prohibition on pledging and derivative transactions, and we discuss the relationship between our executive compensation program and risk and the tax treatment of executive compensation. |

1. Executive Summary

Compensation Committee Message and Report

DEAR FELLOW SANDRIDGE ENERGY STOCKHOLDERS,

The success of our business depends on setting and achieving goals tied to our strategic objectives. Incentivizing performance relative to those goals is fundamental to our compensation principles and executive compensation program. As we reflect on 2017, we are proud of the results that our Company delivered during a challenging period of low commodity prices and following the Company’s emergence from Chapter 11 reorganization in October 2016. We believe these results are reflected in our near-top-quartile stock price performance for the year relative to our 2017 peer group. Although our team delivered on key performance goals in 2017, in light of our new strategic direction, discussions with large stockholders and robust deliberation among the independent members of the Board, we determined to transition to a new leadership team, which resulted in the departure of Messrs. J. Bennett, Bott and S. Griffin during the first quarter of 2018.

ALIGNING COMPENSATION WITH STRATEGY AND PERFORMANCE

Our business and principal source of revenue is the production of oil, natural gas, and natural gas liquids (“NGLs”). Our Company exceeded our production growth goals for 2017 while simultaneously surpassing our per unit adjusted operating cost reduction goal and effectively managing its capital program rate of return. We found establishing a balanced set of goals focused our management team on growth that contributes long-term value, not just growth for growth’s sake.

Further, our team delivered on numerous qualitative goals that were fundamental to our Company’s 2017 performance, including:

| ● | Reducing 2017 total reportable incident rate by 33% and our motor vehicle incident rate by 41% compared to 2016. |

| ● | Increasing our NW STACK acreage position and entering into a $200 million development agreement with an initial $100 million tranche to efficiently fund the delineation of our NW STACK asset. |

| ● | Refinancing our non-conforming credit facility to increase our borrowing base, eliminate onerous covenants, release $50 million in cash from escrow and trigger the conversion of $264 million in convertible debt to equity. |

| ● | Selling $21.9 million in non-core assets (resulting in $33.7 million in non-core asset sales since emerging from Chapter 11). |

5

STOCKHOLDER ENGAGEMENT AND FEEDBACK

The Compensation Committee, as well as the full Board, values input and feedback received from our stockholders. We were not satisfied with the outcome of our say-on-pay vote at our 2017 annual meeting of stockholders, having received only 43% of the votes cast. We therefore initiated robust engagement with our largest stockholders and proxy advisory firms Institutional Shareholder Services and Glass Lewis. We took the feedback we received seriously, and our 2017 and 2018 compensation programs are responsive to the concerns we heard. We expect to continue such engagement in the future.

2017 COMPENSATION DECISIONS

For 2017, we returned to historic base salaries and incentive opportunities that were effective prior to our reorganization in 2016 and we implemented a multi-metric performance scorecard comprised of important drivers of value creation for each of the annual incentive program and the performance share units granted under our long-term incentive program. The scorecard balanced production growth with cost reduction and capital program return goals to ensure our management team was not incentivized to pursue growth at any cost, a concern we heard among stockholders. Eliminating the incentive compensation structure the Company adopted during its chapter 11 reorganization, and the absence of comparable emergence equity awards from our 2017 long-term incentive program, addresses feedback we heard regarding outlier compensation levels, particularly for our CEO, in 2016. Our Compensation Committee also replaced its independent compensation consultant with Mercer Company (“Mercer”).

2018 COMPENSATION DECISIONS - GOING FORWARD

For 2018, the Compensation Committee and Board continued applying a balanced scorecard approach in establishing the annual incentive program and committed that 50% of the Company’s long-term incentive awards made later in 2018 would be performance-based. Further, in light of the departure of Mr. J. Bennett and the termination of his employment agreement, which contained minimum base salary and effective minimum bonus and long-term incentive opportunities, the Company may now recalibrate total target compensation for his successor in a way that is both competitive and more reflective of the compensation found among our peer group companies. We believe that the compensation package established for Bill Griffin, our Interim President and CEO, reflects these principles in a way that is consistent with the market for interim chief executives.

We held 7 Compensation Committee meetings during 2017 and numerous other informational update calls in addition to calls and in person meetings with stockholders. We are engaged and take our responsibilities very seriously in establishing and overseeing SandRidge’s executive compensation program.

| By the Compensation Committee of the Board: | |

| Sylvia K. Barnes, Chair | Michael L. Bennett |

6

2017 FINANCIAL AND OPERATIONAL PERFORMANCE

SandRidge Total Shareholder Return (“TSR”) outperformed its E&P peer group average in 2017. For a complete description of the Company’s 2017 peer group, see “Setting 2017 Target Compensation Levels–The Peer Group”.

| TSR PEER SHARE PRICE PERFORMANCE | Rank | TSR Peer | SORTED FY 2017 Return | Quartile | |||

|

1 | MTDR | 19 | % | |||

| 2 | SRCI | -5 | % | Q1 | |||

| 3 | ECR | -9 | % | ||||

| 4 | SD | -10 | % | ||||

| 5 | HK | -18 | % | Q2 | |||

| 6 | MPO | -21 | % | ||||

| 7 | LPI | -29 | % | ||||

| 8 | SN | -44 | % | Q3 | |||

| 9 | CRZO | -44 | % | ||||

| 10 | OAS | -47 | % | ||||

| 11 | WLL | -48 | % | Q4 | |||

| 12 | EPE | -65 | % | ||||

| 13 | JONE | -76 | % | ||||

| TSR Peer Average | -32 | % | |||||

2017 was a year of solid operating performance, delivering within, or exceeding our production and cost guidance.

| What we said we would do1 |

What we did2 | How we did it | ||||

|

4.0 - 4.2 |

|

|

4.2 MMBbls |

Increased production guidance Q2’17 by 200 Mboe (100% liquids) due to well performance in both plays and improved the Niobrara type curve due to shallower decline; generation 3 Niobrara wells collectively outperformed improved type curve by 8%; minimized Midcontinent downtime through various preventative methods with a production deferral rate of only 5% | ||

|

14.0 - 14.7 |

|

14.9 MMBOE |

||||

| $8.00 - $9.00 Lease operating expense per BOE |

|

$6.89 |

Reduced lease operating guidance twice in 2017 (Q2’17 & Q3’17), primarily from efficiency and cost reduction gains in the Midcontinent. Centralized supervision and dispatch allowed for the reduction of associated headcount and water-hauling costs; extended artificial lift run-time and use of existing equipment reduced workover spend; electrical initiatives resulted in lower facility maintenance costs | |||

| $4.25 - $4.50 Adjusted G&A Expense per BOE3 |

|

$5.10 |

Realized savings through intensive office and fleet cost management, reduced consulting spend and project timing, and favorable legal outcomes | |||

|

$3.72 |

| 1 |

As detailed under “2017 Capital Expenditure and Operational Guidance” in the Company’s press release titled, “SandRidge Energy, Inc. Reports Financial and Operational Results for Fourth Quarter and the Full Year of 2016” issued February 22, 2017. |

| 2 |

As detailed under “2017 Actual Results v. 2017 Capital Expenditure and Operational Guidance” in the Company’s press release titled, “SandRidge Energy, Inc. Reports Financial and Operational Results for Fourth Quarter and Full Year of 2017” issued February 21, 2018. |

| 3 | Adjusted G&A expense is a non-GAAP financial measure. The Company has defined this measure and reconciled to the most directly comparable GAAP financial measure in the attached Exhibit 99.4 to this Report. |

7

Safety, capital program return, balance sheet initiatives and acquisition and divestiture activity improved SandRidge’s competitiveness in 2017

|

14.7 MMBOE TRIR of 0.40 MVIR of 1.46 |

|

$264 million Refinanced non-conforming credit facility with onerous covenants to a conforming credit facility with increased borrowing base $9 million savings in Non-D&C workover capex, reduced by 24% |

|

Acquired NW STACK $200 Million |

STOCKHOLDER ENGAGEMENT AND ADVISORY VOTE ON COMPENSATION

Investor Outreach

How we engage with our investors

Both the Compensation Committee and the full Board value the input and feedback received from our stockholders, and we view our stockholder outreach efforts as an important part of our compensation setting process. Beginning in 2017 and continuing into the first quarter of 2018, the Board has supplemented management’s investor outreach with its own extensive engagement to directly solicit and receive stockholder input on the Company’s business strategies, governance and executive compensation. We believe such outreach helps ensure that the issues that matter most to our stockholders are understood and considered by management and the Board. We plan to continue engagement practices adopted by the Board throughout the year.

We heard you and took action

At the 2017 annual meeting of stockholders, our executive compensation program for 2016 received the support of approximately 43% of the votes cast. Acknowledging our vote result, and in line with our commitment to ongoing stockholder engagement, during the fall of 2017, we solicited feedback from our largest stockholders representing approximately 60% of the Company’s outstanding common stock. We held conversations with holders representing greater than 40% of shares then outstanding as well as prominent proxy advisory firms Institutional Stockholder Services and Glass Lewis.

8

While we were not satisfied with the outcome of our 2017 advisory Say-on-Pay vote, we view it as an opportunity to continue to engage with stockholders, evaluate their input, and improve our pay programs and policies. The following timeline of key events reflects the Company’s strong engagement with its stockholders:

9

Stockholders were generally supportive of our outreach and our 2017 compensation programs and approach, as we described them. These were some key themes expressed by our stockholders:

| What we heard | What we did for 2017 | What we are doing for 2018 | ||

|

2016 compensation was too high. |

✓The Company returned to a compensation program consisting of base salary, performance-based annual incentive and a combination of time- and performance-based long-term incentive compensation at historic target levels.

✓The salary for the Company’s CEO returned to the minimum prescribed by his employment agreement and his total direct compensation for 2017 was less than 40% of that in 2016.

|

→The Compensation Committee, in consultation with its independent compensation consultant, has set interim CEO compensation at a competitive level considering relevant market data.

→Going forward, Mr. J. Bennett’s departure permits the Company to recalibrate total target compensation for his successor in a way that is both competitive and more reflective of the compensation found among our peer group companies.

| ||

| Metrics that incentivize growth for growth’s sake are inappropriate. We heard concerns that production growth and reserves growth goals may provide perverse incentives, which could be mitigated if balanced with other metrics. |

✓The Company adopted a balanced scorecard approach in our 2017 annual incentive program. Our Capital Program Return (25%), Per Unit Adjusted Operating Cost (25%) and qualitative (25%) metrics ensure that we are not solely focused on production growth (25%) at any expense.

✓The Compensation Committee determined to use a discretionary approach to long-term incentive metrics relating to earnings before interest, taxes, depreciation and amortization (“EBITDA”) growth and proved reserves growth to eliminate the potential for stale targets and allow the Board and management to make decisions based on the best outcome for the business irrespective of the impact to a specific performance measure. |

→The Company continued a balanced scorecard approach in our 2018 annual incentive program.

→Significant portions of our named executive officer compensation continue to be at risk and tied to stock price performance, which ensures that our executives remain focused on delivering value to stockholders. |

10

| What we heard | What we did for 2017 | What we are doing for 2018 | ||

| A larger proportion of the long-term incentive should be performance-based. We heard concerns regarding the weighting of our long-term incentive program, specifically that the 2016 emergence grant, which consisted of 25% performance units was insufficiently performance-based. |

→While the 2017 long-term incentive program continued with a 25% proportion of performance share units, the Compensation Committee committed that the 2018 long-term incentive program will consist of 50% performance share units when grants are made in July 2018 and incorporate three-year vesting and performance periods.

| |||

|

Single trigger equity acceleration upon a Change in Control. We heard concerns that such a provision may discourage potential buyers of the Company. |

✓Beginning in December 2017, all restricted stock awards contain double trigger vesting language. |

We are committed to continuing to evaluate this and other feedback we receive as part of our ongoing stockholder engagement process. We will continue to refine and update our compensation programs and policies to maintain continued alignment of management’s interests with those of stockholders and ensure that our programs reinforce our strong pay-for-performance philosophy.

11

2. Our Executive Compensation and Governance Principles

HOW OUR COMPENSATION PROGRAM IS ALIGNED WITH COMPANY PERFORMANCE

SandRidge’s compensation programs are driven by the following guiding principles:

| Guiding Principles | How We Meet Our Principles | |

|

Attract, motivate and retain high performing individuals that will successfully execute our strategic financial and operational priorities |

✓Provide a competitive total compensation package taking into account base salary, incentives and benefits

✓Provide a significant portion of each named executive officer’s target total direct compensation in the form of variable, performance-based compensation

✓Long-term incentives with multi-year performance and vesting periods help to retain executives

| |

|

Pay competitive levels considering a combination of market data from our peers, an individual’s duties and responsibilities, and the performance of the individual and the Company |

✓Regularly evaluate our pay programs against the competitive market of our peer group

✓Individual compensation decisions are made based on market rate, as well as individual and Company performance, time in role, scope of responsibility, leadership skills and experience

| |

|

Align compensation – both program design and levels – with stockholder interests, while rewarding long-term value creation and discouraging excessive risk taking |

✓Align our executive compensation with short-term and long-term performance of the Company

✓The annual incentive program uses a balanced approach scorecard containing strategic, financial and operational goals to encourage executives to execute on short-term goals that lead to long-term stockholder value

✓Pay programs contain a substantial proportion of long-term incentive

compensation

✓Share ownership guidelines contribute to alignment between long-term stockholder value and management decisions

✓Clawback policy provides the Board with the discretion to recover incentive compensation paid in connection with misstated financial or operating results resulting from fraud, misconduct, or a violation of Company policy

| |

|

Promote and emphasize high ethical conduct, safety and environmental stewardship |

✓Stock ownership guidelines and clawback, anti-hedging and anti-pledging policies for executive officers and directors

✓Qualitative safety and environmental goals ensure that these matters are front and center when the Company pursues its other operational goals

|

12

What We Do & What We Do Not Do

Below is a summary of executive compensation practices we have adopted, and a list of problematic pay practices that we avoid to help reinforce our compensation principles:

What We Do

| ✓ | Align compensation with stockholders’ interests – the majority of the value of our compensation programs are tied to stock price and/or Company performance |

| ✓ | Link performance incentive compensation to the achievement of pre-established goals tied to operational, financial, and strategic objectives |

| ✓ | Engage in a rigorous target-setting process for incentive plan metrics |

| ✓ | Use market data from a relevant peer group as a key input in our compensation setting process |

| ✓ | Maintain a clawback policy |

| ✓ | Apply robust stock ownership guidelines |

| ✓ | Annually perform a risk assessment of our compensation programs and policies |

| ✓ | Use an independent compensation consultant |

What We Do Not Do

| ✕ | No “single-trigger” change-of-control cash payments |

| ✕ | No tax gross-ups |

| ✕ | No excessive perquisites |

| ✕ | No hedging or pledging of Company stock |

| ✕ | No repricing of underwater stock options |

13

3. Key 2017 Compensation Program Elements

We provide our executives with a mix of compensation featuring short- and long-term pay periods, fixed and variable payment amounts tied to performance, and cash and equity-based consideration reflective of our compensation philosophy and objectives. Retirement programs and other forms of compensation are not detailed in our key compensation programs (for additional information about these programs see “2017 Executive Compensation”).

| Fixed | Variable | ||||||||

| Long-Term Incentive Program | |||||||||

| Base Salary | Annual Incentive Program | Performance Share Units (PSUs): 25% weighting |

Restricted Stock: 75% weighting | ||||||

| What? | |||||||||

| Cash | Stock | ||||||||

| When? | Annual | Annual | 2.5-year performance period (transitioning to three-year performance period beginning in 2018) | Three-tranches vesting over a 2.5-year vesting period (transitioning to three-year vesting period beginning in 2018) | |||||

| How? Measures, Weightings, & Payouts |

Market rate, as well as individual performance, time in role, scope of responsibility, leadership skills and experience |

Multi-metric performance scorecard consisting of: 75% quantitative financial and operational metrics (25% capital program return, 25% per unit adjusted operating costs, 12.5% oil production and 12.5% total production) |

Multi-metric performance scorecard consisting of:

25% relative total stockholder return (quantitative) Value delivered through long-term stock price performance |

Value delivered through long-term stock price performance upon vesting | |||||

| Why? | Attract and retain talent | Motivate executives by linking variable cash compensation to key annual performance goals tied to business strategy | Rewards sustainable performance that delivers long-term value to stockholders through the achievement of key long-term financial and operational goals tied to business strategy, drives ownership mentality and aligns the interests of executives with those of stockholders |

Promotes retention of key talent, drives ownership mentality and reinforces the link between the interest of executives and those of stockholders | |||||

14

TARGET PAY MIX

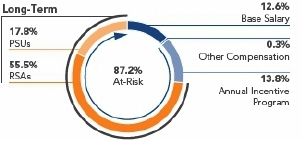

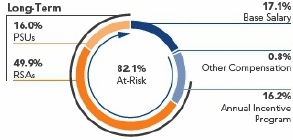

Consistent with our pay-for-performance philosophy, 87.2% of our President & CEO’s target pay package and 82.1% of the average of our other named executive officers (other than Mr. Grubert) target pay packages in 2017 were variable/at-risk and contingent upon the Company’s financial, operational, and/or share price performance. The 2017 target pay package excludes the 2016 performance unit awards, which were a component of the long-term incentive grants made in October 2016 following the Company’s emergence from Chapter 11 reorganization, but are reportable in the Summary Compensation Table in the years that they are earned.

TARGET PAY MIX

| President & CEO | Average of Other Named Executive Officers (other than Mr. Grubert) |

|

|

4. 2017 Executive Compensation

BASE SALARY

The purpose of base salary is to provide a fixed level of cash compensation for performing day-to-day responsibilities. Each named executive officer’s base salary is set considering market median data, as well as the individual’s experience, responsibilities, and performance. The employment agreements we maintain or maintained with our named executive officers establish minimum base salaries, and increases, if any, are based on the achievement of individual and Company objectives, contributions to our performance and culture, leadership accomplishments, and market data for comparable positions in our industry. As discussed further below, the employment agreements in effect at the Company’s emergence from Chapter 11 bankruptcy on October 4, 2016 were assumed pursuant to the plan of reorganization, which was approved by substantial majorities of the Company’s creditors and confirmed by the Bankruptcy Court prior to the appointment of the Company’s Board.

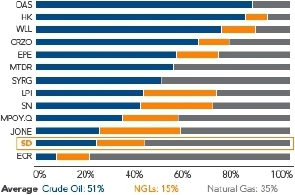

The salaries of our named executive officers have been held flat since 2015, with the exceptions of Mr. Suter’s base salary, which was increased to reflect his appointment to Executive Vice President and Chief Operating Officer in December 2016 and Mr. Grubert’s salary, which was increased in 2016 in recognition of his individual performance and the expansion of his responsibilities without commensurate base salary increases in preceding years. The 2017 base salary of each of Messrs. Bennett, Bott, Suter and Warman reflect the minimum base salary provided in his employment agreement with the Company. Based on the market analysis performed by Alvarez & Marsal North America, LLC (“A&M”), the Compensation Committee's prior independent compensation consultant, Mr. J. Bennett’s 2017 base salary exceeded the 90th percentile of the Company’s 2017 peer group companies and the base salaries of the other named executive officers were generally between the 50th and 75th percentiles of the Company’s 2017 peer group companies.

Base salaries for 2017 for our named executive officers were:

| Executive | Title | 2016 Base Salary(a) |

2017 Base Salary |

Year-over- year change | |||||||

| James D. Bennett | President and CEO | $ | 915,000 | $ | 915,000 | No change | |||||

| Julian M. Bott | Executive Vice President and Chief | $ | 425,000 | $ | 425,000 | No change | |||||

| Financial Officer | |||||||||||

| John P. Suter | Executive Vice President and Chief | $ | 350,000 | (b) | $ | 420,000 | 8.33% | (e) | |||

| Operating Officer | increase | ||||||||||

15

| Executive | Title | 2016 Base Salary(a) |

2017 Base Salary |

Year-over- year change | ||||||

| Philip T. Warman | Executive Vice President, General Counsel | $ | 375,000 | $ | 375,000 | No change | ||||

| and Corporate Secretary | ||||||||||

| Scott Griffin | Senior Vice President, People and Culture | — | (c) | $ | 250,000 | N/A | ||||

| Duane M. Grubert | Former Executive Vice President of Investor | $ | 385,000 | $ | 385,000 | (d) | No change | |||

| Relations and Strategy | ||||||||||

| (a) |

Amounts may differ slightly from the actual base salaries realized during that year as detailed in the Summary Compensation Table for 2016 due to the misalignment of compensation earned versus the pay periods during the calendar year. |

| (b) |

Mr. Suter was appointed Executive Vice President and Chief Operating Officer effective December 1, 2016. This figure reflects his base salary prior to his promotion. |

| (c) |

Mr. S. Griffin was a named executive officer for the first time in 2017. |

| (d) |

Mr. Grubert departed the company effective in July of 2017. This figure reflects his pre-departure annualized base salary. |

| (e) |

The change in salary for Mr. Suter reflects an increase in his base salary upon his appointment as Executive Vice President and Chief Operating Officer. |

16

ANNUAL INCENTIVE PROGRAM2

The purpose of the annual incentive is to motivate executives by linking variable cash compensation to key annual performance goals tied to business strategy. In February 2017, the Compensation Committee adopted baseline hurdle of $50 million in Adjusted EBITDA and established the following metrics, weightings, and goals for our 2017 annual incentive program. These goals tie to our strategic objectives and reflect a balanced scorecard approach to assessing performance. In February 2018, having exceeded the baseline hurdle with Adjusted EBITDA of $193 million, the Board approved annual incentive program payouts of 116% of target based on its assessment of the Company’s performance in 2017.

The following chart shows the metrics, weightings and goals chosen by the Compensation Committee for 2017 and our performance against such metrics.

| Metric | Link to Business Strategy | Weighting | Threshold | Target | Maximum | Result | Weighting Score | |||||||

|

Capital Program Return(1) |

Efficient and effective allocation of capital combined with strong operational performance |

|

|

17.46% |

15.9% | |||||||||

|

Per Unit Adjusted Operating Cost(2) |

Achievement of production targets while operating efficiently and minimizing unnecessary costs |

|

|

$11.28/BOE |

50.0% | |||||||||

|

Oil Production(3) |

Driver of revenue and growth |

|

|

4.16 MMBBL |

13.3% | |||||||||

|

Total Production(4) |

Driver of revenue and growth |

|

|

14.91 MMBOE |

13.9% | |||||||||

|

Strategic and Operational Goals |

Qualitative assessment of various other key operational and strategic value drivers |

|

In consideration of the Company’s achievements in safety and improved capital structure and resource base as well as neutral performance respecting other matters. |

|

23% | |||||||||

| TOTAL: |

116% | |||||||||||||

| (1) |

The capital program return metric equals the weighted average internal rate of return of the 2017 drilling and completion capital program together with certain other capital costs, such as facilities infrastructure construction costs and 3D seismic studies. The IRR calculation reflects actual production and realized pricing for 2017 and forecasted production, pricing and cost assumptions consistent with applicable type curves. |

| (2) |

Per Unit Adjusted Operating Costs G&A expense is a non-GAAP financial measure. The Company has defined this measure and reconciled to the most directly comparable GAAP financial measure in the attached Exhibit 99.4 to this Report. |

| (3) |

Oil Production equals total oil production (excludes NGLs) for 2017, expressed in barrels. |

| (4) |

Total Production equals total production for 2017, expressed in (“BOE”) with Oil and NGLs in barrels, and gas at a 6:1 equivalent ratio. |

17

In February 2017, the Compensation Committee considered our compensation principles and relevant market data and determined to establish target opportunities for each of our named executive officers that were unchanged from 2016.

Based on the market analysis performed by A&M for the Compensation Committee, Mr. J. Bennett’s 2017 target bonus as a percentage of base salary was between the 50th and 75th percentiles of the Company’s 2017 peer group companies and the 2017 target bonus as a percentage of base salary for the other named executive officers ranged from the 25th percentile to the 90th percentile of the Company’s 2017 peer group companies.

The following formula was used to calculate the payment to be awarded to a named executive officer under 2017 annual incentive program:

| Target Bonus (% of Base Salary) |

➔ | Target Bonus ($) | ✕ | Actual Performance (% of Target) |

= | Final Payout |

Based on the Company’s performance relative to the metrics outlined above, the final calculation and amounts paid to our named executive officers for 2017 performance were:

| Name | Target Bonus (% of Base Salary) |

➔ | Target Bonus ($) |

✕ | Actual Performance (% of Target) |

= | Final Payout(1) | ||||||||||

| James D. Bennett | 110 | % | $ | 1,006,500 | 116% | $ | 0 | ||||||||||

| Julian M. Bott | 90 | % | $ | 382,500 | $ | 0 | |||||||||||

| John P. Suter | 100 | % | $ | 420,000 | $ | 487,200 | |||||||||||

| Philip T. Warman | 75 | % | $ | 281,250 | $ | 326,250 | |||||||||||

| Scott Griffin | 65 | % | $ | 162,500 | $ | 188,500 | |||||||||||

| Duane M. Grubert | 90 | % | $ | 346,500 | $ | 0 | |||||||||||

| (1) |

The employment of each of Messrs. J. Bennett, Bott and Grubert was terminated prior to the day on which amounts due under the 2017 annual incentive program were paid out, and they did not receive a payment under the 2017 Annual Incentive Program. |

2017 TRANCHE OF EMERGENCE PERFORMANCE UNITS

Variable Cash-Settled Units

The performance unit awards motivate our executive officers to achieve future annual business objectives that drive long-term performance. The performance unit awards were a component of the long-term incentive grants made in October 2016 following the Company’s emergence from Chapter 11 reorganization and are reportable in the Summary Compensation Table in the years that they are earned. The performance unit awards vest in one-third increments on each of December 31, 2017, 2018 and 2019 and payments are made based on the Company’s performance relative to the metrics established in each year’s annual incentive scorecard.

The first tranche, for which right to payment vested on December 31, 2017, was paid based on the company’s 2017 annual incentive plan performance scorecard.

| Name | Performance Units (vested on 12/31/17) |

➔ | $100 / Unit ($s) |

✕ | Actual Performance (% of Target) |

= | Final Payout | |||||||||

| James D. Bennett | 8,750 | $ | 100 | 116% | $ | 1,015,000 | ||||||||||

| Julian M. Bott | 3,083 | $ | 100 | $ | 357,628 | |||||||||||

| John P. Suter | 1,667 | $ | 100 | $ | 193,372 | |||||||||||

| Philip T. Warman | 1,250 | $ | 100 | $ | 145,000 | |||||||||||

| Scott Griffin | 1,250 | $ | 100 | $ | 145,000 | |||||||||||

| Duane M. Grubert | 1,667 | $ | 100 | $ | 193,372 | |||||||||||

18

LONG-TERM INCENTIVE (“LTI”) PROGRAM

The purpose of long-term incentives is to align executives’ compensation with interests of stockholders, encourage retention, and reward long-term operational and financial performance. For 2017, we granted long-term incentive awards consisting of 25% stock-settled performance share units and 75% time-based restricted stock awards. We changed the timing of our annual long-term incentive grants from February to July to incentivize mid-year retention, to distribute the Compensation Committee’s workload more evenly throughout the year and to permit the incorporation of additional stockholder feedback and say-on-pay results into the current year’s long-term incentive compensation program. Due to this transition, the 2017 performance share units have a performance period of 2.5 years (January 2017 to June 2019) and the restricted stock awards have a 2.5 year vesting period. We expect that in future years, our long-term incentive grants will have a three-year performance and/or vesting period.

In February 2017, the Compensation Committee considered our compensation principles and relevant market data and determined to establish target opportunities for each of our named executive officers that were unchanged from 2016.

Based on the market analysis performed by A&M for the Compensation Committee, Mr. J. Bennett’s target 2017 long-term incentive awards were between the 75th and 90th percentiles of the Company’s 2017 peer group companies and the target 2017 long-term incentive awards for the other named executive officers ranged from less than the 25th percentile to the 75th percentile of the Company’s 2017 peer group companies. The following table reflects the target 2017 long-term incentive awards expressed as a percentage of base salary and the individual and aggregate grant date fair values of the 2017 long-term incentive awards:

| Name | Target LTI (% of Base Salary) |

Target PSU Value (25% Weighting) |

Target RSA Value (75% Weighting) |

Aggregate Target LTI ($ Value)(1) | ||||||||

| James D. Bennett | 588 | % | $ | 1,293,741 | $ | 4,035,133 | $ | 5,328,874 | ||||

| Julian M. Bott | 350 | % | $ | 357,678 | $ | 1,115,619 | $ | 1,473,297 | ||||

| John P. Suter | 360 | % | $ | 363,581 | $ | 1,133,992 | $ | 1,497,573 | ||||

| Philip T. Warman | 150 | % | $ | 135,260 | $ | 421,870 | $ | 557,130 | ||||

| Scott Griffin | 125 | % | $ | 75,136 | $ | 234,366 | $ | 309,502 | ||||

| Duane M. Grubert | 243 | % | $ | 224,961 | $ | 701,643 | $ | 926,604 | ||||

| (1) |

The grant date fair value of the long-term incentive awards for each named executive officer is slightly less than the target long-term incentive expressed as a percentage of his base salary because the Company determined the number of performance share units awarded based on the closing price of the Company’s common stock on the grant date rather than based on the grant date fair value calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation. |

See “Executive Compensation Tables” for the Grants of Plan-based Awards Table.

Performance Share Units (PSUs)

In February 2017, we granted stock-settled performance share units to our named executive officers. The Compensation Committee selected one quantitative goal of relative TSR and three discretionary financial and operational goals including relative adjusted EBITDA growth, proved reserves growth and per unit adjusted operating costs. The Compensation Committee determined to use a discretionary approach to measuring Company performance against the latter three performance measures to eliminate the potential for stale targets, minimize potential competing influence of different performance periods, ease the application of results from merger and acquisition activity and allow the Board and management to make decisions based on the best outcome for the business irrespective of the impact to a specific performance measure. The two relative metrics – relative TSR and relative adjusted EBITDA growth – performance will be measured against the Company’s 2017 peer group described on below.

The ultimate value realized by our named executive officers at the end of the performance period, which runs from January 1, 2017 through June 30, 2019 will be contingent upon both SandRidge’s performance against these goals and the Company’s stock price. PSUs are also subject to a time-vesting requirement, which generally requires a participant to remain employed by the Company through the end of the performance period.

19

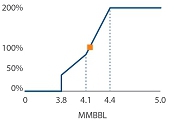

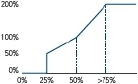

| Metric | Link to Business Strategy | Weighting | Threshold | Target | Maximum | |||||

|

Quantitative: Relative TSR |

Competitive stock price appreciation and value creation |

|

| |||||||

|

Discretionary: Relative Adjusted EBITDA Growth(1) |

Operational effectiveness and profitability |

|

||||||||

|

Proved Reserves Growth |

Increase the amount of high-quality proven assets to drive future production growth and value creation |

|||||||||

|

Per Unit Adjusted Operating Cost(2) |

Achievement of production targets while operating efficiently and minimizing unnecessary costs |

|||||||||

| (1) |

Relative Adjusted EBITDA is a non-GAAP financial measure. The Company has defined this measure in the attached Exhibit 99.4 to this Report. |

| (2) |

Per Unit Adjusted Operating Costs is a non-GAAP financial measure. The Company has defined this measure in the attached Exhibit 99.4 to this Report. |

Restricted Stock Awards

In February 2017, we granted restricted stock to our named executive officers. These awards vest ratably on each of June 30, 2017, 2018, and 2019 and help motivate and retain executives and provide stability to the compensation programs. The ultimate value realized by our named executive officers at the time of vesting will be contingent upon SandRidge’s stock price, thus providing further alignment with stockholders.

OTHER COMPENSATION MATTERS

Health and Welfare Benefits

Our named executive officers were eligible to participate in medical, dental, vision, disability and life insurance to meet their health and welfare needs. These benefits are provided to assure that we are able to maintain a competitive position in terms of attracting and retaining officers and other employees. This is a fixed component of compensation and the benefits are provided on a nondiscriminatory basis to all of our employees.

Limited Perquisites and Other Personal Benefits

We believe that the total mix of compensation and benefits provided to our named executive officers is competitive and, generally, perquisites should not play a large role in our executive officers’ total compensation. As a result, the perquisites and other personal benefits we provide to our executive officers are limited.

401(k) Plan

We maintain a 401(k) retirement plan for the benefit of all of our executive officers and employees on a non-discriminatory basis. Under the plan, eligible employees may elect to defer a portion of their earnings up to the annual maximum allowed by regulations promulgated by the Internal Revenue Service. Beginning in 2017, the aggregate matching contribution available to our 401(k) retirement plan participants equals 100% of the first 10% of deferred base salary (exclusive of incentive compensation). In 2017, we made matching contributions equal to 100% on the first 10% of employee deferred base salary (exclusive of incentive compensation). Matching contributions are made in investment vehicles selected by each employee from a variety of options.

20

Nonqualified Deferred Compensation Plan

Previously, we maintained a nonqualified deferred compensation plan (“NQDC Plan”) to provide our named executive officers and other eligible employees flexibility for meeting their future income needs and assisting them in their retirement planning. Under the terms of the NQDC Plan, eligible employees were provided the opportunity to defer income in excess of the Internal Revenue Service annual limitations on qualified 401(k) retirement plans.

Under the NQDC Plan, we made discretionary contributions to the deferred compensation account of each participant. The Board approved matching contributions for the NQDC Plan equal to 100% of employee contributions up to 10% of the employee’s annual cash compensation minus any matching contributions made under the 401(k) retirement plan.

In December 2016, we initiated termination of the NQDC Plan, following which no additional deferrals were permitted into the NQDC Plan. Active employee balances were distributed in January 2018.

5. Process for Determining 2017 Executive Compensation

COMPENSATION SETTING APPROACH

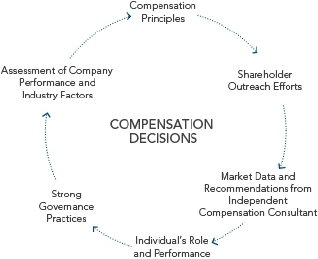

Our approach to setting compensation programs and levels for our named executive officers involves a comprehensive process reflecting the input and consideration of numerous factors.

INDEPENDENT COMPENSATION GOVERNANCE

Independent members of our Board and the Compensation Committee seek input from our CEO and other members of our management team as well as input and advice from the Compensation Committee’s independent compensation consultant to ensure our compensation principles and all information relevant to individual compensation decisions are taken into account in setting executive compensation programs and levels. The following summary sets forth the responsibilities of various parties in connection with the implementation of our compensation programs.

21

| Role | President and CEO |

Management | Independent Compensation Consultant |

Compensation Committee |

Independent Members of Board of Directors | |||||

| Peer Group / Market Data and Best Practices for Compensation Design and Decisions | Reviews | Reviews | Develops | Recommends | Approves | |||||

| Annual Named Executive Officer Target Compensation | Recommends | — | Reviews / Advises | Approves | Ratifies | |||||

| Annual CEO Target Compensation | — | — | Reviews / Advises | Approves | Ratifies | |||||

| Annual and Long-Term Incentive Measures and Performance Targets | Reviews | Develops | Reviews / Advises | Approves | Ratifies | |||||

| Performance Results | Reviews | Develops | Reviews / Advises | Evaluates | Approves | |||||

| Long-Term Incentive Grants to non-executives, Dilution, Burn Rate | Reviews and approves | Develops | Reviews / Advises | Approves | — | |||||

| CD&A Disclosure | Reviews | Develops | Reviews / Advises | Recommends | Approves | |||||

| Say on Pay Result | — | — | Reviews / Advises | Reviews / Recommends | — |

The following describes the roles of the key participants in the compensation-setting process:

Independent Compensation Committee

The Compensation Committee is composed of two non-employee independent directors. The Compensation Committee’s duties in administering the executive compensation programs include the following:

| ● |

Reviewing, evaluating, and approving the Company’s corporate goals and objectives relevant to the compensation of the Company’s CEO and the Company’s other executive officers, as well as other members of the Company’s senior management on an annual basis and making adjustments as it deems appropriate |

| ● |

Evaluating the performance of the Company’s CEO and, in consultation with the CEO, the Company’s other executive officers and other members of the Company’s senior management in light of those goals and objectives |

| ● |

Regularly reviewing and approving the annual total compensation paid to executive officers and other members of senior management |

The Compensation Committee reviews the components of our executive officer compensation program on an annual basis and approves adjustments as it deems appropriate. On an annual basis, the Compensation Committee reviews and makes recommendations to the Board with respect to incentive compensation and equity-based plans that are subject to the Board’s approval.

Management Team

Our CEO (other than for himself) and the head of our People and Culture Department work with the Compensation Committee in establishing compensation levels and performance targets. Our CEO is responsible for reviewing the compensation and performance of executive officers other than himself and making recommendations to the Compensation Committee for adjustments to the annual total compensation of his direct reports. Final compensation determinations are made by the Compensation Committee or, from time to time, the Board. The Company’s People and Culture and Legal departments provide support in the preparation of materials and execution of the Compensation Committee’s responsibilities.

Stockholders and Other Key Stakeholders

The Company and the Compensation Committee value stockholders’ input and consider such input in establishing the type and level of compensation for our executives and setting performance metrics and targets. For more detail, see “Stockholder Engagement and Advisory Vote on Compensation” above. The Company has held advisory votes on named executive officer compensation at each of its annual meetings of stockholders beginning in 2014. At our 2017 annual meeting, our stockholders approved holding our Say-on-Pay vote annually.

22

Independent Compensation Consultant

To facilitate the formulation and administration of our compensation programs, the Compensation Committee continued the engagement of its prior independent compensation consultant, A&M through the fall of 2017, at which point, the Compensation Committee determined to retain Mercer as its independent compensation consultant. In general, A&M provided, and Mercer currently provides, executive and director compensation consulting services to the Compensation Committee, including information and market practices regarding compensation program designs and pay levels, regulatory updates and analyses, and related trends.

In general, at the direction of the Compensation Committee, the compensation consultant attends committee meetings, meets with the Compensation Committee in executive session, and provides advice and expertise on executive and director compensation programs and plan designs. The compensation consultant reports directly to, and takes its charge from, the Compensation Committee on executive compensation matters. Interactions between the compensation consultant and management are generally limited to discussions on behalf of the Compensation Committee or as required to compile information at the Compensation Committee’s direction.

During 2017, A&M also served as restructuring advisor in connection with the Company’s Chapter 11 reorganization. Accordingly, in 2017, the Company purchased $238,984 in non-compensation-related services in connection with the Company’s restructuring in addition to $237,054 in compensation-related services. During 2017, Mercer did not provide any non-compensation-related services to the Company.

The Compensation Committee reviewed the independence of A&M and Mercer pursuant to the requirements approved and adopted by the SEC and the NYSE and determined each is independent from management and that their engagement does not raise a conflict of interest.

Peer Group and Competitive Data

The Compensation Committee generally uses a peer group to compare the competitiveness of the Company’s executive compensation and to evaluate the Company’s performance. The Company updated its peer group for 2017, as detailed below.

SETTING 2017 TARGET COMPENSATION LEVELS

The Peer Group

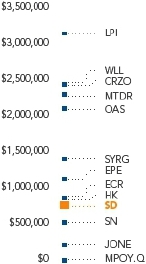

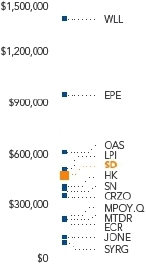

For 2017, to assist with setting executive compensation levels, evaluating compensation programs and assessing performance relative to 2017 performance goals, the Board approved a new peer group of 12 companies operating in the oil and gas exploration and production industry based on the recommendation of the Compensation Committee and A&M, its independent compensation consultant at the time, and with input from management. In establishing the peer group, the Compensation Committee primarily considered industry, annual revenue, asset similarity, and market capitalization.

23

The 2017 peer group was comprised of the following companies:

| MARKET CAPITALIZATION as of 9/30/2016 |

REVENUE as of 9/30/2016 (LTM) |

ASSETS as of 9/30/2016 | ||

|

|

|

| REVENUE SOURCE | RESERVES | |

|

|

| MPOY.Q | Midstates Petroleum Company Inc. | Oasis Petroleum Inc. |

| |||

| JONE | Jones Energy, Inc. | Matador Resources Company | ||||

| SN | Sanchez Energy Corporation | Carrizo Oil & Gas Inc. | ||||

| HK | Halcón Resources Corporation | Whiting Petroleum Corp. | ||||

| ECR | Eclipse Resources Corporation | Laredo Petroleum, Inc. | ||||

| EPE | EP Energy Corporation | SandRidge Energy, Inc. | ||||

| SYRG | Synergy Resources Corporation |

Employment Agreements

We currently maintain, or maintained, during their employment with the Company, employment agreements with our named executive officers, the material terms of which are described throughout this CD&A. The employment agreements in effect at the Company’s emergence from Chapter 11 bankruptcy on October 4, 2016 were assumed pursuant to the Plan of Reorganization, which was approved by substantial majorities of the Company’s creditors and confirmed by the Bankruptcy Court prior to the appointment of the Company’s Board. As previously described herein, the employment of Messrs. J. Bennett, Bott and S. Griffin terminated effective as of February 8, 2018, February 22, 2018, and March 1, 2018 respectively. As such, the discussion of the terms of their employment agreements herein reflects the terms of their employment agreements prior to their termination of employment.

24

The Company’s employment agreements, which have evergreen terms, provide, or provided, in respect of Messrs. J. Bennett, Bott and S. Griffin, for (i) an annual base salary of not less than $915,000 for Mr. J. Bennett, $425,000 for Mr. Bott, $420,000 for Mr. Suter, $225,000 for Mr. S. Griffin, $375,000 for Mr. Warman and $350,000 for Mr. Grubert; (ii) eligibility to participate in the annual incentive program; (iii) eligibility for equity awards under the Company’s incentive plan; and (iv) health and other employee benefits that are generally available to our employees.

In addition, the employment agreements include, or included, in respect of Messrs. J. Bennett, Bott and S. Griffin, provisions governing the payment of severance benefits payable to the named executive officers upon the occurrence of specified events, such as termination of their employment without cause or termination or resignation for good reason following a Change in Control of the Company. The employment agreements between us and our named executive officers and the related severance provisions are designed to meet the following objectives:

| ● | Change in Control. In certain scenarios, the potential to merge with or be acquired by another company may be in the best interest of our stockholders. We have agreed to provide severance compensation to our named executive officers if employment is terminated without cause or the executive resigns with good reason following a change in control transaction in recognition of the fact that our named executive officers may take actions in the best interest of our stockholders that ultimately lead to their departure from the Company. The Company’s emergence from Chapter 11 reorganization constituted a change in control under the terms of each outstanding employment agreement, which means that the terminations of each of Messrs. J. Bennett, Bott, S. Griffin and Grubert entitled him to Change in Control severance benefits. Mr. Warman will remain in a Change in Control period until October 4, 2018, during which time he will be entitled to Change in Control severance benefits in the event of his termination. Mr. Suter’s employment agreement with the Company, effective December 2016, is not currently in a Change in Control period. |

| ● | Termination without Cause. If we terminate any of our named executive officers’ employment without cause, we will pay certain compensation and other benefits to the terminated individual. We believe this arrangement is appropriate because it is consistent with the triggering events and associated payments found in employment agreements of companies that we compete against for executive-level talent. We also believe it is beneficial for us and our named executive officers to have a mutually agreed upon severance package in place prior to any termination event, which we believe provides us with more flexibility to make a change in senior management if such a change is in our and our stockholders’ best interest. |

The terms of our equity compensation plan also govern the payments and benefits named executive officers are entitled to in these situations. For a description of these payments, please read “—Potential Payments Upon Termination or Change in Control” below.

6. Actions Related to 2018 Executive Compensation

DEPARTURE OF PRESIDENT AND CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER