Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - RSP Permian, Inc. | d580186dex314.htm |

| EX-31.3 - EX-31.3 - RSP Permian, Inc. | d580186dex313.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36264

RSP Permian, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 90-1022997 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

|

3141 Hood Street, Suite 500 Dallas, Texas |

75219 | |

| (Address of principal executive offices) | (Zip code) |

(214) 252-2700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer | ☐ | ||

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | ||

| Emerging growth company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates computed by reference to the price at which the common shares were last sold on the New York Stock Exchange as of June 30, 2017, was approximately $4.3 billion. In making the calculation, the registrant has assumed without adjusting for any other purpose, that all of its employees, directors, and entities controlled by or under common control with them, and no other parties, are affiliates.

The registrant had 159,424,148 shares of common stock outstanding at April 16, 2018.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

Table of Contents

EXPLANATORY NOTE

The purpose of this Amendment No. 1 to the Annual Report on Form 10-K of RSP Permian, Inc. for the fiscal year ended December 31, 2017, filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 27, 2018 (the “Original Report” and together with this Amendment No. 1, this “Report”), is to amend Part III, Items 10 through 14 of the Original Report to include information previously omitted from the Original Report in reliance on General Instructions G to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy statement filed with the SEC within 120 days after the end of the fiscal year.

We are also amending Part IV, Item 15 of the Original Report to include certain exhibits to be filed with this Amendment No. 1 to the Original Report.

As previously announced, on March 27, 2018, the Company entered into an Agreement and Plan of Merger with Concho Resources Inc. (“Concho”), a Delaware corporation, and Green Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of Concho (“Merger Sub”), pursuant to which Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Concho. In light of the Merger, the Company agreed to postpone its annual meeting of stockholders during the pendency of the Merger, and thus, will not file and mail a definitive proxy statement for an annual meeting of stockholders prior to the end of the 120-day period referenced above.

Except as described above, this Amendment No. 1 to the Original Report does not amend, update or change any other items or disclosures in the Original Report and does not purport to reflect information or events subsequent to the filing thereof. Among other things, forward-looking statements made in the Original Report have not been revised to reflect events, results or developments that have occurred or facts that have become known to us after the date of the Original Report (other than as discussed above), and such forward-looking statements should be read in their historical context. Accordingly, this Amendment No. 1 to the Original Report should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Report.

Unless the context otherwise indicates, references to “RSP,” “our company,” “the Company,” “us,” “we” and “our” refer to RSP Permian, Inc. and its consolidated subsidiaries.

Table of Contents

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 1 | ||||

| ITEM 11. |

EXECUTIVE COMPENSATION | 7 | ||||

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 32 | ||||

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 35 | ||||

| ITEM 14. |

PRINCIPAL ACCOUNTING FEES AND SERVICES | 38 | ||||

| ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 39 | ||||

| ITEM 16. |

FORM 10-K SUMMARY | 42 | ||||

i

Table of Contents

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Members of the Board of Directors

Set forth below is the name, age, position and a brief description of the business experience during at least the past five years of each of the members of our Board of Directors, as well as specific qualifications, attributes and skills of such member that were identified by the Nominating and Corporate Governance Committee when such member was nominated to serve on the Board of Directors. There are no family relationships among any of the directors or executive officers of the Company.

| Name |

Age | Position | ||

| Kenneth V. Huseman |

65 | Director | ||

| Michael W. Wallace |

54 | Director | ||

| Joseph B. Armes |

56 | Director | ||

| Matthew S. Ramsey |

63 | Director | ||

| Steven Gray |

58 | Director and Chief Executive Officer | ||

| Michael Grimm |

63 | Chairman of the Board | ||

| Scott McNeill |

46 | Director and Chief Financial Officer |

Kenneth V. Huseman, Director, has served as a member of our Board of Directors since May 2015. Mr. Huseman served as a director of Basic Energy Services (“Basic”), a publicly-traded oilfield services company, from 1999 until 2016, and is self-employed in real estate investment and ranching. He previously served as Basic’s President and Chief Executive Officer from 1999 until September 2013. Prior to joining Basic, he was employed in management positions with various energy services companies from 1978 until 1999. Mr. Huseman also previously served as a director of Natural Gas Services Group, Inc. from June 2011 until February 2013. Mr. Huseman is the President and majority owner of Huseman Logistics, Inc., a partner of Mecedora Ranches, LLC and the Managing Partner of Kenneth Huseman Family Partnership, LP and Permian International Energy Services, LLC. Mr. Huseman received a B.B.A. in Accounting from Texas Tech University.

Mr. Huseman has significant experience in the oil and gas industry, including as an executive officer in various positions and a director of oil and gas service companies, and has broad knowledge of the oil and gas industry. We believe his background and skill set enable Mr. Huseman to provide the Board of Directors with executive counsel on a full range of business, strategic and professional matters.

Michael W. Wallace, Director, has served as a member of our Board of Directors since January 2014. Since 2011 Mr. Wallace has been a partner and manager of Wallace Family Partnership, LP (“Wallace LP”), which holds non-operated working interests in oil and gas leases, midstream assets and other investments. Since 2009, Mr. Wallace has also served as the President, director and manager of High Sky Partners LLC, a Midland, Texas-based oil and gas company with operations in the Spraberry Trend of the Permian Basin. From 2007 to 2011, Mr. Wallace was a member and Executive Vice President of Production for Patriot Resource Partners LLC. In 2004, Mr. Wallace founded Flying W Resources, L.L.C., an independent oil and gas production company. In addition, Mr. Wallace served in a variety of technical and managerial roles within Conoco Inc. and ConocoPhillips Company from 2001 to 2004. Prior to joining Conoco Inc., Mr. Wallace served in a variety of roles within Burlington Resources Inc. Mr. Wallace received a B.S. in Petroleum Engineering from Texas Tech University and is a member of the Society of Petroleum Engineers.

Mr. Wallace has significant experience as an independent oil and gas producer and as an executive officer in various positions of oil and gas companies and has broad knowledge of the oil and gas industry. We believe his background and skill set, including that he is a petroleum engineer, enable Mr. Wallace to provide the Board of Directors with executive counsel on a full range of business, strategic and professional matters.

Joseph B. Armes, Director, has served as a member of our Board of Directors since December 2013. Since January 2014, Mr. Armes has been the Chairman of the Board of Capital Southwest Corporation (“CSWC”), a publicly traded investment company. In addition, since September 2015, Mr. Armes has served as Chairman of the Board and Chief Executive Officer of CSW Industrials, Inc., a publicly-traded diversified industrial growth

1

Table of Contents

company. Mr. Armes served as Chief Executive Officer and President of CSWC from June 2013 to September 2015. Since 2010, Mr. Armes served as President and Chief Executive Officer of JBA Investment Partners, a family investment vehicle. From 2005 to 2010, Mr. Armes served as Chief Operating Officer of Hicks Holdings, LLC. Prior to 2005, Mr. Armes served as Executive Vice President and General Counsel and later as Chief Financial Officer of Hicks Sports Group, LLC, as Executive Vice President and General Counsel of Suiza Foods Corporation (now Dean Foods Company) and Vice President and General Counsel of The Morningstar Group Inc. Rangers Equity Holdings GP LLC, a subsidiary of Hicks Sports Group LLC, had an involuntary bankruptcy filed against it in the U.S. Bankruptcy Court for the Northern District of Texas on May 28, 2010. Mr. Armes received a B.B.A. in Finance and an M.B.A. from Baylor University and a J.D. from Southern Methodist University.

Mr. Armes has significant experience as an executive officer and director in a variety of public companies and an extensive background in strategic investing. We believe his background and skill set make Mr. Armes well-suited to serve as a member of the Board of Directors.

Matthew S. Ramsey, Director, has served as a member of our Board of Directors since January 2014. Since November 2015, Mr. Ramsey has served as a director and the President and Chief Operating Officer of the general partner of Energy Transfer Partners, L.P., a publicly-traded master limited partnership owning and operating one of the largest and most diversified portfolios of energy assets in the United States. In April 2015, Mr. Ramsey was appointed as the Chairman of the Board of the general partner of Sunoco, L.P., having been previously appointed to the board in August 2014. Since July 2012, Mr. Ramsey has served as a member of the board of directors of the general partner of Energy Transfer Equity, L.P., and as a member of its audit and compensation committees. Since November 2016, Mr. Ramsey has served as Chairman of the board of directors, President and Chief Operations Officer of PennTex Midstream GP, LLC. From 2000 until November 2015, Mr. Ramsey served RPM Exploration, Ltd., a private oil and gas exploration limited partnership generating and drilling 3-D seismic prospects on the Gulf Coast of Texas, as President and a member of the board of directors of its general partner, Ramsey, Pawelek & Maloy, Inc. From March 2012 to July 2012, Mr. Ramsey served as a member of the board of directors of Southern Union Company. Currently, Mr. Ramsey also serves as President of Ramsey Energy Management, LLC, the general partner of Ramsey Energy Partners, I, Ltd., a private oil and gas partnership; President of Dollarhide Management, LLC, the general partner of Deerwood Investments, Ltd., a private oil and gas partnership; President of Gateshead Oil, LLC, a private oil and gas partnership; and Manager of MSR Energy, LLC, the general partner of Shafter Lake Energy Partners, Ltd., a private oil and gas partnership. Previously, Mr. Ramsey served as President of DDD Energy, Inc. from 2001 until its sale in 2002; President, Chief Executive Officer and a member of the board of directors of OEC Compression Corporation, a publicly-traded oil field service company, from 1996 to 2000; and Vice President of Nuevo Energy Company, an independent energy company, from 1991 to 1996. Additionally, from 1990 to 1996, he was employed by Torch Energy Advisors, Inc., a company providing management and operations services to energy companies, where he last served as Executive Vice President. Mr. Ramsey holds a B.B.A. in Marketing from the University of Texas at Austin and a J.D. from South Texas College of Law. Mr. Ramsey is a graduate of the Harvard Business School Advanced Management Program.

Mr. Ramsey has significant experience as an executive officer and director in a variety of oil and gas companies and has broad knowledge of the oil and gas industry. We believe his background and skill set make Mr. Ramsey well-suited to serve as a member of the Board of Directors.

Steven Gray, Director and Chief Executive Officer, co-founded RSP Permian, L.L.C. in 2010. He has served as our Chief Executive Officer and as a member of our Board of Directors since our formation and served RSP Permian, L.L.C. as Co-Chief Executive Officer from its inception until our IPO and as Chief Executive Officer of RSP Permian, L.L.C. since our IPO. In 2006, Mr. Gray co-founded Pecos Operating Company, LLC, an oil and natural gas exploration and production company with operations in the Permian Basin, with Messrs. Daugbjerg and Huck. In 2000, Mr. Gray founded Pecos Production Company, an NGP-backed oil and natural gas exploration and production company that operated in the Permian Basin until it was sold in 2005 to Chesapeake Energy Corporation. From 1993 to 2000, Mr. Gray was a Co-Founder, President and Chief Operating Officer of NGP-backed Vista Energy Resources (“Vista”). Prior to forming Vista, Mr. Gray was employed for 11 years as a petroleum engineer with various companies. He received a B.S. in Petroleum Engineering from Texas Tech University and has 35 years of experience in the oil and natural gas industry.

Mr. Gray has significant experience as a chief executive officer and chief operating officer of oil and natural gas exploration and production companies and broad knowledge of the oil and natural gas industry. We believe his

2

Table of Contents

background and skill set, including that he is a petroleum engineer, enable Mr. Gray to provide the Board of Directors with executive counsel on a full range of business, strategic and professional matters.

Michael Grimm, Chairman of the Board, co-founded RSP Permian, L.L.C. in 2010 and has served as our Chairman of the Board since our formation. Prior to being named our Chairman of the Board, Mr. Grimm served as the Co-Chief Executive Officer of RSP Permian, L.L.C. since its inception until our initial public offering. In 1995 Mr. Grimm co-founded Rising Star Energy, L.L.C. and served as its President and Chief Executive Officer and in such capacity, was involved in many acquisitions, divestitures and drilling programs in the Permian Basin. From 2001 to 2006, Rising Star Energy, L.L.C. partnered with Natural Gas Partners and operated properties in the Permian Basin and owned interests in properties in South Texas and West Texas. From 2006 to present, Mr. Grimm served as President and CEO of Rising Star Energy Development Company, L.L.C., which owned properties in the Permian Basin and Rising Star Petroleum, L.L.C., which owns properties in the Permian Basin. From 1990 to 1994, Mr. Grimm served as Vice President of Worldwide Exploration and Land for Placid Oil Company. Prior to that, Mr. Grimm was employed for 13 years in the land and exploration department for Amoco Production Company in Houston, New Orleans and Chicago. He has a B.B.A. degree from the University of Texas at Austin. Mr. Grimm has more than 42 years of experience in the oil and gas industry and currently serves as a Director for Energy Transfer Partners, L.P.

Mr. Grimm has significant experience as a chief executive of oil and natural gas exploration and production companies and broad knowledge of the oil and natural gas industry. We believe his background and skill set enable Mr. Grimm to provide the Board of Directors with executive counsel on a full range of business, strategic and professional matters.

Scott McNeill, Director and Chief Financial Officer, has served as our Chief Financial Officer since our formation and as a member of our Board of Directors since December 2013. Mr. McNeill has served RSP Permian, L.L.C. as Chief Financial Officer since April 2013. Prior to joining the company, Mr. McNeill served as a Managing Director in the energy investment banking group of Raymond James. Mr. McNeill spent 15 years as an investment banker advising a wide spectrum of companies operating in the exploration and production, midstream, and energy service and equipment segments of the energy industry. Mr. McNeill is licensed as a Certified Public Accountant. He earned a B.B.A. from Baylor University and an M.B.A. from the University of Texas at Austin.

Mr. McNeill has significant experience with energy companies and investments and broad knowledge of the oil and natural gas industry as well as significant expertise in finance. We believe his background and skill set make Mr. McNeill well-suited to serve as a member of our Board of Directors.

Executive Officers

The following table sets forth the name, age and positions of each of our executive officers:

| Name |

Age | Position | ||

| Steven Gray |

58 | Chief Executive Officer and Director | ||

| Zane Arrott |

60 | Chief Operating Officer | ||

| Erik B. Daugbjerg |

48 | Executive Vice President of Land and Business Development | ||

| William Huck |

62 | Executive Vice President of Operations | ||

| Scott McNeill |

46 | Chief Financial Officer and Director | ||

| James Mutrie |

45 | Vice President, General Counsel and Corporate Secretary |

Biographical information for Messrs. Gray and McNeill is set forth above under the heading “Members of the Board of Directors.”

Zane Arrott, Chief Operating Officer, has served as our Chief Operating Officer since our formation in 2013 and has served RSP Permian, L.L.C. in such capacity since its inception in 2010. Since 1995, Mr. Arrott has served as the Chief Operating Officer for Rising Star Energy Development Company, L.L.C. and continues to serve on the boards of Rising Star Energy Development Company, L.L.C. and Rising Star Petroleum, L.L.C. From 1982 to 1995, Mr. Arrott held several positions with Placid Oil Company and was elevated to General Manager of its Canadian Division in 1988. Mr. Arrott has extensive experience with reservoir engineering, production engineering, project economic forecasting and reserve acquisitions. He has a B.S. in Petroleum Engineering from Texas Tech University.

3

Table of Contents

Erik B. Daugbjerg, Executive Vice President of Land and Business Development, has served as our Executive Vice President of Land and Business Development since March 1, 2017, prior to which he served as our Vice President of Land and Business Development since 2014. From 2013 to 2014 he served as Vice President of Business Development and from 2010 until the present he has served such capacity for RSP Permian, L.L.C. In 2007 Mr. Daugbjerg co-founded Pecos, and he continues to serve as a manager of Pecos Operating Company, LLC, Pecos’ general partner. Mr. Daugbjerg served as President of Pecos River Operating Company, an exploration and production company with operations in southeast New Mexico, from 2000 until its sale in 2005. From 1997 to 2000, Mr. Daugbjerg served as Vice President of Producer Services for Highland Energy Company. From 1992 to 1996, he served in various roles with Hadson Corporation, an oil and natural gas marketing and midstream company with operations in the Permian Basin. Mr. Daugbjerg has a B.B.A. from Southern Methodist University.

William Huck, Executive Vice President of Operations, co-founded RSP Permian, L.L.C. in 2010. He has served as our Executive Vice President of Operations since March 1, 2017, prior to which he served as Vice President of Operations since 2013. He has served RSP Permian, L.L.C. as Vice President of Operations since its inception in 2010. In 2007, Mr. Huck co-founded Pecos, and he continues to serve as a manager of Pecos Operating Company, LLC, Pecos’ general partner. Mr. Huck co-founded Pecos Production Company in 2000 and served as its Vice President—Production until it was sold to Chesapeake Energy Corporation in 2005. In addition, he serves as President of Huck Engineering, Inc. From 1998 to 2000, Mr. Huck served as an Operating Manager for Collins & Ware, Inc., an oil and natural gas production company in Midland, Texas. From 1994 to 1998, Mr. Huck operated an independent engineering consulting firm, Huck Engineering, Inc. Mr. Huck has a B.S. in Petroleum Engineering from Marietta College.

James Mutrie, Vice President, General Counsel and Corporate Secretary, has served as our, and RSP Permian, L.L.C.’s, Vice President, General Counsel and Corporate Secretary since June 2014. From February 2007 to May 2014, Mr. Mutrie first served as Assistant General Counsel and later as General Counsel and Compliance Officer at United Surgical Partners International, Inc. From October 2003 to January 2007, Mr. Mutrie practiced corporate law at Vinson & Elkins L.L.P., representing public and private companies in capital markets offerings and mergers and acquisitions, frequently in the oil and gas industry. He received a B.A. from Cornell University, a J.D. from Northwestern University School of Law and a Certificate in Financial Management from Cornell University.

Involvement in Certain Legal Proceedings

To the best of our knowledge, there is no involvement of any of the Company’s directors or officers in legal proceedings during the past ten years that is required to be disclosed pursuant to Regulation S-K 401(f).

Section 16(a) Beneficial Ownership Reporting Compliance

The Section 16 officers and directors of the Company and persons who own more than 10% of the Company’s common stock are required to file reports with the SEC, disclosing the amount and nature of their beneficial ownership in common stock, as well as changes in that ownership. Based solely on its review of reports and written representations that the Company has received, the Company believes that all required reports were timely filed during 2017 except that (i) Mr. Gray filed a late Form 4 on March 9, 2018 to report transactions that took place on October 19, 2017 and November 29, 2017, respectively, (ii) Mr. Daugbjerg filed a late Form 4 on March 9, 2018 to report a transaction that took place on October 19, 2017, and (iii) Mr. Huck filed a late Form 4 on March 9, 2018 to report a transaction that took place on October 19, 2017.

Corporate Governance Guidelines

The Company monitors developments in the area of corporate governance and reviews its processes and procedures in light of such developments. Accordingly, the Company reviews federal laws affecting corporate governance, such as the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Wall Street Reform and Consumer Protection Act as well as various rules promulgated by the SEC and the New York Stock Exchange, which we refer to as the NYSE. The Company believes that it has procedures and practices in place that are designed to enhance and protect the interests of its stockholders.

The Board of Directors has approved Corporate Governance Guidelines for the Company. The Corporate Governance Guidelines address, among other things:

4

Table of Contents

| ● | The composition of the Board of Directors, including size and membership criteria; |

| ● | Director responsibilities and expectations; |

| ● | Service on other boards; |

| ● | Functioning of the Board, including regularly held meetings and executive sessions of non-management directors; |

| ● | Director compensation; |

| ● | Structure and functioning of the Committees; |

| ● | Director access to independent advisors, management and employees; |

| ● | Management evaluation and succession planning; and |

| ● | Board and Committee performance evaluations. |

Corporate Code of Business Conduct and Ethics

In addition to the Corporate Governance Guidelines, the Board of Directors has adopted a Corporate Code of Business Conduct and Ethics, which we refer to as the Code of Ethics. The Code of Ethics, along with the Corporate Governance Guidelines and the Financial Code of Ethics described below, serves as the foundation for the Company’s system of corporate governance. It provides guidance for maintaining ethical behavior, requires that directors and employees comply with applicable laws and regulations, addresses conflicts of interest and provides mechanisms for reporting violations of the Company’s policies and procedures.

In the event the Company makes any amendment to, or grants any waiver from, a provision of the Code of Ethics that requires disclosure under applicable SEC or NYSE rules, the Company intends to disclose such amendment or waiver on its website at www.rsppermian.com.

Financial Code of Ethics

In addition to the Corporate Governance Guidelines and Code of Ethics, the Board of Directors has adopted a Financial Code of Ethics. It provides the ethical principles by which the Company’s Chief Executive Officer, Chief Financial Officer (or other principal financial officer), Controller (or other principal accounting officer) and other senior financial officers are expected to conduct themselves when carrying out their duties and responsibilities.

In the event the Company makes any amendment to, or grants any waiver from, a provision of the Financial Code of Ethics that applies to the principal executive officer, principal financial officer or principal accounting officer and that requires disclosure under applicable SEC or NYSE rules, the Company will disclose such amendment or waiver on its website at www.rsppermian.com.

Availability of Documents

The full text of the Corporate Governance Guidelines, the Code of Ethics, the Financial Code of Ethics, the charter of each of the Audit Committee, the Compensation Committee and the Nominating & Governance Committee of our Board of Directors and the other corporate governance materials are accessible by following the links to “Investor Relations” and “Corporate Governance” on the Company’s website at www.rsppermian.com. The Company will furnish without charge a copy of any of these documents to any person who requests them in writing and states that he or she is a beneficial owner of common stock of the Company. Requests should be addressed to: RSP Permian, Inc., 3141 Hood Street, Suite 500, Dallas, Texas 75219, Attention: Investor Relations.

Audit Committee

Rules implemented by the NYSE and the SEC require us to have an audit committee comprised of at least three directors who meet the independence and experience standards established by the NYSE and the Securities

5

Table of Contents

Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee consists of Messrs. Armes (Chair), Huseman and Ramsey, each of whom is independent under the rules of the SEC and the NYSE. As required by the rules of the SEC and listing standards of the NYSE, the Audit Committee consists solely of independent directors. The Board of Directors has determined that Messrs. Armes and Ramsey satisfy the definition of “audit committee financial expert” under applicable federal securities laws.

The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to the Board of Directors, including the selection of our independent registered public accounting firm, the scope of our annual audits, fees to be paid to the independent registered public accounting firm, the performance of our independent registered public accounting firm and our accounting practices. In addition, the Audit Committee oversees our compliance programs relating to legal and regulatory requirements. We have an Audit Committee charter defining the Committee’s primary duties in a manner consistent with the rules of the SEC and NYSE or market standards. The Audit Committee held 5 meetings in fiscal 2017.

6

Table of Contents

| ITEM 11. | EXECUTIVE COMPENSATION |

COMPENSATION DISCUSSION AND ANALYSIS

The purpose of this Compensation Discussion and Analysis the (“CD&A”) is to explain the Compensation Committee’s philosophy for determining the compensation program for our Chief Executive Officer (“CEO”), Chief Financial Officer and our four other most highly compensated executive officers for 2017, which includes one highly compensated executive officer voluntarily disclosed due to the similar level of compensation of such officer compared with the other executive officers for the 2017 year (the “named executive officers,” or “NEOs”). This CD&A will discuss how the 2017 compensation packages for the NEOs were determined and will provide the context needed to more fully understand the data presented in the compensation tables that follow this CD&A. Following this discussion are tables that include compensation information for the NEOs. Our NEOs for 2017 are as follows:

| ● | Steven Gray, Chief Executive Officer and Director; |

| ● | Scott McNeill, Chief Financial Officer and Director;* |

| ● | Zane Arrott, Chief Operating Officer; |

| ● | William Huck, Executive Vice President of Operations; |

| ● | Jim Mutrie, Vice President, General Counsel and Corporate Secretary; and |

| ● | Erik B. Daugbjerg, Executive Vice President of Land and Business Development. |

* On April 17, 2017 our Chief Accounting Officer, Barry Turcotte, resigned from the Company. Mr. McNeill also performed the duties of our Chief Accounting Officer following Mr. Turcotte’s resignation until July 10, 2017, at which time we hired Uma L. Datla as our new Chief Accounting Officer.

Executive Summary

Company Compensation Philosophy and Components

Our executive compensation program is designed to emphasize “pay for performance.” The three main components of the executive compensation program are:

| ● | Base salary - fixed cash compensation component, |

| ● | Annual cash bonus incentive award - variable cash payout based on the Company and individual NEO performance, |

| ● | Long-term incentive plan awards – we provide both time-based and performance-based equity, and compensation awards, intended to provide our NEOs with value that is dependent on the performance of our common stock over specified long-term periods |

Company Performance

Highlights of our performance during the year ended December 31, 2017 include the following:

| ● | In March 2017, we closed the acquisition of Silver Hill E&P II, LLC for an aggregate purchase price of approximately $646.0 million of cash and 16.0 million shares of our common stock in aggregate, before purchase price adjustments. The cash portion of the purchase price was funded with cash on hand. See Note 3 in the notes to our consolidated financial statements for the year ended December 31, 2017 for additional information. |

| ● | Increased our total proved reserves by 59% from 236.9 MMBoe as of December 31, 2016 to 375.9 MMBoe as of December 31, 2017. |

7

Table of Contents

| ● | Increased our average daily production rate by 89% for the year ended December 31, 2017 as compared to the same period in 2016. Our average daily production rate during 2017 was 55,255 Boe/d, compared with the 2016 average daily production of 29,161 Boe/d. Oil production was 72% of total production on a volumetric basis and oil sales were 88% of our total revenues in 2017. |

| ● | Increased our borrowing base under the Revolving Credit Facility to $1.5 billion in October 2017. |

| ● | Acquired $279.0 million of additional undeveloped acreage and mineral interests. |

| ● | Acquired water infrastructure assets which service Delaware Basin properties for an aggregate purchase price of $19.2 million. |

| ● | During 2017, we participated in the drilling of 136 gross horizontal wells (95 operated) and participated in the completion of 113 gross horizontal wells (70 operated). At the end of 2017, we operated three horizontal rigs in the Midland Basin and four horizontal rigs in the Delaware Basin. During 2016, we participated in the drilling of 81 gross horizontal wells (46 operated) and participated in the completion of 90 gross horizontal wells (53 operated). In our 2016 vertical drilling program, we drilled 4 gross vertical operated wells and completed 6 gross operated vertical wells. |

| ● | Top-Tier Stockholder Return |

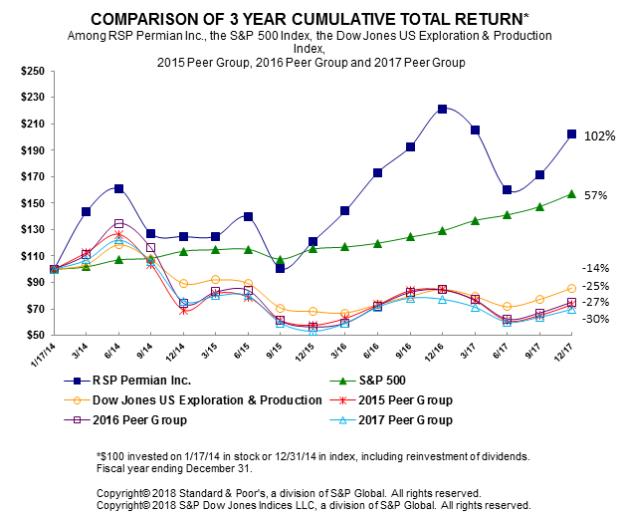

| o | The following graph compares the three-year change in the cumulative total stockholder return on the Company’s common stock relative to the cumulative total returns of (i) the S&P 500 Index, (ii) the Dow Jones US Exploration & Production Index, (iii) a customized group of thirteen peer companies used in the Company’s 2015 performance graph, (iv) a customized group of eighteen peer companies used in the Company’s 2016 performance graph and (v) a customized group of sixteen peer group companies used for 2017 compensation purposes. The comparison assumes that $100 was invested on January 17, 2014 (the first day of trading for the Company’s common stock) in the indices or in the Company’s common stock and assumes reinvestment of dividends, if any. |

| o | Companies in the 2015 peer group are Approach Resources Inc., Carrizo Oil & Gas, Inc., Diamondback Energy, Inc., Exco Resources, Inc., Gulfport Energy Corporation, Jones Energy Inc., Laredo Petroleum, Inc., Matador Resources Company, Parsley Energy, Inc., PDC Energy, Inc., Resolute Energy Corporation, SM Energy Company and Vanguard Natural Resources, LLC. In 2014, the peer group also included Forest Oil Corporation, which merged with Sabine Oil & Gas LLC in December 2014, and Rosetta Resources Inc., which merged with Noble Energy, Inc. in July 2015. |

| o | Companies in the 2016 peer group are Bonanza Creek Energy Inc., Callon Petroleum Co, Carrizo Oil & Gas Inc., Clayton Williams Energy Inc., Concho Resources Inc., Diamondback Energy Inc., Energen Corp, Ep Energy Corp, Laredo Petroleum Inc., Matador Resources Co, Newfield Exploration Co, Oasis Petroleum Inc., Parsley Energy Inc., PDC Energy Inc., QEP Resources Inc., SM Energy Co, Whiting Petroleum Corp and WPX Energy Inc. |

| o | Companies in the 2017 peer group are Antero Resources Corporation, Cabot Oil & Gas Corporation, Cimarex Energy Co, Concho Resources, Inc., Diamondback Energy, Inc., Energen Corp, Laredo Petroleum, Inc., Newfield Exploration Co, Oasis Petroleum Inc., Parsley Energy, Inc., PDC Energy, Inc., QEP Resources, Inc., Range Resources Corporation, SM Energy Company, Whiting Petroleum Corp and WPX Energy, Inc. |

8

Table of Contents

| o | The stock price performance shown on the graph above is based on historical data and not necessarily indicative of, or intended to forecast, future price performance. Information used in the graph was obtained from Research Data Group, Inc., a source believed to be reliable, but the Company is not responsible for any errors or omissions in such information. |

| o | Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings made under the Securities Act of 1933, as amended, which we refer to as the Securities Act, or the Exchange Act, that might incorporate by reference this Report or future filings made by the Company under those statutes, the Audit Committee Report, reference to the independence of the Audit Committee members and of other Board of Directors members and the preceding Stock Performance Graph are not “soliciting material” and are not deemed filed with the SEC, and will not be deemed incorporated by reference into any of those such prior filings or into any future filings made by the Company under those statutes. |

2017 Compensation Actions

The following is a summary of the material compensation decisions made by the Compensation Committee for 2017:

| ● | Engagement of Independent Compensation Consultant – The Compensation Committee engaged Longnecker & Associates (“Longnecker”) to conduct a competitive review of compensation practices for |

9

Table of Contents

| our NEOs and members of our Board of Directors, and to establish appropriate marketplace compensation levels for such individuals. The Compensation Committee does not formally benchmark any element of compensation, but it believes that it is important to understand market trends and norms in order to design an appropriate and competitive compensation package for our NEOs and Board members. Overall Longnecker found that the compensation packages for each of our NEOs was well below the market median for our peers during the 2016 year, and recommended making certain increases to each element of compensation in order to better align our NEOs with the compensation packages found at our peers for similarly situated employees. |

| ● | Base salary – In past years, with the assistance of Longnecker, the Compensation Committee determined that 2015 base salaries were generally aligned at levels that fell below the twenty-fifth percentile of NEO salaries at our peer companies, while our overall Company performance was in the top twenty-fifth percentile compared to our peers. However, with the challenging industry conditions in early 2016, the Compensation Committee decided to focus on preserving cash for the Company and adjusted NEO’s base salaries only modestly upward for the 2016 year as compared to 2015, in general less than a ten percent increase, intending to keep NEO’s base salaries below the median of the peer group for their respective positions. At the beginning of 2017, Longnecker again provided base salary information that showed our NEOs in the aggregate were still receiving base salaries that were well below the median for our peers, generally below the twenty-fifth percentile, although our performance continued to place us in the top twenty-fifth percentile compared to our peer group. Although base salary increases would be necessary to better align our NEO’s salaries with our peers, Longnecker suggested, and the Compensation Committee agreed, that base salary increases of more than ten percent in any given year would in general be looked at unfavorably by some shareholders and advisory firms. Therefore, except for our CEO, who was paid in the lowest quartile of our peers, base salaries for other executives were capped at ten percent increases with respect to the 2017 calendar year, even though an increase of 20% would be necessary to place our other NEOs at the median of our peers. |

| ● | Annual cash bonus incentive award – Similar to base salaries, the target bonus compensation levels for our NEOs for the 2015 and 2016 years were aligned with levels that were in the bottom quarter of our peer group. Again focusing on preserving cash, the Compensation Committee kept bonus target amounts generally consistent from the 2015 year to the 2016 year. With respect to the 2017 year, the Compensation Committee determined to increase bonus targets modestly, to align target bonus compensation levels for our NEO above the bottom quarter of our peer group, but below the median. Following the end of the 2017 year, the Compensation Committee assessed the Company’s performance and, based on the Company’s strong performance and execution in 2017, arrived at a final payout level of 140% of target bonuses to recognize the achievements of both the Company and the NEOs. |

| ● | Annual long-term incentive plan awards – In February 2017, the Compensation Committee approved long-term incentive awards in two different forms: time-based restricted stock and performance-based restricted stock awards, each of which are governed by the 2014 Long Term Incentive Plan (the “LTIP”). The Compensation Committee continued this mix of time and performance-based awards during the 2017 year. |

Good Governance and Best Practices

The Compensation Committee continually monitors developing practices in the areas of executive compensation and corporate governance. The following reflect the practices and policies that we feel support a responsible executive compensation program:

| ● | The Compensation Committee emphasizes long-term performance, with a majority of the NEOs’ total compensation being in the form of long-term incentive awards. |

| ● | We have a policy that prohibits directors, officers and employees from engaging in short sales or in transactions involving derivatives based on our common stock. |

| ● | The Compensation Committee has engaged a compensation consultant that is independent of management and free of conflicts of interest with the Company. |

10

Table of Contents

| ● | We do not provide gross-ups for excise taxes on severance or other payments in connection with a change of control. |

| ● | We have previously recommended that our shareholders be allowed to provide an advisory vote on our executive compensation program on an annual basis. While the vote is not binding on the Company, we believe that it is good corporate practice to receive feedback from our shareholders regularly, and we have decided to seek their advisory vote annually. In connection with the advisory vote that was held last year during the 2017 Annual Meeting, our shareholders approved our executive compensation program by approximately 99%. Given the significant support that our shareholders expressed for our executive compensation program, the Compensation Committee did not make any material changes to our program due to the most recent advisory shareholder vote. |

Executive Compensation Philosophy

Philosophy to Pay for Performance

In general, our philosophy for executive compensation is based on the premise that a significant portion of each executive’s compensation should be incentive-based or “at-risk” compensation and that executives’ total compensation levels should be competitive in the marketplace for executive talent and abilities. Our current goal is to design a total compensation program that will provide for approximately the median market annual base compensation and incentive-based compensation designed to reward both short and long-term performance. We believe the incentive-based balance is achieved by (i) the payment of annual cash bonuses that consider the achievement of both the Company’s financial performance objectives for a fiscal year set at the beginning of such fiscal year and the individual contributions of our NEOs to the success of the Company and the achievement of the annual financial performance objectives, (ii) the annual grant of time-based restricted stock awards, which awards are intended to provide a longer term incentive and retention value to our key employees to focus their efforts on increasing the market price of our common stock, and (iii) the grant of performance-based restricted stock awards, which directly align the compensation of our NEOs with the Company’s performance and provides a direct alliance between our NEOs and our stockholders. We believe that these equity-based incentive arrangements are important in attracting and retaining our executive officers and key employees as well as motivating these individuals to achieve our business objectives.

For a more detailed description of the compensation of our NEOs, please see “Executive Compensation Tables” below.

Compensation Philosophy

Our compensation program is structured to provide the following benefits:

| ● | Reward executives with an industry-competitive total compensation package of base salaries, bonuses and equity awards yielding a total compensation package approaching the median of the market. With respect to the 2015 and 2016 years, our total compensation packages have fallen below the median of our peers, and with respect to the 2017 year we maintained total compensation packages for our NEOs that were below the median of our peers even though our performance places us above the median of our peers. |

| ● | Attract, retain and reward talented executive officers and key management employees by providing total compensation competitive with that of other executive officers and key management employees employed by peers of similar size and in similar lines of business. |

| ● | Motivate executive officers and key employees to achieve strong financial and operational performance. |

| ● | Emphasize performance-based or “at-risk” compensation. |

| ● | Reward individual performance. |

Our Compensation Committee determines the mix of compensation, both among short-term and long-term compensation and cash and non-cash compensation, to establish structures that it believes are appropriate for each of

11

Table of Contents

our NEOs. In making compensation decisions with respect to each element of compensation, the Compensation Committee considers numerous factors, including:

| ● | the individual’s particular background and circumstances, including training, |

| ● | the individual’s role with us and the compensation paid to similar persons at comparable peer companies; |

| ● | the demand for individuals with the individual’s specific expertise and experience, |

| ● | achievement of individual and Company performance goals and other expectations relating to the position, |

| ● | comparison to other executives within the Company having similar levels of expertise and experience and the uniqueness of the individual’s industry skills, and |

| ● | aligning the compensation of our executives with our performance on both a short-term and long-term basis. |

Executive Compensation Components

The components of our executive compensation program for 2017 and the respective purposes of each within the framework of our compensation philosophy and objectives are described in the table below.

| Compensation Component |

Description | Purpose and Philosophy | ||

| Base Salary | Fixed annual cash compensation | Provides a stable, fixed element of cash compensation. Recognizes and considers the internal value of the position within the Company and the individual’s experience, leadership potential and demonstrated performance.

| ||

| Annual Cash Bonus Incentive | Annual cash compensation based on annual Company and individual performance goals | Rewards executives for the achievement of annual financial, operating and strategic goals and individual performance. It allows the Compensation Committee to evaluate both objective and subjective considerations when determining final payout amounts. | ||

| Long-Term Incentive, in two components –

|

||||

| Performance-based Restricted Stock | Performance awards - equity compensation with payout based on total stockholder return in relation to peers generally over a three-year period | Ensures that realized value to the executive aligns with value delivered to stockholders. Realized value is dependent on the Company’s performance over the long-term (approximately three years), with performance payout being dependent on relative total stockholder return against industry peers. Reinforces executive stock ownership through a combination of award types, encourages executives to take the proper level of risk in developing and executing our business plans with a true long-term focus. The awards are critical to our ability to attract, motivate and retain our key employees.

| ||

| Time-Based Restricted Stock | Restricted stock - equity compensation with time-based, three-year vesting | |||

| Other Compensation | Retirement benefits | Addresses post-retirement welfare of executives | ||

12

Table of Contents

In determining compensation components and their design, the Compensation Committee also considers the typical practices of our industry peers. Compensation opportunities approximate the median of our peers based on values at the date of Compensation Committee approval; however, the values ultimately realized by the NEOs are largely based on the Company’s performance.

Compensation Setting Process

Role of the Compensation Committee and the CEO. As a part of its oversight of our executive compensation program, the Compensation Committee:

| ● | administers our executive compensation program, |

| ● | establishes our overall compensation philosophy and strategy, and |

| ● | ensures NEOs are rewarded appropriately in light of the guiding principles as described in the sections above. |

In determining the compensation of the NEOs, other than the CEO, the Compensation Committee considers the CEO’s evaluation of their performance and his recommendations as to their compensation, but the Compensation Committee makes all final decisions regarding the NEOs’ compensation. The Compensation Committee determines the individual elements of the CEO’s total compensation and benefits, approves specific annual corporate goals and objectives relative to the CEO’s and the other NEO’s compensation and reviews the CEO’s performance in meeting these corporate goals and objectives. The Compensation Committee also reviews historical target and actual compensation levels to determine whether the compensation plan design is meeting the Compensation Committee’s objectives of providing fair compensation and effective retention and supporting the program’s emphasis on pay-for-performance.

Role of the Compensation Consultant and Information Obtained from Longnecker during 2017. The Compensation Committee has the authority to engage the services of outside advisors, experts and others to assist in performing its responsibilities. It selects our compensation consultant taking into consideration the factors identified by the SEC rules and regulations and the NYSE listing standards on this subject. For 2017, the Compensation Committee retained Longnecker to serve as an independent consultant to the Compensation Committee to provide information and objective advice regarding executive and director compensation. All of the decisions with respect to our executive compensation, however, are made by the Compensation Committee. The Compensation Committee did not direct Longnecker to perform its services in any particular manner or under any particular method. The Compensation Committee has the final authority to hire and terminate the compensation consultant, and the Compensation Committee evaluates the compensation consultant annually. Longnecker does not provide any services to the Company other than in its role as advisor to the Compensation Committee, and the Compensation Committee has determined, under the independence factors established by the SEC and the NYSE, that no conflicts of interest exist as a result of the engagement of Longnecker and that Longnecker is considered to be an independent consulting firm.

One of the services that Longnecker provided during the 2017 year was assisting the Compensation Committee in determining an appropriate peer group. The peer group reflects a current sampling of companies within our industry that Longnecker and we believe we compete with for talented executives and that are comparable in size based on market capitalization, revenue, total assets, net income and enterprise value. Longnecker was also asked to ensure appropriateness, defensibility and applicability of peers following our Silver Hill acquisition that closed in two parts in late 2016 and early 2017 respectively. We plan to review our peer group on an annual basis to ensure that we continue to have an appropriate and relevant basis on which to compare our compensation program within our industry. The peers that we used for general compensation comparisons with respect to 2017 compensation decisions were as follows:

| Antero Resources Corporation |

| Cabot Oil & Gas Corporation |

| Cimarex Energy Co. |

| Concho Resources, Inc. |

13

Table of Contents

| Diamondback Energy, Inc. |

| Energen Corp. |

| Laredo Petroleum, Inc. |

| Newfield Exploration Co. |

| Oasis Petroleum Inc. |

| Parsley Energy, Inc. |

| PDC Energy, Inc. |

| QEP Resources, Inc. |

| Range Resources Corporation |

| SM Energy Company |

| Whiting Petroleum Corp. |

| WPX Energy, Inc. |

In setting compensation for 2017, the Compensation Committee used 2016 compensation data as it deemed appropriate, but also took into consideration certain findings and general recommendations from Longnecker. In its report, Longnecker provided competitive data for similarly situated executives at the peer group companies (if such data was available for a particular NEO), focusing on the following elements of compensation: (i) the annual base salary, (ii) the target annual cash incentive bonus, assuming target performance is achieved, (iii) the total target annual cash compensation consisting of the two elements referenced above, (iv) the value of long-term incentive awards as of the date of grant and (v) the total direct compensation, consisting of the total target annual cash compensation and the value of long-term incentive awards as of the date of grant. Longnecker also analyzed how these elements of compensation compare to elements of compensation afforded to our executive officers, including the NEOs.

Based on the recommendations of our CEO for our other NEOs, and taking into account Longnecker’s analysis, the Compensation Committee determined that a material amount of executive compensation should be tied to performance and a significant portion of the total prospective compensation of each NEO should be tied to financial and operational objectives. These performance metrics include performance criteria relative to our peer group. In general, during periods when performance meets or exceeds established objectives, our NEOs should be paid at or above targeted levels, respectively. When our performance does not meet key objectives and falls below the threshold, no bonus payments will generally be made to such executive officers. The decisions that were made with respect to individual elements of compensation are described more fully below within the section titled “Elements of the Company’s Compensation Program.”

Because the competitive compensation information found at our peers is just one of the inputs used in setting executive compensation, the Compensation Committee has discretion in determining the nature and extent of its use. When exercising its discretion, the Compensation Committee may consider factors such as the nature of officer’s duties and responsibilities as compared to the corresponding position in the peer group, the experience and value the officer brings to the role, the officer’s performance results, demonstrated success in meeting key financial and other business objectives and the amount of the officer’s pay relative to the pay of his or her peers within the Company.

Elements of the Company’s Compensation Program

The following sections describe in greater detail each of the components of our executive compensation program and how the amounts of each element were determined for 2017.

Base Salary

The Compensation Committee reviewed with Longnecker its base salary survey data and analyzed how effectively the survey data matched each executive’s duties and responsibilities. The Compensation Committee determined that each NEO’s base salary was generally below our goal of aligning with the median of our peer group companies as base salaries were still within the twenty-fifth percentile of our peers. Accordingly our Compensation Committee approved 2017 base salaries for the NEOs at the following amounts:

14

Table of Contents

| NEO | 2017 Base Salary | 2016 Base Salary | ||

| Steven Gray |

$800,000 | $600,000 | ||

| Scott McNeill |

$460,000 | $420,000 | ||

| Zane Arrott |

$440,000 | $400,000 | ||

| William Huck |

$425,000 | $375,000 | ||

| James Mutrie |

$375,000 | $350,000 | ||

| Erik Daugbjerg |

$400,000 | $325,000 |

Annual Cash Bonus Incentive Program

Annual cash bonuses are a significant component of our compensation program. In determining cash bonuses, the Compensation Committee uses Company-wide performance metrics as guidelines to assess our overall performance and individual discretionary metrics to evaluate the individual performance of our NEOs. By having the Compensation Committee review Company performance metrics we are considering key performance criteria that drives stockholder value over time. Also taking into consideration non-quantifiable and individual NEO performance allows the Company to make appropriate adjustments based on the individual successes of our executives.

For the 2017 year the Compensation Committee set a target bonus amount for each NEO that was equal to a percentage of the NEO’s base salary for the 2017 year. Although the Compensation Committee retains the discretion to modify this target amount in its discretion, setting an estimated target bonus amount at the beginning of the year provides the NEOs with an approximate incentive goal for that year. For the 2017 fiscal year, the target bonus amounts were as follows:

| NEO | Target Percentage of Salary | Target Bonus Amount | ||

| Steven Gray |

120% | $960,000 | ||

| Scott McNeill |

95% | $437,000 | ||

| Zane Arrott |

95% | $418,000 | ||

| William Huck |

85% | $361,250 | ||

| James Mutrie |

75% | $281,250 | ||

| Erik Daugbjerg |

80% | $320,000 |

For fiscal year 2017, the Compensation Committee determined that the annual bonus would be based on six factors. Although the Compensation Committee does not use a specific formula for the bonus determination, it determined that the 2017 bonus would generally be based fifty percent on five pre-determined Company performance factors, and fifty percent on discretionary factors that the Compensation Committee determined to be appropriate for bonus considerations throughout the 2017 year. In light of decreasing commodity prices at the beginning of 2017 and the uncertainty whether such prices would continue to decrease or rebound, the Compensation Committee determined that it was necessary to allow a large portion of the 2017 bonuses to be determined based on factors that would accurately reflect how the named executive officers directed the Company through the uncertain environment that existed at the beginning of the 2017 year. Additionally, the Compensation Committee chose not to use factors that focused on growth, but rather, focused on costs and capital efficiency. The Compensation Committee also desired to retain the flexibility to focus on events that impacted the Company’s balance sheet outside of the NEO’s control.

The Compensation Committee reviewed the following five specific performance factors in order to assess the Company’s performance throughout the year: (i) lease operating expense per barrel of oil equivalent (“BOE”); (ii) cash general and administrative expense (“G&A”) per BOE; (iii) finding and development costs, calculated both on a proved developed and drill bit finding cost basis; (iv) the ratio of the Company’s capital expenditures to production added; and (v) the Company’s production growth per debt-adjusted share recycle ratio (defined as operating margin divided by finding costs). Although the Compensation Committee does not assign any specific value to the Company performance guidelines and neither target goals nor actual results will guarantee that any portion of the bonus becomes payable, the Compensation Committee did set an estimated target for the five performance guidelines in 2017, in order to better evaluate the Company’s overall performance at the end of the

15

Table of Contents

year. The target goals and the Company’s actual performance results for each performance guideline used in 2017 are set forth below.

| 2017 Bonus Criteria |

Percentage Weighting |

Threshold Metric |

Target Metric |

Actual Metric | ||||

| Lease Operating Expense/BOE |

10% | $6.18/BOE | $5.56/BOE | $6.09 | ||||

| Cash G&A/BOE |

5% | $1.50/BOE | $1.35/BOE | $1.50 | ||||

| Finding and Development Costs: |

||||||||

| Proved Developed Finding & Development Cost, $/BOE* |

5% | $10.47/BOE | $9.42/BOE | $14.20 | ||||

| Drill Bit Finding & Development Cost, $/BOE* |

5% | $5.00/BOE | $4.50/BOE | $7.25 | ||||

| Capital Expenditures/Production Added |

10% | $32,700 | $32,700 | $37,800 | ||||

| Production Growth Per Debt Adjusted Share** |

15% | 24% | 29% | 21% | ||||

| * | Excludes revisions to reserves and acquisitions. |

| ** | Excludes certain effects of acquisition costs. |

The Compensation Committee did not set specific individual goals for the NEOs at the beginning of 2017. In the first part of 2018, the Compensation Committee consulted with the Company’s Chief Executive Officer (with respect to the NEOs other than himself) to evaluate the individual performance of the executives for the 2017 year. The Compensation Committee also reviewed the fiscal year 2017 performance factors above, evaluated the Company’s achievement of these goals and considered the performance of the Company and the NEO’s in the context of the economic environment upstream companies operated in in 2017. The Committee considered, in particular, that oil prices were lower than budgeted by the Company in 2017 and service costs were significantly higher, resulting in difficulty for the Company to achieve the performance factors above, since they were based largely on cost and efficiency measures and difficult to achieve with falling oil prices and higher than anticipated service costs. The Compensation Committee also considered that the NEO’s led the successful integration of the Company’s $2.4 billion acquisition of Silver Hill, nearly doubling the acreage of the Company and expanding its workforce by over sixty percent, and met the production, capex and other guidance numbers the Company provided to the public at the start of 2017. In addition, the NEO’s led the expansion of the Company into a new, core operating basin, the Delaware Basin, and the Company incurred substantial costs in connection with preparing the Delaware Basin for efficient, full-scale development, such as acquiring and building fresh and salt water facilities and tank batteries. By the end of 2017, the NEO’s had prepared the Company’s Delaware Basin assets for efficient development similar to the Company’s Midland Basin assets. In light of the fact that the executive team was responsible for multiple accomplishments that exceeded the Compensation Committee’s expectations for the 2017 year, the Compensation Committee determined that it would be appropriate to pay annual bonus awards at 140% of target amounts for the 2017 year. Actual amounts paid to the NEOs are reflected within the “Bonus” column of the Summary Compensation Table below.

Annual Long-term Incentive Awards

Late in the 2016 year, the Compensation Committee began the process of determining the total dollar amount of the 2017 annual long-term incentive awards to be granted to each NEO by engaging Longnecker to review competitive compensation data related to long-term incentive awards, including median award levels at companies within the Company’s peer group, in accordance with our compensation philosophy to generally target the mid-range of compensation at our peers. In January 2017, the Compensation Committee reviewed each NEO’s total compensation level and each NEO’s performance, along with Longnecker’s peer group information regarding target long-term incentive values granted to executives at our peer companies with similar positions as the NEOs. Although the Compensation Committee may review the size and current value of prior long-term incentive awards, it did not consider prior award values dispositive in determining the 2017 long-term incentive award for the NEOs due to the fact that 2015 and 2016 compensation appeared to be well below market levels and the Compensation

16

Table of Contents

Committee believes that future awards should be competitive with the NEO’s current peer group positions in order to retain and motivate the NEOs. At the Compensation Committee’s February 2017 meeting, the Compensation Committee concluded that each NEO should be eligible for an annual long-term incentive award targeted at approximately the seventy-fifth percentile level for each NEO’s position and accordingly made equity awards at levels that approximated those percentile goals using the grant date value of our stock.

The Compensation Committee next reviewed our approach for delivering long-term incentives to NEOs. As a part of its review, the Compensation Committee considered the balance of risk in the long-term incentive program, peer company practices and input from senior management and Longnecker. In accordance with the pay-for-performance philosophy of our compensation program, the Compensation Committee re-approved the mix of long-term incentives for NEOs for 2017 at fifty percent performance-based restricted stock awards and fifty percent time-based restricted stock awards. The Compensation Committee believes this mix of long-term incentive awards provides a good balance of risk, where restricted stock awards provide a retention and incentive feature, and performance awards provide benefits based on the performance of our stock price over a three-year period in relation to certain peers total stockholder return.

For 2017, the approved dollar amounts of the aggregate long-term incentive awards granted to each NEO, and the allocation among the two award types, are shown in the table below. To arrive at the resulting number of restricted shares and target performance awards granted, the dollar value of the award was divided by the closing price of our common stock on the day prior to the date of grant.

| NEO | Target Long-Term Incentive Percentage of Salary (%) |

Total Target Value ($)(1) |

Allocation Among Awards (1) | |||||

|

Time-Based Restricted Stock (#) |

Performance-Based Restricted Stock (#)(2) | |||||||

| Steven Gray |

700 | $5,600,000 | 66,225 | 132,450 | ||||

| Scott McNeill |

525 | $2,415,000 | 28,560 | 57,120 | ||||

| Zane Arrott |

500 | $2,200,000 | 26,017 | 52,034 | ||||

| William Huck |

475 | $2,018,750 | 23,874 | 47,748 | ||||

| James Mutrie |

400 | $1,500,000 | 17,739 | 35,478 | ||||

| Erik Daugbjerg |

425 | $1,700,000 | 25,104(3) | 40,208 | ||||

| (1) | These dollar amounts may vary from the values disclosed in the Summary Compensation Table and the 2017 Grants of Plan-Based Awards table below because those amounts are calculated based on the grant date fair value of the awards in accordance with SEC rules. See the footnotes to those tables for further information regarding the methodology for determining the values of the awards for purposes of those tables. | |||

| (2) | The number reflected in this column shows the target number of awards granted, but the amounts that could be earned are capped at a maximum of 100% of this target grant number (with a full payment range between 0-100% of target). This reflects a change from the design of the performance-based restricted stock units granted in 2015, some awards of which will still be reflected in the equity tables following this CD&A. The target number of 2015 awards could receive a payout of 0-200%. | |||

| (3) | Includes a one-time bonus of 5,000 shares of time-based restricted stock granted to Mr. Daugbjerg for helping to close the Silver Hill transaction. | |||

Time-Based Restricted Stock Awards. For the 2017 restricted stock awards, the awards vest in three equal installments on each anniversary of the date of grant, subject to the NEO remaining employed with us continuously through the vesting dates. Potential acceleration events are described further below within the section titled “Potential Payments Upon Termination or Change in Control.” Any individual, including our NEOs, that holds an outstanding restricted stock award will hold voting and dividend rights with respect to each underlying share of our common stock.

Performance-Based Restricted Stock Awards. For the 2017 performance awards, the Compensation Committee determined that performance should be measured objectively rather than subjectively and should be based on

17

Table of Contents

relative total stockholder return, or “TSR” (as defined in the award agreements) over a three-year performance period. The Compensation Committee believes relative TSR is an appropriate long-term performance metric because it generally reflects all elements of a company’s performance and provides the best alignment of the interests of management and our stockholders. The Compensation Committee also believes that the performance unit program provides a good balance to the restricted stock program.

The Compensation Committee used the 16-company peer group identified by Longnecker in its 2017 report for purposes of comparing TSR for our 2017 performance awards. As depicted in the following table, the payout will range from zero percent to 100 percent of a target number of performance awards awarded based on our relative ranking in the peer group at the end of the three-year performance period that begins January 1, 2017 and ends on December 31, 2019, with applicable vesting to occur on January 1, 2020. The 2015 and 2016 performance awards were also designed using the same TSR performance metric as described above, although the TSR ranking for the 2016 awards ranged from 1-18. The 2015 TSR awards were designed with target awards granted at 100%, with a potential payout range of 0-200% of those target amounts. The Compensation Committee lowered the range of potential payments to 0-100% of target grant awards for both the 2016 and 2017 awards. This change in the potential payment range for the 2016 and 2017 awards does not modify the value of our equity awards on the grant date from the equal 50 percent split between time-based awards and performance-based awards, as the target value of awards reflected below will now also be the maximum number of performance-based awards that may become earned during the performance period.

| TSR Rank Against Peers (1 = First Ranked) |

Percentile Ranking |

Percent of Target Shares to Become Vested | ||

| 1 | 100% | 100% | ||

| 2 | 94% | 96% | ||

| 3 | 88% | 90% | ||

| 4 | 81% | 84% | ||

| 5 | 75% | 78% | ||

| 6 | 69% | 72% | ||

| 7 | 63% | 66% | ||

| 8 | 56% | 60% | ||

| 9 | 50% | 55% | ||

| 10 | 44% | 48% | ||

| 11 | 38% | 42% | ||

| 12 | 31% | 36% | ||

| 13 | 25% | 30% | ||

| 14 | 19% | 0% | ||

| 15 | 13% | 0% | ||

| 16 | 6% | 0% | ||

| 17 | 0% | 0% |

The performance period for the 2015 performance awards ended on December 31, 2017, although the awards did not vest fully until January of 2018 following certification of the performance period. The Company’s performance was at number five, therefore the 2015 awards vested at 145% for those awards. As of December 31, 2017, the Company’s TSR ranking for the 2016 and 2017 performance awards, respectively, would be at number four and six, so 86% and 72% of the 2016 and 2017 TSR awards would vest based on the Company’s performance. However, the awards will generally not vest, if at all, until immediately following the end of the performance period, so it is unknown at this time what percentage of the 2016 and 2017 awards could eventually become vested. Amounts within the Outstanding Equity Awards Table at Fiscal Year-End are time-shot estimates as of December 31, 2017 and are subject to change.

Assuming a continuation of this approach to our performance awards, the awards granted each year provide an additional balance of risk to the long-term incentive award program because a new performance period starts at the

18

Table of Contents

beginning of each year. In administering the annual long-term incentive plan, performance awards are currently made to NEOs under the following guidelines:

| ● | All long-term incentive awards are approved during the regularly scheduled February Compensation Committee meeting. |

| ● | We do not time the release of material non-public information to affect the value of the executive equity compensation awards. |

| ● | Annual performance awards cliff vest after approximately three years, subject generally to the continued employment of the executive officer. |

Other Compensation Elements

Perquisites

The Compensation Committee reviews the desirability of providing perquisites to our NEOs from time to time. During the 2016 year, the Compensation Committee did not provide any perquisites to the NEOs.

Health and Welfare Benefits

Our NEOs participate in health and welfare benefit plans, including medical, dental, disability and life insurance arrangements, on the same basis as the Company’s other employees. We share the cost of health and welfare benefits with our employees, a cost that is dependent on the level of benefits coverage that each employee elects.

Retirement Plans

All eligible employees, including the NEOs, may participate in our 401(k) Plan. We provide an employer match into the 401(k) Plan that is up to five percent of the amount that the employee has deferred into the plan, and all employer contributions are 100% vested at all times. The amounts that we contributed on each NEOs behalf with respect to the 2017 year have been included in “All Other Compensation” column of the Summary Compensation Table below.

Severance and Change in Control Arrangements

While we have not entered into employment agreements with our executive officers, we have adopted a change in control and severance plan for certain employees, including our NEOs, that contains termination and change in control provisions. We believe such an arrangement assists the Company in retaining executives, provides continuity of management in the event of an actual or threatened change in control and provides the executive with the security to make decisions that are in the best long-term interest of our stockholders. The terms of the severance plan, as well as additional details on potential acceleration events for outstanding equity compensation awards, are described later in the section titled “Potential Payments Upon Termination or Change in Control.”

Prohibited Equity Transactions

We have a policy that prohibits directors, officers or employees from engaging in short sales or in transactions involving derivatives based on our common stock, such as option contracts, straddles, collars, hedges and writing puts or calls. In addition, we have a policy that prohibits directors and executive officers from pledging our securities as collateral for a loan or holding our securities in a margin account without advance approval from the Company. In addition, our policy requires that directors and executive officers must obtain authorization from the Company before entering into a trading plan that, under the SEC’s Rule 10b5-1, would permit the sale of our stock including at times when the director or executive officer is in the possession of material nonpublic information.

Deductibility of Executive Compensation