UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

| ☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission file number 1-11037

Praxair, Inc.

(exact name of Registrant as specified in its charter)

|

|

|

| Praxair, Inc.

10 Riverview Drive Danbury, Connecticut

06810-6268 Tel. (203) 837-2000

(Address of principal executive offices) |

|

State of incorporation: Delaware

IRS identification number: 06-124 9050 |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class: |

|

Registered on: |

| Common Stock ($0.01 par value) |

|

New York Stock Exchange |

| 1.50% Euro notes due 2020 |

|

New York Stock Exchange |

| 1.20% Euro notes due 2024 |

|

New York Stock Exchange |

| 1.625% Euro notes due 2025 |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K

(§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “ smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated

filer ☑ Accelerated

filer ☐ Non- accelerated

filer ☐ Smaller reporting company ☐ Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting

common stock held by non-affiliates as of June 30, 2017, was approximately $38 billion (based on the closing sale price of the stock on that date as reported on the New York Stock Exchange).

At January 31, 2018, 287,136,596 shares of common stock of Praxair, Inc. were outstanding.

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year

ended December 31, 2017 (the 2017 Annual Report on Form 10-K) originally filed on February 28, 2018 (the “Original Filing”) by Praxair, Inc., a Delaware corporation (“Praxair” or

the “Company”). Praxair is filing this Amendment to (A) add an executive officer biography of David P. Strauss in Part I, Item 1 in the subsection entitled “Executive Officers” to those executive officer biographies that were

included in the Original Filing; and (B) present the information required by Item 11 (“Executive Compensation”) of Part III of Form 10-K because Praxair will not file a definitive proxy statement

within 120 days of the end of the fiscal year ended December 31, 2017. Praxair will not file a definitive proxy statement within such time frame because, as Praxair publicly announced on January 29, 2018, the Board of Directors of Praxair

has postponed the 2018 Annual Meeting of Shareholders given Praxair’s proposed business combination with Linde AG (“Linde”) pursuant to the Business Combination Agreement dated as of June 1, 2017, as amended, among Praxair,

Linde, Linde plc and certain of their subsidiaries. As such, Praxair does not anticipate distributing a proxy statement to shareholders, from which certain information required by Part III would be incorporated by reference. Except for the executive

officer biography that is being added in Part I, Item 1 (which Item 1 is being refiled in its entirety to include this biography), and except for Part III, Item 11- Executive Compensation that are being

filed with this Amendment, all other information required by Part I, Item 1, and by Part III was filed with the Original Filing.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by Praxair’s principal executive officer and principal financial officer are filed as exhibits to this Amendment under Item 15 of

Part IV hereof.

Except as stated herein, no other changes to any of the information have been made to the Original Filing. The Original Filing continues to speak

as of the date of the Original Filing, and, other than the information provided in Parts I, III and IV hereof, Praxair has not updated the disclosures contained in the Original Filing to reflect any events which occurred at a date subsequent to the

filing of the Original Filing.

PRAXAIR, INC.

AMENDMENT NO. 1 TO

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2017

TABLE OF CONTENTS

PART I

General

Praxair, Inc. (Praxair or the company) was founded in 1907 and became an independent publicly traded company in 1992. Praxair was the first company in

the United States to produce oxygen from air using a cryogenic process and continues to be a technological innovator in the industrial gases industry.

Praxair is a leading industrial gas company in North and South America and one of the largest worldwide. Praxair’s primary products in its

industrial gases business are atmospheric gases (oxygen, nitrogen, argon, rare gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, acetylene). The company also designs, engineers, and builds equipment that

produces industrial gases primarily for internal use. The company’s surface technologies segment, operated through Praxair Surface Technologies, Inc., supplies wear-resistant and high-temperature corrosion-resistant metallic and ceramic

coatings and powders. Praxair’s sales were $11,437 million, $10,534 million, and $10,776 million for 2017, 2016, and 2015, respectively. Refer to Item 7, Management’s Discussion and Analysis, for a discussion of consolidated sales and Note

18 to the consolidated financial statements for additional information related to Praxair’s reportable segments.

Praxair serves a diverse

group of industries including healthcare, petroleum refining, manufacturing, food, beverage carbonation, fiber-optics, steel making, aerospace, chemicals and water treatment. In 2017, 95% of sales were generated in four geographic segments (North

America, Europe, South America and Asia) primarily from the sale of industrial gases, with the balance generated from the surface technologies segment. Praxair provides a competitive advantage to its customers by continuously developing new products

and applications, which allow them to improve their productivity, energy efficiency and environmental performance.

Proposed Business Combination with Linde AG

On June 1, 2017, Praxair and Linde AG entered into a definitive Business Combination Agreement, as amended (the “Business Combination

Agreement”), pursuant to which, among other things, Praxair and Linde AG agreed to combine their respective businesses through an all-stock transaction, and become subsidiaries of a new holding company incorporated in Ireland, Linde plc.

Pursuant to the business combination agreement, Linde’s business will be brought under Linde plc through Linde plc’s offer to exchange Linde AG shares for Linde plc shares and Praxair’s business will be brought under Linde plc through

a merger of an indirect wholly-owned Delaware subsidiary of Linde plc with and into Praxair, with Praxair surviving the merger. Praxair’s stockholders approved the merger at Praxair’s special meeting held on September 27, 2017, and on

November 24, 2017, the tender period for the exchange offer expired with approximately 92% of all Linde AG shares entitled to voting rights being tendered.

Completion of the Business Combination remains subject to approval by requisite governmental regulators and authorities, including approvals under

applicable competition laws. The parties currently expect the Business Combination to be completed in the second half of 2018. Refer to Item 1A. “Risk Factors” and Note 20 to the consolidated financial statements for further details.

Industrial Gases Products and Manufacturing Processes

Atmospheric gases are the highest volume products produced by Praxair. Using air as its raw material, Praxair produces oxygen, nitrogen and argon

through several air separation processes of which cryogenic air separation is the most prevalent. Rare gases, such as krypton, neon and xenon, are also produced through cryogenic air separation. As a pioneer in the industrial gases industry, Praxair

is a leader in developing a wide range of proprietary and patented applications and supply systems technology. Praxair also led the development and commercialization of non-cryogenic air separation technologies for the production of industrial

gases. These technologies open important new markets and optimize production capacity for the company by lowering the cost of supplying industrial gases. These technologies include proprietary vacuum pressure swing adsorption (“VPSA”) and

membrane separation to produce gaseous oxygen and nitrogen, respectively.

Process gases, including carbon dioxide, hydrogen, carbon monoxide,

helium, specialty gases and acetylene are produced by methods other than air separation. Most carbon dioxide is purchased from by-product sources, including

1

chemical plants, refineries and industrial processes or is recovered from carbon dioxide wells. Carbon dioxide is processed in Praxair’s plants to produce commercial and food-grade carbon

dioxide. Hydrogen and carbon monoxide can be produced by either steam methane reforming or auto-thermal reforming of natural gas or other feed streams such as naphtha. Hydrogen is also produced by purifying by-product sources obtained from the

chemical and petrochemical industries. Most of the helium sold by Praxair is sourced from certain helium-rich natural gas streams in the United States, with additional supplies being acquired from outside the United States. Acetylene is primarily

sourced as a chemical by-product, but may also be produced from calcium carbide and water.

Industrial Gases Distribution

There are three basic distribution methods for industrial gases: (i) on-site or tonnage; (ii) merchant or bulk liquid; and (iii) packaged

or cylinder gases. These distribution methods are often integrated, with products from all three supply modes coming from the same plant. The method of supply is generally determined by the lowest cost means of meeting the customer’s needs,

depending upon factors such as volume requirements, purity, pattern of usage, and the form in which the product is used (as a gas or as a cryogenic liquid).

On-site. Customers that require the largest volumes of product (typically oxygen, nitrogen and hydrogen) and that have a relatively constant

demand pattern are supplied by cryogenic and process gas on-site plants. Praxair constructs plants on or adjacent to these customers’ sites and supplies the product directly to customers by pipeline. On-site product supply contracts generally

are total requirement contracts with terms typically ranging from 10-20 years and containing minimum purchase requirements and price escalation provisions. Many of the cryogenic on-site plants also produce liquid products for the merchant market.

Therefore, plants are typically not dedicated to a single customer. Advanced air separation processes allow on-site delivery to customers with smaller volume requirements. Customers using these systems usually enter into requirement contracts with

terms typically ranging from 5-15 years.

Merchant. The merchant business is generally associated with distributable liquid oxygen, nitrogen,

argon, carbon dioxide, hydrogen and helium. The deliveries generally are made from Praxair’s plants by tanker trucks to storage containers at the customer’s site which are owned and maintained by Praxair and leased to the customer. Due to

distribution cost, merchant oxygen and nitrogen generally have a relatively small distribution radius from the plants at which they are produced. Merchant argon, hydrogen and helium can be shipped much longer distances. The customer agreements used

in the merchant business are usually three-to seven-year requirement contracts.

Packaged Gases. Customers requiring small volumes are

supplied products in metal containers called cylinders, under medium to high pressure. Packaged gases include atmospheric gases, carbon dioxide, hydrogen, helium, acetylene and related products. Praxair also produces and distributes in cylinders a

wide range of specialty gases and mixtures. Cylinders may be delivered to the customer’s site or picked up by the customer at a packaging facility or retail store. Packaged gases are generally sold under one to three-year supply contracts and

through purchase orders.

A substantial amount of the cylinder gases sold in the United States is distributed by independent distributors that buy

merchant gases in liquid form and repackage the products in their facilities. Packaged gas distributors, including Praxair, also distribute hardgoods and welding equipment purchased from independent manufacturers. Over time, Praxair has acquired a

number of independent industrial gases and welding products distributors at various locations in the United States and continues to sell merchant gases to other independent distributors. Between its own distribution business, joint ventures and

sales to independent distributors, Praxair is represented in 48 states, the District of Columbia and Puerto Rico.

Surface Technologies

Praxair Surface Technologies is a leading worldwide supplier of coating services and thermal spray consumables to customers in the aircraft, energy,

printing, primary metals, petrochemical, textile, and other industries. Its coatings are used to provide wear resistance, corrosion protection, thermal insulation, and many other surface-enhancing functions which serve to extend component life,

enable optimal performance, and reduce operating costs. It also manufactures a complete line of electric arc, plasma and wire spray, and high-velocity oxy-fuel (“HVOF”) equipment.

Inventories – Praxair carries inventories of merchant and cylinder gases, hardgoods and coatings materials to supply products to its customers on a

reasonable delivery schedule. On-site plants and pipeline complexes have limited inventory. Inventory obsolescence is not material to Praxair’s business.

2

Customers – Praxair is not dependent upon a single customer or a few customers.

International – Praxair is a global enterprise with approximately 57% of its 2017 sales outside of the United States. It conducts industrial gases business

through consolidated companies in Argentina, Bahrain, Belgium, Bolivia, Brazil, Canada, Chile, China, Colombia, Costa Rica, Denmark, Dominican Republic, France, Germany, India, Ireland, Italy, Japan, Mexico, the Netherlands, Norway, Panama,

Paraguay, Peru, Portugal, Puerto Rico, Russia, South Korea, Spain, Sweden, Taiwan, Thailand, United Arab Emirates, the United Kingdom, and Uruguay. Societa Italiana Acetilene & Derivati S.p.A. (“S.I.A.D.”), an Italian company

accounted for as an equity company, also has established positions in Austria, Bosnia, Bulgaria, Croatia, the Czech Republic, Hungary, Romania, Russia, Serbia, Slovakia, Slovenia and Ukraine. Refrigeration and Oxygen Company Limited

(“ROC”), a Middle Eastern company accounted for as an equity company, has operations in the United Arab Emirates, Kuwait and Qatar. Praxair’s surface technologies segment has operations in Brazil, Canada, China, France, Germany,

India, Italy, Japan, Singapore, South Korea and the United Kingdom.

Praxair’s international business is subject to risks customarily

encountered in foreign operations, including fluctuations in foreign currency exchange rates, import and export controls, and other economic, political and regulatory policies of local governments. Also, see Item 1A. “Risk Factors”

and Item 7A. “Quantitative and Qualitative Disclosures About Market Risk.”

Seasonality – Praxair’s business is generally not

subject to seasonal fluctuations to any significant extent.

Research and Development – Praxair’s research and development is directed toward

developing new and improved methods for the production and distribution of industrial gases and the development of new markets and applications for these gases. This results in the development of new advanced air separation and hydrogen process

technologies and the frequent introduction of new industrial gas applications. Research and development for industrial gases is principally conducted at Tonawanda, New York and Burr Ridge, Illinois.

Praxair conducts research and development for its surface technologies to improve the quality and durability of coatings and the use of specialty

powders for new applications and industries. Surface technologies research is conducted at Indianapolis, Indiana.

Patents and Trademarks – Praxair owns

or licenses a large number of United States and foreign patents that relate to a wide variety of products and processes. Praxair’s patents expire at various times over the next 20 years. While these patents and licenses are considered important

to our individual businesses, Praxair does not consider its business as a whole to be materially dependent upon any one particular patent, or patent license, or family of patents. Praxair also owns a large number of valuable trademarks. Only the

“Praxair” trademark is important to our business as a whole.

Raw Materials and Energy Costs – Energy is the single largest cost item in the

production and distribution of industrial gases. Most of Praxair’s energy requirements are in the form of electricity, natural gas and diesel fuel for distribution.

The supply of energy has not been a significant issue in the geographic areas where the company conducts business. However, energy availability and

price is unpredictable and may pose unforeseen future risks.

For carbon dioxide, carbon monoxide, helium, hydrogen, specialty gases and surface

technologies, raw materials are largely purchased from outside sources. Praxair has contracts or commitments for, or readily available sources of, most of these raw materials; however, their long-term availability and prices are subject to market

conditions.

Competition – Praxair operates within a highly competitive environment. Some of its competitors are larger in size and capital base than

Praxair. Competition is based on price, product quality, delivery, reliability, technology and service to customers.

Major competitors in the

industrial gases industry both in the United States and worldwide include Air Products and Chemicals, Inc., L’Air Liquide S.A., and Linde AG. Principal competitors for the surface technologies business are Chromalloy Gas Turbine LLC, a

subsidiary of Sequa Corporation, Bodycote, PLC, and OC Oerlikon Corp AG. There are other industrial gas and surface coating competitors that compete on a local geography basis.

Employees and Labor Relations – As of December 31, 2017, Praxair had 26,461 employees worldwide. Of this number, 10,382 are employed in the United

States. Praxair has collective bargaining agreements with unions at numerous locations throughout the world, which expire at various dates. Praxair considers relations with its employees to be good.

3

Environment – Information required by this item is incorporated herein by reference to the section captioned

“Management’s Discussion and Analysis – Environmental Matters” in Item 7 of this 10-K.

Available Information – The company

makes its periodic and current reports available, free of charge, on or through its website, www.praxair.com, as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission

(“SEC”). Investors may also access from the company website other investor information such as press releases and presentations. Information on the company’s website is not incorporated by reference herein.

In addition, the public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room located at 100 F Street NE,

Washington, D.C. 20549. The public may also obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, that contains reports, proxy information statements and

other information regarding issuers that file electronically.

Executive Officers – The following Executive Officers have been elected by the Board of

Directors and serve at the pleasure of the Board. It is expected that the Board will elect officers annually following each annual meeting of shareholders.

Stephen F. Angel, 62, is Chief Executive Officer of Praxair, Inc. since January 1, 2007, and Chairman since May 1, 2007. Before becoming the Chief

Executive Officer, Mr. Angel served as President and Chief Operating Officer from March to December 2006, and as Executive Vice President from 2001 to March 2006. Prior to joining Praxair in 2001, Mr. Angel spent 22 years in a variety of management

positions with General Electric. Mr. Angel is a director of PPG Industries, Inc. where he serves on the Officers-Directors Compensation Committee, and the Technology and Environment Committee. He is also a member of The Business Council and is a

member of the Board of the U.S. - China Business Council and its Nominating Committee.

Guillermo Bichara, 43, was appointed Vice President, General

Counsel and Corporate Secretary of Praxair, Inc. effective January 1, 2015. Prior to this, from 2013-2014, he was Associate General Counsel and Assistant Secretary. From 2011-2013, Mr. Bichara served as Associate General Counsel with responsibility

for Praxair Europe, Praxair Mexico and corporate transactions. He was Vice President and General Counsel of Praxair Asia from 2007-2011, and joined Praxair in 2006 as director of legal affairs at Praxair Mexico. Prior to joining Praxair, Mr. Bichara

served as corporate counsel at CEMEX, Mexico’s global leader in the building materials industry, and was a foreign associate and counsel, respectively, at the law firms of Skadden, Arps, Slate, Meagher & Flom and White & Case.

Kelcey E. Hoyt, 48, was named Vice President and Controller effective August 1, 2016. Prior to becoming Controller, she served as Praxair’s

Director of Investor Relations since 2010. She joined Praxair in 2002 and served as Director of Corporate Accounting and SEC Reporting through 2008, and later served as Controller for various divisions within Praxair’s North American Industrial

Gas business. Previously, she had five years of experience in audit at KPMG, LLP. She is a certified public accountant.

Eduardo F. Menezes, 54, was

promoted to Executive Vice President from Senior Vice President effective March 1, 2012. He oversees Praxair’s businesses in Asia, Europe, Mexico, and South America. From 2010 to March 2011, he was a Vice President of Praxair with

responsibility for the North American Industrial Gases business. From 2007 to 2010, he was President of Praxair Europe. He served as Managing Director of Praxair’s business in Mexico from 2004 to 2007, as Vice President and General Manager for

Praxair Distribution, Inc. from 2003 to 2004 and as Vice President, U.S. West Region, for North American Industrial Gases, from 2000 to 2003.

Anne K. Roby, age 53, was named Senior Vice President on January 1, 2014, responsible for Global Supply Systems, R&D, Global Market Development,

Global Operations Excellence, Global Strategic Sales, Global Procurement, Sustainability and Safety, Health and Environment. From 2011to 2013, she served as President of Praxair Asia, responsible for Praxair’s industrial gases business in

China, India, South Korea and Thailand as well as the electronics market globally. In 2010, Dr. Roby became President of Praxair Electronics, after having served as Vice President, Global Sales, for Praxair from 2009 to 2010. Prior to this, she was

Vice President of the U.S. South Region from 2006 to 2009. Dr. Roby joined Praxair in 1991 as a development associate in the Company’s R&D organization and was promoted to other positions of increasing responsibility.

4

David P. Strauss, 59, was appointed Vice President and Chief Human Resources officer of Praxair in 2016. He

joined Praxair in 1990 holding positions of increasing responsibility in the electronics materials business including general manager of North America, vice president of operations and managing director of Electronic Materials, a global business

focused on manufacturing and selling high purity metals and ceramics to the electronics industry. Most recently, he served as Vice President of Safety, Health and Environment for Praxair. In this role, he focused on all aspects of health,

environmental and FDA compliance, personal and process safety, while working closely with the Praxair business communities to achieve sustainable best in class results.

Scott E. Telesz, 50, was promoted to Executive Vice President from Senior Vice President, effective March 1, 2012. He is responsible for Praxair’s

U.S. atmospheric gases businesses, and it’s business in Canada, Praxair Distribution, Praxair Surface Technologies, and Helium-Rare Gases. Before joining Praxair in 2010, he was a Vice President from 2007 to 2010 of SABIC Innovative Plastics, a

major division of Riyadh-based Saudi Basic Industries Corporation, a global manufacturer of chemicals, fertilizers, plastics and metals. From 1998 to 2007, he held a variety of general management positions with General Electric, and from 1989 to

1998, Mr. Telesz held several positions, including Engagement Manager, in the United States and Australia, with McKinsey & Company.

Matthew J. White, 45, was appointed Senior Vice President and Chief Financial Officer effective January 1, 2014. Prior to this, Mr. White was President

of Praxair Canada from 2011-2014. Mr. White joined Praxair in 2004 as finance director of Praxair’s largest business unit, North American Industrial Gases. In 2008, he became Vice President and Controller of Praxair, then was named Vice

President and Treasurer in 2010. Before joining Praxair, Mr. White was vice president, finance, at Fisher Scientific and before that he held various financial positions, including group controller, at GenTek, a manufacturing and performance

chemicals company.

PART III

| ITEM 11. |

EXECUTIVE COMPENSATION |

Executive Compensation Matters

Report of the Compensation Committee

The

Compensation Committee reviewed and discussed with management the “Compensation Discussion and Analysis” and recommended to the Board that it be included herein. The Compensation Committee has represented to management that, to the extent

that the “Compensation Discussion and Analysis” discloses the Compensation Committee’s deliberations and thinking in making executive compensation policies and decisions, it is accurate and materially complete.

The Compensation & Management Development Committee

Edward G.

Galante, Chairman

Oscar Bernardes

Nance K. Dicciani

Wayne T. Smith

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) provides context for the policies and decisions

underlying the compensation reported in the executive compensation tables included herein for Praxair’s Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and the three other executive officers who had the

highest total compensation for 2017,

as set forth in the “Summary Compensation Table” herein (these five executive officers are collectively referred to as the “Named Executive Officers” or the “NEOs”).

The Compensation Committee of the Company’s Board of Directors is responsible for policies and decisions regarding the compensation and benefits for NEOs.

5

Praxair’s Executive Compensation Program

Praxair’s Executive Compensation Objectives

Praxair’s executive compensation program is focused on motivating performance to effectively build shareholder

value. The Company delivers a total compensation package that includes salary, performance-based cash and equity incentives, and a competitive employee benefits program. The Compensation Committee has established the following objectives for

Praxair’s executive compensation program:

| |

· |

|

attract and retain executive talent; |

| |

· |

|

motivate executives to deliver strong business results in line with shareholder expectations; |

| |

· |

|

build and support a sustainable performance-driven culture; and |

| |

· |

|

encourage executives to own Company stock, aligning their interests with those of shareholders.

|

Determining Compensation Opportunity

In order to align executive compensation with Company performance, the Compensation Committee considers a variety of

factors, including the degree to which executive compensation is “at risk.”

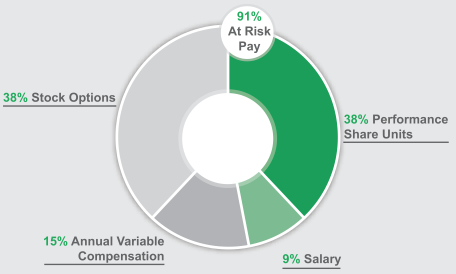

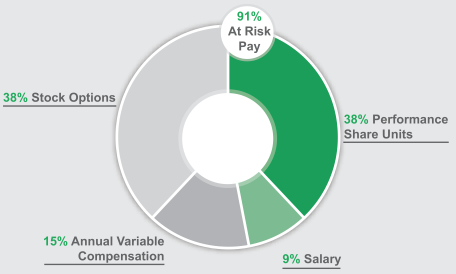

At Risk Pay

Between 73% and 91% of the NEOs’ target total direct compensation opportunity for 2017 was in the form of performance-based variable compensation and equity

grants, motivating them to deliver strong business performance and drive shareholder value. This portion of compensation is “at risk” and dependent upon the Company’s achievement

of pre-established financial and other business goals set by the Compensation Committee and, for equity incentives, the Company’s stock price performance. The annual variable compensation payout and the

ultimate value of the equity compensation awards could be zero if the Company does not perform.

CEO Pay Mix

Performance-based equity compensation is valued at the “grant-date fair value” of each award as determined under

accounting standards related to share-based compensation.

6

Aggregate Compensation

CONSIDERATIONS: The Compensation Committee considers whether the value of each

NEO’s aggregate compensation package is consistent with its objectives for Praxair’s executive compensation program. It evaluates the following factors when determining compensation levels for NEOs:

| |

· |

|

internal equity: respective role, responsibilities and reporting relationships |

| |

· |

|

experience and time-in-position |

| |

· |

|

contribution to results, and exhibition of values, competencies and behaviors critical to the success of the Company |

| |

· |

|

year-to-year updates in market median data |

The Compensation Committee does not have a set formula for determining target compensation

opportunity, however it refers to the median benchmark data during its regular review. Compensation levels tend to be established towards the lower end of a competitive market range for an executive officer who is new to the role. Conversely, a

longer tenured executive officer who consistently performs at a high level will have target compensation levels set higher in the competitive range.

As part of the

review, the Compensation Committee compares the CEO’s pay to that of the other NEOs. As in previous years, the CEO’s pay as a multiple of the next highest paid NEO was determined to be appropriate, as the organization does not have a Chief

Operating Officer, and the CEO has business executives reporting directly to him. It was also noted that the ratio of CEO pay to the pay of other NEOs collectively changes year-over-year to reflect shifts in executive officer roles from promotions

to, and retirements from, those roles.

Compensation Peer Group

The Compensation Committee reviews the benchmark companies used to assess competitive market compensation ranges for U.S.-based officers (the Key Company Group).

Elements considered when choosing companies to be included are:

| |

· |

|

Market capitalization Considerable weight is given to market capitalization, as the Company’s market capitalization has consistently been about three times its annual revenue. |

| |

· |

|

Revenue and net income Companies are included in the review if they are generally similar in size to Praxair in one or both of these measures. |

| |

· |

|

Other considerations Assets, number of employees, whether or not a company had global operations and whether a company’s operations were similar to that of Praxair or Praxair’s customers are

considered. |

Though the Compensation Committee reviews the Key Company Group annually, it values year-over-year consistency in the peer group

and only makes changes when appropriate. When the review was performed in October 2016, the Compensation Committee determined to remove EMC from the peer group as it no longer was a publically traded company. The following Key Company Group

was used for setting 2017 compensation:

|

|

|

|

|

|

Key Company

Group |

| Air Products and Chemicals |

|

Danaher |

|

Mosaic |

| Anadarko Petroleum Corp |

|

DuPont |

|

Norfolk Southern |

| Applied Materials |

|

Ecolab |

|

PPG Industries |

| Baker Hughes |

|

General Mills |

|

Sherwin-Williams |

| Baxter International |

|

Illinois Tool Works |

|

Stryker |

| Colgate-Palmolive |

|

International Paper |

|

Texas Instruments |

| Corning |

|

Kellogg |

|

Thermo Fisher Scientific |

| CSX Corp |

|

Kimberly-Clark |

|

|

| Cummins |

|

Monsanto |

|

|

7

Role of the Compensation Consultant

The Compensation Committee engages a third-party compensation consultant to assist in analysis as is necessary to inform

and support the Compensation Committee’s decisions on executive compensation. For its consideration of 2017 executive compensation, the Compensation Committee engaged Deloitte Consulting LLP (“Deloitte Consulting”).

In 2017, the scope of Deloitte Consulting’s engagement included:

| |

· |

|

Advice on the determination of NEO’s compensation, the consultant’s view of the CEO’s recommendations for other NEO compensation, as well as input on the CEO’s compensation |

| |

· |

|

Preparation and presentation to the Compensation Committee of reports on executive compensation trends and other various materials |

| |

· |

|

Review of the peer group analysis and compensation benchmarking studies prepared by management and review of other independent compensation data

|

Pay Design and Decisions

Direct Compensation for Executive Officers

Salary

The salary level for each NEO was established by the Compensation Committee after its consideration of multiple factors including positioning to market, CEO input

(other than for himself) and advice from Deloitte Consulting. Salary adjustments, if any, are typically effective April 1 of each year.

Annual Performance-Based Variable Compensation

The Compensation Committee sets annual goals to drive desired short-term business performance by focusing executives on key objectives that position Praxair for

sustained growth and create shareholder value without compromising long-term business objectives. The program is designed to deliver pay commensurate with performance: results that are greater than goals are rewarded with above target payout levels,

and performance not meeting minimum threshold expectations reduces the payout to zero.

8

|

|

|

|

|

| |

|

No changes in 2017 design |

|

|

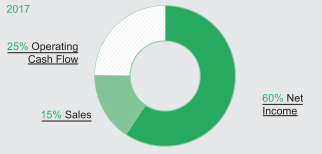

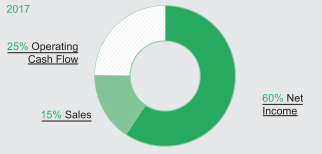

2017 DESIGN The Compensation

Committee reviewed the financial measures in the annual variable compensation program and, in recognition of the continued importance of profitability and cash flow to the Company and to investors, determined to make no design changes to the

financial goals of net income at a weighting of 60%, operating cash flow at a weighting of 25%, and sales at a weighting of 15%.

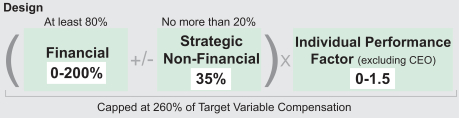

BUSINESS RESULTS:

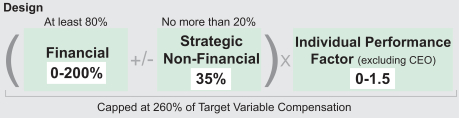

FINANCIAL GOALS Awards are determined based on Company performance against challenging, pre-established

financial goals. Payouts can range from zero to 200% of target variable compensation, and the financial performance must contribute at least 80% of the total business results for NEOs.

STRATEGIC NON-FINANCIAL GOALS The Compensation Committee may

make a positive or negative adjustment of up to 35 percentage points to the total financial payout earned based on the Committee’s detailed review and assessment of performance against pre-established non-financial goals that relate directly to the Company’s

strategic objectives. Points awarded for strategic non-financial goals cannot

exceed 20% of the total business payout for NEO payout determination.

INDIVIDUAL PERFORMANCE: The Compensation Committee does not assign an individual performance factor for the CEO, though it retains the discretion to decrease (but not increase) his payout if deemed appropriate. The Compensation Committee may

positively or negatively adjust each other NEO’s performance-based variable compensation to reflect each individual’s contribution to Company performance. Individual performance adjustments can reduce each NEO’s payout to as low as

zero or increase it by a factor of up to 1.5, however, in the past ten years, the maximum awarded has not exceeded 1.3.

MAXIMUM PAYOUT: Total payout for officers is capped at 260% of target variable compensation except for the CEO, whose maximum is 235%.

Annual Performance-Based Variable Compensation Opportunity for 2017

In December 2016, the 2017 variable compensation target for each NEO (expressed as a percent of salary that would be earned for 100% achievement of the performance

goals) was established by the Compensation Committee. The target level for each NEO ranged from 75% to 160% of base salary.

9

DETERMINING FINANCIAL GOALS

At the time goals are established, the Compensation Committee considers many factors including the degree of control senior management may have over certain factors that

affect financial performance. Goals are established with the expectation that executives will be rewarded with higher variable compensation payouts if performance exceeds expectations. Factors considered in assessing the challenge inherent in

setting the threshold, target and maximum financial performance goals for each financial measure include:

| |

· |

|

management’s operating plan, including expected year-over-year challenges in performance, |

| |

· |

|

external earnings guidance provided to shareholders, |

| |

· |

|

macro-economic trends and outlooks in each of the countries in which the Company operates, |

| |

· |

|

foreign exchange rate trends and outlook, |

| |

· |

|

expected industrial gases industry peer performance and that of the broader S&P 500, |

| |

· |

|

shifts in key customer markets, and |

| |

· |

|

expected contribution from contracts already awarded and decisions or actions already made or taken.

|

DETERMINING STRATEGIC NON-FINANCIAL GOALS

The Company’s culture has been institutionalized over decades and is the foundation on which employees drive and deliver financial results. The Board believes

culture must be driven from the top by example. As such, the Compensation Committee confirmed the importance of setting non-financial objectives to reinforce leadership’s focus on maintaining an enduring

culture that supports both short- and long-term sustainable results. The Compensation Committee identified the non-financial elements that were considered most important to long-term sustainable success and

established annual non-financial goals with respect to those elements.

Most of the strategic

non-financial goals are linked to quantitative and measurable objectives, although the Compensation Committee ultimately uses its judgment when determining the points awarded for goal achievement after a

rigorous review of the results.

|

|

|

| GOAL |

|

ADDITIONAL DETAIL |

| Safety, Environmental Performance and Sustainability:

· Zero

fatalities

· Maintain

best in class safety rates

· Superior

performance in sustainable development including environmental stewardship |

|

·

Providing our employees with a safe operating environment through investing in state of the art technology and by driving a culture in which safety is a top priority

· Rigorous

processes and procedures to ensure compliance with all applicable environmental regulations, to meet sustainable development performance targets and to continuously reduce the environmental impact of our operations in the communities in which we

operate |

| People Development:

·

Strengthen leadership pipeline, including globally diverse talent |

|

·

Attraction, retention and development of a diverse and engaged workforce through a robust succession planning process · Employee value proposition includes providing strong, dynamic leadership, a challenging work environment, industry-leading performance,

competitive pay and benefits, and rewards and recognition for outstanding performance |

| Compliance:

· Maintain

a strong global compliance program and culture |

|

· Create

and maintain a strong ethical culture in every country where we operate · All employees accountable for ensuring that business results are achieved in compliance with local laws and regulations and our

Standards of Business Integrity |

| Strategy:

· Position

the business for long-term performance |

|

· Deliver

excellent results in the short-term and over a longer, sustainable period of time · Rigorously assess the quality and future impact of actions taken, as benefits may not be recognized for several years |

| Project Selection and Execution:

· Maintain

industry-leading performance |

|

· Maintain

a thorough capital allocation process to ensure careful selection of projects · Focus on meeting schedules and cost estimates, starting-up plants reliably and efficiently, and

supporting plant availability |

| Productivity:

· Enhance

organizational capabilities in tools, processes and practices |

|

· Deliver

value through continuous innovation to help our customers enhance their product quality, service, reliability, productivity, safety, and environmental performance

· Work

across disciplines, industries and sectors, with our employees, customers, suppliers and a range of other stakeholders to get more output utilizing fewer resources and with less environmental impact |

| Relative Performance:

· Strong

performance relative to peer companies |

|

· Continue

to be the best performing industrial gases company in the world · Assess how well we anticipate and manage adversity to optimize results

·

Determine if management’s actions appear more or less effective than those of our peers · Appropriately respond to macroeconomic or other external factors unknown at the time financial goals were established |

10

2017 Annual Performance-Based Variable Compensation Results and Payout

FINANCIAL BUSINESS RESULTS

As noted above, financial goals are set considering multiple factors with the recognition that there are some items that cannot be easily predicted, and over which

management has less control, such as foreign exchange rates and certain raw materials price changes. As part of the variable compensation plan design, certain pre-determined adjustments may be made by the

Compensation Committee to actual financial results in order to account for these elements. The Compensation Committee may also conclude that additional adjustments are appropriate based upon unforeseen factors it deems extraordinary, non-recurring or otherwise properly modified.

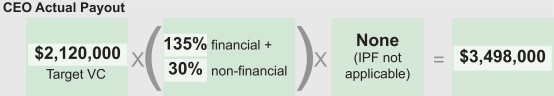

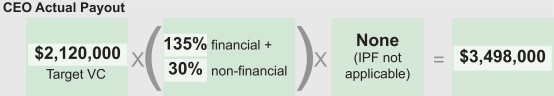

The Company generated record operating cash flow of $3 billion, 10% above prior year. Net income also grew by 10%

versus prior year, and sales results significantly exceeded the goal. The overall payout for financial performance was 135% of target.

The chart below shows for

each financial performance measure, the Company’s 2017 financial targets set by the Compensation Committee and the actual performance achieved.

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial

Measure |

|

Target

($ millions) |

|

Actual

($ millions) |

|

Weight |

|

Achievement |

|

Payout |

| Sales* |

|

10,786 |

|

11,248 |

|

15% |

|

141% |

|

|

21% |

|

| Net Income* |

|

1,620 |

|

1,664 |

|

60% |

|

126% |

|

|

76% |

|

| Operating Cash Flow |

|

2,801 |

|

3,041 |

|

25% |

|

151% |

|

|

38% |

|

* For the annual variable

compensation program, sales and net income are measured in accordance with GAAP subject to certain adjustments that the Compensation Committee approves.

STRATEGIC NON-FINANCIAL BUSINESS RESULTS

Coupled with its assessment of performance related to financial goals, the Compensation Committee reviewed the strategic actions taken by management that focused on

long term sustainable success. In December 2017, management presented to the Compensation Committee, the degree of achievement in meeting each goal, and for each element, provided its view of the relative degree of importance to long term success.

Based on the results, the Compensation Committee determined that the Company’s performance with respect to the

non-financial goals was favorable and awarded a positive 30% adjustment. The Compensation Committee noted the following as examples of actions that support the Company’s strategic objectives in

determining 2017 variable compensation payouts:

| |

· |

|

Maintained world class performance in safety with a reduction of over 25% in significant safety events |

| |

· |

|

Lowest ever high severity product vehicle accident rates |

| |

· |

|

Maintained industry leading project execution with 98% first year reliability |

| |

· |

|

Optimized base business through productivity and cost structure alignment |

| |

· |

|

Strategically pursued resilient markets; grew to 28% of total sales versus 27% in 2016 |

| |

· |

|

Signed long-term agreement with Samsung; largest investment in a customer project to date

|

| |

· |

|

Commercialized over 25 new technologies in support of growth opportunities |

| |

· |

|

Continued to execute on backlog and won $1.1 billion of new projects in the U.S. Gulf Coast |

| |

· |

|

Continued to develop a diverse pipeline of future senior leaders |

| |

· |

|

Received Public Recognition: |

| |

· |

|

Dow Jones Sustainability World Index for 15th year in a row |

| |

· |

|

10th consecutive year on the Climate Disclosure Leadership Index, and recognized as only industrial gases company that made the “A-List” for the Materials sector

|

| |

· |

|

Received “Top 25 Noteworthy Company” by DiversityInc and a perfect score of 100 for the second consecutive year by The Human Rights Campaign for workplace equality and advocacy |

| |

· |

|

Recognized as a 2017 World’s Most Ethical Company by the Ethisphere Institute |

| |

· |

|

Had over 220 sites achieving over 90% waste reduction |

INDIVIDUAL PERFORMANCE ADJUSTMENTS

Excluding the CEO, the Compensation Committee may make a positive, negative or no adjustment to each NEO’s performance-based variable compensation

based on its evaluation of individual performance. In evaluating if an individual performance adjustment was appropriate, the Compensation Committee considered various qualitative factors, such as the NEO’s:

11

| |

· |

|

performance in his or her principal area of responsibility, |

| |

· |

|

degree of success in leading the Company to meet its strategic objectives, and |

| |

· |

|

championing of the values and competencies that are important to the success of the Company.

|

Adjustments were made to the payouts of each NEO based upon individual performance in 2017. The Compensation Committee

did not find it practical, nor did it attempt, to assign relative weights to any individual factors or subject them to pre-defined, rigid formulas, or set financial or other objective goals related to personal

performance, and the importance and relevance of specific factors varied for each NEO. None of the adjustments made were material to annual performance-based variable compensation payments.

2018 DESIGN

The Compensation Committee reviewed the design of the annual variable compensation program in anticipation of the

completion of the proposed merger with Linde AG in the second half of 2018. Due to this extraordinary corporate event, it was determined that in the event the merger is completed, business results will be measured through the date of merger to

determine the pro rata portion of the award earned through closing and that the award for the remaining portion of the year will be determined at target. It

was also determined that the non-financial results for 2018 will be based on performance through the date of merger and applied as an adjustment to the

full year payout. No other additions to the design of the annual variable compensation program were made.

Equity Awards

Equity awards are the largest portion of each NEO’s target compensation. This weighting helps ensure a strong

alignment of NEOs’ and shareholders’ long-term interests. Annual grants of equity awards are made to incent and reward sustained performance.

Equity

awards are granted as a mix of stock option and performance share unit (PSU) awards. The mix and type of awards granted to the CEO and other NEOs is the same as those granted to all eligible executives of the Company.

Fully aligning the leadership team, from mid-management to officers, is a

long-standing practice of the Company that helps sustain its culture of incenting and rewarding all participants with the same goals and performance results.

12

|

| Stock Options

The Compensation Committee believes that stock options continue to present an appropriate balance

of risk and reward in that the options have no value unless the Company’s stock price increases above the option exercise price and that the opportunity for leveraged appreciation from growth in shareholder value over the ten-year grant term encourages long term decision-making. The Compensation Committee notes that the Company’s historical record of strong stock price performance results in the Company’s executives placing

high value on stock options as a compensation vehicle.

· Exercise price

is fixed at 100% of the closing market price on date of grant.

· Vest in equal

annual tranches over three years and expire after ten years.

· Repricing only

with shareholder approval. · NEOs must hold all shares obtained from exercise, net of taxes and exercise price, until the stock ownership requirement is met.

|

|

| Performance Share

Units The Compensation Committee recognizes that PSUs can provide appropriate

rewards to executives for performance while also potentially mitigating some of the impact of an economic downturn on the stock option portion of the annual awards. A three-year performance period is believed to be an appropriate balance between the

one-year performance-based variable compensation goals and the longer-term stock option share price growth goals. Additionally, the overlapping three-year performance periods that result from regular annual

grants promote retention and encourage management to focus on sustainable growth and shareholder returns.

· Vest if pre-established performance goals are attained and forfeited if threshold goal is not met.

· Pay no dividends

nor accumulate dividend equivalents prior to vesting. · NEOs must hold all after-tax shares derived from vested awards until the stock ownership requirement

is met. |

2017 EQUITY AWARDS

In December 2016, the target dollar value of 2017 equity awards for each NEO was established. Particular emphasis was placed on retention considerations and the

importance of providing NEOs incentive and appropriate reward for taking high quality actions to support sustainable long-term growth.

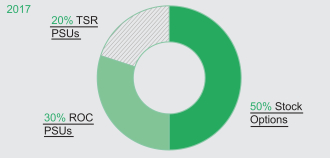

The Compensation Committee

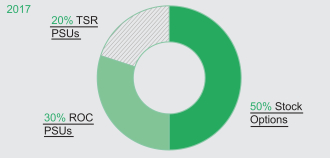

examined current usage and projections of available shares in the shareholder approved long-term incentive plan, and discussed specific terms of proposed awards. Based on its review it was determined that the mix of stock options and PSUs should be

50% of the 2017 equity award value in stock options, 30% in PSUs that measure three-year ROC performance, and 20% as

PSUs that measure relative total shareholder return (“TSR”) over a three year period.

ROC-measured performance share units

In January 2017, the ROC goal for the PSU awards covering

fiscal years 2017 - 2019 was determined after the Compensation Committee examined prior-year ROC results, industry ROC averages, capital expenditure projections and the Company’s weighted average cost of capital. It was acknowledged that the

Company had maintained industry-leading ROC, and the payout schedule set for the PSU awards would encourage and reward the executive team for taking actions that result in maintaining ROC performance.

The February 2017 awards are measured against the

following ROC goals:

13

|

|

|

|

|

|

|

|

|

| 2017-2019 |

|

Average Annual ROC |

|

|

Payout* |

|

| Below Threshold |

|

|

<11.0% |

|

|

|

0% |

|

| Threshold |

|

|

11.0% |

|

|

|

50% |

|

| Target |

|

|

12.5% |

|

|

|

100% |

|

| Maximum |

|

|

³13.5% |

|

|

|

200% |

|

*Interpolated for results between threshold and maximum.

ROC is the Company’s after-tax return on capital as reported in its Form 8-K Results of Operations and Financial Condition, adjusted to eliminate the after-tax effect of any material acquisition occurring during the Performance Period that was not

known at the time the goals were set.

Relative TSR-measured performance share units

For the February 2017 awards based on relative TSR, performance is measured against the companies of the S&P 500 as of January 1, 2017, excluding the Financial

sector, and payouts will be determined based on the following schedule:

|

|

|

|

|

|

|

|

|

| 2017-2019 |

|

TSR Rank |

|

|

Payout* |

|

| Below Threshold |

|

|

<25%ile |

|

|

|

0% |

|

| Threshold |

|

|

25%ile |

|

|

|

25% |

|

| Target |

|

|

50%ile |

|

|

|

100% |

|

| Maximum |

|

|

³75%ile |

|

|

|

200% |

|

*Interpolated for results between threshold and maximum.

2015 - 2017 PERFORMANCE SHARE UNIT PAYOUTS

In

February 2018, the grants of the ROC-measured 2015 PSUs that met the pre-established performance criteria at the end of 2017 became vested and were converted to shares

and distributed.

Though ROC over the 2015 - 2017 performance cycle remained industry-leading and the average annual ROC of 12.4% exceeded

the performance threshold, actual performance was lower than the 13% required for a target level payout of the awards. The Compensation Committee certified the vesting of 70% of the target number of PSUs granted.

|

|

|

|

|

| ROC |

| ROC Target |

|

Average ROC |

|

2015 - 17 Payout* |

| 13% |

|

12.4% |

|

70.0% |

*Payout determined based on linear interpolation from actual results to the target.

Half of the PSUs awarded in 2015 had pre-established goals based on the Company’s adjusted diluted cumulative EPS growth

for the 2015 - 2017 performance cycle. The EPS goals, which included a 20% growth target, were not met. Therefore, the Compensation Committee determined that these PSUs would be forfeited.

2018 EQUITY AWARDS

Recognizing the additional

complexity in design considerations for the 2018 awards as a result of the proposed merger with Linde AG, the Compensation Committee determined that it would be appropriate to grant restricted stock units (RSUs) that vest on the third anniversary of

the grant date, and provide a mix of 50% stock options and 50% RSUs for the 2018 equity awards.

Benefits Available to Executive Officers

The Company makes available to NEOs essentially the same benefit plans generally available to other U.S. employees, and

also provides to them limited perquisites and personal benefits.

Health, Welfare and Retirement Plans

Competitive benefits are provided to attract executive talent and promote employee health and well-being, to provide opportunity for retirement income accumulation,

including opportunities to “invest in” Company stock and to encourage long term service.

TAX-QUALIFIED PENSION PLAN

| |

· |

|

The Company maintains a tax-qualified pension plan for eligible employees, including the NEOs.

|

SUPPLEMENTAL RETIREMENT INCOME PLAN

| |

· |

|

The plan is maintained for the primary purpose of providing retirement benefits that would otherwise be paid to employees under the tax-qualified pension plan but for certain

limitations under federal tax law. |

| |

· |

|

Incremental benefits paid are calculated in the same manner as the underlying tax-qualified pension plan. |

| |

· |

|

Only base salary and annual variable compensation awards are considered in pension calculations. |

401(K) PLAN

| |

· |

|

Contributions to the plan are voluntary and may be invested in various funds, including the Company’s stock fund.

|

14

DEFERRED COMPENSATION

| |

· |

|

Employees eligible to participate in the Variable Compensation Plan, including the NEOs, may participate in the plan. |

| |

· |

|

Contributions to the plan are voluntary and represent compensation already earned by the participants. |

| |

· |

|

No above-market earnings are payable. |

OTHER PLANS

| |

· |

|

Medical and dental plans, disability, life insurance, relocation and vacation programs are provided.

|

Perquisites and Personal Benefits

The Compensation Committee reviews items that could be construed as perquisites or personal benefits for each NEO to ensure they are provided for limited and

specifically defined business purposes. No “tax gross-up” is permitted for any executive officer unless such gross-up is available to employees generally. The

Company’s internal audit department performs an annual audit of executive officer expense reports for compliance with Company policies and the independent auditors review that work.

Other Compensation Policies and

Considerations

Severance and

Change-in-Control Arrangements

The Company maintains a severance plan that

provides certain benefits to eligible employees, including NEOs. The Company has also entered into executive severance compensation agreements with certain senior executives, including NEOs. Additional information about these arrangements is

included in the section below entitled “Severance and Other Change-In-Control Benefits.”

Stock Ownership, Retention Requirements, Hedging, and Pledging

In order to align executives’ interests with shareholder interests, the Compensation Committee has established a stock ownership policy for NEOs (see disclosure on

details of this policy in the “Executive Stock Ownership and Shareholding Policy” section below). NEOs may comply with this policy by acquiring Company stock or stock-equivalent units through equity

incentive grants, as well as through the Company’s Compensation Deferral Program, 401(k) Plan, Dividend Reinvestment and Stock Purchase Plan and through other personal investments. Under the Company’s Stock Ownership Policy, unless the

stock ownership level is met, an executive officer may not sell any of his or her holdings of Company stock, and must hold all shares acquired after tax upon vesting of PSUs or restricted stock units and shares acquired upon an option exercise net

of shares used to pay taxes and/or the option exercise price. An executive officer may not engage in hedging transactions related to Company stock that would have the effect of reducing or eliminating the economic risk of holding Company stock. In

addition, no executive officer

may pledge or otherwise encumber any of his or her Praxair stock.

The Compensation Committee reviewed 2017

stock transactions by executive officers and their year-end holdings to ensure that executives were compliant with the stock ownership policy, including the policy’s anti-hedging and anti-pledging

provisions. Based on this review, the Compensation Committee determined that the equity incentives previously granted to NEOs continue to be used appropriately.

Executive Stock Ownership and Shareholding Policy

A stock ownership and shareholding policy has been established for the Company’s

officers that requires them to own a minimum number of shares as set forth below. Individuals must meet the applicable ownership level no more than five years after first becoming subject to it by acquiring at least 20% of the required stock each

year. Until the stock ownership requirement is met, executive officers (i) may not sell, transfer, or otherwise dispose of any of their Praxair common stock, and (ii) must retain and hold all Praxair common stock acquired from all equity

incentive awards, net of shares withheld for taxes and option exercise prices, including performance share unit awards, restricted stock unit awards and stock options.

Set forth below is the minimum number of shares required by the policy for each officer position. As of the date of this filing, all covered individuals are in

compliance with this policy.

15

|

|

|

| |

|

Minimum Shares

to be Owned |

| Chief Executive Officer |

|

100,000 |

| Executive Vice Presidents |

|

30,000 |

| Chief Financial Officer |

|

25,000 |

| Senior Vice Presidents |

|

20,000 |

| Other Executive Officers |

|

10,000-15,000 |

Recapture Clawback Policy

The Compensation Committee has adopted a policy for the recapture of annual performance-based variable compensation

payouts, equity grants and certain equity gains in the event of a later restatement of financial results. Specifically, if the Board, or an appropriate committee thereof, has determined that any fraud by any elected officer of the Company materially

contributed to the Company having to restate all or a portion of its financial statement(s), the Board or committee shall take, in its discretion, such action as it deems necessary to remedy the misconduct. In determining what remedies to pursue,

the Board or committee will take into account all relevant factors, including consideration of fairness and equity. Among those remedies, the Board or committee, to the extent permitted by applicable law, may require reimbursement of any

performance-based cash, stock or equity-based award paid or granted to, or gains realized by (such as through the exercise of stock options or sale of equity securities), any or all elected officers of the Company, if and to the extent that:

| |

· |

|

the amount of such cash, stock or equity-based award was calculated based upon, or realized gain can reasonably be attributed to, certain financial results that were subsequently reduced due to a restatement, and

|

| |

· |

|

the amount of the cash, stock or equity-based award, or gain that would have been paid or granted or realized,

|

| |

|

would have been lower than the amount actually paid or granted or realized. |

Tax and Accounting

Under Internal Revenue Code Section 162(m), the Company may not take a tax deduction for compensation paid to any

NEO that exceeds $1 million in any year. The Tax Cuts and Jobs Act of 2017 eliminated the exemption for performance-based compensation, expanded the scope of the provision to cover the Company’s CFO

and all other NEOs reported after 2016, and included a “grandfathering” exception for compensation provided by a written binding contract in effect on November 2, 2017 and not subsequently materially modified. While the Compensation

Committee considers tax deductibility when determining compensation, it retains discretion to authorize compensation that is not tax deductible in order to remain competitive to market and meet business objectives.

Accounting treatments were also reviewed by the Committee but did not impact the selection and design of equity and equity-related compensation for 2017, although all

such grants to NEOs were made in such a manner as to not require liability accounting treatment.

16

EXECUTIVE COMPENSATION TABLES

The tables below present compensation information for NEOs and include footnotes and other narrative explanations important for understanding of the compensation

information in each table. The Summary Compensation Table summarizes key components of NEO compensation for 2017, 2016 and 2015. The tables following the Summary Compensation Table provide more detailed information about the various types of NEO

compensation for 2017, some of which are included in the Summary Compensation Table. The final table provides information regarding compensation that NEOs would receive if their employment with the Company terminates under various circumstances or

in connection with a change-in-control.

Summary Compensation

Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NAME AND PRINCIPAL POSITION |

|

Year |

|

|

Salary

($)(1) |

|

|

Stock

Awards ($)(2) |

|

|

Option

Awards ($)(2) |

|

|

Non-equity

Incentive Plan Compensation ($)(3) |

|

|

Change in

Pension Value and Nonqualified

Deferred Compensation Earnings

($)(4) |

|

|

All Other

Compensation ($)(5) |

|

|

Total

($) |

|

| Stephen F. Angel, |

|

|

2017 |

|

|

|

1,325,000 |

|

|

|

5,287,145 |

|

|

|

5,402,622 |

|

|

|

3,498,000 |

|

|

|

6,229,000 |

|

|

|

227,904 |

|

|

|

21,969,671 |

|

| Chairman, President & Chief |

|

|

2016 |

|

|

|

1,318,750 |

|

|

|

4,227,958 |

|

|

|

3,709,390 |

|

|

|

2,236,600 |

|

|

|

1,357,000 |

|

|

|

187,364 |

|

|

|

13,037,062 |

|

| Executive Officer |

|

|

2015 |

|

|

|

1,300,000 |

|

|

|

5,043,233 |

|

|

|

3,130,159 |

|

|

|

702,000 |

|

|

|

4,733,000 |

|

|

|

171,133 |

|

|

|

15,079,525 |

|

| Matthew J. White, |

|

|

2017 |

|

|

|

637,500 |

|

|

|

883,894 |

|

|

|

902,338 |

|

|

|

1,136,025 |

|

|

|

95,000 |

|

|

|

32,867 |

|

|

|

3,687,623 |

|

| Senior Vice President & |

|

|

2016 |

|

|

|

587,500 |

|

|

|

865,778 |

|

|

|

759,108 |

|

|

|

635,279 |

|

|

|

25,000 |

|

|

|

29,250 |

|

|

|

2,901,915 |

|

| Chief Financial Officer |

|

|

2015 |

|

|

|

537,500 |

|

|

|

789,918 |

|

|

|

489,951 |

|

|

|

193,500 |

|

|

|

19,000 |

|

|

|

26,750 |

|

|

|

2,056,619 |

|

| Eduardo F. Menezes, |

|

|

2017 |

|

|

|

642,500 |

|

|

|

866,648 |

|

|

|

885,046 |

|

|

|

1,036,272 |

|

|

|

3,047,000 |

|

|

|

38,094 |

|

|

|

6,515,560 |

|

| Executive Vice President |

|

|

2016 |

|

|

|

611,250 |

|

|

|

904,659 |

|

|

|

793,542 |

|

|

|

688,474 |

|

|

|

1,458,000 |

|

|

|

35,922 |

|

|

|

4,491,847 |

|

|

|

|

2015 |

|

|

|

578,750 |

|

|

|

915,969 |

|

|

|

568,003 |

|

|

|

203,662 |

|

|

|

160,000 |

|

|

|

34,246 |

|

|

|

2,460,630 |

|

| Scott E. Telesz, |

|

|

2017 |

|

|

|

631,625 |

|

|

|

837,380 |

|

|

|

855,606 |

|

|

|

885,854 |

|

|

|

87,000 |

|

|

|

44,220 |

|

|

|

3,341,686 |

|

| Executive Vice President (6) |

|

|

2016 |

|

|

|

615,000 |

|

|

|

903,570 |

|

|

|

792,429 |

|

|

|

554,140 |

|

|

|

31,000 |

|

|

|

43,813 |

|

|

|

2,939,951 |

|

|

|

|

2015 |

|

|

|

595,000 |

|

|

|

915,969 |

|

|

|

568,003 |

|

|

|

200,277 |

|

|

|

29,000 |

|

|

|

41,293 |

|

|

|

2,349,542 |

|

| Anne K. Roby, |

|

|

2017 |

|

|

|

493,750 |

|

|

|

480,388 |

|

|

|

490,680 |

|

|

|

702,668 |

|

|

|

2,177,000 |

|

|

|

18,931 |

|

|

|

4,363,417 |

|

| Senior Vice President |

|

|

2016 |

|

|

|

471,250 |

|

|

|

501,862 |

|

|

|

440,159 |

|

|

|

430,859 |

|

|

|

1,139,000 |

|

|

|

17,526 |

|

|

|

3,000,656 |

|

| |

|

|

2015 |

|

|

|

452,500 |

|

|

|

512,607 |

|

|

|

317,602 |

|

|

|

125,433 |

|

|

|

26,000 |

|

|

|

14,651 |

|

|

|

1,448,793 |

|

| (1) |

Amounts reported are actual salaries paid for the calendar year and include adjustments to base salary rates if applicable. Base salary adjustments are typically effective April 1 of each year.

|

| (2) |

These amounts were not paid in the respective year but rather are the full grant date fair value of equity awards made for each year as determined under accounting standards related to share-based compensation. The

Stock Awards amounts are the values for PSU grants made to each NEO in each of the years valued at the target number of shares granted. The Option Awards amounts are the values for options granted in each of the years. The maximum payout values of

the PSU awards (based upon the price per share used to compute the full grant date fair values in the table above) are: Mr. Angel: $10,574,290, $8,455,916, and $10,086,466 for 2017, 2016 and 2015, respectively; Mr. White: $1,767,788,

$1,731,556, and $1,579,837 for 2017, 2016 and 2015, respectively; Mr. Menezes: $1,733,296, $1,809,318, and $1,831,939 for 2017, 2016 and 2015, respectively; Mr. Telesz: $1,674,760, $1,807,140, and $1,831,939 for 2017, 2016 and 2015,

respectively; and Ms. Roby: $960,776, $1,003,724 and $1,025,213 for 2017, 2016 and 2015, respectively. The assumptions used in computing the Option Awards and Stock Awards amounts are included in Note 15 to the Company’s 2017 financial

statements in the 2017 Form 10-K and Annual Report. |

The amounts shown in the Stock

Awards and Option Awards columns are subject to vesting and performance conditions that may or may not result in actual payouts in future years. In addition, a stock option has value only if the Company’s stock price increases above the option

exercise price (an “in-the-money” option). If a NEO exercises an in-the-money