Attached files

| file | filename |

|---|---|

| EX-99.2 - FIRST QUARTER 2018 INVESTOR SUPPLEMENT OF KEMPER CORPORATION - KEMPER Corp | kmpr2018033118ex992supplem.htm |

| EX-99.1 - REGISTRANTS PRESS RELEASE DATED APRIL 30, 2018 - KEMPER Corp | kmpr2018033118ex991release.htm |

| 8-K - 8-K - KEMPER Corp | kmpr20180331188-kreleasean.htm |

First Quarter

2018 Earnings

April 30, 2018

2 Earnings Call Presentation – 1Q 2018

Preliminary Matters

Cautionary Statements Regarding Forward-Looking Information

This communication may contain or incorporate by reference statements or information that are, include or are based on forward-looking statements

within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations,

intentions, beliefs or forecasts of future events or otherwise for the future, and can be identified by the fact that they relate to future actions,

performance or results rather than relating strictly to historical or current facts. Words such as “believe(s),” “goal(s),” “target(s),” “estimate(s),”

“anticipate(s),” “forecast(s),” “project(s),” “plan(s),” “intend(s),” “expect(s),” “might,” “may,” “could” and variations of such words and other words and

expressions of similar meaning are intended to identify such forward-looking statements. However, the absence of such words or other words and

expressions of similar meaning does not mean that a statement is not forward-looking.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such

statements. Forward-looking statements involve a number of risks and uncertainties that are difficult to predict, and are not guarantees or assurances

of future performance. No assurances can be given that the results and financial condition contemplated in any forward-looking statements will be

achieved or will be achieved in any particular timetable. Forward-looking statements involve a number of risks and uncertainties that are difficult to

predict, and can be affected by inaccurate assumptions or by known or unknown risks and uncertainties that may be important in determining actual

future results and financial condition. The general factors that could cause actual results and financial condition to differ materially from those

expressed or implied include, without limitation, the following: (a) the satisfaction or waiver of the conditions precedent to the consummation of the

proposed merger transaction involving Kemper Corporation (the “Company”), a wholly-owned subsidiary of the Company and Infinity Property and

Casualty Corporation (“Infinity”), including, without limitation, the receipt of stockholder and regulatory approvals (including approvals, authorizations

and clearance by insurance regulators necessary to complete such proposed merger transaction) on the terms desired or anticipated (and the risk that

such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of such proposed

merger transaction); (b) unanticipated difficulties or expenditures relating to such proposed merger transaction; (c) risks relating to the value of the

shares of the Company’s common stock to be issued in such proposed merger transaction; (d) disruptions of the Company’s and Infinity’s current plans,

operations and relationships with third persons caused by the announcement and pendency of such proposed merger transaction, including, without

limitation, the ability of the combined company to hire and retain any personnel; (e) legal proceedings that may be instituted against the Company and

Infinity in connection with such proposed merger transaction; and (f) those factors listed in annual, quarterly and periodic reports filed by the Company

and Infinity with the Securities and Exchange Commission (the “SEC”), whether or not related to such proposed merger transaction.

The Company assumes no, and expressly disclaims any, duty or obligation to update or correct any forward-looking statement as a result of events,

changes, effects, states of facts, conditions, circumstances, occurrences or developments subsequent to the date of this communication or otherwise,

except as required by law. Readers are advised, however, to consult any further disclosures the Company makes on related subjects in its filings with

the SEC.

3 Earnings Call Presentation – 1Q 2018

Preliminary Matters

Additional Information Regarding the Transaction and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This

communication relates to the proposed merger transaction involving the Company, a wholly-owned subsidiary of the Company and Infinity, among other

things. In connection therewith, the Company filed with the SEC a Registration Statement on Form S-4 that includes a definitive joint proxy statement of the

Company and Infinity and also constitutes a definitive prospectus of the Company, and each of the Company and Infinity may be filing with the SEC other

documents regarding the proposed transaction. The Company and Infinity commenced mailing of the definitive joint proxy statement/prospectus to the

Company’s stockholders and Infinity’s shareholders on April 30, 2018. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND

SECURITYHOLDERS OF THE COMPANY AND/OR INFINITY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE

PROPOSED MERGER TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN

THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and securityholders may obtain free copies of the

definitive joint proxy statement/prospectus, any amendments or supplements thereto and other documents filed with the SEC by the Company and Infinity

through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by the Company are available free of charge under the

“Investors” section of the Company’s website located at http://www.kemper.com or by contacting the Company’s Investor Relations Department at

312.661.4930 or investors@kemper.com. Copies of the documents filed with the SEC by Infinity are available free of charge under the “Investor Relations”

section of Infinity’s website located at http://www.infinityauto.com or by contacting Infinity’s Investor Relations Department at 205.803.8186 or

investor.relations@infinityauto.com.

Participants in the Solicitation

The Company and Infinity, and their respective directors and executive officers, certain other members of their respective management and certain of their

respective employees, may be considered participants in the solicitation of proxies in connection with the proposed merger transaction. Information about the

directors and executive officers of the Company is set forth in the definitive joint proxy statement/prospectus, which was filed with the SEC on April 27, 2018

and serves as the Company’s proxy statement for its 2018 annual meeting of stockholders, and its annual report on Form 10-K for the fiscal year ended

December 31, 2017, which was filed with the SEC on February 13, 2018. Information about the directors and executive officers of Infinity is set forth in its

annual report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on February 15, 2018, as amended on Form 10-K/A,

filed with the SEC on April 23, 2018. Each of the foregoing can be obtained free of charge from the sources indicated above. Other information regarding the

participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive joint

proxy statement/prospectus and other relevant materials to be filed with the SEC.

Non-GAAP Financial Measures

This presentation contains non-GAAP financial measures that the company believes are meaningful to investors. Non-GAAP financial measures have been

reconciled to the most comparable GAAP financial measure.

All data in this presentation is as of and for the period ending March 31, 2018 unless otherwise stated.

4 Earnings Call Presentation – 1Q 2018

Kemper Is a Leading Multi-Line Insurer

• Multi-line national insurance company

– Provide specialty auto and preferred personal

insurance (auto, home & umbrella)

– Provide basic life, accident & health products

– Founded in 1990 and headquartered in Chicago, with

subsidiaries writing policies since 1911

• Multi-channel distribution network

– 2,200 career agents

– 20,000 independent agents

• Strong balance sheet

– Insurance subsidiaries rated¹ ‘Excellent’ by A.M. Best

– ~90% of fixed maturity portfolio is investment grade

– Strong debt-to-capital ratio at 22.3 percent

• Successful execution by proven leadership

team

– Delivering on savings commitments

– Results have exceeded analysts’ expectations for

last 8 quarters

– Announced acquisition of Infinity P&C (Nasdaq:

IPCC) in February 2018

Key Metrics

Market Cap (4/26/18) $3.1 Billion

Debt-to-Capital Ratio 22.3%

A.M. Best Ratings¹ A-

Excess Capital >$225MM

Employees 5,550

In-force policies ~6MM

¹ Alliance United is not rated

$843 $832 $811 $821 $838

$1,069 $946 $835 $786 $786

$415

$376 $654 $902

$1,045

2013 2014 2015 2016 2017

Life & Health Preferred Home & Auto Nonstandard Auto

Operating Revenues: Historical Mix

$2,327 $2,155 $2,300 $2,509 $2,669

(M

M

)

5 Earnings Call Presentation – 1Q 2018

Create Long-Term Shareholder Value

Sustainable competitive

advantages and build

core capabilities

Growing returns

and book value per

share over time

Diversified sources

of earnings;

Strong capital/liquidity

positions;

Disciplined approach

to capital mgmt

Deliver low double digit ROE¹ over time

1 Return on Equity

Consumer-related businesses with opportunities that:

• Target niche markets

• Have limited, weak or unfocused competition

• Require unique expertise (underwriting, claim, distribution, other)

Strategic focus:

6 Earnings Call Presentation – 1Q 2018

Majority of Phase 1 and Phase 2 initiatives are

complete or ahead of schedule

Shifting focus towards Phase 3 as a result of

improved operating performance

• Grow and enhance strategic position in key

focus markets

• Scale business platform and enhance product

suite

• Optimize data and analytics capabilities

• Continue to enhance operational efficiency

with claims initiatives

Taking the Next Step on Kemper’s Journey to Unlock Embedded Value

Grow

Build &

Leverage,

Rebuild

Incubate

W

o

rk

/

E

ff

o

rt

Phase 1 Phase 2 Phase 3

Continued Progress on Specialty Auto Strategic Plan Acquisition of Infinity Accelerates Momentum

• Combines two leading brands in specialty auto

insurance

• Increases scale in specialty auto and attractive

markets

‒ Improves presence in core markets

‒ Expands product offering and customer base

‒ Deepens agency relationships in urban and

Hispanic markets

‒ Bolsters growth opportunities

• Better positioned to serve combined customer base

‒ Specialization optimizes claims process

‒ Efficient expense base enables more competitive

pricing

‒ Enhanced customer experience

‒ Broader product offering enables cross-sell

• Enhances earnings profile and provides significant

financial flexibility

‒ Improved capital generation capabilities

‒ Deploys capital in a strategic acquisition that will

meaningfully enhance shareholder value

Combination of two leading specialty businesses improves our ability to provide

valuable products at reasonable costs to the combined customer base

7 Earnings Call Presentation – 1Q 2018

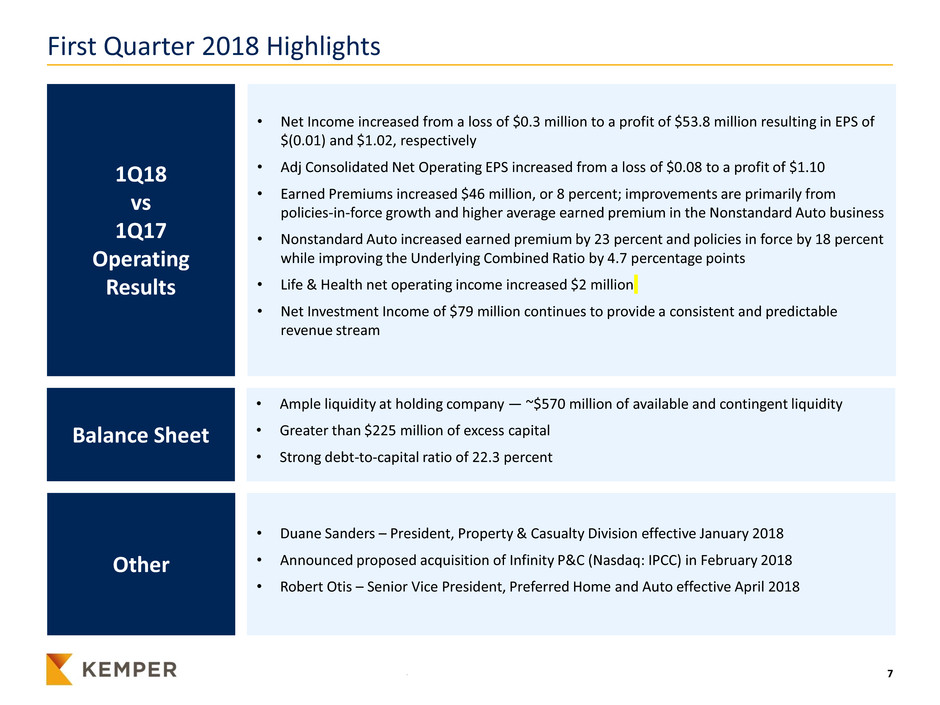

First Quarter 2018 Highlights

• Net Income increased from a loss of $0.3 million to a profit of $53.8 million resulting in EPS of

$(0.01) and $1.02, respectively

• Adj Consolidated Net Operating EPS increased from a loss of $0.08 to a profit of $1.10

• Earned Premiums increased $46 million, or 8 percent; improvements are primarily from

policies-in-force growth and higher average earned premium in the Nonstandard Auto business

• Nonstandard Auto increased earned premium by 23 percent and policies in force by 18 percent

while improving the Underlying Combined Ratio by 4.7 percentage points

• Life & Health net operating income increased $2 million

• Net Investment Income of $79 million continues to provide a consistent and predictable

revenue stream

1Q18

vs

1Q17

Operating

Results

• Ample liquidity at holding company — ~$570 million of available and contingent liquidity

• Greater than $225 million of excess capital

• Strong debt-to-capital ratio of 22.3 percent

Balance Sheet

• Duane Sanders – President, Property & Casualty Division effective January 2018

• Announced proposed acquisition of Infinity P&C (Nasdaq: IPCC) in February 2018

• Robert Otis – Senior Vice President, Preferred Home and Auto effective April 2018

Other

8 Earnings Call Presentation – 1Q 2018

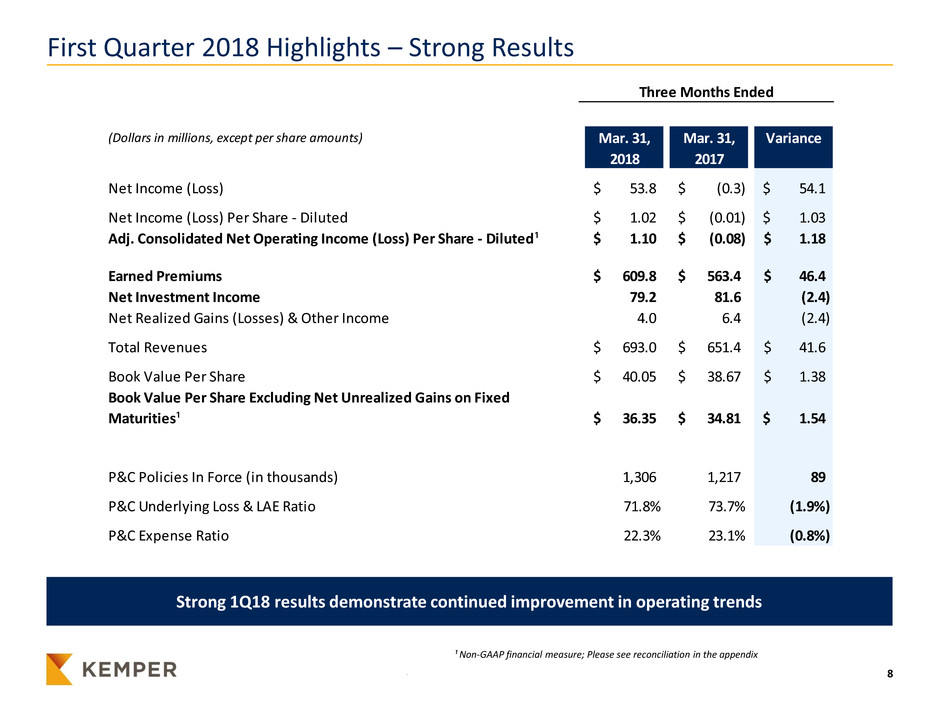

First Quarter 2018 Highlights – Strong Results

¹ Non-GAAP financial measure; Please see reconciliation in the appendix

Strong 1Q18 results demonstrate continued improvement in operating trends

(Dollars in millions, except per share amounts) Mar. 31, Mar. 31, Variance

2018 2017

Net Income (Loss) 53.8$ (0.3)$ 54.1$

Net Income (Loss) Per Share - Diluted 1.02$ (0.01)$ 1.03$

Adj. Consolidated Net Operating Income (Loss) Per Share - Diluted¹ 1.10$ (0.08)$ 1.18$

Earned Premiums 609.8$ 563.4$ 46.4$

Net Investment Income 79.2 81.6 (2.4)

Net Realized Gains (Losses) & Other Income 4.0 6.4 (2.4)

Total Revenues 693.0$ 651.4$ 41.6$

Book Value Per Share 40.05$ 38.67$ 1.38$

Book Value Per Share Excluding Net Unrealized Gains on Fixed

Maturities¹ 36.35$ 34.81$ 1.54$

P&C Policies In Force (in thousands) 1,306 1,217 89

P&C Underlying Loss & LAE Ratio 71.8% 73.7% (1.9%)

P&C Expense Ratio 22.3% 23.1% (0.8%)

Three Months Ended

9 Earnings Call Presentation – 1Q 2018

Improving Underlying Operating Performance

¹ Includes Income from change in fair value of equity securities, net

realized gains on sales of investments and net impairment losses

recognized in earnings

2Non-GAAP financial measure; Please see reconciliation in the appendix

Delivered continued strong underlying operating performance;

Up 47 percent quarter-over-quarter

Dollars per Unrestricted Share - Diluted Mar. 31, Dec. 31, Sep. 30, Jun. 30, Mar. 31, Variance

2018 2017 2017 2017 2017 QoQ

Income (Loss) from Continuing Operations 1.02$ 0.69$ 0.92$ 0.71$ (0.01)$ 1.03

Investment Related (Gains)/Losses1 0.04 0.09 0.07 0.30 0.07 (0.03)

Acquisition Related Transaction and Integration Costs (0.12) - - - - (0.12)

Adj. Consolidated Net Operating Income (Loss)¹ 1.10 0.60 0.85 0.41 (0.08) 1.18

Sources of Volatility:

Catastrophes (0.12) (0.64) (0.41) (0.44) (0.83) 0.71

Prior-year Reserve Development 0.02 (0.01) (0.01) (0.10) (0.14) 0.16

Alternative Investment Income 0.17 0.16 0.21 0.12 0.19 (0.02)

Tax Reform - 0.14 - - - -

Total from Sources of Volatility 0.07$ (0.35)$ (0.21)$ (0.42)$ (0.78)$ 0.85$

Underlying Operating Performance2 1.03$ 0.95$ 1.06$ 0.83$ 0.70$ 0.33$

Three Months Ended

10 Earnings Call Presentation – 1Q 2018

$22 $21

$24 $25 $24

1Q17 2Q17 3Q17 4Q17 1Q18

Net Operating Income

Stable and Predictable Life & Health Earnings

(M

M

)

(M

M

)

• Comparing 1Q18 to 1Q17, earned

premiums grew at a modest pace,

primarily due to growth in A&H premiums

• Net investment income remained

relatively unchanged compared to 1Q17

• L&H continues to provide strong,

predictable cash flows

• Overcame heighten mortality during active

flu season

Revenues

Net Operating Income

$153 $153 $155 $153 $155

$53 $55 $56 $58 $53

1Q17 2Q17 3Q17 4Q17 1Q18

Revenues

Earned Premiums Net Investment Income

$208 $211 $208 $206 $211

11 Earnings Call Presentation – 1Q 2018

97.9

94.5 91.3 95.4 93.2

1Q17 2Q17 3Q17 4Q17 1Q18

Underlying Combined Ratio¹

Profitably Growing Nonstandard Auto

• Business continues to expand market

share in core geographies

• Comparing 1Q18 to 1Q17, earned

premiums increased $40 million, or 23

percent, driven by higher volume and, to a

lesser extent, premium rate increases

• Underlying combined ratio improved 4.7

points in 1Q18 compared to 1Q17, driven

by rate, claims and underwriting actions

• On a sequential basis, underlying

combined ratio also improved; consistent

with typical seasonality

$216 $234

$247 $258 $266

1Q17 2Q17 3Q17 4Q17 1Q18

Earned Premiums

(%

)

(M

M

)

Revenues

Underwriting Results

¹ Non-GAAP financial measure; See reconciliation in the appendix.

Strong Nonstandard Auto franchise continuing to demonstrate profitable growth

12 Earnings Call Presentation – 1Q 2018

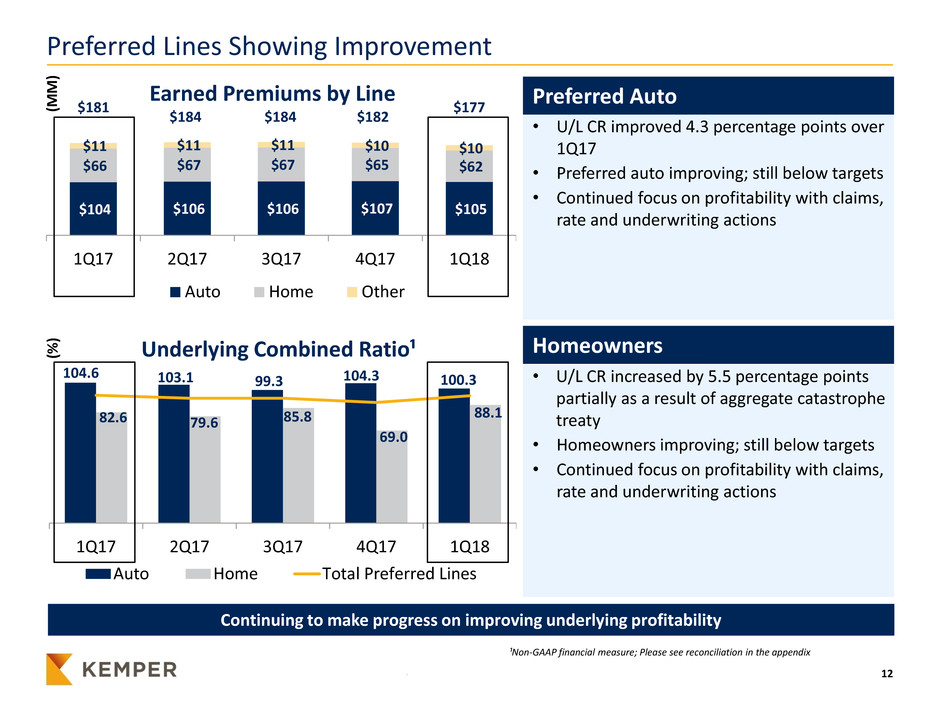

Preferred Lines Showing Improvement

• U/L CR improved 4.3 percentage points over

1Q17

• Preferred auto improving; still below targets

• Continued focus on profitability with claims,

rate and underwriting actions

104.6 103.1 99.3 104.3 100.3

82.6 79.6 85.8

69.0

88.1

1Q17 2Q17 3Q17 4Q17 1Q18

Underlying Combined Ratio¹

Auto Home Total Preferred Lines

• U/L CR increased by 5.5 percentage points

partially as a result of aggregate catastrophe

treaty

• Homeowners improving; still below targets

• Continued focus on profitability with claims,

rate and underwriting actions

$104 $106 $106 $107 $105

$66 $67 $67 $65 $62

$11 $11 $11 $10 $10

1Q17 2Q17 3Q17 4Q17 1Q18

Earned Premiums by Line

Auto Home Other

(%

)

(M

M

)

$177

$184 $184

$181

$182

Preferred Auto

Homeowners

¹Non-GAAP financial measure; Please see reconciliation in the appendix

Continuing to make progress on improving underlying profitability

13 Earnings Call Presentation – 1Q 2018

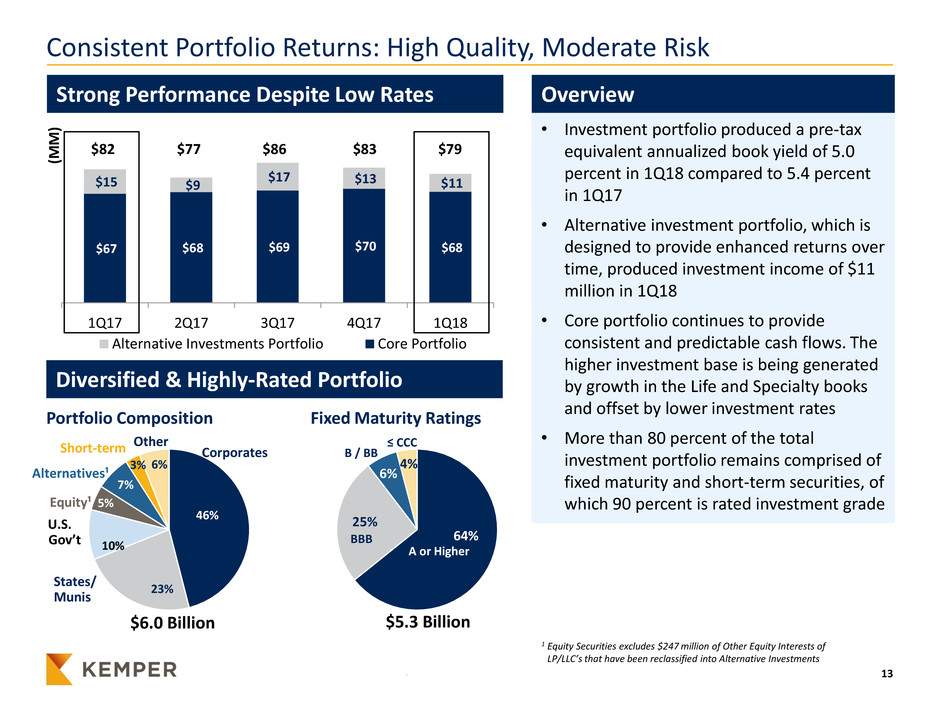

Consistent Portfolio Returns: High Quality, Moderate Risk

64%

25%

6%

4%

46%

23%

10%

5%

7%

3% 6%

Short-term

Diversified & Highly-Rated Portfolio

Portfolio Composition Fixed Maturity Ratings

$5.3 Billion $6.0 Billion

A or Higher

≤ CCC

B / BB

BBB

Other

Alternatives¹

Equity¹

U.S.

Gov’t

States/

Munis

Corporates

• Investment portfolio produced a pre-tax

equivalent annualized book yield of 5.0

percent in 1Q18 compared to 5.4 percent

in 1Q17

• Alternative investment portfolio, which is

designed to provide enhanced returns over

time, produced investment income of $11

million in 1Q18

• Core portfolio continues to provide

consistent and predictable cash flows. The

higher investment base is being generated

by growth in the Life and Specialty books

and offset by lower investment rates

• More than 80 percent of the total

investment portfolio remains comprised of

fixed maturity and short-term securities, of

which 90 percent is rated investment grade

1 Equity Securities excludes $247 million of Other Equity Interests of

LP/LLC’s that have been reclassified into Alternative Investments

$67 $68 $69 $70 $68

$15 $9

$17 $13 $11

1Q17 2Q17 3Q17 4Q17 1Q18

Alternative Investments Portfolio Core Portfolio

Strong Performance Despite Low Rates

(M

M

)

$82 $79 $83 $86 $77

Overview

14 Earnings Call Presentation – 1Q 2018

Strong Current Capital Position with Ample Liquidity

Debt

Cash Flow from Operating Activities Debt-to-Capital Historically <30%

2014 2015 2016 2017 1Q18

26.5%

$2.8B

22.3%

$2.7B

21.9%

$2.7B

27.6%

$2.7B

27.4%

$2.7B

Total

Capitalization

Strong Parent Company Liquidity Risk-Based Capital Ratios

$330 $341 $299

$197 $184

$404 $400 $385

$385 $385

2014 2015 2016 2017 1Q18

Borrowings available under credit agreement & from subs

HoldCo Cash & Investments

(M

M

)

375

415 430

360

330 335

290

310

2015 2016 2017 2018E

Life & Health Legacy P&C¹(%

)

$734

$569 $582

$684

$741

(M

M

)

Capital position and liquidity resources provide significant financial flexibility

$122 $134

$215 $241 $241

[VALUE]

2013 2014 2015 2016 2017 1Q18

¹Excludes Alliance United

Appendix

17 Earnings Call Presentation – 1Q 2018

Non-GAAP Financial Measures

Underlying Operating Performance is a non-GAAP financial measure that is computed by excluding from the Diluted Income (Loss)

from Continuing Operations Per Unrestricted Share the after-tax per unrestricted share impact of 1) income (loss) from change in

fair value of equity securities, 2) net realized gains on sales of investments, 3) net impairment losses recognized in earnings related

to investments, 4) acquisition related transaction and integration costs, 5) loss from early extinguishment of debt, and 6) significant

non-recurring or infrequent items that may not be indicative of ongoing operations. The most directly comparable GAAP financial

measure is Diluted Income (Loss) from Continuing Operations Per Unrestricted Share.

Kemper believes Underlying Operating Performance provides investors with a valuable measure of its ongoing performance because

it reveals underlying operational trends that otherwise might be less apparent if the items were not excluded. Underlying Operating

Performance should not be considered a substitute for the Diluted Income (Loss) from Continuing Operations Per Unrestricted Share

and does not reflect the overall profitability of our business.

Book Value Per Share Excluding Net Unrealized Gains on Fixed Maturities, is a ratio that uses a non-GAAP financial measure. It is

calculated by dividing shareholders’ equity after excluding the after-tax impact of net unrealized gains on fixed income securities by

total Common Shares Issued and Outstanding. Book value per share is the most directly comparable GAAP financial measure. The

Company uses the trend in book value per share, excluding the after-tax impact of net unrealized gains on fixed income securities in

conjunction with book value per share to identify and analyze the change in net worth attributable to management efforts between

periods. The Company believes the non-GAAP financial measure is useful to investors because it eliminates the effect of items that

can fluctuate significantly from period to period and are generally driven by economic developments, primarily capital market

conditions, the magnitude and timing of which are generally not influenced by management. The Company believes it enhances

understanding and comparability of performance by highlighting underlying business activity and profitability drivers.

Mar. 31, 2018 Mar. 31, 2017

Book Value Per Share 40.05$ 38.67$

Less: Net Unrealized Gains on Fixed Maturities Per Share (3.70) (3.86)

Book Value Per Share Excluding Net Unrealized Gains on Fixed

Maturities 36.35$ 34.81$

For the Periods Ended

18 Earnings Call Presentation – 1Q 2018

Non-GAAP Financial Measures

Adjusted Consolidated Net Operating Income (Loss) is an after-tax, non-GAAP financial measure computed by excluding from

Income (Loss) from Continuing Operations the after-tax impact of 1) income (loss) from change in fair value of equity securities, 2)

net realized gains on sales of investments, 3) net impairment losses recognized in earnings related to investments, 4) acquisition

related transaction and integration costs, 5) loss from early extinguishment of debt and 6) significant non-recurring or infrequent

items that may not be indicative of ongoing operations. Significant non-recurring items are excluded when (a) the nature of the

charge or gain is such that it is reasonably unlikely to recur within two years and (b) there has been no similar charge or gain within

the prior two years. The most directly comparable GAAP financial measure is Income (Loss) from Continuing Operations.

Kemper believes that Adjusted Consolidated Net Operating Income (Loss) provides investors with a valuable measure of its ongoing

performance because it reveals underlying operational performance trends that otherwise might be less apparent if the items were

not excluded. Income (loss) from change in fair value of equity securities, net realized gains on sales of investments and net

impairment losses recognized in earnings related to investments included in the Company’s results may vary significantly between

periods and are generally driven by business decisions and external economic developments such as capital market conditions that

impact the values of the Company’s investments, the timing of which is unrelated to the insurance underwriting process. Loss from

early extinguishment of debt is driven by the Company’s financing and refinancing decisions and capital needs, as well as external

economic developments such as debt market conditions, the timing of which is unrelated to the insurance underwriting process.

Acquisition related transaction and integration costs may vary significantly between periods and are generally driven by the timing of

acquisitions and business decisions which are unrelated to the insurance underwriting process. Significant non-recurring items are

excluded because, by their nature, they are not indicative of the Company’s business or economic trends.

19 Earnings Call Presentation – 1Q 2018

Non-GAAP Financial Measures

Diluted Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share is a non-GAAP financial measure computed by

dividing Adjusted Consolidated Net Operating Income (Loss) attributed to unrestricted shares by the weighted-average unrestricted

shares and equivalent shares outstanding. The most directly comparable GAAP financial measure is Diluted Income (Loss) from

Continuing Operations Per Unrestricted Share.

Kemper believes that Diluted Adjusted Consolidated Net Operating Income (Loss) Per Unrestricted Share provides investors with a

valuable measure of its ongoing performance because it reveals underlying operational performance trends that otherwise might be

less apparent if the items were not excluded. Income from change in fair value of equity securities, net realized gains on sales of

investments and net impairment losses recognized in earnings related to investments included in Kemper’s results may vary

significantly between periods and are generally driven by business decisions and external economic developments such as capital

market conditions that impact the values of the company’s investments, the timing of which is unrelated to the insurance

underwriting process.

Per U restricted Share 1Q18 4Q17 3Q17 2Q17 1Q17

Adj. Co soli a d Net Operating Income (Loss) - Diluted 1.10$ 0.60$ 0.85$ 0.41$ (0.08)$

N t I om (L ss) From:

Inc me from Change in Fair Value of Equity Securities 0.01 - - - -

Net Realized Gains on Sales of Investments 0.04 0.14 0.10 0.33 0.13

Net Impairment Losses Recognized in Earnings (0.01) (0.05) (0.03) (0.03) (0.06)

Acquisition Related Transaction and Integration Costs (0.12) - - - -

Income (Loss) from Continuing Operations - Diluted 1.02$ 0.69$ 0.92$ 0.71$ (0.01)$

For the Three Months Ended

20 Earnings Call Presentation – 1Q 2018

Non-GAAP Financial Measures

Underlying Combined Ratio is a non-GAAP financial measure that is computed by excluding the current year catastrophe and LAE ratio and the

prior-year reserve development ratio (both non-catastrophe and catastrophes) from the combined ratio. The most directly comparable GAAP

financial measure is the combined ratio, which is computed by adding the total incurred loss and LAE ratio, including the impact of catastrophe

losses and loss and LAE reserve development from prior years, with the insurance expense ratio.

Kemper believes the underlying combined ratio is useful to investors and is used by management to reveal the trends in Kemper’s property and

casualty insurance businesses that may be obscured by catastrophe losses and prior-year reserve development. These catastrophe losses may

cause loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant

impact on incurred losses and LAE and the combined ratio. Prior-year reserve development is caused by unexpected loss development on

historical reserves. Because reserve development relates to the re-estimation of losses from earlier periods, it has no bearing on the performance

of the company’s insurance products in the current period. Kemper believes it is useful for investors to evaluate these components separately

and in the aggregate when reviewing its underwriting performance. The underlying combined ratio should not be considered a substitute for the

combined ratio and does not reflect the overall underwriting profitability of our business.

1Q17 2Q17 3Q17 4Q17 1Q18

Underlying Combined Ratio 97.9% 94.5% 91.3% 95.4% 93.2%

Current Year Catastrophe Loss and LAE Ratio 0.8% 1.0% 0.6% (0.3%) 0.1%

Prior Years Non-Catastrophe Losses and LAE Ratio (0.4%) (0.4%) 0.9% 1.1% 0.1%

Prior Years Catastrophe Losses and LAE Ratio 0.0% 0.0% 0.0% 0.0% (0.1%)

Combined Ratio as Reported 98.3% 95.1% 92.8% 96.2% 93.3%

For the Three Months Ended

T a N standard Personal Automobile

21 Earnings Call Presentation – 1Q 2018

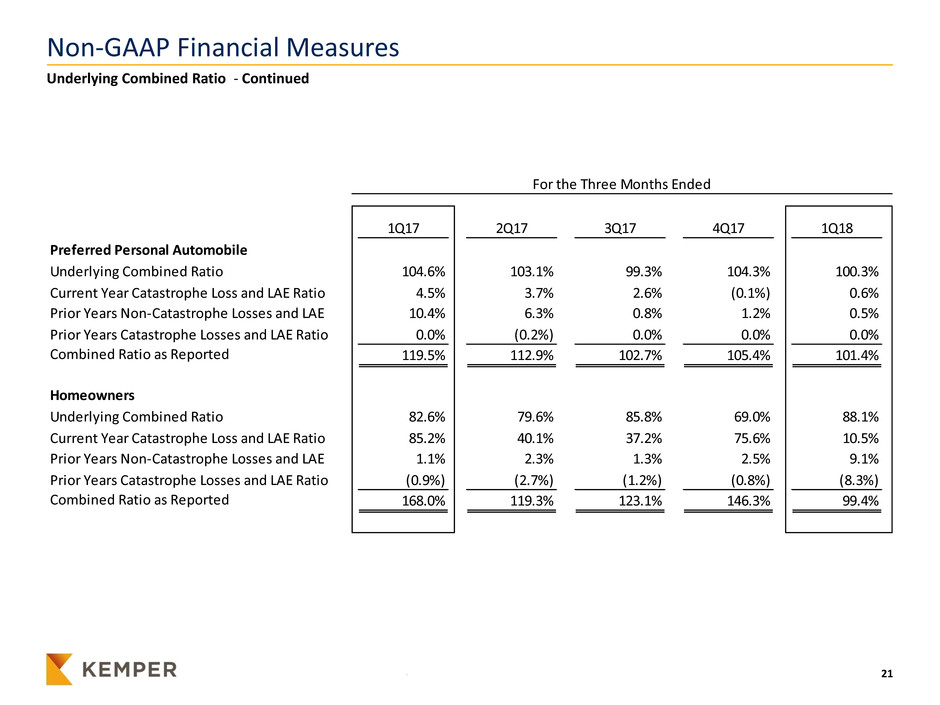

Non-GAAP Financial Measures

Underlying Combined Ratio - Continued

1Q17 2Q17 3Q17 4Q17 1Q18

Preferred Personal Automobile

Underlying Combined Ratio 104.6% 103.1% 99.3% 104.3% 100.3%

Current Year Catastrophe Loss and LAE Ratio 4.5% 3.7% 2.6% (0.1%) 0.6%

Prior Years Non-Catastrophe Losses and LAE 10.4% 6.3% 0.8% 1.2% 0.5%

Prior Years Catastrophe Losses and LAE Ratio 0.0% (0.2%) 0.0% 0.0% 0.0%

Combined Ratio as Reported 119.5% 112.9% 102.7% 105.4% 101.4%

Hom owners

Underlying Combined Ratio 82.6% 79.6% 85.8% 69.0% 88.1%

Current Year Catastrophe Loss and LAE Ratio 85.2% 40.1% 37.2% 75.6% 10.5%

Prior Years Non-Catastrophe Losses and LAE 1.1% 2.3% 1.3% 2.5% 9.1%

Prior Years Catastrophe Losses and LAE Ratio (0.9%) (2.7%) (1.2%) (0.8%) (8.3%)

Combined Ratio as Reported 168.0% 119.3% 123.1% 146.3% 99.4%

For the Three Months Ended