Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - AveXis, Inc. | a18-12433_1ex31d4.htm |

| EX-31.3 - EX-31.3 - AveXis, Inc. | a18-12433_1ex31d3.htm |

| EX-10.27 - EX-10.27 - AveXis, Inc. | a18-12433_1ex10d27.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2017 |

|

Commission file number 001-37693 |

AVEXIS, INC.

|

State of Delaware |

|

90-1038273 |

|

Incorporated under the Laws of the |

|

I.R.S. Employer Identification No. |

2275 Half Day Rd, Suite 200

Bannockburn, Illinois 60015

(847) 572-8280

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $0.0001, par value |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

|

Accelerated filer o |

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on the closing price of the registrant’s common stock for the last business day of the registrant’s most recently completed second fiscal quarter: $2,265,553,538

As of April 27, 2018, 36,816,476 shares of common stock, $0.0001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

AveXis, Inc. (“AveXis,” “we,” “us,” “our” or the “Company”) is filing this Amendment No. 1 (the “Amendment”) to amend its Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (File Number 001-37693) (the “Original Form 10-K Filing”), as filed by the Company with the Securities and Exchange Commission (the “SEC”) on February 28, 2018, solely for the purpose of amending Items 10 through 14 in Part III and Item 15 in Part IV. The information in Part III was previously omitted from the Original Form 10-K Filing in reliance on General Instruction G(3) to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy statement filed with the SEC within 120 days after the end of the fiscal year covered by the report. On April 6, 2018, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Novartis AG, a company organized under the laws of Switzerland (“Parent”), and Novartis AM Merger Corporation, a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), and, as a result, we do not expect to conduct a 2018 annual meeting of stockholders. See “Agreement and Plan of Merger” for a description of the Merger Agreement.

In accordance with, among other things, Rule 12b-15 under the Securities Exchange Act of 1934, as amended, each item of the Original Form 10-K Filing that is amended by the Amendment is also restated in its entirety, and the Amendment is accompanied by currently dated certifications on Exhibit 31.3 by the Company’s Chief Executive Officer and Exhibit 31.4 by the Company’s Chief Financial Officer (because no financial statements have been included in the Amendment and the Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted). The Amendment is being filed to: (i) delete the reference on the cover of the Original Form 10-K Filing to the incorporation by reference information from the Company’s definitive proxy statement, (ii) revise Part III, Items 10 through 14 of the Original Form 10-K Filing to include information previously omitted from the Original Form 10-K Filing and (iii) revise the Exhibit Index of the Original Form 10-K Filing to reflect the filing of the new certifications.

No attempt has been made in the Amendment to modify or update the other disclosures presented in the Original Form 10-K Filing. The Amendment does not reflect events occurring after the filing of the Original Form 10-K Filing or modify or update those disclosures that may be affected by subsequent events, other than as expressly indicated in the Amendment. Accordingly, the Amendment should be read in conjunction with the Original Form 10-K Filing and the Company’s other filings with the SEC.

Agreement and Plan of Merger

On April 6, 2018, the Company entered into the Merger Agreement with Parent and Purchaser, pursuant to which, and upon the terms and subject to the conditions described therein, on April 17, 2018, Purchaser commenced a cash tender offer (the “Offer”) to acquire all of the outstanding shares of the Company’s common stock at a purchase price of $218.00 per share (such price, as it may be increased as described in the following sentence, the “Offer Price”), net to the seller in cash, without interest, subject to any required withholding of taxes. In the event Parent elects to extend the Outside Date (as defined in the Merger Agreement) in accordance with the terms of the Merger Agreement, the Offer Price will be increased to $225.00 per share, net to the seller in cash, without interest, subject to any required withholding of taxes. The Offer will expire at 12:00 Midnight, New York City time, at the end of the day on Monday, May 14, 2018 (unless the Offer is extended).

The obligation of Purchaser to purchase shares of the Company’s common stock tendered in the Offer is subject to customary closing conditions, including (i) shares of the Company’s common stock having been validly tendered and not withdrawn that represent at least a majority of the total number of shares of the Company’s common stock then-outstanding on a fully diluted basis, (ii) the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), without the imposition of a Burdensome Condition (as defined in the Merger Agreement), (iii) the absence of injunctions or other legal restraints preventing the consummation of the Offer or the Merger, as defined below, or imposing a Burdensome

Condition and (iv) certain other conditions set forth in Exhibit A to the Merger Agreement. The consummation of the Offer is not subject to any financing condition.

Following the completion of the Offer, subject to the satisfaction or waiver of certain customary conditions set forth in the Merger Agreement, Purchaser will merge with and into the Company, with the Company surviving as a wholly owned subsidiary of Parent (the “Merger”), pursuant to the procedure provided for under Section 251(h) of the Delaware General Corporation Law (the “DGCL”), without any stockholder approvals. The Merger will be effected as soon as practicable following the time of purchase by Purchaser of shares of the Company’s common stock validly tendered and not withdrawn in the Offer. At the effective time of the Merger (the “Effective Time”), each issued and outstanding share of the Company’s common stock (other than shares owned by (i) the Company, any subsidiary of the Company, Parent, Purchaser and any other subsidiary of Parent and (ii) stockholders of the Company who have validly exercised their statutory rights of appraisal under the DGCL) will be converted into the right to receive the Offer Price, in cash, without interest, subject to any required withholding of taxes.

Until the earlier of the termination of the Merger Agreement and the Effective Time, the Company has agreed to operate its business in the ordinary course and has agreed to certain other operating covenants, as set forth more fully in the Merger Agreement. The Merger Agreement includes customary termination provisions for both the Company and Parent and provides that, in connection with the termination of the Merger Agreement under specified circumstances, including termination by the Company to accept a Superior Company Proposal (as defined in the Merger Agreement), the Company will be required to pay a fee equal to $284 million. The Merger Agreement also provides that, in connection with the termination of the Merger Agreement under specified antitrust related circumstances, Parent will be required to pay to the Company a “reverse termination fee” equal to $437 million, which fee increases in the event Parent elects to extend the Outside Date in accordance with the terms of the Merger Agreement.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

The names of our directors and executive officers, their ages as of March 15, 2018 and certain other information about them are set forth below. There are no family relationships among any of our directors or executive officers.

Executive Officers

Sean P. Nolan, age 50, has served as our President and Chief Executive Officer and as a member of our Board of Directors since June 2015. Prior to joining us, from February 2013 to April 2015, he was the chief business officer of InterMune, Inc., a biotechnology company later acquired by Roche Holding Ltd. While at InterMune, Mr. Nolan led multiple functions across the organization, including North American commercial operations, global marketing, corporate and business development and global manufacturing and supply chain. Mr. Nolan was also responsible for planning and executing the U.S. launch of InterMune’s treatment for idiopathic pulmonary fibrosis, a rare and fatal lung disease with no other approved treatments. Mr. Nolan served as chief commercial officer at Reata Pharmaceuticals, Inc. from August 2011 to December 2012, where he led the market strategy development and commercial planning for Reata Pharmaceuticals’ first in-class product pipeline. From September 2004 to November 2010, Mr. Nolan worked at Ovation Pharmaceuticals, Inc., a company focused on orphan neurology diseases. He held numerous management positions during that period including president of Lundbeck Inc., the U.S. affiliate. Ovation Pharmaceuticals was acquired by H. Lundbeck A/S in March 2009 for $900 million. Mr. Nolan holds a B.A. in biology from John Carroll University. Mr. Nolan currently serves on the board of directors of Aquinox Pharmaceuticals, Inc. Our Board of Directors believes that Mr. Nolan is qualified to serve as a director based on his role as our principal executive officer and his over 27 years of broad leadership and management experience in the biopharmaceutical industry.

Phillip B. Donenberg, age 57, has served as our Senior Vice President and Chief Financial Officer since October 2017. He previously served as our Vice President, Corporate Controller from September 2016 to October 2017. He was the chief financial officer of RestorGenex Corporation from May 2014 to January 2016, when RestorGenex merged with Diffusion Pharmaceuticals LLC and served as the merged company’s consultant CFO until September 2016, and the chief financial officer of 7wire Ventures LLC from September 2013 to May 2014. Prior to that time, Mr. Donenberg served as the chief financial officer of BioSante Pharmaceuticals, Inc. from July 1998 to June 2013, when BioSante merged with ANIP Pharmaceuticals, Inc. Mr. Donenberg holds a B.S. in Accountancy from the University of Illinois Champaign-Urbana College of Business and is a Certified Public Accountant.

Michael B. Johannesen, age 52, has served as our Senior Vice President, General Counsel and Chief Compliance Officer since July 2016. Prior to joining us, from May 2004 to April 2016, he served in various positions, including as vice president, associate general counsel and assistant secretary of Hospira, Inc., where he was responsible for the commercial and compliance functions of Hospira’s legal department. He previously served in the legal departments of Abbott Laboratories and Whirlpool Corporation, and as an associate at the law firm of Winston & Strawn. Mr. Johannesen received a B.A. in political science and public administration from the University of Illinois and a Juris Doctor from the University of Michigan Law School.

Brian K. Kaspar, age 44, has served as our Senior Vice President and Chief Scientific Officer since June 2015, a position he held from June 2015 to December 2015 in connection with his scientific advisory consulting services, and thereafter as our employee. Dr. Kaspar provided scientific advisory consulting services to the Company from January 2014 to December 2015. He has served as a member of our Board of Directors since October 2013. Dr. Kaspar served from August 2004 to September 2017 as a principal investigator in the Center for Gene Therapy at The Research Institute at Nationwide Children’s Hospital and professor in the department of pediatrics and department of neuroscience at The Ohio State University College of Medicine, where his research focused on basic and translational studies related to neurological and neuromuscular disorders. In 2013, Dr. Kaspar was named Fellow of the American Association for the Advancement of Science. In September 2011, Dr. Kaspar co-founded Milo Biotechnology LLC, which develops muscle mass loss treatment and therapies. Dr. Kaspar currently serves as a consultant to Milo Biotechnology LLC in connection with the continuation of its clinical trials. Dr. Kaspar has published more than 100 scientific articles in peer-reviewed journals. Dr. Kaspar holds a B.S. from the University of

Illinois and a Ph.D. from the University of California, San Diego and has done post-doctoral training at the University of California, San Diego and the Salk Institute for Biological Studies. Our Board of Directors believes that Dr. Kaspar is qualified to serve as a director based upon his extensive scientific, operating, regulatory and medical experience, including 20 years of gene therapy experience.

Andrew F. Knudten, age 50, has served as our Senior Vice President, Technical Operations and Chief Technical Officer since March 2018. He previously served as Senior Vice President, Manufacturing and Supply Chain from September 2015 to March 2018. Previously, Mr. Knudten served as vice president of operations and vice president of active pharmaceutical ingredient operations at Hospira, Inc. from March 2012 to September 2015, where he had overall global responsibility for the company’s API business. Mr. Knudten also previously served as global head of contract manufacturing and strategy for Novartis Vaccines and Diagnostics, Inc. from February 2009 to March 2012, and as vice president of manufacturing at CoDa Therapeutics, Inc. from September 2007 to February 2009. From 1994 to 2007, he served in various research, product development, finance and operations roles at Amgen Inc., supporting the development of numerous pipeline products and more than five eventual commercial products now being marketed by Amgen. Mr. Knudten earned a B.S. in biology and health from Concordia University, an M.S. in cell biology from University of Nebraska, Lincoln and an M.B.A. from the Anderson School at the University of California, Los Angeles.

James J. L’Italien, age 65, has served as our Senior Vice President and Chief Regulatory and Quality Officer since July 2015. Before joining us, since 2012, Dr. L’Italien served as senior vice president of regulatory affairs and quality assurance for InterMune, Inc. While at InterMune, he oversaw all global regulatory affairs and quality assurance activities in support of its commercial- and development-stage pharmaceutical programs, including the regulatory process for Esbriet®, which was granted a breakthrough designation by the U.S. Food and Drug Administration. Prior to that, Dr. L’Italien served as vice president of regulatory affairs and quality assurance for Geron Corporation from 2009 until 2012, where he supported development-stage programs in oncology and stem cell therapy. Before joining Geron, he served as senior vice president of regulatory affairs and quality assurance for Somaxon Pharmaceuticals, Inc. from 2007 to 2009, and held the global position of senior vice president of regulatory affairs and compliance at Ligand Pharmaceuticals, Inc. from 2002 to 2007. Dr. L’Italien received a B.S. in chemistry from Merrimack College and a Ph.D. in protein biochemistry from Boston University.

Raken B. Modi, age 49, has served as our Senior Vice President, Chief Business Officer since February 2017. Prior to joining us, Mr. Modi served as chief business officer for Catabasis Pharmaceuticals, Inc. from January 2015 to February 2017. Prior to that, Mr. Modi worked from July 2013 to January 2015 as the senior vice president of global marketing at InterMune, Inc., which was acquired by Hoffman-La Roche AG in 2014. From February 2008 to July 2013, Mr. Modi worked at MedImmune, LLC, a wholly-owned biologics research and development subsidiary of AstraZenca plc, in positions of increasing responsibility, ultimately as the vice president of corporate strategy and portfolio management. From January 2002 to February 2008, Mr. Modi worked at Janssen Biotech, Inc. (formerly Centocor Biotech, Incorporated), a wholly-owned biotechnology subsidiary of Johnson & Johnson, serving in several positions, including as associate director of global market development. Mr. Modi received a B.S. in pharmacy from the University of Iowa and an M.B.A. from The Wharton School of the University of Pennsylvania.

Sukumar Nagendran, age 51, has served as our Senior Vice President and Chief Medical Officer since September 2015. Prior to joining us, from March 2013 to September 2015, he served as vice president, head of medical affairs of U.S. and international business for Quest Diagnostics Inc., the largest lab/diagnostics provider in the world. From October 2012 to February 2013, Dr. Nagendran served as the vice president, head of medical affairs for Reata Pharmaceuticals, Inc., a biotechnology company. He also previously served in a number of leadership positions at Daiichi Sankyo Company from March 2008 until October 2012, including head of new products, metabolism, oncology, biometrics and clinical operations for medical affairs. In February 2009, Dr. Nagendran filed a petition for personal bankruptcy under Chapter 7 of the federal bankruptcy laws, which was subsequently discharged in October 2009. Dr. Nagendran received a B.A. from Rutgers University and an M.D. from the University of Medicine and Dentistry of New Jersey and trained in Internal Medicine at Mayo Clinic in Rochester, Minnesota and is a Mayo Alumni Laureate.

R.A. Session II, age 39, has served as our Senior Vice President, Corporate Strategy and Business Development since December 2017. He previously served as our Senior Vice President, Corporate Strategy and Project Management from March 2017 to December 2017. Prior to joining us, Mr. Session served in various roles for PTC Therapeutics, Inc. from June 2013 to March 2017, most recently as the vice president of commercial development. He previously served in various roles at Reata Pharmaceuticals, Inc. from July 2012 to June 2013, most recently as the senior director of strategic planning and finance. From January 2007 to August 2008, Mr. Session worked at AstraZeneca Pharmaceuticals as senior manager of commercial portfolio and post deal analytics in the managed markets group. He began his career in the pharmaceutical division of Johnson & Johnson, where he served in several positions including as a senior financial analyst in the strategic business group. Mr. Session is a member of the Kauffman Fellows Society. Mr. Session received a B.S.B.A. in finance from the University of North Carolina at Charlotte, a M.S.F. in finance from Texas A&M University-Commerce and an M.B.A. from Texas A&M University-Commerce.

Lori J. Smith, age 54, has served as our Senior Vice President, Chief Human Resources Officer since April 2017. Prior to joining us, Ms. Smith served as an independent business consultant, where she provided strategic guidance to executives in multiple disciplines, since February 2007. She previously served in various roles for Takeda Pharmaceuticals North America, Inc., most recently as the senior vice president, human resources and administration, from February 1999 to January 2007. Ms. Smith received a B.S. in psychology from the University of Wisconsin-La Crosse.

Non-Employee Directors

Daniel Welch, age 60, has served as a member, and the chairman, of our Board of Directors since January 2016. He currently serves as a consultant at Sofinnova Ventures, where he previously served as an executive partner from January 2015 to January 2018. Mr. Welch previously served as the president and chief executive officer of InterMune, Inc. from September 2003 to September 2014, and he served as the chairman of the board of directors of InterMune from May 2007 to September 2014. From August 2002 to January 2003, Mr. Welch served as chairman and chief executive officer of Triangle Pharmaceuticals, Inc. He currently serves on the boards of directors of Seattle Genetics, Inc., Ultragenyx Pharmaceutical Inc., where he also serves as chairman, and Intercept Pharmaceuticals, Inc., and previously served on the board of directors of Hyperion Therapeutics, Inc. from 2012 to 2015. Mr. Welch received a B.S. from the University of Miami and an M.B.A from the University of North Carolina. Our Board of Directors believes that Mr. Welch should serve as chairman based on his operational and strategic expertise and his extensive experience in leading companies from clinical-stage drug development to large-scale global commercialization.

Terrence C. Kearney, age 63, has served as a member of our Board of Directors since January 2016. Most recently, Mr. Kearney served as the Chief Operating Officer of Hospira, Inc., a specialty pharmaceutical and medication management delivery company, from 2006 until his retirement in 2011. From 2004 to 2006, he served as Hospira’s Senior Vice President, Finance, and Chief Financial Officer. He currently serves as a member of the board of directors of Acceleron Pharma, Inc. and Vertex Pharmaceuticals Incorporated, and he previously served as a member of the board of directors of Innoviva, Inc., formerly known as Theravance, Inc. from October 2014 to April 2016. Mr. Kearney received a B.S. in biology from the University of Illinois and an M.B.A. from the University of Denver. Our Board of Directors believes that Mr. Kearney should serve as a director based on his extensive experience in the biotechnology industry as both an executive officer and a director, as well as his financial expertise.

Bong Koh, age 45, has served as a member of our Board of Directors since June 2015. Since 2009, Dr. Koh has been a partner at Venrock, a venture capital firm where he manages Venrock’s public and cross-over biotechnology fund. Dr. Koh earned his B.A. from Yale University, his M.D. from the University of California, San Francisco, and an M.B.A. from Harvard Business School. Our Board of Directors believes that Dr. Koh should serve as a director based on his extensive experience in the biotechnology industry providing leadership in biotechnology investments.

Paul B. Manning, age 62, has served as a member of our Board of Directors since April 2014. Mr. Manning is the president and chief executive officer of PBM Capital Group, a private equity investment firm in the business of investing in healthcare and life-science related companies, which he founded in 2010. Prior to that, Mr. Manning founded PBM Products, LLC in 1997, a producer of infant formula and baby food, which was sold to Perrigo

Corporation in 2010. Mr. Manning is the chairman of Dova Pharmaceuticals, Inc., and was previously on the board of directors of Perrigo Corporation and Concordia Healthcare Corp. Mr. Manning received a B.S. in microbiology from the University of Massachusetts. Our Board of Directors believes that Mr. Manning should serve as a director based on his over 30 years of managerial and operational experience in the healthcare industry and as an investor in healthcare related companies.

Joao Siffert, age 54, has served as a member of our Board of Directors since May 2017. Since May 2016, Dr. Siffert has served as the chief medical officer and head of development at Nestlé Health Science S.A. Previously, Dr. Siffert was executive vice president, research & development and chief medical officer of Avanir Pharmaceuticals, Inc., a position he held from March 2015 to April 2016. Prior to that, he served in various roles at Avanir, including as senior vice president, research and development and chief medical officer from February 2014 to March 2015 and senior vice president, research and development and chief science officer from August 2011 to February 2014 and as chief medical officer of Ceregene, Inc. from September 2007 to August 2011. Dr. Siffert served on the board of Directors of Alcobra Pharmaceuticals from July 2015 to July 2017. Dr. Siffert completed residencies in pediatrics at New York University School of Medicine and in neurology at Harvard Medical School. Dr. Siffert was certified by the American Board of Neurology and Psychiatry in 1996. He holds an M.D. degree from the University of São Paulo School of Medicine as well as an M.B.A. degree from Columbia University Business School. Our Board of Directors believes that Dr. Siffert should serve as a director based on his experience in orphan drug development and regulatory expertise in both the United States and Europe.

Frank Verwiel, age 55, has served as a member of our Board of Directors since December 2015. Dr. Verwiel was the President and Chief Executive Officer of Aptalis Pharma Inc. from 2005 to 2014, where he also served on the board of directors. He currently serves as a member of the board of directors of Achillion Pharmaceuticals, Inc., Bavarian Nordic A/S, Intellia Inc. and ObsEva SA, where he serves as chairman. Dr. Verwiel previously served on the board of directors of InterMune, Inc. from 2012 to 2014. Dr. Verwiel was also a director of the Biotechnology Industry Organization. Dr. Verwiel received his M.D. from Erasmus University, Rotterdam and his M.B.A. from INSEAD. Our Board of Directors believes that Dr. Verwiel should serve as a director based on his scientific acumen and his over 25 years of strategic, operational and international experience in the pharmaceutical industry.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2017, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

Audit Committee and Audit Committee Financial Expert

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. The Audit Committee is comprised of three directors: Messrs. Kearney and Manning and Dr. Verwiel, with Mr. Kearney serving as chair.

The Board of Directors reviews the Nasdaq Stock Market (“Nasdaq”) listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq listing standards and Rule 10A-3 of the Exchange Act).

The Board of Directors has also determined that Mr. Kearney qualifies as an “audit committee financial expert,” as

defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Kearney’s level of knowledge and experience based on a number of factors, including his formal education and experience as a chief financial officer for a public reporting company.

Stockholder Recommendations for Director Candidates

Historically, the Company has not provided a formal process related to stockholder communications with the Board. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. The Company believes its responsiveness to stockholder communications to the Board has been excellent.

Code of Business Conduct and Ethics

The Company has adopted the AveXis, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available in the “Investors + Media” section of the Company’s website at www.avexis.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code of Business Conduct and Ethics to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

Item 11. Executive Compensation.

Compensation Discussion and Analysis

Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

Overview

We are a clinical-stage gene therapy company dedicated to developing and commercializing novel treatments for patients suffering from rare and life-threatening neurological genetic diseases. Our initial product candidate, AVXS-101, is our proprietary gene therapy product candidate for the treatment of spinal muscular atrophy, or SMA. SMA is a severe neuromuscular disease characterized by the loss of motor neurons, leading to progressive muscle weakness and paralysis. The incidence of SMA is approximately one in 10,000 live births. SMA is generally divided into sub-categories termed SMA Type 1, 2, 3 and 4. We are conducting a pivotal clinical trial for AVXS-101 for the treatment of SMA Type 1, the leading genetic cause of infant mortality. We are also currently conducting a Phase 1 clinical trial of AVXS-101 for the treatment of SMA Type 2 and a Phase 3 trial evaluating AVXS-101 in pre-symptomatic patients with SMA Types 1, 2 and 3. In addition to our ongoing clinical trials, we intend to expand our clinical development program of AVXS-101 for the treatment of SMA by initiating additional clinical trials to further evaluate AVXS-101, including in new patient populations. In addition to developing AVXS-101 to treat SMA, we plan to develop other novel treatments for two additional rare neurological monogenetic diseases, Rett syndrome and a genetic form of amyotrophic lateral sclerosis caused by mutations in the superoxide dismutase 1 gene, or genetic ALS.

We became a public company in February 2016, and we filed our 2017 proxy statement under the scaled-down reporting rules applicable to emerging growth companies. As of the close of calendar year 2017, we ceased to be an emerging growth company and, therefore, this year we have included additional detail regarding executive compensation that was previously not required, including: this Compensation Discussion and Analysis, additional compensation tables for “Grants of Plan-Based Awards,” “Option Exercises and Stock Vested,” and “Potential Payments upon Termination or Change in Control”.

This Compensation Discussion and Analysis provides an overview of the material components of our executive compensation program for the fiscal year ended December 31, 2017, for the Company’s Chief Executive Officer,

Chief Financial Officer and its three other most highly compensated executive officers at December 31, 2017, as well as the Company’s former Chief Financial Officer (the “named executive officers”), “named executive officers” who are listed below. This discussion and analysis is intended to assist you to understand the information provided in the compensation tables below and to provide additional context regarding our overall compensation program. In addition, we explain how and why our Board and Compensation Committee determined our compensation policies and specific compensation decisions for our named executive officers during and for fiscal year 2017.

Our named executive officers for the fiscal year ended December 31, 2017, are as follows:

· Sean P. Nolan, President and Chief Executive Officer

· Phillip B. Donenberg, Senior Vice President, Chief Financial Officer(1)

· James J. L’Italien, Ph.D., Senior Vice President, Chief Regulatory and Quality Officer

· Raken B. Modi, Senior Vice President, Chief Business Officer(2)

· Sukumar Nagendran, M.D., Senior Vice President, Chief Medical Officer

· Thomas J. Dee, former Senior Vice President, Chief Financial Officer(1)

(1) In October 2017, Mr. Dee resigned as our Senior Vice President and Chief Financial Officer and Mr. Donenberg was promoted from Vice President, Corporate Controller to Senior Vice President and Chief Financial Officer.

(2) Mr. Modi commenced employment with us as Senior Vice President, Chief Business Officer in February 2017.

Executive Summary

The important features of our executive compensation program include the following:

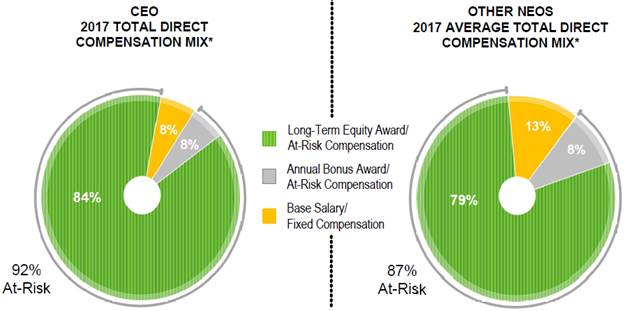

· We tie pay to performance. We structure a significant portion of our named executive officers’ compensation to be variable, at risk and tied directly to our measurable performance. For 2017, 92% of our Chief Executive Officer’s total reported compensation and a significant portion of our other continuing named executive officers’ total reported compensation was linked to performance, consisting of annual performance bonus earned and equity incentives awarded, as reported in the “Summary Compensation Table.”

*Reflects 2017 annual base salaries, performance bonuses earned and grant date fair values of equity awards, as reported in the Summary Compensation Table, for each of our NEOs other than Mr. Dee who terminated service in October 2017. The charts do not include Mr. Modi’s special signing bonus upon commencement of employment and “All Other Compensation”, as reported in the Summary Compensation Table (which represented less than 1% of total compensation for each individual).

· Our executive bonuses are dependent on meeting key corporate objectives. Our annual performance-based bonus opportunities for our named executive officers are dependent upon our achievement of annual corporate objectives established each year. No bonuses are guaranteed. We exceeded our specified corporate objectives for 2017 and each of our current named executive officers received performance bonuses in early 2018.

· We emphasize long-term equity incentives. Equity awards are an integral part of our executive compensation program, and comprise the primary “at-risk” portion of our named executive officer compensation package. We have historically granted equity awards in the form of stock options and we consider stock options performance-based because they provide value only if the market price of our stock increases, and if the executive officer continues in our employment over the option term. These awards strongly align our executive officers’ interests with those of our stockholders by providing a continuing financial incentive to maximize long-term value for our stockholders and by encouraging our executive officers to remain in our long-term employ. We have also recently introduced restricted stock units and performance-vesting restricted stock units as part of our executive compensation program for 2017 and 2018.

· Change in control payments are limited to double-trigger payments which require termination other than for cause or resignation for good reason in connection with a change of control to trigger payments. Equity awards granted on and after our IPO likewise provide only for double-trigger acceleration benefits.

· We do not provide our executive officers with any change in control excise tax gross ups.

· Our Compensation Committee has retained an independent third-party compensation consultant for guidance in making compensation decisions, who advises the Compensation Committee on market practices so that our Compensation Committee can regularly assess the Company’s individual and total compensation programs against those of peer companies, the general marketplace and other industry data points.

· We prohibit any and all hedging and pledging of Company stock.

Objectives, Philosophy and Elements of Compensation

The overall objectives of our executive compensation policies and programs are to:

· attract, retain and motivate superior executive talent;

· provide incentives that reward the achievement of performance goals that directly correlate to the enhancement of stockholder value, as well as to facilitate executive retention;

· align our executives’ interests with those of our stockholders;

· link pay to company performance; and

· offer pay opportunities that are competitive with the biopharmaceutical market in which we compete in order to recruit and retain top talent, while maintaining reasonable cost and dilution to our stockholders.

Our executive compensation program generally consists of, and is intended to strike a balance among, the following three principal components: base salary, annual performance-based bonuses and long-term incentive compensation. We also provide our executive officers with severance and change-in-control benefits, as well as other benefits available to all our employees, including retirement benefits under the Company’s 401(k) plan and participation in employee benefit plans. The following chart summarizes the three main elements of compensation, their objectives and key features.

|

Element of Compensation |

|

Objectives |

|

Key Features |

|

Base Salary (fixed cash) |

|

Provides financial stability and security through a fixed amount of cash for performing job responsibilities. |

|

Generally reviewed annually and determined based on a number of factors (including individual performance, internal equity, retention, expected cost of living increases and the overall performance of our Company) and by reference to market data provided by our independent compensation consultant. |

|

|

|

|

|

|

|

Performance Bonus (at-risk cash) |

|

Motivates and rewards for attaining rigorous annual corporate performance goals that relate to our key business objectives and individual contributions. |

|

Target bonus amounts, calculated as a percentage of base salary, are generally reviewed annually and determined based upon positions that have similar impact on the organization and competitive bonus opportunities in our market. Bonus opportunities are dependent upon achievement of specific corporate performance goals established at the beginning of the year and, except with respect to our Chief Executive Officer, individual performance objectives that relate to the officer’s role and expected contribution toward reaching our corporate goals. Actual bonus amounts earned are determined after the end of the year, based on achievement of the designated corporate performance objectives and, where applicable, individual performance objectives. |

|

|

|

|

|

|

|

Long-Term Incentive (at-risk equity) |

|

Motivates and rewards for long-term Company performance; aligns |

|

Annual equity opportunities are generally reviewed and determined annually or as appropriate during the year for new hires, |

|

|

|

executives’ interests with stockholder interests and changes in stockholder value. Attracts highly qualified executives and encourages their continued employment over the long-term. |

|

promotions, or other special circumstances, such as to encourage retention, or as an incentive for significant achievement. Individual grants are determined based on a number of factors, including current corporate and individual performance, outstanding equity holdings and their retention value and total ownership, historical value of our stock, internal equity amongst executives and market data provided by our independent compensation consultant. Equity grants have historically been provided primarily in the form of stock options that typically vest over a four year period, although we began introducing restricted stock units in 2017 and our March 2018 equity grants included both stock options and restricted stock unit awards. |

In evaluating our executive compensation policies and programs, as well as the short-term and long-term value of our executive compensation plans, we consider both the performance and skills of each of our executives, as well as the compensation paid to executives at similar companies with similar responsibilities. We focus on providing a competitive compensation package which provides significant short-term and long-term incentives for the achievement of measurable corporate objectives. We believe this approach provides an appropriate blend of short-term and long-term incentives to maximize stockholder value.

We do not have any formal policies for allocating compensation among salary, performance bonus awards and equity grants, short-term and long-term compensation or among cash and non-cash compensation. Instead, the Compensation Committee uses its judgment to establish a total compensation program for each named executive officer that is a mix of current, short-term and long-term incentive compensation, and cash and non-cash compensation, that it believes appropriate to achieve the goals of our executive compensation program and our corporate objectives. However, the Compensation Committee aims to structure a significant portion of the named executive officers’ total target compensation to be comprised of performance-based bonus opportunities and long-term equity awards, in order to align the executive officers’ incentives with the interests of our stockholders and our corporate objectives.

In making executive compensation decisions, the Compensation Committee generally considers each executive officer’s total target direct compensation, which consists of base salary, target bonus opportunity, which together with base salary we refer to as target cash compensation, and long-term equity awards (valued based on an approximation of grant date fair value).

How We Determine Executive Compensation

Role of the Compensation Committee and Executive Officers in Setting Executive Compensation

The Compensation Committee reviews and oversees our executive compensation policies, plans and programs and reviews and determines the compensation to be paid to all of our executive officers, including the named executive officers. Our Compensation Committee consists solely of independent members of the Board. In making its executive compensation determinations, the Compensation Committee considers recommendations from the Chief Executive Officer for executive officers other than himself and, with respect to the evaluation of the Chief Executive Officer’s performance, the Compensation Committee considers recommendations from the Chairman of the Board. In making his recommendations for executive officers other than himself, the Chief Executive Officer receives input from our human resources department and has access to various third party compensation surveys and compensation data

provided by the independent compensation consultant to the Compensation Committee, as described below. While the Chief Executive Officer discusses his recommendations for the other executive officers with the Compensation Committee, he does not participate in the deliberations concerning, or the determination of, his own compensation. In addition to our Chief Executive Officer, our Senior Vice President, Chief Human Resources Officer and Senior Vice President, General Counsel and Chief Compliance Officer may also attend Compensation Committee meetings from time to time and may take part in discussions of executive compensation. The Compensation Committee discusses and makes final determinations with respect to executive compensation matters without any named executive officers or other executive officers present (other than the Chief Executive Officer as described above). From time to time, various other members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in the Compensation Committee meetings.

The Compensation Committee meets periodically throughout the year to manage and evaluate our executive compensation program, and generally determines the principal components of compensation (base salary, performance bonus and equity awards) for our executive officers on an annual basis. These annual decisions typically occur in the first or second quarter of the year, however, decisions may occur during the year for new hires, promotions or other special circumstances as our Compensation Committee determines appropriate. The Compensation Committee does not delegate its authority to approve executive officer compensation. The Compensation Committee does not currently maintain a formal policy for the timing of equity awards to our executive officers and has granted awards over the past several years at times when the Compensation Committee determines appropriate.

Role of our Independent Compensation Consultant

The Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. For purposes of evaluating 2017 compensation for each of our executive officers and making 2017 compensation decisions, we retained Compensia, an independent compensation consultant, to assist the Compensation Committee in reviewing our compensation programs and to ensure that our compensation programs remain competitive in attracting and retaining talented executives.

Compensia assisted the Compensation Committee in developing a group of peer companies to use as a reference in making 2017 compensation decisions, evaluating current pay practices and considering different compensation programs and best practices. As described further below, Compensia also prepared an analysis of our compensation practices with respect to base salaries, annual bonuses and long-term incentive grants against market practices. Compensia reported directly to the Compensation Committee, which maintained the authority to direct their work and engagement, and advised the Compensation Committee from time to time. Compensia interacted with management to gain access to Company information that is required to perform services and to understand the culture and policies of our organization. The Compensation Committee and Compensia met in executive session with no members of management present as needed to address various compensation matters, including deliberations regarding the Chief Executive Officer’s compensation.

Beginning in June 2017, the Compensation Committee retained Radford, an Aon Hewitt Company and a subsidiary of Aon plc, to assist the Compensation Committee in evaluating current pay practices, developing a pay philosophy, evaluating its peer group, evaluating compensation and corporate governance best practices and proxy advisory firm considerations and preparing to make 2018 compensation decisions.

Our Compensation Committee analyzed whether the work of Radford as a compensation consultant raised any conflict of interest, taking into consideration the following factors: (i) the fact that Radford and its affiliates do not provide any services directly to AveXis; (ii) the amount of fees paid to Radford and its affiliates by AveXis as a percentage of Radford and its affiliates’ total revenue; (iii) Radford’s policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship of Radford or the individual compensation advisors employed by Radford with any executive officer; (v) any business or personal relationship of the individual compensation advisors with any member of our Compensation Committee; and (vi) any AveXis stock owned by Radford or the individual compensation advisors employed by Radford. Based on its analysis of these factors, our

Compensation Committee determined that the work of Radford and the individual compensation advisors employed by Radford does not create any conflict of interest.

Use of Competitive Market Compensation Data

We aim to attract and retain the most highly qualified executive officers in an extremely competitive market. Accordingly, the Compensation Committee believes that it is important when making its compensation decisions to be informed as to the current practices of comparable public companies with which we compete for top talent. To this end, the Compensation Committee reviews market data for each executive officer’s position, compiled by our compensation consultant, as described below, including information relating to the compensation for executive officers in the development stage biotechnology industry.

In developing a proposed list of our peer group companies to be used in connection with making compensation decisions for 2017, Compensia and the Compensation Committee selected companies that would be appropriate peers based on industry focus, employee size, stage of development and market capitalization. Specifically, companies were selected in the spring of 2017 with the following parameters: operating in the biotechnology and pharmaceuticals industries (with a preference for companies with a focus on genetics and/or rare disease or orphan drugs), which were pre-commercial with clinical stage operations, had employee headcounts of less than 200, and market capitalizations preferably from one-half ($900 million) to two times ($3.6 billion) AveXis’ market value at the time (with AveXis falling in the 55th percentile of such group of companies chosen). Based on these criteria, in March 2017, Compensia recommended, and our Compensation Committee approved, the following companies as our peer group for 2017:

|

Acceleron Pharma Inc. |

|

Global Blood Therapeutics, Inc. |

|

Aerie Pharmaceuticals, Inc. |

|

Juno Therapeutics, Inc. |

|

Agios Pharmaceuticals, Inc. |

|

Kite Pharma, Inc. |

|

Aimmune Therapeutics, Inc. |

|

Puma Biotechnology, Inc. |

|

Alder BioPharmaceuticals, Inc. |

|

Sage Therapeutics, Inc. |

|

Alnylam Pharmaceuticals, Inc. |

|

Sarepta Therapeutics, Inc. |

|

bluebird bio, Inc. |

|

Spark Therapeutics, Inc. |

|

Blueprint Medicines Corporation |

|

Ultragenyx Pharmaceutical Inc. |

|

Epizyme, Inc. |

|

Xencor, Inc. |

|

Five Prime Therapeutics, Inc. |

|

|

In May 2017, Compensia completed an assessment of executive compensation data based on our peer group to inform the Compensation Committee’s determinations of executive compensation for 2017. This market data used for this assessment was compiled from (i) the 2017 selected peer group companies’ publicly disclosed information, or public peer data and (ii) data from the Radford Global Life Sciences Survey with respect to the 2017 selected peer group companies listed above, or the peer survey data. The components of the market data were based on the availability of sufficient comparative data for an executive officer’s position. The peer survey data and the public peer data are collectively referred to as market data, and was reviewed by the Compensation Committee, with the assistance of Compensia, and used as a reference point, in addition to other factors, in setting our named executive officers’ compensation.

Compensia prepared, and the Compensation Committee reviewed, a range of market data reference points (generally at the 25th, 50th, 60th and 75th percentiles of the market data) with respect to base salary, performance bonuses, equity compensation (value based on an approximation of grant date fair value), total target cash compensation (including both base salary and the annual target performance bonus) and total direct compensation (total target cash compensation and equity compensation).

The Compensation Committee’s general aim is for compensation to remain competitive with the market, falling above or below the median of the market data as appropriate based on corporate and individual executive performance, and other factors deemed to be appropriate by the Compensation Committee. Due to our limited history as a public company and our evolving and growing business, we have not developed a specific market positioning or “benchmark” that we consistently aim for in setting compensation levels; instead our Compensation Committee determines each element of compensation, and total target cash and direct compensation, for each named executive officer based on various facts and circumstances appropriate for our company in any given year. Competitive market positioning is only one of several factors, as described below under “Factors Used in Determining Executive Compensation,” that our Compensation Committee considers in making compensation decisions, and therefore individual named executive officer compensation may fall at varying levels as compared to the market data.

In preparation for making 2018 compensation decisions, with input from Radford, the Compensation Committee revalued its peer group and approved the following companies as our peers for 2018 executive compensation decisions:

|

ACADIA Pharmaceuticals Inc. |

|

Juno Therapeutics, Inc. |

|

Aerie Pharmaceuticals, Inc. |

|

Kite Pharma, Inc. |

|

Agios Pharmaceuticals, Inc. |

|

Neurocrine Biosciences, Inc. |

|

Aimmune Therapeutics, Inc. |

|

Portola Pharmaceuticals, Inc. |

|

Alnylam Pharmaceuticals, Inc. |

|

Puma Biotechnology, Inc. |

|

bluebird bio, Inc. |

|

Sage Therapeutics, Inc. |

|

Blueprint Medicines Corporation |

|

Sarepta Therapeutics, Inc. |

|

Clovis Oncology, Inc. |

|

Spark Therapeutics, Inc. |

|

Global Blood Therapeutics, Inc. |

|

Ultragenyx Pharmaceutical Inc. |

|

Intercept Pharmaceuticals, Inc. |

|

|

Factors Used in Determining Executive Compensation

Our Compensation Committee sets the compensation of our executive officers at levels they determine to be competitive and appropriate for each named executive officer, using their professional experience and judgment. Pay decisions are not made by use of a formulaic approach or benchmark; the Compensation Committee believes that executive pay decisions require consideration of a multitude of relevant factors that may vary from year to year and by individual circumstance. In making executive compensation decisions, the Compensation Committee generally takes into consideration the factors listed below.

· Corporate performance, business needs and business impact

· Each named executive officer’s individual performance, experience, job function, change in position or responsibilities, and expected future contributions to our company

· Internal pay equity among named executive officers and positions

· The need to attract new talent to our executive team and retain existing talent in a highly competitive industry

· A range of market data reference points (generally the 25th, 50th, 60th and 75th percentiles of the market data), as described above under “—Use of Competitive Market Compensation Data”

· The total compensation cost and stockholder dilution from executive compensation actions

· Trends and compensation paid to similarly situated officers within our market

· Recommendations of the outside compensation consultant

· A review of a named executive officer’s total targeted and historical compensation and equity ownership

· Our Chief Executive Officer’s recommendations (with respect to executive officers other than himself), based on his direct knowledge of the performance by each named executive officer

2017 Executive Compensation Program

Annual Base Salary

In reviewing and adjusting base salaries for 2017, the Compensation Committee considered current market data as well as each named executive officer’s total cash compensation (consisting of base salary and target bonus opportunity) and individual performance. The Compensation Committee made increases to the base salary of each of Mr. Nolan and Dr. Nagendran as necessary to bring each of their base salaries closer to the 50th percentile of the market data, to remain competitive with companies with whom we compete. Dr. L’Italien’s base salary did not trail the 50th percentile of the market data and as a result the Compensation Committee provided Dr. L’Italien with a smaller 3% merit increase which they felt was appropriate given the general cost of living increase in the market over the past year.

The named executive officers’ 2017 base salaries and increases from each of their 2016 base salaries, if applicable, are reflected in the table below. The 2017 base salaries were effective May 15, 2017, with the exception of Mr. Donenberg, whose base salary was effective upon his commencement with us as Chief Financial Officer on October 19, 2017. Mr. Donenberg’s base salary was set by the Compensation Committee at a level they felt appropriate to retain him, given his level of experience and historical compensation.

|

Named Executive Officer |

|

2017 Base Salary |

|

Increase from 2016 Base Salary |

| |

|

Sean P. Nolan |

|

$ |

555,000 |

|

11 |

% |

|

Phillip B. Donenberg (1) |

|

$ |

350,000 |

|

(1 |

) |

|

James J. L’Italien, Ph.D. |

|

$ |

375,950 |

|

3 |

% |

|

Raken B. Modi (2) |

|

$ |

407,000 |

|

(2 |

) |

|

Sukumar Nagendran, M.D. |

|

$ |

426,000 |

|

8 |

% |

|

Thomas J. Dee (3) |

|

$ |

350,000 |

|

0 |

% |

(1) Prior to his commencement as Chief Financial Officer, Mr. Donenberg served as our Vice President, Corporate Controller and his base salary in such role during 2017 was $284,625 (from April until October 2017) and $275,000 (from January through March 2017).

(2) Mr. Modi commenced as Senior Vice President, Chief Business Officer on February 13, 2017.

(3) Mr. Dee resigned as our Senior Vice President and Chief Financial Officer in October 2017.

Annual Performance-Based Bonuses

Our annual performance-based bonus program for 2017 was developed by our Compensation Committee in early 2017. Under the 2017 annual performance bonus program, each named executive officer was eligible to be considered for a performance bonus based on (1) the individual’s target bonus, as a percentage of base salary, (2) the percentage attainment of our 2017 corporate goals, or key success factors, established by the Compensation Committee, and, with respect to our named executive officers other than Mr. Nolan, (3) the percentage attainment of the 2017 individual goals established by the Compensation Committee, based on recommendations from Mr. Nolan, for each named executive officer.

The Compensation Committee determined that each executive officer other than Mr. Nolan’s performance bonus should be based in part on their own individual performance and contribution towards achievement of the key success

factors; accordingly, for each of the named executive officers other than Mr. Nolan, 80% of the bonus was based on key success factor achievement and 20% of the bonus was based on individual performance achievement. The Compensation Committee determined Mr. Nolan’s bonus should be based solely on the achievement of the key success factors, because as Chief Executive Officer, Mr. Nolan has greater impact on, and responsibility for, corporate performance. The Compensation Committee retained the discretion to make adjustments to the calculated bonus based on unexpected or unplanned events, the overall financial condition of the Company, extraordinary performance or underperformance or other factors as determined appropriate by the Compensation Committee, however, they capped the maximum total bonus pool available to be paid under the 2017 annual performance bonus program, upon maximum performance achievement, at 150% of total employee target bonuses.

Target Bonuses

In May 2017, the Compensation Committee reviewed the named executive officer target bonus percentages, and determined that the 2016 target bonus percentages remained appropriate for each of the named executive officers other than Mr. Nolan. Mr. Nolan’s target bonus percentage was increased from 50% to 60% and each of the other named executive officers’ 2017 target bonus percentage remained at 40%. The Compensation Committee determined Mr. Nolan’s increase in target bonus percentage was appropriate because his target bonus percentage, and total target cash compensation (consisting of base salary and target bonus) fell around the 25th percentile of the market data. The Compensation Committee’s increase in Mr. Nolan’s target bonus percentage, combined with his increase in base salary, was intended to set his total target cash compensation at approximately the 50th percentile of the market data, which the Compensation Committee felt was necessary to incentivize and retain Mr. Nolan. The Compensation Committee was mindful that the other named executive officers’ total target cash compensation generally aligned with the 50th percentile of the market data, and while Dr. L’Italien and Mr. Modi’s total target cash fell above the 50th percentile of the market data as a result of base salary level, the Compensation Committee determined that each of the officers should continue to have the same bonus percentage to reflect each of their similar degrees of impact on our organization and to promote internal equities amongst our senior leadership team.

Corporate Performance

The key success factors and relative overall weighting towards key success factor achievement for 2017 were established by the Compensation Committee in January 2017. Our Compensation Committee assigned a specific weighting to each of our key success factors on which the performance-based bonus for each executive officer would be based. In addition, the Compensation Committee set a total bonus pool payout range based on the overall level of achievement of the key success factors as reflected in the table below. Under this structure, overall key success factor achievement of less than 70% would result in zero bonus payment and if overall key success factor achievement was 130% or more, the total bonus pool would be capped at 150%.

|

|

|

Level of |

|

Bonus Pool |

|

|

Threshold |

|

70 |

% |

50 |

% |

|

Target |

|

100 |

% |

100 |

% |

|

Maximum |

|

130 |

% |

150 |

% |

In early 2018, our Compensation Committee reviewed our performance and approved the extent to which we achieved each of our key success factors. The overall key success factor achievement was 135%, which was the sum of the weight of each key success factor, multiplied by the performance achievement assigned to such factor by the Compensation Committee based on the actual results during 2017. As a result, the total bonus pool was funded

at 150%.

|

Key Success Factor |

|

Weight |

|

|

Manage AVXS-101 good manufacturing practice, or GMP, product availability and manufacturing to support clinical trials and possible accelerated U.S. launch |

|

35 |

% |

|

Execute regulatory plans for SMA franchise |

|

25 |

% |

|

Execute clinical development and research plans for SMA franchise and new programs |

|

20 |

% |

|

Complete commercial readiness activities |

|

15 |

% |

|

Manage finances, execute business development plan, intellectual property development and human resources |

|

5 |

% |

|

Total |

|

100 |

% |

In February 2018, taking into account Mr. Nolan’s evaluation and recommendation, the Compensation Committee evaluated each of the named executive officers other than Mr. Nolan to determine the individual performance component of the performance bonus as follows:

· Mr. Donenberg: our Compensation Committee approved an individual performance factor payout for Mr. Donenberg (as reflected in the table below) based upon Mr. Donenberg’s exceptional work leading and building the accounting and finance functions/systems for AveXis as the Vice President and Controller and transitioning seamlessly to the SVP, Chief Financial Officer position.

· Dr. L’Italien: our Compensation Committee approved an individual performance factor payout for Dr. L’Italien (as reflected in the table below) of exceptional, based upon Dr. L’Italien’s significant contribution to value creation including orchestrating a successful CMC meeting with the FDA, successfully managing FDA information requests and conducting successful meetings with EMA, EU National Authorities and Japan.

· Mr. Modi: our Compensation Committee approved an individual performance factor payout for Mr. Modi (as reflected in the table below), based upon Mr. Modi’s expertise as the company’s senior commercial leader. He was foundational in leading the commercial readiness and preparatory activities to ensure a successful product launch.

· Dr. Nagendran: our Compensation Committee approved an individual performance factor payout for Dr. Nagendran (as reflected in the table below) of exceptional, based upon Dr. Nagendran’s leadership as the Chief Medical Officer coordinating all aspects of our clinical trials design and implementation, as well as being a liaison externally with patients, key opinion leaders and investors.

Based on our overall key success factor achievement and individual performance achievement (other than for Mr. Nolan) in February 2018, the Compensation Committee awarded each of our named executive officers the performance bonuses reflected in the table below.

|

Named Executive Officer |

|

2017 Target Bonus |

|

Total Payout |

| ||

|

Sean P. Nolan |

|

$ |

333,000 |

|

$ |

499,500 |

|

|

Phillip B. Donenberg (1) |

|

$ |

112,959 |

|

$ |

163,790 |

|

|

James J. L’Italien, Ph.D. |

|

$ |

150,380 |

|

$ |

238,051 |

|

|

Raken B. Modi (2) |

|

$ |

162,800 |

|

$ |

232,920 |

|

|

Sukumar Nagendran |

|

$ |

170,400 |

|

$ |

262,080 |

|

|

Thomas J. Dee (3) |

|

$ |

140,000 |

|

$ |

0 |

|

(1) Mr. Donenberg’s bonus was pro-rated for the portion of 2017 in which Mr. Donenberg served as Chief Financial Officer.

(2) Mr. Modi’s bonus was paid for the full 2017 performance period pursuant to the terms of his employment agreement.

(3) Mr. Dee did not receive a performance bonus for 2017. However, as part of his severance payment, Mr. Dee received a pro-rated payment equal to his target performance bonus for 2017(based upon the portion of 2017 in which Mr. Dee was employed with us).

Equity-Based Incentive Awards

We have historically granted equity compensation to our executive officers primarily in the form of stock options, although from time to time we have granted other types of awards as the Compensation Committee determined appropriate. The Compensation Committee determined that our annual 2017 long-term compensation program for the named executive officers would continue to consist of stock options that vest over a four year period, subject to the executive’s continued service with us. The Compensation Committee considered the grant of other types of equity awards and concluded that for the 2017 annual equity award grants, stock options were the appropriate equity award type for our named executive officers, given our limited history as a public company, our executives’ familiarity with and understanding of stock options as incentive tools and the Compensation Committee’s belief that stock options serve as a key pay-for-performance tool in aligning the interests of our executive officers and our stockholders. The Compensation Committee views stock options as inherently performance-based compensation that automatically links executive pay to stockholder return, as the value realized, if any, by the executive from an award of stock options, is dependent upon, and directly proportionate to, appreciation in stock price. Regardless of reported value in the Summary Compensation Table, executives will only receive value from the stock option awards if the price of the stock increases above the price at time of grant, and remains above as the stock options continue to vest. Stock options also do not have downside protection, and the awards will not provide value to the holder when the stock price is below the exercise price. Additionally, the Compensation Committee reviewed market practices in May 2017 and was mindful that stock options are the predominant equity incentive vehicle used by our peer companies.

The Compensation Committee approved the following annual stock options for our named executive officers in May 2017 (except as otherwise noted below), each of which vest over a four-year period:

|

Named Executive Officer |

|

Stock Option Grant (# shares) |

|

|

Sean P. Nolan |

|

96,000 |

|

|

Phillip B. Donenberg (1) |

|

20,000 |

|

|

James J. L’Italien, Ph.D. |

|

27,827 |

|

|

Raken B. Modi (2) |

|

68,940 |

|

|

Sukumar Nagendran |

|

25,200 |

|

|

Thomas J. Dee (3) |

|

25,200 |

|

(1) Mr. Donenberg’s May 2017 grant reflected his annual equity grant in his role as Vice President, Corporate Controller and consisted of an option to purchase 5,594 shares. The Compensation Committee granted Mr. Donenberg an additional option to purchase 4,406 shares of our common stock in September 2017 and an additional option to purchase 10,000 shares of our common stock in October 2017, each of which vests over a four-year period. The Compensation Committee approved these additional grants because they felt these amounts were necessary to incentivize and retain Mr. Donenberg and commensurate with industry experience, exceptional performance and his increased position and duties as a result of his promotion to Senior Vice President, Chief Financial Officer.

(2) Mr. Modi’s May 2017 grant reflected his annual equity grant in his role as Senior Vice President, Chief Business Officer and consisted of an option to purchase 7,940 shares. The Compensation Committee also granted Mr. Modi an option to purchase 61,000 shares at the commencement of his employment to provide him for the value of equity he forfeited when leaving his former employer to join the Company.

(3) Mr. Dee’s stock options were forfeited as a result of his resignation as our Senior Vice President and Chief Financial Officer in October 2017.

The Compensation Committee chose each of the NEO’s grant level based on the amount which they felt, in their judgment, was appropriate to retain and incentivize the NEOs, while remaining reasonable within market standards and considering potential dilution of our share reserves. In making these determinations, the Compensation Committee considered each of the NEO’s current equity holdings, including vested and unvested holdings and the extent to which such holdings were “in-the-money,” the extent to which such holdings remained unvested and therefore continued to serve as a retention tool, the market data provided by Compensia reflecting equity value based on approximated grant date fair value, internal equity amongst the team, and individual performance.

Additionally, the Compensation Committee granted the following performance-vesting restricted stock units, or PRSUs, as a special retention and incentive award to certain executives in March 2017.

|

Named Executive Officer |

|

PRSU Grant (# shares) |

|

|

James J. L’Italien, Ph.D. |

|

9,154 |

|

|

Sukumar Nagendran |

|

9,906 |

|

The Compensation Committee felt these awards were necessary to retain Drs. L’Italien and Nagendran, who are critical to our key programs and structured the awards to vest only if specific performance milestones are achieved, thereby aligning the recipients’ interests with our success. These PRSU awards vest based upon two milestones; first, with respect to 50% of the shares upon U.S. FDA marketing authorization approval of AVXS-101 on or before the three year anniversary of the grant date, or the first milestone, and second, 50% of the shares upon

providing continuous supply of AVXS-101 to the market for 12 months following the first commercial sale that occurs within six months after the first milestone has occurred, or the second milestone, subject in both cases to continued service. The Compensation Committee determined the size of these awards based on their judgement regarding the amount necessary and reasonable to accomplish the desired incentive purposes of the awards.

Other Features of our Executive Compensation Program

Agreements with our Named Executive Officers

Employment Agreements

We have entered into employment agreements with each of our named executive officers that provide for the basic terms of their employment, including base salary, performance bonus opportunity and equity grants, as well as certain severance and change of control benefits. The terms of these agreements are described in greater detail in the section titled “Description of Compensation Arrangements.” Each of our named executive officers is employed at will and may be terminated at any time for any reason.

Severance and Change in Control Benefits