Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Aralez Pharmaceuticals Inc. | a18-12367_1ex31d2.htm |

| EX-31.1 - EX-31.1 - Aralez Pharmaceuticals Inc. | a18-12367_1ex31d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission File number 001-37691

ARALEZ PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

British Columbia, Canada |

|

98-1283375 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

7100 West Credit Avenue, Suite 101, Mississauga, Ontario, Canada L5N 0E4

(Address of principal executive offices)

(905) 876-1118

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of exchange on which registered |

|

Common Shares, without par value |

|

Nasdaq Global Market, Toronto Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

Non-accelerated filer |

|

¨ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

¨ |

|

Emerging growth company |

|

¨ |

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the common shares held by non-affiliates of the registrant (computed by reference to the closing sale price of $1.35 for the registrant’s common shares as reported on the Nasdaq Global Market on June 30, 2017) was approximately $83.1 million. As of the close of business on March 8, 2018, there were 67,010,887 common shares issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Explanatory Note

We are filing this Amendment No. 1 to Form 10-K (“Amendment No. 1”) to amend our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, as filed with the Securities and Exchange Commission on March 14, 2018 (the “Original Form 10-K”), to include the information required by Part III of Form 10-K and to amend and restate the exhibit list in Item 15 of Part IV, solely to reflect the new certifications being filed by our principal executive officer and principal financial officer herewith. The Part III information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information required by Items 10-14 of Part III of the Form 10-K to be incorporated by reference from our definitive proxy statement if such proxy statement is filed no later than 120 days after our fiscal year-end. The information required by Items 10-14 of Part III is no longer being incorporated by reference to the proxy statement relating to our 2018 Annual Meeting of Shareholders. The reference on the cover of the Original Form 10-K to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Form 10-K is hereby deleted. Except as otherwise expressly set forth in this Amendment No. 1, no portion of the Original Form 10-K is being amended or updated by this Amendment No. 1. Unless the context indicates otherwise, references to “Aralez” or the “Company” herein refer to Aralez Pharmaceuticals, Inc.

|

|

|

Page |

|

|

1 | |

|

|

|

|

|

1 | ||

|

6 | ||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

33 | |

|

Certain Relationships and Related Transactions and Director Independence |

36 | |

|

37 | ||

|

|

|

|

|

|

| |

|

|

|

|

|

38 | ||

|

|

|

|

|

|

|

ITEM 10. Directors, Executive Officers and Corporate Governance

The Board in General

The board of directors (the “Board”) is currently comprised of seven directors, each of whose current term of office as a director expires at our 2018 annual meeting of shareholders. The Board is responsible for nominating directors for election to the Board and for filling vacancies on the Board that may occur between annual meetings of shareholders.

Biographical information for each of our directors is provided below. There are no familial relationships among any of the executive officers and directors of the Company.

|

Name |

|

Position with the Company |

|

Age |

|

Director Since |

|

Residence |

|

Adrian Adams |

|

Director and Chief Executive Officer |

|

67 |

|

2015 |

|

Pennsylvania, USA |

|

Neal F. Fowler |

|

Director |

|

56 |

|

2016 |

|

North Carolina, USA |

|

Rob Harris |

|

Director |

|

62 |

|

2016 |

|

Ontario, Canada |

|

Arthur S. Kirsch |

|

Director and Chairperson of the Board |

|

66 |

|

2016 |

|

New York, USA |

|

Kenneth B. Lee, Jr. |

|

Director |

|

70 |

|

2016 |

|

North Carolina, USA |

|

Seth A. Rudnick, M.D. |

|

Director |

|

69 |

|

2016 |

|

North Carolina, USA |

|

F. Martin Thrasher |

|

Director |

|

66 |

|

2016 |

|

Ontario, Canada |

Adrian Adams has been our Chief Executive Officer since February 5, 2016, and has been a director of the Company since December 11, 2015 and Chairperson of the Transaction Committee since November 3, 2016. From May 2015 through February 5, 2016, Mr. Adams was the Chief Executive Officer and a director of POZEN Inc. (“Pozen”), and served as a consultant to Pozen from April 2015 to May 2015. Previously, Mr. Adams served as Chief Executive Officer and President and as a director of Auxilium Pharmaceuticals Inc., a specialty biopharmaceutical company, from December 2011 until January 2015, when it was acquired by Endo International plc. Mr. Adams served as the Chairperson and Chief Executive Officer of and a director of Neurologix, Inc. (“Neurologix”), a company focused on the development of multiple innovative gene therapy development programs, from September 2011 to November 2011. Before Neurologix, Mr. Adams served as President, Chief Executive Officer and a director of Inspire Pharmaceuticals, Inc., a specialty pharmaceutical company, from February 2010 until May 2011, when it was acquired by Merck & Co., Inc. Previously, Mr. Adams served as President and Chief Executive Officer of Sepracor Inc., a specialty pharmaceutical company, from March 2007 and May 2007, respectively, until February 2010, when Sepracor was acquired by Dainippon Sumitomo Pharma Co., Ltd. Prior to his appointment as Chief Executive Officer of Sepracor, Mr. Adams served as its Chief Operating Officer. Prior to joining Sepracor, Mr. Adams served as the President and Chief Executive Officer of Kos Pharmaceuticals, Inc., a specialty pharmaceutical company, from 2002 until its acquisition by Abbott Laboratories in December 2006. Mr. Adams has also held general management and senior international and national marketing positions at SmithKline Beecham, Novartis and ICI (now part of AstraZeneca). Mr. Adams has served as Chairperson of the board of directors of AcelRx Pharmaceuticals, Inc. since February 2013 and served on the board of directors of Amylin Pharmaceuticals, Inc. from October 2007 to August 2012. Mr. Adams graduated from the Royal Institute of Chemistry at Salford University in the U.K.

Mr. Adams is a highly qualified pharmaceutical executive who brings to the Board over 30 years of experience in the industry. Mr. Adams has extensive national and international experience and has been instrumental in launching major global brands in addition to driving successful corporate development activities encapsulating financing, product and company acquisitions, in-licensing and company M&A activities.

Neal F. Fowler has been a director of the Company since February 5, 2016, and was previously a director of Pozen from 2010 through February 5, 2016. Mr. Fowler is Chief Executive Officer of Liquidia Technologies, Inc. (“Liquidia”), a biomedicines company, and has served in that capacity since 2008. Mr. Fowler is also a co-founder of Envisia Therapeutics Inc. (“Envisia”), an ophthalmology spin-out of Liquidia, and concurrently served as Chief Executive Officer of Envisia from its launch in 2013 through 2015. Mr. Fowler joined Liquidia in 2008 after seven years at Johnson & Johnson. While at Johnson & Johnson, he served as President of Centocor, Inc. (“Centocor”), a multi-billion dollar subsidiary focused on development and commercialization of industry leading biomedicines used in the treatment of chronic inflammatory diseases. Prior to Centocor, Mr. Fowler was President of Ortho-McNeil Neurologics Inc. and Vice President of the central nervous system franchise at Ortho-McNeil Pharmaceuticals. Mr. Fowler joined Johnson & Johnson after a 13-year career at Eli Lilly and Company where he held a variety of sales, marketing and business development roles with increasing responsibilities in both the pharmaceutical and medical device divisions. Mr. Fowler is a native of Raleigh, NC and received a Bachelor of Science degree in Pharmacy and Masters of Business Administration from the University of North Carolina at Chapel Hill (UNC-CH).

Mr. Fowler brings to the Board his extensive background in the pharmaceutical industry acquired through a variety of senior positions at several large pharmaceutical companies. He is currently chief executive officer at Liquidia, a position that has provided him with experience in running an emerging growth company.

Rob Harris has been a director of the Company since February 5, 2016. He previously served as President, Chief Executive Officer and a director of Tribute Pharmaceuticals Canada Inc. (now known as Aralez Pharmaceuticals Canada Inc.) (“Tribute”) from December 1, 2011 to February 2016. Mr. Harris founded Tribute Pharma, which later became Tribute Pharma Canada Inc. and Tribute Pharmaceuticals Canada Ltd. in November 2005. Tribute acquired both Tribute Pharma Canada Inc. and Tribute Pharmaceuticals Canada Ltd. on December 1, 2011. Mr. Harris was formerly the President and CEO of Legacy Pharmaceuticals Inc. from September 2004 to October 2005. As the VP of Business Development at Biovail Corporation from October 1997 to September 2004, Mr. Harris was involved in, led and successfully concluded numerous business development transactions, including the licensing of new chemical entities, the acquisition of mature products, the completion of co-promotion deals, distribution agreements, product development and reformulation transactions. Mr. Harris joined Biovail in 1997 as the GM of Biovail Pharmaceuticals Canada at a time when the company experienced rapid growth in the Canadian division. Before Biovail, Mr. Harris worked in various senior commercial management positions during his twenty-year tenure at Wyeth (Ayerst) from 1977 to 1997 and has been involved in numerous product launches during his career.

Mr. Harris brings to the Board over 35 years of pharmaceutical industry experience in both Canada and the United States in sales, marketing, business development and general management.

Arthur S. Kirsch has been a director of the Company, Chairperson of the Board, and Chairperson of the Audit Committee since February 5, 2016. Previously, he was a director of Pozen from 2004 through February 5, 2016. Mr. Kirsch has been Senior Advisor, GCA, LLC (formerly GCA Savvian, LLC), an investment bank, since June 2005. Mr. Kirsch was a Managing Director of Vector Securities, LLC, an investment and merchant banking firm, from 2001 to May 2005. He was a Managing Director and Head of Healthcare Research and Capital Markets of Prudential Vector Healthcare Group, a unit of Prudential Securities, Inc., a full-service brokerage firm, from 1999 to 2001. Mr. Kirsch was the Director, Equity Research of Vector Securities International, Inc., an investment banking firm, from 1995 to 1999. He served as a director of Immunomedics, Inc., a publicly-traded biopharmaceutical company, from August 2015 until October 2016. He currently serves as a director of Liquidia, a privately held biotechnology company, since December, 2016.

Mr. Kirsch has over 30 years of experience working in equity capital markets and has extensive knowledge of the healthcare and life sciences field. Mr. Kirsch, who has spent the majority of his career in investment banking with a focus on the healthcare industry, brings both financial and industry expertise to the Board.

Kenneth B. Lee, Jr. has been a director of the Company and Chairperson of the Compensation Committee since February 5, 2016. Previously, he was a director of Pozen from 2002 to February 5, 2016, and from 2002 was also Pozen’s lead Independent Director. Since June 2002 he has been an independent consultant and general partner of Hatteras Venture Partners (formerly Hatteras BioCapital, LLC and BioVista Capital, LLC), and the general partner of Hatteras BioCapital Fund, L.P., a venture capital fund focusing on life sciences companies, since 2003. Mr. Lee was President of A.M. Pappas & Associates, a venture capital firm, between January 2002 and June 2002. He was a Partner of Ernst & Young LLP from 1982 through 2000, and was the National Director of the Life Sciences Practice for the firm. He was a Partner of Ernst & Young Corporate Finance LLC from 2000 to 2001, where he served as the Managing Director of Ernst & Young’s Health Sciences Corporate Finance Group from 2000 to 2001. Mr. Lee has served on the board of directors of Biocryst Pharmaceuticals, Inc., a public company, since 2011, and is currently Chairperson of the audit committee and Chairperson of the finance committee. He has also served on the board of directors of Eyenovia, Inc., a public company, since March 2018, and is currently Chairperson of the audit committee. Mr. Lee is also a director of Clinipace Worldwide, a privately held company. Previously, he served on the boards of directors of CV Therapeutics, Inc., for which he served as lead independent director and Chairperson of the audit committee and a member of the compensation committee, Abgenix, Inc., for which he served on the audit committee and the compensation committee, OSI Pharmaceuticals, for which he served as a member of the audit committee, Inspire Pharmaceuticals Inc., for which he served as Chairperson of the board of directors, and Chairperson of the audit committee and a member of the compensation committee and finance committee, and Maxygen, Inc., for which he served as Chairperson of the audit committee and a member of the nominating/governance committee and the compensation committee. Mr. Lee served as a member of the executive committee of the board of directors of the North Carolina Biotechnology Industry Organization and as a member of the board of directors of Ibiliti, a nonprofit organization dedicated to building and expanding networks of resources for advanced medical technology companies. Mr. Lee is also a co-founder of the National Conference on Biotechnology Ventures.

Mr. Lee brings his extensive accounting and financial background to the Board, as well as expertise in the life sciences industry from his experience as a general partner of several venture capital funds specializing in life sciences. He has also served and is serving on the boards and audit committees of several public pharmaceutical companies similar in size to the Company, including serving as Chairperson of the board of directors of Biocryst Pharmaceuticals, Inc.

Seth A. Rudnick, M.D. has been a director of the Company and Chairperson of the Nominating/Corporate Governance Committee since February 5, 2016. Previously, he was a director of Pozen from 2011 through February 5, 2016. Dr. Rudnick was a venture partner and previously general partner at Canaan Partners, a venture capital firm from 1998 to December 2014. Formerly, Dr. Rudnick was the Chief Executive Officer and Chairperson of CytoTherapeutics Inc., a company developing stem cell-based therapies, from 1991 to 1998. He helped found and served as the Head of Research and Development for Ortho Biotech, a division of Johnson & Johnson focusing on cancer and chronic illnesses from 1986 to 1991. He currently serves on the boards of directors of the following privately held biotechnology companies: Liquidia Technologies, Inc., for which he serves as Chairperson, and G1 Therapeutics, for which he serves as Chairperson. Dr. Rudnick also served on the board of directors of Square 1 Financial, Inc., a public financial services company, from 2012 to October 2015. Currently he is a Clinical Adjunct Professor of Medicine at University of North Carolina, Chapel Hill.

Dr. Rudnick brings to the Board deep operational experience in the pharmaceutical and biotechnology industries acquired through a variety of senior research and development positions in several large and mid-size pharmaceutical companies and as Chief Executive Officer, and Chairperson of CytoTherapeutics, Inc., Chairperson of Liquidia Technologies, Inc., and Executive Chairperson of GI Therapeutics. Dr. Rudnick retired from Canaan Partners, a global venture capital firm with significant investments in the healthcare sector, where he served as general venture partner from 1998 to 2013, which provided him with significant experience in and insight into life sciences investments.

F. Martin Thrasher has been a director of the Company since February 5, 2016. Previously, he was a director of Tribute from 2009 to February 2016. Mr. Thrasher is a seasoned international executive. After graduating from the Richard Ivey School of Business in London, Ontario, Mr. Thrasher spent over 30 years working around the globe for companies such as General Foods from 1973 to 1977, McCormick & Co from 1977 to 1988, Campbell Soup Co. from 1988 to 2001 and ConAgra Foods Inc. from 2001 to 2004. He has served as President of FMT Consultants LLC since 2004. Mr. Thrasher has lived and worked in Canada, Australia, Belgium and the U.S. His responsibilities with Campbell Soup Co. included positions as President, International Grocery and President, North America Grocery. At ConAgra Foods Inc., he was President of the Retail Products Co, a $9 billion business with over 30,000 employees. Mr. Thrasher has been President of FMT Consulting, a boutique advisory and consulting firm since August 2004. In this capacity, he has served in a number of interim CEO and Executive Chairperson positions in Canada and the United States.

Mr. Thrasher brings to the Board extensive international business experience acquired from his time serving at several Fortune 500 companies. He has led large, complex organizations and overseen a variety of mergers and acquistions. Mr. Thrasher also has broad board experience having served on a number of private and public company boards.

Executive Officers

Our executive officers are as follows:

|

Name |

|

Age |

|

Position with the Company |

|

Adrian Adams |

|

67 |

|

Chief Executive Officer |

|

Andrew I. Koven |

|

60 |

|

President and Chief Business Officer |

|

Michael Kaseta |

|

42 |

|

Chief Financial Officer |

|

Jennifer L. Armstrong |

|

47 |

|

Executive Vice President, Human Resources and Administration |

|

James P. Tursi, M.D. |

|

53 |

|

Chief Medical Officer |

Our executive officers are appointed by, and serve at the discretion of, the Board. There are no familial relationships among any of our executive officers and directors of the Company.

Adrian Adams — See “The Board in General” for Mr. Adam’s biography.

Andrew I. Koven has been our President and Chief Business Officer since February 5, 2016. Previously, Mr. Koven was the President and Chief Business Officer of Pozen from June 2015 through February 5, 2016. Prior to joining Pozen, Mr. Koven served as Chief Administrative Officer and General Counsel of Auxilium Pharmaceuticals Inc., a specialty biopharmaceutical company, from February 2012 until January 2015, when it was acquired by Endo International plc. Mr. Koven served as President and Chief Administrative Officer and a member of the board of directors of Neurologix, Inc., a company focused on the development of multiple innovative gene therapy development programs, from September 2011 to December 2011. Before Neurologix, Inc., Mr. Koven served as Executive Vice President and Chief Administrative and Legal Officer of Inspire Pharmaceuticals, Inc., a specialty pharmaceutical company, from July 2010 until May 2011 when it was acquired by Merck & Co., Inc. Previously, Mr. Koven served as Executive Vice President, General Counsel and Corporate Secretary of Sepracor Inc., a specialty pharmaceutical company, from March 2007 until February 2010 when it was acquired by Dainippon Sumitomo Pharma Co., Ltd. Prior to joining Sepracor, Mr. Koven served as

Executive Vice President, General Counsel and Corporate Secretary of Kos Pharmaceuticals, Inc., a specialty pharmaceutical company, from August 2003 until its acquisition by Abbott Laboratories in December 2006. Mr. Koven began his career in the pharmaceutical industry first as an Assistant General Counsel and then as Associate General Counsel at Warner-Lambert Company from 1993 to 2000, followed by his role as Senior Vice President and General Counsel at Lavipharm Corporation from 2000 to 2003. From 1986 to 1992 he was a corporate associate at Cahill, Gordon & Reindel in New York. From 1992 to 1993 he served as Counsel, Corporate and Investment Division, at The Equitable Life Assurance Society of the U.S.

Michael Kaseta has been our Chief Financial Officer (Principal Financial Officer, Principal Accounting Officer) since March 13, 2018. Mr. Kaseta previously served as our Head of Finance and Interim Chief Financial Officer beginning November 30, 2017 and Corporate Controller beginning September 26, 2016. Prior to joining the Company, Mr. Kaseta held various positions at Sanofi S.A. (“Sanofi”), including most recently Chief Financial Officer Sanofi North America, Global Services, from April 2015 through September 2016. Mr. Kaseta was previously the Vice President Sanofi NA Pharma Controlling from January 2013 through April 2015, Vice President, Sanofi Financial Shared Services from March 2007 through December 2013 and Director of Technical Accounting from 2005 to 2007.

Jennifer L. Armstrong has been our Executive Vice President, Human Resources and Administration since February 5, 2016. Ms. Armstrong was previously the Executive Vice President, Human Resources and Administration of Pozen from June 2015 through February 5, 2016. Prior to joining Pozen, she served as Senior Vice President of Human Resources at Auxilium Pharmaceuticals, Inc., a specialty biopharmaceutical company, from July 2009 to March 2015. Prior to that, she served at Senior Vice President of Human Resources and Corporate Communications at Genaera Corporation, a specialty biopharmaceutical company, from January 1998 to May 2009. Ms. Armstrong holds a Master’s degree in Arts Administration and a Bachelor’s degree in Corporate Communications, both from Drexel University.

James P. Tursi, M.D. has been our Chief Medical Officer since February 5, 2016. From October 2015 to February 5, 2016, Dr. Tursi was Chief Medical Officer of Pozen. Previously, Dr. Tursi served as Chief Medical Officer of Innocoll AG, a specialty pharmaceutical company, from March 2015 to September 2015, where he was responsible for managing all clinical research and development, medical affairs and safety activities. Prior to joining Innocoll, Dr. Tursi served as Chief Medical Officer at Auxilium Pharmaceuticals Inc., a specialty biopharmaceutical company, from August 2011 to March 2015, and as Vice President of Clinical Research & Development from March 2009 to August 2011. In these positions, Dr. Tursi was responsible for oversight of clinical and nonclinical development programs, clinical operations, medical affairs and global safety activities, and served as the clinical medical safety lead for all regulatory agency interactions with the FDA, Europe and Canada. Prior to Auxilium, he served as Director of Medical Affairs for GlaxoSmithKline Biologicals from January 2006 to March 2009 and directed all medical affairs responsibilities for the cervical cancer vaccine in North America. Dr. Tursi entered the pharmaceutical industry in 2004 as a Medical Director for Procter and Gamble Pharmaceuticals until 2006. He worked on several products and therapeutic areas, which included female sexual dysfunction, overactive bladder, and osteoporosis. His responsibilities included clinical development and medical affairs. Dr. Tursi was a board certified OB/GYN and practiced medicine and surgery for over 10 years. Dr. Tursi received his doctor of medicine degree from the Medical College of Pennsylvania and completed his residency training at the Johns Hopkins Hospital. Dr. Tursi has served as a member of the board of directors of Agile Therapeutics, a women’s health specialty pharmaceutical company, since October 2014, and is Chairperson of the compensation committee.

Audit Committee

The Company has a separately designated standing audit committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and National Instrument 52-110 — Audit Committees (“NI 52-110”). The current members of the Audit Committee are Mr. Kirsch, who serves as Chairperson, Mr. Lee and Mr. Thrasher. The Board has determined that each of the members of the Audit Committee is independent as defined by the applicable Nasdaq listing standards, the Securities and Exchange Commission (“SEC”) rules applicable to audit committee members and within the meaning of NI 52-110. Each of the Audit Committee members is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement, and has an understanding of the accounting principles used to prepare financial statements, as well as an understanding of the internal controls and procedures necessary for financial reporting. See “- The Board in General” above for the relevant education and experience of each current member of the Audit Committee. The Board has also determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K.

Code of Business Conduct and Ethics

We have adopted a Code of Conduct that applies to our employees, officers (including our principal executive officer, principal financial officer and other members of our finance and administration department) and our directors.

The objective of the Code of Conduct is to provide guidelines for maintaining integrity, honesty and ethical conduct, objectivity and impartiality of the Company. The Code of Conduct addresses, among other topics, conflicts of interest, protection and proper use of corporate assets and opportunities, confidentiality, fair dealing with the Company’s shareholders, customers, suppliers, competitors and employees, compliance with laws, rules and regulations and reporting of any illegal or unethical behavior.

As part of the Code of Conduct, any person subject to the Code of Conduct is required to avoid situations involving a conflict, or an appearance of a conflict, between their personal, family or business interests, and interests of those of the Company and must promptly disclose any such conflict, or an appearance of a conflict, to the Company. The Board has the ultimate responsibility for stewardship of the Code of Conduct. The Board has designated the Nominating/Corporate Governance Committee to oversee the administration of the Code of Conduct. The Nominating/Corporate Governance Committee reviews and approves all related party transactions that must be disclosed pursuant to applicable securities laws and regulations.

All persons subject to the Code of Conduct are required to provide, upon request, certification of compliance with the Code of Conduct, as well as compliance with all Company policies.

The foregoing description of the Code of Conduct is intended as summary only and does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all of the provisions, of the Code of Conduct, a copy of which is available on our website at www.aralez.com and available on SEDAR at www.sedar.com. We will disclose on our website any future amendments to and/or waivers from the Conduct of Conduct that relate to our directors or executive officers.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act, and the rules issued thereunder, requires our directors and executive officers and beneficial owners of more than 10% of our equity securities to file reports of ownership and changes in beneficial ownership of our equity securities with the SEC. Copies of these reports are furnished to the Company. Based solely on our review of the copies of such reports furnished to us, and representations from the persons subject to Section 16(a) with respect to the Company, we believe that during 2017 all of our executive officers, directors and 10% shareholders complied with the Section 16(a) requirements, except that former director Jason Aryeh filed a late Form 4 on May 24, 2017 with respect to 51,041 shares that he sold on May 19, 2017.

ITEM 11. Executive Compensation

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the disclosures contained in the “Compensation Discussion and Analysis” below. Based on that review and discussion, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in this Annual Report on Form 10-K.

|

|

COMPENSATION COMMITTEE: |

|

|

|

|

|

Kenneth B. Lee, Jr. (Chairperson) |

|

|

Neal F. Fowler |

|

|

Seth A. Rudnick, M.D. |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis explains our compensation program for the fiscal year ended December 31, 2017 (“Fiscal Year 2017”) as it pertains to our named executive officers. Our named executive officers for Fiscal Year 2017 consisted of the following:

· Adrian Adams, Chief Executive Officer (“CEO”);

· Andrew I. Koven, President and Chief Business Officer;

· Scott J. Charles, Chief Financial Officer until November 30, 2017;

· Michael Kaseta, Head of Finance and interim Chief Financial Officer beginning November 30, 2017, promoted to Chief Financial Officer on March 13, 2018;

· James P. Tursi, MD, Chief Medical Officer; and

· Mark A. Glickman, Chief Commercial Officer until March 30, 2018.

For purposes of this Compensation Discussion and Analysis, we refer to these persons as our “named executive officers.”

Executive Summary

2017 Compensation Actions

During 2017, we continued to refine our executive compensation program and to make adjustments to align the interests of our executive compensation program with the interests of our shareholders, including through the following actions:

· Reduction of 2016 Annual Bonuses. In March 2017, our Compensation Committee determined that the pre-determined Company performance metrics set by the Compensation Committee early in 2016 with respect to our 2016 Annual Incentive Bonus Plan had been achieved at the 196.76% level. However, due to our poor share price performance and certain business challenges, our Compensation Committee and our management determined that adjustments were appropriate in order to achieve a greater degree of alignment between executive pay and the interests of our shareholders. As such, our Compensation Committee agreed with management’s proposal that the 2016 annual incentive bonuses for our named executive officers would be paid out at the target level, rather than the much higher level of actual achievement under the pre-determined Company performance metrics for 2016.

· Removal of Eligibility for 2017 Annual Bonus. In addition to the reduction of the 2016 annual bonuses, Mr. Adams and Mr. Koven proposed in March 2017 that they remove themselves from eligibility for a cash bonus under our Annual Incentive Bonus Plan with respect to the 2017 performance period and, as such, received no bonuses for the 2017 performance period.

· Downward Adjustment of 2017 Annual Bonuses. In early 2018, our Compensation Committee reviewed our 2017 performance and determined that, while we achieved the Company performance metrics with respect to our 2017 Annual Incentive Bonus Plan at the 106.54% level, adjustments were appropriate in order to achieve a better alignment between our executives receiving bonuses and the interests of our shareholders. Instead, payments under our 2017 Annual Incentive Bonus Plan were made to those receiving bonuses at the 90% level for the Company performance metrics rather than the higher 106.54% level. This downward adjustment demonstrates our commitment to the alignment between executive pay and the interests of our shareholders. Individual performance metrics were paid out at the level determined with respect to each individual’s performance metrics to the extent they received any bonus.

· Updated Peer Group. Our Compensation Committee reviewed and updated our peer group during 2017 in order to ensure that our selected peers are comparable in market capitalization and revenue with respect to both our current and our projected market capitalization and revenue.

Compensation Best Practices

The executive compensation program developed by our Compensation Committee is designed to promote the short- and long-term objectives of Aralez, and to ensure that our executives are provided compensation based on their performance and achievement against these objectives. Our Compensation Committee also determined that our executive compensation program would include the following practices and policies, which help to align the interests of our executives and our shareholders and reduce any risks involved in our compensation program:

· Share Ownership Guidelines. Robust share ownership guidelines that apply to our CEO.

· Share Retention Policy. A share retention policy that applies to all of our named executive officers.

· Anti-Pledging Policy. Executives and directors are not permitted to pledge shares.

· Anti-Hedging Policy. Executives and directors may not enter into hedging transactions.

· Clawback Policy. Clawback policy that applies to incentive-based compensation awarded to executives if there is a restatement of financials.

· No Repricings. The Aralez 2016 Amended and Restated Long-Term Incentive Plan (the “2016 Plan”) prohibits repricings without shareholder approval.

· No Single Trigger Awards. Equity awards granted under the 2016 Plan will not automatically accelerate upon a Change of Control.

· No Section 280G Gross-Ups. Employment agreements no longer contain a Section 280G excise tax gross-up.

· Objective Performance Goals. Our annual incentive bonus awards are determined based on objective performance goals that align with the objectives of our business plan.

2017 Shareholder Say-on-Pay Vote

Aralez provides shareholders the opportunity to cast an annual, non-binding advisory vote on executive compensation (a “say-on-pay proposal”). At the Aralez annual meeting of shareholders held on May 3, 2017, approximately 60% of the votes cast on the say-on-pay proposal were voted in favor of the proposal.

In the beginning of 2017, our directors and management engaged in extensive dialogue with many of our shareholders regarding our executive compensation program. Our directors and management contacted shareholders representing an estimated 44% of our issued and outstanding Common Shares to discuss their concerns, if any, with our executive compensation program and the efforts that we have made to better align the compensation of our executives to the interests of our shareholders.

We understand that there is still some room to make improvements to our executive compensation program, but we are pleased that our shareholders understand the adjustments that we have made to date and the steps we have taken to align the interests of our named executive officers with those of our shareholders. We plan to continue the open dialogue with our shareholders on these and other issues.

Philosophy and Compensation Process

The following is a description of our compensation philosophy and process for determining executive compensation, which applied to the compensation decisions made during Fiscal Year 2017.

Objectives of Executive Compensation Program

Our compensation philosophy was developed by our Compensation Committee following the completion of the Tribute acquisition, and will continue to be refined to ensure alignment with our business and human capital objectives. Our executive compensation program is designed:

· to promote the achievement of our annual and long-term performance objectives as approved by the Compensation Committee and/or the Board;

· to ensure that our executive officers’ interests are aligned with maximizing shareholder value and the medium to long-term success of the Company; and

· to provide compensation packages that will attract, retain, and motivate superior executive personnel.

Our executive compensation program is designed to reward achievement of annual and long-term corporate goals, as well as individual goals that are supportive of our corporate and strategic objectives. We aim to provide higher levels of pay when executive and organizational performance exceeds performance standards. Likewise, individual and organizational performance that falls short of the pre-approved standards will result in payments and overall compensation that are at the lower end of competitive pay ranges. Our compensation programs are designed not only to reward past performance, but to provide incentives for continued high levels of executive performance, particularly through the multi-year vesting of time-based equity awards and the performance-based equity awards. All compensation decisions are guided by the overarching principle that the highest comparative levels of compensation should be paid to our highest performing executives when the Company is achieving high levels of performance.

Our Compensation Committee uses a mix of salary, variable cash and equity-based incentives in our executive compensation program in order to motivate our executive officers to work to fulfill our corporate goals and to build long-term value for our shareholders. Our Compensation Committee also believes that employees should be owners of the Company, and all of our executive officers are shareholders or hold unvested equity-based incentive awards.

Our Compensation Committee strives to mitigate excessive risk-taking that could harm our value or reward poor judgment by our executives. Several features of our executive compensation program reflect sound risk management practices that balance incentive opportunities with long-term value creation for our shareholders: (i) our annual cash incentives are based on the achievement of performance metrics that promote progress towards long-term Company goals rather than rewarding high-risk investments at the expense of long-term Company value; (ii) our Compensation Committee allocates compensation among base salary and short and long-term compensation target opportunities in such a way as to not encourage excessive risk-taking; and (iii) our Compensation Committee grants a mix of equity award instruments that include performance-based equity awards, full value awards, and appreciation awards, and have multi-year vesting periods, which mitigates risk and properly accounts for the time horizon of risk. Our Compensation Committee has determined that our policies, practices, and programs do not create risks that are likely to have a material adverse impact on the Company.

Role of Compensation Committee, Executive Officers, and Compensation Consultant

Our Compensation Committee is responsible for our executive compensation program. In accordance with its charter, our Compensation Committee’s responsibilities include reviewing and approving our overall compensation philosophy and the adequacy and market effectiveness of our compensation plans and programs; evaluating the performance of, and reviewing and approving total compensation for, its executive officers; and administering its equity-based and other incentive programs.

As required by its charter, our Compensation Committee is composed solely of independent directors under Nasdaq and SEC rules and “outside directors” as determined under Section 162(m) of the Internal Revenue Code, as amended (the “Code”) and the applicable Treasury Regulations.

Our Compensation Committee, when necessary, receives staff support from members of our executive management team, including Mr. Adams, Jennifer Armstrong, our Executive Vice President, Human Resources and Administration, and Eric Trachtenberg, our former General Counsel, Chief Compliance Officer and Corporate Secretary. Our management provides input to

our Compensation Committee regarding corporate goals and performance criteria for our annual incentive awards and long-term performance awards. In evaluating our executive officers other than the CEO, our Compensation Committee relies in part on the input and recommendations of our CEO. In evaluating our CEO’s compensation, our Compensation Committee considers, among other factors, an annual self-assessment submitted by our CEO, as well as a thorough review of corporate performance. Our CEO is not present during our Compensation Committee’s deliberations or determinations of his compensation.

In addition, our Compensation Committee has engaged Radford, an Aon Hewitt Company, and leading compensation consultant, to assist the Compensation Committee in the performance of its duties. During Fiscal Year 2017, Radford has assisted our Compensation Committee with the design and refinement of our executive compensation program, including an assessment of Board compensation and the establishment of our peer group (described below) and has provided data relating to the compensation practices of our peers. Other than services provided to our Compensation Committee, Radford has not performed any services for Aralez or any of its management during 2017.

Peer Group and Benchmarking

In November 2016, our Compensation Committee engaged Radford to perform an analysis of our peer group to determine its appropriateness and whether any peer companies should be added or removed. Our Compensation Committee considered many factors in selecting peer companies, including whether a potential peer has products on the market, whether a potential peer has executive positions of similar scope and responsibility, as well as whether investors might consider such company as a peer when considering investments in the Company. The peers range from 0.5x to 3.0x of our projected market capitalization and from 0.5x to 3.0x of our projected revenue as of November 2016. The peers have market capitalization ranging from approximately $223 million to $1.4 billion, and annual revenue ranging from approximately $60 million to $441 million.

The peer group, detailed below, was used for purposes of compensation benchmarking for 2017:

|

AMAG Pharmaceuticals |

|

Merrimack Pharmaceuticals |

|

|

Amarin |

|

Momenta Pharmaceuticals |

|

|

ANI Pharmaceuticals |

|

Retrophin |

|

|

Anika Therapeutics |

|

SciClone Pharmaceuticals |

|

|

Arena Pharmaceuticals |

|

Spectrum Pharmaceuticals |

|

|

Enanta Pharmaceuticals |

|

Sucampo Pharmaceuticals |

|

|

ImmunoGen |

|

Vanda Pharmaceuticals |

|

In determining our peer group, our Compensation Committee considered the peer group criteria used by institutional investor advisory groups (such as ISS and Glass Lewis) for making comparisons. Because the institutional investor advisory firms select peer companies from broad industry categories and do not focus on companies with products on the market and with similar business models, we have found that there is only limited overlap between the Aralez peer group and those used by the institutional investor advisory firms.

Our Compensation Committee reviews our peer group annually to ensure that it remains appropriate based on our updated financial performance, market capitalization, and other criteria. In October 2017, our Compensation Committee approved a new peer group, for use in 2018, as detailed below:

|

AMAG Pharmaceuticals |

|

Retrophin |

|

Amarin |

|

SciClone Pharmaceuticals |

|

Amphastar Pharmaceuticals |

|

Spectrum Pharmaceuticals |

|

ANI Pharmaceuticals |

|

Sucampo Pharmaceuticals |

|

Depomed |

|

Teligent |

|

Eagle Pharmaceuticals |

|

Vanda Pharmaceuticals |

|

PDL BioPharma |

|

Vericel |

|

Progenics Pharmaceuticals |

|

VIVUS |

The updated peers range from 0.4x to 3.4x of our projected market capitalization and from 0.3x to 4.0x of our projected revenue as of October 2017. The new peers have market capitalization ranging from $100 million to $916 million, and annual revenue ranging from approximately $53 million to $593 million.

Elements of Compensation

Our executive compensation program, as designed by our Compensation Committee, incorporates four primary elements of compensation, described below:

· Base salary: Fixed compensation based on the role of the executive and the base salary for similar positions in our market for talent. Base salary provides compensation regardless of market performance or external factors and helps to retain our management team.

· Annual cash incentives: Variable compensation based on Company performance and individual performance. Annual cash incentives encourage our executives to work towards our corporate goals and provide our executives an opportunity to earn additional compensation for outstanding performance.

· Long-term incentive compensation: Variable compensation based on the value of our Common Shares. We grant both time-based awards and performance-based awards in order to retain our executives and to reward them for performance. Equity-based compensation aligns the interests of our executives with the interests of our shareholders.

· Other benefits: Our executives participate in our benefit plans on the same basis as other employees, and we do not provide material perquisites.

In addition, employment agreements with each of our named executive officers provide for potential payments upon certain terminations of employment and upon a change of control of our company, which are described in the narrative accompanying the Summary Compensation Table and Grants of Plan-Based Awards in 2017 Table and the section of this Annual Report on Form 10-K entitled “Potential Payments on Termination and Change of Control”. Our Compensation Committee believes that each of these compensation elements complements the others and that together they serve to achieve our compensation objectives.

Compensation awarded to our named executive officers is weighted towards performance-based compensation, with an emphasis on long-term equity incentive awards. We believe that putting a substantial proportion of our named executive officers’ compensation “at risk” motivates our executives to achieve our corporate objectives, and delivering compensation in the form of equity creates an ownership culture amongst our executives and ensures that our executives are focused on the interests of our shareholders.

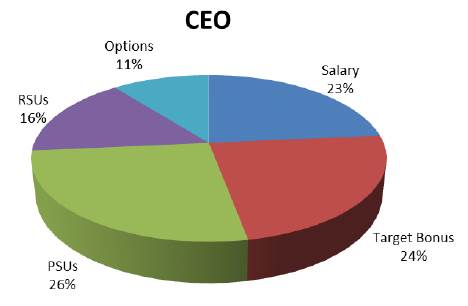

The chart below illustrates the proportion of our CEO’s targeted compensation for 2017 that is allocated to each type of compensation.

The target annual cash incentive bonus and performance share units are earned based on pre-established Company performance goals, meaning that approximately 50% of our CEO’s target compensation is only earned if the performance goals have been satisfied. Equity-based compensation makes up approximately 53% of our CEO’s target compensation, the value of which will increase or decrease with the price of our Common Shares, ensuring an alignment between our executives and our shareholders. Only 23% of our CEO’s target compensation is fixed, and the remaining 77% is variable, based on our performance and/or the price of our Common Shares. In addition, due to his removal of eligibility to receive an annual cash incentive bonus under our 2017 Annual Incentive Bonus

Plan, our CEO was not eligible to receive his target annual compensation for 2017 (which makes up 24% of his targeted compensation), and the value of restricted stock units (“RSUs”) and stock options granted to our CEO during 2017 was reduced by 30% from the targeted level.

Base Salary

The base salary of our CEO and other named executive officers is intended to provide a level of assured cash compensation that is commensurate with their senior professional status and career accomplishments. Accordingly, their base salaries are designed to be competitive with similar positions within the specialty biopharmaceutical industry. Our Compensation Committee relies on peer group analysis, surveys, and the advice of Radford to set base salaries for our named executive officers that are benchmarked to similar roles in the peer group.

Base salary adjustments include a combination of cost-of-living and merit increases, as appropriate, based on the executive’s performance of his or her key responsibilities and duties, and will be generally approved, communicated, and implemented in March of each year to allow for evaluation of the entire year, including our financial performance. Our Compensation Committee considers the CEO’s assessment of and recommendations with respect to each of the other executive officers. In addition, our Compensation Committee considers the market pay practices for the individual jobs.

Our Compensation Committee reviewed the base salaries of our named executive officers in March 2017 and approved a 3% merit-based increase for each of our named executive officers (other than Michael Kaseta). Michael Kaseta received a base salary of $300,000 until November 2017 when he was promoted to interim CFO, at which time his base salary was increased to $350,000. The 2017 base salary for each of our named executive officers is below:

|

Named Executive Officer |

|

2017 Base Salary |

| |

|

Adrian Adams |

|

$ |

721,000 |

|

|

Andrew I. Koven |

|

$ |

463,500 |

|

|

Scott J. Charles |

|

$ |

412,000 |

|

|

James P. Tursi, MD |

|

$ |

412,000 |

|

|

Mark A. Glickman |

|

$ |

397,000 |

|

|

Michael Kaseta |

|

$ |

350,000 |

|

Annual Cash Incentives

We award annual cash incentives to our named executive officers in order to reward them for the achievement of short-term goals relating to the financial performance of the Company as well as their execution of our operating plan and strategic initiatives. Annual cash incentives are paid pursuant to our Annual Incentive Bonus Plan, which is a sub-plan under our 2016 Plan, except that the annual cash incentive awarded to Mr. Kaseta for 2017 was paid pursuant to our bonus plan for non-executives. For 2018 and future years, Mr. Kaseta will be eligible to participate in our Annual Incentive Bonus Plan.

Target annual cash incentives are based on a percentage of each named executive officer’s base salary. The target annual cash incentive level for each named executive officer is specified in his employment agreement. Annual cash incentive targets were set based upon advice from the Compensation Committee’s independent consultants and through negotiations with our executives when they were hired. In 2017, Mr. Charles’ target annual cash incentive was increased from 45% to 50% based on our assessment of the annual cash incentive targets of other Chief Financial Officers in our industry.

|

Named Executive Officer |

|

2017 Annual Cash |

|

|

Adrian Adams |

|

100 |

% |

|

Andrew I. Koven |

|

75 |

% |

|

Scott J. Charles |

|

50 |

% |

|

James P. Tursi, MD |

|

45 |

% |

|

Mark A. Glickman |

|

45 |

% |

Under the Annual Incentive Bonus Plan, the annual cash incentive for our named executive officers is based 70% on the achievement of Company goals and 30% on the achievement of individual performance goals related to the named executive officer’s role with the Company (for the CEO, 75% based on Company goals and 25% based on individual performance goals).

In March 2017, Mr. Adams and Mr. Koven proposed that they remove themselves from eligibility for a cash bonus under the Annual Incentive Bonus Plan with respect to the 2017 performance period in order to align their compensation with the interests of

our shareholders to a very significant degree. As a result, neither Mr. Adams nor Mr. Koven received an annual cash incentive award with respect to 2017.

Company Performance Goals

For Fiscal Year 2017, our Compensation Committee set Company performance goals based on three separate performance metrics, with the weightings set forth below:

|

Company Operating Metric |

|

Weighting |

|

|

Net Revenues |

|

50 |

% |

|

Adjusted EBITDA |

|

25 |

% |

|

Adjusted Net Income |

|

25 |

% |

Adjusted EBITDA and Adjusted Net Income results are adjusted at the end of the performance period to take into account items of significant income or expense which are determined to be appropriate adjustments and to exclude the following one-time/discrete items:

· Items related to a change in accounting principle and tax law;

· Costs to evaluate, execute and integrate acquisitions, and related accounting implications, including acquired in-process research and development;

· Items related to the sale or disposition of a business, segment or product, including discontinued operations;

· Other items including changes in foreign currency exchange rates, asset impairment charges, income tax adjustments and losses on extinguishment or modification of debt;

· Charges related to share-based compensation including charges related to warrants;

· Depreciation and amortization;

· Restructuring costs; and

· Financing costs as well as related interest expense implications.

Performance goals are based on our corporate plan for Fiscal Year 2017, with performance at the budget level resulting in a payout at approximately the target level.

Each performance goal is assigned a threshold, target, stretch, and super-stretch level. Payout (as a percentage of target) for each level of achievement is set forth below:

|

|

|

Payout |

|

|

Below Threshold |

|

0 |

% |

|

Threshold |

|

75 |

% |

|

Target |

|

100 |

% |

|

Stretch |

|

150 |

% |

|

Super-Stretch |

|

250 |

% |

The threshold level of performance must be achieved on the Net Revenue goal and also either Adjusted EBITDA or Adjusted Net Income in order for payment on any performance goal to be paid out above the target level. The Net Revenue target for 2017 was $100.0 million, with a threshold performance target of $70.0 million and maximum payout at the performance target of $150.0 million. The Adjusted EBITDA target was $0.0 million, with a threshold performance target of ($25.0) million and maximum payout at the performance target of $10.0 million. The Adjusted Net Income target was ($35.0) million, with a threshold performance target of ($60.0) million and maximum payout at the performance target of ($10.0) million. Payout percentages are interpolated in a straight-line basis between band points. Our Compensation Committee set performance goals that are aligned with our corporate plan for Fiscal Year 2017 such that the stretch, and super-stretch payout levels would require extraordinary performance.

Individual Performance Goals

For 2017, 30% of each named executive officer’s potential bonus (25% of the CEO’s potential bonus), as set forth above, is based on the achievement of the executive’s individual performance goals for the year. The individual goals are set at the beginning of the year and are based on each executive’s role with the Company and to closely correlate to the Company’s strategic goals for 2017.

Mr. Koven’s individual goals primarily related to his role as President and Chief Business Officer, including management of Aralez Canada, Ireland, and certain business development functions including completion of transition of Zontivity and Toprol-XL® and its authorized generic (the “Toprol-XL Franchise”) to Aralez, and consideration of the sale, out-licensing, or discontinuation of Aralez Canada non-core products.

Dr. Tursi’s individual goals primarily related to his role as Chief Medical Officer, including support of the Zontivity launch and the Yosprala commercialization, submission of Yosprala in Europe, and business development.

Mr. Glickman’s individual goals primarily related to his role as Chief Commercial Officer, including achievement of net revenue targets for Zontivity and Yosprala, managed care initiatives, and executing plans to fully leverage the Toprol-XL Franchise in 2018.

2017 Performance

In the first quarter of 2018, our Compensation Committee reviewed 2017 performance and determined the level of achievement of the performance goals for the annual incentive bonuses and the individual performance of each of our named executive officers other than the CEO. The actual results with respect to 2017 Company performance are set forth below:

|

Company Operating Metric |

|

Actual |

|

Percentage of |

| |

|

Net Revenues |

|

$ |

105.9 |

|

109.83 |

% |

|

Adjusted EBITDA |

|

$ |

(4.5 |

) |

95.49 |

% |

|

Adjusted Net Income |

|

$ |

(32.8 |

) |

111.00 |

% |

|

Total Achievement (as percentage of target): |

|

|

|

106.54 |

% | |

With respect to individual performance, our Compensation Committee accepted Mr. Adams’ proposal that he achieved 25% of his individual objectives and Mr. Koven achieved 89% of his individual objectives, despite the fact that they had removed themselves from eligibility for a 2017 annual bonus. The Compensation Committee further determined that Dr. Tursi achieved 98% of his individual objectives and Mr. Glickman achieved 86% of his individual objectives.

Notwithstanding the higher achievement percentages under the 2017 pre-determined Company performance metrics (i.e., the 106.54% above), the Compensation Committee and our management have determined that the annual incentive bonuses earned under the 2017 formula should be adjusted downward to a flat 105%. However, in order to achieve a greater degree of alignment with our shareholders, our Compensation Committee and management further agreed that the annual cash incentive awards would be paid out only to our executives at the 90% level for the Company performance portion, rather than the approved higher level resulting from the use of the 105% Company performance factor. As a result of this determination, the annual cash incentive awards earned by Dr. Tursi and Mr. Glickman are less than they would have been entitled to receive under the pre-determined formula. In addition, Mr. Adams and Mr. Koven proposed in March 2017 to remove themselves from eligibility for a cash bonus under the Annual Incentive Bonus Plan with respect to the 2017 performance period. The reduction in annual cash incentive awards earned and the foregoing by Mr. Adams and Mr. Koven of their eligibility to receive cash bonuses for 2017 under the Annual Incentive Bonus Plan shows the commitment by the Compensation Committee and management to align our executive compensation program with the interests of our shareholders to a very significant degree. We note that annual incentive bonus is only one component of executive pay. The long-term equity incentive portion of executive pay is already fully aligned with the interests of our shareholders.

The amount each named executive would have been entitled to under the actual 2017 results (including, for Mr. Adams and Mr. Koven, if they had not removed themselves for eligibility to receive a cash bonus for 2017) and the actual amount paid to each named executive officer is set forth below:

|

Named Executive Officer |

|

2017 Annual Cash |

|

2017 Annual Cash |

| ||

|

Adrian Adams(1) |

|

$ |

612,850 |

|

$ |

0 |

|

|

Andrew I. Koven(1) |

|

$ |

348,320 |

|

$ |

0 |

|

|

Scott J. Charles(2) |

|

$ |

0 |

|

$ |

0 |

|

|

James P. Tursi, MD |

|

$ |

190,777 |

|

$ |

171,032 |

|

|

Mark A. Glickman |

|

$ |

177,400 |

|

$ |

158,508 |

|

(1) Mr. Adams and Mr. Koven removed themselves from eligibility to receive an annual bonus for 2017 and, as such, received no bonuses for 2017.

(2) Mr. Charles did not receive an annual bonus for 2017 due to his separation of employment on November 30, 2017.

Bonus Award for Mr. Kaseta

Mr. Kaseta was awarded an annual bonus for 2017 performance under the non-executive annual bonus plan in which he was eligible for a target bonus of 30% of his base salary, which was increased to 35% of his base salary for the portion of 2017 that he held the position of interim CFO, for a total target bonus of $92,708. Mr. Kaseta’s annual bonus was weighted 55% upon the achievement of corporate metrics and 45% upon his individual objectives.

The corporate metrics were identical to the corporate metrics discussed above for the other named executive officers. Mr. Kaseta’s individual goals primarily related to his position as the Company’s Corporate Controller, including financial process improvement, completion of integration of the Toprol-XL Franchise and Zontivity acquisitions, and support of the CFO in business development activities.

Mr. Kaseta received a 2017 annual bonus in the amount of $99,430 which represents achievement of 105% of the corporate metrics and 110% of his individual objectives.

Long-Term Incentive Compensation

Long-term equity-based incentive compensation is a key element of the Aralez executive compensation program. Equity-based incentive compensation ties a significant portion of compensation to Company performance by linking a significant portion of the executive’s total pay opportunity to the price of our Common Shares. The long-term equity-based compensation package granted to our executives is composed of time-based stock options and RSUs, and performance-based restricted stock units (“PSUs”), in the proportions set forth below:

|

Stock |

|

RSUs |

|

PSUs |

|

|

20 |

% |

30 |

% |

50 |

% |

Our Compensation Committee grants these types of awards together in order to balance the goals of retention and pay-for-performance.

|

Stock Options: |

|

Stock options vest over four years, with 25% vesting on the first anniversary of the date of grant and the remaining 75% vesting in equal installments on a monthly basis over the remaining three years, and have an exercise price equal to the fair market value of our Common Shares on the date of grant. Accordingly, the actual value an executive will realize is tied to future stock appreciation and is therefore aligned with corporate performance and shareholder returns. Stock options granted prior to May 2017 vest in equal installments on a monthly basis over four years. |

|

|

|

|

|

Restricted Stock Units: |

|

RSUs vest in equal annual installments over a three year vesting period. RSUs ensure that each of our executives is a true owner of the Company and help to retain our executives over the vesting period. |

|

Performance-Based Restricted Stock Units: |

|

PSUs vest at the end of a three-year performance period based on the achievement of pre-determined performance goals. Our Compensation Committee granted PSUs to our named executive officers in Fiscal Year 2016 with a three-year relative total shareholder return as the performance goal (measured against companies in the Nasdaq biotechnology index with annual revenue between $50 million and $500 million). Target performance (TSR in the 50th percentile) will pay out the target number of PSUs, while threshold performance (TSR in the 25th percentile) will pay out 50% of the PSUs, performance above target (TSR in the 75th percentile) will pay out 150%, and stretch performance (TSR in the 90th percentile) will pay out 200%. PSUs motivate our executives by providing them an opportunity to increase their compensation for extraordinary performance and align the interests of our executives with the interests of our shareholders. |

Our named executive officers (other than Mr. Kaseta) were granted PSUs on March 15, 2017 and stock options and RSUs on May 11, 2017, with the values set forth in the table below (at the target level). It is important to note that, although the value of the stock options and RSUs to be granted to these executives was established by the Committee on March 8, 2017, a decline in the Company’s stock price between March 8, 2017 and May 11, 2017 would have significantly increased the number of stock options and RSUs to which the executives would have been entitled had the awards been made as approved. In order to better align the compensation of these named executive officers with the interests of shareholders, the executives and the Committee agreed to reduce the number of stock options and RSUs to which the executives were entitled by 30%. Accordingly, the grant date fair value of the stock option and RSU awards actually made to the Company’s named executive officers as set forth in the table below are 30% less than those to which they were contractually entitled under their employment agreements and 30% less than the value originally approved by the Committee.

|

Named Executive Officer |

|

Stock Options(1) |

|

RSUs(1) |

|

PSUs(1) |

| |||

|

Adrian Adams |

|

$ |

228,005 |

|

$ |

340,673 |

|

$ |

811,125 |

|

|

Andrew I. Koven |

|

$ |

114,002 |

|

$ |

170,336 |

|

$ |

405,562 |

|

|

Scott J. Charles |

|

$ |

86,859 |

|

$ |

129,780 |

|

$ |

309,001 |

|

|

James P. Tursi, MD |

|

$ |

86,859 |

|

$ |

129,780 |

|

$ |

309,001 |

|

|

Mark A. Glickman |

|

$ |

83,697 |

|

$ |

125,054 |

|

$ |

297,750 |

|

(1) Grant date fair value of stock options was determined using a Black-Scholes model. The grant date fair value of RSUs and PSUs was determined using the “face value” of these awards, based on the closing price of our stock on Nasdaq on the date of grant (although, for accounting purposes and in the Summary Compensation Table, the PSUs will be subject to a “Monte Carlo” simulation).

Mr. Kaseta was not an executive officer at the beginning of 2017, and received grants of stock options and RSUs in 2017, but was not eligible to receive grants of PSUs. Mr. Kaseta received grants of stock options on March 15, 2017, May 11, 2017 and, in connection with his appointment as interim CFO, on November 30, 2017. Mr. Kaseta received a grant of RSUs on March 15, 2017. The vesting terms of Mr. Kaseta’s stock options and RSU grants are the same as set forth above with respect to the other named executive officers.

Procedures and Policies for Granting Equity-Based Awards

Our Compensation Committee approves the grant of all equity and equity-based awards to our CEO and other executive officers, as well as to the non-employee members of our Board. PSUs were granted to our named executive officers for Fiscal Year 2017 in March following the end of our year-end blackout period. Stock options and RSUs were granted to our named executive officers for Fiscal Year 2017 in May after our shareholders approved the increase of shares in the 2016 Plan. In all cases, stock options are granted at exercise prices equal to the closing price of our Common Shares as reported on Nasdaq on the date of grant.

New-hire grants for our executive officers are approved by our Compensation Committee prior to employment. As permitted under the 2016 Plan, our Compensation Committee has delegated to the CEO the authority to grant stock options and RSUs to new non-executive officer employees upon commencement of employment in accordance with a specified schedule of numbers of stock options or RSUs per grant, based on hiring position. However, at this time all stock options and RSUs granted to new non-executive officer employees are brought to and approved by the Compensation Committee.

Other Benefits

Benefits offered to our named executive officers serve as a safety net of protection against financial catastrophes that can result from illness, disability or death. Benefits offered to our named executive officers are substantially the same as those offered to all of our regular full-time employees. We maintain a 401(k) plan for our employees, including our named executive officers, to encourage our employees to save some portion of their cash compensation for their eventual retirement. Effective January 1, 2017, we match 50% of the first 6% of an employee’s eligible earnings in the 401(k) plan, with the 401(k) match capped at $12,000. We generally do not provide substantial perquisites to our executives. In addition, we offer Canadian tax preparation services for our named executive officers who are primarily located in the United States but are required to file tax returns in Canada. We also reimburse our named executive officers for the Canadian Pension Payment that they are required under Canadian law to pay, despite being ineligible to receive Canadian pension benefits, and we provide a tax equalization payment to reimburse these named executive officers for Canadian, U.S. and state taxes that apply to such payment.

Post-Employment Benefits

Providing reasonable severance benefits to our named executive officers in the context of termination by us without cause or by the executive for good reason (as defined in their employment agreements), either in connection with a change of control or otherwise, is an important part of maintaining a competitive executive compensation program and contributes to our ability to attract and retain high quality executives. In part, this reflects a recognition that it may be difficult for a senior executive to find a comparable position in a relatively short period of time following termination of employment. Providing reasonable protections to our named executive officers in the event of a change of control is helpful in aligning our executives’ interests with those of our shareholders in the event a potential change of control situation should occur.

Pozen entered into employment agreements with our named executive officers (other than Mr. Kaseta) when they were initially hired by Pozen. We entered into an employment agreement with Mr. Kaseta in March 2018, when he was appointed CFO. These agreements require that we provide severance and related benefits in the event of a termination of employment or a change of control. Our Compensation Committee received advice from its legal and compensation consultants as to practices and levels of such benefits among comparable companies. These provisions and benefits, as well as an estimate of the dollar value of these benefits that would be payable to our executive officers under specified assumed conditions are described in the section of this Annual Report on Form 10-K entitled “Potential Payments on Termination and Change of Control.”

We do not offer post-employment health or life insurance to our named executive officers other than the continuation of medical (and life insurance for Mr. Adams and Mr. Koven) benefits for a period following certain terminations (subject to payment of active employee rates) pursuant to their employment agreements.

Share Ownership Guidelines

Employee ownership is a core component of our operating culture, and we believe that share ownership encourages our executives to create value for our shareholders over the long term, and promotes retention and affiliation with the Company by allowing our employees to share in our long-term success while aligning employee and executive interests with those of our shareholders. To reflect this commitment to employee ownership, we have adopted share ownership guidelines, which require the CEO to hold shares with a value equal to six times base salary, as well as a share retention policy for all named executive officers, which requires such officers to retain at least 50% of the total equity credited from grants of equity awards (net of amounts required to pay taxes and exercise prices) while such individual remains a named executive officer. As of December 31, 2017, Mr. Adams owned vested Common Shares with a value greater than seven times his 2017 base salary. We expect that the newly hired members of our management team will comply with the share retention policy as their equity awards vest.

Anti-Hedging/Anti-Pledging Policy

Certain short-term or speculative transactions in our securities by directors or executive officers create the potential for heightened legal risk and/or appearance of improper or inappropriate conduct involving our securities. As a result, we do not allow any director or executive officer to hedge the economic risk of his or her ownership of Common Shares, which includes entering into any derivative transaction on Aralez securities (e.g., any short-sale, forward, option, collar). Further, we do not allow any director or executive officer to pledge Aralez securities at any time, which includes having Aralez securities in a margin account or using Aralez securities as collateral for a loan.

Clawback of Incentive Compensation

Our Board adopted an incentive-based compensation recovery policy that applies to all executives, including the named executive officers. The policy relates to the recoupment of incentive compensation awarded to these executives if there is a restatement of published financials.

CEO Pay Ratio