Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMERISERV FINANCIAL INC /PA/ | tv492596_8k.htm |

Exhibit 99.1

2 2018 Annual Shareholders' Meeting

Kerri Mueller Senior Vice President – Retail Banking 3

4 This meeting is being transmitted in its entirety beyond this room via webcast to all interested shareholders and prospective investors.

Craig G. Ford Chairman AmeriServ Financial, Inc. 5

Welcome to our Annual Shareholder Meeting. We appreciate your ongoing loyalty and support. Welcome! 6

Agenda • Proxy Items • Comments by Chairman of the Board • Chief Financial Officer Presentation • President & CEO Comments • Final Report on Proxy Items • Question & Answer Period 7

Election of Class II Directors J. Michael Adams, Jr. Margaret A. O’Malley Mark E. Pasquerilla 8

Honored Guests • Elected Officials • Labor Officials • Distinguished Guests 9 • Past Directors • Present Directors • AmeriServ Employees • Our Shareholders

11 A Community Financial Institution A Different Kind of Community Bank AmeriServ Financial, Inc.

12 How is AmeriServ different?

• Provider of loans to small - and - medium - sized businesses • Five consecutive years lending 90% of deposits to regional businesses and consumers • 10% more than other financial institutions of similar size 13

• Provides high - tech business services • Business owners have flexibility to create business opportunities rather than be tied to their office 14

• AmeriServ Financial Banking Center – One - stop shop for banking – N ew center staffed by trained professionals able to handle routine banking transactions, along with all types of lending, home mortgages, wealth management and financial problem solving 15

• AmeriServ allows the customer to define convenience • If a Financial Banking Center is not their idea of convenience, they may use mobile tools to access their financial institution – day or night 16

AmeriServ Lender of Choice • Designated mortgage lender of choice for Pennsylvania State Education Association (PSEA) • AmeriServ is placing families in homes both locally and across the state • AmeriServ is Banking for Life 17

AmeriServ Trust & Wealth Management • W holly - owned subsidiary of AmeriServ Financial, Inc. • Grown from $294 million in 1994 to $2.1 billion today • Operates six business lines • Prominent in retirement services and financial planning • Manages wealth and provides investment counseling • Diversified services works with special needs situations such as funeral planning • Financial services makes alternative instruments available such as annuities 18

Trust Specialty Real Estate • Builds and rehabilitates properties using union labor • Provides profits for union pension plan sponsors • Over $100 million in projects in progress 19

A New Message • Redefined processes to meet convenience of our customers • A leading lender, a leader in business services, investment counseling and advice, and a leader in leveraging the returns of pension funds for hardworking Americans 21

22 Building an enterprise of value, headquartered in Johnstown, Pennsylvania, and operating significantly and visibly throughout the region. AmeriServ is -

23 The heart and soul of Banking for Life. AmeriServ is -

Michael D. Lynch Senior Vice President Chief Financial Officer Chief Investment Officer Chief Risk Officer 24

Annual Financial Results Through 2017 25

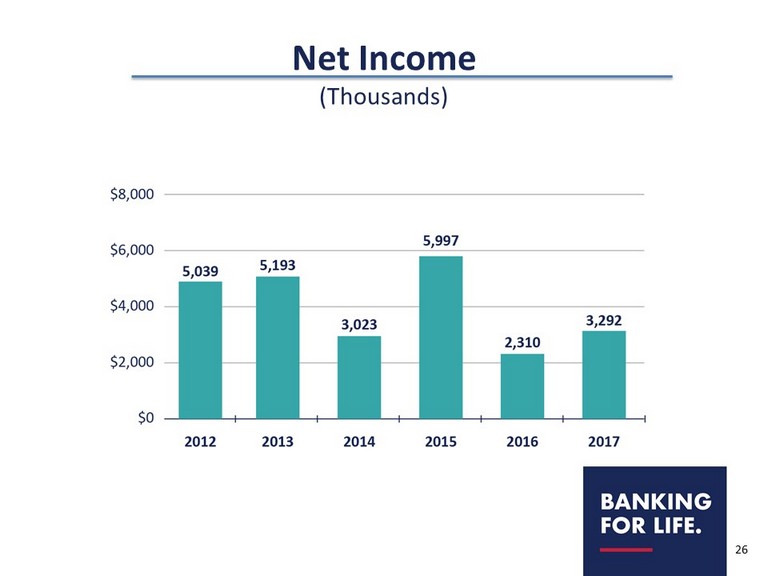

Net Income (Thousands) 26

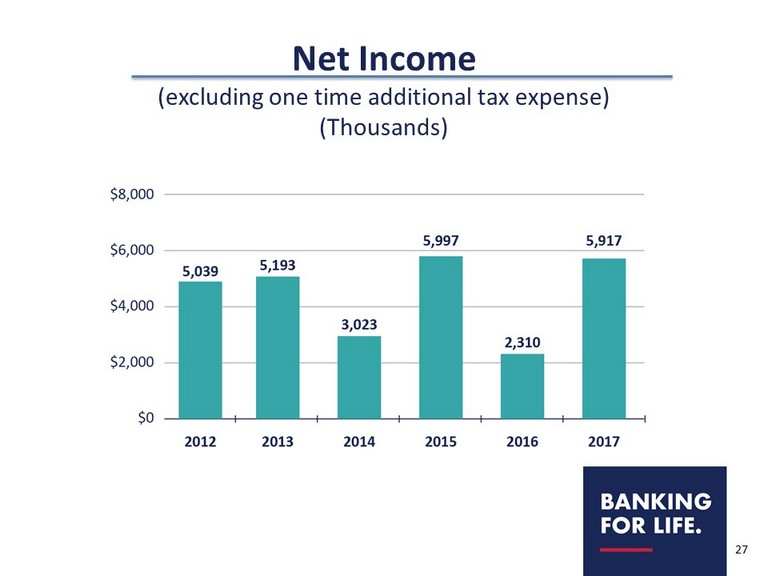

Net Income (excluding one time additional tax expense) (Thousands) 27

Net Interest Income (Thousands) 28

Net Interest Margin 29

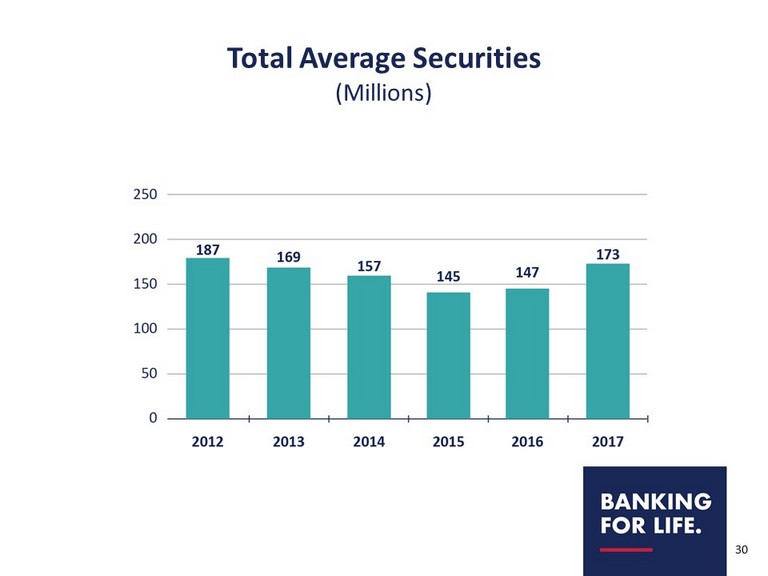

Total Average Securities (Millions) 30

Total Average Loans (Millions) 31

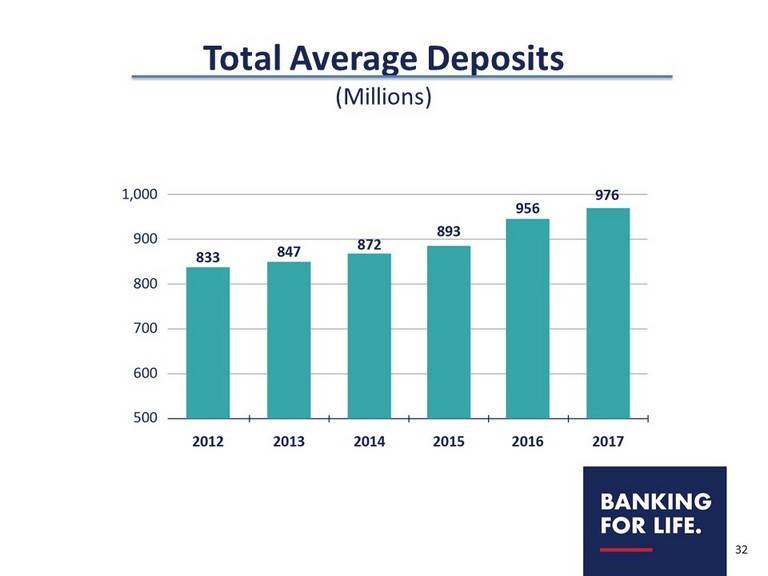

Total Average Deposits (Millions) 32

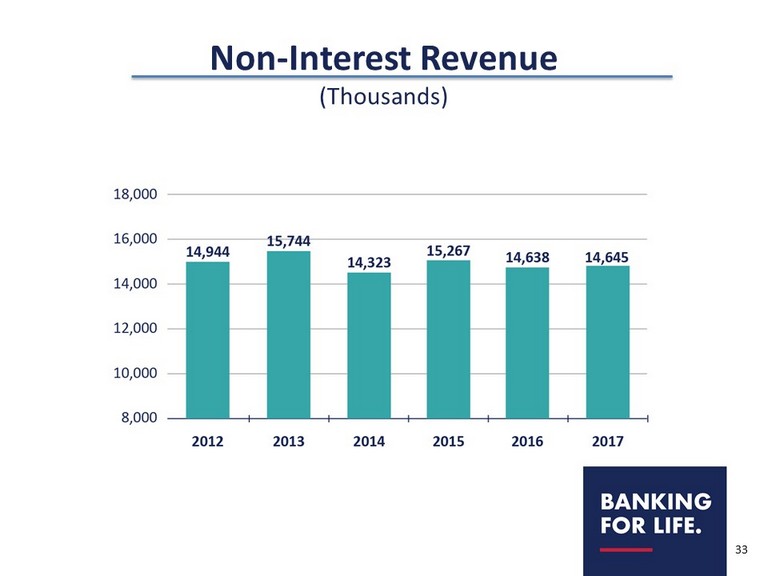

Non - Interest Revenue (Thousands) 33

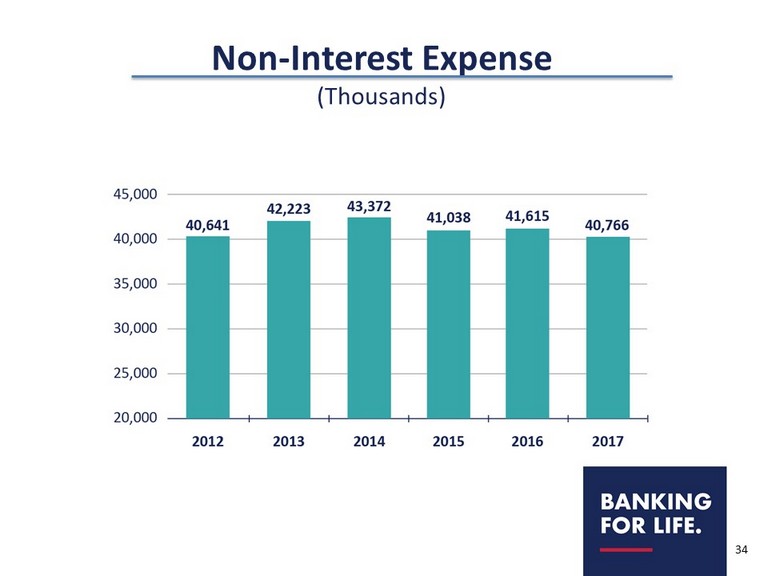

Non - Interest Expense (Thousands) 34

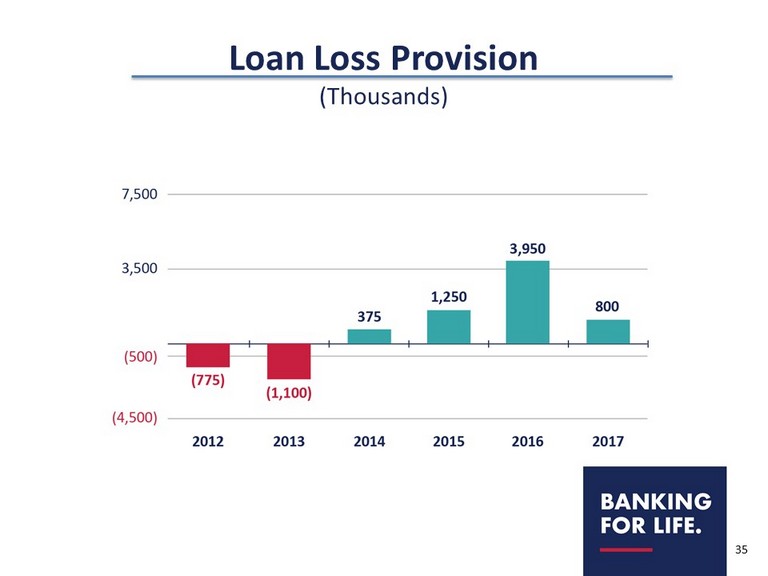

Loan Loss Provision (Thousands) 35

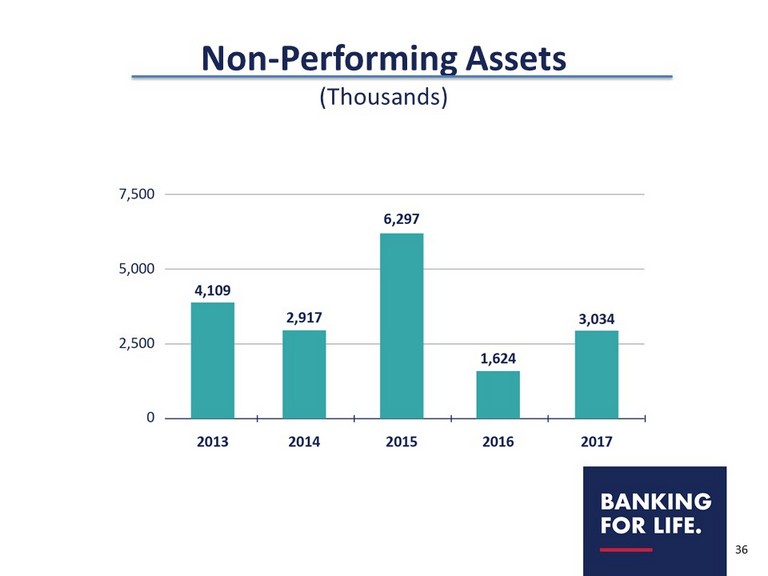

Non - Performing Assets (Thousands) 36

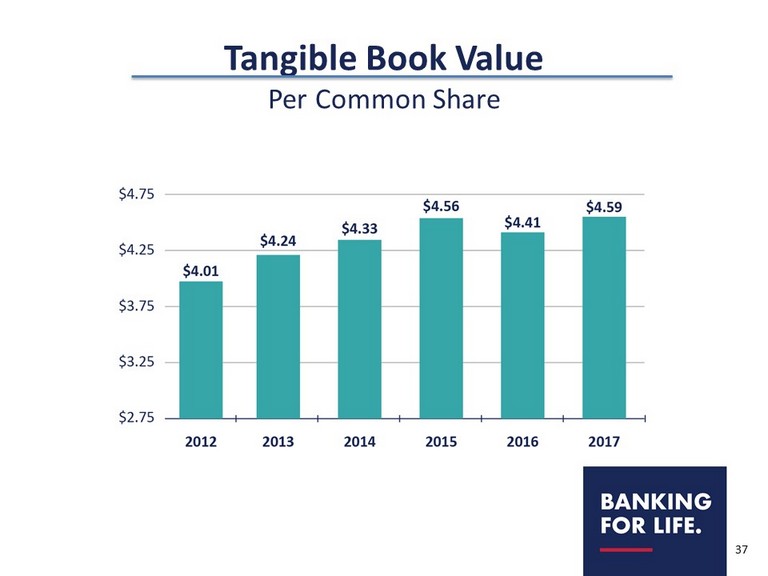

Tangible Book Value Per Common Share 37

Earnings Per Share 38

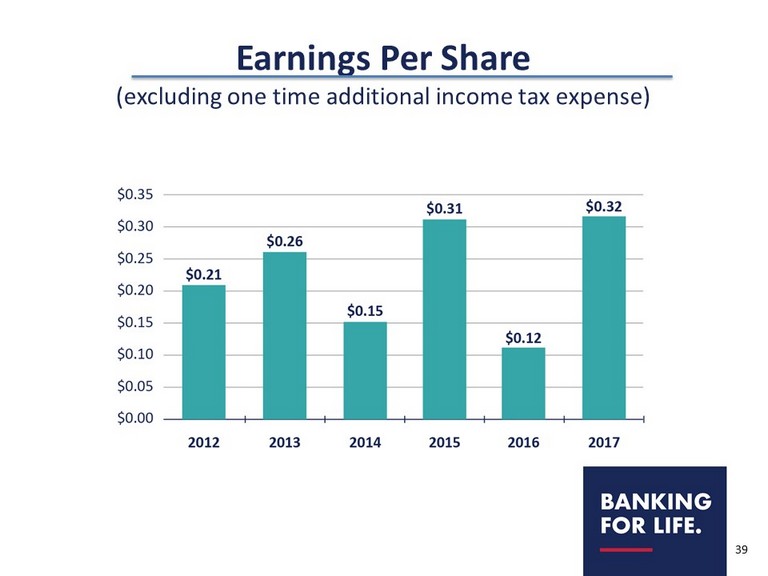

Earnings Per Share (excluding one time additional income tax expense) 39

Financial Results Through 1 st Quarter 2018 40

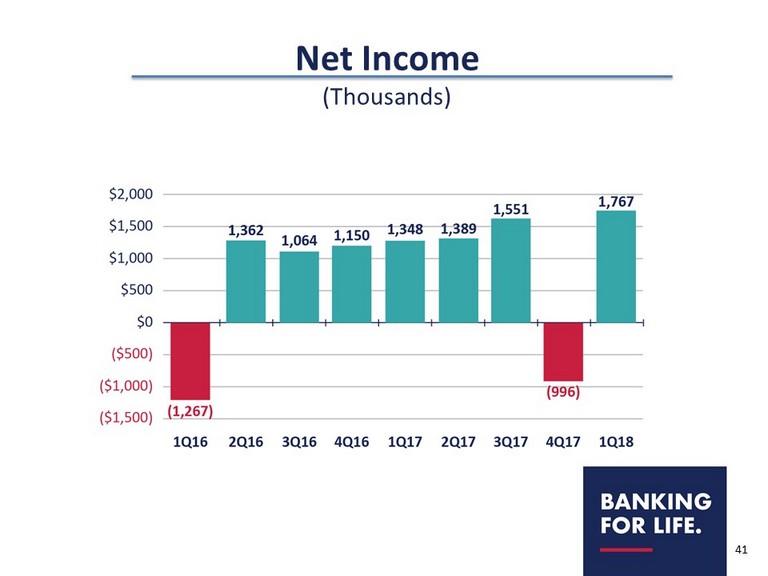

Net Income (Thousands) 41

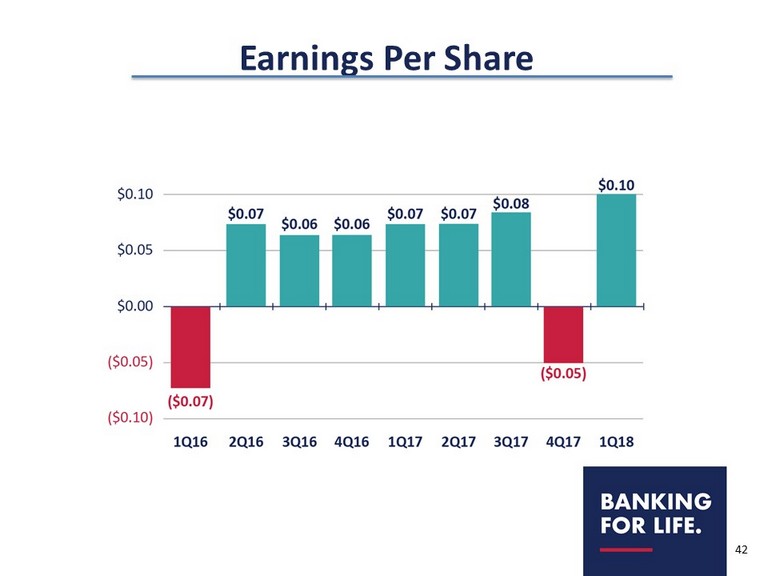

Earnings Per Share 42

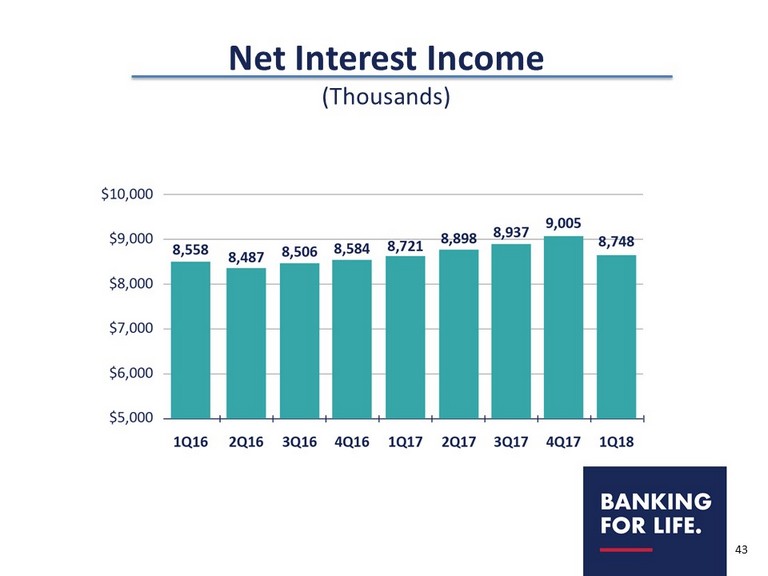

Net Interest Income (Thousands) 43

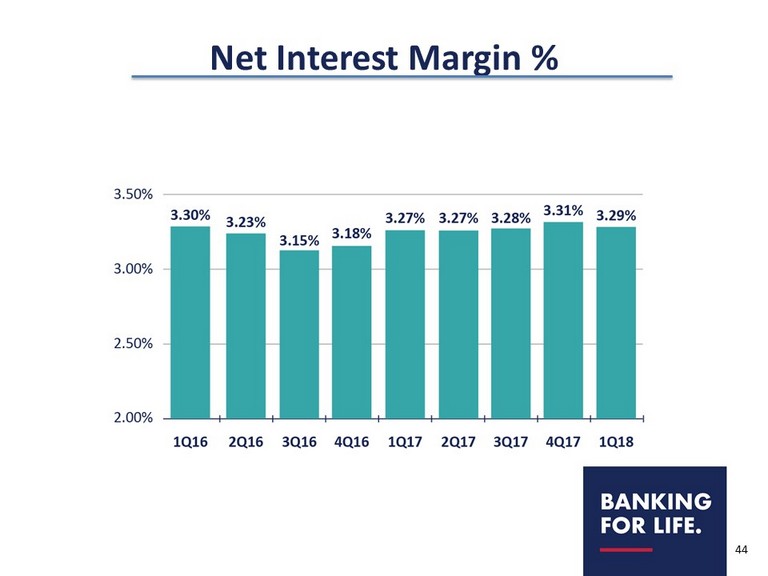

Net Interest Margin % 44

Average Loans (Millions) 45

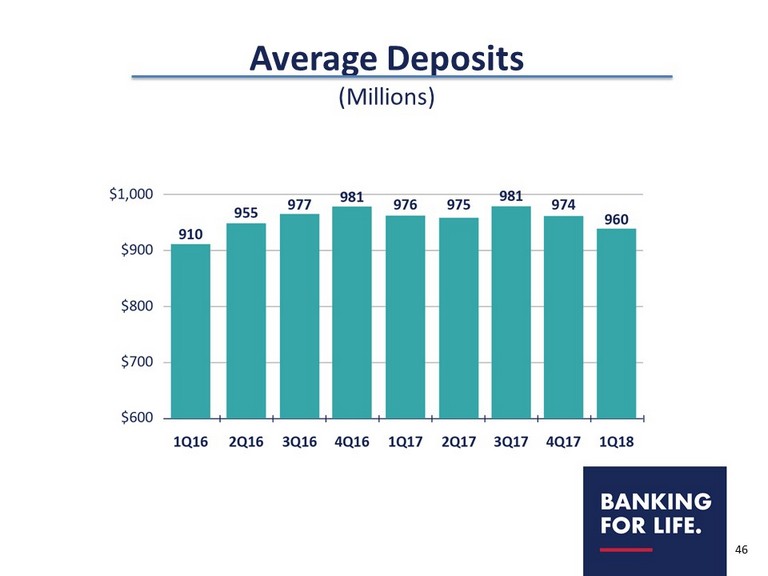

Average Deposits (Millions) 46

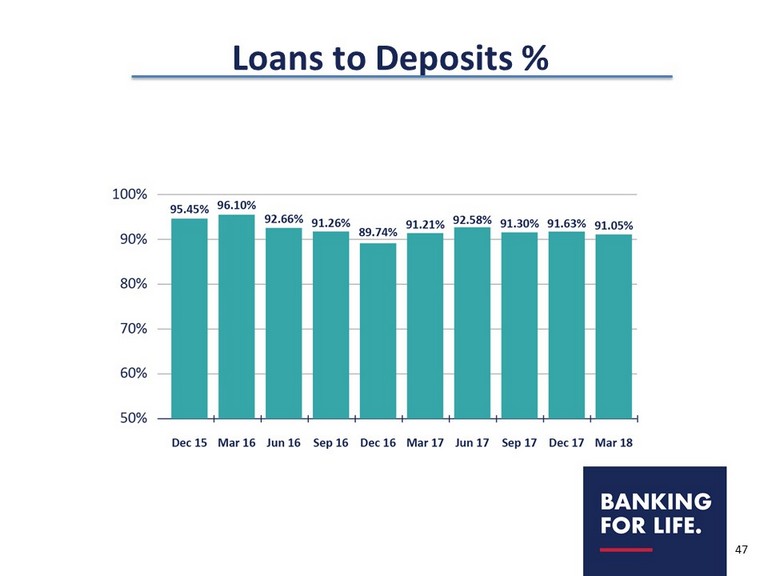

Loans to Deposits % 47

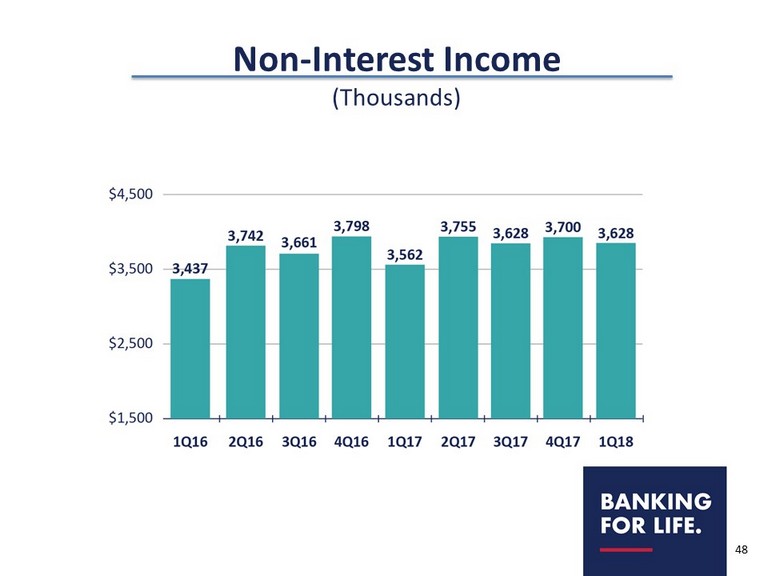

Non - Interest Income (Thousands) 48

Non - Interest Expense (Thousands) 49

Loan Loss Provision (Thousands) 50

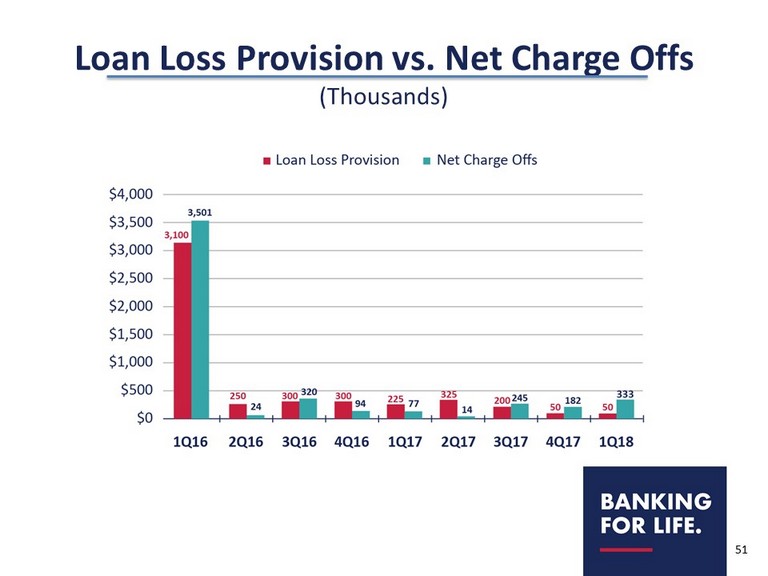

Loan Loss Provision vs. Net Charge Offs (Thousands) 51

Allowance for Loan Loss vs. Non - Performing Assets (Thousands) 52

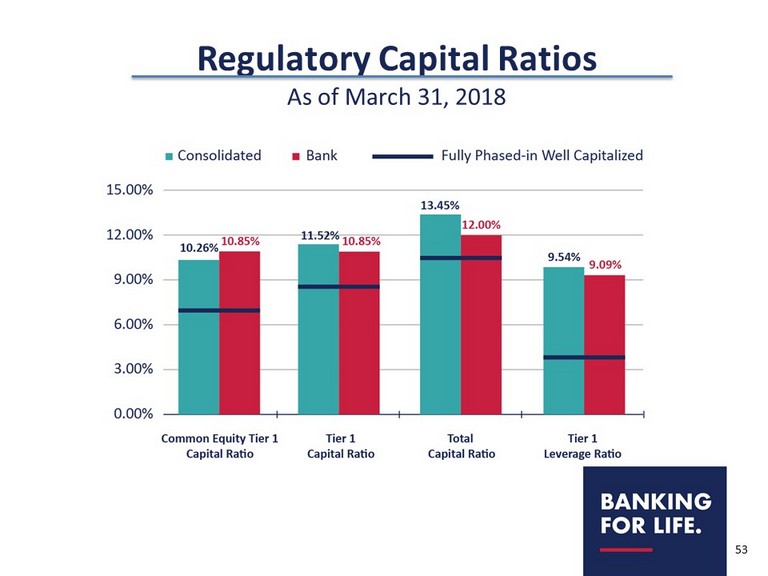

Regulatory Capital Ratios As of March 31, 2018 53

2018 First Quarter Summary 54 • In 2017 our goal was to re - establish the financial performance level that we reported to you in 2015. We met this goal and established positive performance momentum that carried forward into the first quarter of 2018 . • We did indeed recognize improved earnings in the first quarter of 2018 that resulted from lower income tax expense, a reduction in non - interest expense and a controlled loan loss provision due to outstanding asset quality.

Jeffrey A. Stopko President & Chief Executive Officer AmeriServ Financial, Inc. 55

AmeriServ Financial, Inc. Strategic Plan 2017 - 2019 • Built around Banking for Life philosophy • Focuses on four key constituencies – Shareholders – Customers – Staff – Communities 56

AmeriServ Strategic Plan 57 Create long - term value for our shareholders by: – Maintaining financially strong balance sheet – Appropriately managing risk – Consistently improving shareholder returns

AmeriServ Strategic Plan Shareholder value creation focuses on: – Increasing Earnings Per Share (EPS) – Providing Strong Capital Returns to Shareholders 58

AmeriServ Strategic Plan 59 Increasing Earnings Per Share (EPS) – Striving to grow EPS by at least 10% annually – Improve profitability metrics – Narrow financial performance gap – Careful balance sheet and income statement management

AmeriServ Financial 2017 60 Key Strategic Financial Accomplishments – Achieved 10% EPS annual growth goal with reported EPS increasing 50% and adjusted EPS excluding tax charge increasing 167% – Achieved positive operating leverage as total revenue grew while total non - interest expense declined – Maintained strong asset quality resulting in reduced loan loss provision and lower net charge - offs – Strengthened regulatory capital ratios

AmeriServ Strategic Plan Strong Capital Returns to Shareholders – Strategic plan goal – Return 75% of earnings to shareholders through a combination of dividends and share repurchases – Subject to maintaining sufficient capital to support balance sheet growth 61

2017 Capital Returns 62 2017 Net Income (excluding tax charge) $5,917,000 Common Stock Repurchase Program $3,405,000 Common Stock Dividend Payments $1,113,000 Total Capital Returned to Shareholders $4,518,000 % of Earnings Returned to Shareholders 76.4%

AmeriServ Financial 2017 63 Key Strategic Customer Accomplishments – Introduced AmeriServ Financial Banking Center concept at University Heights and North Atherton Locations – Provides customers with a comprehensive offering of financial solutions including retail and business banking, home mortgages and wealth management at one location – Completed in a cost effective manner as two existing branches were closed and customer accounts were consolidated into these newly renovated banking centers

AmeriServ Financial 2017 64 Key Strategic Technology Accomplishments – C ost effectively leverage technology with core systems vendor contract extension – New contract enables us to install several platform enhancements including: Consumer eBanking (with mobile), Business eBanking (with new mobile feature), Hosted ACH Tracker , Online Account Opening, New Account Desk and more tailored deposit service charging capabilities

AmeriServ Financial 2017 65 Key Strategic Technology Accomplishments – T echnology platform conversions are ongoing and will continue over next two years – Cost effective contract extension will save Company approximately $600,000 in vendor - related costs over contract term – Developed and launched new AmeriServ Website and Digital S trategy

AmeriServ Financial 2017 66 Key Strategic Employee Accomplishments – N ew 4 - year labor contract with United Steelworkers of America – Key financial terms – • A nnual wage increases of 3 % • T ransition of union employees to new exclusive health care provider plan insures better control of future health care costs

AmeriServ Financial 2017 67 Key Strategic Wealth Management Accomplishments – Developed new strategic plan – Focuses on revenue expansion of business lines – Continue to invest in talent within wealth management business – Important strategically for AmeriServ Financial since non - interest income represents almost 30% of total revenue

AmeriServ Financial 2018 68 Outlook 2018 – Key Strategic Initiatives – Continue to execute strategic plan and further improve earnings – Bring as much income tax savings from corporate tax reform to bottom line so we can accrete capital faster and further close financial performance gap to peer – Maintain strong asset quality and sound credit underwriting while further strengthening risk management practices related to commercial real estate concentrations

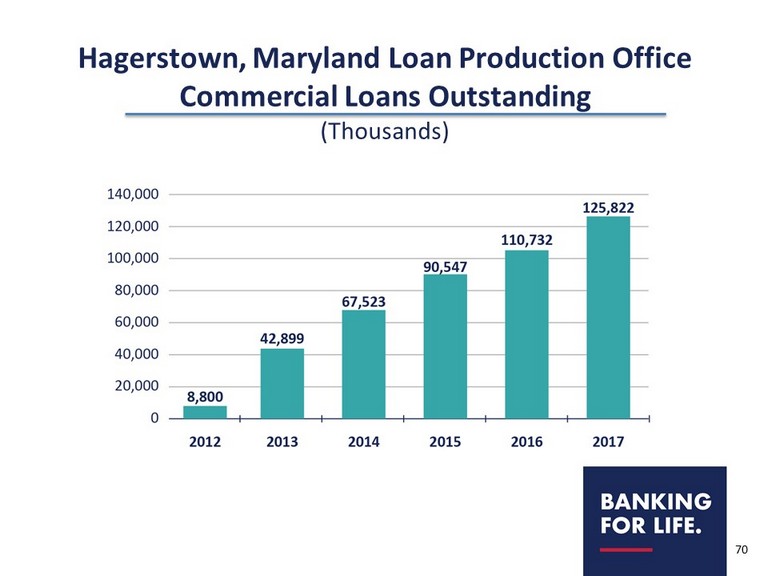

AmeriServ Financial 2018 69 Outlook 2018 – Key Strategic Initiatives – Further grow Maryland presence by consolidating successful Hagerstown Loan Production Office into new full - service AmeriServ Financial Banking Center in Hagerstown, Maryland.

Hagerstown, Maryland Loan Production Office Commercial Loans Outstanding (Thousands) 70

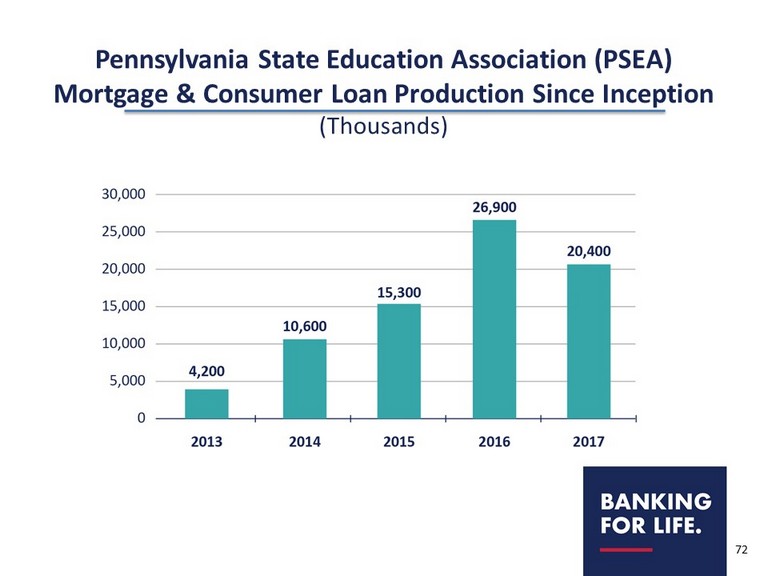

AmeriServ Financial 2018 71 Outlook 2018 – Key Strategic Initiatives – Further leverage union - related revenue streams through expansion of affinity group mortgage and consumer loan programs

Pennsylvania State Education Association (PSEA) Mortgage & Consumer Loan Production Since Inception (Thousands) 72

AmeriServ Financial 2018 73 Outlook 2018 – Key Strategic Initiatives – Increase deposits by taking advantage of larger competitor branch dislocations in rural markets – Good opportunity with closure of $26 million competitor branch in New Florence, PA which is near ASRV Seward, PA office

AmeriServ Financial 2018 74 Outlook 2018 – Key Strategic Initiatives – Increase common stock price through improved earnings and active capital returns to shareholders while ensuring we maintain sufficient capital to support balance sheet growth

AmeriServ Strategic Plan 75 Outlook 2018 – Strong Capital Returns to Shareholders – April 2018: Increased quarterly common stock cash dividend by ½ cent or 33% to $0.02 per share – 1 st Quarter 2018: Completed most recently authorized common stock buyback program by repurchasing 106,000 shares at a cost of $445,000

AmeriServ Strategic Plan 76 Outlook 2018 – Strong Capital Returns to Shareholders – Completed buyback program in 14 months; repurchased 945,000 shares at a total cost of $3.8 million or average price of $4.07 per share – A ccretive use of capital given all shares were repurchased at a price below tangible book value per share which currently rests at $4.65 – Buyback program beneficial to EPS; able to spread increased earnings over a smaller number of shares

AmeriServ Strategic Plan 77 Outlook 2018 – Strong Capital Returns to Shareholders – P erformance in 2017 and to date in 2018 demonstrates commitment to providing strong capital returns to shareholders – With the completion of the buyback program and announced increase in the cash dividend, ASRV Board of Directors will evaluate what capital return strategy makes most sense as we remain committed to our strategic plan goal of annually returning up to 75% of earnings to shareholders

AmeriServ Strategic Plan 78 Outlook 2018 – Strong Capital Returns to Shareholders – Current stock price $ 4.10; representing $0.15 or 4% increase from the 2017 Annual Meeting – Stock continues to trade at attractive multiples 10.3 times annualized 1Q earnings and 88% of tangible book value

James Huerth President AmeriServ Trust & Financial Services Company 79

Mike Baylor Executive Vice President Chief Commercial Banking Officer 80

Report On Election 81

Question & Answer Period 82