Attached files

| file | filename |

|---|---|

| EX-31.(D) - EX-31(D) - WESTAR ENERGY INC /KS | d573439dex31d.htm |

| EX-31.(C) - EX-31(C) - WESTAR ENERGY INC /KS | d573439dex31c.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-3523

WESTAR ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Kansas | 48-0290150 | |

|

|

| |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

| 818 South Kansas Avenue, Topeka, Kansas 66612 | (785) 575-6300 | |

|

|

| |

| (Address, including Zip code and telephone number, including area code, of registrant’s principal executive offices) | ||

| Securities registered pursuant to section 12(b) of the Act:

Common Stock, par value $5.00 per share |

New York Stock Exchange | |

|

|

| |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Act). Yes ☒ No ☐

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Act). Check one:

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

If emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting common equity held by non-affiliates of the registrant was approximately $7,533,791,379 at June 30, 2017

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock, par value $5.00 per share | 142,233,103 shares | |

|

|

| |

| (Class) | (Outstanding at April 27, 2018) |

DOCUMENTS INCORPORATED BY REFERENCE: None

Table of Contents

EXPLANATORY NOTE

Westar Energy, Inc. (the “Company,” “we,” “our” or “us”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) to amend our Annual Report on Form 10-K for the year ended December 31, 2017, originally filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2018 (the “Original Filing”), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G (3) to Form 10-K. This Amendment No. 1 consists solely of the preceding cover page, this explanatory note, the information required by Part III, Items 10, 11, 12, 13, and 14 of Form 10-K, a signature page and certifications required to be filed as exhibits.

The reference on the cover of the Original Filing to the incorporation by reference of portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted. In addition, in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, including Items 10 through 14 of the Original Filing, is hereby amended and restated in its entirety.

This Amendment No. 1 does not reflect events occurring after the filing of the Original Filing, and, except as described above, does not modify or update any other disclosures.

The section of this Amendment No. 1 entitled “Report of the Compensation Committee” is not deemed to be “soliciting material” or to be “filed” with the SEC under or pursuant to Section 18 of the Exchange Act or subject to Regulation 14A thereunder, and shall not be incorporated by reference or deemed to be incorporated by reference into any filing by the Company under either the Securities Act of 1933, as amended, or the Exchange Act, unless otherwise specifically provided for in such filing.

i

Table of Contents

| EXPLANATORY NOTE |

i | |||

| TABLE OF CONTENTS |

ii | |||

| 1 | ||||

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

1 | |||

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| Companies Included in the Willis Towers Watson 2016 Energy Services Executive Compensation Database |

17 | |||

| 18 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 26 | ||||

| 28 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

39 | |||

| Transactions with Related Persons, Promoters and Certain Control Persons |

40 | |||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 47 |

ii

Table of Contents

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

The names, ages and backgrounds, including the business experience, principal occupations and employment, of all directors of the Company are set forth below. Directors are elected to serve for three-year staggered terms according to the class to which they were elected or until they resign or are removed, or until their successors are elected.

Class I – Term Expiring in 2018

Charles Q. Chandler IV, age 64, has served as our director since December of 1999 and chairman of our board of directors since December of 2002. Mr. Chandler has forty-one years of leadership experience with large, regional financial institutions. Mr. Chandler has been chief executive officer of INTRUST Bank, N.A. since 1996 (as well as president from 1996 to 2013) and president and chief executive officer of INTRUST Financial Corporation since 1990 and 2009, respectively. Mr. Chandler is also chairman of the board of both INTRUST Bank, N.A. and INTRUST Financial Corporation. Both companies are large regional financial institutions headquartered in Wichita, Kansas. Prior to this time period, Mr. Chandler spent thirteen years in other officer positions within those institutions. Mr. Chandler is also a director of Fidelity State Bank and Trust Company in Topeka, Kansas, First Bank of Newton in Newton, Kansas, HCA Wesley Medical Center in Wichita, Kansas, as well as several non-profit organizations. Mr. Chandler also served previously as a director of the First National Bank of Pratt, Kansas and New Horizons Foundation. Mr. Chandler’s qualifications to serve as our chairman of the board include his extensive leadership experience as a chief executive officer, his financial expertise and his knowledge of the business community in Wichita, Kansas, the largest city we serve.

R. A. Edwards III, age 72, has served as our director since October of 2001. Mr. Edwards has forty-three years of leadership experience with locally-based financial institutions. Mr. Edwards is chairman of the board of First National Bank of Hutchinson and was its president and chief executive officer from 1981 to 2010. Mr. Edwards is also a director and president of First Kansas Bancshares of Hutchinson, the parent corporation of First National Bank of Hutchinson. Mr. Edwards served as vice president of First Kansas Bancshares from 1986 to 2011. Both companies are financial institutions located in Hutchinson, Kansas. Mr. Edwards spent six years in executive positions and thirty-eight years as a director, including nine years as chairman of the board, with Douglas County Bank, a financial institution located in Lawrence, Kansas. Mr. Edwards served twenty-three years as a director, including seven years as chairman of the board, with Data Center, Inc., a bank technology company located in Hutchinson, Kansas. Mr. Edwards also serves as a director and member of the audit committee of Kansas Natural Gas, a private company located in Hays, Kansas, a director of Mitchelhill Seed Company, a private company located in Missouri, and a director or trustee of several non-profit organizations and foundations. Mr. Edwards’ qualifications to serve as our director include his substantial leadership experience as a chief executive officer and his financial expertise.

Jerry B. Farley, age 71, has served as our director since October of 2004. Mr. Farley has forty-six years of experience in the administration of the academic, business and fiscal operations of universities. Since 1997, Mr. Farley has been president of Washburn University located in Topeka, Kansas. Prior to that position, Mr. Farley worked in executive positions for the University of Oklahoma and Oklahoma State University. Mr. Farley has also been a Certified Public Accountant since 1972 and, although he has not practiced public accounting, his business responsibilities have included all aspects of financial management and reporting at three large public universities. Mr. Farley is a director and member of the audit and trust committees of CoreFirst Bank and Trust in Topeka, Kansas, and a director and

1

Table of Contents

member of the audit and governance committees of Guggenheim Investors, formerly The Security Group of Mutual Funds, also located in Topeka, Kansas. Mr. Farley also serves as a director for various non-profit and charitable organizations. Mr. Farley’s qualifications to serve as our director include his substantial leadership experience as the president of a public university, his extensive knowledge of the administration, financial and operational management of large organizations and his significant experience serving as a director of institutions in the financial industry.

Class II – Term Expiring in 2019

Richard L. Hawley, age 69, has served as our director since October of 2011. Mr. Hawley has over forty-one years of business experience, including twelve years as a chief financial officer within the electric and gas utility industries and fourteen years as a partner with an international accounting firm. From December of 2003 until December of 2011, Mr. Hawley was executive vice president and chief financial officer of Nicor, Inc. and its regulated natural gas distribution utility subsidiary, Northern Illinois Gas Company, each located in Naperville, Illinois. From 1998 until 2002, Mr. Hawley was vice president and chief financial officer of Puget Energy, Inc. and its regulated electric and natural gas distribution utility subsidiary, Puget Sound Energy, Inc., each located in Bellevue, Washington. Prior to that, Mr. Hawley was an audit partner with Coopers & Lybrand (now PricewaterhouseCoopers), an international accounting firm, from 1984 to 1998 and he also served in various other positions with that firm from 1973 to 1984. His audit experience included a significant emphasis on utility industry clients. From 2003 to 2013, Mr. Hawley was a director, chairman of the audit committee and member of the nominating and corporate governance committee of Fisher Communications, Inc., a media company located in Seattle, Washington. Mr. Hawley’s qualifications to serve as our director include his work experience as a chief financial officer and audit partner, his years of experience within the electric and gas utility industries and his experience as a director of a public company.

B. Anthony Isaac, age 65, has served as our director since December of 2003. Mr. Isaac has forty years of business experience, thirty-five of which were spent in leadership positions within the hotel industry. From 2011 until April of 2015, Mr. Isaac was Senior Vice President and Head of Select Service Strategy and Development of Hyatt Hotels Corporation, a global hotel management, franchising, ownership and development company based in Chicago, Illinois with properties worldwide. From 2000 until 2011, Mr. Isaac was president of LodgeWorks, L.P., a hotel management and development company based in Wichita, Kansas, which was acquired by Hyatt Hotels Corporation in 2011. Prior to 2000, Mr. Isaac held management positions with Wyndham International, Summerfield Hotel Corporation, Residence Inn Company and the Marriott Corporation. Mr. Isaac is currently chairman of the board and chair of the executive committee of Via Christi Health System in Wichita, Kansas. Mr. Isaac was formerly chairman of the board and chairman of the compensation, finance and strategic planning committees of The Via Christi Wichita Regional Health Network, a subsidiary of Via Christi Health System, and a trustee of Wichita Collegiate School, located in Wichita, Kansas. Mr. Isaac’s qualifications to serve as our director include his extensive leadership experience both as the chief executive officer of a privately-held company and as an executive with other large companies in the hotel industry, and his substantial experience with strategic planning and financial matters.

S. Carl Soderstrom, Jr., age 64, has served as our director since July of 2010. Mr. Soderstrom previously served as senior vice president and chief financial officer for ArvinMeritor, an automotive and commercial vehicle components manufacturer based in Troy, Michigan. Mr. Soderstrom brings over twenty-nine years of experience in operations, finance, engineering and product development in the automotive and manufacturing industries to our board of directors. Mr. Soderstrom’s experience includes executive and management positions at Rockwell International, General Electric Company and Emerson Electric. Mr. Soderstrom is a director, chairman of the audit committee and a member of the nominating and corporate governance committee of FreightCar America, Inc., a railcar manufacturing company located in Chicago, Illinois. Mr. Soderstrom is also a director, chairman of the corporate governance committee and member of the audit review committee of Lydall, Inc., a technology and manufacturing

2

Table of Contents

company headquartered in Manchester, Connecticut. Mr. Soderstrom’s qualifications to serve as our director include his substantial financial expertise, his operations and engineering knowledge from his experience at other large public companies and his substantial experience serving as a director of other public companies.

Class III – Term Expiring in 2020

Mollie H. Carter, age 56, has served as our director since June of 2003. Ms. Carter has thirty-one years of business experience, including twenty-two years as a chief executive of a financial institution. Ms. Carter was president and chief executive officer of Sunflower Bank, N.A. from 2005 to 2018 and has been president and chief executive officer of FirstSun Capital Bancorp (formerly Sunflower Financial, Inc. and Sunflower Banks, Inc.) since 1996. These entities have headquarters in Denver, Colorado with substantial operations in Salina, Kansas. Ms. Carter is also chairman of the board of FirstSun Capital Bancorp and Sunflower Bank, N.A. These entities have headquarters in Denver, Colorado, and Salina, Kansas, respectively. Ms. Carter is also president of Star A, Inc., and has held officer positions with Star A, Inc. since 1997. Star A, Inc. is a family owned company with Kansas agricultural and other investment interests. Prior to holding these positions, Ms. Carter served ten years as a senior investment officer for John Hancock Mutual Life Insurance Company. Ms. Carter previously served as a director of Archer-Daniels-Midland Company, an agricultural processor, as a director of Premium Standard Farms, Inc., a large processor of pork products, as a member of the Kansas Governor’s Council of Economic Advisors, and as a director of Foley Equipment Company, a private company. Currently, Ms. Carter serves as a director of the Kansas Health Foundation and as a member of the board of directors and serves on the membership/sponsorship committee of the Heartland Chapter of the National Association of Corporate Directors. Ms. Carter’s qualifications to serve as our director include her substantial leadership experience as a chief executive officer, her financial expertise and her significant experience serving as a director of a large public company.

Sandra A.J. Lawrence, age 60, has served as our director since October of 2004. Ms. Lawrence brings thirty-nine years of varied business experience to her position as our director. Since 2016, Ms. Lawrence has been executive vice president and chief administrative officer of Children’s Mercy Hospital located in Kansas City, Missouri and, prior to that, she was executive vice president and chief financial officer from 2005 to 2016. From December of 2004 until March of 2005, Ms. Lawrence was senior vice president and treasurer, and from March of 2005 until December of 2005, she was senior vice president and chief financial officer, of MRI Global (formerly Midwest Research Institute), an independent, non-profit, contract research organization located in Kansas City, Missouri. Prior to that Ms. Lawrence spent twenty-six years in professional or management positions in the architecture, real estate, financial services, packaging, and medical research industries. Ms. Lawrence serves as a director and member of the audit, compensation, finance and nominating committees of American Shared Hospital Services, a medical device sales and financing organization, vice-chair of the board and chair of the governance/nominating committee of the Heartland Chapter of the National Association of Corporate Directors, a director and chair of the audit committee and member of the investment committee of the Hall Family Foundation, a private charitable organization, and a director, chair of the audit committee and member of the investment committee of the Nelson-Atkins Museum, located in Kansas City, Missouri. Ms. Lawrence is also a former director of Turn the Page KC, a former director and former chair of the Greater Kansas City Community Foundation, a former director and former chair of the Kansas BioScience Authority, an organization dedicated to the advancement of Kansas’ leadership in bioscience, an appointee to the Mayor’s Google Task Force in Kansas City, Missouri, as a director on The Kansas City Market Board of US Bank, and as a director of Children’s Mercy Hospital, J.E. Dunn Construction Group, Inc., and numerous other private, non-profit and civic organizations. Ms. Lawrence’s qualifications to serve as our director include her substantial financial expertise and her extensive service as a director with public and private organizations.

3

Table of Contents

Mark A. Ruelle, age 56, has served as our director and president since May of 2011 and as our chief executive officer since August of 2011. Mr. Ruelle brings thirty-one years of business leadership experience to the board of directors. From 2003 to 2011, Mr. Ruelle was our executive vice president and chief financial officer. In that role, he had responsibility for large construction projects, information technology and human resources in addition to accounting, finance and investor relations. Between 1997 and 2002, Mr. Ruelle served in various executive positions at Sierra Pacific Resources, Inc., the owner of the largest electric utilities in Nevada. While there, Mr. Ruelle served four years as senior vice president and chief financial officer and one year as president of its Nevada Power Company unit. From 1986 to 1997, Mr. Ruelle worked for us in various executive positions. Mr. Ruelle was also a director and member of the audit, compensation and nominating and corporate governance committees of US BioEnergy Corporation from 2006 to 2008. Mr. Ruelle currently serves as a director, chairman of the nominating and governance committee and member of the audit committee of Houston Wire & Cable Company, a distributor of electrical wire and cable products and services based in Houston, Texas. Mr. Ruelle also serves as a director of the Edison Electric Institute, an association of shareholder owned electric companies, as a board member of GO Topeka Economic Partnership, a local civic organization, as a director of Stormont Vail Healthcare, an integrated health care system located in Topeka, Kansas. Mr. Ruelle was formerly an advisory board member for a privately-held sports apparel concern located in Kansas and vice chairman of the Electricity Information Sharing and Analysis Center, a collaboration between the electricity sector and the Department of Energy and the Electricity Sector Coordinating Council. Mr. Ruelle’s qualifications to serve as our director include his leadership experience, his financial expertise and his extensive utility industry experience.

Section 16(a) Beneficial Ownership Reporting Compliance

The SEC’s rules require our directors and executive officers to file reports of their holdings and transactions in our common stock. Based solely on our review of the reports filed under Section 16(a) of the Exchange Act and written representations that no other reports were required, we believe that, during the fiscal year ended December 31, 2017, all required filings applicable to our executive officers, directors and owners of more than ten percent of our common stock were made and that such persons were in compliance with the applicable requirements.

We have adopted a code of ethics that applies to all of our directors, officers and employees, including our chief executive officer, chief financial officer and controller. Our Code of Business Conduct and Ethics is available, without charge, from our Corporate Secretary and made available on our Internet website at www.westarenergy.com. We intend to post on our Internet website any amendments to, or waivers from, our Code of Business Conduct and Ethics that apply to our chief executive officer, chief financial officer or controller within five business days of the date of the amendment or waiver. The information contained on our Internet website is not part of, or incorporated by reference into, this document.

The chairman of the Audit Committee is Mr. Hawley. The other members of the committee are Mr. Edwards, Mr. Farley and Mr. Soderstrom. The board of directors has determined that each of the members of the committee meets the experience and independence requirements of the rules of the New York Stock Exchange (“NYSE”). The board of directors has determined that at least one member of the committee possesses the qualifications of an audit committee financial expert as determined under Regulation S-K Item 407(d) of the Exchange Act and has designated Mr. Hawley as that expert.

4

Table of Contents

| ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

Introduction

This section provides a discussion and analysis of our philosophy and objectives for compensation of our named executive officers, the process we utilize when annually reviewing executive compensation and the elements of our executive compensation program. This discussion is generally applicable to all of our officers. Compensation data for each of our named executive officers appear in the Summary Compensation Table and the other tables appearing later in this Item 11.

Executive Summary

Philosophy. Our executive compensation philosophy is to provide a total compensation opportunity for our officers, as a group, approximating the market median for officers of peer utilities, to reward company and individual officer performance and to strongly align the interests of our officers with those of our shareholders.

Our executive compensation program consists of the following primary elements:

| • | base salary; |

| • | long-term incentive compensation in the form of time-based and performance-based restricted share units with three-year vesting and performance measurement periods; and |

| • | retirement and other benefits made available through our company-wide benefit plans and supplemented by retirement benefit and 401(k) restoration plans that result in officer benefits being calculated on the same basis as benefits for other covered employees. |

Though customary in our industry and among our peers, we do not pay our officers annual cash incentives. Rather, our compensation program focuses our officers on long-term performance.

Features. The Compensation Committee (the “Committee”), which administers our executive compensation program, believes the following features of our executive compensation program are especially important in supporting the program’s philosophy and objectives:

| • | market median compensation is based primarily on data obtained by Willis Towers Watson from its annual survey of energy services companies, with the data adjusted based on revenues; |

| • | the reasonableness of the survey data is corroborated by comparing it to compensation data for a peer group that is also used to determine relative total shareholder return; |

| • | individual officer compensation is set based on individual officer considerations such as performance and experience; |

| • | the program provides for a significantly higher proportion of long-term incentive compensation than market median due to the absence of an annual short-term incentive; |

| • | 50% of long-term incentive compensation is comprised of performance-based restricted share units with performance and vesting tied to our relative total shareholder return measured over a three-year period; |

| • | performance-based restricted share units pay out in a range from zero to 200% of the target level, depending upon whether our total shareholder return is above or below the targeted total shareholder return of a peer group measured over the applicable performance period; |

5

Table of Contents

| • | each officer is required to own shares of our common stock valued at one to five times his or her base salary depending on his or her position; |

| • | officers do not receive perquisites; |

| • | officers do not have employment agreements; |

| • | the change in control agreements with our officers have only “double-trigger” provisions (that is, benefits would be paid under the change in control agreements only if the officer’s employment terminates for qualifying reasons following the change in control) and payments under these agreements are capped if necessary to avoid excise taxes; and |

| • | the Committee relies on an independent compensation consultant engaged by and reporting directly to the Committee. |

Total Shareholder Return Performance. For compensation purposes, we calculated total shareholder return of approximately 48% for the three-year performance period ended in 2017. On a relative basis, this total shareholder return for the three-year performance period placed us at approximately the 57th percentile of the total shareholder return of our peer group. As a result, performance-based restricted share units with performance tied to relative total shareholder return for this period paid out at 117.85% of the target level, as shown in the table below. Please see “Executive Officer Compensation Program Structure—Long-Term Incentive Compensation” for information on this calculation. A detailed description of our financial results is included in Part II of the Original Filing.

| Total Shareholder Return Relative to Peer Group |

Payout of Performance- Based Restricted Share Units | |||

| 2015-2017 Target |

50th percentile | 100% of target | ||

| 2015-2017 Actual |

57.14th percentile | 117.85% of target |

Compensation Actions Taken During 2017. In 2017, the Committee, as part of its annual executive compensation review processes:

| • | approved increases in base salaries for our named executive officers (excluding Mr. Ruelle, our chief executive officer) and other officers to more closely align compensation for our officer team with the market median; and |

| • | approved annual long-term incentive compensation grants for our named executive officers and other officers; |

| • | 50% time-based restricted share units with three-year vesting; and |

| • | 50% performance-based restricted share units with three-year vesting and performance measurement periods, and with performance measured by our total shareholder return relative to a peer group. |

Consideration of Results of the 2017 Shareholder Advisory Vote. In October 2017, we provided our shareholders with an advisory vote on the 2016 named executive officer compensation as disclosed in our 2017 annual meeting proxy statement (a “say-on-pay” vote). Approximately 96% of the votes cast were in favor of the 2016 compensation of our named executive officers. The Committee regarded this result as evidence of strong shareholder support of our executive compensation philosophy and considered the advisory vote as a factor in its decision to continue our current executive compensation program.

6

Table of Contents

Our shareholders also voted on their preferred frequency of the say-on-pay vote at the October 2017 meeting. Approximately 81% of the votes cast were in favor of an annual advisory vote on say-on-pay. Based on the preference indicated by our shareholders in October 2017, our Board of Directors reaffirmed its policy to hold the “say-on-pay” vote each year at the annual meeting of the shareholders.

Executive Compensation Objectives

In furtherance of our philosophy described above, the principal objectives of our executive compensation program are to:

| • | provide a compensation package that is competitive among our peers and will attract and retain a talented executive team; |

| • | recognize and reward strong performers; |

| • | create long-term shareholder value; |

| • | align our officers’ interests with those of our shareholders; |

| • | encourage a stable management team; and |

| • | motivate executives with appropriate incentives. |

Overall, our intent is to provide a total compensation opportunity for our officers as a group that approximates the market median compensation opportunity at peer utilities, while also providing the Committee the flexibility to recognize relative individual performance. Because of its emphasis on stock-based compensation and the creation of long-term shareholder value, the Committee believes this compensation program is especially suited to our mission and business as a regulated electric utility where we believe a long-term perspective should guide most of our decisions and plans.

Executive Compensation Process

Compensation Program Review. To ensure that our compensation policies and practices are consistent with our compensation philosophies and objectives, each year the Committee assesses and analyzes our executive compensation program, including each named executive officer’s compensation. As part of this process, the Committee obtains market information about compensation at other utilities and energy companies and obtains independent analysis and recommendations on competitive market practices from Meridian Compensation Partners, LLC (“Meridian”), an independent compensation consultant engaged by and reporting to the Committee.

When making officer compensation decisions, we determine an aggregate pool of base salaries and target total compensation for the named executive officers and all of our other officers, but excluding the chief executive officer, after referencing the median level of target annual total compensation in the market data for the comparable positions held by our officers. (See below under “Benchmarking” for a more detailed discussion regarding the market data used and related methodology.) The aggregate pool of restricted share units comprising the long-term incentive is calculated based on the aggregate difference between target total compensation and base salary.

For the chief executive officer’s compensation, the Committee develops a range of compensation for the full board of directors to consider in light of the full board’s evaluation of the chief executive officer’s performance. Differences among officers in base salary and target annual total compensation reflect differences in median compensation levels for similar positions at comparably sized utilities, each officer’s experience, the scope of his or her responsibilities and the Committee’s or the chief executive

7

Table of Contents

officer’s subjective evaluation of an officer’s relative contribution, performance and consideration in our succession plans. Base salary and target annual total compensation may also take into account situations where we have assigned an officer to take on a cross-developmental assignment. The aggregate compensation pool is allocated among the officers other than our chief executive officer based primarily on the recommendations of our chief executive officer, but subject to review and approval by the Committee.

We have a history of developing and promoting executives from within the company when possible. As a result, compensation levels for our officers often begin significantly below the market medians for their respective positions. Depending upon their performance, these officers may receive proportionately larger increases to move their salaries and target total compensation close to the market medians.

Benchmarking. To provide competitive total compensation, the Committee considers national market information about base salaries and other compensation from two sources described below. The Committee believes it is appropriate to look at national market data because we compete for executive talent on a national basis.

In 2017, the Committee relied principally on market information provided by Willis Towers Watson derived from Willis Towers Watson’s 2016 Energy Services Executive Compensation Database. We refer to this database as the “Willis Towers Watson Database.” The database is an annual compilation of compensation for executive officer positions at a broad group of energy and utility companies nationwide prepared by Willis Towers Watson. The companies included in the Willis Towers Watson Database are listed at the end of this section. After discussing each of our officer positions with management and Meridian, including the duties and responsibilities associated with each position, Willis Towers Watson obtained data from its database for positions that in its judgment most closely corresponded to the positions held by our officers. Willis Towers Watson then aggregated the data for the identified positions and adjusted it using recognized statistical methods to account for the different total revenues of the companies in its database as compared to our revenues. Meridian reviewed this market data to ensure that Willis Towers Watson’s methodology was consistent with our executive compensation philosophy. The reports provided to the Committee showed market information for base salary and target annual total compensation for each benchmark position at the market median.

As an additional point of reference, the Committee also reviewed data derived by Meridian from the 2016 proxy statements for companies in the same peer group used to measure total shareholder return for performance-based restricted share units. The proxy data was used to compare the compensation levels of our named executive officers against the compensation of corresponding named executive officers of companies in the peer group. This comparison allowed the Committee to evaluate the reasonableness of the survey data and of our compensation program. The Committee may make compensation adjustments based on this comparison.

8

Table of Contents

The companies included in the peer group for purposes of 2017 compensation decisions are listed below.

| Company |

2017 Revenues ($ billions) |

Company |

2017 Revenues ($ billions) |

|||||||

| ALLETE, Inc. |

1.4 | NiSource, Inc. | 4.9 | |||||||

| Alliant Energy Corporation |

3.4 | Northwestern Corporation | 1.3 | |||||||

| Ameren Corporation |

6.2 | OGE Energy Corporation | 2.3 | |||||||

| Avista Corporation |

1.4 | Pinnacle West Capital Corporation | 3.6 | |||||||

| Black Hills Corporation |

1.7 | PNM Resources, Inc. | 1.4 | |||||||

| CMS Energy Corporation |

6.6 | Portland General Electric Company | 2.0 | |||||||

| El Paso Electric Company |

0.9 | SCANA Corporation | 4.4 | |||||||

| Great Plains Energy, Inc. |

2.7 | Vectren Corporation | 2.7 | |||||||

| IDACORP, Inc. |

1.3 | |||||||||

| Peer group median |

2.3 | |||||||||

| Westar Energy, Inc. |

2.6 | |||||||||

The Committee periodically reviews the peer group and may remove or add a company for various reasons, such as merger and acquisition activity.

Executive Officer Compensation Program Structure

Components. Our 2017 officer compensation program contained the following principal elements.

| Program Element |

Element Objectives |

Element Features | ||

| Base Salary |

• Provide competitive level of fixed cash compensation • Recognize strong performers |

• Evaluated in relation to market median reflecting factors unique to each officer’s role and responsibilities • Adjustments based on subjective evaluation of performance and responsibilities, as well as internal equity • No short-term incentive | ||

| No Annual Cash Incentive |

• Provide incentive through long- term incentive compensation |

• Absence of an annual cash incentive supports focus on long-term performance | ||

| Restricted Share Units |

• Create long-term shareholder value • Align compensation with shareholder interests • Promote management team stability • Provide appropriate incentives |

• 50-50 allocation of time-based and performance-based restricted share units except for mid-year officer promotions • Performance-based units pay out between zero and 200% of target based on relative total shareholder return compared to peer group |

9

Table of Contents

| Pension and Other Benefits |

• Provide competitive total compensation package |

• 401(k) Plan matching • Group life insurance • Pension plan • Retirement benefit and 401(k) restoration plan |

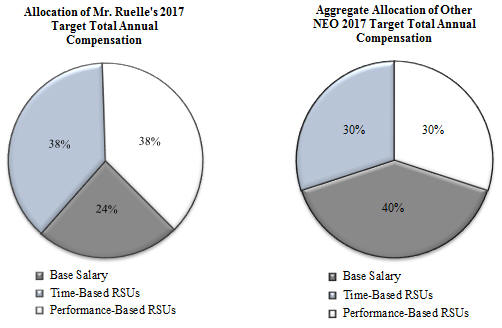

Consistent with our compensation philosophy and objectives, a significant portion of our officers’ annual total compensation is at risk or in the form of long-term incentives that align the interests of our officers with those of our shareholders. The following charts indicate the allocation of 2017 target annual total compensation approved in February 2017 between base salary and restricted share units for Mr. Ruelle and our other named executive officers.

Base Salary. Base salary provides our officers competitive fixed cash compensation. While the aggregate amount of the base salaries for all of the officers (named executive officers and all other officers) is targeted at approximately the market median, base salaries for individual officers are set above or below the market median for the reasons discussed above.

The Committee reviews base salaries annually. In February 2017, the Committee considered an adjustment to the compensation of Mr. Ruelle. Mr. Ruelle made no recommendation regarding his own compensation, nor was he present in any discussions or presentations regarding his compensation. The Willis Towers Watson market information provided to the Committee showed that Mr. Ruelle’s 2016 base salary approximated the market median base salary. The Committee decided to leave Mr. Ruelle’s base salary at $850,000.

In February 2017, the Committee approved increases in base salaries for our other named executive officers. The approved increases, which were based in part on the Willis Towers Watson market information and the recommendation of Mr. Ruelle, raised the aggregate amount of the base salaries for these officers to a level that was near the market median and reflected the Committee’s objective of providing a competitive executive compensation program in light of prevailing business and economic conditions.

10

Table of Contents

Taking into account these adjustments, the following table shows prior base salaries and the new base salaries for the named executive officers as approved by the Committee in February 2017.

| Name |

Prior Base Salary ($) | March 2017 Base Salary ($) | ||||||

| Mark A. Ruelle |

850,000 | 850,000 | ||||||

| Greg A. Greenwood |

430,000 | 445,000 | ||||||

| Anthony D. Somma |

425,000 | 440,000 | ||||||

| Larry D. Irick |

365,000 | 385,000 | ||||||

| Bruce A. Akin |

310,000 | 320,000 | ||||||

Annual Cash Incentive. Though unusual for the utility industry, our executive compensation program does not include an annual cash incentive component in order to focus our executives on long-term performance. The Committee believes the overall compensation program is appropriately performance-based without an annual cash incentive because of the potential for appreciation in the price of our common stock received when restricted share units vest, and the potential for above or below target payouts of performance-based restricted share units. The Committee has considered this issue from time to time and may revisit this issue again in the future. Because our executive compensation program does not include an annual cash incentive, total cash compensation for our officers is typically significantly less than the relevant market median of total cash compensation.

Long-Term Incentive Compensation.

Overview. The Committee approves long-term incentive compensation for our officers and other key employees who are in positions to make positive contributions to our long-term performance and to create shareholder value through the development and execution of our business strategies. For 2017, 50% of the named executive officers’ long-term incentive is in the form of time-based restricted share units and the other 50% is in the form of performance-based restricted share units. Because we do not provide an annual cash incentive, restricted share units make up a larger percentage of the target annual total compensation of our officers than does the long-term incentive compensation component of the target annual total compensation for officers of our peer group.

The Committee believes restricted share units accomplish our executive compensation program objectives because they:

| • | align the interests of management directly with those of our shareholders; |

| • | focus management’s efforts on performance that will create long-term shareholder value and sustain increases in the price of our common stock and our ability to pay dividends; |

| • | provide a competitive long-term incentive opportunity; and |

| • | provide a retention incentive for key employees because the restricted share units vest over time and will be forfeited in whole or in part if an officer’s employment terminates prior to vesting. |

Our time-based restricted share units are designed to provide total compensation below the target market median if our common stock price significantly decreases after approval, but above the target market median if our common stock price significantly increases. The Committee believes this design also provides an incentive to our officers to continue their employment with us for the duration of the vesting period, thus providing us with continuity and stability of management.

11

Table of Contents

Performance-based restricted share units compensate an officer based on relative total shareholder return, which is a measure of our stock price appreciation and dividend payments relative to those of a peer group. The Committee settled on relative total shareholder return as an appropriate performance measure because this measure focuses our officers on creating long-term shareholder value when developing and implementing strategic plans. The Committee believes that the risk and reward inherent in performance-based restricted share units provides an appropriate incentive for officers to manage the Company in the long-term interests of shareholders without encouraging inappropriate risk taking. See “Other Matters – Risk Assessment” below.

Process for Determining Long-Term Incentives. Annually, the Committee reviews base salaries and target annual total compensation of our officers. Target annual total compensation is determined in a similar way to base salaries, with reference to the market median. The dollar amount of long-term incentive compensation is target annual total compensation less base salary. To determine the number of restricted share units, we use the average closing price of our common stock for the twenty trading days preceding the first day of the performance period, which customarily has been the first day of the year. Decisions related to the approval of long-term incentives are made independently of announcements of material information or stock price as of any particular date.

Restricted Share Unit Terms. Each restricted share unit represents the right upon vesting to receive one share of our common stock. Prior to vesting, each time-based restricted share unit gives the holder the right to receive a cash payment equal to each dividend paid on one share of our common stock and which is paid at the same time as our common stock dividend. This right to receive a cash payment is referred to as a dividend equivalent. Dividend equivalents change when we change the dividend paid on our common stock. In the case of performance-based restricted share units, dividend equivalents are paid following vesting, but only to the extent vesting actually occurs.

Time-based restricted share units vest in three years, subject to the officer’s continued employment through the vesting date. Performance-based restricted share units vest in three years, subject to satisfaction of performance measures tied to our total shareholder return relative to the total shareholder return for a peer group over the three-year performance period. Total shareholder return is equal to the difference between the value of a share of common stock at the beginning and end of the three-year performance period using the average closing price of our common stock for the twenty trading days preceding such days, plus dividends paid as if reinvested in stock. For this measure, our total shareholder return is compared to total shareholder return of a peer group for the same three-year period. See “Benchmarking” above for a list of the companies included in our peer group for purposes of 2017 compensation.

The relative total shareholder return targets, and the corresponding payouts expressed as a percentage of the target number of performance-based restricted share units, are as follows:

| Relative TSR Performance |

Percentage Payout | |||

| 90th percentile or above |

200% | |||

| 50th percentile to 90th percentile |

100% to 200% | |||

| 25th percentile to 50th percentile |

25% to 100% | |||

| Below 25th percentile |

0% | |||

Interpolation is used to determine payouts if relative total shareholder return falls between the percentiles shown above.

Vesting of all restricted share units is subject to the officer’s employment with us continuing uninterrupted through the vesting date, except that a prorated portion of the restricted share units will vest on the scheduled vesting date if the officer’s employment terminates as a result of death, disability or retirement. Retirement means termination of an officer’s employment after reaching age 60 and ten years of service. Additionally, in the event of a change in control, all restricted share units will vest as of the date of the change in control. See “Potential Payments Upon Termination or Change In Control” below.

12

Table of Contents

2017 Approvals. In February 2017 the Committee approved long-term incentives for officers, including the named executive officers, as reflected in the following table:

| Name |

2017 Target Annual Long-Term Incentive Compensation ($)(1) |

2017 Time-Based Restricted Share Units (#)(2) |

2017 Performance- Based Restricted Share Units (Target) (#)(2) |

|||||||||

| Mark A. Ruelle |

2,650,000 | 23,360 | 23,360 | |||||||||

| Greg A. Greenwood |

810,000 | 7,140 | 7,140 | |||||||||

| Anthony D. Somma |

800,000 | 7,050 | 7,050 | |||||||||

| Larry D. Irick |

540,000 | 4,760 | 4,760 | |||||||||

| Bruce A. Akin |

335,000 | 2,955 | 2,955 | |||||||||

| (1) | These amounts consist of target annual total compensation less base salary. |

| (2) | The number of units, which are divided equally between time-based and performance-based units, is calculated using the average closing price of our common stock for the twenty trading days immediately preceding January 1, 2017, or $56.724 per share. |

Pension and Other Benefits

Other Benefit Programs and Perquisites. Our officers have the opportunity to participate in employee benefit programs available to all of our non-union employees, including the employees’ 401(k) Plan, medical, dental and life insurance programs, a defined benefit pension plan and assistance with moving expenses in some instances. Additionally, as explained below, our officers are eligible to participate in retirement and 401(k) benefit restoration plans that replace benefits lost because of limitations on benefits imposed by the Internal Revenue Code. Officers, including the named executive officers, do not receive any “perquisites” or special benefits such as car allowances, discretionary allowances, personal expense reimbursements, personal use of aircraft or personal club memberships.

From time to time, in various circumstances, such as when an officer retires below age 60 or retires after age 60 but without ten years of service, the Committee considers one time payments or other arrangements, including the accelerated vesting of restricted share units, that it considers appropriate. No such payments or arrangements were made in 2017.

Pension and Retirement Plans. Our officers, including the named executive officers, participate in the same defined benefit pension plan that we make available to all of our employees.

Our named executive officers also participate in a retirement benefit restoration plan. As a result of having this plan, the retirement benefits for named executive officers are calculated on the same basis as benefits for other covered employees.

Officers who participate in our retirement plan as cash balance members also participate in a 401(k) benefit restoration plan. As a result of having this plan, we credit matching contributions to an account established for officers who participate in our retirement plan as a cash balance member in an amount determined irrespective of limitations on contributions to the 401(k) Plan imposed by the Internal Revenue Code.

13

Table of Contents

In an earlier period of employment with the Company, Mr. Ruelle accrued vested benefits for his prior period of employment under an executive salary continuation plan. He is not accruing additional benefits under this plan in connection with his current employment, and none of the other named executive officers are accruing benefits under this plan. Please see “Pension Benefits” below for a more detailed discussion of the benefits provided to Mr. Ruelle under this plan. The Committee has not taken into account these benefits related to a prior period of employment in setting current compensation for Mr. Ruelle, although the Committee did consider these benefits in its evaluation of the adoption of the retirement benefit restoration plan discussed above.

Change in Control Agreements. The possibility of a change in control can create uncertainty and generate questions among management that may result in the departure or distraction of management personnel to the detriment of the Company and its shareholders. Accordingly, the Committee and the board of directors have taken steps to both minimize the risk that our officers will depart prior to a change in control, and to reinforce and encourage the continued attention and dedication of officers to their assigned duties without distraction in circumstances arising from the possibility of a change in control. The board of directors believes it important that our officers be able to continue their management responsibilities without being influenced by the uncertainties of their personal situations when faced with a potential transfer of control. The board of directors authorized change in control agreements for all of our officers.

The board of directors believes that the payments that could be made under the change in control agreements are reasonable because of the amounts involved and, among other things:

| • | no cash payments are made to executive officers unless there is both a change in control and subsequently a qualifying change in employment (this is commonly referred to as a “double-trigger” provision); |

| • | the agreements provide for a two times payment multiple related to annual compensation; |

| • | if necessary to avoid tax penalties, the payments are reduced to the maximum amount that can be paid without triggering tax penalties; |

| • | there are no “gross-up” payments to executive officers for taxes they would incur as a result of receiving the change in control payments; and |

| • | we have the right to terminate the agreements with 180 days’ notice at any time prior to an event that would lead to a change in control. |

Please see “Potential Payments Upon Termination or Change in Control” later in this Item 11 for a more detailed description of the terms of the change in control agreements and the amount of the benefits payable to each of our named executive officers in the event of the termination of his employment for various reasons following a change in control.

Deferred Compensation. We do not currently have a deferred compensation plan for cash compensation paid to any of our officers. However, we have a plan that authorizes the Committee, at its discretion, to permit officers to defer the receipt of shares of common stock that would otherwise be issued upon the vesting of restricted share units, when we would not otherwise be able to take a related tax deduction.

14

Table of Contents

Executive Compensation Administration

Compensation Committee. The Committee assists our board of directors in administering our executive compensation program. The Committee meets frequently, both in conjunction with regularly scheduled meetings of the board of directors and in special meetings.

Compensation Consultant. In order to fulfill its duties, the Committee seeks independent advice from a compensation consultant. The Committee has full, independent authority to retain its compensation consultant. The Committee generally looks to the consultant for market information rather than recommendations about the amount of compensation for individual officers. The Committee sometimes discusses a project directly with the consultant, and sometimes provides directions to members of management who then work with the consultant and report back to the Committee. In keeping with the Committee’s practice of continuing oversight of our executive compensation program, the compensation consultant is retained throughout the year and typically attends the Committee’s regular and special meetings in person or telephonically. The Committee also annually reviews the performance of the compensation consultant.

During 2017, the Committee was assisted by Meridian, its compensation consultant. Prior to its engagement by the Committee in 2010, Meridian had not provided services to the Committee or the Company. In connection with its assignments in 2017, Meridian provided information to the Committee about market compensation practices in the utility industry and made recommendations related to the executive compensation program. Meridian also worked with management to develop market information for the Committee’s review in connection with the Committee’s consideration in February 2017 of adjustments to officer compensation. During 2017, Meridian provided no services to us other than those described above. The Committee considered the independence of Meridian using NYSE independence rules and found Meridian to be independent.

Management also worked with Willis Towers Watson to develop market information for the Committee’s review in connection with the Committee’s annual consideration of adjustments to officer compensation. In 2017, management also retained Willis Towers Watson on the Company’s behalf to provide services related to our benefit plans, including actuarial and consulting services and brokerage services in connection with post-retirement health insurance. The Willis Towers Watson data was reviewed by Meridian as the Committee’s independent consultant to ensure that Willis Towers Watson’s methodology was consistent with our executive compensation philosophy.

Participation of Executive Officers. Our officers and members of senior management are involved in various aspects of the Committee’s evaluation and determination of officer compensation. Our chief executive officer makes recommendations to the Committee for the compensation of officers other than himself. Some officers, including our chief executive officer, attend portions of Committee discussions about compensation for officers generally and individual compensation for officers other than themselves. As noted above, management may work with compensation consultants to provide information requested by consultants for their reports to the Committee.

Our officers do not work with the board of directors or the Committee in establishing measures or targets that affect their own compensation, although officers did participate in discussions about the performance measures for our performance-based restricted share units. Our officers do not participate in discussions of the Committee or the full board of directors about their own compensation. Further, our officers do not meet with the Committee’s compensation consultants on an individual basis regarding their own compensation.

In the view of the Committee, the involvement by management does not hinder the ability of the Committee to make independent decisions about officer compensation.

Tally Sheets. The Committee annually reviews a tally sheet for each officer, including each named executive officer, to ensure that the Committee is fully informed about the total compensation and benefits of each officer, including the potential compensation in various scenarios should an officer’s employment be terminated. The tally sheets also help to ensure the Committee is considering all benefits and previously granted restricted share units when making compensation decisions. Each tally sheet is prepared by management with the assistance of our human resources staff and the Committee’s independent compensation consultant and includes a summary of an officer’s compensation including current salary, unvested restricted share units, pension and other benefits.

15

Table of Contents

Other Matters

Risk Assessment. The Committee believes the design of the executive compensation program does not encourage excessive or unnecessary risk-taking, based on, among other factors, the following:

| • | Officers are not paid annual cash incentives that might encourage short-term risk taking. |

| • | Long-term incentive compensation awards vest in three years, encouraging a focus on long-term value creation. |

| • | Long-term compensation awards have a maximum payout of two times the target amount. |

| • | Our officers and directors have minimum stock ownership requirements that discourage excessive risk taking. |

Stock Ownership Requirements. Each officer is required to own an amount of our common stock having a value equal to a multiple of the officer’s base salary. The multiple ranges from one to five times base salary, depending upon the position of the officer, with a higher requirement for more senior officers. The Committee believes these requirements further align the interests of officers with the interests of our shareholders by ensuring our officers have a significant long-term stake in the Company and are subject to the risks of equity ownership. At the same time, the Committee believes these requirements balance the personal needs of officers to be able to diversify personal assets and investments. We determine whether the requirements have been met using our closing stock price on the last trading day of the immediately preceding calendar year. We expect officers to achieve the applicable ownership requirement, which includes unvested time-based restricted share units but excludes unvested performance-based restricted share units, within five years of their appointment to an officer position.

Each of the named executive officers has met the current requirements, which are set forth below.

| Executive Officer |

Requirement | |||

| Mr. Ruelle |

5x | |||

| Mr. Greenwood, Mr. Somma and Mr. Akin |

3x | |||

| Mr. Irick |

1x | |||

Tax Deductibility of Compensation. Under Section 162(m) of the Internal Revenue Code, we may not deduct compensation in excess of $1 million paid in any taxable year to certain employees. Performance-based compensation was not historically subject to the deduction limitation if certain requirements were met. However, Section 162(m) was amended by the Tax Cuts and Jobs Act of 2017, and the amendment repealed the performance-based deduction limitation, and also expanded the group of employees for which deducibility is disallowed. We are assessing the impact of Section 162(m), as amended, on our compensation programs. The Committee considers deductibility of compensation for federal income tax purposes in structuring our executive compensation program; however, to maintain flexibility in compensating executive officers in a manner designed to promote our various goals, the Committee may, but does not necessarily, design compensation programs based upon tax consequences.

16

Table of Contents

Companies Included in the Willis Towers Watson 2016 Energy Services Executive Compensation Database

17

Table of Contents

The Compensation Committee has reviewed and discussed with the Company’s management the Compensation Discussion and Analysis included in this Item 11. Based on that review and discussion, the Compensation Committee has recommended to the board of directors that the Compensation Discussion and Analysis be included in this Amendment to the Annual Report on Form 10-K for the year ended December 31, 2017.

| The Compensation Committee

Mollie H. Carter, Chairman Richard L. Hawley B. Anthony Isaac Sandra A.J. Lawrence |

18

Table of Contents

The following tables, narrative and footnotes discuss the compensation for 2015, 2016 and 2017 of our named executive officers.

| Name & Principal Position |

Year | Salary ($)(1) |

Stock Awards ($)(2) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings(3) |

All Other Compensation ($)(4) |

Total ($) | ||||||||||||||||||

| Mark A. Ruelle |

2017 | 850,000 | 2,110,109 | 180,349 | 39,798 | 3,180,256 | ||||||||||||||||||

| President and Chief Executive |

2016 | 845,000 | 2,707,444 | 152,036 | 39,523 | 3,744,003 | ||||||||||||||||||

| Officer |

2015 | 812,500 | 2,263,051 | 60,955 | 37,985 | 3,174,491 | ||||||||||||||||||

| Greg A. Greenwood |

2017 | 442,500 | 644,956 | 395,506 | 12,976 | 1,495,938 | ||||||||||||||||||

| Senior Vice President, |

2016 | 426,667 | 861,817 | 338,842 | 12,712 | 1,640,038 | ||||||||||||||||||

| Strategy |

2015 | 405,833 | 714,795 | 112,714 | 12,664 | 1,246,006 | ||||||||||||||||||

| Anthony D. Somma |

2017 | 437,500 | 636,827 | 374,622 | 12,966 | 1,461,915 | ||||||||||||||||||

| Senior Vice President, |

2016 | 420,000 | 834,091 | 340,013 | 12,683 | 1,606,787 | ||||||||||||||||||

| Chief Financial Officer and Treasurer |

2015 | 391,667 | 699,612 | 134,032 | 12,645 | 1,237,956 | ||||||||||||||||||

| Larry D. Irick |

2017 | 381,667 | 429,971 | 337,563 | 13,107 | 1,162,308 | ||||||||||||||||||

| Vice President, General |

2016 | 361,667 | 552,672 | 258,340 | 12,823 | 1,185,502 | ||||||||||||||||||

| Counsel and Corporate Secretary |

2015 | 339,167 | 466,275 | 133,730 | 12,736 | 951,908 | ||||||||||||||||||

| Bruce A. Akin |

2017 | 318,333 | 266,925 | 292,797 | 12,745 | 890,800 | ||||||||||||||||||

| Senior Vice President, Power |

2016 | 306,667 | 353,507 | 227,558 | 12,482 | 900,214 | ||||||||||||||||||

| Delivery |

2015 | 286,667 | 297,665 | 35,073 | 12,443 | 631,848 | ||||||||||||||||||

| (1) | See the Compensation Discussion and Analysis section earlier in this Item 11 for information about adjustments to base salaries in 2017. |

| (2) | Amounts reflect the aggregate grant date fair value of time-based restricted share units and performance-based restricted share units approved in 2017, as determined pursuant to Financial Accounting Standards Board Codification Topic 718. For additional information about the assumptions we used in calculating these amounts, see Note 12 in our Notes to Consolidated Financial Statements, Employee Benefit Plans, Stock-Based Compensation Plans, found in the Original Filing. |

Amounts relate to annual long-term incentives approved for all the named executive officers. See “Compensation Discussion and Analysis—Long-Term Incentive Compensation” for additional information about these long-term incentives and their terms, including vesting conditions that must be met for any compensation to be received and, for performance-based restricted share units, their performance measures, the target payout level and the payout range, which is between zero and 200% of the target level. These amounts do not reflect actual compensation realized by the named executive officers and are not a guarantee of the amount that the named executive officers will receive from the long-term incentives. The actual compensation will be based on our common stock price at vesting and the performance level achieved for the applicable performance period.

19

Table of Contents

The grant date fair value for the time-based restricted share units is determined by multiplying the number of restricted share units granted by the closing stock price on the grant date of the underlying common stock. The grant date fair value for the performance-based restricted share units in 2017 is based on an accounting value of 99% of the target value for the annual long-term awards. Assuming achievement of the performance goals at the maximum level and the receipt of the maximum number of performance-based restricted share units, the aggregate grant date fair value of the restricted share unit awards in 2017 would be: Mr. Ruelle, $3,731,760; Mr. Greenwood $1,140,615; Mr. Somma, $1,126,238; Mr. Irick $760,410; and Mr. Akin, $472,061.

| (3) | Amounts reported reflect the aggregate change in the actuarial present value of each named executive officer’s accumulated pension benefits. These values do not represent cash received by the named executive officers in the indicated years. Year-over-year changes in pension value are driven in large part by changes in actuarial pension assumptions. The material terms of our pension plans and the assumptions and methods used to determine these amounts are described following the Pension Benefits section in Item 11. |

| (4) | The following table identifies the amount of each item included in the All Other Compensation column of the Summary Compensation Table with respect to 2017 compensation. |

| Name |

Company Matching 401(k) Plan Contributions ($) |

Company 401(k) Restoration Plan Contributions ($) |

Life Insurance ($)(a) |

Discount on Stock for Compensation Program ($)(b) |

Total ($) |

|||||||||||||||

| Mark A. Ruelle |

12,150 | 26,100 | 1,548 | — | 39,798 | |||||||||||||||

| Greg A. Greenwood |

12,150 | 826 | 12,976 | |||||||||||||||||

| Anthony D. Somma |

12,150 | 816 | 12,966 | |||||||||||||||||

| Larry D. Irick |

12,150 | 701 | 256 | 13,107 | ||||||||||||||||

| Bruce A. Akin |

12,150 | 595 | 12,745 | |||||||||||||||||

| (a) | Amounts reflect premiums paid on term life insurance for the benefit of the named executive officers under our group term life insurance plan provided to all non-union employees. |

| (b) | Pursuant to a stock-for-compensation plan that was discontinued in 2001, executive officers could elect to receive restricted share units in lieu of cash compensation. Mr. Irick, a participant in this plan, previously made an irrevocable election to defer payout under the plan until his retirement. The amount in this column reflects the value of discounts received by Mr. Irick on share units acquired through reinvested dividends pursuant to the terms of the plan. |

20

Table of Contents

Annual long-term incentives were approved for each of the named executive officers in 2017 consisting of time-based restricted share units and performance-based restricted share units. See “Compensation Discussion and Analysis—Long-Term Incentive Compensation” for information about the terms of these restricted share units. The following table sets forth information about the grants.

| Estimated Future Payouts Under Equity Incentive Plan Awards |

All Other Stock Awards: Number of Shares of Stock or Units (#) |

Grant Date Fair Value of Stock and Option Awards ($)(1)(2)(3) |

||||||||||||||||||||||

| Name |

Grant Date | Threshold (#) |

Target (#) |

Maximum (#) |

||||||||||||||||||||

| Mark A. Ruelle |

2/22/2017 | — | — | — | 23,360 | 1,243,920 | ||||||||||||||||||

| 2/22/2017 | — | 23,360 | 46,720 | — | 866,189 | |||||||||||||||||||

| Greg A. Greenwood |

2/22/2017 | — | — | — | 7,140 | 380,205 | ||||||||||||||||||

| 2/22/2017 | — | 7,140 | 14,280 | — | 264,751 | |||||||||||||||||||

| Anthony D. Somma |

2/22/2017 | — | — | — | 7,050 | 375,413 | ||||||||||||||||||

| 2/22/2017 | — | 7,050 | 14,100 | — | 261,414 | |||||||||||||||||||

| Larry D. Irick |

2/22/2017 | — | — | — | 4,760 | 253,470 | ||||||||||||||||||

| 2/22/2017 | — | 4,760 | 9,520 | — | 176,501 | |||||||||||||||||||

| Bruce A. Akin |

2/22/2017 | — | — | — | 2,955 | 157,354 | ||||||||||||||||||

| 2/22/2017 | — | 2,955 | 5,910 | — | 109,571 | |||||||||||||||||||

| (1) | Represents the aggregate grant date fair value of time-based and performance-based restricted share units in 2017, as determined pursuant to Financial Accounting Standings Board Codification 718. |

| (2) | The grant date fair value of time-based restricted share units reported in the All Other Stock Awards column is determined by multiplying the number of restricted share units by our closing stock price on the grant date ($53.25 on February 22, 2017). The grant date fair value for the performance-based restricted share units in 2017 is based on an accounting value of 99% of the target value for the annual long-term awards. See footnote 2 to the Summary Compensation Table for assumptions used in the calculation of these amounts. |

| (3) | Restricted share units with a three-year vesting period for time-based restricted share units and a three-year performance period for performance-based restricted share units. |

21

Table of Contents

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information as of December 31, 2017, with regard to unvested restricted share units held by the named executive officers.

| Stock Awards | ||||||||||||||||

| Name |

Number of Shares or Units of Stock that Have Not Vested (#)(1) |

Market Value of Shares or Units of Stock that Have Not Vested ($)(2) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)(3) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(2) |

||||||||||||

| Mark A. Ruelle |

80,975 | 4,275,480 | 80,975 | 4,275,480 | ||||||||||||

| Greg A. Greenwood |

25,410 | 1,341,648 | 25,410 | 1,341,648 | ||||||||||||

| Anthony D. Somma |

24,830 | 1,311,024 | 24,830 | 1,311,024 | ||||||||||||

| Larry D. Irick |

16,575 | 875,160 | 16,575 | 875,160 | ||||||||||||

| Bruce A. Akin |

10,505 | 554,664 | 10,505 | 554,664 | ||||||||||||

| (1) | Represents the number of unvested time-based restricted share units. The vesting schedules are shown in the table below. |

| (2) | Reported market value equals the total number of unvested restricted share units multiplied by our closing stock price on December 29, 2017 of $52.80 per share. |

| (3) | Represents the target number of performance-based restricted share units that could be earned assuming the target performance criteria are met. |

As of December 31, 2017, restricted share units that had not vested were subject to the vesting schedule indicated in the following table.

| Name |

Year of Award |

Unvested Share Units (#)(1) |

Unearned and Unvested Share Units (#)(2) |

Vesting Date | ||||||||||||

| Mark A. Ruelle |

|

2015 2016 2017 |

|

|

28,320 29,295 23,360 |

|

|

28,320 29,295 23,360 |

|

|

January 1, 2018 January 1, 2019 January 1, 2020 |

| ||||

| Greg A. Greenwood |

|

2015 2016 2017 |

|

|

8,945 9,325 7,140 |

|

|

8,945 9,325 7,140 |

|

|

January 1, 2018 January 1, 2019 January 1, 2020 |

| ||||

| Anthony D. Somma |

|

2015 2016 2017 |

|

|

8,755 9,025 7,050 |

|

|

8,755 9,025 7,050 |

|

|

January 1, 2018 January 1, 2019 January 1, 2020 |

| ||||

| Larry D. Irick |

|

2015 2016 2017 |

|

|

5,835 5,980 4,760 |

|

|

5,835 5,980 4,760 |

|

|

January 1, 2018 January 1, 2019 January 1, 2020 |

| ||||

| Bruce A. Akin |

|

2015 2016 2017 |

|

|

3,725 3,825 2,955 |

|

|

3,725 3,825 2,955 |

|

|

January 1, 2018 January 1, 2019 January 1, 2020 |

| ||||

| (1) | Includes time-based restricted share units. |

| (2) | Includes the target number of performance-based restricted share units that may be earned by the named executive officers if the performance criteria are met. |

22

Table of Contents

Option Exercises and Stock Vested

The following table sets forth information about the value of shares of our common stock received by the named executive officers as a result of the vesting of restricted share units in 2017.

| Name |

Number of Shares Acquired on Vesting (#) |

Value Realized on Vesting ($) |

||||||

| Mark A. Ruelle |

94,335 | 5,315,777 | ||||||

| Greg A. Greenwood |

30,195 | 1,701,488 | ||||||

| Anthony D. Somma |

29,475 | 1,660,916 | ||||||

| Larry D. Irick |

20,040 | 1,129,254 | ||||||

| Bruce A. Akin |

12,495 | 704,093 | ||||||

The market value of the shares received by the named executive officers is based on our closing stock price on the date of vesting or the trading day immediately preceding the date of vesting in instances where the date of vesting was not a trading day.

The following table sets forth, at December 31, 2017, the present value of accumulated benefits payable to the named executive officers under our Retirement Plan, our Executive Salary Continuation Plan, and our Retirement Benefit Restoration Plan.

| Name |

Plan Name |

Number of Years of Credited Service (#) |

Present Value of Accumulated Benefit ($) |

Payments During Last Fiscal Year ($) |

||||||||||

| Mark A. Ruelle |

Retirement Plan (final average earnings) | 10.5 | 204,681 | — | ||||||||||

| Retirement Plan (cash balance) | 15.0 | 393,834 | — | |||||||||||

| Executive Salary Continuation Plan | 10.5 | 208,688 | — | |||||||||||

| Retirement Benefit Restoration Plan | n/a | 457,778 | — | |||||||||||

| Greg A. Greenwood |