Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 2ND QUARTER FISCAL 2018 EARNINGS PRESS RELEASE - MATTHEWS INTERNATIONAL CORP | ex991_2q2018earningspr.htm |

| 8-K - 8-K - 2ND QUARTER FISCAL 2018 EARNINGS PRESS RELEASE - MATTHEWS INTERNATIONAL CORP | form8k-2018q2earnings.htm |

©2018 Matthews International Corporation. All Rights Reserved.

Second Quarter Fiscal 2018

Earnings Teleconference

April 27, 2018

Joseph C. Bartolacci

President and Chief Executive Officer

Steven F. Nicola

Chief Financial Officer

©2018 Matthews International Corporation. All Rights Reserved. 2

Disclaimer

Any forward-looking statements with respect to Matthews International Corporation (the “Company”) in connection with this presentation are being made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be

materially different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that

such expectations will prove correct. Factors that could cause the Company’s results to differ from those presented herein are set forth in the Company’s Annual Report on Form 10-K and other periodic

filings with the Securities and Exchange Commission (“SEC”).

The Company periodically provides information derived from financial data which is not presented in the consolidated financial statements prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). Certain of this information are considered “non-GAAP financial measures” under the SEC rules. The Company believes that this information provides management and investors

with a useful measure of the Company’s financial performance on a comparable basis. These non-GAAP financial measures are supplemental to the Company’s GAAP disclosures and should not be

considered an alternative to the GAAP financial information.

The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision making by removing the impact of certain items that

management believes do not directly reflect the Company’s core operations including acquisition-related items, system-integration costs, adjustments related to intangible assets, litigation items, and

strategic initiative and other charges, which includes non-recurring charges related to operational initiatives and exit activities. Management believes that presenting non-GAAP financial measures is

useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items, (ii) permits investors to view performance using

the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be

useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP

financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could

not be obtained absent these disclosures.

The Company has presented free cash flow and free cash flow yield as supplemental measures of cash flow that are not required by, or presented in accordance with, GAAP. Management believes that

these measures provide relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the cash

generated by operations, excluding certain expenses, above and beyond the annual capital expenditures. These measures allows management, as well as analysts and investors, to assess the

Company’s ability to pursue growth and investment opportunities designed to increase Shareholder value.

The Company also has presented adjusted operating profit and believes that it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s

management in assessing both consolidated and segment performance. Adjusted operating profit provides the Company with an understanding of the results from the primary operations of its business

by excluding the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in

evaluating the underlying primary operating performance of the Company’s segments and business overall on a consistent basis.

Similarly, the Company believes that EBITDA and adjusted EBITDA provide relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in

assessing the performance of its business. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the

effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating

operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure performance as well as strategic planning and forecasting.

The Company has also presented adjusted earnings per share and believes it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s

management in assessing the performance of its business. Adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by

excluding the per share effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of our operations. This measure provides management with insight

into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, this measure may be useful to an investor in evaluating the underlying operating

performance of the Company’s business overall, as well as performance trends, on a consistent basis.

Lastly, the Company has presented adjusted net income and believes it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s

management in assessing financial performance. Adjusted net income provides the Company with an understanding of the results from the primary operations of its business by excluding the effects of

certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating the underlying

performance of the business.

©2018 Matthews International Corporation. All Rights Reserved. 3

Financial Overview

©2018 Matthews International Corporation. All Rights Reserved. 4

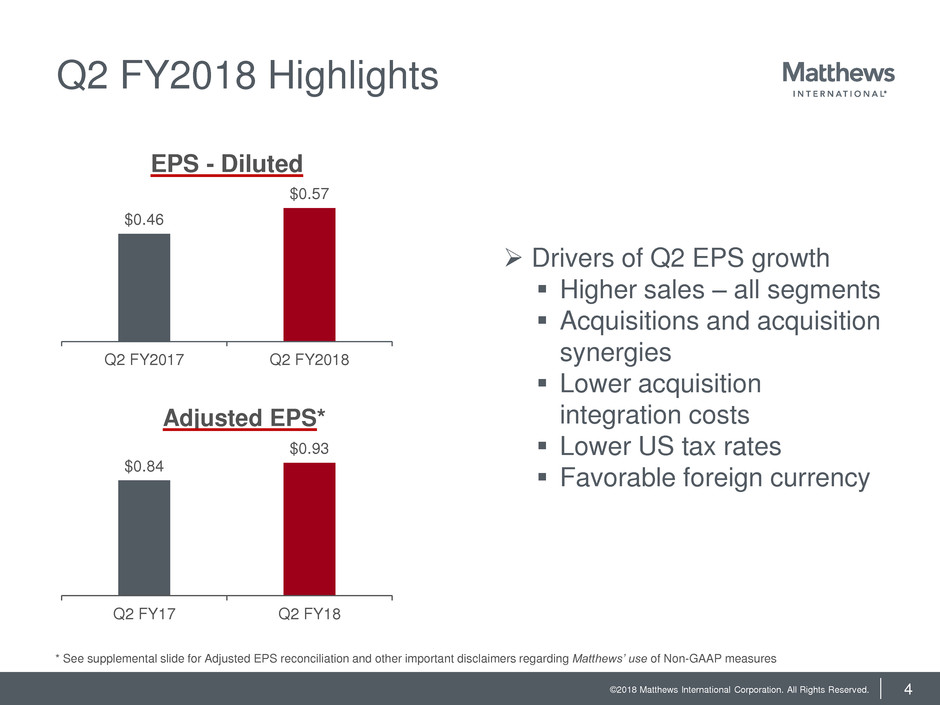

Q2 FY2018 Highlights

$0.46

$0.57

Q2 FY2017 Q2 FY2018

EPS - Diluted

$0.84

$0.93

Q2 FY17 Q2 FY18

Adjusted EPS*

Drivers of Q2 EPS growth

Higher sales – all segments

Acquisitions and acquisition

synergies

Lower acquisition

integration costs

Lower US tax rates

Favorable foreign currency

* See supplemental slide for Adjusted EPS reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 5

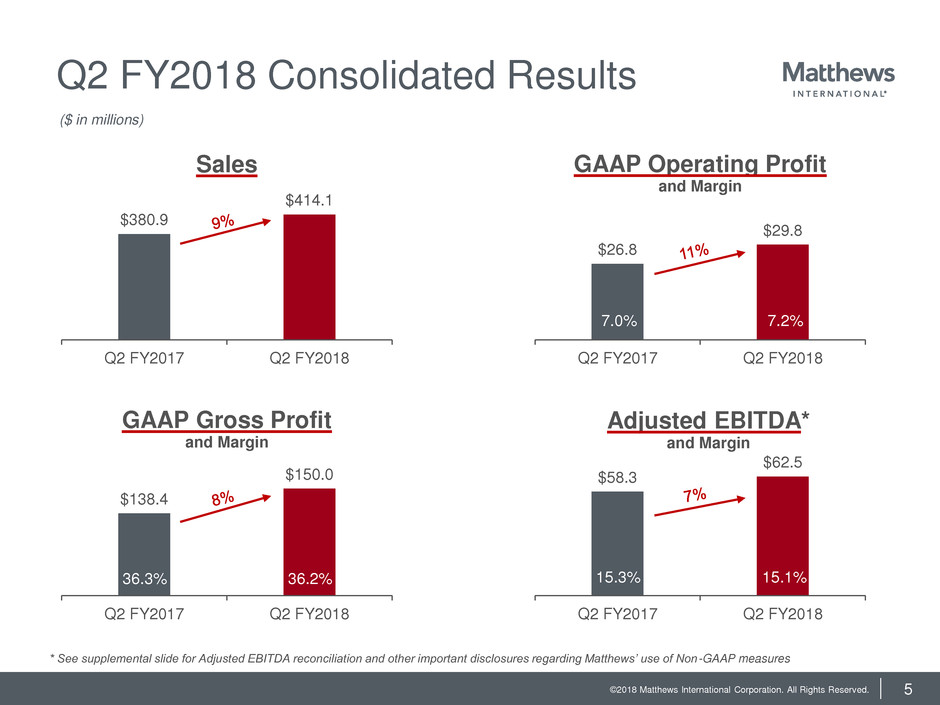

Q2 FY2018 Consolidated Results

$380.9

$414.1

Q2 FY2017 Q2 FY2018

Sales

$138.4

$150.0

Q2 FY2017 Q2 FY2018

GAAP Gross Profit

and Margin

$26.8

$29.8

Q2 FY2017 Q2 FY2018

GAAP Operating Profit

and Margin

$58.3

$62.5

Q2 FY2017 Q2 FY2018

Adjusted EBITDA*

and Margin

36.3% 36.2%

7.0% 7.2%

15.3% 15.1%

($ in millions)

* See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 6

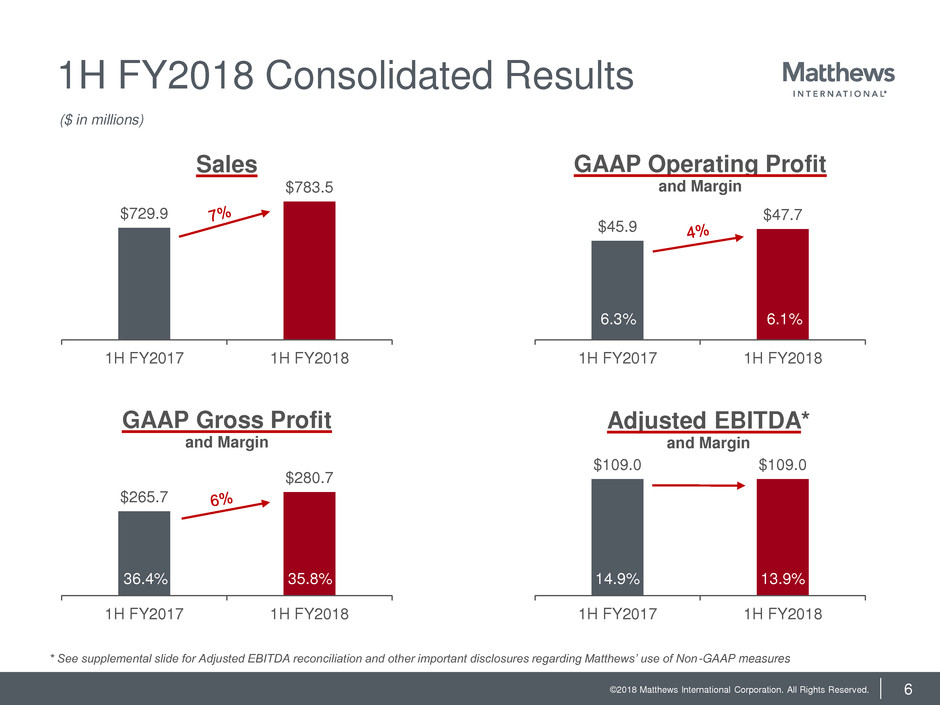

1H FY2018 Consolidated Results

$729.9

$783.5

1H FY2017 1H FY2018

Sales

$265.7

$280.7

1H FY2017 1H FY2018

GAAP Gross Profit

and Margin

$45.9

$47.7

1H FY2017 1H FY2018

GAAP Operating Profit

and Margin

$109.0 $109.0

1H FY2017 1H FY2018

Adjusted EBITDA*

and Margin

36.4% 35.8%

* See supplemental slide for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

6.3% 6.1%

14.9% 13.9%

($ in millions)

©2018 Matthews International Corporation. All Rights Reserved. 7

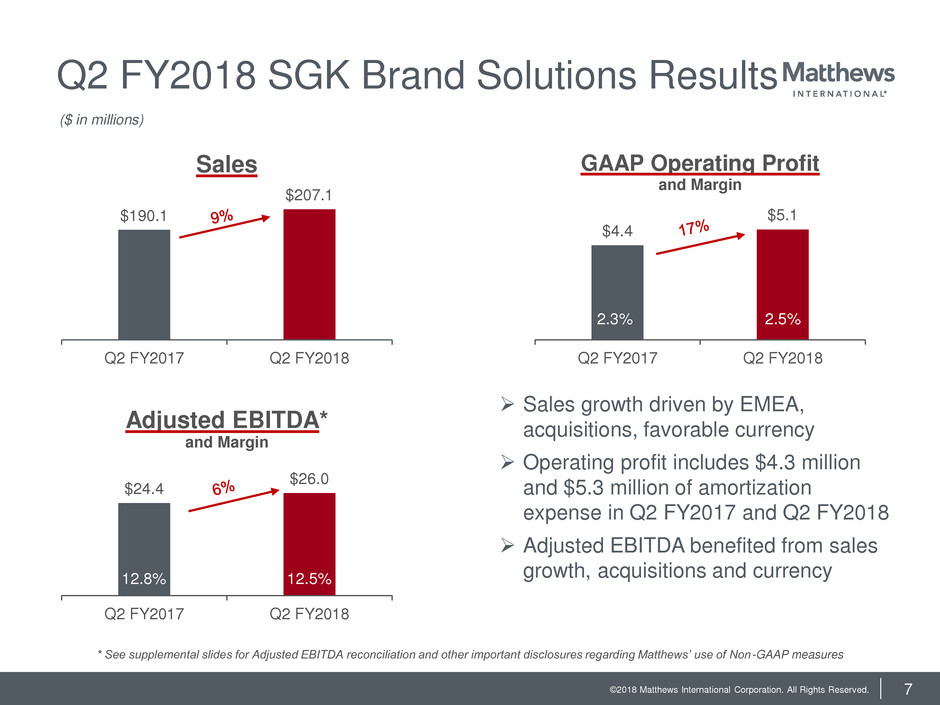

Q2 FY2018 SGK Brand Solutions Results

$190.1

$207.1

Q2 FY2017 Q2 FY2018

Sales

$24.4

$26.0

Q2 FY2017 Q2 FY2018

Adjusted EBITDA*

and Margin

$4.4

$5.1

Q2 FY2017 Q2 FY2018

GAAP Operating Profit

and Margin

Sales growth driven by EMEA,

acquisitions, favorable currency

Operating profit includes $4.3 million

and $5.3 million of amortization

expense in Q2 FY2017 and Q2 FY2018

Adjusted EBITDA benefited from sales

growth, acquisitions and currency 12.8% 12.5%

* See supplemental slides for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

2.3% 2.5%

($ in millions)

©2018 Matthews International Corporation. All Rights Reserved. 8

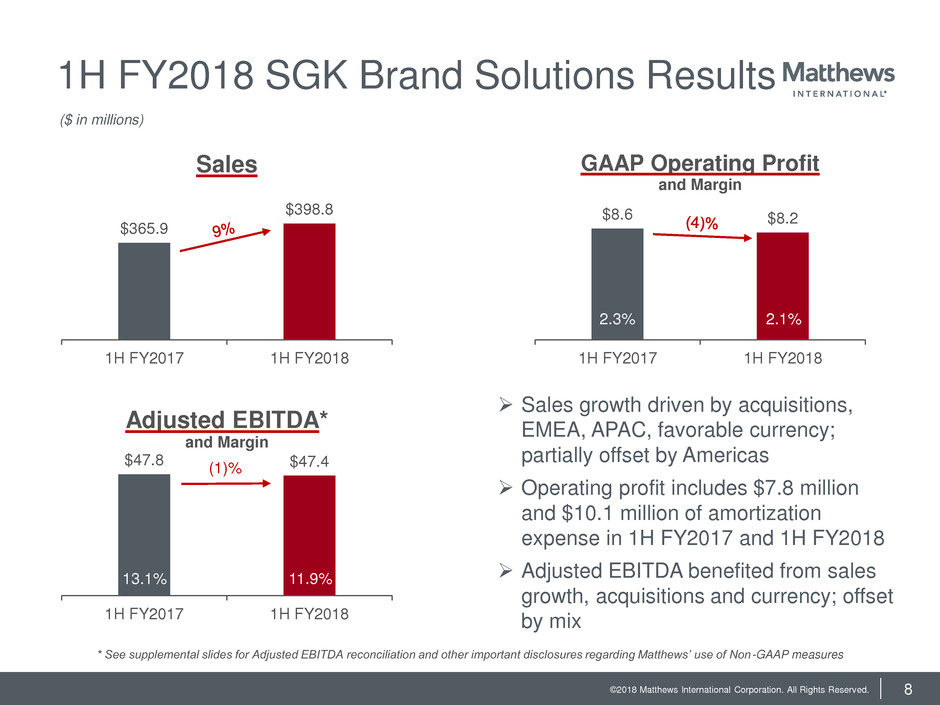

Sales growth driven by acquisitions,

EMEA, APAC, favorable currency;

partially offset by Americas

Operating profit includes $7.8 million

and $10.1 million of amortization

expense in 1H FY2017 and 1H FY2018

Adjusted EBITDA benefited from sales

growth, acquisitions and currency; offset

by mix

1H FY2018 SGK Brand Solutions Results

$365.9

$398.8

1H FY2017 1H FY2018

Sales

$47.8 $47.4

1H FY2017 1H FY2018

Adjusted EBITDA*

and Margin

$8.6 $8.2

1H FY2017 1H FY2018

GAAP Operating Profit

and Margin

13.1% 11.9%

(1)%

2.3% 2.1%

($ in millions)

* See supplemental slides for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 9

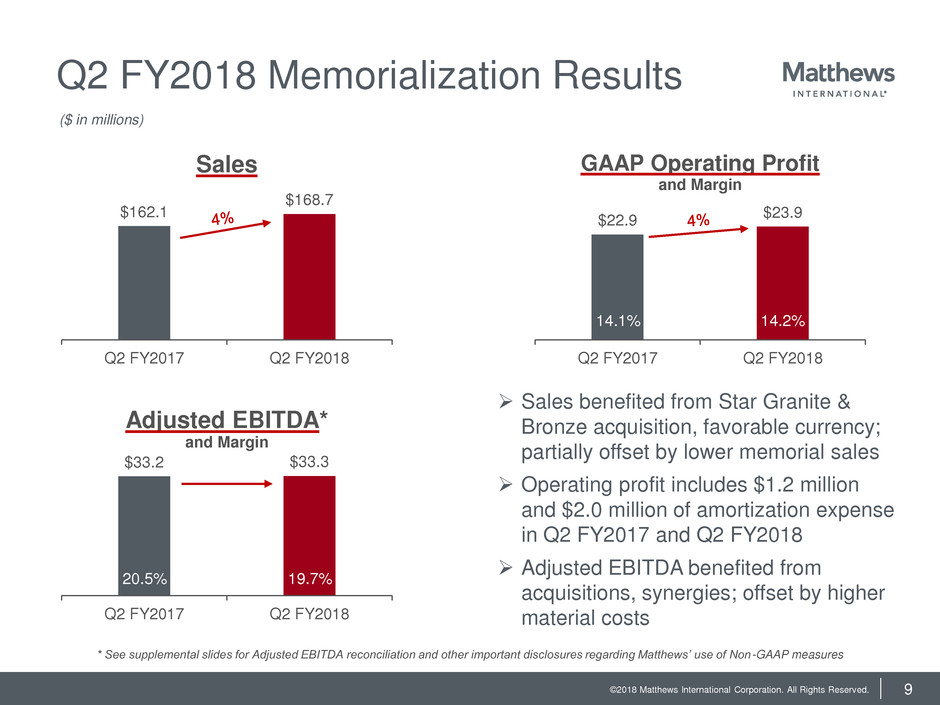

Q2 FY2018 Memorialization Results

$162.1

$168.7

Q2 FY2017 Q2 FY2018

Sales

$33.2 $33.3

Q2 FY2017 Q2 FY2018

Adjusted EBITDA*

and Margin

$22.9

$23.9

Q2 FY2017 Q2 FY2018

GAAP Operating Profit

and Margin

Sales benefited from Star Granite &

Bronze acquisition, favorable currency;

partially offset by lower memorial sales

Operating profit includes $1.2 million

and $2.0 million of amortization expense

in Q2 FY2017 and Q2 FY2018

Adjusted EBITDA benefited from

acquisitions, synergies; offset by higher

material costs

20.5% 19.7%

14.1% 14.2%

($ in millions)

* See supplemental slides for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 10

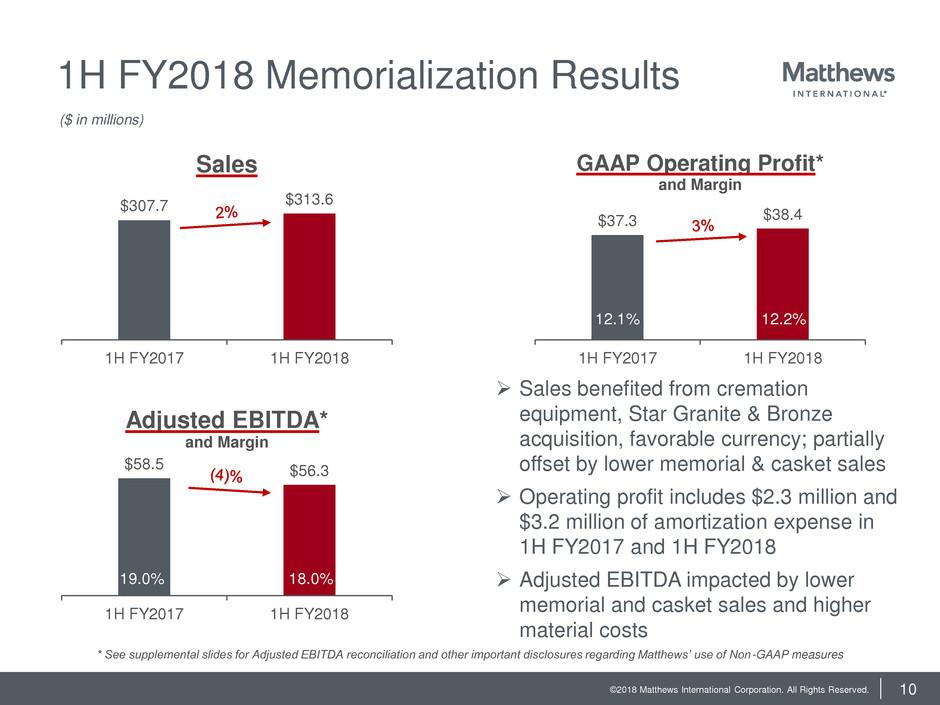

1H FY2018 Memorialization Results

$307.7 $313.6

1H FY2017 1H FY2018

Sales

$58.5 $56.3

1H FY2017 1H FY2018

Adjusted EBITDA*

and Margin

$37.3 $38.4

1H FY2017 1H FY2018

GAAP Operating Profit*

and Margin

Sales benefited from cremation

equipment, Star Granite & Bronze

acquisition, favorable currency; partially

offset by lower memorial & casket sales

Operating profit includes $2.3 million and

$3.2 million of amortization expense in

1H FY2017 and 1H FY2018

Adjusted EBITDA impacted by lower

memorial and casket sales and higher

material costs

19.0% 18.0%

12.1% 12.2%

($ in millions)

* See supplemental slides for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 11

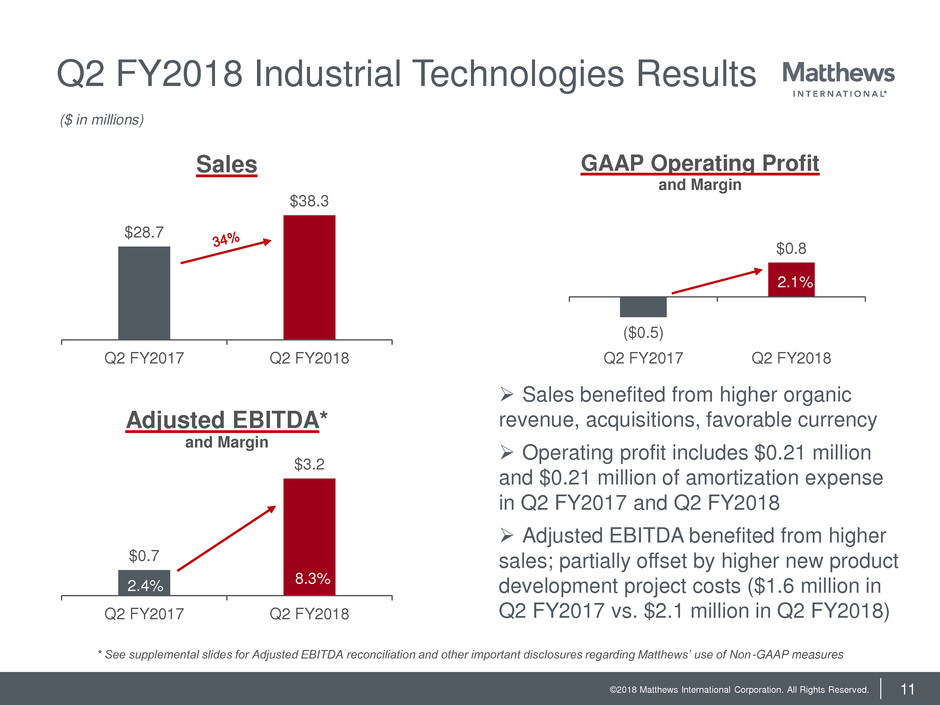

Q2 FY2018 Industrial Technologies Results

$28.7

$38.3

Q2 FY2017 Q2 FY2018

Sales

$0.7

$3.2

Q2 FY2017 Q2 FY2018

Adjusted EBITDA*

and Margin

($0.5)

$0.8

-1

-0.5

0

0.5

1

1.5

2

Q2 FY2017 Q2 FY2018

GAAP Operating Profit

and Margin

Sales benefited from higher organic

revenue, acquisitions, favorable currency

Operating profit includes $0.21 million

and $0.21 million of amortization expense

in Q2 FY2017 and Q2 FY2018

Adjusted EBITDA benefited from higher

sales; partially offset by higher new product

development project costs ($1.6 million in

Q2 FY2017 vs. $2.1 million in Q2 FY2018)

2.4% 8.3%

2.1%

($ in millions)

* See supplemental slides for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 12

1H FY2018 Industrial Technologies Results

$56.3

$71.1

1H FY2017 1H FY2018

Sales

$2.7

$5.2

1H FY2017 1H FY2018

Adjusted EBITDA*

and Margin

$0.04

$1.1

1H FY2017 1H FY2018

GAAP Operating Profit

and Margin

Sales benefited from higher organic

revenue, acquisitions, favorable currency

Operating profit includes $0.42 million

and $1.6 million of amortization expense in

1H FY2017 and 1H FY2018

Adjusted EBITDA benefited from higher

sales; partially offset by higher new product

development project costs ($3.2 million in

1H FY2017 vs. $3.9 million in 1H FY2018)

4.8% 7.4%

1.6%

($ in millions)

* See supplemental slides for Adjusted EBITDA reconciliation and other important disclosures regarding Matthews’ use of Non-GAAP measures

©2018 Matthews International Corporation. All Rights Reserved. 13

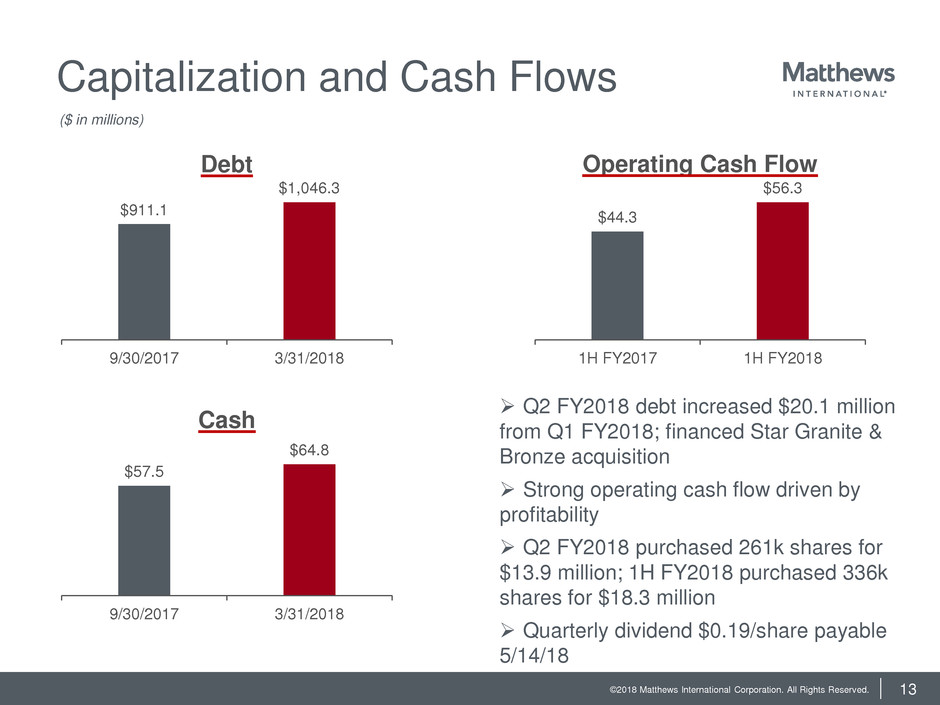

Capitalization and Cash Flows

$911.1

$1,046.3

9/30/2017 3/31/2018

Debt

$57.5

$64.8

9/30/2017 3/31/2018

Cash

$44.3

$56.3

1H FY2017 1H FY2018

Operating Cash Flow

Q2 FY2018 debt increased $20.1 million

from Q1 FY2018; financed Star Granite &

Bronze acquisition

Strong operating cash flow driven by

profitability

Q2 FY2018 purchased 261k shares for

$13.9 million; 1H FY2018 purchased 336k

shares for $18.3 million

Quarterly dividend $0.19/share payable

5/14/18

($ in millions)

©2018 Matthews International Corporation. All Rights Reserved. 14

Business Overview

©2018 Matthews International Corporation. All Rights Reserved. 15

Business Highlights & Market Climate

Gaining market share – environmental solutions, pet cremation,

Star Granite & Bronze, Aurora showing strength

Commodity cost pressures

Very strong organic growth driving backlog, Compass showing

strength

Expecting new product beta testing in Q3 FY2018, new product

launch by January 2019

Robust pipeline driven by solid sales discipline – EMEA tobacco

orders, Equator, APAC and Americas new wins ramping up,

Ungricht and VCG progressing well

Minor UK divestiture

SGK Brand

Solutions

Memorialization

Industrial

Technologies

©2018 Matthews International Corporation. All Rights Reserved. 16

Acquisitions Integration

SGK Brand Solutions

Equator (March 2017)

Ungricht (January 2017)

VCG (January 2017)

Memorialization

Star Granite & Bronze (February 2018)

Aurora (August 2015)

Industrial Technologies

Compass Engineering (November 2017)

RAF Technology (February 2017)

©2018 Matthews International Corporation. All Rights Reserved. 17

Outlook for Fiscal 2018*

Growth in non-GAAP EPS by at least 10% over FY 2017

Operating cash flow currently expected to exceed

FY2017 record level

* As of April 26, 2018

©2018 Matthews International Corporation. All Rights Reserved. 18

Supplemental Information

©2018 Matthews International Corporation. All Rights Reserved. 19

Reconciliations of

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures to assist in comparing its performance on a

consistent basis for purposes of business decision making by removing the impact of certain items

that management believes do not directly reflect the Company’s core operations including

acquisition-related items, adjustments related to intangible assets, litigation items, and strategic

initiative and other charges, which includes non-recurring charges related to operational initiatives

and exit activities. Management believes that presenting non-GAAP financial measures (such as

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income and Adjusted EPS) is

useful to investors because it (i) provides investors with meaningful supplemental information

regarding financial performance by excluding certain items, (ii) permits investors to view

performance using the same tools that management uses to budget, forecast, make operating and

strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental

information that may be useful to investors in evaluating the Company’s results. The Company

believes that the presentation of these non-GAAP financial measures, when considered together

with the corresponding GAAP financial measures and the reconciliations to those measures,

provided herein, provides investors with an additional understanding of the factors and trends

affecting the Company’s business that could not be obtained absent these disclosures. These non-

GAAP financial measures are supplemental to the Company’s GAAP disclosures and should not be

considered an alternative to the GAAP financial information.

©2018 Matthews International Corporation. All Rights Reserved. 20

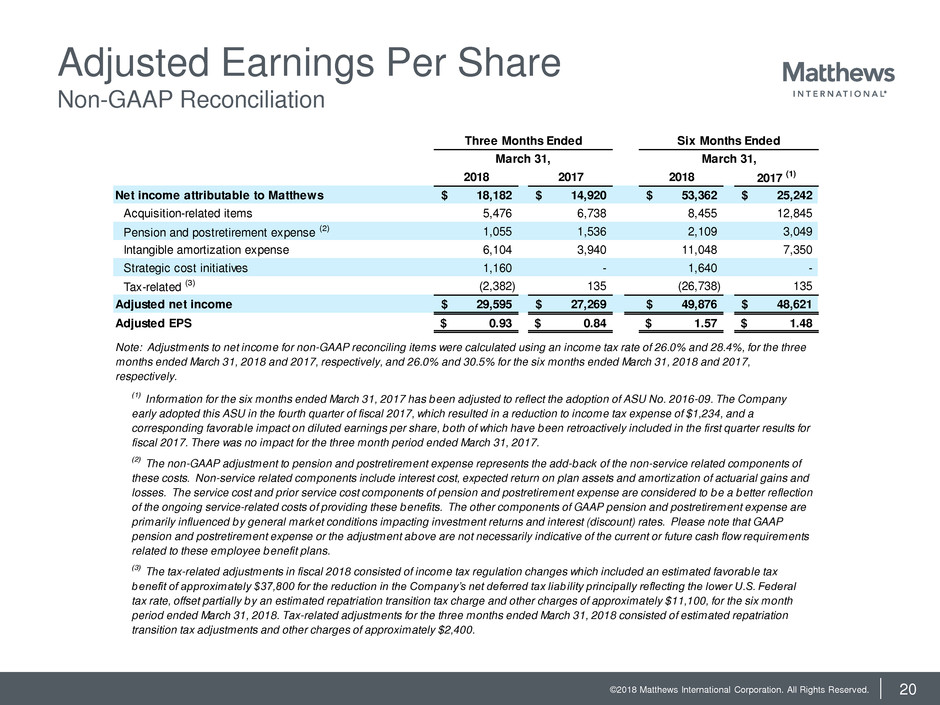

Adjusted Earnings Per Share

Non-GAAP Reconciliation

2018 2017 2018 2017 (1)

Net income attributable to Matthews 18,182$ 14,920$ 53,362$ 25,242$

Acquisition-related items 5,476 6,738 8,455 12,845

Pension and postretirement expense (2) 1,055 1,536 2,109 3,049

Intangible amortization expense 6,104 3,940 11,048 7,350

Strategic cost initiatives 1,160 - 1,640 -

Tax-related (3) (2,382) 135 (26,738) 135

Adjusted net income 29,595$ 27,269$ 49,876$ 48,621$

Adjusted EPS 0.93$ 0.84$ 1.57$ 1.48$

(1)

Information for the six months ended March 31, 2017 has been adjusted to reflect the adoption of ASU No. 2016-09. The Company

early adopted this ASU in the fourth quarter of fiscal 2017, which resulted in a reduction to income tax expense of $1,234, and a

corresponding favorable impact on diluted earnings per share, both of which have been retroactively included in the first quarter results for

fiscal 2017. There was no impact for the three month period ended March 31, 2017.

(2)

The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components of

these costs. Non-service related components include interest cost, expected return on plan assets and amortization of actuarial gains and

losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a better reflection

of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postretirement expense are

primarily influenced by general market conditions impacting investment returns and interest (discount) rates. Please note that GAAP

pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements

related to these employee benefit plans.

(3)

The tax-related adjustments in fiscal 2018 consisted of income tax regulation changes which included an estimated favorable tax

benefit of approximately $37,800 for the reduction in the Company’s net deferred tax liab ility principally reflecting the lower U.S. Federal

tax rate, offset partially by an estimated repatriation transition tax charge and other charges of approximately $11,100, for the six month

period ended March 31, 2018. Tax-related adjustments for the three months ended March 31, 2018 consisted of estimated repatriation

transition tax adjustments and other charges of approximately $2,400.

Three Months Ended Six Months Ended

March 31, March 31,

Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 26.0% and 28.4%, for the three

months ended March 31, 2018 and 2017, respectively, and 26.0% and 30.5% for the six months ended March 31, 2018 and 2017,

respectively.

©2018 Matthews International Corporation. All Rights Reserved. 21

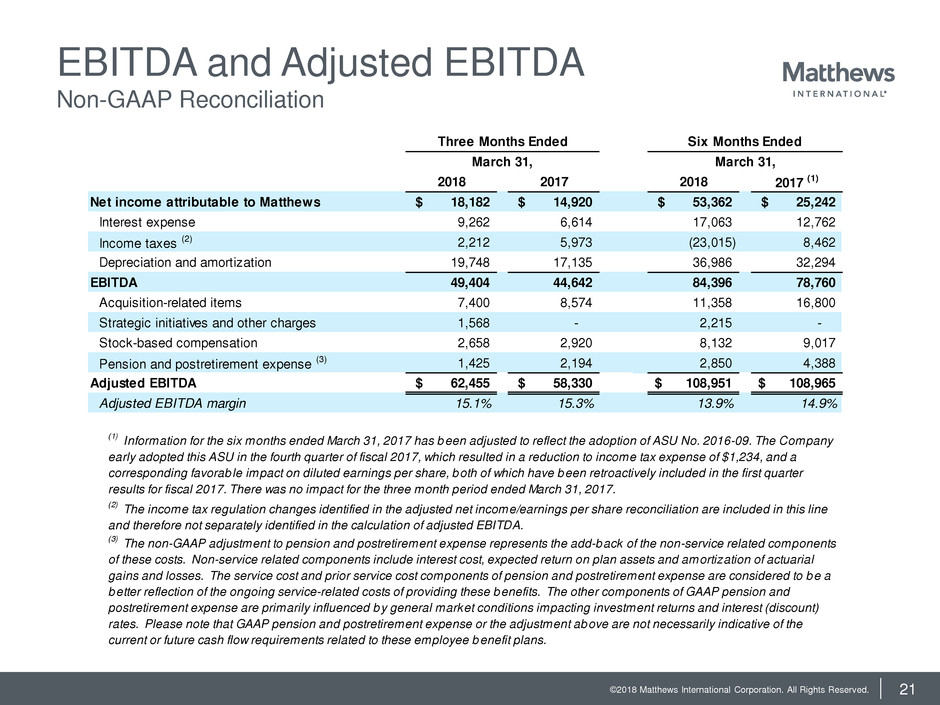

EBITDA and Adjusted EBITDA

Non-GAAP Reconciliation

2018 2017 2018 2017 (1)

Net income attributable to Matthews 18,182$ 14,920$ 53,362$ 25,242$

Interest expense 9,262 6,614 17,063 12,762

Income taxes (2) 2,212 5,973 (23,015) 8,462

Depreciation and amortization 19,748 17,135 36,986 32,294

EBITDA 49,404 44,642 84,396 78,760

Acquisition-related items 7,400 8,574 11,358 16,800

Strategic initiatives and other charges 1,568 - 2,215 -

Stock-based compensation 2,658 2,920 8,132 9,017

Pension and postretirement expense (3) 1,425 2,194 2,850 4,388

Adjusted EBITDA 62,455$ 58,330$ 108,951$ 108,965$

Adjusted EBITDA margin 15.1% 15.3% 13.9% 14.9%

Six Months EndedThree Months Ended

March 31, March 31,

(3)

The non-GAAP adjustment to pension and postretirement expense represents the add-back of the non-service related components

of these costs. Non-service related components include interest cost, expected return on plan assets and amortization of actuarial

gains and losses. The service cost and prior service cost components of pension and postretirement expense are considered to be a

better reflection of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and

postretirement expense are primarily influenced by general market conditions impacting investment returns and interest (discount)

rates. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the

current or future cash flow requirements related to these employee benefit plans.

(1)

Information for the six months ended March 31, 2017 has been adjusted to reflect the adoption of ASU No. 2016-09. The Company

early adopted this ASU in the fourth quarter of fiscal 2017, which resulted in a reduction to income tax expense of $1,234, and a

corresponding favorable impact on diluted earnings per share, both of which have been retroactively included in the first quarter

results for fiscal 2017. There was no impact for the three month period ended March 31, 2017.

(2)

The income tax regulation changes identified in the adjusted net income/earnings per share reconciliation are included in this line

and therefore not separately identified in the calculation of adjusted EBITDA.

©2018 Matthews International Corporation. All Rights Reserved. 22

Adjusted EBITDA by Segment

Non-GAAP Reconciliation

Note: See Disclaimer (Page 2) for Management’s assessment of

supplemental information related to EBITDA and adjusted EBITDA.

(1) Information for the first six months ended March 31, 2017 has

been adjusted to reflect the adoption of ASU No. 2016-09. The

Company early adopted this ASU in the fourth quarter of fiscal

2017, which resulted in a reduction to income tax expense of

$1,234, and a corresponding favorable impact on diluted

earnings per share, both of which have been retroactively

included in the first quarter results for fiscal 2017. There was

no impact for the three month period ended March 31, 2017.

(2) One-time depreciation and amortization charges related to recent

acquisitions are included in the Depreciation and amortization.

(3) Other represents Investment (loss) income, Other income

(deductions), net, and Net loss (income) attributable to

noncontrolling interests

(4) One-time non-operating related charges are included in the

calculation of Adjusted EBITDA.

(5) The non-GAAP adjustment to pension and postretirement

expense represents the add-back of the non-service related

components of these costs. Non-service related components

include interest cost, expected return on plan assets and

amortization of actuarial gains and losses. The service cost and

prior service cost components of pension and post retirement

expense are considered to be a better reflection of the ongoing

service-related costs of providing these benefits. The other

components of GAAP pension and postretirement expense are

primarily influenced by general market conditions impacting

investment returns and interest (discount) rates. Please note that

GAAP pension and postretirement expense or the adjustment

above are not necessarily indicative of the current or future cash

flow requirements related to these employee benefit plans.

2018 2017 2018 2017 (1)

SGK Brand Solutions

Operating profit 5,090$ 4,361$ 8,242$ 8,551$

Depreciation and amortization (2) 12,565 10,926 24,018 19,898

Other (3) (63) 316 (142) 267

EBITDA 17,592 15,602 32,118 28,717

Acquisition-related items (2) 6,139 6,475 9,646 12,877

Strategic initiatives and other charges (4) 429 - 698 -

Stock-based compensation 1,159 1,331 3,576 4,149

Pension and postretirement expense (5) 663 1,020 1,325 2,040

Adjusted EBITDA 25,982$ 24,429$ 47,363$ 47,783$

Memorialization

Operating profit 23,910$ 22,938$ 38,364$ 37,305$

Depreciation and amortization (2) 5,647 5,574 10,248 11,103

Other (3) (64) 323 (145) 273

EBITDA 29,493 28,834 48,467 48,681

Acquisition-related items (2) 1,180 1,956 1,631 3,479

Strategic initiatives and other charges (4) 642 - 930 -

Stock-based compensation 1,290 1,371 3,961 4,259

Pension and postretirement expense (5) 677 1,042 1,354 2,084

Adjusted EBITDA 33,282$ 33,203$ 56,343$ 58,503$

Industrial Technologies

Operating profit 791$ (471)$ 1,109$ 35$

Depreciation and amortization (2) 1,536 636 2,720 1,293

Other (3) (8) 41 (18) 35

EBITDA 2,319 205 3,811 1,362

Acquisition-related items (2) 81 143 81 444

Strategic initiatives and other charges (4) 497 - 587 -

Stock-based compensation 209 218 595 610

Pension and postretirement expense (5) 86 132 171 263

Adjusted EBITDA 3,191$ 698$ 5,244$ 2,679$

Consolidated

Operating profit 29,791$ 26,828$ 47,715$ 45,891$

Depreciation and amortization (2) 19,748 17,135 36,986 32,294

Other (3) (135) 679 (305) 575

EBITDA 49,404 44,642 84,396 78,760

Acquisition-related items (2) 7,400 8,574 11,358 16,800

Strategic initiatives a d other charges (4) 1,568 - 2,215 -

Stock-based com s tion 2,658 2,920 8,132 9,017

Pension and postr ti ent expense (5) 1,425 2,194 2,850 4,388

Adjusted EBITDA 62,455$ 58,330$ 108,951$ 108,965$

March 31, March 31,

©2018 Matthews International Corporation. All Rights Reserved.

Second Quarter Fiscal 2018

Earnings Teleconference

April 27, 2018