Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - IRONWOOD PHARMACEUTICALS INC | a18-12130_1ex31d4.htm |

| EX-31.3 - EX-31.3 - IRONWOOD PHARMACEUTICALS INC | a18-12130_1ex31d3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-34620

IRONWOOD PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

04-3404176 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

301 Binney Street |

|

02142 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 621-7722

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Class A common stock, $0.001 par value |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Aggregate market value of voting stock held by non-affiliates of the Registrant as of June 30, 2017: $2,706,473,658

As of April 20, 2018, there were 137,871,330 shares of Class A common stock outstanding and 13,997,357 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the year ended December 31, 2017 originally filed on February 22, 2018 (the “Original Report”) by Ironwood Pharmaceuticals, Inc. (“Ironwood,” the “company,” “we” or “us”). Pursuant to General Instruction G(3) to Form 10-K, the company incorporated by reference the information required by Part III of Form 10-K from its definitive proxy statement for its 2018 annual meeting of stockholders (the “2018 Proxy Statement”), which the company originally intended to file with the U.S. Securities and Exchange Commission (“SEC”) no later than 120 days after December 31, 2017, the end of its fiscal year. As the 2018 Proxy Statement will not be filed with the SEC before such date, the company is filing this Amendment to provide the additional information required by Part III of Form 10-K.

Also included in this Amendment are (i) the signature page, (ii) certifications required of the principal executive officer and principal financial officer under Section 302 of the Sarbanes-Oxley Act of 2002 and (iii) Item 15, which has been restated in its entirety as set forth below to include the additional certifications and other exhibits. Because no financial statements are contained within this Amendment, we are not including certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as set forth in this Amendment, no other changes are made to the Original Report. Unless expressly stated, this Amendment does not reflect events occurring after the filing of the Original Report, nor does it modify or update in any way the disclosures contained in the Original Report, which speak as of the date of the Original Report. Accordingly, this Amendment should be read in conjunction with the Original Report and the Company’s other SEC filings subsequent to the filing of the Original Report. Some of the information provided in this Amendment may be superseded by the information provided in the 2018 Proxy Statement to be filed with the SEC.

|

|

|

|

|

Page |

|

|

|

1 | ||

|

|

|

5 | ||

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

36 | |

|

|

Certain Relationships and Related Transactions, and Director Independence |

|

40 | |

|

|

|

41 | ||

|

|

|

|

|

|

|

|

|

42 | ||

|

|

|

|

49 | |

Item 10. Directors, Executive Officers and Corporate Governance

Our Board of Directors

The following table sets forth certain information, as of April 30, 2018, with respect to each of our directors:

|

Name |

|

Age |

|

Class |

|

Year |

|

|

Lawrence S. Olanoff, M.D., Ph.D. |

|

66 |

|

II |

|

2018 |

|

|

Amy W. Schulman |

|

57 |

|

II |

|

2018 |

|

|

Douglas E. Williams, Ph.D. |

|

60 |

|

II |

|

2018 |

|

|

Marsha H. Fanucci |

|

65 |

|

III |

|

2019 |

|

|

Terrance G. McGuire, Chair |

|

62 |

|

III |

|

2019 |

|

|

Edward P. Owens |

|

71 |

|

III |

|

2019 |

|

|

Andrew Dreyfus |

|

59 |

|

I |

|

2020 |

|

|

Peter M. Hecht, Ph.D., Chief Executive Officer |

|

54 |

|

I |

|

2020 |

|

|

Julie H. McHugh |

|

53 |

|

I |

|

2020 |

|

Class II Directors (accepted nomination for election at the 2018 annual meeting)

Lawrence S. Olanoff, M.D., Ph.D., 66, Independent

Director since 2015

Dr. Olanoff most recently served as chief operating officer for Forest Laboratories, Inc. (acquired by Allergan plc) from October 2006 to December 2010. Dr. Olanoff also served as a director of Forest from October 2006 to July 2014. From July 2005 to October 2006, Dr. Olanoff was president and chief executive officer at Celsion Corporation. He also served as executive vice president and chief scientific officer of Forest from 1995 to 2005. Prior to joining Forest in 1995, Dr. Olanoff served as senior vice president of clinical research and development at Sandoz Pharmaceutical Corporation (now a division of the Novartis Group) and at the Upjohn Company in a number of positions including corporate vice president of clinical development and medical affairs.

In addition, he is currently an adjunct assistant professor and special advisor to the president for corporate relations at the Medical University of South Carolina (MUSC), an ex-officio director of the MUSC Foundation for Research Development, chairman of the board of the Clinical Biotechnology Research Institute at Roper St. Francis Hospital, a board member of the Horizon Project and the Zucker Institute for Applied Neurosciences, and a former board member of Axovant Sciences Ltd.

Dr. Olanoff received his Ph.D. in biomedical engineering and M.D. degree from Case Western Reserve University. Dr. Olanoff’s detailed knowledge of the pharmaceutical industry, his broad operational experience and his research and development leadership over the course of his career make him an important asset to our board of directors.

Douglas E. Williams, Ph.D., 60, Independent

Director since 2014

Dr. Williams has been the president and chief executive officer of Codiak Biosciences Inc. since August 2015; previously he served as executive vice president, research and development at Biogen Inc. from January 2011 to July 2015. Before joining Biogen, Dr. Williams held several senior executive positions at ZymoGenetics Inc., a biopharmaceutical company, including chief executive officer and a director from January 2009 to October 2010, president and chief scientific officer from July 2007 to January 2009 and executive vice president, research and development and chief scientific officer from 2004 to July 2007. Previously, he held leadership positions within the biotechnology industry, including chief scientific officer and executive vice president of research and development at Seattle Genetics Inc., and senior vice president and

Washington site leader at Amgen Inc. Dr. Williams also served in a series of scientific and senior leadership positions over a decade at Immunex Corp., including as executive vice president and chief technology officer and senior vice president of discovery research, as well as previously serving as a director of the company.

Prior to that, Dr. Williams served on the faculty of the Indiana University School of Medicine and the Department of Laboratory Medicine at the Roswell Park Memorial Institute in Buffalo, New York. Dr. Williams serves on the board of directors of Ovid Therapeutics, Inc., and previously served on the board of directors of Regulus Therapeutics Inc. and Oncothyreon Inc.

Dr. Williams received his B.S. in Biological Sciences from the University of Massachusetts Lowell and Ph.D. in Physiology from the State University of New York at Buffalo, Roswell Park Memorial Institute Division. Dr. Williams brings to our board of directors significant senior management and scientific experience at biotechnology companies, which we believe is important to our goal of maximizing our current products and executing on our corporate strategy and associated pipeline.

Amy W. Schulman, 57, Independent

Director since 2017

In July 2015, Ms. Schulman co-founded and joined Lyndra, Inc. as chief executive officer. In February 2017, she became chief executive officer of Olivo Laboratories, LLC. Ms. Schulman is also a senior lecturer at Harvard Business School, where she was appointed to the faculty in July 2014, and has been a partner at Polaris Partners since August 2014. Ms. Schulman served as chief executive officer of Arsia Therapeutics, Inc. from August 2014 to November 2016 when Arsia was acquired by Eagle Pharmaceuticals, Inc. Ms. Schulman was previously the executive vice president and general counsel of Pfizer Inc. from May 2008 to July 2014, where she also served as the business unit lead for Pfizer’s consumer healthcare business from April 2012 to December 2013. Before joining Pfizer, she was a partner at the law firm DLA Piper, where she was a member of the board and executive policy committees.

Ms. Schulman also serves as a director of Arsanis, Inc., Alnylam Pharmaceuticals, Inc. and Blue Buffalo Pet Products, Inc., and previously served as a director of BIND Therapeutics, Inc. Ms. Schulman graduated with honors with B.A. degrees in philosophy and English from Wesleyan University, where she was elected to Phi Beta Kappa, and earned her J.D. from Yale Law School in 1989. Ms. Schulman brings to our board of directors extensive leadership experience in the biotechnology industry in areas of great importance to the success of our business as we execute on our corporate objectives, including commercial strategy, corporate development and capability building.

Class III Directors (term expires at the 2019 annual meeting)

Marsha H. Fanucci, 65, Independent

Director since 2009

Ms. Fanucci served as senior vice president and chief financial officer of Millennium Pharmaceuticals, Inc. from July 2004 through January 2009, where she was responsible for corporate strategy, treasury, financial planning and reporting and operations. While at Millennium, she also served as vice president, finance and corporate strategy and vice president, corporate development and strategy. Previously, she was vice president of corporate development and strategy at Genzyme Corporation, a biotechnology company, from 1998 to 2000. From 1987 to 1998, Ms. Fanucci was employed at Arthur D. Little, Inc. where she most recently served as vice president and director.

Ms. Fanucci presently serves on the board of directors of Alnylam Pharmaceuticals, Inc. and Syros Pharmaceuticals, Inc., and previously served on the board of directors of Momenta Pharmaceuticals, Inc. She received her B.S. in pharmacy from West Virginia University and her M.B.A. from Northeastern University. Because of her extensive financial experiences at Millennium Pharmaceuticals and Genzyme in addition to her current and former directorships at Syros Pharmaceuticals, Alnylam Pharmaceuticals and Momenta Pharmaceuticals, we believe that Ms. Fanucci provides valuable industry insight and essential financial expertise as we execute our corporate objectives.

Terrance G. McGuire, 62, Independent

Director since 1998

Chair since 2015

Mr. McGuire was a co-founder and is currently a general partner of Polaris Partners. Prior to starting Polaris

Partners in 1996, Mr. McGuire spent seven years at Burr, Egan, Deleage & Co., investing in early stage medical and information technology companies. He serves on the board of directors of Arsanis, Inc. and Pulmatrix, Inc. and several private companies and has served on the boards of Acceleron Pharma, Inc., Akamai Technologies, Inc., Aspect Medical Systems, Inc., Cubist Pharmaceuticals, Inc., deCODE genetics, Inc., Trevena, Inc. and various private companies.

Mr. McGuire is the former chairman of the National Venture Capital Association, which represents ninety percent of the venture capitalists in the U.S., chairman of the board of the Thayer School of Engineering at Dartmouth College, and a member of the boards of The David H. Koch Institute for Integrative Cancer Research at the Massachusetts Institute of Technology and The Arthur Rock Center for Entrepreneurship at Harvard Business School. Mr. McGuire earned a B.S. in physics and economics from Hobart College, an M.S. in engineering from The Thayer School at Dartmouth College, and an M.B.A from Harvard Business School. Mr. McGuire brings to our board extensive experience as a venture capitalist focused on the biotechnology industry, as well as many years of experience as a director of biotechnology companies guiding them in the execution of their corporate strategy and objectives.

Edward P. Owens, 71, Independent

Director since 2013

Mr. Owens was previously partner, portfolio manager and global industry analyst with Wellington Management Company, LLP where he worked in investment management since 1974. He was the portfolio manager of the Vanguard Health Care Fund for 28 years from its inception in May 1984 until his retirement from Wellington in December 2012.

Mr. Owens has a B.S. in physics from the University of Virginia and an M.B.A. from Harvard Business School. He brings to our board extensive experience in evaluating and investing in life sciences companies, providing valuable insight as we continue to strive towards our goal of maximizing long-term stockholder value.

Class I Directors (term expires at the 2020 annual meeting)

Andrew Dreyfus, 59, Independent

Director since 2016

Mr. Dreyfus has served as president and chief executive officer for Blue Cross Blue Shield of Massachusetts, or BCBSMA, one of the largest independent, not-for-profit Blue Cross Blue Shield plans in the country, since September 2010. From July 2005 to September 2010, Mr. Dreyfus served as the executive vice president of health care services of BCBSMA. Prior to joining BCBSMA, he served as the first president of the Blue Cross Blue Shield of Massachusetts Foundation. Mr. Dreyfus also previously served as executive vice president of the Massachusetts Hospital Association and held a number of senior positions in Massachusetts state government, including undersecretary of consumer affairs and business regulation.

Mr. Dreyfus is chair of the board of the National Institute for Health Care Management and serves on the board of directors of BCBSMA, Blue Cross Blue Shield Association, Jobs for Massachusetts, and the advisory board of Ariadne Labs. Mr. Dreyfus received a B.A. in English from Connecticut College. Mr. Dreyfus brings to our board of directors significant expertise in the healthcare payer and reimbursement market, and broad management and executive leadership experience, providing valuable insight as we continue to develop and commercialize medicines in an evolving healthcare landscape.

Peter M. Hecht, 54, Chief Executive Officer

Director and chief executive officer since founding in 1998

Under Dr. Hecht’s leadership, Ironwood has grown from nine Ph.D. scientists to a commercial biotechnology company. Prior to founding Ironwood, Dr. Hecht was a research fellow at Whitehead Institute for Biomedical Research. Dr. Hecht serves on the advisory board of Ariadne Labs. Dr. Hecht earned a B.S. in mathematics and an M.S. in biology from Stanford University, and holds a Ph.D. in molecular biology from the University of California at Berkeley. Dr. Hecht’s experiences as one of our founders and his tenure as our chief executive officer make him a valuable member of our board of directors.

Julie H. McHugh, 53, Independent

Director since 2014

Ms. McHugh most recently served as chief operating officer for Endo Health Solutions, Inc., from March 2010 through May 2013, where she was responsible for the specialty pharmaceutical and generic drug businesses. Prior to joining

Endo, Ms. McHugh was the chief executive officer of Nora Therapeutics, Inc., a venture capital backed biotech start-up company focused on developing novel therapies for the treatment of infertility disorders. Before that she served as company group chairman for Johnson & Johnson’s (J&J) worldwide virology business unit, and previously she was president of Centocor, Inc., a J&J subsidiary. While at J&J, Ms. McHugh oversaw the development and launches of several products, including Remicade® (infliximab), Prezista® (darunavir) and Intelence® (etravirine), and she was responsible for oversight of a research and development portfolio including compounds for HIV, hepatitis C, and tuberculosis. Prior to joining Centocor, Ms. McHugh led the marketing communications for gastrointestinal drug Prilosec® (omeprazole) at Astra-Merck Inc.

She currently serves on the board of visitors for the Smeal College of Business of the Pennsylvania State University as well as on the board of directors of Aerie Pharmaceuticals, Inc., Lantheus Holdings, Inc. and Trevena, Inc., all publicly held companies, and The New Xellia Group, a privately held company. She previously served on the board of directors for ViroPharma Inc., Epirus Biopharmaceuticals, Inc., the Biotechnology Industry Organization (BIO), the Pennsylvania Biotechnology Association and the New England Healthcare Institute (NEHI).

Ms. McHugh received her masters of business administration degree from St. Joseph’s University and her Bachelor of Science degree from Pennsylvania State University. Ms. McHugh’s experience as a chief executive officer and a chief operating officer at large multinational pharmaceutical companies make her a valuable member of our board of directors, particularly as we evolve as a company and seek to maximize our current products and execute on our corporate strategy and associated pipeline.

Audit Committee.

We have a separately designated standing audit committee established by our board for the purpose of overseeing our accounting and financial reporting processes and audits of our financial statements. The members of our audit committee are Mses. Fanucci and McHugh and Mr. Dreyfus. Ms. Fanucci chairs the audit committee. Our audit committee met five times during 2017. Our audit committee assists our board of directors in its oversight of significant risks facing Ironwood, the integrity of our financial statements and our independent registered public accounting firm’s qualifications, independence and performance.

Our audit committee’s responsibilities include:

· reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements, earnings releases and related disclosures;

· reviewing and discussing with management and our independent registered public accounting firm our internal controls and internal auditing procedures, including any material weaknesses in either;

· discussing our accounting policies and all material correcting adjustments with our management and our independent registered public accounting firm;

· discussing with our management and our independent registered public accounting firm any significant risks facing the company and the related mitigation plans, as well as monitoring our internal control over financial reporting and disclosure controls and procedures;

· appointing, overseeing, and approving the compensation for and, when necessary, terminating our independent registered public accounting firm;

· approving all audit services and all permitted non-audit, tax and other services to be performed by our independent registered public accounting firm, in each case, in accordance with the audit committee’s pre-approval policy;

· discussing with the independent registered public accounting firm its independence and ensuring that it receives the written disclosures regarding these communications required by the Public Company Accounting Oversight Board;

· reviewing and approving all transactions or series of similar transactions to which we were or are a party in which the amount involved exceeded or exceeds $120,000 and in which any of our directors, executive officers, holders of more than 5% of any class of our voting securities, or any member of the immediate family of any of the foregoing persons, had or will have a direct or indirect material interest, other than compensation

arrangements with directors and executive officers;

· recommending whether the audited financial statements should be included in our annual report and preparing the audit committee report required by SEC rules;

· reviewing all material communications between our management and our independent registered public accounting firm;

· reviewing, updating and recommending to our board approval of our code of business conduct and ethics; and

· establishing procedures for the receipt, retention, investigation and treatment of accounting related complaints and concerns.

Ms. Fanucci is an audit committee financial expert, as defined in Item 407(d)(5) of Regulation S-K.

Certain information regarding our executive officers is set forth at the end of Part I, Item 1 of the Original Report under the heading, “Executive Officers of the Registrant.”

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors, executive officers and beneficial owners of more than 10% of our Class A common stock and Class B common stock, combined, are required under Section 16(a) of the Exchange Act to file reports of ownership and changes in ownership of our securities with the SEC. Our staff assists our directors and executive officers in preparing ownership reports and reporting ownership changes, and typically files these reports on their behalf. Based on a review of the copies of reports filed by us or by our 10% stockholders and representations that no other reports were required, we believe that during 2017 our directors, executive officers and 10% stockholders complied with all Section 16(a) filing requirements.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics applicable to our directors, executive officers and all other employees. A copy of that code is available on our corporate website at http://www.ironwoodpharma.com. Any amendments to the code of business conduct and ethics, and any waivers thereto involving our executive officers, also will be available on our corporate website. A printed copy of these documents will be made available upon request. The content on our website is not incorporated by reference into this Amendment.

Item 11. Executive Compensation

Executive and Director Compensation

Compensation Discussion and Analysis

Executive Summary

We are a commercial biotechnology company, and we and our named executive officers are committed to our mission of creating and commercializing medicines that make a difference for patients, building value for our fellow stockholders, and empowering our passionate team.

Our executive officer compensation program is designed to attract and motivate the owner-oriented employees we seek and align their interests with those of our fellow stockholders and to create long-term stockholder value. The three primary elements of our executive officer compensation program are base salary, cash bonus and long term equity incentive compensation. Long term equity incentive compensation represents a significant percentage of each named executive officer’s total direct compensation. By linking the ultimate value of their compensation to our stockholders’ returns, we believe this emphasis on equity strongly reinforces the concept of “pay for performance.”

Our current named executive officers have modeled this owner-oriented mindset through their own actions. In aggregate, during the five-year period from 2013 through 2017, they either held or exercised and held more than 80% of their total vested stock options. Further, the majority of options exercised by our named executive officers during this period were exercised because the options were expiring.

In addition, the pay opportunity of our chief executive officer, Dr. Hecht, demonstrates the strong alignment of our compensation program with our stock’s performance. Pay opportunity includes base salary, target bonuses and grant-date fair value of stock options awarded in this time frame, while realizable pay includes actual salary received, bonuses paid and in-the-money value of stock options granted during the period. Dr. Hecht has also consistently declined annual cash bonuses and increases in his base salary, including for 2017, and he continues to earn the salary of $100,000 per year that he was first awarded 20 years ago in 1998.

Our performance in 2017 included the following achievements:

· Irritable Bowel Syndrome with Constipation, or IBS-C, and Chronic Idiopathic Constipation, or CIC

· Grew LINZESS® (linaclotide) U.S. net sales, as reported by Ironwood’s U.S. collaboration partner Allergan plc, to $701.2 million for the full year 2017, an increase of 12% compared to the full year 2016.

· Received U.S. FDA approval for a 72 mcg dose of LINZESS for the treatment of CIC in adult patients in February 2017 and introduced the LINZESS 72 mcg dose into the market in March 2017.

· Updated the linaclotide life cycle management strategy in the U.S., which includes (1) identification of a development path with LINZESS intended to obtain abdominal symptom claims including bloating and discomfort, two highly bothersome symptoms associated with IBS-C, through a single Phase III trial, and (2) advancement of linaclotide delayed release as a potential visceral, non-opioid, pain-relieving agent for patients suffering from all forms of IBS.

· Our partner Astellas Pharma Inc. launched LINZESS for adults with IBS-C in Japan, and submitted a Supplemental New Drug Application with the Pharmaceuticals and Medical Devices Agency in Japan for approval for the additional indication of chronic constipation.

· Uncontrolled Gout

· Received U.S. FDA approval for DUZALLO® (lesinurad and allopurinol) for patients who have not achieved target serum uric acid levels with a medically appropriate dose of allopurinol alone. We began commercializing DUZALLO in October 2017. DUZALLO is the first FDA-approved fixed-dose combination treatment that addresses both causes of hyperuricemia in gout, over-production and under-excretion of serum uric acid, in a single pill.

· Uncontrolled Gastroesophageal Reflux Disease, or uGERD

· Reported positive top-line data from a Phase IIb clinical trial of IW-3718 in adult patients with uGERD, supporting potential advancement into a Phase III program.

· Diabetic Nephropathy and Heart Failure with Preserved Ejection Fraction, or HFpEF

· Advanced our lead sGC stimulator, praliciguat (IW-1973), into Phase II trials for the potential treatment of diabetic nephropathy and of HFpEF.

· Reported top-line data from two Phase IIa trials of praliciguat, demonstrating positive cardiovascular, metabolic and endothelial effects in patients with type 2 diabetes and hypertension.

· Sickle Cell Disease and Achalasia

· Advanced our second clinical sGC stimulator, IW-1701, into Phase II trials for the potential treatment in patients with sickle cell disease and patients with achalasia.

· Financial Highlights

· Recorded Ironwood collaborative arrangements revenue of $298.3 million for the full year 2017, driven primarily by $258.0 million in our share of the net profits from the sales of LINZESS in the

U.S., $29.7 million in linaclotide active pharmaceutical ingredient to Astellas in Japan, $3.1 million in ZURAMPIC and DUZALLO product revenue, and $7.5 million in linaclotide royalties, co-promotion and other revenue.

· Demonstrated strong financial performance, meeting all financial guidance set out at the beginning of 2017.

In determining compensation for our named executive officers, our compensation and HR committee emphasizes the achievement of our corporate goals designed to drive and maximize stockholder value. We made strong progress in 2017. However, we did not achieve all of the aggressive corporate goals that we set in the beginning of the year and, as a result, our company performance achievement multiplier for 2017 was 84% as determined by the compensation and HR committee. Accordingly, payments made to our named executive officers under our annual cash bonus program in 2018 for performance in 2017 were below their target payments.

We highly value the insights and feedback we obtain from our stockholders. Based on the 2017 recommendation of our stockholders, our board determined to provide our stockholders the opportunity to cast an advisory (non-binding) vote on named executive officer compensation, or a “say-on-pay” vote, every year. We believe this will allow our stockholders to provide us with regular, timely and direct input on executive compensation philosophy, policies and practices in order to further align our compensation programs with our stockholders’ interests, and to enhance our ability to take timely stockholder feedback into consideration as part of our compensation review process.

Therefore, this year our stockholders will have an opportunity at the 2018 annual meeting of stockholders to vote on say-on-pay. The last time we sought stockholder input with the say-on-pay vote was at our 2017 annual meeting of stockholders, and over 98% of votes cast by our stockholders voted in support of our named executive officer compensation.

In addition to the formal say-on-pay vote, our senior management frequently meets with stockholders informally through regular investor relations channels to discuss topics important to our business, including Ironwood’s corporate strategy, capital allocation, governance and executive compensation. In 2017, senior management met with nearly all of Ironwood’s top 25 stockholders, representing more than 70% of our outstanding shares. We believe that these discussions are essential to understanding the topics that are most important to our stockholders, and our learnings play a critical role in developing and executing our strategy.

Named Executive Officers

This section discusses the principles underlying our policies and decisions with respect to the compensation of our executive officers who are named in the Summary Compensation Table, or our “named executive officers”. Provided below are all material factors we believe are relevant to an analysis of these policies and decisions. Our named executive officers are:

· Peter M. Hecht, Ph.D., chief executive officer;

· Gina Consylman, chief financial officer and senior vice president;

· Mark G. Currie, Ph.D., senior vice president, chief scientific officer, and president of research and development;

· Halley E. Gilbert, senior vice president, chief legal officer, and secretary;

· Thomas A. McCourt, senior vice president, marketing and sales, and chief commercial officer; and

· Tom Graney, former chief financial officer and senior vice president, finance and corporate strategy.

SEC rules require that we discuss the compensation of all individuals serving in the role of chief financial officer during 2017. As a result, Ms. Consylman, who became chief financial officer effective November 27, 2017, and Mr. Graney, who served as our chief financial officer until September 13, 2017, are discussed in such capacity. Ms. Consylman was previously our interim chief financial officer from September 13, 2017 through November 26, 2017. The only compensation paid to Mr. Graney in connection with his departure was for unused but accrued vacation time.

Compensation Philosophy

The objective of our compensation policies is to provide compensation and incentives that align employee actions and motivations with the interests of our stockholders; attract, motivate and reward outstanding talent across Ironwood through well-communicated programs that are aligned with our core values and business mission; and support a positive company culture.

Our core values are:

· Ownership: drive outstanding long-term value.

· Collaboration: achieve more together.

· Innovation: make a difference for patients.

· Excellence: foster greatness in each other.

· Humanity: act with honesty, integrity and respect.

· Have fun.

In addition, we have incorporated the concept of “critical success factors” into our performance management and compensation philosophy that we believe provide a useful framework for being a productive and successful member of our team. Among other uses, these success factors enable managers to use a common language of expected behaviors upon which individual performance can be managed and evaluated.

We are guided by the following principles with respect to our compensation determinations:

· design compensation and incentive programs that align employee actions and motivations with the interests of our stockholders, support our business objectives and hold employees accountable for the achievement of key goals and milestones;

· foster and support our performance-driven culture by setting clear, high-value, aggressive goals, rewarding outstanding performers to the extent these goals are achieved, and making sure our best performers know clearly that we value their contributions;

· as with all spending, serve as careful stewards of our stockholders’ assets when making compensation decisions;

· maximize our employees’ sense of ownership so that they have a long-term owner’s perspective, can see the impact of their efforts on our success, and can share in the benefits of that success through the opportunity to become stockholders of Ironwood via stock options, restricted stock units (RSUs) and other equity awards;

· recognize that compensation is one of a number of tools to stimulate and reward productivity, great drug making, and successful commercialization, together with recognizing individual growth potential, providing a great workplace culture, and sharing in our success;

· foster a strong team culture, focused on our principles of great drug making and commercializing those drugs that we discover or in-license and develop, which is reinforced through our compensation and incentive programs;

· design compensation and incentive programs that are fair, equitable and competitive; and

· design compensation and incentive programs that are simple and understandable.

Highlighted procedures and tools that we use to ensure effective governance of compensation plans and decisions include:

· our compensation and HR committee has the authority to hire independent counsel and other advisors;

· our compensation and HR committee conducts a regular review and assessment of risk as it relates to our compensation policies and practices;

· as part of our insider trading prevention policy, our executive officers and directors are prohibited from engaging in any hedging or monetization transactions of our common stock, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds;

· we have no perquisites other than broad-based health and welfare benefits, transportation and fitness stipends, a 401(k) plan and a relocation program that we make available to all of our employees; under our relocation program, participants are required to pay back the full amount of all relocation benefits in connection with their departure from Ironwood in certain circumstances;

· our Amended and Restated 2010 Employee, Director and Consultant Equity Incentive Plan, or our 2010 Plan, prohibits options’ repricing (absent stockholder approval) and options’ backdating;

· our executive severance arrangements and our change of control severance benefit plan, which applies to all of our employees including our executive officers, do not provide for tax gross-ups;

· our change of control severance benefit plan contains double-trigger requirements for equity acceleration and other benefits in the event of a change of control;

· eight of our nine directors are independent, including all members of our compensation and HR committee, and, subject to certain limited exceptions, no director may transfer any shares of restricted stock while such person is a director of Ironwood; and

· if we are required to restate our financial results due to our material noncompliance with any financial reporting requirements under the federal securities laws as a result of misconduct, our chief executive officer and chief financial officer may be legally required to reimburse us for any bonus or other incentive-based or equity-based compensation they receive in accordance with the provisions of section 304 of the Sarbanes-Oxley Act of 2002. Additionally, we intend to implement a Dodd-Frank Wall Street Reform and Consumer Protection Act-compliant clawback policy after the SEC issues final rules regarding such requirements.

Basis for Our Compensation Policies and Decisions

Summary

Our compensation policies and individual compensation determinations are evaluated annually, and we take into consideration our results of operations, our long- and short-term goals, individual goals, market data, the competitive market for our executive officers and general economic factors. As set forth in our compensation and HR committee’s written charter, our compensation and HR committee has the responsibility of reviewing and approving the compensation of our executive officers; annually reviewing and determining our chief executive officer’s compensation based on the committee’s evaluation of his performance; recommending to the full board the adoption of new compensation plans; administering our existing plans; recommending director and committee compensation to the full board; and overseeing succession planning for our senior management. In addition, our compensation and HR committee is responsible for ensuring that our compensation policies are aligned with our compensation philosophy and guiding principles.

Our compensation and HR committee makes all of the compensation determinations with respect to each of our executive officers. In making its determinations with respect to Dr. Hecht, our compensation and HR committee takes into account the feedback from the other members of our board, as well as the feedback from each of our other executive officers, and a number of other members of our management team. In making its determinations with respect to each of our executive officers other than Dr. Hecht, our compensation and HR committee takes into account the feedback and recommendations from Dr. Hecht, the executive officer’s direct reports and other members of our management team.

The components of each of our executive officer’s initial compensation package was based on numerous factors, including:

· the individual’s particular background and circumstances, including prior relevant work experience and compensation paid prior to joining us;

· the individual’s role with us and the compensation paid to similar persons in the companies represented in the compensation data that we reviewed;

· the demand for people with the individual’s specific expertise and experience at the time of hire;

· performance goals and other expectations for the position;

· comparison to other executive officers within Ironwood having similar levels of expertise and experience; and

· uniqueness of industry skills.

Our compensation and HR committee has the authority to select and retain independent advisors and consultants to assist it with carrying out its responsibilities, and we are required to pay any related expenses approved by the committee. For 2017, our compensation and HR committee exercised its authority to engage Pearl Meyer & Partners, LLC, or PM, as a compensation consultant. PM reported directly to our compensation and HR committee and did not provide us with any services other than those requested by our compensation and HR committee and the review of this Compensation Discussion and Analysis for conformance with best practices. Based on the scope of our compensation and HR committee’s engagements with PM, it was determined that PM does not have a conflict of interest in its role as compensation consultant under applicable rules.

In order to assist us in setting 2017 compensation, PM conducted a competitive assessment of 2016 compensation for our executive officers, which reflected that Dr. Hecht’s target total cash compensation was well below market median, and while his equity-based compensation bridged some of the gap, his target total direct compensation was below the market median. The assessment also reflected that target total direct compensation for our other executive officers was also below the market median in aggregate. PM’s assessment analyzed:

· base salary;

· target total cash compensation (which is base salary plus the target bonus);

· long-term equity incentives (which are valued based on grant date fair value); and

· target total direct compensation (which is target total cash compensation plus the value of the most recent long-term incentive grant).

The table below reflects our 2016 target compensation in comparison to the competitive assessment data.

|

|

|

2016 Target Compensation vs. |

| ||

|

|

|

Chief Executive |

|

Average for Other |

|

|

Base Salary |

|

13 |

% |

103 |

% |

|

Target Total Cash Compensation |

|

11 |

% |

103 |

% |

|

Equity |

|

100 |

% |

75 |

% |

|

Target Total Direct Compensation |

|

80 |

% |

82 |

% |

In performing this competitive assessment, PM used two data sources—our peer group and data from the Radford Global Life Sciences Survey employing the appropriate industry, headcount and executive role perspectives. Our peer group is comprised of publicly traded companies in the pharmaceutical, biotechnology and life sciences industries that represent competitors for executive talent and capital. In recognition that our peer group companies tend to be larger than us (including with respect to revenues), while the Radford Global Life Sciences Survey includes companies that represent a broader market perspective and may not share our growth prospects, PM combined peer group data and broad industry data for companies

our size weighing each source equally, to enable a composite competitive assessment of executive compensation. Our compensation and HR committee reviewed the 25th, 50th and 75th percentiles for these market composite pay positions to better understand how competitive pay varied with company size and other factors. PM also prepared an analysis of incentive program market trends, including analyses of the short- and long-term elements of compensation as compared to those in our peer group, and a detailed equity usage and dilution analysis of Ironwood as compared with the companies in our peer group.

Our compensation and HR committee considered the results of PM’s competitive assessment in evaluating compensation for 2017, and determined that no significant changes to the design of our executive officers’ compensation were warranted. The results of PM’s assessment have been, and will continue to be, taken into consideration when making compensation decisions, but will not be used to mandate any specific actions.

Our peer group, which was compiled by PM with input from our management team, our board, and our compensation and HR committee, is reviewed annually by our compensation and HR committee for composition and appropriateness. We take a rules-based approach in reviewing and setting our peer group and apply a qualitative lens to the result to help focus the group on the companies with which we are competing for talent. We first identify a potential pool of peer companies from a number of sources, including the companies listing Ironwood in their peer groups and the other companies listed in such peer companies’ peer groups, as well as companies included in third-party peer group assessments. We then apply certain size filters including revenue, number of employees and research and development expense, as well as certain business model filters including product focus, market capitalization and growth.

As a result of the 2017 peer group assessment, our compensation and HR committee, with input from our management team and PM, removed Medivation, Inc. because it was acquired and was no longer a standalone public company, in addition to Arena Pharmaceuticals, Inc. and Merrimack Pharmaceuticals, Inc. because they were determined to be different in size or business model from Ironwood. Our compensation and HR committee added Agios Pharmaceuticals, Inc., Intercept Pharmaceuticals, Inc. and Tesaro, Inc., each of which met all or most of the business model and size filters at the time of our review. As a result, our peer group is composed of the following 15 companies, which at the time of our review had a median market capitalization of approximately $3.3 billion, a median of approximately 545 employees, and a commercial drug or drug candidate in later stage development:

|

Acorda Therapeutics, Inc. |

|

Incyte Corporation |

|

Agios Pharmaceuticals, Inc. |

|

Intercept Pharmaceuticals, Inc. |

|

Alkermes plc |

|

Momenta Pharmaceuticals, Inc. |

|

Alnylam Pharmaceuticals, Inc. |

|

Nektar Therapeutics |

|

AMAG Pharmaceuticals, Inc. |

|

Seattle Genetics, Inc. |

|

Depomed, Inc. |

|

Tesaro, Inc. |

|

Horizon Pharma plc |

|

United Therapeutics Corporation |

|

|

|

Vertex Pharmaceuticals Incorporated |

Process for Determining Individual Compensation and Role of Executive Officers

Each January, our compensation and HR committee, in conjunction with our senior management, finalizes its assessment of our corporate performance for the prior year. Upon completion of our goal assessment, our bonus and equity pools are calibrated for corporate performance and approved by our compensation and HR committee. Our compensation and HR committee assigns a portion of each of these pools to all of our employees other than our executive officers, and delegates the allocation of these portions to our chief executive officer and our chief financial officer. Our compensation and HR committee also approves any salary increase, cash bonus and equity awards for our chief executive officer and, in consultation with our chief executive officer, for each of our other executive officers. In making these compensation-related decisions for 2017, our compensation and HR committee and senior management considered the competitive assessment prepared by PM and described in more detail above, as well as the other factors described in this Compensation Discussion and Analysis.

Additionally, our compensation and HR committee may decide, as appropriate, to modify the mix or amount of base salary, bonus, and long-term incentives to best fit an executive officer’s specific circumstances or, if required by competitive market conditions, to attract and motivate skilled personnel. For example, our compensation and HR committee may decide to grant additional equity awards to an executive officer if that officer receives a base salary or cash bonus award significantly below that of his or her counterparts in our peer group or other market data reviewed by our compensation and HR committee, despite successful attainment of our corporate or his or her individual goals. We believe that this discretion and flexibility allows our compensation and HR committee to better achieve our compensation objectives.

Corporate and Individual Goals for 2017

For 2017, allocations of cash and equity awards were, in large part, dependent upon us meeting certain weighted corporate performance goals. We work thoughtfully with our compensation and HR committee and other members of our board of directors to establish what we believe are challenging corporate goals. In early 2017, our compensation and HR committee approved the following corporate performance goals for 2017:

· maximizing the impact of our products, including successfully driving appropriate growth of our IBS/CIC franchise and our gout franchise in the United States according to certain financial and commercial performance metrics, obtaining approval of a new dose of LINZESS, and obtaining approval of and launching DUZALLO;

· accessing value-creating assets;

· advancing our mid- and late-stage pipeline programs by achieving clinical and other milestones;

· meeting certain financial goals; and

· leveraging our talent, team and culture by further embedding quality into our culture, evolving our dynamic culture as a source of competitive advantage, improving capabilities, and enhancing value through communications.

In addition to the foregoing corporate performance goals, our compensation and HR committee also approved certain challenging stretch goals directly related to our corporate goals, and which were intended to inspire innovation, creativity and strong performance. Dr. Hecht’s performance evaluation was based primarily on the achievement of our corporate goals. Our other executive officers were evaluated on the achievement of corporate goals and additional individual goals which contribute toward, and relate directly to, the accomplishment of our corporate goals.

Our performance against 2017 corporate goals was used to determine compensation awards and adjustments in early 2018. In January 2018, our compensation and HR committee determined that we achieved 84% of our 2017 corporate goals. These goals and our actual level of achievement of these goals in 2017, are as follows:

|

Corporate Goal |

|

Target |

|

Actual Level of |

|

|

Maximize the impact of our products: successfully drive appropriate growth of our IBS/CIC franchise and our gout franchise in the United States according to certain financial and commercial performance metrics, obtain approval of a new dose of LINZESS, and obtain approval of and launch DUZALLO |

|

35 |

% |

26 |

% |

|

Access value-creating assets |

|

5 |

% |

5 |

% |

|

Advance our mid- and late-stage pipeline programs by achieving clinical and other milestones |

|

30 |

% |

28 |

% |

|

Meet certain financial goals |

|

15 |

% |

11 |

% |

|

Leverage our talent, team and culture |

|

15 |

% |

14 |

% |

|

Totals |

|

100 |

% |

84 |

% |

In addition to the 2017 corporate goals identified above, for which each of our named executive officers was directly accountable, the following is a summary of the 2017 individual goals for our named executive officers set in early 2017, other than Dr. Hecht, who is compensated primarily on the basis of the achievement of our corporate goals.

|

Name |

|

Summary of Individual Goals |

|

Gina Consylman |

|

· Serve as an enterprise leader and strategic partner to the chief executive officer in all parts of our business · Lead and guide the company on all financial decisions, including managing a strong balance sheet to enable the company to meet its objectives and be positioned to achieve its long-term goals |

|

|

|

· Drive value creation in the evaluation and, when appropriate, pursuit of business development opportunities for the organization through effective cross-functional collaboration and strategic guidance · Represent Ironwood within the investment community · Ensure company compliance with financial regulations and standards, including those related to The Sarbanes-Oxley Act of 2002, as well as SEC reporting · Evolve our culture of ownership, collaboration and innovation to drive incremental value for the company · Create integrated workforce, talent and capability plans that position us to execute our goals and longer-term strategy |

|

|

|

|

|

Mark G. Currie, Ph.D. |

|

· Serve as an enterprise leader and strategic partner to the chief executive officer in all parts of our business · Serve as strategic leader on all research and development decisions and manage investments and expenses to enable the company to meet its objectives and be positioned to achieve its long-term goals · Advance our products and product candidates and further our discovery efforts through pipeline investments in the key value drivers of our business, including with respect to our mid to late stage pipeline · Enhance the clinical profile of LINZESS and drive linaclotide development programs to advance in additional indications, populations and formulations · Leverage internal research and development capability to support the advancement of our uncontrolled gout program · Drive value creation in the evaluation and, when appropriate, pursuit of business development opportunities for the organization through effective cross functional collaboration and strategic guidance · Evolve our culture of ownership, collaboration and innovation to drive incremental value for the company · Create integrated workforce, talent and capability plans that position us to execute our goals and longer-term strategy |

|

|

|

|

|

Halley E. Gilbert |

|

· Serve as an enterprise leader and strategic partner to the chief executive officer in all parts of our business · Lead and guide the company on all legal decisions and appropriately manage investments and expenses to enable the company to meet its objectives and be positioned to achieve its long-term goals · Provide the highest quality advice on all legal, intellectual property and compliance matters, serving the company’s priority business objectives while ensuring financial management and discipline and managing and mitigating risk · Drive value creation in the evaluation and, when appropriate, pursuit of business development opportunities for the organization through effective cross functional collaboration and strategic guidance · Evolve our culture of ownership, collaboration and innovation to drive incremental value for the company · Create integrated workforce, talent and capability plans that position us to execute our goals and longer-term strategy |

|

|

|

|

|

Thomas A. McCourt |

|

· Serve as an enterprise leader and strategic partner to the chief executive officer in all parts of our business · Serve as strategic leader on all commercial decisions and appropriately manage investments and expenses to enable the company to meet its objectives and be positioned to achieve its long-term goals · Build brand awareness and appropriate growth, while enhancing the global brand for linaclotide through close collaboration with partners and other members of senior management · Drive demand for LINZESS and build Gout franchise through sales of ZURAMPIC and DUZALLO |

|

|

|

· Lead the commercial field sales force in successfully commercializing our products, while maintaining a culture of compliant, patient centered care · Drive value creation in the evaluation and, when appropriate, pursuit of business development opportunities for the organization through effective cross functional collaboration and strategic guidance · Evolve our culture of ownership, collaboration and innovation to drive incremental value for the company · Create integrated workforce, talent and capability plans that position us to execute our goals and longer-term strategy |

|

|

|

|

|

Tom Graney |

|

· Serve as an enterprise leader and strategic partner to the chief executive officer in all parts of our business · Lead and guide the company on all financial decisions, including managing a strong balance sheet to enable the company to meet its objectives and be positioned to achieve its long term goals · Lead corporate strategy and business development functions to drive Ironwood’s growth and long term success · Drive value creation in the evaluation and, when appropriate, pursuit of business development opportunities for the organization through effective cross functional collaboration and strategic guidance · Guide the company on strategic portfolio investment decisions focused on delivering value · Drive long-range planning based on the corporate strategy, portfolio opportunities and risks, financing needs, valuation models and organizational capabilities · Evolve our culture of ownership, collaboration and innovation to drive incremental value for the company · Create integrated workforce, talent and capability plans that position us to execute our goals and longer-term strategy |

In early 2018, Dr. Hecht evaluated each named executive officer’s individual performance and provided feedback and made recommendations to our compensation and HR committee, which approved the named executive officers’ compensation, taking into account Ironwood’s level of achievement of its corporate goals as well as the fact that each named executive officer met or exceeded all or substantially all of his or her respective individual goals for 2017.

Compensation Actions in 2017 and 2018

Summary

The following table summarizes the compensation actions taken by our compensation and HR committee for each of our named executive officers in recognition of the company’s and his or her performance in 2017 and to motivate him or her toward achievement of our goals in 2018.

|

Name |

|

Peter M. |

|

Gina |

|

Mark G. |

|

Halley E. |

|

Thomas A. |

|

Tom |

| ||||||

|

Title |

|

Chief |

|

Chief |

|

Senior |

|

Senior |

|

Senior |

|

Former |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Base salary increase |

|

— |

(2) |

$ |

— |

(3) |

$ |

15,000 |

|

$ |

20,000 |

|

$ |

15,000 |

|

— |

| ||

|

2017 base salary |

|

$ |

100,000 |

|

$ |

415,000 |

|

$ |

470,000 |

|

$ |

440,000 |

|

$ |

450,000 |

|

$ |

445,000 |

|

|

2018 base salary |

|

$ |

100,000 |

|

$ |

415,000 |

|

$ |

485,000 |

|

$ |

460,000 |

|

$ |

465,000 |

|

— |

| |

|

Cash bonus(4) |

|

— |

(2) |

$ |

185,000 |

|

$ |

210,000 |

|

$ |

195,000 |

|

$ |

191,000 |

|

— |

| ||

|

Annual restricted stock units awarded(5) |

|

— |

|

30,000 |

(6) |

— |

|

35,000 |

|

21,875 |

|

— |

| ||||||

|

Annual stock options awarded(7) |

|

390,000 |

|

60,000 |

(6) |

215,000 |

|

70,000 |

|

131,250 |

|

— |

| ||||||

|

Stock options awarded in lieu of base salary increase and cash bonus(7) |

|

190,000 |

(8) |

— |

|

— |

|

— |

|

— |

|

— |

| ||||||

(1) Mr. Graney departed from Ironwood in September 2017.

(2) Our compensation and HR committee recommended a salary increase and a cash bonus for Dr. Hecht, but he declined to accept either.

(3) Ms. Consylman’s base salary, reviewed and approved by the compensation and HR committee in November 2017 in connection with her promotion to chief financial officer, remained $415,000 for 2018 due to the substantial completion of calendar year 2017 at the time of her promotion. Ms. Consylman’s salary as Vice President of Finance and Chief Accounting Officer prior to her promotion in 2017 was $325,700.

(4) Consists of payments made under our annual cash bonus program in 2018 for performance in 2017.

(5) These RSUs for shares of our Class A common stock were awarded on February 21, 2018 under our 2010 Plan and vest over four years as to 25% of the award on each approximate anniversary of the grant thereof.

(6) The equity grant Ms. Consylman received in 2018 connection with her 2017 promotion is excluded from the table above, as it was not part of our annual compensation process, and is discussed elsewhere in this Amendment.

(7) These stock options for shares of our Class A common stock were granted under our 2010 Plan and have an exercise price of $14.55 per share (the closing price of our Class A common stock on the NASDAQ Global Select Market on the grant date of February 21, 2018). Such stock options vest over four years as to 1/48th of the award on each monthly anniversary of January 1, 2018.

(8) Our compensation and HR committee consulted with PM to understand competitive market trends for chief executive officer total direct compensation and elected to grant Dr. Hecht an additional annual stock option award, which is discussed further below, in order to keep his overall compensation competitive with that of our peers while accounting for his declination of a salary increase or a cash bonus.

Chief Executive Officer

Dr. Hecht’s salary of $100,000 represents the salary that he has been receiving since he began serving as chief executive officer in 1998, and his compensation is reviewed and approved annually by our compensation and HR committee. In January 2018, our compensation and HR committee recommended an increase to Dr. Hecht’s base salary to be market competitive with his peers, as well as a bonus based on our achievement of 84% of our corporate goals, but Dr. Hecht declined to accept either. Since co-founding Ironwood in 1998, Dr. Hecht has declined both cash bonuses and increases to base salary each year. Dr. Hecht has further indicated to our compensation and HR committee that he would not expect or desire his cash compensation to increase in the future.

We recognize that Dr. Hecht’s cash compensation is well below his market peers, but believe that the emphasis on stock ownership significantly aligns his interests with those of our fellow stockholders’ and the creation of long-term stockholder value. In lieu of cash bonuses or salary increases, our compensation and HR committee has granted Dr. Hecht stock options to keep his overall compensation competitive with that of our peers. In January 2017, Dr. Hecht was granted an annual stock option award of 530,000 shares based primarily on 123% achievement of our 2016 corporate goals, and an additional stock option award of 230,000 shares in lieu of a cash bonus or salary increase. In February 2018, Dr. Hecht was granted an annual stock option award of 390,000 shares based primarily on the achievement of 84% of our 2017 corporate goals, as well as an additional stock option award of 190,000 shares in lieu of a cash bonus or salary increase. We expect that

Dr. Hecht’s total compensation mix will continue to be focused more heavily on equity than our other executive officers.

We believe that time-based stock options are inherently performance-based, as they provide value to the recipient only if there is future stock price appreciation and do not provide any value if the stock price declines below the exercise price. This results in a close alignment of chief executive officer compensation with the value of our long-term stockholders’ investment in Ironwood. Dr. Hecht has long been a substantial stockholder in the company, currently beneficially owning nearly 5% of our total outstanding stock as of March 31, 2018 (as calculated in the beneficial ownership table beginning on page 36). In addition, in the five-year period from 2013 through 2017, Dr. Hecht either held or exercised and held approximately 90% of his total vested stock options, demonstrating his commitment to Ironwood and his alignment with our stockholders. Further, nearly all stock options exercised by Dr. Hecht during this period were exercised because they were expiring and the vast majority of stock options exercised and sold during this period were to cover the tax liabilities arising out of the exercises of such stock options as well as prior exercises in which Dr. Hecht paid the exercise price and held the underlying shares at the time of exercise.

Five-year Pay Opportunity vs. Five-year Realizable Pay

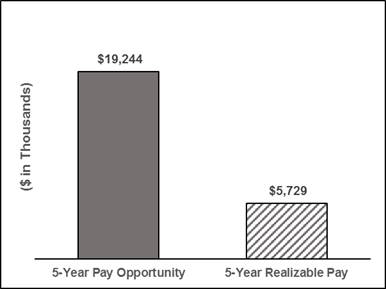

In the past five years, applying a Black-Scholes valuation methodology of the stock option grants issued to Dr. Hecht, because of our stock price performance, Dr. Hecht’s realizable pay has significantly trailed his disclosed pay opportunities as shown in the chart below. Dr. Hecht’s realizable pay is approximately 30% of the pay opportunity provided from 2013 through 2017, significantly driven by the value of the stock options granted to him during this period.

· Pay opportunity is defined as planned base salary, target bonuses and grant-date fair value of stock options granted from 2013 through 2017.

· Realizable pay is defined as actual salary received, bonuses paid and in-the-money value of stock options granted from 2013 through 2017 calculated by determining the difference between the December 29, 2017 closing price of our Class A common stock on the NASDAQ Global Select Market and the exercise price of each stock option.

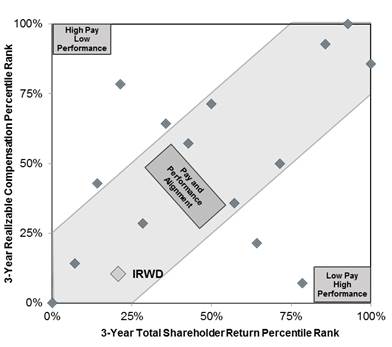

Three-year Realizable Pay vs. Three-year Total Shareholder Return

Further, Dr. Hecht’s total realizable pay from 2015 through 2017 shows a strong connection to our total shareholder return, or TSR, relative to our peer group, as shown in the graph below. Data points that are within the shaded area designate peer group companies that exhibit pay-for-performance alignment (meaning less than 25 percentage point difference between CEO realizable pay percentile and company TSR percentile).

· Realizable pay percentile rank was determined using Dr. Hecht’s realizable pay for 2015 through 2017 and comparing it to realizable pay for the CEOs of our peer group companies for 2014 through 2016, which is the most recent period for which data was available as of December 31, 2017, in each case as reported by the applicable company in its proxy statement.

· TSR percentile rank was determined using the actual TSR for Ironwood from 2015 through 2017 and for each of the companies in our peer group for the period from 2014 through 2016, which is the most recent period for which data was available as of December 31, 2017.

This analysis shows appropriate alignment of Dr. Hecht’s compensation with our TSR for 2015 through 2017. We believe this is a complete depiction of pay and performance alignment for the following reasons:

· The analysis is based on the peer group set by the compensation and HR committee and described above;

· It takes into account stock price movement after the grant date (as opposed to grant date fair value reported in the Summary Compensation Table);

· For performance-based equity, the number of shares or units actually vesting is used for time periods where the performance period has been completed; and

· It excludes Other Compensation reported in the Summary Compensation Table which includes items that are not part of total direct compensation. For Ironwood, All Other Compensation is typically a small portion (i.e., 2-3% for) of Summary Compensation Table pay for Dr. Hecht for the entire year. However, at our peer group companies, items related to executive turnover such as severance payments, vacation payouts to former executives and relocation payments are reported as All Other Compensation, which can be significant and can skew pay levels.

Other Named Executive Officers

Base Salary

In January 2017, our compensation and HR committee reviewed and approved the following base salaries for 2017 for our named executive officers other than Dr. Hecht: Dr. Currie received a $16,000 increase in base salary from $454,000 to $470,000, Ms. Gilbert received a $17,000 increase in base salary from $423,000 to $440,000, Mr. McCourt received a

$15,000 increase in base salary from $435,000 to $450,000, and Mr. Graney received a $10,000 increase in base salary from $435,000 to $445,000. The increase in base salary for each of Dr. Currie, Ms. Gilbert, Mr. McCourt and Mr. Graney was in recognition of their meeting or exceeding all or substantially all of their respective individual performance goals in 2016, and took into account peer group and other market data from the PM competitive assessment discussed above. Ms. Consylman became chief financial officer of the company in November 2017, at which time, our compensation and HR committee reviewed and approved a base salary of $415,000 for Ms. Consylman, a $89,300 increase in base salary from $325,700, her salary as Vice President of Finance and Chief Accounting Officer prior to her promotion. In setting Ms. Consylman’s base salary, our compensation and HR committee considered a number of factors, including Ms. Consylman’s background, the compensation paid to chief financial officers at our peer group companies and other benchmark data, and executive compensation parity within Ironwood, as well as input from PM.

In January 2018, our compensation and HR committee reviewed and approved the following base salaries for 2018 for our named executive officers other than Dr. Hecht: Dr. Currie received a $15,000 increase in base salary from $470,000 to $485,000, Ms. Gilbert received a $20,000 increase in base salary from $440,000 to $460,000; and Mr. McCourt received a $15,000 increase from $450,000 to $465,000. Ms. Consylman’s base salary, reviewed and approved by the compensation and HR committee in November 2017, remained $415,000 for 2018 due to the substantial completion of calendar year 2017 at the time of her promotion.

Bonus

In January 2018, our compensation and HR committee reviewed and approved the following bonuses for 2017 performance for our named executive officers other than Dr. Hecht: Ms. Consylman—$185,000, Dr. Currie—$210,000, Ms. Gilbert—$195,000 and Mr. McCourt—$191,000. Seventy percent of such bonus amounts for Ms. Consylman, Dr. Currie, Ms. Gilbert and Mr. McCourt was tied solely to the achievement of 84% of our corporate goals (as described above), and 30% of such amounts was tied to corporate and individual goal achievement. Each of Ms. Consylman, Dr. Currie, Ms. Gilbert and Mr. McCourt met or exceeded all or substantially all of their respective individual goals for 2017. Mr. Graney did not receive a bonus for 2017 performance because he departed from Ironwood in September 2017.

Annual Equity Awards

Our compensation and HR committee has set the equity pool each year based on achievement of our corporate goals. Individual equity award amounts are then determined based on peer group and market data, and our compensation and HR committee has adjusted these amounts after considering relative company performance and, in the case of our executive officers other than Dr. Hecht, individual performance.

Our compensation and HR committee determined that we achieved 123% of our 2016 corporate goals. Ms. Consylman, Dr. Currie, Ms. Gilbert, Mr. McCourt and Mr. Graney met or exceeded all or substantially all of their respective individual goals in 2016. Accordingly, in January 2017, each of our named executive officers other than Dr. Hecht was awarded the following stock option and RSU awards for Class A common stock based on performance during 2016:

|

Executive Officer* |

|

2017 Annual Stock Option |

|

2017 Annual RSU |

|

|

Gina Consylman |

|

— |

|

26,250 |

* |

|

Mark G. Currie, Ph.D. |

|

250,000 |

|

— |

|

|

Halley E. Gilbert |

|

80,000 |

|

40,000 |

|

|

Thomas A. McCourt |

|

157,500 |

|

26,250 |

|

|

Tom Graney |

|

127,500 |

|

21,250 |

|

* Ms. Consylman became chief financial officer of the company in November 2017, and her annual equity award in 2017 for 2016 performance reflected her prior role as Vice President of Finance and Chief Accounting Officer.

These stock options and RSUs were granted on February 27, 2017 under our 2010 Plan. The stock options have an exercise price of $16.77 per share (the closing price of our Class A common stock on the NASDAQ Global Select Market on

the grant date).

Our compensation and HR committee determined that we achieved 84% of our 2017 corporate goals. Ms. Consylman, Dr. Currie, Ms. Gilbert and Mr. McCourt met or exceeded all or substantially all of their respective individual goals in 2017. Accordingly, in February 2018, each of our named executive officers other than Dr. Hecht was awarded the following stock option and RSU awards for Class A common stock based on performance during 2017:

|

Executive Officer* |

|

2018 Annual Stock Option |

|

2018 Annual RSU |

|

|

Gina Consylman |

|

60,000 |

|

30,000 |

|

|

Mark G. Currie, Ph.D. |

|

215,000 |

|

— |

|

|

Halley E. Gilbert |

|

70,000 |

|

35,000 |

|

|

Thomas A. McCourt |

|

131,250 |

|

21,875 |

|

*Mr. Graney did not receive an annual equity award in 2018 because he departed from Ironwood in September 2017.

These stock options and RSUs were granted on February 21, 2018 under our 2010 Plan. The stock options have an exercise price of $14.55 per share (the closing price of our Class A common stock on the NASDAQ Global Select Market on the grant date).

In addition, in connection with Ms. Consylman’s promotion to chief financial officer in November 2017, Ms. Consylman received an additional grant of 15,000 stock options and 7,500 RSUs, each for shares of our Class A common stock under our 2010 Plan, on January 2, 2018. Subject to Ms. Consylman’s continued employment with the company, (i) such stock options will vest over four years as to 1/48th of the total shares on each monthly anniversary of Ms. Consylman’s promotion, and (ii) such RSUs will vest as to 25% of the shares on each approximate anniversary of the grant.

Other Compensation