Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CTS CORP | q12018investorpresentation.htm |

April 2018

April 2018

Safe Harbor Statement

This presentation contains statements that are, or may be deemed to be, forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but

are not limited to, any financial or other guidance, statements that reflect our current expectations concerning

future results and events, and any other statements that are not based solely on historical fact. Forward-looking

statements are based on management's expectations, certain assumptions and currently available information.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of

the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily

are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties

and other factors, which could cause our actual results, performance or achievements to differ materially from

those presented in the forward-looking statements. Examples of factors that may affect future operating results

and financial condition include, but are not limited to: changes in the economy generally and in respect to the

businesses in which CTS operates; unanticipated issues in integrating acquisitions; the results of actions to

reposition our businesses; rapid technological change; general market conditions in the automotive,

communications, and computer industries, as well as conditions in the industrial, defense and aerospace, and

medical markets; reliance on key customers; unanticipated natural disasters or other events; the ability to protect

our intellectual property; pricing pressures and demand for our products; unanticipated developments that could

occur with respect to contingencies such as litigation and environmental matters as well as any product liability

claims; and risks associated with our international operations, including trade and tariff barriers, exchange rates

and political and geopolitical risks. Many of these, and other, risks and uncertainties are discussed in further detail

in Item 1A. of CTS’ Annual Report on Form 10-K. We undertake no obligation to publicly update our forward-

looking statements to reflect new information or events or circumstances that arise after the date hereof,

including market or industry changes.

2

2017 Sales: $423 Million

Sales by Market:

▪ Transportation – 65%

▪ Industrial – 18%

▪ Medical – 9%

▪ Aero & Defense – 4%

▪ Telecom & IT – 4%

Sales by Region:

▪ Americas – 54%

▪ Asia – 31%

▪ Europe – 15%

Our Company

Ticker: CTS (NYSE)

Founded: 1896

Business: CTS is a leading designer

and manufacturer of sensors,

actuators and electronic components.

Locations: 15 manufacturing locations

throughout North America, Asia and

Europe.

Number of Employees: ~3,200

Globally

Note: Sales by market and region based on trailing twelve months

sales as of March 31, 2018

3

Our History - 120 Years of Innovation

4

Our Vision and Value Proposition

We aim to be a leading provider of sensing and motion devices as well as

connectivity components, enabling an intelligent and seamless world.

5

Product Applications in Transportation

Engine Efficiency

▪ Accelerator Pedal Module

▪ Current Sensor

▪ Gear Position Sensor

▪ Throttle Position Sensor

▪ Turbo Actuator

▪ Turbo Position Sensor

▪ Variable Valve Lift Sensor

Key Customers

6

Fuel Handling

▪ Contacting Fuel Level Card

Chassis / Driveline

▪ Brake Pedal Sensor

▪ Chassis Height Sensor

▪ Transmission Speed

Sensor

▪ Transmission Range

Sensor

▪ Wheel Speed Sensor

Occupant Safety

▪ Seat Belt Buckle Switch

▪ Seat Belt Tension Sensor

▪ Seat Track Position Sensor

Exhaust Management /

Aftertreatment

▪ EGR Position Sensor

▪ DPF RF SensorAutonomous Drive

▪ PLL Module

Key Customers

Industrial Printers, HVAC, Automation and Safety Products

▪ Piezo Micro-Actuators

▪ Switches

▪ Encoders

▪ Frequency Control

▪ EMI Filters

▪ Flow Meter Transducers

▪ Thermal Solution For LED High Bay Lighting

Product Applications in Industrial

7

Industrial Inkjet Printers

Industrial HVAC

Product Applications in Medical

Key Customers

Ultrasound / IVUS, Infusion Pumps, CPAPs and other medical devices

▪ Single Crystal Piezo

▪ Bulk Piezo

▪ Encoders

▪ Frequency Control

▪ Piezo Micro-Valves

▪ Switches

▪ Joysticks

8

Infusion Pumps

CPAP Machines

Ultrasound Equipment

Dental Equipment

Key Customers

Military Sonar and Communication Products

▪ Piezo Hydrophones

▪ Piezo Sonar Arrays

▪ Frequency Control

▪ EMI Filters

Product Applications in Aero & Defense

9

Unmanned Aerial

Vehicles (UAV)

Maritime Applications

Communications Products

▪ RF Filters

▪ EMI/RFI Filters

▪ Frequency Control

▪ Timing Modules

▪ Thermal Products

▪ Multilayer Piezo

▪ Bulk Piezo

Product Applications in Telecom & IT

10

Key Customers

Macro Cell Base Stations

Small Cell Base Stations

Mobile Devices

Backhaul CommunicationsWireless Infrastructure

Wireline Infrastructure

Positioning for Growth with Fundamental Market Trends

11

Autonomous

Vehicle

SMART

Smart Home/

Building

Unmanned

Aerial Vehicles

(Drones)

Improved

Medical

Diagnosis

Fuel Efficiency/

Vehicle

Electrification

Miniaturization

Energy

Harvesting

EFFICIENT

Green Buildings

Diagnos

Remote

Monitoring

Industry 4.0

Internet of

Things

5G & Small

Cells

CONNECTED

Elec ifi io

Communications

Information

Technology

Transportation

IndustrialMedical

Defense &

Aerospace

Moni or

5G mall

emote

CTS Addressable Markets Expected to Grow Mid-Single Digits

12

▪ Hydrophones for sonar applications

▪ Military communication

Organic Growth Drivers

▪ 100GB & 400GB wireline networks

▪ Small cell deployment

▪ Security and haptics for mobile devices

▪ 3D and textile printing

▪ New products for industrial controls

▪ Actuators for harsh environments

▪ RF Sensing for particulate filters

▪ Autonomous drive

▪ Medical 3D/4D ultrasound

▪ HMI control for medical devices

▪ Wireless pacemakers

Aero & Defense

Telecom & IT

Industrial

Transportation

Market

Medical

SAM in $ Billions

$2.9

$1.1

$0.9

$0.3

$1.1

Organic Growth

13

Investments to Grow

Technologies and Products that

Sense, Connect and Move

Total Booked Business

Note: Total Booked Business represents open purchase orders, contractual commitments, and the total expected lifetime revenue from business

awarded to CTS in multi-year platform awards.

($ Millions)

Dec 2017 Mar 2018

$351

$1,762

Expected to ship in 2018

▪ Improve Customer Intimacy

▪ R&D Investments at ~6% of Sales

▪ Enhance Sales Force Capabilities

▪ Improvements to Cost Structure

▪ Continuous Improvement

$1,737

$295

Targeted Acquisitions

14

Disciplined approach to acquisitions:

▪ Returns in excess of cost of capital

▪ Accretive to earnings

▪ Maintain balance sheet strength

▪ Synergy opportunities

▪ Targeting 10% growth (both inorganic and organic)

Expand

Product

Range

Broaden

Geographic

Reach

Enhance

Technology

Portfolio

Strengthen

Customer

Relationships

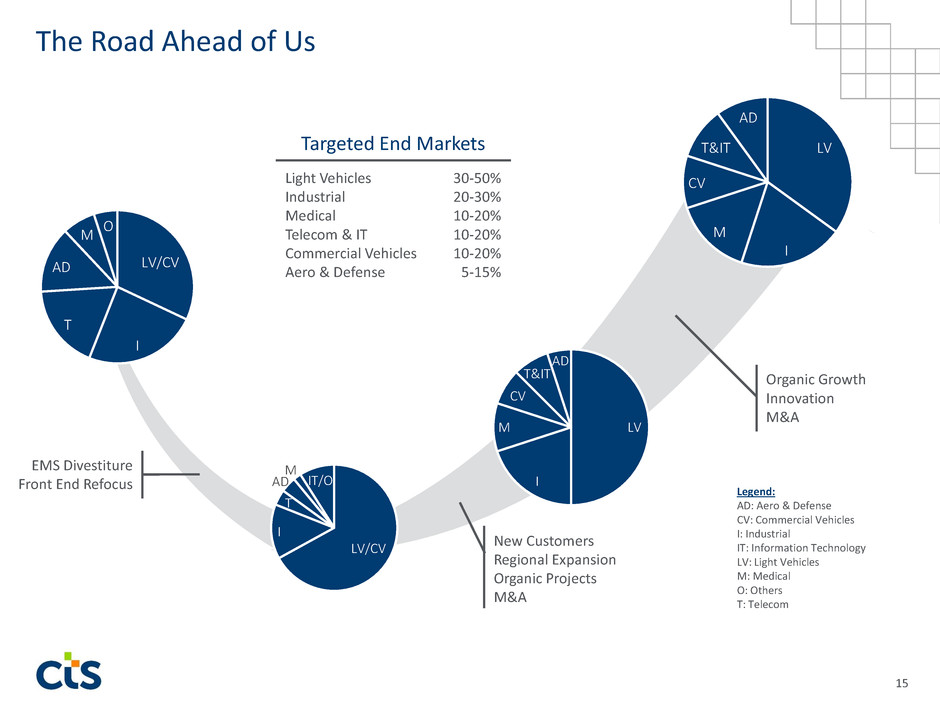

The Road Ahead of Us

LV

I

M

CV

T&IT

AD

LV/CV

I

T

AD

M

IT/O

LV

I

M

CV

T&IT

AD

30-50%

20-30%

10-20%

10-20%

10-20%

5-15%

Targeted End Markets

Light Vehicles

Industrial

Medical

Telecom & IT

Commercial Vehicles

Aero & Defense

EMS Divestiture

Front End Refocus

New Customers

Regional Expansion

Organic Projects

M&A

Legend:

AD: Aero & Defense

CV: Commercial Vehicles

I: Industrial

IT: Information Technology

LV: Light Vehicles

M: Medical

O: Others

T: Telecom

Organic Growth

Innovation

M&A

LV/CV

I

T

AD

M

O

15

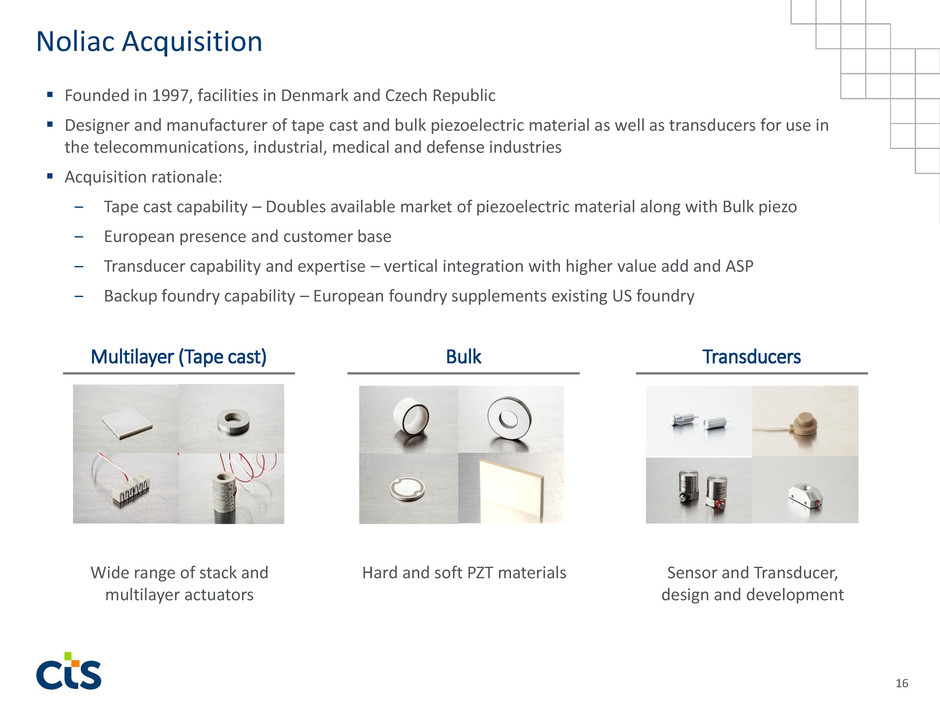

Noliac Acquisition

Multilayer (Tape cast)

▪ Founded in 1997, facilities in Denmark and Czech Republic

▪ Designer and manufacturer of tape cast and bulk piezoelectric material as well as transducers for use in

the telecommunications, industrial, medical and defense industries

▪ Acquisition rationale:

‒ Tape cast capability – Doubles available market of piezoelectric material along with Bulk piezo

‒ European presence and customer base

‒ Transducer capability and expertise – vertical integration with higher value add and ASP

‒ Backup foundry capability – European foundry supplements existing US foundry

Wide range of stack and

multilayer actuators

16

Bulk

Hard and soft PZT materials

Transducers

Sensor and Transducer,

design and development

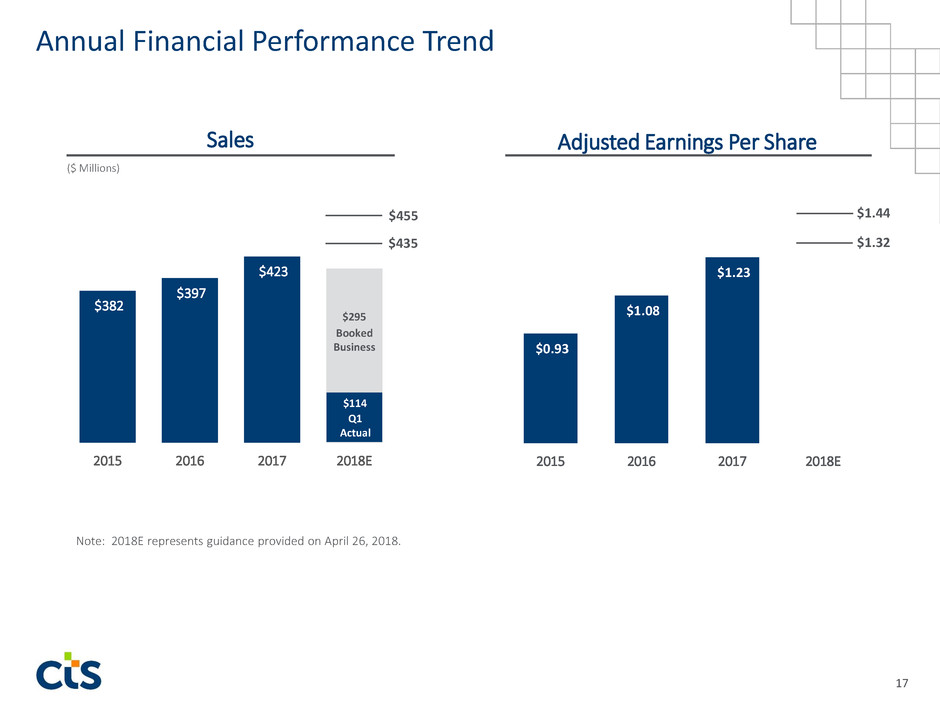

$382

$397

$423

2015 2016 2017 2018E

Sales

$0.93

$1.08

$1.23

2015 2016 2017 2018E

Adjusted Earnings Per Share

$455

Note: 2018E represents guidance provided on April 26, 2018.

Annual Financial Performance Trend

17

$435

$1.44

$1.32

($ Millions)

Q3 YTD

Actual

$0.84

Booked

Business

$295

Q1

Actual

$114

Equity

83%

Debt 17%

$157

$114 $114

$121

$91 $90

$76 $74

2015 2016 2017 Q1 2018

Note 1: Change in Cash/Debt in 2016 due to Single Crystal Acquisition

Note 2: Total available credit increased from $200M to $300M in 2Q 2016

Capital Structure

Cash and Debt

Net

Debt

$(66)

Current Capital Structure

DebtCash

$(24) $(38)

18

($ Millions)

$(47)

Capital Structure

Leverage = 1.0x - 2.5x EBITDA

Operating Cash Flow

Return Capital to

Shareholders

~4% of Sales*

20-40% of Free Cash Flow

12-14% of Sales

60-80% of

Free Cash Flow

Target Capital Deployment – Disciplined Approach

Growth

AcquisitionsInvestment

Dividends & Buybacks

19

*7-9% in 2018

Financial Framework

20

2012 2017

Long-Term

Target Range

Gross Margin 30.0% 34.3% 34-37%

SG&A Expense 20.7% 15.5% 13-15%

R&D Expense 6.9% 5.4% 5-7%

CapEx 2.6% 4.3% ~4%*

Targeting 10% Annual Growth (Organic + Inorganic)

*7-9% in 20181 Excludes the impact of the pension settlement charge recorded in Q4 2017 which reduced gross margin

by $4.8M or 1.1%, increased SG&A by $6.5M or 1.5%, and increased R&D by $2.1M or 0.5%.

1

1

1

Appendix

21

CTS Core Values

22

Financial Summary

Note 1: See Regulation G reconciliations from GAAP to Non-GAAP measures and adjustments.

Note 2: All figures are from continuing operations except for Adjusted Diluted EPS (As Reported),

Operating Cash Flow and Total Debt / Capitalization

($ Millions, except percentages and Adjusted Diluted EPS)

Net Sales

Adjusted Diluted EPS (As Reported)

Operating Cash Flow

Total Debt / Capitalization

Depreciation and Amortization

2015

$382.3

$0.93

$39.2

24.4%

$16.3

Adjusted EBITDA

Adjusted EBITDA % of Sales

$60.9

15.9%

2016

$396.7

$1.08

$47.2

22.1%

$19.0

$77.4

19.5%

23

Adjusted Gross Margin

Adjusted Gross Margin % of Sales

$127.1

33.2%

$140.4

35.4%

2017

$423.0

$1.23

$58.0

18.2%

$20.7

$80.0

18.9%

$145.2

34.3%

Q1 2018

$113.5

$0.34

$20.2

17.2%

$5.5

$20.8

18.4%

$38.4

33.9%

Regulation G Schedules

($ Millions, except percentages)

Adjusted Gross Margin

24

2018 2017 2017 2016 2015

Gross margin 38.4$ 34.2$ 140.4$ 140.4$ 127.1$

Adjustments to reported gross margin:

Pension settlement charge - - 4.8 - -

Adjusted gross margin 38.4$ 34.2$ 145.2$ 140.4$ 127.1$

Sales 113.5$ 100.2$ 423.0$ 396.7$ 382.3$

Adjusted gross margin as a % of sales 33.9% 34.2% 34.3% 35.4% 33.2%

Full YearQ1

Regulation G Schedules

($ Millions, except percentages)

Adjusted EBITDA

25

2018 2017 2017 2016 2015

Net earnings 11.5$ 8.5$ 14.4$ 34.4$ 7.0$

Depreciation and amortization expense 5.5 4.7 20.7 19.0 16.3

Interest expense 0.5 0.7 3.3 3.7 2.6

Tax expense 3.8 3.7 25.8 22.9 5.3

EBITDA 21.3 17.6 64.2 80.0 31.2

Adjustments to EBITDA:

Restructuring charges 1.2 0.8 4.1 3.0 15.2

Loss on sale-leaseback - - - 0.1 -

Loss (gain) on sale of facilities, net of expenses - - 0.7 (11.1) -

Non-recurring environmental charge - - - - 14.5

Pension settlement charge - 13.4 - -

Transaction costs and other one-time costs - - 0.5 0.8 -

Lease termination charge - - 0.1 0.8 -

Foreign currency (gain) loss (2.0) (0.4) (3.0) 3.8 -

Non-recurring costs of tax improvement initiatives 0.3 - - - -

Total adjustments to reported operating earnings (0.5) 0.4 15.8 (2.6) 29.7

Adjusted EBITDA 20.8$ 18.0$ 80.0$ 77.4$ 60.9$

Sales 113.5$ 100.2$ 423.0$ 396.7$ 382.3$

Adjusted EBITDA as a % of sales 18.4% 18.0% 18.9% 19.5% 15.9%

Full YearQ1

Regulation G Schedules

Adjusted Diluted EPS

($ Millions, except percentages)

Total Debt to Capitalization

26

2018 2017 2017 2016 2015

Diluted earnings per share 0.34$ 0.25$ 0.43$ 1.03$ 0.21$

Tax affected adjustments to reported diluted earnings per share:

Restructuring charges 0.03 0.02 0.08 0.06 0.40

Increase in valuation allowance and revaluation of deferred taxes as a

result of restructuring activities - - - 0.07 -

Loss (gain) on sale of facilities, net of expenses - - 0.01 (0.22) -

Non-recurring environmental charge - - - - 0.27

Pension settlement charge - - 0.26 - -

Transaction costs and other one-time costs - - 0.01 0.02 -

Lease termination charge - - - 0.02 -

Foreign currency (gain) loss (0.04) (0.01) (0.07) 0.09 -

Tax impact of cash repatriation - - - - 0.26

(Decrease) increase in recognition of valuation allowances - - (0.05) 0.03 0.10

Tax impact of non-recurring stock compensation charge - - - (0.02) -

Increase in reserve on uncertain tax benefits - - - - 0.17

Tax impact of U.S. tax reform - - 0.54 - -

Tax impact of other foreign taxes - - 0.02 - (0.48)

Non-recurring costs of tax improvement initiatives 0.01 - - - -

Adjusted diluted earnings per share 0.34$ 0.26$ 1.23$ 1.08$ 0.93$

Full YearQ1

2018 2017 2017 2016 2015

Total debt (A) 74.0$ 95.0$ 76.3$ 90.1$ 90.7$

Total shareholders' equity (B) 355.7$ 326.1$ 343.8$ 317.9$ 281.7$

Total capitalization (A+B) 429.7$ 421.1$ 420.1$ 408.0$ 372.4$

Total debt to capitalization 17.2% 22.6% 18.2% 22.1% 24.4%

As of December 31Q1