Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BYLINE BANCORP, INC. | by-8k_20180427.htm |

Q1 2018 Financial Results Exhibit 99.1

Forward Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements reflect various assumptions and involve elements of subjective judgment and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update any of these statements in light of new information, future events or otherwise unless required under the federal securities laws.

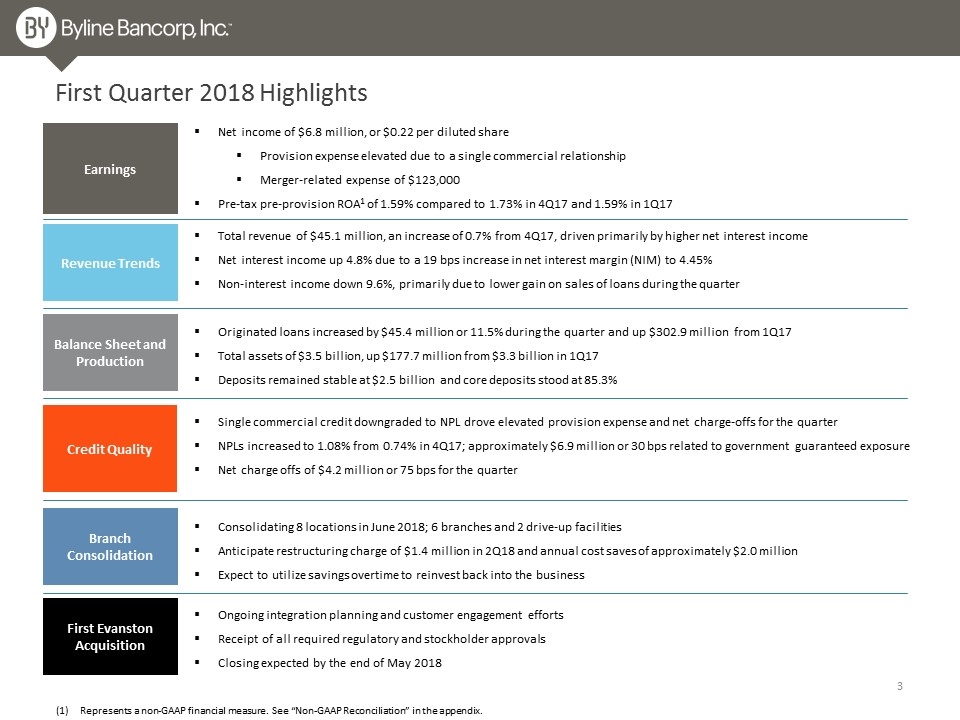

First Quarter 2018 Highlights Earnings Credit Quality Revenue Trends Balance Sheet and Production Branch Consolidation Net income of $6.8 million, or $0.22 per diluted share Provision expense elevated due to a single commercial relationship Merger-related expense of $123,000 Pre-tax pre-provision ROA1 of 1.59% compared to 1.73% in 4Q17 and 1.59% in 1Q17 Single commercial credit downgraded to NPL drove elevated provision expense and net charge-offs for the quarter NPLs increased to 1.08% from 0.74% in 4Q17; approximately $6.9 million or 30 bps related to government guaranteed exposure Net charge offs of $4.2 million or 75 bps for the quarter Originated loans increased by $45.4 million or 11.5% during the quarter and up $302.9 million from 1Q17 Total assets of $3.5 billion, up $177.7 million from $3.3 billion in 1Q17 Deposits remained stable at $2.5 billion and core deposits stood at 85.3% Consolidating 8 locations in June 2018; 6 branches and 2 drive-up facilities Anticipate restructuring charge of $1.4 million in 2Q18 and annual cost saves of approximately $2.0 million Expect to utilize savings overtime to reinvest back into the business First Evanston Acquisition Total revenue of $45.1 million, an increase of 0.7% from 4Q17, driven primarily by higher net interest income Net interest income up 4.8% due to a 19 bps increase in net interest margin (NIM) to 4.45% Non-interest income down 9.6%, primarily due to lower gain on sales of loans during the quarter Ongoing integration planning and customer engagement efforts Receipt of all required regulatory and stockholder approvals Closing expected by the end of May 2018 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

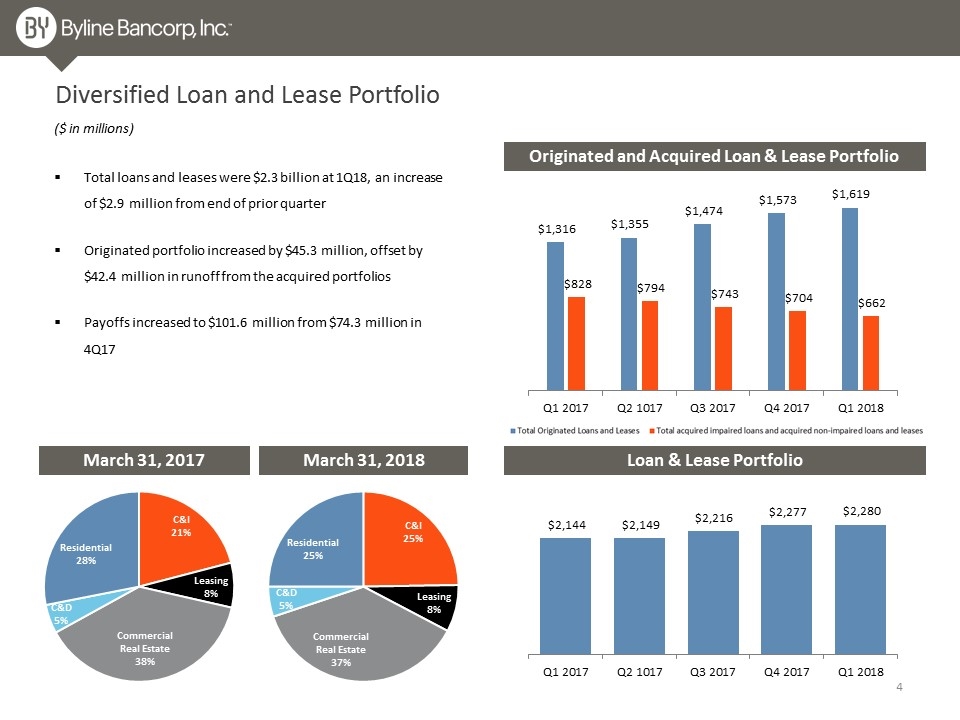

Diversified Loan and Lease Portfolio Loan & Lease Portfolio March 31, 2017 March 31, 2018 ($ in millions) Originated and Acquired Loan & Lease Portfolio Total loans and leases were $2.3 billion at 1Q18, an increase of $2.9 million from end of prior quarter Originated portfolio increased by $45.3 million, offset by $42.4 million in runoff from the acquired portfolios Payoffs increased to $101.6 million from $74.3 million in 4Q17

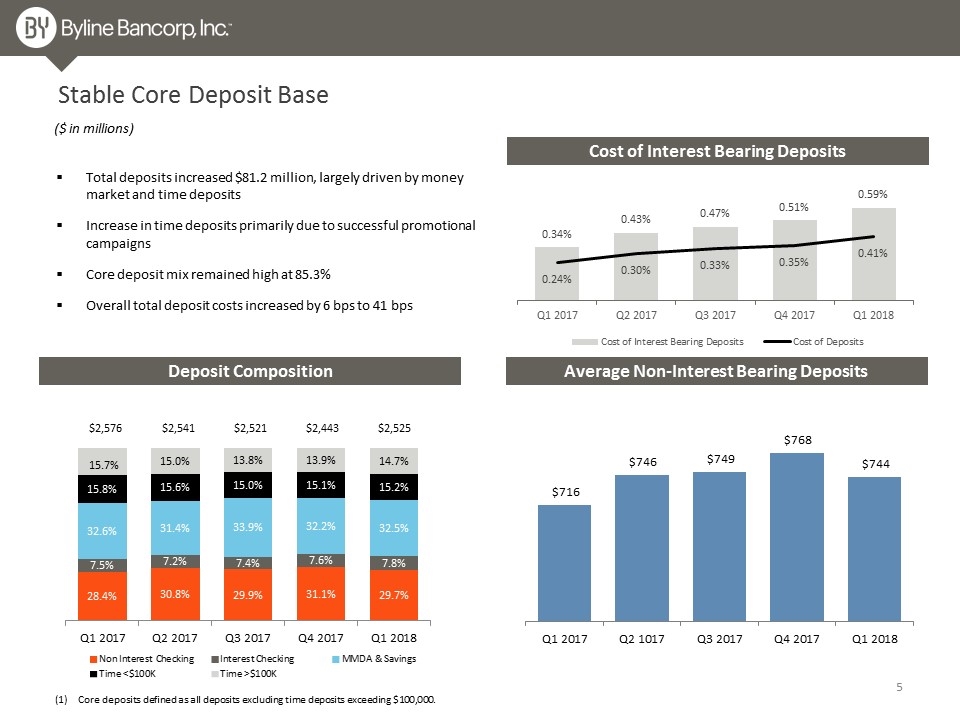

Total deposits increased $81.2 million, largely driven by money market and time deposits Increase in time deposits primarily due to successful promotional campaigns Core deposit mix remained high at 85.3% Overall total deposit costs increased by 6 bps to 41 bps Stable Core Deposit Base Average Non-Interest Bearing Deposits ($ in millions) Deposit Composition (1) Core deposits defined as all deposits excluding time deposits exceeding $100,000. $2,521 $2,443 $2,576 $2,541 Cost of Interest Bearing Deposits $2,525

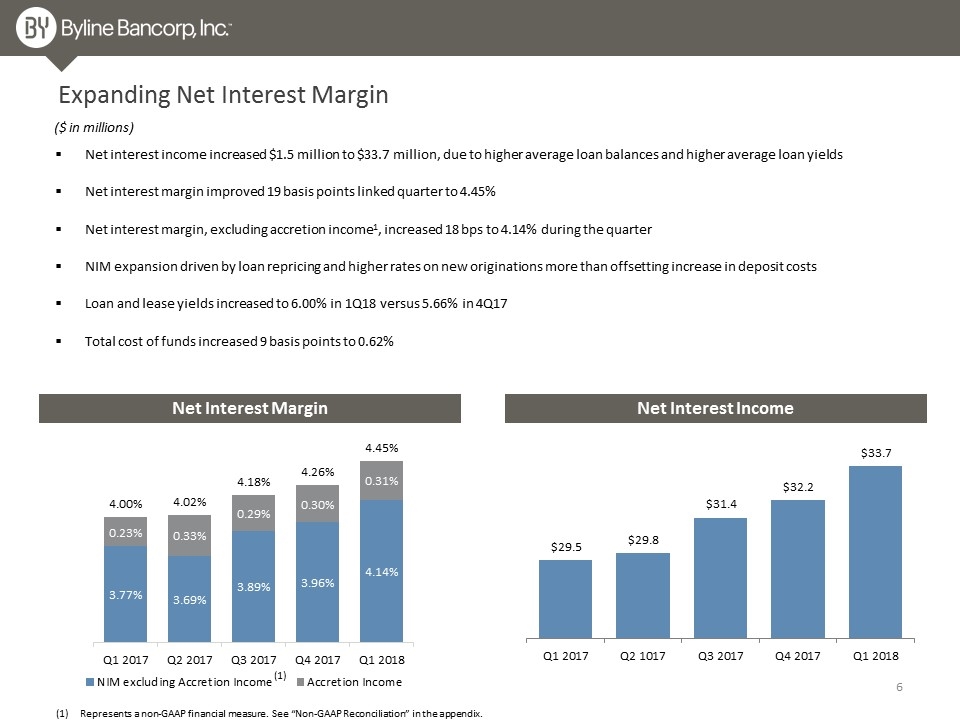

Expanding Net Interest Margin Net interest income increased $1.5 million to $33.7 million, due to higher average loan balances and higher average loan yields Net interest margin improved 19 basis points linked quarter to 4.45% Net interest margin, excluding accretion income1, increased 18 bps to 4.14% during the quarter NIM expansion driven by loan repricing and higher rates on new originations more than offsetting increase in deposit costs Loan and lease yields increased to 6.00% in 1Q18 versus 5.66% in 4Q17 Total cost of funds increased 9 basis points to 0.62% Net Interest Margin Net Interest Income Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. ($ in millions) (1)

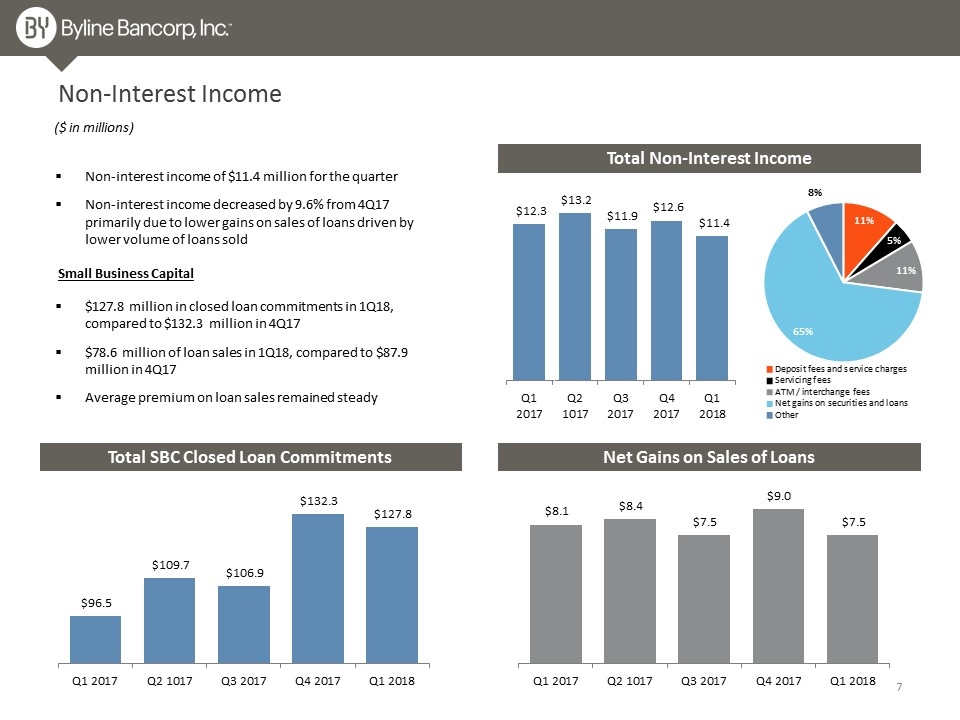

Total Non-Interest Income Non-Interest Income Non-interest income of $11.4 million for the quarter Non-interest income decreased by 9.6% from 4Q17 primarily due to lower gains on sales of loans driven by lower volume of loans sold ($ in millions) Total SBC Closed Loan Commitments Net Gains on Sales of Loans $127.8 million in closed loan commitments in 1Q18, compared to $132.3 million in 4Q17 $78.6 million of loan sales in 1Q18, compared to $87.9 million in 4Q17 Average premium on loan sales remained steady Small Business Capital

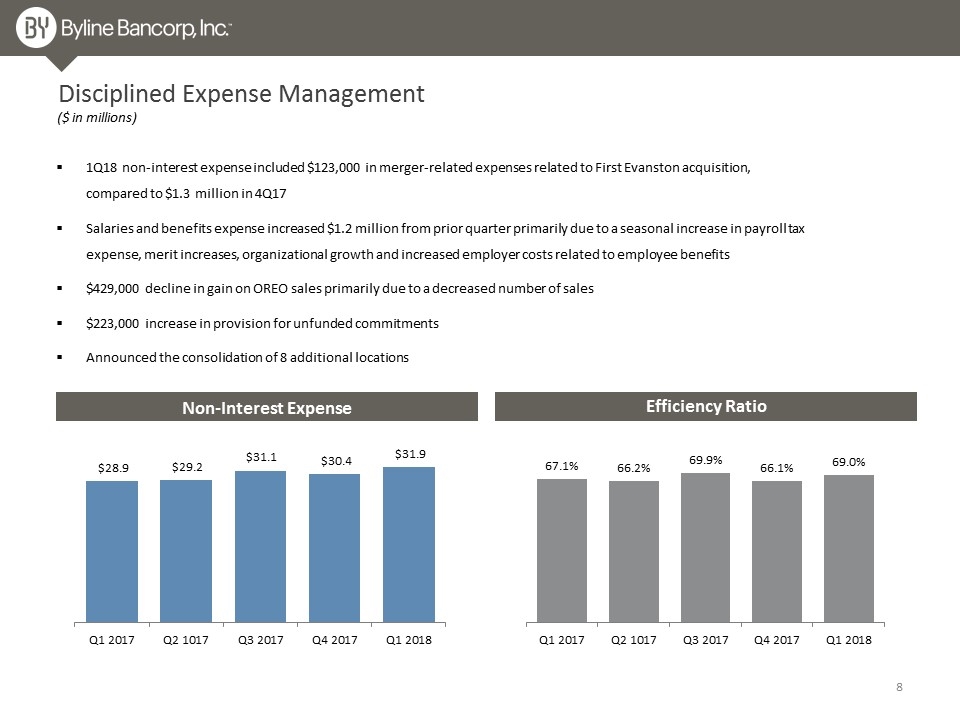

Disciplined Expense Management 1Q18 non-interest expense included $123,000 in merger-related expenses related to First Evanston acquisition, compared to $1.3 million in 4Q17 Salaries and benefits expense increased $1.2 million from prior quarter primarily due to a seasonal increase in payroll tax expense, merit increases, organizational growth and increased employer costs related to employee benefits $429,000 decline in gain on OREO sales primarily due to a decreased number of sales $223,000 increase in provision for unfunded commitments Announced the consolidation of 8 additional locations ($ in millions) Efficiency Ratio Non-Interest Expense

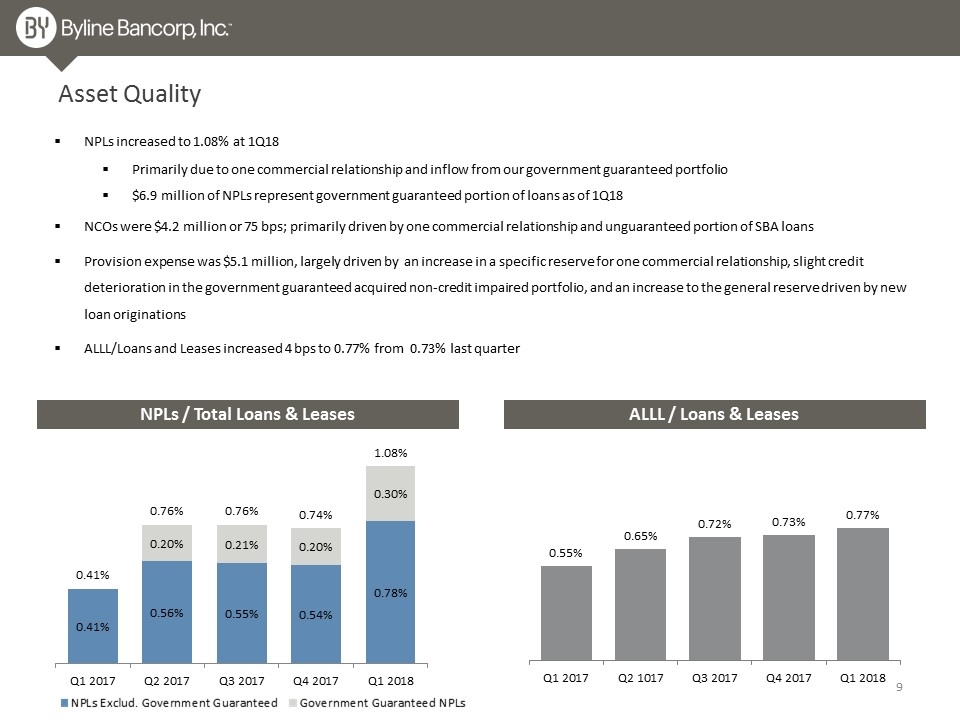

Asset Quality NPLs increased to 1.08% at 1Q18 Primarily due to one commercial relationship and inflow from our government guaranteed portfolio $6.9 million of NPLs represent government guaranteed portion of loans as of 1Q18 NCOs were $4.2 million or 75 bps; primarily driven by one commercial relationship and unguaranteed portion of SBA loans Provision expense was $5.1 million, largely driven by an increase in a specific reserve for one commercial relationship, slight credit deterioration in the government guaranteed acquired non-credit impaired portfolio, and an increase to the general reserve driven by new loan originations ALLL/Loans and Leases increased 4 bps to 0.77% from 0.73% last quarter NPLs / Total Loans & Leases ALLL / Loans & Leases

Appendix

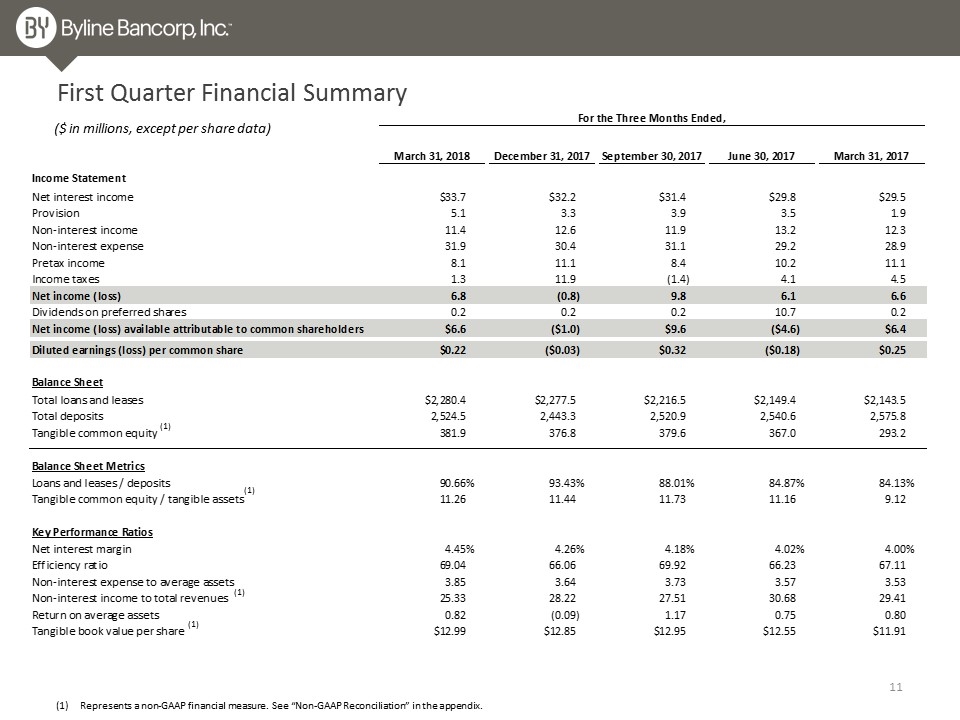

First Quarter Financial Summary ($ in millions, except per share data) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. (1) (1) (1) (1)

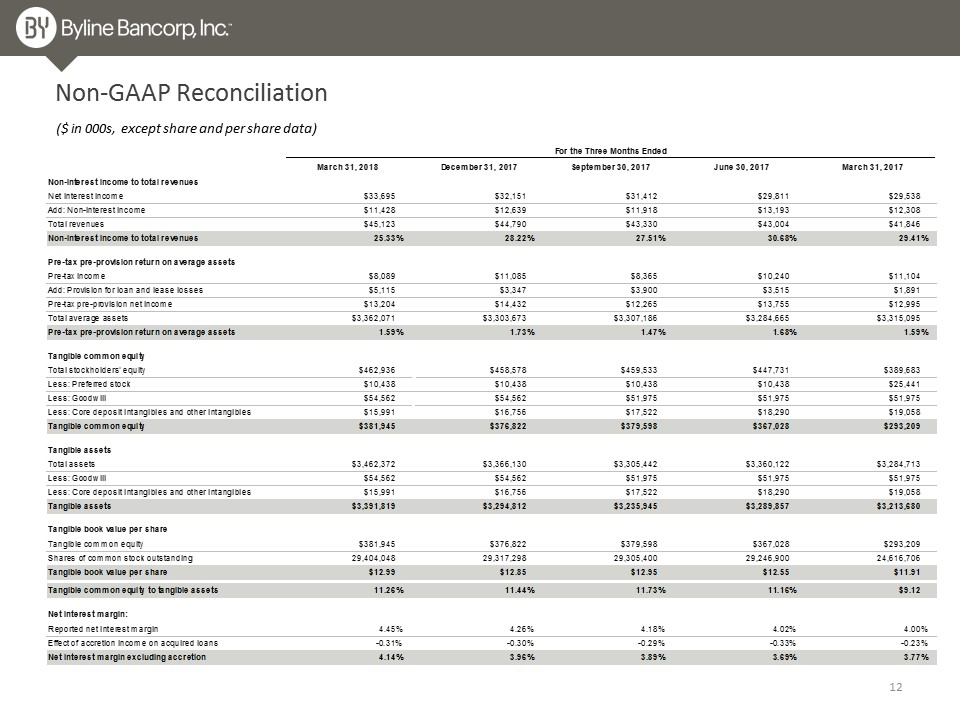

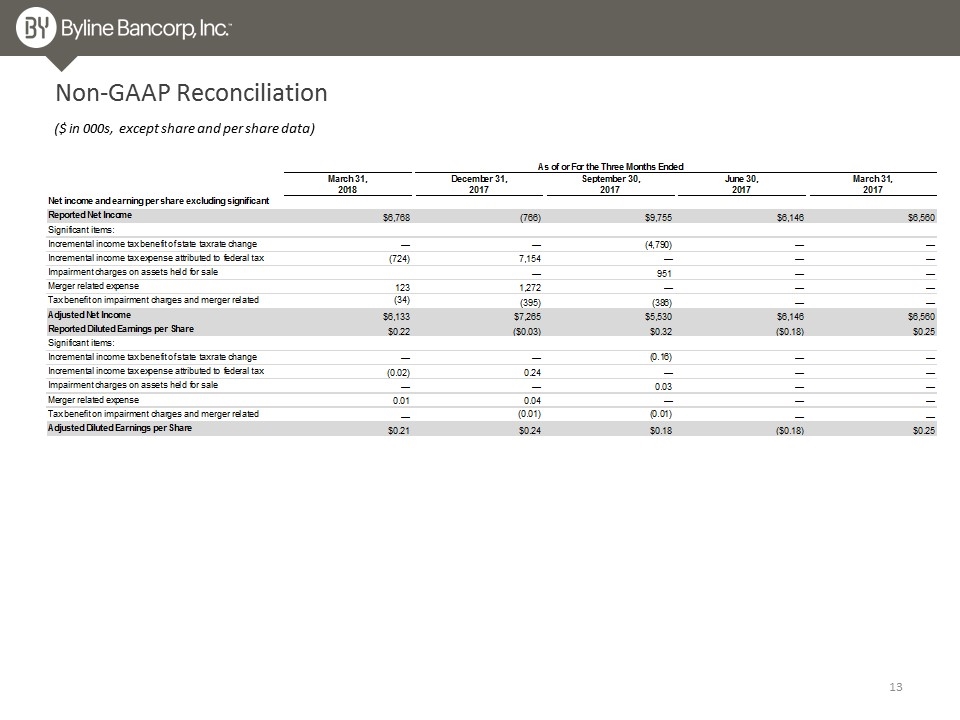

Non-GAAP Reconciliation ($ in 000s, except share and per share data)

Non-GAAP Reconciliation ($ in 000s, except share and per share data)