Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE - WESCO INTERNATIONAL INC | wcc-1q2018earningsrelease.htm |

| 8-K - FORM 8-K - WESCO INTERNATIONAL INC | wcc-1q2018earnings8k.htm |

Webcast Presentation – April 26, 2018

Q1 2018 Earnings

2 Q1 2018 Earnings Webcast 4/26/18

Safe Harbor Statement

All statements made herein that are not historical facts should be considered as “forward-looking

statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve

known and unknown risks, uncertainties and other factors that may cause actual results to differ

materially. Such risks, uncertainties and other factors include, but are not limited to: adverse economic

conditions; disruptions in operations or information technology systems; increase in competition;

expansion of business activities; supply chain disruptions, changes in supplier strategy or loss of key

suppliers; personnel turnover or labor cost increases; risks related to acquisitions, including the

integration of acquired businesses; tax law changes or challenges to tax matters, including uncertainties

in the interpretation and application of the Tax Cuts and Jobs Act of 2017; exchange rate fluctuations;

debt levels, terms, financial market conditions or interest rate fluctuations; stock market, economic or

political instability; legal or regulatory matters; litigation, disputes, contingencies or claims; and other

factors described in detail in the Form 10-K for WESCO International, Inc. for the year ended December

31, 2017 and any subsequent filings with the Securities & Exchange Commission. The following

presentation includes a discussion of certain non-GAAP financial measures. Information required by

Regulation G with respect to such non-GAAP financial measures can be found in the appendix and

obtained via WESCO’s website, www.wesco.com.

3 Q1 2018 Earnings Webcast 4/26/18

Q1 2018 Highlights

…performance exceeded outlook

• Strong first quarter results

‒ Double digit sales, operating profit and EPS growth

versus prior year

• Continued positive business momentum and growth

across all end markets and geographies

• Reported sales were up 12%, organic sales were up 11%:

‒ Up 10% in the U.S.

‒ Up 10% in Canada

‒ Up 24% in International

• Highest organic sales growth rate since 2011

• Estimated pricing impact +2%

• April MTD sales up low double digits

• Q1 backlog at an all-time record level, up 4% sequentially

and up 14% versus prior year

• Free cash flow at 105% of net income

(6.7)

(3.1)

(6.2)

(3.6)

(1.7)

1.0

8.6

10.1

10.9

Organic Growth

(%)

Jan 9%

Feb 14%

Mar 11%

Note: Organic growth excludes the impact of acquisitions in the first year of

ownership, foreign exchange rates and number of workdays. See appendix for

non-GAAP reconciliations.

Q4Q1

2016

Q2 Q3 Q4 Q1

2017

Q2 Q3

2018

Q1

4 Q1 2018 Earnings Webcast 4/26/18

2017

8.0%

Industrial End Market

• Q1 2018 Sales

− Organic sales were up 10% versus prior year

(up 9% in the U.S. and up 17% in Canada in local

currency)

− Down 1% sequentially

• Increasing business momentum with industrial

customers

• Sales growth was broad-based across the U.S. and

Canada

• Global Account and Integrated Supply opportunity

pipeline and bidding activity levels remain strong

• Customer trends include continued high expectations

for supply chain process improvements, cost

reductions, and supplier consolidation

Organic Sales Growth versus Prior Year

37%

Industrial

• Global Accounts

• Integrated Supply

• OEM

• General Industrial

Awarded a multi-year contract to supply electrical MRO materials and support capital

projects for a large chemical manufacturer in the U.S. and Canada.

Note: See appendix for non-GAAP reconciliations.

1.2%

6.0%

11.2%

13.9%

10.4%

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

5 Q1 2018 Earnings Webcast 4/26/18

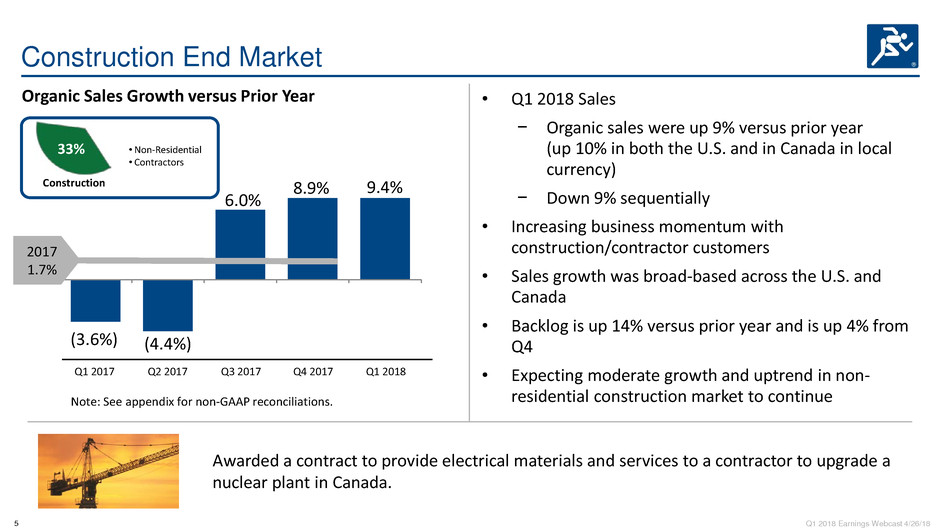

(3.6%) (4.4%)

6.0%

8.9% 9.4%

• Q1 2018 Sales

− Organic sales were up 9% versus prior year

(up 10% in both the U.S. and in Canada in local

currency)

− Down 9% sequentially

• Increasing business momentum with

construction/contractor customers

• Sales growth was broad-based across the U.S. and

Canada

• Backlog is up 14% versus prior year and is up 4% from

Q4

• Expecting moderate growth and uptrend in non-

residential construction market to continue

• Non-Residential

• Contractors

Construction

33%

Organic Sales Growth versus Prior Year

Construction End Market

Awarded a contract to provide electrical materials and services to a contractor to upgrade a

nuclear plant in Canada.

Note: See appendix for non-GAAP reconciliations.

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

2017

1.7%

6 Q1 2018 Earnings Webcast 4/26/18

Utility End Market

Organic Sales Growth versus Prior Year

16%

Utility

• Investor Owned

• Public Power

• Utility Contractors

• Q1 2018 Sales

− Organic sales were up 18% versus prior year (up

21% in the U.S. and down 6% in Canada in local

currency)

− Down 5% sequentially

• Continued scope expansion and value creation with

investor-owned utility, public power, and generation

customers

• Continued interest in Integrated Supply solution

offerings

• Favorable economic conditions, continued improvement

in construction market, renewables growth, and

consolidation trend within Utility industry remain

positive catalysts for future spending

Awarded a contract to provide electrical materials for wind farm substation project in the US.

(4.5%) (4.4%)

8.6% 9.1%

17.9%

Q1 2017 Q2 2017 Q3 2017 Q4 2017

Note: See appendix for non-GAAP reconciliations.

Q1 2018

2017

2.3%

7 Q1 2018 Earnings Webcast 4/26/18

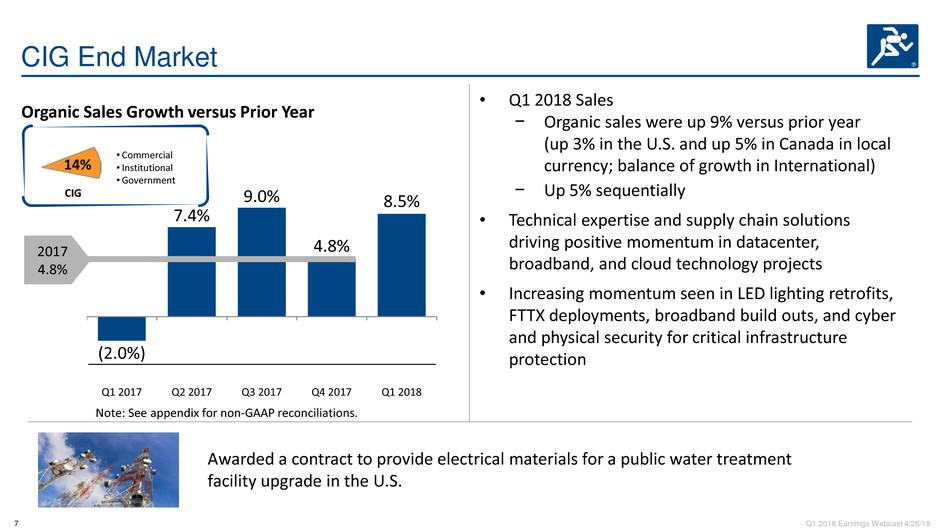

CIG End Market

• Q1 2018 Sales

− Organic sales were up 9% versus prior year

(up 3% in the U.S. and up 5% in Canada in local

currency; balance of growth in International)

− Up 5% sequentially

• Technical expertise and supply chain solutions

driving positive momentum in datacenter,

broadband, and cloud technology projects

• Increasing momentum seen in LED lighting retrofits,

FTTX deployments, broadband build outs, and cyber

and physical security for critical infrastructure

protection

Organic Sales Growth versus Prior Year

CIG

• Commercial

• Institutional

• Government

14%

Awarded a contract to provide electrical materials for a public water treatment

facility upgrade in the U.S.

Note: See appendix for non-GAAP reconciliations.

(2.0%)

7.4%

9.0%

4.8%

8.5%

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018

2017

4.8%

8 Q1 2018 Earnings Webcast 4/26/18

Q1 2018 Results

Outlook Actual YOY

Sales 6% to 9% $2.0B Up 12.5%

Gross Margin 19.1% Down 60 bps, down 10 bps sequentially (1)

SG&A $291M, 14.6% Up 9%, improved 50 bps

Operating Profit $73M Up 10%

Operating Margin 3.5% to 3.8% 3.7% Down 10 bps

Effective Tax Rate ~22% 19.6% Down 540 bps

EPS $0.93 Up 22%

10.4%

Growth

190 bps

790 bps

$2.0B

$1.8B

Q1 2018

Sales

InternationalCanadaU.S.Q1 2017

Sales

9.9%

Growth

23.5%

Growth

10.9%

Organic

Growth

12.5%

Growth

Note: See appendix for non-GAAP reconciliations.

(1) Reflects the impact of a 15 bps reclassification of certain labor costs from selling, general and administrative expenses.

Foreign

Exchange

160 bps110 bps

…margins stabilizing, positive operating profit pull through

9 Q1 2018 Earnings Webcast 4/26/18

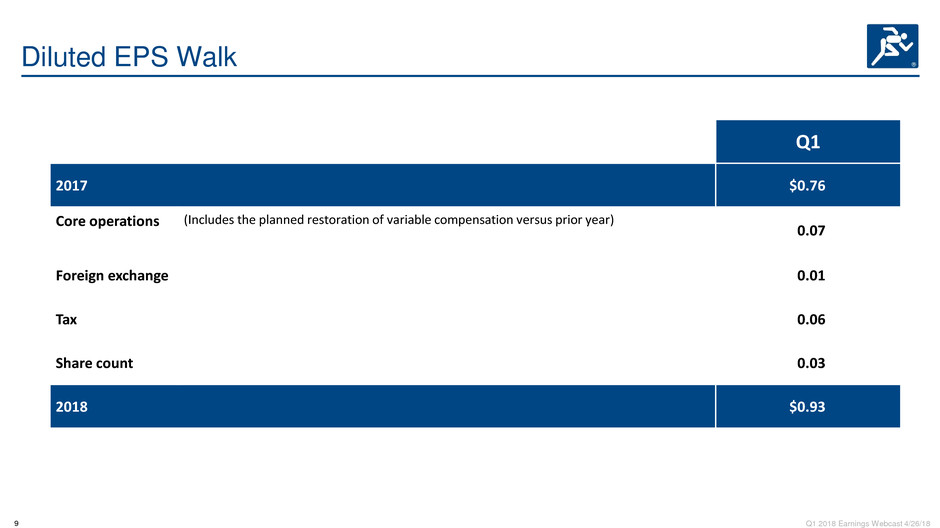

Diluted EPS Walk

Q1

2017 $0.76

Core operations (Includes the planned restoration of variable compensation versus prior year)

0.07

Foreign exchange 0.01

Tax 0.06

Share count 0.03

2018 $0.93

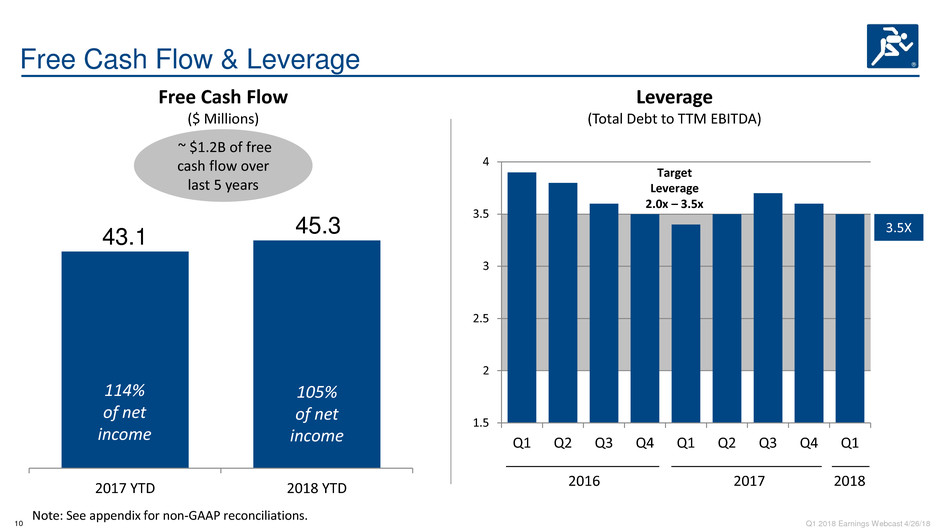

10 Q1 2018 Earnings Webcast 4/26/18

1.5

2

2.5

3

3.5

4

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

Free Cash Flow & Leverage

43.1 45.3

2017 YTD 2018 YTD

Free Cash Flow

($ Millions)

Note: See appendix for non-GAAP reconciliations.

105%

of net

income

114%

of net

income

~ $1.2B of free

cash flow over

last 5 years

Target

Leverage

2.0x – 3.5x

3.5X

Leverage

(Total Debt to TTM EBITDA)

2016 2017 2018

11 Q1 2018 Earnings Webcast 4/26/18

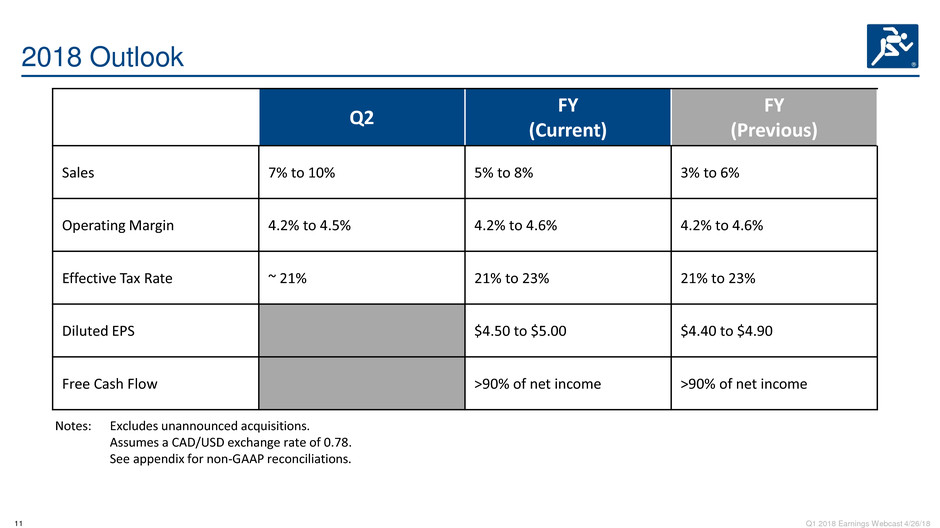

2018 Outlook

Q2

FY

(Current)

FY

(Previous)

Sales 7% to 10% 5% to 8% 3% to 6%

Operating Margin 4.2% to 4.5% 4.2% to 4.6% 4.2% to 4.6%

Effective Tax Rate ~ 21% 21% to 23% 21% to 23%

Diluted EPS $4.50 to $5.00 $4.40 to $4.90

Free Cash Flow >90% of net income >90% of net income

Notes: Excludes unannounced acquisitions.

Assumes a CAD/USD exchange rate of 0.78.

See appendix for non-GAAP reconciliations.

12 Q1 2018 Earnings Webcast 4/26/18

Appendix

NON-GAAP FINANCIAL MEASURES

This presentation includes certain non-GAAP financial measures. These financial measures include organic

sales growth, gross profit, financial leverage, earnings before interest, taxes, depreciation and amortization

(EBITDA), and free cash flow. Management believes that these non-GAAP measures are useful to investors as

they provide a better understanding of sales performance, and the use of debt and liquidity on a comparable

basis. Management does not use these non-GAAP financial measures for any purpose other than the reasons

stated above.

13 Q1 2018 Earnings Webcast 4/26/18

WESCO Profile 2018

37%

33%

16%

14%

40%

15%

15%

12%

10%

8%

Note: Markets & Customers and Products & Services percentages reported on a TTM consolidated basis.

Products & ServicesMarkets & Customers

Utility

CIG

Industrial

Construction

Investor Owned | Public Power

Utility Contractors

Commercial | Institutional | Government

Global Accounts | Integrated Supply

OEM | General Industrial

Non-Residential | Contractors

Automation, Controls & Motors

Lighting & Sustainability

General Supplies

Communications & Security

Wire, Cable & Conduit

Electrical Distribution & Controls

14 Q1 2018 Earnings Webcast 4/26/18

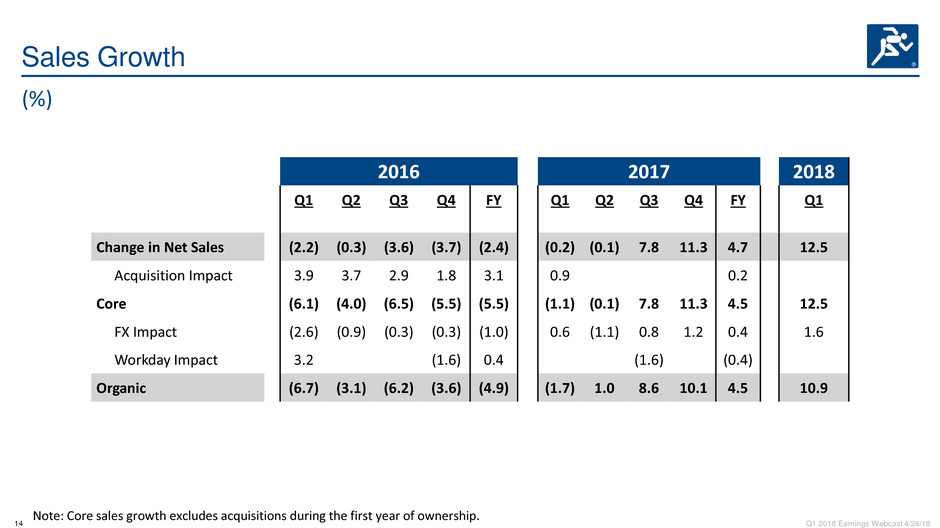

Sales Growth

2016 2017 2018

Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1

Change in Net Sales (2.2) (0.3) (3.6) (3.7) (2.4) (0.2) (0.1) 7.8 11.3 4.7 12.5

Acquisition Impact 3.9 3.7 2.9 1.8 3.1 0.9 0.2

Core (6.1) (4.0) (6.5) (5.5) (5.5) (1.1) (0.1) 7.8 11.3 4.5 12.5

FX Impact (2.6) (0.9) (0.3) (0.3) (1.0) 0.6 (1.1) 0.8 1.2 0.4 1.6

Workday Impact 3.2 (1.6) 0.4 (1.6) (0.4)

Organic (6.7) (3.1) (6.2) (3.6) (4.9) (1.7) 1.0 8.6 10.1 4.5 10.9

(%)

Note: Core sales growth excludes acquisitions during the first year of ownership.

15 Q1 2018 Earnings Webcast 4/26/18

Q1 2018 Organic Sales Growth by Geography

U.S. Canada International WESCO

Change in net sales (USD) 10.4 15.6 32.7 12.5

Impact from acquisitions - - - -

Impact from foreign exchange rates - 5.7 9.2 1.6

Impact from number of workdays - - - -

Organic sales growth 10.4 9.9 23.5 10.9

(%)

16 Q1 2018 Earnings Webcast 4/26/18

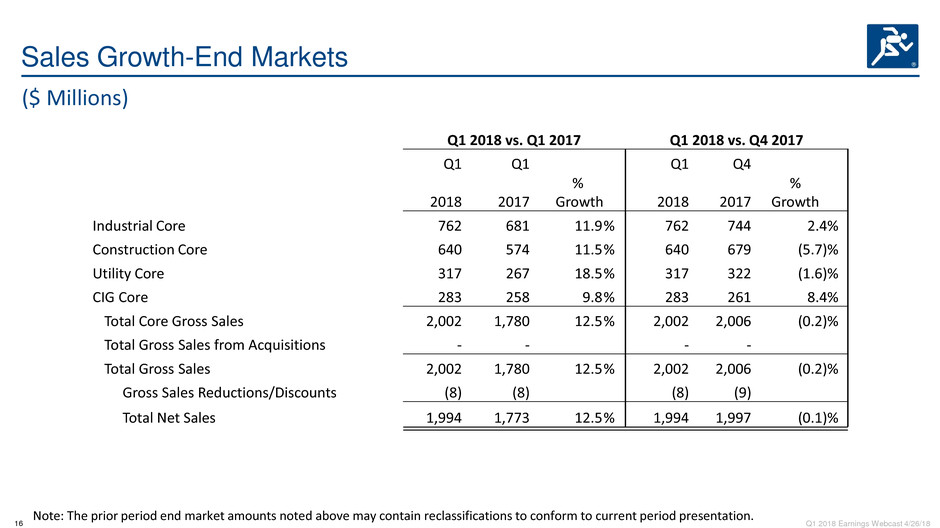

Note: The prior period end market amounts noted above may contain reclassifications to conform to current period presentation.

($ Millions)

Sales Growth-End Markets

Q1 2018 vs. Q1 2017 Q1 2018 vs. Q4 2017

Q1 Q1 Q1 Q4

2018 2017

%

Growth 2018 2017

%

Growth

Industrial Core 762 681 11.9% 762 744 2.4%

Construction Core 640 574 11.5% 640 679 (5.7)%

Utility Core 317 267 18.5% 317 322 (1.6)%

CIG Core 283 258 9.8% 283 261 8.4%

Total Core Gross Sales 2,002 1,780 12.5% 2,002 2,006 (0.2)%

Total Gross Sales from Acquisitions - - - -

Total Gross Sales 2,002 1,780 12.5% 2,002 2,006 (0.2)%

Gross Sales Reductions/Discounts (8) (8) (8) (9)

Total Net Sales 1,994 1,773 12.5% 1,994 1,997 (0.1)%

17 Q1 2018 Earnings Webcast 4/26/18

Q1 2018 Organic Sales by End Market

Industrial Construction Utility CIG WESCO

Core Sales Growth 11.9 11.5 18.5 9.8 12.5

FX Impact 1.5 2.1 0.6 1.3 1.6

Workday Impact - - - - -

Organic Growth 10.4 9.4 17.9 8.5 10.9

(%)

18 Q1 2018 Earnings Webcast 4/26/18

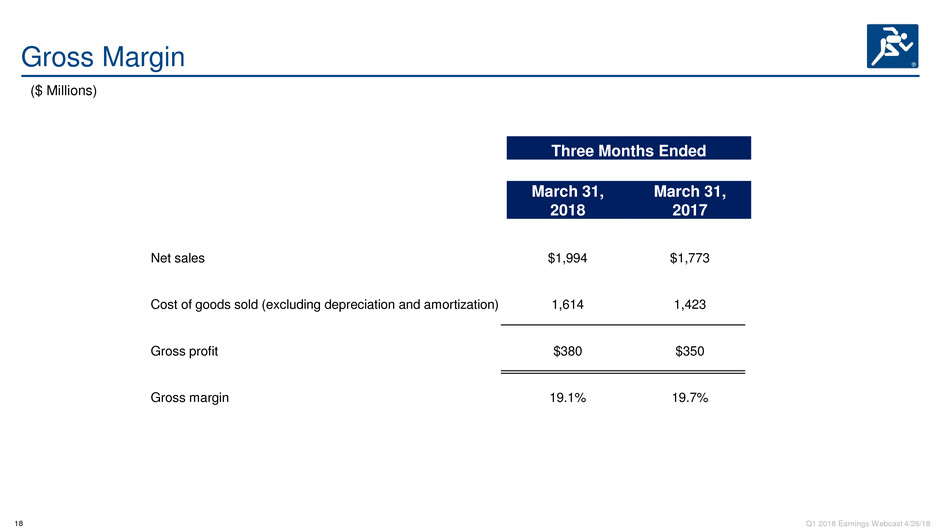

Gross Margin

($ Millions)

Three Months Ended

March 31,

2018

March 31,

2017

Net sales $1,994 $1,773

Cost of goods sold (excluding depreciation and amortization) 1,614 1,423

Gross profit $380 $350

Gross margin 19.1% 19.7%

19 Q1 2018 Earnings Webcast 4/26/18

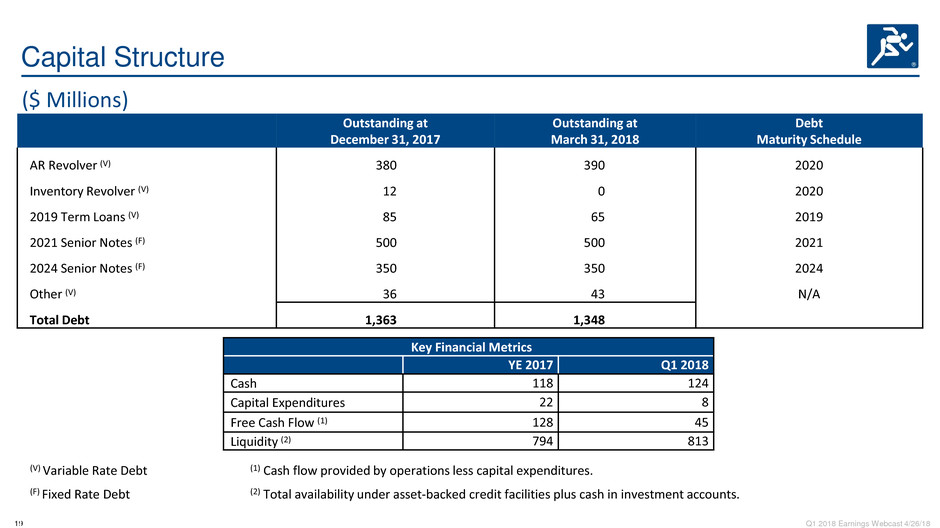

Outstanding at

December 31, 2017

Outstanding at

March 31, 2018

Debt

Maturity Schedule

AR Revolver (V) 380 390 2020

Inventory Revolver (V) 12 0 2020

2019 Term Loans (V) 85 65 2019

2021 Senior Notes (F) 500 500 2021

2024 Senior Notes (F) 350 350 2024

Other (V) 36 43 N/A

Total Debt 1,363 1,348

Capital Structure

Key Financial Metrics

YE 2017 Q1 2018

Cash 118 124

Capital Expenditures 22 8

Free Cash Flow (1) 128 45

Liquidity (2) 794 813

($ Millions)

(V) Variable Rate Debt (1) Cash flow provided by operations less capital expenditures.

(F) Fixed Rate Debt (2) Total availability under asset-backed credit facilities plus cash in investment accounts.

20 Q1 2018 Earnings Webcast 4/26/18

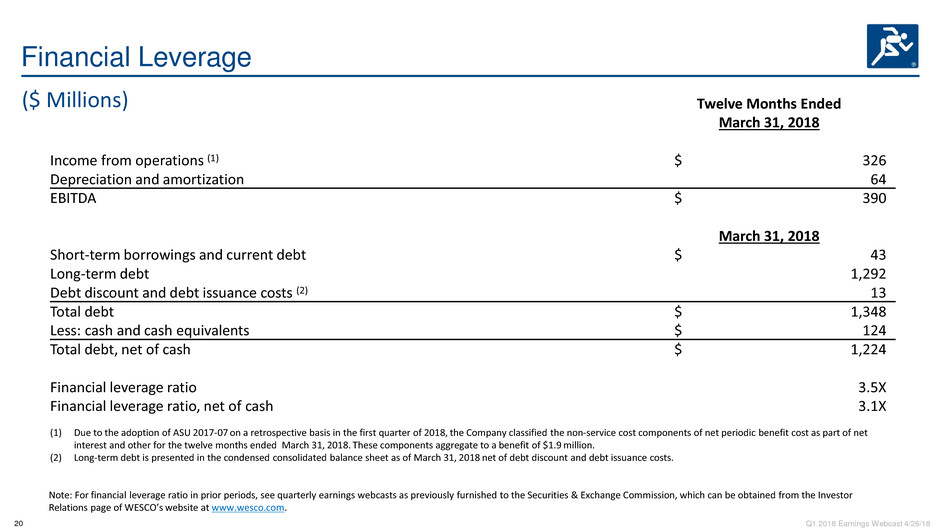

Financial Leverage

Twelve Months Ended

March 31, 2018

Income from operations (1) $ 326

Depreciation and amortization 64

EBITDA $ 390

March 31, 2018

Short-term borrowings and current debt $ 43

Long-term debt 1,292

Debt discount and debt issuance costs (2) 13

Total debt $ 1,348

Less: cash and cash equivalents $ 124

Total debt, net of cash $ 1,224

Financial leverage ratio 3.5X

Financial leverage ratio, net of cash 3.1X

(1) Due to the adoption of ASU 2017-07 on a retrospective basis in the first quarter of 2018, the Company classified the non-service cost components of net periodic benefit cost as part of net

interest and other for the twelve months ended March 31, 2018. These components aggregate to a benefit of $1.9 million.

(2) Long-term debt is presented in the condensed consolidated balance sheet as of March 31, 2018 net of debt discount and debt issuance costs.

($ Millions)

Note: For financial leverage ratio in prior periods, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the Investor

Relations page of WESCO’s website at www.wesco.com.

21 Q1 2018 Earnings Webcast 4/26/18

Free Cash Flow Reconciliation

Q1

2017

Q1

2018

Cash flow provided by operations 47.6 53.0

Less: Capital expenditures (4.5) (7.7)

Free cash flow 43.1 45.3

Net income 37.8 42.9

Percentage of net income 114% 105%

Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash

flow to determine free cash flow. Free cash flow is available to fund investing and financing activities.

($ Millions)

22 Q1 2018 Earnings Webcast 4/26/18

Work Days

Q1 Q2 Q3 Q4 FY

2016 64 64 64 62 254

2017 64 64 63 62 253

2018 64 64 63 62 253