Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - IRON MOUNTAIN INC | amendment-irm8xkq12018earn.htm |

Q1 2018

Quarterly Results

Conference Call

April 26, 2018

Safe Harbor Language and

Reconciliation of Non-GAAP Measures

2

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws and is subject to the safe-

harbor created by such Act. Forward-looking statements include, but are not limited to, our financial performance outlook and statements concerning our operations, economic performance,

financial condition, goals, beliefs, future growth strategies, investment objectives, plans and current expectations such as 2018 guidance, and statements about our investment and other goals.

These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors. When we use words such as "believes," "expects," "anticipates,"

"estimates" or similar expressions, we are making forward-looking statements. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected

results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include,

among others: (i) our ability to remain qualified for taxation as a real estate investment trust for U.S. federal income tax purposes ("REIT"); (ii) the adoption of alternative technologies and shifts

by our customers to storage of data through non-paper based technologies; (iii) changes in customer preferences, and demand for our storage and information management services; (iv) the

cost to comply with current and future laws, regulations and customer demands relating to data security and privacy issues, as well as fire and safety standards; (v) the impact of litigation or

disputes that may arise in connection with incidents in which we fail to protect our customers' information; (vi) changes in the price for our storage and information management services

relative to the cost of providing such storage and information management services; (vii) changes in the political and economic environments in the countries in which our international

subsidiaries operate and changes in the global political climate; (viii) our ability or inability to manage growth, expand internationally, complete acquisitions on satisfactory terms, to close

pending acquisitions and to integrate acquired companies efficiently; (ix) changes in the amount of our growth and maintenance capital expenditures and our ability to invest according to plan;

(x) our ability to comply with our existing debt obligations and restrictions in our debt instruments or to obtain additional financing to meet our working capital needs; (xi) the impact of service

interruptions or equipment damage and the cost of power on our data center operations; (xii) changes in the cost of our debt; (xiii) the impact of alternative, more attractive investments on

dividends; (xiv) the cost or potential liabilities associated with real estate necessary for our business; (xv) the performance of business partners upon whom we depend for technical assistance

or management expertise outside the United States; (xvi) other trends in competitive or economic conditions affecting our financial condition or results of operations not presently

contemplated; and (xvii) other risks described more fully in our filings with the Securities and Exchange Commission, including under the caption “Risk Factors” in our periodic reports, or

incorporated therein. You should not rely upon forward-looking statements except as statements of our present intentions and of our present expectations, which may or may not occur. Except

as required by law, we undertake no obligation to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances after the

date hereof or to reflect the occurrence of unanticipated events.

Reconciliation of Non-GAAP Measures:

Throughout this presentation, Iron Mountain will discuss (1) Adjusted EBITDA, (2) Adjusted Earnings per Share (“Adjusted EPS”), (3) Funds from Operations (“FFO Nareit”), (4) FFO

(Normalized) and (5) Adjusted Funds from Operations (“AFFO”). These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non-

GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but

not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) or

cash flows from operating activities from continuing operations (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required

by Regulation G under the Securities Exchange Act of 1934, as amended, and the definitions are included in Supplemental Financial Information. Iron Mountain does not provide a

reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available

without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition property, plant and

equipment (including of real estate) and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful.

Selected metrics definitions are available in the Appendix.

2018 Off to a Solid Start

3

Strong Q1 ‘18 performance supported by storage rental durability and margin expansion

• Revenue up 11%, Adjusted EBITDA up 17% and AFFO up 30% with 170 bps expansion of Adjusted EBITDA margin

• AFFO growth of 20% including increase in share count, supports targeted dividend per share growth of ~7% for 2018

• Completed IO and Credit Suisse data center acquisitions, and integration well on track

Core business continues to perform well

• Continued worldwide positive internal volume growth

• Improved revenue management continues to more than offset moderating internal volume growth in developed markets

• Continuing to see solid internal revenue growth and attractive acquisition opportunities in Emerging Markets

Healthy growth in key operating metrics

• Strong 3.7% internal storage revenue growth exceeds 3% - 3.5% target for full year

• Internal service revenue growth of 1.4% reflects growth in shredding, imaging and special projects

• Total internal revenue growth of 2.8% represents highest level reported in more than three years

Note: Definition of Non-GAAP and other measures and reconciliations of Non-GAAP to GAAP measures can be found in the Supplemental Financial Information

Data Center Growth Enhances 2020

Plan and Accelerates Long-term Growth

4

80%

Developed Portfolio

North America

and Western Europe

Q1’18: ~2% Internal

Revenue Growth

20%

Growth Portfolio

Emerging Markets, Data

Center and Adj. Businesses

Q1’18: 8% Internal

Revenue Growth

2% 10%

3.5%+ Average Internal Adj. EBITDA Growth

Q1 ’18 Revenue Mix

Adjusted EBITDA Growth

70%

Developed Portfolio

North America

And Western Europe

30%

Growth Portfolio

Emerging Markets, Data

Center and Adj. Businesses

3% 10%

5%+ Average Internal Adj. EBITDA Growth

2020 Revenue Mix

Adjusted EBITDA Growth

Note: Emerging Markets is Other International, excluding Australia and New Zealand

5

Continued Execution of Strategic Plan

Driving Growth and Margins in Developed Markets

• Achieved 2.9% internal storage revenue growth despite net internal volume decrease of (0.5%),

consistent with annual guidance provided on Q4’17 call

• Making further inroads in U.S. Federal business

Invested in Faster-growing Businesses: Data Centers and ABOs

• Q1 data center investment includes IO and Credit Suisse acquisitions and build out of data halls in

Phoenix, Denver and New Jersey with good pre-leasing

• Pending Artex (fine art) acquisition continues industry roll-up strategy adding museum services

Continued Strong Internal Growth in Emerging Markets(1)

• Achieved 5.6% internal storage rental revenue growth in Q1

• Expanded presence and leadership through acquisitions in existing markets

(1) Emerging Markets is Other International, excluding Australia and New Zealand.

2018 Guidance

Disciplined Capital Allocation Designed to

Maximize Returns

Lease Adjusted Net Debt to EBITDAR(1)

6

Dividend as % of AFFO(3)

6.0X 4.0X

4.5X

5.0X

85% 65%

70%75%

Optimal Range(2)

Sources of capital:

• Growth in operating cash flow

• Secured and unsecured borrowings

• Real estate capital recycling

• ATM program or other equity

ROIC hurdle rate above WACC

5.0X

Optimal Range

4.5X

(1) See definition in the appendix of the Supplemental Financial Information

(2) Most restrictive Credit Facility covenant is lease adjusted net debt/EBITDAR of 6.5x.

(3) Targeted dividend increase of 4% annually through 2020

2020 Target

~73%

5.5X

81%

Solid Worldwide Financial Performance

7

Growth

(1) Reflects adjusted gross profit, excluding Significant Transaction Costs; reconciliation can be found in the Supplemental Financial Information on Page 5

(2) Reconciliation for Adjusted EBITDA and AFFO to their respective GAAP measures can be found in the Supplemental Financial Information on Pages 13 and 15, respectively

$ and shares in mm Q1-17 Q1-18 R$ C$ Internal

Growth

Revenue $939 $1,042 11.0% 8.0% 2.8%

Storage $572 $651 13.8% 10.7% 3.7%

Service $367 $391 6.7% 3.7% 1.4%

Adjusted Gross Profit(1) $520 $594 14.2%

Gross Profit Margin(1) 55.4% 57.0% 160 bps

Income from Continuing Operations $59 $46 (22.5%)

Adjusted EBITDA(2) $293 $343 17.2% 13.9%

Adjusted EBITDA Margin 31.2% 32.9% 170 bps

Net Income $59 $45 (22.8%)

AFFO(2) $171 $222 29.6%

Dividend/Share $0.550 $0.588 6.9%

Fully Diluted Shares Outstanding 265 286 8.0%

Strong Internal Revenue Growth in Q1

Developed

Markets(1)

Other

International(2) Total

Internal Revenue Growth

Storage 2.9% 5.6% 3.7%

Service 1.0% 4.4% 1.4%

Total 2.1% 5.1% 2.8%

% of Total Revenue by Segment

Storage 43.9% 12.6% 62.5%

Service 29.3% 7.3% 37.5%

8

(1) Represents North America Records and Information Management, North America Data Management and Western Europe reporting segments

(2) Other International represents emerging markets, Australia and New Zealand

Quarterly segment operating performance can be found on Page 10 of the Supplemental Financial Information

Solid Adjusted EBITDA Margin

Performance Across Segments

9

Adjusted EBITDA Q1 2017 Q1 2018 Change in bps

North America RIM 41.3% 42.8% 150

North America DM 54.8% 53.9% (90)

Western Europe 28.4% 32.2% 380

Other International 29.2% 29.2% 0

Global Data Center 24.2% 44.6% 2040

Total 31.2% 32.9% 170

Reconciliation for Total Adjusted EBITDA to its respective GAAP measure can be found in the Supplemental Financial Information on Page 13

Competitive Capital Structure

10

Source: J.P. Morgan REIT Weekly U.S. Real Estate report April 9, 2018 and company reports

Net Leverage Across REIT Sectors IRM vs. Industry

2020 Plan(1): Profitable, Sustainable Growth

11

(1) Updated to reflect 2017 actuals and 2018 Guidance, including adoption of revenue recognition standards and expansion of data center business. 2020 ranges at 2018 C$ rates.

(2) Assumes Real Estate and Non-Real Estate Maintenance CapEx and Non-Real Estate Investment of 4% of Total Revenue for 2020.

(3) Assumes 287 million shares outstanding for 2018 increasing to 295 to 300 million shares outstanding in 2020, reflecting long-term incentive comp and potential issuances under existing ATM program.

Lease Adjusted Leverage Ratio – Year-End

5.5x

~5.0x

2018E 2020E

$1,260

$1,680 –

$1,760

2017 Actual 2020E

$3,846

$4,600 –

$4,750

2017 Actual 2020E

Worldwide Revenue ($ in MM)

Adjusted EBITDA ($ in MM)

$2.35

$2.54

2018E 2020E

Projected Minimum Dividend per Share(3)

$752

$1,000 -

$1,070

2017 Actual 2020E

AFFO Growth(2) ($ in MM)

Key Takeaways

12

Quarter punctuated by strong total revenue growth and 3.7% internal storage rental revenue growth

Driving continued improvement in Adjusted EBITDA margins

Continuing to execute against our strategic plan to shift revenue mix to faster growing businesses

On track with deleveraging and dividend payout ratio goals, while growing our dividend per share

Accelerating growth in Data Center enhances 2020 plan and creates long-term growth platform

Prudent capital management to drive further shareholder returns

Appendix

2018 Guidance

14

• Expected internal storage rental revenue growth of 3% - 3.5% and total internal revenue growth of 2% - 3%

• Revenue recognition standards: expect to benefit Revenue by $7 mm and Adjusted EBITDA by approximately $15mm. No benefit is

expected for Adjusted EPS or AFFO.

• D&A is expected to be $640 - $660 million; Interest expense is expected to be $415 mm to $425 mm and cash taxes $65 mm to $75 mm

• Expect structural tax rate in the range of 18% - 20%

• Assumes full-year weighted average shares outstanding of 287 mm

• Real Estate and Non-Real Estate maintenance CapEx and Non-Real Estate Investments expected to be $155 to $165 mm

• Real Estate Investment and Innovation of $150 mm to $160 mm

• Optimizing real estate portfolio through capital recycling opportunities

• Base business acquisitions (~$150 mm) plus acquisitions of customer relationships and inducements (~$60 mm), excl. data center

acquisitions

• Data Center growth investment expected to be ~$185 mm excluding future acquisitions

$ in MM except Earnings per Share

2018

C$ Guidance

2018

C$ Growth

Revenue $4,160 - $4,260 7% - 9%

Adjusted EBITDA $1,435 - $1,485 12% - 16%

Adjusted EPS Fully Diluted $1.00 - $1.20 (15)% - 2%

AFFO $805 - $865 5% - 13%

Note: Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such

reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and

other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful.

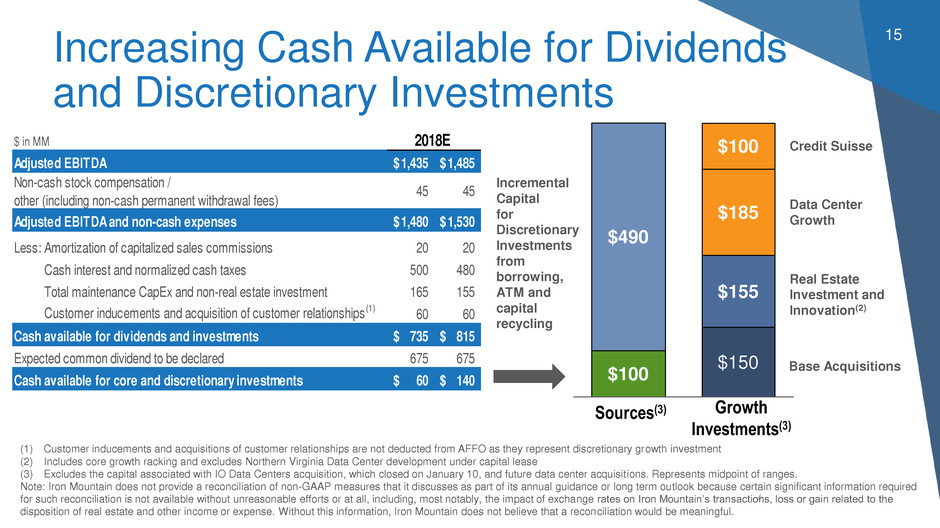

Increasing Cash Available for Dividends

and Discretionary Investments

15

$155

$185

$100

$100

$490

$150

Real Estate

Investment and

Innovation(2)

Data Center

Growth

Credit Suisse

Incremental

Capital

for

Discretionary

Investments

from

borrowing,

ATM and

capital

recycling

Growth

Investments(3)

Sources(3)

(1) Customer inducements and acquisitions of customer relationships are not deducted from AFFO as they represent discretionary growth investment

(2) Includes core growth racking and excludes Northern Virginia Data Center development under capital lease

(3) Excludes the capital associated with IO Data Centers acquisition, which closed on January 10, and future data center acquisitions. Represents midpoint of ranges.

Note: Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required

for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the

disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful.

Base Acquisitions

$ in MM

Adjusted EBITDA 1,435$ 1,485$

Non-cash stock compensation /

other (including non-cash permanent withdrawal fees)

45 45

Adjusted EBITDA and non-cash expenses 1,480$ 1,530$

Less: Amortization of capitalized sales commissions 20 20

Cash interest and normalized cash taxes 500 480

Total maintena ce CapEx and non-real estate investment 165 155

Customer inducements and acquisition of customer relationships (1) 60 60

Cash available for dividends and investments 735$ 815$

Expected common dividend to be declared 675 675

Cash available for core and discretionary investments 60$ 140$

2018E

Storage Continues to Drive Growth

16

10.5%

49.1%

18.7%

Records Management

Secure Shredding

Adjacent Businesses

Data Management

Data Center

Digital Solutions

Q1’18

Service Revenue

38% of total revenues

28% gross profit margin

Q1’18

Storage Revenue

62% of total revenues

74% gross profit margin

19%

of adjusted

gross profit

81%

of adjusted

gross profit

47.0%

9.1%

0.5%

1.5%

4.4%

9.7%

18.3%

0.8%

4.3%

0.1%

4.4%

Developed and Other International

RM Volume

Developed Markets

17

Other International

(1) Q2-17 cube growth has been adjusted to reflect required regulatory divestments in IRM’s legacy Australian business.

(2) Represents CuFt acquired at close. CuFt activity post close flows through new sales, new volume from existing customers, destructions, outperms / terms as appropriate.

Acquisitions/ dispositions reflects business acquisition volume net of dispositions required by Recall transaction and sale of Russia / Ukraine business.

(3) Acquisitions of customer relationships are included in new sales as the nature of these transactions is similar to new customer wins.

(2) (3)

9.9%

-4.3%

11.2%

-3.7%

10.5%

Q2-16

5.2%

-4.6%

86.9%

-4.5%

-4.4%

Q3-16

67.5%

5.9%

11.4%

54.6%

-5.3%

7.3%

Q1-17

1.8%

-5.3%

3.3%

7.6%

3.0%

-2.8%

-3.6%

Q2-17

-0.2%

7.8%

-3.5%

Q3-17

7.6%

-2.8%

Q4-17

1.8%

-2.8%

-3.0%

Q1-18

87.0%

5.4%

61.7%

3.0% 4.3%

6.0% 5.7%

-1.4%

-3.2%

-2.7%

2.6%

80.4%

Q4-16

-4.2%

80.2%

4.8%

2.4%

75.1%

5.2%

-1.7%

Q1-18

2.0%

-1.6%

16.0%

1.7%

Q2-16

-4.4%

16.3%

5.3%

15.3%

-5.0%

-1.7%

4.0%

-5.2%

15.6%

2.1%

-5.2%

5.2%

-1.7%

-4.3%

Q4-16

15.7%

1.8%

2.4%

2.1%

4.4%

-4.5%

-1.6%

Q2-17

-1.7%

0.3% 0.3%

2.0%

-4.3%

-1.7%

Q4-17

0.1%

2.2%

0.5%

2.2%

0.3%

-0.4%

Q3-17

-1.7%

5.2%

17.1%

-4.9%

4.1%

16.5%

Q3-16

14.6%

Q1-17

2.2%

3.9%

(1)

-0.4%