Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Hospitality Investors Trust, Inc. | tv492151_ex99-2.htm |

| 8-K - FORM 8-K - Hospitality Investors Trust, Inc. | tv492151_8k.htm |

Exhibit 99.1

American Realty Capital Hospitality Trust, Inc. HIT REIT Quarterly Investor Presentation April 26, 2018

Risk Factors Investing in our common stock involves a degree of risk . See the section entitled “Risk Factors” in the most recent Annual Report on Form 10 - K of Hospitality Investors Trust, Inc . (“HIT REIT,” the “Company” or “we”) for a discussion of the risks which should be considered in connection with the Company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review Risk Factors at the end of this presentation for a discussion of risks and uncertainties that could cause actual results to differ materially from our forward - looking statements. Risk Factors 2

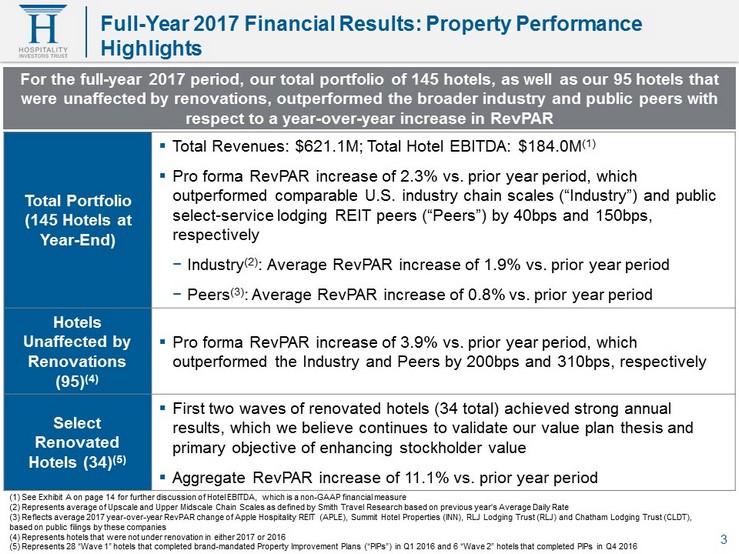

3 Full - Year 2017 Financial Results: Property Performance Highlights Total Portfolio (145 Hotels at Year - End) ▪ Total Revenues: $621.1M; Total Hotel EBITDA: $184.0M (1) ▪ Pro forma RevPAR increase of 2.3% vs. prior year period, which outperformed comparable U.S. industry chain scales (“Industry”) and public select - service lodging REIT peers (“Peers”) by 40bps and 150bps, respectively − Industry (2) : Average RevPAR increase of 1.9% vs. prior year period − Peers (3) : Average RevPAR increase of 0.8% vs. prior year period Hotels Unaffected by Renovations (95) (4) ▪ Pro forma RevPAR increase of 3.9% vs. prior year period, which outperformed the Industry and Peers by 200bps and 310bps, respectively Select Renovated Hotels (34) (5) ▪ First two waves of renovated hotels (34 total) achieved strong annual results, which we believe continues to validate our value plan thesis and primary objective of enhancing stockholder value ▪ Aggregate RevPAR increase of 11.1% vs. prior year period For the full - year 2017 period, our total portfolio of 145 hotels, as well as our 95 hotels that were unaffected by renovations, outperformed the broader industry and public peers with respect to a year - over - year increase in RevPAR (1) See Exhibit A on page 14 for further discussion of Hotel EBITDA, which is a non - GAAP financial measure (2) Represents average of Upscale and Upper Midscale Chain Scales as defined by Smith Travel Research based on previous year’ s A verage Daily Rate (3) Reflects average 2017 year - over - year RevPAR change of Apple Hospitality REIT (APLE), Summit Hotel Properties (INN), RLJ Lodg ing Trust (RLJ) and Chatham Lodging Trust (CLDT), based on public filings by these companies (4) Represents hotels that were not under renovation in either 2017 or 2016 (5) Represents 28 “Wave 1” hotels that completed brand - mandated Property Improvement Plans (“PIPs”) in Q1 2016 and 6 “Wave 2” ho tels that completed PIPs in Q4 2016

4 Update: Key Stakeholder/Investor Considerations Updated Per - Share Net Asset Value of $13.87 Recently Announced ▪ 5.1% increase over a nine - month period vs. prior figure of $13.20 (which was published in June 2017) ▪ Signals positive direction for HIT following our recent transformative events (transaction with affiliates of Brookfield Asset Management, Inc. (“Brookfield”) and transition to self - management) ▪ Further discussed on slide 10 Distribution Policy ▪ We continue to reinvest substantially all of our free cash flow into specific renovation programs for each of our assets through brand - mandated Property Improvement Plans (“PIPs”), in accordance with our primary objective of maximizing hotel performance and value enhancement, with the ultimate goal of optimally positioning the Company for a future liquidity event ▪ As of today, we have completed approximately one - half of our PIP program; we do not expect to reinstate distributions prior to the completion of all remaining PIPs, which is likely to continue for at least the next two years Shareholder Redemptions ▪ As a reminder, the shareholder redemption plan also remains terminated ▪ The Company offered a redemption opportunity in Q4 2017 at a significant discount to NAV in response to an unsolicited tender offer made by a third party; the Board of Directors did not recommend that shareholders tender their shares at such a discounted value and less than 1% of shareholders actually did tender ▪ The Board of Directors, with input from management, intends to periodically review reinstatement of a shareholder redemption program; however, such a program could be at a discount to NAV, and there can be no assurance that we will resume shareholder redemptions at any time in the future Liquidity Event Timetable (1) ▪ We continue to work towards positioning HIT for a liquidity event (such as a public listing, merger or sale) within three to five years, depending on capital market and current macroeconomic conditions ▪ We will continue to assess the possibility of earlier liquidity opportunities (1) Reflects Company assumptions which are subject to change; there can be no assurance a liquidity event will be achieved wi thi n this estimated timeframe or at all

5 Review of 2017 2018 Outlook Hotel Capital Investment ▪ $217M of combined PIP and capital expenditures with respect to our hotels since acquisition ▪ First four waves of brand - mandated PIPs completed as of year - end (51 hotels) ▪ PIPs in progress at 35 hotels (Wave 5) ▪ 30 additional hotels (Waves 6 and 7) scheduled to commence PIPs in late 2018 / early 2019, marking 116 hotels renovated since acquisition ▪ PIPs to continue for at least the next two years Debt Capital Structure Enhancements ▪ Closed $1.225Bn / L+3.02% refinancing − Reduced interest rate by 50bps (1) − Provided strategic flexibility and maturity through 2022 on majority of mortgage debt ▪ Redeemed $56.1M of preferred equity interests held by affiliates of the Whitehall real estate private equity funds sponsored by Goldman Sachs (“Whitehall”) ▪ Depending on market conditions, continue to explore strategic refinancing and cost saving opportunities ▪ Additional Whitehall redemptions of $14.4M completed during Q1’18 − Current outstanding balance of $219.7M (as of 4/27/18) − Redemption in full expected by 2/27/19 Acquisitions & Dispositions ▪ Acquired seven hotels from Summit Hotel Properties, Inc. for $66.8M ▪ Sold four non - core hotels for $17.4M (2) ▪ Continue to assess non - core disposition and premium acquisition reinvestment opportunities, subject to market conditions Structural Initiatives ▪ Received $400M convertible preferred equity capital commitment from Brookfield, $160M of which has been funded to date ▪ In conjunction, we completed our transition to self - management and are therefore no longer externally advised by AR Global affiliates ▪ Continue to advance plans for a potential liquidity event in three to five years (3) Strategic Initiatives: Review of 2017 and 2018 Outlook (1) Reflects interest rate reduction on aggregate loan balance of $1.13Bn repaid in refinancing in April 2017 (2) Three hotels were sold prior to year - end 2017, while the fourth hotel (Hampton Inn Chattanooga, TN) was under contract at ye ar - end 2017 and sold on 3/29/18 (3) Reflects Company assumptions which are subject to change; there can be no assurance a liquidity event will be achieved wi thi n this estimated timeframe or at all

▪ We own and acquire premier select - service hotels that are: ▪ Affiliated with premium national brands such as Hilton, Marriott and Hyatt ▪ Operated by award - winning and experienced property management companies ▪ Located in strong U.S. markets with diverse demand generators ▪ Well maintained, with brand - mandated renovations expected to further drive hotel operating performance ▪ Positioned as market leaders with attractive rates, occupancies and cash flows ▪ Purchased at what we believe to be a discount to replacement cost ▪ Best in class capital providers signal institutional affirmation of our platform and strategy Hospitality Investors Trust Business Thesis: 6 Investment Strategy

7 Validation of our Thesis Significant Performance Improvement at our Recently Renovated Hotels ▪ Our 34 hotels that completed brand - mandated PIPs during Q1’16 (Wave 1) and Q4’16 (Wave 2), respectively, have experienced a significant uptick in operating performance and achieved a combined RevPAR increase of 11.1% for full - year 2017 vs. the prior year period : ▪ Wave 1 (28 hotels): RevPAR increased by 11.2% in 2017 vs. the prior year period ▪ Wave 2 (six hotels): RevPAR increased by 10.2% in 2017 vs. the prior year period Year - End 2017 Operating Performance: 34 Recently Renovated Hotels Wave 1 Hotels (28) Wave 2 Hotels (6) Combined (34 Hotels) YE 2017 YE 2016 % Chg. YE 2017 YE 2016 % Chg. YE 2017 YE 2016 % Chg. Occupancy 80.1% 73.7% 8.7% 76.2% 69.7% 9.3% 79.5% 73.1% 8.8% ADR $125.41 $122.55 2.3% $120.85 $119.90 0.8% $124.72 $122.15 2.1% RevPAR $100.44 $90.29 11.2% $92.07 $83.56 10.2% $99.13 $89.23 11.1% Note: There can be no assurance, and management does not expect, that this growth rate will be sustainable; management believ es RevPAR growth for recently renovated hotels is likely to become more correlated with industry averages over time, as properties become further removed from renovation completion date s

($ in millions, except ADR and RevPAR) (1) The Company sold the Hampton Inn Chattanooga, TN on 3/29/18, resulting in a current portfolio of 144 hotels totaling 17,3 16 keys (2) Pro forma results include the results of 7 of the 145 hotels not owned for all of the periods presented, as if they had b een owned for all of the periods presented (3) The Company had 50 hotels classified as under renovation as of December 31, 2017; for this purpose, “under renovation” is ge nerally defined as extensive renovation of core aspects of the hotels, such as rooms, meeting space, lobby, bars, restaurants and other public spaces; we consider hotels to be under renova tio n beginning in the quarter that they start material renovations and continuing until the end of the fourth full quarter following substantial completion of the renovations (4) As a result of the mandatory redemption feature and other characteristics of this instrument, it is treated as debt in ac cor dance with GAAP (5) As of December 31, 2017, the liquidation preference was $140.2 million; as a result of the contingent redemption features an d other characteristics of this instrument, it is treated as temporary equity in accordance with GAAP (6) See Exhibit A for further discussion of Hotel EBITDA, which is a non - GAAP financial measure 8 Financial Summary: Year - End 2017 Portfolio Summary (1) Operating Metrics (2) as of December 31, 2017 Pro Forma Year Ended December 31, 2017 Hotels 145 & December 31, 2016 Keys 17,483 2017 2016 % chg. States 33 Total Portfolio (145 Hotels) MSAs 78 Number of Rooms 17,483 17,483 Occupancy 76.3% 75.7% 0.8% Capital Structure Summary ADR $122.91 $121.16 1.4% as of December 31, 2017 RevPAR $93.82 $91.71 2.3% Total Assets $2,420.7 Mortgage Debt $1,495.8 Hotels Not Under Renovation (95 Hotels) (3) Promissory Note Payable $1.0 Number of Rooms 11,810 11,810 Mandatorily Redeemable Preferred Equity (4) $233.1 Occupancy 77.4% 75.4% 2.7% Contingently Redeemable Class C Units (5) $128.0 ADR $123.50 $121.98 1.2% Debt / Assets 61.8% RevPAR $95.57 $91.99 3.9% Debt + Preferred + Class C / Assets 76.8% Summary of Actual Financials During Period of Ownership Year Ended December 31, 2017 Total Revenue $621.1 Hotel Expenses ($437.1) Hotel EBITDA (6) $184.0

Hotels Keys % Keys Summary by Brand 63 8,012 45.8% 62 6,831 39.1% 17 2,230 12.8% Other 4 531 2.3% Total 145 17,483 100.0% Hotels Keys % Keys Top 5 Flags 44 5,321 30.4% 23 2,796 16.0% 16 2,081 11.9% 19 1,751 10.0% 11 1,494 8.5% Top 5 MSAs Hotels Keys % Keys Miami / East Coast of South FL 7 780 4.5% Orlando 4 780 4.5% Chicago 5 763 4.4% Atlanta 3 543 3.1% Baton Rouge 5 499 2.9% Portfolio Composition (1) Geography (145 Hotels, 33 States) (1) Top Hotels by State 9 Hotel Portfolio Snapshot: Year - End 2017 22 14 12 9 6 6 5 5 5 5 5 FL TN TX GA KY IL OH MI LA CA CO (1) The Company sold the Hampton Inn Chattanooga, TN on 3/29/18, resulting in a current portfolio of 144 hotels totaling 17,3 16 keys

10 Updated Per - Share NAV of $13.87 Announced on April 23 rd Represents 5.1% Increase Compared to Prior NAV ▪ On April 23, 2018, our Board of Directors unanimously approved the estimated per - share net asset value (“Estimated Per - Share NAV”) of the Company’s common stock equal to $13.87, as of December 31, 2017 ▪ This represents an increase of 5.1% over a nine - month period compared to our previous Estimated Per - Share NAV of $13.20, which was calculated as of March 31, 2017 ▪ We will publish an updated Estimated Per - Share NAV on at least an annual basis that we expect will continue to be based on year - end results

11 Conclusion ▪ In 2017, we saw improved operating results and performance following our hotel capital investments, generating what we believe to be a strong return on capital ▪ 5.1% NAV increase over nine - month period signals positive trend for the Company following its transition to self - management and transformative Brookfield transaction; PIP program will continue and is expected to improve the competitive position of our hotels, drive performance and ultimately maximize stockholder value ▪ $1.225Bn refinancing closed in Q2’17 affords the Company attractive long - term financing and flexibility; lending group offers best in class credit investors who we believe are willing to grow with us in the future ▪ Capital recycling initiatives (acquisitions and dispositions) expected to further facilitate portfolio enhancement ▪ Board and Management continue to be committed to the Company’s stakeholders and maximizing stakeholder value

See ‘‘Risk Factors’’ beginning on page 8 of the Company’s 2017 Form 10 - K for a discussion of the risks that should be considered in connection with your investment in our common stock, including : • We have entered into agreements with Brookfield Strategic Real Estate Partners II Hospitality REIT II LLC (the “Brookfield Investor”), pursuant to which, among other things, the Brookfield Investor has purchased $160.0 million in units of a new class of limited partner interests in our operating partnership entitled “Class C Units” (the “Convertible Preferred Units”), and the Brookfield Investor has agreed to purchase additional Convertible Preferred Units in an aggregate amount of up to $240.0 million at subsequent closings (“Subsequent Closings”). We may require funds, which may not be available on favorable terms or at all, in addition to our operating cash flow, cash on hand and the proceeds that may be available from sales of Convertible Preferred Units at Subsequent Closings, which are subject to conditions, to meet our capital requirements. • The interests of the Brookfield Investor may conflict with our interests and the interests of our stockholders, and the Brookfield Investor has significant governance and other rights that could be used to control or influence our decisions or actions. • The prior approval rights of the Brookfield Investor will restrict our operational and financial flexibility and could prevent us from taking actions that we believe would be in the best interest of our business. • We no longer pay distributions and there can be no assurance we will resume paying distributions in the future. • We may not be able to make additional investments unless we are able to identify an additional source of capital on favorable terms and obtain prior approval from the Brookfield Investor. • We have a history of operating losses and there can be no assurance that we will ever achieve profitability. • We have terminated our advisory agreement with our former advisor, American Realty Capital Hospitality Advisors, LLC, and other agreements with its affiliates as part of our transition from external management to self - management. As part of this transition, our business may be disrupted and we may become exposed to risks to which we have not historically been exposed. 12 Risk Factors

13 Risk Factors • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. • All of the properties we own are hotels, and we are subject to risks inherent in the hospitality industry. • Increases in interest rates could increase the amount of our debt payments. • We have incurred substantial indebtedness, which may limit our future operational and financial flexibility. • We depend on our operating partnership and its subsidiaries for cash flow and are effectively structurally subordinated in right of payment to their obligations, which include distribution and redemption obligations to holders of Convertible Preferred Units and the preferred equity interests issued by two of our subsidiaries that indirectly own 111 of our hotels. • The amount we would be required to pay holders of Convertible Preferred Units in a fundamental sale transaction may discourage a third party from acquiring us in a manner that might otherwise result in a premium price to our stockholders. • We may fail to realize the expected benefits of our acquisitions of hotels within the anticipated timeframe or at all and we may incur unexpected costs. • Increases in labor costs could adversely affect the profitability of our hotels. • Our operating results will be affected by economic and regulatory changes that have an adverse impact on the real estate market in general, and we may not be profitable or realize growth in the value of our real estate properties. • A prolonged economic slowdown, a lengthy or severe recession or declining real estate values could harm our investments. • Our real estate investments are relatively illiquid and subject to some restrictions on sale, and therefore we may not be able to dispose of properties at the time of our choosing or on favorable terms. • Our failure to continue to qualify to be treated as a real estate investment trust for U.S. federal income tax purposes could have a material adverse effect on us.

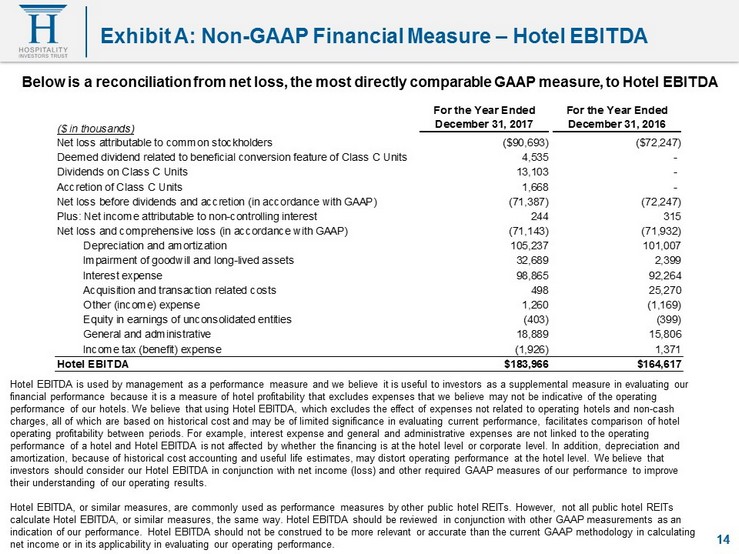

Below is a reconciliation from net loss, the most directly comparable GAAP measure, to Hotel EBITDA Hotel EBITDA is used by management as a performance measure and we believe it is useful to investors as a supplemental measur e i n evaluating our financial performance because it is a measure of hotel profitability that excludes expenses that we believe may not be indica tiv e of the operating performance of our hotels. We believe that using Hotel EBITDA, which excludes the effect of expenses not related to operating ho tels and non - cash charges, all of which are based on historical cost and may be of limited significance in evaluating current performance, faci lit ates comparison of hotel operating profitability between periods. For example, interest expense and general and administrative expenses are not linked to the operating performance of a hotel and Hotel EBITDA is not affected by whether the financing is at the hotel level or corporate level. In ad dition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the hotel le vel. We believe that investors should consider our Hotel EBITDA in conjunction with net income (loss) and other required GAAP measures of our perf orm ance to improve their understanding of our operating results. Hotel EBITDA, or similar measures, are commonly used as performance measures by other public hotel REITs. However, not all pu bli c hotel REITs calculate Hotel EBITDA, or similar measures, the same way. Hotel EBITDA should be reviewed in conjunction with other GAAP mea sur ements as an indication of our performance. Hotel EBITDA should not be construed to be more relevant or accurate than the current GAAP met hod ology in calculating net income or in its applicability in evaluating our operating performance. 14 Exhibit A: Non - GAAP Financial Measure – Hotel EBITDA 14 For the Year Ended For the Year Ended ($ in thousands) December 31, 2017 December 31, 2016 Net loss attributable to common stockholders ($90,693) ($72,247) Deemed dividend related to beneficial conversion feature of Class C Units 4,535 - Dividends on Class C Units 13,103 - Accretion of Class C Units 1,668 - Net loss before dividends and accretion (in accordance with GAAP) (71,387) (72,247) Plus: Net income attributable to non-controlling interest 244 315 Net loss and comprehensive loss (in accordance with GAAP) (71,143) (71,932) Depreciation and amortization 105,237 101,007 Impairment of goodwill and long-lived assets 32,689 2,399 Interest expense 98,865 92,264 Acquisition and transaction related costs 498 25,270 Other (income) expense 1,260 (1,169) Equity in earnings of unconsolidated entities (403) (399) General and administrative 18,889 15,806 Income tax (benefit) expense (1,926) 1,371 Hotel EBITDA $183,966 $164,617