Attached files

| file | filename |

|---|---|

| EX-31.6 - EXHIBIT 31.6 KEVIN BRYANT CERTIFICATION - GREAT PLAINS ENERGY INC | exhibit316certkevinebryant.htm |

| EX-31.5 - EXHIBIT 31.5 TERRY BASSHAM CERTIFICATION - GREAT PLAINS ENERGY INC | exhibit315certterrybassham.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _______to_______

Exact name of registrant as specified in its charter, | ||||

Commission | state of incorporation, address of principal | I.R.S. Employer | ||

File Number | executive offices and telephone number | Identification Number | ||

001-32206 | GREAT PLAINS ENERGY INCORPORATED | 43-1916803 | ||

(A Missouri Corporation) | ||||

1200 Main Street | ||||

Kansas City, Missouri 64105 | ||||

(816) 556-2200 | ||||

Each of the following classes or series of securities registered pursuant to Section 12(b) of the Act is registered on the New York Stock Exchange: | ||||||

Registrant | Title of each class | |||||

Great Plains Energy Incorporated | Common Stock, without par value | |||||

Securities registered pursuant to Section 12(g) of the Act: None. | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | |||||||||||||

Great Plains Energy Incorporated | Yes | X | No | _ | |||||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | |||||||||||||

Great Plains Energy Incorporated | Yes | _ | No | X | |||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | |||||||||||||

Great Plains Energy Incorporated | Yes | X | No | _ | |||||||||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | |||||||||||||

Great Plains Energy Incorporated | Yes | X | No | _ | |||||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. | |||||||||||||

Great Plains Energy Incorporated | X | ||||||||||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | |||||||||||||

Great Plains Energy Incorporated | Large accelerated filer | X | Accelerated filer | _ | |||||||||

Non-accelerated filer | _ | Smaller reporting company | _ | ||||||||||

Emerging Growth Company | _ | ||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | |||||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | |||||||||||||

Great Plains Energy Incorporated | Yes | _ | No | X | |||||||||

The aggregate market value of the voting and non-voting common equity held by non-affiliates of Great Plains Energy Incorporated (based on the closing price of its common stock on the New York Stock Exchange on June 30, 2017) was approximately $6,311,042,442. | |||||||||||||

On April 15, 2018, Great Plains Energy Incorporated had 215,795,884 shares of common stock outstanding. | |||||||||||||

Documents Incorporated by Reference | |||||||||||||

None. | |||||||||||||

EXPLANATORY NOTE

Great Plains Energy Incorporated (the “Company” or “Great Plains Energy”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) to amend its Annual Report on Form 10-K for the year ended December 31, 2017, originally filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2018 (the “Original Filing”), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K. This Amendment No. 1 consists solely of the preceding cover page, this explanatory note, the information required by Part III, Items 10, 11, 12, 13, and 14 of Form 10-K, a signature page and certifications required to be filed as exhibits.

The reference on the cover page of the Original Filing to the incorporation by reference of portions of our definitive proxy statement into Part III of the Original Filing related to Great Plains Energy is hereby deleted. In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, including Items 10 through 14 of the Original Filing, solely as they relate to Great Plains Energy, is hereby amended and restated in its entirety.

This Amendment No. 1 does not reflect events occurring after the Original Filing, and, except as described above, does not modify or update any other disclosures. In particular, no changes have been made to the Original Filing with respect to Kansas City Power & Light Company (“KCP&L”), and this Form 10-K/A is not, and shall not be deemed to be an amendment of the Form 10-K filed by KCP&L as part of the Original Filing.

i

TABLE OF CONTENTS | |

Page | |

EXPLANATORY NOTE | |

TABLE OF CONTENTS | |

PART III | |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

Directors | |

ITEM 11. EXECUTIVE COMPENSATION | |

Director Compensation | |

Compensation Committee Interlocks and Insider Participation | |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND OFFICERS | |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

Related Party Transactions | |

Director Independence | |

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

PART IV | |

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES EXHIBIT INDEX | |

Signature | |

ii

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

DIRECTORS

The names, ages and backgrounds, including the business experience, principal occupations and employment, of all directors of the Company are set forth below. Directors are elected to serve until the next annual meeting of the shareholders and until his or her successor shall be elected and qualified.

Terry Bassham | Director since 2011 |

Mr. Bassham, 57, is Chairman of the Board (since May 2013), President (since May 2011) and Chief Executive Officer (“CEO”) (since June 2012) of Great Plains Energy, KCP&L and KCP&L Greater Missouri Operations Company (“GMO”). He served as Chief Operating Officer of Great Plains Energy, KCP&L and GMO (2011-2012). He served as Executive Vice President-Utility Operations of KCP&L and GMO (2010-2011) and Executive Vice President-Finance and Strategic Development and Chief Financial Officer of Great Plains Energy (2005-2010) and of KCP&L and GMO (2009-2010). Mr. Bassham also currently serves on the board of Commerce Bancshares, Inc. (since 2013). | |

Mr. Bassham holds a Bachelor of Business Administration degree in accounting from the University of Texas-Arlington and a Juris Doctor degree from St. Mary’s University Law School in San Antonio, Texas. Mr. Bassham has extensive regulated public utility experience with over 25 years in the industry. As President and CEO of the Company and the former Chief Operating Officer, he also brings to the Board deep insight and knowledge about the operations and capabilities of the Company. | |

David L. Bodde | Director since 1994 |

Dr. Bodde, 75, is a Professor Emeritus effective 2017 at Clemson University (since 2004). He previously held the Charles N. Kimball Chair in Technology and Innovation (1996-2004) at the University of Missouri-Kansas City. He is a trustee of The Commerce Funds (since 1994). Prior to academic service, he was Vice President of the Midwest Research Institute and President of its subsidiary, MRI Ventures, Inc. Dr. Bodde serves as a member of the Company’s Audit and Governance Committees. Dr. Bodde is also a director of KCP&L (since 1994) and GMO (since 2008). | |

Dr. Bodde holds a Bachelor of Science from West Point, Master of Science degrees in nuclear engineering and management from the Massachusetts Institute of Technology, and a Doctor of Business Administration degree from Harvard University. He has extensive experience in research, teaching, writing and consulting on energy policy, electric utility strategy, enterprise risk management, and technology assessment. His current work focuses on managing the risks of emerging energy technologies, especially related to electric utilities. His latest book, Chance and Intent, concerns managing the risks of innovation and entrepreneurship. His experience as a director provides valuable perspective and institutional knowledge to the Board’s discussions and actions. | |

1

Randall C. Ferguson, Jr. | Director since 2002 |

Mr. Ferguson, 66, was the Senior Partner for Business Development for Tshibanda & Associates, LLC (2005-2007), a consulting and project management services firm committed to assisting clients to improve operations and achieve long-lasting, measurable results. He previously served as Senior Vice President Business Growth & Member Connections with the Greater Kansas City Chamber of Commerce (2003-2005). Mr. Ferguson serves as a member of the Company’s Compensation and Development and Governance Committees. Mr. Ferguson is also a director of KCP&L (since 2002) and GMO (since 2008). | |

Mr. Ferguson has extensive and varied senior management leadership experience and accomplishments gained through his 30-year career at IBM and at Tshibanda & Associates. He has broad strategic experience and insight into economic growth and policy through his prior leadership position at the Greater Kansas City Chamber of Commerce. Mr. Ferguson also brings a strong focus on the Company’s community service and diversity activities. He has been recognized for his leadership and community service on numerous occasions, including recognition by The Kansas City Globe as one of Kansas City’s most influential African Americans. | |

Gary D. Forsee | Director since 2008 |

Mr. Forsee, 68, was President of the four-campus University of Missouri System (2008-2011). He previously served as Chairman of the Board (2006-2007) and CEO (2005-2007) of Sprint Nextel Corporation, and Chairman of the Board and CEO (2003-2005) of Sprint Corporation. He serves on the boards of Ingersoll-Rand Public Limited Company (since 2007) and DST Systems, Inc. (since 2015). Mr. Forsee serves as the Lead Director of the Board and as a member of the Company’s Audit, Compensation and Development, and Governance Committees. Mr. Forsee is also a director of KCP&L and GMO (since 2008). | |

Mr. Forsee has extensive and varied senior management leadership experience and accomplishments gained as President of the University of Missouri System and through his more than 35-year telecommunications career at Sprint Nextel, BellSouth Corporation, Global One, AT&T and Southwestern Bell. Mr. Forsee’s experience and insight acquired through managing large technologically complex and rapidly changing companies in dynamic regulatory environments is of particular value to the Company, which is facing similar challenges. | |

Scott D. Grimes | Director since 2014 |

Mr. Grimes, 55, is Chief Executive Officer and Founder of Cardlytics, Inc. (since 2008), an international technology company that has pioneered card-linked marketing. Mr. Grimes previously served as Senior Vice President and General Manager, Payments (2005-2008) and as Vice President, Strategy (2003-2005) of Capital One Financial Corporation and Principal (2001-2003) at Canaan Partners. Mr. Grimes serves as a member of the Company’s Audit and Compensation and Development Committees. Mr. Grimes is also a director of KCP&L and GMO (since 2014). | |

Mr. Grimes has extensive and varied senior management leadership experience and accomplishments gained as the Chief Executive Officer at Cardlytics, Inc. and a former executive at Capital One. As an entrepreneur and strategist, Mr. Grimes brings deep insight and entrepreneurial focus to the Company’s strategic planning. | |

2

Thomas D. Hyde | Director since 2011 |

Mr. Hyde, 69, served as Executive Vice President, Legal, Compliance, Ethics and Corporate Secretary of Wal-Mart Stores, Inc. (“Wal-Mart”), an international retail store operator (2005-2010). Mr. Hyde previously served as Executive Vice President, Legal and Corporate Affairs and Corporate Secretary of Wal-Mart (2003-2005), and as Executive Vice President, Senior General Counsel of Wal-Mart (2001-2003). Mr. Hyde served on the board of Vail Resorts, Inc. (2006-2012). He serves as a Trustee of the University of Missouri-Kansas City (since 2010). Mr. Hyde serves as a member of the Company’s Audit and Governance Committees. Mr. Hyde is also a director of KCP&L and GMO (since 2011). | |

Mr. Hyde has extensive and varied senior management leadership experience and accomplishments gained through his career at Wal-Mart, and through such experience, he provides deep insight and understanding on corporate governance matters. Mr. Hyde graduated from the University of Kansas in 1970 with a degree in English. He received his Juris Doctor degree from the University of Missouri-Kansas City in 1975, and a Master of Business Administration degree in Finance from the University of Kansas in 1981. | |

Ann D. Murtlow | Director since 2013 |

Ms. Murtlow, 57, is President and Chief Executive Officer of the United Way of Central Indiana (since 2013). Previously, she served as Principal of AM Consulting LLC (2011-2013). She served as Vice President and Group Manager of AES Corporation (1999-2011) and President, Chief Executive Officer and Director of Indianapolis Power & Light Company (“IPL”) and IPALCO Enterprises (2002-2011), which are wholly-owned subsidiaries of AES Corporation. Ms. Murtlow currently serves on the boards of First Internet Bancorp and its subsidiary, First Internet Bank (since 2013), and Wabash National Corporation (since 2013). She previously served on the boards of the Federal Reserve Bank of Chicago (2007-2012), Herff Jones (2009-2015) and AEGIS Insurance Services, Inc. (2009-2011). Ms. Murtlow serves as a member of the Company’s Audit and Governance Committees. Ms. Murtlow is also a director of KCP&L and GMO (since 2013). | |

Ms. Murtlow has extensive and varied senior management leadership experience and accomplishments gained through her career at AES Corporation and Bechtel Corporation. Her expertise acquired at IPL and IPALCO brings deep insight and knowledge about the operations and challenges of a vertically integrated, regulated electric utility. Ms. Murtlow has been named a Board Leadership Fellow by the National Association of Corporate Directors. | |

Sandra J. Price | Director since 2016 |

Ms. Price, 59, is the former Senior Vice President, Human Resources of Sprint Corporation (2006 - 2016). Previously, she led the Human Resources, Communications and Brand Management functions of the Sprint Local Telephone Division and a variety of other human resources roles (1993-2006). Prior to Sprint, she was a principal in the Blue Valley School District, Overland Park, Kansas, and in the Jenks Public School District, Tulsa, Oklahoma. She currently serves as co-chair for KC Rising, a regional economic development initiative. Ms. Price serves as a member of the Company’s Compensation and Development and Governance Committees. Ms. Price is also a director of KCP&L and GMO (since 2016). | |

Ms. Price has extensive and varied senior management leadership experience and accomplishments gained through her career. Her expertise acquired by leading all aspects of the Sprint human resources function and developing creative initiatives brings valuable depth to the Company’s human capital perspective. Ms. Price was named to the Kansas City Business Journal’s “Women Who Mean Business” list and to the Profiles in Diversity Journal’s “Women Worth Watching.” | |

3

John J. Sherman | Director since 2009 |

Mr. Sherman, 63, is the vice chairman of the Cleveland Indians Baseball Club and a director of Crestwood Equity GP LLC (formerly known as Inergy GP, LLC). He was a director of Crestwood Midstream GP LLC (formerly known as NRGM GP, LLC) prior to its merger with Crestwood Equity GP, LLC. He formerly served as the Chief Executive Officer, President and Director of NRGM GP, LLC, general partner of Inergy Midstream, L.P. (2011-2013). He also served as Founder, Chief Executive Officer and Director of Inergy GP, LLC (the general partner of Inergy, L.P.) (2001-2013) and served as President, Chief Executive Officer and a director of Inergy Holdings GP, LLC (2005-2010). Mr. Sherman serves as a member of the Company’s Audit and Compensation and Development Committees. Mr. Sherman is also a director of KCP&L and GMO (since 2009). | |

Mr. Sherman has extensive and varied senior management leadership experience, accomplishments and energy policy expertise gained through his career in the propane industry with Inergy, Dynegy, LPG Services Group (which he co-founded) and Ferrellgas. In addition to this expertise, Mr. Sherman brings a strong entrepreneurial focus to the Company’s strategic planning. | |

CORPORATE GOVERNANCE

Audit Committee

The Company has an audit committee. The audit committee’s current members are Messrs. Hyde (Chair), Forsee, Grimes and Sherman, Dr. Bodde and Ms. Murtlow. The Board has determined that all members of the committee are financially literate and that Messrs. Forsee, Grimes, Hyde, Sherman and Ms. Murtlow are “audit committee financial experts” as that term is defined by the SEC. The Board of Directors has determined that each of the members of the committee meets the experience and independence requirements of the rules of the New York Stock Exchange.

Code of Ethical Business Conduct

Lawful and ethical business conduct is required at all times. Our Board has adopted a Code of Ethical Business Conduct (the “Code”), which applies to our directors, officers and employees. Although the Code is designed to apply directly to our directors, officers and employees, we expect all parties who work on behalf of the Company to embrace the spirit of the Code. The Code is one part of our process to ensure lawful and ethical business conduct throughout the Company; other parts of the process include policies and procedures, compliance monitoring and reporting, and periodic training on various areas of the law and the Code. We have also established a ConcernsLine that can be accessed via a toll-free telephone number or through its website. The ConcernsLine is independently administered and is available 24 hours a day, every day, for the confidential and anonymous reporting of concerns and complaints by anyone inside or outside the Company. The ConcernsLine telephone number is listed in our Code.

The Code is available on the Company’s website at www.greatplainsenergy.com and is also available in print to any shareholder upon request. Requests should be directed to Corporate Secretary, Great Plains Energy Incorporated, 1200 Main Street, Kansas City, MO 64105. The Company intends to disclose any change in the Code, or any waiver from a provision in the Code granted to a director or an executive officer, by posting such information on its website or by filing a Form 8-K. Information on, or that can be accessed through, the Company’s website is not, and shall not be deemed to be, a part of this Amendment No. 1. or incorporated into any other filings the Company makes with the SEC.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons owning more than 10 percent of our common stock to file reports of holdings and transactions in our common stock with

4

the SEC. Due to administrative error by the Company, Mr. Heidtbrink had one late Form 4 filing relating to an award of time-based restricted stock. Based upon our records, we believe that all other required reports for 2017 have been timely filed.

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

We are a public utility holding company, and our financial performance is driven by the performance of our two electric utility subsidiaries, KCP&L and GMO. Both subsidiaries are integrated electric utilities; that is, they generate, transmit and distribute electricity to their customers. KCP&L serves retail and wholesale customers in parts of Missouri and Kansas; GMO serves retail and wholesale customers in parts of Missouri.

Our compensation philosophy and decisions, which we explain below, are directly tied to our utility business. Our business is capital-intensive and subject to extensive and dynamic utility and environmental regulation. We operate in a technological environment that is complex and evolving. Our retail customer service areas and rates are fixed by the Missouri and Kansas utility commissions, which means that our financial health and growth potential are, in large part, directly tied to the communities we serve and the decisions of our regulatory commissions.

This Compensation Discussion and Analysis provides a comprehensive explanation of the compensation awarded to, earned by, or paid to the following individuals listed below, who are our named executive officers (“NEOs”) for 2017:

• | Terry Bassham, Chairman of the Board, President and Chief Executive Officer of Great Plains Energy, KCP&L and GMO; |

• | Kevin E. Bryant, Senior Vice President-Finance and Strategy and Chief Financial Officer of Great Plains Energy, KCP&L and GMO; |

• | Heather A. Humphrey, Senior Vice President-Corporate Services and General Counsel of Great Plains Energy, KCP&L and GMO; |

• | Lori A. Wright, Vice President-Corporate Planning, Investor Relations and Treasurer of Great Plains Energy, KCP&L and GMO; |

• | Charles A. Caisley, Vice President-Marketing and Public Affairs of Great Plains Energy, KCP&L and GMO; and |

• | Scott H. Heidtbrink, former Executive Vice President and Chief Operating Officer of KCP&L and GMO. |

Mr. Heidtbrink retired from the Company effective May 1, 2017.

Committee Consideration of the Company’s 2017 Shareholder Vote on Executive Compensation

At our May 2017 annual meeting, approximately 97 percent of our shareholders voting on the matter approved our 2016 executive compensation program. The Compensation and Development Committee (referred to throughout the “Compensation Discussion and Analysis” and “Executive Compensation” sections as the “Committee”) believes this affirms the shareholders’ support of the Company’s approach to

5

executive compensation, including our emphasis on pay for performance. The Committee decided that no significant changes to our executive compensation program were necessary for 2017.

Executive Summary of 2017 Compensation Decisions

2017 Performance Achievements

Our 2017 compensation decisions continued to be focused on pay for performance – the achievement of interrelated short-term and long-term objectives that are critical to our operations, financial health and growth. We believe a majority of each NEO’s target compensation should be performance-based, or “at risk.” Therefore, a significant portion of each NEO’s compensation is tied to our total shareholder return (“TSR”) and the achievement of Company-wide objectives for designated performance periods (see “2017 Compensation Decisions”). In order to align the interests of our NEOs with shareholder and customer interests, our executive compensation program provides more potential value to the NEOs through performance-based incentives than it does through base salary.

We believe that our focus on pay for performance helped motivate our NEOs and other officers throughout 2017. Through management’s efforts, we achieved the following highlights, among others:

• | Executing strategy through proposed merger with Westar Energy, Inc. (“Westar”) |

In July 2017, we entered into an amended and restated agreement and plan of merger with Westar. By merging with Westar, we expect to build long-term value for our shareholders and cost savings for customers. Once the merger is complete, the combined company is expected to have more than 1.5 million customers in Kansas and Missouri, nearly 13,000 megawatts of owned generation capacity, almost 10,000 miles of transmission lines and over 52,000 miles of distribution lines. In addition, more than 45 percent of the combined utility’s retail customer demand are expected to be met with emission-free energy.

The transactions contemplated by our amended and restated merger agreement were approved by our shareholders in November 2017.

• | Investing to continue to meet the needs of our region in an environmentally conscientious manner |

Federal and state agencies require us to comply with environmental and renewable energy mandates, and we have proactively responded to continue to meet the generation needs of our customers. In 2017, we announced retirement plans for six units at three power plants totaling 900 megawatts of capacity. The coal units are expected to be retired by the end of 2018 and the gas unit is expected to retired by the end of 2019. In addition, in 2017, we entered into two new wind power purchase agreements totaling 444 megawatts. This additional wind capacity will be generated at two new wind farms located in Kansas.

In 2017, Kansas City made significant steps to adopting electric vehicles (“EVs”), which is helping transform the region into a premium location for EVs in the United States. KCP&L’s Clean Charge Network is one of the nation’s largest electric car charging networks and the first major network implemented by a public utility.

The Company also published its first sustainability report, which is available on the Company’s website at www.greatplainsenergy.com. All of these actions demonstrate our commitment to a sustainable future for our customers and our region.

6

• | Continuing with our outstanding record of reliability |

KCP&L was again recognized by PA Consulting Group, Inc. as the recipient of the 2017 Outstanding Customer Reliability Experience Award and was also named as the recipient of the ReliabilityOneTM Award for Outstanding Reliability Performance in the Plains Region. Providing safe and reliable power for all of our customers continues to be a top priority for our employees and one of the foundations of KCP&L’s operating strategy.

2017 Executive Compensation Decisions

The Committee and Board considered the achievements described above and made the following key executive compensation decisions:

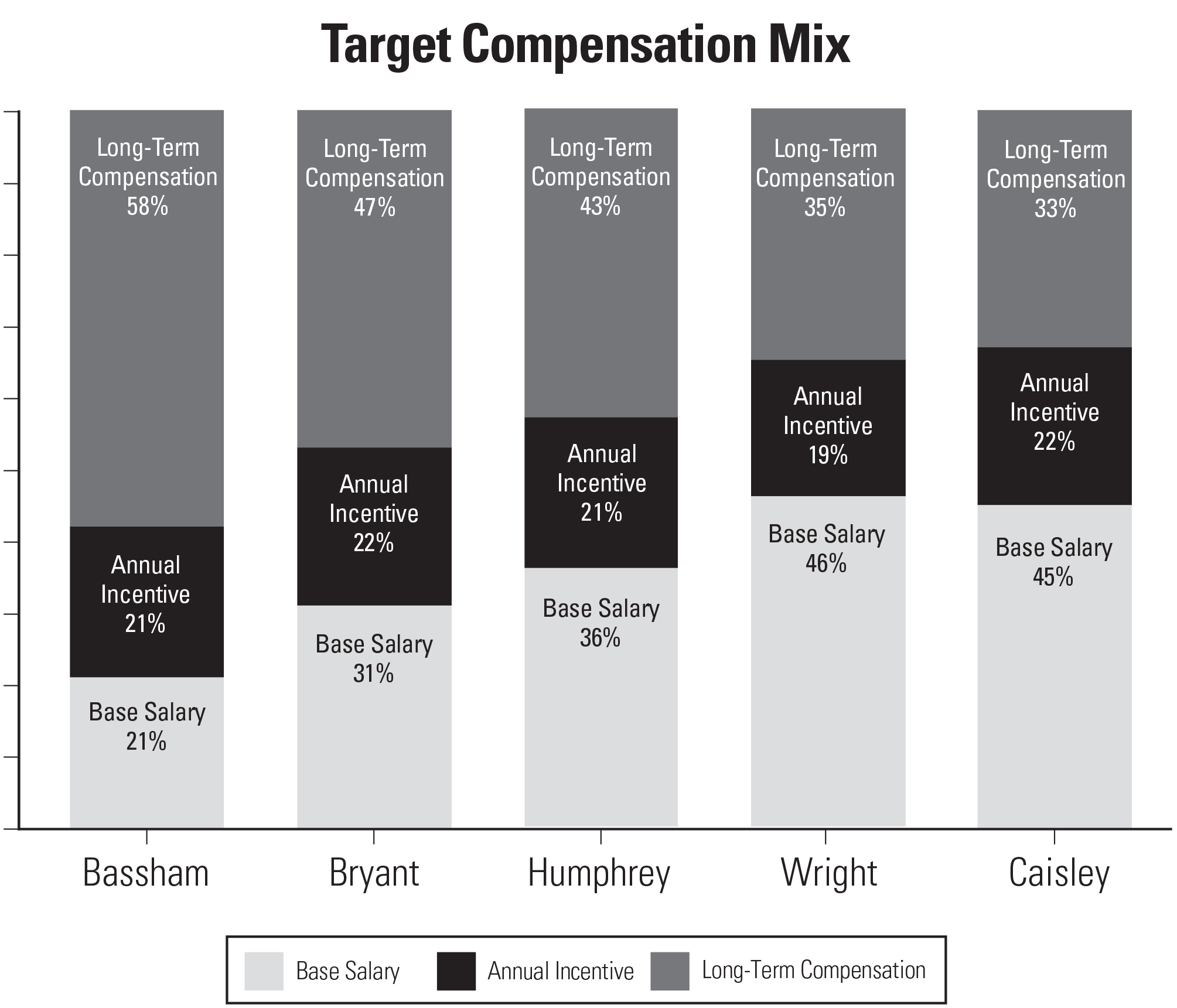

• | Balanced Mix of Compensation Elements. As in prior years, the Committee established, and the independent members of the Board approved, a mix of short-term and long-term compensation elements that reflected financial and operational goals and encouraged overall balanced performance to support sustainable shareholder value. The following chart shows the target pay mix of the 2017 direct compensation elements (base salary, annual incentive awards and long-term equity compensation awards) set out in the Summary Compensation Table on page 26 for each of our NEOs, except Mr. Heidtbrink, who retired from the Company effective May 1, 2017. |

The compensation of each NEO also includes retirement benefits, generally available employee benefits, deferred compensation benefits and modest perquisites, as well as post-termination compensation.

• | Annual and Long-Term Performance Awards Tied to Achievement of Critical Objectives. To align compensation with shareholder and customer interests, a significant portion of each NEO’s compensation is tied to our short-term and long-term financial and operational performance. |

7

Our 2017 annual incentive objectives and achievements were as follows:

2017 Annual Incentive Objectives | Weighting (Percent) | Achievement (Percent of Target) | Weighted Payout Percentage | |||||||

Safety Audits & Training | 10 | 150 | 15 | % | ||||||

Equivalent Availability (Coal Units, Winter and Summer Peak Months) | 10 | 61 | 6 | % | ||||||

Equivalent Availability (Nuclear Only) | 5 | 200 | 10 | % | ||||||

System Average Interruption Duration Index (SAIDI) (minutes) | 10 | 200 | 20 | % | ||||||

Adjusted Earnings Per Share (excludes impact of proposed Westar merger and the initial impact of U.S. federal income tax reform) | 50 | 144 | 72 | % | ||||||

JD Power Customer Satisfaction Index (Residential Customer Satisfaction) | 10 | 0 | 0 | % | ||||||

Investment Across the Energy Value Chain that is Adjacent to our Existing Business | 5 | 0 | 0 | % | ||||||

The Company’s total 2017 weighted scorecard achievement was 123 percent of target. Under the Annual Incentive Plan (“AIP”), the Company introduced an umbrella funding structure whereby if the primary earnings per share (“EPS”) objective was achieved at the threshold performance level the AIP plan funds at the maximum level (200 percent of target), but the Committee retained discretion to exercise negative discretion to reduce the size of an individual’s award (e.g., down to the actual scorecard achievement, or another amount between maximum and scorecard achievement). This umbrella structure was introduced to provide the Committee with maximum flexibility during a period of uncertainty surrounding the potential transaction with Westar (concerning both the length of the performance period and performance outcomes).

As a result of the officer team, including the NEOs, providing significant leadership during a lengthy period of uncertainty and their focus on delivering solid operational and financial results during this period, the Committee elected to exercise its discretion not to reduce the percentage payout from 200 percent down to the actual weighted scorecard achievement; accordingly each NEO, excluding Messrs. Bassham and Heidtbrink, received a 200 percent payout under the 2017 AIP. A discussion of the actual results of each objective starts on page 15.

8

Based on this successful performance, the following 2017 annual performance cash awards were paid to our NEOs:

Name | 2017 Annual Incentive Award At Target (Percent of Annual Base Salary) | 2017 Actual Award Paid (Percent of Annual Base Target) | 2017 Actual Award Paid (Dollars) | |||||||

Mr. Bassham | 100 | 123 | 1,082,400 | |||||||

Mr. Bryant | 70 | 200 | 646,800 | |||||||

Ms. Humphrey | 60 | 200 | 495,600 | |||||||

Ms. Wright | 40 | 200 | 248,800 | |||||||

Mr. Caisley | 50 | 200 | 300,000 | |||||||

Mr. Heidtbrink(1) | 70 | — | — | |||||||

(1) | Mr. Heidtbrink retired from the Company effective May 1, 2017. Pursuant to the terms of a retirement agreement with the Company, Mr. Heidtbrink forfeited his 2017 annual incentive award. The terms of the agreement are more fully described under Other Agreements on page 23. | |||||||||

The Company had solid performance for the 2015-2017 performance period under the Long-Term Incentive Plan (“LTIP”). For the 2015-2017 performance period that ended on December 31, 2017, there was one performance objective: a TSR objective versus the Edison Electric Institute Index of Electric Utilities (“EEI Index”). The performance objective and actual results for the 2015-2017 performance period were as follows:

2015-2017 Performance Share Objective | Weighting (Percent) | Threshold (50%) | Target (100%) | Stretch (150%) | Superior (200%) | Actual Results | Achievement (Percentage of Target) | |

TSR versus EEI Index(1) | 100% | 30th Percentile | 50th Percentile | 70th Percentile | 90th Percentile | 38.1 | 70.25% | |

(1) | TSR was compared to an industry peer group of the EEI Index of electric companies during the three-year measurement period 2015-2017. At the end of the three-year measurement period, we assessed our TSR compared to the EEI Index. Our NEOs received a percentage of the performance share grants based on performance. To appropriately balance our actual performance against our relative performance to the EEI Index, payout for the period was capped at target (100 percent) if our actual TSR performance was negative. | |||||||

In 2017, we awarded a mix of performance shares (75 percent) and time-based restricted stock (25 percent) to retain and incentivize our NEOs. The performance share objective was:

2017-2019 Performance Share Objective | Weighting (Percent) | |

TSR versus EEI Index | 100 | |

A detailed summary of the 2017 long-term awards to each NEO starts on page 20. The restricted stock awards are expected to vest in 2020, and any performance shares received will be based on the level of achievement of the performance objective listed above. Following the closing of the Westar transaction, all awards will remain outstanding and will be based upon the level of achievement of the new combined company.

Compensation Governance Practices

The Committee is committed to high standards of corporate governance, as it works to establish an overall compensation program that aligns the interests of officers with the Company’s shareholders. The following key compensation governance practices highlight this commitment:

9

• | Committee Structure. The Committee is solely comprised of independent directors, and the Committee directly retains an independent compensation consultant, Mercer (“Mercer”), to regularly review and evaluate our compensation program. |

• | Stock Ownership Guidelines. We have significant stock ownership and holding guidelines for all of our executive officers. Our CEO is expected to hold an equity level of at least five times base salary. Other executive officers, including the other NEOs, are expected to hold equity that is either two or three times their base salaries. |

• | Clawback Policy. The Company may recover cash incentive compensation and equity awards from officers in the event of a restatement of or other inaccuracy in the Company’s financial statements for a period of up to three years. |

• | Risk Assessment of Compensation Plans. We annually conduct a risk assessment to evaluate whether our compensation program creates any risks that may have a material adverse effect on the Company. |

• | Change in Control Benefit Triggers. Our Change in Control Severance Agreements have a “double trigger” and require both a change in control and termination for a qualifying event or circumstance such as being terminated without “cause” or leaving employment for “good reason.” |

• | No Employment Contracts. We do not have employment contracts with any of our executive officers, including the NEOs. |

• | No Dividend Payments for Unvested Performance Shares. Dividends are not paid on unvested performance shares, unless and until such shares vest. |

• | Modest Perquisites. We provide modest perquisites that we believe provide a sound benefit to the Company. |

• | Alignment with Shareholder Interests. A significant portion of each executive officer’s compensation is in the form of equity in an effort to align the economic interests of our executive officers with our shareholders. |

Compensation Philosophy and Objectives

The primary objectives of our executive compensation program are to:

• | Attract and Retain Qualified Leaders. Attract and retain highly qualified executive officers using a competitive pay package, with base salaries around the median level of comparable companies and opportunities for higher levels of compensation through time-based and performance-based incentives. |

• | Pay for Performance. Motivate executive officers to deliver a consistently high level of performance in the markets in which the Company operates, using incentives based on both short-term and long-term financial and operating results. |

• | Reward Long-Term Growth and Sustained Profitability. Align the economic interests of executive officers with those of our shareholders, by delivering a significant portion of total compensation in the form of time-based and performance-based equity awards based on incentive goals that, if achieved, are expected to increase TSR over the long term and contribute to the long-term success of the Company. |

• | Encourage Teamwork and Close Collaboration. Reward performance that encourages teamwork and close collaboration among executives which drives efficiencies for the benefit of customers and shareholders. |

10

• | Encourage Integrity and Ethics. Reward performance that supports the Company’s Guiding Principles and Code of Ethical Business Conduct by promoting, instilling and striving to attain the highest standards in terms of a culture of integrity, business ethics and community service. |

The Committee’s Use of an Independent Compensation Consultant and Management’s Role in the Executive Compensation Process

The Committee retains an independent compensation consultant to advise on executive and director compensation matters, assess the overall compensation program levels and elements, and evaluate competitive compensation trends. In 2017, the Committee retained Mercer to act as its independent compensation consultant. Mr. Michael Halloran, a Senior Partner at Mercer with more than 25 years of executive compensation experience, is the lead consultant who has worked with the Committee since 2008. The Committee retains the sole authority to select, retain, direct, or dismiss its compensation consultant. Our Corporate Secretary, in conjunction with other members of senior management, works directly with the compensation consultant to provide information, coordination and support. To assure independence, the Committee also pre-approves all other work unrelated to executive compensation proposed to be provided by Mercer if the fees would be expected to exceed $10,000. In February 2017, the Committee assessed the independence of Mercer and concluded that no conflict of interest exists that would prevent Mercer from independently representing the Committee.

In addition, beginning in 2017, members of management, including our Corporate Secretary, actively participated in the executive compensation review process with the assistance of management’s compensation consultant, Willis Towers Watson (“WTW”). WTW worked with management to review, design, benchmark, and develop executive compensation information for review and consideration by the Committee’s compensation consultant, the Committee, and the Board.

Role of Peer Group

Mercer recommends for Committee consideration peer group candidates with a size and business mix similar to ours. Potential peer group companies are assessed using three criteria: annual revenues, market value and percentage of total revenues from regulated electric operations. The Committee used the following peer group for the Committee’s 2017 executive compensation decisions.

ALLETE, Inc. | Black Hills Corporation | PNM Resources, Inc. | |

Alliant Energy Corporation | IDACORP, Inc. | Portland General Electric Company | |

Ameren Corporation | NiSource Inc. | SCANA Corporation | |

AVANGRID | OGE Energy Corp. | Westar Energy, Inc. | |

Avista Corporation | Pinnacle West Capital Corporation | ||

When other surveys are used, Mercer conducts, where possible, regression analyses to adjust the compensation data for differences in the companies’ revenues, allowing the Committee to compare compensation levels to similarly-sized companies.

The Compensation Review Process

Each year, the CEO provides to the Committee for consideration and review his performance self-assessment and development plan. This assessment is reviewed by the Committee and the Board and the Board provides feedback to the CEO. The CEO also provides compensation recommendations for all other executive officers. Such recommendations are based on a review and assessment of the (i) proxy data from

11

the companies in our peer group, (ii) survey data and (iii) factors previously identified by the Committee, such as individual performance, time in position, scope of responsibility and experience.

The Committee also annually reviews a tally sheet for each NEO that shows each element of compensation and the total compensation paid to each NEO for the past two years. The tally sheets also show the equity awards granted and realized, and the amounts that would be payable to each NEO in the event of termination without cause and termination in connection with a change in control of the Company. This information provides the Committee with a clear picture of (i) how its decisions with respect to each element of compensation affect the total compensation package, (ii) how current compensation relates to compensation in the previous years and (iii) the total amount each NEO would receive, including the value of equity awards, under various termination scenarios. The Committee also reviews the total value of each NEO’s proposed salary, target bonus and grant date value of equity awards for the year compared to the median total compensation of individuals in similar positions as described above. Total compensation for each NEO is generally targeted near the median of the market data for similar positions, while considering the factors above.

As a part of this review, the Committee also considers internal pay equity, both in terms of the total compensation of each executive officer compared to the CEO and within the officer group as compared to each other, considering individual responsibilities and experience levels. The Committee also evaluates the financial implications of compensation to mitigate financial inefficiencies to the greatest extent possible.

The Committee reviews these recommendations and corresponding information and makes final recommendations for Board approval.

Role of Executive Officers

While the CEO regularly attends meetings of the Committee, he is not a member and does not vote on Committee matters. In addition, there are portions of Committee meetings when the CEO is not present, such as when the Committee is in closed executive session or discusses the CEO’s performance or individual compensation. The CEO’s compensation levels and performance goals are recommended by the Committee for approval by the independent members of the Board. The CEO and other executive officers play a role in the early stages of design and evaluation of the Company’s compensation programs and policies. Notwithstanding this limited involvement of executive officers, all compensation decisions are ultimately recommended by the Committee and approved by the independent members of the Board.

Summary and Analysis of Executive Compensation

Consistent with prior years, the elements of executive compensation were: (1) cash compensation in the form of base salaries, annual incentives and discretionary cash awards; (2) equity compensation under our LTIP; (3) deferred compensation; (4) retirement benefits; (5) post-termination compensation; and (6) modest perquisites and generally available employee benefits.

12

Compensation Component | Description | Objective | ||||

Cash Compensation | ||||||

Base Salary | Ÿ | Fixed compensation that is reviewed annually taking into consideration peer compensation information, as well as individual performance. | Ÿ | Provide a fixed level of compensation that fairly considers job responsibilities, level of experience, internal and external comparisons and individual performance evaluations. | ||

Ÿ | Attract and retain talent. | |||||

Ÿ | Competitively aligned with median market salary. | |||||

Annual Incentives under AIP | Ÿ | Variable compensation earned based on performance of pre-established annual objectives and targets. | Ÿ | Reward the achievement of annual financial and operating objectives that ultimately contribute to long-term value for shareholders and customers. | ||

Discretionary Cash Awards | Ÿ | Discretionary cash awards for significant achievements. | Ÿ | Reward individual performance and/or aid in retention. | ||

Ÿ | Attract talent. | |||||

Equity Compensation | ||||||

Performance Shares and Restricted Stock Grants under the LTIP | Ÿ | Performance shares that are paid based on achievement of three-year performance objectives. | Ÿ | Motivate performance that creates long-term value to shareholders and customers. | ||

Ÿ | Align the economic interests of participants with shareholders and customers by rewarding executives for financial and operational achievements. | |||||

Ÿ | Time-based restricted stock, generally vesting over three years. | |||||

Ÿ | Build stock ownership. | |||||

Ÿ | Provide a competitive total package to attract and retain executives. | |||||

Discretionary Stock Awards | Ÿ | Discretionary stock awards for significant achievements. | Ÿ | Reward individual performance and/or aid in retention. | ||

Deferred Compensation | ||||||

Benefits | Ÿ | A non-qualified and unfunded plan that allows all officers, including NEOs, to defer the receipt of up to 50 percent of base salary and 100 percent of awards under the AIP. | Ÿ | Provide compensation deferrals in a tax-efficient manner. | ||

13

Compensation Component | Description | Objective | ||||

Retirement Benefits | ||||||

Pension Plan | Ÿ | Funded, tax-qualified, noncontributory defined benefit plan for all employees, including NEOs. This plan is not available to any non-union employee, including any officer hired after December 31, 2013. | Ÿ | Provide a competitive total package to retain executives and other employees. | ||

Ÿ | Provide some retirement income security in a tax efficient manner. | |||||

SERP | Ÿ | An unfunded plan that provides additional retirement income to all executives, including NEOs. This plan is not available to any executive hired after December 31, 2013. | Ÿ | Provide a competitive total package to retain executives. Provide additional supplemental retirement income. | ||

401(k) Plan | Ÿ | Tax-qualified retirement savings plan provided to all employees, including NEOs. | Ÿ | Provide retirement savings in a tax efficient manner. | ||

Ÿ | Provide a competitive total package to attract and retain executives and other employees. | |||||

Other Post-termination Compensation | ||||||

Change in Control Severance Agreements | Ÿ | Payments and other benefits in the event of (i) change in control and (ii) termination of employment. | Ÿ | Encourage executives to act in the best interests of shareholders and customers in times of fundamental change and uncertainty. | ||

Ÿ | Aid in recruitment and retention. | |||||

Perquisites and Generally Available Employee Benefits | ||||||

Benefits | Ÿ | Limited perquisites that are consistent with peer companies. Benefits include financial planning services and executive health physicals. | Ÿ | Provide a competitive total package to attract and retain key talent. | ||

Ÿ | General employee benefits, such as medical benefits, life insurance, and disability benefits. | |||||

Cash Compensation

Cash compensation to our NEOs includes a market-competitive base salary, performance-driven annual incentives and, from time to time, discretionary cash awards. The Committee believes total compensation to be delivered in cash or cash opportunities should vary based on each NEO’s position and circumstance, and that, in general, the level of cash opportunity should decrease in proportion to equity compensation as officers move to higher levels of responsibility.

14

Base Salary

Base salaries are reviewed annually. The Committee considers performance evaluations and base salary recommendations submitted by the CEO for the NEOs other than himself. The CEO’s performance evaluation is reviewed by the Committee and then reviewed and approved by the Board. Salary recommendations are not determined by formula, but instead take into consideration job responsibilities, level of experience, internal comparisons, comparisons to the salaries of executives in similar positions at similar companies obtained from market surveys, other competitive data and input provided by Mercer, and individual performance evaluations. Individual performance evaluations include major accomplishments during the performance period, as well as qualitative factors, including personal leadership, engagement of employees, disciplined performance management, accountability for results, and community involvement.

The 2017 base salaries of the NEOs are as follows:

Name | 2017 Base Salary | ||

Mr. Bassham | $880,000 | ||

Mr. Bryant | $462,000 | ||

Ms. Humphrey | $413,000 | ||

Ms. Wright | $311,000 | ||

Mr. Caisley | $300,000 | ||

Mr. Heidtbrink(1) | $570,000 | ||

(1) | Mr. Heidtbrink retired from the Company effective May 1, 2017. | ||

Annual Incentives

The Company’s AIP for all executive officers is based upon a mix of Company-wide financial and operational metrics. The Committee believes that the AIP continues to focus the Company on, and reward executives for, delivering key financial results, strategic business outcomes, and exceptional performance. For 2017, the Company utilized an “umbrella” funding structure for granting annual incentive awards under the AIP. Under this umbrella funding structure, if the primary EPS objective was achieved at the threshold performance level, the AIP awards were funded at the maximum level, subject to reduction based on the Company’s level of achievement of other secondary Company objective “scorecard” goals. This annual incentive structure provided the Committee with the ability to exercise negative discretion and to differentiate bonus amounts among officers based on individual performance and achievements and the Committee’s assessment of the individual’s overall contributions to the Company.

The Committee established target incentives for each NEO as a percentage of base pay, using survey data provided by Mercer for comparable positions and markets, as well as comparisons for internal equity. The basic structure of the AIP provided for individual maximum payout of 200 percent if the Company’s scorecard goal was achieved at the superior level of objective performance, followed by reduction down to a 100 percent payout if achievement was obtained at the target level of objective performance and a reduction down to 50 percent payout if achievement was obtained at the threshold level of objective performance. Following the application of the Committee’s negative discretion, no officer received less than the amounts he or she was eligible to receive based on scorecard performance; however, an officer could receive more than the actual scorecard performance amount based solely on the Committee’s discretionary evaluation of individual performance and overall contributions to the Company. No awards could exceed the total individual maximum payout amount of 200 percent of target. Objective scorecard performance was interpolated between the threshold, target and maximum performance levels. Objective scorecard performance achievement on EPS that was less than threshold achievement would result in a zero payment.

15

The 2017 AIP results are shown in the following table:

2017 Annual Incentive Objectives | Weighting (Percent) | Threshold 50% | Target 100% | Stretch 150% | Superior 200% | Actual Performance Result | Weighted Payout Percentage | Achievement (Percent of Target) |

Safety Audits & Training(1) | 10 | See footnote.(1) | See Stretch footnote.(1) | 15% | 150% | |||

Equivalent Availability (Coal Units, Winter and Summer Peak Months) | 10 | 75.5% | 83.9% | 85.8% | 87.6% | 77.3% | 6% | 61% |

Equivalent Availability (Nuclear Only) | 5 | 80.0% | 97.0% | 98.1% | 99.3% | 99.9% | 10% | 200% |

System Average Interruption Duration Index (SAIDI) (minutes) | 10 | 96.75 | 86.09 | 84.20 | 82.32 | 70.77 | 20% | 200% |

Adjusted EPS (excludes impact of Westar merger and the initial impact of U.S. federal income tax reform) | 50 | $1.50 | $1.67 | $1.75 | $1.84 | $1.74 | 72% | 144% |

JD Power Customer Satisfaction Index (Residential Customer Satisfaction) | 10 | Ranked 10 out of 16 | Ranked 9 out of 16 | Ranked 8 out of 16 | Ranked 7 out of 16 | Ranked 11 out of 16 | 0% | 0% |

Investment Across the Energy Value Chain that is Adjacent to our Existing Business(2) | 5 | See footnote.(2) | (1) $7 Million Investment in GXP Investments, Inc. (an investment subsidiary) (“GXPI”) and (2) $2.3 Million Investment in Transource Energy, LLC (“Transource”) | 0% | 0% | |||

100 | Weighted Achievement % | 123% | 123% | |||||

16

(1) | Threshold 50% | Target 100% | Stretch 150% | Superior 200% |

(1) Company-wide safety training 100 percent complete; (2) 1.5 safety and health self-audits completed per month with 95.0 percent of related correction plans to be completed within 45 days or plan to achieve; and (3) 9 Physical Conditions Audits with 95.0 percent of related correction plans to be completed within 45 days or a plan to achieve. | (1) Company-wide safety training 100 percent complete; (2) 2 safety and health self-audits completed per month with 97.5 percent of related correction plans to be completed within 45 days or plan to achieve; and (3) 12 Physical Conditions Audits with 97.5 percent of related correction plans to be completed within 45 days or a plan to achieve. | (1) Company-wide safety training 100 percent complete; (2) 2.5 safety and health self-audits completed per month with 100 percent of related correction plans to be completed within 45 days or plan to achieve; and (3) 18 Physical Conditions Audits with 100 percent of related correction plans to be completed within 45 days or a plan to achieve. | (1) Company-wide safety training 100 percent complete; (2) 4 safety and health self-audits completed per month with 100 percent of related correction plans to be completed within 45 days or plan to achieve; and (3) 24 Physical Conditions Audits with 100 percent of related correction plans to be completed within 45 days or a plan to achieve. | |

(2) | Threshold 50% | Target 100% | Stretch 150% | Superior 200% |

(1) $15.0 million in investment by GXPI and (2) $2.4 million investment in Transource. | (1) $18.0 million investment by GXPI and (2) $2.7 million investment in Transource. | (1) $19.0 million investment by GXPI and (2) $2.9 million investment in Transource. | (1) $20.0 million investment by GXPI and (2) $3.1 million investment in Transource. | |

Individual targets and awards earned by each of the NEOs are shown below and in the Summary Compensation Table on page 26.

Name | 2017 Annual Incentive Award at Target (Percent of Annual Base Salary) | 2017 Actual Award Paid (Percent of Annual Base Target) (1) | 2017 Actual Award Paid (Dollars) | |||||||

Mr. Bassham | 100 | 123 | 1,082,400 | |||||||

Mr. Bryant | 70 | 200 | 646,800 | |||||||

Ms. Humphrey | 60 | 200 | 495,600 | |||||||

Ms. Wright | 40 | 200 | 248,800 | |||||||

Mr. Caisley | 50 | 200 | 300,000 | |||||||

Mr. Heidtbrink(2) | 70 | — | — | |||||||

(1) | As a result of the officer team, including the NEOs, providing significant leadership during a lengthy period of uncertainty and their focus on delivering solid operational and financial results during this period, the Committee elected to exercise its discretion not to reduce the percentage payout from 200 percent down to the actual weighted scorecard achievement; accordingly each NEO, excluding Messrs. Bassham and Heidtbrink, received a 200 percent payout under the 2017 AIP. | |||||||||

(2) | Mr. Heidtbrink retired from the Company effective May 1, 2017. Pursuant to the terms of a retirement agreement with the Company, Mr. Heidtbrink forfeited his 2017 annual incentive award. The terms of the agreement are more fully described under Other Agreements on page 23. | |||||||||

Discretionary Cash or Stock Awards

From time to time, the Committee may grant a discretionary cash or stock award for special accomplishments or achievements. No discretionary cash or stock awards were made in 2017.

Equity Compensation

We believe that a significant portion of NEO compensation should be in the form of equity in order to best align executive compensation with the interests of our shareholders. Equity awards, which are made

17

under our shareholder approved LTIP, are generally targeted near the median range of officers in companies of similar size in the industry.

The Committee uses a mix of time-based restricted stock and performance shares that are paid solely on the basis of the attainment of performance goals. Performance shares can be earned at the end of the performance period from 0 percent to 200 percent of the target amount, depending on actual performance. Payment for performance shares must generally be made in shares of Company common stock. However, the Committee, in its sole discretion, may authorize payment in such combination of cash and shares, or all cash as it deems appropriate. Performance results for a goal that are less than threshold will result in a zero payment for that goal.

Dividend equivalents on the number of performance shares actually earned are paid in cash at the same time as the vesting of the earned performance shares. Dividends accrued on all restricted stock awards are reinvested during the period under the Company’s Dividend Reinvestment and Direct Stock Purchase Plan, and are subject to the same restrictions as the associated restricted stock.

While our NEOs are eligible for equity awards under the LTIP, none of them has any right to be granted awards.

The performance share metrics discussed below have been established for compensation purposes only. They do not constitute any guidance, projection or estimate of these measures, and should not be relied upon for any purpose other than understanding our compensation program.

2015-2017 Performance Period

For the three-year performance period ended December 31, 2017, the Board, upon the recommendation of the Committee, modified the performance objectives under the LTIP prior to the commencement of the 2015-2017 performance period. Previously, the Board utilized two equally-weighted performance share objectives (i) a credit objective (three-year average Funds from Operations (“FFO”) to Total Adjusted Debt) and (ii) a total shareholder return objective (TSR versus EEI Index). However, for the 2015-2017 performance period, there was one performance objective, total shareholder return (TSR versus EEI Index). The Committee believed that this change better aligned each officer’s performance with the interests of shareholders and focused the Company’s leadership team on our strategic initiatives to increase stock price and dividend growth. Consistent with the 2014-2016 performance period, the Committee established the distribution between performance shares and restricted stock at 75 percent/25 percent, respectively.

Additionally, to better align with market and industry practices, specific performance targets were set with interpolation between the targets. To appropriately balance our actual performance against our relative performance to the EEI Index, any potential payout for the period would be capped at Target (100 percent) if actual TSR performance was negative.

Consistent with prior years, performance share and restricted stock awards for the 2015-2017 performance period were based on percentages of 2015 base salary. The percentages of 2015 base salary (reflecting the target amount of awards) were as follows: Mr. Bassham, 270 percent; Mr. Bryant, 120 percent; Ms. Humphrey, 120 percent; Ms. Wright, 75 percent; Mr. Caisley, 75 percent; and Mr. Heidtbrink, 175 percent.

18

The 2015-2017 performance period objective and criteria were as follows:

2015-2017 Performance Share Objective | Weighting (Percent) | Threshold (50%) | Target (100%) | Stretch (150%) | Superior (200%) | Actual Results | Weighted Payout Percentage | |

TSR versus EEI Index(1) | 100% | 30th Percentile | 50th Percentile | 70th Percentile | 90th Percentile | 38.1 | 70.25% | |

(1) | TSR was compared to an industry peer group of the EEI Index of electric companies during the three-year measurement period 2015-2017. At the end of the three-year measurement period, we assessed our TSR compared to the EEI Index. The officers received a percentage of the performance share grants based on performance. To appropriately balance our actual performance against our relative performance to the EEI Index, payout for the period was capped at target (100 percent) if actual TSR performance was negative. | |||||||

Based upon the results above, performance share awards for the 2015-2017 performance period for each of the NEOs are shown below:

Name | Value of Actual Award Paid ($)(1) | |||

Mr. Bassham | 1,091,621 | |||

Mr. Bryant(2) | 223,766 | |||

Ms. Humphrey | 252,862 | |||

Ms. Wright | 127,052 | |||

Mr. Caisley | 123,093 | |||

Mr. Heidtbrink(3) | — | |||

(1) | In addition, cash dividend equivalents were paid after the end of the performance period, as follows: Mr. Bassham ($116,775), Mr. Bryant ($23,937), Ms. Humphrey ($27,050), Ms. Wright ($13,591), and Mr. Caisley ($13,168). | |||

(2) | On September 2, 2015, Mr. Bryant became the Senior Vice President-Finance and Strategy and Chief Financial Officer. Mr. Bryant’s target was increased to 120 percent on a prorated basis. In conjunction with his promotion, Mr. Bryant received additional restricted stock and performance share awards. | |||

(3) | Mr. Heidtbrink retired from the Company effective May 1, 2017. Pursuant to the terms of a retirement agreement with the Company, Mr. Heidtbrink received all his restricted shares and a prorated number of performance share awards for the 2015-2017 performance period. The terms of the agreement are more fully described under Other Agreements on page 23. | |||

2016-2018 Performance Period

For the three-year performance period ending December 31, 2018, the performance objective is the same as the performance objective for the 2015-2017 performance period. There is one performance objective, total shareholder return (TSR versus EEI Index). To continue to focus on performance, the Board, upon the recommendation of the Committee, established the distribution between performance shares and restricted stock at 75 percent/25 percent, respectively. Similar to the 2015-2017 performance period, specific performance targets were set with interpolation between the targets. To appropriately balance our actual performance against our relative performance to the EEI Index, any potential payout for the period will be capped at Target (100 percent) if actual TSR performance is negative.

Consistent with prior years, performance share and restricted stock awards for the 2016-2018 performance period are based on percentages of 2016 base salary. The percentages of 2016 base salary (reflecting the target amount of awards) are as follows: Mr. Bassham, 270 percent; Mr. Bryant, 120 percent; Ms. Humphrey, 120 percent; Ms. Wright, 75 percent; Mr. Caisley, 75 percent; and Mr. Heidtbrink, 175 percent. This resulted in the following long-term incentive grants in 2016 of time-based restricted stock and performance shares, which may be paid after the end of the period depending on performance:

19

Name | Restricted Stock(1) | Performance Shares (at target)(1) | |||||

Mr. Bassham | 18,538 | 55,613 | |||||

Mr. Bryant | 4,141 | 12,421 | |||||

Ms. Humphrey | 4,048 | 12,143 | |||||

Ms. Wright | 1,906 | 5,716 | |||||

Mr. Caisley | 1,841 | 5,523 | |||||

Mr. Heidtbrink(2) | 8,156 | 24,466 | |||||

(1) | The restricted stock grants vest on March 1, 2019; the cash and common stock payments related to the performance shares, if any, will also occur on March 1, 2019. Actual performance shares may be between 0 percent and 200 percent of the target number of shares. | ||||||

(2) | Mr. Heidtbrink retired from the Company effective May 1, 2017. Pursuant to the terms of a retirement agreement with the Company, Mr. Heidtbrink received all his restricted stock and a prorated number of performance shares for the 2016-2018 performance period. The terms of the agreement are more fully described under Other Agreements on page 23. | ||||||

The 2016-2018 performance period objective and criteria are as follows:

2016-2018 Performance Share Objective | Weighting (Percent) | Threshold (50%) | Target (100%) | Stretch (150%) | Superior (200%) | |

TSR versus EEI Index(1) | 100% | 30th Percentile | 50th Percentile | 70th Percentile | 90th Percentile | |

(1) | TSR is compared to an industry peer group of the EEI Index of electric companies during the three-year measurement period 2016-2018. At the end of the three-year measurement period, we will assess our TSR compared to the EEI Index. Depending on how we rank, the officers will receive a percentage of the performance share grants. To appropriately balance our actual performance against our relative performance to the EEI Index, any payout for the period would be capped at Target (100 percent) if actual TSR performance is negative. | |||||

Following the closing of the Westar transaction, all awards will remain outstanding and will be based upon the level of achievement of the new combined company.

2017-2019 Performance Period

For the three-year performance period ending December 31, 2019, the performance objective is the same as the performance objective for the 2016-2018 performance period. There is one performance objective, total shareholder return (TSR versus EEI Index). To continue to focus on performance, the Board, upon the recommendation of the Committee, established the distribution between performance shares and restricted stock at 75 percent/25 percent, respectively. Similar to the 2016-2018 performance period, specific performance targets were set with interpolation between the targets. To appropriately balance our actual performance against our relative performance to the EEI Index, any potential payout for the period will be capped at Target (100 percent) if actual TSR performance is negative.

Consistent with prior years, performance share and restricted stock awards for the 2017-2019 performance period were based on percentages of 2017 base salary. The percentages of 2017 base salary (reflecting the target amount of awards) were as follows: Mr. Bassham, 270 percent; Mr. Bryant, 150 percent; Ms. Humphrey, 120 percent; Ms. Wright, 75 percent; Mr. Caisley, 75 percent; and Mr. Heidtbrink, 175 percent. This resulted in the following long-term incentive grants in 2017 of time-based restricted stock and performance shares, which may be paid after the end of the period depending on performance:

20

Name | Restricted Stock(1) | Performance Shares (at target)(1) | |||||

Mr. Bassham | 20,547 | 61,640 | |||||

Mr. Bryant | 5,993 | 17,979 | |||||

Ms. Humphrey | 4,286 | 12,858 | |||||

Ms. Wright | 2,018 | 6,052 | |||||

Mr. Caisley | 1,946 | 5,838 | |||||

Mr. Heidtbrink(2) | 8,626 | 25,878 | |||||

(1) | The restricted stock grants vest on March 2, 2020; the cash and common stock payments related to the performance shares, if any, will also occur on March 2, 2020. Actual performance shares may be between 0 percent and 200 percent of the target number of shares. | ||||||

(2) | Mr. Heidtbrink retired from the Company effective May 1, 2017. Pursuant to the terms of a retirement agreement with the Company, Mr. Heidtbrink forfeited his restricted stock and performance share awards for the 2017-2019 performance period. The terms of the agreement are more fully described under Other Agreements on page 23. | ||||||

The 2017-2019 performance period objective was as follows:

2017-2019 Performance Share Objective | Weighting (Percent) | Threshold (50%) | Target (100%) | Stretch (150%) | Superior (200%) | |

TSR versus EEI Index(1) | 100% | 30th Percentile | 50th Percentile | 70th Percentile | 90th Percentile | |

(1) | TSR is compared to an industry peer group of the EEI Index of electric companies during the three-year measurement period 2017-2019. At the end of the three-year measurement period, we will assess our TSR compared to the EEI Index. Depending on how we rank, the officers will receive a percentage of the performance share grants. To appropriately balance our actual performance against our relative performance to the EEI Index, any payout for the period would be capped at Target (100 percent) if actual TSR performance is negative. | |||||

Following the closing of the Westar transaction, all awards will remain outstanding and will be based upon the level of achievement of the new combined company.

2017 Equity Vesting, Payments and Special Grants

The restricted stock and performance share awards under the 2014-2016 LTIP performance period for the NEOs vested in 2017. In connection with his appointment as Senior Vice President-Finance and Strategy and Chief Financial Officer, Mr. Bryant was awarded a special one-time retention grant of 12,346 shares of restricted stock on September 2, 2015. Thirty-four percent of these shares vested on September 2, 2016, 33 percent vested on September 5, 2017 and 33 percent vest on September 4, 2018. The following table summarizes these grant vestings and payments:

21

Name | 2017 Vesting of Restricted Stock (# shares)(1) | 2014-2016 Performance Share Payments (# shares)(2) | Total Number of Shares Acquired at Vesting | |||||||

Mr. Bassham(3) | 27,530 | 51,610 | 79,140 | |||||||

Mr. Bryant(4) | 9,195 | 5,944 | 15,139 | |||||||

Ms. Humphrey(3) | 6,994 | 12,083 | 19,077 | |||||||

Ms. Wright | 2,233 | 5,997 | 8,230 | |||||||

Mr. Caisley | 2,186 | 5,866 | 8,052 | |||||||

Mr. Heidtbrink(3)(5) | 34,031 | 54,626 | 88,657 | |||||||

(1) | The amounts shown for restricted stock vestings include reinvested dividends related to the underlying restricted stock grants. | |||||||||

(2) | The shares shown in this column are the earned amounts of performance shares for the 2014-2016 performance period, which were paid in 2017. Dividend equivalents over the performance period were paid in cash at the time of payment of the underlying performance shares. As permitted by our LTIP, the earned performance shares were paid in a combination of cash for the cash dividend equivalent, (which was used to satisfy withholding tax obligations) and common stock. | |||||||||

(3) | Amounts include a one-time discretionary grant award of restricted stock and reinvestment dividends that vested in March 2017. | |||||||||

(4) | Amounts for Mr. Bryant include the special one-time award of restricted stock and reinvested dividends that vested in September 2017. | |||||||||

(5) | Mr. Heidtbrink retired from his position as Executive Vice President and Chief Operating Officer of KCP&L effective May 1, 2017. | |||||||||

Deferred Compensation

The Company’s non-qualified deferred compensation plan (“DCP”) allows all officers, including NEOs, to defer the receipt of up to 50 percent of base salary and 100 percent of any cash incentive award. The earnings rate on deferral amounts is annually determined by the Committee and based on the Company’s weighted average cost of capital. A detailed discussion of the DCP begins on page 35.

Retirement Benefits

Pension Plan and Supplemental Executive Retirement Plan

The Company maintains a funded, tax-qualified, noncontributory defined benefit plan (the “Pension Plan”) for all non-union employees hired or rehired on or before December 31, 2013, including NEOs. Benefits under the Pension Plan are based on each employee’s years of service and the average annual base salary over a specified period.

The Company also has an unfunded Supplemental Executive Retirement Plan (“SERP”) for its executives, including all NEOs. This unfunded plan provides the difference between the amount that would have been payable under the Pension Plan in the absence of Internal Revenue Service tax code limitations and the amount actually payable under the Pension Plan. It also provides a slightly higher benefit accrual rate than the Pension Plan. All executives hired or rehired on or before December 31, 2013, including NEOs, are eligible to participate in the SERP.

In 2007, non-union employees of Great Plains Energy and KCP&L, including the NEOs, were given a one-time election to remain in their existing Pension Plan and 401(k) Plan (“Old Retirement Plan”), or choose a new retirement program that includes a slightly reduced benefit accrual formula under the Pension Plan paired with an enhanced benefit under the 401(k) Plan (“Current Retirement Plan”). Messrs. Bassham, Bryant, and Caisley and Mses. Humphrey and Wright elected to participate in the Current Retirement Plan. Mr. Heidtbrink joined the Company subsequent to 2007 and participates in the Current Retirement Plan.

22

401(k) Plan

Our 401(k) Plan is offered to all employees as a tax-qualified retirement savings plan.

• | Employees in the Old Retirement Program can contribute up to 40 percent of base pay. After one year of employment, the Company matches 50 percent of the first 6 percent of base pay that is contributed. Employees are fully vested in the Company matching contribution and associated earnings after six (6) years. |

• | Employees in the Current Retirement Program can contribute up to 75 percent of base pay, bonus incentive, and overtime pay. The Company matches 100 percent of the first 6 percent of total pay that is contributed. Company contributions vest immediately. |

• | Employees hired on or after January 1, 2014 are eligible to participate in the new Retirement Program Plus. In this program, employees can contribute up to 75 percent of base pay, bonus incentive, and overtime pay. The Company matches 100 percent of the first 6 percent of total pay that is contributed and contributes an annual non-elective amount equal to 4 percent of employee base pay. The Company matching contribution vests immediately and the annual non-elective contribution and associated earnings vest after three (3) years of service. |

• | Contributions are limited by the tax code. |

Other Post-termination Compensation

The Company has entered into change in control agreements with its executive officers, including NEOs, to encourage their continued employment and dedication when an executive may have concerns about their continued employment. The Company believes these agreements and benefits are important recruitment and retention devices. The Company has historically authorized certain agreements with retiring officers to ensure a smooth transition.

Change in Control Severance Agreements

We have change in control agreements with all of our executive officers, including the NEOs, to ensure their continued service, dedication, and objectivity in the event of a transaction that would result in a change in control of the Company. These agreements support the objective assessment and execution of potential changes in the Company’s strategy and enhance retention by reducing concerns about employment continuity. These agreements provide for payments and other benefits if the officer’s employment terminates for a qualifying event or circumstance, such as being terminated without “Cause” or leaving employment for “Good Reason,” as these terms are defined in the agreements. All the agreements require a double trigger so that both a change in control and a termination (actual or constructive) of the executive’s employment must occur to trigger benefits. Generally, the Committee and Board determined the eligibility for potential payments upon change in control, based on comparable practices in the market.

Additional information, including a quantification of benefits that would have been received by NEOs had termination occurred on December 31, 2017, is found under the heading “Potential Payments Upon Termination or Change in Control” starting on page 35.

Other Agreements

None of the Company’s executive officers, including the NEOs, have a written employment agreement. However, in May 2017, the Company entered into a retirement agreement with Mr. Heidtbrink in connection with his retirement from the Company. The agreement provided for, among other things: (a) the forfeiture of restricted stock and performance share grants made in 2017 to Mr. Heidtbrink; (b) the vesting of restricted stock grants made to Mr. Heidtbrink prior to 2017; (c) vesting of all performance share awards granted prior to 2017 to be paid on a pro rata basis; and (d) a general cross-release of claims. The value of the restricted

23

stock and performance shares that vested on Mr. Heidtbrink’s retirement date was $1,407,671. In addition, the agreement provided for a bonus of $302,827 paid upon Mr. Heidtbrink’s retirement.

Perquisites and Generally Available Employee Benefits