Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MARTIN MIDSTREAM PARTNERS L.P. | exhibit991earningspressrel.htm |

| 8-K - 8-K - MARTIN MIDSTREAM PARTNERS L.P. | a20180331form8k-earningsre.htm |

1

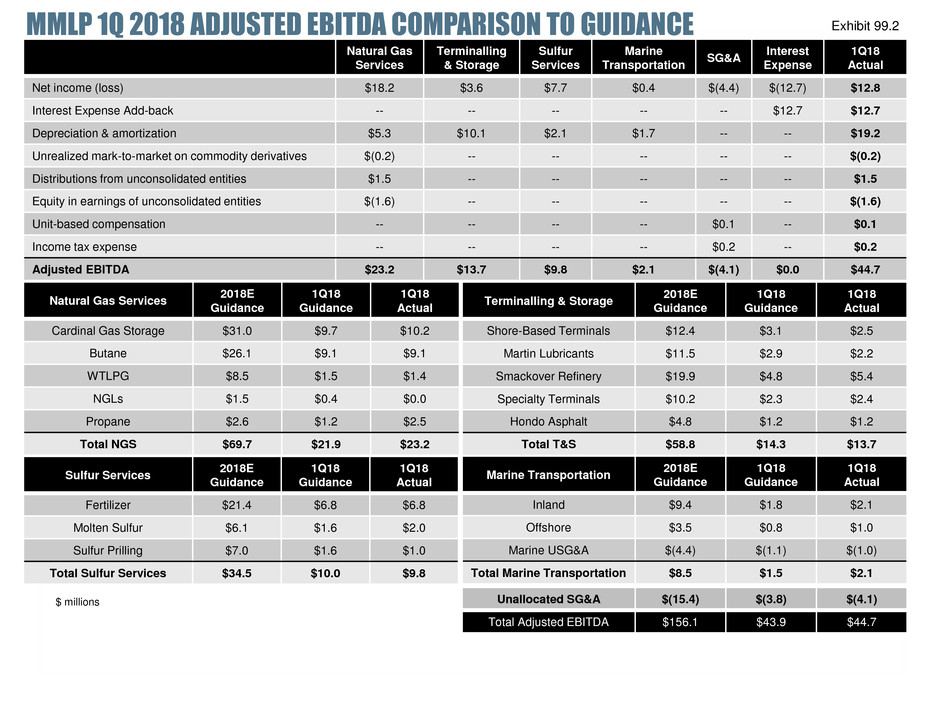

Unallocated SG&A $(15.4) $(3.8) $(4.1)

Total Adjusted EBITDA $156.1 $43.9 $44.7

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

1Q18

Actual

Net income (loss) $18.2 $3.6 $7.7 $0.4 $(4.4) $(12.7) $12.8

Interest Expense Add-back -- -- -- -- -- $12.7 $12.7

Depreciation & amortization $5.3 $10.1 $2.1 $1.7 -- -- $19.2

Unrealized mark-to-market on commodity derivatives $(0.2) -- -- -- -- -- $(0.2)

Distributions from unconsolidated entities $1.5 -- -- -- -- -- $1.5

Equity in earnings of unconsolidated entities $(1.6) -- -- -- -- -- $(1.6)

Unit-based compensation -- -- -- -- $0.1 -- $0.1

Income tax expense -- -- -- -- $0.2 -- $0.2

Adjusted EBITDA $23.2 $13.7 $9.8 $2.1 $(4.1) $0.0 $44.7

Terminalling & Storage

2018E

Guidance

1Q18

Guidance

1Q18

Actual

Shore-Based Terminals $12.4 $3.1 $2.5

Martin Lubricants $11.5 $2.9 $2.2

Smackover Refinery $19.9 $4.8 $5.4

Specialty Terminals $10.2 $2.3 $2.4

Hondo Asphalt $4.8 $1.2 $1.2

Total T&S $58.8 $14.3 $13.7

Natural Gas Services

2018E

Guidance

1Q18

Guidance

1Q18

Actual

Cardinal Gas Storage $31.0 $9.7 $10.2

Butane $26.1 $9.1 $9.1

WTLPG $8.5 $1.5 $1.4

NGLs $1.5 $0.4 $0.0

Propane $2.6 $1.2 $2.5

Total NGS $69.7 $21.9 $23.2

Sulfur Services

2018E

Guidance

1Q18

Guidance

1Q18

Actual

Fertilizer $21.4 $6.8 $6.8

Molten Sulfur $6.1 $1.6 $2.0

Sulfur Prilling $7.0 $1.6 $1.0

Total Sulfur Services $34.5 $10.0 $9.8

Marine Transportation

2018E

Guidance

1Q18

Guidance

1Q18

Actual

Inland $9.4 $1.8 $2.1

Offshore $3.5 $0.8 $1.0

Marine USG&A $(4.4) $(1.1) $(1.0)

Total Marine Transportation $8.5 $1.5 $2.1

$ millions

MMLP 1Q 2018 ADJUSTED EBITDA COMPARISON TO GUIDANCE Exhibit 99.2

2

$ millions

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

2018E

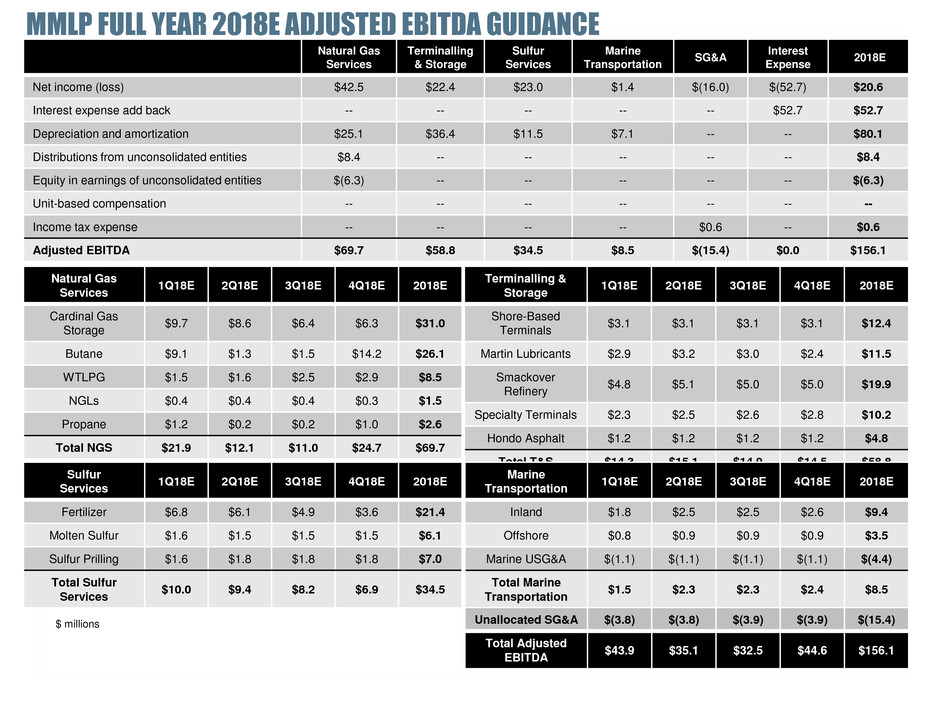

Net income (loss) $42.5 $22.4 $23.0 $1.4 $(16.0) $(52.7) $20.6

Interest expense add back -- -- -- -- -- $52.7 $52.7

Depreciation and amortization $25.1 $36.4 $11.5 $7.1 -- -- $80.1

Distributions from unconsolidated entities $8.4 -- -- -- -- -- $8.4

Equity in earnings of unconsolidated entities $(6.3) -- -- -- -- -- $(6.3)

Unit-based compensation -- -- -- -- -- -- --

Income tax expense -- -- -- -- $0.6 -- $0.6

Adjusted EBITDA $69.7 $58.8 $34.5 $8.5 $(15.4) $0.0 $156.1

Natural Gas

Services

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Cardinal Gas

Storage

$9.7 $8.6 $6.4 $6.3 $31.0

Butane $9.1 $1.3 $1.5 $14.2 $26.1

WTLPG $1.5 $1.6 $2.5 $2.9 $8.5

NGLs $0.4 $0.4 $0.4 $0.3 $1.5

Propane $1.2 $0.2 $0.2 $1.0 $2.6

Total NGS $21.9 $12.1 $11.0 $24.7 $69.7

Terminalling &

Storage

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Shore-Based

Terminals

$3.1 $3.1 $3.1 $3.1 $12.4

Martin Lubricants $2.9 $3.2 $3.0 $2.4 $11.5

Smackover

Refinery

$4.8 $5.1 $5.0 $5.0 $19.9

Specialty Terminals $2.3 $2.5 $2.6 $2.8 $10.2

Hondo Asphalt $1.2 $1.2 $1.2 $1.2 $4.8

Total T&S $14.3 $15.1 $14.9 $14.5 $58.8

Sulfur

Services

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Fertilizer $6.8 $6.1 $4.9 $3.6 $21.4

Molten Sulfur $1.6 $1.5 $1.5 $1.5 $6.1

Sulfur Prilling $1.6 $1.8 $1.8 $1.8 $7.0

T tal Sulfur

Services

$10.0 $9.4 $8.2 $6.9 $34.5

Marine

Transportation

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Inland $1.8 $2.5 $2.5 $2.6 $9.4

Offshore $0.8 $0.9 $0.9 $0.9 $3.5

Marine USG&A $(1.1) $(1.1) $(1.1) $(1.1) $(4.4)

Total Marine

Transportation

$1.5 $2.3 $2.3 $2.4 $8.5

MMLP FULL YEAR 2018E ADJUSTED EBITDA GUIDANCE

Unallocated SG&A $(3.8) $(3.8) $(3.9) $(3.9) $(15.4)

Total Adjusted

EBITDA

$43.9 $35.1 $32.5 $44.6 $156.1

$ millions

3

Natural Gas

Services

Terminalling

& Storage

Sulfur Services

Marine

Transportation

SG&A

Interest

Expense

2Q2018E

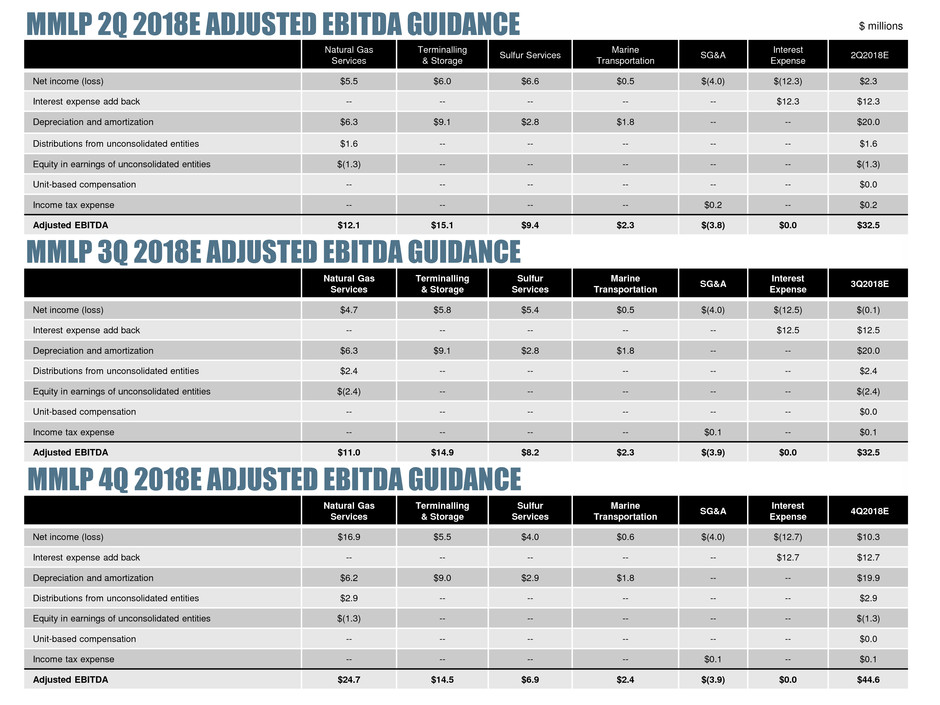

Net income (loss) $5.5 $6.0 $6.6 $0.5 $(4.0) $(12.3) $2.3

Interest expense add back -- -- -- -- -- $12.3 $12.3

Depreciation and amortization $6.3 $9.1 $2.8 $1.8 -- -- $20.0

Distributions from unconsolidated entities $1.6 -- -- -- -- -- $1.6

Equity in earnings of unconsolidated entities $(1.3) -- -- -- -- -- $(1.3)

Unit-based compensation -- -- -- -- -- -- $0.0

Income tax expense -- -- -- -- $0.2 -- $0.2

Adjusted EBITDA $12.1 $15.1 $9.4 $2.3 $(3.8) $0.0 $32.5

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

3Q2018E

Net income (loss) $4.7 $5.8 $5.4 $0.5 $(4.0) $(12.5) $(0.1)

Interest expense add back -- -- -- -- -- $12.5 $12.5

Depreciation and amortization $6.3 $9.1 $2.8 $1.8 -- -- $20.0

Distributions from unconsolidated entities $2.4 -- -- -- -- -- $2.4

Equity in earnings of unconsolidated entities $(2.4) -- -- -- -- -- $(2.4)

Unit-based compensation -- -- -- -- -- -- $0.0

Income tax expense -- -- -- -- $0.1 -- $0.1

Adjusted EBITDA $11.0 $14.9 $8.2 $2.3 $(3.9) $0.0 $32.5

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

4Q2018E

Net income (loss) $16.9 $5.5 $4.0 $0.6 $(4.0) $(12.7) $10.3

Interest expense add back -- -- -- -- -- $12.7 $12.7

Depreciation and amortization $6.2 $9.0 $2.9 $1.8 -- -- $19.9

Distributions from unconsolidated entities $2.9 -- -- -- -- -- $2.9

Equity in earnings of unconsolidated entities $(1.3) -- -- -- -- -- $(1.3)

Unit-based compensation -- -- -- -- -- -- $0.0

Income tax expense -- -- -- -- $0.1 -- $0.1

Adjusted EBITDA $24.7 $14.5 $6.9 $2.4 $(3.9) $0.0 $44.6

MMLP 3Q 2018E ADJUSTED EBITDA GUIDANCE

MMLP 4Q 2018E ADJUSTED EBITDA GUIDANCE

MMLP 2Q 2018E ADJUSTED EBITDA GUIDANCE $ millions

4

The Partnership's management uses a variety of financial and operational measurements other than its financial statements prepared

in accordance with United States Generally Accepted Accounting Principles (“GAAP”) to analyze its performance. These include: (1)

net income before interest expense, income tax expense, and depreciation and amortization (“EBITDA”), and (2) adjusted

EBITDA. The Partnership's management views these measures as important performance measures of core profitability for its

operations and the ability to generate and distribute cash flow, and as key components of its internal financial reporting. The

Partnership's management believes investors benefit from having access to the same financial measures that management uses.

EBITDA and Adjusted EBITDA. Certain items excluded from EBITDA and adjusted EBITDA are significant components in

understanding and assessing an entity's financial performance, such as cost of capital and historical costs of depreciable assets. The

Partnership has included information concerning EBITDA and adjusted EBITDA because it provides investors and management with

additional information to better understand the following: financial performance of the Partnership's assets without regard to financing

methods, capital structure or historical cost basis; the Partnership's operating performance and return on capital as compared to those

of other similarly situated entities; and the viability of acquisitions and capital expenditure projects. The Partnership's method of

computing adjusted EBITDA may not be the same method used to compute similar measures reported by other entities. The

economic substance behind the Partnership's use of adjusted EBITDA is to measure the ability of the Partnership's assets to generate

cash sufficient to pay interest costs, support its indebtedness and make distributions to its unitholders.

EBITDA and adjusted EBITDA should not be considered alternatives to, or more meaningful than, net income, cash flows from

operating activities, or any other measure presented in accordance with GAAP. The Partnership's method of computing these

measures may not be the same method used to compute similar measures reported by other entities.

USE OF NON-GAAP FINANCIAL INFORMATION