Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - SYNOVUS FINANCIAL CORP | d571865dex992.htm |

| EX-99.1 - EX-99.1 - SYNOVUS FINANCIAL CORP | d571865dex991.htm |

| 8-K - 8-K - SYNOVUS FINANCIAL CORP | d571865d8k.htm |

First Quarter 2018 Results April 24, 2018 Exhibit 99.3

Forward Looking Statements This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus’ use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “should,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’ future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, among others, statements on (1) future loan growth; (2) future deposit growth; (3) future net interest income and net interest margin; (4) future adjusted non-interest income; (5) future non-interest expense levels, efficiency ratios, and operating leverage; (6) future credit trends and key metrics; (7) future effective tax rates; (8) our strategy and initiatives for future growth, capital management, strategic transactions and our brand initiative; and (9) our assumptions underlying these expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation. Many of these factors are beyond Synovus’ ability to control or predict. These forward-looking statements are based upon information presently known to Synovus’ management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2017 under the captions “Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. Use of Non-GAAP Financial Measures This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non-GAAP financial measures include the following: adjusted diluted earnings per share; adjusted return on average assets; adjusted return on average common equity; adjusted return on average tangible common equity; average non-time core deposits; cost of interest bearing core deposits; adjusted non-interest income; adjusted non-interest expense; adjusted efficiency ratio; tangible common equity ratio; and common equity Tier 1 (CET1) ratio (fully phased-in). The most comparable GAAP measures to these measures are diluted earnings per share; return on average assets; return on average common equity; total average deposits; cost of funds rate; total non-interest income; total non-interest expense; efficiency ratio; total shareholders’ equity to total assets ratio; and CET1 ratio, respectively. Management uses these non-GAAP financial measures to assess the performance of Synovus’ business and the strength of its capital position. Management believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management, investors, and bank regulators in evaluating Synovus’ operating results, financial strength, the performance of its business and the strength of its capital position. However, these non-GAAP financial measures have inherent limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of operating results or capital position as reported under GAAP. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant items and other factors, and since they are not required to be uniformly applied, they may not be comparable to other similarly titled measures at other companies. Adjusted diluted earnings per share, adjusted return on average assets, and adjusted return on average common equity are measures used by management to evaluate operating results exclusive of items that are not indicative of ongoing operations and impact period-to-period comparisons. Adjusted return on average tangible common equity is a measure used by management to compare Synovus’ performance with other financial institutions because it calculates the return available to common shareholders without the impact of intangible assets and their related amortization, thereby allowing management to evaluate the performance of the business consistently. Average non-time core deposits is a measure used by management to evaluate organic growth of deposits and the quality of deposits as a funding source. The cost of interest bearing core deposits is a measure used to evaluate the cost of deposits as a funding source exclusive of brokered deposits and deposits. Adjusted non-interest income is a measure used by management to evaluate non-interest income exclusive of net investment securities gains/losses, changes in fair value of private equity investments, net. Adjusted non-interest expense and the adjusted efficiency ratio are measures utilized by management to measure the success of expense management initiatives focused on reducing recurring controllable operating costs. The tangible common equity ratio is used by management and bank regulators to assess the strength of our capital position. The computations of the non-GAAP financial measures used in this slide presentation are set forth in the Appendix to this slide presentation.

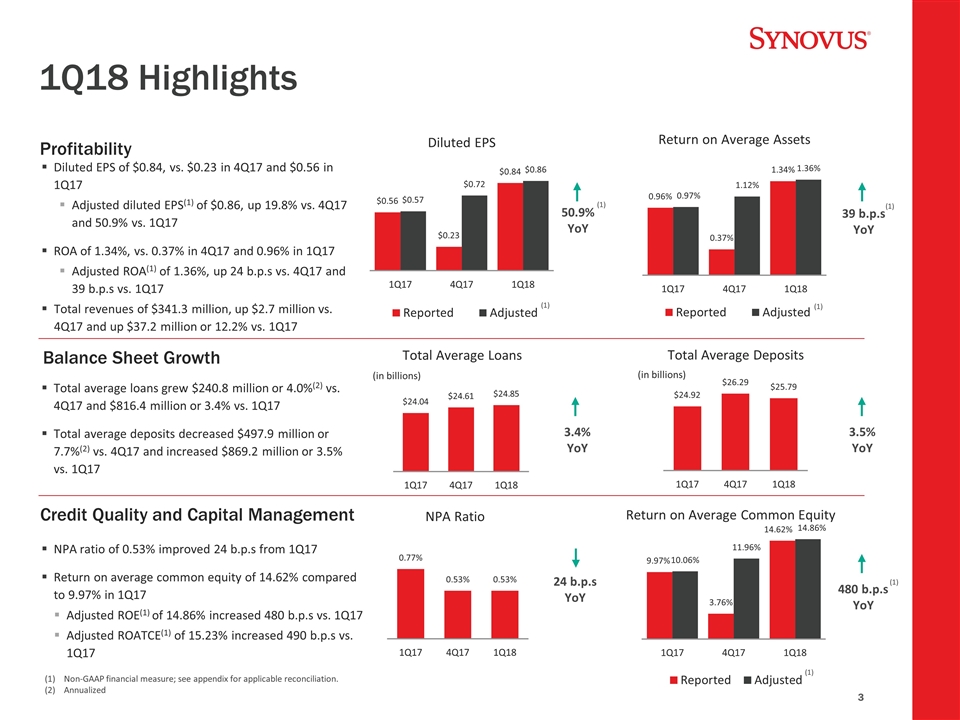

1Q18 Highlights 50.9% YoY (1) 39 b.p.s YoY (1) (in billions) 3.4% YoY Total Average Deposits (in billions) 3.5% YoY 24 b.p.s YoY Return on Average Common Equity (1) (1) (1) Non-GAAP financial measure; see appendix for applicable reconciliation. Annualized 480 b.p.s YoY Diluted EPS of $0.84, vs. $0.23 in 4Q17 and $0.56 in 1Q17 Adjusted diluted EPS(1) of $0.86, up 19.8% vs. 4Q17 and 50.9% vs. 1Q17 ROA of 1.34%, vs. 0.37% in 4Q17 and 0.96% in 1Q17 Adjusted ROA(1) of 1.36%, up 24 b.p.s vs. 4Q17 and 39 b.p.s vs. 1Q17 Total revenues of $341.3 million, up $2.7 million vs. 4Q17 and up $37.2 million or 12.2% vs. 1Q17 Profitability Balance Sheet Growth Total average loans grew $240.8 million or 4.0%(2) vs. 4Q17 and $816.4 million or 3.4% vs. 1Q17 Total average deposits decreased $497.9 million or 7.7%(2) vs. 4Q17 and increased $869.2 million or 3.5% vs. 1Q17 Credit Quality and Capital Management NPA ratio of 0.53% improved 24 b.p.s from 1Q17 Return on average common equity of 14.62% compared to 9.97% in 1Q17 Adjusted ROE(1) of 14.86% increased 480 b.p.s vs. 1Q17 Adjusted ROATCE(1) of 15.23% increased 490 b.p.s vs. 1Q17 (1)

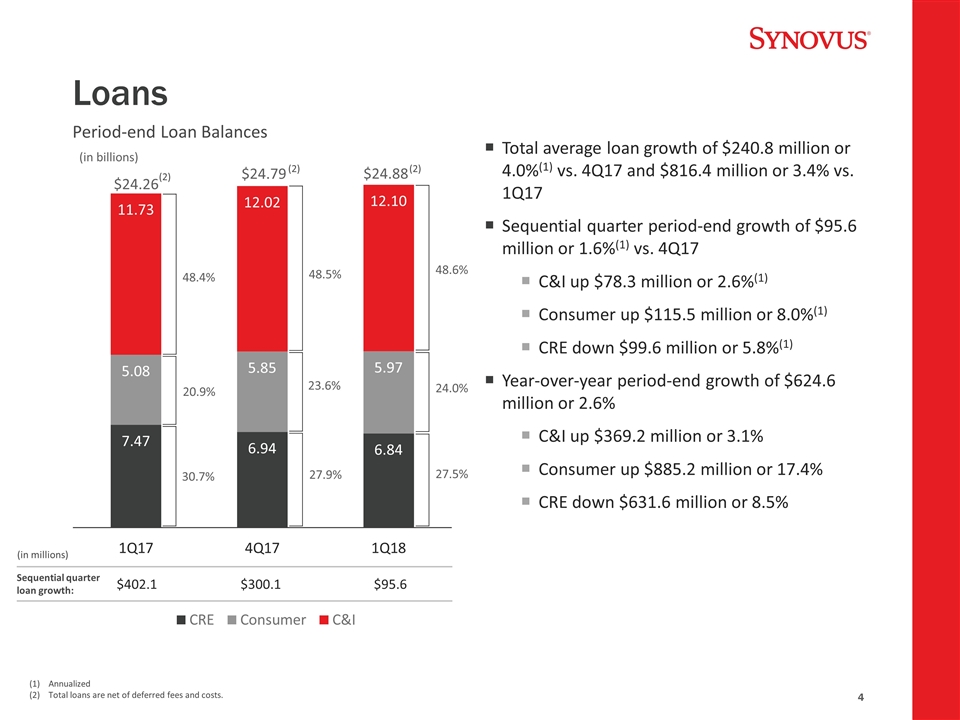

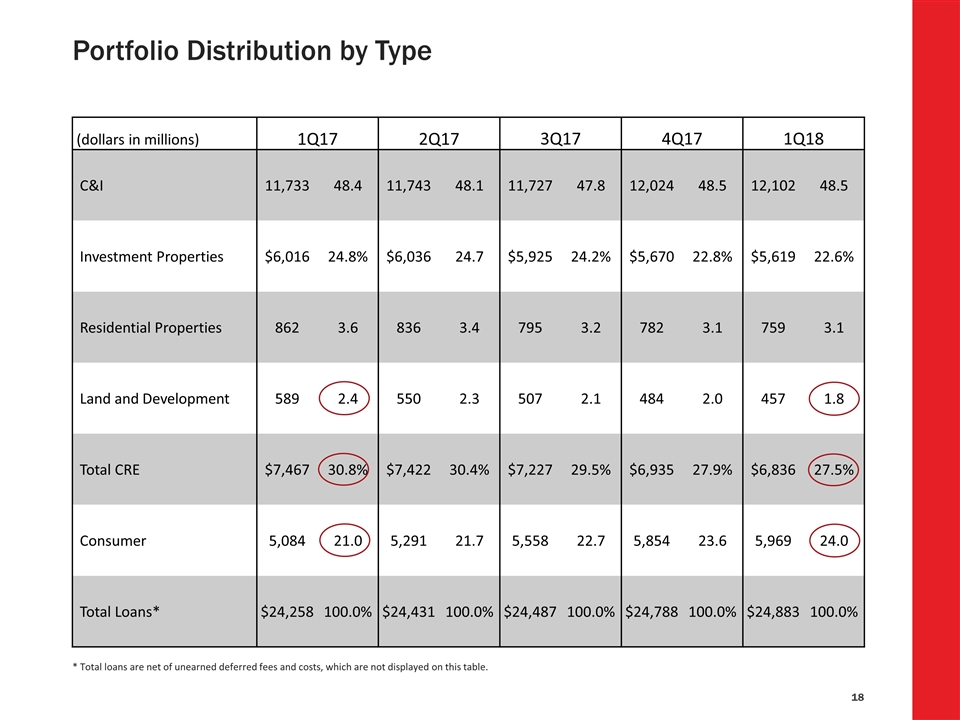

Loans Total average loan growth of $240.8 million or 4.0%(1) vs. 4Q17 and $816.4 million or 3.4% vs. 1Q17 Sequential quarter period-end growth of $95.6 million or 1.6%(1) vs. 4Q17 C&I up $78.3 million or 2.6%(1) Consumer up $115.5 million or 8.0%(1) CRE down $99.6 million or 5.8%(1) Year-over-year period-end growth of $624.6 million or 2.6% C&I up $369.2 million or 3.1% Consumer up $885.2 million or 17.4% CRE down $631.6 million or 8.5% (in billions) $24.26 $24.88 $24.79 48.6% 24.0% 27.5% 48.4% 20.9% 30.7% 48.5% 23.6% 27.9% Sequential quarter loan growth: $402.1 $300.1 $95.6 (in millions) Annualized Total loans are net of deferred fees and costs. (2) (2) (2) Period-end Loan Balances

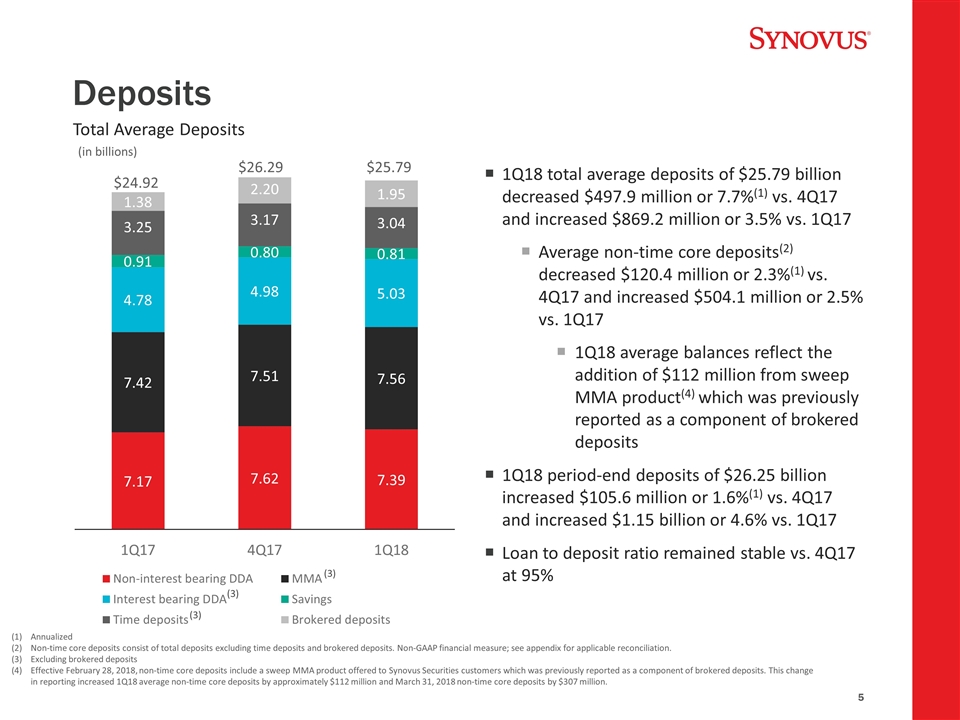

Deposits 1Q18 total average deposits of $25.79 billion decreased $497.9 million or 7.7%(1) vs. 4Q17 and increased $869.2 million or 3.5% vs. 1Q17 Average non-time core deposits(2) decreased $120.4 million or 2.3%(1) vs. 4Q17 and increased $504.1 million or 2.5% vs. 1Q17 1Q18 average balances reflect the addition of $112 million from sweep MMA product(4) which was previously reported as a component of brokered deposits 1Q18 period-end deposits of $26.25 billion increased $105.6 million or 1.6%(1) vs. 4Q17 and increased $1.15 billion or 4.6% vs. 1Q17 Loan to deposit ratio remained stable vs. 4Q17 at 95% (in billions) $24.92 $25.79 $26.29 Total Average Deposits Annualized Non-time core deposits consist of total deposits excluding time deposits and brokered deposits. Non-GAAP financial measure; see appendix for applicable reconciliation. Excluding brokered deposits Effective February 28, 2018, non-time core deposits include a sweep MMA product offered to Synovus Securities customers which was previously reported as a component of brokered deposits. This change in reporting increased 1Q18 average non-time core deposits by approximately $112 million and March 31, 2018 non-time core deposits by $307 million. (3) (3) (3)

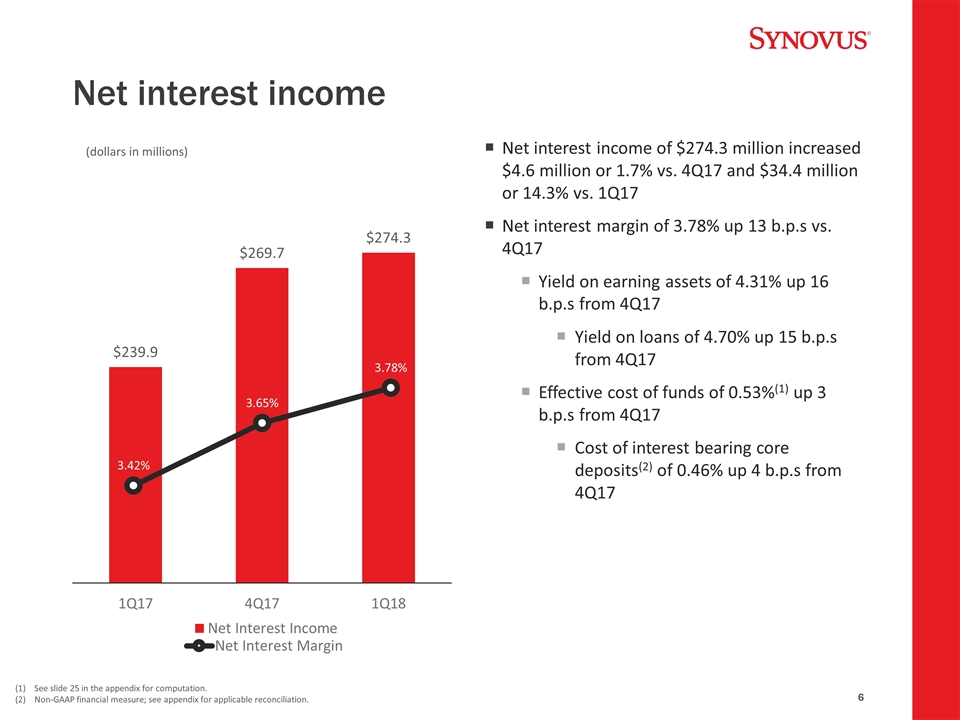

Net interest income Net interest income of $274.3 million increased $4.6 million or 1.7% vs. 4Q17 and $34.4 million or 14.3% vs. 1Q17 Net interest margin of 3.78% up 13 b.p.s vs. 4Q17 Yield on earning assets of 4.31% up 16 b.p.s from 4Q17 Yield on loans of 4.70% up 15 b.p.s from 4Q17 Effective cost of funds of 0.53%(1) up 3 b.p.s from 4Q17 Cost of interest bearing core deposits(2) of 0.46% up 4 b.p.s from 4Q17 (dollars in millions) See slide 25 in the appendix for computation. Non-GAAP financial measure; see appendix for applicable reconciliation.

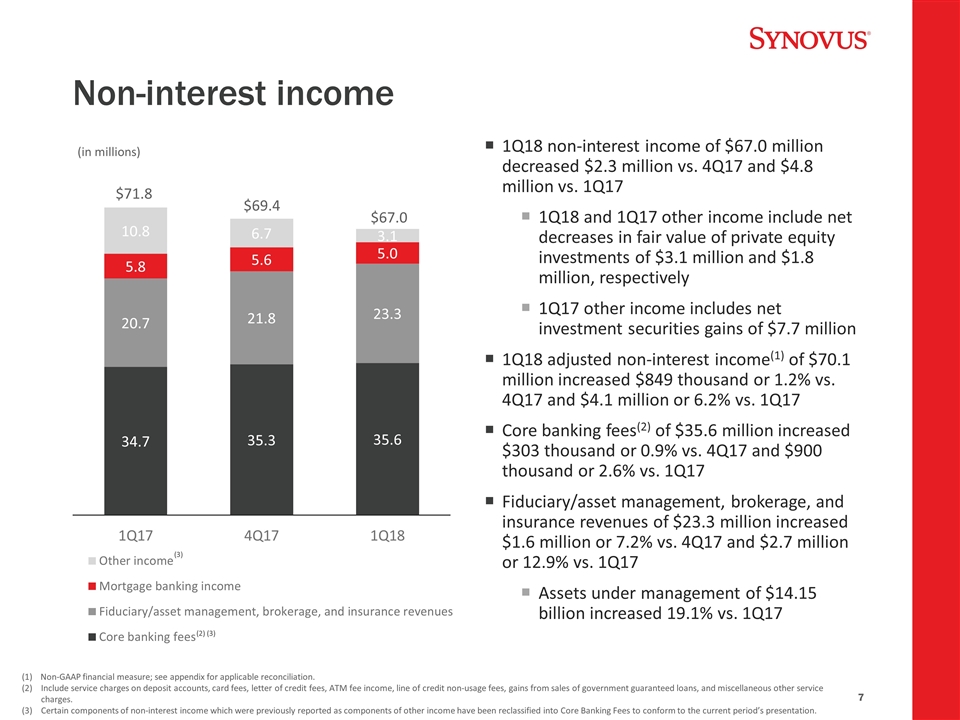

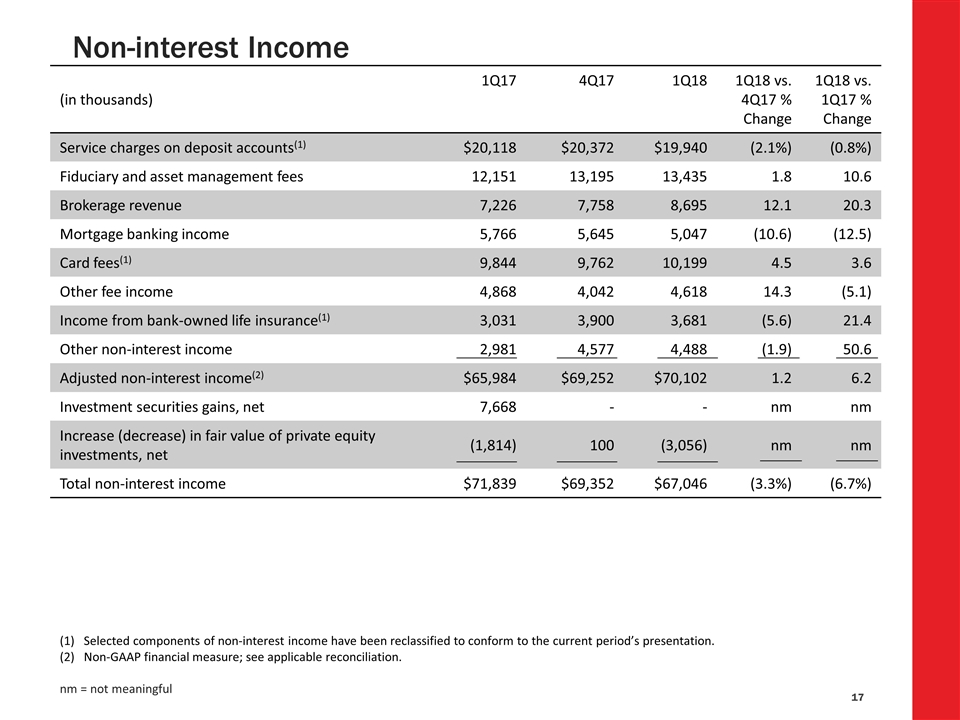

Non-interest income 1Q18 non-interest income of $67.0 million decreased $2.3 million vs. 4Q17 and $4.8 million vs. 1Q17 1Q18 and 1Q17 other income include net decreases in fair value of private equity investments of $3.1 million and $1.8 million, respectively 1Q17 other income includes net investment securities gains of $7.7 million 1Q18 adjusted non-interest income(1) of $70.1 million increased $849 thousand or 1.2% vs. 4Q17 and $4.1 million or 6.2% vs. 1Q17 Core banking fees(2) of $35.6 million increased $303 thousand or 0.9% vs. 4Q17 and $900 thousand or 2.6% vs. 1Q17 Fiduciary/asset management, brokerage, and insurance revenues of $23.3 million increased $1.6 million or 7.2% vs. 4Q17 and $2.7 million or 12.9% vs. 1Q17 Assets under management of $14.15 billion increased 19.1% vs. 1Q17 (in millions) $71.8 $67.0 $69.4 Non-GAAP financial measure; see appendix for applicable reconciliation. Include service charges on deposit accounts, card fees, letter of credit fees, ATM fee income, line of credit non-usage fees, gains from sales of government guaranteed loans, and miscellaneous other service charges. Certain components of non-interest income which were previously reported as components of other income have been reclassified into Core Banking Fees to conform to the current period’s presentation. (2) (3) (3)

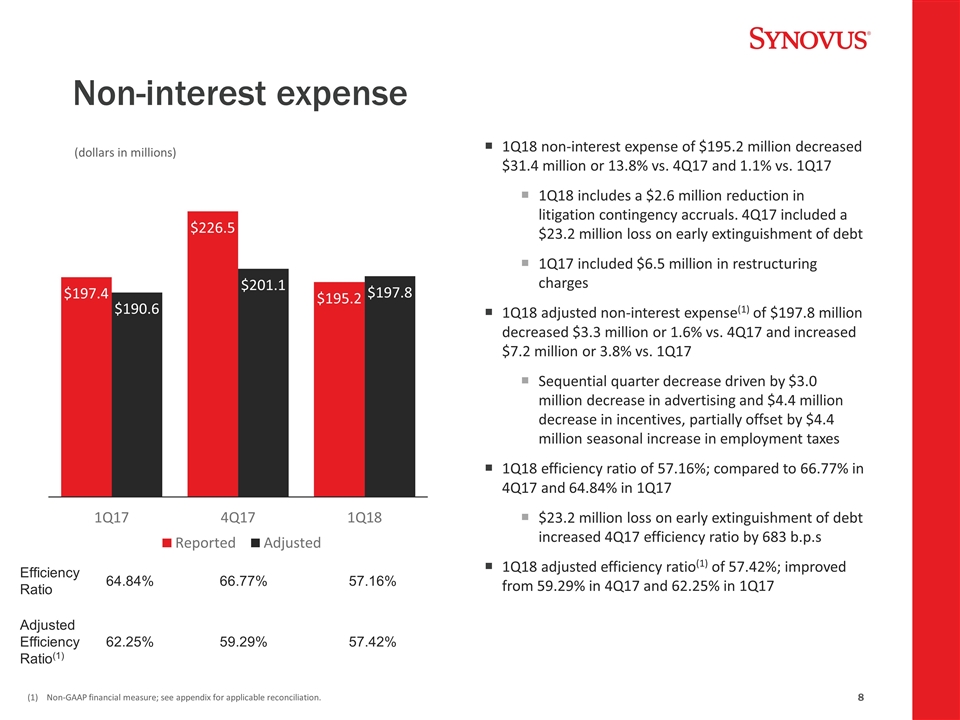

Non-interest expense 1Q18 non-interest expense of $195.2 million decreased $31.4 million or 13.8% vs. 4Q17 and 1.1% vs. 1Q17 1Q18 includes a $2.6 million reduction in litigation contingency accruals. 4Q17 included a $23.2 million loss on early extinguishment of debt 1Q17 included $6.5 million in restructuring charges 1Q18 adjusted non-interest expense(1) of $197.8 million decreased $3.3 million or 1.6% vs. 4Q17 and increased $7.2 million or 3.8% vs. 1Q17 Sequential quarter decrease driven by $3.0 million decrease in advertising and $4.4 million decrease in incentives, partially offset by $4.4 million seasonal increase in employment taxes 1Q18 efficiency ratio of 57.16%; compared to 66.77% in 4Q17 and 64.84% in 1Q17 $23.2 million loss on early extinguishment of debt increased 4Q17 efficiency ratio by 683 b.p.s 1Q18 adjusted efficiency ratio(1) of 57.42%; improved from 59.29% in 4Q17 and 62.25% in 1Q17 (dollars in millions) Non-GAAP financial measure; see appendix for applicable reconciliation. Efficiency Ratio 64.84% 66.77% 57.16% Adjusted Efficiency Ratio(1) 62.25% 59.29% 57.42%

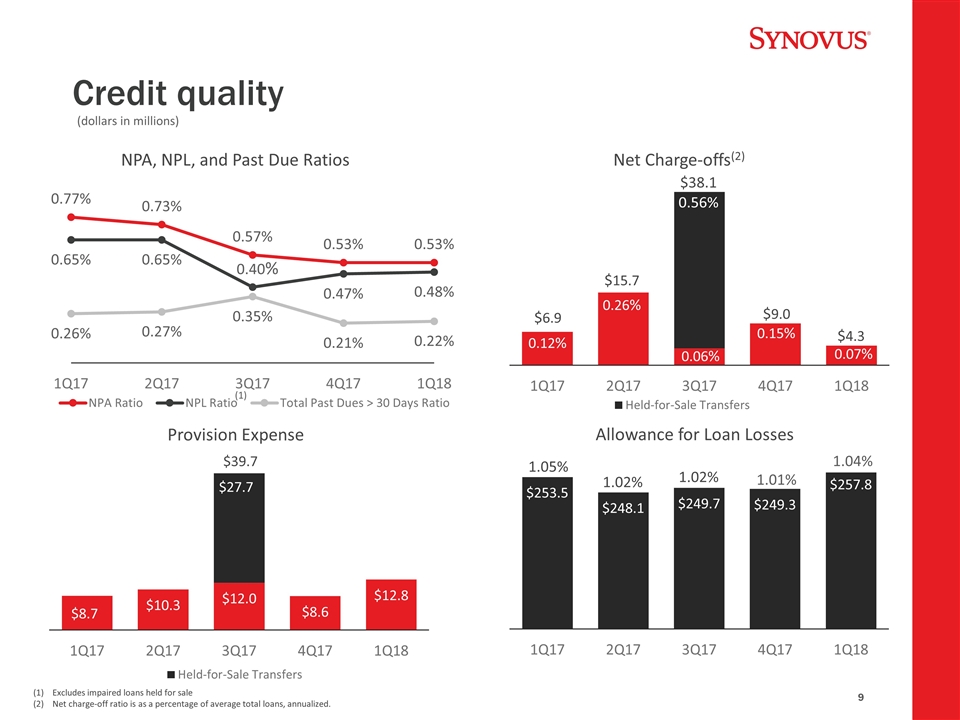

Credit quality (dollars in millions) (2) 0.12% 0.26% 0.06% 0.15% 0.56% $6.9 $15.7 $38.1 $9.0 Net Charge-offs(2) $27.7 Provision Expense Allowance for Loan Losses 1.05% 1.02% 1.02% 1.01% 0.40% NPA, NPL, and Past Due Ratios Excludes impaired loans held for sale Net charge-off ratio is as a percentage of average total loans, annualized. (1) $39.7 $4.3 0.07% 1.04%

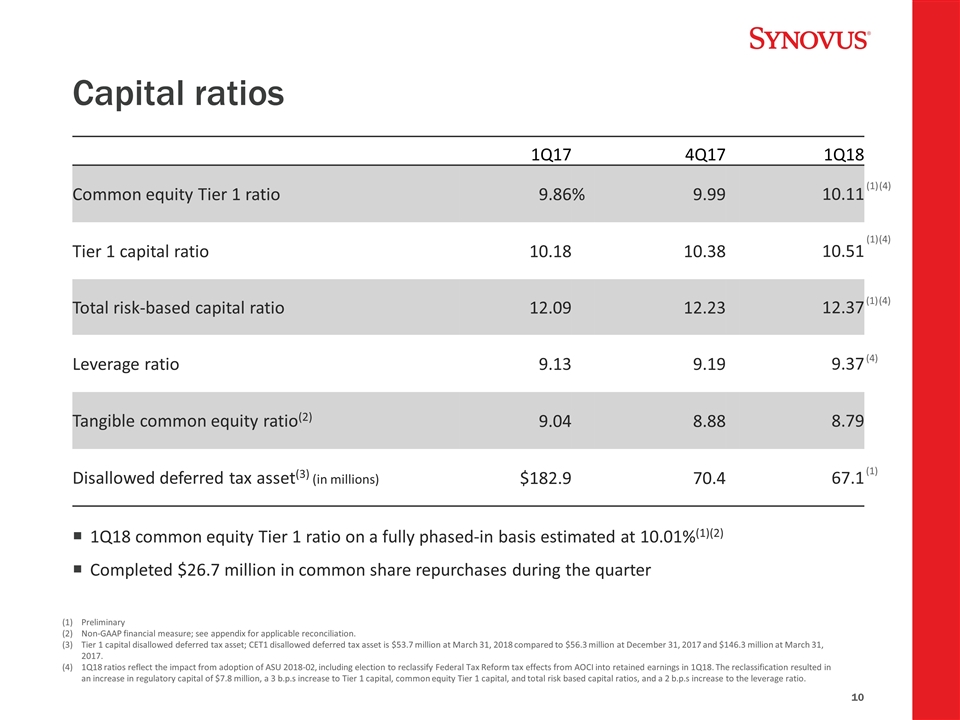

Capital ratios 1Q17 4Q17 1Q18 Common equity Tier 1 ratio 9.86 % 9.99 10.11 Tier 1 capital ratio 10.18 10.38 10.51 Total risk-based capital ratio 12.09 12.23 12.37 Leverage ratio 9.13 9.19 9.37 Tangible common equity ratio(2) 9.04 8.88 8.79 Disallowed deferred tax asset(3) (in millions) $182.9 70.4 67.1 (1) Preliminary Non-GAAP financial measure; see appendix for applicable reconciliation. Tier 1 capital disallowed deferred tax asset; CET1 disallowed deferred tax asset is $53.7 million at March 31, 2018 compared to $56.3 million at December 31, 2017 and $146.3 million at March 31, 2017. 1Q18 ratios reflect the impact from adoption of ASU 2018-02, including election to reclassify Federal Tax Reform tax effects from AOCI into retained earnings in 1Q18. The reclassification resulted in an increase in regulatory capital of $7.8 million, a 3 b.p.s increase to Tier 1 capital, common equity Tier 1 capital, and total risk based capital ratios, and a 2 b.p.s increase to the leverage ratio. 1Q18 common equity Tier 1 ratio on a fully phased-in basis estimated at 10.01%(1)(2) Completed $26.7 million in common share repurchases during the quarter (4) (1) (4) (1) (4) (4) (1)

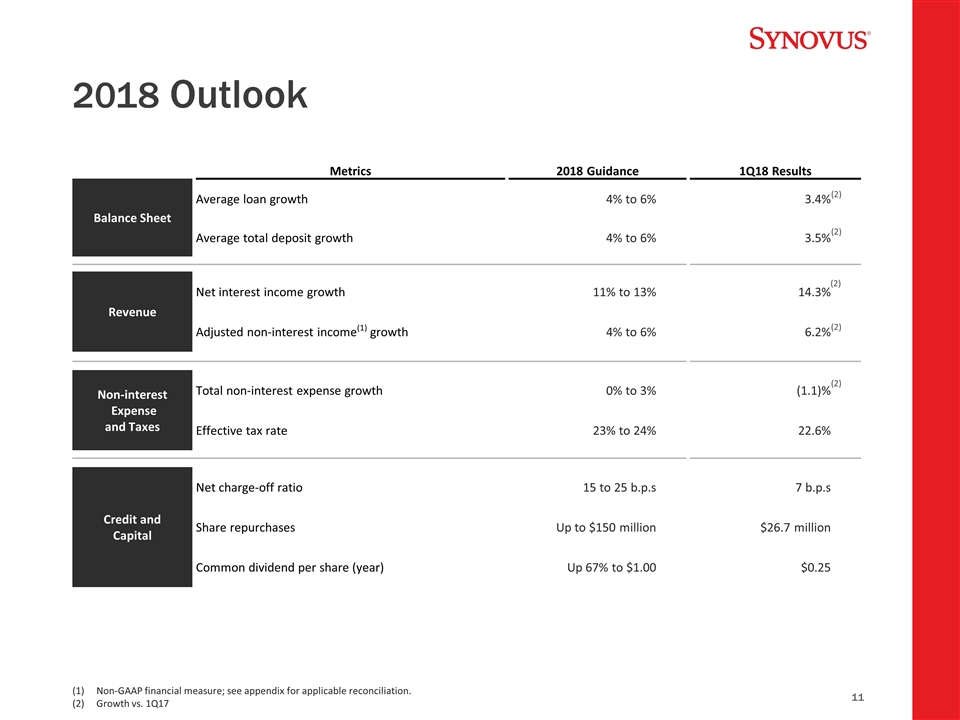

2018 Outlook Metrics 2018 Guidance 1Q18 Results Balance Sheet Average loan growth 4% to 6% 3.4% Average total deposit growth 4% to 6% 3.5% Revenue Net interest income growth 11% to 13% 14.3% Adjusted non-interest income(1) growth 4% to 6% 6.2% Non-interest Expense and Taxes Total non-interest expense growth 0% to 3% (1.1)% Effective tax rate 23% to 24% 22.6% Credit and Capital Net charge-off ratio 15 to 25 b.p.s 7 b.p.s Share repurchases Up to $150 million $26.7 million Common dividend per share (year) Up 67% to $1.00 $0.25 Non-GAAP financial measure; see appendix for applicable reconciliation. Growth vs. 1Q17 (2) (2) (2) (2) (2)

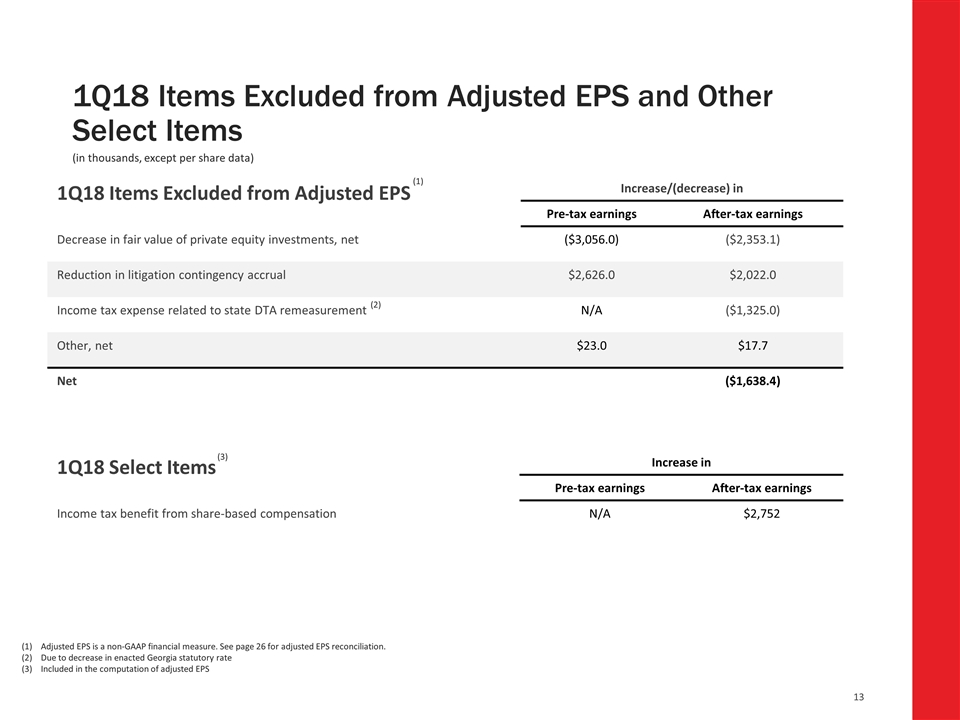

1Q18 Items Excluded from Adjusted EPS and Other Select Items (in thousands, except per share data) Adjusted EPS is a non-GAAP financial measure. See page 26 for adjusted EPS reconciliation. Due to decrease in enacted Georgia statutory rate Included in the computation of adjusted EPS (1) (2) 1Q18 Items Excluded from Adjusted EPS Increase/(decrease) in Pre-tax earnings After-tax earnings Decrease in fair value of private equity investments, net ($3,056.0) ($2,353.1) Reduction in litigation contingency accrual $2,626.0 $2,022.0 Income tax expense related to state DTA remeasurement N/A ($1,325.0) Other, net $23.0 $17.7 Net ($1,638.4) 1Q18 Select Items Increase in Pre-tax earnings After-tax earnings Income tax benefit from share-based compensation N/A $2,752 (3)

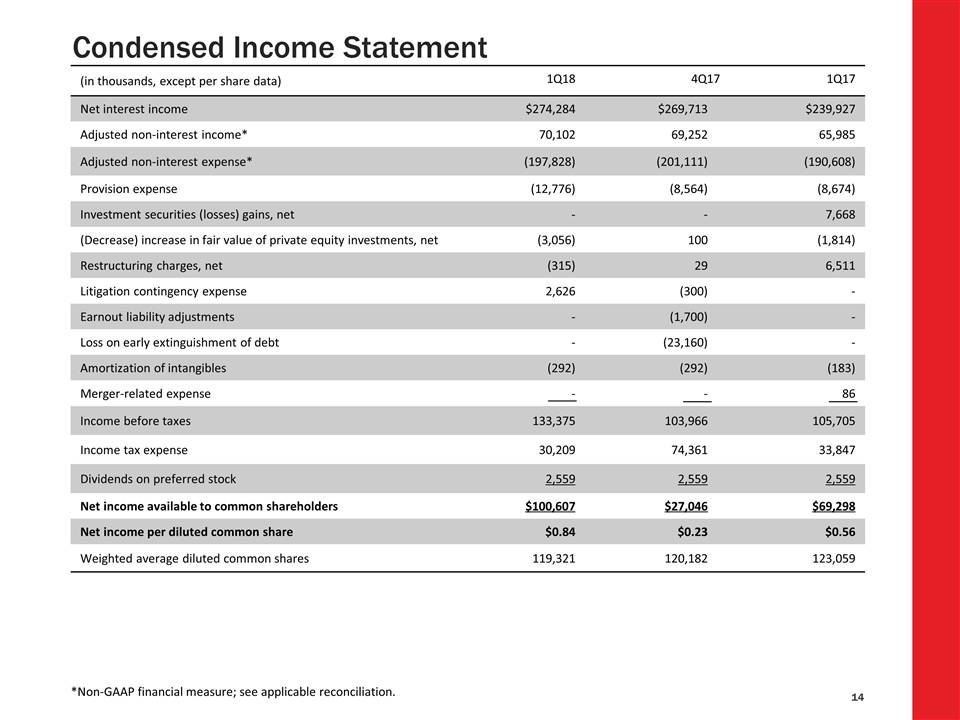

Condensed Income Statement (in thousands, except per share data) 1Q18 4Q17 1Q17 Net interest income $274,284 $269,713 $239,927 Adjusted non-interest income* 70,102 69,252 65,985 Adjusted non-interest expense* (197,828) (201,111) (190,608) Provision expense (12,776) (8,564) (8,674) Investment securities (losses) gains, net - - 7,668 (Decrease) increase in fair value of private equity investments, net (3,056) 100 (1,814) Restructuring charges, net (315) 29 6,511 Litigation contingency expense 2,626 (300) - Earnout liability adjustments - (1,700) - Loss on early extinguishment of debt - (23,160) - Amortization of intangibles (292) (292) (183) Merger-related expense - - 86 Income before taxes 133,375 103,966 105,705 Income tax expense 30,209 74,361 33,847 Dividends on preferred stock 2,559 2,559 2,559 Net income available to common shareholders $100,607 $27,046 $69,298 Net income per diluted common share $0.84 $0.23 $0.56 Weighted average diluted common shares 119,321 120,182 123,059 *Non-GAAP financial measure; see applicable reconciliation.

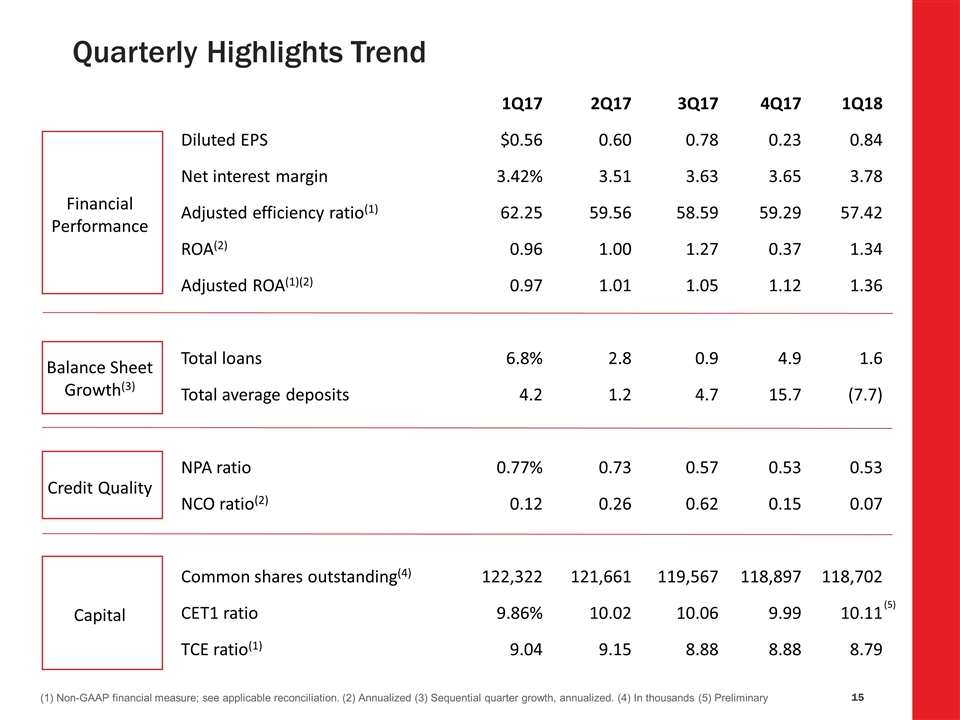

Quarterly Highlights Trend 1Q17 2Q17 3Q17 4Q17 1Q18 Diluted EPS $0.56 0.60 0.78 0.23 0.84 Financial Performance Net interest margin 3.42% 3.51 3.63 3.65 3.78 Adjusted efficiency ratio(1) 62.25 59.56 58.59 59.29 57.42 ROA(2) 0.96 1.00 1.27 0.37 1.34 Adjusted ROA(1)(2) 0.97 1.01 1.05 1.12 1.36 Balance Sheet Growth(3) Total loans 6.8% 2.8 0.9 4.9 1.6 Total average deposits 4.2 1.2 4.7 15.7 (7.7) Credit Quality NPA ratio 0.77% 0.73 0.57 0.53 0.53 NCO ratio(2) 0.12 0.26 0.62 0.15 0.07 Capital Common shares outstanding(4) 122,322 121,661 119,567 118,897 118,702 CET1 ratio 9.86% 10.02 10.06 9.99 10.11 TCE ratio(1) 9.04 9.15 8.88 8.88 8.79 (1) Non-GAAP financial measure; see applicable reconciliation. (2) Annualized (3) Sequential quarter growth, annualized. (4) In thousands (5) Preliminary (5)

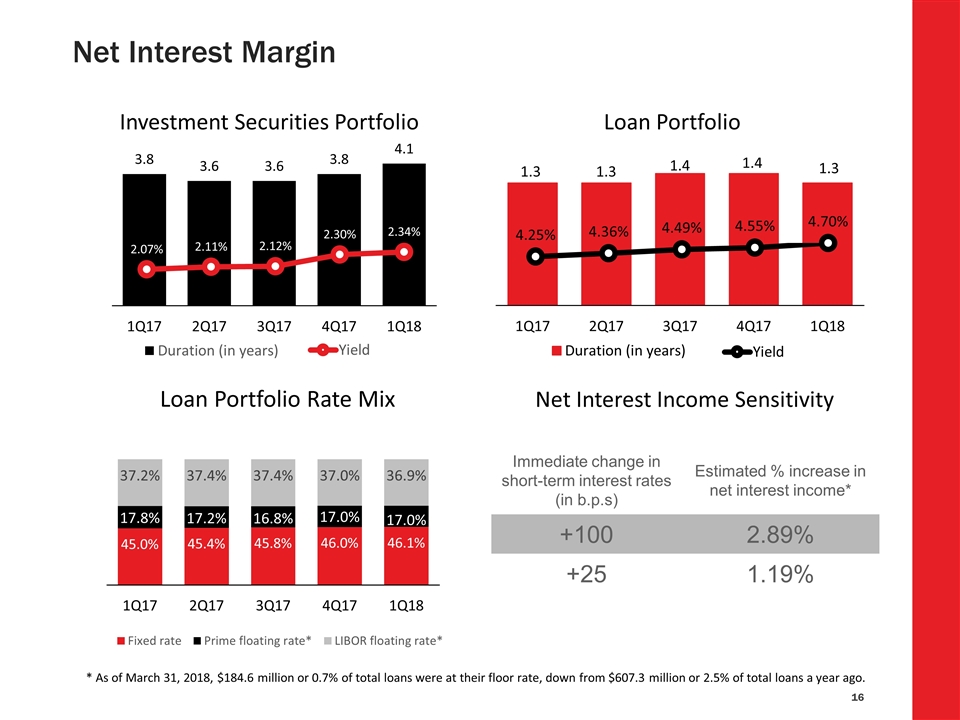

Net Interest Margin (2) Immediate change in short-term interest rates (in b.p.s) Estimated % increase in net interest income* +100 2.89% +25 1.19% Net Interest Income Sensitivity * As of March 31, 2018, $184.6 million or 0.7% of total loans were at their floor rate, down from $607.3 million or 2.5% of total loans a year ago.

Non-interest Income (in thousands) 1Q17 4Q17 1Q18 1Q18 vs. 4Q17 % Change 1Q18 vs. 1Q17 % Change Service charges on deposit accounts(1) $20,118 $20,372 $19,940 (2.1%) (0.8%) Fiduciary and asset management fees 12,151 13,195 13,435 1.8 10.6 Brokerage revenue 7,226 7,758 8,695 12.1 20.3 Mortgage banking income 5,766 5,645 5,047 (10.6) (12.5) Card fees(1) 9,844 9,762 10,199 4.5 3.6 Other fee income 4,868 4,042 4,618 14.3 (5.1) Income from bank-owned life insurance(1) 3,031 3,900 3,681 (5.6) 21.4 Other non-interest income 2,981 4,577 4,488 (1.9) 50.6 Adjusted non-interest income(2) $65,984 $69,252 $70,102 1.2 6.2 Investment securities gains, net 7,668 - - nm nm Increase (decrease) in fair value of private equity investments, net (1,814) 100 (3,056) nm nm Total non-interest income $71,839 $69,352 $67,046 (3.3%) (6.7%) Selected components of non-interest income have been reclassified to conform to the current period’s presentation. Non-GAAP financial measure; see applicable reconciliation. nm = not meaningful

Portfolio Distribution by Type * Total loans are net of unearned deferred fees and costs, which are not displayed on this table. (dollars in millions) 1Q17 2Q17 3Q17 4Q17 1Q18 C&I 11,733 48.4 11,743 48.1 11,727 47.8 12,024 48.5 12,102 48.5 Investment Properties $6,016 24.8% $6,036 24.7 $5,925 24.2% $5,670 22.8% $5,619 22.6% Residential Properties 862 3.6 836 3.4 795 3.2 782 3.1 759 3.1 Land and Development 589 2.4 550 2.3 507 2.1 484 2.0 457 1.8 Total CRE $7,467 30.8% $7,422 30.4% $7,227 29.5% $6,935 27.9% $6,836 27.5% Consumer 5,084 21.0 5,291 21.7 5,558 22.7 5,854 23.6 5,969 24.0 Total Loans* $24,258 100.0% $24,431 100.0% $24,487 100.0% $24,788 100.0% $24,883 100.0%

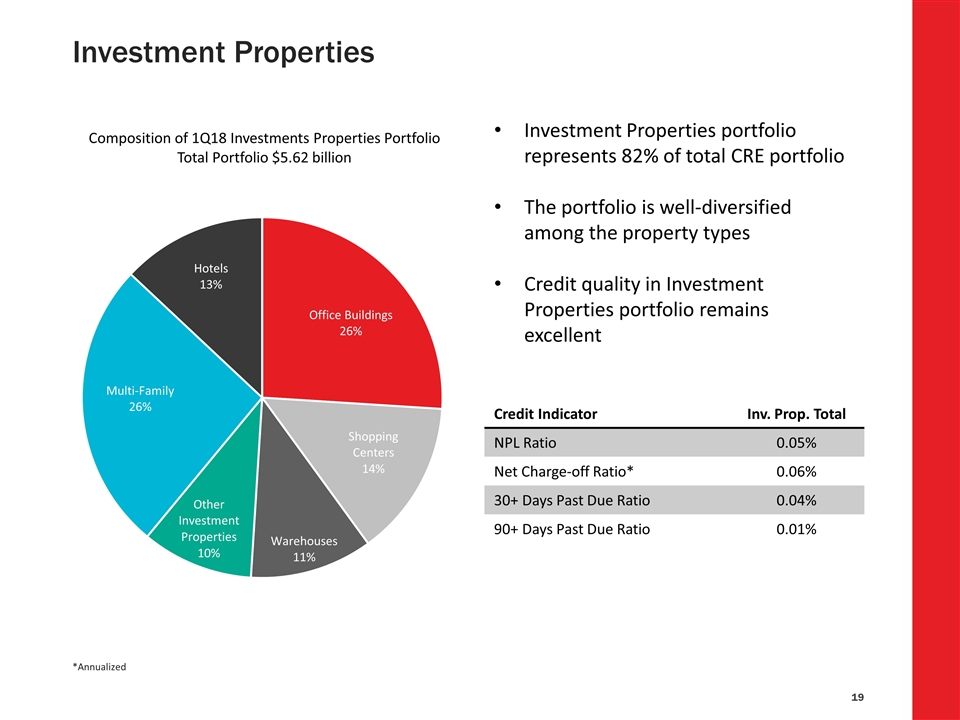

Investment Properties *Annualized Credit Indicator Inv. Prop. Total NPL Ratio 0.05% Net Charge-off Ratio* 0.06% 30+ Days Past Due Ratio 0.04% 90+ Days Past Due Ratio 0.01% Investment Properties portfolio represents 82% of total CRE portfolio The portfolio is well-diversified among the property types Credit quality in Investment Properties portfolio remains excellent

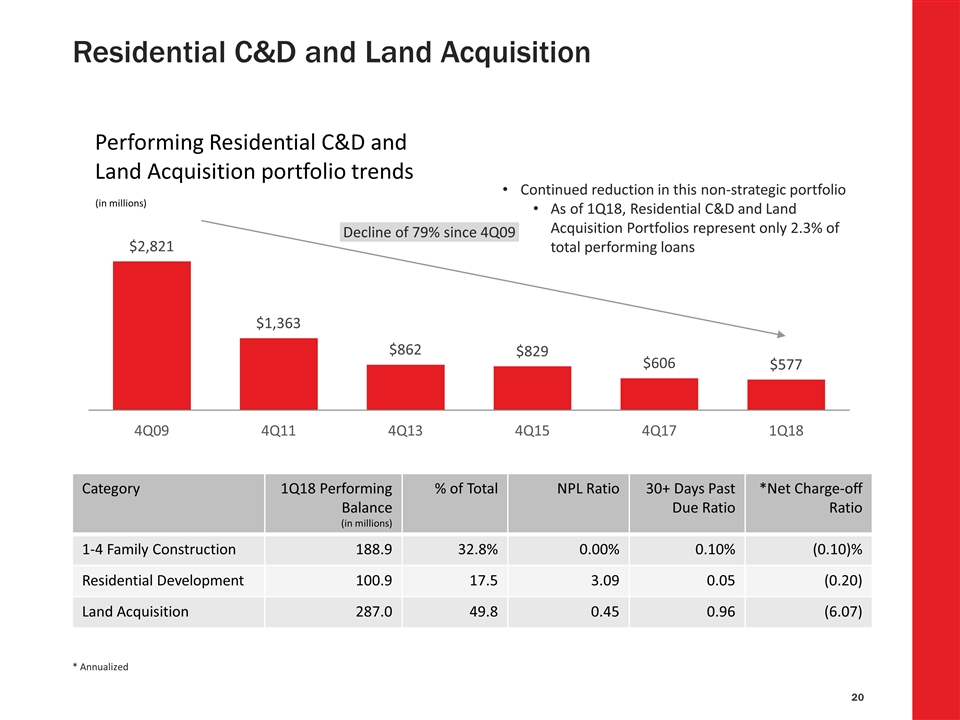

Residential C&D and Land Acquisition * Annualized Category 1Q18 Performing Balance (in millions) % of Total NPL Ratio 30+ Days Past Due Ratio *Net Charge-off Ratio 1-4 Family Construction 188.9 32.8% 0.00% 0.10% (0.10)% Residential Development 100.9 17.5 3.09 0.05 (0.20) Land Acquisition 287.0 49.8 0.45 0.96 (6.07) Continued reduction in this non-strategic portfolio As of 1Q18, Residential C&D and Land Acquisition Portfolios represent only 2.3% of total performing loans (in millions)

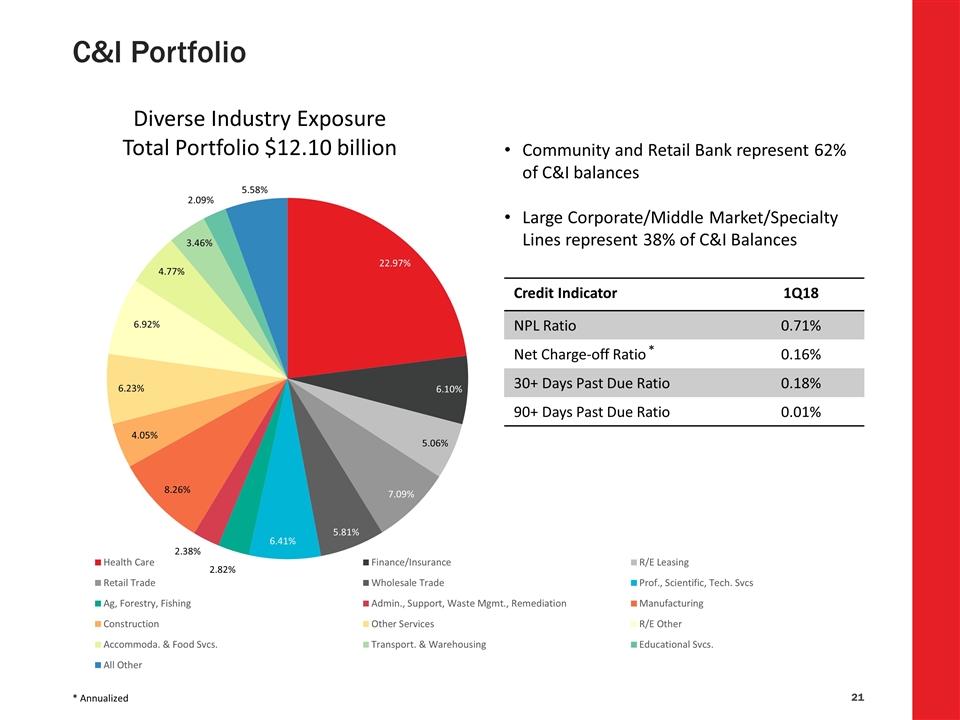

C&I Portfolio * Annualized Credit Indicator 1Q18 NPL Ratio 0.71% Net Charge-off Ratio 0.16% 30+ Days Past Due Ratio 0.18% 90+ Days Past Due Ratio 0.01% Community and Retail Bank represent 62% of C&I balances Large Corporate/Middle Market/Specialty Lines represent 38% of C&I Balances *

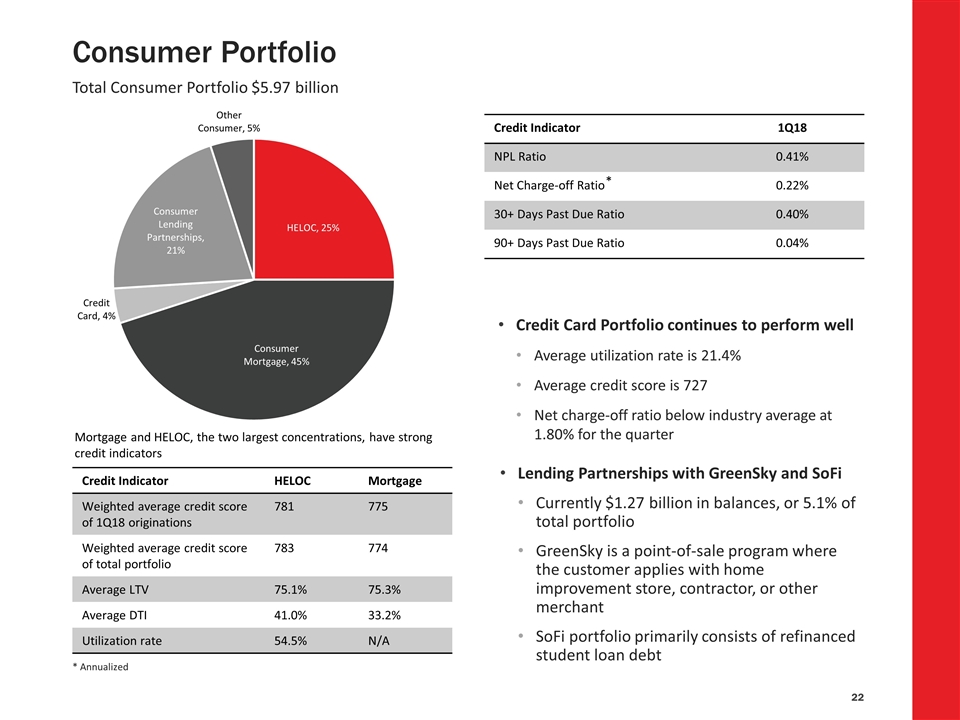

Consumer Portfolio * Annualized Credit Indicator 1Q18 NPL Ratio 0.41% Net Charge-off Ratio 0.22% 30+ Days Past Due Ratio 0.40% 90+ Days Past Due Ratio 0.04% Credit Card Portfolio continues to perform well Average utilization rate is 21.4% Average credit score is 727 Net charge-off ratio below industry average at 1.80% for the quarter Total Consumer Portfolio $5.97 billion Lending Partnerships with GreenSky and SoFi Currently $1.27 billion in balances, or 5.1% of total portfolio GreenSky is a point-of-sale program where the customer applies with home improvement store, contractor, or other merchant SoFi portfolio primarily consists of refinanced student loan debt Credit Indicator HELOC Mortgage Weighted average credit score of 1Q18 originations 781 775 Weighted average credit score of total portfolio 783 774 Average LTV 75.1% 75.3% Average DTI 41.0% 33.2% Utilization rate 54.5% N/A Mortgage and HELOC, the two largest concentrations, have strong credit indicators *

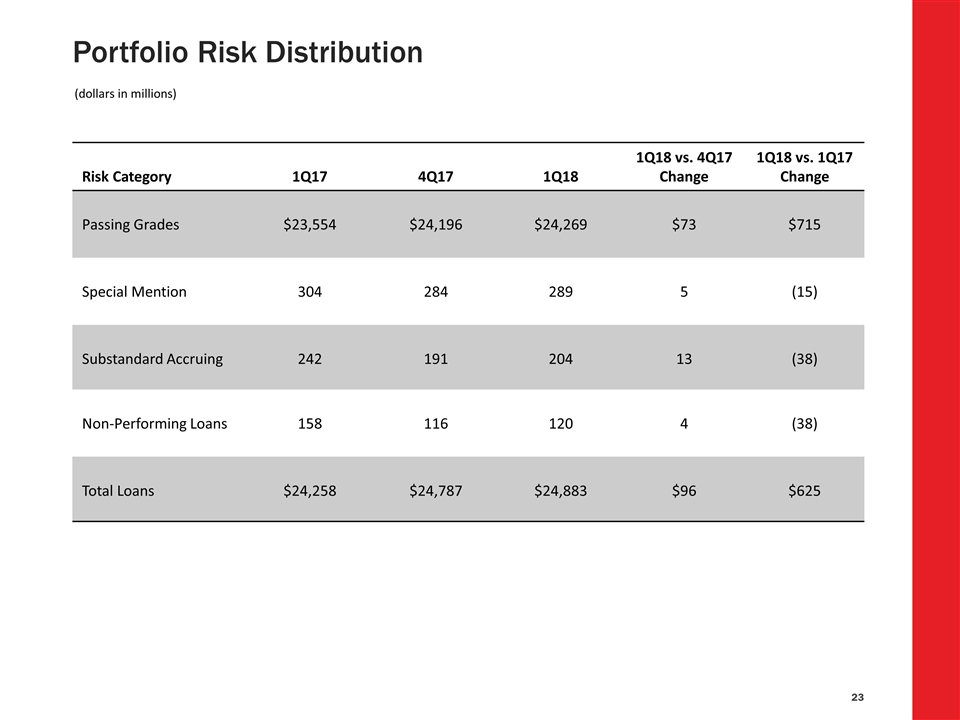

Portfolio Risk Distribution Risk Category 1Q17 4Q17 1Q18 1Q18 vs. 4Q17 Change 1Q18 vs. 1Q17 Change Passing Grades $23,554 $24,196 $24,269 $73 $715 Special Mention 304 284 289 5 (15) Substandard Accruing 242 191 204 13 (38) Non-Performing Loans 158 116 120 4 (38) Total Loans $24,258 $24,787 $24,883 $96 $625 (dollars in millions)

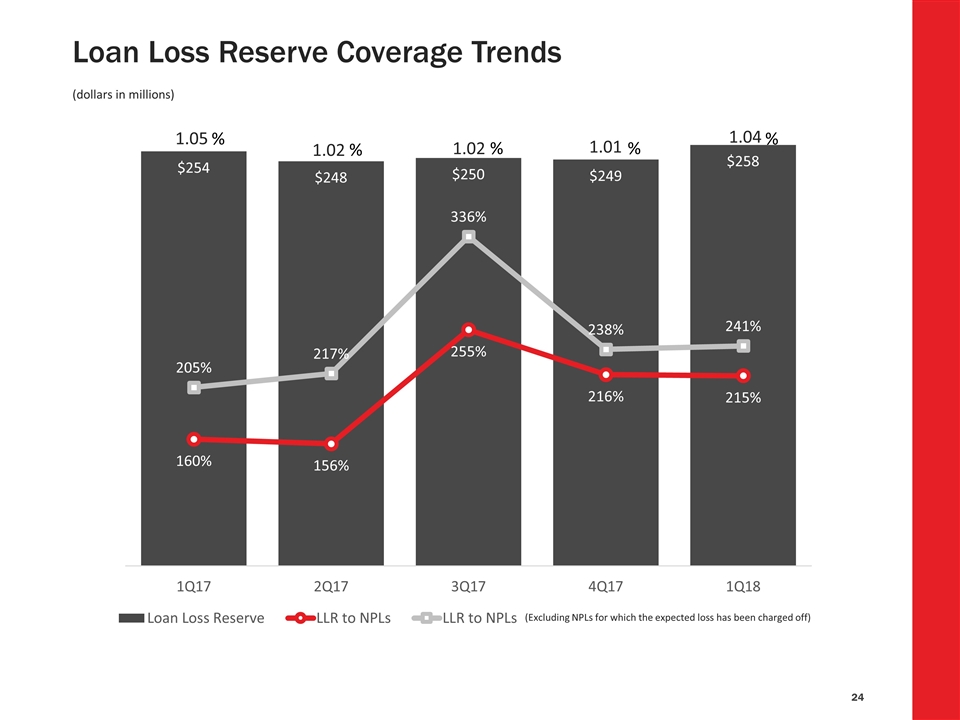

Loan Loss Reserve Coverage Trends (Excluding NPLs for which the expected loss has been charged off) (dollars in millions) 1.05 % % % % %

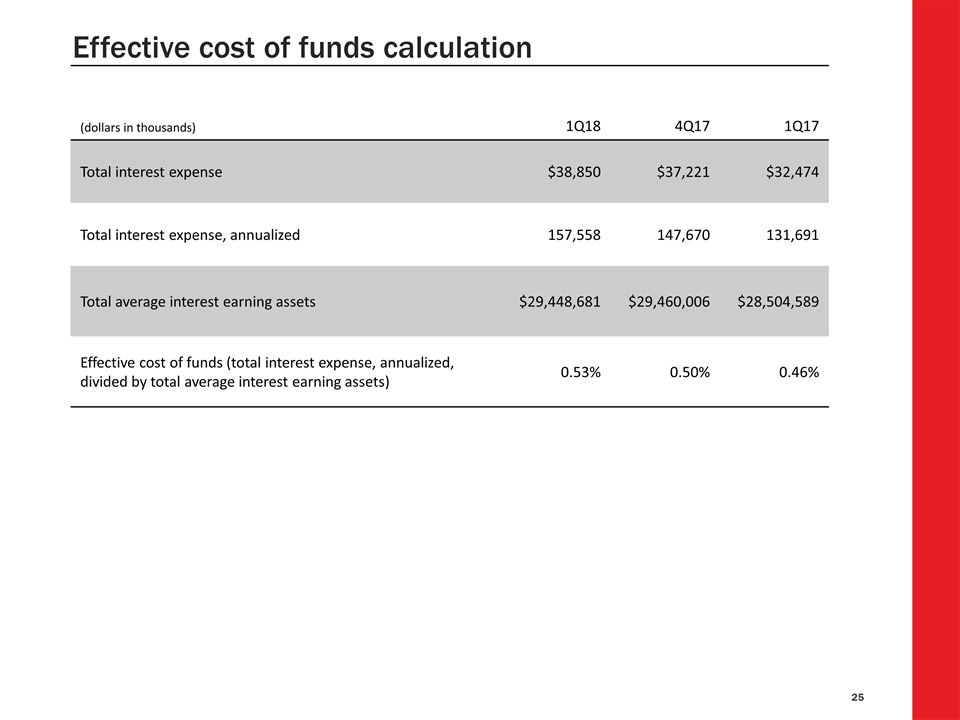

Effective cost of funds calculation (dollars in thousands) 1Q18 4Q17 1Q17 Total interest expense $38,850 $37,221 $32,474 Total interest expense, annualized 157,558 147,670 131,691 Total average interest earning assets $29,448,681 $29,460,006 $28,504,589 Effective cost of funds (total interest expense, annualized, divided by total average interest earning assets) 0.53% 0.50% 0.46%

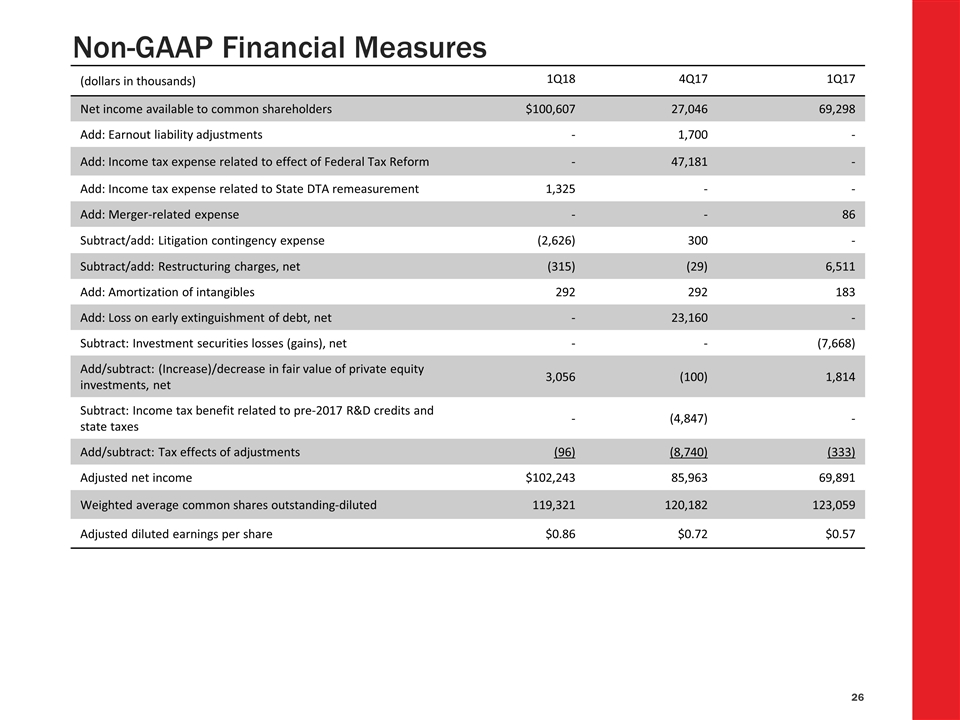

Non-GAAP Financial Measures (dollars in thousands) 1Q18 4Q17 1Q17 Net income available to common shareholders $100,607 27,046 69,298 Add: Earnout liability adjustments - 1,700 - Add: Income tax expense related to effect of Federal Tax Reform - 47,181 - Add: Income tax expense related to State DTA remeasurement 1,325 - - Add: Merger-related expense - - 86 Subtract/add: Litigation contingency expense (2,626) 300 - Subtract/add: Restructuring charges, net (315) (29) 6,511 Add: Amortization of intangibles 292 292 183 Add: Loss on early extinguishment of debt, net - 23,160 - Subtract: Investment securities losses (gains), net - - (7,668) Add/subtract: (Increase)/decrease in fair value of private equity investments, net 3,056 (100) 1,814 Subtract: Income tax benefit related to pre-2017 R&D credits and state taxes - (4,847) - Add/subtract: Tax effects of adjustments (96) (8,740) (333) Adjusted net income $102,243 85,963 69,891 Weighted average common shares outstanding-diluted 119,321 120,182 123,059 Adjusted diluted earnings per share $0.86 $0.72 $0.57

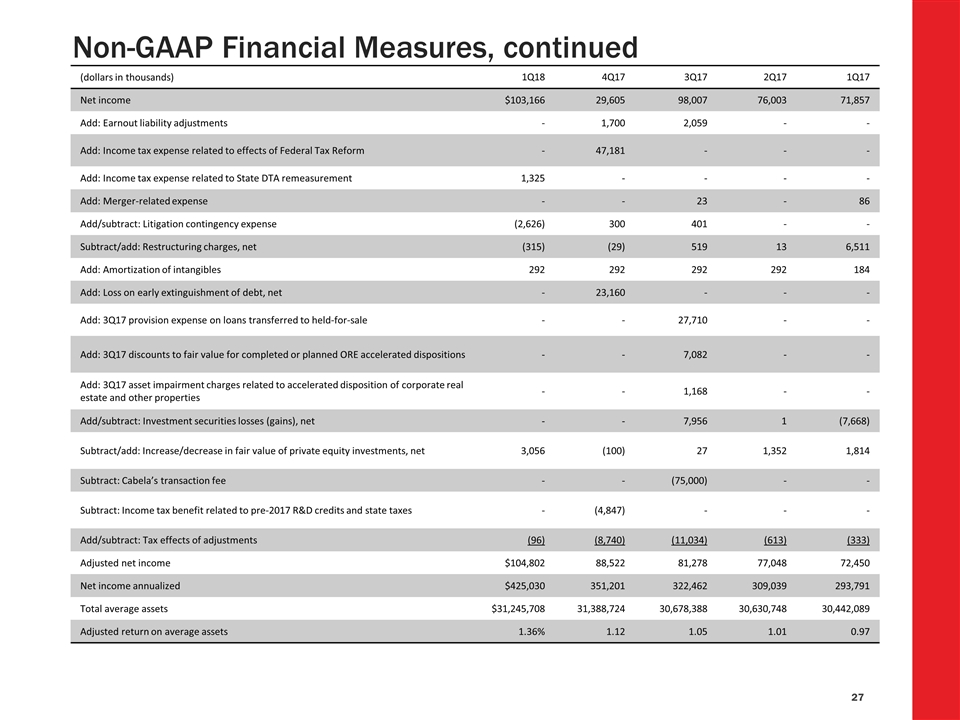

Non-GAAP Financial Measures, continued (dollars in thousands) 1Q18 4Q17 3Q17 2Q17 1Q17 Net income $103,166 29,605 98,007 76,003 71,857 Add: Earnout liability adjustments - 1,700 2,059 - - Add: Income tax expense related to effects of Federal Tax Reform - 47,181 - - - Add: Income tax expense related to State DTA remeasurement 1,325 - - - - Add: Merger-related expense - - 23 - 86 Add/subtract: Litigation contingency expense (2,626) 300 401 - - Subtract/add: Restructuring charges, net (315) (29) 519 13 6,511 Add: Amortization of intangibles 292 292 292 292 184 Add: Loss on early extinguishment of debt, net - 23,160 - - - Add: 3Q17 provision expense on loans transferred to held-for-sale - - 27,710 - - Add: 3Q17 discounts to fair value for completed or planned ORE accelerated dispositions - - 7,082 - - Add: 3Q17 asset impairment charges related to accelerated disposition of corporate real estate and other properties - - 1,168 - - Add/subtract: Investment securities losses (gains), net - - 7,956 1 (7,668) Subtract/add: Increase/decrease in fair value of private equity investments, net 3,056 (100) 27 1,352 1,814 Subtract: Cabela’s transaction fee - - (75,000) - - Subtract: Income tax benefit related to pre-2017 R&D credits and state taxes - (4,847) - - - Add/subtract: Tax effects of adjustments (96) (8,740) (11,034) (613) (333) Adjusted net income $104,802 88,522 81,278 77,048 72,450 Net income annualized $425,030 351,201 322,462 309,039 293,791 Total average assets $31,245,708 31,388,724 30,678,388 30,630,748 30,442,089 Adjusted return on average assets 1.36% 1.12 1.05 1.01 0.97

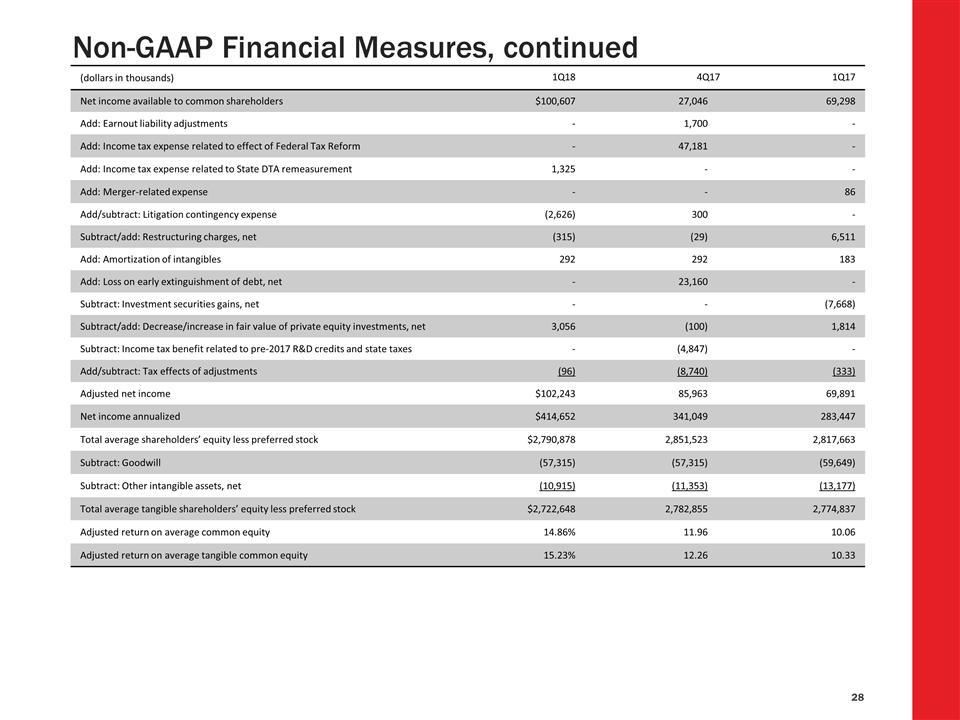

Non-GAAP Financial Measures, continued (dollars in thousands) 1Q18 4Q17 1Q17 Net income available to common shareholders $100,607 27,046 69,298 Add: Earnout liability adjustments - 1,700 - Add: Income tax expense related to effect of Federal Tax Reform - 47,181 - Add: Income tax expense related to State DTA remeasurement 1,325 - - Add: Merger-related expense - - 86 Add/subtract: Litigation contingency expense (2,626) 300 - Subtract/add: Restructuring charges, net (315) (29) 6,511 Add: Amortization of intangibles 292 292 183 Add: Loss on early extinguishment of debt, net - 23,160 - Subtract: Investment securities gains, net - - (7,668) Subtract/add: Decrease/increase in fair value of private equity investments, net 3,056 (100) 1,814 Subtract: Income tax benefit related to pre-2017 R&D credits and state taxes - (4,847) - Add/subtract: Tax effects of adjustments (96) (8,740) (333) Adjusted net income $102,243 85,963 69,891 Net income annualized $414,652 341,049 283,447 Total average shareholders’ equity less preferred stock $2,790,878 2,851,523 2,817,663 Subtract: Goodwill (57,315) (57,315) (59,649) Subtract: Other intangible assets, net (10,915) (11,353) (13,177) Total average tangible shareholders’ equity less preferred stock $2,722,648 2,782,855 2,774,837 Adjusted return on average common equity 14.86% 11.96 10.06 Adjusted return on average tangible common equity 15.23% 12.26 10.33

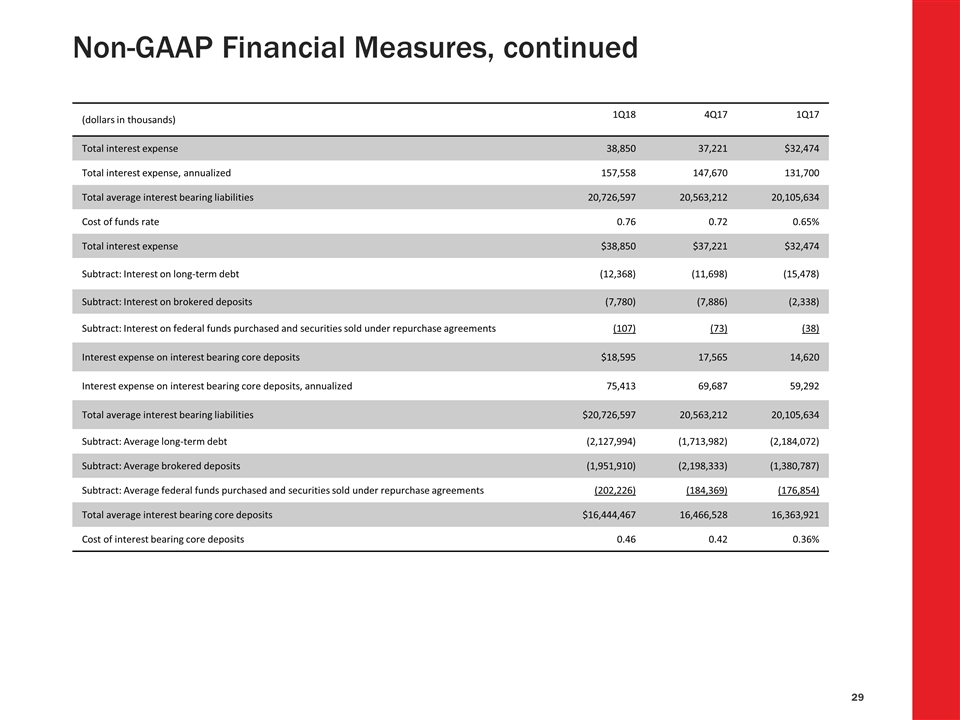

Non-GAAP Financial Measures, continued (dollars in thousands) 1Q18 4Q17 1Q17 Total interest expense 38,850 37,221 $32,474 Total interest expense, annualized 157,558 147,670 131,700 Total average interest bearing liabilities 20,726,597 20,563,212 20,105,634 Cost of funds rate 0.76 0.72 0.65% Total interest expense $38,850 $37,221 $32,474 Subtract: Interest on long-term debt (12,368) (11,698) (15,478) Subtract: Interest on brokered deposits (7,780) (7,886) (2,338) Subtract: Interest on federal funds purchased and securities sold under repurchase agreements (107) (73) (38) Interest expense on interest bearing core deposits $18,595 17,565 14,620 Interest expense on interest bearing core deposits, annualized 75,413 69,687 59,292 Total average interest bearing liabilities $20,726,597 20,563,212 20,105,634 Subtract: Average long-term debt (2,127,994) (1,713,982) (2,184,072) Subtract: Average brokered deposits (1,951,910) (2,198,333) (1,380,787) Subtract: Average federal funds purchased and securities sold under repurchase agreements (202,226) (184,369) (176,854) Total average interest bearing core deposits $16,444,467 16,466,528 16,363,921 Cost of interest bearing core deposits 0.46 0.42 0.36%

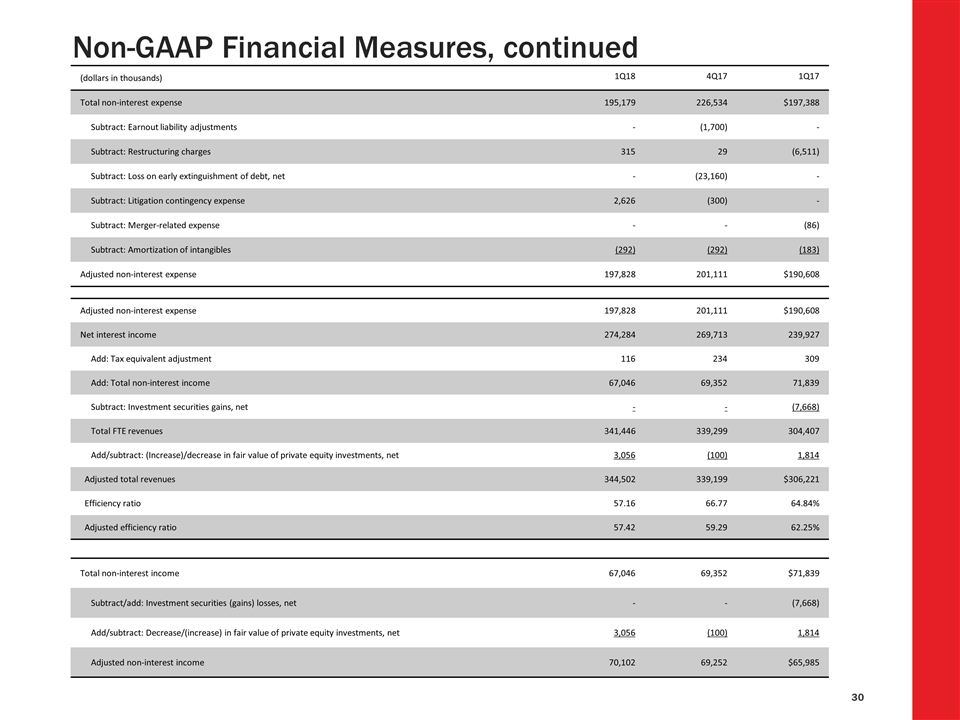

Non-GAAP Financial Measures, continued (dollars in thousands) 1Q18 4Q17 1Q17 Total non-interest expense 195,179 226,534 $197,388 Subtract: Earnout liability adjustments - (1,700) - Subtract: Restructuring charges 315 29 (6,511) Subtract: Loss on early extinguishment of debt, net - (23,160) - Subtract: Litigation contingency expense 2,626 (300) - Subtract: Merger-related expense - - (86) Subtract: Amortization of intangibles (292) (292) (183) Adjusted non-interest expense 197,828 201,111 $190,608 Adjusted non-interest expense 197,828 201,111 $190,608 Net interest income 274,284 269,713 239,927 Add: Tax equivalent adjustment 116 234 309 Add: Total non-interest income 67,046 69,352 71,839 Subtract: Investment securities gains, net - - (7,668) Total FTE revenues 341,446 339,299 304,407 Add/subtract: (Increase)/decrease in fair value of private equity investments, net 3,056 (100) 1,814 Adjusted total revenues 344,502 339,199 $306,221 Efficiency ratio 57.16 66.77 64.84% Adjusted efficiency ratio 57.42 59.29 62.25% Total non-interest income 67,046 69,352 $71,839 Subtract/add: Investment securities (gains) losses, net - - (7,668) Add/subtract: Decrease/(increase) in fair value of private equity investments, net 3,056 (100) 1,814 Adjusted non-interest income 70,102 69,252 $65,985

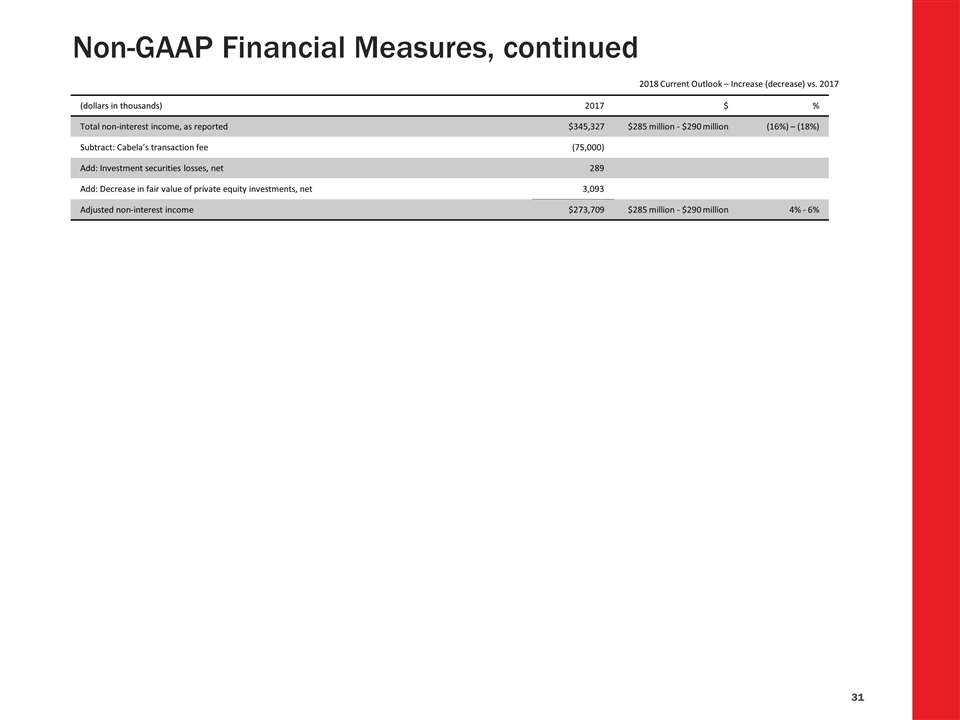

Non-GAAP Financial Measures, continued (dollars in thousands) 2017 $ % Total non-interest income, as reported $345,327 $285 million - $290 million (16%) – (18%) Subtract: Cabela’s transaction fee (75,000) Add: Investment securities losses, net 289 Add: Decrease in fair value of private equity investments, net 3,093 Adjusted non-interest income $273,709 $285 million - $290 million 4% - 6% 2018 Current Outlook – Increase (decrease) vs. 2017

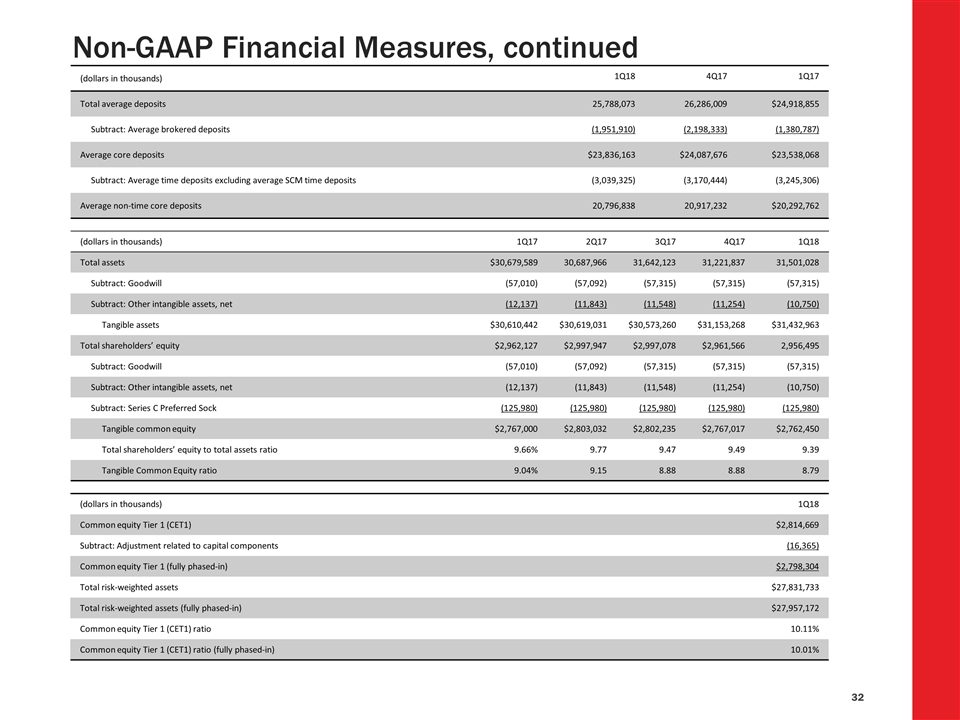

Non-GAAP Financial Measures, continued (dollars in thousands) 1Q18 4Q17 1Q17 Total average deposits 25,788,073 26,286,009 $24,918,855 Subtract: Average brokered deposits (1,951,910) (2,198,333) (1,380,787) Average core deposits $23,836,163 $24,087,676 $23,538,068 Subtract: Average time deposits excluding average SCM time deposits (3,039,325) (3,170,444) (3,245,306) Average non-time core deposits 20,796,838 20,917,232 $20,292,762 (dollars in thousands) 1Q17 2Q17 3Q17 4Q17 1Q18 Total assets $30,679,589 30,687,966 31,642,123 31,221,837 31,501,028 Subtract: Goodwill (57,010) (57,092) (57,315) (57,315) (57,315) Subtract: Other intangible assets, net (12,137) (11,843) (11,548) (11,254) (10,750) Tangible assets $30,610,442 $30,619,031 $30,573,260 $31,153,268 $31,432,963 Total shareholders’ equity $2,962,127 $2,997,947 $2,997,078 $2,961,566 2,956,495 Subtract: Goodwill (57,010) (57,092) (57,315) (57,315) (57,315) Subtract: Other intangible assets, net (12,137) (11,843) (11,548) (11,254) (10,750) Subtract: Series C Preferred Sock (125,980) (125,980) (125,980) (125,980) (125,980) Tangible common equity $2,767,000 $2,803,032 $2,802,235 $2,767,017 $2,762,450 Total shareholders’ equity to total assets ratio 9.66% 9.77 9.47 9.49 9.39 Tangible Common Equity ratio 9.04% 9.15 8.88 8.88 8.79 (dollars in thousands) 1Q18 Common equity Tier 1 (CET1) $2,814,669 Subtract: Adjustment related to capital components (16,365) Common equity Tier 1 (fully phased-in) $2,798,304 Total risk-weighted assets $27,831,733 Total risk-weighted assets (fully phased-in) $27,957,172 Common equity Tier 1 (CET1) ratio 10.11% Common equity Tier 1 (CET1) ratio (fully phased-in) 10.01%