Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SMARTFINANCIAL INC. | a33118earningsrelease-ex991.htm |

| 8-K - 8-K 033118 EARNINGS RELEASE COVER - SMARTFINANCIAL INC. | a33118earningsreleasecover.htm |

First Quarter 2018 Earnings Call

April 25, 2018

Important Information

Forward Looking Statements

This presentation contains forward-looking statements. SmartFinancial cautions you that a number of important factors could cause actual results to differ materially from

those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: the expected revenue synergies and cost savings from the proposed

merger with Tennessee Bancshares, Inc. (the “Tennessee Bancshares merger”) or the recently completed merger with Capstone Bancshares, Inc. (the “Capstone merger”) may

not be fully realized or may take longer than anticipated to be realized; the disruption from either the Tennessee Bancshares merger or the Capstone merger with customers,

suppliers or employees or other business partners’ relationships; the risk of successful integration of our business with that of Tennessee Bancshares or Capstone; the amount

of costs, fees, expenses, and charges related to Tennessee Bancshares merger; risks of expansion into new geographic or product markets, like the proposed expansion into

the Nashville, TN MSA associated with the proposed Tennessee Bancshares merger; changes in management’s plans for the future, prevailing economic and political

conditions, particularly in our market area; credit risk associated with our lending activities; changes in interest rates, loan demand, real estate values and competition;

changes in accounting principles, policies, and guidelines; changes in any applicable law, rule, regulation or practice with respect to tax or legal issues; and other economic,

competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services and other factors that may be described in our

annual report on Form 10-K and quarterly reports on Form 10-Q as filed with the Securities and Exchange Commission from time to time.

The forward-looking statements are made as of the date of this presentation, and, except as may be required by applicable law or regulation, SmartFinancial assumes no

obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Non-GAAP Measures

Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables, which provide a reconciliation of non-

GAAP financial measures to GAAP financial measures. SmartFinancial management uses several non-GAAP financial measures, including: (i) net operating earnings available

to common shareholders; (ii) operating efficiency ratio; (iii) tangible common equity, and (iv) net interest income –ex purchase accounting. adjustments in its analysis of the

company's performance. Net operating earnings available to common shareholders excludes the following from net income available to common shareholders: securities

gains and losses, merger and conversion costs, OREO gain and losses, the effect of the December, 2017 tax law change, and the income tax effect of adjustments. The

operating efficiency ratio excludes securities gains and losses, merger and conversion costs, and adjustment for OREO gains and losses from the efficiency ratio. Adjusted

allowance for loan losses adds net acquisition accounting fair value discounts to the allowance for loan losses. Tangible common equity excludes total preferred stock,

preferred stock paid in capital, goodwill, and other intangible assets. Net interest income –ex purchase accounting adjustments adds the taxable equivalent adjustment for

tax free yielding assets and removes loan purchase accounting adjustments that are above the contractual loan interest amount. Management believes that non-GAAP

financial measures provide additional useful information that allows readers to evaluate the ongoing performance of the company and provide meaningful comparisons to its

peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and

investors should consider SmartFinancial's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance

or financial condition of the company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute

for analysis of the results or financial condition as reported under GAAP.

2

SMBK at-a-glance

• Core franchise in East Tennessee – SmartBank founded in 2007

• Corporate Headquarters – Knoxville, Tennessee

• 22 Branch Offices located in Knoxville, Pigeon Forge/Gatlinburg and

Chattanooga/Cleveland regions in TN; in Tuscaloosa and southern AL; and in Pensacola,

Destin and Panama City, FL.

• SmartBank is currently a $1.7B+ and expected to be approximately $2B by 2Q18, after

closing the Southern Community acquisition.

• Business Strategy

• Create a valuable Southeastern banking franchise through organic growth in strong markets coupled with an

acquisition model positioning our company as a partner of choice for banks in our region.

• Continually improve earnings and efficiency metrics as we build out our model.

• Disciplined growth strategy with a focus on strong credit metrics.

• Build a solid franchise in all of our markets focusing on strong core deposit growth.

• Create a strong, consistent culture with an environment where top performers want to work.

3

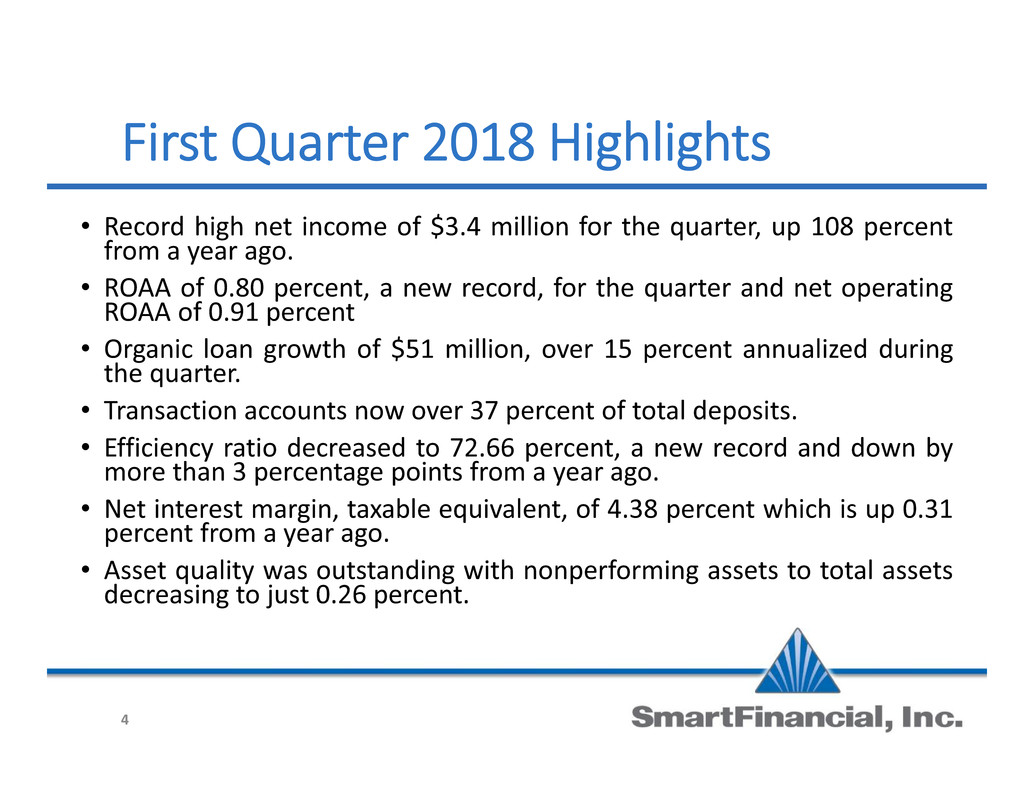

First Quarter 2018 Highlights

• Record high net income of $3.4 million for the quarter, up 108 percentfrom a year ago.

• ROAA of 0.80 percent, a new record, for the quarter and net operatingROAA of 0.91 percent

• Organic loan growth of $51 million, over 15 percent annualized duringthe quarter.

• Transaction accounts now over 37 percent of total deposits.

• Efficiency ratio decreased to 72.66 percent, a new record and down bymore than 3 percentage points from a year ago.

• Net interest margin, taxable equivalent, of 4.38 percent which is up 0.31percent from a year ago.

• Asset quality was outstanding with nonperforming assets to total assetsdecreasing to just 0.26 percent.

4

Summary Results

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

ROAA Net Operating ROAA

3.60%

3.70%

3.80%

3.90%

4.00%

4.10%

4.20%

Net interest income / average assets

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

Noninterest income / average assets

3.00%

3.10%

3.20%

3.30%

3.40%

Noninterest expense / average assets

5

Earnings Profile – First Quarter 2018

• EPS up over 55% year over year.

• Earnings before taxes up over 65%

year over year.

• Net interest income up over 70%

year over year primarily due higher

average earning asset balances and

higher earning asset yields.

• Increases in noninterest expense

primarily driven by salaries from the

increased headcount from three full

months of post Capstone

acquisition headcount and merger

and conversion expenses.

1Q18 4Q17 1Q17

Total interest income 19,378$ 17,244$ 10,944$

Total interest expense 2,567 1,902 1,129

Net interest income 16,811 15,342 9,815

Provision for loan losses 689 442 12

Net interest income after provision for loan losses 16,123 14,898 9,803

Total noninterest income 1,642 1,581 947

Total noninterest expense 13,409 12,566 8,160

Earnings before income taxes 4,355 3,913 2,590

Income tax expense 940 3,875 946

Net income 3,415 38 1,644

Dividends on preferred stock — — 195

Net income available to common shareholders 3,415$ 38$ 1,449$

Net income per common share

Basic $0.30 $— $0.19

Diluted $0.30 $— $0.19

Net operating earnings per common share (Non-GAAP):

Basic $0.35 $0.35 $0.19

Diluted $0.34 $0.35 $0.19

6

Net Interest Income

• Net interest margin, taxable equivalent, decreased quarter to

quarter primarily due to lower purchase accounting adjustments on

acquired loans.

• Compared to a year ago earning asset yields are up 51bps while cost

of interest bearing liabilities are up 22bps.

• Excluding the effect of purchase accounting adjustments net interest

margin, taxable equivalent, increased 0.25% quarter to quarter

1Q18 4Q17 1Q17

Loans 5.49% 5.61% 5.11%

Investment securities and interest-bearing due

from banks 2.11% 1.73% 1.70%

Federal funds and other 4.87% 4.68% 4.47%

Earning Asset Yields 5.05% 5.09% 4.54%

Total interest-bearing deposits 0.79% 0.68% 0.60%

Securities sold under agreement to repurchase 0.33% 0.30% 0.35%

Federal Home Loan Bank advances and other

borrowings 2.33% 3.90% 0.82%

Total interest-bearing liabilities 0.82% 0.70% 0.60%

Net interest margin 4.38% 4.52% 4.07%

Cost of Funds 0.68% 0.59% 0.50%

Average Yields and Rates

3.50%

3.75%

4.00%

4.25%

4.50%

4.75%

1Q17 2Q17 3Q17 4Q17 1Q18

Net Interest Margin

Net interest margin, TEY

Net interest margin, TEY- ex purchase acct. adj

1Q18 4Q17 1Q17

Net interest income 16,811$ 15,341$ 9,815$

Average Earning Assets 1,558,516 1,317,719 979,535

7

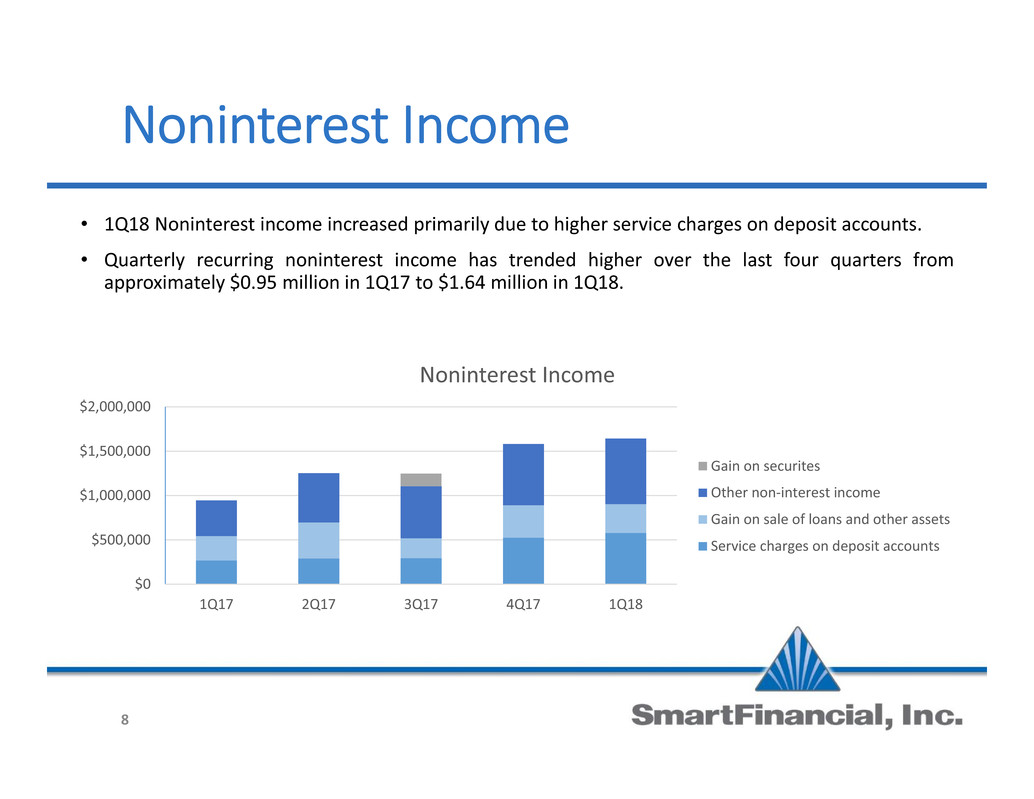

Noninterest Income

• 1Q18 Noninterest income increased primarily due to higher service charges on deposit accounts.

• Quarterly recurring noninterest income has trended higher over the last four quarters from

approximately $0.95 million in 1Q17 to $1.64 million in 1Q18.

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

1Q17 2Q17 3Q17 4Q17 1Q18

Noninterest Income

Gain on securites

Other non-interest income

Gain on sale of loans and other assets

Service charges on deposit accounts

8

Noninterest Expense

• Efficiency ratio dropped to 72.66%, the lowest of any quarter since the Cornerstone merger in 2015.

• Salary increases are primarily due three months of Alabama associates vs. two in the prior quarter.

• Data processing slightly elevated due to operating two core systems for half of the quarter.

68.0%

70.0%

72.0%

74.0%

76.0%

78.0%

80.0%

$0

$5,000,000

$10,000,000

$15,000,000

1Q17 2Q17 3Q17 4Q17 1Q18

Noninterest Expense

Merger Expense

Other

Amortization of Intangibles

Data Processing

Occupancy

Salaries & Benefits

Efficiency Ratio

9

Balance Sheet

• Assets increased primarily due to organic loan

growth.

• Cash & cash equivalents drawn down to fund

loans.

• Securities held fairly flat to allocate funds to

loans.

• Deposit composition shifted to DDAs as a result

of conversion related reclassifications and

organic growth.

• FHLB & other borrowings includes $10 million

in holding company line of credit, with the

remaining balance in short term FHLB

borrowings.

1Q18 4Q17 1Q17

Cash & cash equivalents 96,710$ 113,027$ 55,548$

Securities available for sale 156,210 151,945 137,133

Other investments 7,808 6,431 5,628

Total loans 1,374,257 1,323,258 807,539

Allowance for loan losses (6,477) (5,860) (5,152)

Premises and equipment 44,202 43,000 30,802

Foreclosed assets 2,665 3,254 2,371

Goodwill and other intangibles 50,660 50,837 6,583

Cash surrender value of life insurance 21,797 21,647 1,329

Other assets 12,593 13,232 9,305

Total assets 1,760,425$ 1,720,771$ 1,051,086$

Non-interest demand 276,249$ 220,520$ 160,673$

Interest-bearing demand 278,965 231,644 167,433

Money market and savings 491,243 543,645 274,994

Time deposits 453,276 442,774 286,600

Total deposits 1,499,733 1,438,583 889,700

Repurchase agreements 15,968 24,055 23,153

FHLB & other borrowings 30,000 43,600 60

Other liabilities 5,775 8,681 5,622

Total liabilities 1,551,476$ 1,514,919$ 918,535$

Total shareholders' equity 208,949$ 205,852$ 132,551$

Total liabilities & shareholders' equity 1,760,425$ 1,720,770$ 1,051,086$

10

Loan Portfolio

• Loan balance increases due to strong organic growth, over 15% annualized.

• Loan composition shifted slightly with of C&I increasing 1%, with an equivalent decrease in non-

owner occupied CRE.

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

$1,600,000

1Q17 2Q17 3Q17 4Q17 1Q18

Portfolio Composition

Other

Consumer RE

CRE, non-owner occupied

CRE, owner occupied

C&D

C&I

11

CRE Ratios

• C&D levels still well below regulatory guidance levels.

• 300 ratio up slightly as a result of taking advantage of attractive growth opportunities.

50.00%

75.00%

100.00%

125.00%

150.00%

Q4

20

14

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

15

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

16

Q1

20

17

Q2

20

17

Q3

20

17

Q4

20

17

Q1

20

18

100 Ratio

12

200.00%

250.00%

300.00%

350.00%

400.00%

Q4

20

14

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

15

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

16

Q1

20

17

Q2

20

17

Q3

20

17

Q4

20

17

Q1

20

18

300 Ratio

Asset Quality

• Excellent asset quality with nonperforming assets at just 0.26% of total assets.

• Purchase accounting discounts on acquired loans are over 2.5x current Allowance.

0.10%

0.30%

0.50%

0.70%

$0

$1,000

$2,000

$3,000

$4,000

$5,000

1Q17 2Q17 3Q17 4Q17 1Q18

Nonperforming Assets

Foreclosed assets

Nonperforming loans

Nonperforming assets to total assets

13

0.30%

0.40%

0.50%

0.60%

0.70%

0.80%

0.90%

$0

$4,000

$8,000

$12,000

$16,000

$20,000

1Q17 2Q17 3Q17 4Q18 1Q18

Loan Discounts

Allowance for loan losses (GAAP)

Net acquisition accounting fair value discounts to loans

Allowance for loan losses to loans

Deposits

• Well diversified deposit mix with growth of money market, savings, and noninterest demand

replacing mostly wholesale time deposits.

• About 30% of the growth in DDAs was organic, 70% being conversion related reclassifcations

• Cost of funds up just 18bps while Fed Funds has increased 75bps over the last year.

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

$1,600,000

1Q17 2Q17 3Q17 4Q17 1Q18

Deposit Composition

Time deposits

Money market and savings

Interest-bearing demand

Noninterest demand

Cost of Funds

Fed Funds Target

14

Conclusions

• Record high net income of $3.4 million for the quarter, up 108 percent from a year ago.

• ROAA of 0.80 percent, a new record, for the quarter and net operating ROAA of 0.91 percent

• Organic loan growth of $51 million, over 15 percent annualized during the quarter.

• Transaction accounts are over 37 percent of total deposits.

• Efficiency ratio decreased to 72.66 percent, a new record and down by more than 3percentage points from a year ago.

• Net interest margin, taxable equivalent, of 4.38 percent which is up 0.31 percent from a yearago.

• Asset quality was outstanding with nonperforming assets to total assets decreasing to just0.26 percent.

• Tennessee Bancshares acquisition closing second quarter.

• SMBK continues focus on long-term shareholder value by:

• Building the foundation for organic growth and profitability.

• Exploring expansion to strategic markets.

• Q&A

15

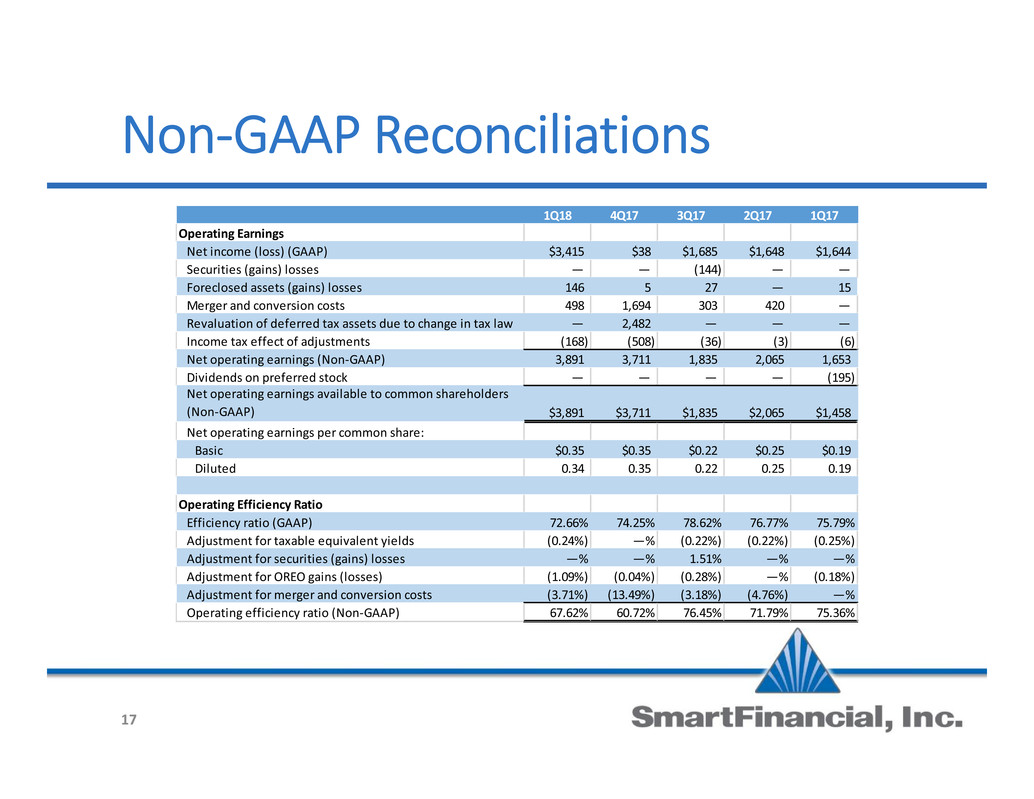

Non-GAAP Reconciliations

1Q18 4Q17 3Q17 2Q17 1Q17

Net interest income -ex purchase acct. adj.

Net interest income (GAAP) 16,811$ 15,341$ 10,924$ 10,249$ 9,815$

Taxable equivalent adjustment 32 16 22 21 21

Net interest income TEY (Non-GAAP) 16,823 $15,357 $10,946 10,270 $9,836

Purchase accounting adjustments 1,274 2,411 888 696 540

Net interest income -ex purchase acct. adj. (Non-GAAP) 15,549$ 12,947$ 10,058$ 9,574$ 9,296$

Loan Discount Data

Allowance for loan losses (GAAP) 6,477$ 5,860$ 5,498$ 5,393$ 5,152$

Net acquisition accounting fair value discounts to loans 16,323 17,862 9,086 8,167 9,831

Tangible Common Equity

Shareholders' equity (GAAP) 208,949$ 205,852$ 136,588$ 134,734$ 132,551$

Less goodwill and other intangible assets 50,660 50,837 7,414 7,492 6,583

Tangible common equity (Non-GAAP) 158,289$ 155,015$ 129,174$ 127,242$ 125,968$

16

Non-GAAP Reconciliations

1Q18 4Q17 3Q17 2Q17 1Q17

Operating Earnings

Net income (loss) (GAAP) $3,415 $38 $1,685 $1,648 $1,644

Securities (gains) losses — — (144) — —

Foreclosed assets (gains) losses 146 5 27 — 15

Merger and conversion costs 498 1,694 303 420 —

Revaluation of deferred tax assets due to change in tax law — 2,482 — — —

Income tax effect of adjustments (168) (508) (36) (3) (6)

Net operating earnings (Non-GAAP) 3,891 3,711 1,835 2,065 1,653

Dividends on preferred stock — — — — (195)

Net operating earnings available to common shareholders

(Non-GAAP) $3,891 $3,711 $1,835 $2,065 $1,458

Net operating earnings per common share:

Basic $0.35 $0.35 $0.22 $0.25 $0.19

Diluted 0.34 0.35 0.22 0.25 0.19

Operating Efficiency Ratio

Efficiency ratio (GAAP) 72.66% 74.25% 78.62% 76.77% 75.79%

Adjustment for taxable equivalent yields (0.24%) —% (0.22%) (0.22%) (0.25%)

Adjustment for securities (gains) losses —% —% 1.51% —% —%

Adjustment for OREO gains (losses) (1.09%) (0.04%) (0.28%) —% (0.18%)

Adjustment for merger and conversion costs (3.71%) (13.49%) (3.18%) (4.76%) —%

Operating efficiency ratio (Non-GAAP) 67.62% 60.72% 76.45% 71.79% 75.36%

17

First Quarter 2018

18

Supplemental Information

Loan & Deposit Composition 1Q18

C&I

19%

C&D

10%

CRE,

owner

occupied

21%

CRE, non-

owner

occupied

27%

Consumer

RE

22%

Other

1%

Loans

Noninterest

demand

15%

Interest-

bearing

demand

19%

Money market

and savings

33%

Time

deposits

30%

Deposits

19

Loan Composition History

C&I 256,333$ 238,690$ 119,782$ 105,129$ 90,649$

C&D 142,702 135,409 98,212 101,151 115,675

CRE, owner occupied 288,666 281,297 210,489 211,469 197,032

CRE, non-owner occupied 375,028 361,536 237,131 233,707 210,901

Consumer RE 299,148 292,795 199,704 206,667 186,344

Other 12,380 13,555 6,361 7,298 6,938

Total Loans, gross 1,374,257$ 1,323,283$ 871,679$ 865,421$ 807,539$

20

Deposit Composition History

1Q18 4Q17 3Q17 2Q17 1Q17

Deposits

Noninterest demand 276,249$ 220,520$ 185,386$ 183,324$ 160,673$

Interest-bearing demand 278,965 231,643 156,953 156,150 167,433

Money market and savings 491,243 543,645 306,358 324,014 274,994

Time deposits 453,276 442,774 311,490 318,147 286,600

Total Deposits 1,499,733$ 1,438,582$ 960,187$ 981,635$ 889,700$

21

Management Team

22

Billy Carroll

President & CEO

Miller Welborn

Chairman of the Board

C. Bryan Johnson

Chief Financial Officer

Rhett Jordan

Chief Credit Officer

Gary Petty

Chief Risk Officer

Greg Davis

Chief Lending Officer