Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - VECTREN CORP | d564514dex991.htm |

| EX-2.1 - EX-2.1 - VECTREN CORP | d564514dex21.htm |

| 8-K - FORM 8-K - VECTREN CORP | d564514d8k.htm |

| Exhibit 99.2

|

CENTERPOINT ENERGY AND VECTREN MERGER Delivering Energy, Service and Value April 23, 2018

|

Cautionary Statement This presentation and the oral

statements made in connection herewith contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than

statements of historical fact included in this presentation and the oral statements made in connection herewith are forward-looking statements made in good faith by us and are intended to qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “target,” “will” or other similar words are

intended to identify forward-looking statements. Forward-looking statements include, but are not limited to, statements relating to: (1) CenterPoint Energy’s proposed acquisition of Vectren, (2) shareholder and regulatory approvals,

(3) the completion of the proposed transactions, (4) benefits of the proposed transactions, (5) integration plans and expected synergies, (6) the expected timing of completion of the transactions, and (7) anticipated future

financial measures and operating performance and results, including estimates for growth and other matters affecting future operations. Risks Related to the Merger Important factors that could cause actual results to differ

materially from those indicated by the provided forward-looking information include risks and uncertainties relating to: (1) the risk that Vectren may be unable to obtain shareholder approval for the proposed transactions, (2) the risk

that CenterPoint Energy or Vectren may be unable to obtain governmental and regulatory approvals required for the proposed transactions, or that required governmental and regulatory approvals or agreements with other parties interested therein may

delay the proposed transactions or may be subject to or impose adverse conditions or costs, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed transactions or could otherwise

cause the failure of the proposed transactions to close, (4) the risk that a condition to the closing of the proposed transactions or the committed financing may not be satisfied, (5) the failure to obtain, or to obtain on favorable terms,

any equity, debt or other financing necessary to complete or permanently finance the proposed transactions and the costs of such financing, (6) the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be

instituted relating to the proposed transactions, (7) the receipt of an unsolicited offer from another party to acquire assets or capital stock of Vectren that could interfere with the proposed transactions, (8) the timing to consummate

the proposed transactions, (9) the costs incurred to consummate the proposed transactions, (10) the possibility that the expected cost savings, synergies or other value creation from the proposed transactions will not be realized, or will

not be realized within the expected time period, (11) the risk that the companies may not realize fair values from properties that may be required to be sold in connection with the merger, (12) the credit ratings of the companies following

the proposed transactions, (13) disruption from the proposed transactions making it more difficult to maintain relationships with customers, employees, regulators or suppliers, and (14) the diversion of management time and attention on the

proposed transactions. Risks Related to CenterPoint Energy Important factors related to CenterPoint Energy, its affiliates, and its and their operations that could cause actual results to differ materially from those indicated by the provided

forward-looking information include risks and uncertainties relating to: (1) the performance of Enable Midstream Partners, LP (Enable), the amount of cash distributions CenterPoint Energy receives from Enable, Enable’s ability to redeem

the Series A Preferred Units in certain circumstances and the value of CenterPoint Energy’s interest in Enable, and

factors that may have a material impact on

such performance, cash distributions and value, including factors such as: (A) competitive conditions in the midstream industry, and actions taken by Enable’s customers and competitors, including the extent and timing of the entry of

additional competition in the markets served by Enable; (B) the timing and extent of changes in the supply of natural gas and associated commodity prices, particularly prices of natural gas and natural gas liquids (NGLs), the competitive

effects of the available pipeline capacity in the regions served by Enable, and the effects of geographic and seasonal commodity price differentials, including the effects of these circumstances on

re-contracting available capacity on Enable’s interstate pipelines; (C) the demand for crude oil, natural gas, NGLs and transportation and storage services; (D) environmental and other

governmental regulations, including the availability of drilling permits and the regulation of hydraulic fracturing; (E) recording of non-cash goodwill, long-lived asset or other than temporary impairment

charges by or related to Enable; (F) changes in tax status; (G) access to debt and equity capital; and (H) the availability and prices of raw materials and services for current and future construction projects; (2) industrial,

commercial and residential growth in CenterPoint Energy’s service territories and changes in market demand, including the effects of energy efficiency measures and demographic patterns; (3) timely and appropriate rate actions that allow

recovery of costs and a reasonable return on investment; (4) future economic conditions in regional and national markets and their effect on sales, prices and costs; (5) weather variations and other natural phenomena, including the impact

of severe weather events on operations and capital; (6) state and federal legislative and regulatory actions or developments affecting various aspects of CenterPoint Energy’s and Enable’s businesses, including, among others, energy

deregulation or re-regulation, pipeline integrity and safety and changes in regulation and legislation pertaining to trade, health care, finance and actions regarding the rates charged by our regulated

businesses; (7) tax reform and legislation, including the effects of the comprehensive tax reform legislation informally referred to as the TCJA and uncertainties involving state commissions’ and local municipalities’ regulatory

requirements and determinations regarding the treatment of excess deferred taxes and CenterPoint Energy’s rates; (8) CenterPoint Energy’s ability to mitigate weather impacts PAGE 2

|

Cautionary Statement (Continued) through

normalization or rate mechanisms, and the effectiveness of such mechanisms; (9) the timing and extent of changes in commodity prices, particularly natural gas, and the effects of geographic and seasonal commodity price differentials;

(10) problems with regulatory approval, construction, implementation of necessary technology or other issues with respect to major capital projects that result in delays or in cost overruns that cannot be recouped in rates; (11) local,

state and federal legislative and regulatory actions or developments relating to the environment, including those related to global climate change; (12) the impact of unplanned facility outages; (13) any direct or indirect effects on

CenterPoint Energy’s facilities, operations and financial condition resulting from terrorism, cyber-attacks, data security breaches or other attempts to disrupt CenterPoint Energy’s businesses or the businesses of third parties, or other

catastrophic events such as fires, earthquakes, explosions, leaks, floods, droughts, hurricanes, pandemic health events or other occurrences; (14) CenterPoint Energy’s ability to invest planned capital and the timely recovery of

CenterPoint Energy’s investment in capital; (15) CenterPoint Energy’s ability to control operation and maintenance costs; (16) actions by credit rating agencies; (17) the sufficiency of CenterPoint Energy’s insurance

coverage, including availability, cost, coverage and terms; (18) the investment performance of CenterPoint Energy’s pension and postretirement benefit plans; (19) commercial bank and financial market conditions, CenterPoint

Energy’s access to capital, the cost of such capital, and the results of CenterPoint Energy’s financing and refinancing efforts, including availability of funds in the debt capital markets; (20) changes in interest rates and their

impact on CenterPoint Energy’s costs of borrowing and the valuation of its pension benefit obligation; (21) changes in rates of inflation; (22) inability of various counterparties to meet their obligations to CenterPoint Energy; (23) non-payment for CenterPoint Energy’s services due to financial distress of its customers; (24) the extent and effectiveness of CenterPoint Energy’s risk management and hedging activities,

including, but not limited to, its financial and weather hedges; (25) timely and appropriate regulatory actions allowing securitization for any future hurricanes or natural disasters or other recovery of costs, including costs associated with

Hurricane Harvey; (26) CenterPoint Energy’s or Enable’s potential business strategies and strategic initiatives, including restructurings, joint ventures and acquisitions or dispositions of assets or businesses (including a reduction

of CenterPoint Energy’s interests in Enable, whether through its decision to sell all or a portion of the Enable common units it owns in the public equity markets or otherwise, subject to certain limitations), which CenterPoint Energy cannot

assure will be completed or will have the anticipated benefits to it or Enable; (27) acquisition and merger activities involving CenterPoint Energy or its competitors; (28) CenterPoint Energy’s or Enable’s ability to recruit,

effectively transition and retain management and key employees and maintain good labor relations; (29) the ability of GenOn Energy, Inc. (formerly known as RRI Energy, Inc., Reliant Energy and RRI), a wholly-owned subsidiary of NRG Energy, Inc.

(NRG), and its subsidiaries, currently the subject of bankruptcy proceedings, to satisfy their obligations to CenterPoint Energy, including indemnity obligations; (30) the outcome of litigation; (31) the ability of retail electric

providers (REPs), including REP affiliates of NRG and Vistra Energy Corp., formerly known as TCEH Corp., to satisfy their obligations to CenterPoint Energy and its subsidiaries; (32) changes in technology, particularly with respect to efficient

battery storage or the emergence or growth of new, developing or alternative sources of generation; (33) the timing and outcome of any audits, disputes and other proceedings related to taxes; (34) the effective tax rates; and (35) the

effect of changes in and application of accounting standards and pronouncements.

Risks Related to Vectren Important factors related to Vectren, its affiliates, and

its and their operations that could cause actual results to differ materially from those indicated by the provided forward-looking information include risks and uncertainties relating to: (1) factors affecting utility operations such as

unfavorable or unusual weather conditions; catastrophic weather-related damage; unusual maintenance or repairs; unanticipated changes to coal and natural gas costs; unanticipated changes to gas transportation and storage costs, or availability due

to higher demand, shortages, transportation problems or other developments; environmental or pipeline incidents; transmission or distribution incidents; unanticipated changes to electric energy supply costs, or availability due to demand, shortages,

transmission problems or other developments; or electric transmission or gas pipeline system constraints, (2) new or proposed legislation, litigation and government regulation or other actions, such as changes in, rescission of or additions to

tax laws or rates, pipeline safety regulation and environmental laws and regulations, including laws governing air emissions, carbon, waste water discharges and the handling and disposal of coal combustion residuals that could impact the continued

operation, and/or cost recovery of generation plant costs and related assets; compliance with respect to these regulations could substantially change the operation and nature of Vectren’s utility operations, (3) catastrophic events such as

fires, earthquakes, explosions, floods, ice storms, tornadoes, terrorist acts, physical attacks, cyber attacks, or other similar occurrences could adversely affect Vectren’s facilities, operations, financial condition, results of operations,

and reputation, (4) approval and timely recovery of new capital investments related to the electric generation transition plan, including timely approval to build and own generation, ability to meet capacity requirements, ability to procure

resources needed to build new generation at a reasonable cost, ability to appropriately estimate costs of new generation, the effects of construction delays and cost overruns, ability to fully recover the investments made in retiring portions of the

current generation fleet, scarcity of resources and labor, and workforce retention, development and training, (5) increased competition in the energy industry, including the effects of industry restructuring, unbundling, and other sources of

energy, (6) regulatory factors such as uncertainty surrounding the composition of state regulatory commissions, adverse regulatory changes, unanticipated changes in rate-setting policies or procedures, recovery of investments and costs made

under regulation, interpretation of regulatory-related legislation by the PAGE 3

|

Cautionary Statement (Continued)

Indiana Utility Regulatory Commission and/or Public Utilities Commission of Ohio and appellate courts that review decisions issued by the agencies, and the frequency and timing of

rate increases, (7) financial, regulatory or accounting principles or policies imposed by the Financial Accounting Standards Board; the SEC; the Federal Energy Regulatory Commission; state public utility commissions; state entities which

regulate electric and natural gas transmission and distribution, natural gas gathering and processing, electric power supply; and similar entities with regulatory oversight, (8) economic conditions including the effects of inflation, commodity

prices, and monetary fluctuations, (9) economic conditions, including increased potential for lower levels of economic activity; uncertainty regarding energy prices and the capital and commodity markets; volatile changes in the demand for

natural gas, electricity, and other nonutility products and services; economic impacts of changes in business strategy on both gas and electric large customers; lower residential and commercial customer counts; variance from normal population growth

and changes in customer mix; higher operating expenses; and reductions in the value of investments, (10) volatile natural gas and coal commodity prices and the potential impact on customer consumption, uncollectible accounts expense,

unaccounted for gas and interest expense, (11) volatile oil prices and the potential impact on customer consumption and price of other fuel commodities, (12) direct or indirect effects on Vectren’s business, financial condition,

liquidity and results of operations resulting from changes in credit ratings, changes in interest rates, and/or changes in market perceptions of the utility industry and other energy-related industries, (13) the performance of projects

undertaken by Vectren’s nonutility businesses and the success of efforts to realize value from, invest in and develop new opportunities, including but not limited to, Vectren Infrastructure Services Company, Vectren Energy Services Company, and

remaining ProLiance Holdings, LLC assets, (14) factors affecting Infrastructure Services, including the level of success in bidding contracts; fluctuations in volume and mix of contracted work; mix of projects received under blanket contracts;

unanticipated cost increases in completion of the contracted work; funding requirements associated with multiemployer pension and benefit plans; changes in legislation and regulations impacting the industries in which the customers served operate;

the effects of weather; failure to properly estimate the cost to construct projects; the ability to attract and retain qualified employees in a fast growing market where skills are critical; cancellation and/or reductions in the scope of projects by

customers; credit worthiness of customers; ability to obtain materials and equipment required to perform services; and changing market conditions, including changes in the market prices of oil and natural gas that would affect the demand for

infrastructure construction, (15) factors affecting Energy Services, including unanticipated cost increases in completion of the contracted work; changes in legislation and regulations impacting the industries in which the customers served

operate; changes in economic influences impacting customers served; failure to properly estimate the cost to construct projects; risks associated with projects owned or operated; failure to appropriately design, construct, or operate projects; the

ability to attract and retain qualified employees; cancellation and/or reductions in the scope of projects by customers; changes in the timing of being awarded projects; credit worthiness of customers; lower energy prices negatively impacting the

economics of performance contracting

business; and changing market conditions, (16) employee or contractor workforce factors including changes in key

executives, collective bargaining agreements with union employees, aging workforce issues, work stoppages, or pandemic illness, (17) risks associated with material business transactions such as acquisitions and divestitures, including, without

limitation, legal and regulatory delays; the related time and costs of implementing such transactions; integrating operations as part of these transactions; and possible failures to achieve expected gains, revenue growth and/or expense savings from

such transactions, and (18) costs, fines, penalties and other effects of legal and administrative proceedings, settlements, investigations, claims, including, but not limited to, such matters involving compliance with federal and state laws and

interpretations of these laws.

The foregoing list of factors is not all-inclusive because it is not possible to predict all

factors, and any and all differences between the risk factors under the headings “Risks

Related to CenterPoint Energy” or “Risks Related to

Vectren,” except where context dictates otherwise, are not intended to be, and should not be read as, a representation, warranty, statement, affirmation or acknowledgement of any kind by CenterPoint Energy, Vectren or their respective

affiliates that any risk factors present under one heading, but absent under the other, are not potential risk factors for CenterPoint Energy or Vectren, or their respective affiliates, as applicable. Furthermore, it may not be possible to assess

the impact of any such factor on CenterPoint Energy’s or Vectren’s respective businesses or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking

statement. Additional risks and uncertainties will be discussed in other materials that CenterPoint Energy and Vectren will file with the SEC in connection with the proposed transactions. Other risk factors are detailed from time to time in

CenterPoint Energy’s and Vectren’s annual reports on Form 10-K and quarterly reports on Form 10-Q filed with the SEC, but any specific factors that may be

provided should not be construed as exhaustive. Each forward-looking statement speaks only as of the date of the particular statement. While we believe these forward-looking statements to be reasonable, there can be no assurance that they will

approximate actual experience or that the expectations derived from them will be realized. Further, we undertake no obligation to update or revise any of our forward-looking statements whether as a result of new information, future events or

otherwise.

PAGE 4

|

Additional Information

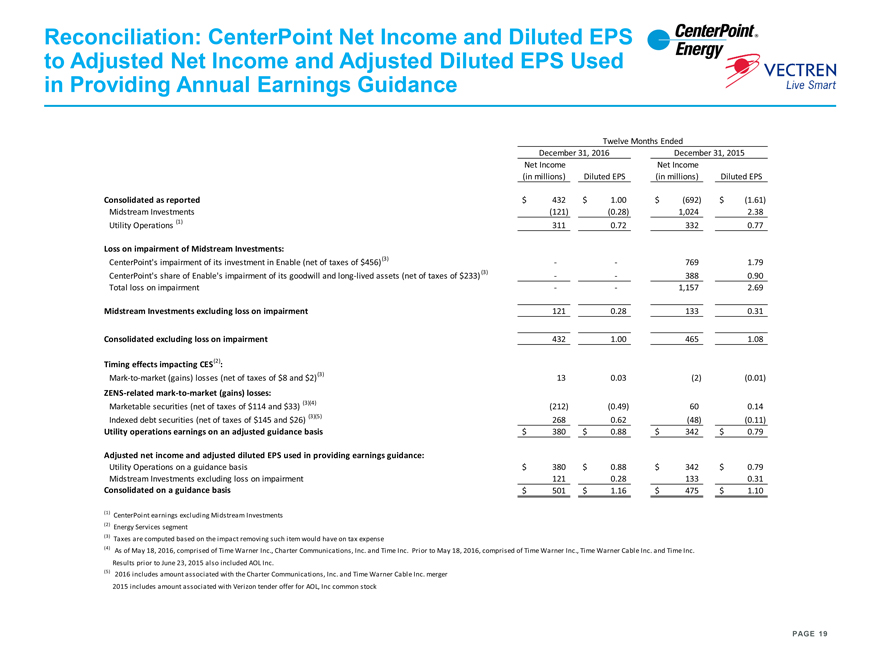

Use of Non-GAAP Financial Measures

In addition to

presenting its financial results in accordance with generally accepted accounting principles (“GAAP”), including presentation of net income and diluted earnings per share, the Company also provides guidance based on adjusted net income and

adjusted diluted earnings per share, which are non-GAAP financial measures. Generally, a non-

GAAP financial measure is a

numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. The Company’s adjusted net

income and adjusted diluted earnings per share calculation excludes from net income and diluted earnings per share, respectively, the impact of ZENS and related securities and

mark-to-market gains or losses resulting from the Company’s Energy Services business. A reconciliation of net income and diluted earnings per share to the basis

used in providing 2015—2017 guidance is provided in this presentation on slide 19 and 20. The Company is unable to present a quantitative reconciliation of forward-looking adjusted net income and adjusted diluted earnings per share because

changes in the value of ZENS and related securities and mark-to-market gains or losses resulting from the Company’s Energy Services business are not estimable.

Management evaluates the Company’s financial performance in part based on adjusted net income and adjusted diluted earnings per share. We believe that

presenting these non-GAAP financial measures enhances an investor’s understanding of the Company’s overall financial performance by providing them with an additional meaningful and relevant

comparison of current and anticipated future results across periods. Management believes the adjustments made in these non-GAAP financial measures exclude or include items, as applicable, to most accurately

reflect the Company’s business performance. These excluded or included items, as applicable, are reflected in the reconciliation tables on slides 19 and 20. The Company’s adjusted net income and adjusted diluted earnings per share non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, net income and diluted earnings per share, which respectively are the most directly comparable GAAP

financial measures. These non-GAAP financial measures also may be different than non-GAAP financial measures used by other companies.

Additional Information and Where to Find It

In connection with the proposed transactions,

Vectren expects to file a proxy statement, as well as other materials, with the SEC. WE URGE INVESTORS TO READ THE PROXY STATEMENT AND THESE OTHER MATERIALS FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors will be able to obtain free copies of the proxy statement (when

available) and other documents that will be filed by Vectren with the SEC at http://www.sec.gov, the SEC’s website, or from Vectren’s website (http://www.vectren.com) under the tab, “Investors” and then under the heading

“SEC Filings.” Security holders may also read and copy any reports, statements and other information filed by Vectren with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

Participants in the Solicitation

The Company, Vectren and certain of their respective

directors, executive officers and other persons may be deemed to be participants in the solicitation of proxies from Vectren’s shareholders with respect to the proposed transactions. Information regarding the directors and executive officers of

the Company is available in its definitive proxy statement for its 2018 annual meeting, filed with the SEC on March 15, 2018, and information regarding the directors and executive officers of Vectren is available in its definitive proxy

statement for its 2018 annual meeting, filed with the SEC on March 22, 2018. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set

forth in the proxy statement and other materials when they are filed with the SEC in connection with the proposed transaction.

PAGE 5

|

Agenda

Transaction Overview

CenterPoint, Vectren and Combined Operations Overview Strategic Rationale

CenterPoint Earnings Guidance 2018—2020 Financing Plan Appendix

PAGE 6

|

Transaction Overview

• CenterPoint Energy, Inc. and Vectren Corporation to combine: $27 billion total enterprise value

• Cash consideration of $72 per share, plus assumed debt

— Approximately

83.1 million shares outstanding

— Forecasted assumed debt is approximately $2.5 billion

• Nearly $29 billion in combined assets and 7.1 million total customers at year end 2017

• Anticipated closing by Q1 2019

• Subject to Vectren shareholder approval

• Subject to approvals by several federal agencies and other customary closing conditions; ancillary regulatory filings to be made in IN and OH; state change

of control filings are not required

PAGE 7

|

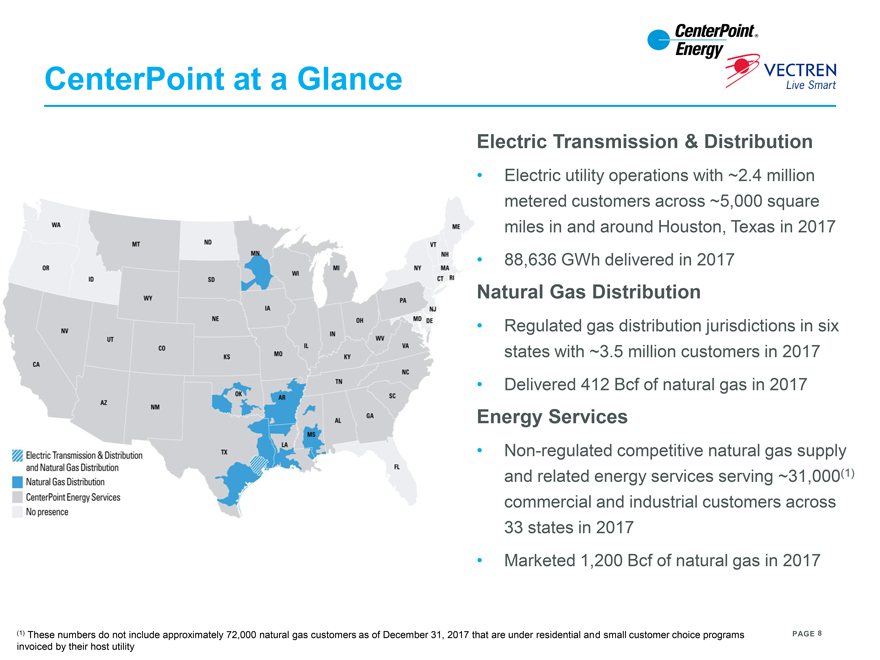

CenterPoint at a Glance

Electric Transmission & Distribution

• Electric utility operations with

~2.4 million metered customers across ~5,000 square miles in and around Houston, Texas in 2017

• 88,636 GWh delivered in 2017

Natural Gas Distribution

• Regulated gas distribution jurisdictions in six states with

~3.5 million customers in 2017

• Delivered 412 Bcf of natural gas in 2017

Energy Services

• Non-regulated competitive

natural gas supply and related energy services serving ~31,000(1) commercial and industrial customers across 33 states in 2017

• Marketed 1,200 Bcf of natural

gas in 2017

(1) These numbers do not include approximately 72,000 natural gas customers as of December 31, 2017 that are under residential and small customer

choice programs PAGE 8 invoiced by their host utility

CenterPoint Vision and Strategy

Our Vision: Lead the nation in delivering energy, service and value

• We are a premier

U.S. energy delivery company

• Delivering energy is CenterPoint Energy’s core business

• Delivering service and value applies to all stakeholders

Our Strategy: Operate, Serve,

Grow

• Ensure safe, reliable, efficient • Add value to energy delivery and environmentally through superior customer responsible energy delivery service,

new technology and businesses innovation

• Utilize new and innovative • Provide leadership in the technology to enhance communities we serve performance

• Develop a diverse and capable employee base

• Invest in core

energy delivery businesses

• Deliver new products and services

PAGE 9

|

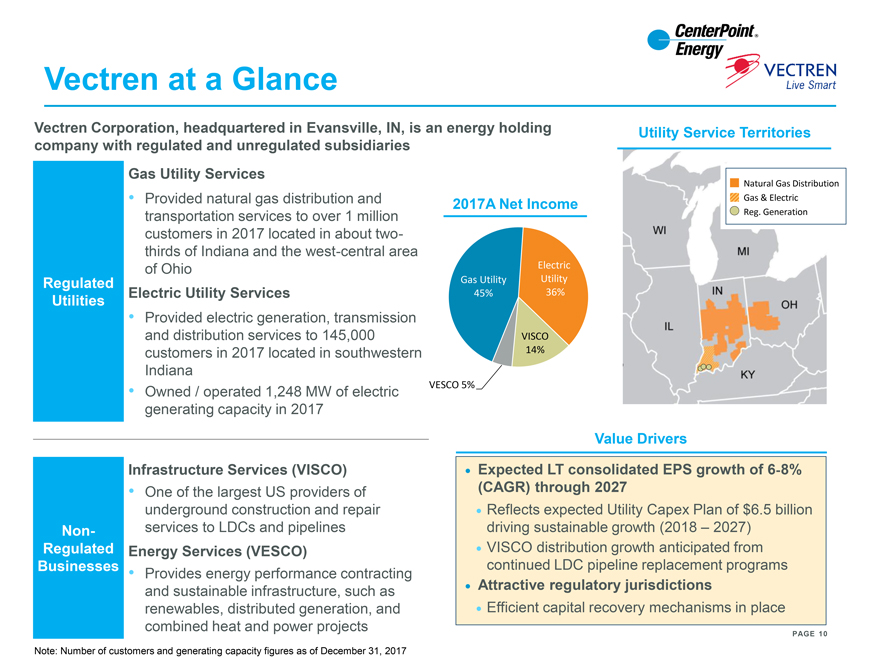

Vectren at a Glance

Vectren Corporation, headquartered in Evansville, IN, is an energy holding Utility Service Territories company with regulated and unregulated subsidiaries

Gas Utility Services Natural Gas Distribution

• Provided natural gas distribution and

2017A Net Income Gas & Electric transportation services to over 1 million Reg. Generation customers in 2017 located in about two-thirds of Indiana and the west-central area

of Ohio Electric Regulated Gas Utility Utility

Electric Utility Services 45% 36% Utilities

• Provided electric generation, transmission

and distribution services to 145,000 VISCO customers in 2017 located in southwestern 14% Indiana

• Owned / operated 1,248 MW of electric VESCO 5% generating

capacity in 2017

Value Drivers

Infrastructure Services (VISCO) •

Expected LT consolidated EPS growth of 6 8%

• One of the largest US providers of (CAGR) through 2027 underground construction and repair • Reflects

expected Utility Capex Plan of $6.5 billion Non- services to LDCs and pipelines driving sustainable growth (2018 – 2027) Regulated Energy Services (VESCO) • VISCO distribution growth anticipated

from Businesses continued LDC pipeline replacement programs

• Provides energy performance contracting and sustainable infrastructure, such as •

Attractive regulatory jurisdictions renewables, distributed generation, and • Efficient capital recovery mechanisms in place combined heat and power projects

PAGE 10

Note: Number of customers and generating capacity figures as of

December 31, 2017

|

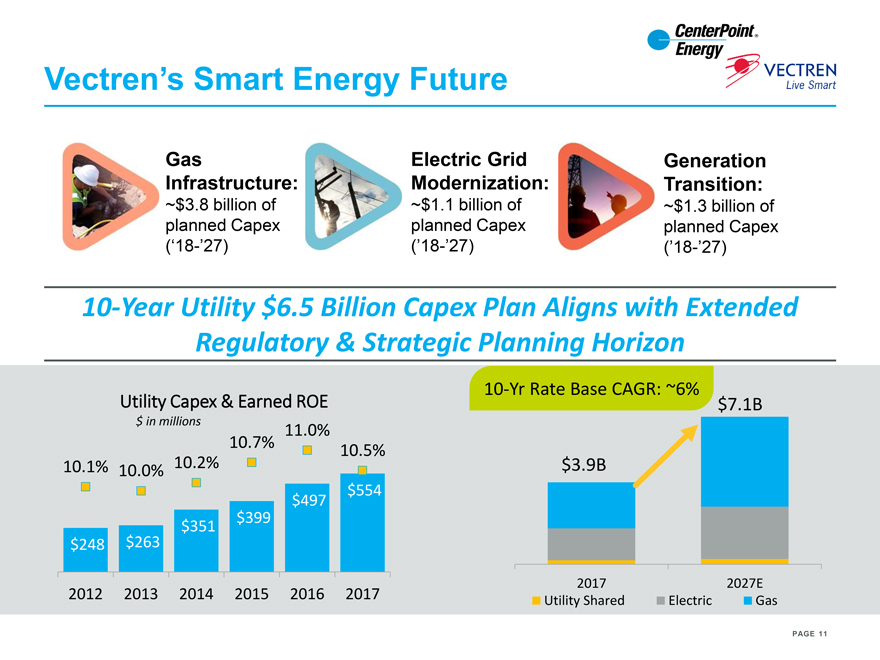

Vectren’s Smart Energy Future

Gas Electric Grid Generation Infrastructure: Modernization: Transition:

~$3.8 billion of

~$1.1 billion of ~$1.3 billion of planned Capex planned Capex planned Capex

(‘18-’27) (’18-’27)

(’18-’27)

10-Year Utility $6.5 Billion Capex Plan Aligns with Extended

Regulatory & Strategic Planning Horizon

10-Yr Rate Base CAGR: ~6%

Utility Capex & Earned ROE $7.1B

$ in millions

11.0% 10.7% 10.5%

10.1% 10.2% $3.9B 10.0% $554 $497 $399 $351 $248 $263

2017 2027E

2012 2013 2014 2015 2016 2017

Utility Shared Electric Gas

PAGE 11

|

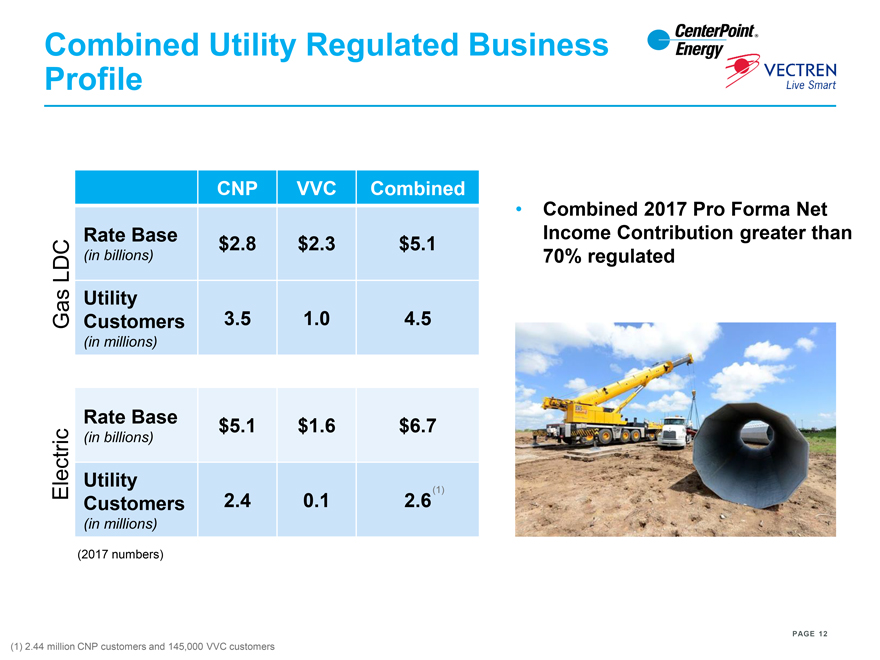

Combined Utility Regulated Business Profile

CNP VVC Combined

• Combined 2017 Pro Forma Net Rate Base Income

Contribution greater than

$2.8 $2.3 $5.1

LDC (in billions) 70% regulated

Utility

Gas Customers 3.5 1.0 4.5

(in millions)

Rate Base

$5.1 $1.6 $6.7

(in billions)

Utility

Electric (1)

Customers 2.4 0.1 2.6

(in millions)

(2017 numbers)

PAGE 12

(1) 2.44 million CNP customers and 145,000 VVC customers

|

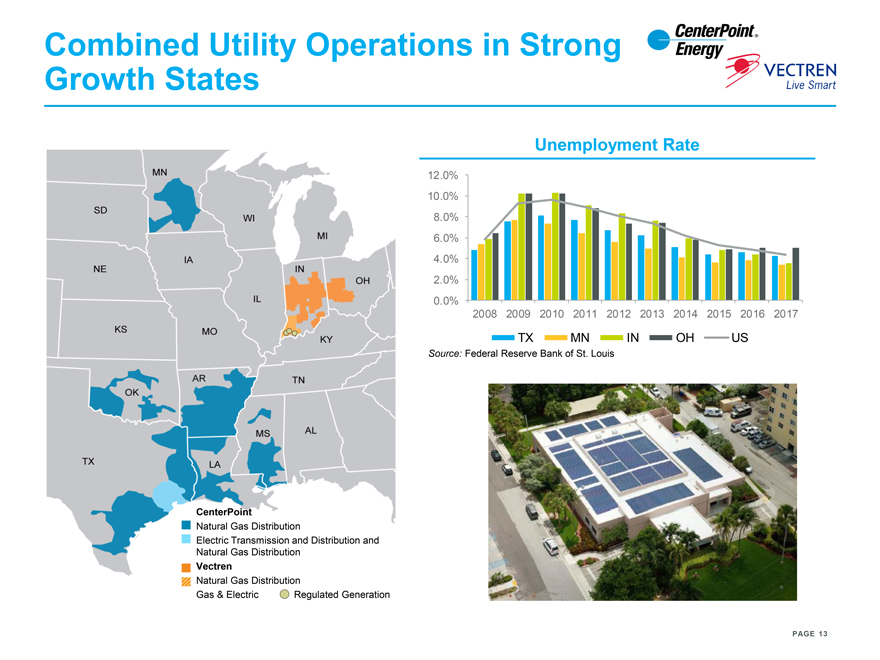

Combined Utility Operations in Strong Growth States

Unemployment Rate

12.0% 10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

TX MN IN OH US

Source: Federal Reserve Bank of St. Louis

CenterPoint

Natural Gas Distribution

Electric Transmission and Distribution and Natural Gas Distribution

Vectren

Natural Gas Distribution

Gas &

Electric Regulated Generation

PAGE 13

|

Strategic Rationale

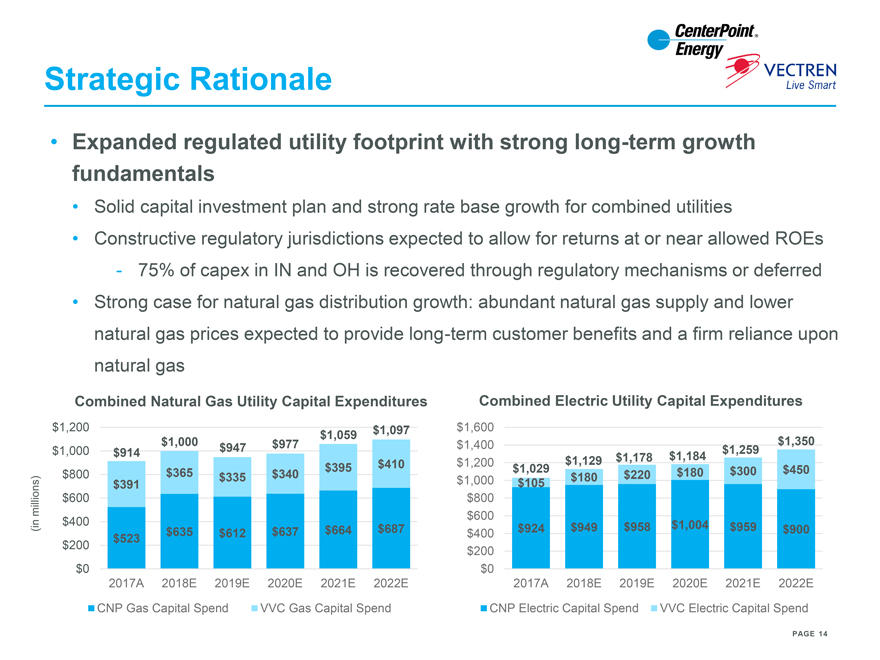

• Expanded regulated utility footprint with strong long-term growth fundamentals

•

Solid capital investment plan and strong rate base growth for combined utilities

• Constructive regulatory jurisdictions expected to allow for returns at or

near allowed ROEs

- 75% of capex in IN and OH is recovered through regulatory mechanisms or deferred

• Strong case for natural gas distribution growth: abundant natural gas supply and lower natural gas prices expected to provide long-term customer benefits and a firm reliance

upon natural gas

Combined Natural Gas Utility Capital Expenditures Combined Electric Utility Capital Expenditures

$1,200 $1,097 $1,600 $1,059 $1,000 $977 $1,400 $1,350 $1,000 $914 $947 $1,259 $1,129 $1,178 $1,184 $395 $410 $1,200 $365 $1,029 $180 $300 $450 $800 $335 $340 $180 $220 $391 $1,000

$105 millions) $600 $800 $400 $600

(in $664 $687 $924 $949 $958 $1,004 $959 $900 $635 $612 $637 $400 $523 $200 $200

$0 $0

2017A 2018E 2019E 2020E 2021E 2022E 2017A 2018E 2019E 2020E 2021E 2022E

CNP Gas Capital Spend VVC Gas Capital Spend CNP Electric Capital Spend VVC Electric Capital Spend

PAGE 14

|

Strategic Rationale

• Complementary skill sets and knowledge base benefit customers

• Combining the

Vectren and CenterPoint utilities better prepares the company for a customer-centric, technology focused utility of the future

– CenterPoint experience with

smart meters, intelligent grid, data management and leak detection technologies

– Vectren experience with energy efficiency and infrastructure services

• Growth opportunities for unregulated businesses

• Complementary

businesses in CES and VESCO

• VISCO growth opportunities due to nationwide infrastructure spend

• Customer base can be leveraged across unregulated businesses

PAGE 15

|

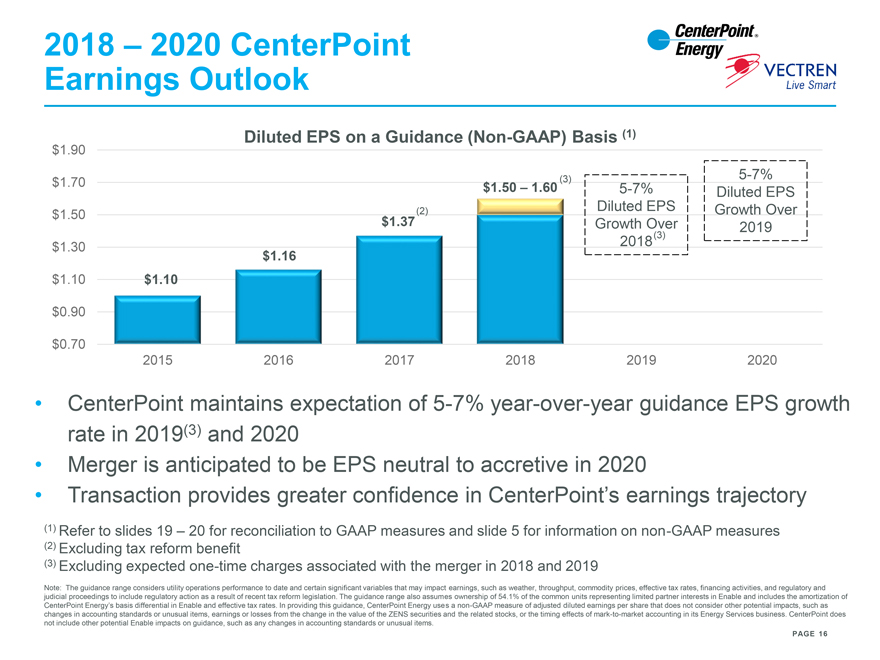

2018 – 2020 CenterPoint Earnings Outlook

Diluted EPS on a Guidance (Non-GAAP) Basis (1)

$1.90

(3) 5-7% $1.70 $1.50 – 1.60 5-7% Diluted EPS

(2) Diluted EPS Growth Over $1.50 $1.37 Growth Over 2019 2018(3) $1.30 $1.16 $1.10 $1.10

$0.90

$0.70

2015 2016 2017 2018 2019 2020

• CenterPoint maintains expectation of 5-7% year-over-year guidance EPS growth rate in 2019(3) and 2020

• Merger is anticipated to be EPS neutral to accretive in

2020

• Transaction provides greater confidence in CenterPoint’s earnings trajectory

(1) Refer to slides 19 – 20 for reconciliation to GAAP measures and slide 5 for information on non-GAAP measures (2) Excluding tax

reform benefit (3) Excluding expected one-time charges associated with the merger in 2018 and 2019

Note: The guidance

range considers utility operations performance to date and certain significant variables that may impact earnings, such as weather, throughput, commodity prices, effective tax rates, financing activities, and regulatory and judicial proceedings to

include regulatory action as a result of recent tax reform legislation. The guidance range also assumes ownership of 54.1% of the common units representing limited partner interests in Enable and includes the amortization of

CenterPoint Energy’s basis differential in Enable and effective tax rates. In providing this guidance, CenterPoint Energy uses a

non-GAAP measure of adjusted diluted earnings per share that does not consider other potential impacts, such as changes in accounting standards or unusual items, earnings or losses from the change in the value

of the ZENS securities and the related stocks, or the timing effects of mark-to-market accounting in its Energy Services business. CenterPoint does not include other

potential Enable impacts on guidance, such as any changes in accounting standards or unusual items.

PAGE 16

|

Financing Plan

• Strength of CenterPoint’s balance sheet should allow flexibility in financing $6 billion purchase price

• Equity: Anticipated $2.5 billion of common equity or equity content securities offered in advance of closing

• Debt: Plan to finance the balance with various debt offerings including commercial paper

• CenterPoint will assume outstanding Vectren debt

• Capital

structure and resulting credit metrics expected to support solid investment grade credit quality

PAGE 17

|

Appendix

PAGE 18

|

Appendix

PAGE 18

|

Reconciliation: CenterPoint Net Income and Diluted

EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance

Twelve Months Ended

December 31, 2016 December 31, 2015 Net Income Net Income (in millions) Diluted EPS (in millions) Diluted EPS

Consolidated as reported $ 432

$ 1.00 $ (692)

$ (1.61) Midstream

Investments (121) (0.28)

1,024 2.38

(1)

Utility

Operations 311 0.72

332 0.77

Loss on impairment of Midstream Investments:

(3)

CenterPoint’s impairment of its investment in Enable (net of taxes of

$456) — —

769 1.79

(3)

CenterPoint’s share of Enable’s impairment of its goodwill and

long-lived assets (net of taxes of

$233) — —

388 0.90 Total loss on

impairment — —

1,157 2.69

Midstream Investments excluding loss on

impairment 121 0.28

133 0.31

Consolidated excluding loss on

impairment 432 1.00

465 1.08

(2)

Timing effects impacting CES :

(3)

Mark-to-market (gains) losses (net of taxes of $8 and

$2)

13 0.03

(2) (0.01)

ZENS-related mark-to-market (gains) losses:

(3)(4)

Marketable securities (net of taxes of $114 and

$33) (212) (0.49)

60 0.14

(3)(5)

Indexed debt securities (net of taxes of $145 and

$26) 268 0.62

(48) (0.11)

Utility operations earnings on an adjusted guidance basis $ 380

$ 0.88 $ 342

$ 0.79

Adjusted net income and adjusted diluted EPS used in

providing earnings guidance:

Utility Operations on a guidance basis

$ 380 $ 0.88

$ 342 $ 0.79 Midstream Investments excluding loss on

impairment 121 0.28

133 0.31

Consolidated on a guidance basis $ 501

$ 1.16 $ 475

$ 1.10

(1) CenterPoint earnings excluding Midstream Investments

(2) Energy Services segment

(3) Taxes are computed based on the impact removing such item would have on tax expense

(4) As of May 18, 2016, comprised of Time Warner Inc., Charter Communications, Inc. and Time Inc. Prior to May 18, 2016, comprised of Time Warner

Inc., Time Warner Cable Inc. and Time Inc. Results prior to June 23, 2015 also included AOL Inc.

(5) 2016 includes amount associated with the Charter Communications, Inc. and Time Warner Cable Inc.

merger 2015 includes amount associated with Verizon tender offer for AOL, Inc common stock

PAGE 19

|

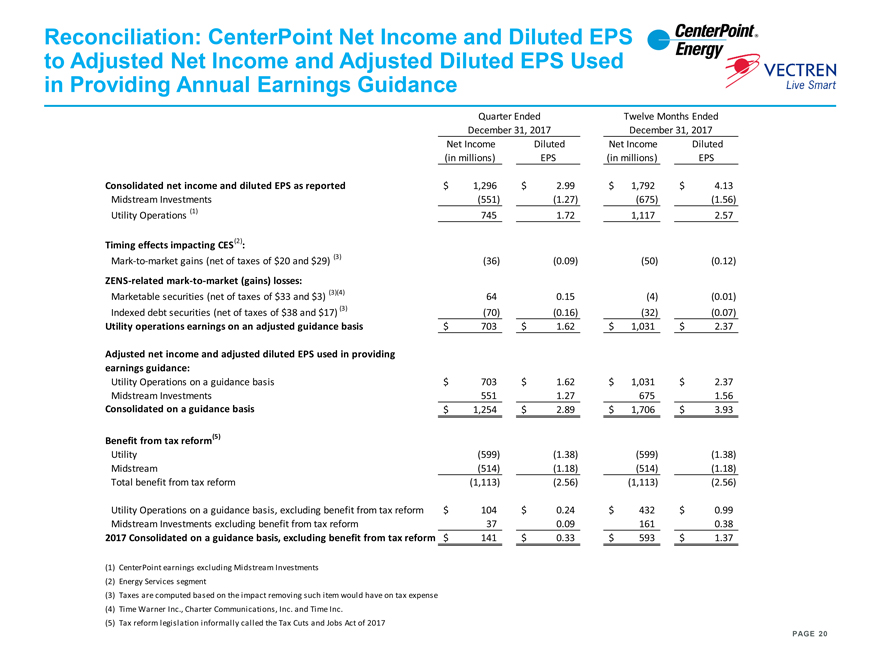

Reconciliation: CenterPoint Net Income and Diluted

EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance

Quarter Ended Twelve Months Ended December 31, 2017

December 31, 2017 Net Income Diluted Net Income Diluted (in millions) EPS (in millions) EPS

Consolidated net income and diluted EPS as reported

$ 1,296 $ 2.99

$ 1,792 $ 4.13 Midstream

Investments (551) (1.27)

(675) (1.56)

(1)

Utility

Operations

745 1.72 1,117

2.57

(2)

Timing effects

impacting CES :

(3)

Mark-to-market gains (net of taxes of $20 and $29)

(36) (0.09) (50)

(0.12)

ZENS-related

mark-to-market (gains) losses:

(3)(4)

Marketable securities (net of taxes of $33 and

$3) 64 0.15

(4) (0.01)

(3)

Indexed debt securities (net of taxes of $38 and $17)

(70) (0.16) (32)

(0.07)

Utility operations earnings on an adjusted guidance basis

$ 703 $ 1.62

$ 1,031 $ 2.37

Adjusted net income and adjusted diluted EPS used in providing earnings guidance:

Utility

Operations on a guidance basis $ 703 $ 1.62

$ 1,031 $ 2.37 Midstream

Investments 551 1.27

675 1.56 Consolidated on a guidance basis

$ 1,254 $ 2.89

$ 1,706 $ 3.93

(5)

Benefit from tax reform

Utility (599)

(1.38) (599) (1.38)

Midstream (514) (1.18)

(514) (1.18) Total benefit from tax

reform (1,113) (2.56)

(1,113) (2.56)

Utility Operations on a guidance basis, excluding benefit from tax reform $ 104

$ 0.24 $ 432

$ 0.99 Midstream Investments excluding benefit from tax

reform

37 0.09 161

0.38

2017 Consolidated on a guidance basis, excluding benefit from tax reform

$ 141 $ 0.33

$ 593 $ 1.37

(1) CenterPoint earnings excluding Midstream Investments (2) Energy Services segment

(3)

Taxes are computed based on the impact removing such item would have on tax expense (4) Time Warner Inc., Charter Communications, Inc. and Time Inc.

(5) Tax

reform legislation informally called the Tax Cuts and Jobs Act of 2017

PAGE 20