Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - HENRY SCHEIN INC | d574770dex992.htm |

| 8-K - FORM 8-K - HENRY SCHEIN INC | d574770d8k.htm |

HENRY SCHEIN TO SPIN OFF AND MERGE ITS ANIMAL HEALTH BUSINESS WITH VETS FIRST CHOICE, CREATING AN INNOVATIVE APPROACH TO ADVANCING VETERINARY CARE April 23, 2018 EXHIBIT 99.1

Safe Harbor Statement Forward Looking Statements In accordance with the "Safe Harbor" provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important factors that, among others, could cause future results to differ materially from the forward-looking statements, expectations and assumptions expressed or implied herein. These statements are identified by the use of such terms as "may," "could," "expect," "intend," "believe," "plan," "estimate," "forecast," "project," "anticipate" or other comparable terms. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction, including future financial and operating results, plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to anticipated synergies and the expected timetable for completing the proposed transaction — are forward-looking statements. All forward-looking statements made by us are subject to risks and uncertainties and are not guarantees of future performance. Therefore you should not rely on any of these forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks associated with the ability to consummate the transaction and the timing of the closing of the transaction; the ability to obtain requisite approvals; the ability to successfully integrate operations and employees; the ability to realize anticipated benefits and synergies of the transaction; the potential impact of the announcement of the transaction or consummation of the transaction on relationships, including with employees, customers and competitors; the ability to retain key personnel; the ability to achieve performance targets; changes in financial markets, interest rates and foreign currency exchange rates; and those additional risks and factors discussed in reports filed with the SEC by Henry Schein from time to time, including those discussed under the heading "Risk Factors" in its most recently filed Annual Report on Form 10-K. We undertake no duty and have no obligation to update any forward-looking statements contained herein. Additional Information and Where to Find It In connection with the proposed transaction, Vets First Corp. plans to file relevant materials with the SEC, including a registration statement on Form S-1/S-4 containing a prospectus, in the coming months. Investors and security holders are urged to carefully read the registration statement/prospectus (including any amendments or supplements thereto and any documents incorporated by reference therein) and any other relevant documents filed with the SEC when they become available, because they will contain important information about the parties and the proposed transaction. The registration statement/prospectus and other relevant documents that are filed with the SEC can be obtained free of charge (when available) from the SEC’s web site at www.sec.gov. These documents can (when available) also be obtained free of charge from Henry Schein, Inc. upon written request to Carolynne Borders at Henry Schein, Inc., 135 Duryea Road, Melville, NY 11747. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures, including operating income. The non-GAAP financial measures contained herein have limitations as analytical tools and should not be considered in isolation or in lieu of an analysis of our results as reported under U.S. GAAP. These non-GAAP measures should be evaluated only on a supplementary basis in connection with our U.S. GAAP results. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the back of this presentation.

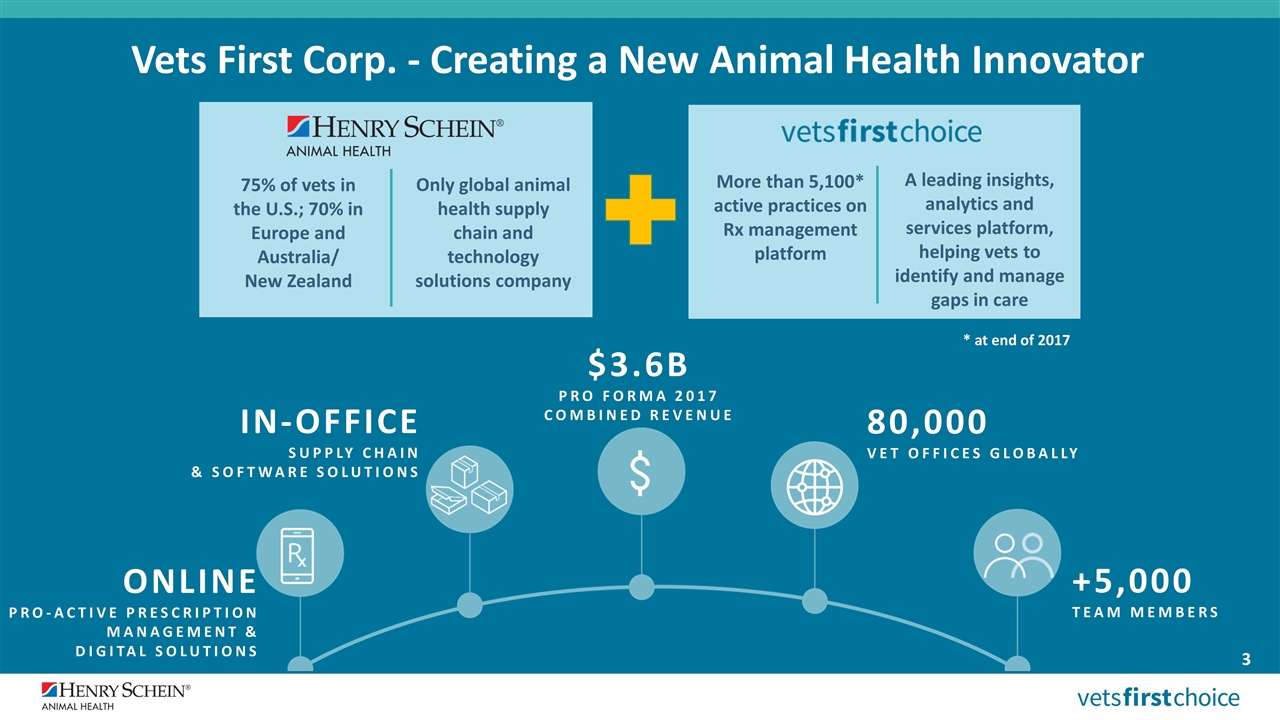

Vets First Corp. - Creating a New Animal Health Innovator More than 5,100* active practices on Rx management platform A leading insights, analytics and services platform, helping vets to identify and manage gaps in care Only global animal health supply chain and technology solutions company 75% of vets in the U.S.; 70% in Europe and Australia/ New Zealand $3.6B PRO FORMA 2017 COMBINED REVENUE +5,000 TEAM MEMBERS 80,000 VET OFFICES GLOBALLY IN-OFFICE SUPPLY CHAIN & SOFTWARE SOLUTIONS ONLINE PRO-ACTIVE PRESCRIPTION MANAGEMENT & DIGITAL SOLUTIONS 3 * at end of 2017

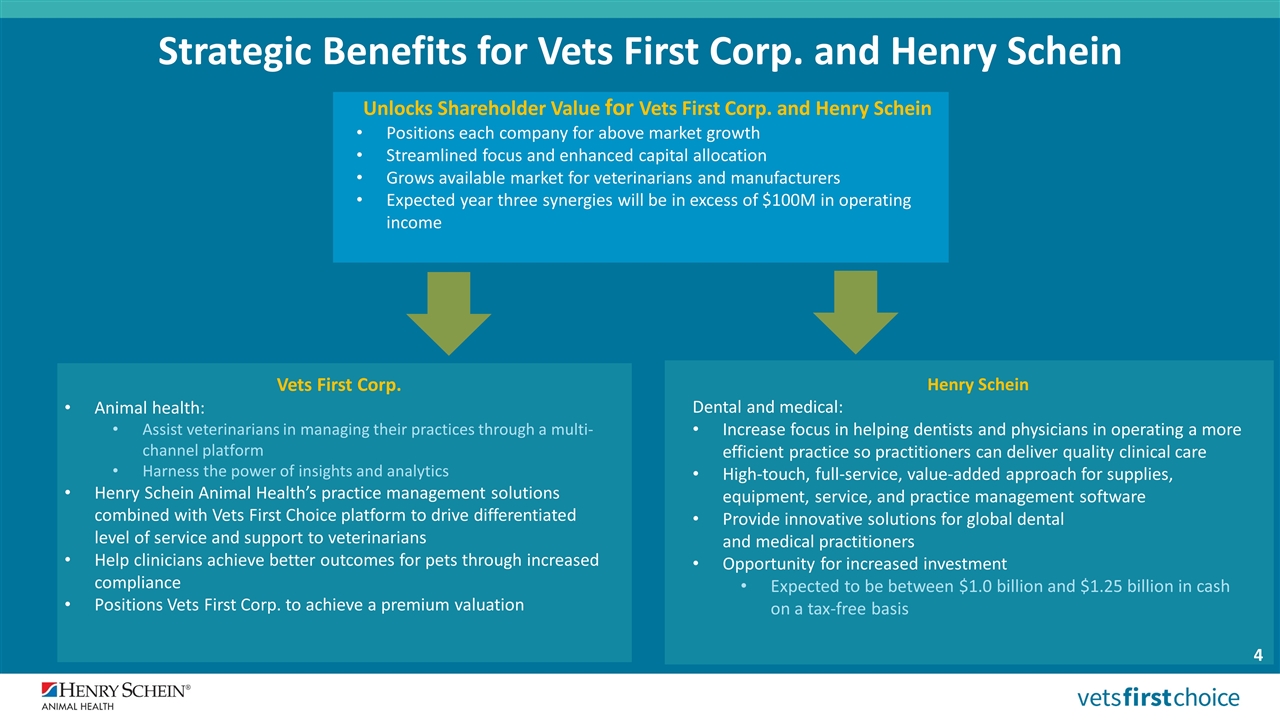

Strategic Benefits for Vets First Corp. and Henry Schein Henry Schein Dental and medical: Increase focus in helping dentists and physicians in operating a more efficient practice so practitioners can deliver quality clinical care High-touch, full-service, value-added approach for supplies, equipment, service, and practice management software Provide innovative solutions for global dental and medical practitioners Opportunity for increased investment Expected to be between $1.0 billion and $1.25 billion in cash on a tax-free basis 4 Unlocks Shareholder Value for Vets First Corp. and Henry Schein Positions each company for above market growth Streamlined focus and enhanced capital allocation Grows available market for veterinarians and manufacturers Expected year three synergies will be in excess of $100M in operating income Vets First Corp. Animal health: Assist veterinarians in managing their practices through a multi-channel platform Harness the power of insights and analytics Henry Schein Animal Health’s practice management solutions combined with Vets First Choice platform to drive differentiated level of service and support to veterinarians Help clinicians achieve better outcomes for pets through increased compliance Positions Vets First Corp. to achieve a premium valuation

5 Vets First Corp. OVERVIEW

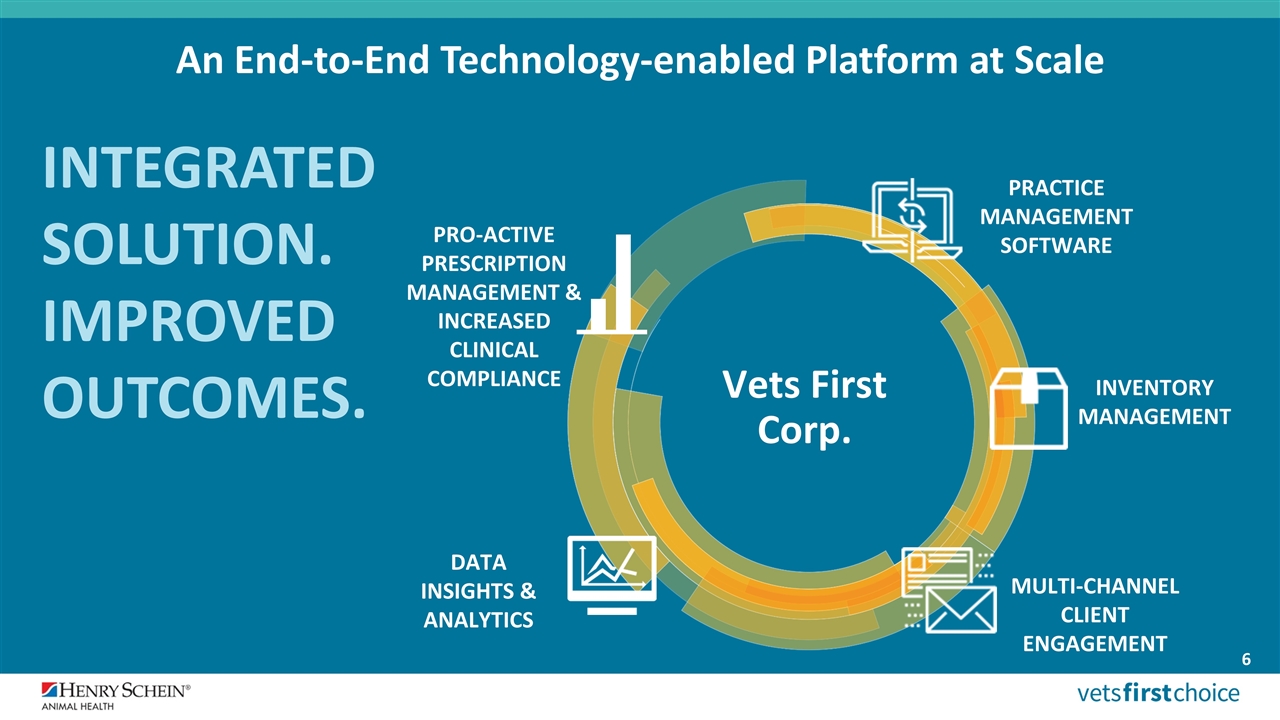

INTEGRATED SOLUTION. IMPROVED OUTCOMES. DATA INSIGHTS & ANALYTICS MULTI-CHANNEL CLIENT ENGAGEMENT INVENTORY MANAGEMENT PRACTICE MANAGEMENT SOFTWARE PRO-ACTIVE PRESCRIPTION MANAGEMENT & INCREASED CLINICAL COMPLIANCE Vets First Corp. An End-to-End Technology-enabled Platform at Scale

Vets First Corp.: Creating a Win for Stakeholders Vet Pet Owner Manufacturer Enhanced medical compliance Improved practice economics Improved pet health Multi-channel healthcare Enhanced client experience Driver of category growth Global partner A new value chain connecting veterinarians, pet owners, and manufacturers to improve the delivery of care and increase value for shareholders Internal Teams Collaborative growth with focused missions Exciting growth opportunities for both companies

Complementary skill sets that create the only multi-channel, integrated platform entirely focused on improving the veterinary practice Significant global scale in an attractive end-market We seek to significantly build on this global leadership position Opportunity to expand margins as recurring revenues accelerate amidst platform adoption The ability to harness technology to create market growth and expand customer lifetime value Evolving consumer trends have created an opportunity for rapid growth on the right platform Vets First Corp.: Well-Positioned to Succeed

9 TRANSACTION SUMMARY

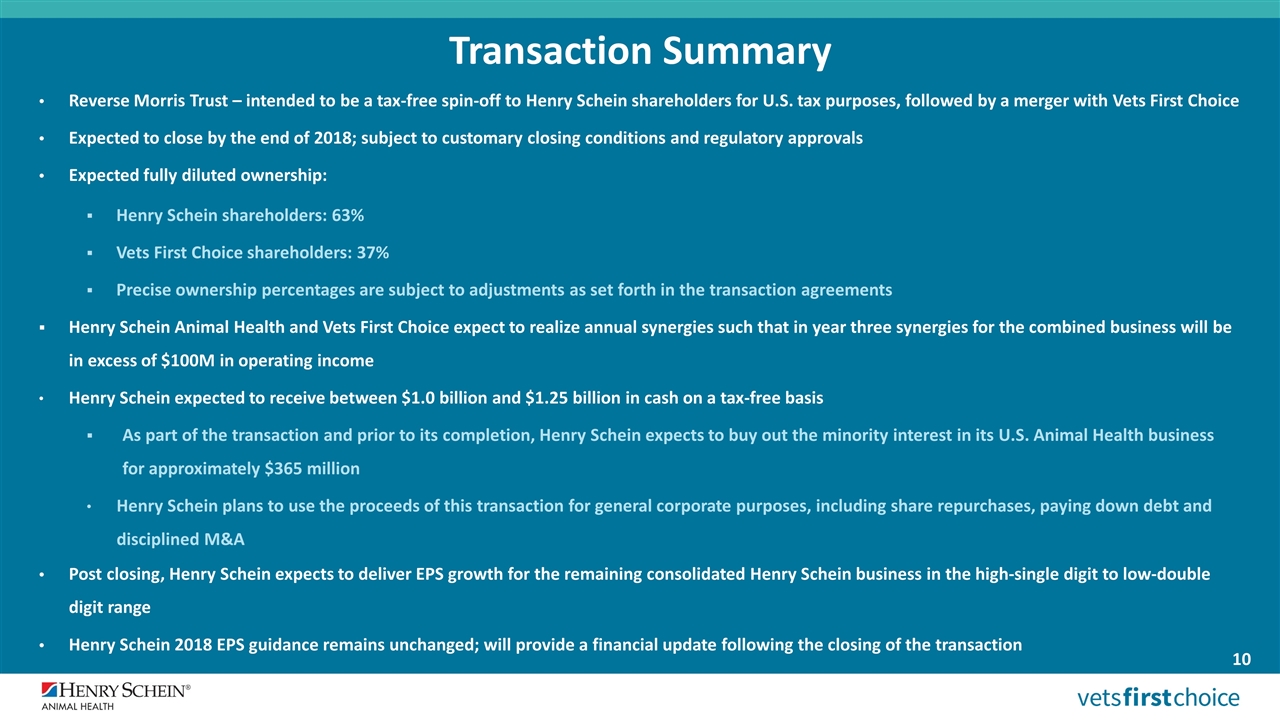

Transaction Summary Reverse Morris Trust – intended to be a tax-free spin-off to Henry Schein shareholders for U.S. tax purposes, followed by a merger with Vets First Choice Expected to close by the end of 2018; subject to customary closing conditions and regulatory approvals Expected fully diluted ownership: Henry Schein shareholders: 63% Vets First Choice shareholders: 37% Precise ownership percentages are subject to adjustments as set forth in the transaction agreements Henry Schein Animal Health and Vets First Choice expect to realize annual synergies such that in year three synergies for the combined business will be in excess of $100M in operating income Henry Schein expected to receive between $1.0 billion and $1.25 billion in cash on a tax-free basis As part of the transaction and prior to its completion, Henry Schein expects to buy out the minority interest in its U.S. Animal Health business for approximately $365 million Henry Schein plans to use the proceeds of this transaction for general corporate purposes, including share repurchases, paying down debt and disciplined M&A Post closing, Henry Schein expects to deliver EPS growth for the remaining consolidated Henry Schein business in the high-single digit to low-double digit range Henry Schein 2018 EPS guidance remains unchanged; will provide a financial update following the closing of the transaction 10

11 Henry Schein, Inc. OVERVIEW

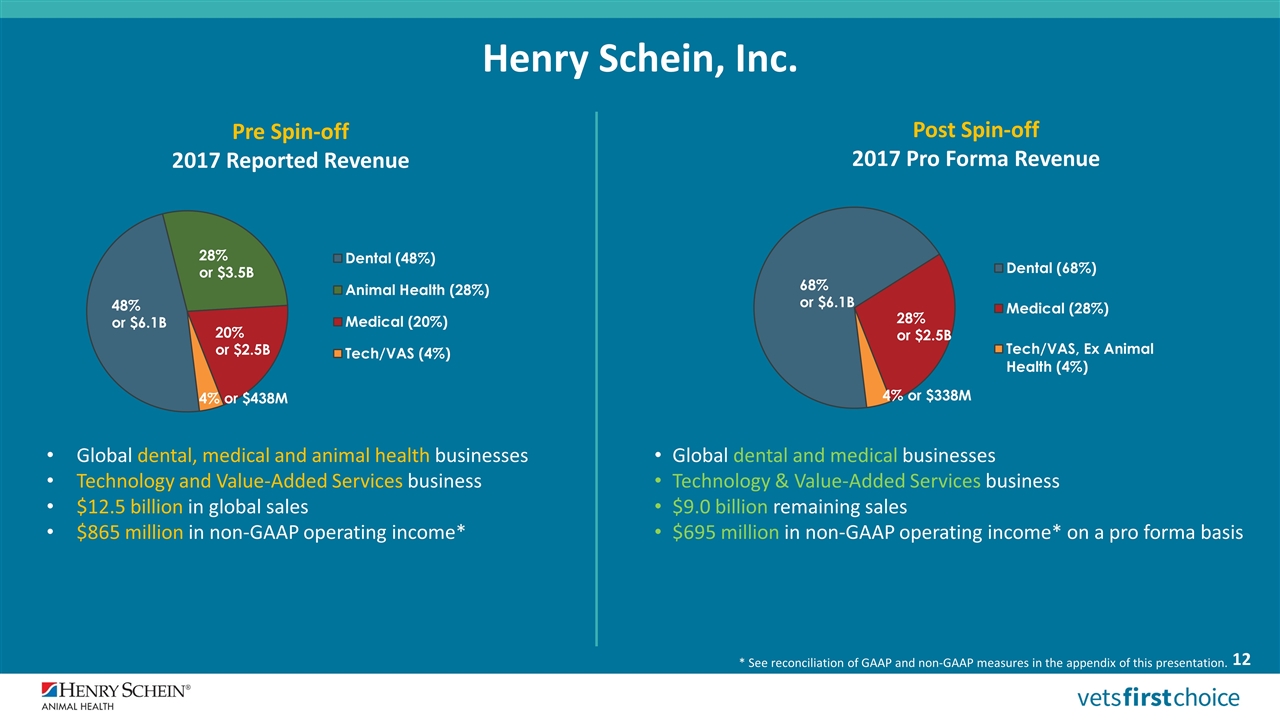

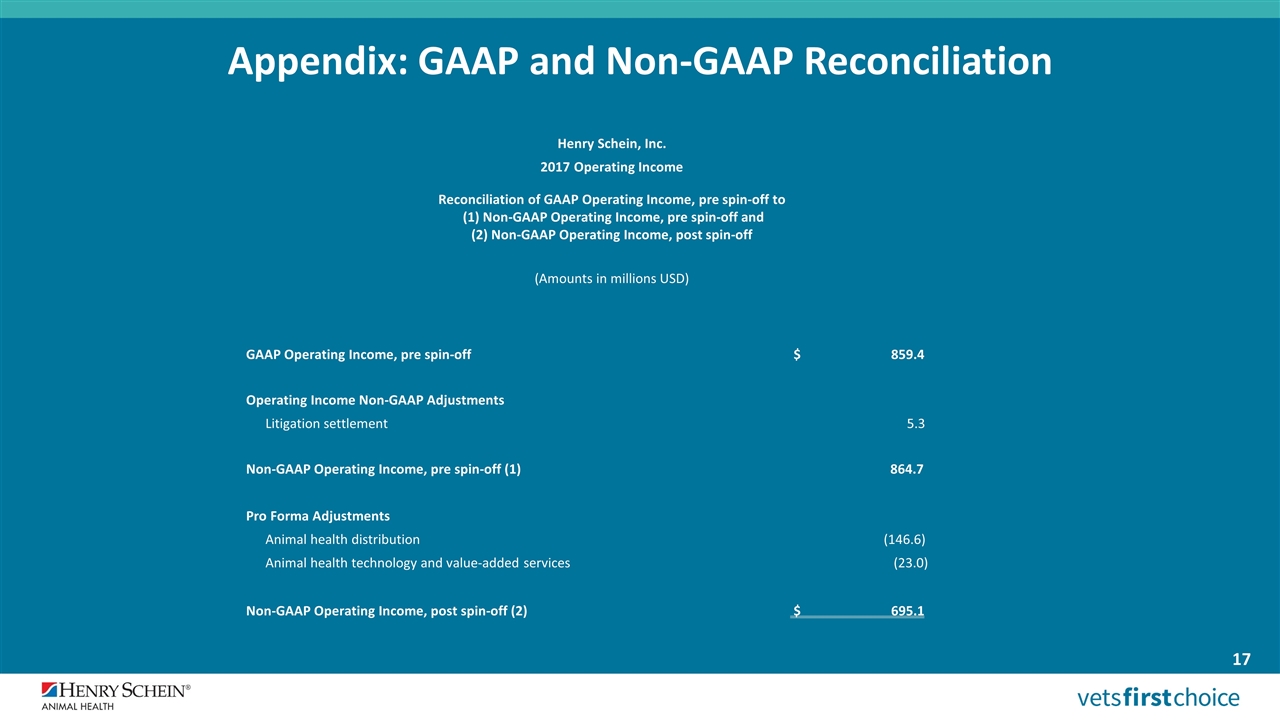

Henry Schein, Inc. 48% or $6.1B 28% or $3.5B 20% or $2.5B Global dental, medical and animal health businesses Technology and Value-Added Services business $12.5 billion in global sales $865 million in non-GAAP operating income* * See a reconciliation of GAAP/Non-GAAP results on the Supplemental Info page of the company’s website. Pre Spin-off 2017 Reported Revenue Post Spin-off 2017 Pro Forma Revenue Global dental and medical businesses Technology & Value-Added Services business $9.0 billion remaining sales $695 million in non-GAAP operating income* on a pro forma basis 12 68% or $6.1B 28% or $2.5B 4% or $338M 4% or $438M * See reconciliation of GAAP and non-GAAP measures in the appendix of this presentation.

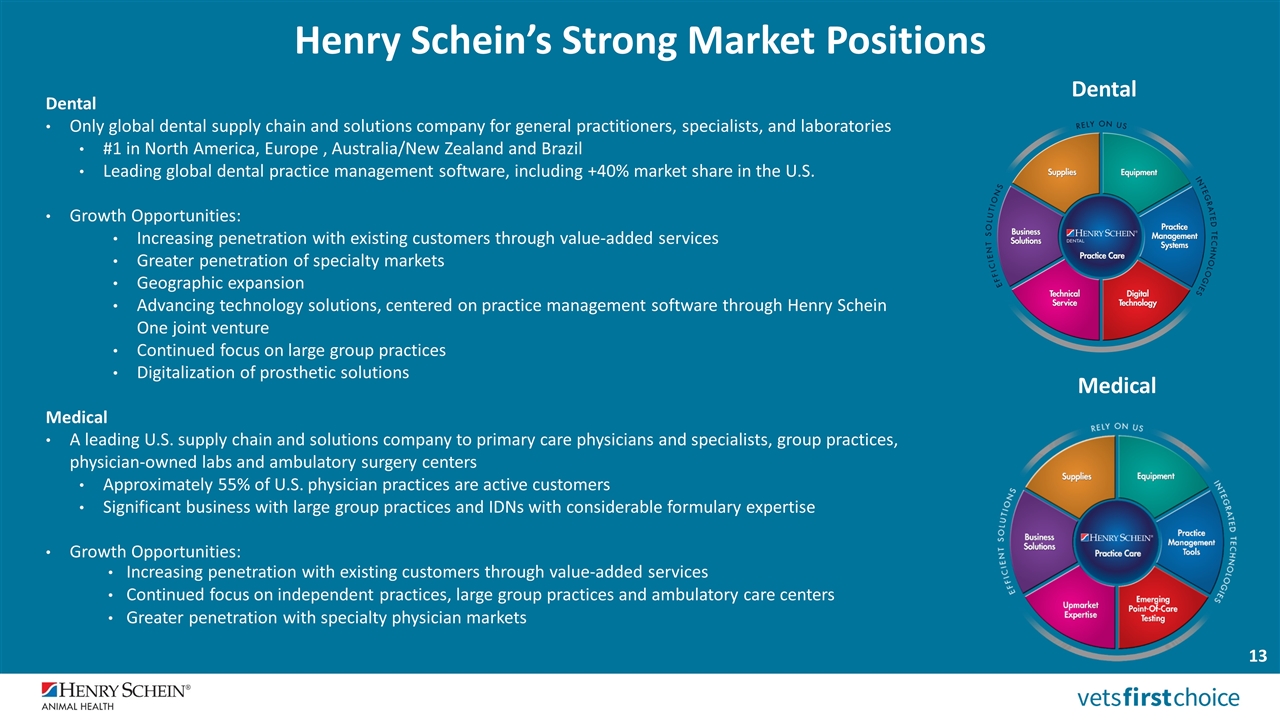

Dental Only global dental supply chain and solutions company for general practitioners, specialists, and laboratories #1 in North America, Europe , Australia/New Zealand and Brazil Leading global dental practice management software, including +40% market share in the U.S. Growth Opportunities: Increasing penetration with existing customers through value-added services Greater penetration of specialty markets Geographic expansion Advancing technology solutions, centered on practice management software through Henry Schein One joint venture Continued focus on large group practices Digitalization of prosthetic solutions Medical A leading U.S. supply chain and solutions company to primary care physicians and specialists, group practices, physician-owned labs and ambulatory surgery centers Approximately 55% of U.S. physician practices are active customers Significant business with large group practices and IDNs with considerable formulary expertise Growth Opportunities: Increasing penetration with existing customers through value-added services Continued focus on independent practices, large group practices and ambulatory care centers Greater penetration with specialty physician markets Henry Schein’s Strong Market Positions 13 Dental Medical

Henry Schein: Strategically Well-Positioned with Continued Financial Strength Henry Schein (Post Close) High touch, value added market approach Focus on delivering solutions that enable customers to deliver the best quality patient care while increasing the efficiency of their practice Patient demand generation Technology and equipment interoperability Providing robust solutions for clinical workstations Uniquely positioned to serve common sites of care for dental and medical Goal to offer investors an attractive return on investment Strong track record of growth, operational excellence and successful M&A, led by a proven management team 14

15 Q&A

Contacts At Henry Schein Investor Relations: Carolynne Borders Vice President, Investor Relations carolynne.borders@henryschein.com (631) 390-8105 Media: Anne Marie Gothard Vice President, Corporate Media Relations Annmarie.gothard@henryschein.com (631) 390-8169 16 At Vets First Choice Investor Relations: Nicholas Jansen Vice President, Investor Relations nicholas.jansen@vetsfirstchoice.com (888) 280-2221, x1103 Media: David Melancon david.melancon@vetsfirstchoice.com (917) 378-8525

17 Appendix: GAAP and Non-GAAP Reconciliation Henry Schein, Inc. 2017 Operating Income Reconciliation of GAAP Operating Income, pre spin-off to (1) Non-GAAP Operating Income, pre spin-off and (2) Non-GAAP Operating Income, post spin-off (Amounts in millions USD) GAAP Operating Income, pre spin-off $ 859.4 Operating Income Non-GAAP Adjustments Litigation settlement 5.3 Non-GAAP Operating Income, pre spin-off (1) 864.7 Pro Forma Adjustments Animal health distribution (146.6) Animal health technology and value-added services (23.0) Non-GAAP Operating Income, post spin-off (2) $ 695.1