Attached files

| file | filename |

|---|---|

| EX-31.4 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 - Blue Buffalo Pet Products, Inc. | exhibit314-cfocertificate.htm |

| EX-31.3 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 - Blue Buffalo Pet Products, Inc. | exhibit313-ceocertificate.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File No. 001-37510

_________________________________________________

BLUE BUFFALO PET PRODUCTS, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 46-0552933 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

11 River Road, Wilton, CT | 06897 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(203) 762-9751

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 par value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý.

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer ¨ Smaller reporting company ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý.

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $2,171,233,581 based on the closing sale price as reported on the NASDAQ Stock Market.

The number of shares of the registrant’s common stock outstanding as of April 20, 2018 was 197,766,723.

Documents Incorporated by Reference:

None.

EXPLANATORY NOTE

Blue Buffalo Pet Products, Inc. and its subsidiaries (the "Company," "we," "us" and "our") is filing this Amendment No. 1 on Form 10-K/A (this "Amendment") to amend the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the "2017 10-K"), originally filed with the Securities and Exchange Commission (the "SEC") on February 26, 2018, to include the information required by Items 10 through 14 of Part III of the 2017 10-K. This information was previously omitted from the 2017 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from the Company's definitive proxy statement if such statement is filed no later than 120 days after the Company's fiscal year-end. This Amendment amends and restates in their entirety Items 10, 11, 12, 13 and 14 of Part III of the 2017 10-K and the exhibit index set forth in Part IV of the 2017 10-K and includes certain exhibits as noted thereon. The cover page of the 2017 10-K is also amended to delete the reference to the incorporation by reference of the Company's definitive proxy statement.

Except as described above, no other changes have been made to the 2017 10-K, and this Amendment does not modify, amend or update in any way any of the financial or other information contained in the 2017 10-K. This Amendment does not reflect events occurring after the date of the filing of our 2017 10-K, nor does it amend, modify or otherwise update any other information in our 2017 10-K. Accordingly, this Amendment should be read in conjunction with our 2017 10-K and with our filings with the SEC subsequent to the filing of our 2017 10-K.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), this Amendment also contains certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted.

Terms used but not defined herein are as defined in our 2017 10-K.

Part III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Below is a list of our directors and their respective ages and a brief account of the business experience of each of them as of April 20, 2018.

Name | Age | Position | ||

William Bishop | 79 | Chairman and Director | ||

Raymond Debbane | 63 | Director | ||

Philippe Amouyal | 59 | Director | ||

Evren Bilimer | 40 | Director | ||

Aflalo Guimaraes | 48 | Director | ||

Michael A. Eck | 55 | Director | ||

Frances Frei | 54 | Director | ||

Amy Schulman | 57 | Director | ||

William Bishop, Jr. | 47 | Director, Chief Executive Officer and President | ||

William ("Bill") Bishop has served as Chairman since 2012 and has served as a member of our Board of Directors since 2007. Bill was President and Chief Executive Officer of Blue Buffalo Company, Ltd. from 2007 to 2012. Bill founded the Blue Buffalo Company in 2002 with his sons Billy Bishop, our Chief Executive Officer and President, and Chris Bishop. Bill has had a long career in advertising and consumer products marketing having started in agency account management for clients like P&G and Unilever. Bill then moved to the corporate side and ran the refreshment beverage business for General Foods until moving back to the advertising side as Chief Executive Officer of a number of agencies including MCA, Ally & Gargano and Ryan Direct Marketing before founding Sierra Communications. Over his long career, Bill has created advertising and marketing programs for many leading brands including Tropicana, Perrier, Nabisco and American Express. In 1995, Bill co-founded SoBe Beverages, driving the brand building and product development of SoBe as Chief Operating Officer of SoBe Beverages until its sale to Pepsi in 2001. Bill graduated from Ohio Wesleyan University with a BA in 1961. Bill was selected to serve as a director because of his unique familiarity with our business, structure, culture and history as a co-founder of our business and his significant executive management and leadership experience.

Raymond ("Ray") Debbane has been a director since 2007. Ray served as Chairman from 2007 to 2012. Ray is the President and Chief Executive Officer of Invus Group, LLC, a global investment firm based in New York which he co-founded in 1985. Ray is the chairman of the board of directors of Weight Watchers and Lexicon Pharmaceuticals. He is the Chief Executive Officer of Artal Group S.A., or Artal, and also serves as chairman or director of a number of private Artal or Invus portfolio companies. Before co-founding Invus, Ray was a management consultant in the Paris office of The Boston Consulting Group, where he served a number of major European and international companies. He holds a BS in agricultural sciences and agricultural engineering from American University of Beirut, an MS in food science and technology from the University of California at Davis, and an MBA from Stanford University. Ray is the Chairman of Action Against Hunger USA and a Trustee Emeritus of Connecticut College. Ray was also a member of the Board of Directors of Ceres, Inc. (NASDAQ: CERE) from March 1998 until December 2014. Ray was selected to serve as a director because of his experience as a management consultant and private equity investor and his extensive knowledge and understanding of corporate strategy, brand management, complex financial matters, and numerous and varied industries.

Philippe Amouyal has been a director since 2007. Philippe is a Managing Director of Invus Group, LLC. He joined Invus in 1999. Philippe is a director of Weight Watchers and Lexicon Pharmaceuticals and also serves on the boards of a number of private Artal or Invus portfolio companies. Prior to joining Invus, Philippe spent 15 years at The Boston Consulting Group in Paris and Boston, where he was a Vice President and Director and coordinated the global electronics and software practice from 1991 on. He holds an MS in engineering and a DEA in management from Ecole Centrale de Paris and was a Research Fellow at the Center for Policy Alternatives of the Massachusetts Institute of Technology. Philippe was selected to serve as a director because of his experience as a management consultant and private equity investor and his extensive knowledge and understanding of corporate strategy, information technology, research and development, and management operations and structures.

Evren Bilimer has been a director since 2012. Evren is a Managing Director of Invus Group, LLC. He joined Invus in 2002. Evren has served on the boards of a number of private Invus portfolio companies. Prior to joining Invus, Evren was a management consultant with McKinsey & Company in New York, where he worked with clients in a wide range of industries including the consumer sector and financial services. Evren graduated summa cum laude from Yale University, double majoring in Electrical Engineering and Economics. Evren was selected to serve as a director because of his experience as a management consultant and private equity investor and his extensive knowledge and understanding of corporate strategy, corporate finance and accounting and the consumer sector.

Aflalo Guimaraes has been a director since 2007. Aflalo is a Managing Director of Invus Group, LLC. He joined Invus in 1998. Aflalo also serves on boards of a number of private Invus portfolio companies. Prior to joining Invus, Aflalo worked at Marakon Associates where as a manager he led strategic consulting engagements for large multinational companies in a wide range of industries including financial services, retail and consumer products. Previously he worked at the Federal Reserve. Aflalo was also a member of the Board of Directors of Ceres, Inc. (NASDAQ: CERE) from December 2014 until April 2016. He holds an MBA from the University of Pennsylvania’s The Wharton School and a BA in Economics and Political Science from Yale University. Aflalo was selected to serve as a director because of his experience as a management consultant and private equity investor and his extensive knowledge and understanding of corporate strategy, corporate finance and accounting and the consumer sector.

Michael (“Mike”) A. Eck has served as a director since 2015. Mr. Eck was the Global Head of the Consumer and Retail Investment Banking Group at Morgan Stanley from 2008 until his retirement in 2014. Prior to that, Mr. Eck worked at Citigroup from 1993 to 2008, where he was the Global Head of the Consumer and Retail Banking Group, and at Credit Suisse First Boston from 1987 to 1993. In January 2016, Mr. Eck joined M Klein and Company, a global strategic advisory firm, as a Senior Advisor. In December 2017, Mr. Eck became Interim CEO of Johnson Controls Hall of Fame Village as part of his role at M Klein and Company. He is currently an independent board member of J.Jill and the co-founder and chief executive officer of Steer for Student Athletes. In addition, he previously served as a member of the Senior Advisory Board of Shopkick and an independent board member of USA Ultimate. Mr. Eck received his Masters in Management from Northwestern University and his B.S. in Business from the McIntire School of Commerce at the University of Virginia. He was selected to serve on our board of directors because of his extensive knowledge of corporate strategy, corporate financing and accounting, capital investment and operations and the consumer sector.

Frances Frei has been a director since 2014. Frances has been the UPS Foundation Professor of Service Management at Harvard Business School since July 2009, and served as the Senior Associate Dean of Harvard Business School from July 2012 to 2017. In addition, she was Chair of the MBA Required Curriculum at Harvard Business School and Course Head of the school's innovative FIELD (Field Immersion Experience for Leadership Development) Method Course, which is Harvard Business School's companion to the case method. Previously, she served at the Harvard Business School as Associate Professor from July 2003 to July 2009 and as Assistant Professor from July 1998 to July 2003. Frances joined Uber as the SVP of Leadership and Strategy in June 2017, served in that role until February 2018, and continues to serve as an advisor to Uber. She holds a PhD in Operations and Information Management from The Wharton School at the University of Pennsylvania, an ME in Industrial Engineering from Pennsylvania State University and a BA in Mathematics from the University of Pennsylvania. Frances was previously a member of the Board of Directors of Advance Auto Parts, Inc. from 2009 until 2013, and currently serves as a member of the Board of Directors of Viewpost, LLC. Frances was selected to serve as a director because of her experience advising companies in operational excellence and her extensive knowledge and understanding of corporate strategy, organizational effectiveness and finance.

Amy Schulman has been a director since 2014. In July 2015, Amy co-founded and joined Lyndra, Inc. as chief executive officer. Amy is also a senior lecturer at Harvard Business School, where she was appointed to the faculty in July 2014, and has been a partner at Polaris Partners since August 2014. Amy served as chief executive officer of Arsia Therapeutics, Inc., from August 2014 to November 2016 when Arsia was acquired by Eagle Pharmaceuticals, Inc. In February 2017 she became chief executive officer of Olivo Laboratories, LLC. Amy was previously the Executive Vice President and General Counsel of Pfizer from 2008 to 2013 and served as the Business Unit Lead for Pfizer's Consumer Healthcare business from 2012 to 2013. Prior to Pfizer, Amy was a Partner at DLA Piper from 1998 to 2008 where she was a member of the board and executive policy committees. Amy also serves as a director of Arsanis, Inc., Alnylam Pharmaceuticals, Inc, Ironwood Pharmaceuticals, and previously served as a director of BIND Therapeutics, Inc. She received a JD from Yale Law School, and graduated with honors with BA degrees in philosophy and English from Wesleyan University, where she was elected to Phi Beta Kappa. Amy was selected to serve as a director because of her experience as a chief executive officer, general counsel and business leader, her extensive knowledge and understanding of corporate strategy and management operations and her financial expertise.

William ("Billy") Bishop, Jr. has served as President since 2012 and has served as our Chief Executive Officer since January 1, 2017. From 2003 until December 31, 2016, Billy also served as Chief Operating Officer. Billy co-founded the Blue Buffalo Company with his father Bill Bishop, the Chairman of our Board, and his brother Chris Bishop in 2002. He has been leading Marketing, Product Development and Operations since our founding. Billy was Vice President of Marketing at SoBe leading its ground breaking guerilla marketing strategy until its sale to Pepsi in 2001. Billy also was an Account Manager at Sierra Communications from 1993 to 1995. Billy has a BA in Sports Marketing from Ohio Wesleyan University.

EXECUTIVE OFFICERS

Below is a list of our other executive officer, besides Billy Bishop, whose biographical information is presented under "Role and Responsibilities of the Board of Directors" above, and his age and a brief account of his business experience as of April 20, 2018:

Name | Age | Position | ||

Michael Nathenson | 54 | Executive Vice President, Chief Financial Officer and Treasurer | ||

Michael ("Mike") Nathenson has served as our Executive Vice President, Chief Financial Officer and Treasurer since 2012. Mike brings a deep financial and strategic background in consumer products with significant leadership experience at PepsiCo and Dean Foods. Mike was with Dean Foods from 2009 to 2012, where he was most recently the Chief Financial Officer of the Dean Foods Dairy Group. At PepsiCo, Mike spent almost 14 years in a variety of operational finance roles including as the Chief Financial Officer of Frito Lay’s Australia subsidiary from 2000 to 2004. He then moved to the corporate side where he led PepsiCo’s FP&A group from 2004 to 2008 and was Senior Vice President of Investor Relations from 2008 to 2009. Mike has a BS in Chemical Engineering from Washington University and an MBA from Harvard Business School.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our executive officers and directors, and persons who beneficially own more than ten percent (10%) of our common stock, file initial reports of ownership and changes in ownership with the SEC and the NASDAQ. Based solely on a review of the copies of such reports and written representations from our executive officers, directors and Invus, we believe that all forms were filed in a timely manner during the year ended December 31, 2017.

CORORATE GOVERNANCE

Role and Responsibilities of the Board of Directors

The Board represents stockholders' interests and is responsible for fostering the long-term success and value of the Company, consistent with its fiduciary duty to the stockholders. The Board has responsibility for establishing broad corporate policies, setting strategic direction and overseeing management, which is responsible for the day-to-day operations of the Company. In fulfilling this role, each director must exercise his or her good faith business judgment in the best interests of the Company and its stockholders. The Company is committed to conducting its business in accordance with ethical business principles. Integrity and ethical behavior are core values of the Company. The Board provides the best example of these values and reinforces their importance at appropriate times.

A director's basic responsibility is to exercise his or her good faith business judgment in the best interests of the Company. In fulfilling this responsibility directors shall:

• | adhere to the Code of Ethics and Business Conduct, including acting pursuant to the duty of loyalty owed to the Company; |

• | approve major strategic decisions and oversee, develop and implement Board policies; |

• | provide oversight of risk assessment processes and processes designed to promote legal compliance; |

• | monitor and assess performance and ask appropriate questions of management to address accountability with established goals; |

• | stay well informed regarding the Company's business; |

• | oversee internal and external audit processes and financial reporting through the Audit Committee; |

• | select, and, through the Compensation Committee, evaluate and approve the compensation of, the CEO; |

• | review and approve compensation of other executive officers through the Compensation Committee; |

• | oversee the Company's disclosure controls and internal controls through the Audit Committee; and |

• | perform such other functions as the Board believes appropriate or necessary, or as otherwise prescribed by rules or regulations. |

Each director shall be entitled to rely on the honesty and integrity of the Company's senior executives and its outside advisors and auditors absent evidence that makes such reliance unwarranted. The directors shall also be entitled (1) to the benefits of indemnification to the fullest extent permitted by the Company's Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation"), Bylaws and any indemnification agreements, and (2) to exculpation as provided by Delaware law and the Certificate of Incorporation.

The Board meets at least quarterly each year and special meetings may be held as specified in the Bylaws. Directors are expected to make every effort to attend and participate in Board meetings and meetings of committees on which they serve, and to spend the time needed and meet as frequently as necessary, to discharge properly their responsibilities. Directors are also expected to make every effort to attend the Annual Meeting of Stockholders.

Board Committee Functions

Our Board has the following standing committees: Audit Committee and Compensation Committee. The charters for the Company's Audit Committee and Compensation Committee are available free of charge on the Company's website at http://ir.bluebuffalo.com under Corporate Governance: Committee Composition. The Board may also establish other committees to assist in the discharge of its responsibilities. The table below identifies the current committee members and committee chairpersons.

Director | Audit Committee | Compensation Committee | ||

Philippe Amouyal | ü | |||

Evren Bilimer | C | |||

Michael A. Eck | C | |||

Frances Frei | ü | ü | ||

Amy Schulman | ü | |||

ü | Member |

C | Chair |

Audit Committee

The Audit Committee consists of Michael A. Eck, who serves as the Chair, Amy Schulman and Frances Frei. The Board has determined that Michael A. Eck, Amy Schulman and Frances Frei qualify as independent directors under our Corporate Governance Principles, NASDAQ corporate governance standards applicable to boards of directors in general and audit committees in particular and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board of Directors has also determined that Michael A. Eck qualifies as an "audit committee financial expert" as such term is defined in Item 407(d)(5) of Regulation S-K.

The purpose of the Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, is to assist the Board of Directors in fulfilling its obligations regarding the accounting, auditing, financial reporting, internal control over financial reporting and legal compliance functions of the Company and its subsidiaries. The Audit Committee's principal functions include assisting the Board of Directors in its oversight of the:

• | accounting, financial reporting and disclosure processes and adequacy of systems of disclosure and internal control established by management; |

• | the audit of, and the quality and integrity of our financial statements; |

• | our independent registered public accounting firm's qualifications and independence; |

• | the performance of our internal audit function and independent registered public accounting firm; |

• | overall risk management profile; and |

• | our compliance with legal and regulatory requirements. |

The Audit Committee meets from time to time in separate executive sessions with each of the representatives of KPMG, the Company's independent registered public accounting firm, the Chief Financial Officer, and Internal Audit management.

The Audit Committee reviews the Company's Code of Ethics and Business Conduct (the "Code") periodically, as well as the adequacy of the policies included in the Code. The Audit Committee confirms with the Company's executive officers periodically that the officers understand and are implementing those policies. The Audit Committee monitors compliance with the Code, investigates any alleged breach or violation of the Code, and enforces the Code.

Compensation Committee

The Compensation Committee consists of Frances Frei, Philippe Amouyal and Evren Bilimer, who serves as the Chair.

The purpose of the Compensation Committee is to discharge certain responsibilities of the Board of Directors relating to compensation for the Company's Chief Executive Officer, executive officers and certain key personnel, and to ensure that management's interests are aligned with the interests of the stockholders of the Company. The Compensation Committee is also responsible for determining compensation for non-employee directors. The Committee's principal functions include:

• | setting our compensation program and compensation of our executive officers, directors and key personnel; |

• | monitoring our incentive-compensation and equity-based compensation plans; |

• | succession planning for our executive officers, directors and key personnel; and |

• | preparing the compensation committee report required to be included in our proxy statement under the rules and regulations of the SEC. |

The charter of the Compensation Committee permits the Committee to delegate any or all of its authority to one or more subcommittees.

Ms. Frei has been determined to be independent as defined by our Corporate Governance Principles and NASDAQ corporate governance standards applicable to boards of directors in general and compensation committees in particular. Our Board has made no affirmative determination with respect to the independence of the other members of the Compensation Committee, Mr. Amouyal and Mr. Bilmer.

Controlled Company Exemption

Affiliates of Invus and The Bishop Family Limited Partnership collectively own more than 50% of the voting power of our shares eligible to vote in the election of directors and for purposes of Schedule 13G are acting as a "group" because they are parties to the Amended and Restated Investor Rights Agreement, dated January 21, 2015. As a result, we are a "controlled company" as set forth in Rule 5615 of the NASDAQ Listing Rules. Under these corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a "controlled company" and may elect to utilize exemptions from certain corporate governance standards, including the requirement (1) that a majority of the Board of Directors consist of independent directors, (2) to have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee's purpose and responsibilities and (3) that our director nominations be made, or recommended to the full Board of Directors, by our independent directors or by a nominations committee that is composed entirely of independent directors and that we adopt a written charter or board resolution addressing the nominations process. We currently are utilizing these exemptions and expect to continue to do so. In the event that we cease to be a "controlled company" and our shares continue to be listed on NASDAQ, we will be required to comply with these provisions within the applicable transition periods.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. Our Code of Ethics and Business Conduct is available on our website at http://ir.bluebuffalo.com under Corporate Governance: Code of Ethics. Our Code of Ethics and Business Conduct is a "code of ethics," as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Ethics and Business Conduct on our website.

Director Independence

Under our Corporate Governance Principles and the NASDAQ Listing Rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with us, which in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Corporate Governance Principles define independence in accordance with the independence standards in the current NASDAQ corporate governance rules for listed companies. Our Corporate Governance Principles require the Board to review the independence of all directors at least annually, subject to an election by the Company to rely on the exemption for controlled companies and the applicable transition periods under the applicable NASDAQ Listing Rules.

In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NASDAQ independence definition, the Board will consider the issue not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation and determine, considering all relevant facts and circumstances, whether such relationship is material.

Our Board has affirmatively determined that each of Mr. Eck, Ms. Frei and Ms. Schulman is independent under the guidelines for director independence set forth in the Corporate Governance Principles and under all applicable NASDAQ guidelines, including with respect to committee membership. Our Board has made no affirmative determination with respect to the independence of Messrs. Bill Bishop, Debbane, Amouyal, Bilimer, Guimaraes and Billy Bishop with respect to board or committee membership.

In making its independence determinations, the Board considered and reviewed all information known to it (including information identified through annual directors' questionnaires).

5

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion & Analysis ("CD&A") is intended to provide our stockholders with a complete understanding of the compensation programs in place for our named executive officers ("NEOs") for 2017 as well as insights into why the programs support the Company's strategy and objectives and ultimately provide for strong alignment with our stockholders. The Executive Summary is intended to provide an overview of the elements of our compensation program that we believe are of the most interest to our stockholders, while the full CD&A provides further details on our programs and practices. Our NEOs for fiscal 2017 were:

• | Billy Bishop, our Chief Executive Officer and President; and |

• | Mike Nathenson, our Executive Vice President, Chief Financial Officer and Treasurer. |

The Executive Summary to our CD&A highlights the following:

• | Executive compensation philosophy; |

• | Material elements of our compensation program; and |

• | Pay for performance alignment. |

The remainder of the CD&A provides more detail on specific information concerning compensation, including:

• | Mix of salary, cash incentive compensation and long-term incentive compensation; |

• | Weighting of performance measures used to determine compensation; |

• | Reasons for selecting particular companies as peers for benchmarking compensation; |

• | Discussion of our stock ownership guidelines; and |

• | Description of our other compensation related practices, including change in control benefits. |

Executive Summary

Compensation Philosophy and Objectives

Our strong performance-oriented culture is built on the goal of delivering high-quality, natural pet foods and pet products. This is only possible with the exceptional talent and dedication of our entire team (the "Herd"). Compensation plays an important part in reinforcing our strong culture and the need to deliver exceptional performance that benefits our stockholders. To that end, we have structured our compensation programs with an underlying philosophy that supports the following objectives for our NEOs and our management team more broadly:

• | Attracts, motivates, retains and rewards superior executive talent as we continue to execute our growth initiatives; |

• | Delivers a significant portion of compensation in vehicles that are "at risk" such that less compensation is earned if we do not meet our goals and more is earned if we exceed our goals; |

• | Aligns the interests of our executive officers and stockholders by rewarding executive officers for behaviors that drive stockholder value creation; and |

• | Encourages executives to take calculated risks that will drive our growth, but does not encourage excessive risk taking. |

6

Compensation Program Highlights

The key components of our compensation programs are outlined below with a more detailed description later in the CD&A.

Compensation Component | Description | Objective |

Base Salary | Ongoing fixed component of compensation | = Compensates executives for executing their responsibilities = Assists with recruiting and retaining talent |

Annual Incentive | Annual incentives reward our NEOs for performance against pre-established net sales growth and adjusted operating income margin goals, measured over a one-year period Target opportunities are expressed as a percentage of base salary Payouts range from 0% to 200% of target, and are made in cash | = Drives and rewards for meeting and exceeding financial targets over a one-year time frame = Reinforces key operating objectives that drive long-term value for stockholders = Focuses on overall corporate performance to support the "Herd" culture |

Equity Compensation | Restricted Stock Units cliff vest on the third anniversary of the grant date Stock options cliff vest on the third anniversary of the grant date | = Rewards strong stock performance = Drives alignment with shareholders = Assists in retention |

Stock ownership guidelines | NEOs are required to hold stock equal to a multiple of their salary (5x for our CEO and 3x for our CFO). Currently our NEOs are compliant with our stock ownership guidelines. | = Further aligns the interests of the executives and stockholders = Assists in mitigating incentives to take excessive risks = Enhances stock ownership |

The table below highlights our executive compensation practices. The left column outlines the practices we believe are conducive to encouraging sound performance by our executives and support a strong governance culture. The right column describes those practices that we have chosen not to implement because we believe they do not further align with stockholders' long-term interests.

7

What we do: | What we don’t do: |

ü Ensure our NEOs meet robust stock ownership guidelines | û No guaranteed annual salary increases or annual bonuses, unless needed for recruitment purposes |

ü Ensure performance-based compensation comprises a significant portion of executive compensation | û No excise tax gross-ups for any executive severance agreements |

ü Provide for the ability to "clawback" awards granted under our 2015 stock incentive plan | û No hedging or short selling company shares permitted under our Insider Trading Policy |

ü Have double trigger change in control vesting on our long-term incentive grants | û No incentivizing short-term results to the detriment of long term goals and results |

ü Use an independent compensation consultant, who works directly for the Compensation Committee and has no conflicts of interest, to advise the Committee | û No compensation plans that encourage excessive risk taking |

ü Cap annual and long-term cash incentive payouts | û No repricing of underwater options without stockholder approval |

ü Offer limited perks | |

Pay Positioning and Peer Group

We do not numerically benchmark the total target compensation of our NEOs or any discrete element of NEO compensation (salary, annual bonus and long-term incentive) against a peer group. However, we do review peer group data and use it as a reference point to understand compensation trends for executives who serve at similar levels. The peer group is comprised of consumer/brand companies of similar size that have similar macroeconomic characteristics, competitive dynamics and growth trajectories. Effective for 2017, our peer group included the following companies:

Amplify Snack Brands, Inc. | The Hain Celestial Group, Inc. |

B&G Foods Inc. | J&J Snack Foods Corp. |

The Boston Beer Company Inc. | Lancaster Colony Corporation |

Calavo Growers Inc. | Prestige Brands, Holdings, Inc. |

Cal-Maine Foods, Inc. | Snyder's-Lance, Inc. |

Helen of Troy Limited | |

Pay Mix

We believe a majority of a senior executive's compensation should be performance-based and oriented toward long-term compensation.

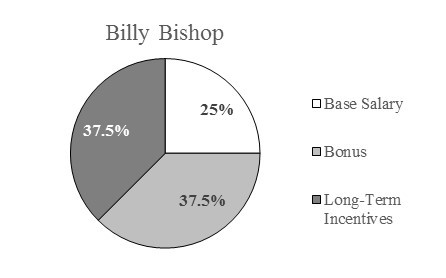

The mix of base salary, annual bonus and long-term incentives for Billy Bishop is presented below.

8

Pay for Performance

We utilize compensation to further align the incentives of our executives with those of our stockholders, as we believe it is important to link pay with performance and long-term stockholder value. As such, executives should be incentivized through their compensation to create value for our stockholders. Accordingly, the total compensation earned by our executives depends on the achievement of Company performance targets. Our executives earn larger amounts when the Company achieves superior performance and smaller amounts if we do not achieve target performance.

2017 CEO Compensation

Effective January 1, 2017, the Board appointed Mr. Bishop to be CEO. Upon the recommendation of the Compensation Committee, the Board approved the following changes to Mr. Bishop's compensation: (1) an increase in base salary to $600,000; (2) an increase to target annual incentive for 2017 to 150% of base salary; and (3) eligibility to receive an award pursuant to the Company's long-term equity incentive plan in 2017 with a target value equal to 150% of base salary.

Pres. & COO (2016) | CEO & Pres. (effective 1/1/2017) | |

Base Salary | $311,505 | $600,000 |

Target Annual Incentive (% of salary) | 67% | 150% |

Long-Term Incentive Award (% of salary) | 125% | 150% |

Base Salary

We provide base salary to our NEOs and other employees to compensate them for services rendered during the year. The base salaries of our NEOs are reviewed on an annual basis and adjustments are made to reflect performance-based factors, as well as competitive conditions. We do not apply specific formulas to determine increases. Generally, executive officers' base salaries are adjusted during the second quarter of each year.

The 2017 base salary for our CEO was set by the Board of Directors, upon the recommendations of the Compensation Committee, in executive session without the CEO present. The 2017 base salary for our CFO was set by our Compensation Committee based on the recommendation of our CEO. The base salary paid to Mr. Bishop represents an increase of approximately 93% over his base salary paid in 2016, due to Mr. Bishop assuming the role of Chief Executive Officer on January 1, 2017. Previously, Mr. Bishop had served as President and Chief Operating Officer. The base salary paid to Mr. Nathenson in 2017 represents an increase of approximately 3% over his base salary paid in 2016. Messrs. Bishop's and Nathenson's base salaries in 2017 were as follows:

9

Billy Bishop | $ | 600,000 | |

Mike Nathenson | $ | 348,100 | |

Annual Cash Incentive Compensation

Our annual cash incentive award is designed to reward our NEOs based on Company performance. Our Compensation Committee establishes a target award opportunity for each NEO on an annual basis, usually in the first quarter of each year. In February 2018, our Compensation Committee approved annual cash incentive awards payable under the fiscal 2017 annual incentive compensation plan.

Each NEO's target annual bonus is typically expressed as a percentage of base salary. For fiscal 2017, the NEOs' target bonus opportunities (as a percentage of each executive's base salary) were as follows: Mr. Bishop, 150% and Mr. Nathenson, 100%. The maximum bonus opportunity for each NEO was 200% of the target bonus opportunity.

For fiscal 2017, annual cash incentive awards were based on achievement of a combination of net sales and adjusted operating income margin goals. Adjusted operating income margin excludes the effects of litigation expenses. The net sales component composed 70% of the total award opportunity, and the adjusted operating income margin component composed 30% of the total award opportunity. The following table outlines the financial performance targets for 2017:

(dollars in millions) | Net Sales (70%) | Adjusted Operating Income Margin (30%) | |||||

Threshold Performance | $ | 1,203 | 22.1 | % | |||

Target Performance | $ | 1,267 | 24.6 | % | |||

Maximum Performance | $ | 1,393 | 29.5 | % | |||

The actual fiscal 2017 annual cash incentive awards for the NEOs were determined by multiplying their respective target annual bonus amounts by the sum of (1) the net sales component weighted achievement factor (70% multiplied by the net sales payout percentage) and (2) the adjusted operating income margin component weighted achievement factor (30% multiplied by the adjusted operating income margin component payout percentage). The financial performance component payout percentages were determined by calculating our achievement against the net sales and adjusted operating income margin targets based on the pre-established scales set forth in the following tables:

Threshold | Target | Maximum | ||||

Net Sales Performance Percentage of Target | 95% | 100% | 110% | |||

Net Sales Payout Percentage | 50% | 100% | 200% | |||

Adjusted Operating Income Margin Performance Percentage of Target | 90% | 100% | 120% | |||

Adjusted Operating Income Margin Payout Percentage | 50% | 100% | 200% | |||

For performance percentages between the specified threshold, target and maximum levels, the resulting payout percentage would have been adjusted on a linear basis.

Our fiscal 2017 net sales performance as a percentage of target net sales performance was 101%, which resulted in a payout percentage of 106% and a weighted achievement factor of 74%. Our fiscal 2017 adjusted

10

operating income performance as a percentage of target adjusted operating income performance was 97%, which resulted in a payout percentage of 87% and a weighted achievement factor of 26%. This resulted in a combined achievement factor of 100%.

The following table illustrates the calculation of the annual cash incentive awards payable to each of our NEOs under the fiscal 2017 annual incentive compensation plan based on the financial performance results. These awards are also reported under the Non-Equity Incentive Plan Compensation column of the Summary Compensation Table.

December 31, 2017 Ending Salary | Bonus Target Percentage | Bonus Target Amount | Combined Achievement Factor | Actual Bonus Paid | |||||||||||||

Billy Bishop | $ | 600,000 | 150% | $ | 900,000 | 100 | % | $ | 900,000 | ||||||||

Mike Nathenson | $ | 348,100 | 100% | $ | 348,100 | 100 | % | $ | 348,100 | ||||||||

Long-term Equity Incentive Compensation

We use equity awards to incentivize and reward our executive officers for long-term corporate performance based on the value of our common stock and, thereby, to align the interests of our executive officers with those of our stockholders.

We currently have two long-term equity incentive plans: the 2012 Stock Purchase and Option Plan of Blue Buffalo Pet Products, Inc., or the 2012 Plan, and the Blue Buffalo Pet Products, Inc. 2015 Omnibus Incentive Plan, or the 2015 Plan. Pursuant to the 2012 Plan we have provided long-term equity compensation to Mr. Nathenson in the form of stock options.

In 2016 we implemented a new long-term equity incentive program consisting of stock options and restricted stock units for senior leaders, which were granted under the 2015 Omnibus Plan (the "2015 Plan"). We believe stock options inspire high growth and long-term mentality, while restricted stock units aid in retention.

In March 2017, in connection with our annual review of our compensation for executives, upon the recommendation of our Compensation Committee the Board of Directors determined to grant to each of our NEOs (1) options and (2) restricted stock units ("RSUs") based on a multiple of the NEO’s base salary. Upon the recommendation of the Compensation Committee the Board of Directors determined these awards should be more heavily weighted towards options, with 67% of the total target value of the March 2017 equity award grants to our NEOs allocated to options and the remaining 33% allocated to RSUs. Both the options and the RSUs granted to our NEOs will vest in full on the third anniversary of the grant date, subject to continued employment through the applicable vesting date.

For fiscal 2017 our NEOs were granted options and RSUs on March 31, 2017 in the following amounts:

Stock Options | RSUs | ||||

Billy Bishop | 86,142 | 12,913 | |||

Mike Nathenson | 33,318 | 4,994 | |||

The values are set forth in the 2017 Grants of Plan-Based Awards Table.

11

Long-term Cash Incentive Compensation

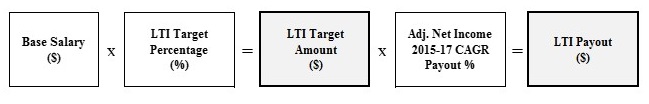

In 2015, the Compensation Committee approved a one-time long-term cash incentive program designed to reward our NEOs, along with other members of management, for long-term corporate performance based upon our adjusted net income growth in advance of the implementation of an annual long-term equity incentive program in 2016. Each NEO’s target long-term cash incentive award is expressed as a percentage of base salary as of January 1, 2015, and were as follows: Mr. Bishop, 125% and Mr. Nathenson, 125%.

The long-term cash incentive awards were granted on January 1, 2015, and vested after 3 years in varying degrees based upon our adjusted net income compounded annual growth rate, or CAGR, at December 31, 2017, relative to our adjusted net income for fiscal 2014. Adjusted net income excludes the effects of public offering preparation costs, litigation expenses, and an unusual, non-recurring or one time item (provision for legal settlement).

In granting the long-term cash incentive awards, the Compensation Committee evaluated the difficulty of achieving CAGR targets and considers both the historic performance of the Company, and the CAGR targets established for the upcoming fiscal year. This evaluation was conducted with a view to driving stockholder value, paying our NEOs competitively, and rewarding superior financial performance. The Compensation Committee's intent was to set targets that are challenging but reasonably achievable. Potential payouts ranged from 0% for threshold performance to a maximum of 150% for above-target performance.

The long-term cash incentive awards were paid to Mssrs. Bishop and Nathenson on March 1, 2018. The table below summarizes the award, targets, and the actual amounts paid.

January 1, 2015 Salary | LTI Target Percentage | LTI Target Amount | LTI Max Amount | LTI Payout Percentage | LTI Actual Paid Amount | ||||||||||||||||

Billy Bishop | $ | 272,950 | 125% | $ | 341,188 | $ | 511,782 | 150 | % | $ | 511,782 | ||||||||||

Mike Nathenson | $ | 321,360 | 125% | $ | 401,700 | $ | 602,550 | 150 | % | $ | 602,550 | ||||||||||

Options Granted in Previous Fiscal Years

For fiscal 2016 our NEOs were granted options and RSUs on April 1, 2016 in the following amounts:

Stock Options | RSUs | ||||

Billy Bishop | 33,677 | 5,085 | |||

Mike Nathenson | 36,207 | 5,467 | |||

There were no long-term equity incentive awards granted to our NEOs in fiscal 2014 and 2013 and in fiscal 2015 we granted the cash long-term incentive awards. In fiscal 2012, in connection with the commencement of his employment with us, Mr. Nathenson was granted incentive stock options under the 2012 Plan that were subject solely to time-based vesting restrictions, to vest in equal installments on the first five anniversaries of the grant

12

date. Because Mr. Nathenson has been employed continually with us through the applicable vesting dates, his options granted under the 2012 Plan fully vested in 2017.

In connection with the option grants, Mr. Nathenson became parties to the Investor Rights Agreement. See "Certain Relationships and Related-Party Transactions-Investor Rights Agreement." In addition, Mr. Nathenson also executed standard confidentiality, non-competition and proprietary rights agreements with the Company. These agreements subject Mr. Nathenson to restrictive covenants, including an indefinite covenant on confidentiality of information, and covenants related to non-competition, non-disparagement and non-solicitation of our employees, consultants and customers at all times during employment, and for one year after any termination of employment.

Any fully vested options will generally remain outstanding and exercisable for 90 days after termination of employment, although this period is extended to one year if the termination of employment is due to death, "permanent disability" or "retirement" (as such terms are defined in the incentive stock option agreement), and any fully vested options will immediately terminate if the named executive officer's employment is terminated by us for "cause" (as defined in the incentive stock option agreement). Any vested options that are not exercised within the applicable post-termination exercise window will terminate.

Compensation Risk Assessment

Our Compensation Committee, with assistance from Compensation Advisory Partners ("CAP"), reviewed our incentive compensation program to assess whether the program encourages risks that are reasonably likely to have a material adverse effect on Blue Buffalo. The Committee's review included an assessment of Blue Buffalo’s broad-based incentive compensation plans in addition to the compensation program for our NEOs. Several factors that mitigate compensation risk were identified, including award caps, multiple performance metrics, multi-year vesting/performance periods, clawback provisions and stock ownership guidelines. Further, final decisions regarding our executive compensation policies and practices, as well as individual NEO compensation outcomes, are made by the Compensation Committee. Based on these findings, the Compensation Committee has determined that our incentive compensation program does not create risks that are reasonably likely to have a material adverse effect on us.

Hedging and Pledging

Our Amended and Restated Insider Trading Policy prohibits our directors, officers and employees from engaging in certain transactions involving our securities, including hedging and publicly traded options. The Amended and Restated Insider Trading Policy also prohibits our directors, officers and employees from holding any of our securities in a margin account or pledging any of our securities as collateral for a loan, unless pre-cleared by the board in the case of directors and senior officers and a committee of senior officers in the case of all other employees. None of our directors or executive officers have pledged any of our securities as collateral for a loan.

Clawback

The Compensation Committee, in its sole discretion, has the ability to cancel awards granted under the 2015 Plan and/or require the repayment of any gains realized on the vesting or exercise of such awards if the executive violates any restrictive covenant or agreement by which the executive is bound or otherwise has engaged in or engages in any other detrimental activity, including fraud. In addition, all awards granted under the 2015 Plan are subject to any clawback policy adopted by the Board or the Compensation Committee from time to time or any clawback provisions required by applicable law. Further, if the executive receives any amount in excess of the amount that the executive should have otherwise received under the terms of any award granted under the 2015 Plan for any reason (including, without limitation, by reason of a financial restatement, mistake in calculations or other administrative error), the executive will be required to repay any such excess amount to the Company. We plan to adopt a formal clawback policy that complies with regulations mandated under the Dodd-Frank Act when the applicable rules become effective.

13

Role of the Compensation Committee, Compensation Consultant and Management

The Compensation Committee retains an independent compensation consultant, CAP, to provide information, analyses and advice regarding executive and director compensation. CAP reports directly to the Compensation Committee and provides only executive compensation consulting. In December 2017, the Compensation Committee determined that CAP is independent from management and CAP's work had not raised any conflict of interest.

At the discretion of the Committee, CAP has provided the following services:

• | Evaluated the competitive positioning of select executives' target total compensation relative to peers and survey data; |

• | Reviewed the peer group; |

• | Advised the Committee on performance measures, performance targets and payout leverage for the annual incentive plan; |

• | Advised the Committee on long-term incentive plan mix/vehicles, and the performance measures and payout leverage for the long-term cash incentive program; |

• | Assisted with the development of share ownership guidelines; |

• | Assisted the Compensation Committee with a risk assessment to determine whether any elements of our compensation programs encourage excessive risk taking; |

• | Assisted with the development of a director compensation program; and |

• | Assisted with the preparation of this CD&A. |

At the direction of the Committee, our Chief Executive Officer makes recommendations for base salary and annual cash incentive compensation for our Chief Financial Officer. Our Chief Executive Officer does not participate in the determination of his own compensation.

Stock Ownership Guidelines

In order to align our interests with those of stockholders, we have adopted stock ownership guidelines that are applicable to our named executive officers. Each NEO must maintain ownership of a sufficient number of shares of Common Stock having a market value equal to the applicable multiple of their annual base salary:

Stock Ownership as Multiple of Base Salary | |

CEO | 5x |

CFO | 3x |

Shares that count towards the guideline include:

• | Shares owned directly (regardless of how/when acquired); |

• | Shares owned indirectly (e.g., by a spouse, partnership, LLC, trust or other similar vehicle through which the Participant is deemed to be the beneficial owner of such shares of common stock); |

• | Vested restricted stock, restricted stock units or phantom stock; and |

• | Shares underlying "in-the-money" vested stock options under our incentive plans. |

14

Compliance with these ownership guidelines will be measured on the last trading day of each calendar year, using each NEO's base salary then in effect and the closing price of our common stock on that day. As of the measurement date, December 29, 2017, both NEOs were compliant with these ownership guidelines.

Employment Agreements for NEOs

We do not have formal employment agreements with either of our NEOs. However, we typically enter into offer letters with our executive officers. In connection with the commencement of his employment in 2012, we entered into an offer letter with Mr. Nathenson setting forth his initial compensation and benefits. In addition, under the terms of the offer letter, Mr. Nathenson is entitled to change in control benefits. The change in control benefits to which Mr. Nathenson is entitled under the terms of his offer letter are described under "Potential Payments Upon Termination or Change in Control."

401(k) Plan

We have established a tax-qualified Section 401(k) retirement savings plan, or the 401(k) Plan, for employees, including our NEOs, who satisfy certain eligibility requirements. The 401(k) Plan permits employee contributions up to statutory limits, of which we provide matching contributions of up to 4% of the employee's eligible compensation contributed to the 401(k) Plan, at a rate of 100% on the first 3% of the employee's eligible compensation contributed to the 401(k) Plan and 50% on the next 2% of the employee’s eligible compensation contributed to the 401(k) Plan. Employees are 100% vested in matching Company contributions when such contributions are made. We may make non-elective contributions to employees. Employees become 20% vested in non-elective contributions per year of service up to 100% vested after five years of service.

Other Benefits and Perquisites

We offer minimal other benefits and perquisites to our NEOs. For fiscal year 2017, both of our NEOs were provided company-paid life insurance premiums and an auto allowance. For additional information regarding other benefits and perquisites, refer to the "Summary Compensation Table". The Compensation Committee in its discretion may revise, amend or add to such NEOs benefits and perquisites if it deems it advisable. We believe these benefits and perquisites are currently in line with those provided by comparable companies.

Tax and Accounting Considerations

Generally, to the extent that a recipient recognizes ordinary income, the company will be entitled to a corresponding deduction provided that, among other things, the income meets the test of reasonableness, is an ordinary and necessary business expense, is not an "excess parachute payment" within the meaning of Code Section 280G and, together with other compensation paid certain "covered employees," is below the $1,000,000 deduction limitation imposed by IRC Section 162(m). Generally a "covered employee" is an executive who is or was a named executive officer beginning with the named executive officers listed in this proxy statement and future proxy statements. Compensation paid to a covered employee whether performance-based or not, will not be deductible to the extent such amounts exceed $1 million in any one year, unless grandfathered under the Tax Cut and Jobs Act of 2017 (the Tax Act).

On December 22, 2017, the Congress enacted tax legislation commonly referred to as the Tax Cuts and Jobs Act. Among other things, the Tax Act substantially amended IRC Section 162(m) of the Internal Revenue Code. IRC 162(m) imposes a $1 million cap on the company's tax deduction on compensation paid to its highest five paid executives. Prior to 2018, qualified performance-based compensation meeting the process requirements of Section 162(m) was exempt from the $1 million cap. The Tax Act repealed the qualified performance-based compensation exception under Section 162(m) effective for tax years beginning on or after January 1, 2018 and expanded the group of covered employees potentially subject to the $1 million deductibility cap. The Tax Act grandfathered arrangements entered into on or before November 2, 2017.

15

As a result of the Tax Act changes to Section 162(m), we expect that equity awards or other compensation, whether or not performance based, granted or provided under arrangements entered into or modified after November 2, 2017 to any person who is or was one of the Company's five highest paid executives will not be deductible to the extent such amounts exceed $1 million in any one year.

Compensation Actions in Connection with Proposed Merger

Treatment of Equity Awards under Merger Agreement

Under the Merger Agreement we entered into with GMI, at the effective time of the proposed Merger, each stock option of the Company, including the stock options held by our NEOs, whether vested or unvested, that is outstanding immediately prior to the Effective Time of the proposed Merger will automatically be canceled and will only entitle the holder of such stock option to receive, without interest, an amount in cash equal to the product of (i) the total number of shares of Common Stock subject to the stock option multiplied by (ii) the excess, if any, of the merger consideration ($40.00) over the exercise price of such stock option, less applicable tax withholding. At the effective time of the proposed Merger, each restricted stock unit of the Company, including the restricted stock units held by our NEOs, outstanding immediately prior to the effective time of the proposed Merger will, whether vested or unvested, automatically be canceled and will only entitle the holder thereof to receive, without interest, an amount in cash equal to the product of (i) the total number of shares of common stock subject to the restricted stock unit multiplied by (ii) the merger consideration ($40.00), less applicable tax withholding. Immediately prior to the effective time of the proposed Merger, the holding restrictions applicable to each share of restricted stock of the Company outstanding immediately prior to the effective time of the Merger will automatically expire and each such share of restricted stock will be converted into the right to receive the merger consideration.

2018 Long-Term Incentive Awards

Under the Merger Agreement, we agreed to make our long-term incentive awards to our NEOs and others eligible to receive long-term incentive awards in 2018 in the form of cash rather than equity. Accordingly, we granted cash long-term incentive awards to Messrs. Bishop and Nathenson in the target amounts of $975,000 and $357,499, respectively. The actual amounts payable will be determined based on our achievement of net revenue (70% of the award) and adjusted operating income (30% of the award) targets and range from 50% for threshold performance to 100% for target performance to a maximum of 200% for above-target performance. Adjusted operating income excludes the effects of litigation expenses. These awards will become payable on the third anniversary of the date of grant subject to the NEO's continued employment through such date and our net revenue and adjusted operating income performance or, in the event that the NEO is terminated without cause (as defined in the 2015 Plan) prior to the first anniversary following a change in control, the NEO will be entitled to receive a pro-rata portion of his long-term incentive award, subject to our then-current net revenue and adjusted operating income performance.

16

DIRECTOR COMPENSATION

To ensure the compensation we offer is sufficient to recruit and retain highly qualified non-employee directors, our Compensation Committee, working with our independent compensation consultant, established a non-employee director compensation program that we believe reinforces our practice of encouraging stock ownership by our non-employee directors. In setting these competitive pay levels we do not numerically benchmark the total compensation of our directors or any discrete element of director compensation against a peer group. We do, however, review peer group data and use it as a reference point to understand director compensation trends. The peer group is comprised of the same companies that we use for NEO compensation and is described under the "Compensation Discussion and Analysis - Pay Positioning and Peer Group."

Our Chairman Bill Bishop receives an annual retainer of $180,000, and each of our non-employee directors receives an annual retainer of $60,000, paid on a quarterly basis in arrears. In addition, as our Chairman, Bill Bishop also receives a grant of our common stock valued at approximately $220,000 and each of our non-employee directors receive a grant of our common stock valued at approximately $85,000. Common stock is fully vested at grant, with a three year holding restriction. Our Audit Committee Chairman and Audit Committee members also receive an additional retainer of $15,000 and $7,500, respectively, paid on a quarterly basis in arrears. Our Compensation Committee Chairman and Compensation Committee members also receive an additional retainer of $10,000 and $5,000, respectively, paid on a quarterly basis in arrears.

All of our directors are reimbursed for their reasonable out-of-pocket expenses related to their service as a member of the Board of Directors or one of its committees.

Because of the proposed Merger, in 2018, we paid our directors an additional cash retainer in an amount equal to their annual equity awards rather than granting them equity awards in 2018.

The following table sets forth information concerning the compensation of our directors (other than directors who are named executive officers) for the year ended December 31, 2017.

FISCAL 2017 DIRECTOR COMPENSATION TABLE

Name | Fees earned or paid in cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($) (3) | Total ($) | ||||||||

Bill Bishop | $ | 180,000 | $ | 219,995 | $ | 5,821 | $ | 405,816 | ||||

Philippe Amouyal | $ | 65,000 | $ | 84,985 | $ | — | $ | 149,985 | ||||

Evren Bilimer | $ | 70,000 | $ | 84,985 | $ | — | $ | 154,985 | ||||

Raymond Debbane | $ | 60,000 | $ | 84,985 | $ | — | $ | 144,985 | ||||

Michael A. Eck | $ | 75,000 | $ | 84,985 | $ | — | $ | 159,985 | ||||

Frances Frei | $ | 72,500 | $ | 84,985 | $ | — | $ | 157,485 | ||||

Aflalo Guimaraes | $ | 60,000 | $ | 84,985 | $ | — | $ | 144,985 | ||||

Amy Schulman | $ | 67,500 | $ | 84,985 | $ | — | $ | 152,485 | ||||

(1) | This column reports the amount of cash compensation earned in 2017 through annual cash retainers. |

(2) | On March 31, 2017, the Company granted shares of fully vested common stock to each of its directors with a grant date fair value of $23.00 per share. Amounts shown represent the aggregate grant date fair value of such awards computed in accordance with FASB ASC Topic 718 and based solely on the closing price of our common stock on the date of grant. The table below forth the number of fully vested common shares granted by director. |

17

Name | Common stock granted | |

Bill Bishop | 9,565 | |

Philippe Amouyal | 3,695 | |

Evren Bilimer | 3,695 | |

Raymond Debbane | 3,695 | |

Michael A. Eck | 3,695 | |

Frances Frei | 3,695 | |

Aflalo Guimaraes | 3,695 | |

Amy Schulman | 3,695 | |

(3) | This column reports the amount of all other compensation earned in 2017. The amount reported reflects Company-paid medical, dental, vision, and life insurance premiums. |

18

COMPENSATION COMMITTEE REPORT

This report of the Compensation Committee is required by the SEC and, in accordance with the SEC's rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this Annual Report on Form 10K/A into any filing under the Securities Act or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed "soliciting material" or "filed" under either the Securities Act or the Exchange Act.

Our Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and based on such review and discussions, the Compensation Committee recommended to our board of directors that the Compensation Discussion and Analysis be included in this Annual Report on Form 10K/A for the fiscal year ended December 31, 2017.

Submitted by the Compensation Committee

Evren Bilimer, Chair

Frances Frei

Philippe Amouyal

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee has at any time been one of our executive officers or employees. None of our executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

We are parties to certain transactions with Invus L.P. our controlling shareholder (our "Sponsor") and certain of our directors described in the section of this Annual Report on Form 10K/A entitled "Certain Relationships and Related Party Transactions."

19

SUMMARY COMPENSATION TABLE

The following table sets forth information regarding compensation awarded to, earned by, or paid to our NEOs during the years ended December 31, 2017, 2016 and 2015.

Name and principal position | Year | Salary ($) (2) | Stock Awards ($) (3) | Option Awards ($) (3) | Non-equity incentive plan compensation ($) (4) | All other compensation ($) (5) | Total ($) | |||||||||||||||||||

Billy Bishop (1) | 2017 | $ | 600,000 | $ | 296,999 | $ | 602,994 | $ | 1,411,782 | $ | 27,230 | $ | 2,939,005 | |||||||||||||

Chief Executive Officer and President | 2016 | $ | 311,505 | $ | 130,044 | $ | 264,029 | $ | 234,457 | $ | 26,770 | $ | 966,805 | |||||||||||||

2015 | $ | 293,421 | $ | — | $ | — | $ | 187,083 | $ | 26,770 | $ | 507,274 | ||||||||||||||

Mike Nathenson | 2017 | $ | 348,100 | $ | 114,862 | $ | 233,226 | $ | 950,650 | $ | 28,224 | $ | 1,675,062 | |||||||||||||

Chief Financial Officer | 2016 | $ | 336,720 | $ | 139,816 | $ | 283,869 | $ | 252,076 | $ | 27,686 | $ | 1,040,167 | |||||||||||||

2015 | $ | 327,866 | $ | — | $ | — | $ | 205,646 | $ | 27,394 | $ | 560,906 | ||||||||||||||

(1) | Mr. Bishop served as President and Chief Operating Officer in 2016 and 2015. Mr. Bishop assumed the role of Chief Executive Officer on January 1, 2017. |

(2) | Amounts reflect actual base salary payments made to the NEOs. |

(3) | Represents the aggregate grant date fair value of stock and option awards made for each year computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation - Stock Compensation ("Topic 718"). The assumptions used in calculating the Option Awards and Stock Awards amounts are included in Note 11 - Stock-Based Compensation to the Company's consolidated financial statements included in the Company's 2017 10-K. The Stock Awards, which represent restricted stock units, and the Option Awards are both subject to a three-year cliff vesting. |

(4) | Reflects amounts earned under our fiscal 2017, 2016 and 2015 annual incentive compensation plans, respectively. In 2017, also reflects amounts earned under our long-term cash incentive awards granted in 2015. |

(5) | Amounts shown as "All other compensation" for 2017 consist of the following: |

Name | 401(k) Company Match | Auto Allowance | Other | Total | ||||||||||||

Billy Bishop | $ | 10,600 | $ | 15,000 | $ | 1,630 | $ | 27,230 | ||||||||

Mike Nathenson | $ | 10,600 | $ | 15,000 | $ | 2,624 | $ | 28,224 | ||||||||

Amounts in the "Other" column for Mssrs. Bishop and Nathenson relate to company-paid life insurance premiums ($1,170 and $1,794, respectively), company-paid short-term disability premiums and, for Mr. Nathenson, reimbursement for pet food purchases.

20

GRANTS OF PLAN-BASED AWARDS IN FISCAL YEAR 2017

The following table provides information concerning each grant of plan-based awards made to a NEO in year ended December 31, 2017. The threshold, target, and maximum columns reflect the range of estimated payouts under these plans for year ended December 31, 2017.

Estimated Possible Payouts Under Non-Equity Incentive Plan Awards (1) | All Other Stock Awards: Number of Shares of Stock or Units (#) | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($) (2) | ||||||||||||||||||||||||||

Name | Grant Date | Award Type | Threshold ($) | Target ($) | Maximum ($) | |||||||||||||||||||||||||

Billy Bishop | Annual Cash Incentive | $ | 135,000 | $ | 900,000 | $ | 1,800,000 | |||||||||||||||||||||||

3/31/2017 | RSU Award | 12,913 | $ | 296,999 | ||||||||||||||||||||||||||

3/31/2017 | Option Award | 86,142 | $ | 23.00 | $ | 602,994 | ||||||||||||||||||||||||

Mike Nathenson | Annual Cash Incentive | $ | 52,515 | $ | 348,100 | $ | 696,200 | |||||||||||||||||||||||

3/31/2017 | RSU Award | 4,994 | $ | 114,862 | ||||||||||||||||||||||||||

3/31/2017 | Option Award | 33,318 | $ | 23.00 | $ | 233,226 | ||||||||||||||||||||||||

1) The amounts shown under the "Threshold" column represent an assumption that the Company achieves a percentage of target adjusted operating income margin that is equal to 90% and a percentage of its target net sales that is less than 95%. The amounts shown under the "Target" column represent 100% of the target cash incentive compensation, assuming target-level performance is achieved under the financial performance measures. The amounts shown under the "Maximum" column represent 200% of the target cash incentive compensation, assuming maximum-level performance is achieved under the financial performance measures. The amounts paid are described in the "Non-Equity Incentive Plan Compensation" column of the Summary Compensation Table.

2) Represents the grant date fair value of the awards computed in accordance with Topic 718, using the assumptions discussed in Note 11 - Stock-Based Compensation to the Company's consolidated financial statements included in the 2017 10-K.

21

OUTSTANDING EQUITY AWARDS AT 2017 FISCAL YEAR-END

The following table shows outstanding equity awards at the end of 2017. The material terms of the option grants and RSUs are described in the footnotes to the table below.

Option Awards | Stock Awards | ||||||||||||||||||||

Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (1) | Market Value of Shares or Units of Stock That Have Not Vested (2) | ||||||||||||||

Billy Bishop | 3/31/2017 | (a) | — | 86,142 | $ | 23.00 | 3/31/2027 | — | — | ||||||||||||

3/31/2017 | 12,913 | $ | 423,417 | ||||||||||||||||||

4/1/2016 | (b) | — | 33,677 | $ | 25.57 | 4/1/2026 | — | — | |||||||||||||

4/1/2016 | 5,085 | $ | 166,737 | ||||||||||||||||||

Mike Nathenson | 3/31/2017 | (a) | — | 33,318 | $ | 23.00 | 3/31/2027 | — | — | ||||||||||||

3/31/2017 | 4,994 | $ | 163,753 | ||||||||||||||||||

4/1/2016 | (b) | — | 36,207 | $ | 25.57 | 4/1/2026 | — | — | |||||||||||||

4/1/2016 | 5,467 | $ | 179,263 | ||||||||||||||||||

12/18/2012 | (c) | 552,470 | — | $ | 5.60 | 12/18/2022 | — | — | |||||||||||||

(1) The RSUs granted in fiscal 2017 have a three-year cliff vesting and will vest on March 31, 2020, subject to the NEO's continued employment through such date. The RSUs granted in fiscal 2016 have a three-year cliff vesting and will vest on April 1, 2019, subject to the NEO's continued employment through such date.

(2) Amounts reported are based on the closing pricing of our common stock on the NASDAQ of $32.79 per share on December 29, 2017, multiplied by the number of shares of our common stock underlying the RSUs.

(a) The options granted in fiscal 2017 have a three-year cliff vesting and will vest on March 31, 2020, subject to the NEO's continued employment through such date.

(b) The options granted in fiscal 2016 have a three-year cliff vesting and will vest on April 1, 2019, subject to the NEO's continued employment through such date.

(c) Options reported relate to the awards listed in the table below. The time-based stock options granted during fiscal 2012 vest in five equal, annual installments on each anniversary of the date of the grant.

22

Name | Grant Date | Time-Based Options Granted | Option Exercise Price ($) | ||||||

Mike Nathenson | 12/18/2012 | 803,300 | $ | 5.60 | |||||

23

OPTION EXERCISES AND STOCK VESTED IN FISCAL YEAR 2017

The following table provides information concerning our NEOs' exercises of stock options during the year ended December 31, 2017. The table reports, on an aggregate basis, the number of securities acquired upon exercise of stock options, and the dollar value realized upon exercise of stock options.

Option Awards | |||||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) (a) | |||||

Billy Bishop | — | $ | — | ||||

Mike Nathenson | 187,072 | $ | 3,666,767 | ||||

a) Aggregate dollar amounts was calculated by multiplying the number of shares acquired by the difference between the market price of the underlying securities at the time of exercise and the exercise price of the stock options.

2017 PENSION BENEFITS

We have no pension benefits for our executive officers.

2017 NON-QUALIFIED DEFERRED COMPENSATION