Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Avangrid, Inc. | d576159dex991.htm |

| 8-K - 8-K - Avangrid, Inc. | d576159d8k.htm |

Results Presentation /1Q2018 Avangrid, “utility of the future” Exhibit 99.2 |

2 Avangrid, “utility of the future” Legal Notice Investors@AVANGRID.com FORWARD LOOKING STATEMENTS Certain statements in this presentation may relate to our future business and financial performance and future events or developments involving us and our subsidiaries that are not purely historical and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “should,” “would,” “could,” “can,” “expect(s,)” “believe(s),” “anticipate(s),” “intend(s),” “plan(s),” “estimate(s),” “project(s),”“assume(s),” “guide(s),” “target(s),” “forecast(s),” “are (is) confident that” and “seek(s)” or the negative of such terms or other variations on such terms or comparable terminology. Such forward looking statements include, but are not limited to, statements about our plans, objectives and intentions, outlooks or expectations for earnings, revenues, expenses or other future financial or business performance, strategies or expectations, or the impact of legal or regulatory matters on our business, results of operations or financial condition. Such statements are based upon the current reasonable beliefs, expectations and assumptions of our management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2017, which is on file with the Securities and Exchange Commission (SEC) and available on our investor relations website at www.Avangrid.com and on the SEC website at www.sec.gov. Additional information will also be set forth in subsequent filings with the SEC. You should consider these factors carefully in evaluating for-ward looking statements. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this presentation whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. About AVANGRID About AVANGRID: AVANGRID, Inc. (NYSE: AGR) is a diversified energy and utility company with approximately $32 billion in assets and operations in 27 states. The Company operates regulated utilities and electricity generation through two primary lines of business, Avangrid Networks and Avangrid Renewables. Avangrid Networks includes eight electric and natural gas utilities, serving 3.2 million customers in New York and New England. Avangrid Renewables owns and operates 7.1 gigawatts of electricity capacity, primarily through wind power, with presence in 22 states across the United States. AVANGRID employs approximately 6,600 people. For more information, visit www.avangrid.com.

|

3 Avangrid, “utility of the future” Legal Notice Use of Non-GAAP Financial Measures To supplement our consolidated financial statements presented in accordance with U.S. GAAP, AVANGRID considers certain non-GAAP financial measures that are not prepared in accordance with U.S. GAAP, including adjusted net income, adjusted EPS, adjusted gross margin and adjusted EBITDA. The non-GAAP financial measures we use are specific to AVANGRID and the non-GAAP financial measures of other companies may not be calculated in the same manner. We use these non-GAAP financial measures, in addition to U.S. GAAP measures, to establish operating budgets and operational goals to manage and monitor our business, evaluate our operating and financial performance and to compare such performance to prior periods and to the performance of our competitors. We believe that presenting such non-GAAP financial measures is useful because such measures can be used to analyze and compare profitability between companies and industries because it eliminates the impact of financing and certain non-cash charges as well as allow for an evaluation of AVANGRID with a focus on the performance of its core operations. In addition, we present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance. We provide adjusted net income, which is adjusted to reflect the effect of mark-to-market changes in the fair value of derivative instruments used by AVANGRID to economically hedge market price fluctuations in related underlying physical transactions for the purchase and sale of electricity, adjustments for the non-core Gas Storage business, and the impairment of certain investments and excludes the sale of certain equity investments. We define adjusted EBITDA as net income attributable to AVANGRID, adding back income tax expense, depreciation, amortization, impairment of non-current assets and interest expense, net of capitalization, and then subtracting other income and earnings from equity method investments. We also define adjusted gross margin as adjusted EBITDA adding back operations and maintenance and taxes other than income taxes and then subtracting transmission wheeling. The most directly comparable U.S. GAAP measure to adjusted EBITDA and adjusted gross margin is net income. We believe that presenting these non-GAAP financial measures is useful in understanding and evaluating actual and projected financial performance and contribution of AVANGRID core lines of business and to more fully compare and explain our results. The most directly comparable U.S. GAAP measure to adjusted net income is net income. We also provide adjusted EPS, which is adjusted net income converted to an earnings per share amount. We provide adjusted net income and adjusted earnings per share, which are adjusted to reflect the effect of mark-to-market changes in the fair value of derivative instruments used by AVANGRID to economically hedge market price fluctuations in related underlying physical transactions for the purchase and sale of electricity, adjustments for the non-core Gas Storage business including certain losses related to its sale, and restructuring charges primarily associated with reorganizing to better align our people resources with business demands and priorities as part of the Forward 2020+ program. We define adjusted EBITDA as net income attributable to AVANGRID, adding back income tax expense, depreciation, amortization, impairment of non-current assets and interest expense, net of capitalization, and then subtracting other income and earnings from equity method investments. We also define adjusted gross margin as adjusted EBITDA adding back operations and maintenance and taxes other than income taxes and then subtracting transmission wheeling. The most directly comparable U.S. GAAP measure to adjusted EBITDA and adjusted gross margin is net income. We believe that presenting these non-GAAP financial measures is useful in understanding and evaluating actual and projected financial performance and contribution of AVANGRID core lines of business and to more fully compare and explain our results. The most directly comparable U.S. GAAP measure to adjusted net income is net income. We also provide adjusted EPS, which is adjusted net income converted to an earnings per share amount. |

4 Avangrid, “utility of the future” 1Q 2018 Highlights James Torgerson |

5 Avangrid, “utility of the future” Highlights (1) See Appendix for reconciliation of adjusted net income and adjusted EPS to net income and EPS.

1Q ’18 Adjusted Net Income $243M, $0.78/share (1) 1Q ’18 Net Income $244M, $0.79/share • Completed the sale of the Gas Trading business on March 1

• Definitive agreement reached for sale of the Gas Storage business, expected

closing in May • ~497 MW onshore wind & solar

under construction •

Central Maine Power’s NECEC transmission project selected in MA RFP

• Vineyard Wind is first offshore bid in MA RFP to file Construction and

Operations Plan (COP) & commence environmental

assessment process • Submitted bid in CT RFP for 190 MW of offshore wind IMPLEMENTING OUR STRATEGIC PLAN EXECUTING ON NEW OPPORTUNITIES |

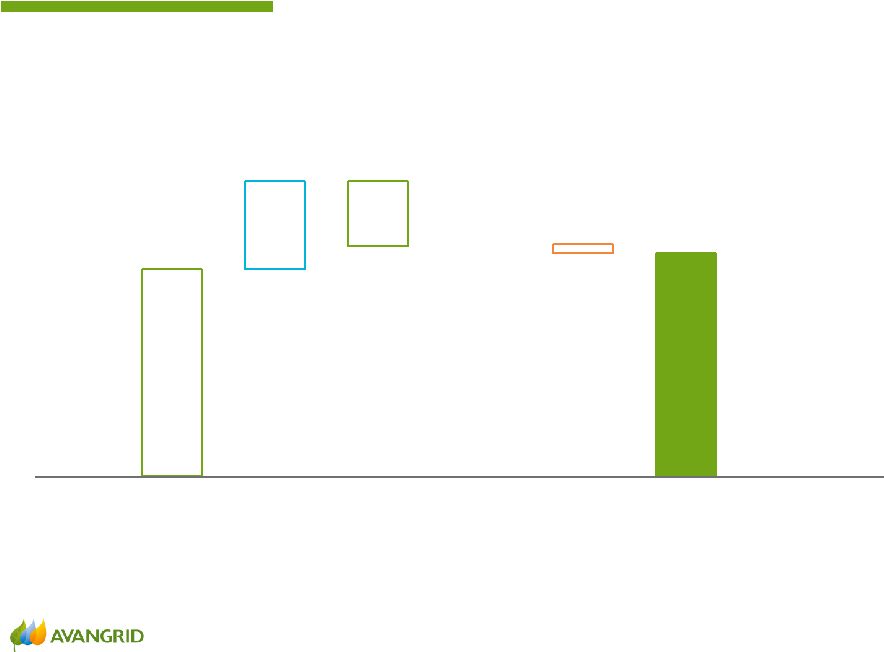

6 Avangrid, “utility of the future” 1Q ’17 1Q ’18 Earnings Results – 1Q ’18 vs. 1Q ’17 & Reconciliation 1Q ’18 Net income reflects Gas Storage, two months of Gas Trading results & MTM Amounts may not add due to rounding. Reconciliation of 1Q ’18 EPS to 1Q’18 Adjusted EPS (1) 1Q ’18 EPS $0.79 Gas Storage & Trading Results -$0.04 Gas Storage & Trading Loss from Held for Sale Measurement +$0.05 Renewables MtM -$0.01 1Q ’18 Adjusted EPS $0.78 1Q ’18 vs. 1Q ’17 EPS ($/share) (1) See Appendix for reconciliation of adjusted EPS to EPS. $0.77 $0.79 +2% |

7 Avangrid, “utility of the future” Key drivers include: • Multi-year plans in NY (2) & CT • Ongoing implementation of best practices & cost management • Positive operating performance at Renewables with improved wind resource & ~590 MW new wind &

solar projects increasing production & PTCs (3) o Renewables operating performance was strong (Adjusted Gross Margin up 11%),

although positive discrete tax adjustments in 1Q ’17 reduced the year-over-year comparison

1Q ’18 vs. 1Q ’17 EPS Adjusted EPS ($/share) (1) Adjusted Earnings Results 1Q ’18 Earnings performance positions us well to achieve our annual guidance target (1) See Appendix for reconciliation of adjusted EPS to EPS & adjusted gross margin to net income.

(2) 1Q ’17 included sharing charge for Rate Year 1 in NY of $10M pre-tax; Rate Year 2 sharing charge expected to be determined in 2Q

’18. (3)

Renewables net income & adjusted net income includes ~$0.01 related to the

implementation of tax reform. Amounts may not add due to

rounding. 1Q ’17 vs. 1Q ’18 Impacts

1Q ’17 Net Income $0.73 Networks +$0.09 Renewables -$0.04 Corporate $0.00 1Q ’18 Adjusted Net Income $0.78 +7% $0.73 $0.78 1Q '17 1Q '18 |

8 Avangrid, “utility of the future” • March Staff recommendation - net benefits to be deferred & passed back to customers through current rate case or sur-credit effective October 1, ’18 • Company proposal to offset storm costs & AMI revenue requirements Networks Regulatory Updates 2017 Tax Cut & Jobs Act Reviewing impacts & methodology for ensuring ratepayer benefit NY ME • Proposing Tax Act savings to offset recovery of October ’17 major storm costs in July 1, ’18

annual true up CT/MA • New England Transmission Owner formula rate will automatically capture benefits (UI &

CMP); FERC opened proceedings & is addressing comments

• Proceedings in process FERC Other NY • AMI discussions ongoing – anticipate approval later in ’18; Earnings Adjustment Mechanism discussions impacted by ongoing storm activity, AMI discussions, etc. • Planned rate filings for CNG & BGC in 2Q ’18 • ALJ recommended no change in the ROE for Complaint IV – existing ROE not shown to be unjust & unreasonable (1) • No progress on Complaint I remand or Complaint II/III CT/MA FERC (1) 10.57% Base ROE; 11.74% maximum. |

9 Avangrid, “utility of the future” NECEC Key Permits/Approvals/Reviews: MA PUC Approval of Contracts ME PUC Certificate of Public Convenience and Necessity Maine DEP Approval Presidential Permit ISO-NE System Impact Study Army Corps of Engineers Environmental Assessment FERC Approval of Tariff • $950M investment, excluding AFUDC • Fixed, levelized price for 20 years • Construction ’19-’22 • Ongoing contract negotiations with Electric Distribution Companies in MA o Goal of filing with the MA DPU shortly; approval expected in ’19 • Remaining Permits/Approvals all filed in ’17 o Expect to receive all ME approvals by end of ’18 & other approvals by end of ’19 |

10 Avangrid, “utility of the future” • 1,600 MW required by legislation • Current RFP for up to 800 MW (Selection Expected in May) • Vineyard Wind bid 400 MW & 800 MW o Expect COD by ’21 o Only company to provide direct benefits to Cape Cod o O&M center will be located on Martha’s Vineyard o First company to apply for COP & to start its environmental assessment process Focus on Clean Energy – Offshore Wind Offshore wind prospects gaining considerable momentum CURRENT OPPORTUNITIES • Current RFP for renewable energy sources • Vineyard Wind bid 190 MW offshore wind (Selection To Be Announced June ’18) Vineyard Wind, MA (~3 GW) 50/50 Partnership with Copenhagen Infrastructure Partners (CIP) Most Mature Offshore Wind Project in the MA RFP Kitty Hawk, NC (~2.5 GW) 100% AVANGRID Ownership AVANGRID OFFSHORE LEASES NY MA CT NJ NC RI CT MA Additional Offshore Opportunities Upcoming in NY, RI, MA & NJ |

11 Avangrid, “utility of the future” Focus on Clean Energy – Offshore Wind AVANGRID is well-positioned for leadership in U.S. offshore market Significant, Proven U.S. Onshore Renewables & Transmission Experience • Renewables has 3 rd largest installed capacity in U.S. • Recent, successful completion of >$1B Transmission project on-time & on-budget Significant, Proven Global Offshore Experience • AVANGRID affiliates &

Vineyard Wind partner CIP have significant expertise with

offshore wind o

Deep technical knowledge & engineering experience

o Well developed supply chain & relationships o Experience managing offshore O&M Strong financing capabilities • AVANGRID’s robust balance sheet & CIP’s experience investing in & financing offshore wind Local Knowledge Global Teams |

12 Avangrid, “utility of the future” Executing Opportunities to Achieve our Strategic Goals Exiting Gas Trading & Storage Businesses March 1, ’18: Completed Sale of Gas Trading Business

February 16, ’18: Definitive agreement

reached to sell Gas Storage Business (Enstor Gas, LLC) to Amphora

Gas Storage USA, LLC, an affiliate of ArcLight Capital Partners, LLC; The

transaction is expected to be completed May ’18 Removes volatility related to

commodities & trading, eliminates ongoing net losses from

the business Entered into Contract for 100 MW Klamath Peaking Plant Renewables entered into a contract with Portland General Electric for 100 MW from its

Klamath Peaking Plant; Contract term is 5 years, beginning in 2019 Moving Forward with Targeting of Transmission in New Regions Networks registered to submit Transmission bids into RFPs in the MISO

Continuing to Progress on Execution of Renewables Growth Plans

Highly Likely projects increased by ~100

MW; Secured plus Highly Likely ~1,746 MW |

13 Avangrid, “utility of the future” Highlights (1) See Appendix for reconciliation of adjusted EPS to EPS. Long Term Outlook is on Target to Meet Expectations • New wind projects in operation & multi-year rate plans for NYSEG, RGE, UI & SCG

• Continue to employ Best Practices & achieve cost mitigation • Implementing tax reform in all regulatory jurisdictions • NECEC transmission project selected in MA RFP • Positioned for growth in Offshore wind, with lease ownership & multiple New England

region offshore wind targets & RFPs

• Gas Trading - completed March 1; Gas Storage expected to close in May SOLID EARNINGS PERFORMANCE IN 1Q ’18 WELL-POSITIONED FOR LONG-TERM GROWTH OUTSIDE OF PLAN COMPLETED SALE OF NON-CORE BUSINESS Affirming ’18 EPS Outlook: EPS $2.16-$2.46 & Adjusted EPS (1) $2.22-$2.50 ’18 Guidance is based on Adjusted EPS |

14 1Q Financial Results Richard Nicholas |

15 Avangrid, “utility of the future” 1Q '17 Networks Renewables Corporate Gas 1Q '18 Results by Business $0.77 $0.79 $0.09 ($0.07) $0.00 ($0.01) 1Q ’18 Earnings are on track with our annual expectations EPS Amounts may not add due to rounding. Results include Gas Storage & two months of the Gas Trading businesses |

16 Avangrid, “utility of the future” 1Q '17 Networks Renewables Corporate 1Q '18 Results by Business $0.73 $0.78 $0.09 ($0.04) $0.00 Adjusted EPS (1) improves with new rate years & ~590 MW of new wind & solar COD in ’17 Adjusted EPS (1) (1) See Appendix for reconciliation of adjusted EPS to EPS. Amounts may not add due to rounding. Positive operating performance in Networks & Renewables, although year-over-year Renewables variance was impacted by 1Q ’17 positive discrete tax adjustments |

17 Avangrid, “utility of the future” 1Q ’18 Adjusted Net Income $201M (1) 1Q ’18 vs. 1Q ’17 +$29M (+$0.09/share) Distribution • NYSEG & RGE – Year 2 of Rate Plans • UI – Year 2 of Rate Plan • SCG – Year 1 of Rate Plan • Implementation of Best Practices & Cost Management • Year-over-year sharing impacts (2) +$0.07 Transmission • Increase in rate base +$0.01 Other +$0.01 Results by Business (1) See Appendix for reconciliation of adjusted net income to net income and adjusted EPS to EPS.

(2) 1Q ’17 included sharing charge for Rate Year 1 in NY of $10M pre-tax; Rate Year 2 sharing charge expected to be determined in 2Q

’18. (3)

Renewables net income & adjusted net income includes ~$0.01 related to the

implementation of tax reform. (4)

Primarily includes amounts related to cumulative adjustments to state unitary taxes

taken in 1Q ’17. Amounts may not add due to rounding.

1Q ’18 Net income $200M

1Q ’18 Adjusted Net Income $47M (1)(3) 1Q ’18 vs. 1Q ’17 -$13M (-$0.04/share) New Wind & Solar - including PTCs & Depreciation +$0.06 Existing Wind & Solar – Sales +$0.01 Existing Wind - PTCs rolling off -$0.02 Existing Wind - RECs -$0.02 Tax & Other (4) -$0.07 1Q ’18 Net income $50M 1Q ’18 Net income ($5M) 1Q ’18 Adjusted Net Income ($5M) (1) 1Q ’18 vs. 1Q ’17 - $1M ($0.00/share) Networks Renewables Corporate +17% -21% |

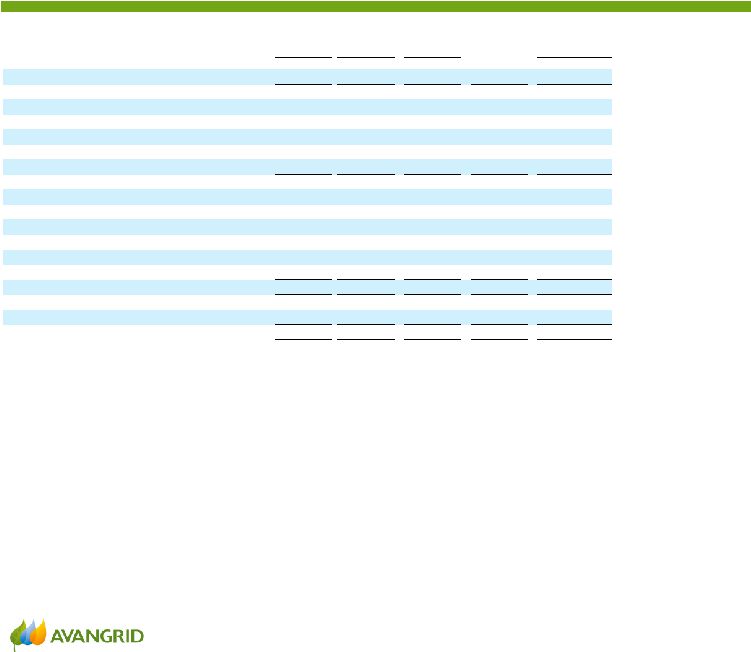

18 Avangrid, “utility of the future” Avangrid Renewables Metrics Year-over-year impacts largely reflect the addition of new projects in ’17 Load Factor (1) (1) Average annual capacity factor based on wind production & capacity. (2) Includes PPA, merchant and RECs. Amounts may not add due to rounding. 1Q ’17 1Q ’18 Wind Production GWh Wind & Solar Installed Capacity (MW) Montague 201 MW Karankawa 286

MW Wy’East 10 MW Avg. Price (2) ($/MWh) MidCont South & Texas 23% 24% 26% 27% 1Q ’18 West Northeast + 15% -1% +46% +23% +5% +590 +7% -2% 5,905 6,495 497 1Q '17 1Q '18 Capacity under construction 31.5% 33.6% $48.4 $47.5 1Q ’17 1Q ’18 |

19 Avangrid, “utility of the future” Results – Avangrid Renewables YTD '17 New Capacity Existing MWhs Pricing PTC's Other YTD '18 -$2 $249 1Q ’18 Net income $50M & adjusted net income $47M 1Q ’18 Adjusted gross margin (1) increases 11% to $249M $224 +$21 (1) Adjusted gross margin is a non-GAAP financial measure; see Appendix for reconciliation of adjusted gross margin to net income. Other consists

of Thermal & Power Trading results combined with other wind activities (transmission, contracted assets, curtailment revenues, utilities costs, & firming and shaping revenues). Amounts may not add due to rounding. +$5 Effects on Adjusted Gross Margin ($M) +$6 -$5 |

20 Avangrid, “utility of the future” AVANGRID Financial Strength Maintaining our strong balance sheet 1Q ’18 $6.1B Net Debt Credit Metrics (1) Net Debt/Adjusted EBITDA Net Leverage (1) See Appendix for Company definitions of metrics and reconciliation of adjusted EBITDA to net income, funds from operations (FFO) to net income and net debt to debt. S&P Moody’s Fitch FFO/Debt Credit Ratings BBB+ Baa1 BBB+ 2.9x 28% 30% |

21 Avangrid, “utility of the future” Affirming 2018 Outlook (1) Adjusted EPS excludes the Gas Storage & Trading businesses. Renewables MTM is not excluded because it cannot be estimated. See

Appendix for reconciliation of non-GAAP adjusted net income and

adjusted EPS to net income. For 2018 management uses adjusted EPS in determining its outlook. ’18 Guidance is Based on: AVANGRID Adjusted EPS (1) $2.22 - $2.50 ’18 Guidance is based on adjusted EPS (1) AVANGRID EPS $2.16 - $2.46 Sale of Gas Trading on 03/1/18; Anticipate sale of Gas Storage assets by May ’18 Networks Renewables Corporate $1.78 - $1.86 $0.55 - $0.70 ($0.15) – ($0.05) Gas Storage ($0.06) – ($0.03) Networks Renewables Corporate $1.78 - $1.86 $0.55 - $0.70 ($0.15) – ($0.05) • Sale of Gas Storage Trading business closed in 1Q ’18 & Gas Storage facilities in 2Q ’18

• ~($0.06/share) loss of interest income at Corporate (recapitalization due to Gas Storage sale)

• Normal wind • Earning allowed returns & into the sharing bands at the utilities through the implementation of best

practices & cost management

• Renewables 590 MW COD in ’17 |

| 22 Avangrid, “utility of the future” Appendix |

23 Avangrid, “utility of the future” Reconciliation AVANGRID 1Q ’18 Adjusted Net Income AVANGRID CONS Networks Renewables Corporate Gas Storage Net Income (Loss) Attributable to Avangrid, Inc. 244 200 $

50

$

(5)

$

(1)

$

Adjustments: Add: Mark-to-market adjustments - Renewables (5) — (5) — — Restructuring charges (1) 1 1 — — — Loss from held for sale measurement (2) 5 — — — 5 Income tax impact of adjustments (3) 10 (0) 1 — 9 Gas Storage & Transportation adjustment, net of tax (4)

(13)

—

—

—

(13)

Adjusted Net Income

243

$

201

$

47

$

(5)

$

—

$

Add: Net loss attributable to noncontrolling interests

(6)

—

(6)

—

—

Income tax expense (5)

81

63

18

(1)

—

Depreciation and amortization (6)

255

147

108

—

—

Interest expense, net of capitalization (7)

38

24

9

5

—

Less: Other income and (expense)

—

—

—

—

—

Earnings (losses) from equity method

investments 2

2

—

—

—

Adjusted EBITDA

608

$

433

$

176

$

(0)

$

—

$

Add: Operations and maintenance (8) 379 316 63 0 — Taxes other than income taxes 141 130 11 0 — Adjusted Gross Margin 1,129 $ 880 $

249

$

0

$

—

$

(1) Restructuring charges relate to costs resulted from restructuring actions involving targeted voluntary workforce reductions within

the Networks segment. (2) The amount of loss from

measurement of assets and liabilities held for sale of Gas Storage & Transportation activity. (3) Income tax impact of adjustments: $1 million from mark-tomarket (MtM) adjustment, $(0.3) million from restructuring

charges, $9 million from loss from held for sale

measurement for the three months ended March 31, 2018.

(4) Removal of the impact from Gas Storage & Transportation activity in the

reconciliation of Net Income to adjusted EBITDA and adjusted gross margin. Three Months Ended March 31, 2018 (in millions) (5) Adjustments have been made for production tax credit adjustments for the amount of $28 million for three months ended March 31, 2018,

have been reclassified from revenues to reflect classification by

nature in the three months ended March 31, 2018. After reflecting these by nature classification adjustments the calculated effective income tax rate are impacted for the period presented under this by nature classification presentation.

(6) Adjustments have been made for the inclusion of vehicle depreciation and

bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle depreciation was $4 million and bad debt provision was $17 million in Networks, for

the three months ended March 31, 2018. Additionally,

government grants and investment tax credits amortization have

been presented within other operating income and not within depreciation and amortization based on the by nature classification as follows: government grants of $1.0 million in Networks and investment tax credits of $22 million in Renewables, for the

three months ended March 31, 2018. (7) Adjustments have been made

for allowance for funds used during construction, debt portion, to reflect these amounts within other income and expenses in Networks for the periods presented. (8) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification

of these items for the periods presented. In addition,

the vehicle depreciation and bad debt provision have been

reflected within depreciation and amortization in Networks for the periods presented. |

24 Avangrid, “utility of the future” Reconciliation AVANGRID 1Q ’17 Adjusted Net Income AVANGRID CONS Networks Renewables Corporate Gas Storage Net Income (Loss) Attributable to Avangrid, Inc. 239 $

172

$

70

$

(5)

$

2

$

Adjustments: Mark-to-market adjustments - Renewables (17) — (17) — — Income tax impact of adjustments (1) 6 — 6 — — Gas Storage, net of tax (2) (2) — — — (2) Adjusted Net Income 227 $

172

$

59

$

(5)

$

—

$

Add: Income tax expense (3)

96

102

(15)

9

—

Depreciation and amortization (4)

240

139

101

—

—

Interest expense, net of capitalization (5)

36

33

7

(4)

—

Less: Earnings from equity method

investments 1

4

(3)

—

—

Adjusted EBITDA

598

$

443

$

155

$

—

$

—

$

Add: Operations and maintenance (6)

382

326

59

(2)

—

Taxes other than income taxes

137

125

11

1

—

Adjusted Gross Margin

1,117

$

893

$

224

$

—

$

—

$

(1) Income tax impact

of adjustments: $6 million from mark-to-market adjustment . (2) Removal of the impact from Gas Storage & Transportation activity in the reconciliation of Net Income to adjusted EBITDA and

adjusted gross margin. Three Months

Ended March 31, 2017

(in millions)

(3) Adjustments have been made for Production Tax Credit Adjustments for the

amount of $12 million for the three months ended March 31, 2017,

as they have been included in operating revenues and $14 million

for Unfunded Future Income Taxes as amounts have been reclassified from revenues based on the by nature classification. After reflecting these by nature classification adjustments the calculated effective income tax rates are impacted for both periods presented under this

by nature classification presentation. (4) Adjustments have been

made for the inclusion of vehicle depreciation and bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle Depreciation was $5 million and bad debt provision was $12 million, for the three months

ended March 31, 2017. Additionally, government grants and

investment tax credits amortization have been presented within other operating income and not within depreciation and amortization based on the by nature classification. Government grants were $1.6 million and investment tax credits were $22 million for the three months ended March

31, 2017. (5) Adjustments have been made for allowance for funds

used during construction, debt portion, to reflect these amounts within other income and expenses. (6) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification

of these items. In addition the vehicle depreciation

and bad debt provision have been reflected within depreciation

and amortization. |

25 Avangrid, “utility of the future” Reconciliation AVANGRID 1Q ’18 & 1Q ’17 Adjusted EPS 2018 2017 '18 vs '17 Networks 0.65 $

0.56

$

0.09

$

Renewables

0.16

0.23

(0.07)

Corporate

(0.02)

(0.02)

(0.00)

Gas Storage

(0.00)

0.01

(0.01)

Earnings Per Share

0.79

$

0.77

$

0.02

$

Adjustments:

Restructuring charges

0.00

-

0.00

Mark-to-market

adjustments

-

Renewables

(0.02)

(0.06)

0.04

Loss from held for sale measurement

0.02

-

0.02

Income tax impact of adjustments*

0.03

0.02

0.02

Gas Storage, net of tax

(0.04)

(0.01)

(0.03)

Adjusted Earnings Per Share

0.78

0.73

$

0.05

$

Weighted-avg # of Shares

(M): 309.5

309.5

Amounts may not add due to rounding

Adjusted 2018

Adjusted 2017

Adjusted '18

vs

'17

Networks

0.65

$

0.56

$

0.09

$

Renewables

0.15

0.19

(0.04)

Corporate

(0.02)

(0.02)

(0.00)

Adjusted Earnings Per Share

0.78

$

0.73

$

0.05

$

Weighted-avg # of Shares

(M): 309.5

309.5

Amounts may not add due to rounding

Non-GAAP Adjusted Earnings (Loss) Per

Share Three months ended March

31, * 2018:

EPS

Income

tax

impact

of

adjustments:

$0.00

from

mark-to

market

adjustment

-

Renewables

and

$(0.00)

from

restructuring charges -

Networks, $0.03 from loss from held for sale

measurement. * 2017:

EPS

Income

tax

impact

of

adjustments:

$0.02

from

mark-to-market

adjustment

-

Renewables.

Three months ended March 31,

Avangrid, Inc.

Reconciliation of Adjusted Non-GAAP Earnings (Loss) Per

Share (EPS) (Unaudited)

|

26 Avangrid, “utility of the future” Reconciliation – AVANGRID Net Debt The Net Debt quantitative reconciliation as of March 31, 2018 and December 31, 2017 is as follows $M 2018 2017 Non-current debt 5,160 $

5,196

$

Add: Current

portion of debt 214

183

Notes payable (including affiliates)

662

786

Other

notes

payable

-

long-term

38

42

Debt

6,074

6,207

Add: Tax equity financing

arrangements

0

98

Interest accrued

65

57

Less: Cash and cash equivalents

40

41

Net Debt

6,099

$

6,321

$

|

27 Avangrid, “utility of the future” Reconciliation – AVANGRID FFO Adjusted FFO table The Adjusted Funds from Operations (FFO) quantitative reconciliation as of March 31, 2018 and December 31,

2017 is as follows $M

As of

March 31, 2018

December 31, 2017

Net Income Attributable to Avangrid, Inc.

244

381

Adjustments:

Add:

Mark-to-market

adjustments

-

Renewables

(5)

15

Restructuring charges (1)

1

20

Loss from held for sale measurement (2)

5

642

Impact of the Tax Act (3)

—

(328)

Impairment of equity method and other investment

(4) —

49

Income tax impact of adjustments (5)

10

(162)

Gas Storage & Transportation adjustment, net of tax

(6) (13)

64

Adjusted Net Income

243

682

Add: Net (loss) income attributable to noncontrolling

interests (6)

1

Depreciation and amortization

255

1,021

Deferred Income Taxes

71

93

Cash distribution from equity method

investments 5

20

Less: Other income and (expense)

—

1

Earnings (losses) from equity method

investments 2

5

Adjusted FFO

566

1,811

2017 Adjusted FFO

1,811 3 months Adjusted FFO 566 559 Last 12 months Adjusted FFO 1,818 FFO/Net Debt 29.8% 28.7% (2) The amount of loss from measurement of assets and liabilities held for sale of Gas Storage & Transportation

activity. (4) The amount of other than temporary impairment (OTTI)

on equity method investment in 2017 and other investment in 2016 (in millions) (1) Restructuring charges relate to costs resulted from restructuring actions involving targeted voluntary workforce reductions and

related costs in our plan to vacate a lease, predominantly within

the Networks segment. (3) The amount of the impact from

measurement of deferred income tax balances as a result of the Tax Cuts and Jobs Act of 2017, (Tax Act) enacted by the U.S. federal government on December 22, 2017. (6) Removal of the impact from Gas Storage & Transportation activity in the reconciliation of Net Income to adjusted EBITDA and

adjusted gross margin. (5) Income tax impact of

adjustments: 2018 - $1 million from mark-to market (MtM) adjustment, $(0.3) million from restructuring charges, $9 million from loss from held for sale measurement; 2017 - $(5) million from mark-to-market adjustment, $(8) million

from restructuring charges, $(13) million from other than

temporary impairment on equity method investment, $(179) million from loss from held for sale measurement and $43 million from adjustment to unitary income taxes at Renewables as a result of expected future sale of Gas.

|

28 Avangrid, “utility of the future” AVANGRID Renewables Average Price PPA prices decrease Energy prices plus RECs for merchant decrease (1) Includes JVs (2) Includes RECs & hedges 1Q ’17 1Q ’18 PPA Avg. Price ($/MWh) 1Q ’17 1Q ’18 Merchant Avg. Price (1) ($/MWh) 1Q ’17 1Q ’18 Other (2) Energy Avg. Price (3) ($/MWh) (3) Includes PPA, merchant & RECS -3% -7% -2% $53.8 $52.0 $21.0 $24.7 $17.6 $11.4 $38.6 $36.1 $48.4 $47.5 |

29 Avangrid, “utility of the future” Avangrid Renewables Regional Data (1) Average annual capacity factor based on wind production & capacity. (2) Includes PPAs, merchant and RECs. Amounts may not add due to rounding. Load Factor (1) by Area 1Q ’18 vs. 1Q ’17 West 26% +35.9pp MidCont 38% -1.2pp Northeast 38% +2.5pp South/Texas 35% +0.8pp Wind Production by Area (GWh) 1Q ’18 vs. 1Q ’17 West 1,019 +46% MidCont 1,157 -1% Northeast 1,070 +5% South/Texas 1,209 +23% TOTAL 4,455 +15% Avg. Price (2) Var% vs. 1Q’17 West -1% -$0.41/MWh MidCont +2% +$0.64/MWh Northeast -10% -$5.70/MWh South/ Texas -5% -$2.05/MWh |

30 Avangrid, “utility of the future” Building the Grid of the Future - NECEC Overview: • 1,200 MW Transmission project delivering hydro-power from Canada • $950M investment at CMP (T); Not in

Long-Term Outlook • Construction ’19-’22 • Expect Maine permits by end of ’18 & other approvals by end of ’19

• Strong support from Maine Governor, Legislators, Local Communities (95%) & Environmentalists • 100%-owned right of way, with ~2/3 in existing transmission corridor • CMP’s proven ability to

deliver a commercial-scale transmission project on-schedule &

on-budget • Lowest cost solution to deliver

Canadian hydro (shortest route, over-head DC line) o Largest wholesale energy market

savings of ~$3.9B over 20-year contract o Customer savings: $150M annually (MA)

& $40M annually (ME) • Significant economic benefits, adding

jobs & increasing GDP in MA, ME & New England, &

property taxes in ME •

Provides enough clean electricity for up to 1.5 million homes in New England

Project Benefits: |

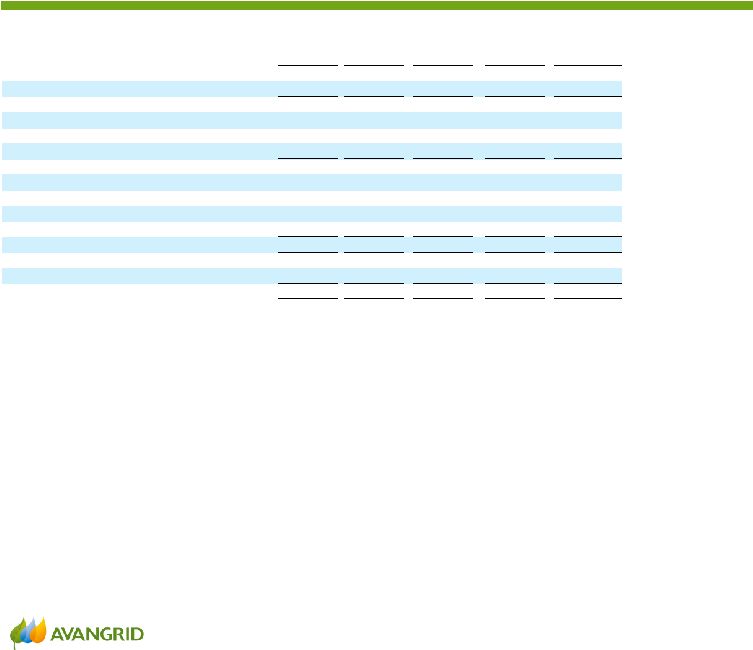

31 Avangrid, “utility of the future” Focus on Clean Energy – Onshore Renewables Highly Likely projects in Long-Term Outlook (’17-’22) increase Highly Likely - Advanced -stage contract negotiations Likely - Engineering, site assessments, applications (1) See FACTBOOK for additional detail on Secured projects Secured - COD/PPA/Contract (1) : 2,744 2,744 Previous Current 53% 1,446 9% 210 38% 1,088 Secured Highly Likely Likely TOTAL 53% 1,446 11% 300 36% 998 Secured Highly Likely Likely TOTAL |