Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - GrowGeneration Corp. | f8k042018_growgeneration.htm |

Exhibit 99.1

OTCQX: GRWG 1 2017 Annual Shareholder Meeting growgeneration.com OTCQX: GRWG

OTCQX: GRWG 2 Safe Harbor Statement This presentation is being provided for information purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any of the Company’s securities . This presentation is not intended, nor should it be distributed, for advertising purposes, nor is it intended for broadcast or publication to the general public . Any such offer of the Company’s securities will only be made in compliance with applicable state and federal securities laws pursuant to a prospectus or an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request . This presentation may include predictions, estimates or other information that might be considered forward - looking within the meaning of applicable securities laws . While these forward - looking statements represent our current judgments, they are subject to risks and uncertainties that could cause actual results to differ materially . You are cautioned not to place undue reliance on these forward - looking statements, which reflect our opinions only as of the date of this presentation . Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward - looking statements in light of new information or future events . When used herein, words such as "look forward," "believe," "continue," "building," or variations of such words and similar expressions are intended to identify forward - looking statements . Factors that could cause actual results to differ materially from those contemplated in any forward - looking statements made by us herein are often discussed in filings we make with the United States Securities and Exchange Commission, available at : www . sec . gov, and on our website, at : www . growgeneration . com . growgeneration.com

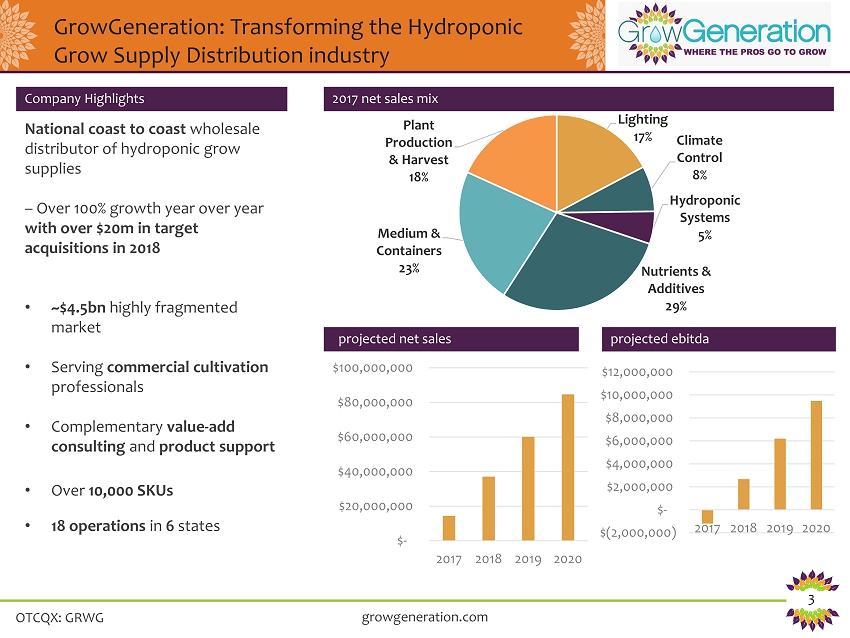

OTCQX: GRWG 3 GrowGeneration: Transforming the Hydroponic Grow Supply Distribution industry growgeneration.com Company Highlights 2017 net sales mix projected net sales National coast to coast wholesale distributor of hydroponic grow supplies – Over 100% growth year over year with over $20m in target acquisitions in 2018 • ~$4.5bn highly fragmented market • Serving commercial cultivation professionals • Complementary value - add consulting and product support • Over 10,000 SKUs • 18 operations in 6 states Lighting 17% Climate Control 8% Hydroponic Systems 5% Nutrients & Additives 29% Medium & Containers 23% Plant Production & Harvest 18% $- $20,000,000 $40,000,000 $60,000,000 $80,000,000 $100,000,000 2017 2018 2019 2020 $(2,000,000) $- $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 2017 2018 2019 2020 projected ebitda

OTCQX: GRWG 4 2017 - 2020 Proj. Rev and Adjusted EBITDA $14.3M $37M $60M $84.6M $(1.2M) $2.6M $6.5M $9.5M $(10,000,000) $- $10,000,000 $20,000,000 $30,000,000 $40,000,000 $50,000,000 $60,000,000 $70,000,000 $80,000,000 $90,000,000 2017 2018 2019 2020 2017 - 2020 (Revenue and EBITDA in millions) growgeneration.com • Profitable q2 2018 • 165% y/y 2017 - 2018 rev. growth • GPM 27 - 28% • Net income 10 - 12% 2019 - 2020

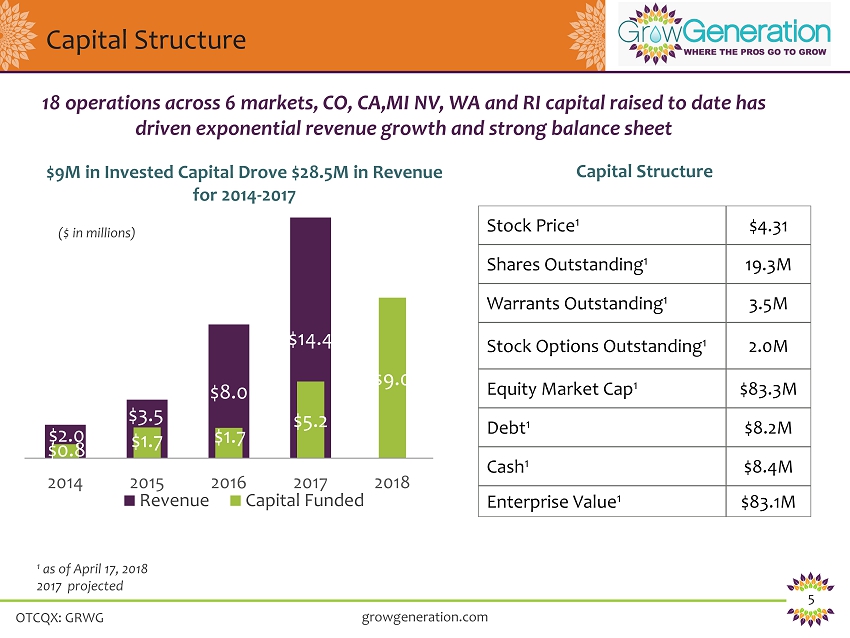

OTCQX: GRWG 5 Capital Structure growgeneration.com 18 operations across 6 markets, CO, CA,MI NV, WA and RI capital raised to date has driven exponential revenue growth and strong balance sheet Stock Price 1 $4.31 Shares Outstanding 1 19.3M Warrants Outstanding 1 3.5M Stock Options Outstanding 1 2.0M Equity Market Cap 1 $83.3M Debt 1 $8.2M Cash 1 $8.4M Enterprise Value 1 $83.1M 1 as of April 17, 2018 2017 projected $2.0 $3.5 $8.0 $14.4 $0.8 $1.7 $1.7 $5.2 $9.0 2014 2015 2016 2017 2018 Revenue Capital Funded ($ in millions) $9M in Invested Capital Drove $28.5M in Revenue for 2014 - 2017 Capital Structure

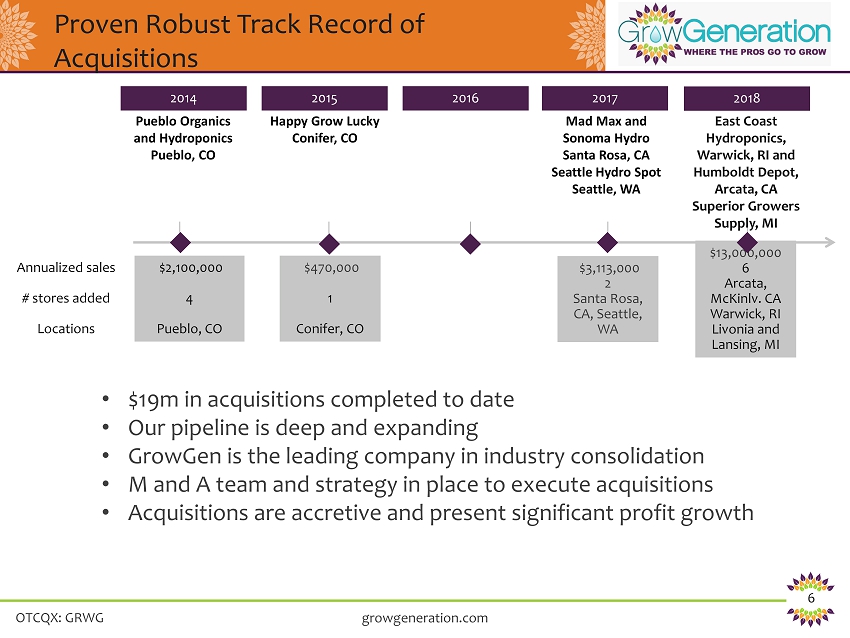

OTCQX: GRWG 6 Proven Robust Track Record of Acquisitions growgeneration.com 2017 2016 2015 2014 $2,100,000 4 Pueblo, CO $470,000 1 Conifer, CO $3,113,000 2 Santa Rosa, CA, Seattle, WA Annualized sales # stores added Locations $13,000,000 6 Arcata, McKinlv. CA Warwick, RI Livonia and Lansing, MI 2018 • $19m in acquisitions completed to date • Our pipeline is deep and expanding • GrowGen is the leading company in industry consolidation • M and A team and strategy in place to execute acquisitions • Acquisitions are accretive and present significant profit growth East Coast Hydroponics, Warwick, RI and Humboldt Depot, Arcata, CA Superior Growers Supply, MI Mad Max and Sonoma Hydro Santa Rosa, CA Seattle Hydro Spot Seattle, WA Happy Grow Lucky Conifer, CO Pueblo Organics and Hydroponics Pueblo, CO

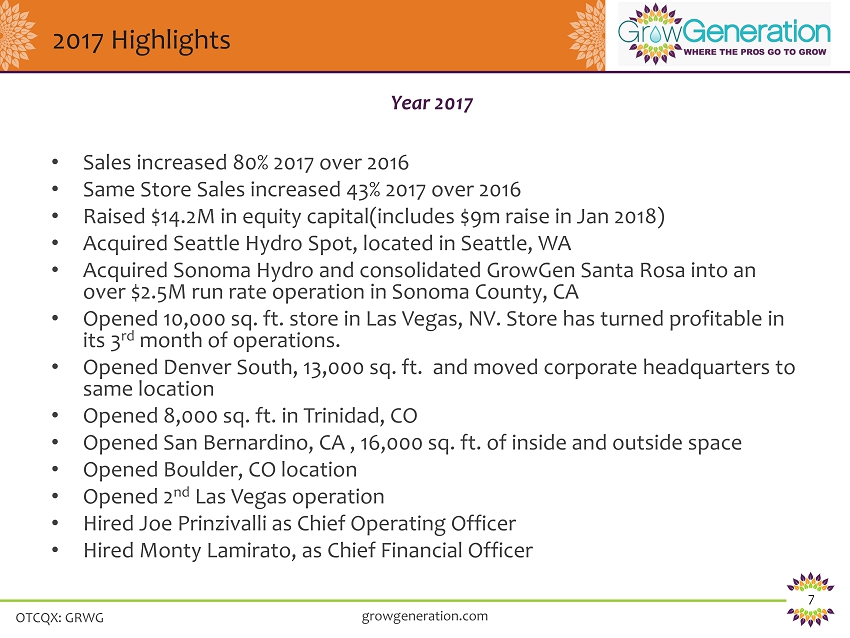

OTCQX: GRWG 7 2017 Highlights • Sales increased 80% 2017 over 2016 • Same Store Sales increased 43% 2017 over 2016 • Raised $14.2M in equity capital(includes $9m raise in Jan 2018) • Acquired Seattle Hydro Spot, located in Seattle, WA • Acquired Sonoma Hydro and consolidated GrowGen Santa Rosa into an over $2.5M run rate operation in Sonoma County, CA • Opened 10,000 sq. ft. store in Las Vegas, NV. Store has turned profitable in its 3 rd month of operations. • Opened Denver South, 13,000 sq. ft. and moved corporate headquarters to same location • Opened 8,000 sq. ft. in Trinidad, CO • Opened San Bernardino, CA , 16,000 sq. ft. of inside and outside space • Opened Boulder, CO location • Opened 2 nd Las Vegas operation • Hired Joe Prinzivalli as Chief Operating Officer • Hired Monty Lamirato, as Chief Financial Officer Year 2017 growgeneration.com

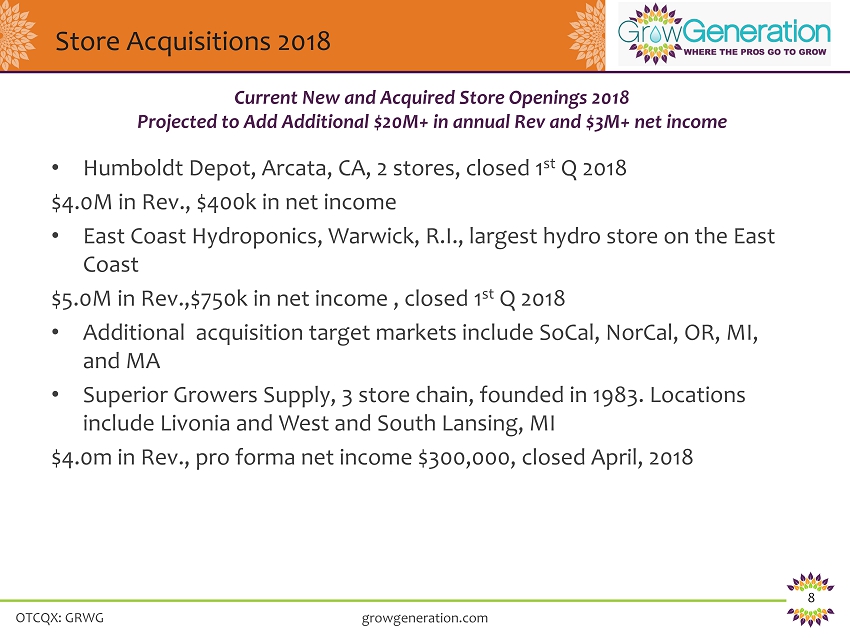

OTCQX: GRWG 8 Store Acquisitions 2018 • Humboldt Depot, Arcata, CA, 2 stores, closed 1 st Q 2018 $4.0M in Rev., $400k in net income • East Coast Hydroponics, Warwick, R.I., largest hydro store on the East Coast $5.0M in Rev.,$750k in net income , closed 1 st Q 2018 • Additional acquisition target markets include SoCal, NorCal, OR, MI, and MA • Superior Growers Supply, 3 store chain, founded in 1983. Locations include Livonia and West and South Lansing, MI $4.0m in Rev., pro forma net income $300,000, closed April, 2018 Current New and Acquired Store Openings 2018 Projected to Add Additional $20M+ in annual Rev and $3M+ net income growgeneration.com

OTCQX: GRWG 9 Growth Strategy: National Expansion Growth to be fueled by both new store openings and acquisitions • Current operations in 18 stores across 6 states • 2018 - 2019 expansion markets: CA,OR,MI and MA - Current Operations - Targeted for Expansion in 2018 - 2018 growgeneration.com Alabama Arizona Arkansas California (4) Colorado (7) Florida Georgia Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Ma

ine Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada (2) New Hampshire New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington ( (1) W.Va Wisconsin Wyoming Connecticut Maryland Rhode Island