Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Cincinnati Bancorp | tv491464_ex99-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Cincinnati Bancorp | tv491464_ex10-1.htm |

| 8-K - 8-K - Cincinnati Bancorp | tv491464_8k.htm |

Exhibit 99.1

Cincinnati Bancorp/Cincinnati Federal to Acquire Kentucky Federal Savings & Loan

General Information and Limitations This investor presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward - looking statements may include: management plans relating to the proposed transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; the ability to obtain any required regulatory, stockholder or other approvals; any statements of the plans and objectives of management for future or past operations, products or services, including the execution of integration plans; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. Forward - looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions. Forward - looking statements are subject to numerous assumptions, risks and uncertainties, which may change over time. Forward - looking statements speak only as of the date they are made. Cincinnati Bancorp (“CNNB”) does not assume any duty and does not undertake any duty to update forward - looking statements. Because forward - looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that CNNB anticipated in its forward - looking statements and future results could differ materially from historical performance.

Transaction Details □ Kentucky Federal will merge into Cincinnati Federal and will operate as Kentucky Federal, a Division of Cincinnati Federal □ Customers of both banks will have access to their accounts at all offices of both banks □ Cincinnati Federal is headquartered in Green Township, Ohio, with three branch offices in Price Hill, Anderson Township, and Miami Township (all in Hamilton County, Ohio), and a Loan Production Office (LPO) in Mason □ Kentucky Federal is a mutual savings association headquartered in Covington, Kentucky, with branch offices in Florence, Kentucky, and Williamstown, Kentucky □ Kentucky Federal will receive one seat on the Cincinnati Federal boards (MHC, Bank, and Bancorp) □ Four remaining Kentucky Federal Board Members will serve on an Advisory Board to Cincinnati Federal to assist in growing the footprint in the Northern Kentucky Market

Transaction Details □ The transaction is consistent with Cincinnati Federal’s move in 2015 to create a Mutual Holding Company (MHC) allowing for capital enhancement while maintaining the ability to acquire mutual banks □ The transaction enhances Cincinnati Federal’s capital while at the same time not being dilutive to CNNB shareholders □ Expected closing of the transaction is in the second half of 2018, subject to regulatory approval and the approval of Kentucky Federal’s members □ CNNB – CF Mutual Holding Company (MHC) relationship Prior to Closing Expected Post Closing (1) Public Ownership 46.06% 43.93% MHC Ownership 53.94% 56.07% (1) Based on CNNB price of $10.12 as of April, 17, 2018

Location Overview □ 6581 Harrison Ave, Cincinnati, OH 45247 □ 4310 Glenway Ave, Cincinnati, OH 45205 □ 1270 Nagel Rd, Cincinnati, OH 45255 □ 7553 Bridgetown Rd, Cincinnati, OH 45248 □ 4680 Parkway Dr #201, Mason, OH 45040 □ 1050 Scott St, Covington, KY 41011 □ 6890 Dixie Highway, Florence, KY 41042 □ 100 S Main St, Williamstown, KY 41097 Loan Production Office

Financial Highlights (1) Cincinnati Federal Category Kentucky Federal $170,452,926 Assets $31,337,537 $147,020,218 Loans $16,127,565 $114,732,609 Deposits $27,522,038 $10,266,824 Cash, Short Term Investments $12,235,934 (1) All information as of December 31, 2017 .

Pro Forma Deposit Composition (1) Deposit Type Balance % Total Checking $22,957,000 20.15% Savings & MMDA $23,840,000 20.92% Certificate of Deposit $67,151,000 58.93% Total $113,948,000 100% Cincinnati Federal Kentucky Federal Combined 20.15% 20.92% 58.93% Checking Savings & MMDA Certificate of Deposit Deposit Type Balance % Total Checking $2,642,000 9.60% Savings & MMDA $8,580,000 31.20% Certificate of Deposit $16,300,000 59.20% Total $27,522,000 100% Deposit Type Balance % Total Checking $25,599,000 18.09% Savings & MMDA $32,420,000 22.92% Certificate of Deposit $83,451,000 58.99% Total $141,470,000 100% 18.09% 22.92% 58.99% Checking Savings & MMDA Certificate of Deposit 9.60% 31.20% 59.20% Checking Savings & MMDA Certificate of Deposit (1) From 2017 10K Report CNNB and Call Report KF

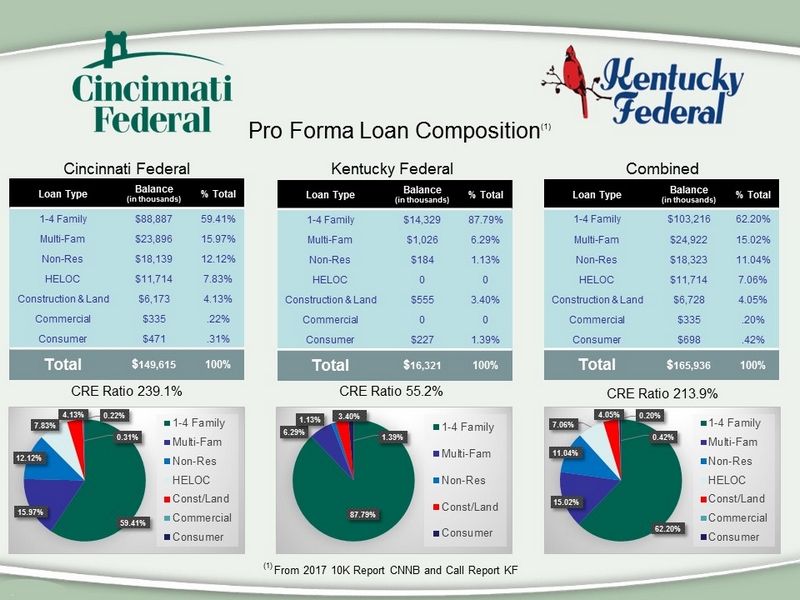

Pro Forma Loan Composition (1) Loan Type Balance (in thousands) % Total 1 - 4 Family $88,887 59.41% Multi - Fam $23,896 15.97% Non - Res $18,139 12.12% HELOC $11,714 7.83% Construction & Land $6,173 4.13% Commercial $335 .22% Consumer $471 .31% Total $ 149,615 100% Cincinnati Federal Kentucky Federal Combined 59.41% 15.97% 12.12% 7.83% 4.13% 0.22% 0.31% 1-4 Family Multi-Fam Non-Res HELOC Const/Land Commercial Consumer CRE Ratio 239.1% CRE Ratio 55.2% 87.79% 6.29% 1.13% 3.40% 1.39% 1-4 Family Multi-Fam Non-Res Const/Land Consumer CRE Ratio 213.9% 62.20% 15.02% 11.04% 7.06% 4.05% 0.20% 0.42% 1-4 Family Multi-Fam Non-Res HELOC Const/Land Commercial Consumer (1) From 2017 10K Report CNNB and Call Report KF Loan Type Balance (in thousands) % Total 1 - 4 Family $14,329 87.79% Multi - Fam $1,026 6.29% Non - Res $184 1.13% HELOC 0 0 Construction & Land $555 3.40% Commercial 0 0 Consumer $227 1.39% Total $ 16,321 100% Loan Type Balance (in thousands) % Total 1 - 4 Family $103,216 62.20% Multi - Fam $24,922 15.02% Non - Res $18,323 11.04% HELOC $11,714 7.06% Construction & Land $6,728 4.05% Commercial $335 .20% Consumer $698 .42% Total $ 165,936 100%