Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------

FORM 10-K/A-1

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission File Number: 333-182072

--------------------------

Hunt Mining Corp.

(Exact name of Registrant as specified in its charter)

|

British Columbia

|

1041

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

23800 East Appleway Ave.

Liberty Lake, WA 99019

(509)-290-5659

(Address of principal executive offices)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Securities registered pursuant to section 12(g) of the Act:

|

|

None

(Title of Class)

|

Common Stock

(Title of Class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Check whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

Large Accelerated Filer

|

☐

|

Accelerated Filer

|

☐

|

|

|

|

Non-accelerated Filer

|

☐

|

Smaller Reporting Company

|

☑

|

|

|

|

Emerging Growth Company

|

☐

|

|||

|

|

(Do not check if a smaller reporting company)

|

||||

ADDITIONAL INFORMATION

Descriptions of agreements or other documents in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the Exhibit Index at the end of this report for a complete list of those exhibits.

PART I

Item 1. Business

Hunt Mining Corp. (the "Company" or "Hunt"), is a mineral exploration company incorporated on January 10, 2006 under the laws of Alberta, Canada and, together with its subsidiaries, is engaged in the exploration of mineral properties in Santa Cruz Province, Argentina.

Effective November 6, 2013, the Company continued from the Province of Alberta to the Province of British Columbia. The Company's registered office is located at 25th Floor, 700 West Georgia Street,

Vancouver, B.C. V7Y 1B3. The Company's head office is located at 23800 E Appleway Avenue, Liberty Lake, Washington, 99019 USA.

Vancouver, B.C. V7Y 1B3. The Company's head office is located at 23800 E Appleway Avenue, Liberty Lake, Washington, 99019 USA.

The consolidated financial statements include the accounts of the following subsidiaries after elimination of intercompany transactions and balances:

|

Corporation

|

Incorporation

|

Percentage

ownership

|

Business Purpose

|

|

Cerro Cazador S.A. ("CCSA")

|

Argentina

|

100%

|

Holder of Assets and Exploration Company

|

|

Ganadera Patagonia(1)

|

Argentina

|

40%

|

Land Holding Company

|

|

1494716 Alberta Ltd.

|

Alberta

|

100%

|

Nominee Shareholder

|

|

Hunt Gold USA LLC

|

Washington, USA

|

100%

|

Management Company

|

The Company's activities include the exploration of mineral properties in Argentina. On the basis of information to date, the Company has not yet determined whether the exploration properties contain economically recoverable ore reserves. The underlying value of the mineral properties is entirely dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete development and upon future profitable production or a sale of these properties.

The Company has one reportable segment, consisting of evaluation, acquisition and exploration activities which are focused principally in Argentina. The Company evaluates, acquires, and explores for advanced silver and gold exploration and potential development projects, which may lead to silver and gold production or value adding strategic transactions. In 2017, the Company began exploration activities at the Martha Project which resulted in recoveries from sale of silver and gold concentrate as "Silver and gold recovery, net of expenses" in the amount of $5,757,321 during the year ended December 31, 2017 (December 31, 2016- $0 (zero)). Geographic location of mineral properties and plant and equipment is provided in Item 2 – Properties and Notes 8 and 10 – Mineral Properties and Property and Equipment to the Consolidated Financial Statements under the section heading "Item 8. Financial Statements and Supplementary Data" below.

- 2 -

Competitive Business Conditions

The mineral exploration business is an extremely competitive industry. The Company is competing with other exploration companies for the capital necessary to sustain exploration and development programs. There is competition for the limited number of silver and gold acquisition and exploration opportunities. As a result, the Company may have difficulty acquiring attractive silver and gold projects at reasonable prices. The Company also competes for skilled labor and consultants for the man hours and consulting time.

The year ended, 2017, was the first year of milling production for the refurbished Martha Mill. The mill began limited trial operations in January of 2017, with regular milling activities of ore from exploration activities commencing in April 2017. The risks associated exploration, mining and milling operations include risks typical of the mining industry. For example, the Company's operational effectiveness in the processing plan must be properly calibrated and managed to avoid lower recovery of the economic metals. Mechanical failure of equipment could increase costs, decrease efficacy or result in significant delays. The Company manages these risks with detailed mine planning and extraction processes, a maintenance program, and hiring experienced and technically proficient management.

Generally, the Company is subject to the risks inherent to the mineral industry. The primary risk of mineral exploration is the low probability of finding a major deposit of ore. The Company attempts to mitigate this risk by focusing its efforts in areas known to host significant mineral deposits, and by relying on its experienced management team to drive acquisitions of properties that have higher-than-average probabilities of success. In addition to deal essentials, such as cost, terms, timing, and market considerations, the Company's process of property acquisition involves screening target properties based on geological, engineering, environmental, and metallurgical factors. In all its operations the Company also competes for skilled labor within the mining industry.

Another significant risk in the mining industry is the price of metals such as gold and silver. If the prices of these metals were to fall substantially it could lead to a loss of investor interest in the mineral exploration sector, which would make it more difficult to raise the capital necessary for the Company or other potential customers to move exploration and development plans forward.

Effect of Existing or Probable Government Regulation

The Company's exploration and development activities and other property interests are subject to various national, state, provincial and local laws and regulations in the United States, Argentina, and other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. The Company has obtained or has pending applications for those licenses, permits or other authorizations currently required to conduct exploration and other programs. The Company believes that it complies in all material respects with applicable mining, health, safety and environmental statutes and regulations in all the jurisdictions in which it operates. The Company is not aware of any current orders or directions relating to us with respect to the foregoing laws and regulations.

- 3 -

Environmental Regulation

The Company's projects are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. The Company's policy is to conduct business in a way that safeguards public health and the environment. The Company believes that its operations are conducted in material compliance with applicable laws and regulations. Changes to current local, state or federal laws and regulations in the jurisdictions where it operates could require additional capital expenditures and increased operating and/or reclamation costs. The Company is unable to predict what additional legislation, if any, might be proposed or enacted, or what additional regulatory requirements could impact the economics of its projects. During 2017, none of the project sites had any material non-compliance occurrences with any applicable environmental regulations.

The Company generally will be required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and revegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts would be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Employees

As at December 31, 2017, the Company had 32 full and part time employees and 11 individuals working on a consulting basis. Its operations are managed by officers with input from directors.

Item 1A. Risk Factors

The Company is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and is not required to provide the information under this item.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Ongoing production at the Martha Project is being undertaken without established mineral resources or reserves and the Company has not established the economic viability of the operations on the Martha Project. As a result, there is increased uncertainty and economic risk of failure associated with these production activities. A NI 43-101 compliant technical report from 2010 does exist for the La Josefina project with measured, indicated and inferred resources. The Ailin vein is part of this resource estimate.

Klaus Triebel, Hunt Mining's director of project development, is the qualified person under National Instrument 43-101 who has approved the technical and scientific aspects of this press release.

The majority of the Company's assets are located in Argentina. The Company's material holdings consist of

|

·

|

Approximately 25,000-acre property on which the Company's La Josefina project is located

|

|

·

|

Approximately 29,600-hectare parcel on which the Company's La Valenciana project is located

|

|

·

|

Approximately 35,700-hectare parcel on which the Company's Martha project is located

|

The Company also owns mobile housing units, trucks and additional mechanical equipment, all purchased within the last ten years and in good physical condition.

- 4 -

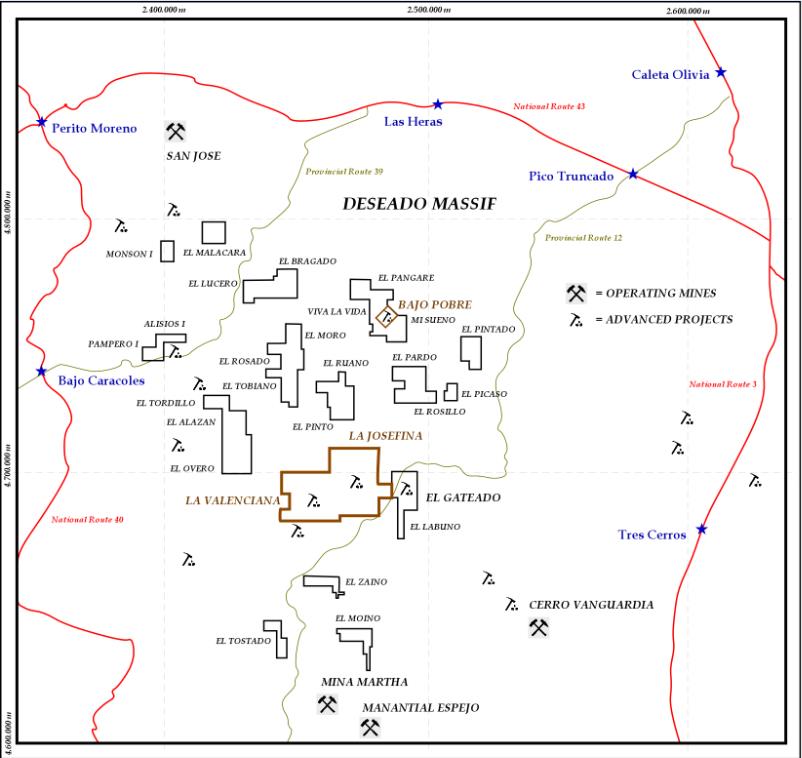

Geology of the land holdings is characterized by abundant middle-to-late Jurassic Age volcanic and volcaniclastic rock units. All projects are within the Deseado Massif of the Santa Cruz province of Argentina which is dominated by rhyolitic to rhyodacitic ignimbrite flows and lava domes together with subordinate agglomerates, volcanic breccias and tuffs with minor basalts, andesites and volcanic agglomerates intercalated upward with mafic tuffs, conglomerates and sediments. Faults active during the period of intense Jurassic extension and volcanism generally trend NNW-SSE and form a series of grabens, and horst blocks.

General Geology of the Deseado Massif

The geology of the Deseado Massif region has been described and discussed in numerous papers and reports published during the last fifteen years. The geology has been mapped at various scales by government agencies, most recently covered by a series of 1: 250,000 quadrangles published by the Instituto de Geología y Recursos Minerales and Servico Geológico Minero Argentino.

The Deseado Massif is dominated by a few major regional sequences comprised of felsic volcanic and volcaniclastic rocks deposited in middle- to late-Jurassic time. The rocks are broken by a series of regional fractures that probably represent reactivated basement fracture zones. Faults that were active during the period of intense Jurassic extension and volcanism trend mostly NNW-SSE and form a series of grabens, half-grabens and horst blocks which are tilted slightly to the east. Since Jurassic time, the rocks have been cut by normal faults of several different orientations, mainly NW-SE and ENE-WSW, but have undergone very little compression. As a result, they remain relatively undeformed and generally flat-lying to gently dipping, except locally where close to faults, volcanic domes or similar features.

Exposures of rocks older than Jurassic are limited. The oldest pre-Jurassic "basement" rocks are small outcrops of metamorphic rocks thought to be late Precambrian to early Paleozoic in age (about 540 Ma). These rocks have been assigned to the La Modesta Formation in the western part of the area and to the Complejo Río Deseado in the eastern part. They consist of schists, phyllites, quartzites, gneisses and amphibolites and plutonic intrusions.

- 5 -

The Precambrian and older Paleozoic rocks are unconformably overlain by thick continental sedimentary sequences of late-Paleozoic to early-Mesozoic age, called La Golondrina Formation and El Tranquilo Group. La Golondrina Formation is Permian (299–251 Ma) and is up to 2,200m of arkosic to lithic sandstones, siltstones and conglomerates deposited in N-S to NW-SE rift basins along older reactivated basement structures. El Tranquilo Group is Triassic in age (251– 200 Ma) and is up to 650m of rhythmically bedded arkosic sandstones and shales which grade upward into conglomerates and redbeds.

The Triassic sequence is intruded and overlain by the first indications of igneous activity related to the crustal separation and extension initiated in early Jurassic: La Leona and the Roca Blanca Formations. La Leona Formation, early Jurassic in age (175–200 Ma), is composed of calc-alkaline granitic intrusive bodies sparsely scattered throughout the northeastern part of the Deseado Massif. The Roca Blanca Formation is also early Jurassic age, and consists of up to 900m of a coarsening-upward fluvial to lacustrine mudstone and sandstone sequence deposited in grabens or other rift basins, mainly in the south-central part of the Deseado Massif. The upper third of the sequence is distinctly richer in volcanic tuffs and other pyroclastic materials.

The Jurassic volcanic rocks are divided into formal units but can be treated as a single bimodal (andesite-rhyolite) Jurassic volcanic complex. There are three units in this volcanic complex: the Cerro Leon and Bajo Pobre Formations and the Bahía Laura Group. The last two units make up the most extensive unit in the massif.

The Cerro Leon unit (lower to middle Jurassic in age) consists of hypabyssal mafic rocks composed of andesitic to basaltic dykes and shallow intrusions located in the south-central part of the massif. The Bajo Pobre Formation (middle to upper Jurassic in age) is typically 150-200m thick and is locally up to 600m thick. It is composed of andesites and volcanic agglomerates with minor basalts, which intercalate upwards with mafic tuffs, conglomerates and sediments. Olivine basalts, common in the lower part of the formation in the El Tranquilo anticline region are thought to be products of fissure eruptions from rifts related to the early stages of the Gondwana breakup and continental separation.

The Bahia Laura Group (middle to upper Jurassic in age) covers more than half the area of the massif and hosts more than 90 percent of the known gold-silver occurrences. It is a complex sequence of felsic volcanic-sedimentary rocks that has been divided into two formations according to whether there is a predominance of volcanic flows (Chon Aike Formation) vs. a predominance of volcaniclastic and sedimentary debris (La Matilde Formation). These two formations are complexly intercalated and have rapid lateral changes in facies and thickness which make it virtually impossible to define a coherent regional stratigraphy.

Non-marine sediments of late Jurassic to early Cretaceous age occur at various places throughout the Deseado Massif filling structural or erosional basins in the underlying Jurassic terrain. The presence of continental sediments in these basins, typically less than 150 meters thick, indicates that the massif remained as a positive geological feature throughout the Cretaceous. The most extensive cover rocks are a series of young basalt lava flows, Miocene to Quaternary in age, which blanket large parts of the region. The flows are typically only a few meters thick except where they fill paleo-valleys in the old land surface. In some cases, these thicker lava accumulations stand in relief above the surrounding landscape, providing classic examples of inverted topography caused by differential erosion. The youngest deposit consists of an extensive veneer of Quaternary gravels, especially in the eastern part of the massif.

- 6 -

Mina Martha Property

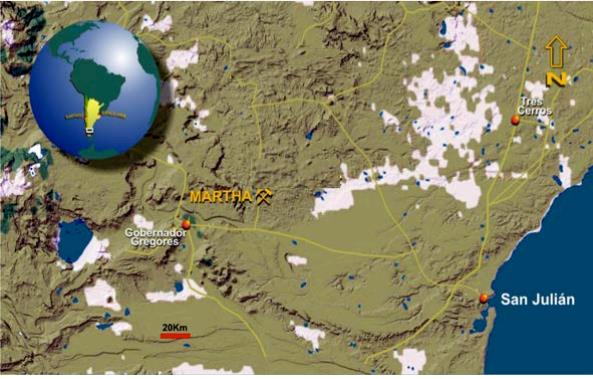

Location

Martha is located in the province of Santa Cruz, Argentina, at 48o , 41', 33.94" south latitude and 69o , 42', 00.79" west longitude (degrees, minutes, seconds) at approximately 350 meters elevation. The closest community is the town of Gobernador Gregores, situated approximately 50 road kilometers (km) to the west-southwest of Martha.

.

Property Description and Ownership

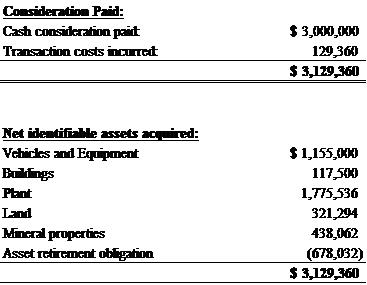

The property was purchased in 2016 by Cerro Cazador SA (CCSA), an Argentine subsidiary of the Company, from an Argentine subsidiary of Coeur. The intent to purchase was announced February 10, 2016 and closed May 11, 2016 as disclosed by the Company on its website (www.huntmining.com). See note 8 of the 2017 financial statements for details on the purchase of the Mina Martha property.

The Martha property consists of approximately 7,850 hectares of concessions, various buildings and facilities, surface and underground mining and support equipment, a 480 tonne per day (tpd - maximum) crushing, grinding and flotation plant, tailings facility, various stockpiles and waste dumps, employee living and cafeteria quarters, and miscellaneous physical materials. The Company restored and repaired the physical assets acquired in the purchase during the latter part of 2016 and the first quarter of 2017. The In addition, the Company has access to surface ranch ("estancia") lands surrounding the mine and mill site that are approximately 35,700 hectares in size.

Royal Gold Inc. holds a 2% Net Smelter Return (NSR) royalty on all production from the Martha property; the obligation for which transferred from Coeur to the Company (www.royalgold.com). In addition, the provincial government holds a 3% pit-head royalty from future production.

- 7 -

Geology and Mineralization

Silver and gold mineralization at Martha is hosted in Jurassic-aged felsic volcanic rocks of the Chon Aike Formation of the Bahia Laura volcanic complex (BLVC). Host rocks are relatively shallowly dipping ignimbrites, locally inter-bedded with thin sections of sedimentary strata.

The oldest geological unit in the Martha area is a crystal rich, dacitic ignimbrite, which is overlain by a thin, tuffaceous unit. Further up in the Chon Aike sequence rocks change to crystal rich, rhyolitic ignimbrite followed again by a thin layer of tuffaceous sediments. The upper part of the sequence at Martha is comprised of lithic rich, rhyodacitic ignimbrite related to a caldera-forming, volcanic event.

Most of the historic mineral deposits were hosted in the crystal rich ignimbrites and tuffaceous units (Paéz et al, 2015) although, locally, upper lithic fragment tuffs and ignimbrites can host high-grades of vein-hosted silver and gold. An example of the latter is the mineralization in the Betty deposit at Martha.

Martha mineralization is epithermal, intermediate sulfidation in style, hosted in quartz veins, veinlets and vein breccias cutting the margins of the Jurassic-aged caldera (Primero de Abril Caldera; Paéz et al, 2015). Vein widths vary significantly on surface from a few centimeters up to several meters. Banded textures are common in the wider veins. Adularia is a common gangue mineral in the quartz veins.

History

Exploration and production at Martha has a relatively short history, commencing in the late 1990's with the activities of Yamana. On April 3, 2002, Coeur purchased Yamana's 100 percent interest in Polimet. From that point in time to late 2007, Coeur mined and shipped material. Beginning in January 2008, all mine production from Martha was processed at a new mill and flotation plant located at the Martha mine site.

Yamana

In 1997, Yamana conducted regional exploration reconnaissance work in Santa Cruz, Argentina. This program resulted in the discovery of a wide vein, up to 4.7 true width meters on surface, grading up to 6.9 grams/metric tonne (g/t) gold (Au) and 5,200 g/t silver (Ag). This discovery outcrop occurred on the vein subsequently named Martha. Surface work continued in the area in the spring of 1997.

Yamana initiated reconnaissance drilling on the property in January 1998 with shallow reverse circulation (RC) methods. Holes drilled during this phase returned samples with precious metals values of sufficient grade, in sulfidic and oxidized material along the Martha vein system, to justify additional drilling. Definition drilling used a combination of diamond drill core (DDH) and RC methods sited between (in-filling) the reconnaissance-phase drill holes. This work supported the completion of an initial Mineral Resource estimation in late 1999, followed by creation of the first mine plan for the property in February 2000.

The mineral rights were subsequently transferred to Compañía Minera Polimet S.A (Polimet); a wholly owned subsidiary of Yamana. Mine development started in October 2000 utilizing contractors. Mine production, from shallow surface pits, started late that year and the first direct shipping ore (DSO) was exported in February 2001. Mining activities lasted until October 2001 and the export of DSO continued to February 2002. Yamana produced nearly 2,300 gold ounces and 1.7 million silver ounces from approximately 4,000 tonnes of material (Coeur, Martha Mine Technical Report, 2006).

- 8 -

Coeur

On April 3, 2002, Coeur purchased Yamana's 100 percent interest in Polimet for US$2.5 million. From that point in time to late 2007, Coeur shipped Martha mined material to its Cerro Bayo mill and concentrator facilities near the town of Chile Chico, Chile; a distance of nearly 900 kilometers by road. Beginning in January 2008, all mine production from Martha was processed at a new mill and flotation plant located at the Martha mine site.

Exploration History

Since discovery of the Martha vein by Yamana, exploration proceeded at Martha annually until Coeur terminated activities in 2012. Typically, methods used in exploration included initial prospecting, sampling and mapping, followed by detailed sampling via trenching, geochemical analyses on the collected samples, air and ground geophysical surveying and, ultimately, drilling by RC and Core methods to evaluate anomalous geochemical results; in general, all of which are typical methods used within the minerals industry.

Yamana used RC drilling methods with track-mounted drills in the early days of the project. Coeur conducted some RC drilling in the province but shifted to diamond coring methods at Martha. Core drilling, completed from surface and underground platforms, consisted of IEW (25 mm), BQ (36 mm), NQ (47 mm) and HQ (64 mm) diameter drill holes. In addition, Coeur collected a significant amount of data from other exploration techniques, such as air and ground geophysics, Aster remote sensing data collection and interpretation and high-resolution topographic data collection.

Mine and Mill Production

Mining began at Martha by Yamana and continued by Coeur until late 2012. Yamana's mine production yielded Direct Shipping Ore (DSO), from shallow pits and limited underground workings, which was sent to foreign smelters.

From 2002 through late 2007, Coeur shipped all of its Martha concentrates to its Cerro Bayo mill and flotation plant near the town of Chile Chico in Region XI of southern Chile. Concentrates were trucked east from Martha to San Julian then north to Comodoro Rivadavia then west to Chile Chico; a distance of over 900 km. The cutoff grade for Mineral Reserves was, as a result, high.

In 2006 and 2007, exploration and definition drilling were increased to define sufficient Mineral Reserves and additional Mineral Resources to justify the capital expense to build a mill and flotation concentrator on site at Martha. This program was successful and onsite processing commenced in December 2007.

During its years of production, Martha produced over 530,000 tonnes of material and over 24 million ounces of silver and 31 thousand ounces of gold).

Martha Mineralized Zones

Silver and gold mineralization at Martha is located within a series banded and brecciated, veins and veinlets. The style of mineralization has been interpreted to be intermediate-sulfidation in character. The main trend of the mineralized systems is WNW and EW and dip steeply to moderately to the S, SW. On surface, mineralized structures can be several meters wide but often are much less than a meter in true width but may expand in width in the subsurface.

- 9 -

Present Status of Work Completed and Exploration Plans

Exploration on this property by the Company began in 2017 and currently the mine and mill facilities at Martha are active and processing the minerals from exploration activities. Other vein-hosted silver and gold mineralization targets occur on the Martha property and are targeted for future exploration.

Several valid exploration target areas exist on the acquired property. They are grouped herein into three priority areas based on historic mineral resources, proximity to the mill and the amount and results of prior exploration work.

Priority 1. Martha Cluster; This cluster has produced the majority of Martha's silver and gold and contained the largest amount of historic mineral resources all from the Martha, R4 and Del Medio System veins. Together, the three systems form a belt of WNW-striking veins that is nearly 2 km long. Generally, the veins dip to the S and SW at steep to moderate angles.

Priority 2. Areas peripheral to Martha; Veins in this area are Martha Oeste Martha Sur, Futuro, Esperanza, Estero and Wendy. It is reasonable to expect that review of historic data will identify zones deserving of new exploration investment.

Priority 3. This area lies to the north of the main Martha concession within the Ana concession. A small breccia body of sulfidic, base and precious metal mineralization, called Tesoro, occurs in this block. Other notable vein targets in the Ana block are Leonor and Teres Exploration

Royalties and Taxes

The provincial governments in Argentina own the minerals. In October 2014, a new provincial law increased the mining royalty applicable to doré and concentrate to 3% of the pit-head (mine mouth) value, with certain allowable deductions. In addition, Royal Gold holds a 2% Net Smelter Return royalty on Martha.

The Company is not aware of any other rights, encumbrances, or obligations attached to the Company's Martha property.

La Josefina Property

Location

The La Josefina Project is situated about 450 km northwest of the city of Rio Gallegos, in the Santa Cruz province of Argentina within a scarcely populated steppe-like region known as Patagonia. The La Josefina property occupies 52,800 hectares and makes up approximately 90% of all meters drilled by the Company.

The La Josefina Project consists of mineral rights composed by an area of 528 square kilometers established in 1994 as a Mineral Reserve held by Fomicruz, an oil and mining company owned by the Santa Cruz provincial government. The La Josefina Project comprises 16 Manifestations of Discovery totaling 52,767 hectares which are partially covered by 399 pertenencias.

- 10 -

Property Description and Ownership

Exploration Agreement between Fomicruz and CCSA

In March 2007, CCSA was awarded the exploration and development rights from Fomento Minero de Santa Cruz Sociedad del Estado ("Fomicruz") through a required public bidding process to explore the La Josefina Project. As Fomicruz is a government owned company in Santa Cruz province in Argentina, it cannot make individual agreements with a private company without first publishing the offer and giving other private companies the opportunity to submit bids, but the first company making an offer has the right to match any new offer.

The definitive agreement between CCSA and Fomicruz was finalized in July 2007. Pursuant to this agreement, CCSA was obligated to spend US$6 million in exploration and complete pre-feasibility and feasibility studies during a 4-year exploration period (excluding three months each year for winter holiday) commencing in October 2007 at La Josefina in order to earn mining and production rights for a 40-year period in a joint venture partnership ("JV") with Fomicruz. CCSA may terminate this agreement at the end of each exploration stage if results are negative.

The 4-year exploration period was originally planned to proceed in the following three stages:

|

|

Year 1

|

Year 2

|

Years 3 & 4

|

|

|

Target Area

|

To July 2008

|

July 2008 to

July 2009

|

July 2009 to

July 2011

|

Totals

|

|

Noreste Area

|

US$300,000

|

US$400,000

|

US$500,000

|

US$1,200,000

|

|

Veta Norte

|

500,000

|

800,000

|

800,000

|

2,100,000

|

|

Central Area

|

500,000

|

800,000

|

900,000

|

2,200,000

|

|

Piedra Labrada

|

200,000

|

100,000

|

200,000

|

500,000

|

|

TOTAL US$

|

US$1,500,000

|

US$2,100,000

|

US$2,400,000

|

US$6,000,000

|

Other conditions of the agreement:

|

1.

|

CCSA posted a US$600,000 performance bond (equal to 10% of the total proposed exploration investment).

|

|

2.

|

CCSA must maintain the La Josefina mining rights by paying the annual canons due the province on the project's 398 pertenencias.

|

|

3.

|

CCSA must complete surface agreements (lease or buy) with the surface landowners, as required by the Federal mining law, to gain legal access to the ranches (estancias) that cover the project. Most of the project and all the current target areas lie within two large ranches that have been unoccupied for many years - Estancia La Josefina and Estancia Piedra Labrada. The major part of mineralization occurs on Estancia La Josefina, which CCSA purchased in 2007. CCSA rents Estancia Piedra Labrada, which it uses as an exploration field camp.

|

The Company is currently in negotiations with Fomicruz to develop a new joint venture that will have joint participating ownership.

Since CCSA fulfilled its exploration requirement mandated by the agreement with Fomicruz, the performance bond was no longer required to secure the La Josefina project. In June 2010, the Company used the bond to secure the La Valenciana project (discussed later in this document).

- 11 -

On November 15, 2012, the Company signed an amendment to the agreement with Fomicruz which extends the time to develop the La Josefina project by four years, from 2015 to 2019. The Company has agreed to make a minimum investment of US$12 million, of which it has already invested approximately US$9 million. Additionally, and subject to proof of compliance with committed investments, the Company has the option to continue exploration for a second additional term of four years, ending on June 30, 2019, requiring it to make an additional investment US$6 million, which will bring the total investments in the La Josefina Project to US$18 million.

Total costs incurred to date are approximately US$19 million.

The 2012 agreement provided a participating interest for Fomicruz over the minerals and metals extracted of 19% and the purchase option of up to a 49% participating interest in the incorporation of the future Company to be organized for the production and exploitation of the project, having Fomicruz contributing capital for the equivalent of such increase in percentage of participation. The Company has the right to buy back any increase in Fomicruz's ownership interest in the JV Corporation at a purchase price of USD$200,000 per each percentage interest owned by Fomicruz down to its initial ownership interest of 19%; the Company can purchase 10% of the Fomicruz's initial 19% JV Corporation ownership interest by negotiating a purchase price with Fomicruz.

In December 2007, CCSA purchased the "La Josefina Estancia", a 92 square kilometer parcel of land within the La Josefina Project area. CCSA plans to use the La Josefina Estancia as a base of operations for Santa Cruz exploration. The purchase price for the La Josefina Estancia was US$710,000.

Initially, the La Josefina property was excluded from an exploration agreement the Company had with Eldorado Gold. This property was made subject to this agreement with Eldorado Gold on May 7, 2013, but in July 2013 the agreement was terminated by Eldorado Gold.

Present Status of Work Completed and Exploration Plans

In 2014, the Company conducted a shallow Diamond drilling campaign, including 12 holes totaling 651 meters in length completed on the Maria Belen target and 15 holes totaling 957 meters on the Sinter target. Detailed results of the La Josefina drilling program are included in the Company's website, www.huntmining.com.

By late 2015, when the options for test milling the material that would be mined at La Josefina under this bulk sampling program seemed very limited, the Company began talks and eventual negotiations with Coeur Mining Inc. to the purchase the assets of the Mina Martha project approximately 110 km (65 miles) to the south of La Josefina from Coeur's Argentine subsidiary, Coeur Argentina SRL.

The Company has been actively pursuing a new exploration partner for the La Josefina project, as of the date of this filing these discussions are still in process.

The Company obtained permission from Fomicruz for extraction of mineral from the property for test purposes and plans to begin doing so early 2018. The material extracted will be processing at the Company's Mina Martha facility.

Much of the following information is derived from, and based upon the La Josefina 2010 Technical Report, which is available for Hunt Mining Corp. on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com.

History

Santa Cruz province - and indeed much of Patagonia - has only a short history of mineral prospecting and mining. Until the Cerro Vanguardia mine was commissioned in late 1989, only a few mineral occurrences had been identified within the 100,000 square kilometer area of the Deseado Massif. Notably, although Coeur Mining Corporation ceased active mining operations at its Martha Mine in September 2012, the Deseado Massif continues to host three producing mines: the Cerro Vanguardia Mine (AngloGold Ashanti Limited - Fomicruz), the San Jose – Huevos Verdes Mine (Hochschild Mining plc – Minera Andes Incorporated) and the Manantial Espejo Mine (Pan American Silver Corp.). Additionally, several new mines are being readied for production, and many active exploration projects (including Coeur Mining's Joaquin exploration project) are in progress.

- 12 -

In 1975, the first occurrence of metals known in the La Josefina area was publicly mentioned by the Patagonian delegation of the National Ministry of Mining. They reported the presence of an old lead-zinc mine in veins very near Estancia La Josefina. The mineralization received no further attention until 1994 when a research project by the Institute of Mineral Resources of the Universidad Nacional de la Plata and the geology department of the University of Patagonia San Juan Bosco examined the occurrence. That investigation corroborated not only the presence of base metals, but also precious metals.

In 1994, immediately after the La Josefina gold-silver discovery, Fomicruz claimed the area as a Provincial Mineral Reserve and explored the project in collaboration with the Instituto de Recursos Minerales (INREMI) of La Plata University. The geology and alteration of the project area was mapped at a scale of 1:20,000. Mineralized structures and zones of sinter were mapped at 1:2,500, trenches across the structures were continuously sampled and mapped at scales of 1:100 and ground geophysical surveys consisting of 6,000 m of IP-resistivity and 5,750 meters of magnetic surveys were completed over sectors of greatest interest.

In 1998, after four years of exploring and advancing interest in the project, Fomicruz offered La Josefina for public bidding by international mining companies. In accordance with provincial law, the winner would continue exploring the project to earn the right to share production with Fomicruz of any commercial discoveries. The bid was awarded to Minamérica S. A. ("Minamerica"), a private Argentine mining company. Minamerica dug a limited number of new trenches, initiated a program of systematic surface geochemical sampling, completed several new IP-Resistivity geophysical survey lines and drilled the first exploration holes on the project – 12 diamond core holes totaling 1,320 meters in length. The results of this effort were relatively encouraging but Minamerica nevertheless abandoned the project a year later in 1999.

In 2000, Fomicruz resumed exploration of the project and continued their efforts until 2006. Pits were dug to bedrock over some of the target areas, 3,900 meters of new trenches were dug and sampled, more than 8,000 float, soil and outcrop samples were collected for geochemical analyses, some new IP-Resistivity surveys were completed under contract to Quantec Geophysical Co., and 59 diamond core holes (total 3,680 meters) were drilled to average shallow depth below surface of 55 meters. Of these holes, 37 were NQ-size core (47.6mm diameter) and 22 were HQ-size core (63.5mm).

Fomicruz reported spending more than US$2.8 million in exploring and improving infrastructure on the La Josefina Project from 1994 to 2006. In late-2006, the La Josefina Project was again opened to international bidding and in May 2007, CCSA was awarded the right to explore the project. Throughout 2007 and 2008, CCSA was mainly focused on an intensive drill plan (37,605 meters), and in 2009 and the first quarter of 2010 reviewed all the data gathered in order to generate a geological model for the project and continued working on regional exploration to define new additional targets for next drilling stages.

Royalties

Mineral properties in Argentina carry no federal royalties but the provinces are entitled to collect up to 3% mine-mouth royalty (MMR).

In Santa Cruz, the province has opted to drop this MMR to 1% if the operation is a precious metal mine that produces doré bullion within the province. The agreement between CCSA and Fomicruz stipulates that any doré bullion resulting from future La Josefina operations must be produced in the province, so it is likely the project will carry the minimal 1% MMR unless it is processed at the Martha Mill which produces concentrate and not a doré. However, because La Josefina is a Mining Resource in which the mineral rights belong to Fomicruz, the project also carries an additional 5% MMR payable to the province. Therefore, the total MMR for any future gold/silver/base metal production at La Josefina under the current agreement could total 6%.

- 13 -

Environmental Liabilities

There are no known environmental liabilities associated with the La Josefina Property.

Permits Required

No permits are required at this time to conduct the proposed exploration.

La Valenciana Property

Location

La Valenciana is located on the central-north area of the Santa Cruz Province, Argentina. The project encompasses an area of approximately 29,600 hectares and is contiguous to the Company's La Josefina property to the east. The La Valenciana project is comprised of 11 Manifestations of Discovery covering segments of Estancia Canodon Grande, Estancia Flecha Negra, Estancia Las Vallas, Estancia La Florentina, Estancia La Valenciana and Estancia La Modesta (inactive ranches).

Property Description and Ownership

The Company leases the surface rights to the approximate 29,600 hectares of land on which the La Valenciana is located and has a joint venture with Fomicruz for the mineral rights.

Exploration Agreement between Fomicruz and CCSA

In 2017 the La Valenciana Project was combined under the same agreement with Fomicruz as La Josefina and now operates under the terms of that contract.

The previous agreement for La Valenciana was the following:

In 2010, the right to develop and mine the property was opened up for bidding to private companies. Hunt Mining Corp, through CCSA, was awarded the prospects and mining rights. The Company entered into an agreement with Fomicruz effective as of November 15, 2012, for the right to explore and develop the La Valenciana property for a period of seven years. The agreement with Fomicruz requires the Company to spend USD $5,000,000 in exploration on the project over 7 years.

Total costs incurred to date are approximately US$4.6 million.

Since CCSA fulfilled its exploration requirement mandated by the La Josefina agreement with Fomicruz, the performance bond was no longer required to secure the La Josefina project. In June 2010, the Company used the bond to secure the La Valenciana project.

If the Company elects to exercise its option to bring the La Valenciana project into production, it must grant Fomicruz a 9% ownership in a new JV Corporation to be created by the Company to manage the project. If Fomicruz elects to increase their ownership they can under the following formula up to a maximum of 49% interest.

|

·

|

To purchase an additional 10% in the JV corporation, Fomicruz must reimburse the Company for 10% of the exploration expenses made by the Company during the exploration period;

|

|

·

|

To purchase the next 10% interest in the JV corporation, Fomicruz must reimburse the Company for 20% of the exploration expenses made by the Company during the exploration period;

|

- 14 -

|

·

|

To purchase a final additional 20% interest in the JV Corporation, Fomicruz must reimburse the Company for 25% of the exploration expenses made by the Company during the exploration period; bringing Fomicruz's total ownership interest in the JV Corporation to 49%.

|

At the Company's option it can purchase all but the 9% granted ownership interest in the JV Corporation from Fomicruz for USD $200,000 per percentage point owned. The remaining 9% can be purchased for a mutually agreed amount, to be determined by negotiation between Fomicruz and the Company

Geology and Mineralization

Geology of La Valenciana Project, within the Deseado Massif, is characterized by abundant middle-to-late Jurassic Age volcanic and volcaniclastic rock units. The units are dominated by rhyolitic to rhyodacitic ignimbrite flows and lava domes together with subordinate agglomerates, volcanic breccias and tuffs with minor basalts, andesites and volcanic agglomerates intercalated upward with mafic tuffs, conglomerates and sediments. Faults active during the period of intense Jurassic extension and volcanism generally trend NNW-SSE and form a series of grabens, and horst blocks.

Since Jurassic time, the rocks have been cut by normal faults of several different orientations but have undergone only a moderate amount of compression. In general, the Jurassic rocks remain relatively undeformed and remain flat to gently dipping, except locally where close to faults, volcanic domes or similar features. Thin Quaternary Age basalt flows conceal about half of the Jurassic Age rocks on the La Valenciana project.

The type of mineralization and alteration styles present across the project area are classified as sulfidation type epithermal deposits. Gold and silver occur in fissure vein systems localized in structures, often a meter or wider and hundreds of meters long. They are comprised of quartz veins, stockworks and breccias, rich in adularia with some calcite, that carry gold, silver, electrum and some sulfides, primarily pyrite with small amounts of base metal sulfides.

The La Valenciana project is without known reserves as defined by SEC industry Guide No. 7.

The exploration targets consist of gold and silver mineralized quartz veins in volcanic host rocks. Current work is conducted on the La Josefina and La Valenciana claim blocks. La Josefina includes four major vein systems while La Valenciana harbors three. A total of more than 900 trenches and drill holes have been drilled with approximately 40,000 assayed samples. Higher gold values exceed 100 g/tone and higher silver values are above 1,000 g/t. Veins are formed by upward fluid migration and are therefore typically open to depth.

There is no geophysics. Geochemistry is conducted through ICP analysis (35+ elements) of all field and drill-hole samples. Even if no elevated precious metal grades are encountered this trace element analysis can still expose possible trends which often preclude gold and silver mineralization.

History

Several historical exploration programs, consisting of trenching, mapping and drilling by Fomicruz carried out from 1994 to 2000 and air geophysics including gamma spectrometry from 1996 to 1998, have taken place to date at La Valenciana, with the most recent exploration being conducted by CCSA. Initially, the La Valenciana property was excluded from the exploration agreement with Eldorado Gold. This property was made subject to the exploration agreement with Eldorado Gold on May 7, 2013, an agreement later terminated by Eldorado in July 2013.

- 15 -

In 2014, CCSA conducted a shallow Diamond drilling campaign on the La Valenciana project. This was the first drill program undertaken by the Company at La Valenciana and consisted of 42 holes totaling 3,000 meters, designed to partially test four separate targets: Principal, 19 holes totaling 1,135 meters; Valenciana, 6 holes totaling 438 meters; Rosario, 7 holes totaling 521 meters; and Florentina, 10 holes totaling 726 meters. Detailed results of the La Valenciana drilling program are included in the Company's website, www.huntmining.com.

Present Status of Work Completed and Exploration Plans

The Company has been actively pursuing a new exploration partner for the La Valenciana project, as of the date of this filing these discussions are still in process.

There was no drilling activity during 2017 at La Valenciana.

Royalties

Mineral properties in Argentina carry no federal royalties but the provinces are entitled to collect up to 3% mine-mouth royalty.

In Santa Cruz, the province has opted to drop this MMR to 1% if the operation is a precious metal mine that produces doré bullion within the province. The agreement between CCSA and Fomicruz stipulates that any doré bullion resulting from future La Valenciana operations must be produced in the province, so it is likely the project will carry the minimal 1% MMR. However, because La Valenciana is a Mining Reserve in which the mineral rights belong to Fomicruz, the project also carries an additional 5% MMR payable to the province. Therefore, the total MMR for any future gold/silver/base metal production at La Josefina under the current agreement could total 6%.

Environmental Liabilities

There are no known environmental liabilities associated with the La Valenciana Property.

Permits Required

No permits are required at this time to conduct the proposed exploration.

Other Properties

Bajo Pobre Property

The Bajo Pobre property covers 3,190 hectares and is mainly on the Estancia Bajo Pobre and is owned 100% by the Company. The property is located 90 kilometers south of the town of Las Heras.

In January 2006, CCSA signed a letter of intent with FK Minera S.A., an arm's length party to CCSA and CCSA's former parent corporation, to acquire a 100% interest in the Bajo Pobre property, a gold exploration property located in Santa Cruz province, Argentina. On March 27, 2007 CCSA signed a definitive lease purchase agreement with FK Minera to acquire the Bajo Pobre property. Pursuant to this agreement, CCSA can earn up to a 100% equity interest in the Bajo Pobre property by making cash payments and exploration expenditures over a 5 year earn-in period.

The Company has completed all lease payments to FK Minera S.A., the owner of the Bajo Pobre property. The parties to the contract have finalized an amendment to the contract terms and therefore the Company's ability to retain rights to explore the Bajo Pobre property is affirmed. As part of the amendment, the Company's obligation of exploration expenditures has been waived by FK Minera S.A., thus affirming the Company's right to ownership.

Geology and Mineralization

The Bajo Pobre project comprises an extensive low sulphidation epithermal gold/silver vein and stock work system located in the North-central region of the Deseado Massif in Santa Cruz Argentina. The known extent of the Bajo Pobre gold system encompasses more than 12 kilometers of exposed vein strike within a 5 square kilometer area of intense hydrothermal alteration. The main vein system generally trends northeast and is comprised of at least five outcropping sub-parallel structures, varying between 1 and 10 meters in width, with an average outcrop width of 3 meters. These sub parallel veins converge on a hill which shows extensive stockwork, strong silicification, acid leaching and argillic alteration. The mineralization is hosted within permeable dacitic to andesitic tuffaceous rocks of the Jurassic age Bajo Pobre Formation.

- 16 -

The Company's Bajo Pobre project does not have any known reserves, and the property does not have any processing infrastructure or equipment on site. There are no power generation facilities on the property, and if it was to become a mine a power generation facility would have to be built or power lines would have to be run to the project. The property does have access to a good water supply that can be utilized for both drilling and processing should it become a mine.

The Bajo Pobre project is without known reserves as defined by SEC industry Guide No. 7.

History

The Bajo Pobre property was discovered in 1970 and has been worked intermittently by several government entities and private companies. However, serious exploration was not initiated until the mid- 90's with detailed geologic mapping and surface sampling. Assays from this sampling yielded up to 40 grams per ton gold. Drill targets identified from surface sampling were augmented in 2002 with additional targets derived from geophysical surveys. In 2003 and 2004, the property saw a limited amount of exploration drilling which tested a small portion of these targets. The specific work that was conducted from 1996 to 2004 included 62-line kilometers of IP/resistivity geophysical surveys, the emplacement and sampling of 40 trenches totaling 2,500 meters, more than 1000 surface chip and channel samples and 12 widely spaced shallow drill holes.

The Company has conducted cursory reconnaissance on the Bajo Pobre property. The Bajo Pobre property was included in the exploration agreement with Eldorado Gold, an agreement later terminated by Eldorado in July 2013.

Mineral Exploration Activity

The Company completed detailed geological mapping, surface soil sampling and advanced drill targeting during 2012 on the Bajo Pobre project. The Company did not carry out any exploration work on the Bajo Pobre project in 2013, 2014, 2015, 2016, or 2017.

Total costs incurred to date are approximately US$1.5 million.

There are no current detailed plans to conduct exploration on the property.

Royalties

If CCSA is able to commence commercial production on the Bajo Pobre property, CCSA shall pay FK Minera S.A. the greater of a 1% Net Smelter Royalty ("NSR") on commercial production or US$100,000 per year. CCSA has the option to purchase the NSR for a lump sum payment of US$1,000,000 less the sum of all royalty payments made to FK Minera S.A. to that point.

Environmental Liabilities

There are no known environmental liabilities associated with the Bajo Pobre Property.

- 17 -

El Gateado Property

In March 2006, CCSA acquired the right to conduct exploration on the El Gateado property through a claim staking process for a period of at least 1,000 days, commencing after the Government issues a formal claim notice, and retain 100% ownership of any mineral deposit found within.

The Company has not yet received a formal claim notice pertaining to the El Gateado property. Should a mineral deposit be discovered, CCSA has the exclusive option to file for mining rights on the property. The surface rights of the El Gateado claim are held by the following Ranches, Estancia Los Ventisqueros, Estancia La Primavera, Estancia La Virginia and Estancia Piedra Labrada. The El Gateado claims are filed with the government under file #406.776/DPS/06.

The El Gateado project is without known reserves as defined by SEC industry Guide No. 7.

El Gateado is a 10,000-hectare exploration concession filed with the Santa Cruz Provincial mining authority. The El Gateado property is located in the north-central part of Santa Cruz province, contiguous to La Josefina on the east.

Environmental Liabilities

There are no known environmental liabilities associated with the El Gateado Property.

History

No known exploration had taken place at El Gateado prior to the work completed by CCSA from 2006 to 2011. During that time CCSA conducted an exploration program consisting of surface channel outcrop sampling, trenching, geological mapping, topographic surveying and more than 3,500 meters of diamond core drilling.

Mineral Exploration Activity - El Gateado

CCSA began field reconnaissance work on the El Gateado property in 2006 with the completion of a topographic survey, base map generation, and a staked grid. In late 2006 and early 2007, CCSA drilled 13 holes on the El Gateado property. Results of this drilling program, based on assay results over 1 g/t Au, are included in the Company's Filing Statement dated November 30, 2009, as filed on SEDAR on December 3, 2009.

CCSA incurred approximately US$706,000 in exploration expenses on the initial El Gateado drilling program. CCSA's management conducted all exploration processes except for drilling, which was conducted by an independent Argentine drilling contractor. All assay results above were based on assay work performed by an independent assay laboratory.

CCSA was encouraged by these drilling results. However, did not conduct any exploration activity on the El Gateado property in 2008, 2009 or 2010.

In the first quarter of 2011, CCSA prepared roads and drill pads at El Gateado. The Company has spent approximately $50,000 on this infrastructure work. During 2011, the Company completed 2,358 meters of drilling on the El Gateado property.

The Company did not carry out any exploration work on the El Gateado project in 2012, 2013 or 2014.

Total costs incurred to date are approximately US$1.5 million and no current detailed plans to conduct exploration on the property

- 18 -

Item 3. Legal Proceedings

A lawsuit was filed in Buenos Aires on March 18, 2011 by a former director and accounting consultant against the Company and its subsidiaries for damages in the amount of US$249,041, including wages, alleged bonus payments, interest and penalties. Subsequent to December 31, 2017 a settlement was reached (see Note 19(a) and Note 23 to the audited consolidated financial statements for the year ended December 31, 2017).

Item 4. Mine Safety Disclosures

The Company has no outstanding mine safety violations or other regulatory safety matters to report.

- 19 -

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The common stock is listed on the TSX Venture Exchange, also referred to as the "TSXV", and trades under the symbol "HMX.V". The following table sets forth the high and low sales prices per share expressed in Canadian dollars and

|

High

|

Low

|

Volume

|

|

|

2016

|

$ CAD

|

$ CAD

|

(shares)

|

|

First Quarter

|

0.08

|

0.02

|

617,300

|

|

Second Quarter

|

0.35

|

0.05

|

1,603,700

|

|

Third Quarter

|

0.40

|

0.19

|

992,400

|

|

Fourth Quarter

|

0.35

|

0.24

|

550,600

|

|

High

|

Low

|

Volume

|

|

|

2017

|

$ CAD

|

$ CAD

|

(shares)

|

|

First Quarter

|

0.34

|

0.21

|

416,000

|

|

Second Quarter

|

0.24

|

0.16

|

756,500

|

|

Third Quarter

|

0.28

|

0.13

|

778,800

|

|

Fourth Quarter

|

0.25

|

0.14

|

2,208,400

|

As of December 31, 2017, there were 1,419 registered holders of record of the Company's common share and an undetermined number of beneficial holders.

Exchange Rates

The Company maintains its books of account in United States dollars and references to dollar amounts herein are to the lawful currency of the United States except that it is traded on the Toronto Venture Stock Exchange (TSXV) and, accordingly, stock price quotes and sales of stock are conducted in Canadian dollars (C$). The following table sets forth, for the periods indicated, certain exchange rates based on the noon rate provided by the Bank of Canada. Such rates are the number of Canadian dollars per one (1) U.S. dollar (US$). The high and low exchange rates for each month during the previous six months were as follows:

|

Month

|

High

|

Low

|

|

Jan-18

|

1.2535

|

1.2293

|

|

Dec-17

|

1.2886

|

1.2545

|

|

Nov-17

|

1.2888

|

1.2683

|

|

Oct-17

|

1.2893

|

1.2472

|

|

Sep-17

|

1.2505

|

1.2128

|

|

Aug-17

|

1.2755

|

1.2482

|

- 20 -

The following table sets out the exchange rate (price of one U.S. dollar in Canadian dollars) information as at each of the years ended December 31, 2016 and 2017.

|

Year Ended December 31

|

||

|

(Canadian $ per U.S. $)

|

||

|

|

2017

|

2016

|

|

Rate at end of Period

|

1.2545

|

1.3427

|

|

Low

|

1.2128

|

1.2562

|

|

High

|

1.3743

|

1.4661

|

Dividends

The Company has not paid any cash dividends on common shares since inception and do not anticipate paying any cash dividends in the foreseeable future. The Company plans to retain earnings, if any, to provide funds for the expansion of business.

Outstanding Share Data

The authorized share capital of the Company consists of an unlimited number of common shares and preferred shares without nominal or par value. As at December 31, 2017, the Company's outstanding equity and convertible securities were as follows:

|

Securities

|

Outstanding

|

|

Voting equity securities issued and outstanding(1)

|

63,588,798 common shares

|

|

Securities convertible or exercisable into voting equity securities – stock options

|

Stock options to acquire up to 4,380,000 common shares

|

|

Securities convertible or exercisable into voting equity securities – warrants

|

22,500,000 warrants to acquire 22,500,000 common shares at an exercise price of $0.075 CAD per share before July 20, 2020

|

|

25,000,000 warrants to acquire 25,000,000 common shares at an exercise price of $0.050 CAD per share before October 13, 2020

|

|

|

1,362,500 warrants to acquire 1,362,500 common shares at an exercise price of $0.40 CAD per share before November 25, 2018

|

|

(1)

|

On June 24, 2015, the Company's common shares were consolidated on the basis of one (1) post-consolidation common share for every ten (10) pre-consolidation common shares. All common share, share option, share purchase warrant and per share figures have been adjusted to reflect the 10:1 share consolidation.

|

- 21 -

Holders

As of December 31, 2017, the Company had 1,419 stockholders of record.

Dividends

The Company has never declared or paid cash dividends. There are currently no restrictions which limit the ability to pay dividends in the future.

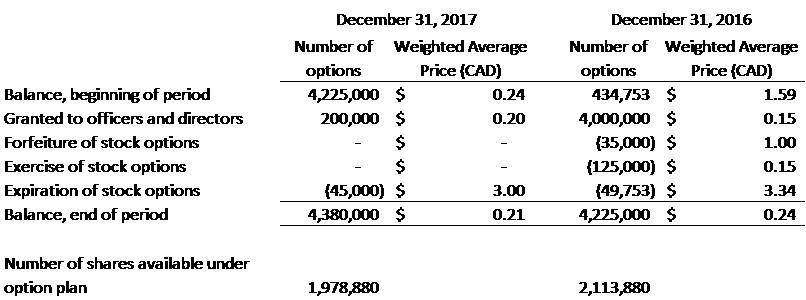

Securities authorized for issuance under equity compensation plans

Unlimited number of common shares without par value

Under the Company's share option plan, and in accordance with TSX Venture Exchange requirements, the number of common shares reserved for issuance under the option plan shall not exceed 10% of the issued and outstanding common shares of the Company. In connection with the foregoing, the number of common shares reserved for issuance to: (a) any individual director or officer will not exceed 5% of the issued and outstanding common shares; and (b) all consultants will not exceed 2% of the issued and outstanding common shares.

Equity Compensation Plan Information for the Incentive Stock Option Plan

|

Plan category

|

Number of securities issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights (CAD)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|

Equity compensation plans approved by security holders

|

4,380,000

|

$ 0.21

|

1,978,880

|

|

Equity compensation plans not approved by security holders

|

-

|

$ -

|

-

|

- 22 -

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Company and Affiliated Purchasers

None.

Section 15(g) of the Securities Exchange Act of 1934

The company's shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell securities and may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as "bid" and "offer" quotes, a dealers "spread" and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

The application of the penny stock rules may affect your ability to resell your shares.

ITEM 6: SELECTED CONSOLIDATED FINANCIAL DATA

The Company is a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Special Note on Forward-Looking Statements

Certain statements contained in this report (including information incorporated by reference) are "forward-looking statements." The Company's forward-looking statements include current expectations and projections about future production, results, performance, prospects and opportunities, including reserves and other mineralization. The Company has tried to identify these forward-looking statements by using words such as "may," "might," "will," "expect," "anticipate," "believe," "could," "intend," "plan," "estimate" and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, the forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause actual production, results, performance, prospects or opportunities, including reserves and mineralization, to differ materially from those expressed in, or implied by, these forward-looking statements.

- 23 -

Given these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements. Projections and other forward-looking statements included in this report have been prepared based on assumptions, which the Company believes to be reasonable, and in accordance with United States generally accepted accounting principles ("GAAP") or any guidelines of the Securities and Exchange Commission ("SEC"). Actual results may vary, perhaps materially. You are strongly cautioned not to place undue reliance on such projections and other forward-looking statements. All subsequent written and oral forward-looking statements attributable to Hunt Mining Corporation or to persons acting on the Company's behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

You should read the following discussion and analysis of the Company's financial condition and results of operations together with its financial statements and related notes in this annual report on Form 10-K. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those set forth under "Risk Factors" in this annual report on Form 10-K.

The Company

Hunt Mining Corp., is a mineral exploration company incorporated on January 10, 2006 under the laws of Alberta, Canada and, together with its subsidiaries, is engaged in the exploration of mineral properties in Santa Cruz Province, Argentina.

Effective November 6, 2013, the Company continued from the Province of Alberta to the Province of British Columbia. The Company's registered office is located at 25th Floor, 700 W Georgia Street, Vancouver, B.C. V7Y 1B3. The Company's head office is located at 23800 E Appleway Avenue, Liberty Lake, Washington, 99019 USA.

During the year ended December 31, 2017, the major source of funding was from sales of silver-gold concentrate and tailings, exceeding $9.2 million. Other sources of funding included loans from the Hunt Family Limited Partnership, and a loan facility from Ocean Partners; advanced against future concentrate sales. The Company incurred net operating losses for the aggregate of years ended December 31, 2017 and 2016 but were profitable in 2017 by approximately $1.66 million. The Company remains focused on evaluating its mining properties in Argentina, with near term prospects of mining the La Josefina gold property and the continuation of production of silver-gold concentrate from the Mina Martha property. The Company is also reviewing strategic opportunities, focusing primarily on development or operating properties.

Results of Operations

For the Years Ended December 31, 2017 compared to December 31, 2016

Liquidity and Capital Resources

For the year ended December 31, 2017 the Company generated a net income of $1,655,914, or $0.03 per basic share, compared to a net loss of $3,109,074 or $0.05 per basic share, for the year ended December 31, 2016. The increase was due to the sale of silver and gold concentrate and tailings from the Mina Martha property.

Working capital increase from 2016 to 2017 of $2,860,011 is primarily due to the sale of concentrate and negotiating more favorable repayment terms on loans. See Notes 12 and 14 of the financial statements for further details.

The total assets increase from 2016 to 2017 of $2,460,200 primarily due to the continued restoration of the Mina Martha plant and equipment to bring it to intended useable state and receivables related to the sale of concentrate. Other capital assets were also acquired during the year that were needed for the extraction and processing of minerals.

- 24 -

The non-current liability increased balance from 2016 and 2017 of $1,170,335 is due to accretion of the asset retirement obligation for the Mina Martha property as well as reclassifying current debt to non-current. See Note 14 of the financial statements.

The total shareholder's equity increase from 2016 to 2017 of $1,777,057 is due to the net income less adjustments for other comprehensive income, and for stock option offerings during 2017.

Summary of Results of Operations:

|

December 31,

|

December 31,

|

Change from prior year

|

||||||||||

|

2017

|

2016

|

Favorable (Unfavorable)

|

||||||||||

|

Net income (loss) for the year

|

$

|

1,655,914

|

$

|

(3,109,074

|

)

|

$

|

4,764,988

|

|||||

|

Net loss per share – basic:

|

0.03

|

(0.05

|

)

|

0.08

|

||||||||

|

Net loss per share – diluted:

|

0.01

|

(0.05

|

)

|

0.06

|

||||||||

|

Working capital

|

(5,308,822

|

)

|

(8,168,833

|

)

|

2,860,011

|

|||||||

|

Total assets

|

8,531,328

|

6,071,128

|

2,460,200

|

|||||||||

|

Total non-current liabilities

|

2,142,030

|

971,695

|

(1,170,335

|

)

|

||||||||

|

Total shareholders' equity

|

(1,544,661

|

)

|

(3,321,718

|

)

|

1,777,057

|

|||||||

The Company is in the exploration phase and has incurred losses since its inception up to 2017 at which point it began selling silver and gold concentrate. As shown in the accompanying consolidated financial statements, the Company has an accumulated loss of $35,993,656 through December 31, 2017. The Company intends to fund operations for the next twelve months sales of material from the Mina Martha property and the Josefina property

Financial Position

Cash

There was a small decrease in cash from 2016 mostly because the company used all excess cash generated from sales to pay down liabilities and purchase new operating assets. Of the $3,432,377 cash generated from operations, $2,599,799 was used for investing activities in mining assets and 1,040,289 was used to for financing activities to repay loans. See the accompanying footnotes 10-14 of the financial statements for details of the significant transactions.

Accounts Receivable

The sale of concentrate played a significant role in the Company's operations during 2017. With sales of 8,740,854, of which $1,144,740 remained receivable at December 31, 2017, the Company was able to achieve net income for the year. The company also has a value added tax recoverable of approximately $1,000,120.

Inventory

There remained approximately $333,000 of mineral inventory at December 31, 2017 from the results of mining and exploration.

- 25 -

Property, plant and equipment

Property plant and equipment consists of office furniture, computer equipment, geological equipment, and the Mina Martha plant and equipment assets. In May 2016 the Mina Martha property purchased for $3 million and in 2017 it underwent a restoration project to bring it to a useable state. The costs incurred during the restoration process along with acquisition of other mining equipment were the primary reason for the increase in asset costs of $1,264,299 from 2016. Net of depreciation, total property, plant and equipment value increased by $98,707.

Trade Liabilities

The Company was able to eliminate liabilities related to the purchase of the Martha property of $1,500,000, however; there were increases in trade accounts payable and accrued liabilities of approximately $1,159,331 primarily due to the increase in mining activities.

Loan Payable and Long-term Debt

The Company acquired a new loan facility from a related party during the year up to $1,000,000 at any given time, of which $700,000 was outstanding as at December 31, 2017. The Company was also able to renegotiate the terms of its loan acquired in 2016 resulting in $1,368,594 being reclassified as a non-current liability.

Off-balance sheet arrangements

At December 31, 2017, the Company had no material off-balance sheet arrangements such as guarantee contracts, contingent interest in assets transferred to an entity, derivative instruments obligations or any obligations that trigger financing, liquidity, market or credit risk to us.

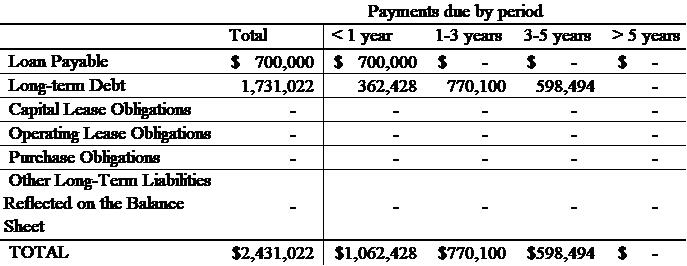

Contractual Obligations

- 26 -

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. During the year ended December 31, 2017, the Company had net income of $1,655,914. As at December 31, 2017, the Company had an accumulated deficit of $35,993,656. The Company intends to continue funding operations through operation of the Martha Mine and equity financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ending December 31, 2018.