Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - NowNews Digital Media Technology Co. Ltd. | tv491118_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - NowNews Digital Media Technology Co. Ltd. | tv491118_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - NowNews Digital Media Technology Co. Ltd. | tv491118_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - NowNews Digital Media Technology Co. Ltd. | tv491118_ex31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - NowNews Digital Media Technology Co. Ltd. | tv491118_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| (Mark One) | FORM 10-K |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to ___________________

Commission file number: 333-171637

NOWNEWS DIGITAL MEDIA TECHNOLOGY CO. LTD.

(Exact name of registrant as specified in its charter)

| Nevada | 36-4794119 | |

| State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization | Identification No.) |

| 4F, No. 32, Ln. 407, Sec. 2, Tiding Road, Neihu District, Taipei City, Taiwan | 114 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +886-2-87978775

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

On June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the Common Stock held by non-affiliates of the registrant was $80,881,500, based upon the closing price on that date of the Common Stock of the registrant on the OTCQB of $5.00. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

The number of shares of common stock, par value $0.001 (the “Common Stock”), outstanding as of April 16, 2018 is 23,072,000.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

| 2 |

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K (“Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Annual Report. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Annual Report describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Annual Report could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report or the date of documents incorporated by reference herein that include forward-looking statements.

Corporate History

We were incorporated as Forever Zen Ltd. on March 20, 2010 under the laws of the State of Nevada. On December 13, 2013, we changed our name to NowNews Digital Media Technology Co., Ltd. and planned to enter into the business of internet media and news content. Prior to the Share Exchange described below, we were a development stage company and had not yet realized any revenues from our planned operations.

On November 14, 2014, we entered into and closed a share exchange agreement (the “Share Exchange Agreement”), with Worldwide Media Investments Corp., an Anguilla corporation (“Worldwide”), the shareholders of Worldwide, and NOWnews Network Co., Ltd., a Taiwan corporation (“NOWnews Network”). Pursuant to the Share Exchange Agreement, (i) the Company issued an aggregate of 20,000,000 shares of common stock to the shareholders of Worldwide in exchange for all the issued and outstanding capital stock of Worldwide. Worldwide, through its wholly owned subsidiary, Sky Media Investments Co., Ltd. (“Sky Media”), owns 66% of all the issued and outstanding capital stock of NOWnews Network(the “Share Exchange”). As a result of the Share Exchange, Worldwide and Sky Media become our wholly owned subsidiary and NOWnews Network is now our majority owned subsidiary in which we indirectly holds 66% of the equity interest. Upon consummation of the Share Exchange, we ceased to be a shell company.

| 3 |

On August 5, 2015, NOWnews Network, Sky Media, Mr. Alan Chen, the former Chairman of the Company, and Ms. Tu entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Gamania Digital Entertainment Co. Ltd. (“Gamania Digital”) and Ta Ya Venture Capital Co. Ltd. (“Ta Ya”), pursuant to which there were two phases of stock transfers. In Phase I, NOWnews Network was committed to issue and sell to Gamania Digital and Ta Ya 1,250,000 and 400,000 shares of its outstanding shares at a price of NT$10 per share, respectively. The share transfer of Phase I shall be completed sixty (60) days upon signing the agreement. In Phase II, Gamania Digital and Ta Ya were expected, but not obligated, to purchase the same amount of shares from NOWnews Network, and Mr. Chen and Ms. Tu, as in Phase I. On August 14, 2015, NOWnews Network has fulfilled its obligation of Phase I through the issuance and sale of 1,250,000 and 400,000 shares at a price of NT$10 per share to Gamania Digital and Ta Ya for approximately $388,803 (or NT$12.5 million) and $124,417 (or NT$4.0 million), respectively. On September 8, 2015, NOWnews Network issued and sold additional 350,000 shares at a price of NT$10 per share to Gamania Digital for approximately $107,230 (or NT$3.5 million). On November 30, 2016, NOWnews Network issued and sold additional 1,000,000 shares at a price of NT$10 per share to Gamania Digital for approximately $313,283 (or NT$10 million). On March 16, 2017, NOWnews Network issued and sold additional 2,200,000 shares at a price of NT$10 per share to Gamania Digital for approximately $711,054 (or NT $22,000,000). On March 31, 2017, Sky Media purchased 1,065,000 shares of NOWnews Network held by Jin Hao Kang Marketing Co., Ltd for a purchase price of approximately US$30,930 (or NT$937,200). On October 2, 2017 and November 17, 2017, NOWnews Network issued and sold additional 1,114,100 and 600,000 shares at a price of NT$10 per share to Gamania Digital for approximately $366,722 (or NT$11,141,000) and $199,667 (or NT$6,00,000), respectively. On November 17, 2017, Sky Media also made capital contribution to NOWnews Network in cash of NT$10,000,000 (approximately $332,779). As a result of the above transactions, NOWnews Network remains the Company’s majority owned subsidiary in which Company indirectly holds 50.36% of the equity interest at December 31, 2017.

On August 19, 2015, we incorporated Dawnrain Media Co., Ltd. (“Dawnrain”) in the Republic of Seychelles (“Seychelles”). Dawnrain is our wholly owned subsidiary. On August 27, 2015, Dawnrain incorporated New Taoyard Cultural Transmission Co., Ltd. (“New Taoyard”) in Seychelles. On November 15, 2016, we incorporated Asia Well Ltd. in Seychelles. Dawnrain, New Taoyard, and Asia Well are holding companies and have not carried out substantive business operations of their own.

On August 1, 2017, New Taoyard entered into a share purchase agreement (the “Lovelife Agreement) with Shanghai Lovelife Trading Co., Ltd. (“Lovelife”), a limited liability formed in the People’s Republic of China, and its sole shareholder and director. Pursuant to the Lovelife Agreement, Lovelife shall transfer 100% of its equity interest to New Taoyard. As of the date of this report, Lovelife has a registered capital of USD 160,000 but no capital has been actually paid to Lovelife.

| 4 |

Corporate Structure

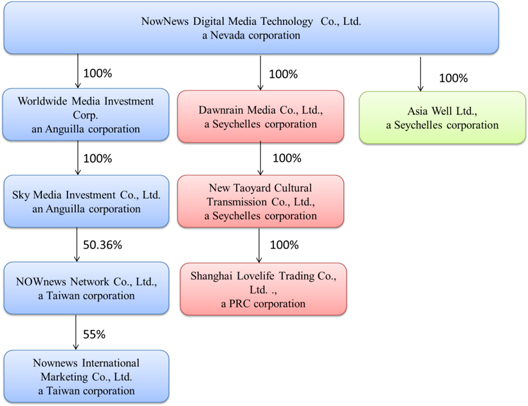

The diagram below illustrates our corporate structure as of the date of this report:

Worldwide was incorporated in Anguilla on June 4, 2013 under the Anguilla International Business Companies Act, 2000. Worldwide is a holding company and has not carried out substantive business operations of its own. Mr. Alan Chen is the sole director and controlling beneficiary shareholder of Worldwide.

Sky Media was incorporated under the laws of Anguilla on June 4, 2013.

NOWnews Network Co. Ltd. (“NOWnews Network”) was incorporated in Taipei City, Taiwan on June 8, 2006. NOWnews Network is a media company with operations in Taiwan and is our primary operating subsidiary as of December 31, 2016.

NOWnews Network owns 55% of the equity interest of Nownews International Marketing Co., Ltd, a Taiwan corporation (“Nownews International”), primarily engaged in sales of advertising spaces in newspapers. The operation of Nownews International was terminated in December 2013. On January 17, 2017, Nownews International started the liquidation process and registered as a dissolved company in process.

Dawnrain was incorporated in Seychelles on August 19, 2015. Dawnrain is a holding company and has not carried out substantive business operations of its own.

On August 27, 2015, Dawnrain incorporated New Taoyard Cultural Transmission Co., Ltd. in Seychelles. New Taoyard is a holding company and has not carried out substantive business operations of its own.

On November 15, 2016, Asia Well Ltd. was incorporated in Seychelles. Asia Well Ltd. is a holding company and has not carried out substantive business operations of its own.

On May 16, 2017, each of Dawnrain, New Taoyard and Asian Well Ltd. has amended its share registry to reduce the amount of the issued and outstanding shares to 10, 10, and 100 shares, respectively. Accordingly, there were capital contribution of $10, $10, and $100 paid into each of Dawnrain, New Taoyard and Asian Well Ltd., respectively.

On August 1, 2017, New Taoyard entered into a share purchase agreement with Lovelife and its sole shareholder and director, pursuant to which New Taoyard acquired 100% of the registered capital interest of Lovelife.

| 5 |

Recent Development

As discussed above, on August 1, 2017, the Company’s wholly-owned subsidiary, New Taoyard, entered into the Lovelife Agreement with Lovelife, its sole shareholder and director. Pursuant to the Lovelife Agreement, Lovelife shall transfer 100% of its equity interest to New Taoyard. As of the date of this report, Lovelife has a registered capital of USD160,000 but no capital has acutally been paid to Lovelife.

Principal Services

We generate our revenues primarily from online advertising and marketing services and news content licensing.

Advertising and Marketing

Our advertising product offerings consist of banner, button, text-link and video advertisements that appear on pages within our website, and advertising campaign design and management services. Our primary advertising and sponsorship client base for advertising and sponsorships includes international and local companies. We offer brand advertising services in display formats on our website as well as performance-based online marketing solutions, such as promoted feeds on mobile or tablet. Display advertising comprises the text, images and other interactive ads that run across the web on computers and mobile devices, including content specially formatted to be displayed on smartphones, tablets and other mobile personal digital devices.

We also provide advertising campaign design and management services for a fee. Our services include design and implementation of marketing and advertising projects consisting of content advertising through publishing topic news and experience articles, pop-up or embedded advertisements on our website or applications, creation of visual/mobile/audio advertisement, etc. Through these services, we help our clients establish their corporate image and brand and market their products.

News Content Licensing

We have our own team comprising journalists and editors who produce approximately 350 - 500 news articles/reports on a daily basis, covering real-time diversified news including politics, finance, life, technology, sport, entertainment, travel and others. Besides, NOWnews Network also licenses its self-created news content to major portals and corporate partners with more extensive news network, such as Yahoo Hong Kong, Yahoo Taiwan, MSN Taiwan, Yam, Sina Taiwan, Taiwan Mobile, Chunghwa Telecom, Far EasTone Telecommunications Co. Ltd., Vibo Telecom, etc.

Historically, we provided editing services to customers including selecting, sorting, editing news for other website operators such as Yahoo Taiwan. We ceased this service in December 2013 because this service was not profitable. In addition, we used to provide film/video editing services and licensed copyrights to a related party, Chunghwa Wideband Best Network Co., Ltd., and stopped in later 2013.

Seasonality

We have experienced seasonality in our online advertising business. Historically, the periods from May through August and from November to January have seen increase of more than 20% in advertising revenues due to the summer break and the winter holiday season. February has historically been the worst month for our advertising business as it is after the Lunar New Year holidays when advertising revenues are generally down nationwide. Past performance may not be indicative of future trends, as the mix of advertising industry sectors, which may have different seasonality factors, may shift from quarter to quarter. There is no seasonality in its licensing business.

| 6 |

Major Customers

For the fiscal year ended December 31, 2017, our top three customers and their respective sale amount are as follows:

| Percentage of Total | ||||||||

| Name | Sales ($) | Revenue | ||||||

| OUI Marketing Co., Ltd. | 264,958 | 7.06 | % | |||||

| Zenithoptimedia Co., Ltd. | 233,540 | 6.23 | % | |||||

| GuoShi Partners Co. | 137,890 | 3.68 | % | |||||

For the fiscal year ended December 31, 2016, our top three customers and their respective sale amount are as follows:

| Percentage of Total | ||||||||

| Name | Sales ($) | Revenue | ||||||

| Kose Corporation | 344,935 | 11.05 | % | |||||

| Zenithoptimedia Co., Ltd. | 177,649 | 5.69 | % | |||||

| GuoShi Partners Co. | 162,945 | 5.22 | % | |||||

Employees

As of the date of this report, we have 103 employees, all of whom are full-time and are based in Taiwan. The breakdown of our employees based on departments is set forth below:

| Department | Number of Employees | |

| News | 52 | |

| Sales and Marketing | 32 | |

| Innovation and Development | 9 | |

| Finance | 2 | |

| Administration | 8 |

There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

Regulation

Regulatory Authorities

We are subject to the supervision of the National Communications Commission of Republic of China (the “NCC”). The NCC was established in February 2006.

Permits, Licenses and Approvals

Pursuant to the Provisions on Broadcasting and Television Program Supply, to obtain the permit to engage in broadcasting and TV program supply business, we are required to meet two criteria: (i) minimum registered capital of NT$1,200,000 and (ii) minimum office area of approximately 377square feet. The operating permit should be obtained from Ministry of Culture before we apply for the business license for regular companies. As of the date of this report, NOWnews Network has obtained the approval for (i) production and distribution of radio and TV programs and (ii) radio and TV advertisement.

We believe we have all requisite permits, approvals and licenses to conduct our businesses.

Rating of Internet Content

The Regulations for the Rating of Internet Content was abolished by the NCC in 2012. At present, the rating of internet content is governed by Article 46 of the Protection of Children and Youths Welfare and Rights Act (last amended on December 16, 2015), which requires that all internet platform providers adopt their own rules implementing “clear and practicable” protection measures in accordance with the internet content supervisory institutions engaged by the NCC and other relevant authorities to prevent youth and children from having access to harmful internet contents. An internet platform provider is required to restrict children and youths from having access to internet content upon the relevant authority’s notification that such internet contents may be harmful or that such internet platform provider failed to implement “clear and practicable” protection measures.

| 7 |

Personal Data Protection Act

On May 26, 2010, the President of the Republic of China announced the amendment of the Personal Information Protection Act, or PIPA, which replaced the former Computer-Processed Personal Data Protection Act, or CPPDPA, and became fully effective on October 1, 2012, except for its Articles 6 and 54 that await further determination by the Executive Yuan. Under the PIPA, every individuals or governmental or non-governmental agencies, including us, should be subject to certain requirements and restrictions for collecting, processing or using personal data. The definition of “personal data” is extended to cover a broad scope, including name, birthday, ID, special features, fingerprints, marriage status, family, education, occupation, medical records, medical history, generic information, sex life, health examination report, criminal records, contact information, financial status, social activities, and any other data which is sufficient to directly or indirectly identify a specific person. If we fail to comply with the PIPA, we may be subject to serious punishment for civil claims, criminal offenses and administrative liabilities: the ceiling of the aggregate compensation amount for damages payable in a single case will be up to NT$200 million or the actual value of loss arising from our violation provided the amount of actual value of such loss is higher than NT$200 million; the defendant may be subject to an imprisonment of up to five years; and the penalty for administrative liabilities will be up to NT$500,000 for each violation, and may be imposed consecutively if such violation continues.

Foreign Investment

Pursuant to the provisions of the Statute for Investment by Foreign Nationals, there are only a few industries where foreign investments are restricted. None of the businesses of NOWnews Network fall under the restricted industries. Therefore, there is no restriction on foreign ownership in NOWnews. However, Taiwan restricts investments by the PRC nationals. In accordance with the Rules on Investment Permit by Nationals from the People’s Republic of China, only certain industries are open to the PRC nationals. The following businesses of NOWnews Network are open to the PRC nationals: portal website operation, data processing, website management and related services.

News Regulation

As a news generator, we are subject to regulations on contents of news. We are prohibited from creating or distributing certain news including but not limited to the following:

News that damages people’s reputation

News that invades people’s privacy

News that involves information on national defense

News that might influence judicial proceedings

Depending on the circumstances, in the event of violation of any of the foregoing restrictions, we may be subject to fines or criminal liabilities. In addition, we need to comply with requirements on news regarding election, public polls, and pharmaceuticals, etc.

Regulation on Advertisement

Companies are prohibited from using false or misleading advertising language and advertising agencies cannot help its clients design or create untrue or misleading advertisements. Otherwise, the agencies may be subject to the same liabilities as their clients.

| 8 |

Foreign Exchange

Foreign exchange regulation in Taiwan is primarily governed by the Ordinance of Foreign Exchange Administration, latest amended on April 29, 2009 (the “Foreign Exchange Ordinance”). Under the Foreign Exchange Ordinance, foreign exchange refers to foreign currency, bills and marketable securities. The authority managing the administration of foreign exchange is Ministry of Finance of Republic of China, while the authority managing the practical operation of foreign exchange business is Central Bank of Republic of China. The Foreign Exchange Ordinance also specifies the allocated power of Ministry of Finance and Central Bank, respectively. To the extent that any foreign exchange receipts, payments or transactions reach the threshold of NT$500,000 ($16,869) or equivalent in foreign currency, it must be reported to the Central Bank or its designated authorities. Upon incurrence of any of the following events, the State Council of Republic of China may determine and announce that for a period of time, to close the foreign exchange market, suspend or restrict all or partial foreign exchange payment, order a mandatory sale or deposit of all or partial foreign exchange into a designed bank, or dispose in any other manner as it deems necessary:

the disorder in domestic or international economy to the detriment of the stability of Taiwan’s economy; or Taiwan suffers serious trade deficit.

Tax

The current principal regulations governing tax in Taiwan include the following:

Income Tax Law, latest amended on February 7, 2018;

The Implementation Rules of Income Tax Law, latest amended on September 30, 2014;

Value-Added and Non-Value-Added Business Tax Law, latest amended on June 14, 2017; and

The Implementation Rules of Value-Added and Non-Value-Added Business Tax Law, latest amended on May 1, 2017.

Under the Income Tax Law, there are two kinds of income tax, comprehensive income tax for individuals and income tax for enterprises operating for profit, respectively.

Individuals who have income with a source within Taiwan must pay comprehensive income tax on their income sourced within Taiwan; while non-resident individuals having income with a source within Taiwan, except otherwise provided in the Income Tax Law, shall pay tax based on the amount attributable to the sources of their income.

The enterprise with head office located in Taiwan shall pay profit-seeking income tax on its global income both within and outside Taiwan; while the enterprises with head office outside Taiwan shall only pay profit-seeking income tax on its business income sourced from within Taiwan.

Rate of Income Tax

The individual comprehensive income tax exemption threshold is NT$60,000 ($2,024) per person per year. Any income beyond such exemption threshold is subject to a progressive tax rate ranging from 5% to 40%.

With respect to enterprises operating for profit, the exemption threshold is NT$120,000 ($4,048). Any income beyond such exemption threshold is subject to 20% tax rate on its taxable income.

Sale of goods or service, import of goods in Taiwan are subject to a Value-Added or Non-Value-Added Business Tax. The Rate of business tax, except as otherwise stipulated in the relevant tax law, ranges from 5% to 10% as determined by the State Council of Taiwan.

Enforceability of Judgments in Taiwan

All of our directors and executive officers named in this report are residents of Taiwan and substantially all of our assets and the assets of those persons are located in Taiwan. As a result, it may not be possible for investors to effect service of process upon us or those persons outside of Taiwan, or to enforce against them judgments obtained in courts outside of Taiwan. Any final judgment obtained against us in any court other than the courts of the Republic of China in connection with any legal suit or proceeding arising out of or relating to our securities will be enforced by the courts of the Republic of China without further review of the merits only if the court of the Republic of China in which enforcement is sought is satisfied that:

| 9 |

the court rendering the judgment has jurisdiction over the subject matter according to the laws of the Republic of China;

the judgment and the court procedure resulting in the judgment are not contrary to the public order or good morals of the Republic of China;

if the judgment was rendered by default by the court rendering the judgment, we, or our officers and directors, were duly served within a reasonable period of time in accordance with the laws and regulations of the jurisdiction of the court or process was served on us with judicial assistance of the Republic of China; and

judgments at the courts of the Republic of China are recognized and enforceable in the court rendering the judgment on a reciprocal basis.

A party seeking to enforce a foreign judgment in the Republic of China would be required to obtain foreign exchange approval from the Central Bank of the Republic of China (Taiwan) for the payment out of Taiwan of any amounts recovered in connection with the judgment denominated in a currency other than NT dollars if a conversion from NT dollars to a foreign currency is involved.

Market Opportunities

Our current primary focus is on the Taiwan market. The success of our business is tied to the size and vitality of Taiwan’s economy. According to the International Monetary Fund, Taiwan’s gross domestic product in 2017 grew 2.84% year over year to $519.15 billion.

Taiwan has one of the most advanced telecommunications networks in Asia. With excellent telecommunications infrastructure in place and the innovative use of breakthrough information technologies, Taiwan continues to be well placed to drive both mobile and data communications services.

Competition

The market for Web sites offering online content and services targeting the global Chinese community is competitive and we expect competition to increase in the future. Many of the companies attempting to address this market offer portal, content and e-commerce services. The following table lists the Chinese-language Web sites that we believe are currently our primary competitors in Taiwan:

udn.com

appledaily.com.tw

Chinatimes.com

ltn.com.tw

ettoday.net

As internet usage in Mainland China, Hong Kong, Macau and Taiwan (collectively, the “Greater China”) increases and the Greater China market becomes more attractive to advertisers and for conducting fee-based services, large global competitors, such as Facebook, LinkedIn, Google, Twitter, Line, Kakao and WhatsApp, may increasingly focus their resources on the Greater China market. We cannot assure you that we will succeed in competing against the established and emerging competitors in the market. The increased competition could result in reduced traffic, loss of market share and revenues, and lower profit margins.

Our ability to compete successfully depends on many factors, including the quality of our content, the breadth, depth and ease of use of our services, our sales and marketing efforts and the performance of our technology.

| 10 |

Competitive Strength

We provide online content and services for the global Chinese community with a focus on Taiwan, including but not limited to informational features, social media and social networking services as well as other fee-based services. This industry can be characterized as highly competitive and rapidly changing due to the fast growing market demand. Barriers to entry are relatively low, and current and new competitors can launch new websites or services at a relatively low cost. Many companies offer various content and services targeting this community that compete with us. Many of our competitors have greater financial resources, a longer history of providing online services, a larger and more active user base, more established brand names and currently offer a greater breadth of products that may be more popular than our online offerings. However, we believe that we possess the following competitive strengths that enable us to compete effectively:

We have an outstanding editorial team which produces hundreds of news on a daily basis, covering real-time diversified news including politics, finance, life, technology, sport, entertainment, travel and others. Besides, we license our self-created news content to major portals and corporate partners with a stable and extensive news network. We believe this is very critical to attract readers and increase traffic volume of our website.

We have been focusing on new media operations and interaction with its members and fans. We believe we are the first news media which opened official accounts on LINE and WeChat, two very popular mobile messengers in Asia and created NOWnews Network fan group on Facebook.

With the growing popularity of mobile devices, we are the first to develop applications on mobile devices offering users real-time news anywhere at any time. The current daily traffic on our website exceeds 14 million and is mobile website has a daily traffic volume of approximately 4 million.

We have won many awards and is highly recognized and rated among our peers. Recognition and awards include:

| · | 10th among the top 100 websites in Taiwan in the survey conducted by comScore |

| · | 18th on the “Top 100 Hottest Websites in Taiwan” and first among the original news websites by Digital Times in 2014 |

| · | 22th on the “Top 100 Most Popular Fan Clubs in Taiwan” by Digital Times in 2013 |

| · | The Seventh and Eighth Quality Journalism Awards by the Ministry of the Interior of Taiwan |

| · | The 13th Cross-Strait News Reporting Award – Citizen News |

| · | The 2011 Excellent Alliance Partners by Yahoo Shopping Center |

We have a very large member base, which includes approximately 430,000 Facebook fans and 840,000 LINE subscribers and 100,000 WeChat subscribers. We believe this member base will keep increasing and we will leverage this membership base to expand our business. PRC implements strict control over the media. However, we are the only Taiwan internet media to which the PRC residents have full access – this, we believe, provides us with access to a very large potential reader base and tremendous business opportunities. Currently, approximately 9% of our traffic is from the PRC. Through our platform, we can build a cross-strait service system where we can promote Taiwan’s services or products to readers in the PRC. However, PRC regulatory authorities may find the contents on our website/mobile applications objectionable and block users in China from accessing our website and/or mobile applications.

Technology Infrastructure

Our operating infrastructure is designed to serve and deliver hundreds of millions of page views a day to our users. This scalable infrastructure allows our users to access our products and services quickly and efficiently, regardless of their geographical location. Our infrastructure is also designed to provide high-speed access by forwarding queries to our Web hosting sites with greater resources or lower loads. Our Web pages are generated, served and cached by servers hosted at various co-location Web hosting sites in Taiwan and the United States.

| 11 |

Our servers run on our own web-based platforms. These servers are maintained at Amazon in the United States and our offices in Taiwan. We believe that our hosting partners provide significant operating advantages, including an enhanced ability to protect our systems from power loss, break-ins and other potential external causes of service interruption. They provide continuous customer service, multiple connections to the Internet and a continuous power supply to our systems. In addition, we conduct online monitoring of all our systems for accessibility, load, system resources, network- server intrusion and timeliness of content.

Sales and Marketing

We enhance our brand images and visibility through participating in various public events, exchanging resources with other companies, and establishing partnership with other media companies. In addition, we focus on keyword marketing and search engine optimizing to increase the search ranking of our news content.

Research and Development

Currently, we focus on (i) developing the Drupal platform to host our website and (ii) using Drupal to build daily news from personal blogs and company applications. Drupal is an open source content management platform powering millions of websites and applications. It’s built, used, and supported by an active and diverse community of people around the world and has thousands of add-on modules and designs available for us to build and improve our website.

Intellectual Property

We rely on a combination of copyright, trademark, patent and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our technology. Monitoring unauthorized use of our products is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our technology, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

In addition, third parties may initiate litigation against us alleging infringement of their proprietary rights. In the event of a successful claim of infringement and our failure or inability to develop non-infringing technology or license the infringed or similar technology on a timely basis, our business could be harmed. In addition, even if we are able to license the infringed or similar technology, license fees could be substantial and may adversely affect our results of operations.

Patents

We have the following patents as of the date of this report:

| Patent Name | Type | Jurisdiction | Valid Period | Certificate No. | ||||

| Portable multimedia sharing device | Utility Model | Taiwan | May 11, 2011 – September 15, 2020 | M403695 | ||||

| Multimedia device with embedded multimedia information | Utility Model | Taiwan | May 21, 2012 – September 26, 2021 | M429933 | ||||

| Information browsing system | Utility Model | Taiwan | April 11, 2012 – September 29, 2021 | M426832 | ||||

| Multimedia file with embedded information | Utility Model | The PRC | May 11, 2011 – September 15, 2020 | 2495374 |

| 12 |

Trademarks

As of the date of this report, we have registered an aggregate of 17 trademarks in various categories and are in the process of applying for an additional four trademarks in Taiwan and the PRC. Set forth below is a list of our trademarks:

| Valid Period | ||||||||

| Trademarks | Jurisdiction | From | To | Categories | ||||

|

Taiwan | 2/16/2007 | 1/31/2018 | 35, 41 | ||||

| 2/16/2008 | 2/15/2018 | 16, 35,42 | ||||||

| 13 |

| Valid Period | ||||||||

| Trademarks | Jurisdiction | From | To | Categories | ||||

|

Taiwan | 5/7/2007 | 2/15/2018 | 16, 35, 42 | ||||

| 5/7/2007 | 8/31/2018 | 9, 38, 41 | ||||||

|

Taiwan | 4/3/2008 | 12/15/2018 | 9, 16, 35, 38, 41 | ||||

|

Taiwan | 5/6/2009 | 4/15/2020 | 35 | ||||

| 5/6/2009 | 2/15/2020 | 38 | ||||||

| 5/6/2009 | 2/15/2025 | 9 | ||||||

|

Taiwan | 6/30/2010 | 9/15/2021 | 9, 16, 35, 38, 41 | ||||

| PRC | 8/2/2010 | 12/23/2023 | 9 | |||||

| 8/2/2010 | 4/13/2022 | 16 | ||||||

| 8/2/2010 | 5/6/2024 | 35 | ||||||

| 8/2/2010 | 6/2/2024 | 41 | ||||||

|

Taiwan | 5/19/2010 | 1/31/2021 | 9, 16, 35, 38, 41 | ||||

|

Taiwan | 5/6/2009 | 4/15/2020 | 35 | ||||

| 5/6/2009 | 2/15/2020 | 9, 38, 41 | ||||||

|

Taiwan | 2/1/2013 | 1/31/2023 | 35 | ||||

| 14 |

| Valid Period | ||||||||

| Trademarks | Jurisdiction | From | To | Categories | ||||

|

Taiwan | 8/18/2013 | 7/31/2023 | 16 | ||||

| 11/16/2013 | 11/15/2023 | 35, 41 | ||||||

|

Taiwan | 11/2/2012 | 8/15/2023 | 35 | ||||

|

PRC | 4/7/2008 | 2/6/2022 | 16 | ||||

Not applicable.

Item 1B. Unresolved Staff Comments.

Not applicable.

Our corporate headquarters are located at 4F, No. 32, Ln. 407, Sec. 2, Tiding Road, Neihu District, Taipei City 114, Taiwan, where we lease approximately 7,117.35 square feet of office space under a lease that expires September 14, 2022. Our monthly lease payment for this office space is approximately $9,296 (NT$275,520).

Our servers are primarily maintained in Taiwan. We believe the leased premise is sufficient to meet the immediate needs of our business.

We are currently not involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our Company or any of our subsidiaries, threatened against or affecting our Company, our common stock, any of our subsidiaries or of our Company’s or our Company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not applicable.

| 15 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Common Equity and Related Stockholder Matters

Our common stock is currently quoted on the OTCQB under the symbol “NDMT.” There has not been any significant trading to date in the Company’s common stock. The table below presents the high and low bid for our common stock for each quarter for the years ended December 31, 2017 and 2016. These prices reflect inter-dealer prices, without retail markup, markdown, or commission, and may not represent actual transactions.

| High | Low | |||||||

| First Quarter of 2018 (for the period end March 31, 2018) | $ | 2.84 | $ | 1.83 | ||||

| Year ended December 31, 2017 | ||||||||

| 1st Quarter | $ | 4.80 | $ | 2.50 | ||||

| 2nd Quarter | $ | 5.15 | $ | 3.09 | ||||

| 3rd Quarter | $ | 5.00 | $ | 1.00 | ||||

| 4th Quarter | $ | 3.90 | $ | 2.65 | ||||

| Year ended December 31, 2016 | ||||||||

| 1st Quarter | $ | 6.80 | $ | 5.99 | ||||

| 2nd Quarter | $ | 6.10 | $ | 2.90 | ||||

| 3rd Quarter | $ | 5.00 | $ | 1.81 | ||||

| 4th Quarter | $ | 5.00 | $ | 3.00 | ||||

As of April 16, 2018, we had 23,072,000 shares of common stock outstanding and held of record by 537 stockholders.

Securities Authorized for Issuance under Equity Compensation Plans.

None.

Stock Transfer Agent

Our stock transfer agent is Empire Stock Transfer, 1859 Whitney Mesa Dr., Henderson, NV 89014.

Dividends

The Company has never declared or paid any cash dividends on its common stock. The Company currently intends to retain future earnings, if any, to finance the expansion of its business. As a result, the Company does not anticipate paying any cash dividends in the foreseeable future.

Repurchase of Equity Securities

None.

Recent Sales of Unregistered Securities

During the period covered by this annual report on Form 10-K, there were no sales by us of unregistered securities except as noted below and as described in Note 9 to the Audited Financial Statements.

On June 22, 2017, the Company entered into a subscription agreement (the “Subscription Agreement”) with a Taiwanese investor (the “Investor”). Pursuant to the Subscription Agreement, the Investor agreed to purchase 100,000 restricted shares (the “Subscription Shares”) of common stock, par value $.001 of the Company (“Share Purchase”) for an aggregate price of $530,000 (the “Subscription Price”). As of the date of this report, the Company has received the Subscription Price but not issued any Subscription Shares.

The issuance of the Subscription Shares will be exempt from registration under Rule 903 of Regulation S of the Securities Act on the basis that the transaction will be an “offshore transaction”, as defined in Rule 902(h) of Regulation S.

| 16 |

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations .

This Management Discussion and Analysis (“MD&A”) contains “forward-looking statements”, which represent our projections, estimates, expectations or beliefs concerning among other things, financial items that relate to management’s future plans or objectives or to our future economic and financial performance. In some cases, you can identify these statements by terminology such as “may”, “should”, “plans”, “believe”, “will”, “anticipate”, “estimate”, “expect” “project”, or “intend”, including their opposites or similar phrases or expressions. You should be aware that these statements are projections or estimates as to future events and are subject to a number of factors that may tend to influence the accuracy of the statements. These forward-looking statements should not be regarded as a representation by the Company or any other person that the events or plans of the Company will be achieved. You should not unduly rely on these forward-looking statements, which speak only as of the date of this MD&A. Except as may be required under applicable securities laws, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this MD&A or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks we describe under “Risk Factors” in our reports filed with the Securities and Exchange Commission. Actual results may differ materially from any forward looking statement.

Overview

We were incorporated as Forever Zen Ltd. on March 20, 2010 under the laws of the State of Nevada. On December 13, 2013, we changed our name to NowNews Digital Media Technology Co Ltd. with the plan to enter into the business of internet media and news content. Prior to the Share Exchange as defined below, we were a development stage company and had not yet realized any revenues from our planned operations.

On November 14, 2014, we entered into and closed a share exchange agreement (the “Share Exchange Agreement”), with Worldwide Media Investments Corp., an Anguilla corporation (“Worldwide”), the shareholders of Worldwide, and NOWnews Network Co., Ltd., a Taiwan corporation (“NOWnews Network”). Pursuant to the Share Exchange Agreement, the Company issued an aggregate of 20,000,000 shares of common stock to the shareholders of Worldwide in exchange for all the issued and outstanding capital stock of Worldwide (the “Share Exchange”). Worldwide, through its wholly owned subsidiary, Sky Media Investments Co., Ltd. (“Sky Media”), owned 66% of all the issued and outstanding capital stock of NOWnews Network immediately following the Share Exchange.

As a result of the consummation of the Share Exchange on November 14, 2014, NOWnews Network became, indirectly through Worldwide and Sky Media, a majority-owned subsidiary of the Company. We are now, through NOWnews Network, engaged in creating, collecting and distributing news and information through our website http://www.nownews.com/ and our applications on mobile phones or tablets.

We currently generate revenue primarily from online advertising and marketing services and news content licensing. We historically had revenues from online product sales in the E-commerce business and editing services for customers. Since our editing service was not profitable, we ceased this service in December 2013. In addition, we also suspended our E-commerce business in April 2014 and eventually terminated the E-commerce business at the end of 2015 due to the continuous loss from this business.

| 17 |

On August 5, 2015, NOWnews Network, Sky Media, Mr. Alan Chen, the former Chairman of the Company, and Ms. Tu entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Gamania Digital Entertainment Co. Ltd. (“Gamania Digital”) and Ta Ya Venture Capital Co. Ltd. (“Ta Ya”), pursuant to which there were two phases of stock transfers. In Phase I, NOWnews Network was committed to issue and sell to Gamania Digital and Ta Ya 1,250,000 and 400,000 shares of its outstanding shares at a price of NT$10 per share, respectively. The share transfer of Phase I shall be completed sixty (60) days upon signing the agreement. In Phase II, Gamania Digital and Ta Ya were expected, but not obligated, to purchase the same amount of shares from NOWnews Network, and Mr. Chen and Ms. Tu, as in Phase I. On August 14, 2015, NOWnews Network has fulfilled its obligation of Phase I through the issuance and sale of 1,250,000 and 400,000 shares at a price of NT$10 per share to Gamania Digital and Ta Ya for approximately $388,803 (or NT$12.5 million) and $124,417 (or NT$4.0 million), respectively. On September 8, 2015, NOWnews Network issued and sold additional 350,000 shares at a price of NT$10 per share to Gamania Digital for approximately $107,230 (or NT$3.5 million). On November 30, 2016, NOWnews Network issued and sold additional 1,000,000 shares at a price of NT$10 per share to Gamania Digital for approximately $313,283 (or NT$10 million). On March 16, 2017, NOWnews Network issued and sold additional 2,200,000 shares at a price of NT$10 per share to Gamania Digital for approximately $711,054 (or NT $22,000,000). On March 31, 2017, Sky Media purchased 1,065,000 shares of NOWnews Network held by Jin Hao Kang Marketing Co., Ltd for a purchase price of approximately US$30,930 (or NT$937,200). On October 2, 2017 and November 17, 2017, NOWnews Network issued and sold additional 1,114,100 and 600,000 shares at a price of NT$10 per share to Gamania Digital for approximately $366,722 (or NT$11,141,000) and $199,667 (or NT$6,00,000), respectively. On November 17, 2017, Sky Media also made capital contribution to NOWnews Network in cash of NT$10,000,000 (approximately $332,779). As a result of the above transactions, NOWnews Network remains the Company’s majority owned subsidiary in which Company indirectly holds 50.36% of the equity interest at December 31, 2017.

On August 19, 2015, we incorporated Dawnrain Media Co., Ltd. (“Dawnrain”) in the Republic of Seychelles (“Seychelles”). Dawnrain is our wholly owned subsidiary. On August 27, 2015, Dawnrain incorporated New Taoyard Cultural Transmission Co., Ltd. (“New Taoyard”) in Seychelles. On November 15, 2016, we incorporated Asia Well Ltd. in Seychelles. Dawnrain, New Taoyard, and Asia Well are holding companies and have not carried out substantive business operations of their own.

On August 1, 2017, New Taoyard entered into a share purchase agreement (the “Lovelife Agreement) with Shanghai Lovelife Trading Co., Ltd. (“Lovelife”), a limited liability formed in the People’s Republic of China, and its sole shareholder and director. Pursuant to the Lovelife Agreement, Lovelife shall transfer 100% of its equity interest to New Taoyard. As of the date of this report, Lovelife has a registered capital of USD 160,000 but no capital has actually been paid to Lovelife.

Results of Operations for the Years Ended December 31, 2017 and 2016

| For The Years Ended | ||||||||||||||||

| December 31, | Change in | |||||||||||||||

| 2017 | 2016 | $ | % | |||||||||||||

| Net revenue | $ | 3,750,894 | $ | 3,121,143 | $ | 629,751 | 20 | |||||||||

| Cost of revenue | (3,116,151 | ) | (2,172,313 | ) | (943,838 | ) | 43 | |||||||||

| Gross profit | 634,743 | 948,830 | (314,087 | ) | (33 | ) | ||||||||||

| Selling expenses | (1,127,259 | ) | (608,924 | ) | (518,335 | ) | 85 | |||||||||

| General and administrative expenses | (4,288,928 | ) | (1,072,645 | ) | (3,216,283 | ) | 300 | |||||||||

| Financial advisory service fee – related party | - | (2,970,000 | ) | 2,970,000 | (100 | ) | ||||||||||

| Total operating expense | (5,416,187 | ) | (4,651,569 | ) | (764,618 | ) | 16 | |||||||||

| Operating loss | (4,781,444 | ) | (3,702,739 | ) | (1,078,705 | ) | 29 | |||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | 757 | 106 | 651 | 614 | ||||||||||||

| Interest expense | (248 | ) | (870 | ) | 622 | (71 | ) | |||||||||

| Other income, net | 796 | 6,868 | (6,072 | ) | (88 | ) | ||||||||||

| Total other income (expense) | 1,305 | 6,104 | (4,799 | ) | (79 | ) | ||||||||||

| Loss from continuing operations before income taxes | (4,780,139 | ) | (3,696,635 | ) | (1,083,504 | ) | 29 | |||||||||

| Income taxes | - | - | - | - | ||||||||||||

| Loss from continuing operations | (4,780,139 | ) | (3,696,635 | ) | (1,083,504 | ) | 29 | |||||||||

| Income (Loss) from discontinued operations, net of income taxes | 1 | 2 | (1 | ) | (50 | ) | ||||||||||

| Net loss | (4,780,138 | ) | (3,696,633 | ) | (1,083,505 | ) | 29 | |||||||||

| Net loss attributable to noncontrolling interests: | ||||||||||||||||

| Net loss from continuing operations | 842,646 | 164,529 | 678,117 | 412 | ||||||||||||

| Net loss from discontinued operations | (1 | ) | (2 | ) | 1 | (50 | ) | |||||||||

| Total net loss attributable to noncontrolling interest | 842,645 | 164,527 | 678,118 | 412 | ||||||||||||

| Net loss attributable to NowNews Digital Media Technology Co., Ltd. | $ | (3,937,493 | ) | $ | (3,532,106 | ) | $ | (405,387 | ) | 11 | ||||||

| 18 |

Net Revenue

Our net revenue for the year ended December 31, 2017 was $3.75 million, an increase of $0.63 million or 20% from $3.12 million for the year ended December 31, 2016. The increase was primarily due to the increase in advertisement revenue.

Advertising

Our advertising avenue was $3.53 million for the year ended December 31, 2017, an increase of $0.67 million, or 23%, from $2.86 million for the year ended December 31, 2016. We will continue focus on the internet advertising and marketing business.

Licensing and Services

Our revenue from content licensing was $0.23 million for the year ended December 31, 2017, a decrease of $0.03 million, or 14%, from $0.26 million for the year ended December 31, 2016.

Cost of Revenue

Cost of revenue mainly consists of advertisement costs, content licensing costs, copyright costs, website maintenance costs, and labor costs.

Cost of revenue was $3.12 million for the year ended December 31, 2017, an increase of $0.95 million, or 43%, as compared to $2.17 million for the year ended December 31, 2016. The increase was mainly due to the increase of $0.31 million in advertisement cost and $0.56 million in labor cost.

Gross Profit

Gross profit decreased approximately $0.31 million, or 33%, for the year ended December 31, 2017, as compared to the same period in 2016, due to the substantial increase in cost of revenue. Gross profit margin was 17% for the year ended December 31, 2017 as compared to 30% for the same period in 2016.

Selling Expenses

Total selling expenses consist primarily of payroll, labor and health insurance, and advertisement expenses. The amount increased by $0.52 million, or 85%, from $0.61 million for the year ended December 31, 2016, to $1.13 million for the year ended December 31, 2017. The increase in selling expenses was primarily due to the increase in labor costs resulting from the increase in the number of salespersons.

| 19 |

General and Administrative Expenses

General and administrative expenses primarily consist of payroll, welfare, labor and health insurance, post-retirement benefits, office rent and management fees, depreciation & amortization expenses, professional services, and expenses for other general corporate activities. General and administrative expenses increased by approximately $3.22 million, or 300%, from $1.07 million for the year ended December 31, 2016 to $4.29 million for the year ended December 31, 2017. The increase in general and administration expenses was principally due to the increase in the number of employees and the recognition of stock compensation cost awarded to directors and consultant in a total of $2,239.250 during the year ended December 31, 2017.

Financial advisory service fee – related party

Financial advisory service fee increased by $2.97 million was due to the services provided by GIA Consultants Limited In resolution of the Company’s outstanding obligations pertaining to the services that have been rendered to the Company as of August 12, 2016, the Company and GIA Consultants Limited (“GIA”) entered into a Financial Advisory Service Recognition Agreement (the “Agreement”) on September 20, 2016, pursuant to which the Company agrees to issue 660,000 shares of common stock, par value $0.001 per share, to GIA in recognition of services that have been previously rendered to the Company as of August 12, 2016. The common stock price was $4.50 per share as of closing on August 12, 2016, the closing price as of the last business day prior to August 15, 2016, totaling an aggregate sum of $2,970,000. On October 4, 2016, the Company issued 660,000 shares of common stock to GIA Consultants Limited to fulfill the Agreement signed on September 20, 2016. The Company did not receive financial advisory service from GIA and was not obligated to pay financial advisory service fee for the year ended December 31, 2017.

Net Loss

As a result of the above factors, we have net loss of approximately $4.78 million for the year ended December 31, 2017 as compared to net loss of approximately $3.70 million for the year ended December 31, 2016, representing an increase of loss of approximately $1.08 million, or approximately 29%.

Liquidity and Capital Resources

Our consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. We have incurred significant losses and have not demonstrated the ability to generate sufficient cash flows from operations to satisfy its liabilities and sustain operations. We had accumulated deficits of $11,869,788 and $7,932,295, and stockholders’ deficits of $2,115,848 and $1,380,173 as of December 31, 2017 and 2016, respectively. The net losses attributable to common stockholders of $3,937,493 and $3,532,106 for the years ended December 31, 2017 and 2016, respectively. In addition, current liabilities exceed current assets by $1,837,035 and $858,428 as of December 31, 2017 and 2016, respectively, representing significant working capital deficits. These matters raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on us obtaining adequate capital to fund operating losses until it becomes profitable. If we are unable to obtain adequate capital, it could be forced to cease operations. The accompanying consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Management’s Plan to Continue as a Going Concern

In order to continue as a going concern, we will need, among other things, additional capital resources. Management’s plans to obtain such resources for us include (1) obtaining capital from the sale of its equity securities, (2) sales of our services, (3) short-term and long-term borrowings from banks, and (4) short-term borrowings from stockholders or other related party(ies) when needed. However, management cannot provide any assurance that we will be successful in accomplishing any of its plans.

Our ability to continue as a going concern is dependent upon our ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure other sources of financing and attain profitable operations.

| 20 |

We believe that our current levels of cash, cash flows from operations, and bank/related party borrowings, will be sufficient to meet our anticipated cash needs for at least the next 12 months. However, we may need additional cash resources in the future if we experience changed business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for investment, acquisition, strategic cooperation or other similar actions. If we ever determine that our cash requirements exceed our amounts of cash and cash equivalents on hand, we may seek to issue debt or equity securities or obtain a credit facility. Any future issuance of equity securities could cause dilution for our shareholders. Any incurrence of indebtedness could increase our debt service obligations and cause us to be subject to restrictive operating and financial covenants. It is possible that, when we need additional cash resources, financing will only be available to us in amounts or on terms that would not be acceptable to us, if at all.

As of December 31, 2017, we had working capital deficit of $1,837,035 as compared to working capital deficit of $858,428 as of December 31, 2016. We had cash and cash equivalents of $186,494 as of December 31, 2017, a decrease of $58,197, or 24% from $244,691 as of December 31, 2016. Our principal sources and uses of funds were as follows:

For the Years Ended December 31, | ||||||||

| 2017 | 2016 | |||||||

| Net cash used in operating activities | $ | (2,326,964 | ) | $ | (648,129 | ) | ||

| Net cash used in investing activities | (254,258 | ) | (5,334 | ) | ||||

| Net cash provided by financing activities | 2,502,153 | 592,999 | ||||||

| Net cash used in discontinued operations | 4,275 | - | ||||||

| Effect of exchange rate change on cash and cash equivalents | 16,597 | 3,950 | ||||||

| Net decrease in cash and cash equivalents | $ | (58,197 | ) | $ | (56,514 | ) | ||

Net cash used in operating activities of continuing operations was approximately $2.33 million for the year ended December 31, 2017, compared to net cash used in operating activities of approximately $0.65 million for the year ended December 31, 2016. The increase of $1.68 million of cash used in operating activities was primarily due to the increase in net loss of $1.08 million, security deposits of $0.04 million, and other current assets of $0.09 million, and the decrease in accounts payable of $0.19 million, partially offset by the increase in accrued expenses of $0.34 million.

Net cash used in investing activities of continuing operations was $254,258 for the year ended December 31, 2017, compared to $5,334 for the same period last year. We used $0.25 million in the addition of electronic equipment, computer equipment and office equipment and furniture during the year ended December 31, 2017.

Net cash provided by financing activities of continuing operations amounted to approximately $2.50 million for the year ended December 31, 2017, resulting an increase in net cash provided by financial activities of $1.91 million compared to approximately $0.59 million cash provided for the year ended December 31, 2016. The increase was mainly due to the capital contributions of $0.98 million from noncontrolling interest and the increase of $0.53 million from stock subscriptions received in advance during the year ended December 31, 2017.

Critical Accounting Policies

Basis of presentation:

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. Since the Company, Worldwide, and NOWnews Network were entities under common control prior to the restructuring transaction. All the assets and liabilities of Worldwide and NOWnews Network were transferred to the Company at their respective carrying amounts on the date of transaction. The Company and Worldwide have recast prior period financial statements to reflect the conveyance of NOWnews Network to Sky Media as if the restructuring transaction had occurred as of January 1, 2014. All significant intercompany transactions and account balances have been eliminated. The nature of and effects on earnings per share (EPS) of nonrecurring intra-entity transactions involving long-term assets and liabilities is not required to be eliminated and EPS amounts have been recast to include the earnings (or losses) of the transferred net assets.

| 21 |

The functional currency of NOWnews Network and NOWnews International is the New Taiwan dollars, however the accompanying consolidated financial statements have been translated and presented in United States Dollars ($). In the accompanying consolidated financial statements and notes, “$”, “US$” and “U.S. dollars” mean United States dollars, and “NT$” and “NT dollars” mean New Taiwan dollars.

Use of estimates and assumptions:

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results. The most significant estimates reflected in the consolidated financial statements include depreciation, useful lives of property and equipment, deferred income taxes, useful life of intangible assets and contingencies. Estimates and assumptions are periodically reviewed and the effects of revisions are reflected in the consolidated financial statements in the period they are determined to be necessary.

Cash and cash equivalents:

The Company considers all cash on hand and in banks, certificates of deposit and other highly-liquid investments with original maturities of three months or less, when purchased, to be cash and cash equivalents. As of December 31, 2017 and 2016, the Company has uninsured deposits in banks of $41,540 and $122,508, respectively.

Accounts receivable:

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. As of December 31, 2017 and 2016, the Company assessed the allowance for doubtful accounts of $10,345 and $9,464, respectively.

Property and equipment:

Property and equipment are recorded at cost less accumulated depreciation. Gains or losses on disposals are reflected as gain or loss in the year of disposal. The cost of improvements that extends the life of property and equipment are capitalized. These capitalized costs may include structural improvements, equipment, and fixtures. All ordinary repair and maintenance costs are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets or lease term as follows:

| Electronic Equipment | 3 to 5 years |

| Computer Equipment | 5 years |

| Office Equipment and Furniture | 5 years |

| Leasehold Improvement | Lesser of term of the lease or the estimated useful lives of the assets |

| 22 |

Long-lived assets:

The Company applies the provisions of FASB ASC Topic 360 (ASC 360), “Property, Plant, and Equipment” which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. The Company periodically evaluates the carrying value of long-lived assets to be held and used in accordance with ASC 360, at least on an annual basis. ASC 360 requires the impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal.

Intangible assets:

Intangible assets consist of software, trademark, and copyrights (see Note 6). At least annually, the Company evaluates intangible assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. An impairment loss would be recognized when estimated undiscounted future cash flows expected to result from the use of the asset and its eventual disposition are less than its carrying amount. Estimating future cash flows related to an intangible asset involves significant estimates and assumptions. If the Company’s assumptions are not correct, there could be an impairment loss or, in the case of a change in the estimated useful life of the asset, a change in amortization expense. There was no impairment of intangible assets as of and for the years ended December 31, 2017 and 2016, respectively.

Leases:

Lease agreements are evaluated to determine if they are capital leases meeting any of the following criteria at inception: (a) Transfer of ownership; (b) Bargain purchase option; (c) The lease term is equal to 75 percent or more of the estimated economic life of the leased property; (d) The present value at the beginning of the lease term of the minimum lease payments, excluding that portion of the payments representing executory costs such as insurance, maintenance, and taxes to be paid by the lessor, including any profit thereon, equals or exceeds 90 percent of the excess of the fair value of the leased property to the lessor at lease inception over any related investment tax credit retained by the lessor and expected to be realized by the lessor.

If at its inception a lease meets any of the four lease criteria above, the lease is classified by the lessee as a capital lease; and if none of the four criteria are met, the lease is classified by the lessee as an operating lease.

Fair Value Measurements:

FASB ASC 820, “Fair Value Measurements” defines fair value for certain financial and nonfinancial assets and liabilities that are recorded at fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. It requires that an entity measure its financial instruments to base fair value on exit price, maximize the use of observable units and minimize the use of unobservable inputs to determine the exit price. It establishes a hierarchy which prioritizes the inputs to valuation techniques used to measure fair value. This hierarchy increases the consistency and comparability of fair value measurements and related disclosures by maximizing the use of observable inputs and minimizing the use of unobservable inputs by requiring that observable inputs be used when available. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the assets or liabilities based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy prioritizes the inputs into three broad levels based on the reliability of the inputs as follows:

| · | Level 1 – Inputs are quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. Valuation of these instruments does not require a high degree of judgment as the valuations are based on quoted prices in active markets that are readily and regularly available. |

| · | Level 2 – Inputs other than quoted prices in active markets that are either directly or indirectly observable as of the measurement date, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| 23 |

| · | Level 3 – Valuations based on inputs that are unobservable and not corroborated by market data. The fair value for such assets and liabilities is generally determined using pricing models, discounted cash flow methodologies, or similar techniques that incorporate the assumptions a market participant would use in pricing the asset or liability. |

The carrying values of certain assets and liabilities of the Company, such as cash and cash equivalents, accounts receivable, due from related parties, other current assets, accounts payable, accrued expenses, due to shareholders, and other current liabilities approximate fair value due to their relatively short maturities.

Revenue recognition:

Product and service revenue is recognized when the following fundamental criteria are met: (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred or the service has been performed, (iii) the Company’s price to the customer is fixed or determinable and (iv) collection of the resulting accounts receivable is reasonably assured. Payments received before satisfaction of all of the relevant criteria for revenue recognition are recorded as unearned revenue. The Company recognizes revenue for product sales upon transfer of title to the customer. The Company recognizes revenue for services upon performance of the service. Customer purchase orders and/or contracts will generally be used to determine the existence of an arrangement. Shipping documents and the completion of any customer acceptance requirements, when applicable, will be used to verify product delivery or that services have been rendered. The Company will assess whether a price is fixed or determinable based upon the payment terms associated with the transaction and whether the sales price is subject to refund or adjustment. The Company will record reductions to revenue for estimated product returns and pricing adjustments in the same period that the related revenue is recorded. These estimates will be based on industry-based historical data, historical sales returns, if any, analysis of credit memo data, and other factors known at the time.

Post-retirement and post-employment benefits:

NOWnews Network adopted the government mandated defined contribution plan pursuant to the Labor Pension Act (the “Act”) in Taiwan. Such labor regulations require that the rate of contribution made by an employer to the Labor Pension Fund per month shall not be less than 6% of the worker's monthly salaries. Pursuant to the Act, NOWnews Network makes monthly contribution equal to 6% of employees’ salaries to the employees’ pension fund. NOWnews Network has no legal obligation for the benefits beyond the contributions made. The total amounts for such employee benefits, which were expensed as incurred, were $118,375 and $78,327 for the years ended December 31, 2017 and 2016, respectively. Other than the above, the Company does not provide any other post-retirement or post-employment benefits.

Stock-based Compensation:

The Company measures expense associated with all employee stock-based compensation awards using a fair value method and recognizes such expense in the consolidated financial statements on a straight-line basis over the requisite service period in accordance with ASC Topic 718 “Compensation-Stock Compensation”. Total employee stock-based compensation expenses were $1,444,250 and $0 for the years ended December 31, 2017 and 2016, respectively.

The Company accounted for stock-based compensation to non-employees in accordance with ASC Topic 505-50 “Equity-Based Payments to Non-Employees” which requires that the cost of services received from non-employees is measured at fair value at the earlier of the performance commitment date or the date service is completed and recognized over the period the service is provided. Total non-employee stock-based compensation expenses were $795,000 and $0 for the years ended December 31, 2017 and 2016, respectively.

| 24 |

Foreign currency translation:

The Company uses the United States dollar ("U.S. dollars") for financial reporting purposes. The Company maintains the books and records in its functional currency, being the primary currency of the economic environment in which its operations are conducted. For reporting purpose, the Company translates the assets and liabilities to U.S. dollars using the applicable exchange rates prevailing at the balance sheet dates, and the statements of income are translated at average exchange rates during the reporting periods. Gain or loss on foreign currency transactions are reflected on the income statement. Gain or loss on financial statement translation from foreign currency are recorded as a separate component in the equity section of the balance sheet and is included as part of accumulated other comprehensive income. The functional currency of the Company and its subsidiaries in Taiwan is New Taiwan Dollars.

Statement of cash flows:

In accordance with FASB ASC Topic 230, “Statement of Cash Flows,” cash flows from the Company’s operations are calculated based upon the local currencies, and translated to the reporting currency using an average foreign exchange rate for the reporting period. As a result, amounts related to changes in assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

Income taxes: