Attached files

| file | filename |

|---|---|

| EX-32.1 - Kaya Holdings, Inc. | f2s10kkays041018ex32_1.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - Kaya Holdings, Inc. | f2s10kkays041018ex31_1.htm |

| EX-23.1 - CONSENT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS - Kaya Holdings, Inc. | f2s10kkays041018ex23_1.htm |

| EX-21.1 - SUBSIDIARIES OF REGISTRANT - Kaya Holdings, Inc. | f2s10kkays041018ex21_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission File No. 333-177532

KAYA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 90-0898007 | |

| (State of other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

888 S. Andrews Avenue

Suite 302

Ft. Lauderdale, Florida 33316

(Address of principal executive offices)

(954)-892-6911

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [X] Yes [ ] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

[ ] Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company

[X] Emerging growth company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of the voting stock held by non-affiliates of the Registrant was approximately $16,305,935 as of June 30, 2017, based on the closing price on such date of $0.148 of the Company’s common stock on the OTCQB tier of the over-the-counter market operated by OTC Markets Group,

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. There were 139,409,719 shares of common stock outstanding as of April 16, 2018.

DOCUMENTS INCORPORATED BY REFERENCE: No documents are incorporated by reference into this Annual Report on Form 10-K except those Exhibits so incorporated as set forth in the list of Exhibits set forth in Item 15 of this Annual Report on Form 10-K.

KAYA HOLDINGS, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

| Page | ||

| Part I | ||

| Item 1. | Business. | 1 |

| Item 1A. | Risk Factors. | 30 |

| Item 1 B. | Unresolved Staff Comments. | 36 |

| Item 2. | Properties. | 36 |

| Item 3. | Legal Proceedings. | 37 |

| Item 4. | Mine Safety Disclosures. | 37 |

| Part II | ||

| Item 5. | Market for Registrant’s Common Equity and Related Stockholder Matters. | 37 |

| Item 6. | Selected Financial Data. | 40 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | 40 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. | 46 |

| Item 8. | Financial Statements and Supplementary Data. | 46 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 46 |

| Item 9A. | Controls and Procedures. | 48 |

| Item 9B. | Other Information. | 48 |

| Part III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 48 |

| Item 11. | Executive Compensation. | 49 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 51 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 52 |

| Item 14. | Principal Accountant Fees and Services. | 52 |

| Part IV | ||

| Item 15. | Exhibits, Financial Statement Schedules. | 54 |

| Signatures | 56 |

As used in this Annual Report on Form 10-K (the “Annual Report”), the terms “KAYS,” “the Company,” “we,” “us” and “our” refer to Kaya Holdings, Inc. and its owned and controlled subsidiaries, unless the context indicates otherwise.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information contained in this Annual Report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the ‘Exchange Act”). These forward-looking statements are contained principally in the sections titled “Item 1. Business,” “Item 1A. Risk Factors,” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

The forward-looking statements herein represent our expectations, beliefs, plans, intentions or strategies concerning future events. Our forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that any projections or other expectations included in any forward-looking statements will come to pass. Moreover, our forward-looking statements are subject to various known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements.

Except as required by applicable laws, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

PART I

Item 1. Business.

Background

Kaya Holdings, Inc., was incorporated in Delaware in 1993 under the name Gourmet Market, Inc. and has engaged in a number of businesses. Its name was changed on May 11, 2007 to Netspace International Holdings, Inc. (“Netspace”). Netspace acquired 100% of the capital stock of Alternative Fuels Americas, Inc., a Florida corporation in January 2010 in a stock for stock transaction and issued 100,000 shares of Series C convertible preferred stock to existing shareholders of the Florida corporation. The Company’s name was changed in October 2010 from Netspace International Holdings, Inc. to Alternative Fuels Americas, Inc.

From 2010 through 2014 the Company was engaged in seeking to develop a biofuels business. In January 2015, the Company determined that it was in the best interests of its stockholders to discontinue its biofuel development activities, and to instead leverage its agricultural and business development experience and focus all its resources on the development of legal medical and recreational marijuana opportunities in the United States and in select international markets.

Legal Medical and Recreational Marijuana Operations

In January 2014, KAYS incorporated a subsidiary, Marijuana Holdings Americas, Inc. a Florida corporation (“MJAI”) to focus on opportunities in the legal recreational and medical marijuana in the United States. MJAI has concentrated its efforts in Oregon, where through controlled Oregon limited liability companies, it initially secured licenses to operate a medical marijuana dispensary (an “MMD”) and since the advent of legalization of recreational cannabis use in Oregon, has secured licenses to operate a total of four retail outlets for the sale of recreational and medical cannabis, as well as each hold a license for home delivery of cannabis products. Additionally, MJAI has operated medical Marijuana Grows in Oregon, and KAYS has purchased 26 acres which it has targeted for development of the Kaya Farms™ Medical and Recreational Marijuana Grow and Manufacturing Complex. The Company has developed the Kaya Shack™ brand for its retail operations.

| 1 |

In March 2014, we applied for and were awarded our first license to operate an MMD and on July 3, 2014 opened our first Kaya Shack™ Medical Marijuana Dispensary in Portland, Oregon, thereby becoming the first publicly traded U.S. company to own and operate an MMD. Initial customer acceptance and media coverage was very positive, including many references to KAYS as the “Starbucks of Medical Marijuana” by television news stations, news print publications and online news sources. In March 2015, the Company changed its name to Kaya Holdings, Inc. to better reflect its new plan of operations.

In April 2015, KAYS commenced its own medical marijuana grow operations for the cultivation and harvesting of legal marijuana thereby becoming the first publicly traded U.S. company to own a majority interest in a vertically integrated legal marijuana enterprise in the United States. In October 2015, concurrent with Oregon commencing legal sales of recreational marijuana through MMDs, KAYS opened its second retail operation in Salem, Oregon, our first Kaya Shack™ Marijuana Superstore. Oregon. During 2015, the Company also consolidated its grow operations and manufacturing operations into a single facility in Portland, Oregon.

In 2016, Oregon began the process to transition legal marijuana sales from Oregon Health Authority (“OHA”) licensed MMDs and grow operations to Oregon Liquor Control Commission (“OLCC”) licensed recreational marijuana retailers and producer and processing facilities. Effective January 1, 2017, all retailers of recreational marijuana were required to have a recreational marijuana sales license issued by the OLLC for each retail outlet operated.

Accordingly, in 2016 the Company applied for OLLC licenses for its two initial Kaya Shack™ retail outlets (Portland, Oregon and South Salem, Oregon), and also submitted license applications for its two additional locations, which were under construction and development at that time.

Recent Developments

OLCC Licensing and Additional Legal and Recreational Marijuana Stores

In late December 2016, we received our OLCC recreational, medical and home delivery license for the South Salem Kaya Shack™ Marijuana Superstore (Kaya Shack™ OLCC Marijuana Retailer License #1) and recreational and medical sales continued without interruption from 2016 through the present at that location.

On March 21, 2017, we received our OLCC recreational, medical and home delivery license for the North Salem Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #2) a 2,600-square foot Kaya Shack™ Marijuana Superstore in North Salem, Oregon, whereupon the location opened for business with both recreational and medical sales.

On May 2, 2017, we received our OLCC recreational, medical and home delivery license for our Portland Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #3) after a delay of approximately four months. During that period, we were limited to solely medical sales at the Portland location. Upon receipt of Kaya Shack™ OLCC Marijuana Retailer License #3, recreational sales recommenced at that location.

On February 15, 2018 we received our Our OLCC recreational, medical and home delivery license for the Central Salem Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #4) a 3,100-square foot Kaya Shack™ Marijuana Superstore in Central Salem, Oregon. After various construction and permitting delays, on April 12, 2018 the location opened for business with both recreational and medical sales.

A video depicting our Company’s OLCC Licensed Stores can be seen by accessing the following link:

https://www.dropbox.com/s/49i5emi3wc0ha0d/Store%20Tour%20Final%20%28hi-res%29.mp4?dl=0

| 2 |

Additional Kaya Shack™ Marijuana Superstores

In addition to the four Kaya Shack™ retail marijuana stores the Company operates in Oregon, the Company plans to identify and lease locations for, license and operate up to four additional Kaya Shack™ Marijuana Superstores in other Oregon markets over the next 18 to 24 months, as well as explore opportunities in other states to increase its retail footprint. Additionally, the Company is exploring opportunities to further its operation in Oregon and elsewhere through the acquisition of currently licensed and operating retail operations, which can be converted to the Kaya Shack™ model.

Expansion of Grow and Manufacturing Operations

On March 21, 2017, KAYS announced that it was in the process of expanding its grow and manufacturing operations and had retained a realtor to assist in identifying a suitable 30-60 acre tract of land in Oregon which would permit KAYS to expand its grow operations. As part of this expansion, KAYS ceased operations of its Portland grow facility at the end of March 2017, arranged to maintain its genetics library of over 30 strains of cannabis at an OHA licensed medical grow site and contracted with farmers to meet demand until the new facility is secured, built and fully operational.

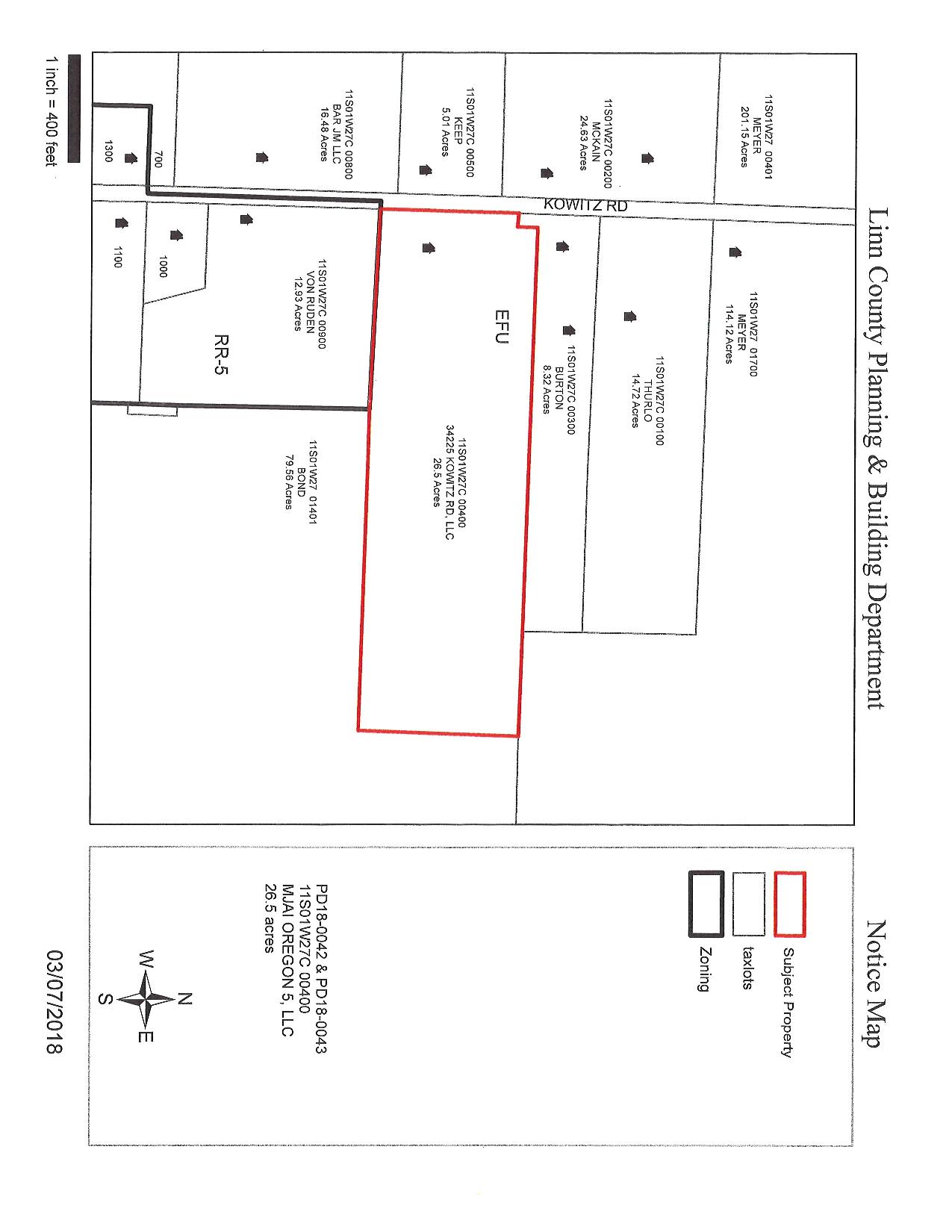

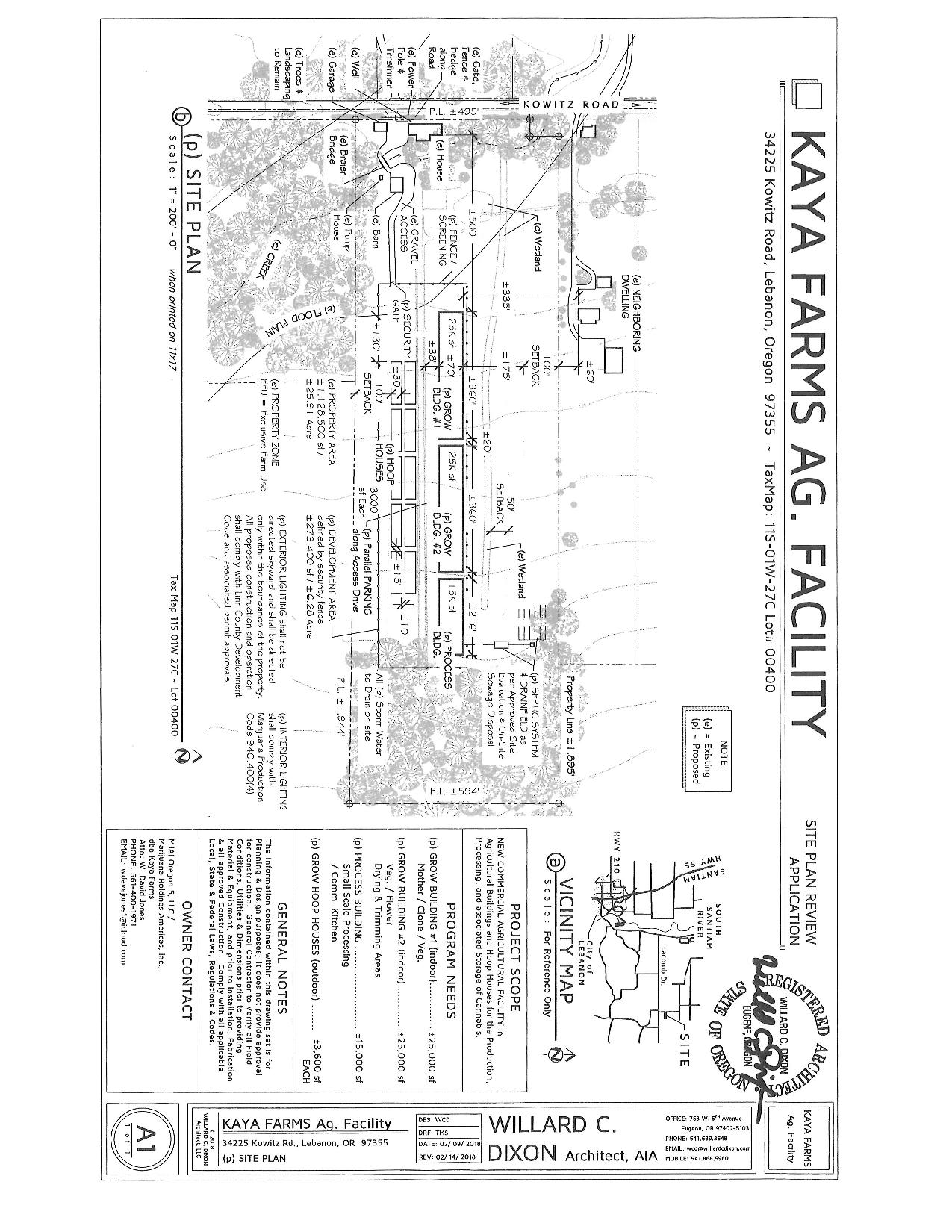

In August 2017, KAYS acquired a 26 acre parcel in Lebanon, Oregon, which KAYS intends to develop as a legal cannabis cultivation and manufacturing facility. KAYS believes that the acquisition of a property will position the Company for future development, including increased Marijuana Canopy production to the maximum extent allowed by law through use of both greenhouse and outdoor grows, as well as expansion of its production capabilities with brands in oils, vape cartridges, concentrates, a selection of edibles, and infused creams and lotions.

A video of the Kaya Farms™ (Architect’s Project Rendition) can be seen at the following link:

https://www.dropbox.com/s/3po31ksdilcl9l9/Kaya_Farms%20Final.mp4?dl=0

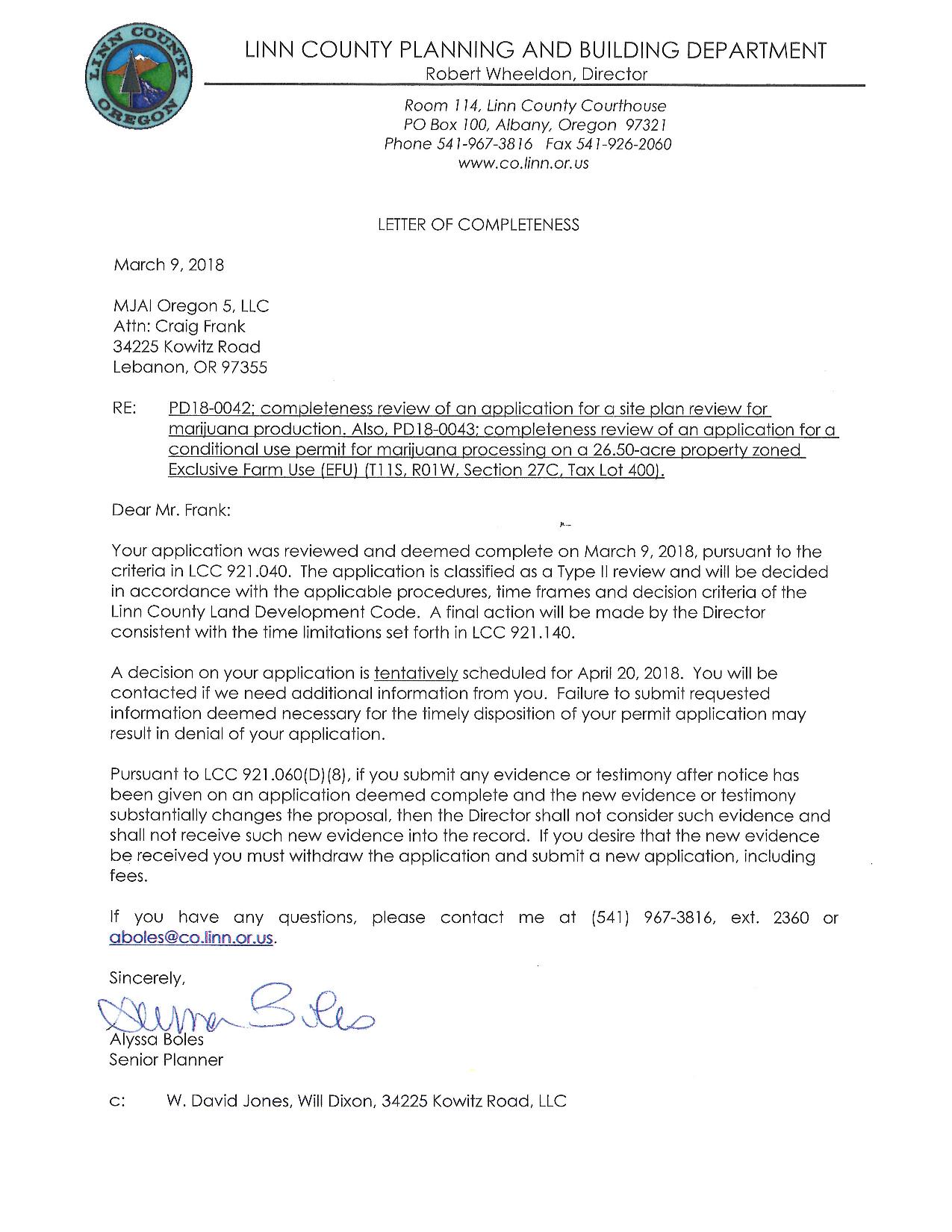

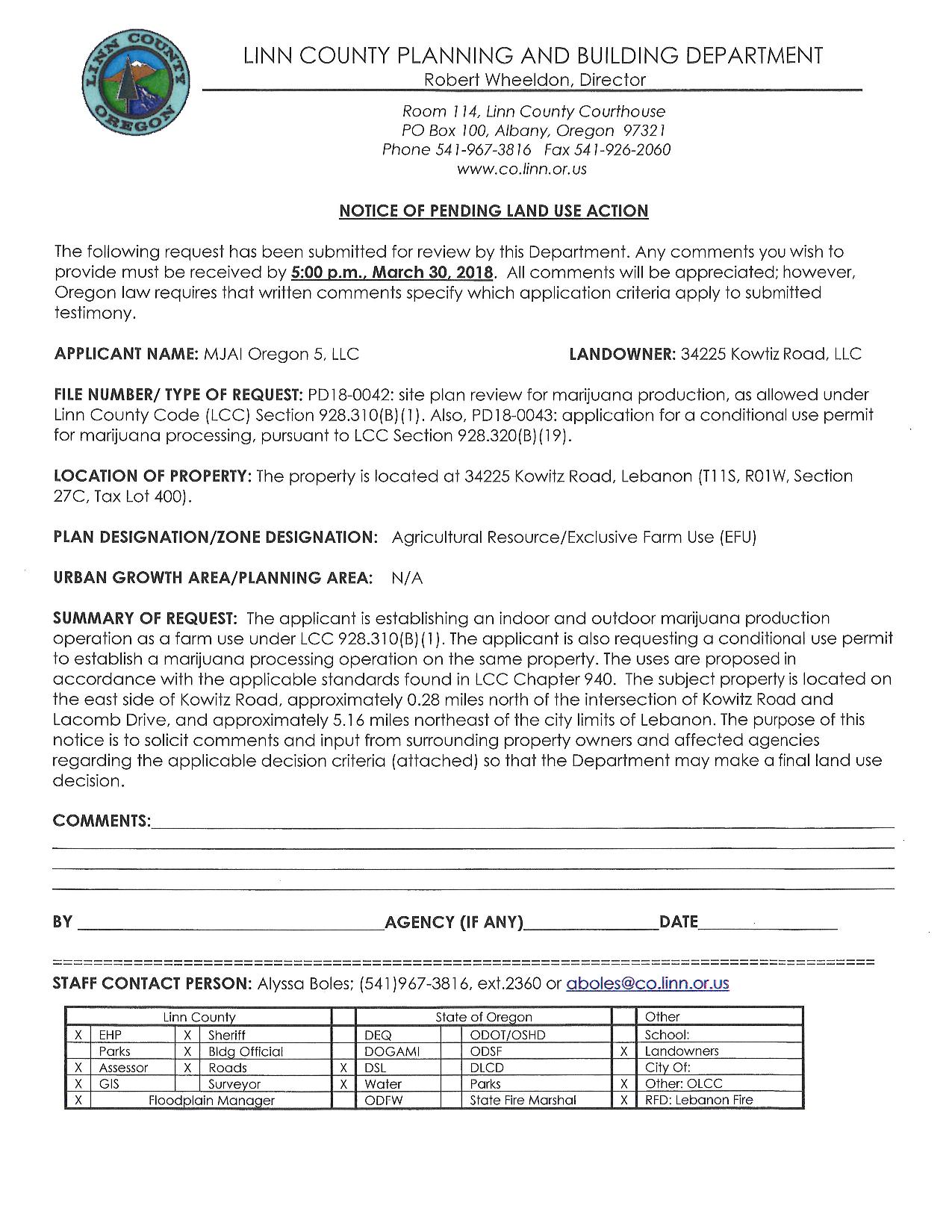

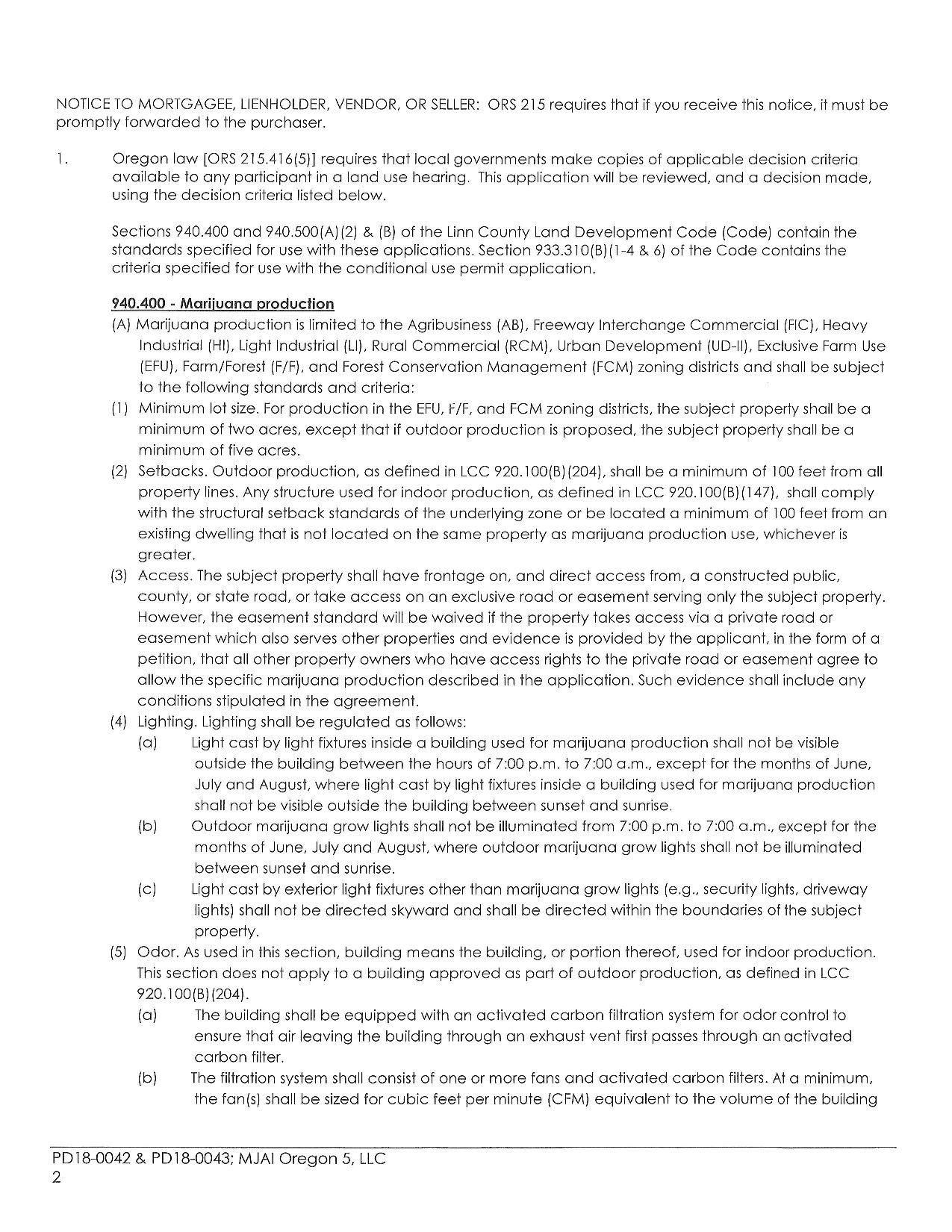

On February 9, 2018 KAYS submitted a site plan review for the Company’s envisioned 101,000 square foot OLCC licensed Kaya Farms™ Marijuana Grow and Manufacturing Complex and an application for a conditional use permit for marijuana processing on the Company owned 26.50-acre property zoned Exclusive Farm Use (EFU) with the Linn County, Oregon Planning and Building Department.

On March 9, 2018 the Company was notified by the Linn County, Oregon Planning and Building Department that the application was deemed complete and received an official letter of completeness with respect to the application. The formal “Letter of Completeness,” sent March 9, 2018 by a Linn County Senior Planner, confirmed the eligibility of the Company’s 26-acre plot for the purposes of growing legal cannabis, as well as the eligibility of the property for a special purpose exemption for the Company’s proposed manufacturing operations. The County has tentatively scheduled a decision on the application for April 20, 2018.

$2.1 Million Financing

In March 2017, the Company completed a $2.1 million financing with an institutional investor (the “Institutional Investor”) who had previously furnished KAYS with $1.2 million in financing, pursuant to a financing agreement (the “$2.1M Financing Agreement”) entered into between the Company and the Institutional Investor in December 2016. Pursuant to the $2.1M Financing Agreement, the Institutional Investor purchased $2.1 million in principal amount of convertible notes (the “$2.1M Notes”) from the Company as follows:

| • | $400,000 in principal amount of $2.1M Notes which are convertible into shares of the Company’s common stock at a conversion price of $0.04; |

| • | $700,000 in principal amount of $2.1M Notes which are convertible into shares of the Company’s common stock at a conversion price of $0.07; and |

| • | $1,000,000 in principal amount of $2.1M Notes which are convertible into shares of the Company’s common stock at a conversion price of $0.10. |

| 3 |

The purchase price for the $2.1M Notes is equal to the principal amount thereof. The $2.1M Notes have a term of two years from issuance and bear interest at the rate of eight percent (8%) annum, which accrues and is payable to together with interest at maturity. The Investor may convert the principal amount of the $2.1M Notes (as well as other notes it currently holds as referenced above), together with accrued but unpaid interest thereon, into shares at the applicable conversion price, at any time or from time to time prior to maturity. The conversion price is subject to adjustment for stock splits, stock dividends, recapitalizations and similar transactions. The $2.1M Notes also provide that at no time may they be convertible if the number of shares being issued upon conversion to and then held by the Institutional Investor would result in the Institutional Investor beneficially owning in excess of 4.99% of the Company’s then outstanding shares of common stock, after giving effect to the proposed conversion.

May 2017 Financing Agreement

On May 11, 2017, we entered into a second financing agreement with the Institutional Investor to provide the Company with up to an additional $5.8 million in convertible note funding (the “May 2017 Notes”) through July 31, 2018 (the “May 2017 Financing Agreement”). The May 2011 Financing Agreement was amended as of July 31, 2017, to increase the amount of funding available to the Company thereunder to $6.3 million and to extend the time period for such funding to May 31, 2019 and was subsequently amended as of November 15, 2017 and as of March 31, 2018, to further increase the amount of funding available to the Company thereunder to $7.75 million and to provide for the remaining $5.8million in principal amount of May 2017 Notes to be (a) convertible into shares of the Company’s common stock at conversion prices ranging from $0.03 to $0.11 pursuant to the terms of each May 2017 Note as described below; and (b) to extend the time period for such funding to April 30, 2020.

Moreover, pursuant to an additional agreement reached as of March 31, 2018, KAYS and the Institutional Investor agreed that effective as of January 1, 2019, (a) the maturity date of all then outstanding Company promissory notes held by the Institutional Investor and its affiliate, NWP Finance LTD, will be extended from January 1, 2019 to January 1, 2020; (b) all of the $1.75 million in principal amount of May 2017 Notes currently outstanding and the remaining $5.8 million in principal amount of May 2017 Notes which may be issued under the Agreement, as amended, are to be secured by a mortgage lien on the Company’s 26-acre Lebanon, Oregon property, substantially similar in form and substance to the mortgage securing the $500,000 in principal amount of $0.03 Secured Notes purchased by the Institutional Investor, with the caveat that the property, improvements or rights to utilize them cannot be directly or indirectly leased, assigned or otherwise pledged to any entity without approval of the Institutional Investor, and in the event that there is a change in control of the Company or its subsidiaries the May 2017 Notes become immediately due and payable; and (c) the Institutional Investor will be granted piggy-back registration rights with respect to shares of the Company’s common stock it may hold or is issuable upon conversion of any Notes it or its Assigns may hold in the event the Company files a Registration Statement on Form S-1 with the Securities and Exchange Commission under the Securities Act of 1933, as amended to sell shares of its common stock or permit the resale by shareholders of previously issued shares of common stock, up to a maximum of 30% of the shares registered under such registration statement.

Except as set forth above, the May 2017 Notes are substantially similar in form and substance to the $2.1M Notes that were part of the $2.1 million Financing Agreement entered into between the Company and the Institutional Investor in December 2016 and completed in March of 2017 (as well as the promissory notes evidencing approximately $1.2 million in financing previously received from the Institutional Investor in 2014 and 2015).

As of the date of this Annual Report, the Institutional Investor has purchased an aggregate of $1,750,000 in principal amount of May 2017 Notes from the Company under the May 2017 Financing Agreement, as amended to date, of which (a) $500,000 in principal amount of May 2017 Notes are convertible into shares of the Company’s common stock at a conversion price of $0.05 (the “$0.05Notes”); (b) $750,000 in principal amount of May 2017 Notes, which are convertible into shares of the Company’s common stock at a conversion price of $0.03 (the “$0.03Notes”); (c) $500,000 in principal amount of May 2017 Notes, which are (i) convertible into shares of the Company’s common stock at a conversion price of $0.03; and (ii) secured by a mortgage lien on the Company’s 26 acre Lebanon, Oregon property (the “$0.03 Secured Notes”).

| 4 |

Under the May 2017 Financing Agreement, as amended to date, the Investor has the right to purchase another tranche of $0.03 Notes up to an aggregate of $500,000 in principal amount, at any time and from time to time through July 31, 2018.

Provided the Investor has fulfilled its obligation to purchase the additional $500,000 in principal amount of $0.03 Notes from the Company on or before July 31, 2018, the Investor will have the right to purchase another tranche of $0.03 Notes up to an aggregate of $500,000 in principal amount, at any time and from time to time through December 31, 2018.

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $500,000 in principal amount of $0.03 Notes from the Company on or before December 31, 2018, the Institutional Investor will have the right to purchase up to an aggregate of $500,000 in principal amount of $0.05 Notes, at any time and from time to time through March 31, 2019.

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $500,000 in principal amount of $0.05 Notes from the Company on or before March 31, 2018, the Institutional Investor will have the right to purchase another tranche of $0.05 Notes up to an aggregate of $500,000 in principal amount, at any time and from time to time through June 30, 2019.

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $500,000 in principal amount of $0.05 Notes from the Company on or before June 30, 2019, the Institutional Investor will have the right to purchase up to an aggregate of $400,000 in principal amount of May 2017 Notes, which are convertible into shares of the Company’s common stock at a conversion price of $0.08 per share, at any time and from time to time through September 30, 2019 (the “$0.08 Notes”).

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $400,000 in principal amount of $0.08 Notes from the Company on or before September 30, 2019, the Institutional Investor will have the right to purchase another tranche of $0.08 Notes up to an aggregate of $400,000 in principal amount, at any time and from time to time through December 31, 2019.

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $400,000 in principal amount of $0.08 Notes from the Company on or before December 31, 2019, the Institutional Investor will have the right to purchase another tranche of $0.08 Notes up to an aggregate of $400,000 in principal amount, at any time and from time to time through March 31, 2020.

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $400,000 in principal amount of $0.08 Notes from the Company on or before March 31, 2020, the Institutional Investor will have the right to purchase another tranche of $0.08 Notes up to an aggregate of $400,000 in principal amount, at any time and from time to time through June 30, 2020.

Provided the Institutional Investor has fulfilled its obligation to purchase all $400,000 in principal amount of $0.08 Notes from the Company on or before June 30, 2020, the Institutional Investor will have the right to purchase up to an additional $550,000 in principal amount of May 2017 Notes from the Company at any time and from time to time through September 30, 2020, which Notes will be convertible into shares of common stock at a conversion price of $0.11 per share (the “$0.11 Notes”).

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $550,000 in principal amount of $0.11 Notes from the Company on or before September 30, 2020, the Institutional Investor will have the right to purchase another tranche of $0.11 Notes up to an aggregate of $500,000 in principal amount, at any time and from time to time through December 31, 2020.

Provided the Institutional Investor has fulfilled its obligation to purchase the additional $550,000 in principal amount of $0.11 Notes from the Company on or before December 31, 2020, the Institutional Investor will have the right to purchase another tranche of $0.11 Notes up to an aggregate of $1,100,000 in principal amount, at any time and from time to time through April 30, 2021.

| 5 |

January 2018 Financing

Effective January 22, 2018, we entered into a financing agreement with a high net worth investor (the “HNW Investor”) to provide the Company with up to $1.4 million in convertible note funding (the “January 2018 Notes”) through July 31, 2018 (the “January 2018 Financing Agreement”). Pursuant to the January 2018 Financing Agreement, upon execution of the January 2018 Financing Agreement, the HNW Investor purchased $100,000 in principal amount of January 2018 Notes, which are convertible into shares of the Company’s common stock at a conversion price of $0.10 per shares (the “$0.10 Notes”).

Use of Proceeds

The proceeds from the offer and sale of the $2.1M Notes, the May 2017 Notes and the January 2018 notes, are and will be used to fund the Company’s growth plan, including expansion of our chain of Kaya Shack™ Marijuana Superstores in Oregon, acquisition and development of our Lebanon, Oregon legal cannabis cultivation and manufacturing facility and the introduction of new Kaya Shack™ branded cannabis products.

Market Overview

According to research firm Cowen & Co., legal cannabis sales in the U.S. are expected to reach $75 billion by 2030. The industry research firm Arcview, estimates a $22.6 billion legal cannabis market in North America by 2021, with 87% of all sales occurring in the United States. The Arcview forecast assumes a 27% compound annual growth rate, an assumption supported by current rates of growth, while reliant on additional states passing both recreational and medical cannabis laws.

Thirty states and the District of Columbia have legalized marijuana in some capacity. Additionally, eight states (Alaska, California, Colorado, Maine, Massachusetts, Nevada, Oregon and Washington State) and the District of Colombia have approved the implementation of legal recreational marijuana use. The Marijuana Business Factbook 2017, published by industry news source Marijuana Business Daily, estimates that the legal marijuana sector will grow more than 300% from sales of $1.8 billion to $17.1 billion in 2021. The firm estimates that the economic impact of the legal cannabis industry will exceed $70 billion, placing it almost on par with nutraceuticals and ahead of movie tickets and retail ice cream. According to the Factbook, “to get another idea of just how big the marijuana industry has become, look to employment numbers. The cannabis sector now employs between 165,000-230,000 full and part-time workers….to put this in perspective, there are now more marijuana industry workers than there are bakers or massage therapists in the United States”.

Kaya Cares Cannabis Opioids Swap Program

In November 2017 the Company assisting in initiating a conversation on the role marijuana can play in addressing the opioid epidemic by announcing a willingness to implement Kaya Cares, an opioid – cannabis replacement program for current opioid prescription holders seeking to explore the efficacy of marijuana as a pain management substitute. The Company is proud to announce that its initiative was promoted online by a Now Weed Episode that gathered more than half a million views, attracted the support of minor celebrities, and reached the highest echelons of the Oregon State Government. The Company is further pleased to share that the Oregon Liquor Control Commission (“OLCC”) which is the State of Oregon’s marijuana licensing and regulatory authority, has opened a dialogue with local experts to explore legal and practical ways to use cannabis to alleviate some of the consequences of the opioid epidemic in Oregon. Kaya Holdings management has and will be participating in this critical dialogue and hopes to be part of the solution.

Corporate Information

Our corporate office is located at 888 South Andrews Avenue, Suite 302, Fort Lauderdale, Florida, 33316. Our website is www.kayaholdings.com. Information contained on our website does not constitute part of this Annual Report.

| 6 |

The Kaya Shack™ Brand

Kaya Holdings operates the Kaya Shack™ brand of legal medical and recreational retail marijuana stores.

Kaya Holdings operates four recreational marijuana retail outlets and medical marijuana dispensaries in Oregon under the Kaya Shack™ brand. In addition to these four Kaya Shack™ retail marijuana stores, the Company plans to identify and lease locations for, license and seek to open up to four additional Kaya Shack™ Marijuana Superstores in other Oregon markets over the next 18 to 24 months, as well as explore opportunities in other states to increase its retail footprint. Additionally, the Company is exploring opportunities to further its operation in Oregon and elsewhere through the acquisition of currently licensed and operating retail operations, which can be converted to the Kaya Shack™ model.

Dubbed by the mainstream press as the “Starbucks of Marijuana” after our first outlet opened in July 2014, our operating concept is simple to deliver a consistent customer experience (quality products, fair prices and superior customer service) to a broad and diverse base of customers. Kaya Shack™ meets the quality needs of the “marijuana enthusiast”, the comfort and atmosphere of all including “soccer moms” and the price sensitivities of casual smokers.

The Kaya Shack™ brand communicates positive thinking and joy, with signs adorning the walls that read “It’s a Good Day to have a Good Day,” “Some of our Happiest Days Haven’t Even Happened Yet,” and our signature “Be Kind.”

Kaya Shack™ retail outlets are open 7 days a week- Monday through Saturday from 8:00 am to 10:00 pm, and Sunday 8:00 AM to 9:00 PM. Operations follow an operational manual that details procedures for 18 areas of operation including safety, compliance, store opening, store closing, merchandising, handling of cash, inventory control, product intake, store appearance and employee conduct.

In compliance with regulations, all marijuana and marijuana infused products sold through our stores are quality tested by independent labs to assure adherence to strict quality and OLCC regulations.

| 7 |

Kaya Shack™ Retail Outlets

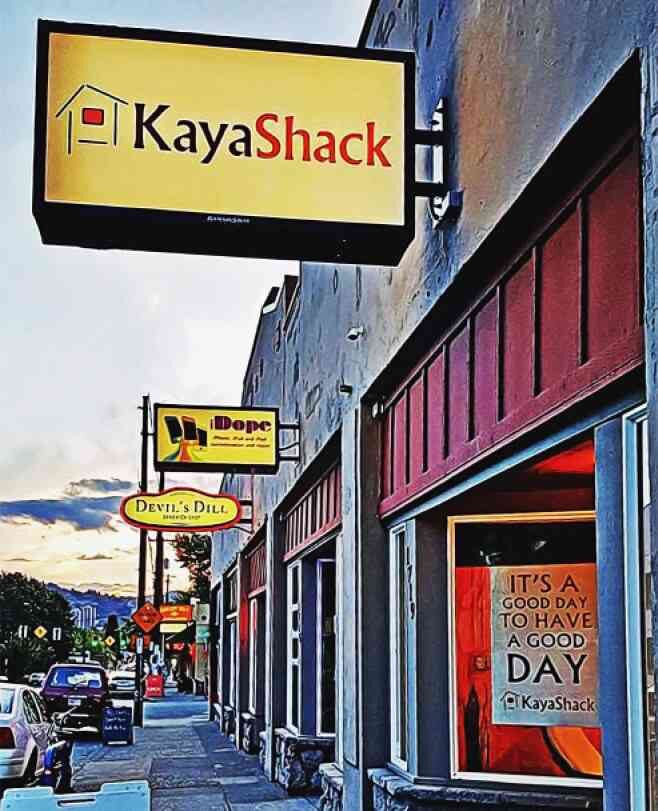

I. Kaya Shack™, 1719 SE Hawthorne Blvd., Portland, Oregon

Our first Kaya Shack™ is in the heart of the trendy Hawthorne district in southeast Portland (the Greenwich Village of the West Coast). The store is located next door to a cell phone repair shop, and near to Devil’s Dill restaurant and No Fun pub. There are also a McMenamins restaurant, tattoo parlor, convenience store, hair/nail salon and a soccer sports bar. The area around the shop is mixed use (commercial and residential).

| 8 |

The first Kaya Shack™ is approximately 700 square feet and is the model for the Company’s small urban shops. The store features an 8’ display case showcasing at least 25 strains of marijuana flower, an additional 8’ display case with a varied selection of oils, concentrates and topicals, and a standing display case with edibles such as cookies, chocolates, gummies, hard candies and more. The store also has a hospitality area that offers free water, coffee, tea and hot cocoa. As required by law, all products containing marijuana are either behind locked glass or behind the counter and out of customer reach.

Our Portland outlet initially operated as an MMD. In connection with the transition of recreational marijuana retailer licenses from the OHA to the OLCC, we applied for an OLCC license for the facility in 2016. However, issuance of the OLCC license for the Portland, Oregon outlet was delayed because of the need to resolve various local issues with the City of Portland. Accordingly, from January 1, 2017 until May 2, 2017, when we received Kaya Shack TMOLCC Marijuana Retailer License #3 for this location, sales at the Portland, Oregon location were limited to medical marijuana and as such our revenues from this location were impacted.

| 9 |

II. Kaya Shack ™ Marijuana Superstore, South Salem, Oregon

Our second location (the first Kaya Shack TM Marijuana Superstore) opened for business on October 17, 2015 in South Salem, Oregon in time to take advantage of early recreational sales. Our South Salem Kaya Shack ™ Marijuana superstore received Kaya Shack TM OLCC Marijuana Retailer License prior to the January 1, 2017 deadline to do so and both recreational and medical marijuana sales have continued at this location seamlessly.

| 10 |

The store is located in a strip mall alongside a Caesar’s Pizza, Aaron’s furniture, a convenience store, a tanning salon, and a nail salon. The plaza also has a Subway, a sports bar and a laundromat. The area around the shop is primarily commercial with residential complexes to be constructed beginning in 2018.

Located in the southern portion of Oregon’s capital city, Salem, this Kaya Shack™ is approximately 2,100 square feet and is the model for the Company’s marijuana superstore. The store features an 8’ display case with more than 25 strains of marijuana flower, an additional 8’ display case with a varied selection of oils, concentrates and topicals, an 8’ display case with accessories such as pipes, papers and brand related merchandise, and a standing display case with edibles such as cookies, chocolates, gummies, hard candies and more. The store also has a hospitality area that offers free water, coffee, tea and hot cocoa, and a “third space” sitting area. A fresh juice bar and a production room offering customers a chance to watch as the Company’s branded marijuana cigarettes, Kaya Buddies™, are produced are being installed.

| 11 |

III. Kaya Shack™ Marijuana Superstore, North Salem, Oregon

Our third Kaya Shack™ (located in North Salem, Oregon) received Kaya Shack TM OLCC Marijuana Recreational Retailer License #3 on March 21, 2017. The store is located in a strip mall alongside a Starbucks Coffee, laundromat, and Adam’s Rib. The plaza also has medical offices and an Applebee’s. The area around the shop is primarily commercial.

| 12 |

Located in the northern portion of Oregon’s capital city, Salem, this Kaya Shack™ is 2,600 square feet. The store features an 8’ display case with more than 25 strains of marijuana flower, an additional 8’ display case with a varied selection of oils, concentrates and topicals, an 8’ display case with accessories such as pipes, papers and brand related merchandise, and standing display cases with edibles such as cookies, chocolates, gummies, hard candies and more. The store also has a hospitality area that offers free water, coffee, tea and hot cocoa and a “third space” sitting area. The Company plans to install a fresh juice bar, and a glassed-off kitchen facility slated to produce edibles and confections.

| 13 |

IV. Kaya Shack™ Marijuana Superstore, Central Salem, Oregon

Our fourth Kaya Shack™ is located in North Salem, Oregon in a strip mall directly behind Carl Jr. and Popeye’s Chicken restaurants and alongside a microbrewery sports bar, laundromat, and Hawaiian sandwich shop. The area around the shop is primarily commercial with residential complexes to be constructed in 2018. It has a footprint of approximately 3100 square feet and utilizes the Kaya Shack™ Marijuana Superstore model reflected in our third outlet and we believe substantially completes our geographic penetration of the Salem, Oregon market.

| 14 |

We received Kaya Shack TM OLCC Marijuana Recreational Retailer License #4 on February 15, 2018. After various construction and permitting delays, on April 12, 2018 the location opened for business with both recreational and medical sales.

The store features an 8’ display case with more than 25 strains of marijuana flower, an additional 8’ display case with a varied selection of oils, concentrates and topicals, an 8’ display case with accessories such as pipes, papers and brand related merchandise, and standing display cases with edibles such as cookies, chocolates, gummies, hard candies and more. The store also has a hospitality area that offers free water, coffee, tea and hot cocoa. The superstore concept also provides for a “third space” sitting area, a fresh juice bar, and in this location, an area for the production of the Company’s brand of custom glass pipes.

| 15 |

Kaya Shack™ Home Delivery

In early February of 2017, the Company began the process of filing applications to add Home Delivery Service for three of its Kaya Shack™ retail marijuana stores at the advice of one of their OLCC examiners. As of the date of this Annual Report, the Company has received approvals from the OLCC to add Home Delivery to all four of its currently OLCC licensed locations.

In addition to providing added value and convenience for our customers, extending visibility and building brand recognition for the Kaya Shack™ brand, we believe that Home Delivery provides greater market penetration, by allowing sales throughout the geographic area that our stores are licensed in. There is no limit to the number of delivery vehicles that can service an individual area using just one store as a home base, so in effect we intend to use this service to construct additional “virtual” Kaya Shacks™ without the added costs of additional brick and mortar locations.

On April 11, 2017 the Company took delivery of its first four Fiat 500 cars to begin building their Kaya Car™ Home Delivery Service fleet. The cars have been customized with distinctive Kaya Shack™ vehicle wrapping featuring the Company’s branding logos and colors and outfitted with safes and security, and the Company is developing the Kaya Shack™ Delivery App for use by its customers to order “Fast, Free Delivery” of the complete line of both medical and recreational grade Kaya Shack™ cannabis products.

The Company intends to initiate its Kaya Car™ Home Delivery Service within the next 30 days, contemporaneously with a grand opening celebration for all four OLCC-Licensed Kaya Shack™ retail marijuana stores and to commence to move to the next stage of branding and retail development. The Company has reserved and is developing the website www.kayadelivers.com to advance the growth of its delivery service.

| 16 |

Kaya Farms™ Marijuana Grow and Manufacturing Complex

On March 21, 2017, KAYS announced that it was in the process of expanding its grow and manufacturing operations and had retained a realtor to assist in identifying a suitable acre tract of land in Oregon which would permit KAYS to expand its grow operations. As part of this expansion, KAYS ceased operations of its then existing Portland grow facility at the end of March 2017, arranged to maintain its genetics library of over 30 strains of cannabis at an OHA licensed medical grow site and contracted with farmers to meet demand until the new facility is secured, built and fully operational.

In August 2017, KAYS acquired a 26 acre parcel in Lebanon, Oregon, which KAYS intends to develop as a legal cannabis cultivation and manufacturing facility. KAYS believes that the acquisition of a property will position the Company for future development, including increased Marijuana Canopy production to the maximum extent allowed by law through use of both greenhouse and outdoor grows, as well as expansion of its production capabilities with brands in oils, vape cartridges, concentrates, a selection of edibles, and infused creams and lotions.

| 17 |

Kaya Farms™ Pending Zoning Activity

On February 9, 2018 KAYS submitted a site plan review for the Company’s envisioned 101,000 square foot OLCC licensed Kaya Farms™ Marijuana Grow and Manufacturing Complex and an application for a conditional use permit for marijuana processing on the Company owned 26.50-acre property zoned Exclusive Farm Use (EFU) with the Linn County, Oregon Planning and Building Department.

On March 9, 2018 the Company was notified by the Linn County, Oregon Planning and Building Department that the application was deemed complete and received an official letter of completeness with respect to the application. The formal “Letter of Completeness,” sent March 9, 2018 by a Linn County Senior Planner, confirmed the eligibility of the Company’s 26-acre plot for the purposes of growing legal cannabis, as well as the eligibility of the property for a special purpose exemption for the Company’s proposed manufacturing operations. The County has tentatively scheduled a decision on the application for April 20, 2018.

Please see the following pages to view a copy of the Linn County “Letter of Completeness” for the Kaya Farms™ Marijuana Grow and Manufacturing Complex

| 18 |

| 19 |

| 20 |

| 21 |

| 22 |

| 23 |

| 24 |

| 25 |

| 26 |

Kaya Farms™ - Cannabis and Cannabis Products

Kaya Buddie™ Strain Specific Cannabis Cigarettes

In 2016 the Company introduced a signature line of strain-specific connoisseur-grade, pre-rolled cannabis cigarettes branded as “Kaya Buddies™”. Kaya Buddies™ cannabis cigarettes have been very well received by medical patients and recreational users, with the Company selling almost 100,000 Kaya Buddies™ since launching the brand in January 2016. The brand, marketed under the tagline “Buds with Benefits”, features over 50 different strains of connoisseur-grade, high quality cannabis and proprietary specialty blends. In early 2018 the Company set up a formal manufacturing center for the production of Kaya Buddies™ at its South Salem Kaya Shack Superstore (Kaya #2) and is in the process of completing remodeling there to showcase the production of their Kaya Buddies™ cannabis cigarettes to shoppers.

| 27 |

Other Potential Markets

We believe that revenues and profitability will be enhanced through our planned opening of additional retail outlets utilizing the Kaya Shack™ brand and model in our chain, as well as economies of scale achieved by being a multi-location retail chain and being vertically integrated with grow and manufacturing operations. Ultimately, we believe that we can successfully enter other markets as they open up by applying our “brand” retail chain and vertically integrated grow and manufacture model to other states that legalize recreational marijuana use. Where applicable, we will seek to leverage our public company status to finance organic growth and enable acquisitions of existing locations for the Kaya Shack brand, as well as look to acquire and grow additional brands.

The California recreational cannabis market is by far the largest potential market in the country, and our operations in Oregon allow for a natural progression and expansion down the I-5 corridor into California. Florida, should it become a recreational market, could be a potentially large market for us as well, because we believe that KAYS would have a distinct advantage in the state, as it is one of the few Florida-based entities whose management has significant experience in owning and operating retail dispensaries, a grow and manufacturing operations.

Growth Strategy

The Company has established a well-defined strategy for entering and maintaining a strong presence in the legal marijuana sector. The cornerstones of this strategy include:

| · | All operations are to be conducted in accordance with State and Local Laws and Federal Enforcement Policies and Priorities as it relates to Marijuana (as outlined in the Justice Department's Cole Memo dated August 29, 2013, US Attorney General Jeff Sessions Memo dated January 4, 2018, and subsequent commentary from US Attorney for the District of Oregon Billy Williams). |

| · | The Company will seek to operate in a vertically integrated manner (grow, process and sell) wherever permitted by law. In states where vertical integration is not permitted, the Company plans to determine which of the permitted activities offers the most potential for growth and value creation. |

| · | The Company will seek to engage, sponsor or lead local advocacy and lobbying groups that have a significant impact on the evolution and character of laws and the regulations under which legal marijuana operations are implemented in select markets. |

| · | The Company shall work with law enforcement and government officials to insure compliance with all regulations. |

Marketing and Sales

The Company will only market its legal marijuana as in compliance with applicable state law.

The Company employs a marketing campaign consisting of four cornerstones:

| · | Promoting and establishing the Kaya Shack™ brand. |

| · | A positive and active online presence. |

| · | Daily specials and promotions. |

| · | Quirky and fun holiday specials. |

| 28 |

Our core strategic marketing objectives include:

| Establishingthe Kaya Shack™ Brand – positioning the Company’s brand to have positive and value related associations with all prospective and existing customers. |

| Operating Cooperatively - cooperation, as a strategy, helps develop a network of suppliers and marketing channels able to promote Kaya Shack™. |

| Delivering Value - customer value is achieved when the perceived value of what we sell along with the value of the experience we deliver exceeds the price we charge. |

| Driving Customer Traffic - the only two ways to increase store income is to sell more to our existing customers and attract new customers. Programs are in place to accomplish both tasks. |

Government Regulation

We are subject to general business regulations and laws, as well as regulations and laws directly applicable to our operations. As we continue to expand the scope of our operations, the application of existing laws and regulations could include matters such as pricing, advertising, consumer protection, quality of products, and intellectual property ownership. In addition, we will also be subject to new laws and regulations directly applicable to our activities.

Any existing or new legislation applicable to us could expose us to substantial liability, including significant expenses necessary to comply with such laws and regulations, which could hinder or prevent the growth of our business.

Federal, state and local laws and regulations governing legal recreational and medical marijuana use are broad in scope and are subject to evolving interpretations, which could require us to incur substantial costs associated with compliance. In addition, violations of these laws or allegations of such violations could disrupt our planned business and adversely affect our financial condition and results of operations. In addition, it is possible that additional or revised federal, state and local laws and regulations may be enacted in the future governing the legal marijuana industry. There can be no assurance that we will be able to comply with any such laws and regulations and its failure to do so could significantly harm our business, financial condition and results of operations.

Competition

The legal marijuana sector is rapidly growing and the Company faces significant competition in the operation of retail outlets, MMDs and grow facilities. Many of these competitors will have far greater experience, more extensive industry contacts and greater financial resources than the Company. There can be no assurance that we can adequately compete to succeed in our business plan.

Employees

As of the date of this Annual Report, our Oregon operations have a total of 17 part-time store employees including budtenders, trimmers, growers, and 5 full-time employees, consisting of two store managers, a Sales and Marketing Coordinator, the Director of Dispensary and Grow Operations and a Master Grower. Additionally, we engage several consultants to assist with daily duties and business plan implementation and execution. Additional employees will be hired and other consultants engaged in the future as our business expands.

| 29 |

ITEM 1A. Risk Factors.

We have a limited operating history with our current business .

The Company was incorporated in 1993 and has engaged in a number of businesses as both a private and as a publicly held company, including the online sale of specialty foods, online marketing and website development.

KAYS’s legal marijuana business, which it has focused on since 2014, only commenced generating more than a limited level of revenues subsequent to the commencement of legal recreational marijuana sales in Oregon on October 1, 2015. Accordingly, our operations continue to be subject to all the problems, expenses, difficulties, complications and delays encountered in an early stage business. There can be no assurance that the Company will generate significant revenues or operate at a profit.

The Company will require additional financing to become commercially viable.

The Company’s current legal marijuana operations can be capital intensive.

During the years ended December 31, 2017 and 2016, we raised approximately $3,150,000 and $1,185,000 respectively, through a series of private of debt and equity offerings to finance operations for its legal marijuana operations in Oregon.

The Company incurred net losses of 14,881,793 and $19,849,262 for the years ended December 31, 2017 and 2016, respectively. The majority of our net losses during these years ended December 31, 2017 and 2016 were not actual operating losses but were a result of the derivative liabilities from the conversion of debt from the stabilization of our stock prices the reduces the volatility factors used in the derivative calculations.

At December 31, 2017, we had a total stockholders' deficit of $32,402,409 and a working capital deficiency of $1,499,656. There can be no assurance that the Company will become commercially viable without additional financing, the availability and terms of which are uncertain. If the Company cannot secure necessary capital when needed on commercially reasonable terms, its business, condition (financial and otherwise) and commercial viability may be harmed. Although management believes that it will be able to successfully execute its business plan, which includes third party financing and the raising of capital to meet the Company’s future liquidity needs, there can be no assurances in this regard. These matters raise substantial doubt about the Company’s ability to continue as a going concern.

We currently rely on certain key individuals, and the loss of one of these key individuals could have an adverse effect on the Company.

Our success depends to a certain degree upon certain key members of our management and certain key consultants to the company. These individuals are a significant factor in our growth and success. The loss of the services of such members of management could have a material adverse effect on our Company.

The Company’s success will be dependent in part upon its ability to attract qualified personnel and consultants.

The Company’s success will be dependent in part upon its ability to attract qualified creative marketing, sales and development professionals. The inability to do so on favorable terms may harm the Company’s proposed business.

KAYS must effectively meet the challenges of managing expanding operations.

The Company’s business plan anticipates that operations will undergo significant expansion in 2017 and beyond. This expansion will require the Company manage a larger and more complex organization, which could place a significant strain on our managerial, operational and financial resources. Management may not succeed with these efforts. Failure to expand in an efficient manner could cause expenses to be greater than anticipated, revenues to grow more slowly than expected and could otherwise have an adverse effect on the business, financial condition and results of operations.

| 30 |

Marijuana remains illegal in the United States under federal law.

Notwithstanding its legalization for recreational and/or medical use by a growing number of states, the growing, transport, possession or selling of marijuana continues to be illegal under federal law. Although the Obama administration had made a policy decision to allow implementation of state laws legalizing recreational and/or medical marijuana use and not to federally prosecute anyone operating under state law, the continuance of that policy is not assured under the Trump administration and could change at any time, which might render our marijuana operations illegal and adversely affecting KAYS’s business, financial condition and results of operations.

The marketing and market acceptance of marijuana may not be as rapid as KAYS expects.

The market for legal marijuana is quickly evolving, and activity in the sector is expanding rapidly. Demand and market acceptance for legal marijuana are subject to uncertainty and risk, as changes in the price and possible adverse political efforts could influence and denigrate demand. KAYS cannot predict whether, or how fast, this market will grow or how long it can be sustained. If the market for legal marijuana develops more slowly than expected or becomes saturated with competitors, KAYS’s operating results could be adversely impacted.

KAYS’s marijuana activities are part of an emerging industry.

The Company intends to implement an aggressive plan of growth to enter the legal recreational and medical marijuana industry. The legal marijuana industry is new and emerging, and has yet to fully define competitive, operational, financial and other parameters for successful operations. By pursuing a growth strategy to enter a new and emerging industry, the Company’s operations may be adversely impacted as the industry’s competitive, operational, financial and other parameters take shape. Given the fluidity of the industry, the Company may make errors in implementing its business plan, thereby limiting some or all of its ability to perform in accordance with its expectations.

Our business could be affected by changes in governmental regulation.

Federal, state and local laws and regulations governing legal recreational and medical marijuana use are broad in scope and are subject to evolving interpretations, which could require us to incur substantial costs associated with compliance. In addition, violations of these laws or allegations of such violations could disrupt KAYS’s planned business and adversely affect our financial condition and results of operations. In addition, it is possible that additional or revised federal, state and local laws and regulations may be enacted in the future governing the legal marijuana industry. There can be no assurance that KAYS will be able to comply with any such laws and regulations and its failure to do so could significantly harm our business, financial condition and results of operations.

Our business will be subject to other operating risks which may adversely affect the Company’s financial condition.

Our planned operations will be subject to risks normally incidental to manufacturing operations which may result in work stoppages and/or damage to property. This may be caused by:

| · | breakdown of the equipment; |

| · | labor disputes; |

| · | imposition of new government regulations; |

| · | sabotage by operational personnel; |

| · | cost overruns; and |

| · | fire, flood, or other acts of God. |

| 31 |

We will likely face significant competition.

The legal marijuana industry is in its early stages and is attracting significant attention from both small and large entrants into the industry. KAYS expects to encounter significant competition as it implements its business strategy. The ability of KAYS to effectively compete could be hindered by a lack of funds, poor positioning, management error, and other factors. The inability to effectively compete could adversely affect our business, financial condition and results of operations.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act `Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial office and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| · | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company |

| · | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| · | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. |

We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our testing, we may identity other deficiencies that we may not be able to timely remediate. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 (“ Sarbanes Oxley”). Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly

The Jumpstart our Business Startups Act of 2012 (the “Jobs Act”) has reduced the information that the Company is required to disclose.

Under the Jobs Act, the information that the Company will be required to disclose has been reduced in a number of ways.

As a company that had gross revenues of less than $1 billion during the Company’s last fiscal year, the Company is an “emerging growth company ,” as defined in the Jobs Act (an “EGC”). The Company will retain that status until the earliest of (a) the last day of the fiscal year which the Company has total annual gross revenues of $1,000,000,000 (as indexed for inflation in the manner set forth in the Jobs Act) or more; (b) the last day of the fiscal year of following the fifth anniversary of the date of the first sale of the common stock pursuant to an effective registration statement under the Securities Act; (c) the date on which the Company has, during the previous three year period, issued more than $1,000,000,000 in non-convertible debt; or (d) the date on which the Company is deemed to be a “large accelerated filer,” as defined in Rule 12b-2 under the Exchange Act or any successor thereto. As an EGC, the Company is relieved from the following:

| 32 |

| · | The Company is excluded from Section 404(b) of Sarbanes-Oxley, which otherwise would have requiredt he Company’s auditors to attest to and report on the Company’s internal control over financial reporting. The Jobs Act also amended Section 103(a)(3) of Sarbanes-Oxley to provide that (i) any new rules that may be adopted by the PCAOB requiring mandatory audit firm rotation or changes to the auditor’s report to include auditor discussion and analysis (each of which is currently under consideration by the PCAOB) shall not apply to an audit of an EGC; and (ii) any other future rules adopted by the PCAOB will not apply to the Company’s audits unless the SEC determines otherwise. |

| · | The Jobs Act amended Section 7(a) of the Securities Act to provide that the Company need not present more than two years of audited financial statements in an initial public offering registration statement and in any other registration statement, need not present selected financial data pursuant to Item 301 of Regulation S-K for any period prior to the earliest audited period presented in connection with such initial public offering. In addition, the Company is not required to comply with any new or revised financial accounting standard until such date as a private company (i.e., a company that is not an “issuer” as defined by Section 2(a) of Sarbanes-Oxley) is required to comply with such new or revised accounting standard. Corresponding changes have been made to the Exchange Act, which relates to periodic reporting requirements, which would be applicable if the Company were required to comply with them. |

| · | As long as the Company is an EGC, the Company may comply with Item 402 of Regulation S-K, which requires extensive quantitative and qualitative disclosure regarding executive compensation, by disclosing the more limited information required of a “smaller reporting company.” |

| · | In the event that the Company registers the common stock under the Exchange Act,t he Jobs Act will also exempt the Company from the following additional compensation-related disclosure provisions that were imposed on U.S. public companies pursuant to the Dodd-Frank Act: |

| (i) | the advisory vote on executive compensation required by Section 14A(a) of the Exchange Act; |

| (ii) | the requirements of Section 14A(b) of the Exchange Act relating to shareholder advisory notes on “golden parachute” compensation; |

| (iii) | the requirements of Section 14(i) of the Exchange Act as to disclosure relating to the relationship between executive compensation and our financial performance; and |

| (iv) | the requirement of Section 953(b)(1)of the Dodd-Frank Act, which requires disclosureas to the relationship between the compensation of the Company’s chief executive officer and median employee pay. |

The costs of being a public company could result in us being unable to continue as a going concern.

As a public company, we are required to comply with numerous financial reporting and legal requirements, including those pertaining to audits and internal control. The costs of this compliance could be significant. If our revenues do not increase and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs in the normal course of business that would result in our being unable to continue as a going concern.

Management and the Board of Directors may be indemnified.

The Certificate of Incorporation and Bylaws of KAYS provide for indemnification of directors and officers at the expense of the respective corporation and limit their liability. This may result in a major cost to the corporation and hurt the interests of stockholders because corporate resources may be expended for the benefit of directors and officers. The Company has been advised that, in the opinion of the Securities and Exchange Commission, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

| 33 |

The market for the KAYS Shares is extremely limited and sporadic

KAYS’s common stock is quoted on the OTCQB tier of the over-the-counter market operated by OTC Markets Group, Inc. The market KAYS’s for common stock is limited and sporadic. Trading in stock quoted on the OTCQB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of KAYS’s common stock for reasons unrelated to operating performance. Moreover, the trading of securities in the OTCQB is often more sporadic than the trading of securities listed on a quotation system like NASDAQ, or a stock exchange like the New York Stock Exchange.

KAYS’s common stock is a penny stock. Trading of KAYS’s common stock may be restricted by the penny stock regulations adopted by the Securities and Exchange Commission (the “SEC”) and FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our common stock.

KAYS’s common stock is a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. KAYS’s common stock is covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, KAYS’s common stock.

In addition to the penny stock rules promulgated by the SEC, FINRA (the Financial Industry Regulatory Authority) has adopted rules that require when recommending an investment to a customer, a broker- dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low -priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker-dealers to recommend that their customers buy KAYS’s common stock, which may limit investor ability to buy and sell KAYS’s common stock.

The market for penny stocks has experienced numerous frauds and abuses that could adversely impact KAYS’s common stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

· control of the market for the security by one or a few broker-dealers that are often related to a promoter

or issuer;

| 34 |

| · | manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| · | boiler room practices involving high pressure sales tactics and unrealistic price projections by sales persons; |

| · | excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| · | wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

The board of directors of KAYS has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial to common stockholders and with the ability to adversely affect common stockholder voting power and rights upon liquidation.

KAYS’s Certificate of Incorporation allows us to issue shares of preferred stock without any vote or further action by our stockholders. Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders of preferred stock the rights to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock.

The ability of our principal stockholders, including our CEO, to control our business may limit or eliminate minority stockholders’ ability to influence corporate affairs.

The principal stockholder of KAYS holds 22,996,833 shares of common stock and $500K in principal amount of convertible promissory notes which are convertible into 50,000 shares of Series C Convertible Stock. Additionally, our CEO owns 5,280,144 shares of common stock and 50,000 shares of Series C Convertible Preferred Stock. These preferred shares notes can be converted into a total of 43,329,970 shares of KAYS common stock which, added to the common shares of KAYS held by both parties gives them approximately 41% of votes on matters presented to stockholders. Accordingly, they are in a position to significantly influence membership of our board of directors as well as all other matters requiring stockholder approval. The interests of our principal stockholders may differ from the interests of other stockholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of other officers and directors and other business decisions. The minority stockholders have no way of overriding decisions made by our principal stockholders. This level of control may also have an adverse impact on the market value of our shares because our principal stockholders may institute or undertake transactions, policies or programs that result in losses and/or may not take any steps to increase our visibility in the financial community and/or may sell sufficient numbers of shares to significantly decrease our price per share.

We do not expect to pay cash dividends in the foreseeable future.

KAYS has not paid cash dividends on its shares of common stock and does not intend to do so at any time in the foreseeable future. The future payment of dividends depends upon future earnings, capital requirements, financial requirements and other factors that the companies’ boards of directors will consider. Since they do not anticipate paying cash dividends on the common stock, return on investment, if any, will depend solely on an increase, if any, in the market value of the common stock.

The conversion of KAYS’ outstanding preferred stock by the CEO and convertible debt held by our principal stockholder would result in the issuance of 43,329,970 shares of KAYS’ common stock. Additionally, conversion of other convertible debt described in this Annual Report would result in further dilution to KAYS’ stockholders. Accordingly, such market overhang could adversely impact the market price of the common stock.

| 35 |

KAYS has 50,000 shares of Series C Convertible Preferred Stock outstanding, all of which are held by our CEO. Additionally, KAYS has $500K in principal amount of convertible promissory notes outstanding held by our principal stockholder, which are convertible into 50,000 shares of Series C Convertible Stock. These preferred shares and convertible promissory notes can be converted into a total of 43,329,970 shares of KAYS common stock. Additionally, the company has other convertible debt described in this Annual Report, which would result in further dilution if converted Such market overhang could adversely impact the market price of KAYS’s common stock as a result of the dilution which would result if such securities were converted into shares of KAYS common stock.

Future sales of shares of KAYS common stock pursuant to Rule 144 under the Securities Act could adversely affect the market price of KAYS’s common stock.

KAYS has a substantial number of shares of common stock which were issued in transactions exempt from the registration requirements of the Securities Act and are now available for public sale pursuant to the Rule 144 under the Securities Act. Such sales could adversely affect the market price of KAYS’s common stock.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protection against interested-director transactions, conflicts of interest and similar matters.

Sarbanes-Oxley as well as rule changes proposed and enacted by the SEC, the NYSE/AMEX and the NASDAQ Stock Market as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the NASDAQ Stock Market. Because we are not currently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with voluntary compliance, we have not yet adopted these measures.

We do not currently have independent audit or compensation committees. As a result, directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested- director transactions, conflicts of interest, if any, and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations as a result thereof.

We intend to comply with all corporate governance measures relating to director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley. The enactment of Sarbanes-Oxley has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.