Attached files

| file | filename |

|---|---|

| 10-K/A - GREENWAY TECHNOLOGIES INC | gway10k123117.htm |

| EX-32 - GREENWAY TECHNOLOGIES INC | ex322.htm |

| EX-31 - GREENWAY TECHNOLOGIES INC | ex312.htm |

| EX-31 - GREENWAY TECHNOLOGIES INC | ex311.htm |

| EX-32 - GREENWAY TECHNOLOGIES INC | ex321.htm |

| EX-10 - GREENWAY TECHNOLOGIES INC | ex1036.htm |

| EX-10 - GREENWAY TECHNOLOGIES INC | ex1035.htm |

| EX-10 - GREENWAY TECHNOLOGIES INC | ex1034.htm |

Exhibit 10.33 Wildcat Note Payable

Promissory Note

Borrower: Greenway Technologies, Inc.

8851 Camp Bowie West, Suite 240

Fort Worth, TX 76116

Lender: Wildcat Consulting Group LLC PO Box 81175

Las Vegas, NV 89180-1175

I. Promise to Pay

Borrower agrees to pay Lender the total amount of $100,000.00, together with interest payable on the unpaid principal at the flat one-time rate of 100/0.

Payment will be delivered to Lender at: PO Box 81175, Las Vegas, NV 891801175 or such other address mutually agreed upon both parties.

Il. Repayment

The amount owed under this Promissory Note will be repaid in a lump sum of $110,000.00. The lump sum payment will be due on or before February 28, 2018. In addition, the Borrower agrees to honor its commitment to pay the $4,000.00 monthly consulting fee due Lender, beginning with the November 1, 2017 payment. Borrower agrees to bring current the August 1, 2017 through October 1, 2017 payments totaling $12,000.00 that are past due.

111. Late Payment Fees

If Borrower defaults on the lump sum payment of $110,000.00 by more than five (5) days from the time set forth herein, then Borrower shall issue an additional 500 Warrants at $.30 each to Lender, along with an additional 500 Warrants for every whole or partial thirty (30) day period thereafter, until the $110,000.00 is paid in full. In addition, the Borrower shall issue an additional 500 Warrants for every whole or partial month after February 28, 2018, until the August through October 2017 past due amount of $12,000.00 in consulting fees is paid in full. No pre-payment penalties will apply in either case.

IV. Additional Costs

In case of default in the payment of this Promissory Note, Borrower will pay to

Lender

such further amount as will be sufficient to cover the cost and expenses of collection, including, without limitation, reasonable

attorney's fees, expenses, and disbursements. These costs will be added to the outstanding principal and will become immediately

due.

Lender

such further amount as will be sufficient to cover the cost and expenses of collection, including, without limitation, reasonable

attorney's fees, expenses, and disbursements. These costs will be added to the outstanding principal and will become immediately

due.

V. Transfer of the Promissory Note

Borrower hereby waives any notice of the transfer of this Note by Lender or by any subsequent holder of this Note, agrees to remain bound by the terms of this Note subsequent to any transfer, and agrees that the terms of this Note may be fully enforced by any subsequent holder of this Note.

VI. Amendment; Modification; Waiver

No amendment, modification or waiver of any provision of this Promissory Note or consent to departure therefrom shall be effective unless by written agreement signed by both Borrower and Lender.

VII. Successors

The terms and conditions of this Promissory Note shall inure to the benefit of and be binding jointly and severally upon the successors, assigns, heirs, survivors and personal representatives of Borrower and shall inure to the benefit of any holder, its legal representatives, successors and assigns.

VIll. Breach of Promissory Note

No breach of any provision of this Promissory Note shall be deemed waived unless it is waived in writing. No course of dealing and no delay on the part of Lender in exercising any right will operate as a waiver thereof or otherwise prejudice Lender's rights, powers, or remedies. No right, power, or remedy conferred by this Promissory Note upon Lender will be exclusive of any other rights, power, or remedy referred to in this Note, or now or hereafter available at law, in equity, by statute, or otherwise.

IX. Governing Law

The validity, construction and performance of this Promissory Note will be governed by the laws of Texas, excluding that body of law pertaining to conflicts of law. Borrower hereby waives presentment, notice of non-payment, notice of dishonor, protest, demand and diligence.

The parties hereby indicate by their signatures below that they have read and agree with the terms and conditions of this agreement in its entirety.

Borrower Signature:

Greenway Technologies, Inc.

Lender Signature:

Wildcat Consulting Group LLC Date: 11/13/17.

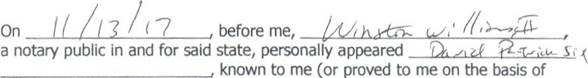

Certificate of Acknowledgment of Notary Public

State of

County of

known

to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument

and acknowledged to me that he or she executed the same in his or her authorized capacity and that by his or her signature on the

instrument, the person, or the entity upon behalf of which the person acted, executed the instrument.

known

to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument

and acknowledged to me that he or she executed the same in his or her authorized capacity and that by his or her signature on the

instrument, the person, or the entity upon behalf of which the person acted, executed the instrument.

WINSTON WILLIAMS

Notary State of Texas

Comm. Expires 01-20-2019 Notary 12849777-7

[NOTARY SEAL]

My commission expires