Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Orexigen Therapeutics, Inc. | d570207d8k.htm |

Exhibit 99.1

Case 18-10518-KG Doc 92 Filed 03/27/18 Page 1 of 2

Docket #0092 Date Filed: 03/27/2018

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| In re: Orexigen Therapeutics, Inc. | Case No. 18-10518 | |||||

INITIAL MONTHLY OPERATING REPORT

File report and attachments with Court and submit copy to United States Trustee within 15 days after order for relief.

Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation.

Bank accounts and checks must bear the name of the debtor, the case number, and the designation “Debtor in Possession.”

Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit

agreement/certificate of authority, signature card, and/or corporate checking resolution.

| REQUIRED DOCUMENTS |

Document Attached |

Explanation Attached | ||

| 12-Month Cash Flow Projection (Form IR-1) |

X | Note 1 | ||

| Certificates of Insurance: |

||||

| Workers Compensation |

X | |||

| Property |

X | |||

| General Liability |

X | |||

| Vehicle |

||||

| Other: Products Liability, D&O |

X | |||

| Identify areas of self-insurance w/liability caps |

||||

| Evidence of Debtor in Possession Bank Accounts |

Note 2 | |||

| Tax Escrow Account |

||||

| General Operating Account |

X | |||

| Money Market Account pursuant to Local Rule 4001-3 for the |

||||

| District of Delaware only. Refer to: |

||||

| http://www.deb.uscourts.gov/ |

||||

| Other: Utility Deposit Account, Accounts closed post-petition |

X | |||

| Retainers Paid (Form IR-2) |

X | |||

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief.

|

3/27/2018 | |

| Date | ||

| Stephen Moglia | VP, Chief Accounting Officer | |

| Printed Name of Authorized Individual | Title of Authorized Individual | |

| * | Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. |

Case 18-10518-KG Doc 92 Filed 03/27/18 Page 2 of 2

| In re: Orexigen Therapeutics, Inc. | Case No. 18-10518 |

Notes

Note 1: The Debtor did not prepare a 12-month cash flow in accordance with Form IR-1; however, pursuant to the DEBTOR’S MOTION FOR ENTRY OF INTERIM AND FINAL ORDERS (I) APPROVING DEBTOR-IN-POSSESSION FINANCING PURSUANT TO 11 U.S.C. §§ 105(a), 362, AND 364, FED. R. BANKR. P. 2002, 4001 AND 9014 AND LOCAL BANKRUPTCY RULE 4001-2; (II) AUTHORIZING USE OF CASH COLLATERAL PURSUANT TO 11 U.S.C. §§ 105, 361, 362 AND 363 OF THE BANKRUPTCY CODE; (III) GRANTING ADEQUATE PROTECTION AND SUPER-PRIORITY ADMINISTRATIVE CLAIMS; (IV) SCHEDULING A FINAL HEARING; AND (V) GRANTING RELATED RELIEF dated March 12, 2018, the Debtor has prepared a 5-week budget (the “Budget”). The Debtor provides the Budget, a copy of which is annexed hereto as Exhibit 1, in lieu of Form IR-1. Note that a new proposed Budget and supporting schedules are required to be delivered to the DIP Lenders on April 4, 2018 and every 2 weeks thereafter.

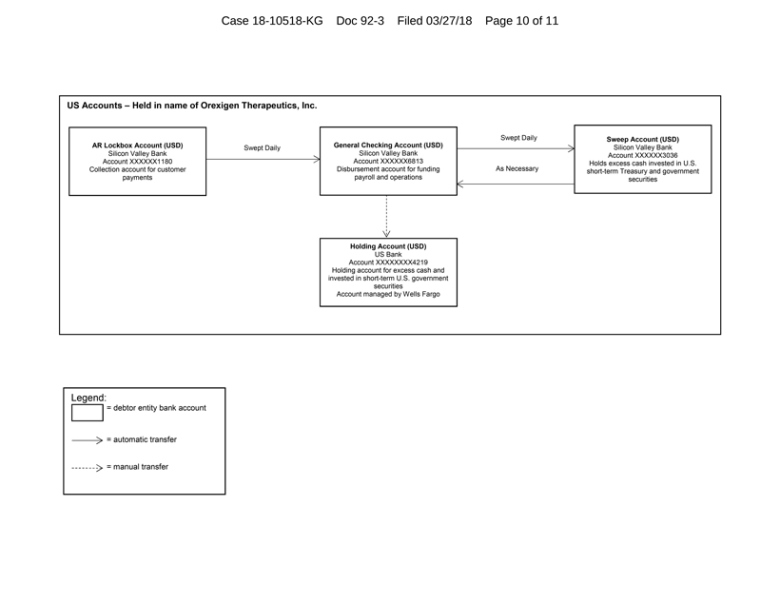

Note 2: Pursuant to the INTERIM ORDER (A) AUTHORIZING THE DEBTOR TO (I) CONTINUE ITS CASH MANAGEMENT SYSTEM, (II) HONOR CERTAIN RELATED PREPETITION OBLIGATIONS, (III) MAINTAIN EXISTING BUSINESS FORMS, AND (IV) CONTINUE TO PERFORM INTERCOMPANY TRANSACTIONS, (B) AUTHORIZING AND DIRECTING THE DEBTOR’S BANKS TO HONOR ALL RELATED PAYMENT REQUESTS, (C) GRANTING INTERIM AND FINAL WAIVERS OF THE DEBTOR’S COMPLIANCE WITH SECTION 345(B) OF THE BANKRUPTCY CODE, (D) SCHEDULING A FINAL HEARING, AND (E) GRANTING RELATED RELIEF dated March 13, 2018 (the “Interim Cash Management Order”), the Debtor is permitted to maintain its existing bank accounts and is not required to maintain separate Debtor-in-Possession bank accounts. A copy of the Interim Cash Management Order is annexed hereto as Exhibit 3. Additionally, the Debtor provides a list of Debtor bank accounts, a copy of which is also annexed hereto as Exhibit 3.

Case 18-10518-KG Doc 92-1 Filed 03/27/18 Page 1 of 2

Exhibit 1

Budget

Case 18-10518-KG Doc 92-1 Filed 03/27/18 Page 2 of 2

Draft - Subject to Material Change

Orexigen Therapeutics, Inc.

DIP Cash Flow Forecast (USD)

$ in 000s

| Post | Post | Post | Post | Post | ||||||||||||||||||||

| Week Ended |

Forecast 3/16/2018 |

Forecast 3/23/2018 |

Forecast 3/30/2018 |

Forecast 4/6/2018 |

Forecast 4/13/2018 |

3/16 - 4/13 Total |

||||||||||||||||||

| Forecast Week |

1 | 2 | 3 | 4 | 5 | |||||||||||||||||||

| Operating Cash Flow |

||||||||||||||||||||||||

| Receipts |

||||||||||||||||||||||||

| Operating Receipts |

$ | 741 | $ | 1,159 | $ | 1,724 | $ | 3,075 | $ | 2,297 | $ | 8,997 | ||||||||||||

| Miscellaneous Receipts |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Receipts |

$ | 741 | $ | 1,159 | $ | 1,724 | $ | 3,075 | $ | 2,297 | $ | 8,997 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Disbursements |

||||||||||||||||||||||||

| Payroll & Benefits / Contractors |

$ | (1,626 | ) | $ | (301 | ) | $ | (983 | ) | $ | (214 | ) | $ | (1,782 | ) | $ | (4,905 | ) | ||||||

| Inventory |

(1,461 | ) | — | — | — | — | (1,461 | ) | ||||||||||||||||

| Manufacturing and Logistics |

(362 | ) | (181 | ) | (131 | ) | (37 | ) | (137 | ) | (847 | ) | ||||||||||||

| Gross to Net Disbursements |

(2,982 | ) | (1,572 | ) | (2,038 | ) | (1,727 | ) | (1,727 | ) | (10,047 | ) | ||||||||||||

| Marketing / Commercial Operations |

(7,661 | ) | (74 | ) | (5,941 | ) | (75 | ) | (75 | ) | (13,826 | ) | ||||||||||||

| Ordinary Course Professionals |

(300 | ) | (191 | ) | (191 | ) | (133 | ) | (133 | ) | (948 | ) | ||||||||||||

| Rent / Facilities / Equipment |

(25 | ) | (5 | ) | (5 | ) | (134 | ) | (4 | ) | (173 | ) | ||||||||||||

| Insurance |

— | — | — | (76 | ) | — | (76 | ) | ||||||||||||||||

| IT / Utilities |

(71 | ) | (30 | ) | (30 | ) | (24 | ) | (24 | ) | (179 | ) | ||||||||||||

| Regulatory and Compliance |

(236 | ) | (3 | ) | (3 | ) | (175 | ) | (5 | ) | (423 | ) | ||||||||||||

| Other G&A |

(192 | ) | (33 | ) | (33 | ) | (450 | ) | (25 | ) | (733 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Operating Disbursements |

$ | (14,915 | ) | $ | (2,391 | ) | $ | (9,354 | ) | $ | (3,045 | ) | $ | (3,912 | ) | $ | (33,617 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating Cash Flow |

$ | (14,174 | ) | $ | (1,231 | ) | $ | (7,631 | ) | $ | 31 | $ | (1,615 | ) | $ | (24,621 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Restructuring Costs |

||||||||||||||||||||||||

| DIP Loan Interest and Fees |

$ | (50 | ) | $ | — | $ | — | $ | — | $ | (40 | ) | $ | (90 | ) | |||||||||

| Restructuring Professional Fees |

— | — | — | (998 | ) | — | (998 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Restructuring Costs |

$ | (50 | ) | $ | — | $ | — | $ | (998 | ) | $ | (40 | ) | $ | (1,088 | ) | ||||||||

| Net Cash Flow |

$ | (14,224 | ) | $ | (1,231 | ) | $ | (7,631 | ) | $ | (967 | ) | $ | (1,655 | ) | $ | (25,708 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Beginning Cash Balance |

$ | 21,160 | $ | 6,936 | $ | 5,705 | $ | 3,000 | $ | 3,000 | $ | 21,160 | ||||||||||||

| Net Cash Flow |

(14,224 | ) | (1,231 | ) | (7,631 | ) | (967 | ) | (1,655 | ) | (25,708 | ) | ||||||||||||

| DIP Draw |

— | — | 4,926 | 967 | 1,655 | 7,548 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ending Cash Balance (maintain $3.0m min) |

$ | 6,936 | $ | 5,705 | $ | 3,000 | $ | 3,000 | $ | 3,000 | $ | 3,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| DIP Loan Balance |

||||||||||||||||||||||||

| Opening DIP Balance |

$ | — | $ | 350 | $ | 350 | $ | 5,276 | $ | 6,243 | $ | — | ||||||||||||

| DIP Draw |

350 | — | 4,926 | 967 | 1,655 | 7,898 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ending DIP Loan Balance |

$ | 350 | $ | 350 | $ | 5,276 | $ | 6,243 | $ | 7,898 | $ | 7,898 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| DIP Loan Availability |

$ | 35,000 | $ | 35,000 | $ | 30,074 | $ | 29,107 | $ | 27,452 | $ | 27,452 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

1 of 1

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 1 of 18

Exhibit 2

Certificates of Insurance

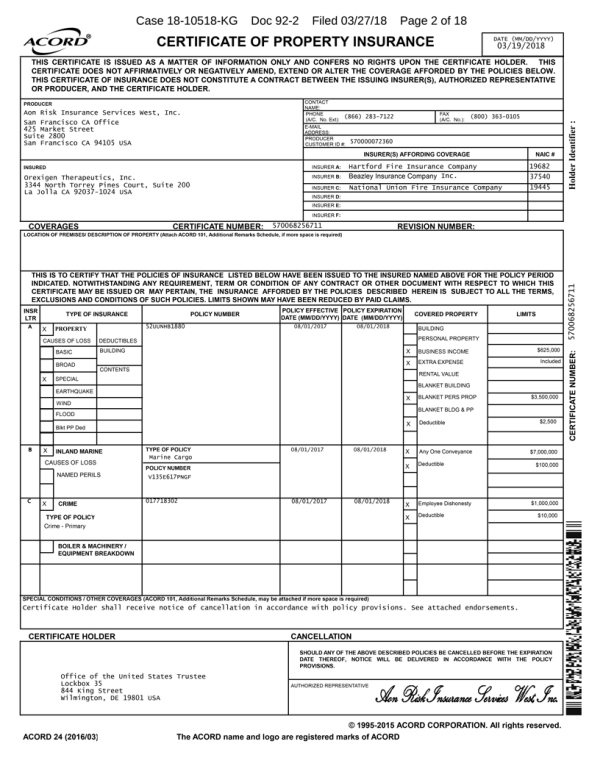

CERTIFICATE OF PROPERTY INSURANCE DATE (MM/DD/YYYY) 03/19/2018

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR

ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER.

PRODUCER Aon Risk Insurance Services West, Inc. San Francisco CA Office 425 Market Street Suite 2800 San Francisco CA 94105 USA INSURED Orexigen Therapeutics, Inc. 3344 North

Torrey Pines Court, Suite 200 La Jolla CA 92037-1024 USA CONTACT NAME: PHONE (A/C. No. Ext): (866) 283-7122 FAX (A/C. No.): (800) 363-0105

E-MAIL ADDRESS: PRODUCER CUSTOMER ID #: 570000072360 INSURER(S) AFFORDING

COVERAGE NAIC #

INSURER A: Hartford Fire Insurance Company INSURER B: Beazley Insurance Company Inc. INSURER C: National Union Fire

Insurance Company 19682 37540 19445 INSURER D: INSURER E: INSURER F:

COVERAGES CERTIFICATE NUMBER: 570068256711 REVISION NUMBER:

LOCATION OF PREMISES/DESCRIPTION OF PROPERTY (Attach ACORD 101, Additional Remarks Schedule, if more space is required) THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED

BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY ISSUED OR MAY PERTAIN, THE INSURANCE

AFFORED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. INSR LTR A B C TYPE OF INSURANCE X PROPERTY CAUSES OF LOSS BASIC BOARD X SPECIAL

EARTHQUAKE WIND FLOOD Blkt PP Ded DEDUCTIBLES BUILDING CONTENTS X INLAND MARINE CAUSES OF LOSS NAMED PERILS X CRIME TYPE OF POLICY Crime – Primary BOILER & MACHINERY/EQUIPMENT BREAKDOWN POLICY NUMBER 52UUNHB1880 TYPE OF POLICY Marine

Cargo POLICY NUMBER V135E617PNGF 017718302 POLICY EFFECTIVE DATE (MM/DD/YYYY) 08/01/2017 08/01/2017 08/01/2017 POLICY EXPIRATION DATE (MM/DD/YYYY) 08/01/2017 08/01/2018 08/01/2018 COVERED PROPERTY BUILDING PERSONAL PROPERTY X BUSINESS INCOME X EXTRA

EXPENSE RENTAL VALUE BLANKET BUILDING X BLANKET PERS PROP BLANKET BLDG & PP X Deductible

X Any One Conveyance X Deductible X Employee Dishonesty X

Deductible LIMITS $625,000 Included $3,500,000 $2,500 $7,000,000 $100,000 $1,000,000 $10,000 SPECIAL CONDITIONS/OTHER COVERAGES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) Certificate Holder shall receive

notice of cancellation in accordance with policy provisions. See attached endorsements. CERTIFICATE HOLDER CANCELLATION Office of the United States Trustee Lockbox 35 844 King Street Wilmington, DE 19801 USA SHOULD ANY OF THE ABOVE DESCRIBED

POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. AUTHORIZED REPRESENTATIVE 1995-2015 ACORD CORPORATION. All rights reserved. ACORD 24 (2016/03) The ACORD name and logo are

registered marks of ACORD

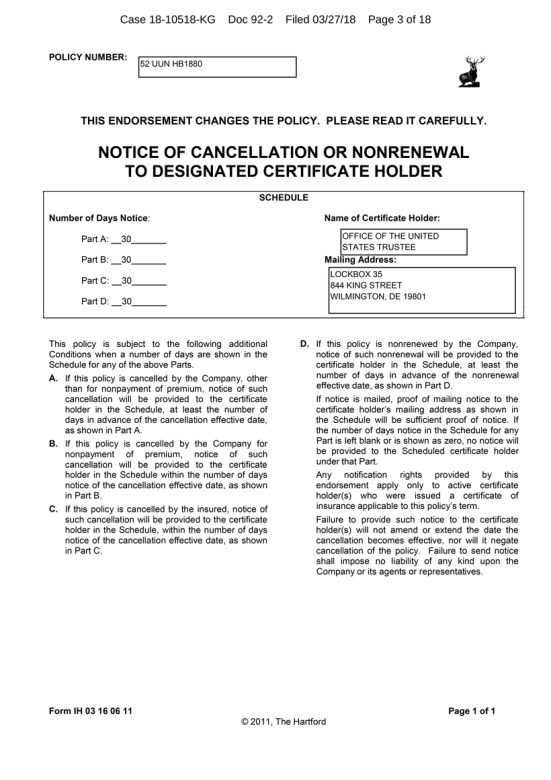

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 3 of 18 POLICY NUMBER: 52 UUN HB1880

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

NOTICE OF CANCELLATION OR

NONRENEWAL

TO DESIGNATED CERTIFICATE HOLDER

SCHEDULE Number of Days Notice:

Part A: __30 Part B: __30 Part C: __30 Part D: __30

Name of

Certificate Holder:

OFFICE OF THE UNITED STATES TRUSTEE

Mailing Address:

LOCKBOX 35 844 KING STREET WILMINGTON, DE 19801

This policy is subject to the

following additional Conditions when a number of days are shown in the Schedule for any of the above Parts. A. If this policy is cancelled by the Company, other than for nonpayment of premium, notice of such cancellation will

be provided to the certificate holder in the Schedule, at least the number of days in advance of the cancellation effective date, as shown in Part A.

B. If this policy is cancelled by the Company for nonpayment of premium, notice of such cancellation will be provided to the certificate

holder in the Schedule within the number of days notice of the cancellation effective date, as shown in Part B.

C. If this policy is

cancelled by the insured, notice of such cancellation will be provided to the certificate holder in the Schedule, within the number of days notice of the cancellation effective date, as shown in Part C.

D. If this policy is nonrenewed by the Company, notice of such nonrenewal will be provided to the certificate holder in the Schedule, at least the number of

days in advance of the nonrenewal effective date, as shown in Part D.

If notice is mailed, proof of mailing notice to the certificate holder’s mailing address

as shown in the Schedule will be sufficient proof of notice. If the number of days notice in the Schedule for any Part is left blank or is shown as zero, no notice will be provided to the Scheduled certificate holder under that Part. Any

notification rights provided by this endorsement apply only to active certificate holder(s) who were issued a certificate of insurance applicable to this policy’s term. Failure to provide such notice to the certificate holder(s) will not amend

or extend the date the cancellation becomes effective, nor will it negate cancellation of the policy. Failure to send notice shall impose no liability of any kind upon the Company or its agents or representatives.

Form IH 03 16 06 11 © 2011, The Hartford Page 1 of 1

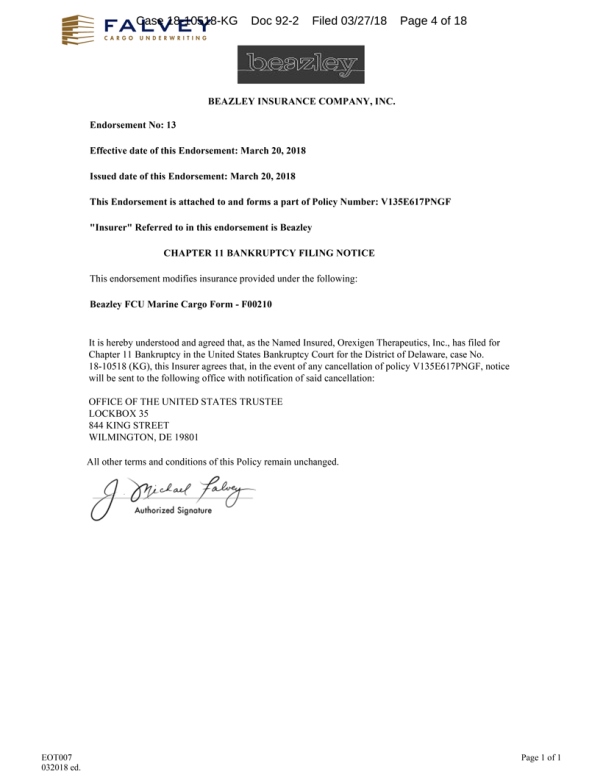

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 4 of 18 BEAZLEY INSURANCE COMPANY, INC.

Endorsement No: 13

Effective date of this Endorsement: March 20, 2018

Issued date of this Endorsement: March 20, 2018

This Endorsement is

attached to and forms a part of Policy Number: V135E617PNGF “Insurer” Referred to in this endorsement is Beazley

CHAPTER 11 BANKRUPTCY FILING NOTICE

This endorsement modifies insurance provided under the following:

Beazley FCU

Marine Cargo Form—F00210

It is hereby understood and agreed that, as the Named Insured, Orexigen Therapeutics, Inc., has filed for

Chapter 11 Bankruptcy in the United States Bankruptcy Court for the District of Delaware, case No.

18-10518 (KG), this Insurer agrees that, in the event of any cancellation of policy V135E617PNGF, notice will be sent to the following

office with notification of said cancellation:

OFFICE OF THE UNITED STATES TRUSTEE

LOCKBOX 35

844 KING STREET

WILMINGTON, DE 19801

All other terms and conditions of this Policy remain unchanged.

Authorized Signature EOT007 032018 ed. Page 1 of 1

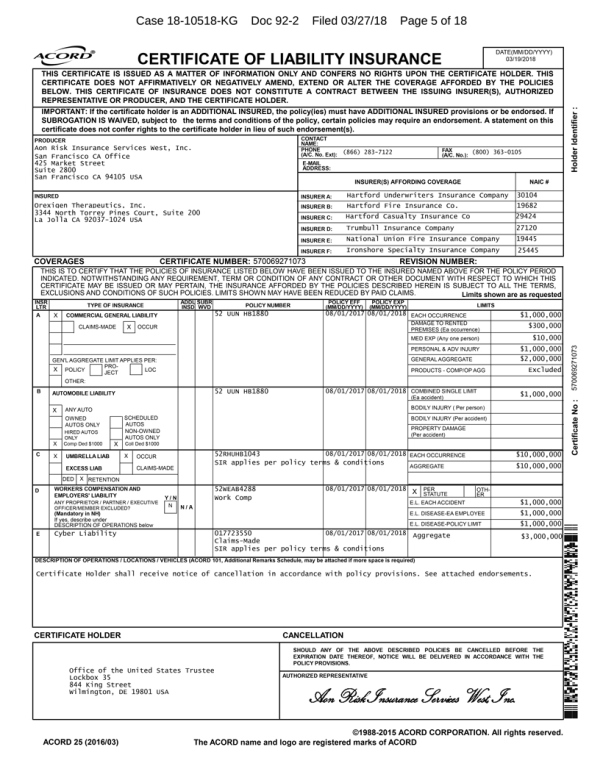

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 5 of 18 CERTIFICATE OF LIABILITY INSURANCE DATE(MM/DD/YYYY) 03/19/2018 THIS CERTIFICATE IS

ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES

NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be

endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).

PRODUCER Aon Risk Insurance Services West, Inc. San Francisco CA Office 425 Market Street Suite 2800 San Francisco CA 94105 USA INSURED Orexigen Therapeutics, Inc. 3344 North Torrey Pines Court, Suite 200 La Jolla CA 92037-1024 USA CONTACT NAME:

PHONE (A/C. No. Ext): (866) 283-7122 FAX (A/C. No.): (800) 363-0105 E-MAIL ADDRESS: INSURER(S) AFFORDING

COVERAGE INSURER A: Hartford Underwriters Insurance Company INSURER B: Hartford Fire Insurance Co. INSURER C: Hartford Casualty Insurance Co INSURER

D: Trumbull Insurance Company INSURER E: National Union Fire Insurance Company INSURER F: Ironshore Specialty Insurance Company NAIC # 30104 19682 29424 27120 19445 25445 COVERAGES CERTIFICATE NUMBER:

570069271073 REVISION NUMBER: THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER

DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID

CLAIMS. Limits shown are as requested INSR LTR A TYPE OF INSURANCE X COMMERCIAL GENERAL LIABILITY CLAIMS-MADE X OCCUR ADDL INSD SUBR WVD POLICY NUMBER POLICY

EFF (MM/DD/YYYY) POLICY EXP (MM/DD/YYYY) LIMITS GEN’L AGGREGATE LIMIT APPLIES PER: X POLICY PROJECT LOC OTHER: 52 UUN HB1880 08/01/2017 08/01/2018 EACH OCCURRENCE DAMAGE TO RENTED PREMISES (Ea

occurrence) MED EXP (Any one person) PERSONAL & ADV INJURY GENERAL AGGREGATE PRODUCTS - COMP/OP AGG $1,000,000 $300,000 $10,000 $1,000,000 $2,000,000 Excluded B C D E AUTOMOBILE LIABILITY X ANY AUTO OWNED AUTOS ONLY HIRED AUTOS ONLY X Comp

Ded $1000 SCHEDULED AUTOS NON-OWNED AUTOS ONLY X Coll Ded $1000 X UMBRELLA LIAB EXCESS LIAB X OCCUR CLAIMS-MADE DED X RETENTION WORKERS COMPENSATION AND EMPLOYERS’ LIABILITY ANY PROPRIETOR / PARTNER /

EXECUTIVE OFFICER/MEMBER EXCLUDED? (Mandatory in NH) If yes, describe under DESCRIPTION OF OPERATIONS below Y / N N N/A Cyber Liability 52 UUN HB1880 08/01/2017 08/01/2018 52RHUHB1043 SIR applies per policy terms & conditions 08/01/2017

08/01/2018 52WEAB4288 Work Comp 08/01/2017 08/01/2018 017723550 Claims-Made SIR applies per policy terms & conditions 08/01/2017 08/01/2018 COMBINED SINGLE LIMIT (Ea accident) BODILY INJURY ( Per person) BODILY INJURY

(Per accident) PROPERTY DAMAGE (Per accident) EACH OCCURRENCE AGGREGATE X PER OTH X STATUTE ER E.L. EACH ACCIDENT E.L. DISEASE-EA EMPLOYEE E.L. DISEASE-POLICY

LIMIT Aggregate $1,000,000 $10,000,000 $10,000,000 $1,000,000 $1,000,000 $1,000,000 $3,000,000 DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required)

Certificate Holder shall receive notice of cancellation in accordance with policy provisions. See attached endorsements.

CERTIFICATE HOLDER

Office of the United States Trustee Lockbox 35 844 King Street Wilmington,

DE 19801 USA

CANCELLATION

SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE

CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. AUTHORIZED REPRESENTATIVE

©1988-2015 ACORD

CORPORATION. All rights reserved. The ACORD name and logo are registered marks of ACORD

ACORD 25 (2016/03)

Certificate No: 570069271073 Holder Identifier:

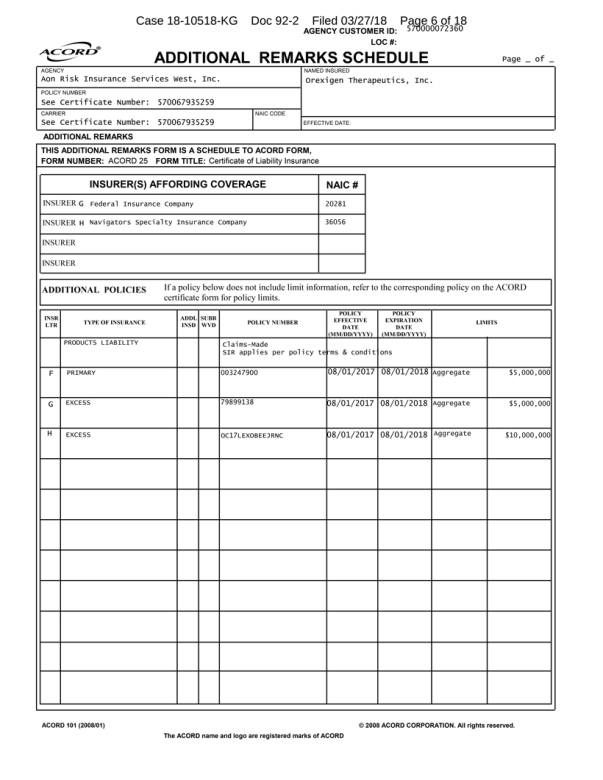

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 6 of 18

AGENCY CUSTOMER ID: 570000072360 LOC #:

ADDITIONAL REMARKS SCHEDULE Page of

AGENCY

Aon Risk Insurance Services West, Inc.

POLICY NUMBER

See Certificate Number: 570067935259

CARRIER See Certificate Number: 570067935259 NAIC CODE

NAMED INSURED Orexigen Therapeutics,

Inc. EFFECTIVE DATE:

ADDITIONAL REMARKS FORM IS A SCHEDULE TO ACORD FORM, FORM NUMBER: ACORD 25 FORM TITLE: Certificate of Liability Insurance

INSURER(S) AFFORDING COVERAGE

INSURER G Federal Insurance Company

INSURER H Navigators Specialty Insurance Company

INSURER

INSURER

NAIC #

20281

36056

ADDITIONAL POLICIES If a policy below does not include limit information, refer to the corresponding policy on the ACORD certificate form for policy limits.

INSR LTR F G H

TYPE OF INSURANCE PRODUCTS LIABILITY PRIMARY EXCESS EXCESS

ADDL INSD SUBR WVD

POLICY NUMBER Claims-Made SIR applies per policy

teams & conditions 003247900 79899138 OC17LEXOBEEJRNC

POLICY EFFECTIVE DATE (MM/DD/YYYY) 08/01/2017 08/01/2017 08/01/2017

POLICY EXPIRATION DATE (MM/DD/YYYY) 08/01/2018 08/01/2018 08/01/2018 LIMITS

Aggregate

Aggregate Aggregate $5,000,000 $5,000,000 $10,000,000 ACORD 101 (2008/01) © 2008 ACORD CORPORATION. All rights reserved. The ACORD name and logo are registered marks of ACORD

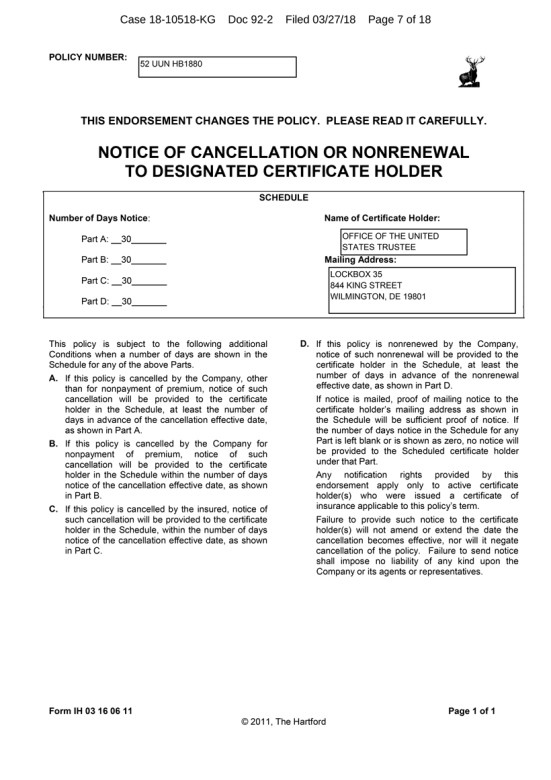

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 7 of 18

POLICY NUMBER: 52 UUN HB1880

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

NOTICE OF CANCELLATION OR NONRENEWAL TO DESIGNATED CERTIFICATE HOLDER

Number of Days Notice:

SCHEDULE

Part A: __30

Part B: __30

Part C: __30

Part D: __30

Name of Certificate Holder:

OFFICE OF THE UNITED STATES TRUSTEE

Mailing Address:

LOCKBOX 35 844 KING STREET WILMINGTON, DE 19801

This policy is subject to the following

additional Conditions when a number of days are shown in the Schedule for any of the above Parts.

A. If this policy is cancelled by the

Company, other than for nonpayment of premium, notice of such cancellation will be provided to the certificate holder in the Schedule, at least the number of days in advance of the cancellation effective date, as shown in Part A.

B. If this policy is cancelled by the Company for nonpayment of premium, notice of such cancellation will be provided to the certificate holder in the

Schedule within the number of days notice of the cancellation effective date, as shown in Part B.

C. If this policy is cancelled by the

insured, notice of such cancellation will be provided to the certificate holder in the Schedule, within the number of days notice of the cancellation effective date, as shown in Part C.

D. If this policy is nonrenewed by the Company, notice of such nonrenewal will be provided to the certificate holder in the Schedule, at least the number of

days in advance of the nonrenewal effective date, as shown in Part D.

If notice is mailed, proof of mailing notice to the certificate holder’s mailing address

as shown in the Schedule will be sufficient proof of notice. If the number of days notice in the Schedule for any Part is left blank or is shown as zero, no notice will be provided to the Scheduled certificate holder under that Part.

Any notification rights provided by this endorsement apply only to active certificate holder(s) who were issued a certificate of insurance applicable to this policy’s term.

Failure to provide such notice to the certificate holder(s) will not amend or extend the date the cancellation becomes effective, nor will it negate cancellation

of the policy. Failure to send notice shall impose no liability of any kind upon the Company or its agents or representatives.

Form IH 03 16 06 11© 2011, The

Hartford Page 1 of 1

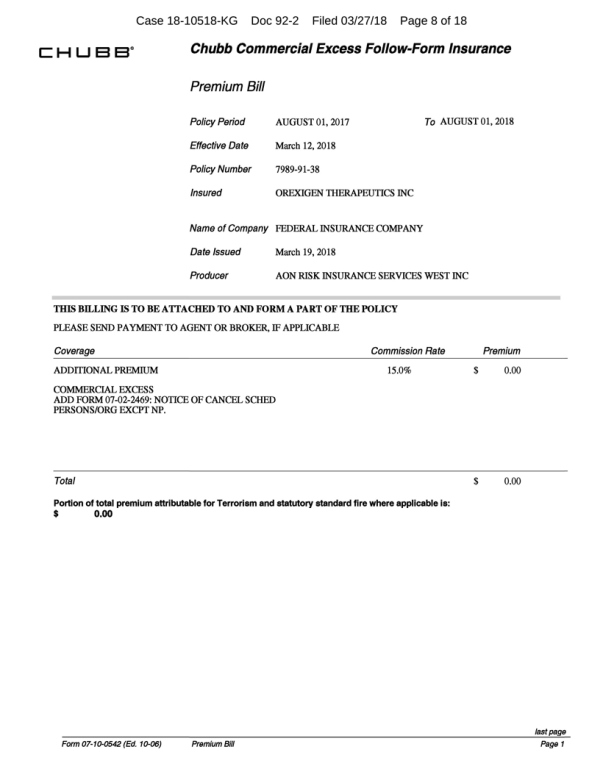

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 8 of 18

Chubb Commercial Excess Follow-Form Insurance

Premium Bill

Policy Period AUGUST 01, 2017 To AUGUST 01, 2018

Effective Date March 12, 2018 Policy Number 7989-91-38 Insured OREXIGEN THERAPEUTICS INC

Name of Company FEDERAL INSURANCE COMPANY

Date Issued March 19, 2018

Producer AON RISK INSURANCE SERVICES WEST INC

THIS BILLING IS TO BE ATTACHED TO AND FORM A PART OF THE POLICY

PLEASE SEND PAYMENT TO AGENT OR BROKER, IF APPLICABLE

Coverage

ADDITIONAL PREMIUM COMMERCIAL EXCESS ADD FORM 07-02-2469: NOTICE OF CANCEL SCHED PERSONS/ORG EXCPT

NP.

Commission Rate 15.0% Premium $0.00

Total $0.00 Portion of total premium

attributable for Terrorism and statutory standard fire where applicable is: $0.00

Form

07-10-0542 (ED. 10-06) last page page 1 Premium Bill

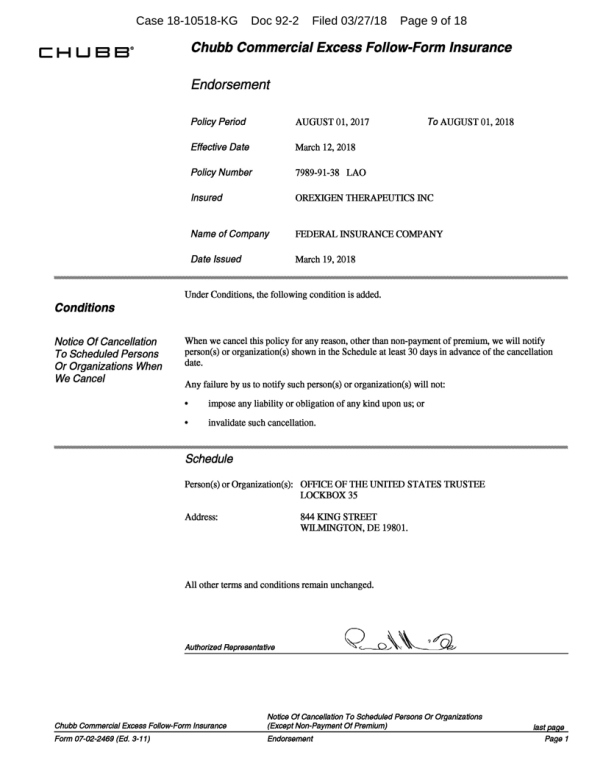

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 9 of 18

Chubb Commercial Excess Follow-Form Insurance

Endorsement

Policy Period AUGUST 01, 2017 To AUGUST 01, 2018 Effective Date March 12,

2018 Policy Number 7989-91-38 LAO Insured OREXIGEN THERAPEUTICS INC Name of Company FEDERAL INSURANCE COMPANY Date Issued March 19, 2018

Under Conditions, the following condition is added.

Conditions

Notice of Cancellation To Scheduled Persons Or Organizations When We Cancel

When we cancel

this policy for any reason, other than non-payment of premium, we will notify person(s) or organization(s) shown in the Schedule at least 30 days in advance of the cancellation date.

Any failure by us to notify such person(s) or organization(s) will not:

impose any liability

or obligation of any kind upon us; or invalidate such cancellation.

Schedule

Peron(s) or Organizations(s): OFFICE OF THE UNITED STATES TRUSTEE LOCKBOX 35

Address: 844 KING STREET WILMINGTON, DE 19801.

All other terms and conditions

remain unchanged.

Authorized Representative

Chubb Commercial Excess

Follow-Form Insurance

Form 07-02-2469 (ED.

8-11)

Notice of Cancellation To Scheduled Persons or Organizations (Except

Non-Payment Of Premium) Endorsement last page Page 1

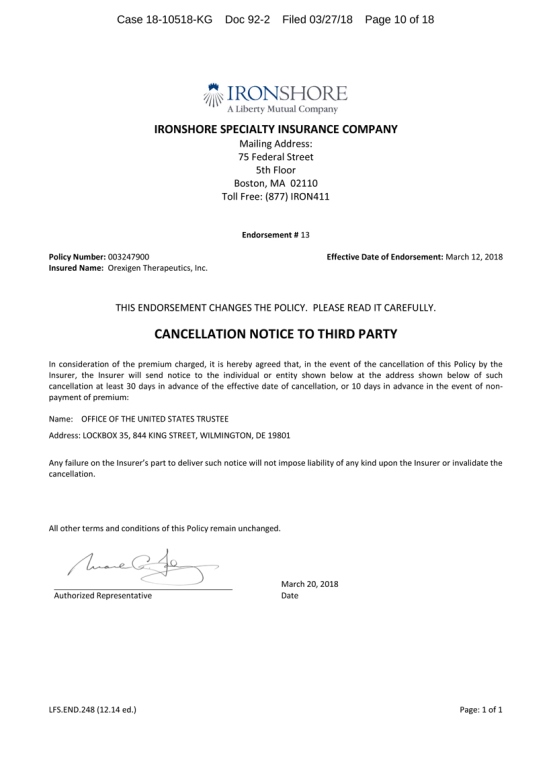

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 10 of 18 AIRONSHORE

A Liberty Mutual Company

IRONSHORE SPECIALTY INSURANCE COMPANY

Mailing Address:

75 Federal Street

5th Floor

Boston, MA 02110

Toll Free: (877) IRON411

Endorsement # 13

Policy Number: 003247900

Insured Name: Orexigen Therapeutics, Inc.

Effective Date of Endorsement: March 12, 2018

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE

READ IT CAREFULLY.

CANCELLATION NOTICE TO THIRD PARTY

In consideration of the

premium charged, it is hereby agreed that, in the event of the cancellation of this Policy by the Insurer, the Insurer will send notice to the individual or entity shown below at the address shown below of such cancellation at least 30 days in

advance of the effective date of cancellation, or 10 days in advance in the event of non-payment of premium:

Name: OFFICE

OF THE UNITED STATES TRUSTEE

Address: LOCKBOX 35, 844 KING STREET, WILMINGTON, DE 19801

Any failure on the Insurer’s part to deliver such notice will not impose liability of any kind upon the Insurer or invalidate the cancellation.

All other terms and conditions of this Policy remain unchanged.

Authorized Representative

March 20, 2018 Date

LFS.END.248 (12.14 ed.) Page: 1 of 1

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 11 of 18

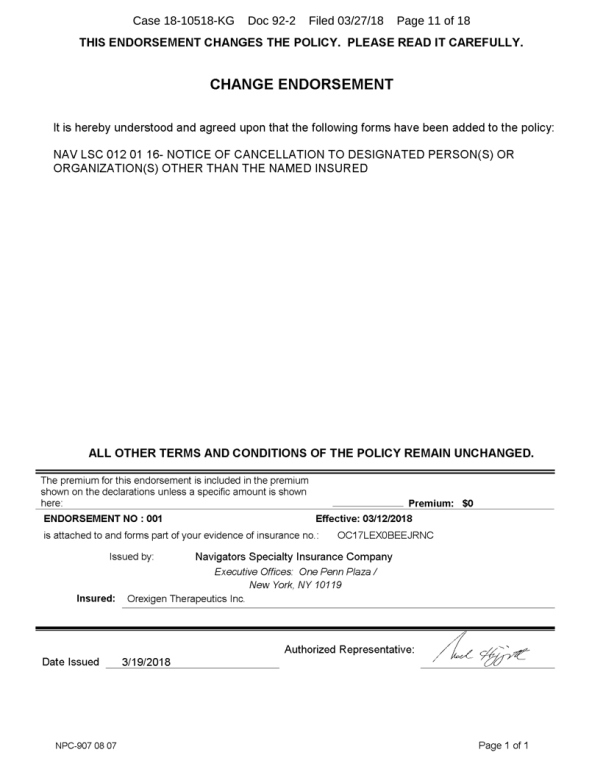

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

CHANGE ENDORSEMENT

It is hereby understood and agreed upon that the following forms have been

added to the policy:

NAV LSC 012 01 16- NOTICE OF CANCELLATION TO DESIGNATED PERSON(S) OR ORGANIZATION(S) OTHER THAN THE

NAMED INSURED

ALL OTHER TERMS AND CONDITIONS OF THE POLICY REMAIN UNCHANGED.

The premium for this endorsement is included in the premium shown on the declarations unless a specific amount is shown here:

ENDORSEMENT NO : 001 Premium: $0 Effective: 03/12/2018

is attached to and forms part of your

evidence of insurance no.: OC17LEX0BEEJRNC

Issued by: Navigators Specialty Insurance Company

Executive Offices: One Penn Plaza / New York, NY 10119

Insured: Orexigen Therapeutics Inc.

Date Issued 3/19/2018 Authorized Representative:

NPC-907 08 07 Page 1 of 1

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 12 of 18

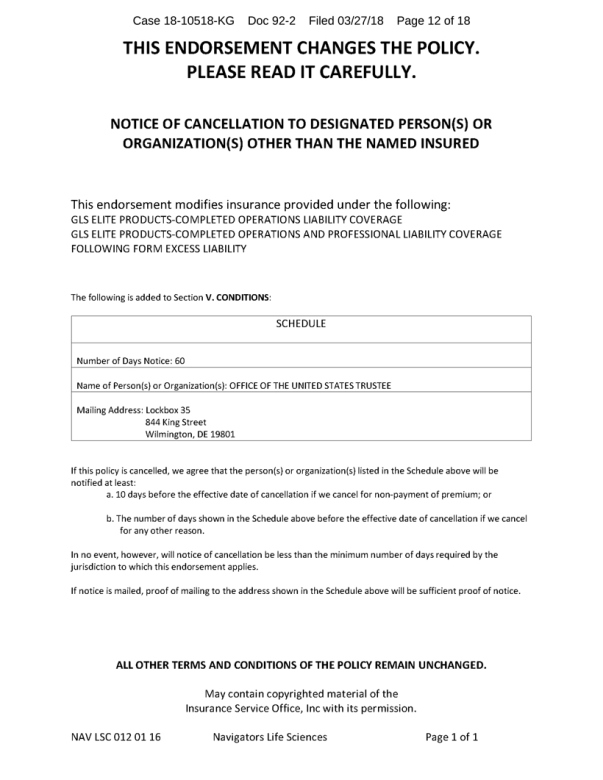

THIS ENDORSEMENT CHANGES THE POLICY.

PLEASE READ IT CAREFULLY.

NOTICE OF CANCELLATION TO DESIGNATED PERSON(S) OR

ORGANIZATION(S) OTHER THAN THE NAMED INSURED

This endorsement modifies insurance provided

under the following:

GLS ELITE PRODUCTS-COMPLETED OPERATIONS LIABILITY COVERAGE

GLS ELITE PRODUCTS-COMPLETED OPERATIONS AND PROFESSIONAL LIABILITY COVERAGE

FOLLOWING FORM EXCESS LIABILITY

The following is added to Section V.

CONDITIONS:

SCHEDULE

Number of Days Notice: 60

Name of Person(s) or Organization(s): OFFICE OF THE UNITED STATES TRUSTEE

Mailing Address:

Lockbox 35

844 King Street Wilmington, DE 19801

If this policy is cancelled,

we agree that the person(s) or organization(s) listed in the Schedule above will be notified at least:

a. 10 days before the effective date

of cancellation if we cancel for non-payment of premium; or

b. The number of days shown in the

Schedule above before the effective date of cancellation if we cancel

for any other reason.

In no event, however, will notice of cancellation be less than the minimum number of days required by the jurisdiction to which this endorsement applies.

If notice is mailed, proof of mailing to the address shown in the Schedule above will be sufficient proof of notice.

ALL OTHER TERMS AND CONDITIONS OF THE POLICY REMAIN UNCHANGED.

May contain copyrighted

material of the

Insurance Service Office, Inc with its permission.

NAVLSC012

01 16 Navigators Life Sciences Page 1 of 1

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 13 of 18

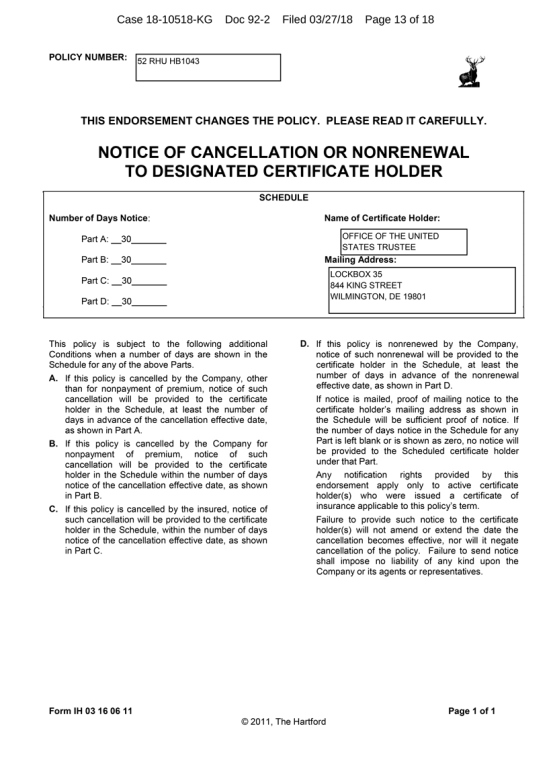

POLICY NUMBER: 52 RHU HB1043

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

NOTICE OF CANCELLATION OR

NONRENEWAL

TO DESIGNATED CERTIFICATE HOLDER

SCHEDULE

Number of Days Notice:

Part A: __30

Part B: __30

Part C: __30

Part D: __30

Name of Certificate Holder:

OFFICE OF THE UNITED STATES TRUSTEE

Mailing Address:

LOCKBOX 35 844 KING STREET WILMINGTON, DE 19801

This policy is subject to the following

additional Conditions when a number of days are shown in the Schedule for any of the above Parts.

A. If this policy is cancelled by the

Company, other than for nonpayment of premium, notice of such cancellation will be provided to the certificate holder in the Schedule, at least the number of days in advance of the cancellation effective date, as shown in Part A.

B. If this policy is cancelled by the Company for nonpayment of premium, notice of such cancellation will be provided to the certificate holder in the

Schedule within the number of days notice of the cancellation effective date, as shown in Part B.

C. If this policy is cancelled by the

insured, notice of such cancellation will be provided to the certificate holder in the Schedule, within the number of days notice of the cancellation effective date, as shown in Part C.

D. If this policy is nonrenewed by the Company, notice of such nonrenewal will be provided to the certificate holder in the Schedule, at least the number of

days in advance of the nonrenewal effective date, as shown in Part D.

If notice is mailed, proof of mailing notice to the certificate holder’s mailing address

as shown in the Schedule will be sufficient proof of notice. If the number of days notice in the Schedule for any Part is left blank or is shown as zero, no notice will be provided to the Scheduled certificate holder under that Part.

Any notification rights provided by this endorsement apply only to active certificate holder(s) who were issued a certificate of insurance applicable to this policy’s term.

Failure to provide such notice to the certificate holder(s) will not amend or extend the date the cancellation becomes effective, nor will it negate cancellation

of the policy. Failure to send notice shall impose no liability of any kind upon the Company or its agents or representatives.

Form IH 03 16 06 11 © 2011, The

Hartford Page 1 of 1

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 14 of 18

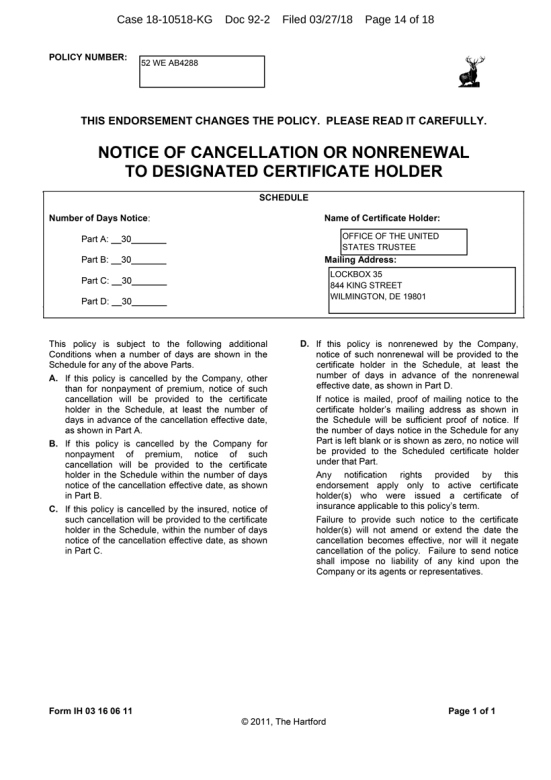

POLICY NUMBER: 52 WE AB4288

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

NOTICE OF CANCELLATION OR

NONRENEWAL

TO DESIGNATED CERTIFICATE HOLDER

SCHEDULE

Number of Days Notice:

Part A: __30

Part B: __30

Part C: __30

Part D: __30

Name of Certificate Holder:

OFFICE OF THE UNITED STATES TRUSTEE

Mailing Address:

LOCKBOX 35 844 KING STREET WILMINGTON, DE 19801

This policy is subject to the following

additional Conditions when a number of days are shown in the Schedule for any of the above Parts.

A. If this policy is cancelled by the

Company, other than for nonpayment of premium, notice of such cancellation will be provided to the certificate holder in the Schedule, at least the number of days in advance of the cancellation effective date, as shown in Part A.

B. If this policy is cancelled by the Company for nonpayment of premium, notice of such cancellation will be provided to the certificate holder in the

Schedule within the number of days notice of the cancellation effective date, as shown in Part B.

C. If this policy is cancelled by the

insured, notice of such cancellation will be provided to the certificate holder in the Schedule, within the number of days notice of the cancellation effective date, as shown in Part C.

D. If this policy is nonrenewed by the Company, notice of such nonrenewal will be provided to the certificate holder in the Schedule, at least the number of

days in advance of the nonrenewal effective date, as shown in Part D.

If notice is mailed, proof of mailing notice to the certificate holder’s mailing address

as shown in the Schedule will be sufficient proof of notice. If the number of days notice in the Schedule for any Part is left blank or is shown as zero, no notice will be provided to the Scheduled certificate holder under that Part.

Any notification rights provided by this endorsement apply only to active certificate holder(s) who were issued a certificate of insurance applicable to this policy’s term.

Failure to provide such notice to the certificate holder(s) will not amend or extend the date the cancellation becomes effective, nor will it negate cancellation

of the policy. Failure to send notice shall impose no liability of any kind upon the Company or its agents or representatives.

Form IH 03 16 06 11 © 2011, The

Hartford Page 1 of 1

Case 18-10518-KG Doc

92-2 Filed 03/27/18 Page 15 of 18

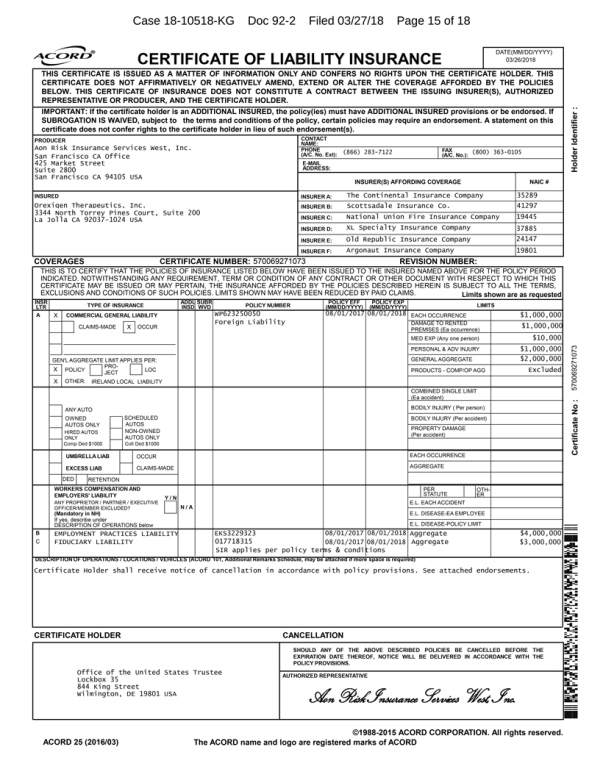

CERTIFICATE OF LIABILITY INSURANCE DATE(MM/DD/YYYY) 03/26/2018

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR

ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER.

IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the

terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).

PRODUCER

Aon Risk Insurance Services West, Inc.

San Francisco CA Office

425 Market Street

Suite 2800

San Francisco CA 94105 USA

INSURED

Orexigen Therapeutics, Inc.

3344 North Torrey Pines Court, Suite 200

La Jolla CA 92037-1024 USA

CONTACT NAME: PHONE (A/C. No. Ext): (866) 283-7122 FAX (A/C. No.): (800) 363-0105

E-MAIL ADDRESS:

INSURER(S) AFFORDING COVERAGE

INSURER A: The Continental Insurance Company

INSURER

B: Scottsadale Insurance Co.

INSURER C: National Union Fire Insurance Company

INSURER D: XL Specialty Insurance Company

INSURER

E: Old Republic Insurance Company

INSURER F: Argonaut Insurance Company

NAIC #

35289

41297

19445

37885

24147

19801

COVERAGES CERTIFICATE NUMBER: 570069271073 REVISION NUMBER:

THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR

CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS

SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. Limits shown are as requested

INSR LTR A B C TYPE OF INSURANCE

X COMMERCIAL GENERAL LIABILITY

CLAIMS-MADE X OCCUR

GEN’L AGGREGATE LIMIT APPLIES PER:

X POLICY PROJECT LOC

X OTHER: IRELAND LOCAL LIABILITY

ANY AUTO OWNED AUTOS ONLY HIRED AUTOS

ONLY Comp Ded $1000

SCHEDULED AUTOS NON-OWNED AUTOS ONLY Coll Ded $1000

UMBRELLA LIAB EXCESS LIAB OCCUR CLAIMS-MADE DED | RETENTION

WORKERS

COMPENSATION AND EMPLOYERS’ LIABILITY

ANY PROPRIETOR / PARTNER / EXECUTIVE OFFICER/MEMBER EXCLUDED? (Mandatory in NH) If yes, describe under DESCRIPTION OF

OPERATIONS below Y / N N / A

EMPLOYMENT PRACTICES LIABILITY FIDUCIARY LIABILITY

ADDL INSD SUBR WVD

POLICY NUMBER WP623250050 Foreign Liability

EKS3229323 017718315 SIR applies per policy terms & conditions

POLICY EFF

(MM/DD/YYYY) 08/01/2017 08/01/2017 08/01/2017

POLICY EXP (MM/DD/YYYY) 08/01/2018 08/01/2018 08/01/2018

LIMITS

EACH OCCURRENCE

DAMAGE TO RENTED PREMISES (Ea occurrence)

MED EXP (Any one person)

PERSONAL & ADV INJURY

GENERAL AGGREGATE

PRODUCTS - COMP/OP AGG

COMBINED SINGLE LIMIT (Ea accident)

BODILY INJURY ( Per person)

BODILY INJURY (Per accident)

PROPERTY DAMAGE

(Per accident)

EACH OCCURRENCE

AGGREGATE

PER STATUTE OTHER

E.L. EACH ACCIDENT

E.L. DISEASE-EA EMPLOYEE

E.L. DISEASE-POLICY LIMIT

Aggregate

Aggregate

$1,000,000

$1,000,000

$10,000

$1,000,000

$2,000,000

Excluded

$4,000,000

$3,000,000

DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) Certificate Holder shall receive notice of

cancellation in accordance with policy provisions. See attached endorsements.

CERTIFICATE HOLDER CANCELLATION

Office of the United States Trustee

Lockbox 35

844 King Street

Wilmington, DE 19801 USA SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE

CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. AUTHORIZED REPRESENTATIVE ACORD 25 (2016/03) ©1988-2015 ACORD CORPORATION. All rights reserved. The ACORD name and logo are

registered marks of ACORD

Certificate No : 570069271073 Holder Identifier :

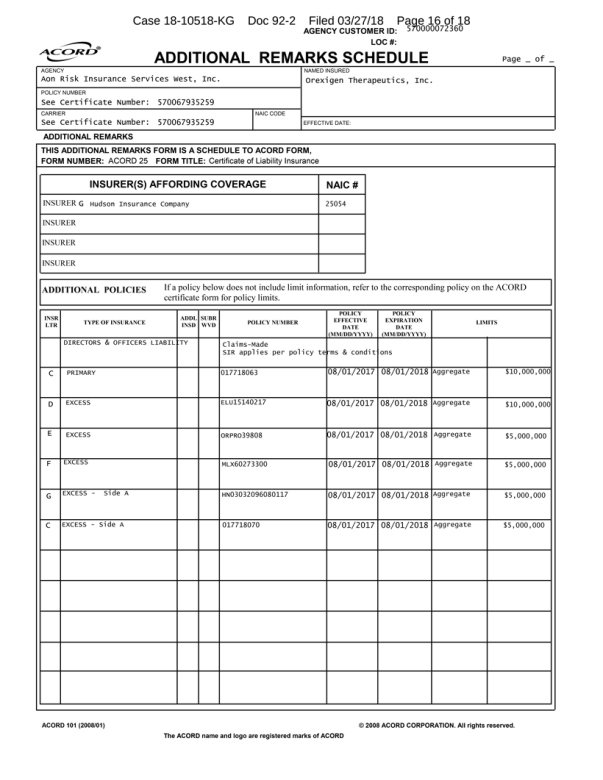

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 16 of 18

AGENCY CUSTOMER ID: 570000072360

LOC #:

ADDITIONAL REMARKS SCHEDULE Page of

AGENCY Aon Risk Insurance Services West, Inc.

POLICY NUMBER See Certificate Number: 570067935259

CARRIER See Certificate Number:

570067935259 NAIC CODE

NAMED INSURED Orexigen Therapeutics, Inc.

EFFECTIVE

DATE: ADDITIONAL REMARKS

THIS ADDITIONAL REMARKS FORM IS A SCHEDULE TO ACORD FORM, FORM NUMBER: ACORD 25 FORM TITLE: Certificate of Liability Insurance

INSURER(S) AFFORDING COVERAGE

INSURER G Hudson Insurance Company

INSURER

INSURER

INSURER

NAIC #

25054

ADDITIONAL POLICIES If a policy below does not include limit information, refer to the

corresponding policy on the ACORD certificate form for policy limits.

INSR LTR C D E F G C

TYPE OF INSURANCE

DIRECTORS & OFFICERS LIABILITY

PRIMARY

EXCESS

EXCESS

EXCESS

EXCESS - Side A

EXCESS - Side A

ADDL INSD SUBR WVD

POLICY NUMBER

Claims-Made SIR applies per policy terms & conditions

017718063

ELU15140217

ORPRO39808

MLX60273300

HN03032096080117

017718070

POLICY

EFFECTIVE

DATE

(MM/DD/YYYY)

08/01/2017

08/01/2017

08/01/2017

08/01/2017

08/01/2017

08/01/2017

POLICY

EXPIRATION

DATE

(MM/DD/YYYY)

08/01/2018

08/01/2018

08/01/2018

08/01/2018

08/01/2018

08/01/2018

LIMITS

Aggregate

Aggregate

Aggregate

Aggregate

Aggregate

Aggregate

$10,000,000

$10,000,000

$5,000,000

$5,000,000

$5,000,000

$5,000,000

ACORD 101 (2008/01)

© 2008 ACORD CORPORATION. All rights reserved.

The ACORD name and logo are registered marks of ACORD

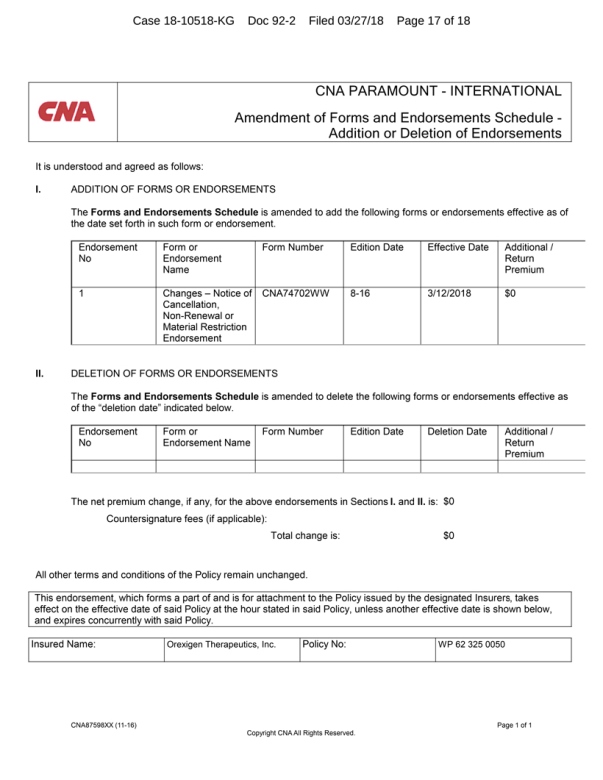

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 17 of 18

CNA PARAMOUNT – INTERNATIONAL

Amendment of Forms and Endorsements Schedule - Addition or

Deletion of Endorsements

It is understood and agreed as follows:

I. ADDITION

OF FORMS OR ENDORSEMENTS

The Forms and Endorsements Schedule is amended to add the following forms or endorsements effective as of the date set forth in such form

or endorsement.

Endorsement No 1

Form or Endorsement Name

Changes - Notice of Cancellation, Non-Renewal or Material Restriction Endorsement

Form Number

CNA74702WW

Edition Date 8-16

Effective Date 3/12/2018 Additional /

Return Premium $0

II. DELETION OF FORMS OR ENDORSEMENTS

The Forms and Endorsements Schedule is amended to delete the following forms or endorsements effective as of the “deletion date” indicated below.

Endorsement No

Form or Endorsement Name

Form Number

Edition Date

Deletion Date

Additional / Return Premium

The net premium change, if any, for the above endorsements in Sections I. and II. is: $0 Countersignature fees (if applicable):

Total change is: $0

All other terms and conditions of the Policy remain unchanged. This

endorsement, which forms a part of and is for attachment to the Policy issued by the designated Insurers, takes effect on the effective date of said Policy at the hour stated in said Policy, unless another effective date is shown below, and expires

concurrently with said Policy.

Insured Name: Orexigen Therapeutics, Inc. Policy No: WP 62 325 0050 CNA87598XX (11-16) Page 1 of 1 Copyright CNA All Rights

Reserved.

Case 18-10518-KG Doc 92-2 Filed 03/27/18 Page 18 of 18

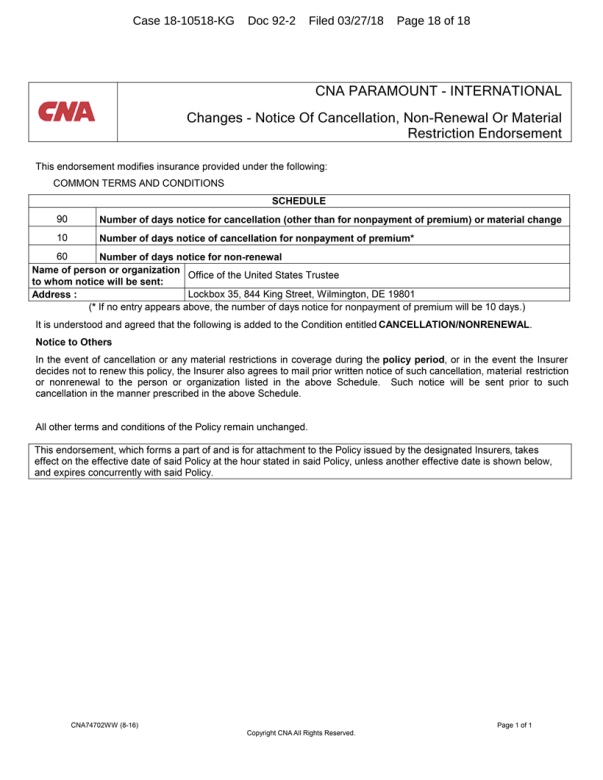

CNA PARAMOUNT – INTERNATIONAL Changes - Notice Of Cancellation, Non-Renewal Or Material Restriction Endorsement

This endorsement modifies insurance provided under the following: COMMON TERMS AND CONDITIONS SCHEDULE

90 Number of days notice for cancellation (other than for nonpayment of premium) or material change

10 Number of days notice of cancellation for nonpayment of premium*

60 Number of days notice

for non-renewal

Name of person or organization to whom notice will be sent:

Address : Office of the United States Trustee

Lockbox 35, 844 King Street,

Wilmington, DE 19801

(* If no entry appears above, the number of days notice for nonpayment of premium will be 10 days.)

It is understood and agreed that the following is added to the Condition entitled CANCELLATION/NONRENEWAL.

Notice to Others

In the event of cancellation or any material restrictions in coverage during

the policy period, or in the event the Insurer decides not to renew this policy, the Insurer also agrees to mail prior written notice of such cancellation, material restriction or nonrenewal to the person or organization listed in the above

Schedule. Such notice will be sent prior to such cancellation in the manner prescribed in the above Schedule.

All other terms and conditions of the Policy remain

unchanged.

This endorsement, which forms a part of and is for attachment to the Policy issued by the designated Insurers, takes

effect on the effective date of said Policy at the hour stated in said Policy, unless another effective date is shown below,

and expires concurrently with said Policy.

CNA74702WW (8-16) Page 1 of 1 Copyright CNA All

Rights Reserved.

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 1 of 11

Exhibit 3 Bank Accounts

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 2 of 11

Docket #0047 Date Filed: 03/13/2018

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF

DELAWARE

In re Orexigen Therapeutics, Inc., Debtor.1

Chapter 11

Case No. 18-10518 (KG)

Re: D.I. 7

INTERIM ORDER GRANTING DEBTOR’S MOTION FOR ENTRY OF INTERIM AND FINAL ORDERS (A) AUTHORIZING THE DEBTOR TO (I) CONTINUE ITS CASH MANAGEMENT SYSTEM, (II) HONOR

CERTAIN RELATED PREPETITION OBLIGATIONS, (III) MAINTAIN EXISTING BUSINESS FORMS, AND (IV) CONTINUE TO PERFORM INTERCOMPANY TRANSACTIONS, (B) AUTHORIZING AND DIRECTING THE DEBTOR’S BANKS TO HONOR ALL RELATED PAYMENT REQUESTS,

(C) GRANTING INTERIM AND FINAL WAIVERS OF THE DEBTOR’S COMPLIANCE WITH SECTION 345(B) OF THE BANKRUPTCY CODE, (D) SCHEDULING A FINAL HEARING, AND (E) GRANTING RELATED RELIEF

Upon the motion (the “Motion”)2 of the above-captioned debtor and debtor in possession

(the “Debtor”) for entry of interim (this “Interim Order”) and final orders, (a) authorizing the

Debtor to (i) continue its Cash Management System, (ii) honor certain related prepetition obligations, (iii) maintain its existing Business Forms in the ordinary

course of business, and (iv) continue to perform the Intercompany Transactions in the ordinary course and with the consent of the DIP Administrative Agent (b) authorizing and directing the Debtor’s Banks to honor all

related payment requests, (c) waiving the Debtor’s compliance with investment guidelines set forth in section 345(b) of the Bankruptcy Code, (d) scheduling a final

hearing (the “Final Hearing”) to consider entry of the proposed final order granting the Motion and (e) granting related relief, all as more fully set forth in the Motion; and upon the First Day Declaration; and

1 The last four digits of the Debtor’s federal tax identification number are 8822. The Debtor’s mailing address for purposes of this Chapter 11 Case is 3344 North Torrey

Pines Court, Suite 200, La Jolla, CA, 92037.

2 Capitalized terms not defined in this Order are defined in the Motion.

1810518180313000000000020

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 3 of 11

this Court having jurisdiction over this matter pursuant to 28 U.S.C. §§ 157 and 1334 and the Amended Standing Order of Reference from the United States District Court

for the District of Delaware, dated February 29, 2012; and this Court having found that this is a core proceeding pursuant to 28 U.S.C. § 157(b)(2); and that this Court may enter a final order consistent with Article III of the United

States Constitution; and this Court having found that venue of this proceeding and the Motion in this district is proper pursuant to 28 U.S.C. §§ 1408 and 1409; and this Court having found that the relief requested in the Motion is in the

best interests of the Debtor’s estate, its creditors, and other parties in interest; and this Court having found that the Debtor’s notice of the Motion was appropriate under the circumstances and no other notice need be provided; and this

Court having reviewed the Motion and having heard the statements in support of the relief requested therein at a hearing before this Court (the “Hearing”); and this Court having determined that the legal and factual bases set forth in the

Motion and at the Hearing establish just cause for the relief granted herein; and upon all of the proceedings had before this Court; and after due deliberation and sufficient cause appearing therefor, it is

HEREBY ORDERED THAT:

1. The Motion is GRANTED on an interim basis as set forth herein.

2. The Final Hearing, if required, on the Motion will be held on April 11, 2018 at 10:00 a.m. (prevailing Eastern time). Objections, if any, that relate to

the Motion shall be filed and served so as to be actually received by the Debtor’s proposed counsel on or before April 3, 2018 at 4:00 p.m. (prevailing Eastern time). Any objection shall set forth in writing and with particularity the

factual and legal basis of the objection. If no objections are filed to the Motion, the Court may enter the Final Order without further notice or hearing. 2

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 4 of 11

3. The Debtor is authorized, but not directed, to: (a) continue operating the Cash Management System, as described in the Motion; (b) honor its prepetition obligations

related thereto; (c) maintain its existing Business Forms; and (d) continue to perform Intercompany Transactions in the ordinary course and with the consent of the DIP Administrative Agent in an aggregate amount not to exceed $25,000 on an

interim basis, in each case subject to the limitations described in the Motion and this Interim Order.

4. The Debtor is further authorized, in its sole discretion,

to: (a) continue to use, with the same account numbers, the Bank Accounts in existence as of the Petition Date, including those accounts identified on Exhibit C attached to the Motion; (b) use, in their present form, the Business Forms, as

well as correspondence, checks and other documents related to the Bank Accounts existing immediately before the Petition Date and thereafter, without reference to the Debtor’s status as debtor in possession; provided that once the Debtor’s

preprinted correspondence, Business Forms (including letterhead) and existing checks have been used, the Debtor shall, when reordering, require the designation “Debtor in Possession” and the corresponding bankruptcy case number on all such

documents; provided further that, with respect to checks and letterhead which the Debtor or its agents print themselves, the Debtor shall begin printing the “Debtor in Possession” legend and the bankruptcy case number on such items within

ten (10) days of the date of entry of this Order; (c) treat the Debtor’s existing Bank Accounts for all purposes as accounts of the Debtor as debtor in possession; (d) deposit funds in and withdraw funds from the Bank Accounts by

all usual means, including checks, wire transfers, and other debits; (e) pay the prepetition Bank Fees; and (f) pay any ordinary course Bank Fees incurred in connection with the Debtor’s existing Bank Accounts, and to otherwise

perform its obligations under the documents governing the Debtor’s existing Bank Accounts. 3

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 5 of 11

Any requirements by the United States Trustee or otherwise to open separate debtor-in¬possession accounts are waived, unless otherwise specified herein.

5. Each of the Banks is authorized to debit the Debtor’s accounts in the

ordinary course

of business without need for further order of this Court for: (a) all checks, items, and other payment orders drawn on the Debtor’s accounts which are cashed at such Bank’s counters or exchanged for cashier’s checks by the payees

thereof prior to the Bank’s receipt of notice of filing of this Chapter 11 Case; (b) all checks, automated clearing house entries, and other items deposited or credited to one of the Debtor’s accounts with such Bank prior to the

commencement of this Chapter 11 Case which have been dishonored, reversed, or returned unpaid for any reason, together with any fees and costs in connection therewith, to the same extent the individual Debtor was responsible for such items prior to

commencement of this Chapter 11 Case; and (c) all undisputed prepetition amounts outstanding as of the date hereof, if any, owed to any Bank as service charges for the maintenance of the Cash Management System.

6. All Banks at which the Debtor’s existing Bank Accounts are maintained are authorized to continue to maintain, service, and administer the Debtor’s existing Bank

Accounts as accounts of the Debtor as debtor in possession, without interruption and in the ordinary course, and to receive, process, honor, and pay, to the extent of available funds, any and all checks, drafts, wires, credit card payments, and ACH

transfers issued and drawn on the Debtor’s existing Bank Accounts after the Petition Date by the holders or makers thereof, as the case may be. For Banks at which the Debtor holds Bank Accounts that are party to a Uniform Depository agreement

with the Office of the United States Trustee for the District of Delaware, within fifteen (15) days of the date of entry of this Order the Debtor shall (a) contact each Bank, (b) provide the Bank with the Debtor’s employer

identification number and (c) identify each of 4

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 6 of 11

its Bank Accounts held at such Banks as being held by a debtor in possession in a bankruptcy case, and provide the case number.

7. All Banks provided with notice of this Interim Order maintaining any of the Debtor’s existing Bank Accounts shall not honor or pay any bank payments drawn on the listed

Bank Accounts or otherwise issued before the Petition Date for which the Debtor specifically issues stop payment orders in accordance with the documents governing such Bank

Accounts.

8. In the course of providing cash management services to the Debtor, each of the

Banks is authorized, without further order of this Court, to deduct the applicable fees from the appropriate accounts of the Debtor, and further, to charge back to the appropriate accounts of the Debtor any amounts resulting from returned checks or

other returned items, including returned items that result from ACH transactions, wire transfers, or other electronic transfers of any kind, regardless of whether such items were deposited or transferred prepetition or postpetition and regardless of

whether the returned items relate to prepetition or postpetition

items or transfers.

9. Subject to the terms set forth herein, any of the Debtor’s Banks may rely on the representations of the Debtor with respect to whether any check, item, or other payment

order drawn or issued by the Debtor prior to filing of the Petition should be honored pursuant to this or any other order of this Court, and such Bank shall not have any liability to any party for relying on such representations by the Debtor as

provided for herein.

10. Any Banks are further authorized to (a) honor the Debtor’s directions with respect to the opening and closing of any Bank

Account and (b) accept and hold, or invest, the Debtor’s funds in accordance with the Debtor’s instructions; provided, however, that the 5

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 7 of 11

Debtor’s Banks shall not have any liability to any party for relying on such representations to the extent such reliance otherwise complies with applicable law.

11. The Debtor is authorized to open any new Bank Accounts or close any existing Bank Accounts as it may deem necessary and appropriate in its sole discretion; provided, however,

that the Debtor gives notice within fifteen (15) days to the Office of the United States Trustee for the District of Delaware and any statutory committees appointed in the chapter 11 case; provided, further, however, that the Debtor shall open

any such new Bank Account at banks that have executed a Uniform Depository Agreement with the Office of the United States Trustee for the District of Delaware, or at such banks that are willing to immediately execute such an agreement.

12. The Debtor’s time to comply with section 345(b) of the Bankruptcy Code with respect to any uncovered financial institutions is hereby extended for a period of thirty

(30) days from the date of this Interim Order (the “Extension Period”), provided that such extension is without prejudice to the Debtor’s right to request a further extension of the Extension Period or the waiver of the

requirements of section 345(b) of the Chapter 11 Case, including at the Final Hearing.

13. The Debtor is authorized to continue engaging in Intercompany

Transactions in connection with the Cash Management System in the ordinary course of business and with the consent of the DIP Administrative Agent; provided, however, that there shall be no intercompany loans from the Debtor to any non-debtors,

absent further order of the Court; and provided further that prior to the final order on this Motion, transfers from the Debtor to non-Debtor affiliates shall not exceed $25,000. 6

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 8 of 11

14. Notwithstanding the relief granted in this Interim Order and any actions taken pursuant to such relief, nothing in this Interim Order shall be deemed: (a) an admission as

to the validity of any prepetition claim against a Debtor entity; (b) a waiver of the Debtor’s right to dispute any prepetition claim on any grounds; (c) a promise or requirement to pay any prepetition claim; (d) an implication

or admission that any particular claim is of a type specified or defined in this Interim Order or the Motion; (e) a request or authorization to assume any prepetition agreement, contract, or lease pursuant to section 365 of the Bankruptcy Code;

or (f) a waiver of the Debtor’s rights under the Bankruptcy Code or any other applicable law.

15. The contents of the Motion satisfy the requirements of

Bankruptcy Rule

6003(b).

16. Notice of the Motion as provided therein shall

be deemed good and sufficient notice of such Motion and the requirements of Bankruptcy Rule 6004(a) and the Local Rules are satisfied by such notice.

17.

Notwithstanding Bankruptcy Rule 6004(h), the terms and conditions of this Interim Order are immediately effective and enforceable upon its entry.

18. The Debtor is

authorized to take all actions necessary to effectuate the relief granted in this Interim Order in accordance with the Motion.

19. This Court retains exclusive

jurisdiction with respect to all matters arising from or related to the implementation, interpretation, and enforcement of this Interim Order.

,2018 Wilmington,

Delaware THE HONORABLE KEVIN CROSS UNITED STATES BANKRUPTCY JUDGE 7

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 9 of 11

DEBTOR’S BANK ACCOUNTS

| Account Holder |

Bank Name |

Account Description |

Last 4 Digits of Account No. | |||

| Orexigen Therapeutics, Inc. | Silicon Valley Bank | AR Lockbox Account | 1180 | |||

| Orexigen Therapeutics, Inc. | Silicon Valley Bank | General Checking Account | 6813 | |||

| Orexigen Therapeutics, Inc. | Silicon Valley Bank | Sweep Account | 3036 | |||

| Orexigen Therapeutics, Inc. | US Bank | Holding Account | 4219 | |||

| Orexigen Therapeutics, Inc. | Silicon Valley Bank | Utility Deposit Account | 7307 | |||

| Orexigen Therapeutics, Inc. | State Street Bank & Trust | Investment Account | 2355* | |||

| Orexigen Therapeutics, Inc. | Wells Fargo | Foreign Wire Transfer Account | 3348* |

| * | indicates an account that is in the process of being closed |

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 10 of 11

US Accounts - Held in name of Orexigen Therapeutics, Inc.

Legend:

= debtor entity bank account

= automatic transfer

= manual transfer

AR Lockbox Account (USD) Silicon Valley Bank Account XXXXXX1180 Collection

account for customer payments Swept Daily General Checking Account (USD) Silicon Valley Bank Account XXXXXX6813 Disbursement account for funding payroll and operations Swept Daily As Necessary

Sweep Account (USD) Silicon Valley Bank Account XXXXXX3036 Holds excess cash invested in U.S. short-term Treasury and government securities

Holding Account (USD) US Bank Account XXXXXXXX4219 Holding account for excess cash and invested in short-term U.S. government securities Account managed by Wells Fargo

Case 18-10518-KG Doc 92-3 Filed 03/27/18 Page 11 of 11

| In re: Orexigen Therapeutics, Inc. | Case No. 18-10518 |

SCHEDULE OF RETAINERS PAID TO PROFESSIONALS

(This schedule is to include each Professional paid a retainer)

| Payee |

Check or Wire | Name of Payor |

Amount | Amount Applied to Date |

Balance | |||||||||||||||

| Date | Number | |||||||||||||||||||

| Ernst & Young LLP - Audit |

1/19/2018 | Wire: 19587 | Orexigen Therapeutics, Inc. | $ | 100,000.00 | $ | 100,000.00 | $ | — | |||||||||||

| Ernst & Young LLP - Audit |

2/9/2018 | Wire: 15581 | Orexigen Therapeutics, Inc. | $ | 100,000.00 | $ | 97,848.00 | $ | 2,152.00 | |||||||||||

| Ernst & Young LLP - Audit |

2/21/2018 | Wire: 14547 | Orexigen Therapeutics, Inc. | $ | 35,000.00 | $ | — | $ | 35,000.00 | |||||||||||

| Ernst & Young LLP - Audit |

2/21/2018 | Wire: 14547 | Orexigen Therapeutics, Inc. | $ | 25,000.00 | $ | — | $ | 25,000.00 | |||||||||||

| Ernst & Young LLP - Restructuring |

12/21/2017 | Wire: 26007 | Orexigen Therapeutics, Inc. | $ | 100,000.00 | $ | 100,000.00 | $ | — | |||||||||||

| Ernst & Young LLP - Restructuring |

2/28/2018 | Wire: 3353 | Orexigen Therapeutics, Inc. | $ | 300,000.00 | $ | 300,000.00 | $ | — | |||||||||||

| Ernst & Young LLP - Restructuring |

3/2/2018 | Wire: 21309 | Orexigen Therapeutics, Inc. | $ | 50,000.00 | $ | 50,000.00 | $ | — | |||||||||||

| Ernst & Young LLP - Restructuring |

3/9/2018 | Wire: 2547 | Orexigen Therapeutics, Inc. | $ | 175,000.00 | $ | 121,642.50 | $ | 53,357.50 | |||||||||||

| Ernst & Young LLP - Transaction Tax |

2/21/2018 | Wire: 14547 | Orexigen Therapeutics, Inc. | $ | 20,000.00 | $ | 20,000.00 | $ | — | |||||||||||

| Ernst & Young LLP - Transaction Tax |

2/26/2018 | Wire: 3353 | Orexigen Therapeutics, Inc. | $ | 70,000.00 | $ | 2,977.00 | $ | 67,023.00 | |||||||||||

|

|

|

|||||||||||||||||||

| Subtotal |

$ | 182,532.50 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Hogan Lovells US LLP |

2/23/2018 | Wire: 19167 | Orexigen Therapeutics, Inc. | $ | 350,000.00 | $ | 350,000.00 | $ | — | |||||||||||

| Hogan Lovells US LLP |

2/28/2018 | Wire: 22901 | Orexigen Therapeutics, Inc. | $ | 75,000.00 | $ | 75,000.00 | $ | — | |||||||||||

| Hogan Lovells US LLP |

3/5/2018 | Wire: 19189 | Orexigen Therapeutics, Inc. | $ | 50,000.00 | $ | 50,000.00 | $ | — | |||||||||||

| Hogan Lovells US LLP |

3/9/2018 | Wire: 2523 | Orexigen Therapeutics, Inc. | $ | 250,000.00 | $ | 241,618.05 | $ | 8,381.95 | |||||||||||

|

|

|

|||||||||||||||||||

| Subtotal |

$ | 8,381.95 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Morris Nichols Arsht & Tunnell LLP |

2/21/2018 | Wire: 14551 | Orexigen Therapeutics, Inc. | $ | 50,000.00 | $ | 50,000.00 | $ | — | |||||||||||

| Morris Nichols Arsht & Tunnell LLP |

2/28/2018 | Wire: 22501 | Orexigen Therapeutics, Inc. | $ | 29,522.20 | $ | 29,522.20 | $ | — | |||||||||||

| Morris Nichols Arsht & Tunnell LLP |

3/5/2018 | Wire: 15763 | Orexigen Therapeutics, Inc. | $ | 12,227.50 | $ | 2,373.64 | $ | 9,853.86 | |||||||||||

| Morris Nichols Arsht & Tunnell LLP |

3/9/2018 | Wire: 2545 | Orexigen Therapeutics, Inc. | $ | 16,717.00 | $ | — | $ | 16,717.00 | |||||||||||

| Morris Nichols Arsht & Tunnell LLP |

3/9/2018 | Wire: 19773 | Orexigen Therapeutics, Inc. | $ | 20,000.00 | $ | — | $ | 20,000.00 | |||||||||||

|

|

|

|||||||||||||||||||

| Subtotal |

$ | 46,570.86 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Kurtzman Carson Consultants LLC |

2/20/2018 | Wire: 17619 | Orexigen Therapeutics, Inc. | $ | 25,000.00 | $ | 2,688.37 | $ | 22,311.63 | |||||||||||

| Perella Weinberg Partners L.P. |

3/9/2018 | Wire: 2555 | Orexigen Therapeutics, Inc. | $ | 30,000.00 | $ | 30,000.00 | $ | — | |||||||||||