Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED APRIL 13, 2018 - MICT, Inc. | f8k041018ex99-1_micronet.htm |

| 8-K - CURRENT REPORT - MICT, Inc. | f8k041018_micronetenertec.htm |

Exhibit 99.2

Full Year 2017 Financial Results Conference Call

Forward Looking Statement 2 This presentation contains express or implied forward - looking statements within the Private Securities Litigation Reform Act of 1995 and other U.S. federal securities laws. These forward - looking statements include, but are not limited to, those statements regarding our expected sale of our aerospace and defense business, Enertec, that we believe the sale of Enertec will fortify our balance sheet and enable us to invest and focus on growing our MRM business both organically and through acquisition, our belief that an increasing stream of orders from our current and new customers will drive sustainable growth for Micronet during the coming quarters, that we see demand continuing to grow for Micronet’s products as the Electronic Logging Device, or ELD, mandate nears, that as Micronet works to produce increasing quantities of its new products, and as it delivers on its purchase orders, we expect even more favorable top line numbers during the following quarters, our belief that the ELD compliant SmartHubTREQ - r5 expands Micronet's market opportunity, particularly with the smaller fleet size customers, that we are broadening our portfolio of products to address additional target market segments in the MRM market to drive our expansion, and that it is our expectation that the ELD mandate and local fleet market will be the growth engines of Micronet’s business. Such forward - looking statements and their implications involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to differ materially from those projected. The forward - looking statements contained in this presentation are subject to other risks and uncertainties, including those discussed in the "Risk Factors" section and elsewhere in the Company's annual report on Form 10 - K for the year ended December 31, 2016, the Company’s annual report on Form 10 - K for the year ended December 31, 2017 which is to be filed and in subsequent filings with the Securities and Exchange Commission. Except as otherwise required by law, the Company is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward - looking statements whether as a result of new information, future events or otherwise. .

Focusing on MRM Business 3 ▪ In 2017, Micronet achieved increases in revenues and gross margins. ▪ A strong backlog ▪ A growing number of purchase orders from existing and new customers ▪ In 2018, we plan to launch additional and advanced products ▪ MICT to focus on high - growth Mobile Resource Management, or MRM, business ▪ MICT signed a definitive agreement to sell Enertec to Coolisys Technologies ▪ We believe the potential transaction will contribute to a stronger balance sheet

4 2017 YE Overview ▪ Full year 2017 revenues increased by 38% to $18.4 million over 2016 revenues of $13.3 million ▪ Gross margin increased from 20% in 2016 to 23% in 2017 ▪ Combined backlog of $17.4 million as of December 31, 2017, approximately $9 million driven by contracts for new MRM products including the TREQ® - 317 and TREQr5 ▪ Demand expected to continue to grow as electronic logging device (ELD) mandate requirement deadline nears and additional new MRM products are introduced by Micronet

Sales of TREQ® - 317 and TREQ - r 5 5 ▪ Strong pipeline with growing amount of customers evaluating products in the field ▪ TREQ® - 317 ▪ $ 1.9 million from a current strategic customer that is a leading US telematics service provider ▪ TREQr - 5 /Smart - Hub ▪ $ 3.1 million order for the SmartHub - TREQr 5 from a current customer, a leading ELD compliance telematics provider ▪ Order included $ 100,000 annual recurring revenue license ▪ $ 8.9 million backlog with orders from current and new customers

Positive Outlook for MRM Business 6 MRM ▪ Purchase orders of increasing value in MRM business are being placed by both new and current customers, pointing to strong customer satisfaction with Micronet’s products ▪ New Software as a Service (SaaS) offering generates high margin, annually recurring licensing revenues ▪ Micronet's new rugged on - board computing products create strong value for customers ▪ MRM devices enhance efficiencies and improve cash flow for customers ▪ Local fleet market and the ELD expected to be the growth engines of the company December 2019: Final date for mandate to be in compliance with ELD market, carriers and drivers who currently use an automated on - board recorded device ▪ Broadening product portfolio to target the additional segments in the 10 billion MRM market Trends

2017 vs. 2016 Revenues 7 $13.30 $ 18.40 $0 $5 $10 $15 $20 2016 2017 (in millions) Revenues for the full year 2017 vs. 2016 Revenues for Q4 2017 vs. Q4 2016 $1.30 $6.40 $0 $1 $2 $3 $4 $5 $6 $7 Q4 2016 Q4 2017

8 Income Statement Highlights (in 000s except share and per share data) Year ended December 31, 2017 2016 Revenues $ 18,366 $ 13,284 Cost of revenues 14,094 10,657 Gross profit 4,272 2,627 Operating expenses: Research and development 1,964 1,802 Selling and marketing 1,883 1,352 General and administrative 4,116 4,535 Amortization of intangible assets 978 926 Total operating expenses 8,941 8,615 Loss from operations (4,669 ) (5,988 ) Finance expense, net 401 319 Loss before provision for income taxes (5,070 ) (6,307 ) Taxes on income (benefit) (10 ) (45 ) Net loss from continued operation (5,060 ) (6,262 ) Net loss from discontinued operation (4,901 ) (1,251 ) Total Net Loss (9,961 ) (7,513 ) Net loss attributable to non - controlling interests 1,804 1,706 Net loss attributable to Micronet Enertec $ (8,157 ) $ (5,807 ) Loss per share attributable to Micronet Enertec: Basic and diluted loss per share from continued operation Basic and diluted loss per share from discontinued operation $ $ (0.70 (0.68 ) ) $ $ (0.76 (0.21 ) ) Weighted average common shares outstanding: Basic and diluted 7,128,655 5,966,622

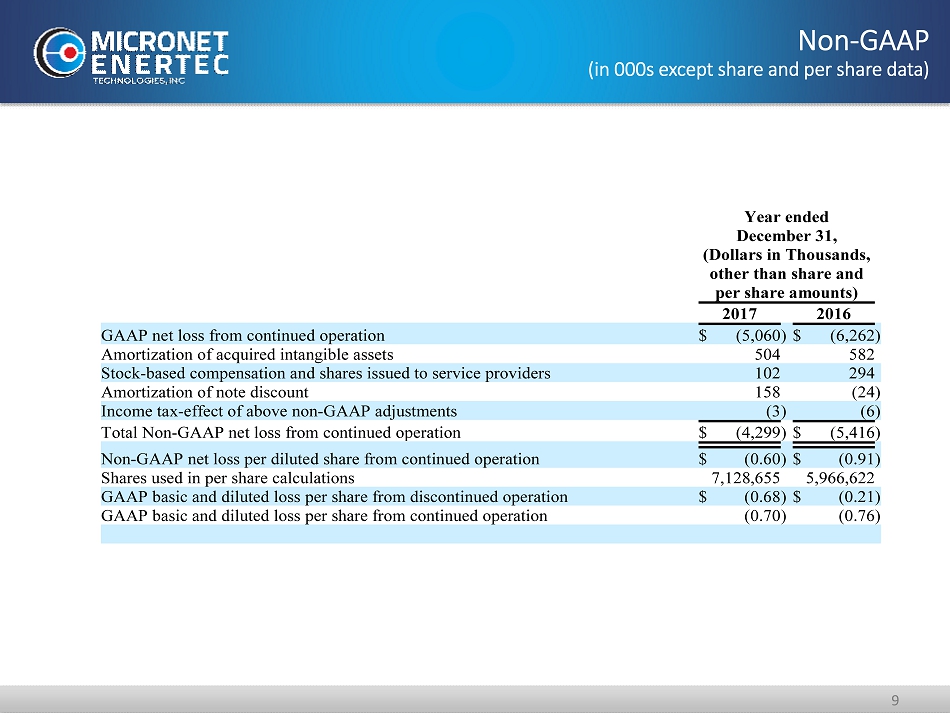

Non - GAAP (in 000s except share and per share data) 9 Year ended December 31, (Dollars in Thousands, other than share and per share amounts) 2017 2016 GAAP net loss from continued operation $ (5,060 ) $ (6,262 ) Amortization of acquired intangible assets 504 582 Stock-based compensation and shares issued to service providers 102 294 Amortization of note discount 158 (24 ) Income tax-effect of above non-GAAP adjustments (3 ) (6 ) Total Non-GAAP net loss from continued operation $ (4,299 ) $ (5,416 ) Non-GAAP net loss per diluted share from continued operation $ (0.60 ) $ (0.91 ) Shares used in per share calculations 7,128,655 5,966,622 GAAP basic and diluted loss per share from discontinued operation $ (0.68 ) $ (0.21 ) GAAP basic and diluted loss per share from continued operation (0.70 ) (0.76 )

Balance Sheet December 31, 2017 December 31, 2016 Cash, cash equivalents and marketable securities $2.4M $4.1M Trade account receivable, net $5.2M $3.1M Bank & others debts $5.2M $7.4M Net working capital $3M $7M Stockholders’ equity $6.0M $11.0M 10

Thank You 11 Q & A