Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RITE AID CORP | tv490871_ex99-1.htm |

| 8-K - FORM 8-K - RITE AID CORP | tv490871_8k.htm |

Exhibit 99.2

April 12, 2018

Cautionary Statement Regarding Forward Looking Statements Statements in this presentation that are not historical, are forward - looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . Such statements include, but are not limited to, statements regarding Rite Aid’s outlook for fiscal 2019 , the pending merger (the “Merger”) between Rite Aid and Albertsons Companies, Inc . (“Albertsons”) ; the expected timing of the closing of the Merger and the subsequent closings of the sale of Rite Aid distribution centers and assets to WBA ; the ability of the parties to complete the Merger considering the various closing conditions to the Merger ; the ability of the parties to complete the distribution center closing considering the various closing conditions applicable to the distribution centers and related assets being transferred at such distribution center closing ; the outcome of legal and regulatory matters in connection with the Merger and the sale of stores and assets of Rite Aid to WBA ; the expected benefits of the transactions such as improved operations, growth potential, market profile and financial strength ; the competitive ability and position of Rite Aid following completion of the proposed transactions ; the ability of Rite Aid to implement new business strategies following the completion of the proposed transactions and any assumptions underlying any of the foregoing . Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” and “will” and variations of such words and similar expressions are intended to identify such forward - looking statements . These forward - looking statements are not guarantees of future performance and involve risks, assumptions and uncertainties, including, but not limited to, our high level of indebtedness and our ability to make interest and principal payments on our debt and satisfy the other covenants contained in our debt agreements ; general economic, industry, market, competitive, regulatory and political conditions ; our ability to improve the operating performance of our stores in accordance with our long term strategy ; the impact of private and public third - party payers continued reduction in prescription drug reimbursements and efforts to encourage mail order ; our ability to manage expenses and our investments in working capital ; outcomes of legal and regulatory matters ; changes in legislation or regulations, including healthcare reform ; our ability to achieve the benefits of our efforts to reduce the costs of our generic and other drugs ; risks related to the proposed transactions with WBA, including the possibility that the remaining transactions may not close, or the business of Rite Aid may suffer as a result of uncertainty surrounding the proposed transactions ; risks related to the expected timing and likelihood of completion of the Merger, including the risk that the Merger may not close due to one or more closing conditions to the Merger not being satisfied or waived, such as the remaining Ohio Department of Insurance regulatory approval not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused to grant approval for the consummation of the Merger or required certain conditions, limitations or restrictions in connection with such approvals, or that the required approval of the merger agreement by the stockholders of Rite Aid was not obtained ; risks related to the ability to realize the anticipated benefits of the proposed transactions with Albertsons and WBA ; risks related to diverting management's or employees' attention from ongoing business operations ; the risk that any announcements relating to the Merger could have adverse effects on the market price of Rite Aid’s common stock, and the risk that the Merger and its announcement could have an adverse effect on the ability of Rite Aid to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally ; the risk that Rite Aid's stock price may decline significantly if the Merger or sale of distribution centers and related assets to WBA is not completed ; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement (including circumstances requiring Rite Aid to pay Albertsons a termination fee pursuant to the merger agreement) ; significant transaction costs ; unknown liabilities ; the risk of litigation and/or regulatory actions related to the proposed transactions ; potential changes to our strategy in the event the remaining proposed transactions do not close, which may include delaying or reducing capital or other expenditures, selling assets or other operations, attempting to restructure or refinance our debt, or seeking additional capital, and other business effects . These and other risks, assumptions and uncertainties are more fully described in Item 1 A (Risk Factors) of our most recent Annual Report on Form 10 - K and in the registration statement on Form S - 4 , as it may be amended, that was filed with the SEC by Albertsons on April 6 , 2018 in connection with the Merger, and in other documents that we file or furnish with the Securities and Exchange Commission (the “SEC”), which you are encouraged to read . Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward - looking statements . Accordingly, you are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date they are made . Rite Aid expressly disclaims any current intention to update publicly any forward - looking statement after the distribution of this presentation, whether as a result of new information, future events, changes in assumptions or otherwise . Safe Harbor Statement

Additional Information and Where to Find It In connection with the proposed merger involving Rite Aid and Albertsons, Rite Aid and Albertsons have prepared and Albertsons has filed with the SEC on April 6 , 2018 a registration statement on Form S - 4 that includes a proxy statement of Rite Aid that also constitutes a prospectus of Albertsons . The registration statement is not yet final and will be amended . Rite Aid will mail the proxy statement/prospectus and a proxy card to each stockholder entitled to vote at the special meeting relating to the proposed merger . Rite Aid and Albertsons also plan to file other relevant documents with the SEC regarding the proposed merger . INVESTORS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AS WELL AS OTHER DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . RITE AID’S EXISTING PUBLIC FILINGS WITH THE SEC SHOULD ALSO BE READ, INCLUDING THE RISK FACTORS CONTAINED THEREIN . Investors and security holders may obtain copies of the Form S - 4 , including the proxy statement/prospectus, as well as other filings containing information about Rite Aid, free of charge, from the SEC’s Web site (www . sec . gov) . Investors and security holders may also obtain Rite Aid’s SEC filings in connection with the transaction, free of charge, from Rite Aid’s Web site (www . RiteAid . com) under the link “Investor Relations” and then under the tab “SEC Filings,” or by directing a request to Rite Aid, Byron Purcell, Attention : Senior Director, Treasury Services & Investor Relations . Copies of documents filed with the SEC by Albertsons will be made available, free of charge, on Albertsons’ website at www . albertsonscompanies . com . Participants in Solicitation Rite Aid, Albertsons and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of Rite Aid common stock in respect of the proposed transaction . Information regarding Rite Aid’s directors and executive officers is available in its definitive proxy statement for Rite Aid’s 2017 annual meeting of stockholders filed with the SEC on June 7 , 2017 , as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such definitive proxy statement . Information about the directors and executive officers of Albertsons is set forth in the registration statement on Form S - 4 , including the proxy statement/prospectus, as it may be amended, that has been filed with the SEC on April 6 , 2018 . Other information regarding the interests of the participants in the proxy solicitation may be included in the definitive proxy statement/prospectus when it becomes available . These documents can be obtained free of charge from the sources indicated above . Non - Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Safe Harbor Statement

Cautionary Note Regarding Pro Forma Information : The following presentation provides certain pro forma information regarding the impact of Rite Aid’s proposed sale of stores and assets to Walgreens Boots Alliance, Inc . on Rite Aid’s results of operations and capital structure . The pro forma information is for illustrative purposes only, was prepared by management in response to investor inquiries and is based upon a number of assumptions . The pro forma information assumes the completion of all the asset sales when they will actually take place over an extended period of time . Additional items that may require adjustments to the pro forma information may be identified and could result in material changes to the information contained herein . The information in this presentation is not necessarily indicative of what actual financial results of Rite Aid would have been had the sale occurred on the dates or for the periods indicated, nor does it purport to project the financial results of Rite Aid for any future periods or as of any date . Such pro forma information has not been prepared in conformity with Regulation S - X . Rite Aid’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to this preliminary financial information . Accordingly, they do not express an opinion or provide any form of assurance with respect thereto . The information in this presentation should not be viewed in replacement of results prepared in compliance with Generally Accepted Accounting Principles or any pro forma financial statements subsequently required by the rules and regulations of the Securities and Exchange Commission . The outlook provided herein does not reflect the impact, including opportunities to cut costs and grow revenues, of the pending transaction with Albertsons Companies, Inc . Safe Harbor Statement

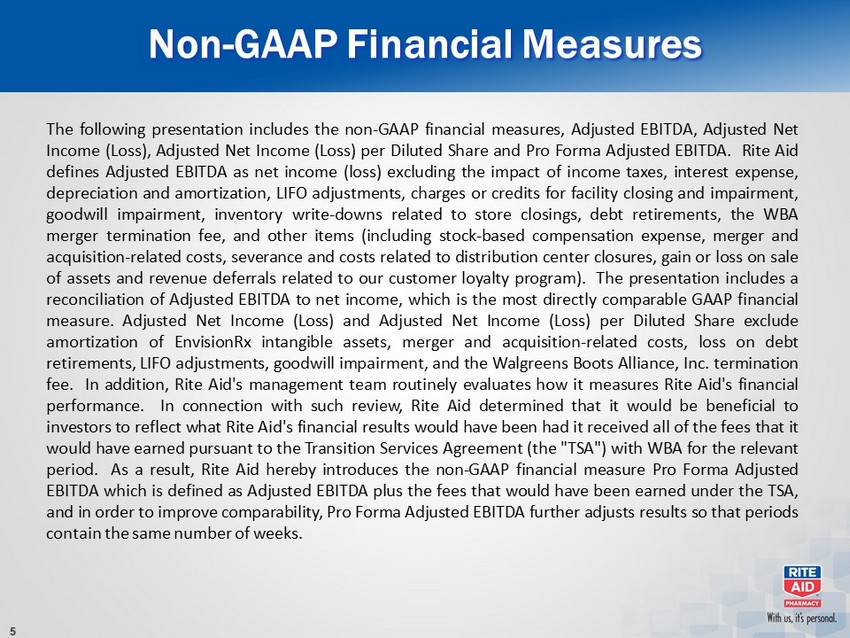

Non - GAAP Financial Measures The following presentation includes the non - GAAP financial measures, Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share and Pro Forma Adjusted EBITDA . Rite Aid defines Adjusted EBITDA as net income (loss) excluding the impact of income taxes, interest expense, depreciation and amortization, LIFO adjustments, charges or credits for facility closing and impairment, goodwill impairment, inventory write - downs related to store closings, debt retirements, the WBA merger termination fee, and other items (including stock - based compensation expense, merger and acquisition - related costs, severance and costs related to distribution center closures, gain or loss on sale of assets and revenue deferrals related to our customer loyalty program) . The presentation includes a reconciliation of Adjusted EBITDA to net income, which is the most directly comparable GAAP financial measure . Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per Diluted Share exclude amortization of EnvisionRx intangible assets, merger and acquisition - related costs, loss on debt retirements, LIFO adjustments, goodwill impairment, and the Walgreens Boots Alliance, Inc . termination fee . In addition, Rite Aid's management team routinely evaluates how it measures Rite Aid's financial performance . In connection with such review, Rite Aid determined that it would be beneficial to investors to reflect what Rite Aid's financial results would have been had it received all of the fees that it would have earned pursuant to the Transition Services Agreement (the "TSA") with WBA for the relevant period . As a result, Rite Aid hereby introduces the non - GAAP financial measure Pro Forma Adjusted EBITDA which is defined as Adjusted EBITDA plus the fees that would have been earned under the TSA, and in order to improve comparability, Pro Forma Adjusted EBITDA further adjusts results so that periods contain the same number of weeks .

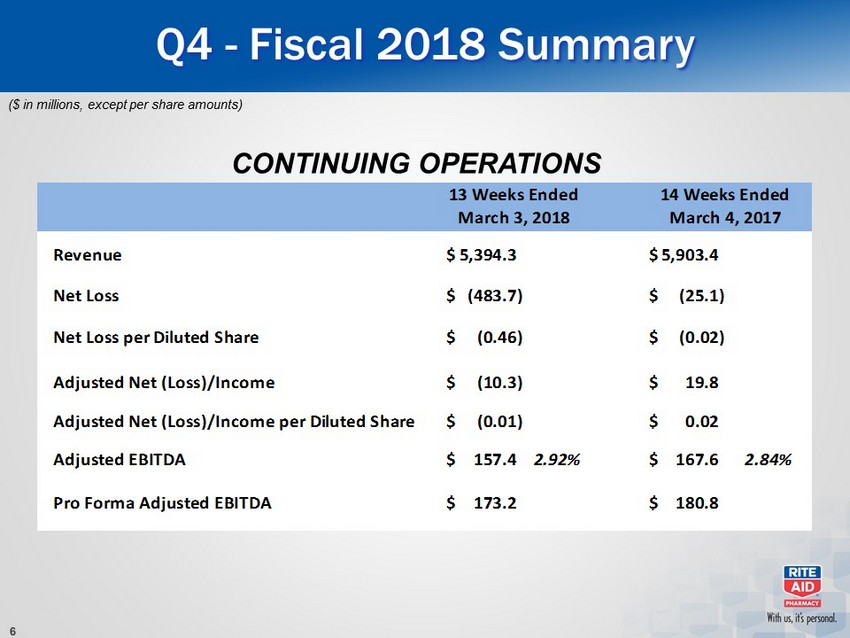

Revenue 5,394.3$ 5,903.4$ Net Loss (483.7)$ (25.1)$ Net Loss per Diluted Share (0.46)$ (0.02)$ Adjusted Net (Loss)/Income (10.3)$ 19.8$ Adjusted Net (Loss)/Income per Diluted Share (0.01)$ 0.02$ Adjusted EBITDA 157.4$ 2.92% 167.6$ 2.84% Pro Forma Adjusted EBITDA 173.2$ 180.8$ 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Q4 - Fiscal 2018 Summary ($ in millions, except per share amounts) CONTINUING OPERATIONS

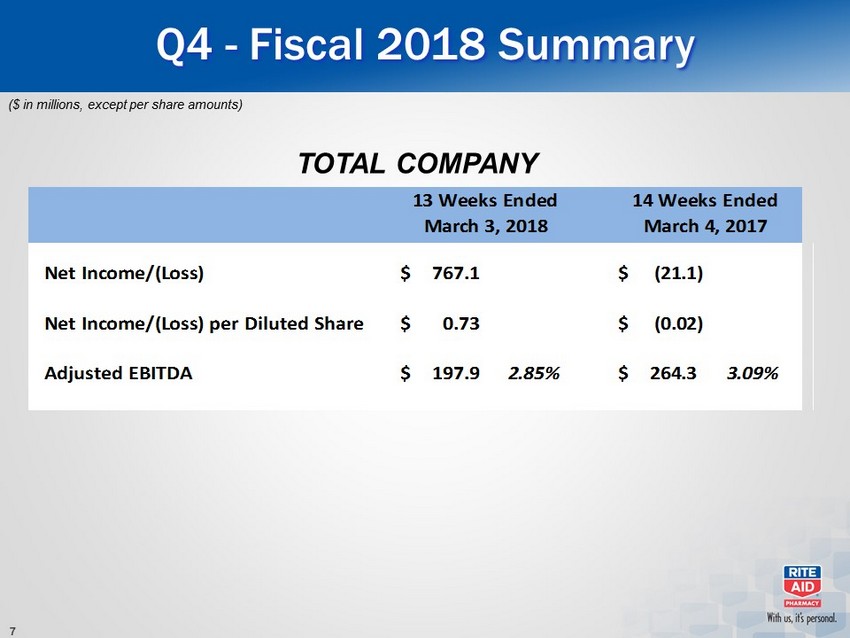

Net Income/(Loss) 767.1$ (21.1)$ Net Income/(Loss) per Diluted Share 0.73$ (0.02)$ Adjusted EBITDA 197.9$ 2.85% 264.3$ 3.09% 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Q4 - Fiscal 2018 Summary ($ in millions, except per share amounts) TOTAL COMPANY

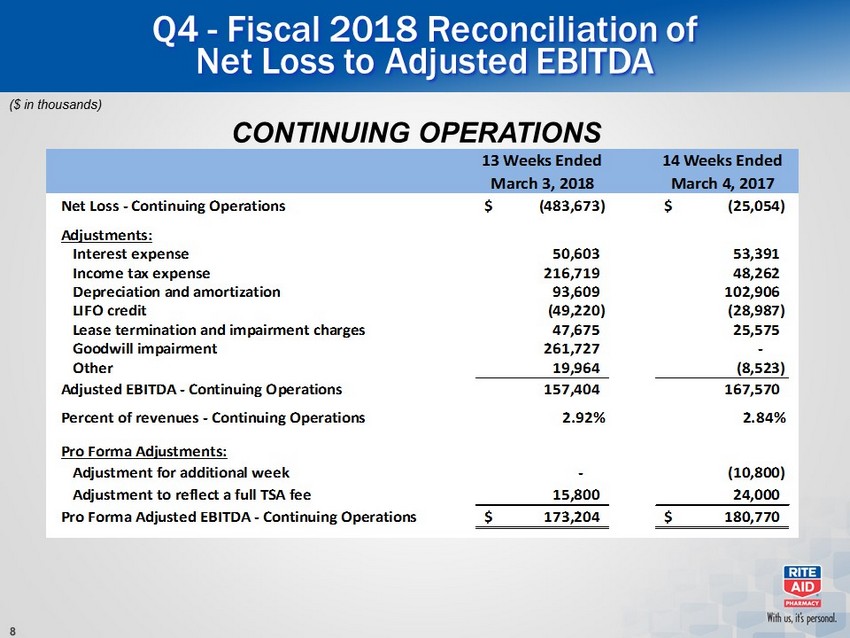

Q4 - Fiscal 2018 Reconciliation of Net Loss to Adjusted EBITDA ($ in thousands) 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Net Loss - Continuing Operations (483,673)$ (25,054)$ Adjustments: Interest expense 50,603 53,391 Income tax expense 216,719 48,262 Depreciation and amortization 93,609 102,906 LIFO credit (49,220) (28,987) Lease termination and impairment charges 47,675 25,575 Goodwill impairment 261,727 - Other 19,964 (8,523) Adjusted EBITDA - Continuing Operations 157,404 167,570 Percent of revenues - Continuing Operations 2.92% 2.84% Pro Forma Adjustments: Adjustment for additional week - (10,800) Adjustment to reflect a full TSA fee 15,800 24,000 Pro Forma Adjusted EBITDA - Continuing Operations 173,204$ 180,770$ CONTINUING OPERATIONS

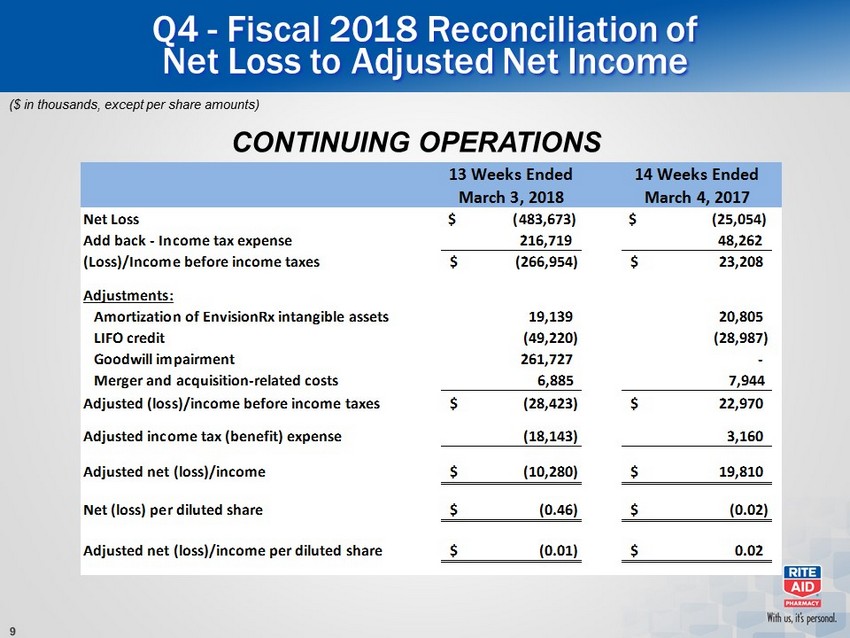

Q4 - Fiscal 2018 Reconciliation of Net Loss to Adjusted Net Income ($ in thousands, except per share amounts) 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Net Loss $ (483,673) $ (25,054) Add back - Income tax expense 216,719 48,262 (Loss)/Income before income taxes (266,954)$ 23,208$ Adjustments: Amortization of EnvisionRx intangible assets 19,139 20,805 LIFO credit (49,220) (28,987) Goodwill impairment 261,727 - Merger and acquisition-related costs 6,885 7,944 Adjusted (loss)/income before income taxes (28,423)$ 22,970$ Adjusted income tax (benefit) expense (18,143) 3,160 Adjusted net (loss)/income (10,280)$ 19,810$ Net (loss) per diluted share (0.46)$ (0.02)$ Adjusted net (loss)/income per diluted share (0.01)$ 0.02$ CONTINUING OPERATIONS

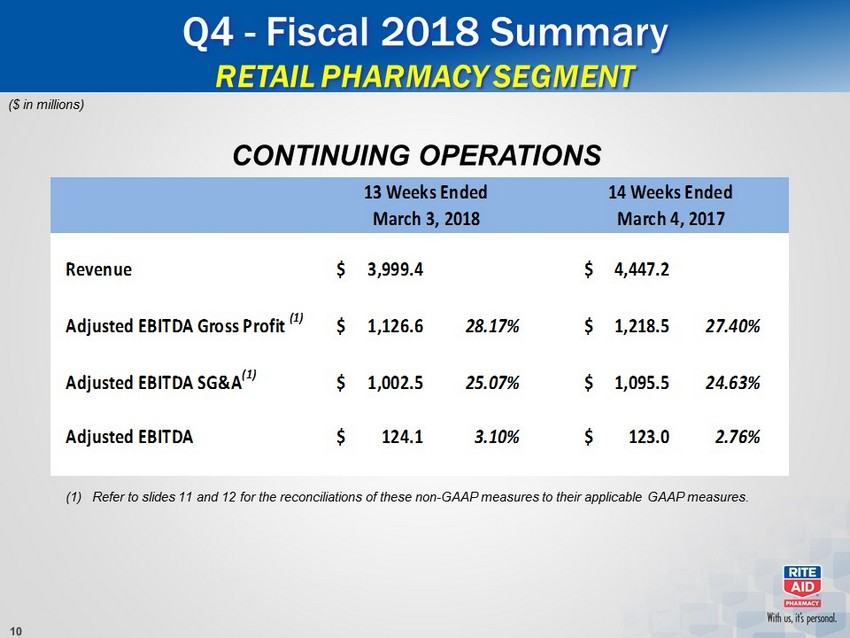

Revenue 3,999.4$ 4,447.2$ Adjusted EBITDA Gross Profit (1) 1,126.6$ 28.17% 1,218.5$ 27.40% Adjusted EBITDA SG&A (1) 1,002.5$ 25.07% 1,095.5$ 24.63% Adjusted EBITDA 124.1$ 3.10% 123.0$ 2.76% 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Q4 - Fiscal 2018 Summary RETAIL PHARMACY SEGMENT ($ in millions) (1) Refer to slides 11 and 12 for the reconciliations of these non - GAAP measures to their applicable GAAP measures. CONTINUING OPERATIONS

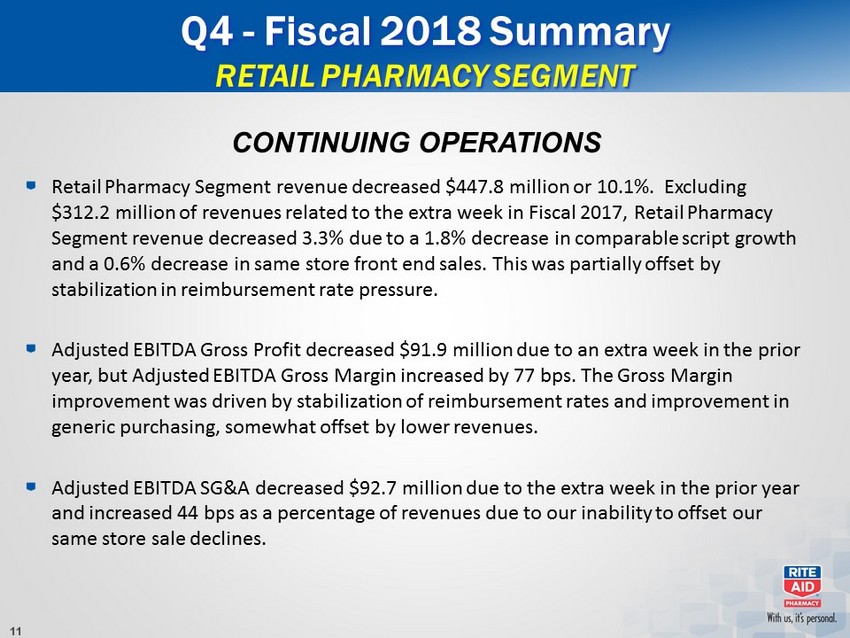

Q4 - Fiscal 2018 Summary RETAIL PHARMACY SEGMENT Retail Pharmacy Segment revenue decreased $447.8 million or 10.1%. Excluding $312.2 million of revenues related to the extra week in Fiscal 2017, Retail Pharmacy Segment revenue decreased 3.3% due to a 1.8% decrease in comparable script growth and a 0.6% decrease in same store front end sales. This was partially offset by stabilization in reimbursement rate pressure. Adjusted EBITDA Gross Profit decreased $91.9 million due to an extra week in the prior year, but Adjusted EBITDA Gross Margin increased by 77 bps. The Gross Margin improvement was driven by stabilization of reimbursement rates and improvement in generic purchasing, somewhat offset by lower revenues. Adjusted EBITDA SG&A decreased $92.7 million due to the extra week in the prior year and increased 44 bps as a percentage of revenues due to our inability to offset our same store sale declines. CONTINUING OPERATIONS

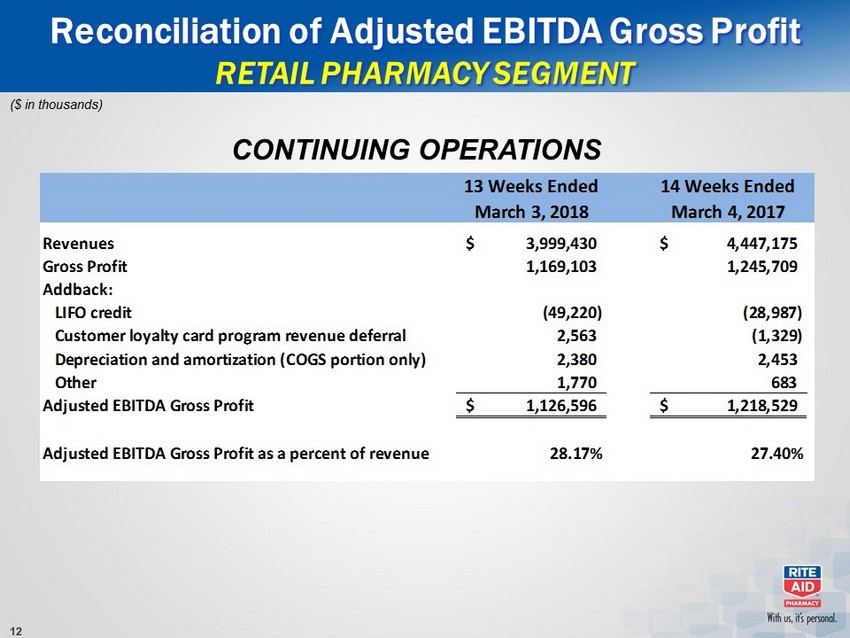

Reconciliation of Adjusted EBITDA Gross Profit RETAIL PHARMACY SEGMENT ($ in thousands) 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Revenues 3,999,430$ 4,447,175$ Gross Profit 1,169,103 1,245,709 Addback: LIFO credit (49,220) (28,987) Customer loyalty card program revenue deferral 2,563 (1,329) Depreciation and amortization (COGS portion only) 2,380 2,453 Other 1,770 683 Adjusted EBITDA Gross Profit 1,126,596$ 1,218,529$ Adjusted EBITDA Gross Profit as a percent of revenue 28.17% 27.40% CONTINUING OPERATIONS

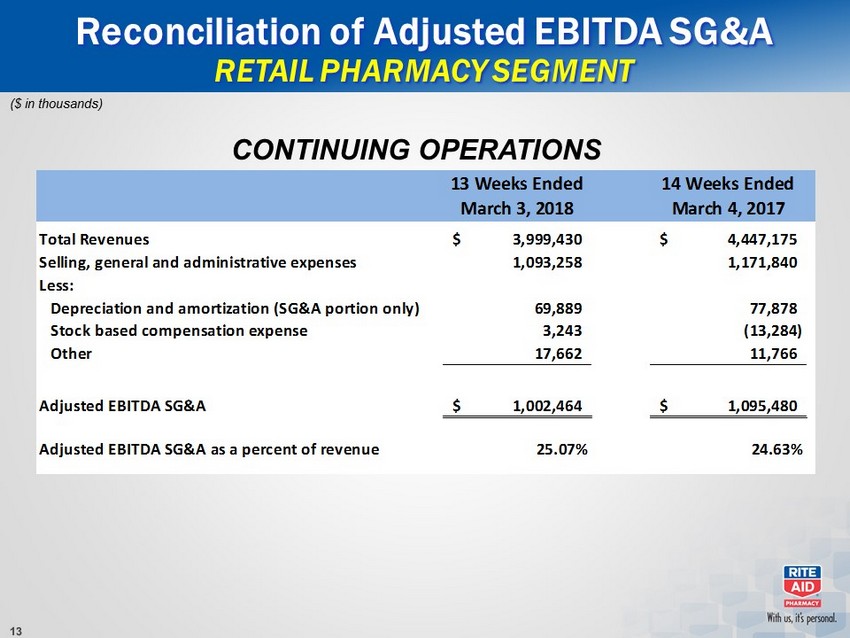

Reconciliation of Adjusted EBITDA SG&A RETAIL PHARMACY SEGMENT ($ in thousands) 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Total Revenues 3,999,430$ 4,447,175$ Selling, general and administrative expenses 1,093,258 1,171,840 Less: Depreciation and amortization (SG&A portion only) 69,889 77,878 Stock based compensation expense 3,243 (13,284) Other 17,662 11,766 Adjusted EBITDA SG&A 1,002,464$ 1,095,480$ Adjusted EBITDA SG&A as a percent of revenue 25.07% 24.63% CONTINUING OPERATIONS

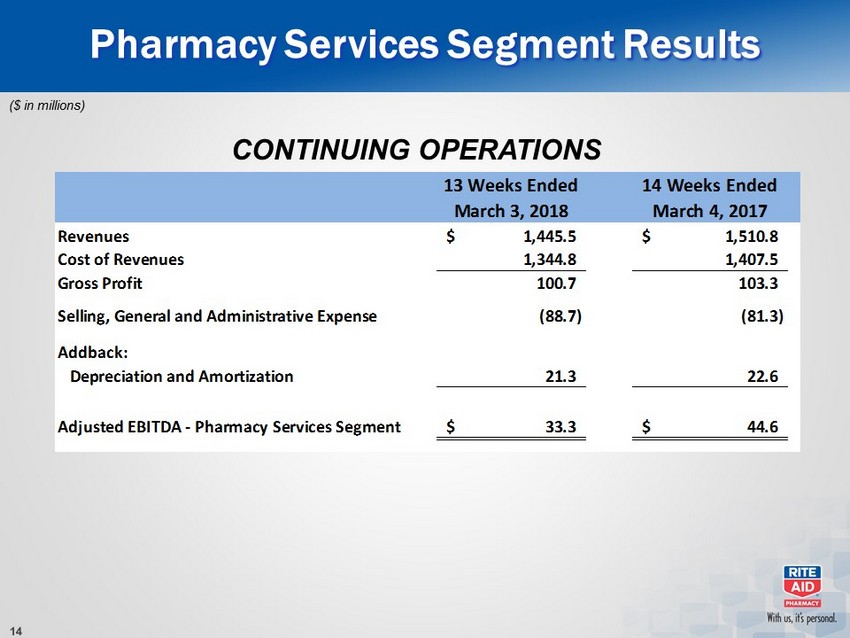

Pharmacy Services Segment Results ($ in millions) 13 Weeks Ended March 3, 2018 14 Weeks Ended March 4, 2017 Revenues 1,445.5$ 1,510.8$ Cost of Revenues 1,344.8 1,407.5 Gross Profit 100.7 103.3 Selling, General and Administrative Expense (88.7) (81.3) Addback: Depreciation and Amortization 21.3 22.6 Adjusted EBITDA - Pharmacy Services Segment 33.3$ 44.6$ CONTINUING OPERATIONS

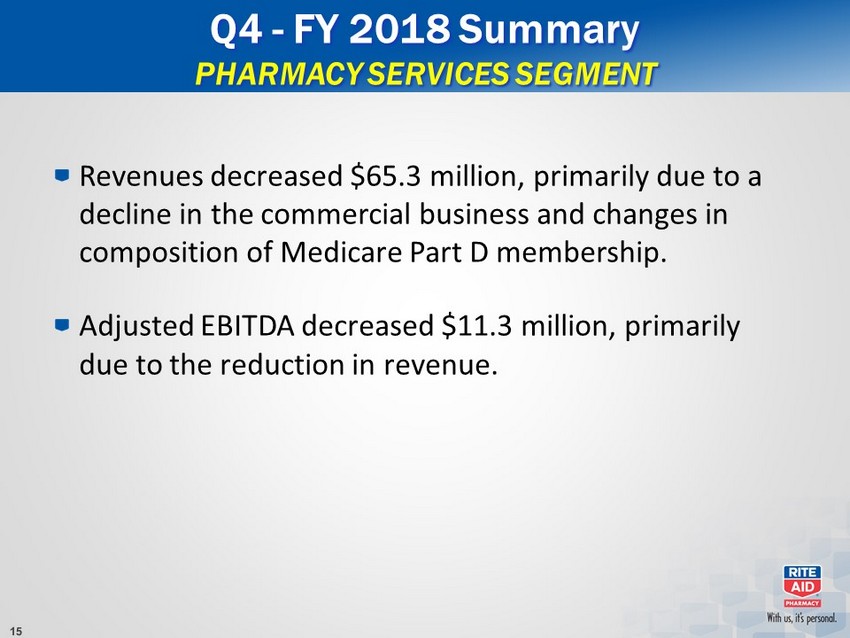

Q4 - FY 2018 Summary PHARMACY SERVICES SEGMENT Revenues decreased $65.3 million, primarily due to a decline in the commercial business and changes in composition of Medicare Part D membership. Adjusted EBITDA decreased $11.3 million, primarily due to the reduction in revenue.

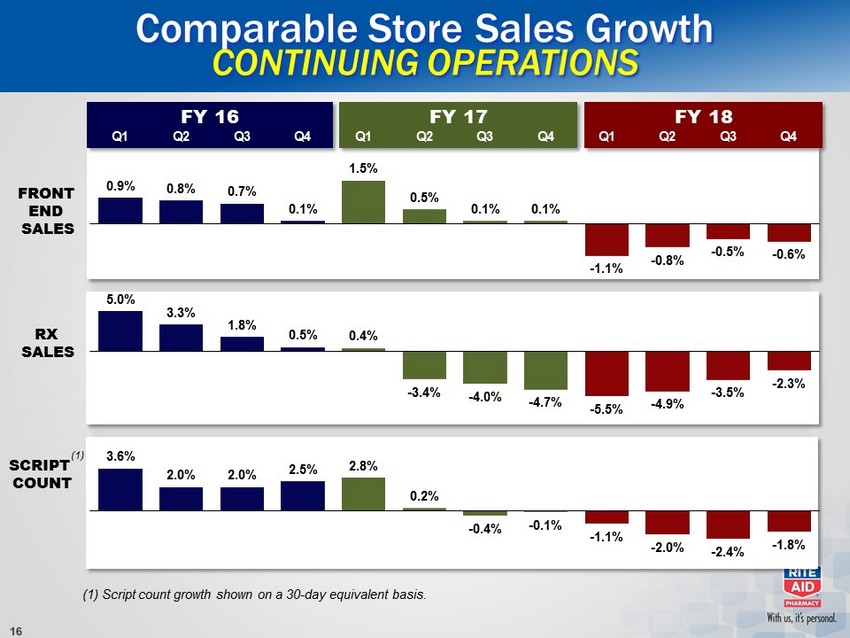

FY 18 FY 16 FY 17 FRONT END SALES RX SALES SCRIPT COUNT 0.9% 0.8% 0.7% 0.1% 1.5% 0.5% 0.1% 0.1% - 1.1% - 0.8% - 0.5% - 0.6% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 5.0% 3.3% 1.8% 0.5% 0.4% - 3.4% - 4.0% - 4.7% - 5.5% - 4.9% - 3.5% - 2.3% Comparable Store Sales Growth CONTINUING OPERATIONS 3.6% 2.0% 2.0% 2.5% 2.8% 0.2% - 0.4% - 0.1% - 1.1% - 2.0% - 2.4% - 1.8% (1) (1) Script count growth shown on a 30 - day equivalent basis.

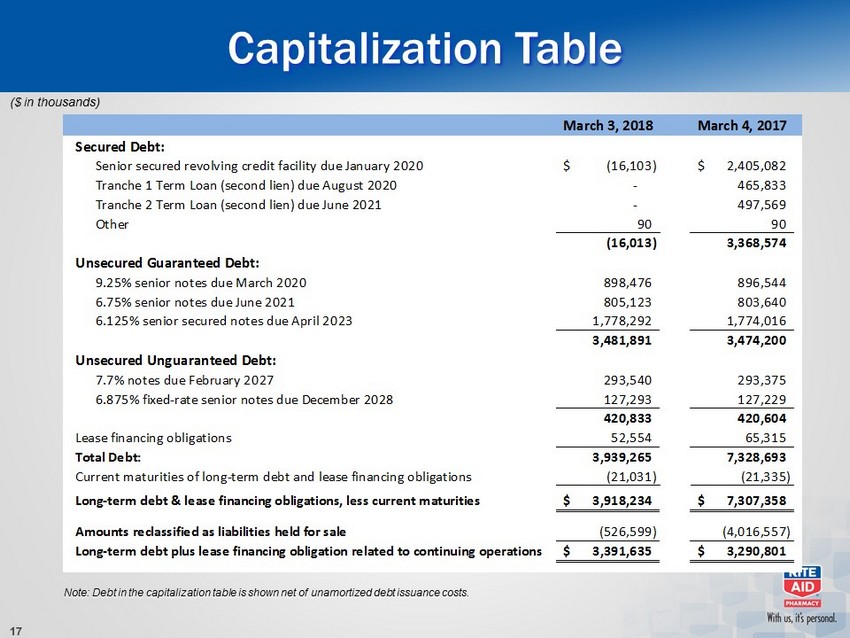

Capitalization Table ($ in thousands) Note: Debt in the capitalization table is shown net of unamortized debt issuance costs. March 3, 2018 March 4, 2017 Secured Debt: Senior secured revolving credit facility due January 2020 (16,103)$ 2,405,082$ Tranche 1 Term Loan (second lien) due August 2020 - 465,833 Tranche 2 Term Loan (second lien) due June 2021 - 497,569 Other 90 90 (16,013) 3,368,574 Unsecured Guaranteed Debt: 9.25% senior notes due March 2020 898,476 896,544 6.75% senior notes due June 2021 805,123 803,640 6.125% senior secured notes due April 2023 1,778,292 1,774,016 3,481,891 3,474,200 Unsecured Unguaranteed Debt: 7.7% notes due February 2027 293,540 293,375 6.875% fixed-rate senior notes due December 2028 127,293 127,229 420,833 420,604 Lease financing obligations 52,554 65,315 Total Debt: 3,939,265 7,328,693 Current maturities of long-term debt and lease financing obligations (21,031) (21,335) Long-term debt & lease financing obligations, less current maturities 3,918,234$ 7,307,358$ Amounts reclassified as liabilities held for sale (526,599) (4,016,557) Long-term debt plus lease financing obligation related to continuing operations 3,391,635$ 3,290,801$

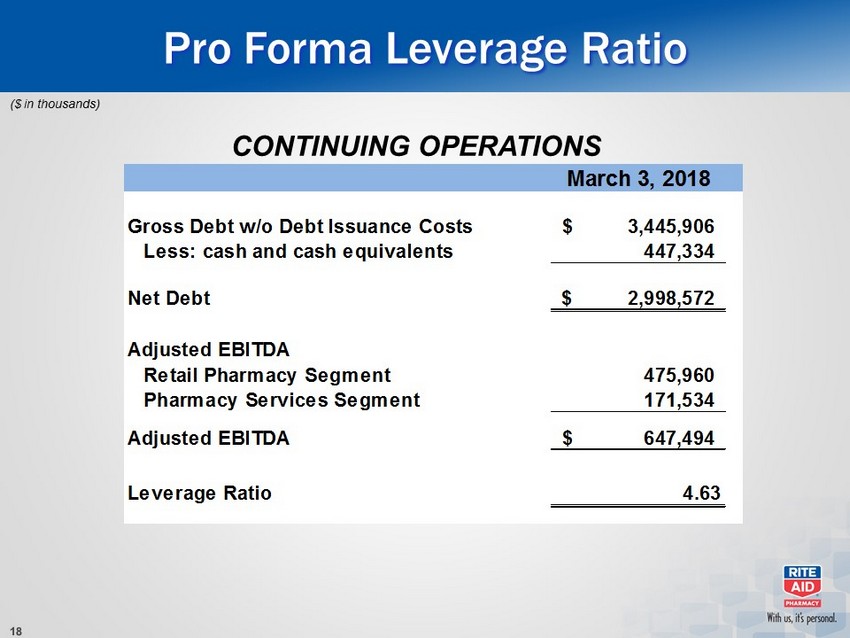

Pro Forma Leverage Ratio ($ in thousands) March 3, 2018 Gross Debt w/o Debt Issuance Costs 3,445,906$ Less: cash and cash equivalents 447,334 Net Debt 2,998,572$ Adjusted EBITDA Retail Pharmacy Segment 475,960 Pharmacy Services Segment 171,534 Adjusted EBITDA 647,494$ Leverage Ratio 4.63 CONTINUING OPERATIONS

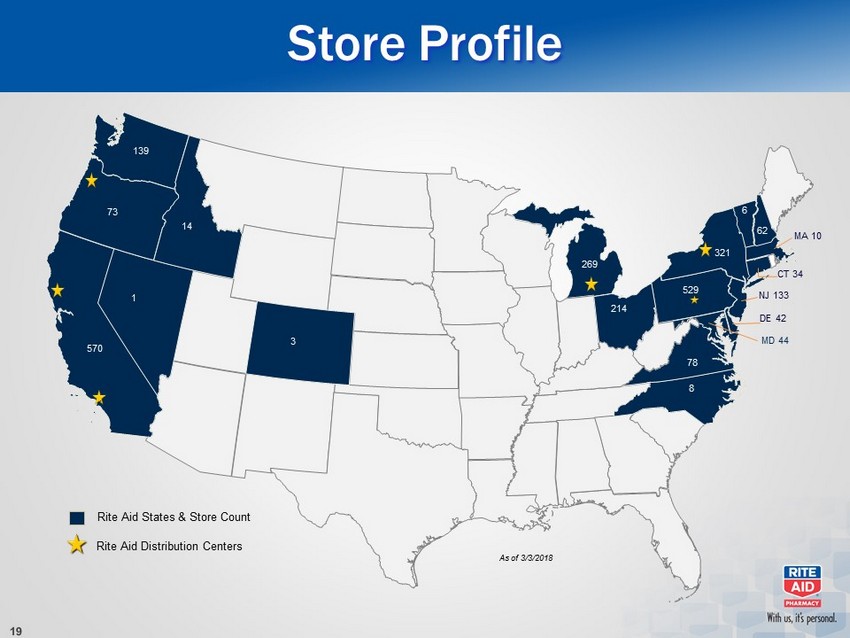

Store Profile Rite Aid States & Store Count Rite Aid Distribution Centers As of 3/3/2018 139 14 73 1 570 3 269 214 8 529 78 6 62 MA 10 CT 34 NJ 133 DE 42 . 321 MD 44

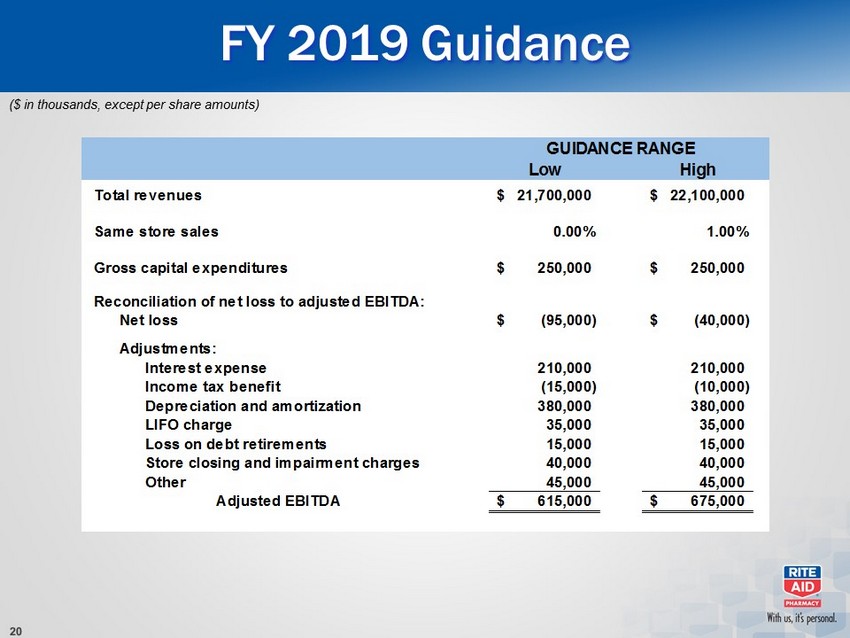

FY 2019 Guidance ($ in thousands, except per share amounts) Low High Total revenues 21,700,000$ 22,100,000$ Same store sales 0.00% 1.00% Gross capital expenditures 250,000$ 250,000$ Reconciliation of net loss to adjusted EBITDA: Net loss (95,000)$ (40,000)$ Adjustments: Interest expense 210,000 210,000 Income tax benefit (15,000) (10,000) Depreciation and amortization 380,000 380,000 LIFO charge 35,000 35,000 Loss on debt retirements 15,000 15,000 Store closing and impairment charges 40,000 40,000 Other 45,000 45,000 Adjusted EBITDA 615,000$ 675,000$ GUIDANCE RANGE

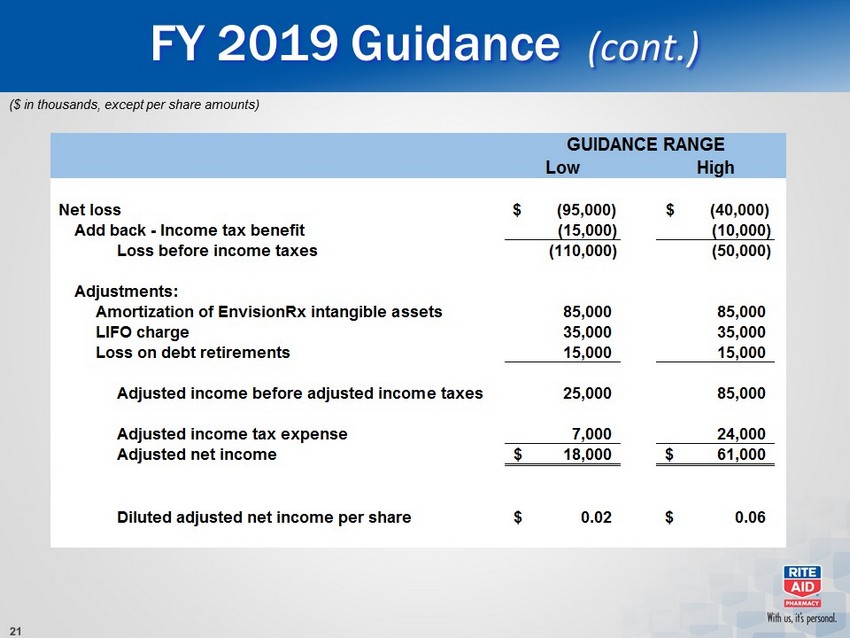

FY 2019 Guidance (cont.) ($ in thousands, except per share amounts) Low High Net loss $ (95,000) $ (40,000) Add back - Income tax benefit (15,000) (10,000) Loss before income taxes (110,000) (50,000) Adjustments: Amortization of EnvisionRx intangible assets 85,000 85,000 LIFO charge 35,000 35,000 Loss on debt retirements 15,000 15,000 Adjusted income before adjusted income taxes 25,000 85,000 Adjusted income tax expense 7,000 24,000 Adjusted net income 18,000$ 61,000$ Diluted adjusted net income per share 0.02$ 0.06$ GUIDANCE RANGE