Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Virginia National Bankshares Corp | vnb30097838-8k.htm |

INVESTOR UPDATE

April 6, 2018

Dear Fellow Shareholders:

On behalf of the Board of Directors and the management team of Virginia National Bankshares Corporation (the Company or VABK), we are pleased to provide our view of the banking industry and regulatory environment, along with an update on our performance for the year ended December 31, 2017. Additionally, for the first time, we will inform you of the Company’s actions regarding some of the social issues that we dealt with both locally in Charlottesville and in the country.

The banking environment of 2017, like the previous three years, presented constant change. Bank mergers and acquisitions, specifically in the community bank sector, continued at a rapid, but predictable pace. S&P Global Market Intelligence recently reported that “only 19% of the 1,773 community banks formed in the 1990s are still operating.” Today, community bank formation is almost nonexistent due to the current regulatory and capital requirements and the difficulty in achieving profitability within the first three years. This new reality might seem grim since we were formed in 1998, but we have successfully navigated obstacles many times over the past 20 years. Our high-performing bank ended 2017 with a record Return on Average Assets (ROAA) and efficiency ratio, and solid earnings as well!

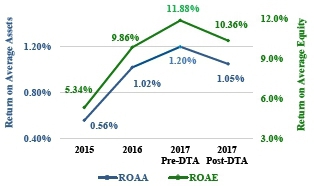

So, how do you measure whether a bank is high-performing? Some investors watch metrics such as efficiency ratio, asset quality, ROAA, and Return on Average Equity (ROAE). Others focus on stock performance, dividend growth, earnings per share, market growth and technology products. All are acceptable ways to evaluate your investment. The following assesses our Company’s performance.

Virginia National Bank (the Bank or VNB), the Company’s subsidiary, again surpassed its ROAA goal by finishing 2017 at 1.23% prior to the deferred tax asset (DTA) adjustment discussed on page 3. Based on the Bank’s strong performance and VNBTrust’s contribution, the consolidated company also increased its ROAA to 1.20% prior to the DTA adjustment. Our Company’s efficiency ratio improved again due to technology efficiencies in the operational areas of the Bank and VNBTrust, as well as the recognized savings from our renegotiated core technology contract. Some of these savings were reallocated to hire four new commercial lenders in the Charlottesville and Winchester markets in an effort to grow organically in these areas. Overall, we reduced our total headcount from 85 to 81 in 2017.

We experienced a solid year of net loan growth of 9.7%, which consisted of net organic loan growth of $27.5 million and net non-organic loan growth of $19.2 million. Non-organic loan growth was driven by the purchase of a $15.1 million privately-insured student loan package and $17.8 million of the government guaranteed portion of USDA loans, bringing our non-organic loan balances to $100.8 million at year-end. This non-organic mix of loans consisted primarily of variable rate loans, which will increase loan yields in a rising rate environment. In 2017, we also remained competitive in our markets, increased our deposits, upheld our superior asset quality, and maintained our low cost of funds. We are excited about the Bank’s success in 2017 and are looking forward to an even better 2018.

VNBTrust, a subsidiary of the Bank operating under the trade name VNB Wealth Management, continued its focused, three-year journey of changing the structure of its lines of business, which included eliminating five positions. These actions set the stage for further improvement in profitability. While all of this was occurring, assets under management and earnings still grew in 2017.

The information above and later in this letter proves this Company is a high-performing community bank; however, it does not reveal the underlying reason why, which we believe is an experienced, hands-on executive officer team. This is another significant factor that is rarely talked about, but many times is present in high-performing businesses and is the reason for our superior performance in key categories. Most banks comparable to our size have 40% more staff with at least two supervisors between the executive officer and the employees. This slows information gathering and decision making significantly, which in an ever-changing regulatory and competitive environment, creates not only management frustration, but a lag in earnings. Additionally, our executive managers have an average of 30 years of banking experience in both small and large banking institutions. Decisions tend to be made more quickly and will serve us well as the Company significantly grows. Finally, we all have a willingness to stay engaged in many of the details of running a successful company. We want to assure our investors that we are deeply committed to this philosophy and to the success that comes with it.

Investor Update

April 6, 2018

|

The Company dealt with several social issues in 2017, both locally and nationally. Charlottesville, home of our corporate headquarters, made the national headlines several times in 2017 due to the racial hatred and violence that erupted in our city during the summer. We kept all of our employees and properties secure and safe. Even so, the community must heal and address the issues that were presented during the turmoil. Progress regarding these issues is slowly being made on many fronts, and it is clear that much more must be done to create positive change. Always involved in the community, our Company immediately engaged to help facilitate day-to-day conversations and dialogues regarding advancement for all. We increased our community giving budget, as well as the number of non-profit Public Service Announcements from 100 to over 400 monthly slots for those non-profits that were directly involved in the healing process. We also supported non-profits that provided funds for those injured as a result of the violence. The adjacent chart reflects this initiative, and we will continue to stay engaged. |

Community Giving in 2017 |

The national social issues we addressed were soaring health care costs, equal pay for women, especially as they move up the corporate ladder, and the corporate tax cut enacted in late 2017. The Company absorbed the increased employee health care costs, raising its contribution from 45% three years ago to 58% in 2017 and we are committed to contributing more over the next two years. Regarding equal pay, it is important to note that our Chief Credit Officer, Chief Financial Officer, General Counsel, Senior Commercial Lender and Chief Operations Officer are all women and are among our highest paid employees. Lastly, our Company used a portion of the tax savings to reward our non-officer employees with an unscheduled bonus and to raise our minimum hourly rate to $15.00 an hour, which became effective on March 1, 2018.

We want to assure our shareholders, employees and customers that we are a community bank that intends to remain focused on performance, take care of our high-performing employees, and deliver convenient and secure financial services. Please enjoy reading the following information about our financial results.

VIRGINIA NATIONAL BANKSHARES CORPORATION

STOCK AND CAPITAL PERFORMANCE

|

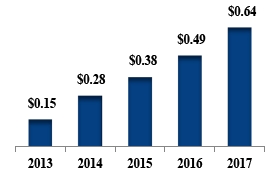

Once again, 2017 was another successful year for our Company and our shareholders. We increased the quarterly dividend to shareholders for the fifth consecutive year. Since the Company declared its first cash dividend in the amount of $0.05 per share during the second quarter of 2013, the quarterly dividend has increased 280% to $0.19 per share. In March 2018, the Company’s Board of Directors declared a 5% stock dividend, payable April 13, 2018 to shareholders of record as of April 3, 2018. This stock dividend is in addition to the regular quarterly cash dividend of $0.19 that will be paid April 27, 2018 on the increased number of shares to shareholders of record as of April 3, 2018. |

Cash Dividends Per Share |

Page 2

Investor Update

April 6, 2018

Regulatory Capital Summary |

The Company and the Bank continue to be well-capitalized based on regulatory guidelines. The Company’s Tier 1 capital ratio was 12.23% at December 31, 2017, while its risk-based capital and leverage ratios were 12.99% and 10.58%, respectively. The Bank’s Tier 1 capital ratio was 12.02% at December 31, 2017, with risk-based capital and leverage ratios of 12.78% and 10.40%, respectively. The common equity Tier 1 ratios for the Company and the Bank equal the Tier 1 capital ratios for each. Minimum regulatory guidelines for well-capitalized banks are 10.0%, 8.0%, 6.5% and 5.0% for risk-based capital, Tier 1 capital, common equity Tier 1 and leverage ratios, respectively. Our strong capital position allows us to continue to increase shareholder return. |

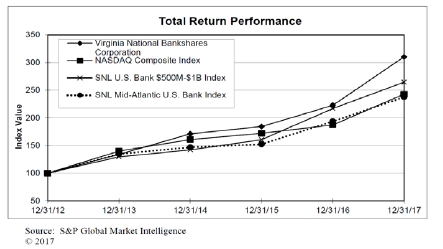

In 2017, our stock price per share increased 37% from $28.50 at December 31, 2016 to $39.00 at December 31, 2017. The following graph compares the cumulative total shareholder return of VABK common stock to several indices. The graph assumes that $100 was invested on December 31, 2012 in the Company’s common stock and in each of the indices, and that dividends were reinvested. If you had invested $10,000 on December 31, 2012 and reinvested dividends, the stock would be worth over $31,000 at December 31, 2017. In January 2018, the Company was named to the OTCQX Best 50, which is an annual ranking of the top performing OTCQX companies based on total return and growth in average daily dollar volume in 2017.

COMPARATIVE EARNINGS DATA

|

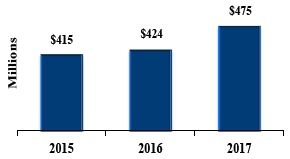

The Company’s net income improved 14% to $6.6 million, or $2.71 per diluted share, in 2017 from $5.7 million, or $2.41 per diluted share, in 2016. Net income for 2017 was reduced by $963 thousand due to the re-measurement of, and adjustment to, deferred tax assets (DTA) as a result of the enactment of the Tax Cuts and Jobs Act (Tax Reform) in December 2017. This DTA adjustment represents the impact of reducing the federal tax rate applicable to the Company’s DTAs to 21% in 2018 from 34% previously, which the Company was required to take as a one-time, non-cash tax charge in our consolidated financial statements for 2017 when the Tax Reform was enacted. Excluding the impact of Tax Reform, the Company would have realized $7.5 million in net income, or $3.11 per diluted share for 2017, which would have been a 31% increase compared to net income of 2016. |

Consolidated Net Income |

Page 3

Investor Update

April 6, 2018

|

There were two primary components contributing to the increase in net income. First, net interest income rose $3.1 million, primarily due to the increase in rate and volume of our student loan portfolio and elevated average balances within our commercial and real estate loan portfolios. Second, noninterest income increased $397 thousand, due to growth in trust income, royalty income, and advisory and brokerage income, offset by one-time losses on sales of securities due to planned restructuring of that portfolio. These favorable variances were offset by the following increases: $1.8 million in provision for income taxes, $586 thousand in noninterest expense, and $307 thousand in the provision for loan loss. |

Net Income Per Share  |

|

Return on Average Assets and Equity

|

Prior to the DTA adjustment as previously discussed, the Company’s ROAA reached a record level of 1.20% for 2017. Our ROAE pre-DTA adjustment also reached a record level of 11.88% for the period. The Bank’s pre-DTA adjusted ROAA and ROAE were 1.23% and 12.33%, respectively. Post-DTA adjustment, the Bank’s ROAA and ROAE were 1.09% and 10.87%, respectively. Based on each of these metrics, we outperformed most of our national peers with ROAA and ROAE averages of 1.06% and 9.64%, respectively. We also compared favorably to similarly-sized Virginia peers whose ROAA average was 0.59% and ROAE average was 5.52% for the same year. Peers are defined as all commercial banks with assets of $100 million to $1 billion. |

VIRGINIA NATIONAL BANK

NET INTEREST INCOME, MARGINS AND YIELDS

|

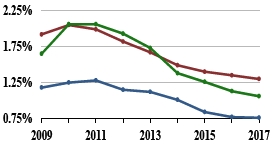

In 2017, our net interest margin continued to improve as a result of increased loan yield and continued low cost of funds. We realized a net interest margin of 3.83%, which was 34 basis points (bps) higher than 2016. Our average loan yield of 4.24% for 2017 was 11 bps higher than the loan yield realized in 2016 of 4.13%. Average consumer loan balances increased $21 million to $83 million, with an average yield of 4.99% in 2017 compared to 4.42% in 2016. We successfully maintained our low cost of funding, averaging only 21 bps for 2017 compared to 19 bps in 2016, which is still strong compared to the average for national and Virginia peers of 48 bps and 49 bps, respectively. Net Interest Margin and Average Loan Yield

|

Net Interest Income

As the Federal Reserve has shifted the target for fed funds higher six times since December 2015 and is on course for more rate hikes this year, we anticipate that the Bank’s net interest margin will continue to improve. Approximately 37% of our loan portfolio re-prices within six months of a rate increase, which will positively impact net interest income. |

Page 4

Investor Update

April 6, 2018

OPERATIONAL EFFICIENCY

One of the key ratios we closely monitor is the efficiency ratio, which measures the cost to produce one dollar of revenue. A lower ratio is an indicator of greater operational efficiency. We have experienced a positive trend over the last three years in our efficiency ratio due to higher yielding assets, cost containment, and expense reduction strategies. This trend is shown in the graph below, which uses the efficiency ratio as calculated by the FDIC.

|

|

Efficiency Ratio (Bank only)

|

BALANCE SHEET

|

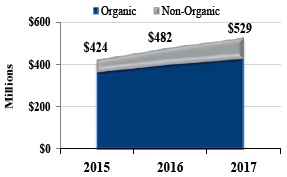

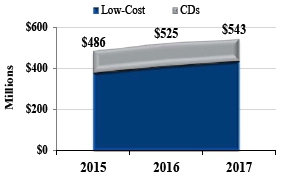

Assets  |

The Bank sustained meaningful growth rates in the balance sheet categories reflected in these charts. Building on our decision in 2014 to supplement organic loan growth and enhance earnings, we continued to diversify our loan portfolio by purchasing additional privately-insured student loans and the government guaranteed portion of USDA loans. Non-organic loan balances increased to $101 million, or 19% of the total loan portfolio as of December 31, 2017, compared to $82 million, or 17%, as of December 31, 2016. We continued our success of self-funding by increasing deposits to $543 million, or 3.4%, while maintaining a low cost of funds of 21 bps for 2017. |

|

Loans

|

Deposits

| |

|

Loans are presented on a gross basis. |

Low-cost deposits include demand and money market accounts. |

Page 5

Investor Update

April 6, 2018

CREDIT QUALITY

|

Period-end loans increased by 9.7% year-over-year, and we did not sacrifice credit quality to achieve growth. During 2017, net loan charge-offs totaled only $63 thousand and, relative to gross loans, was de minimis at only 0.01%. The ratio of the allowance for loan losses to total loans declined slightly as we ended 2017 at 0.76%, which was significantly below the average for our national and Virginia peers. We continue to have a low level of nonperforming loans, which is reflective of our disciplined approach to underwriting. Our core values relative to credit quality continue to serve us well. |

Net Charge-offs to Total Loans  |

|

Loan Loss Allowance  |

Nonperforming Assets/Assets  |

VNB WEALTH MANAGEMENT

|

VNB Wealth Management has several sources of revenue: ●Management and trust service fees – Derived from Assets Under Management (AUM) ●Incentive income – Based on the investment returns generated on performance-based AUM ●Royalty and revenue sharing arrangement on both fixed and incentive fees ●Advisory and brokerage revenue from the investment services group |

Assets Under Management

|

VNB Wealth Management significantly increased AUM over the last year. The chart does not include assets managed by the investment services group, which totaled $67 million at the end of 2017. Due to reduced expenses, increased fixed-fee recurring revenue, and increased incentive fees, our year-over-year net income increased by $495 thousand. The Company is in the process of changing the structure of its VNB Wealth lines of business. The Company intends to form a registered investment adviser (RIA) to offer investment advisory and management services to clients through separately managed accounts and through one or more private investment funds. This will allow us to offer our investment strategy to a wider range of clients. The Company also plans to merge VNBTrust into the Bank. Following that merger, the Bank will continue to offer investment management and trust and estate administration services, as well as VNB Investment Services. The Company expects these changes to occur during the second quarter of 2018, subject to regulatory approvals.

Page 6

Investor Update

April 6, 2018

CRITICAL ISSUES FOR FUTURE SUCCESS

The top opportunities and challenges for the Company in 2018 are as follows:

| ● | VNB Wealth Management – Optimize the structure for these lines of business and diversify the financial services offered to clients, thereby attracting new clients and profitable AUM to increase noninterest income. |

| ● | Deposit Growth – Attract commercial deposits and high net worth clients by creating new deposit products, offering competitive rates, launching mobile banking and initiating new marketing strategies. |

| ● | Capital Allocation – Adhere to capital adequacy guidelines for continued focus on commercial real estate (CRE) lending and take measures to ensure capital levels are commensurate with the risk profile of our CRE portfolio. |

| ● | Loan Growth – Recruit talented commercial bankers in existing and new markets as well as adjust our loan terms as the market demands. |

| ● | Net Interest Margin – Proactively manage our loan yield through disciplined loan pricing, including the potential use of swap and/or hedging products, and preemptively price deposit products in a rising rate environment. |

The Company has an unwavering commitment to delivering long-term value to our shareholders. We will continue to seek opportunities to reduce expenses, embrace technology, and create new ways to generate earnings. Our progress in 2017 demonstrates we are dedicated to these actions, and we are confident in our ability to thrive and prosper for years to come.

Your confidence and support are sincerely appreciated. Should you have any questions, please do not hesitate to call us at (434) 817-8649.

| Sincerely, | |

|

|

|

Glenn W. Rust |

Tara Y. Harrison |

Forward-Looking Statements; Other Information: Statements in this letter which express or imply a view about the objectives and future performance of the Virginia National Bankshares Corporation are “forward-looking statements.” Such statements are often characterized by use of qualified words such as “expect,” “believe,” “estimate,” “project,” “anticipate,” “intend,” “will,” “should,” or words of similar meaning or other statements concerning the opinions or judgment of the Company and its management about future events. While Company management believes such statements to be reasonable, future events and predictions are subject to circumstances that are not within the control of the Company and its management, and actual events in the future may be substantially different from those expressed in this letter. The Company’s past results are not necessarily indicative of future performance. Factors that could cause future performance to differ from past performance or anticipated performance could include, but are not limited to, changes in national and local economies, employment or market conditions; changes in interest rates, deposits, loan demand and asset quality; competition; changes in banking regulations and accounting principles or guidelines; and performance of assets under management. These statements speak only as of the date made, and the Company does not undertake to update them to reflect changes or events that may occur later. Information based on other sources is believed by management of the Company to be reliable, but has not been independently verified. For more information about the Company’s 2017 performance, please refer to the Company’s audited consolidated financial statements in its Annual Report on Form 10-K for the year ended December 31, 2017 filed with the Securities and Exchange Commission on March 27, 2018.

Page 7

FINANCIAL SERVICES

| ● | Personal Accounts |

| ● | Business Accounts and Treasury Management |

| ● | Online Services including Mobile and Online Banking |

| ● | Commercial, Retail and Mortgage Lending |

| ● | Credit Cards |

| ● | Investment Management |

| ● | Wealth Advisory |

| ● | Trust and Estate |

| LOCATIONS |

| Virginia National Bankshares | VNB Wealth Management |

| Corporation Headquarters | 404 People Place |

| 404 People Place | Charlottesville, VA 22911 |

| Charlottesville, VA 22911 |

VIRGINIA NATIONAL BANK

BRANCH LOCATIONS

|

Pantops |

|

||||

|

|

29 North |

Barracks Road |

| |||

|

|

|||||

|

Downtown Mall |

Creekside |

VIRGINIA NATIONAL BANKSHARES CORPORATION

EXECUTIVE OFFICERS

|

|

|||

| Glenn W. Rust | Tara Y. Harrison | |||

| President & Chief Executive Officer | Chief Financial Officer & Executive Vice President | |||

|

|

|||

|

Virginia R. Bayes |

Donna G. Shewmake |

VIRGINIA NATIONAL BANK EXECUTIVE TEAM

| Glenn W. Rust | Jennifer H. Matheny | ||

| President & Chief Executive Officer | Chief Operations Officer | ||

| Samuel T. Ashworth | Mark A. Meulenberg | ||

| Market President, Shenandoah Valley | Chief Investment Officer, VNB Wealth Management | ||

| Virginia R. Bayes | Adam T. Perry | ||

| Chief Credit Officer | Chief Technology Officer | ||

| Jeffrey S. Boppe | Larry K. Pitchford | ||

| Market President, Winchester | Human Resources Director | ||

| Tara Y. Harrison | Donna G. Shewmake | ||

| Chief Financial Officer | General Counsel | ||

| Linda W. Hitchings | Alan R. Williams | ||

| Senior Lending Officer | Director of Retail Banking | ||

VIRGINIA NATIONAL BANKSHARES CORPORATION

ORGANIZATIONAL INFORMATION

Virginia National Bankshares Corporation (Company), headquartered in Charlottesville, Virginia, became a bank holding company in 2013 following reorganization of Virginia National Bank (Bank) into a holding company form of ownership. When the reorganization became effective on December 16, 2013, the Bank became the wholly-owned subsidiary of the Company. The Bank has one subsidiary, VNBTrust, National Association.

Virginia National Bank offers a full range of banking and related financial services to locally owned businesses and individuals through its five banking offices located in Central Virginia and online at www.vnb.com. Four of the offices are located in Charlottesville/Albemarle County and one is located in Winchester. The Bank received its federal banking charter from the Office of the Comptroller of the Currency on July 29, 1998. Virginia National Bank is a member of the Federal Reserve System and is an Equal Housing Lender whose deposits are insured by the Federal Deposit Insurance Corporation.

Investment management and trust services are offered through VNBTrust under the trade name of VNB Wealth Management. For more information, visit www.vnbwealth.com.

SHAREHOLDER INFORMATION

The Company’s common stock is quoted on the OTC Market Group’s OTCQX marketplace under the symbol VABK. Analysts, investors, the press and others seeking financial information about Virginia National Bankshares Corporation should contact Tara Y. Harrison, Chief Financial Officer and Executive Vice President, (434) 817-8587, at the Corporate Offices located at 404 People Place, Charlottesville, Virginia 22911.

ANNUAL MEETING

The 2018 Virginia National Bankshares Corporation Annual Shareholders Meeting will be held at 11:00 a.m., Friday, May 18, 2018, at the Hilton Garden Inn, 1793 Richmond Road, Charlottesville, Virginia 22911.

INDEPENDENT AUDITORS

Yount, Hyde & Barbour, P.C.

50 South Cameron Street

P.O. Box 2560

Winchester, VA 22601

(540) 662-3417

www.yhbcpa.com

REGISTRAR & TRANSFER AGENT

American Stock Transfer & Trust Co.

6201 15th Avenue

Brooklyn, NY 11219

(800) 937-5449

www.astfinancial.com

WEBSITE ADDRESSES

www.vnb.com

www.vnbwealth.com

www.vnbcorp.com

VISION

By unleashing possibilities, creating opportunities, and celebrating in mutual successes, we will be recognized as a trusted partner.

MISSION

As a leader in the community, we have an unwavering commitment to invest in the long-term financial health and stability of businesses, citizens, and charitable organizations. Proud to be community bankers, we leverage individuality and local knowledge to deliver caring and innovative solutions to our customers. We embrace diversity and provide growth and enrichment opportunities for customers, employees, and shareholders.