Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - ANALOGIC CORP | d559440dex993.htm |

| EX-99.1 - EX-99.1 - ANALOGIC CORP | d559440dex991.htm |

| EX-3.1 - EX-3.1 - ANALOGIC CORP | d559440dex31.htm |

| EX-2.1 - EX-2.1 - ANALOGIC CORP | d559440dex21.htm |

| 8-K - 8-K - ANALOGIC CORP | d559440d8k.htm |

April 10, 2018 ANALOGIC TO BE ACQUIRED BY ALTARIS CAPITAL PARTNERS Exhibit 99.2

Forward Looking Statements Statements in this presentation regarding the proposed transaction between Altaris Capital Partners, LLC (including affiliated entities, “Altaris”) and Analogic, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and any other statements about future expectations, plans, and prospects for the Company, including statements containing the words “believes,” “anticipates,” “plans,” “expects,” and similar expressions, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the risk that the proposed merger may not be completed in a timely manner, or at all, which may adversely affect Analogic’s business and the price of its common stock; the failure to satisfy all of the closing conditions of the proposed merger, including the adoption of the merger agreement by Analogic’s stockholders and the receipt of regulatory approvals; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the effect of the announcement or pendency of the proposed merger on Analogic’s business, operating results, and relationships with customers, suppliers, competitors and others; risks that the proposed merger may disrupt Analogic’s current plans and business operations; potential difficulties retaining employees as a result of the proposed merger; risks related to the diverting of management’s attention from Analogic’s ongoing business operations; the outcome of any legal proceedings that may be instituted against Analogic related to the merger agreement or the proposed merger; risks relating to product development and commercialization, limited demand for the Company’s products, limited number of customers, risks associated with competition, uncertainties associated with regulatory agency approvals, competitive pricing pressures, downturns in the economy, the risk of potential intellectual property litigation, acquisition related risks, and other factors discussed in our most recent quarterly and annual reports filed with the SEC. In addition, the forward-looking statements included in this presentation represent the Company’s views as of the date of this document. While the Company anticipates that subsequent events and developments will cause the Company’s views to change, the Company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s views as of any later date.

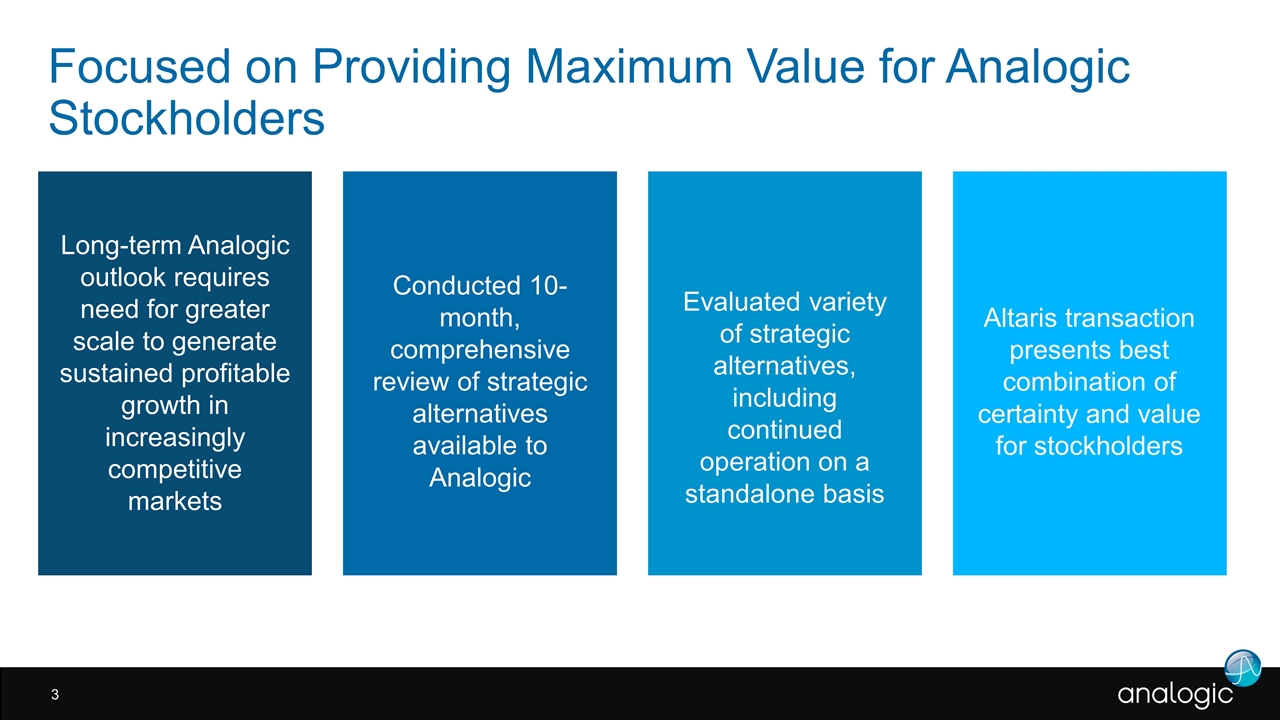

Focused on Providing Maximum Value for Analogic Stockholders Altaris transaction presents best combination of certainty and value for stockholders Conducted 10-month, comprehensive review of strategic alternatives available to Analogic Long-term Analogic outlook requires need for greater scale to generate sustained profitable growth in increasingly competitive markets Evaluated variety of strategic alternatives, including continued operation on a standalone basis

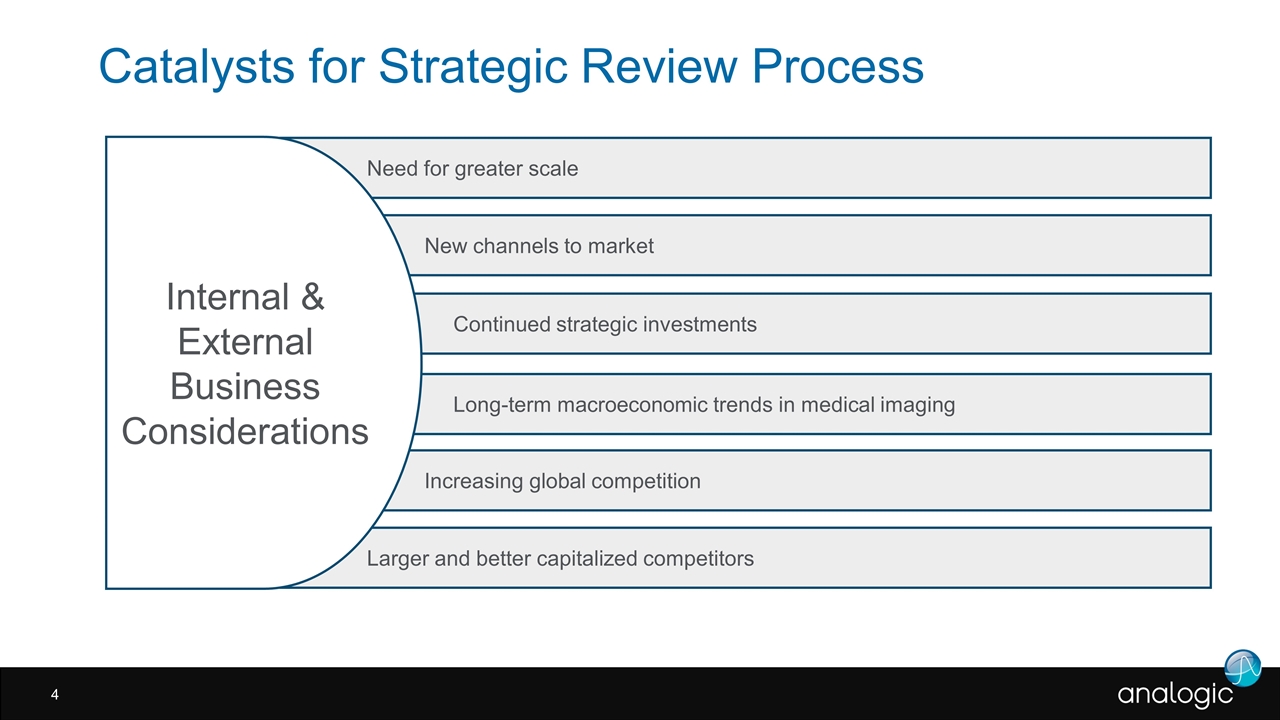

Larger and better capitalized competitors Long-term macroeconomic trends in medical imaging Continued strategic investments New channels to market Need for greater scale Increasing global competition Catalysts for Strategic Review Process Internal & External Business Considerations

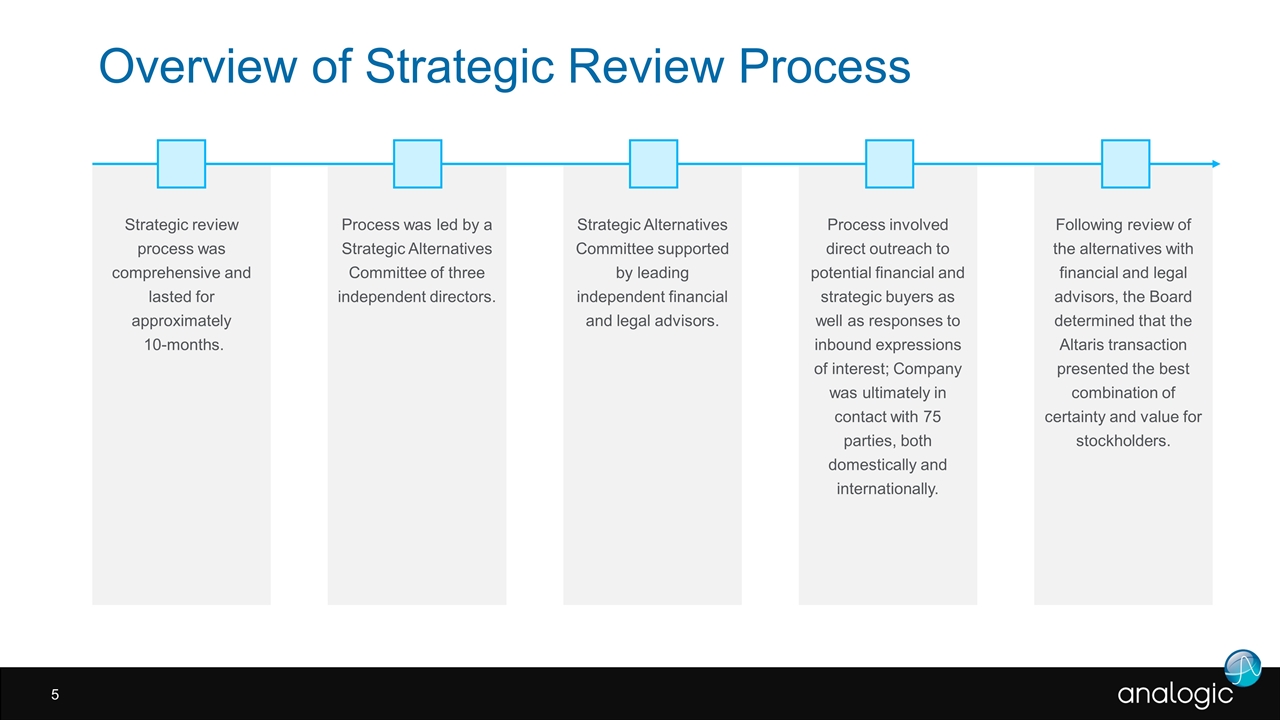

Following review of the alternatives with financial and legal advisors, the Board determined that the Altaris transaction presented the best combination of certainty and value for stockholders. Strategic review process was comprehensive and lasted for approximately 10-months. Process was led by a Strategic Alternatives Committee of three independent directors. Strategic Alternatives Committee supported by leading independent financial and legal advisors. Process involved direct outreach to potential financial and strategic buyers as well as responses to inbound expressions of interest; Company was ultimately in contact with 75 parties, both domestically and internationally. Overview of Strategic Review Process

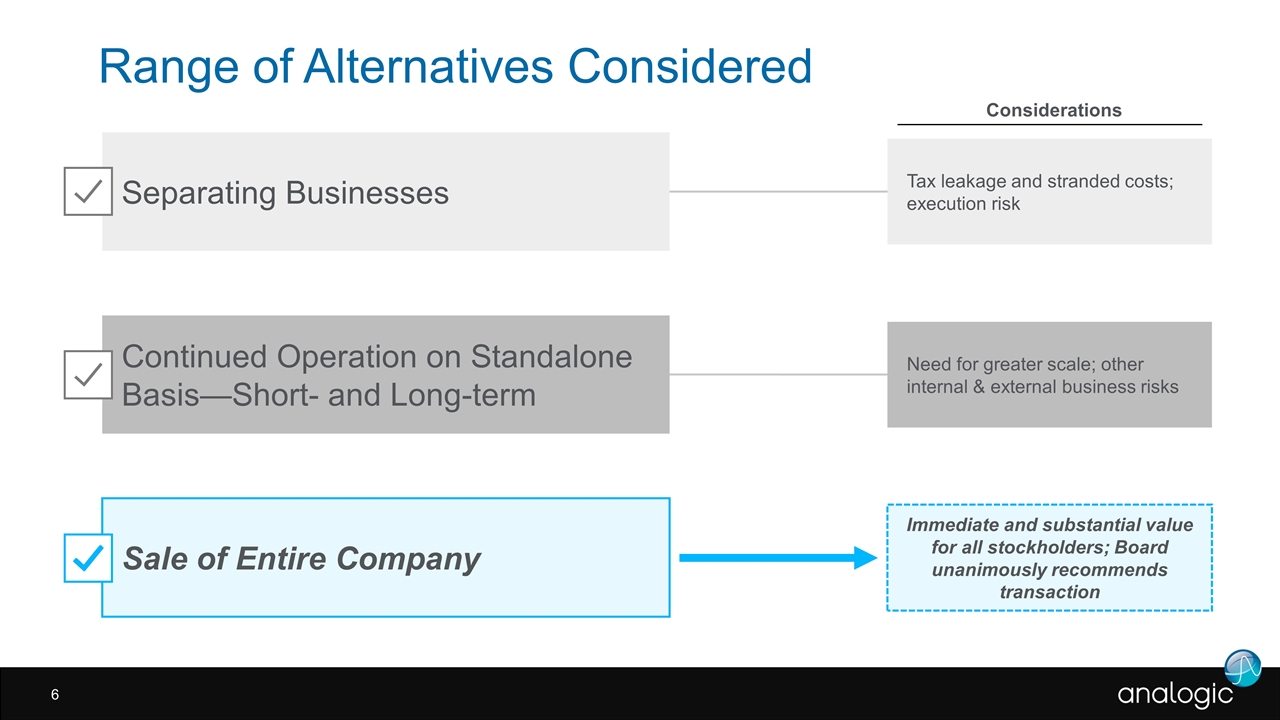

Sale of Entire Company Range of Alternatives Considered Separating Businesses Immediate and substantial value for all stockholders; Board unanimously recommends transaction Tax leakage and stranded costs; execution risk Continued Operation on Standalone Basis—Short- and Long-term Need for greater scale; other internal & external business risks Considerations

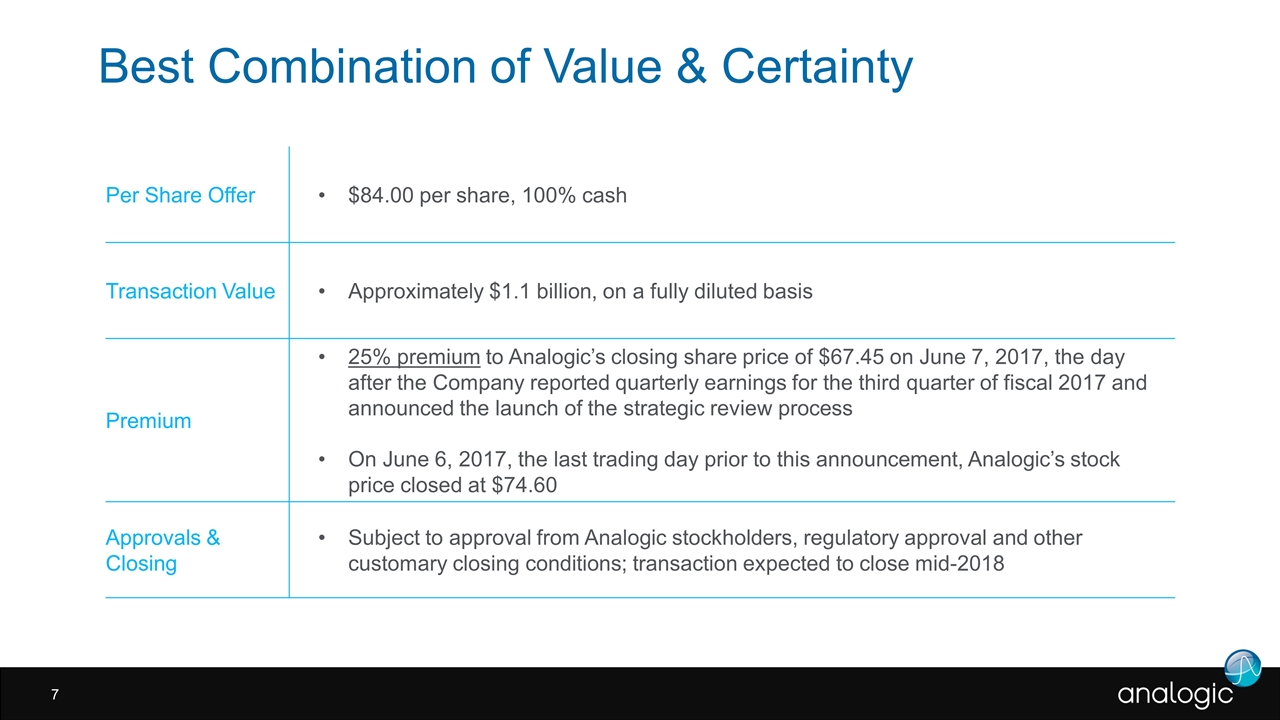

Best Combination of Value & Certainty Per Share Offer $84.00 per share, 100% cash Transaction Value Approximately $1.1 billion, on a fully diluted basis Premium 25% premium to Analogic’s closing share price of $67.45 on June 7, 2017, the day after the Company reported quarterly earnings for the third quarter of fiscal 2017 and announced the launch of the strategic review process On June 6, 2017, the last trading day prior to this announcement, Analogic’s stock price closed at $74.60 Approvals & Closing Subject to approval from Analogic stockholders, regulatory approval and other customary closing conditions; transaction expected to close mid-2018

Overview Established in 2003 Deep expertise in the medical device and diagnostic equipment industries, including imaging technologies Analogic would represent 17th platform company to design and manufacture high value, FDA-regulated medical products and components Invested in 34 companies spanning subsectors such as: Medical device and diagnostics Pharmaceuticals Healthcare and payor services Healthcare IT History of working with growth companies that deliver innovative products, technologies and solutions Established track record as engaged and supportive partner to management teams and employees Investment strategy focuses on creating long-term value for all stakeholders

Long-term Analogic outlook requires need for greater scale to generate sustained profitable growth in increasingly competitive markets Focused on Providing Maximum Value for Analogic Stockholders Conducted 10-month, comprehensive review of strategic alternatives available to Analogic Evaluated variety of strategic alternatives, including continued operation on a standalone basis Altaris transaction presents best combination of certainty and value for stockholders

Important Additional Information Analogic plans to file with the Securities and Exchange Commission (the “SEC”) and mail to its stockholders a Proxy Statement in connection with the transaction. The Proxy Statement will contain important information about Altaris, Analogic, the transaction and related matters. Investors and security holders are urged to read the Proxy Statement carefully when it is available. Investors and security holders will be able to obtain free copies of the Proxy Statement and other documents filed with the SEC by Analogic through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Proxy Statement from Analogic by contacting the Investor Relations department via e-mail at investorrelations@analogic.com or by calling 978-326-4058. Analogic and its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the merger agreement. Information regarding Analogic’s directors and executive officers is contained in Analogic’s Form 10-K for the year ended July 31, 2017 and its proxy statement dated November 2, 2017, which are filed with the SEC. These documents can be obtained free of charge from the sources listed above. Additional information regarding the direct and indirect interests of Analogic’s directors and executive officers in the proposed transaction will be included in the Proxy Statement when it is filed with the SEC.