Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - MONSANTO CO /NEW/ | q2earnings.htm |

| 8-K - FORM 8-K - MONSANTO CO /NEW/ | form8-k.htm |

APRIL 5, 2018

SECOND QUARTER 2018

FINANCIAL RESULTS

Certain statements contained in this presentation are “forward-looking statements,” such as statements concerning the

company’s anticipated financial results, current and future product performance, regulatory approvals, business and

financial plans and other non-historical facts, as well as the pending transaction with Bayer Aktiengesellschaft (“Bayer”).

These statements are based on current expectations and currently available information. However, since these

statements are based on factors that involve risks and uncertainties, the company’s actual performance and results may

differ materially from those described or implied by such forward-looking statements. Factors that could cause or

contribute to such differences include, among others: risks related to the pending transaction between the company and

Bayer, including the risk that the regulatory approvals required for the transaction may not be obtained on the anticipated

terms or time frame or at all, the risk that the other conditions to the completion of the transaction may not be satisfied,

the risk that disruptions or uncertainties related to the pending transaction could adversely affect the company’s

business, financial performance and/or relationships with third parties, and the risk that certain contractual restrictions

during the pendency of the transaction could adversely affect the company’s ability to pursue business opportunities or

strategic transactions; continued competition in seeds, traits and agricultural chemicals; the company’s exposure to

various contingencies, including those related to intellectual property protection, regulatory compliance and the speed

with which approvals are received, and public understanding and acceptance of our biotechnology and other agricultural

products; the success of the company’s research and development activities; the outcomes of major lawsuits, including

potential litigation related to the pending transaction with Bayer; developments related to foreign currencies and

economies; fluctuations in commodity prices; compliance with regulations affecting our manufacturing; the accuracy of

the company’s estimates related to distribution inventory levels; the levels of indebtedness, continued availability of

capital and financing and rating agency actions; the company’s ability to fund its short-term financing needs and to obtain

payment for the products that it sells; the effect of weather conditions, natural disasters, accidents, and security

breaches, including cybersecurity incidents, on the agriculture business or the company’s facilities; and other risks and

factors detailed in the company’s most recent periodic report to the SEC. Undue reliance should not be placed on these

forward-looking statements, which are current only as of the date of this presentation. The company disclaims any

current intention or obligation to update any forward-looking statements or any of the factors that may affect actual

results.

Forward

Looking

Statements

© 2018 Monsanto Company 2

Fiscal Year

References to year, or to fiscal year, are on a

fiscal year basis and refer to the 12-month period

ending August 31.

Trademarks

Trademarks owned by Monsanto Company and its

wholly-owned subsidiaries are italicized in this

presentation. All other trademarks are the property

of their respective owners.

The information on unregistered pesticides in this presentation is for educational purposes and is not an offer to sell or use

any unregistered product mentioned in this presentation.

Non-GAAP

Financial

Information

3

This presentation may use the non-GAAP financial measures of earnings per share (EPS) on an ongoing basis,

gross profit on an ongoing basis, operating expenses on an ongoing basis and net income (loss) attributable to

Monsanto Company on an ongoing basis. Collectively, “Ongoing Financial Measures”.

A non-GAAP EPS financial measure, which we refer to as ongoing EPS, excludes certain after-tax items that we

do not consider part of ongoing operations, which are identified in the reconciliation. Earnings (loss) is intended

to mean net income (loss) attributable to Monsanto Company as presented in the Statements of Consolidated

Operations under GAAP. Ongoing gross profit and ongoing operating expenses exclude certain pretax items that

we do not consider part of ongoing operations, which are identified in the reconciliations. Ongoing net income

(loss) attributable to Monsanto Company is defined as net income (loss) attributable to Monsanto Company

excluding the cumulative after-tax impact of certain items we do not consider part of ongoing operations.

We believe that our Ongoing Financial Measures presented with these adjustments are useful to investors as

they best reflect our ongoing performance and business operations during the periods presented and are also

useful to investors for comparative purposes. In addition, management uses the Ongoing Financial Measures as

a guide in its budgeting and long-range planning processes, and the ongoing EPS financial measure is used as a

guide in determining incentive compensation.

Our presentation of non-GAAP financial measures is intended to supplement investors’ understanding of our

operating performance, not replace gross profit, operating expenses, other expenses, net, net income (loss)

attributable to Monsanto Company, diluted EPS, cash flows, financial position, or comprehensive income (loss),

as determined in accordance with GAAP. Furthermore, these non-GAAP financial measures may not be

comparable to similar measures used by other companies. The non-GAAP financial measures used in this

presentation are reconciled to the most directly comparable financial measures calculated and presented in

accordance with GAAP.

Financial Results: Fiscal 2018 Second Quarter

4

2018 FISCAL 2ND QUARTER 2017 FISCAL 2ND QUARTER CHANGE

As

Reported

Adjustments1 Ongoing1

As

Reported

Adjustments1 Ongoing1 As Reported Ongoing

NET SALES $5,019M - $5,019M $5,074M - $5,074M (1)% (1)%

GROSS PROFIT $2,966M $4M $2,970M $2,952M $6M $2,958M 0% 0%

OPERATING EXPENSES $1,070M $(35)M $1,035M $1,088M $(59)M $1,029M (2)% 1%

NET INCOME

ATTRIBUTABLE TO MONSANTO COMPANY

$1,459M $(25)M $1,434M $1,368M $41M $1,409M 7% 2%

DILUTED EPS $3.27 $(0.05) $3.22 $3.09 $0.10 $3.19 6% 1%

1. Adjustments and ongoing metrics defined at the front of this presentation and reconciled at the end of this presentation.

1. Adjustments and ongoing metrics defined at the front of this presentation and reconciled at the end of this presentation.

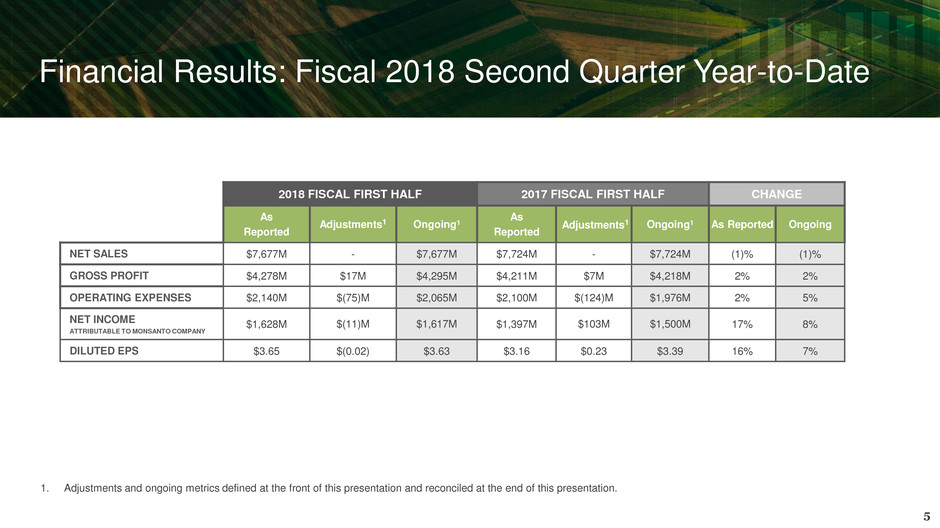

Financial Results: Fiscal 2018 Second Quarter Year-to-Date

5

2018 FISCAL FIRST HALF 2017 FISCAL FIRST HALF CHANGE

As

Reported

Adjustments1 Ongoing1

As

Reported

Adjustments1 Ongoing1 As Reported Ongoing

NET SALES $7,677M - $7,677M $7,724M - $7,724M (1)% (1)%

GROSS PROFIT $4,278M $17M $4,295M $4,211M $7M $4,218M 2% 2%

OPERATING EXPENSES $2,140M $(75)M $2,065M $2,100M $(124)M $1,976M 2% 5%

NET INCOME

ATTRIBUTABLE TO MONSANTO COMPANY

$1,628M $(11)M $1,617M $1,397M $103M $1,500M 17% 8%

DILUTED EPS $3.65 $(0.02) $3.63 $3.16 $0.23 $3.39 16% 7%

Bayer and Monsanto to Create Global Leader in Agriculture1

Combination creates a leader in life science with a balanced portfolio

Path to Completion

6

Q1 FY17

Sep-Nov

Q2 FY17

Dec-Feb

Q3-Q4 FY17

Mar-Aug

Q1-Mar FY18

Sep-Mar

Regulatory approvals received from

almost two-thirds of the relevant

authorities, including the EU

Commission, CIFIUS in the U.S.,

CADE in Brazil and MOFCOM in

China

Expected

transaction

closure is

within

calendar Q2

of 2018 and

the time

contemplated

by the

agreement

Filings with regulatory agencies

December 13,

2016

Monsanto

shareowners

approve

transaction; 99% of

votes cast vote in

favor of merger

agreement

September 14, 2016

Signing of merger

agreement between

Bayer and Monsanto

Transaction

Summary

• All-cash consideration of

$128 per Monsanto share

• Reverse break-up fee of

$2 billion

• Transaction approved by

Monsanto’s shareowners

1. The acquisition is subject to customary closing conditions including receipt of required regulatory approvals.

0

2

4

6

8

10

12

14

16

18

20

2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026

Trendline Actual

20

25

30

35

40

45

50

55

60

2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026

Trendline Actual

Global Population and Income Growth Fuel Long-Term

Demand Trends in Corn and Soybeans

7

Meeting trendline demand requires >2-fold increase in corn yield rate of gain and >4-fold increase in soybean

yield rate of gain by 2050

B

ill

io

n

s

o

f

B

u

s

h

e

ls

CAGR=3.4%

CAGR=2.8%

Corn Long-Term Demand Trends1

CAGR=4.1%

CAGR=3.6%

Soybeans Long-Term Demand Trends1

B

ill

io

n

s

o

f

B

u

s

h

e

ls

1. USDA historical data for actual and trendline – WASDE March 2018. Trendline based on avg. growth from 2011-2016, per USDA.

~1.3B BU incremental

demand in ‘17/’18 would

require >14M acres at

constant global yields

~ 515M BU incremental

demand in ‘17/’18 would

require ~13M acres at

constant global yields

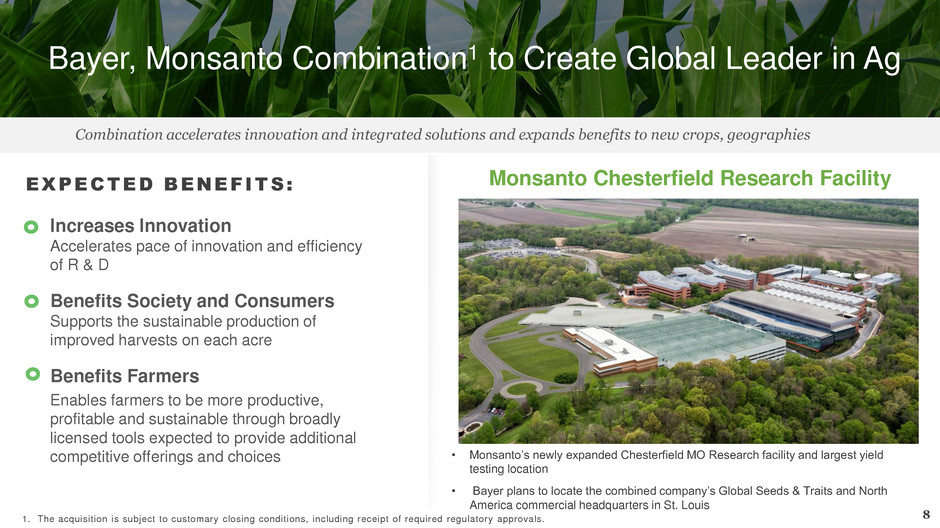

Bayer, Monsanto Combination1 to Create Global Leader in Ag

Combination accelerates innovation and integrated solutions and expands benefits to new crops, geographies

Increases Innovation

Accelerates pace of innovation and efficiency

of R & D

Benefits Society and Consumers

Supports the sustainable production of

improved harvests on each acre

Benefits Farmers

Enables farmers to be more productive,

profitable and sustainable through broadly

licensed tools expected to provide additional

competitive offerings and choices

8 1. The acquisition is subject to customary closing conditions, including receipt of required regulatory approvals.

EXPECTED BENEFITS:

Monsanto Chesterfield Research Facility

• Monsanto’s newly expanded Chesterfield MO Research facility and largest yield

testing location

• Bayer plans to locate the combined company’s Global Seeds & Traits and North

America commercial headquarters in St. Louis

Soybean Gross Profit Growth Drivers

S

O

Y

BEA

N

G

R

O

SS

PR

O

F

IT

G

R

O

W

T

H

D

R

IVER

S

Global Soybean Gross Profit Foundation: $1.9 billion FY17 from >200M1

soybean acres globally containing at least one Monsanto technology

Annual Germplasm Upgrade

Weed Control: Roundup Ready 2 Xtend soybeans, Future generations of herbicide tolerance weed

control systems

Insect Control: Current and next generations of Intacta RR2 PRO soybeans

1. Monsanto internal estimate 9

NEAR-TERM LONGER-TERM 2021+

Innovation across seeds, traits, crop protection, biologicals and digital ag expected to drive gross profit growth

2018 Outlook

Climate FieldView Digital Agriculture Platform

Next -Gen Seed Applied Products: Biologicals, Acceleron Seed

Applied Solutions Upgrades, NemaStrike Technology

• Delivered 17% growth in

soybean gross profit in the first

half of FY18 from strong start in

South America

• Intacta RR2 PRO soybeans

reached 60M acres in FY18,

from >50M acre base in South

America in FY17

• Roundup Ready 2 Xtend

soybeans expected to reach 40M

acres in second year of full

system launch, from a base of

>20M acres in FY17

FY14 FY15 FY16 FY17 FY18

First generation expected to rapidly penetrate 100M acre opportunity; second generation already in Phase 4

10

INTACTA RR2 PRO: South America

Technology Adoption Rate Key Metrics

• Penetrated more than 50M acres in

FY17; and reached 60M acres in FY18

• Next-generation Intacta 2 Xtend

soybeans approved for planting in Brazil

with expected commercial launch in

2021

• 2017 was fourth year of an average of

>4 BU/AC yield advantage in South

America

• Licensed technology to DuPont;

technology licensed to germplasm

providers with >90% share in South

America

3M

ACRES

15M

ACRES

35M

ACRES

>50M

ACRES

Intacta RR2 PRO Soybeans: Consistent Trait Performance

Provides Strong Foundation for Growth

60M

ACRES

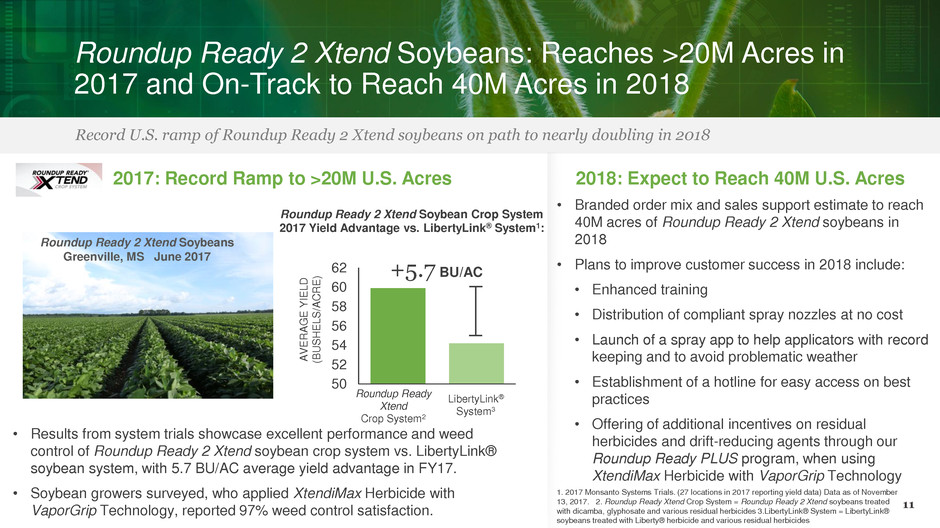

Roundup Ready 2 Xtend Soybeans: Reaches >20M Acres in

2017 and On-Track to Reach 40M Acres in 2018

11

Record U.S. ramp of Roundup Ready 2 Xtend soybeans on path to nearly doubling in 2018

• Branded order mix and sales support estimate to reach

40M acres of Roundup Ready 2 Xtend soybeans in

2018

• Plans to improve customer success in 2018 include:

• Enhanced training

• Distribution of compliant spray nozzles at no cost

• Launch of a spray app to help applicators with record

keeping and to avoid problematic weather

• Establishment of a hotline for easy access on best

practices

• Offering of additional incentives on residual

herbicides and drift-reducing agents through our

Roundup Ready PLUS program, when using

XtendiMax Herbicide with VaporGrip Technology

• Results from system trials showcase excellent performance and weed

control of Roundup Ready 2 Xtend soybean crop system vs. LibertyLink®

soybean system, with 5.7 BU/AC average yield advantage in FY17.

• Soybean growers surveyed, who applied XtendiMax Herbicide with

VaporGrip Technology, reported 97% weed control satisfaction.

2018: Expect to Reach 40M U.S. Acres 2017: Record Ramp to >20M U.S. Acres

Roundup Ready 2 Xtend Soybeans

Greenville, MS June 2017

Roundup Ready 2 Xtend Soybean Crop System

2017 Yield Advantage vs. LibertyLink® System1:

50

52

54

56

58

60

62

A

V

E

R

A

GE

Y

IE

L

D

(B

U

S

H

E

L

S

/A

C

R

E

)

Roundup Ready

Xtend

Crop System2

LibertyLink®

System3

1. 2017 Monsanto Systems Trials. (27 locations in 2017 reporting yield data) Data as of November

13, 2017. 2. Roundup Ready Xtend Crop System = Roundup Ready 2 Xtend soybeans treated

with dicamba, glyphosate and various residual herbicides 3.LibertyLink® System = LibertyLink®

soybeans treated with Liberty® herbicide and various residual herbicides

+5.7 BU/AC

Corn Gross Profit Growth Drivers

Innovation across seeds, traits, crop protection, biologicals and digital ag expected to drive gross profit growth

Global Corn Gross Profit Foundation: ~$4.0 billion in FY17 from >140M1 corn acres

globally containing at least one Monsanto technology

Annual Germplasm Upgrade

Insect control: Trecepta, SmartStax PRO corn2

Next-Gen Seed Applied Products: Biologicals – Acceleron B-360

ST3, NemaStrike Technology

Climate FieldView Digital Agriculture Platform

NEAR-TERM LONGER-TERM 2021+

C

O

R

N

G

R

O

SS PR

O

F

IT

G

R

O

W

T

H

D

R

IVER

S

12

Weed Control: Future generations of

herbicide tolerance weed control systems

2018 Outlook

1. Monsanto internal estimate 2.Pending regulatory approvals 3. Also includes Acceleron B-300 SAT. Product to be branded as Acceleron B-360-ST and subject to regulatory approvals.

• Gross profit declined 11% in the

first half of FY18 due mostly to

volumes from timing shifts and

an expected decline in acres

planted in the U.S., plus a

decline in acres planted in Brazil

• Persistent low commodity prices

challenges germplasm price mix

lift in local currency, despite

introduction of new hybrids

globally

• Anticipate holding global genetic

share with new and existing

hybrids

Complementary Crops Gross Profit Growth Drivers

Innovation across seeds, traits, crop protection and digital ag further strengthens leading share position

A

L

L

O

T

HE

R

C

R

O

PS

G

R

O

SS

PR

O

F

IT

G

R

O

W

T

H

D

R

IVER

S

Cotton, Vegetable and Other Crops Gross Profit Foundation:

~$1.1 billion FY17

Cotton: Annual Germplasm Upgrades

Canola, Wheat, Sorghum

Annual Germplasm Upgrades, TruFlex Canola with Roundup Ready

technology

Vegetables: Annual Germplasm Upgrades; Disease Resistance Packages

Mid-Single

Digits Gross

Profit CAGR

FY17F to

FY21F1

13

NEAR-TERM LONGER-TERM 2021+

Cotton: New Trait Introductions: Bollgard II XtendFlex, Bollgard 3 XtendFlex, Cotton

Lygus Seed Applied Products: NemaStrike Technology

COTTON TRIALS

LUBBOCK, TX 2017

• Excellent performance on yield and fiber quality for

Bollgard II XtendFlex

• High grower demand; expect nearly 8M acres in

FY18 in the U.S.; >6M acres penetrated in FY17

• Grew nearly 13 share points1 across our U.S. cotton

brands and licensees in FY17

Bollgard II XtendFlex

Cotton System

Dow’s Enlist® Cotton

System

1. Per internal estimates.

• Penetrated 120M acres with Climate FieldView Platform in

FY17

• 25 Platform Partners:

• Imagery, Soil Testing, Financial Decision-Making, Other:

U.S. - Veris Technology, Ceres Imaging, TerrAvion, Agribotix (+pilot in

Brazil), Conservis, Deveron UAS Corp., AgWorks, DroneDeploy,

MyAgData, Sentera, AgReliant, SkyMatics

Brazil - Farmbox, Aegro, IBRA Laboratory

• Connectivity: John Deere, Agrian, SSI–Agvance Mapping, Echelon,

FieldAlytics, FS Advanced Information Services, MapShots-Ag Studio,

SST Summit, AGCO, CNH

• In discussions with several additional potential technology providers

Climate FieldView Platform Continues Commitment to Deliver Open, Digital

Ag Ecosystem of Tools to Optimize Farm Management Decisions

14

Innovation leadership and open infrastructure enables platform expansion opportunities

C L I M AT E F I E L D V I E W P L AT F O R M

PLATFORM ADOPTION

• Penetrated >35M paid acres in the U.S. in

FY17; expect 50M paid acres globally in FY18

• Selling through 6 strategic retail partnerships

enabling 3,000+ trusted advisors

• Expanding in Canada, Europe and Brazil and

planning expansions in Argentina, Australia and

South Africa

CLIMATE FIELDVIEW SERVICES

Geographic and Acre Expansion Driving Climate FieldView

Platform Growth in the Americas and Europe

Climate builds upon industry leading U.S. footprint by expanding into meaningful geographies

• Commercial launch May 2017,

reaching nearly 1.4M acres in first

year

• 3 new platform partners added

December 2017

Product features:

• Climate FieldView data connectivity,

data visualization and ability to

analyze effectiveness of planting

decisions and remote monitoring

Brazil

120M acres opportunity

Europe

195M acres opportunity

• NEW: Expansion of Climate FieldView Platform in

Germany, France and Ukraine in FY18

• Acquired VitalFields platform, which operates in 7

countries within Europe, and HydroBio in FY17

Product features:

• VitalFields platform provides simplified tracking and

reporting of all crop inputs to ensure compliance with

European Union environmental standards

• Climate FieldView platform provides data connectivity,

data visualization and ability to analyze effectiveness

of planting decisions and remote monitoring

Canada

55M acres opportunity

• Platform availability in Eastern

Canada beginning in winter 2016

and in FY18 for Western Canada

Product features:

• Climate FieldView platform

provides data connectivity, data

visualization and ability to analyze

effectiveness of planting decisions

and remote monitoring

• Deveron provides advanced aerial

imagery data and analytics

15

Driving Value through Greater Efficiency:

Expected to Yield Annual Savings of $500 Million in 2018

16

Using business analytics aligned with strategic objectives to enhance commercial success & optimize cost structure

Restructuring and cost savings initiatives:

$500M

TOTAL EXPECTED ANNUAL

SAVINGS IN FY18F

Restructuring Expense:

~$890M to $955M

FY15-FY18F Four strategic commercial hubs

Modernize and optimize IT and supply chain networks

Accelerate use of data and analytics to speed up R&D cycle

Global R&D centers of excellence

1

2

3

4

NON-GAAP

F I N A N C I A L I N F O R M A T I O N

Reconciliation of Non-GAAP Financial Measures

18

RECONCILIATION OF ONGOING EPS

See slides 20-21 at the end of the presentation for discussion of reconciling items.

Fiscal 2nd Quarter Fiscal First Half

$ Per share 2018 2017 2018 2017

Diluted Earnings per Share $3.27 $3.09 $3.65 $3.16

Restructuring Charges (a) ($0.03) $0.03 ($0.01) $(0.02)

Environmental and Litigation Matters (b) $0.02 $0.02 $0.04 $0.02

Pending Bayer Transaction Related Costs(c) $0.04 $0.04 $0.07 $0.22

Argentine-Related Tax Matters (e) ($0.23) $0.02 ($0.26) $0.04

Impact of Income Tax Legislation (f) $0.15 -- $0.15 --

Income from Discontinued Operations (d) -- ($0.01) ($0.01) ($0.03)

Diluted EPS from Ongoing Business $3.22 $3.19 $3.63 $3.39

Fiscal 2nd Quarter Fiscal First Half

$ Millions 2018 2017 2018 2017

Operating Expenses (GAAP) $1,070 $1,088 $2,140 $2,100

Restructuring Charges $1 $(23) $(3) $13 (a)

Environmental and Litigation Matters $(11) $(9) $(27) $(17) (b)

Pending Bayer Transaction Related Costs $(25) $(27) $(45) $(120) (c)

Ongoing Operating Expenses $1,035 $1,029 $2,065 $1,976

Reconciliation of Non-GAAP Financial Measures

19

Fiscal 2nd Quarter Fiscal First Half

$ Millions 2018 2017 2018 2017

Gross Profit (GAAP) $2,966 $2,952 $4,278 $4,211

Restructuring Charges $4 $6 $17 $7 (a)

Ongoing Gross Profit $2,970 $2,958 $4,295 $4,218

Fiscal 2nd Quarter Fiscal First Half

$ Millions 2017 2016 2017 2016

Net Income Attributable to Monsanto Co. (GAAP) $1,459 $1,368 $1,628 $1,397

Pretax Restructuring Charges $3 $29 $20 $(6) (a)

Pretax Environmental and Litigation Matters $11 $9 $27 $17 (b)

Pretax Pending Bayer Transaction Related Costs $25 $27 $45 $158 (c)

Income Tax Benefit (1) $(23) $(28) $(44) $(70)

Argentine-Related Tax Matters (2) $(105) $7 $(122) $17 (e)

Impact of Income Tax Legislation $66 - $66 - (f)

Income from Discontinued Operations $(2) $(3) $(3) $(13) (d)

Ongoing Net Income Attributable to Monsanto Co. $1,434 $1,409 $1,617 $1,500

RECONCILIATION OF ONGOING OPERATING EXPENSES RECONCILIATION OF ONGOING

GROSS PROFIT

RECONCILIATION OF ONGOING NET INCOME Attributable to Monsanto Company

See slide 20-21 at the end of the presentation for discussion of reconciling items. 1. Income tax impact of non-GAAP adjustments is the summation of the calculation of income tax (benefit) charge related to each non-GAAP non-income tax adjustment.

Income tax charge is calculated using the actual tax rate in effect during the period for the locality of the related non-GAAP adjustment. 2. Item includes a translation gain recorded in other income, net of $38 million for the three and six months ended Feb.

28, 2018 and a net reversal of previously recognized charges against tax expense of $67 million and $84 million, respectively, for the three and six months ended Feb. 28, 2018. Item includes a translation loss recorded in other income, net of $7 million

and an immaterial net reversal of previously recognized charges against tax expense for the three months ended Feb. 28, 2017, and it resulted in a translation gain recorded in other income, net of $11 million and a net charge against tax expense of $28

million for the six months ended Feb. 28, 2017.

Reconciliation of Non-GAAP Financial Measures

20

DEFINITION OF ONGOING ADJUSTMENTS

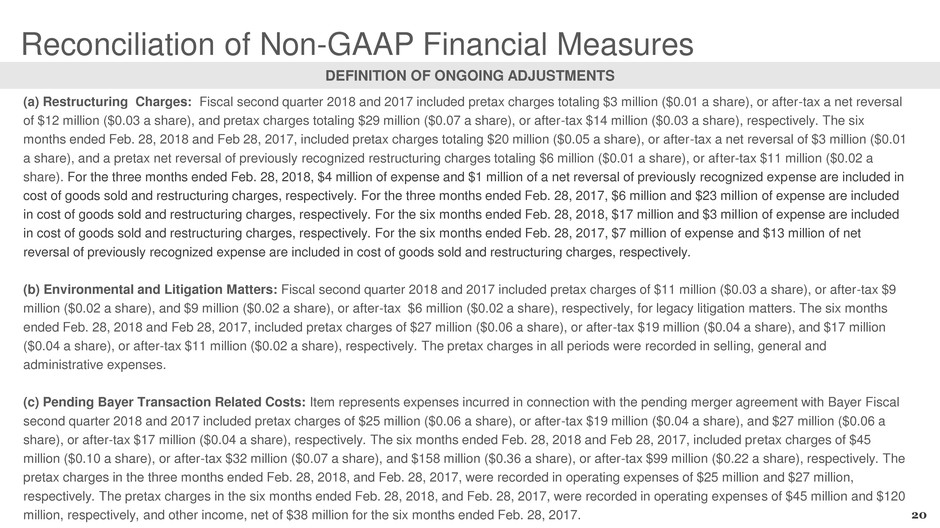

(a) Restructuring Charges: Fiscal second quarter 2018 and 2017 included pretax charges totaling $3 million ($0.01 a share), or after-tax a net reversal

of $12 million ($0.03 a share), and pretax charges totaling $29 million ($0.07 a share), or after-tax $14 million ($0.03 a share), respectively. The six

months ended Feb. 28, 2018 and Feb 28, 2017, included pretax charges totaling $20 million ($0.05 a share), or after-tax a net reversal of $3 million ($0.01

a share), and a pretax net reversal of previously recognized restructuring charges totaling $6 million ($0.01 a share), or after-tax $11 million ($0.02 a

share). For the three months ended Feb. 28, 2018, $4 million of expense and $1 million of a net reversal of previously recognized expense are included in

cost of goods sold and restructuring charges, respectively. For the three months ended Feb. 28, 2017, $6 million and $23 million of expense are included

in cost of goods sold and restructuring charges, respectively. For the six months ended Feb. 28, 2018, $17 million and $3 million of expense are included

in cost of goods sold and restructuring charges, respectively. For the six months ended Feb. 28, 2017, $7 million of expense and $13 million of net

reversal of previously recognized expense are included in cost of goods sold and restructuring charges, respectively.

(b) Environmental and Litigation Matters: Fiscal second quarter 2018 and 2017 included pretax charges of $11 million ($0.03 a share), or after-tax $9

million ($0.02 a share), and $9 million ($0.02 a share), or after-tax $6 million ($0.02 a share), respectively, for legacy litigation matters. The six months

ended Feb. 28, 2018 and Feb 28, 2017, included pretax charges of $27 million ($0.06 a share), or after-tax $19 million ($0.04 a share), and $17 million

($0.04 a share), or after-tax $11 million ($0.02 a share), respectively. The pretax charges in all periods were recorded in selling, general and

administrative expenses.

(c) Pending Bayer Transaction Related Costs: Item represents expenses incurred in connection with the pending merger agreement with Bayer Fiscal

second quarter 2018 and 2017 included pretax charges of $25 million ($0.06 a share), or after-tax $19 million ($0.04 a share), and $27 million ($0.06 a

share), or after-tax $17 million ($0.04 a share), respectively. The six months ended Feb. 28, 2018 and Feb 28, 2017, included pretax charges of $45

million ($0.10 a share), or after-tax $32 million ($0.07 a share), and $158 million ($0.36 a share), or after-tax $99 million ($0.22 a share), respectively. The

pretax charges in the three months ended Feb. 28, 2018, and Feb. 28, 2017, were recorded in operating expenses of $25 million and $27 million,

respectively. The pretax charges in the six months ended Feb. 28, 2018, and Feb. 28, 2017, were recorded in operating expenses of $45 million and $120

million, respectively, and other income, net of $38 million for the six months ended Feb. 28, 2017.

Reconciliation of Non-GAAP Financial Measures

21

DEFINITION OF ONGOING ADJUSTMENTS

(d) Income from Discontinued Operations: The company reports annual earn-out payments received as a result of the 2008 divestment of the Dairy

Business as discontinued operations. The three months ended Feb. 28, 2018, and Feb. 28, 2017, included pretax income from discontinued operations of

$2 million (less than $0.01 a share), or after-tax $2 million (less than $0.01 a share), and $5 million ($0.01 a share), or after-tax $3 million ($0.01 a share),

respectively. The six months ended Feb. 28, 2018, and Feb. 28, 2017, included pretax income from discontinued operations of $4 million ($0.01 a share),

or after-tax $3 million ($0.01 a share), and $21 million ($0.05 a share), or after-tax $13 million ($0.03 a share), respectively.

(e) Argentine-Related Tax Matters: Due to losses generated in Argentina in recent years as well as recent uncertainties around the Argentina business,

the company evaluated the recoverability of various items on the Statement of Consolidated Financial Position related to the Argentina business and

determined an allowance against certain assets was necessary in the third quarter of fiscal year 2016. The three months ended Feb. 28, 2018, and Feb.

28, 2017, included a net reversal of charges related to Argentine-related tax matters of $105 million ($0.23 a share), and a net charge of $7 million ($0.02

a share), respectively. The six months ended Feb. 28, 2018, and Feb. 28, 2017, included a net reversal of charges related to Argentine-related tax matters

of $122 million ($0.26 a share), and a net charge of $17 million ($0.04 a share), respectively. This resulted in a translation gain recorded in other income,

net of $38 million and a net reversal of previously recognized charges against tax expense of $67 million for the three months ended Feb. 28, 2018; and it

resulted in a translation loss recorded in other income, net of $7 million and an immaterial net reversal of previously recognized charges against tax

expense for the three months ended Feb. 28, 2017. For the six months ended Feb. 28, 2018, it resulted in a translation gain recorded in other income, net

of $38 million and a net reversal of previously recognized charges against tax expense of $84 million. For the six months ended Feb. 28, 2017, it resulted

in a translation gain recorded in other income, net of $11 million and a net charge against tax expense of $28 million.

(f) Impact of Income Tax Legislation: The three and six months ended Feb. 28, 2018, include $66 million of charges recorded within the income tax

provision line item from the impact of new income tax legislation in various countries in which Monsanto operates.