Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Celebiddy, Inc. | f10k2017ex32-2_celebiddyinc.htm |

| EX-32.1 - CERTIFICATION - Celebiddy, Inc. | f10k2017ex32-1_celebiddyinc.htm |

| EX-31.2 - CERTIFICATION - Celebiddy, Inc. | f10k2017ex31-2_celebiddyinc.htm |

| EX-31.1 - CERTIFICATION - Celebiddy, Inc. | f10k2017ex31-1_celebiddyinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-55679

Celebiddy, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 81-3425396 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) | |

18 Narbonne Newport Beach, California |

92660 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (626) 644-0070

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common stock, par value $0.0001 per share.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No ☐

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the bid and asked price of such common equity, as of June 30, 2017 was approximately $0.00, as no trading market has developed for the registrant’s common equity.

As of April 5, 2018, the registrant had 21,300,000 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

CELEBIDDY, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

i

Use of Certain Defined Terms

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company”, “the Company” or “Celebiddy” are to the business of Celebiddy, Inc.

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved, and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

ii

| ITEM 1. | BUSINESS |

Business Overview

Celebiddy Inc. (referred to as “the Company,” or “Celebiddy”), a Delaware corporation, is a corporation formed for purpose of managing and operating Date Kickstarter, an online-dating management subscription service. Date Kickstarter is a web and mobile dating application service designed to help online dating platform users to generate higher frequency authentic responses from other users on existing respective dating platforms. The Company’s mission is to improve the online dating experience by effectively managing online dating users’ dating profiles to facilitate higher response rates with other users. To fulfill its mission, the Company has acquired and obtained all rights and sole ownership in and to the DateKickstarter Afterburner Dating System, a match-making software (the “Technology”). The Technology shall function in combination with manual service of DateKickstarter dating assistants, to be employed or contracted as the Company develops and user base expands and utilizing this combination of human evaluation and program-based matchmaking software, the Company shall streamline and expedite user-to-user outbound first messages, thereby producing a set number of responses, based on robust search criteria. Date Kickstarter will be operational on most popular dating sites, such as Tinder, Match.com, E-Harmony.com, OKCupid, PlentyOfFish and has already initiated a soft launch of its services, which occurred on February 1, 2018. After an initial six-month trial period, the Company shall test its application and improve upon functionality based on user feedback. The Company subsequently shall initiate full launch, deploying a targeted marketing campaign to attract users on a wide scale.

Our Corporate History and Background

The Company was incorporated in the State of Delaware on July 22, 2016 and was formerly known as Sparrow Street Acquisition Corporation. In August 2016, Sparrow Street Acquisition Corporation filed a registration statement with the Securities and Exchange Commission on Form 10 by which it became a public reporting company.

In April 2017, the Company implemented a change of control by redeeming shares of existing shareholders, issuing shares to new shareholders, electing new officers and directors and accepting the resignations of its then existing officers and directors. In connection with the change of control, the shareholders of the Company and its board of directors unanimously approved the change of the Company’s name from Sparrow Street Acquisition Corporation to Celebiddy, Inc.

On August 25, 2017, the Company entered into a Copyright License Agreement (the “Copyright License”) pursuant to which software developer Adam Watson (“Licensor”) licensed exclusively to the Company all of Licensor’s copyrights, use and exploitation rights of and relating to Licensor’s proprietary Afterburner online/mobile dating software application, or the Technology, including resale rights and rights in and to any and all associated media. Date Kickstarter will utilize the Afterburner Dating System to deliver date management services to the Company’s user base.

On November 1, 2017, the Company appointed one John Malek to serve as Vice President of the Company and to perform such duties and task as designated by the Board of Directors or President of the Company. Mr. Malek is a shareholder of the Company and is the son to Mary Malek, the sole officer and director and majority shareholder of the Company. John Malek is the founder and CFO of DripTrive Inc., a European market company. Mr. Malek completed the Business Management/Marketing/Finance boot camp and has developed talents in business marketing and optimization, as well as forecasting and implementing strategic business growth. Mr. Malek also created, developed and implemented the DateKickstarter project. Mr. Malek is also currently developing innovative crypto-technologies in the digital currency and block-chain space.

Subsequent Events

On February 1, 2018, the Company entered into a Modification of the Copyright License Agreement (the “Modification Agreement”) pursuant to which, all rights that were previously licensed by Licensor to the Company were then purchased, such that all rights in and to the Technology became solely and exclusively owned by the Company.

| 1 |

In exchange and in consideration for the rights granted pursuant to the Modification Agreement, the Company agreed to remunerate Licensor as follows:

| 1. | Payment of $5,000 (five thousand dollars) as total cash consideration for purchase of the Technology and all aforementioned associated rights thereto; and | |

| 2. | Payment of a monthly commission equal to 10% (ten percent) of the Company’s monthly net profit (if any) (“Seller’s Commission”), first payment which was to be due February 1, 2018 and further payments to endure indefinitely so long as the Company remains in existence and in good standing, unless mutually terminated by the Parties. |

On the same date, the Company initiated a soft launch of its Date Kickstarter services. The Company is currently assessing user feedback and modifying its program, as needed, to resolve bugs and other technical issues, as they are discovered.

On February 22, 2018, the Company and Halcyon Innovation, LLC (“Consultant”) entered into a Consulting Services Agreement (the “Consulting Agreement”) pursuant to which Consultant, which is in the business of providing customized technology solutions, was engaged to implement a decentralized block-chain based profile storage solution (the “Development Work”) for the Company’s website, http://datekickstarter.com (the “Website”).

In exchange and in consideration for the services to be provided pursuant to the Consulting Agreement, the Company agreed to remunerate Consultant as follows:

| 1. | Payment of $10,000 (ten thousand dollars) as total cash consideration due for the Development Work, to be paid in installments. The first installment of $3,500 (three thousand and five hundred dollars) shall be paid by the Company upon order; the second installment of $3,500 (three thousand and five hundred dollars) to be paid upon delivery of an Alpha of the Development Work, and final installment of $3,000 (three thousand dollars) shall be paid by the Company upon completion of the Development Work; and |

| 2. | If any additional services are required beyond those included in the Development Work, the Company agreed to pay pursuant to the Agreement an hourly rate, provided as $50 (fifty dollars) per hour for development work and $75 (seventy-five dollars) per hour for graphic design. |

Business Plan

The basic premise of the Company is to enable online dating platform users to outsource the management of their online dating profiles to the Company in order to sufficiently increase authentic responses from other users on respective dating platforms such as OKCupid, Match.Com or other web and mobile dating websites and/or mobile applications. The Company, through its website domain www.datekickstarter.com (“Date Kickstarter” or the “Website”) will then launch a dating “campaign” based on the type of subscription selected by the user. Upon selection, the user will be rewarded with higher frequency match responses than they were likely to achieve without use of the Company’s targeted search software. The Company will charge a monthly subscription fee of $19.99 per month that shall correspond to the user’s desired number of messages sent on behalf of the user which is 3000 messages/month for Tinder users and 1000 messages/month for all other Dating Platforms users.

User payments shall be processed and recur on a month-to-month basis, and users may cancel the service at any time. Date Kickstarter will be operational on most popular dating sites, such as Tinder, Match.com, E-Harmony.com, OKCupid, PlentyOfFish and Badoo and has already initiated a soft launch of its services, which occurred on February 1, 2018. After an initial six-month trial period whereby, the Company shall test its application and improve upon functionality based on user feedback. The Company subsequently shall initiate full launch, deploying a targeted marketing campaign to attract users on a wide scale.

| 2 |

Our Strategy

As of the date of this Report, Mary Malek, the Company’s founder and Chief Executive Officer, has invested $90,000 (Ninety Thousand Dollars) to fund development of the Company’s website, implement into the website data-control block-chain technology, and to acquire all rights in and to the Afterburner Dating System matchmaking software (ie the “Technology”).

With respect to the website build, in June 2017, pursuant to a master service agreement (the “MSA”), Celebiddy engaged Giraffe Builder (“GB”), an eSolutions provider, to provide the following services and build-out (altogether referred to here-as the “Web Development”) for the benefit of the Company:

| ● | Desktop and Mobile Responsive Custom Theme-Based e-commerce / subscription model Website; | |

| ● | 5 Dating Platforms affiliates URL Links – Redirect to sign up pages of external dating site; | |

| ● | Upsell Sales Feature – within the shopping cart for Add-on options; | |

| ● | Location Search with filter city / state, age, gender of user; | |

| ● | Custom Site Design; | |

| ● | Custom Development on Framework; | |

| ● | Copy content and logo as provided by the Company; | |

| ● | Social media integration; and | |

| ● | Merchant Account Payment Gateway and SSL Certificate Integration |

The Web Development includes integrated solutions for iPhone and Android mobile device platforms, including optimal graphic design, user-friendly digital architecture and programming, and build-out was completed in July 2017. With the completion of the Web Development and subsequent integration of the Afterburner Dating System and block-chain data-control technologies, the Company has already initiated a soft launch of its services, which occurred on February 1, 2018. Soft launch is expected to run for six months and to continue until full launch, estimated for June 1, 2018. To fulfill its launch goals, the Company and has engaged a team of developers, coders, wire-framers, influencer recruiters, graphic designers, and web developers to optimize and refine its product and to build out a full service digital marketplace application prior to launch.

The Afterburner Dating System

Instrumental to effective launch was the acquisition, and thereafter the successful implementation of the Afterburner Dating System technology into the Date Kickstarter website and development. The Technology, created by software developer Mr. Adam Watson, was designed to facilitate dating “matches” for mobile and online-dating users by streamlining and expediting user-to-user manual outbound first messages, thereby producing a set number of responses, based on robust search criteria, when users elect to use our service.

The Company acquired exclusive rights in and to the Technology on February 1, 2018. In return for rights granted, the Company paid to the software’s developer a purchase price of $5,000, and the Company also consented to pay Mr. Watson a monthly commission equal to 10% (ten percent) of the Company’s monthly net profit (if any), to endure indefinitely so long as Company is in existence and good standing, barring any subsequent mutual rescission.

| 3 |

Block-chain Technology

The Company places a supreme value on protection of its users’ data, account details and other privately stored information. To maximize effectiveness of the protection of its users’ data, the Company shall implement a decentralized block-chain based profile storage solution (the “Development Work”) for the Website. The Development Work is intended to encrypt user data, including passwords, profile and other personal information stored on the Company’s website. To Implement the Development Work, on February 22, 2018 the Company engaged Halcyon Innovation, LLC (“Halcyon”), a company which is in the business of providing customized technology solutions, to craft, design and integrate the block-chain technology into the Website. In consideration for these services, the Company agreed to remit a purchase price of $10,000 (ten thousand dollars) as total cash consideration due for the Development Work, to be paid in installments. The first installment of $3,500 (three thousand and five hundred dollars) was paid by the Company upon order; the second installment of $3,500 (three thousand and five hundred dollars) is to be paid upon delivery of an Alpha of the Development Work, and final installment of $3,000 (three thousand dollars) shall be paid by the Company upon completion of the Development Work.

The Company anticipates completion of the Alpha on April 15, 2018 and final installment should be complete by no later than June 1, 2018.

Operations

Upon launch, Online Dating Platform users will visit the Company’s Date Kickstarter website and watch a video tutorial which explains the functionality and utility of the Company’s Management Service. Upon subscription, users will then create personal profiles where they enter personal information, search criteria for desired matches along with their dating platforms login credentials they are currently members of (e.g. Match.com, Tinder, OKCupid, etc.). Users will then be required to accept a disclaimer enabling the Company to manage their various online dating accounts. The Company’s Terms and Conditions also shall apply and must be accepted by each User prior to subscription.

To subscribe, users simply have to choose a package with the number of authentic messages they wish to purchase. Users will be required to provide payment information for a monthly subscription based on the particular selections of the user. Once payment is accepted, the Company will initiate the user’s dating campaign, where the Management Service will target dating matches based on the user’s selected search criteria. The campaign will take 3-30 days to fulfill a user’s selected package. Once the target number of messages has been sent, notification emails are sent to users to advise them of such.

Date Kickstarter is intended to initially service the following dating platforms: Match.com, E-harmony.com, Tinder, Plenty of Fish, OKCupid, and Badoo. In the future, the Company intends to service additional dating platforms. Search criteria shall consist of age, gender and location, to be provided by the user. The Company’s response-generating in-house software is partially automated and involves minimal manual labor. The Company will operate its business virtually to minimize costs.

Market Assessment

The Market

The dating services industry has grown rapidly since 2010. According to IBISWorld, the industry is projected to reach $2.7BN in revenue in 2017, with the majority of sales being generated from online and mobile dating platforms. IBISWorld projects that revenue for the Dating Services industry will grow at an annualized rate of 5.7% over the next five years and will reach an estimated $3.5 billion by 2022. This figure includes an estimated 7.8% growth in 2018 alone.

Market Needs

While there has been a robust growth of online and mobile dating, male users typically struggle to generate a response from female users. In a study performed by Evan Marc Katz, a famous dating author and recognized dating coach by CNN, Wall Street and other journals covering online dating, it was concluded that on average women who utilize online dating platforms receive 20 times more messages than men who utilize the same platforms. At the current response rate for even the most popular man, it would take 2.3 years to fill up his inbox, compared to 2 months and 13 days for a popular woman. Bearing these statistics in mind, the Company is confident that its Management Service will satisfy a tremendous need to help male users generate responses from female users that many are currently seeking through frequent use of online dating platforms but failing to realize. Currently, as indicated by Katz’s study, most professional men do not have the have time nor dedication to pursue the number of female users necessary to get match with a target date.

| 4 |

To demonstrate the need for the target market, Mr. Katz conducted an experiment where 10 fake OKCupid profiles were generated with similar sounding usernames, with the same written profile, personal stats, and levels of education. The only difference between the accounts was that each profile had a different photo of a man or woman of varying attractiveness. The intent of the experiment was to test frequency of response based on gender. The results of the experiment produced the following results:

| ● | The women as a group received over 20 times more messages than the men; | |

| ● | The two most attractive women received 83% of all messages; | |

| ● | The two most attractive women probably would have received several thousand more if their inboxes hadn’t reached maximum capacity; | |

| ● | It took 2 months and 13 days for the most popular woman’s inbox to fill up; | |

| ● | At the current rate, it would take the most popular man 2.3 years to fill up his inbox contrasted with the women. |

Marketing Plan

The Company will invest significantly in famous social media stars with large number of followers (300,000+) to endorse Date Kickstarter and develop engaging social media campaigns to educate its target market on the Company’s value proposition. Given the innovative nature of Date Kickstarter and its proprietary Management Service, the Company anticipated that the service will gain significant traction and increased exposure through utilization of public relations outreach.

Marketing for the Company will be executed through a variety of channels including the internet, social media, high profile social media influencers and ultimately word of mouth. Word of mouth will round out the marketing model and has the potential of providing the most marketing push, as it will allow the organization to deliver an authentic, trusted marketing message.

Social Media: The Company will allocate a large portion of its annual marketing budget to generate brand awareness and manage its brand on social media sites, such as Facebook and Instagram. A strong presence on these other social media sites will strengthen interest in the Company and further drive growth. Media coverage will increase the Company’s credibility and recognition from the Company’s target market.

Influencer Marketing: The Company will engage with high profile social media influencers to endorse the Company’s services online and promote company sales. The right endorsements are ones that appeal to the male customer base. The Company currently has a number of influencers interested in this market who can be retained on a fee basis.

Press Releases: Press releases will alert all relevant online and traditional media channels to the Company’s offerings, business updates, and other newsworthy items. Media coverage will increase the Company’s credibility without costing the Company much money. Given the large need for men to attract additional attention on the various dating platforms, the Company’s services are expected to be very newsworthy.

SEO Optimization and Sponsored in-app Ads: The Company will utilize its User-friendly web application to increase search engine ranks and accommodate pay for sponsored ads to generate traffic and subscriptions.

Potential Revenue

The Company’s primary source of revenue will be generated from subscription proceeds. Pricing will vary based on the Management Service package selected by the user. The pricing matrix below represents an anticipated initial roll-out of the Company’s subscription packages:

| Packages | ||||||||||||||||

| Number of Responses | 25 | 50 | 125 | 250 | ||||||||||||

| Pricing / per Month/per package | $ | 9.99 | $ | 19.99 | $ | 39.99 | $ | 79.99 | ||||||||

| Percent expectAncy | 50 | % | 15 | % | 10 | % | 25 | % | ||||||||

| 5 |

The below are the expected user assumptions that pertain to the Company’s business model and potential revenue projections:

| Assumptions | Metrics | |||

| Average Number of Platforms / user | 1.5 | |||

| Average Usage (Months) | 3 | |||

| Average Expenditure / User | $ | 143.96 | ||

The Dating Services Industry

According to IBISWorld, The Dating Services industry has grown exponentially over the past five years as an increasing number of consumers have turned to the internet looking for love. The greater legitimacy surrounding online dating has helped the industry outpace the overall economy, as indicated by the following growth figures:

IBISWorld notes that the Dating Services industry has experienced strong growth over the past five years. The advent of online dating has significantly changed the industry landscape and the majority of industry revenue is now generated through online dating services. The rising number of broadband connections and the declining stigma of online dating have fueled industry demand during the period. Overall, the industry grew 5.3% to $2.7 billion over the five years to 2017. Bolstered by improving economic conditions, revenue is projected to rise 5.4% in 2017 alone.

Market Outlook

According to IBISWorld, the industry is projected to reach $2.7BN in revenue in 2017, with the majority of sales being generated from online and mobile dating platforms. IBISWorld projects (in a 2017 article/website/etc.) that revenue for the Dating Services industry will grow at an annualized rate of 5.7% over the next five years and will reach an estimated $3.5 billion by 2022. This figure includes an estimated 7.8% growth in 2018 alone.

Market Trends

In addition to the introduction of mobile applications, IBISWorld determined that industry operators have been investing in software development to attract users based on better match-making and functionality than operator competitors. Online providers of dating services are increasingly investing in the development of algorithms and computer engines that can capably read user data. These Algorithms allow computers to read user behavior, such as the profiles they view, the messages they send and the hours they use services, to recommend better matches. For instance, viewing a profile may register as light interest, while sending a message will register as high interest. Providers can then better understand the type of partner a user is interested in and make recommendations based on past activity.

| 6 |

Market Segmentation

The Company intends to collaborate work and lend its services to both online dating sites and Mobile dating applications. Currently, the Company’s proprietary application will support a limited number of platforms, but as the Company grows the application will develop to accommodate more platforms.

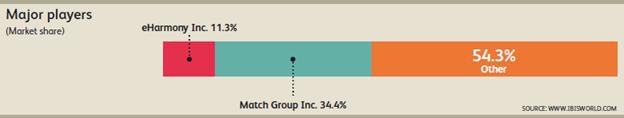

The following represents dating website industry leaders as of 2017 according to Ibisworld.com, who the Company intends to lend its services to:

| Company | Market Share | Description | ||

Match Group Inc. (owns Plenty of Fish and OkCupid) |

34.4% | Originally incorporated under InterActiveCorp (IAC), Match Group Inc. spun off from IAC in November 2015 through a $460.0 million initial public offering. Match Group comprises over 45 brands, the majority of which are used to find a romantic connection. The company offers dating products in 38 languages across more than 190 countries. In previous years, the Match Group has expanded by added OKCupid to its growing list of websites. OKCupid is an advertiser=supported site with an estimated 3.8 million active users, making it one of the largest free dating websites. The acquisition was particularly useful because OKCupid targets a younger consumer base, mainly individuals in their mid-twenties. In October 2015, the company finalized the purchase of Plentyoffish Media for $575.0 million in cash. Headquartered in Vancouver, Canada, the company boasts 90 million registered users and 3.6 million active daily users. Services are free to members, though there are upgrades to-paid memberships available. These monthly subscription fees are still relatively inexpensive compared with many other dating sites. | ||

| eHarmony inc | 11.3% | The company is situated in the higher end dating market; its services cost almost twice as much as competitors like Match.com. The company justifies its high price tag because it intends to provide serious relationships, as reflected in its recent initiative to sell annual memberships rather than monthly. | ||

| Other Companies | <1% | The number of companies operating in this industry is estimated to total 4,642 operators in 2017. The majority of these are non-employers that operate with a market share of less than 1.0%. The industry includes a variety of operators, including companies that provide online dating, singles events, personals advertisements, speed dating and offline matchmaking, among others. The vast majority of these enterprises are small matchmakers that generate a minute proportion of total industry revenue. |

The Company anticipates that its primary customer base will be comprised of men, ages 18 to 49. Men have the largest need for this software as this segment is expected to reach out to women and women in return can choose to respond or not. Men in this age range are also in their professional careers and/or advanced schooling; as such, they have limited time at their disposal to reach out to the number of women required to merit a response.

| 7 |

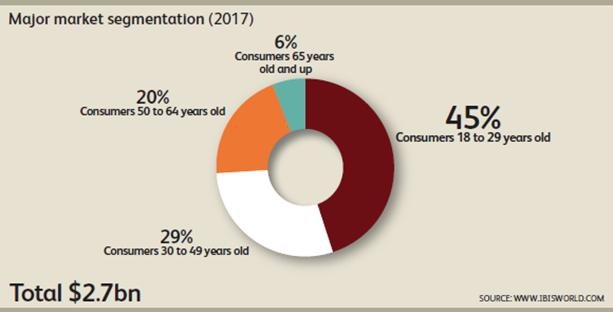

Consumer data of adults who use dating services is given below, as provided by IBISWorld:

Consumers aged 18 to 29

Consumers aged 18 to 29 years old account for the majority of industry revenue, at an estimated 45.0%. According to the US Census Bureau’s America’s Families and Living Arrangements 2013, 86.3% of individuals between 20 and 24 have never been married. Additionally, users in this age category are the most likely to own smartphones and use all the technology available to them, such as applications focused on online dating. These individuals have the highest internet usage rates and are also more likely to use more casual dating services, which are aimed at mobile devices, compared with their older counterparts. Over the past five years, consumers aged 18 to 29 have grown as a proportion of revenue. The average marriage age has continued to climb over the past decade as more individuals date and hold off before getting married.

Consumers aged 30 to 49 years old

Consumers aged 30 to 49 years old account for 29.0% of revenue, collectively. Consumers aged 35 to 49 accounts for over one-quarter of total revenue and individuals in this segment are more likely to be looking for serious relationships and, therefore, use dating sites such as Match and eHarmony. There are fewer individuals in this age category that have never been married; however, more individuals are likely to have been divorced. Over the past five years, consumers aged 30 to 49 have declined slightly as a proportion of revenue, though this has only been because of the rising number of young individuals using dating services. The segment continues to grow in absolute terms and be a key driver of revenue for industry operators.

Online dating

Dating websites, free and subscription based, comprise the largest segment in the industry. Some of the more popular websites are Match.com, eHarmony, Tinder, OKCupid, Chemistry.com, and Plenty of Fish. Subscription-based websites like Match.com and eHarmony typically charge between $30 and $60 per month to its users. Free dating websites like OKCupid garner the majority of their revenue through advertising, although these sites typically also offer premium membership options. This service segment is the largest contributor to industry revenue and is estimated to account for 49.0% of revenue. The price of subscription-based websites has increased during the past five years, supporting revenue growth for the industry. Demand for this segment has grown in the five-year period, as online dating has become more socially acceptable among consumers.

| 8 |

Mobile dating

Mobile dating represents the fastest growing segment for industry operators. Typically, mobile dating exists as an extension of online dating; therefore, revenue for this segment represents income earned in online dating through advertising viewed or subscriptions activated through mobile internet connections. In addition to online dating sites that offer smartphone applications, a number of new companies have entered the industry with mobile-only applications. This includes companies such as Tinder, who have capitalized on additional mobile functionality and smartphone penetration. This has become exceptionally popular, as users with GPS functionality on their cell phones are able to search for dates within their immediate vicinity. Smartphones allow users a more casual experience, which has helped reduce the stigma associated with online dating. Additionally, mobile dating allows individuals to message rapidly without having to return to a computer and access their profile. Therefore, this segment is expected to continue to see strong growth over the next five years as smartphone penetration rises. Overall, this segment is estimated to account for 26.0% of total industry revenue.

Competition

The Company is keenly aware that it must consistently analyze the local competitive landscape to accelerate its position in the marketplace. As the Company builds its position and competitive advantages, it will continue to execute a marketing plan that highlights the benefits of its services. Any business that operates with a similar model serves as a direct or indirect competitor. The identified competitors are described below:

| ● | Headquarters: New York New York | |

| ● | Target Market: Online Dating Concierge for men | |

| ● | Website: http://personaldatingassistants.com |

This Company offers the following services:

| ● | Manages users’ online dating profiles; | |

| ● | Sends out laser targeted, personalized introductions on the user’s behalf; | |

| ● | Generates profile views, resulting in more interest, matches, and inbound messages; and | |

| ● | Facilitates live dating for benefit of its users |

Virtual Dating Assistants

| ● | Headquarters: Atlanta | |

| ● | Target Market: Full Service Dating Coaching | |

| ● | Website: http://personaldatingassistants.com |

This Company operates for the following platforms:

| ● | Jdate | |

| ● | Tinder | |

| ● | Chritian Mingle | |

| ● | eHarmony | |

| ● | POF | |

| ● | OKCupid | |

| ● | Match.com | |

| ● | MillionaireMatch |

| 9 |

Profile Polish

| ● | Headquarters: New, York, New York | |

| ● | Target Market: Mass Marketing Dating Assistance Services | |

| ● | Website: http://www.profilepolish.com |

Profile Polish, founded in 2013, specializes in improving user profiles, photos and content writing. The company offers online dating profile makeovers including ghostwriting, photo editing, and tip services for OkCupid, Match.com, and Tinder platforms. Profile Polish will ask its users a set of questions and works with all genders, races and sexual orientations. Profile Polish charges approximately $149 to $397 for its monthly subscriptions.

Description of Property

The Company owns no real estate. Its corporate office, through lease by the owner, is located at 18 Narbonne, Newport Beach, CA 92660.

Employees

Currently the Company has no employees other than its executive officers and directors who devote approximately 90% of their time to the business of the Company.

Government Regulation

The Company’s business is subject to government regulation in the jurisdictions in which it operates, and its software, which it intends to make available worldwide, may be subject to laws regulating the Internet even in jurisdictions where the Company does not do business. Celebiddy may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply.

Revenues from the Company’s digital products and/or services could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to online privacy and the collection and use of consumer data in digital media. In addition, any failure, or perceived failure, by the Company to comply with its posted privacy policies or with any data-related requirements could result in claims against it by governmental entities or others, or could require the Company to change its practices, which could adversely affect its business.

Intellectual Property

At present, the Company does not possess any intellectual property protection, except those rights of and relating to the Technology, obtained upon acquisition of the Technology, and trademark protection for the “Date Kickstarter” brand. The Company may decide in the future to pursue efforts to further protect its intellectual property, trade secrets and proprietary methods and processes.

| ITEM 1A. | RISK FACTORS |

The following risk factors could materially affect our business, financial condition, and results of operations. These risk factors and other information in this Annual Report should be carefully considered in evaluating our business. They are provided for investors as permitted by the Private Securities Litigation Reform Act of 1995. It is not possible to identify or predict all such factors and, therefore, the following should not be considered to be a complete statement of all the uncertainties we face.

The Company has no independent operating history and as such an investor cannot assess its profitability or performance but must rely on the experience of its president and other officers.

The Company is a development stage company and has no operating history and it is therefore not possible for an investor to assess prior performance or determine whether it will likely meet its projected business plan. Such lack of experience may result in the Company experiencing difficulty in adequately attracting users or effectively managing user growth, thereby causing the Company to function improperly or provide inadequate utility for which it is intended. If the Company’s Technology cannot be completed or consistently functions improperly or performs below expectations, the Company will likely be unable to meet and sustain its intended growth projections. An investor will be required to make an investment decision based solely on the management’s history and its projected operations in light of the risks, expenses and uncertainties that may be encountered by engaging in the digital and mobile date management application business.

| 10 |

The Company’s independent auditors have issued a report questioning the Company’s ability to continue as a going concern.

In their audited financial report, the Company’s independent auditors have issued added an explanatory paragraph that unless the Company is able to generate sufficient cash flows from operations and/or obtain additional financing, there is a substantial doubt as to its ability to continue as a going concern. The Company anticipates that it would need substantial capital over the next 12 months to continue as a going concern to expand its operations in accordance with its current business plan.

The Company has an accumulated deficit of $38,016 as of December 31, 2017.

As of December 31, 2017, the Company has an accumulated deficit of $38,016. This deficit may impact on the Company in various ways including, but not limited to, making it more difficult to borrow money, sell stock or to maintain a good market price.

The offering price of the Shares has been arbitrarily determined and such price should not be used by an investor as an indicator of the fair market value of the Shares.

Currently there is no public market for the Company’s common stock. The offering price for the Shares has been arbitrarily determined and does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. Thus, an investor should be aware that the offering price does not reflect the fair market price of the Shares.

Reliance on Management

Management will participate in all decisions with respect to the management of the Company, including (without limitation) determining business strategy, operations, and development. In the event of the dissolution, death, retirement or other incapacity of the Management, the business and operations of the Company may be adversely affected.

The Company’s CEO controls a majority of the outstanding stock.

The CEO of the Company currently beneficially owns more than a majority of the Company’s outstanding common stock. As such, she controls most matters requiring approval by stockholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s common stock or prevent stockholders from realizing a premium over the market price for their Shares. Ms. Maria Malek will retain substantial control over matters requiring approval, such as (without limitation) the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control.

The Company may not be able to successfully manage its growth, which could lead to an inability to implement its business plan.

The Company’s growth is expected to place a significant strain on its managerial, operational and financial resources, especially considering that the Company currently only has a small number of executive officers, employees and advisors. Further, as the Company’s business grows, it may be required to manage multiple relationships with various consultants, businesses and other third parties. There can be no assurance that the Company’s systems, procedures and/or controls will be adequate to support its operations or that the Company’s management will be able to achieve the rapid execution necessary to successfully implement its business plan. If the Company is unable to manage its growth effectively, the Company’s business, results of operations and financial condition will be adversely affected.

The Company can give no assurance of success or profitability to its investors.

There is no assurance that the will ever operate profitably. There is no assurance that the Company will generate revenues or profits, or that the price of its common stock will be increased thereby.

| 11 |

Global and national financial events may have an impact on the Company’s business and financial condition in ways that the Company currently cannot predict.

A credit crisis, turmoil in the global or U.S. financial system, recession or similar possible events in the future could negatively impact the Company. A financial crisis or recession may limit the Company’s ability to raise capital through credit and equity markets. The prices for the products and services that the Company intends to provide may be affected by a number of factors, and it is unknown how these factors may be impacted by a global or national financial event.

Little Experience in Being a Public Company

The Company is an early-stage company and as such has little experience in managing a public company. Such lack of experience may result in the Company experiencing difficulty in adequately operating and growing its business. Further, the Company may be hampered by lack of experience in addressing the issues and considerations which are common to growing companies. If the Company’s operating or management abilities consistently perform below expectations, the Company’s business is unlikely to thrive.

The Company is an early-stage company with no developed finance and accounting organization and the rigorous demands of being a public company require a structured and developed finance and accounting group. As a reporting company, the Company is already subject to the reporting requirements of the Securities Exchange Act of 1934. However, the requirements of these laws and the rules and regulations promulgated thereunder entail significant accounting, legal and financial compliance costs which may be prohibitive to the Company as it develops its business plan, services and scope. These costs have made, and will continue to make, some activities more difficult, time consuming or costly and may place significant strain on its personnel, systems and resources.

The Securities Exchange Act requires, among other things, that companies maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain the requisite disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight are required. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on the development of the Company’s business, financial condition and results of operations.

These rules and regulations may also make it difficult and expensive for the Company to obtain director and officer liability insurance. If the Company is unable to obtain adequate director and officer insurance, its ability to recruit and retain qualified officers and directors, especially those directors who may be deemed independent, will be significantly curtailed.

The Company will depend upon management, but it may have limited participation of management.

The Company’s directors, Ms. Mary Malek and Mr. John Malek, also act as the Company’s sole officers. As such the Company will be heavily dependent upon Ms. Malek and Mr. Malek’s skills, talents, and abilities to implement the Company’s business plan, and may, from time to time, find that the inability of either Ms. Malek or Mr. Malek to devote their full-time attention to the business may result in a delay in progress toward implementing the Company’s business plan.

Ms. Malek, Mr. Malek, or other directors and officers whom may be nominated to the Company’s board of directors in the future, are, or may become, in their individual capacities, officers, directors, controlling shareholder and/or partners of other entities engaged in a variety of businesses. Thus, the Company’s current and/or future officers and directors may have or develop potential conflicts including their time and efforts involved in participation with other business entities. Celebiddy’s officers and directors may engage in business activities outside of its business but the amount of time they devote as officers and directors to Celebiddy will be the amount they feel is necessary in their discretion to properly manage the business. (See “Directors and Executive Officers.”) Because investors will not be able to manage the business, they should critically assess all of the information concerning the Company’s officers and directors.

| 12 |

Ms. Malek is currently the President of New Life Treatment Center, a drug and alcohol rehabilitation center in Orange County (the “Treatment Center”). While Ms. Malek is devoted to the Company, certain amount of time will still be allocated to the Treatment Center, unless or until she resigns or otherwise departs from her position at the Treatment Center. As such, Ms. Malek expects to dedicate at a maximum 30 hours per week to the business of the Company.

Mr. Malek is the founder and CFO of DripTrive Inc., a European market company and is currently developing crypto-technologies. While Mr. Malek is devoted to the Company, certain amount of time will be allocated to ongoing developments of the crypto-technologies. As such, Mr. Malek expects to dedicate at a maximum 50 hours per week to the business of the Company.

The Company’s officers and directors may have conflicts of interests as to corporate opportunities which the Company may not be able or allowed to participate in.

Presently there is no requirement contained in the Company’s Certificate of Incorporation, Bylaws, or minutes which requires officers and directors of the Company to disclose business opportunities which come to their attention. Celebiddy’s current and future officers and directors do, however, have a fiduciary duty of loyalty to the Company to disclose any business opportunities which come to their attention, in their capacity as an officer and/or director or otherwise. Excluded from this duty would be opportunities in the business which the person learns about through her involvement as an officer and director of another company.

We have agreed to indemnification of officers and directors as provided by California Statute.

The General Corporation Law of Delaware and the California Corporations Code provides for the indemnification of its directors, officers, employees and/or agents, under certain circumstances. Indemnification requirements set forth by law, in the Company Bylaws or pursuant to Company policies may result in substantial expenditures by the Company that it may be unable to recoup.

The Company will have to compete with an already established and ever-evolving market.

The Company competes in a highly competitive market with numerous other developers and suppliers of matchmaking services. These services create competition in a number of ways, including competing for the attention of prospective customers. The barriers to entry for new competitors wishing to target our market sector are not prohibitive. Competition from other online dating service companies may be significant and may impact upon the Shares and our potential for profitability. The Company’s financial performance or operating margins could be adversely affected if the actions of competitors or potential competitors become more effective, or if new competitors enter the market and we are unable to counter these actions. The Company is also susceptible to being overtaken in the market if other more established and larger organizations aggressively expand and integrate new technologies.

The Company will rely heavily rely upon cost-efficient marketing strategies to organically grow its subscription-base, which may prove to be unsuccessful.

In early stages of development, the Company intends to keep marketing costs low, relying upon word-of-mouth to generate and grow subscribers. It is possible however that the Company’s initiatives to market its offerings according to the prescribed strategy may fail, or may not produce the projected levels, which may have an adverse impact on the financial position and performance of the Company.

The Company is susceptible to changes in the cost and value of advertising.

Promotion and marketing of products and services, developed by the Company, is intrinsically linked to the cost, availability and value of on-line and mobile advertising. These parameters are variable, and also affected by the changes in costs and availability of space within the wider advertising economy. Changes in the advertising market, such as higher prices or lower availability may have a negative impact on the business.

| 13 |

The Company’s intellectual property protection may prove insufficient or the Company may not be able to adequately enforce the intellectual property it holds.

The Company has not patented any intellectual property, due to the difficulty in obtaining patents applying to technology and software development. At some point in time the Company may review this policy and seek patent protection if it is deemed appropriate. The Company will hold, as a matter of law, copyright protection to the programming code of its matchmaking software. The Company further intends to seek trademark protection in relevant jurisdictions as is considered appropriate for newly branded products and design. The success of the Company in the future may depend in some cases on the ability to enforce trademark and copyright protection as well as in maintaining and growing goodwill in the Company’s branded software and/or algorithms. There can be no unqualified assurance that the Company will be able to enforce any trademark protection, or copyright, or that such protection will be sufficient to protect the Company’s intellectual property.

The Company’s potential for maximizing profits may be impacted if they are unable, or if the contracting party is unwilling to waive the monthly commission associated with the Company’s acquisition of the Afterburner Dating System technology.

On February 1, 2018, the Company entered into a Modification of a Copyright License Agreement (the “Modification Agreement”) pursuant to which, the Company acquired exclusive rights in and to the Afterburner Dating System technology (the “Technology”), previously owned by software developer Mr. Adam Watson.

In exchange and in consideration for the rights granted pursuant to the Modification Agreement, in addition to a payment of $5,000 (five thousand dollars), the Company agreed to pay to Mr. Watson a monthly commission equal to 10% (ten percent) of the Company’s monthly net profit (if any) (“Seller’s Commission”). The first payment under the Seller’s Commission was due February 1, 2018 and further payments, per the Modification Agreement, will endure indefinitely unless modified, cancelled or otherwise renegotiated between the parties. If the parties do not renegotiate, or if Mr. Watson is otherwise unwilling to modify or waive the Seller’s Commission, the Company’s potential for profits will be adversely impacted.

The Company’s success depends on its ability to respond and adapt to changes in technology and user behavior.

Technology in the online dating industry continues to evolve rapidly. With the advent of artificial intelligence and virtual reality looming, such advances in technology may lead to a significant shift in the user experience of online dating, upon which Celebiddy’s business relies. Changes in technology and user behavior pose a number of challenges that could adversely affect the Company’s revenues and competitive position. For example, among others:

| ● | Celebiddy may be unable to develop products or services for mobile devices or other digital platforms that consumers find engaging, that work with a variety of operating systems and networks and that achieve a high level of market acceptance; | |

| ● | there may be changes in user sentiment about the quality or usefulness of the Company’s existing products or concerns related to privacy, security or other factors; | |

| ● | failure to successfully manage changes in search engine optimization and social media traffic to increase the Company’s digital presence and visibility may reduce traffic levels; | |

| ● | Celebiddy may be unable to maintain or update its technology infrastructure in a way that meets market and consumer demands; | |

| ● | the distribution of the Company’s content on delivery platforms of third parties may lead to limitations on monetization of the Company’s products, the loss of control over distribution of its content and loss of a direct relationship with Celebiddy’s audience; and | |

| ● | The Company may experience challenges in creating display advertising on mobile devices that does not disrupt the user experience. |

Responding to these changes may require significant investment. The Company may be limited in its ability to invest funds and resources in digital products, services or opportunities, and the Company may incur expense in building, maintaining and evolving its technology infrastructure. Unless the Company is able to use new and existing technologies to distinguish its products and services from those of its competitors and develop in a timely manner compelling new products and services that engage users across platforms, its business, financial condition and prospects may be adversely affected.

| 14 |

Security breaches and other network and information systems disruptions could affect the Company’s ability to conduct its business effectively.

Celebiddy’s online systems shall store and process confidential subscriber, employee and other sensitive personal data, and therefore maintaining its network security is of critical importance. The Company shall use third-party blockchain technology and systems for a variety of operations, including encryption and authentication technology, employee email, domain name registration, content delivery to customers, back-office support and other functions. The Company’s systems, and those of third parties upon which the Company’s business relies, may be vulnerable to interruption or damage that can result from natural disasters, fires, power outages, acts of terrorism or other similar events, or from deliberate attacks such as computer hacking, computer viruses, worms or other destructive or disruptive software, process breakdowns, denial of service attacks, malicious social engineering or other malicious activities, or any combination of the foregoing. Such an event could result in a disruption of the Company’s services or improper disclosure of personal data or confidential information, which could harm Celebiddy’s reputation, require the Company to expend resources to remedy such a security breach or defend against further attacks, divert management’s attention and resources or subject the Company to liability under laws that protect personal data, resulting in increased operating costs or loss of revenue.

Mobile malware, viruses, hacking and phishing attacks, spamming, and improper or illegal use of the Company’s technology could seriously harm our business and reputation.

Mobile malware, viruses, hacking, and phishing attacks have become more prevalent in our industry, have occurred on our competitor’s systems in the past, and may occur on our systems in the future. As we gain prominence, we believe that we may become an attractive target for these sorts of attacks. Although it is difficult to determine what, if any, harm may directly result from an interruption or attack, any failure to maintain performance, reliability, security, and availability of our products and technical infrastructure to the satisfaction of our users may seriously harm our reputation and our ability to retain existing users and attract new users.

In addition, spammers may attempt to use our products to send targeted and untargeted spam messages to users, which may embarrass or annoy users and make our products less user friendly. We cannot be certain that the technologies that we have developed to repel spamming attacks will be able to eliminate all spam messages from our products. Our actions to combat spam may also require diversion of significant time and focus of our engineering team from improving our products. As a result of spamming activities, our users may use our products less or stop using them altogether and result in continuing operational cost to us.

Similarly, terrorist, sexual predator and other criminal groups may use our products to promote their goals and encourage users to engage in terror, solicit illicit and/or engage in other illegal or inappropriate activities. We expect that as more people use our applications, these groups will increasingly seek to misuse our products. Although we intend to invest significant resources to combat these activities, including by implementing policies to suspend or terminate accounts we believe will violate our Terms of Service and Community Guidelines, we expect these groups will continue to seek ways to act inappropriately and illegally when utilizing our application. Combating these groups requires our Company to divert significant time and focus from improving our products. In addition, we may not be able to control or stop Celebiddy from becoming the preferred application of use by these groups, which may become public knowledge and seriously harm our reputation or lead to lawsuits or attention from regulators. If these activities develop through use of our development applications, our reputation, user growth and user engagement, and operational cost structure could be seriously harmed.

Legislative and regulatory developments, including with respect to privacy, could adversely affect the Company’s business.

The Company’s business is subject to government regulation in the jurisdictions in which it operates, and its software, which it intends to make available worldwide, may be subject to laws regulating the Internet even in jurisdictions where the Company does not do business. Celebiddy may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply.

Revenues from the Company’s digital products and/or services could be adversely affected, directly or indirectly, in particular by existing or future laws and regulations relating to online privacy and the collection and use of consumer data in digital media. In addition, any failure, or perceived failure, by the Company to comply with its posted privacy policies or with any data-related requirements could result in claims against it by governmental entities or others, or could require the Company to change its practices, which could adversely affect its business.

| 15 |

The loss of key employees or the failure to attract qualified personnel could have a material adverse effect on our ability to run our business.

The loss of any of our current executives, key employees or key advisors, or the failure to attract, integrate, motivate and retain additional key employees, including software developers, coders, wire-framers, influencer recruiters, graphic designers, web developers, and app designers, could have a material adverse effect on our business. We do not have “key person” insurance on the lives of any of our management team. Also, as we become a public company and develop additional capabilities, we may require more skilled personnel who must be highly skilled and have a sound understanding of our industry, business or processing requirements. The failure to attract or retain qualified personnel could have a material adverse effect on our business. Recruiting qualified personnel is highly competitive.

Litigation Risk

The Company does not have any business liability, disruption or litigation insurance, and any business disruption or litigation the Company experiences might result in it incurring substantial costs and diversion of resources.

Investors in the offering may experience immediate dilution of the value of their shares.

Purchasers of the Shares will experience immediate dilution in the value of their Shares. Dilution represents the difference between the price per share paid by investors ($0.10) and the net tangible book value per share immediately after completion of the Offering. Net tangible book value per share is the net tangible assets of the Company (total assets less total liabilities less intangible assets), divided by the number of shares of common stock outstanding. Thus, if at some other time, shares had been sold by the Company at a price less than the $0.10 paid by purchasers of the Shares or had been issued by the Company for services or as other non-cash consideration, then the value of such investor Shares immediately after purchase would be less than the $0.10 purchase price. In this respect, all proceeds from this Offering will go to the Selling Shareholders. As such, purchasers of the Shares will experience an immediate dilution in the value of their shares, and such shareholders will have a negative equity and will have no residual value in the Company.

There has been no prior public market for the Company’s common stock and the lack of such a market may make resale of the Shares difficult.

No prior public market has existed for the Company’s securities and the Company cannot assure any purchaser that a market will develop subsequent to this offering. The Company intends to apply for quotation of its common stock on the OTC Bulletin Board. However, the Company does not know if it will be successful in such application, how long such application will take, or, if successful, that a market for the common stock will ever develop or continue on that or any other trading market. If for any reason a trading market for the Shares does not develop, investors may have difficulty selling their common stock should they desire to do so.

The Company’s election not to opt out of JOBS Act extended accounting transition period may not make its financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised, and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

The Company’s stock may be considered a penny stock and any investment in the Company’s stock will be considered a high-risk investment and subject to restrictions on marketability.

If the Shares commence trading, the trading price of the Company’s common stock may be below $5.00 per Share. If the price of the common stock is below such level, trading in its common stock would be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended. These rules require additional disclosure by broker-dealers in connection with any trades generally involving any non-NASDAQ equity security that has a market price of less than $5.00 per Share, subject to certain exceptions. Such rules require the delivery, before any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally institutions). For these types of transactions, the broker-dealer must determine the suitability of the penny stock for the purchaser and receive the purchaser’s written consent to the transactions before sale. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in the Company’s common stock which could impact the liquidity of the Company’s common stock.

| 16 |

The Board of Directors could use the issuance or designation of preferred stock to impede or discourage an acquisition of the Company that may otherwise be beneficial to some shareholders.

The Company is authorized to issue up to 20,000,000 shares of preferred stock. The issuance of shares of preferred stock, or the issuance of rights to purchase such shares, could be used to discourage an unsolicited acquisition proposal. For instance, the issuance of a series of preferred stock might impede a business combination by including class voting rights that would enable the holder to block such a transaction or facilitate a business combination by including voting rights that would provide a required percentage vote of the stockholders. In addition, under certain circumstances, the issuance of preferred stock could adversely affect the voting power of the holders of the common stock. Although the Company’s board of directors is required to make any determination to issue such preferred stock based on its judgment as to the best interests of the stockholders of the Company, the board of directors could act in a manner that would discourage an acquisition attempt or other transaction that some, or a majority, of the stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then market price of such stock. The board of directors does not intend to seek stockholder approval prior to any issuance of currently authorized stock, unless otherwise required by law or otherwise.

Limited Transferability of Shares

There is no public market for the Shares. While the Company intends to develop a public market in the future, there can be no assurance if or when such a market would be expected to develop in the future. Even if a potential buyer could be found, the transferability of these Shares is also restricted by the provisions of the Securities Act of 1933, as amended, and Rule 144 promulgated thereunder. Unless an exemption is available, these Shares may not be sold or transferred without registration under the Securities Act of 1933, as amended.

Investors must be capable of bearing the economic risks of this investment with the understanding that these Shares may not be liquidated by resale or redemption and should expect to hold their Shares as a long-term investment (especially if no public trading market develops).

Speculative Nature of Investment

Investment in these Shares is speculative and, by investing, each investor assumes the risk of losing the entire investment. The Company has limited operations as of the date of this Private Placement Memorandum and will be solely dependent upon the Company and the Company’s portfolio of assets, both of which are subject to the risks described herein. Accordingly, only investors who are able to bear the loss of their entire investment and who otherwise meet the investor suitability standards should consider purchasing these Shares.

Each prospective investor who invests in the Company must understand that investment in the Shares is speculative. By investing, potential investors understand that they may lose their entire investment in investing with the Company.

No Expectation to Pay Dividends

The Company has not paid any dividends with respect to its outstanding Shares and cannot predict when, or if, dividends will be paid. The Company does not currently anticipate paying any dividends on the Shares until a product is successfully commercialized and liquidity is realized. There is no guarantee the Company will ever receive any profit from its operations so as to be able to declare and pay dividends. There can be no assurance with respect to the amount and timing of any dividends other than to the shareholders, or that they will ever be made. Future dividends will be determined by the Management of the Company in light of prevailing financial conditions, earnings, if any, as well as other relevant factors.

| 17 |

Unforeseen Changes

While the Company has enumerated certain material risk factors herein, it is impossible to know all risks which may arise in the future. In particular, shareholders may be negatively affected by changes in any of the following: (i) laws, rules and regulations; (ii) regional, national and/or global economic factors; (iii) the capacity, circumstances and relationships of partners of the Company or the Management; or (iv) general changes in financial or capital markets.

The Company continuously encounters changes in its operating environment, and the Company may have fewer resources than many of its competitors to continue to adjust to those changes. The operating environment of the Company is undergoing rapid changes, with frequent introductions of laws, regulations, competitors, market approaches, and economic impacts. Future success will depend, in part, upon the ability of the Company to adapt to those changes and providing products and services that will satisfy the demands of their respective businesses and projects. Many of the competitors have substantially greater resources to adapt to those changes. The Company may not effectively react to all of the changes in its operating environment or be successful in adapting its products and approach.

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

The Company has no properties and at the period covered by this Report has no agreements to acquire any properties. The Company currently uses the offices of Management at no cost to the Company.

| Item 3. | Legal Proceedings. |

There is currently no pending, threatened or actual legal proceedings of a material nature in which the Company is a party.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market for Common Equity and Related Stockholder Matters

There is currently no public market for the Company's securities.

Securities Authorized for Issuance under Equity Compensation Plans.

None.

Stock Transfer Agent

Not Applicable at this time.

Common Shareholders

On April 5, 2018, we had approximately 39 shareholders of record.

| 18 |

Dividends

The Company has not paid any dividends to date. The Company intends to employ all available funds for the growth and development of its business, and accordingly, does not intend to declare or pay any dividends in the foreseeable future.

Repurchase of Equity Securities

None.

Recent Sales of Unregistered Securities

None.

| Item 6. | Selected Financial Data. |

Not applicable.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This Management’s Discussion and Analysis of Financial Condition and Results of Operations is intended to provide a reader of our financial statements with a narrative from the perspective of our management on our financial condition, results of operations, liquidity, and certain other factors that may affect our future results. The following discussion and analysis should be read in conjunction with our audited financial statements and the accompanying notes thereto included in “Item 8. Financial Statements and Supplementary Data.”

Overview