Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Vislink Technologies, Inc. | tv489017_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Vislink Technologies, Inc. | tv489017_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Vislink Technologies, Inc. | tv489017_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Vislink Technologies, Inc. | tv489017_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Vislink Technologies, Inc. | tv489017_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35988

xG Technology, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5856795 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

240 S. Pineapple Avenue, Suite 701

Sarasota, FL 34236

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code): (941) 953-9035

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, par value $0.00001 | The NASDAQ Stock Market LLC | |

| Warrant to purchase Common Stock (expiring July 24, 2018) | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III or this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨(Do not check if smaller reporting company) | Smaller reporting company x | |

| Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $18.3 million based on the closing price of $1.62 for the registrant’s common stock as quoted on NASDAQ Capital Market on that date. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

The registrant had 14,959,782 shares of its common stock outstanding as of April 2, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Part III is incorporated by reference as it will be included in the Proxy Statement for the 2018 Annual Meeting of Stockholders.

XG TECHNOLOGY, INC.

FORM 10-K

ANNUAL REPORT

For the Fiscal Year Ended December 31, 2017

TABLE OF CONTENTS

| i |

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) (the “Report”) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar words and phrases are intended to identify forward-looking statements. However, this is not an all-inclusive list of words or phrases that identify forward-looking statements in this Report. Also, all statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Report reflect the good faith judgment of our management, such statements can only be based on facts and circumstances currently known by us. Forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those discussed elsewhere in this Report.

We file reports with the Securities and Exchange Commission (“SEC”), and those reports are available free of charge on our website (www.xgtechnology.com) under “About/Investor Information/SEC Filings.” The reports available include our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, which are available as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements to reflect any event or circumstance that may arise after the date of this Report. We urge you to carefully review and consider all of the disclosures made in this Report.

Overview

The overarching strategy of xG Technology, Inc. (“xG Technology”, “xG”, the “Company”, “we”, “our”, “us”) is to design, develop and deliver advanced wireless communications solutions that provide customers in our target markets with enhanced levels of reliability, mobility, performance and efficiency in their business operations and missions. xG’s business lines include the brands of Integrated Microwave Technologies LLC (“IMT”), Vislink Communication Systems (“Vislink” or “VCS”), and xMax. There is considerable brand interaction, owing to complementary market focus, compatible product and technology development roadmaps, and solution integration opportunities. In addition to these brands, xG has a dedicated Federal Sector Group focused on providing next-generation spectrum sharing solutions to national defense, scientific research and other federal organizations.

IMT

On January 29, 2016, xG completed the acquisition of the net assets that constituted the business of IMT, pursuant to an asset purchase agreement by and between xG and Skyview Capital, LLC. The IMT business develops, manufactures and sells microwave communications equipment utilizing COFDM (Coded Orthogonal Frequency Division Multiplexing) technology. COFDM is a transmission technique that combines encoding technology with OFDM (Orthogonal Frequency Division Multiplexing) modulation to provide the low latency and high image clarity required for real-time live broadcasting video transmissions. IMT has extensive experience in ultra-compact COFDM wireless technology, which has allowed IMT to develop integrated solutions over the past 20 years that deliver reliable video footage captured from both aerial and ground-based sources to fixed and mobile receiver locations.

IMT provides product and service solutions marketed under the well-established brand names Nucomm, RF Central and IMT. Its video transmission products primarily address three major market areas: broadcasting, sports and entertainment, and surveillance (for military and government).

The broadcasting market consists of electronic news gathering, wireless camera systems, portable microwave, and fixed point to point systems. Customers within this market are blue-chip, tier-1 major network TV stations that include over-the-air broadcasters and cable and satellite news providers. For this market, IMT designs, develops and markets solutions for use in news helicopters, ground-based news vehicles, camera operations, central receive sites, remote onsite and studio newscasts and live television events. In this market, IMT’s Nucomm line is recognized as a premium brand of digital broadcast microwave video systems.

The sports and entertainment market consists of key segments that include sports production, sports venue entertainment systems, movie director video assist, and the non-professional user segment. Customers within this market are major professional sports teams, movie production companies, live video production service providers, system integrators and a growing segment of drone and unmanned ground vehicle providers. Among the key solutions IMT provides to this market are wireless camera systems and mobile radios. IMT’s RF Central is a well-established brand of compact microwave video equipment in the market for both licensed and license-free sports and entertainment applications.

The government/surveillance market consists of key segments that include state and local law enforcement agencies, federal agencies and military system integrators. Customers within this market include recognizable state police forces, sheriff’s departments, fire departments, first responders, the Department of Justice and the Department of Homeland Security. The key solutions IMT provides to this market are mission-critical wireless video solutions for applications, including manned and unmanned aerial and ground systems, mobile and handheld receive systems and transmitters for concealed video surveillance. IMT’s products in this market are sold under the brand name IMT.

Vislink

xG Technology originally announced the acquisition of Vislink on October 20, 2016 in a $16 million binding asset purchase agreement. On February 2, 2017, xG completed the acquisition of the net assets that constituted the business of Vislink pursuant to an asset purchase agreement by and among xG, Vislink PLC, an England and Wales registered limited company (the “Guarantor”), Vislink International Limited, an England and Wales registered limited liability company (the “U.K. Seller”), and Vislink Inc., a Delaware corporation (the “U.S. Seller,” and together with the U.K. Seller, the “Sellers”), dated December 16, 2016, as amended on January 13, 2017.

Vislink specializes in the wireless capture, delivery and management of secure, high-quality, live video from the field to the point of usage. Vislink designs and manufactures products encompassing microwave radio components, satellite communication, cellular and wireless camera systems, and associated amplifier items.

| 1 |

Vislink serves two core markets: (i) broadcast & media and (ii) law enforcement, public safety and surveillance. In the broadcast and media market, Vislink provides broadcast communication links for the collection of live news and sports and entertainment events. Customers in this market include national broadcasters, multi-channel broadcasters, network owners and station groups, sports and live broadcasters and hosted service providers. In the law enforcement, public safety and surveillance market, Vislink provides secure video communications and mission-critical solutions for law enforcement, defense and homeland security applications. Its law enforcement, public safety and surveillance customers include metropolitan, regional and national law enforcement agencies, as well as domestic and international defense agencies and organizations. Across its core markets, Vislink is also a leading global manufacturer of satellite communication services, with solutions destined for use in both fixed installations and small, rapidly-deployable configurations.

In 2017, we began the process of merging Vislink’s product offerings and operations with those of IMT and xG. We have initiated the co-branding of the IMT and Vislink, while still preserving the Vislink brand and its legacy brands, including Gigawave, Link, Advent and MRC, in markets where strong brand identification still exists. IMT has assumed all the Vislink product warranties and will continue to support all the Vislink and IMT product offerings. Vislink’s business in the Americas has become part of IMT, while its business in the rest of the world is operated by Vislink’s existing U.K. operation.

xMax

xMax is a secure, rapid-deploy mobile broadband system that delivers mission-assured wireless connectivity in demanding operating environments. xMax was specifically designed to serve as an expeditionary and critical communications network for use in unpredictable scenarios and during fluid situations. We believe xMax represents a compelling solution for disaster response, emergency communications, and defense applications, among other sectors. xMax has already been deployed at U.S. Army bases and by the U.S. State Department in Mexico.

xG Federal Sector Group

The xG Federal Sector Group leverages xG’s extensive portfolio of patented RF communications technologies to engage in collaborative research and development projects.

Our Strategy

IMT and Vislink Video Brands

Our acquisitions of IMT and Vislink are part of xG’s plan to diversify and grow in the following industries: broadcast and media, sports and entertainment and public safety, surveillance and defense. They allow us to offer a broad array of end-to-end, high-reliability, high-data rate, long-range wireless video transmission solutions. These solutions are being used for applications in growing market segments, including in-game sports video mobile feeds, real-time capture and display of footage from drones and other aerial platforms, and rapid-response electronic news gathering operations.

The key sector strategies for IMT and Vislink are to expand the various markets for existing miniature wireless video products, which include the educational sector, videographers, and video service providers, provide complete end-to-end solutions for the video surveillance market, and introduce complete end-to-end IP technology into the broadcast and media market.

The acquisition of Vislink is expected to offer xG the opportunity to realize synergies with its IMT business unit, while allowing both entities to offer an expanded suite of services and product offerings in the markets they are already active in. A key advantage is that there is currently limited overlap in product offerings, sales channels and market coverage between the two companies. For example, Vislink has a substantial client base in international markets where IMT has had a limited presence. In addition, IMT has a very strong product portfolio targeted to U.S. federal law enforcement and high-end sports broadcasting customers who will now have access to additional solutions based on Vislink’s product configurations. Finally, Vislink has traditionally focused on licensed spectrum solutions where IMT has pioneered the use of non-licensed spectrum for many applications. Combining xG’s shared spectrum and interference mitigation techniques with an expanded IMT/Vislink product lineup will provide an opening into additional customer bases that currently do not have access to licensed spectrum.

| 2 |

xMax

For xMax, our strategy is to leverage elements of our intellectual property portfolio to introduce a range of spectrum agnostic, cognitive radio network solutions for numerous industries and applications. We believe that sales of these xMax-branded products and services, together with our ability to leverage our patent portfolio, present us with an attractive revenue model.

We believe the xMax system represents the only commercially available cognitive radio network system that includes purpose-built interference mitigation. xMax implements our proprietary interference mitigation software that can increase capacity on already crowded airwaves by improving interference tolerance, enabling the delivery of a comparatively high quality of service where other technologies would not be able to cope with the interference.

xG Federal Sector Group

Among the key technological areas in which the xG Federal Sector Group participates in funded research and development initiatives are the following:

| · | inter-agency and government/commercial spectrum sharing and co-use architectures |

| · | cognitive radio systems supporting secure bidirectional voice and data services |

| · | spectrum transitioning and relocation planning |

| · | interference mitigation techniques |

| · | self-organizing networks |

| · | Physical layer (PHY) and MAC (Media Access Control Layer) protocol development |

| · | Digital Signal Processing (DSP) techniques including: |

| · | MIMO antenna systems |

| · | Advanced modulation schemes |

| · | Adaptive filtering algorithms |

| · | Digital broadcasting, security, surveillance and other video transmission technologies |

Market Overview

IMT and Vislink

Our IMT and Vislink services and product offerings broadly address three markets: broadcasting and media, sports and entertainment, and law enforcement, public safety and surveillance (military and government).

The broadcasting and media market consists of electronic news gathering, wireless camera systems, portable microwave, and fixed point to point systems. The market looks to improve operational efficiencies in the gathering, production, and transmission of wireless content. Recent trends in the market include a movement towards IP connectivity over point to point links for infrastructure, high definition upgrades of remote news gathering vehicles, and continued pressure to reduce expenses by improving operational efficiencies. Customers within this market are major network TV stations, including over-the-air broadcasters and cable and satellite news providers, national broadcasters, multi-channel broadcasters, network owners and station groups, sports and live broadcasters and hosted service providers. IMT and Vislink focus on the specific manner in which these customers create and gather content wirelessly.

The sports and entertainment market consists of key segments, including sports production, sports venue entertainment systems, movie director video assist, and the non-professional user segment. Generally, this market is focused on more agile wireless video systems. Drivers in these markets include small, lightweight, easy to use equipment, low-latency video systems, reliability of the wireless links, and the ability to use licensed and unlicensed bands. Current trends within the market are to further reduce the size and improve agility of the wireless video systems as users are demanding higher link reliabilities at longer ranges. Customers within this market are professional sports teams, movie production companies, live video production service providers, system integrators and a growing segment of drone and unmanned ground vehicle providers.

| 3 |

The law enforcement, public safety and surveillance market consists of key segments including state and local law enforcement agencies, federal agencies and military system integrators. The market looks to improve the reliability and quality of video content without adding complexity. The video systems must be operated without technical intervention. State and local agencies benefit from Department of Homeland Security grant programs to improve overall security. Recent trends within these segments include improved interoperability within agencies, and demand for fully integrated systems including robust microwave combined with ubiquitous IP networks. As wireless video systems are becoming more reliable and easier to deploy, the adoption rate of wireless systems is increasing. Customers within this market include state police forces, sheriff’s departments, fire departments, first responders, the Department of Justice and the Department of Homeland Security.

xMax

The key market sectors that rely on communications systems that have mission-critical capabilities are public safety/emergency management and defense.

In emergency management operations, reliable communications are an absolute requirement and cannot be compromised by interference, network congestion caused by other users, or lack of coverage or reliability. Public safety workers cannot lose voice communications in times of emergency or at large public gatherings. In addition, many police and fire organizations are using public cellular or WiFi networks for data communications.

With the onset of body-worn cameras and the use of tablet computers instead of paper forms, data communications are becoming just as critical as voice communications. When they rely on public commercial networks, data communications are susceptible to overload during large public events as well as when emergency situations and disaster-based outages take place. Public data access based on commercial cellular also incurs significant monthly charges per user. WiFi or other unlicensed networks are considered unreliable due to the public availability and allowing anyone to construct a network anywhere without coordination with existing users.

xMax was specifically engineered to deliver voice, video, and data communications in crisis environments. The public safety community can benefit from the following features that the xMax cognitive radio network offers:

| · | Works with common-off-the-shelf smartphones and smart devices | |

| · | Extremely difficult to scan, hack or jam | |

| · | Can enable effective operation in free, unlicensed spectrum | |

| · | Integrates with legacy systems | |

| · | Cost-effective ongoing operations |

In military applications, wireless communications systems must meet or exceed performance parameters that few other communications systems can tolerate. The systems must be extremely mobile, almost infinitely scalable, frequency agile, cost-efficient and have highly flexible deployment schemes. In addition, the systems must be able to securely integrate commercial smartphones and tablets at the tactical edge of operations. And, critically, they must be able to maintain communications integrity in the face of unpredictable RF challenges.

In military wireless communications scenarios, xMax can fulfill the requirements of military wireless communications planners due to the following attributes:

| · | A fully expeditionary communications network that supports voice, video, and broadband data over one set of hardware. |

| · | Exceptionally low probability of jamming or hacking. Patented active interference mitigation technologies make the system resistant to jamming and hacking attempts, with a very low chance of message interception, even in the most unpredictable spectrum conditions. |

| · | Deploys and scales easily. xG’s patented interference mitigation and self-organizing technologies enable rapid deployment and expansion without complex network engineering or frequency planning. |

| · | Suitability in emergency situations. |

| · | Flexible deployment options for fixed, mobile, airborne, or expeditionary deployments. |

| · | Multiple backhaul options, including SATCOM, microwave, Ethernet, cellular, and WiFi. |

| 4 |

| · | Device agnostic, allowing the use of any smartphone, tablet, laptop, or rugged mobile device from any manufacturer. |

| · | All-IP architecture allows xMax to digitally interface with legacy systems. |

| · | Global operation by using the 900-928 MHz frequency band. |

| · | A truly mobile network proven to deliver seamless handoffs at up to 70 mph. |

| · | Deploys in minutes to provide command and control in emergency situations. |

| · | Provides a resilient, robust and redundant network with low operational cost over the service life of the equipment. |

Our Products

Through our IMT and Vislink businesses, we are able to offer a full spectrum of wireless video products which are built around providing complete solutions. Both companies have traditionally focused on the development of core product technologies that have the potential for application in final assembled products that cross market segments. Such technology focus areas include RF and microwave component development spanning the frequency range from DC to 18GHz, waveform modulation, H.264 video encoding and decoding, 4K UHD (Ultra High Definition) camera systems, IP-based electronic newsgathering systems, and digital signal processing. Through these products, we are positioned with significant technology IP and an established reputation for rapidly and economically delivering complex, bespoke engineering products and solutions to customers that are expertly managed to tight deadlines. Production of these products can be rapidly scaled to respond to changes in market demand.

IMT Products

Broadcast: IMT offers a line of high-margin receiver products including the CRx2, CRx6 and CIRAS-X6. These products may be interconnected over IP networks, expanding and simplifying their overall use and reducing the deployment cost significantly. The MicroLite is a small, low-cost wireless camera system enabling broadcast news operators to eliminate the use of coaxial cables in their remote news operations. This significantly reduces labor costs in the operation and increases the speed and agility of the cameramen to focus on capturing engaging content.

CRx2 Receiver

CRx6 Receiver

| 5 |

CIRAS-X6 Receiver

Sports and Entertainment: The MicroLite 2 is a professional-grade wireless transmitter that is available in both licensed and unlicensed frequency bands, the latter enabling non-TV broadcasters to capture broadcast quality video without the cost and limitations of gaining a frequency license. The unlicensed market is very large and just being opened to high quality technologies.

MicroLite 2

Government/Surveillance: IMT has focused on miniature transmitters and handheld receivers and benefits from limited competition in this area. The IMT DragonFly is designed to capture real-time, high-quality video from UAV/UGV/Body Cams/Concealments for display on fixed or mobile receive applications. The MiniMobile Commander and Mobile Commander are handheld receiver/monitors designed for tactical situations. IMT vNet IP Video Distribution Servers enable commanders and managers to view near real time video captured on scene and consumed anywhere in the world over public and private IP networks.

IMT DragonFly

MiniMobile Commander

Receiver Monitor

| 6 |

Mobile Commander

Receiver Monitor

Vislink Products

Vislink designs and manufactures products encompassing microwave radio components, satellite communication, cellular and wireless camera systems, and associated amplifier items. Vislink solutions include the following product categories:

Vislink’s key product offerings include:

| · | HCAM, a 4K Ultra HD-capable on-camera wireless video transmitter; |

| · | HDX-1100, a high-powered aircraft downlink transmitter; |

| · | Newsnet, a revolutionary approach to ENG operations that brings studio workflows directly to the field; |

| · | ViewBack, a lightweight, low power, low latency, dual channel diversity receiver-decoder that enables quicker production, more efficient editing, and more effective collaboration between camera operators and studio teams; and |

| · | SatWare, a high-performance embedded computing and routing system designed to provide enhanced capability and simplified use of broadcast equipment in the field. |

HCAM

| 7 |

HDX-1100

xMax

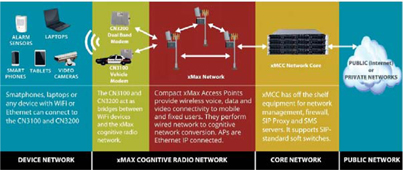

xMax is the flagship implementation of xG’s innovative cognitive radio intellectual property. Operating initially within the 902 – 928 MHz license-free band, xMax is a mobile voice over internet protocol (“VoIP”) and broadband data system that utilizes an end-to-end internet protocol (“IP”) system architecture. xMax technology is spectrum agnostic. In any spectrum band that xMax operates in, we break the band into channels and sub channels. We then use spatial processing and adaptive modulation to mitigate interference in that band. If the band becomes unusable because of overwhelming interference, we then use dynamic spectrum access to change to another channel or band.

A key feature of the xMax system is the ability to leverage off-the-shelf commercial mobile devices (such as smartphones, laptops and tablets), resulting in reduced network infrastructure, maintenance and operational costs. The xMax system allows operation in the free, unlicensed 902 – 928 MHz ISM band spectrum (available in most of the Americas) instead of having to purchase scarce licensed spectrum which can be prohibitively expensive.

The equipment that we develop, manufacture and market under the xMax brand includes a suite of products and services that encompass an integrated, turnkey network solution, as set forth below. These products embody our broad portfolio of innovative intellectual property including spectrum sharing, interference mitigation, multiple-input multiple-output (MIMO) and cognitive and software defined radio (SDR). xMax utilizes an end-to-end IP architecture that allows it to serve as a turnkey network system ranging from a last-mile solution to a full network backbone.

xMax products include the following components:

| · | xMax NOW Transportable Broadband Wireless System; |

| · | CN5100 Mobile Hotspots; |

| · | CN3100 Vehicle Modems designed to be installed inside or outside vehicles; |

| · | CN3200 Dual-Band Routing Modem; |

| · | CN1100 Wireless Access Point; and |

| · | CN7000 Mobile Control Center |

Below is a diagram that provides a high-level overview of the xMax network architecture:

| 8 |

Competition and Competitive Positioning

The primary competitors of IMT and Vislink are Domo Tactical Communications (formerly a division of Cobham), Silvus Technologies, Persistent Systems, Troll Systems and a number of smaller market- specific businesses.

The union of IMT and Vislink created the market share leader in the professional broadcast and media video transmission sector. We believe that their products solve a growing market need for stable, high-definition, wireless video communications. Separately, IMT and Vislink have been able to successfully leverage their long history of broadcast industry leadership, reputations for advanced technology, and ability to provide end-to-end-solutions in order to maintain and increase their customer bases and to continue providing highly competitive offerings. Both companies have mature product offerings that address applications in growing market segments, including in-game sports video mobile feeds, real-time capture and display of footage from drones and other aerial platforms, and rapid-response electronic news gathering operations.

As the businesses continue to be integrated, it is expected that these advantages will be further strengthened. Because there is currently minimal overlap in product offerings between IMT and Vislink, we believe we will now have the opportunity to offer an expanded range of product offerings, additional services and enhanced capabilities. We believe this expansion of product offerings will position us for continued growth in the broadcast and sports and entertainment markets, and we expect near term growth in the government/surveillance market. As we realize full control of the production processes of IMT and Vislink, we expect to be able to realize improving margins, control over product quality and competitive agility.

With respect to xMax, the wireless technology sector is intensely competitive and is rapidly evolving. Several vendors have researched and experimented with cognitive radios. This research predominately falls under the traditional industry defined use of a cognitive radio where cognitive capabilities are restricted to dynamic spectrum access (“DSA”) within the radio device. However, we believe that only a few vendors are undertaking development across all the key elements of cognitive technology: spectrum sensing, spectrum management, spectrum mobility, spectrum sharing, and spatial processing.

We not only face competition from other companies developing cognitive radio solutions, but we are also competing for sales to end-user customers with companies offering solutions utilizing other technologies for access to licensed and unlicensed spectrum, such as LTE and Wi-Fi. In the cognitive radio market, our competitors include, Neul Ltd., Shared Spectrum Corporation and Adaptrum.

The main vendor in the public safety market is Motorola Solutions, which is a global player that holds a dominant market share in the U.S. of over 80% in public safety and government wireless networks. Meanwhile, in the defense market, there are several large and significant companies that provide wireless communications systems to U.S. and international military agencies, including Harris Corporation, ITT Industries, Raytheon, Boeing, Thales Communications and Lockheed Martin. It is common for one competitor to be a subcontractor to another competitor who is the prime contractor and vice versa as programs of record ramp up and ramp down over time.

A number of our current or potential competitors have long operating histories, significant brand recognition, large customer bases and significantly greater financial, technical, sales, marketing and other resources than we do. We believe that xMax possesses the following key features that together constitute a competitive advantage to alternatives in the market:

Mobility and Rapid Deployability — we have developed our product line to support mobility and rapid deployability. xMax has been designed with the ability to automatically perform its own RF planning by utilizing an extended range of non-interfering channels without manual intervention. This allows for the rapid deployment of communications assets which is often essential in the establishment of critical communications infrastructures. It also provides the ability to make the entire network infrastructure mobile, with CN1100 Access Point base stations able to move in relation to each other as well as to CN5100 Mobile Hotspots, CN3200 Dual-Band Routing Modems, xMax CN3100 Vehicle Modems and users. We believe this feature will be unique to xMax and will address a major capability gap for defense, homeland security, and public safety agencies which all require “on the move” communications networks. These agencies currently have no equipment or capacity for this identified and urgently needed capability.

IP Product Architecture — The all-IP architecture on which xMax is based allows end-users to access the network with any IP-enabled device such as smartphones, tablets, and laptops while using their preferred software including VPNs and other security applications. We believe this can reduce costs by eliminating the need for expensive proprietary end-user devices and applications, while freeing users from the constraints of public cellular networks.

Exceptional Flexibility — xMax can serve as either a fixed, mobile, portable, or aerial wireless infrastructure, making it ideal for a number of deployment scenarios, including emergency response, public safety and defense, where communications must often be established quickly in remote areas, as well as for utilities and other critical infrastructure operations.

High Level of Interoperability — Although xMax operates as a self-contained communications infrastructure, it is interoperable with both public and private systems including P25, PSTN, cellular networks, and the forthcoming FirstNet nationwide public safety communications network.

| 9 |

Interference Mitigation — Whereas most competitors’ efforts to date focus on interference avoidance, we have extended our core competency into the realm of interference mitigation. In a world where wireless demand is certain to result in more congested airwaves, we believe the fact that our intellectual property can help to ameliorate interference is a competitive advantage in the marketplace.

We believe we compete favorably with respect to the areas set forth above. However, our industry is evolving rapidly and is becoming increasingly competitive. Other developers could develop alternative wireless cognitive networks and other technologies that may adversely affect our ability to attract and retain customers. These competitors may include companies of which we may not be currently aware.

With respect to our xG Federal Sector Group, we believe that the growing need for wireless spectrum among public and private users will continue to drive interest in technology-based spectrum sharing approaches, such as cognitive radio and opportunistic (i.e. shared) spectrum use. In fact, a number of federal agencies, including the Department of Defense, the National Science Foundation, and the Department of Energy, have ongoing research and development activities in the area of spectrum sharing. For example, the Defense Advanced Research Projects Agency (DARPA) supported early research into cognitive radio and dynamic spectrum access and it continues to address key problem areas in spectrum sharing for military systems. Leveraging elements of our intellectual property portfolio and technological foundation in areas including interference mitigation, cognitive radios and interference mitigation and multiple in, multiple out (“MIMO”) antenna technology, we believe we are well-placed to identify, respond to, and secure funded spectrum sharing research opportunities.

Sales and Marketing

Our sales team currently is comprised of sales managers responsible for defined regional areas, inside sales personnel, and business development representatives focused on targeted sectors and/or regions. They are supported by solution engineers trained in technical sales with a given market focus. This sales team is focused on supporting our current customers, as well as nurturing relationships with prospective customers in key domestic and international markets. For our IMT, Vislink and xMax brands, we employ a combination of sales channels, including direct-to-end customer sales, network group sales, reseller/integrators and Original Equipment Manufacturer (“OEM”) sales channels in order to use the most efficient means of reaching customers depending on the market segment. Sales efforts are supported by marketing and public relations activities, digital and print marketing initiatives, the creation of support materials, and trade show and other event appearances.

Our IMT and Vislink entities have developed significant followings based on the reputation of their product offerings for performance, reliability and use of advanced technology. Both have developed diverse and stable customer bases for repeat product purchases from blue chip, tier-1 clients in the broadcasting and sports and entertainment markets, as well as among high-profile agencies and organizations in the surveillance (military and government) markets.

As of December 31, 2017, our business development, sales and marketing team consisted of 43 full-time employees or contractors.

Customers

Our IMT and Vislink entities have developed significant followings based on the reputation of their product offerings for performance, reliability and use of advanced technology. Both have developed diverse and stable customer bases for repeat product purchases from blue chip, tier-1 clients in the broadcasting and sports and entertainment markets, as well as among high-profile agencies and organizations in the surveillance (military and government) markets.

Manufacturing and Suppliers

We have historically retained contract manufacturers to manufacture, test, assure the quality of, and ship our products. With the acquisitions of IMT and Vislink, we have additional options for both internal and external manufacturing of products. This provides us the opportunity to develop optimal supply chains that are tailored to our needs on a per-product and per-solution basis. Going forward, we anticipate that we will focus on our core strengths, which are innovation and technology design and the development and creation and exploitation of our intellectual property. Accordingly, we ultimately plan to become a designer, developer and fabless supplier of xMax integrated circuits and system software solutions for xMax products where we would supply integrated circuits produced either through the IMT and Vislink assets, if we are able to successfully integrate them into our business, or by third party manufacturing partners under license, software, reference designs, features, tools and technical support.

While we have begun to integrate IMT and Vislink into our plan to build our products, we may continue to rely, particularly in the short term, on third party components and technology to build our products, as we procure components, subassemblies and products necessary for the manufacture of our products based upon our design, development and production needs. While components and supplies are generally available from a variety of sources, we currently depend on a single or limited number of suppliers for several components for our products. We are using a single source digital signal processor that may be difficult to replace with an equivalent performance device. We rely on purchase orders rather than long-term contracts with our suppliers. We do not currently stockpile enough components to mitigate any potential supply disruption if we are required to re-engineer our products to use alternative components.

| 10 |

Intellectual Property

Our business is significantly based on the creation, acquisition, use and protection of intellectual property. Some of this intellectual property is in the form of software code, patented technology and trade secrets that we use to develop our technologies, solutions and products. We have developed a broad portfolio of intellectual property that covers wired and wireless communications systems. As of December 31, 2017, in the U.S., we have 57 patents granted, 1 patent application pending, and no provisional application pending. Internationally, we have 33 patents granted, 4 patent applications pending, and no Patent Cooperation Treaty (PCT) applications.

Areas of our development activities that have culminated in filings and/or awarded patents include:

| · | Spatial Processing (MIMO); | |

| · | Self-Organizing Networks; | |

| · | RF Modulation; | |

| · | Compression (protocols, payload, signaling, etc.); | |

| · | Modulators/Demodulators; | |

| · | Antennas/Shielding; | |

| · | Wired and Wireless Networks; | |

| · | Media Access Control Protocols; | |

| · | Interference Mitigation; | |

| · | Cognition enabling over the air protocols (MAC layer); | |

| · | Wireless data compression; | |

| · | Dynamic Spectrum Access (DSA); | |

| · | Quality of Service; and Quality of Service; and | |

| · | Digital Broadcasting over Microwave Links. |

We protect our intellectual property rights by relying on federal, state and common law rights, as well as contractual restrictions. We control access to our proprietary technology by entering into confidentiality and invention assignment agreements with our employees and contractors, and confidentiality agreements with third parties. We also actively engage in monitoring activities with respect to infringing uses of our intellectual property by third parties.

In addition to these contractual arrangements, we also rely on a combination of trade secret, copyright, trademark, trade dress, domain name and patents to protect our products and other intellectual property. We typically own the copyright to our software code, as well as the brand or title name trademark under which our products are marketed. We pursue the registration of our domain names, trademarks, and service marks in the United States and in locations outside the United States. Our registered trademarks in the United States include “xG”, and “xMax”, “IMT”, “Vislink”, the names of our products, among others.

Circumstances outside our control could pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in the United States or other countries in which our products are sold or distributed. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. In addition, protecting our intellectual property rights is costly and time-consuming. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business, thereby harming our operating results.

Companies in the mobile wireless communications technology and other industries may own large numbers of patents, copyrights and trademarks and may frequently request license agreements, threaten litigation or file suit against us based on allegations of infringement or other violations of intellectual property rights. We may face allegations by third parties, including our competitors and non-practicing entities, that we have infringed their trademarks, copyrights, patents and other intellectual property rights. As our business grows, we will likely face more claims of infringement.

| 11 |

Company Information

The Company was organized as a limited liability company under the laws of the State of Delaware on August 26, 2002 under the name JTS Acquisitions, LLC. On March 21, 2003, we changed our name to xG Technology, LLC. Pursuant to a certificate of conversion and a certificate of incorporation filed with the State of Delaware on November 8, 2006, xG Technology, LLC converted to a Delaware corporation under the name xG Technology, Inc. Our executive offices are located at 240 S. Pineapple Avenue, Suite 701, Sarasota, FL 34236, and our telephone number is (941) 953-9035. Our website address is www.xgtechnology.com. Information contained in our website does not form part of the report and is intended for informational purposes only.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, since we went public in July 2013. We will remain an emerging growth company for up to the last day of the fiscal year following the fifth anniversary of our initial public offering, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenue exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. Pursuant to Section 102 of the JOBS Act, we have provided reduced executive compensation disclosure and have omitted a compensation discussion and analysis from this Report. Pursuant to Section 107 of the JOBS Act, we have elected to utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We will lose our emerging growth status on December 31, 2018.

Employees

As of December 31, 2017, we employed 222 full-time equivalent employees, contractors or consultants, which included 85 in development, 5 officers, 22 in general and administrative, 8 in business development, 67 in operations and 35 in sales and marketing. We also engage a number of temporary employees and consultants. None of our employees are represented by a labor union or are party to collective bargaining agreements. We believe that we have good relations with our employees.

| 12 |

As a smaller reporting company, the Company is not required to include the disclosure required under this Item 1A.

Item 1B. Unresolved Staff Comments

Not applicable.

Our corporate headquarters and marketing and business development office are located in Sarasota, Florida, in an office consisting of a total of 3,403 square feet pursuant to a lease that expires on October 31, 2019. For our research and development, engineering, sales and support personnel we also have an office in Sunrise, Florida consisting of 11,029 square feet pursuant to a lease that expires on May 13, 2018. IMT has 14,416 square feet in Hackettstown, New Jersey pursuant to a lease that expires on April 29, 2020. Vislink has 39,327 square feet in Billerica, Massachusetts pursuant to a lease that expires on May 31, 2021; 12,435 square feet in Hemel, United Kingdom pursuant to a lease that expires October 31, 2020; 14,000 square feet in Colchester, United Kingdom pursuant to a lease that expires on March 24, 2025; 839 square feet in Dubai, U.A.E. pursuant to a lease that expires on July 31, 2018; 1,100 square feet in Singapore pursuant to a lease that expires on August 9, 2020; and 3,000 square feet in Anaheim, California pursuant to a lease that expires on June 30, 2018. We believe our current facilities are sufficient for our current needs and will be adequate, or that suitable additional or substitute space will be available on commercially reasonable terms, for the foreseeable future.

We are currently not involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our company’s or our company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect. From time to time, we may become involved legal proceedings, lawsuits, claims and regulations in the ordinary course of our business.

Item 4. Mine Safety Disclosures

Not applicable.

| 13 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our shares of common stock are currently listed on The NASDAQ Stock Market under the symbol “XGTI”.

The following table shows the high and low market prices for our shares for each fiscal quarter for the two most recent fiscal years. Market prices for our shares have fluctuated significantly. As a result, the market prices shown in the following table may not be indicative of the market prices at which our shares of common stock will trade after this filing. These prices reflect the 1-for-10 reverse stock split on July 17, 2015, the 1-for-12 reverse stock split on June 20, 2016 and the 1-for-10 reverse stock split on December 15, 2016.

| Share Price | ||||||||

| Quarter | High | Low | ||||||

| Fourth Quarter 2017 | $ | 1.98 | $ | 1.35 | ||||

| Third Quarter 2017 | $ | 2.65 | $ | 1.55 | ||||

| Second Quarter 2017 | $ | 2.29 | $ | 1.31 | ||||

| First Quarter 2017 | $ | 2.92 | $ | 1.34 | ||||

| Fourth Quarter 2016 | $ | 6.20 | $ | 1.17 | ||||

| Third Quarter 2016 | $ | 11.70 | $ | 2.50 | ||||

| Second Quarter 2016 | $ | 34.80 | $ | 8.40 | ||||

| First Quarter 2016 | $ | 28.80 | $ | 9.60 | ||||

Holders

As of April 2, 2018, there were 14,959,782 shares of common stock outstanding and approximately 149 holders of record of our shares. Because shares of our common stock are held by depositories, brokers and other nominees, the number of beneficial holders of our shares is substantially larger than the number of stockholders of record. Our transfer agent and registrar is Continental Stock Transfer & Trust Company, 17 Battery Place, 8th Floor, New York, New York 10004.

Dividend Policy

We have never declared or paid any cash dividend on our common stock. We intend to retain any future earnings and do not expect to pay any cash dividends in the foreseeable future.

Securities Authorized For Issuance under Equity Compensation Plans

Reference is made to “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters—Securities Authorized for Issuance under Equity Compensation Plans” for the information required by this item which will be included in our 2018 Proxy Statement.

Recent Sales of Unregistered Securities

None.

| 14 |

Item 6. Selected Financial Data

As a smaller reporting company, the Company is not required to include the disclosure required under this Item 6.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations for the years ended December 31, 2017 and December 31, 2016 should be read in conjunction with the accompanying consolidated financial statements and the related notes included in Item 8 in this Annual Report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements.

Overview

The overarching strategy of xG Technology, Inc. (“xG Technology”, “xG”, the “Company”, “we”, “our”, “us”) is to design, develop and deliver advanced wireless communications solutions that provide customers in our target markets with enhanced levels of reliability, mobility, performance and efficiency in their business operations and missions. xG’s business lines include the brands of Integrated Microwave Technologies LLC (“IMT”), Vislink Communication Systems (“Vislink” or “VCS”), and xMax. There is considerable brand interaction, owing to complementary market focus, compatible product and technology development roadmaps, and solution integration opportunities. In addition to these brands, xG has a dedicated Federal Sector Group focused on providing next-generation spectrum sharing solutions to national defense, scientific research and other federal organizations.

IMT

On January 29, 2016, xG completed the acquisition of the net assets that constituted the business of IMT, pursuant to an Asset Purchase Agreement by and between xG and Skyview Capital, LLC. The IMT business develops, manufactures and sells microwave communications equipment utilizing COFDM (Coded Orthogonal Frequency Division Multiplexing) technology. COFDM is a transmission technique that combines encoding technology with OFDM (Orthogonal Frequency Division Multiplexing) modulation to provide the low latency and high image clarity required for real-time live broadcasting video transmissions. IMT has extensive experience in ultra-compact COFDM wireless technology, which has allowed IMT to develop integrated solutions over the past 20 years that deliver reliable video footage captured from both aerial and ground-based sources to fixed and mobile receiver locations.

IMT provides product and service solutions marketed under the well-established brand names Nucomm, RF Central and IMT. Its video transmission products primarily address three major market areas: broadcasting, sports and entertainment, and surveillance (for military and government).

The broadcasting market consists of electronic news gathering, wireless camera systems, portable microwave, and fixed point to point systems. Customers within this market are blue-chip, tier-1 major network TV stations that include over-the-air broadcasters and cable and satellite news providers. For this market, IMT designs, develops and markets solutions for use in news helicopters, ground-based news vehicles, camera operations, central receive sites, remote onsite and studio newscasts and live television events. In this market, IMT’s Nucomm line is recognized as a premium brand of digital broadcast microwave video systems.

The sports and entertainment market consists of key segments that include sports production, sports venue entertainment systems, movie director video assist, and the non-professional user segment. Customers within this market are major professional sports teams, movie production companies, live video production service providers, system integrators and a growing segment of drone and unmanned ground vehicle providers. Among the key solutions IMT provides to this market are wireless camera systems and mobile radios. IMT’s RF Central is a well-established brand of compact microwave video equipment in the market for both licensed and license-free sports and entertainment applications.

The government/surveillance market consists of key segments that include state and local law enforcement agencies, federal agencies and military system integrators. Customers within the government/surveillance market include recognizable state police forces, sheriff’s departments, fire departments, first responders, the Department of Justice and the Department of Homeland Security. The key solutions IMT provides to this market are mission-critical wireless video solutions for applications, including manned and unmanned aerial and ground systems, mobile and handheld receive systems and transmitters for concealed video surveillance. IMT’s products in this market are sold under the brand name IMT.

| 15 |

Vislink

xG originally announced the acquisition of Vislink on October 20, 2016 in a $16 million binding asset purchase agreement. On February 2, 2017, xG completed the acquisition of the net assets that constituted the business of Vislink, pursuant to an asset purchase agreement by and among xG, Vislink PLC, an England and Wales registered limited company, Vislink International Limited, an England and Wales registered limited liability company, and Vislink Inc., a Delaware corporation, dated December 16, 2016, as amended on January 13, 2017.

Vislink specializes in the wireless capture, delivery and management of secure, high-quality, live video from the field to the point of usage. Vislink designs and manufactures products encompassing microwave radio components, satellite communication, cellular and wireless camera systems, and associated amplifier items.

Vislink serves two core markets: (i) broadcast and media and (ii) law enforcement, public safety and surveillance. In the broadcast and media market, Vislink provides broadcast communication links for the collection of live news and sports and entertainment events. Customers in this market include national broadcasters, multi-channel broadcasters, network owners and station groups, sports and live broadcasters and hosted service providers. In the law enforcement, public safety and surveillance market, Vislink provides secure video communications and mission-critical solutions for law enforcement, defense and homeland security applications. Its law enforcement, public safety and surveillance customers include metropolitan, regional and national law enforcement agencies, as well as domestic and international defense agencies and organizations.

In 2017, we began the process of merging Vislink’s product offerings and operations with those of IMT and xG. We have initiated the co-branding of the IMT and Vislink product lines, while still preserving the Vislink brand and its legacy brands, including Gigawave, Link, Advent and MRC, in markets where strong brand identification still exists. IMT has assumed all the Vislink product warranties and will continue to support all the Vislink and IMT product offerings. Vislink’s business in the Americas has become part of IMT, while its business in the rest of the world is being handled by Vislink’s existing U.K. operation.

xMax

xMax is a secure, rapid-deploy mobile broadband system that delivers mission-assured wireless connectivity in demanding operating environments. xMax was specifically designed to serve as an expeditionary and critical communications network for use in unpredictable scenarios and during fluid situations. We believe xMax represents a compelling solution for disaster response, emergency communications, and defense applications, among other sectors. xMax has already been deployed at U.S. Army bases and by the U.S. State Department in Mexico.

The equipment that we develop, manufacture and market under the xMax brand includes a suite of products and services that includes access points, fixed and mobile dual-band WiFi hotspots, mobile switching centers, as well as network management and deployment tools. These products embody our broad portfolio of innovative intellectual property including spectrum sharing, interference mitigation, multiple-input multiple-output (MIMO) and cognitive and software defined radio (SDR). xMax utilizes an end-to-end Internet Protocol (IP) architecture that allows it to serve as a turnkey network system ranging from a last-mile solution to a full network backbone.

xG Federal Sector Group

The xG Federal Sector Group leverages xG’s extensive portfolio of patented RF communications technologies to engage in collaborative research and development projects.

| 16 |

Results of Operations

The following table sets forth the items contained in the consolidated statements of operations of the financial statements included herewith for the fiscal years ended December 31, 2017 and December 31, 2016.

xG TECHNOLOGY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(IN THOUSANDS)

| For the Years Ended | ||||||||

| December 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenue | $ | 47,824 | $ | 6,574 | ||||

| Cost of revenue and operating expenses | ||||||||

| Cost of components and personnel | 28,220 | 3,133 | ||||||

| Inventory valuation adjustments | 1,781 | 2,417 | ||||||

| General and administrative expenses | 27,015 | 9,534 | ||||||

| Research and development | 9,799 | 6,106 | ||||||

| Impairment charge | — | 2,683 | ||||||

| Amortization and depreciation | 4,398 | 5,561 | ||||||

| Total cost of revenue and operating expenses | (71,213 | ) | (29,434 | ) | ||||

| Loss from operations | (23,389 | ) | (22,860 | ) | ||||

| Other income (expenses) | ||||||||

| Changes in fair value of derivative liabilities | (88 | ) | 2,545 | |||||

| Offering expenses | — | (684 | ) | |||||

| Gain on bargain purchase | 10,911 | 2,749 | ||||||

| Gain on debt and payable extinguishment | 2,900 | — | ||||||

| Other expense | (251 | ) | (1,727 | ) | ||||

| Interest expense | (629 | ) | (925 | ) | ||||

| Total other income | 12,843 | 1,958 | ||||||

| Net loss | $ | (10,546 | ) | $ | (20,902 | ) | ||

| Dividends and deemed dividends | — | (1,808 | ) | |||||

| Net loss attributable to common shareholders | $ | (10,546 | ) | $ | (22,710 | ) | ||

Revenue

Revenues for the year ended December 31, 2017 were $47.8 million compared to $6.6 million for the year ended December 31, 2016, representing an increase of $41.2 million or 624%. The increase was primarily due to the revenue generated by Vislink.

Of the $47.8 million in revenue in 2017, $46.9 million resulted from sales of equipment and $0.9 million resulted from engineering and consulting services agreements. Of the $6.6 million in revenue in 2016, $6.3 million resulted from sales of equipment and $0.3 million resulted from engineering and consulting services agreements.

| 17 |

Cost of Revenue and Operating Expenses

Cost of Components and Personnel

Cost of components and personnel for the year ended December 31, 2017 were $28.2 million compared to $3.1 million for the year ended December 31, 2016, representing an increase of $25.1 million or 810%. The increase is attributed to the acquisition of Vislink during the first quarter of 2017. Gross margins were lower than what we anticipate them to be in the future due to the increase in fair value assessed by the third-party appraisals (“Inventory Step-Up”) associated with the acquisition of IMT and Vislink being included in cost of components for the years ended December 31, 2017 and 2016. The assigned fair value associated with our business acquisitions have been amortized and included in cost of components and personnel in the amounts of $3.5 million and $0.3 million for the years ended December 31, 2017 and 2016, respectively.

Of the $28.2 million cost of components and personnel in 2017, $27.8 million is based on the cost of components and the time allocated to building the products sold and $0.4 million is based on the cost of the time allocated towards the engineering and consulting services agreements. Of the $3.1 million cost of components and personnel in 2016, $3.0 million is based on the cost of components and the time allocated to building the products sold and $0.1 million is based on the cost of the time allocated towards the engineering and consulting services agreements.

We do anticipate an increase in revenue and the related costs in 2018 due to Vislink’s revenue and related costs being included for a full year. We do anticipate higher gross margins in 2018 since the Inventory Step-Ups are fully amortized.

Inventory Valuation Adjustments

Inventory valuation adjustments consist primarily of items that are written off due to obsolescence or written down to their net realizable value. Inventory valuation adjustments decreased by $0.6 million or 25%, from $2.4 million in the year ended December 31, 2016 to $1.8 million in the year ended December 31, 2017. The decrease is primarily due to larger write-downs of xG legacy inventory in 2016 due to lack of sales.

General and Administrative Expenses

General and administrative expenses are the expenses of operating the business on a daily basis and include salary and benefit expenses including stock-based compensation and payroll taxes, as well as the costs of trade shows, marketing programs, promotional materials, professional services, facilities, general liability insurance, and travel.

General and administrative expenses for the year ended December 31, 2017 were $27.0 million compared to $9.5 million for the year ended December 31, 2016, representing an increase of $17.5 million or 184%.

The increase of $17.5 million is due to the inclusion of $13.1 million of general and administrative expenses as a result of the Vislink acquisition on February 2, 2017. The Company also incurred a one-time fee of $2.5 million payable to MB Technology Holdings, LLC (“MBTH”) related to their role in the completion of the Vislink acquisition and a one-time fee of $0.2 million for their role in the completion of the acquisition of IMT. MBTH provides services in connection with merger and acquisition searches, negotiating and structuring deal terms along with certain management and financial services to the Company. Other increases during the year were $0.9 million of stock based compensation associated with the expensing of stock options granted; $0.7 million in payroll due to the accrual of bonuses and twelve months of IMT payroll compared to 11 months in the prior year; $0.3 million of expense resulting from the grant date fair value of the commitment shares issued to Lincoln Park Capital Fund, LLC as consideration for entering into the purchase agreement with the Company, dated May 19, 2017 (the “Lincoln Park Purchase Agreement”); $0.2 million in consulting expenses; $0.1 million in travel expenses and $0.1 million in franchise taxes and licenses. The increases were offset by a decrease of $0.6 million in consulting fees associated with the Company’s listing on the NASDAQ Capital Market.

We expect general and administrative costs to increase going forward due to Vislink’s operations being included for a full year.

Research and Development

Research and development expenses consist primarily of salary and benefit expenses including stock-based compensation and payroll taxes, as well as costs for prototypes, facilities and travel.

Research and development expenses for the year ended December 31, 2017 were $9.8 million compared to $6.1 million for the year ended December 31, 2016, representing an increase of $3.7 million or 61%.

The increase of $3.7 million is due to the inclusion of $3.7 million of research and development expenses as a result of the acquisition of Vislink on February 2, 2017. The other increase during 2017 includes $0.9 million in stock based compensation associated with the expensing of stock options. The increases were partially offset by decreases of $0.4 million with regard to payroll and $0.4 million in insurance due to a reduction in legacy personnel.

We expect research and development costs to increase going forward due to Vislink’s operations being included for a full year.

| 18 |

Amortization and Depreciation

Amortization and depreciation expenses for the year ended December 31, 2017 were $4.4 million compared to $5.6 million for the year ended December 31, 2016, representing a decrease of $1.2 million or 21%. The decrease is due to the reduction in the amortization of software development costs in 2017 because we recorded impairment charges relating to certain xG software development costs of $2.7 million in 2016. The decrease was partially offset by the amortization of $1.0 million on the step-up in valuation of certain assets of IMT and Vislink in 2017.

Impairment

No impairments related to long-lived assets or amortized intangible assets were recorded during the year ended December 31, 2017 and an impairment charge of $2.7 million was recognized for the year ended December 31, 2016. The Company recorded impairment charges relating to certain xG software development costs due to our analysis of the net realizable value of our capitalized software costs in 2016.

Other Income (Expense)

The changes in fair value of derivative liabilities decreased by $2.6 million, or 104%, from a $2.5 million gain in the year ended December 31, 2016 to $0.1 million loss in the year ended December 31, 2017. This is due to the slight increase in our common stock price in 2017 as compared to 2016 that resulted in an unrealized loss in the fair value of the derivative liabilities.

Offering expenses were $0.0 million for the year ended December 31, 2017 compared to $0.7 million for the year ended December 31, 2016. The $0.7 million is the allocation of the offering expenses associated with the warrants issued in connection with our May 2016 and July 2016 financings, which were classified as derivative liabilities.

The gain on bargain purchase was $10.9 million for the year ended December 31, 2017 compared to $2.7 million for the year ended December 31, 2016. The 2017 gain on bargain purchase of $10.9 million is due to the Company’s acquisition of Vislink on February 2, 2017 compared to the gain on bargain purchase of $2.7 million which was due to the Company acquiring IMT on January 29, 2016. The excess of the aggregate fair value of the net tangible assets and identified intangible assets over the consideration paid has been treated as a gain on bargain purchase in accordance with ASC 805.

The gain on debt extinguishment was $2.9 million for the year ended December 31, 2017 compared to $0 for the year ended December 31, 2016. The 2017 gain on debt extinguishment of $2.9 million is due to the Company’s agreement with the Sellers of Vislink on March 17, 2017, pursuant to which the Company paid $2 million in cash to the Sellers and the Sellers extinguished the remaining $2.9 million of principal owed in connection with the Company’s acquisition of Vislink.

Vislink Bargain Purchase

The Company utilized the services of an independent appraisal company to assist it in assessing the fair value of the Vislink assets and liabilities acquired. This assessment included an evaluation of the fair value of inventory, fixed assets and the fair value of the intangible assets acquired based upon the expected cash flows from the assets acquired. Additionally, the Company incorporated the carrying value of the remaining working capital, as Vislink’s management represented that the carrying value of these assets and liabilities served as a reasonable proxy for fair value. The valuation process included discussion with management regarding the history and business operations of Vislink, a study of the economic and industry conditions in which Vislink competes and an analysis of the historical and projected financial statements and other records and documents.

When it became apparent there was a potential for a bargain purchase gain, management reviewed the Vislink assets and liabilities acquired and the assumptions utilized in estimating their fair values. The Company determined that provisional amounts, previously recognized, required adjustments to reflect new information obtained. According to ASC 805-10-25-15, the Company has a period of time, referred to as the measurement period, to finalize the accounting for a business combination. Upon additional review of identifying and valuing all assets and liabilities of the business, the Company concluded that recording a bargain purchase gain with respect to Vislink was appropriate and required under GAAP.

The Company then undertook a review to determine what factors might contribute to a reasonable conclusion of recognizing the recording of a bargain purchase. Factors that contributed to the conclusion to recognize a bargain purchase price were:

| · | The Vislink acquisition was completed with motivated Sellers who had a public strategy to concentrate on growing their software business as opposed to their technology and hardware businesses. As a strategic decision, the Sellers intended to sell off the assets of the hardware business. |

| · | The announcement of the U.K. leaving the European Union led to a decline in the pound, which led to pressure by Vislink’s creditors to raise funds. The owners of Vislink were motivated to complete a transaction in order to use the proceeds to reduce the line of credit they owed to the bank. |

| · | The industry in 2015 and 2016 experienced a downturn as decreased spending combined with economic uncertainty caused corporations to delay wireless and broadcast infrastructure upgrades. The Sellers believed these trends would continue. According to IBISWorld, industry revenue is expected to fall at an annualized rate of 0.6% over the next five years reflecting further deterioration in the industry. As a result, the Sellers decided to sell the business. |

| · | Prior to the U.K. leaving the European Union, Vislink was under contract to be sold for a much higher price. The Company took advantage of the economic and industry downturn to negotiate a favorable price which was less than the value of the assets acquired for a total purchase consideration of $16 million. |

| 19 |

Based upon these factors, the Company concluded that the occurrence of a bargain purchase was reasonable.

IMT Bargain Purchase

The Company utilized the services of an independent appraisal company to assist it in assessing the fair value of the assets and liabilities acquired. This assessment included an evaluation of the fair value of inventory, fixed assets and the fair value of the intangible assets acquired based upon the expected cash flows from the assets acquired. Additionally, the Company incorporated the carrying value of the remaining working capital as IMT’s management represented that the carrying value of these assets and liabilities served as a reasonable proxy for fair value. The valuation process included discussion with management regarding the history and business operations of IMT, a study of the economic and industry conditions in which IMT competes and an analysis of the historical and projected financial statements and other records and documents.

When it became apparent there was a potential for a bargain purchase gain, management reviewed the assets and liabilities acquired and the assumptions utilized in estimating their fair values. Further revisions to the estimates were not deemed to be appropriate and after identifying and valuing all assets and liabilities of the business, the Company concluded that recording a bargain purchase gain was appropriate and required under GAAP.

The Company then undertook a review to determine what factors might contribute to a reasonable conclusion to recognize the recording of a bargain purchase. Factors that contributed to the conclusion to recognize a bargain purchase price were: