Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - WYTEC INTERNATIONAL INC | wytec_10k-ex3202.htm |

| EX-32.1 - CERTIFICATION - WYTEC INTERNATIONAL INC | wytec_10k-ex3201.htm |

| EX-31.2 - CERTIFICATION - WYTEC INTERNATIONAL INC | wytec_10k-ex3102.htm |

| EX-31.1 - CERTIFICATION - WYTEC INTERNATIONAL INC | wytec_10k-ex3101.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| WYTEC INTERNATIONAL, INC. | ||

| (Exact name of registrant as specified in its charter) |

| Nevada | 333-215496 | 46-0720717 | ||

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

19206 Huebner Rd., Suite 202

San Antonio, Texas 78258

(Address of principal executive offices, including zip code)

(210) 233-8980

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes o No þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | þ |

| Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (defined in Rule 12b-2 of the Act ). Yes oNo þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2017, cannot yet be determined since the outstanding common stock of the registrant is not yet publicly trading on any public securities trading market, and a valuation of the common stock has not otherwise been established.

The number of shares of common stock, $0.001 par value, outstanding on March 30, 2018 was 3,977,310 shares.

WYTEC INTERNATIONAL, INC.

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2017

| i |

Overview

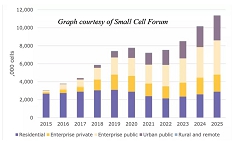

Wytec International, Inc., a Nevada corporation (“Wytec,” the “Company.” “we,” “us,” or “our”) is the developer of a technology called the “LPN-16,” consisting of chipsets, software, hardware designs and antennas that enable strengthened Wi-Fi and cellular transmission within a concentrated coverage area of approximately 500 feet in circumference. The hardware consists of a chassis or framework approximately three (3) feet in height and a radius of approximately 32 inches. It is designed to be installed in the communications zone of a utility pole or upper end of a light pole and can contain up to 16 radios of varying frequencies. The unit, referred to as an outdoor “small cell”, is designed to increase Wi-Fi and cellular capacity and signal strength by placing a large number of them within densely populated areas as compared to a traditional large cellular tower covering a large area of approximately two (2) miles. The growth of small cells is a response to increasing global data traffic and in preparation of the next generation of cellular technology now referred to as 5G. As the chart below indicates, small cells are forecasted to increase to over 11,000,000 units by 2025.

|

|

11,000,000 Small Cells- 2025 |

Small cell equipment market revenue is expected to approach $10 billion by 2019. Deloitte & Touche LLP

In March 2013, we contracted Cambridge Industry Group to design the first LPN-16. The design was completed in December 2013 and subsequently sent to SmartAnt Technologies in February 2014. SmartAnt Technologies was contracted to build our form factor (housing) that supports multiple radios for both Wi-Fi and cellular frequencies. In March 2014, we received our first prototype for the LPN-16 and obtained permission to locate the unit on a utility light pole in downtown San Antonio for testing. The test included the use of three frequencies with two of the three being millimeter wave. The final frequency was with a 5GHz radio located in both the LPN-16 and a Samsung Smartphone. In multiple trials, we were able to produce download and upload speeds at 388.5 Mbps with a latency of 3 milliseconds. By comparison, a popular cellular network produced 35.73 Mbps with a latency of 61 milliseconds.

| 1 |

When Wytec was first founded, we obtained five (5) United States patents (the “Patents”) (three of which have expired) directly relating to local multipoint distribution service (“LMDS”) that is utilized in broadband wireless access technology and was originally designed for digital television transmission. LMDS is a system for broadband microwave wireless transmission direct from a local antenna to homes and businesses within a line- of-sight radius, a solution to the so-called last-mile technology issue of economically bringing high-bandwidth services to users. This technology introduced us to the concept of using high frequency radio bands for broadband backhaul and led us into millimeter wave technology. Today we utilize 70-80 GHz spectrum for our backhaul positioned on the top of multiple buildings as an expansion of Wytec’s conceptual design of a 5G network. The ultimate expansion of the network is designed to transmit from its rooftop millimeter wave backhaul network to the end user via the LPN-16 supporting both Wi-Fi and cellular networks. This configuration is in place today and became a significant part of our LPN-16 test producing the cellular broadband speeds discussed in the previous paragraph.

The LPN-16 technology firmly supports the small cell growth forecasted by RCRWireless News and aligns with the needs of the 5th Generation (“5G”) network technology as defined by the International Telecommunications Union (“ITU”). ITU sets the standards for enabling enhanced mobile broadband service, ultra-reliable, low latency communications, massive machine type communications and a converged fixed and mobile network service that is flexible enough to handle the explosive increase of traffic from new emerging bandwidth-hungry services such as ultra-high definition TV, augmented reality, video conferencing, remote medical treatment and driverless cars.

The 5G network is expected to have a transformative impact as it connects people with devices, data, transport systems and cities in a smart networked communications environment. The 5G network will rely substantially on small cell technology to achieve its goals. To facilitate this, operators need reliable connections with strong signal integrity, significant bandwidth and low latency. Small cells bring improved connectivity (speeds, reliability, and low latency) to the edge of existing macro networks, serving smaller pockets, especially in rural and urban areas.

We believe the LPN-16 small cell specifically solves the long-term challenges faced by operators deploying small cells who need access to backhaul, lower total cost of ownership and easier site acquisition and access, and cities wrestling with the on-going technology upgrades, network growth demands, as well as the political hurdles and new business models needed to realize the benefits of a 5G world.

In addition to aligning with the ITU demands for 5G, the LPN-16 was designed to meet the operator needs cited above and stringently adheres to the Federal Communications Commission (“FCC”) policy initiatives addressing the wide array of interests ranging from public safety entities, wireless innovators, to schools and libraries. Specifically, the FCC’s Report and Order 14-153, Acceleration of Broadband Deployment by Improving Wireless Facilities Siting Policies, adopts rules to help spur wireless broadband deployment by facilitating the sharing of wireless transmission equipment using “neutral host” capabilities to simultaneously support multiple providers. The LPN-16 was specifically designed to promote a neutral host capability. The FCC’s goal of “shared used” and “neutral host” seeks to expand coverage and capacity more quickly, reduce costs and promote access to infrastructure which reduces barriers to deployment and incentivizes sharing resources, rather than relying on new builds for every stakeholder, thereby safeguarding environmental, aesthetic, historic and local land-use values.

The LPN-16’s radio frequency (“RF”) shielding enables a multi-channel transmission system which substantially mitigates one or more of the problems many small cell deployments face in meeting the FCC’s policy initiatives, 5G goals and other technical and political constraints. These challenges include potentially limited data transmission speed capability, upgradeability, and frequency interference. Additionally, some small cells are created using transmitters that tend to be very large in size, expensive, and require ancillary equipment to operate. Accordingly, such transmitters can only be placed in areas that provide large space and sound structural support, such as roof-tops or other inconvenient locations. These inconveniences add time and cost to construction.

In view of the 5G network goals, the demand and challenges of small cell technology placement and the FCC’s policy goals of shared infrastructure, Wytec developed the LPN-16 to be a new cost-effective and easily upgradeable system for providing high transmission speeds through a neutral host and shared infrastructure solution that outperforms other small cells across numerous dimensions.

“While we saw some early carrier interest and activity building small cells to densify their networks ahead of 5G services, we believe 2018 to really be (the) year where small cells are pursued in earnest,”

Jennifer Fritzsche of Wells Fargo Securities |

| 2 |

We have implemented an aggressive intellectual property strategy and continue to pursue patent protection for new innovations. In addition to the LPN-16 invention covered by our current patent, we have identified additional upgrades and additions to the LPN-16 which further tie it to the goals and timelines of the expected 5G network development, FCC policy initiatives and customer business usage which we believe are innovative and patentable. We intend to file for patent protection on these developments. Our strategy is to continually monitor the costs and benefits of our patent applications and pursue those that will best protect our business and expand the core value of the Company.

We have recruited and hired a seasoned management team with both private and public company experience and relevant industry experience to develop and execute our operating plan. In addition, we have identified key engineering resources for intellectual property development, antenna development, hardware, software and firmware engineering, as well as integration and testing that will allow us to continue to expand our technology and intellectual property.

Our Technology

The LPN-16, recognized by the U.S Patent and Trademark Office as Patent number 9,807,032, is an “Upgradeable, High Data Transfer Speed, Multichannel Transmission System.” The LPN-16 is a local area network system that includes modular, multi-frequency, multi-channel, upgradable transmission nodes. The transmission nodes can include one or more independent RF modules and may be configured to include 802.11ac and evolve to LTE and other technology and frequency bands as well as software defined radio attributes. The LPN-16 provides transmission and network services for wireless data, wireless video, wireless voice, voice over internet protocol (“VoIP”), local portal for emergency services, mesh node from one transmission to the next, single channel transmission, multi-channel transmission, Wi-Fi access as well as a number of other similar services. We believe this range of services and the timeline of 5G networks needing small cell capabilities squarely places Wytec in the path of serving several substantial markets such as small cells as a service, outdoor Wi-Fi, the Internet of Things, and a host of other related communications services.

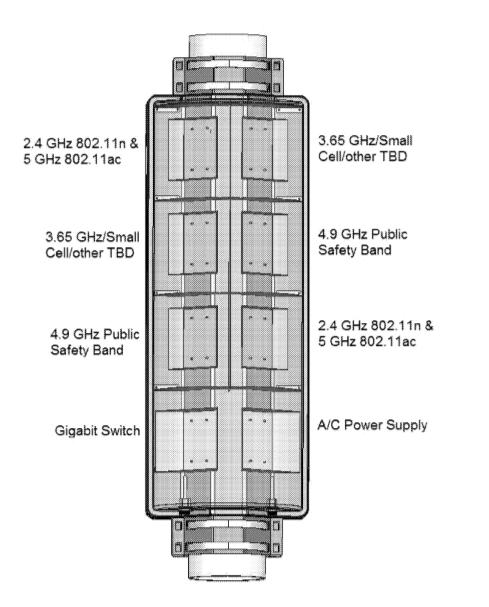

Figure 1 LPN-16 Cross Sectional Representation of Multi-Radio Frequency (RF) Modules

| The features and advantages of the LPN-16 are anchored in its RF interference mitigation capabilities and modular design approach for radio cards, network switch and power supply for flexible arrangement. The LPN-16 uses physical shielding and RF engineering to reduce internal device interference critical in environments where licensed and unlicensed frequencies, such as Wi-Fi, LTE-Unlicensed (“LTE-U”) and licensed assisted access (“LAA”), will operate in close proximity to support small cell deployments. Shielding may consist of varying types of material utilized which can be applied to 1) the card slot element, 2) between each row, or 3) between sectors. |  |

The LPN chassis: The LPN-16 chassis is comprised of two (2) LPN-8’s or halves. Each half has a Small Form Factor Pluggable (“SFP”) module allowing connection to single or multimode fiber as well as a Gigabit Passive Optical Network (“GPON”). Each LPN-8 has a modular gigabit Ethernet switch installed with all ports at 1- gigabit speeds. Current 4G small cell equipment and technology limits the upgradability of the unit and due to their size may only support 1-2 customer types. The LPN-16 chassis is intended to accommodate the modular components listed above in many desired arrangements. The switch can be upgraded to 10- gigabit or more as demand rises. The LPN-16 can be upgraded to have 20-80 gigabits of backhaul at each light pole. Many other outdoor radio manufactures cannot make this claim.

| 3 |

Each chassis half, or LPN-8 configuration, consists of an elongated rounded front outer surface approximately 3-feet long and a back portion having a surface adapted to engage one or more bracket systems for mounting. The LPN size is customizable. Each chassis half is designed to provide transmission to 180 degrees with the full LPN-16 configuration covering 360- degrees. The LPN-16 is capable of withstanding lightening, wind loading of 115 mph with an IP65 environmental rating for protection from dust and jets of water, as well as operating in temperature ranges of -40 degrees Celsius to 65 degrees Celsius (149 degrees Fahrenheit), and when fully dressed weighs 35 pounds.

Radio Frequency: The LPN-16 provides transmission and network services for up to 16 carriers for wireless data, wireless video, wireless voice, and VoIP, a local portal for emergency responders, single and multi-RF transmission, 2.4 GHz 802.11n and 5 GHz 802.11ac Wi-Fi access as well as a number of other similar services. Unlike most 4G small cells, the LPN-16 is not dependent on any particular radio frequency. The RF slots allow an LPN-16 customer to focus on one or more radio frequencies and channels to service individual subscribers based on bandwidth requirements. Each RF slot covers a 90- degree sector (180- degree coverage for each LPN-8 chassis half) and is capable of vertical down tilt of zero or 10 degrees. RF modules tend to come in standard sizes and thus can be interchanged to achieve different functions. The LPN-16 may also house a non-standard RF module size which is not an option in current proprietary 4G small cell equipment.

Form Factor: The form factor of the LPN-16 allows for multiple radio cards to be combined on one transmission module. The form factor of the LPN-16 was designed to allow for various radio types and frequencies to coexist within the LPN-16’s chassis. Radio cards having frequencies bands ranging from Cellular Bands residing on eNodeB Modules – 700 MHz to 2700 MHz, CBRS Band 3550-3700 MHz , 4.9 GHz Public Safety Band and 2.4- 5.x Wi-Fi Bands. The LPN-16’s form factor allows for endless upgrades as radio technologies change without having to conduct a “Wholesale” or “Fork Lift” upgrade to the system. The entire LPN-16 platform is designed to be field upgradable, which we believe makes the LPN-16 the most cost-effective radio platform available on the market today.

The combined RF module may also include 16 service set identifiers (“SSID”) for each band (2.4 and 5GHz). The LPN-16 RF Module can provide for up to 256 concurrent users per radio card--i.e. 2.4 GHz (128 users) 5.0 GHz (256 users) for a total per 2.4/5.0 GHz module of 384 users. Typical small cell units can only support 32 concurrent clients. The RF module is designed to be collocated with 3G/4G modules in the same chassis.

Mounting Options: Although mounting options appear to be mundane among product characteristics, it has come to the forefront for many cities and pole owners. Recently empowered by the FCC’s Public Notice, 6409 (a), many are aggressively pushing for greater access to city rights- of -way (“ROW”), chief of which is the utility pole. Cities are seeing a trend which they feel limits their control of municipal ROW for public safety, environmental compliance, and revenue generation. These concerns are also coupled with the potential cluttering of the public space with thousands of radios deployed by each carrier. Pole owners are also concerned with too many improperly mounted attachments as well as the combined weight of all attachments that can potentially degrade pole integrity.

The LPN-16 can mount to walls or poles. For a pole the LPN-16 would be mounted approximately 8-15 meters from the ground with a line of sight of approximately 350 meters (1,100 feet), however, the height and line of sight ranges are not limited. An advantage of using light poles or traffic light poles is they provide a power source and are evenly, closely, and frequently spaced through different areas fueling Wytec’s small cell densification strategy which is necessary for 5G high-speed and low latency performance.

Our Competition

There are numerous existing and commercially available methods of providing both small cell technology, site rental as well as high-speed Internet to multi-tenant commercial and residential units. This makes the telecommunications industry highly competitive, rapidly evolving, and subject to rapid technology changes. Additionally, there are numerous telecommunications service companies that conduct extensive advertising campaigns to capture market share. We believe the principal competitive factors affecting our lines of business for LPN-16 placement and our hybrid network Internet service will be our time to market in traditionally underserved areas, differentiated service offerings such as FlexSpeed, Internet failover, and our Cel-fi service as well as, traditional business strategies for meeting market pricing levels and clear pricing policies, customer service, and the variety of services offered.

| 4 |

Although we believe our FlexSpeed, G. Fast, and related services allow for market rate pricing, our ability to compete effectively will depend upon our continued capacity to maintain high-quality, market-driven services at prices generally equal to or below those charged by competitors. To maintain a competitive posture, we believe that we may need to reduce our prices in order to meet reductions in rates, if any, by others. Any such reductions could reduce profitability and make it cost prohibitive to continue as a going concern. Many of our current and potential competitors have more financial, personnel and other resources than Wytec, including brand name recognition as well as other competitive advantages.

Competition by Equipment (Small Cell). The Hetnet Bible issued by SNS Research, has identified approximately 19 small cell vendors offering small cell equipment to network developers. Most, if not all of those vendors utilize the same chipset and provide nearly identical form factors (housing) with standard rooftop installations. We are, however, unaware of a single manufacturer who has developed an outdoor small cell device capable of transmitting multiple frequencies on multiple channels from a single device at a single site location without frequency interference such as the LPN-16 small cell technology. We believe our LPN-16 small cell access point will set a new standard in the mobile broadband industry. Wytec is now listed in the updated HetNet Bible version 2014-2020 Report on Small Cells, Carrier Wi-Fi, and DAS.

Competition by Service: (Site Rental). Driven by the thriving ecosystem, SNS Telecom expects small cells and carrier Wi-Fi deployments to account for nearly $352 Billion in mobile data service revenues by the end of 2020, while overall spending on heterogenous network infrastructure is expected to reach $42 Billion annually during the same period. This expected growth has led to numerous competitors who offer site rental services for carriers seeking to attach small cells to utility poles and other mounting assets. Two of the largest publicly traded and national site rental, small cell and DAS network providers are Crown Castle and American Tower.

Crown Castle operates as a real estate investment trust. The company provides broadcast, data, and wireless communications infrastructure services in the US. Wireless carrier customers lease antenna space on Crown Castle's owned or managed towers and distributed antenna systems (“DAS”). It has about 40,000 tower sites and 25,000 small cell nodes supported by more than 26,500 miles of fiber. The company also designs networks, selects and develops sites, and installs antennas. On December 16, 2011, Crown Castle purchased NextG Networks for $1.0 billion in cash. At the time, NextG was the largest U.S. provider of outdoor distributed antenna systems with over 7,000 nodes-on-air and with an additional 1,500 nodes under construction.

American Tower rents space on towers and rooftop antenna systems to wireless carriers and radio and TV broadcasters who use the infrastructure to enable their services. It operates about 40,000 wireless towers in the US, some 57,000 in India, and roughly 43,000 throughout the rest of the world. Its portfolio includes approximately 800 distributed antenna system networks used mainly for indoor communications (malls, casinos, etc.). American Tower also offers tower-related services such as site acquisition, structural analysis to determine support for additional equipment, and zoning and permitting management services.

Competition by Service (Internet). There are a substantial number of local, regional, and national residential and commercial Internet Service Providers (“ISPs”) hosting data, voice and texting services in the United States. Publicly traded brands such AT&T, Verizon, T-Mobile, Sprint, Cox Communications, Spectrum, Comcast, and Tower Stream all provide both commercial and/or residential cellular and wired Internet services. Although we have our own hybrid wired-wireless network for delivering our own branded version of 5G Internet services, we also provide, through wholesale agreements, a 4G LTE voice, text and data service through four largest U.S. wireless carriers. These services have significant competition from the carriers providing similar services at less cost and using other communications technologies unavailable to us as well as substantial financial resources and brand awareness that we do not have. While some of these technologies and services are now operational, others are being developed or may be developed. As a 4G LTE mobile virtual network operator (“MVNO”), we compete for customers based principally on providing better and lower cost market methods. Our primary 4G LTE service offering is a wireless automatic Internet failover service.

Cel-fi Competition. Cel-fi is an alternative to DAS, which according to Markets and Markets, was valued at USD $6.71 Billion in 2015 and expected to reach USD $10.78 Billion by 2022. The DAS industry is dominated by substantially well financed vendors such as CommScope, TE Connectivity (purchased by CommScope), Axell, Corning, Solid and other large DAS providers. Cel-fi (owned by Nextivity) is a new comer in the DAS market with an alternative solution costing 1/3 the current cost of DAS. Nextivity has declared Wytec a premier Certified Solutions Provider and is partnering with Wytec at tradeshows to present the Cel-fi solutions. Nextivity will co-sponsor with Wytec its second partner tradeshow in Dallas, Texas in April 2018.

| 5 |

LPN-16 Target Customers

Cities: to remain competitive cities need to leverage their existing assets, dark fiber and utility poles to increase broadband penetration and data speeds expected in a smart city, as well as the ability to maintain aesthetic infrastructure development, and non-discriminatory means for creating competition.

Pole Owners: the number of pole attachments is forecasted to rise, creating issues related to load, capacity, safety and engineering.

Utility Providers: need infrastructure solutions which easily meet engineering and safety requirements, address the number of pole attachment requests and enable new service capabilities for real time smart grid data communications.

Public Safety: local, state and federal agencies need near-term infrastructure with long-term upgradeability to meet interoperability and service area needs.

Cable/Fiber providers: need cost effective and rapid deployment solutions for FTTH (fiber to the home) type offerings utilizing pole mounted equipment.

Mobile Network Operators: need pole attachments and future-proof network infrastructure that allow upgradeability to reduce congestion, long-term CAPEX, improve network performance and provide high-speed data services via gigabit Wi-Fi and LTE small cells.

Within the United States Wytec plans to incorporate the LPN-16 into its own “network infrastructure” as part of a hybrid wired-wireless network to support not only small cell backhaul, but to also deliver near-term revenue. Wytec has already developed three (3) of these hybrid networks located in San Antonio, Texas, Columbus, Ohio and Denver, Colorado. Empowered with its experience in millimeter wave transmission and recent industry recognition for utilizing millimeter wave technology for small cell backhaul and as a key component to a 5G network, we believe we have created a robust network infrastructure to deliver high-speed Internet connectivity to businesses and residential multi-dwelling units.

Wytec’s Network Infrastructure- Supporting Wytec Products/Services

Millimeter Wave Infrastructure: Wytec’s core infrastructure design consists of a hybrid network construction utilizing the latest wired and wireless technology. Referred to as the “Diamond Ring,” its wireless components employ both point to point and multipoint wireless transmissions utilizing the latest radio frequency technology supporting unlicensed and quasi-licensed spectrum. Each Wytec Diamond Ring originates from a fiber optics connection within the Central Business District (“CBD”) of a chosen city and extends outward utilizing Wytec’s’ patented LPN-16 and proprietary network design. We have constructed three (3) Diamond Ring networks located in San Antonio, Texas, Columbus, Ohio and Denver, Colorado and applied our patented and proprietary design as a part of our extension strategy for delivering our broadband products and services.

Fixed Wireless: Wytec currently offers a Fixed Wireless broadband solution originating from its millimeter wave Diamond Ring directly to a customer’s premises via a wireless local area network (“WLAN”) connection operating in a 5GHz Wi-Fi radio channel. One hundred (100) Mbps speeds are easily obtainable with the ability to increase to one (1) gigabit or more utilizing Wytec design modifications. Additionally, Wytec has developed a unique broadband Internet feature known as “FlexSpeed” which enables customers to modify their Internet service by increasing their upload and/or download speeds. In a recent survey conducted by Galloway Research, over 80% of the respondents indicated their interest in a variable speed Internet service.

The Organization for Economic Co-operation and Development (“OECD”) believes that by the end of 2017 there were 106.3 million fixed broadband subscribers in the United States.

| 6 |

G.Fast: G.Fast broadband originated from digital subscriber line (“DSL”) technology introduced in the 1980’s. DSL still accounts for more than fifteen percent (15%) of all broadband connections within the U.S. today. The original copper wire installation utilized for DSL still exists in millions of connections throughout the United States including residential and commercial multiple dwelling units (“MDUs”) with average broadband speeds limited to approximately three (3) Mbps to the end user.

Recently, however, DSL technology has made vast technology improvements in the “distribution points” connecting a DSL service. This new technology, called “G.Fast”, can support broadband speeds up to one (1) gigabit per second with the use of advanced Distribution Point Units (“DPU”) while still utilizing existing (dormant) copper wire and/or coax cable. This enormous cost savings makes G.Fast a viable alternative to fiber and Cable within multi-tenant/MDUs. As Wytec extends its Diamond Ring rooftop coverage, G.Fast services to the MDU residential and commercial facilities are expected to expand while accelerating subscriber growth at a greatly reduced cost.

Ovum, an independent worldwide analyst and consultancy firm headquartered in London, and specializing in global coverage of the IT and telecommunications industries, predicts by 2021 that G.fast will support almost 29 million subscribers compared to 330,000 in 2017.

Cel-FI: We believe Wytec offers a powerful alternative to the DAS marketplace valued at over $6.5 billion dollars. DAS is designed to strengthen cellular signals in facilities where construction materials interfere with cellular frequencies and diminish the quality of a cellular call or data usage. DAS may be deployed indoors (an iDAS) or outdoors (an “oDAS”), and is a way to deal with isolated spots of poor cellular coverage inside a large building by installing a network of relatively small antennas throughout the building to serve as repeaters. DAS requires the support of the carrier to allow access to their network and can take weeks if not months to obtain.

Cel-fi, costing about one third (1/3) that of DAS, is a viable alternative solution but without the tedious and sometimes delayed support of the carriers. Wytec has established a valuable vendor relationship with Nextivity, the inventor and patented owner of Cel-fi technology, and has been declared a premier provider for Cel-fi technology within the U.S.

According to Markets and Markets, a market analyst to more than 5,000 customers worldwide including 80% of global fortune 1000 companies, predicts the DAS market was valued at USD 6.71 Billion in 2015 and is expected to reach USD 10.78 Billion by 2022.

Wytec, with its preferred vendor relationship with Nextivity, expects to generate significant revenues deploying Cel-fi services while simultaneously developing its G.Fast services within the same buildings.

4G LTE: Wytec has secured a wholesale agreement through a Mobile Virtual Network Enabler (“MVNE”) allowing Wytec to access most of the largest carrier’s 4G LTE network operations in the U.S. The 4G LTE cellular network represents the largest cellular deployment in the world and still growing. The 4G cellular market according to most telecom analysts, is substantially over subscribed and has failed to deliver the minimum standards as defined by the International Telecommunications Union as cellular service. Recently, the carriers have developed a wholesale service allowing qualified partners to re-sell the data portion of the 4G network as a secondary connection for a business “back-up” or “fail-over” in the event the customer’s primary Internet connection fails.

Recent studies indicate that the “downtime” that a business experiences during the failure of its primary service is costly and disruptive. As a result of this primary service failure, the carriers developed a “fail-over” or “back-up” service utilizing the 4G network connection. Wytec has exploited its wholesale agreement in developing its own proprietary version of a 4G “fail-over” product to serve the Small Medium Business (“SMB”) Market under the designation of a qualified MVNO. This has allowed Wytec to leverage a massive existing network to expand its subscriber base while constructing its 5G network. The MVNO designation also allows Wytec to market business and residential cellphone service to include voice, text and data offerings.

According to Information Week “IT Downtime Costs U.S. Businesses $26.5 Billion In lost Revenue per year.

| 7 |

Our Target Markets

Wytec has focused its initial attention to serving primarily MDUs for both the commercial and residential market due to the advantage of securing rooftop access for the expansion of its hybrid network. Essentially, the more rooftops we can secure, the faster our network expands. We believe that this rapid expansion capability opens substantial opportunities to extend the LPN-16 technology to surrounding utility poles and further supporting a 5G class network. We identify our target markets as such:

SMB (Small and Medium-Sized Businesses)

| · | Employees: 0-100 is considered a small-sized business; 100-999 is considered a medium-sized business. Note that these size specifications may be defined differently by some government organizations, such as the Small Business Administration (“SBA”) which uses the size specifications as part of its process for granting small business loans and for consideration of awarding Federal contracts. |

| · | Annual Revenue: $5-$10 million |

| · | IT Staff: Typically one or a few |

| · | IT skills: Modest. Employees usually learn on the job. |

| · | Location: Limited geographical boundaries (but may have more remote workers due to outsourcing) |

| · | Limited CapEx |

| · | Main considerations for technology purchases include price (because of limited CapEx) and ease of use (because of less experienced IT staff). SMBs prefer the pay-as-you-go subscription model for software purchases |

| · | The 28 million small businesses in the US account for 54% of U.S. sales |

Wytec Product Selection: The SMB is a primarily limited to DSL and Cable Business Internet due to the cost differential and limited coverage of fiber optics. As such they do not enjoy the benefits of gigabit broadband speeds or “symmetrical” Internet features. Wytec provides both gigabit speeds and symmetrical Internet features through its Fixed Wireless and G.Fast service solutions to this business sector at competitive rates to their Cable Internet service.

“… the SMB sector is currently significantly underserved in terms of ICT provision and therefore holds considerable potential for growth, the challenge is how to profitably unlock the potential in a sector that is effectively a hybrid of service providers’ other two main targets – large businesses and consumer…” Source: Amdocs, 2015. Selling to SMBs.

SME (Small and Medium Enterprises). Also known as the “Mid-Market”

| · | SME is a more globally-used term than SMB, and is the official market phrase for internationally-based enterprises such as the United Nations, World Bank, World Trade Organization and the European Union. |

| · | Employees: The European Union has defined an SME as a legally independent company with 101-500 employees |

| · | Annual Revenue: $10 million- $1 billion |

| · | IT staff: A small group to several employees |

| · | IT skills: Generalist skills. Employees often lack specialty skills |

| · | Location: Likely to have more than one office location, and more remote employees |

| · | Some CapEx |

| · | Main considerations for technology purchases include capabilities, functionality, and reporting |

| · | If the middle market were a country, its GDP would rank it as the fourth-largest economy in the world. |

Wytec Product Selection: In a recent Galloway survey the SME could easily afford fiber optic connections but was limited (in many cases) to DSL and Cable Business Internet due to the limited coverage of fiber optics in most cities. As such they do not enjoy the benefits of gigabit broadband speeds or “symmetrical” Internet features that support their main considerations for technology purchases, functionality, and reporting. Wytec provides both gigabit speeds and symmetrical Internet features through its Fixed Wireless and G.Fast service solutions to this business sector at competitive rates to their Cable Internet service.

According to Global Market Insights, Inc., Enterprise Application Market size is expected to reach USD $287.71 billion by 2024. Mounting awareness regarding IT connectivity amongst company management, growing need for better internet infrastructure and swift cloud computing adoption by developed organizations will give a fillip to enterprise application market share over the forecast timeline.

| 8 |

Cities and Municipalities (The Smart City)

Today, cities and municipalities are focused on how to develop their “Smart City” initiatives. These initiatives include the integration of information and communication technology (“ICT”), and various physical devices connected to the network (the Internet of things or IoT) to optimize the efficiency of city operations and services and connect to citizens with the best of Internet services that can enhance and promote a quality of life. Smart city technology allows city officials to interact directly with both community and city infrastructure and to monitor what is happening in the city and how the city is evolving.

City government realizes to achieve their smart city initiatives it will need to embrace 5G innovations including direction on how to utilize their under-utilized assets such as “dark” fiber and utility pole access for small cell placement. There has been and continues to be great political turmoil in the utilization of city assets such as utility pole access due to limited space for multiple carrier access and cost placement to interested service providers.

Wytec’s Smart City Solution: Wytec’s LPN-16 small cell technology has been uniquely designed to meet multiple carrier access and resolve difficult political issues through providing a “license free” use of the LPN-16 to the city for pole placement access.

We intend to license the LPN to various customers inside and outside the United States consisting of urban and rural cities/municipalities, manufacturers, utility companies as well as mobile carriers who will have a need for small cells enabling data offloading. Signals and Systems (“SNS”) Research forecast that greater than 60% of today’s mobile network data traffic will be supported by Small Cell technology by 2020 and account for $352 billion in mobile data service revenues.

In addition to the multi-billion-dollar small cells market cited above we believe Wytec will also be an integral part of carrier mobile data offloading which SNS Research has forecasted to exceed $15 billion by 2020, driven by the proliferation of smartphone ownership, expansion of cell infrastructure, and vast adoption of mobile video which will drive mobile data consumption seven-fold by 2021.

Our Business Strategy

The majority of business broadband connections today are still represented by “wired” services such as fiber optics and Cable. Fixed Wireless broadband currently represents less than 10% of the business Internet market but climbing rapidly. Wytec has designed a “hybrid” broadband solution employing both the latest in wired and wireless technologies with the integration of its wireless Diamond Ring backhaul and its wired G.Fast “in building” connection utilizing existing copper wire and coax. This low-cost network deployment design delivers a highly competitive alternative to both Cable and Fiber Optics while complimenting an extension of the network with its patented LPN-16. We believe this extended network will be capable of supporting the benefits and features found in the next generation (5G) of the cellular industry.

We believe our greatest business opportunity is supported by key proprietary network designs, patented technology and strategic business partnerships. We currently have three (3) Diamond Ring networks utilizing millimeter wave technology and have most recently began the sale and deployment of our G.Fast and Cel-fi solutions. As our G.Fast and Cel-fi solutions are expanded thoughout our markets, our LPN-16 small cell opportunities are also expected to expand, contributing to a city-wide 5G branded solution further supporting the exponential growth of wireless solutions.

In November 2017, the United States Patent and Trademark Office (“USPTO”) granted Wytec’s LPN-16 patent on its small cell device. Our patented LPN-16 features multiple capabilities as a small cell device including:

| · | Neutral or agnostic hosting for multiple frequencies without interference |

| · | Designed for installation on a telephone or light pole |

| · | Receives backhaul transmission via millimeter wave |

| · | Producing Internet speeds in excess of 300 Mbps to a Smartphone. |

| · | Can host both cellular and wi-fi services. |

| 9 |

Selling Wytec’s Products

WyQuote: In 2016, Wytec developed, in conjunction with its unique broadband services, its own version of an online quote and ordering service. Through extensive research and observation of business to business (“b2b”) broadband business, Wytec discovered that one of the greatest challenges in delivering b2b broadband services was providing a “live” quote of current services and to be able to immediately order the service “online” through a network of qualified sales agents. WyQuote is currently under development for an upgraded version that allows the “business user” to view Wytec’s products and services and order directly without the aid of an agent. Currently there is no ordering system today that allows a business to view and instantly order broadband services from WyQuote. Traditionally, orders are generated by telephone and/or e-mails while customers have to wait days and sometimes weeks to receive service. The WyQuote system is designed to allow independent agents to view our wireless products and services, evaluate the service, and then purchase the service online in real time. Management believes this functionality will enable us to ramp-up revenues far more quickly than conventional ordering of services. The WyQuote system went live in late 2016 and is fully operational. WyQuote features include:

| · | Real-time Quotes for both wired and wireless services | |

| · | Accelerates sales and revenue growth | |

| · | Immediate ordering of services with electronic confirmation of order within one (1) hour | |

| · | Simple to learn and utilize within hours |

| · | Can be used by existing telecom agents and other channels |

Key Strategic Partnership

Nextivity: Nextivity is an award winning indoor cellular coverage technology winning a Gold Stevie® Award in the Fastest Growing Company of the Year category as part of the 12th Annual International Business Awards, and prevailed over competitors in Canada and the U.S.A. Wytec has been declared as a partner and certified integrator for Nextivity.

Employees

As of December 31, 2017, we have eight (8) full-time employees. Currently, there are no organized labor agreements or union agreements between us and our employees. Assuming we are able to earn additional revenue through organic growth, acquisitions and strategic alliances during 2018, we may need to hire additional employees. In the interim, we intend to use the services of independent consultants and contractors to perform various professional services when appropriate. We believe the use of third-party service providers may enhance our ability to control general and administrative expenses and operate efficiently.

Property

We currently lease approximately 3,395 square feet of office space at 19206 Huebner Road, Suite 202, San Antonio, Texas 78258 for approximately $5,630 per month.

Seasonality

Our operations are not expected to be materially affected by seasonality.

History

Wytec was formed in 2011 as a wholly owned subsidiary of Competitive Companies, Inc., a Nevada corporation (“CCI”) currently trading on the OTC-Pink Sheets (trading symbol CCOP). In November 2017, CCI distributed on a pro rata basis to its shareholders all 865,552 shares of the common stock of Wytec owned by it and all 1,731,104 warrants to purchase Wytec common stock owned by it (the “Spin-Off Warrants”), in a spin-off of Wytec by CCI.

| 10 |

Risks Relating with Our Business and Marketplace

We may be unable to execute our identified business opportunities successfully. Our business success is dependent upon several factors, including but not limited to the following:

| · | Our ability to achieve market acceptance of our technology in the United States and overseas; | |

| · | Our ability to monetize our technology by effectively selling our internet access services through our WyQuote marketing system or otherwise; | |

| · | Our ability to build Diamond Ring wireless transmission systems in numerous cities; | |

| · | Our ability to work effectively with building owners in securing rooftops to install and maintain our transmission equipment; | |

| · | Our ability to obtain access to advantageous locations on utility and light poles for deployment of our LPN-16; | |

| · | Our ability to create and deliver compelling product and service offerings for the wholesale and retail business markets for WiFi and voice services; | |

| · | Our ability to effectively manage the growth and expansion of our business operations without incurring excessive costs, high employee turnover or damage to customer relationships; | |

| · | Our ability to avoid excessive equipment failure or interruption of service which could adversely affect our reputation and our relations with our customers; | |

| · | Our ability to accurately predict and respond to the rapid technological changes in our industry and the evolving demands of the markets we serve; | |

| · | Our ability to configure our products and services to offer customers viable internet access (Wi-Fi) and related telecommunications solutions at a profit; | |

| · | Our ability to be price competitive in a market characterized by intense competition; and | |

| · | Our ability to raise additional capital or financing to fund our growth and to support our operations until we reach profitability, if we achieve profitability. |

Our failure to adequately address any one or more of the above factors could have a significant adverse impact on our ability to execute our business plan. We constructed our first wireless network in Columbus, Ohio to include the installation of our millimeter wave equipment on selective rooftops and other structures (our Diamond Ring) pursuant to lease or license agreements, to send and receive wireless signals necessary for the operation of our network. We typically seek five year initial terms for our leases with three to five year renewal options. Such renewal options are generally exercisable at our discretion before the expiration of the current term. If these leases are terminated or if the owners of these structures are unwilling to continue to enter into leases or licenses with us in the future, or breach those agreements with us, we would be forced to seek alternative arrangements with other building owners or providers. If we are unable to continue to obtain, retain or renew such leases on satisfactory terms, our business would be harmed.

| 11 |

We have a history of operating losses and expect to continue incurring losses for the foreseeable future. Our current business was launched in 2011 and has incurred losses in each year of operation. We cannot anticipate when, if ever, our operations will become profitable. We expect to incur significant net losses as we invest in our technology, expand our markets and pursue our business strategy. We intend to invest significantly in our business before we expect cash flow from operations to be adequate to cover our operating expenses. If we are unable to execute our business strategy and grow our business, either as a result of the risks identified in this section or for any other reason, our business, prospects, financial condition and results of operations will be adversely affected.

There is no assurance that Wytec’s Link Program will be successful. Through January 2016, Wytec had been relying primarily on the sale of registered links (“Links”) for revenue and working capital. Wytec terminated the offer and sale of Links in January 2016, except for two sales in July 2016. Since June 2016, Wytec has been offering to buy back Links in consideration for the issuance of its Series B Preferred Stock and warrants at $3.00 per unit (i.e. one share of Series B Preferred Stock and one warrant exercisable at $1.50 per share until December 31, 2017). As of November 20, 2017, we had repurchased all but 65 outstanding Links that currently remain with third party owners. Those outstanding Links include 14 that are activated and 51 that are not yet activated. We are generally retaining activated (“live”) Links for our use that are repurchased by us and letting pending Links lapse for the present. The previous sale of Links to third parties was not certain and selling costs were substantial. Once Links were sold, Wytec incurs substantial costs to provide equipment and make related lease payments. There is no assurance that Wytec will be able to realize alternative sources of revenue and cash flow in the future, or that the servicing of Links will not cause Wytec to incur operating deficits. In the absence of Link sale revenue, Wytec may not have sufficient funds to execute its business plan, materially adversely affecting its financial condition, operating results and business performance, or causing it to cease operations.

There is no assurance that we will be able to sell our internet access services through our WyQuote system or otherwise. Our revenue model in our business plan includes anticipated sales of our internet access services through a network of independent agents using the WyQuote online price quote system. The WyQuote system was only recently developed by us and its effectiveness has only been tested. There is no assurance that Wytec will be successful in selling and earning revenue from its 4G and eventually 5G internet access service offerings, or any other service or product. The availability of our service as primary access to the internet is currently limited to markets in which we have built a “diamond ring” transmission network. In all other markets, we would be selling service provided by the infrastructure of other carriers, which may be less profitable for us. Furthermore, customers for our internet access services generally must install special equipment, increasing the cost of our services and rendering it more challenging for us to be cost competitive.

Our success depends in part on the results of current and planned tests of our proprietary LPN-16 technology. Testing thus far has included environmental and radio frequency interference testing with our manufacturer and multiple speed tests utilizing an integrated 2.4GHz and 5GHz Qualcomm 802.11ac chipset which we completed in December of 2014. Additional tests will include proof of concept testing for network load balancing, public safety Band 14 and mobile network operator mobile data offloading, and WiFi and backhaul network testing. While we expect future tests of our LPN-16 to go well since preliminary testing of the technology in San Antonio, Texas, was positive, the LPN-16 may not work as we have currently designed and constructed it, causing us material delays and harm. If the LPN-16 fails the upcoming tests or the tests are materially delayed, it could have a material adverse impact on our financial condition, operating results, and business performance. The timing of the commencement of the launch of the LPN-16 product line is currently uncertain, and may be delayed until we have more capital to fund it. There is no assurance that our LPN-16 or any other proprietary technology that we develop will be successful, will work as planned, or can be commercialized or monetized profitably.

We must adapt quickly to changes in technology. Telecommunications technology is a rapidly evolving technology. We must keep abreast of this technological evolution. To do so, we must continually improve the performance, features and reliability of our equipment and related products. If we fail to maintain a competitive level of technological expertise, then we will not be able to compete in our market.

Our inability to respond timely to technological advances could have an adverse effect on our business. We must be able to respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. We can offer no assurance that we will be able to successfully use new technologies effectively or adapt our products and services in a timely manner to a competitive standard. If we are unable to adapt in a timely manner to changing technology, market conditions or customer requirements, then we may not be able to successfully compete in our market.

We may not be able to withstand fluctuations in our industry because our business is not diverse. We have limited financial resources, so it is unlikely that we will be able to diversify our operations. Our probable inability to diversify our activities into more than one area will subject us to economic fluctuations within a particular industry and therefore increase the risks associated with our operations.

| 12 |

Our ability to protect our intellectual property is uncertain. We assigned our five Patents to our subsidiary, Wytec, LLC, which was managed and 50% owned by General Patent Corporation. General Patent Corporation (“GPC”), the oldest patent enforcement firm in the United States, represents clients on patent enforcement rights and licensing transactions on a contingency basis. GPC was the manager of Wytec, LLC until 2017, when it assigned all of its rights in Wytec, LLC back to us. After extensive research and analysis, GPC elected not to assert infringement claims for the Patents on behalf of us and itself through Wytec, LLC. There is no assurance that these Patents are enforceable. We re-acquired the 50% of Wytec, LLC that we do not already own, and became the manager of it. In 2014, we filed a new provisional patent application for our proprietary LPN-16 data transmission technology, and we may apply for additional patents in the future. On October 31, 2017, we received our Patent on the LPN-16. We will have limited resources to fight any infringements on our proprietary rights and if we are unable to protect our proprietary rights or if such rights infringe on the rights of others, our business would be materially adversely affected. The current manufacturer of our LPN-16 owns the intellectual property rights to certain software used in the device, for which our license is only exclusive for the first three years of sales, after which it is nonexclusive in perpetuity. This arrangement may enable our competitors to more readily enter the market for this type of equipment.

Our business may be adversely affected by competition. The telecommunications industry is highly competitive. Many of our current and potential competitors have financial, personnel and other resources, including brand name recognition, substantially greater than ours, as well as other competitive advantages over us. Certain competitors may be able to secure products from vendors on more favorable terms, devote greater resources to marketing and promotional campaigns, and adopt more aggressive pricing than we will. We cannot assure that we will be able to compete successfully against these competitors, which ultimately may have a materially adverse effect on our business, results of operations, financial condition and potential products in the future.

Our business is subject to government regulation. Our registered Links are subject to and designed to comply with the regulations of the FCC. A change in those regulations or significant diminution of the right to access, use or license of the spectrum acquired in our registered Link program would be expected to have a material adverse effect on our operating results, financial condition, and business prospects and performance. We are also subject to regulations applicable to businesses generally. The adoption of any additional laws or regulations may decrease the growth of our business, decrease the demand for services and increase our cost of doing business. Changes in tax laws also could have a significant adverse effect on our operating results and financial condition.

We cannot assure that we will achieve profitability. We cannot assure that we will be able to operate profitably in the future. Profitability, if any, will depend in part upon our ability to successfully develop and market our proprietary telecommunications technology, and other products and services. We may not be able to successfully transition from our current stage of business to a stabilized operation having sufficient revenues to cover expenses. While attempting to make this transition, we will be subject to all the risks inherent in a small business, including the need to adequately service and expand our customer base and to maintain and enhance our current services. Our Link Program may not achieve profitability for a number of reasons, including without limitation insufficient funds to obtain or have access to registered Links, or to install equipment, or to activate the Links, or to sell Link capacity. Our Link Program with individual customers purchasing Links and leasing a portion of their capacity to us may cause operating deficits because sale, installation and activation costs may exceed revenue, if any, from those Links. Our future profitability will be affected by all the risk factors described in this prospectus and inherent in our business.

We are exposed to various possible claims relating to our business and we may not have sufficient insurance to fully protect us. We cannot assure that we will not incur uninsured liabilities and losses as a result of the conduct of our business, even though we currently maintain insurance policies for liability and property insurance coverage, along with workmen’s compensation and related insurance. Should uninsured losses occur, our investors could lose their invested capital.

We may incur additional indebtedness. We cannot assure that we will not incur additional debt in the future, that we will have sufficient funds to repay our indebtedness or that we will not default on our debt, jeopardizing our business viability. Furthermore, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct our business.

We expect to incur losses for the near future. We project that we will incur development and administrative expenses and operate at a loss for the foreseeable future unless we are able to generate substantial revenues from our planned proprietary products and services. We cannot be certain whether or when we will be able to achieve profitability because of the significant uncertainties with respect to our business.

| 13 |

We may incur cost overruns. We may incur substantial cost overruns in the development and deployment of our proprietary products and services. Management is not obligated to contribute capital to us. Unanticipated costs may force us to obtain additional capital or financing from other sources or may cause us to lose our entire investment in our business if we are unable to obtain the additional funds necessary to implement our business plan. We cannot assure that we will be able to obtain sufficient capital to successfully implement our business plan. If a greater investment is required in the business because of cost overruns, the probability of earning a profit or a return on investment in us is diminished.

We could be subject to liens. If we fail to pay for materials and services for our business on a timely basis, our assets could be subject to material men’s and workmen’s liens. We may also be subject to bank liens in the event that we default on loans from banks, if any.

We may face litigation in the future. We may be involved in litigation in the future. The adverse resolution of such litigation to us could impair our ability to continue in business if judgment holders were to seek to liquidate our business through levy and execution. We may incur substantial legal fees and costs in connection with future litigation, if any. If we fail in our defense to future actions, if any, or become subject to a levy and execution on our assets and business, we could be forced to liquidate or to file for bankruptcy and be unable to continue in our business. There is also a risk that we could face litigation and regulatory claims that could have a material adverse effect on our financial condition, operating results, and business.

We may not have adequate funds to implement our business plan. We have limited capital available to us. Although we anticipate securing additional funding from the issuance of additional securities, we cannot assure that we will secure all or any of the funding we anticipate. If our entire original capital is fully expended and additional costs cannot be funded from borrowings or capital from other sources, then our financial condition, results of operations and business performance would be materially adversely affected. We cannot assure that we will have adequate capital or financing to conduct our business or to grow.

Our limited resources may prevent us from retaining key employees or inhibit our ability to hire and train a sufficient number of qualified management, professional, technical and regulatory personnel. Our success may also depend on our ability to attract and retain other qualified management and personnel familiar in telecommunications industry. Currently, we have a limited number of personnel that are required to perform various roles and duties as a result of our limited financial resources. We intend to use the services of independent consultants and contractors to perform various professional services, when appropriate to help conserve our capital. If and when we determine to acquire additional personnel, we will compete for such persons with other companies and other organizations, some of which have substantially greater capital resources than we do. We cannot provide any assurance that we will be successful in recruiting or retaining personnel of the requisite caliber or in adequate numbers to enable us to conduct our business.

The loss of the services of any or our management or key executives could adversely affect our business. Our success is substantially dependent on the performance of our executive officers and key employees. The loss of an officer or director could have a material adverse impact on us. We are generally dependent upon our primary executive officer, William H. Gray, for the direction, management and daily supervision of our operations. We do not currently have any employment agreements with any members of our management team.

The consideration being paid to management has not been determined at arm’s-length. The common stock and cash consideration being paid by us to our management have not been determined based on arm’s-length negotiation. We may grant stock options and other equity incentives to our executive officers and directors, which may further dilute our shareholders’ ownership of us. While management believes that the consideration is fair for the work being performed, there is no assurance that the consideration to management reflects the true market value of its services.

Directors and officers have limited liability. As permitted by the Nevada General Corporation Law, our certificate of incorporation and by-laws limit the personal liability of our directors and officers and authorize our indemnification of them, but such provision does not eliminate or limit the liability of a director or officer in certain circumstances, such as for: (i) any breach of the director’s or officer’s duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174 of the Nevada General Corporate Law; or (iv) for any transaction from which the director derived an improper personal benefit. If we were called upon to perform under our indemnification agreement, then the portion of our assets expended for such purpose would reduce the amount otherwise available for our business.

| 14 |

Our chief executive officer, who is also the chief executive officer of CCI, owns a majority of our voting capital stock and CCI’s voting capital stock, which could create conflicts of interest. Mr. William H. Gray is the chief executive officer, president, chief financial officer, secretary, and chairman of both CCI and Wytec. He is also the holder of all 1,000 outstanding shares of our Series C Preferred Stock, by virtue of which he beneficially owns 51% of our outstanding voting capital stock, and the holder of all 100,000 outstanding shares of CCI’s Series D Preferred Stock, by virtue of which he beneficially owns 51% of CCI’s outstanding voting capital stock. As a result of such stock ownership and managerial control, Mr. Gray is able to generally exercise control over our affairs and CCI’s affairs, which could create conflicts of interest in the future including with respect to agreements and transactions between the two companies. In particular, Mr. Gray will have conflicts of interest in the negotiation, determination of the terms and conditions, and enforcement of contracts and transactions between the two companies, as well as his allocation of time and decisions with respect to corporate opportunities available to both companies at the same time. We cannot assure that such conflicts will be resolved in a manner favorable to the Company.

Risks Relating To Our Common Stock

No market for our common stock currently exists, and an active trading market may not develop or be sustained. Our stock price may fluctuate significantly. There is currently no public market for our common stock. We intend to apply to have our common stock quoted and traded on the OTC-QB Market or possibly the OTC-QX Market. In order to have our common stock quoted for public trading on the OTC-QB or OTC-QX Market, which is an over-the-counter market, not an exchange, we must have a market maker registered with FINRA to sponsor our application for a trading symbol for that over-the-counter market. There is no assurance that we will find a market maker to sponsor our common stock for public trading. An active trading market for our common stock may not develop or may not be sustained in the future. The lack of an active market may make it more difficult for stockholders to sell our shares and could lead to our share price and trading volume being depressed or volatile. We cannot predict the prices at which our common stock may trade. The market price of the common stock may fluctuate widely and decline, depending on many factors, some of which may be beyond our control, including:

| · | actual or anticipated fluctuations in our operating results due to factors related to our businesses; |

| · | success or failure of our business strategies; |

| · | our quarterly or annual earnings or those of other companies in our industries; |

| · | our ability to obtain financing as needed; |

| · | announcements by us or our competitors of significant acquisitions or dispositions; |

| · | changes in accounting standards, policies, guidance, interpretations or principles; |

| · | the failure of securities analysts to cover our common stock; |

| · | changes in earnings estimates by securities analysts or our ability to meet those estimates; |

| · | the operating and stock price performance of other comparable companies; |

| · | investor perception of our company and the internet infrastructure industry; |

| · | overall market fluctuations; |

| · | results from any material litigation or government investigation; |

| · | changes in laws and regulations (including tax laws and regulations) affecting our business; |

| · | changes in capital gains taxes and taxes on dividends affecting stockholders; and |

| · | general economic conditions and other external factors. |

| 15 |

Furthermore, our business profile and market capitalization may not fit the investment objectives of some CCI stockholders and, as a result, these CCI stockholders may sell their shares of Wytec common stock received by them in the spin-off of Wytec from CCI in November 2017. See “Risk Factors—Substantial sales of our common stock may occur after the spin-off, which could cause our stock price to decline.” Low trading volume for our common stock, which may occur if an active trading market does not develop, among other reasons, would amplify the effect of the above factors on our stock price volatility. Stock markets in general have experienced volatility that has often been unrelated to the operating performance of a particular company. These broad market fluctuations could adversely affect the trading price of our common stock.

Substantial sales of our common stock may occur after the spin-off, which could cause our stock price to decline. CCI stockholders receiving shares of our common stock in the spin-off generally may sell those shares immediately in the public market, if and when a public market for our securities is established. Although we have no actual knowledge of any plan or intention of any significant stockholder to sell our common stock following the spin-off, it is likely that some CCI stockholders, possibly including some of its larger stockholders, will sell their Wytec shares for reasons such as our business profile or market capitalization as an independent company, or because we do not fit their investment objectives, or, in the case of index funds, we are not a participant in the index in which they are investing. The sales of significant amounts of our common stock or the perception in the market that this will occur may decrease the market price of our common stock.

The exercise price of the Spin-Off Warrants may be adjusted higher in the future, depending on the public trading price of our common stock. On March 30, 2018, the exercise price of the Spin-Off Warrants may be adjusted to be the greater of (i) $5.00 per share, or (ii) 85% of the average closing price of the Company’s common stock quoted on the public securities trading market on which the Company’s common stock is then trading with the highest trading volume, during the five (5) consecutive trading days immediately preceding March 30, 2018. If our common stock is not publicly traded by March 30, 2018, then the exercise price will remain at $5.00 per share.

The concentration of our capital voting stock ownership may limit our stockholders’ ability to influence corporate matters and may involve other risks. William H. Gray, the chief executive officer of both CCI and us, is currently the beneficial owner of an aggregate (not subject to dilution) of approximately 51% of CCI’s and Wytec’s outstanding voting power. Upon completion of the spin-off, William H. Gray continues to hold the same percentage of outstanding voting power of CCI and Wytec.

Your percentage ownership in us may be diluted in the future. Our board of directors has the authority to cause us to issue additional securities and convertible securities at such prices and on such terms as it determines in its discretion without the consent of the stockholders, including without limitation common stock, preferred stock, warrants, stock options, and convertible notes. Consequently, our shareholders are subject to the risk that their ownership in us will be substantially diluted in the future.

We may not pay dividends in the future. Any return on investment may be limited to the value of our common stock. We do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition, and other business and economic factors affecting us at such time as our board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and marketing. Prospective investors seeking or needing dividend income should therefore not purchase our common stock. If we do not pay dividends, our common stock may be less valuable because a return on investment will only occur if our stock price appreciates.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline. If our stockholders sell substantial amounts of our common stock in the public market, or upon the expiration of any statutory holding period under Rule 144 or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang”, in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our stock price may be volatile. The market price of our common stock may be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control. In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock in general.

| 16 |

Item 1B. Unresolved Staff Comments.

None.

We currently lease approximately 3,395 square feet of office space at 19206 Huebner Road, Suite 202, San Antonio, Texas 78258 for approximately $5,630 per month.

We have entered into multiple rooftop lease agreements for the placement of equipment used in the buildout of our Millimeter Wave Network. The monthly lease payments range from $100 to $575 per month and the leases expire from 2018 to 2024.

None.

Item 4. Mine Safety Disclosures.

Not Applicable.

| 17 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

Market Information

Our common stock has not yet been approved for trading on FINRA’s Over-the-Counter QB Market (OTC:QB).

The Company is authorized to issue 495,000,000 shares of common stock, par value $0.001 per share. The Company is also authorized to issue 20,000,000 shares of preferred stock, par value $0.001 per share, 4,100,000 of which have been designated as Series A Preferred Stock, 3,160,000 of which are issued and outstanding, 6,650,000 of which have been designated as Series B Preferred Stock, 3,691,249 of which are issued and outstanding, and 1,000 of which have been designated as Series C Preferred Stock, 1,000 of which are issued and outstanding as of December 31, 2017. Each share of Series C Preferred Stock has a par value of $0.001 and the equivalent of 51% of the votes on any matter submitted to shareholders for a vote. The Series C Preferred Stock is not convertible into the Company’s common stock and has no rights to dividends and virtually no rights to liquidation preference. The liquidation preference of each share of the Series C Preferred Stock is its par value.

As of March 30, 2018, there were 655 record holders of our common stock, not including shares held in “street name” in brokerage accounts which is unknown. As of March 30, 2018, there were 3,977,310 shares of common stock outstanding on record.

We have never declared or paid dividends on our Common Stock and have no plan to do so in the immediate future.

Equity Compensation Plan and Information