Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Takung Art Co., Ltd | tv488824_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Takung Art Co., Ltd | tv488824_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Takung Art Co., Ltd | tv488824_ex31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Takung Art Co., Ltd | tv488824_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________ to _________________________

Commission file number 001-38036

TAKUNG ART CO., LTD

(Exact name of registrant as specified in its charter)

| Delaware | 26-4731758 |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

| Flat/RM 03-04 20/F Hutchison House 10 Harcourt Road, Central, Hong Kong | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code +852 3158-0977

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to section 12(g) of the Act:

Common Stock par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the bid and ask price of such common equity, as of the last business day of the registrant’s 2017 second fiscal quarter, was $57,710,576.06 (11,076,886 shares of common stock held by non-affiliates, at $5.21 per share, the price at which the common equity was last sold on June 30, 2017).

Note .—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares of common stock, par value $0.001 (the “Common Stock”), outstanding as of April 2, 2018 is 11,208,882.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Table of Contents

| 2 |

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K (“Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Annual Report. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Annual Report describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Annual Report could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report or the date of documents incorporated by reference herein that include forward-looking statements.

Currency, exchange rate, and “China” and other references

Unless otherwise noted, all currency figures in this filing are in U.S. dollars.

References to “US$,” “dollars” and “U.S. dollars” are to the legal currency of the United States.

References to "yuan" or "RMB" are to the Chinese yuan, the lawful currency of China, which is also known as the “Renminbi”.

References to “HK$” are to the Hong Kong dollars, the legal currency of Hong Kong.

Our reporting currency is U.S. Dollars. This Annual Report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of HK$ into U.S. dollars were made at HK$7.8128 and HK$7.7534 to US$1.00 and translations of Renminbi into U.S. dollars were made at RMB6.5063 and RMB6.9430 to US$1.00, the exchange rates set forth in the H.10 statistical release of the Federal Reserve Board on December 31, 2017 and December 31, 2016, respectively. We make no representation that the HK$, Renminbi or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars, HK$ or Renminbi, as the case may be, at any particular rate or at all. As of April 2, 2018, the translations of HK$ and Renminbi into U.S. dollars were made at HK$7.8485 and RMB 6.2764 to US$1.00, respectively.

References to “Common Stock” are to the common stock of Takung Art Co., Ltd, par value $0.001.

References to “PRC” or “China” are to the People’s Republic of China, excluding, for the purposes of this Annual Report only, Taiwan and the special administrative regions of Hong Kong and Macau.

References to “Hong Kong” are to “Hong Kong, Special Administrative Region of the People’s Republic of China”.

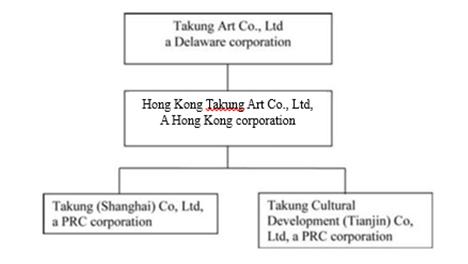

Unless otherwise specified or required by context, references to “we,” “the Company”, “Takung”, “our” and “us” refer collectively to (i) Takung Art Co., Ltd, (ii) the subsidiaries of Takung Art Co., Ltd, Hong Kong Takung Art Co., Ltd (“Hong Kong Takung”), a Hong Kong limited liability company, Takung (Shanghai) Co., Ltd. (“Shanghai Takung”) and Takung Cultural Development (Tianjin) Co., Ltd (“Tianjin Takung”), wholly-owned subsidiaries of Hong Kong Takung incorporated in the Shanghai Free-Trade Zone (SFTZ) in Shanghai, China and Tianjin Pilot Free-Trade Zone (TJFTZ) in Tianjin, China respectively.

| 3 |

References to Shanghai Takung’s “registered capital” and Tianjin Takung’s “registered capital” are to the equity of Shanghai Takung and Tianjin Takung respectively, which under PRC law is measured not in terms of shares owned but in terms of the amount of capital that has been contributed to a company by a particular stockholder or all stockholders. The portion of a limited liability company’s total capital contributed by a particular stockholder represents that stockholder’s ownership of the company, and the total amount of capital contributed by all stockholders is the company’s total equity. Capital contributions are made to a company by deposits into a dedicated account in the company’s name, which the company may access in order to meet its financial needs. When a company’s accountant certifies to PRC authorities that a capital contribution has been made and the company has received the necessary government permission to increase its contributed capital, the capital contribution is registered with regulatory authorities and becomes a part of the company’s “registered capital.”

Overview

Takung Art Co., Ltd is a holding company that, through Hong Kong Takung Art Co., Ltd., a Hong Kong company (“Hong Kong Takung”), our wholly owned subsidiary, and Takung (Shanghai) Co., Ltd and Takung Cultural Development (Tianjin) Co. Ltd., Hong Kong Takung’s wholly-owned subsidiaries in China (“Shanghai Takung” and “Tianjin Takung” respectively), operate an electronic online platform located at http://eng.takungae.com/ for artists, art dealers and art investors to offer and trade in ownership units over valuable artwork.

Through Hong Kong Takung, Shanghai Takung and Tianjin Takung, we offer on-line listing and trading services that allow artists/art dealers/owners to access a much bigger art trading market where they can engage with a wide range of investors that they might not encounter without our platform. Our platform also makes investment in high-end and expensive artwork more accessible to ordinary people without substantial financial resources.

We generate revenue from our services in connection with the offering and trading of artwork on our system, primarily consisting of listing fees, trading commissions, and management fees.

We are headquartered in Hong Kong, Special Administrative Region, People’s Republic of China and conduct business in Hong Kong, Shanghai and Tianjin. We’ve also set up an additional office in Hangzhou to carry out technology development. Our principal executive office is located at Flat/RM 03-04, 20/F, Hutchison House, 10 Harcourt Road, Central, Hong Kong.

Corporate History and Structure

We were incorporated in Delaware under the name Cardigant Medical Inc. on April 17, 2009. Our initial business plan was focused on the development of novel biologic and peptide-based compounds and enhanced methods for local delivery of treatments for vascular diseases including peripheral artery disease and ischemic stroke.

Pursuant to the Stock Purchase Agreement dated as of July 31, 2014, Yong Li, an individual purchased a total of 22,185,230 (pre- Reverse Stock Split) restricted shares of Common Stock of the Company from a group of three former stockholders of the Company. In consideration for the shares, Mr. Li paid the sellers $399,344 in cash which came from his own capital. The sellers were Jerett A. Creed, the Company’s former Chief Executive Officer, Chief Financial Officer, director and formerly a controlling stockholder of the Company, the Creed Family Limited Partnership and Ralph Sinibaldi. The shares represented approximately 95% of the Company’s then issued and outstanding Common Stock. The sale was consummated on August 28, 2014. As a result of the transaction, there was a change in control of the Company.

| 4 |

On August 27, 2014, we entered into a Contribution Agreement with Cardigant Neurovascular. Pursuant to the Contribution Agreement, we assigned all our assets, properties, rights, title and interest used or held for use by our business, (except for certain excluded assets set forth therein) which was the treatment of atherosclerosis and plaque stabilization in both the coronary and peripheral vasculature using systemic and local delivery of large molecule therapeutics and peptide mimetics based on high density lipoprotein targets (“Cardigant Business”). In consideration for such contribution of capital, Cardigant Neurovascular agreed to assume all our liabilities raising from the Cardigant Business prior to the date of the Contribution Agreement and thereafter with regard to certain contributed contacts. We granted Cardigant Neurovascular an exclusive option for a period of 6 months to purchase the excluded assets for $1. Cardigant Neurovascular exercised this option October 20, 2014 and the excluded assets were assigned to Cardigant Neurovascular on October 20, 2014.

Also on October 20, 2014, we acquired the business of Hong Kong Takung through the acquisition of all the share capital of Hong Kong Takung under a Share Exchange Agreement dated September 23, 2014 in exchange for 209,976,000 (pre-Reverse Stock Split) newly-issued restricted shares of our Common Stock to the stockholders of Hong Kong Takung.

Hong Kong Takung is a limited liability company incorporated on September 17, 2012 under the laws of Hong Kong, Special Administrative Region, China. Although Hong Kong Takung was incorporated in late 2012, it did not commence business operations until late 2013.

As a result of the transfer of the excluded assets pursuant to the Contribution Agreement and the acquisition of all the issued and outstanding shares of Hong Kong Takung, we are no longer conducting the Cardigant Business and have now assumed Hong Kong Takung’s business operations as it is now our only operating wholly-owned subsidiary.

On November 5, 2014, we filed a Certificate of Amendment to our Certificate of Incorporation with the Secretary of the State of Delaware to change our name from “Cardigant Medical Inc.” to “Takung Art Co., Ltd.”

On July 28, 2015, Hong Kong Takung incorporated a wholly owned subsidiary, Takung (Shanghai) Co., Ltd. (“Shanghai Takung”), in Shanghai Free-Trade Zone (SFTZ) in Shanghai, China, with a registered capital of $1 million. Shanghai Takung assists in Hong Kong Takung’s operations by receiving deposits from and making payments to online artwork Traders in mainland China on behalf of Hong Kong Takung. On January 27, 2016, Hong Kong Takung incorporated a wholly owned subsidiary, Takung Cultural Development (Tianjin) Co., Ltd (“Tianjin Takung”) in the Tianjin Free Trade Zone (TJFTZ) in Tianjin, China with a registered capital of $1 million. Tianjin Takung provides technology development services to Hong Kong Takung and Shanghai Takung, and also carries out marketing and promotion activities in mainland China.

On August 10, 2015, we filed a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware to effect a reverse stock split of our issued and outstanding shares of Common Stock at a ratio of 1-for-25 (the “Reverse Stock Split”). Upon filing of the Certificate of Amendment, every twenty-five shares of the Company’s issued and outstanding Common Stock were automatically converted into one issued and outstanding share of Common Stock, without any change in par value per share. No fractional shares will be issued as a result of the Reverse Stock Split. Stockholders who would otherwise be entitled to receive a fractional share will be entitled to rounding up their fractional shares to the nearest whole number.

| 5 |

Business History of Hong Kong Takung

Hong Kong Takung is a limited liability company incorporated on September 17, 2012 under the laws of Hong Kong, Special Administrative Region, China. Its authorized capital is 20,000,000 shares. Prior to the Reverse Merger, all its 20,000,000 issued and outstanding shares, par value $0.13 (HK$1) per share, were owned by Kirin Linkage Limited (4,000,000 shares) and Loyal Heaven Limited (16,000,000 shares), both Cayman Islands companies.

Although Hong Kong Takung was incorporated in late 2012, it did not commence business operations until late 2013.

| 6 |

Corporate Structure

The diagram below illustrates our current corporate structure:

Our Trading Platform

Our proprietary platform is an all-electronic trading system, consisting of host computers, client-side terminals and an interconnected communication system. Our trading system supports the trading and payment/settlement of artwork ownership units. It is an electronic platform developed by a third party software development company and customized for us, primarily consisting of a matching system, a transaction monitoring system, an account managing system and a settlement system. Currently, our software development team is stationed in Hangzhou to continue to develop the platform to be more robust, with additional functionalities to further improve the customer experience.

Matching is a core function of our trading platform. Our system concludes transactions by matching all the transactions submitted by the Traders. Transaction monitoring system is responsible for monitoring the daily transactions in real-time to ensure fairness and accuracy in our trading platform. The settlement system verifies and reconciles daily statistical data with the banks’ transaction system, and completes the registration and settlement (or payment) of artwork units once the transaction data is verified.

Our website http://eng.takungae.com/ is an essential part of our trading platform.

The website is important as it is the gateway to our trading platform. It publishes our membership and trading rules, trading information disclosure, and artwork introduction, and provides services to Traders, such as account management. Traders may open, close and manage their accounts with us on our website. Client-end terminal may be downloaded from our website. Through the terminal, Traders may access their account with us and conduct transactions in artwork units, such as purchasing and selling and submitting inquiries. Data transmission between the Traders and our trading system is encrypted to prevent data leaks.

| 7 |

Our trading platform is currently linked to China Merchants Bank, Hong Kong Branch (“CMB”). Traders are required to open an account with CMB and their accounts are linked to our trading and settlement system to ensure the timely settlement of their trades. For RMB settlements in China, our trading platform through Enterprise Resources Planning (ERP) system, can directly connect trader bank accounts to our bank account under Bank of China and Ping An Bank to facilitate account and transaction enquiries. The transaction instructions will be submitted to our trading platform on a real-time basis for their deposit. On January 16, 2017, our trading platform subscribed a new payment function from Ping An Bank which provides real-time payment and settlement service to make deposits quick and easy. If they would like to withdraw money from their trading account, the Traders will put in a request on our trading platform. After confirming the Traders’ accounts have sufficient money for withdrawal, we will transfer the money from the client-money bank account to the Traders’ individual bank account.

In order to execute a trade, a Trader logs into his online bank account and must first transfer funds from his bank account to his trading account with us. This ensures that he has sufficient funds to consummate a trade.

Offering and trading of artwork on our platform involves a number of parties, namely, Original Owner, Offering Agent, and Traders.

| · | An Original Owner is the original owner of the artwork to be offered and traded on our platform. Customarily, the Original Owner is also the artist or creator of the artwork although this is not always the case. The Original Owner must have good and marketable title to the artwork and have the right to dispose of the artwork. |

| · | An Offering Agent is an entity that is experienced with artwork or artwork investment and has a good reputation. The Offering Agent is engaged by the Original Owner to assist him or her with the offering and trading of artwork, such as preparation of listing application and assigning an investment value, research, organizing promotions and marketing activities, communicating with potential investors, etc. |

| · | A Trader is anyone who is 18 years or older or any entity that maintains a trading account with us through our electronic trading platform and participates in the trading of artwork units. Once a Trader acquires one or more units of an artwork, the Trader becomes a Co-Owner of that artwork. Presently, only residents of the People’s Republic of China, Australia, Malaysia, Mongolia, New Zealand, Russia, Singapore and Taiwan are eligible to become a Trader. |

Additional parties such as insurer, appraisal firm, trader service organizations and custodian for artworks will be retained in connection with the offering and trading of artwork on our system. A trader service organization is an independent legal entity pre-approved by us to provide business consulting services to our Traders.

Our trading system hardware platform is hosted in Macau, our clearing system hardware platform is hosted in Hong Kong and our disaster recovery system is set up in the CITIC Telecom IDC room, located in Hong Kong. The real-time data synchronization ensures the safety of transaction data.

Through our subsidiary, Shanghai Takung, we are able to receive deposits from and make payments to online artwork Traders in mainland China on behalf of Hong Kong Takung. As a software development center in Hangzhou, they are supporting our trading platform for the R&D process. Tianjin Takung is a back office for Hong Kong Takung and Shanghai Takung which provides technology support and also carries out marketing and promotion activities in mainland China.

Revenue

We generate revenue from our services in connection with the offering and trading of artwork on our system. Our revenue mainly falls into three broad categories: (i) listing fees, (ii) trading commissions, and (iii) management fees. To a much smaller extent, we have two additional sources of revenue, which we began earning only in 2015. We charge an annual fee for providing Traders and Offering Agents with premium services, including more in-depth information and tools, on the trading platform. This revenue is recognized ratably over the service agreement period. We also began earning authorized agent subscription revenue which is an annual service fee paid by authorized agents to grant them the right to bring their network of artwork owners to list their artwork on our trading platform. This revenue is recognized ratably over the annual agreement period.

| 8 |

Offering

Artwork that is eligible for offering and trading on our platform includes calligraphy, paintings, sculptures, crafts, jade, jewelry, metal ware, ceramics, and antique furniture. The common denominator of our listed paintings is that they are from renowned living artists and are valuable.

For example, the 241 sets of artwork listed for trade on our platform through December 31, 2017 have been 40 sets of paintings and calligraphies from famous Chinese, Russian and Mongolian artists ranging in listing value from $128,327 (HK$1,000,000) to $1,539,922 (HK$12,000,000), 35 pieces of jewelry ranging in listing value from $25,665 (HK$200,000) to $1,283,269 (HK$10,000,000), 126 pieces of precious stones ranging in listing value from $12,833 (HK$100,000) to $769,961 (HK$6,000,000), 29 pieces of amber ranging in listing value from $128,327 (HK$1,000,000) to $1,026,615 (HK$8,000,000), 4 pieces of antique mammoth ivory carving ranging in listing value from $128,327 (HK$1,000,000) to $256,654 (HK$2,000,000), 2 pieces of porcelain pastel paintings ranging in listing value from $102,661 (HK$800,000) to $230,988 (HK$1,800,000), 2 pieces of porcelain in listing value from $38,498 (HK$300,000) to $64,163 (HK$500,000), 1 set of Unit+ product with listing value of $152,452 (HK$1,188,000), 1 piece of Yixing collectable with listing value of $128,327 (HK$1,000,000) and 1 piece of Sports memorabilia with listing value of $128,892 (HK$1,004,400).

Traditionally, artwork is sold and transacted by the creator/owner of it through galleries, stores and agents.

Similarly, an artwork is presented to us for listing by the owner/artist (Original Owner) together with an agent (Offering Agent). Both the Original Owner and the Offering Agent would have discussed and proposed a price for the artwork in their listing application to us. An Offering Agent assists the Original Owner with the listing process, such as getting the artwork appraised by a third party professional, assigning an initial value for each trading unit at listing, performing research and preparing the marketing material and promotional activities to attract Traders’ interest. There may be circumstances in the future that the Original Owner will approach us for the listing, in which case, we will recommend an Offering Agent to assist the Original Owner with the listing process. However, we consider this to be a rare case. For the 241 pieces of artwork that we have listed through December 31, 2017, the listing processes were all initiated by Offering Agents.

On receipt of the application, we will assess and consider the merits of listing the artwork on our platform. Some of the factors we will consider are the appeal of the proposed artwork, the artist, the marketability of the artwork and the likelihood of its appreciation in the future.

Assuming that an artwork is accepted for listing, it will be divided into equal ownership units based on its appraised value. For example, a painting with a listing value of $1,545,993 (HK$12,000,000) may be divided into 12,000,000 units with each unit sold at $0.13 (HK$1). Traders would then be able to bid for and trade these units on our platform.

Qualification for Offering

We have a quantified standards for artwork that is eligible for offering and trading in A-Tier on our platform. Except for the A-Tier standards, we do not have quantified standards for artwork that is eligible for offering and trading on our platform. However, we will generally require the artwork to meet the following qualifications:

| · | Clearly-established ownership |

| · | Having certain economic and artistic value |

| · | Having an appraisal report from professional appraisers |

We do not evaluate or appraise artwork but we rely on expert opinions from third parties on the value of the artwork.

Offering Process

To list an eligible artwork on our platform, the Original Owner and/or his/her Offering Agent must submit a listing application to us together with an investment value research report on the artwork and an offering statement. The investment value research report analyses all the factors that would affect the investment value of the artwork. The artwork should be appraised by a qualified appraisal firm appointed by the Original Owner and/or the Offering Agent.

| 9 |

Generally, an offering statement includes the following information:

| · | Introduction of the artwork, including name, author, date of creation | |

| · | Material facts on the offering, including type of artwork, total offering price, offering method, identity of Offering Agent, the number of artwork units offered, offering number, unit offering price, term of the offering, subscription period, minimum subscription amount, etc. | |

| · | Offering details including subscription procedure, registration, etc. | |

| · | Parties involved in the offering, including Offering Agent, appraisal firm, insurer, custodian | |

| · | Appendices generally include related material documents such as appraisal report |

Prior to the sale to the public, the Original Owner may reserve a certain percentage of the artwork units and the Offering Agent may subscribe for a certain percentage of artwork units, generally 0-10%, maximum up to 30%. These artwork units held by the Original Owner and the Offering Agent may not be traded until 180 days after the date when the artwork is listed.

The offering of ownership units in artwork will be considered successful if the units subscribed reach a prescribed percentage (“Offering Percentage”) of the total units offered. The Offering Percentage is determined by the Original Owner, the Offering Agent, if one is engaged, and us and is set forth in our Offering Agreement with them. The Offering Percentage for our existing listed artwork is 80%. If an Offering Agent is engaged, the total number of subscribed units by Traders and reserved units by the Original Owner should equal or exceed the Offering Percentage; otherwise, the offering is unsuccessful. If no Offering Agent is involved, the total subscribed units should exceed the Offering Percentage; otherwise, the offering is unsuccessful. In the event of an unsuccessful offering, the offer for subscriptions of the artwork units by Traders is voided.

If the total subscribed units exceed the Offering Percentage but are less than the total offered amount, then the Offering Agent is obliged to purchase the remaining units on the same offering terms or if no Offering Agent is engaged, the Original Owner shall retain the remaining units. In the former, the Offering Agent is required to link its bank account at CMB or accounts in PRC with its trading account with us to ensure that it has sufficient funds to purchase any remaining unsold units. The Original Owner and/or the Offering Agent shall pay us a one-time offering fee and a listing deposit. The offering fee is determined based on many factors, such as the type of artwork and the offering size. We generally charge approximately 22.5-48.5% of the total offering price for calligraphies, paintings, jewelry, ambers, precious stones, antique mammoth ivory carving, porcelain pastel paintings and porcelain, which are the major types of artwork listed and traded on our system as of December 31, 2017. The listing fee is earned when the units for the artwork are successfully subscribed for and trades on our platform.

The offering deposit is generally 20% of the total offering price and may vary based on the type of artwork, offering price and other factors. The offering deposit is paid by the Offering Agent through the linked accounts as described above and will be refunded if all offered artwork units are sold. In the event that the total number of units sold exceeds the Offering Percentage but does not reach all of the units offered, the offering deposit will be used to purchase the remaining artwork units that have not been subscribed by Traders.

Upon receipt of all required offering documents, we will review the offering application and decide on a case by case basis, if the artwork should be listed and traded on our platform. Our management team, with the assistance of art consultants (who are appointed by the Offering Agent), conducts a procedural review of the offering application and related documents. We will approve the artwork for offering and trading as long as all listing requirements are met.

As of December 31, 2017 there were 241 pieces of artworks, including 40 sets of paintings and calligraphies, 35 pieces of jewelry, 126 pieces of precious stones, 29 pieces of amber, 4 pieces of antique mammoth ivory carving, 2 pieces of porcelain pastel paintings, 2 pieces of porcelain, 1 set of Unit+ product, 1 piece of Yixing collectable and 1 piece of Sports memorabilia successfully listed and trading on our system.

The first set of paintings and calligraphies was listed in 2013, two sets were listed during the six months ended June 30, 2014, the fourth set was listed during the third quarter of 2014, two sets were listed during the fourth quarter of 2014, three sets were listed during the fourth quarter of 2015, one set was listed during the first quarter of 2016, five sets were listed during the second quarter of 2016, nine sets were listed during the third quarter of 2016, seven sets were listed during the fourth quarter of 2016, two sets were listed during the second quarter of 2017, six sets were listed during the third quarter of 2017 and one set was listed during the fourth quarter of 2017.

Apart from paintings and calligraphies, four pieces of jewelry were listed on the platform on January 22, 2015, three pieces were listed in the first quarter of 2016, two pieces were listed in the second quarter of 2016, six pieces were listed in the third quarter of 2016, three pieces were listed in the fourth quarter of 2016, ten pieces were listed in the first quarter of 2017, five pieces were listed in the second quarter of 2017, one piece was listed in the third quarter of 2017 and one piece was listed in the fourth quarter of 2017.

Five pieces of precious stones were listed in the second quarter of 2015, seven pieces were listed in the third quarter of 2015, thirteen pieces were listed in the fourth quarter of 2015, eleven pieces were listed in the first quarter of 2016, thirty-two pieces were listed in the second quarter of 2016, sixteen pieces were listed in the third quarter of 2016, twelve pieces were listed in the fourth quarter of 2016, seven pieces were listed in the first quarter of 2017, seven pieces were listed in the second quarter of 2017, nine pieces were listed in the third quarter of 2017 and seven pieces were listed in the fourth quarter of 2017.

Three pieces of amber were listed in the third quarter of 2015, eight pieces were listed in the fourth quarter of 2015, five pieces were listed in the first quarter of 2016, six pieces were listed in the second quarter of 2016 and seven pieces were listed in the third quarter of 2016.

One piece of antique mammoth ivory carving was listed in the first quarter of 2016, two pieces were listed in the second quarter of 2016 and one piece was listed in the fourth quarter of 2016.

Two pieces of porcelain pastel paintings was listed in the second quarter of 2016.

One piece of porcelain was listed in the fourth quarter of 2016 and one piece was listed in the first quarter of 2017.

One set of Unit+ product was listed in the third quarter of 2017, one piece of Yixing collectable and one piece of Sports memorabilia were listed in the fourth quarter of 2017.

| 10 |

The Original Owner and the Offering Agent are required to disclose timely all material information regarding the artwork. The disclosure must be true, accurate, complete and not misleading. The Original Owner and the Offering Agent are responsible for their conduct in connection with the offering of the artwork. We also monitor and regulate their conduct. For more information, please refer to our disclosure under “Regulation of Market Participants.”

Subscription Process

Once the offering is approved, the Offering Agent will fund its trading account with the listing deposit and we then register the artwork units in our system. The Traders may log into their trading account to bid for the artwork units. If the artwork units are over-subscribed, we will conduct a lottery to determine which subscriptions will be accepted.

A Trader may receive a lower allocation than the number of units that he or she has applied for. Traders may also be allotted with more or fewer units than others who have applied for the same number of units. It is also possible that Traders are not allotted any units at all. The more units that a Trader applies for, the more likely a Trader is allotted with units. In order to subscribe for units, Traders need to set aside money in their brokerage accounts with us, which is “frozen” during the subscription period. After the announcement of the allotment, the money “frozen” will be released to us in a successful Offering or back to the Traders’ accounts in an unsuccessful one. The funds from successful subscriptions will be disbursed to the Original Owner in accordance with the payment schedule provided in our Offering Agreement with him or her.

Pre-Listing Premium Pricing

In addition to charging a percentage of the total listing amount as listing fee, additional listing revenue may be generated by the Pre-Listing Premium processed by the Offering Agent.

In certain circumstances, if the Offering Agent believes that there are Traders who are willing to pay a premium to be able to purchase the units without entering the balloting process so they can be certain about purchasing the units, the Offering Agent can negotiate with the Original Owner and us to “lock-in” and purchase the units outright on the listing date at a premium. These units will not be entered into the balloting process. The Listing Agreement (between the Owner, Agent and us) would specify the maximum number of units that can be locked in by the Offering Agent. The premium, which is in addition to the total listing amount, is recognized as listing income.

Insurance and Storage of Artwork

We require insurance coverage for artwork offered and traded on our platform. The insurance policy has an insured value equal to the total offering price of the artwork and covers the entire trading period.

The listed artwork is also required to be stored at qualified facilities. The storage companies we select are experienced with artwork storage and transportation. Specifically, the storage facility should meet the following requirements:

| · | Has warehouses with constant temperature and humidity in different locations; |

| · | Has 24 hour video surveillance and infrared burglar alarm system; |

| · | Has professional artwork transportation equipment; and |

| · | Has security personnel. |

Once a Trader purchases certain artwork units, he will become a Co-Owner of this artwork and must abide by a Co-Owner Agreement, which, among other things, authorizes us to select and change, on behalf of the Co-Owners, the Storage Company and insurer for the artwork.

| 11 |

We pay the fees for the insurance and the storage out of the management fees paid to us by the Traders. Our management fee is calculated at $0.0013 (HK$0.01) per 100 artwork units per day. The management fee is accounted for as revenue, and immediately deducted from the proceeds from the sales of artwork units when a transaction is completed.

In the event of a loss, we will receive the insurance monies from the insurer as beneficiary under the relevant insurance policy and then disburse them to all Co-Owners in accordance with the Co-Owner Agreement.

Trading

Our market is open for trading from Monday through Friday. Traders may only purchase or sell artwork units during trading hours. They may nevertheless log into their account and view the account information, such as the balance of funds, type and number of artwork units held during non-business hours.

Traders purchase and sell artwork units listed on our system through a client-end terminal – trading software. The software is available for download from our website http://eng.takungae.com/ and every Trader may commence trading in artwork units once he opens a trading account with us and has funded this account as described above. Each Trader is required to sign a Trading Agreement and abide by a Co-Owner Agreement. The aggregate number of units allowed to be traded per day by a Trader shall not exceed 5% of the total offered artwork units.

On April 1, 2016, we began to charge a predetermined monthly fee (unlimited trades for specific artworks) for specific artworks. These Traders are selected by authorized agents and subject to our review. After review, we negotiate individually with each Trader to determine a fixed monthly fee. Pursuant to negotiations, different Traders may have different rates and once agreed upon, the monthly fee is fixed.

We charge trading commissions for purchase and sale of artwork units. The commission is typically 0.3% of the total amount of each transaction but as a promotion, we currently charge a reduced fee of 0.2% of the transaction value on both the purchase and sale sides resulting in an aggregate commission rate of 0.4%.

We also charge Traders management fees covering the insurance, storage, and transportation for an artwork and trading management of artwork units, which are calculated at $0.0013 (HK$0.01) per 100 artwork units per day. The management fee is deducted from proceeds from the sale of artwork units.

Currently, most of our Traders are from Mainland China and some portion from other countries such as Australia, Malaysia, Mongolia, New Zealand, Russia, Singapore and Taiwan are also eligible to register as Traders.

Trading Halt

We may halt the trading of a listed artwork upon occurrence of the following conditions:

| · | Occurrence of irregular trading activities; | |

| · | 10% or more of a listed artwork is involved in legal proceeding and has been frozen by relevant authorities; | |

| · | Release of information in public media that may materially affect or have affected the trading price of the artwork; | |

| · | The artwork is the subject of a legal proceeding regarding ownership; | |

| · | Upon application by all the Co-Owners to change the terms of Co-Owner Agreement or arrangements regarding transportation, storage, insurance or exhibition of the artwork; | |

| · | The artwork is involved in illegal transactions; and | |

| · | Other circumstances that would make the listing unfit in our discretion. |

Delisting

Each offering statement will stipulate the term in which an artwork trades on our platform. An artwork may be delisted from our platform through voluntary withdrawal or successful sale of the artwork via auction at the end of the term.

Upon application of all the Co-Owners, an artwork may also be delisted from our system. The Co-Owners should submit a delisting application, upon receipt of which we will suspend the trading of the artwork units. If the application is approved, the artwork will be delisted from our platform; otherwise, it will resume trading. Once delisted, the artwork will be returned to the designee of all Co-Owners or the sole owner.

| 12 |

Upon expiration of the trading term as set forth in the offering statement, the trading of the artwork units will be suspended and the artwork will enter into an auction process. The offering price shall be the reserve price for the artwork. Once it is successfully sold through auction, the artwork will be delisted from our system. If the auction is not successful, the artwork units will resume trading for a term to be determined at the time its trading is resumed.

An artwork may also be delisted due to the following reasons:

| · | The artwork was lost in a theft or robbery; | |

| · | The artwork was irreparably damaged; | |

| · | The artwork was adjudicated to be owned by a person other than the Original Owner; and | |

| · | Other circumstances which we deem would render the listing unfit. |

A delisting report will be issued by us upon delisting of an artwork, which report will state the name of the delisted artwork, the delisting date, the delisting decision, related matters following the delisting, etc.

Registration and Settlement

Our trading platform’s settlement system reconciles all trades and payments on a daily basis.

The registration and settlement of the trading of artwork units is currently supervised and managed by our registration and settlement department. This department is responsible for trading account setup and management, registration of artwork units, including initial registration, transfer registration and delisting registration and providing information, consultation or training relating to the registration and settlement of artwork units.

Regulation of Market Participants

The Original Owner and the Offering Agent are required to comply with our rules in connection with the offering of artwork. If we discover any violation, we will request them to take corrective actions. If the Offering Agent engages in fraudulent activities, such as putting out false or misleading advertisement or disclosure on the artwork, it may be barred from participating in any offering for up to two years, in addition to any legal liabilities.

We monitor and regulate the conducts of Traders on a daily basis through our real time monitoring system. If there are irregular trading activities that may affect the trading price and volume of artwork units, we will seek clarification from the Trader(s) by sending inquiries and notices, and conducting interviews, etc. If there is any violation of our trading rules, we may take the following actions:

| · | issue oral or written warnings; | |

| · | request the Trader to submit written commitment; | |

| · | issue a reprimand; | |

| · | impose a fine; | |

| · | suspend or limit trading activities; and | |

| · | revoke the qualifications of the Trader. |

Sales and Marketing

We are currently marketing our electronic trading platform through participation in culture and art exhibitions and internet advertising. Additionally, we encourage existing Traders to introduce new Traders. For fiscal year 2017, we paid commissions to existing Traders who have successfully introduced new Traders at the following rates:

| 13 |

| Number of Referees |

Accumulated Total Gross Trade Amount (in HKD) |

Rebate Ratio | ||

| ≥ 1 person | > $0 | 5% of Referee’s commission |

Effective January 1, 2017 through December 31, 2017, commissions to existing Traders were as follows:

We have also instituted a trader service organization service program. Trader service organizations are separate, independent entities that provide business consultation services to some of our Traders such as providing training on the trading rules of our platform. Under the trader service organization service program, we will pay the relevant trader service organization up to 68% of all trading commissions generated from new Traders referred to us from Traders serviced by such trader service organization (“Service Fee”). The exact terms with each trader service organization which participates in this program vary on a case by case basis although in every case, the Service Fee is contingent on the ongoing business consultation relationship between the trader service organization and the Trader. In other words, if the business consultation relationship is terminated between a Trader and its trader service organization, that trader service organization will no longer earn a Service Fee from trading commissions generated from new Traders introduced by that Trader.

Additionally, a trader service organization may refer other trader service organizations to us. The referring trader service organization will be paid up to 10% of the Service Fee payable to the new trader service organization.

We entered into three other sales and marketing related agreements with Shenzhen Qianrong Cultural Investment Development Co., Ltd (“Qianrong”) in 2015, namely (1) Trader Promotion Services Agreement; (2) Internet and SMS Marketing Services Agreement; (3) Online Marketing Service Agreement.

During 2016, we entered into ten sales and marketing related agreements with Qianrong, with the same three types of agreements as previous year.

We also entered into three Advertising and Promotional Services Agreements with Shenzhen Qianxiang Investment Consulting Co., Ltd. (“Qianxiang”) in 2016.

We utilize Google and Baidu Listing Search and Key Word Search services for search engine optimization in order to promote our website and platform.

In April 2016, we introduced a discount program to our VIP Traders with a contractually determined flat rate of trading commission is applied to the transactions of these certain artworks. Any trading commission charges incurred by the VIP Traders over the flat rate will be waived. The discounted rate varies between the selected artworks. If VIP traders become delinquent on payment, we will cancel the discount program for those individuals and revert to charging them commission per transaction.

Besides this, we also instituted separate discount programs to VIP Traders by waiving their trading management fees during certain promotion periods. The rebates and discounts are recognized as a reduction of revenue in the same period the related revenue is recognized.

Customers

Our customers are the Traders, Original Owners and Offering Agents. We are constantly marketing and increasing our customer base, it is difficult to ascertain if the loss of a single customer, or a few customers would have a material adverse effect on us. Suffice it to say, no one customer constitutes in the aggregate 10% or more of our consolidated revenue.

| 14 |

Seasonality

In view of our operating history, other than the Chinese New Year which could impact the number of listings and trading around that period, , we believe the nature of our business is not cyclical.

Employees

As of February 26, 2018, we had 117 full-time employees, comprising 94 employees who are based in the People’s Republic of China, and 23 employees who are based in Hong Kong. Di Xiao is Hong Kong Takung’s General Manager (apart from being our Chief Executive Officer) as well as its director. Zishen Li is Shanghai and Tianjin Takung’s General Manager and the director of the Company. Chun Hin Leslie Chow is our Chief Financial Officer. As for the other 114 employees, 24 are from the Business Development department, 5 are from the Big Data Analytics department and 5 are from the Marketing department, 5 are from the IT department, 5 are from the Transaction Management department, 16 are from the Administrative and Customer Service department, 3 are from the Clearing and Settlement department, 3 are from the Uplisting department, 27 are from the Software Development department, 5 are from the Legal department, 6 are from the Information System department, 1 from the Internal Control department and 9 are from the Accounting department.

There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

Regulation

U.S. Regulations

On December 22, 2017, the Tax Cuts and Jobs Act (“the Act”) was enacted by the U.S. government which included a wide range of tax reform affecting businesses including the corporate tax rates, international tax provisions, tax credits and deduction with majority of the tax provision effective after December 31, 2017.

The Act establishes a flat corporate income tax rate of 21% which supersedes the current tax rate ranging from 15% through 35% and repeals the corporate alternative minimum tax (AMT) effective in 2018.

Under the Act, U.S. federal net operating losses (NOLs) carryforwards will be indefinitely while the two-year NOL carrybacks for NOLs arising in taxable years ending after December 31, 2017 was repealed. Furthermore, the Act imposes an annual limit of 80% on the amount of the taxable income that such NOLs can offset for the NOLs arising in taxable years ending after December 31, 2017.

The Act has significantly modified the U.S. international business tax regime, essentially transforming the framework by which U.S. and non-U.S. headquartered businesses are taxed. The significant changes consist of:

| · | A partial participation exemption system for profits derived by US-based multinationals from foreign subsidiaries, eliminating the friction of a US tax upon repatriation of overseas profits |

| · | A minimum tax on foreign earnings of US-based multinationals with foreign subsidiaries |

| · | A base erosion tax on transactions between US and non-US affiliated corporations, in structures involving US and non-US headquartered groups |

| · | A one-time tax on the estimated US$2-3 trillion of overseas earnings accumulated by US-based multinationals, payable over eight years, and thus allowing those profits to be repatriated without further US tax |

| 15 |

| · | Several other changes across the US international tax regime addressing the source of income, FTCs, deductibility of payments, and other issues, including ownership and transfers of intangible property (Global Intangible Low-Taxed Income or GILTI) |

Hong Kong Regulations

As a business operating in Hong Kong, we are subject to various regulations and rules promulgated by the Hong Kong government. The following is a brief summary of the Hong Kong laws and regulations that currently materially affect our business. This section does not purport to be a comprehensive summary of all present and proposed regulations and legislation relating to the industries in which we operate.

Securities & Futures

The securities and futures markets in Hong Kong are currently governed by the Securities & Futures Ordinance (“SFO”). The SFO consolidates and authorized the 10 previous ordinances regulating the securities and futures markets. The primary legislation and the subsidiary legislation commenced operation on April 1, 2003. By law, any person carrying on, among others, a business of dealing in securities in Hong Kong, has to be licensed by the Securities and Futures Commission (“SFC”) unless falling within one of the licensing exemptions.

The term “securities” under the SFO is defined as:

| (a) | shares, stocks, debentures, loan stocks, funds, bonds or notes of, or issued by, or which it is reasonably foreseeable will be issued by, a body, whether incorporated or unincorporated, or a government or municipal government authority; |

| (b) | rights, options or interests (whether described as units or otherwise) in, or in respect of, such shares, stocks, debentures, loan stocks, funds, bonds or notes; |

| (c) | certificates of interest or participation in, temporary or interim certificates for, receipts for, or warrants to subscribe for or purchase, such shares, stocks, debentures, loan stocks, funds, bonds or notes; |

| (d) | interests, rights or property, whether in the form of an instrument or otherwise, commonly known as securities; |

| (e) | interests, rights or property, whether in the form of an instrument or otherwise, prescribed by notice under section 392 as being regarded as securities in accordance with the terms of the notice. |

| 16 |

Our business model does not qualify as dealing in securities, as such term is defined in the SFO and as such, we are not required to obtain the requisite license from the SFC.

Sale of Goods

In the event an artwork is “delisted” from our platform, we would arrange to sell the artwork on behalf of all owners of the artwork and then distribute the proceeds of sale to them. We will be considered a “Commercial Agent” under the Hong Kong Factors Ordinance and a “Seller” under the Hong Kong Sales of Goods Ordinance.

The Sale of Goods Ordinance (“SGO”) provides that goods for sale must be:

| · | Of merchantable (satisfactory) quality. Goods must meet the standard that a reasonable person would regard as satisfactory, taking account of any description of the goods, the price and all other relevant circumstances. The quality of goods includes their appearance and finish, their safety and their durability. Goods must be free from defects, even minor ones, except where these defects have been brought to your attention by the seller (section 16 of SGO); | |

| · | Fit for their purposes (section 16 of SGO); | |

| · | As described on the package or a display sign, or by the seller (section 15 of SGO); and | |

| · | Correspond with the sample (section 17 of SGO). |

If sellers fail to meet any one of the above conditions, they are in breach of contract. Under these circumstances, consumers are entitled to reject the goods and demand a full refund. We are accordingly bound by these implied warranties of sale in the event that we sell any artwork previously listed on our platform.

Supply of Services

We provide a platform to trade in artwork units for which we are compensated by receiving listing fees, management fees and trading commissions. The Hong Kong Supply of Services (Implied Terms) Ordinance (“SSO”), provides that in the absence of provisions in the contract for services, services should be carried out with reasonable care and skill (which generally means the services must meet the standard that a reasonable person would regard as satisfactory) ( section 5 of the SSO), the services should be performed within a reasonable time if the time of performance has not been fixed by the contract (section 6 of the SSO); and a reasonable charge should be paid if the charge has not been fixed by the contract (section 7 of the SSO).

If service suppliers fail to meet any one of the above conditions, they would be “in breach of contract”. Under these circumstances, consumers are entitled to sue defaulting suppliers for compensation.

Section 8(1) of the SSO provides that as against a party to a contract for the supply of a service who deals as a consumer, the other party (the service supplier) cannot, by reference to any contract term, exclude or restrict any liability of his arising under the contract by virtue of this Ordinance. In other words, we cannot impose a contract term that excludes or restricts our liability on breach of contract.

In addition, the Hong Kong Control of Exemption Clauses Ordinance subject any attempt by us to exclude our liability for financial loss or damage to property during the course of the provision of our services to the test of “reasonableness”. Our exemption clauses are also controlled by the rules of common law. For example, an exemption clause must be incorporated into the contract, and the person who is seeking to rely on the exemption clause must show that reasonable steps have been taken to bring the clause to the attention of the other party.

The Hong Kong Unconscionable Contracts Ordinance only applies to a contract for the sale of goods or supply of services in which one of the contracting parties is dealing as a consumer. If the Court finds out that the contract or any part thereof was unconscionable (unfair/not sensible) in circumstances relating to the contract at the time when it was made, the Court would have the jurisdiction under section 5 of the Unconscionable Contracts Ordinance to refuse to enforce the contract, or to enforce the remainder of the contract without the unconscionable part, or to limit the application of, or to revise or alter, any unconscionable part so as to avoid any unconscionable result.

| 17 |

Fair Trading

The Trade Descriptions (Unfair Trade Practices) (Amendment) Ordinance 2012 (“Amendment Ordinance”) came into effect on July 19, 2013 and amended the Trade Descriptions Ordinance by prohibiting specified unfair trade practices that may be deployed against customers and strengthen the enforcement mechanism. The Customs and Excise Department is the principal enforcement agency under the Trade Descriptions Ordinance. Concurrent jurisdiction is conferred on the Office of the Communications Authority (“HKCA”) to enforce the new fair trading sections. The key amendments include:

| · | the expansion of the definition of trade descriptions in relation to goods, as well as the extension of the scope to cover services; |

| · | the creation of new criminal offences on unfair trade practices, namely misleading omissions, aggressive commercial practices, bait advertising, bait-and-switch and wrongly accepting payment; |

| · | the introduction of a compliance-based mechanism under which civil enforcement options, namely the acceptance of undertaking from Traders and the seeking of injunction from the court where necessary, can be drawn on to promote compliance with the new fair trading sections introduced by the Amendment Ordinance; and |

| · | the creation of a new private right of action for damages to facilitate consumer redress. |

On July 15, 2013, the Customs and Excise Department and the HKCA published the Enforcement Guidelines for the Amendment Ordinance to state the manner in which they will exercise their enforcement powers and provide guidance on the operation of the new legislative provisions.

Intellectual Property

Our business is dependent on a combination of trademarks, trademark application, trade secrets and industry know-how, and copyright, in order to protect our intellectual property rights. We have submitted trademark applications for “Takung” in Hong Kong, Mainland China, Macau and the United States.

In China, the Trademark Law and the Unfair Competition Law governs our marks. The Hong Kong SAR’s trade mark registration system is separate from the system operating in other parts of China. Trade mark registrations obtained in Chinese Trade Marks Office, or elsewhere in the world, do not automatically get protection in the Hong Kong SAR. Trade marks must be registered in the Hong Kong SAR before they can be protected in the Hong Kong SAR under the Trade Marks Ordinance.

Protection of Personal Data

We have access to certain of our Traders’, Original Owners’ and Offering Agents’ personal information as well as information of Qianrong’s network of art traders. The Hong Kong Personal Data (Privacy) (Amendment) Ordinance 2012 (“Amendment Ordinance”) which changes the Personal Data (Privacy) Ordinance (“PDPO”) governs our use of such personal information in direct marketing activities and in acquiring and transferring such personal data to third parties for direct marketing purposes.

The Amendment Ordinance creates a new direct marketing regime (Part VI A of the PDPO) to establish the rights and obligations of parties using personal information for direct marketing purposes or transferring personal information to a third party for marketing purposes. Under the new regime, an organization can only use or transfer personal information for direct marketing purposes if that organization has provided the required information and consent mechanism to the individual concerned, and obtained his or her consent. Under the Amendment Ordinance it is a criminal offense, punishable by fines and imprisonment, for an organization to fail to comply with any of these new requirements.

| 18 |

We are also now required to have in place procedures to ensure that any personal information transferred to any service provider is not retained for longer than necessary, and is protected against any unauthorized or accidental access, processing, erasure, loss, or use.

Employment

Some of our employees are employed in Hong Kong and we are subject to the Hong Kong Employment Ordinance (“EO”). The EO is the main employment legislation in Hong Kong. It guarantees certain minimum benefits, including:

| · | Paid annual leave. | |

| · | Paid sick leave. | |

| · | Paid maternity leave. |

Subject to limited exceptions, the EO applies to all employees working in Hong Kong, regardless of their nationality. Observing the terms of the EO is generally considered to be mandatory, although it is not specifically expressed to be an overriding statute.

Other mandatory laws that are likely to apply to the employment relationship with our employees include:

| · | Personal Data (Privacy) Ordinance (PDPO). This ordinance regulates an employer's collection or surveillance, use and disclosure of an employee's personal data (including personal data contained in e-mails and phone calls). |

| · | Mandatory Provident Fund Schemes Ordinance (MPFSO). Subject to very limited exceptions, this ordinance requires employers in Hong Kong to enroll employees in a Mandatory Provident Fund (MPF) Scheme (that is, a retirement scheme), to which the employer and employee must make certain contributions. Foreign nationals are exempt if they are posted in Hong Kong to work for a period not exceeding 13 months or belong to a retirement scheme outside of Hong Kong. In certain cases, a Hong Kong national working outside of Hong Kong may still be subject to this ordinance if the employment has sufficient connection with Hong Kong. | |

| · | Occupational Safety and Health Ordinance (OSHO). This ordinance imposes a duty on all employers, as far as is reasonably practical, to ensure the safety and health in the workplace of its employees. The OSHO covers most industrial and non-industrial workplaces in Hong Kong. | |

| · | Employees' Compensation Ordinance (ECO). If an employee suffers injury arising out of and in the course of employment in Hong Kong (or overseas, if the travel is authorized by the employer), the employer is usually liable to compensate the employee under the ECO. Eligible family members of an employee killed in an accident at work can also be entitled to compensation. If an employer carries on business in Hong Kong, its employees are protected under the ordinance. (An employee can work outside Hong Kong but his employment contract must have been entered into in Hong Kong.) All employers must maintain valid employees’' compensation insurance policies to cover their liabilities under the ordinance and at common law. | |

| · | Companies Ordinance. Protects employees of a Hong Kong company (including a Hong Kong subsidiary of a foreign company) in relation to wages and other entitlements if the company is wound up. The employees become preferential creditors in the winding-up. | |

| · | Sex Discrimination Ordinance (SDO), Disability Discrimination Ordinance (DDO), Family Status Discrimination Ordinance (FSDO) and Race Discrimination Ordinance (RDO). All legislate against various forms of discrimination. | |

| · | Basic Law and the Hong Kong Bill of Rights Ordinance. These safeguard certain rights of individuals, although they have limited application in the context of employment law. | |

| · | Labour Tribunal Ordinance. This ordinance empowers the Labour Tribunal to hear and resolve disputes relating to employment contracts as well as alleged breaches of the EO. It potentially covers disputes involving foreign nationals or Hong Kong residents working abroad. | |

| · | Prevention of Bribery Ordinance (POBO). The POBO applies to employees, particularly to those who receive or solicit bribes from third parties (for example, an employee who receives bribes from a supplier of goods in return for placing orders with that supplier). In some cases, employees may also be subject to anti-corruption legislation in other jurisdictions. |

| 19 |

PRC Regulations

Regulations on Foreign Investment

Investment activities in the PRC by foreign investors are principally governed by the Guidance Catalog of Industries for Foreign Investment, or the Catalog, which was promulgated and is amended from time to time by the Ministry of Commerce and the National Development and Reform Commission. Industries listed in the Catalogue are divided into three categories: encouraged, restricted and prohibited. Industries not listed in the Catalogue are generally deemed as constituting a fourth "permitted" category. Establishment of wholly foreign-owned enterprises is generally allowed in the encouraged and permitted industries. Some restricted industries are limited to equity or contractual joint ventures, while in some cases Chinese partners are required to hold the majority interests in such joint ventures. In addition, restricted category projects are subject to higher-level government approvals. Foreign investors are not allowed to invest in industries in the prohibited category. Industries not listed in the Catalogue are generally open to foreign investment unless specifically restricted by other PRC regulations. We conduct business operations that are restricted to foreign investment through our PRC consolidated affiliated entities.

Currently, the business scope of our wholly-owned subsidiary in the PRC, Shanghai Takung, mainly includes the business of wholesale, import and export of arts and crafts and related services, which are in the encouraged category. Under the PRC laws, the establishment of a wholly foreign owned enterprise is subject to the approval of the Ministry of Commerce or its local counterparts and the wholly foreign owned enterprise must register with the competent industry and commerce authority. We have duly obtained the approvals from the competent commerce authority for our interest in Shanghai Takung and completed the registration of Shanghai Takung with the competent industry and commerce authority.

Regulations Relating to Taxation

In January 2008, the PRC Enterprise Income Tax Law took effect. The PRC Enterprise Income Tax Law applies a uniform 25% enterprise income tax rate to both foreign-invested enterprises and domestic enterprises, unless where tax incentives are granted to special industries and projects. Under the PRC Enterprise Income Tax Law and its implementation regulations, dividends generated from the business of a PRC subsidiary after January 1, 2008 and payable to its foreign investor may be subject to a withholding tax rate of 10% if the PRC tax authorities determine that the foreign investor is a non-resident enterprise, unless there is a tax treaty with China that provides for a preferential withholding tax rate. Distributions of earnings generated before January 1, 2008 are exempt from PRC withholding tax. Our PRC subsidiary is subject to PRC enterprise income tax at the statutory rate of 25% on its PRC taxable income.

Under the PRC Enterprise Income Tax Law, an enterprise established outside China with “de facto management bodies” within China is considered a “resident enterprise” for PRC enterprise income tax purposes and is generally subject to a uniform 25% enterprise income tax rate on its worldwide income. A circular issued by the State Administration of Taxation in April 2009 regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese enterprise groups and established outside of China as “resident enterprises” clarified that dividends and other income paid by such PRC “resident enterprises” will be considered PRC-source income and subject to PRC withholding tax, currently at a rate of 10%, when paid to non-PRC enterprise shareholders. This circular also subjects such PRC “resident enterprises” to various reporting requirements with the PRC tax authorities.

Under the implementation regulations to the PRC Enterprise Income Tax Law, a “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and properties of an enterprise. In addition, the tax circular mentioned above specifies that certain PRC-invested overseas enterprises controlled by a Chinese enterprise or a Chinese enterprise group in the PRC will be classified as PRC resident enterprises if the following are located or resident in the PRC: senior management personnel and departments that are responsible for daily production, operation and management; financial and personnel decision making bodies; key properties, accounting books, the company seal, and minutes of board meetings and shareholders’ meetings; and half or more of the senior management or directors having voting rights.

| 20 |

Please see “Risk Factors—We may be treated as a resident enterprise for PRC tax purposes under the PRC Enterprise Income Tax Law, and we may therefore be subject to PRC income tax on our global income.”

Regulations Relating to Labor

We are subject to laws and regulations governing our relationship with our PRC employees, including wage and hour requirements, working and safety conditions, and social insurance, housing funds and other welfare. The compliance with these laws and regulations may require substantial resources.

Pursuant to the PRC Labor Law effective in 1995 and the PRC Labor Contract Law effective in 2008 and amended in 2012, a written labor contract is required when an employment relationship is established between an employer and an employee. Other labor-related regulations and rules of China stipulate the maximum number of working hours per day and per week as well as the minimum wages. An employer is required to set up occupational safety and sanitation systems, implement the national occupational safety and sanitation rules and standards, educate employees on occupational safety and sanitation, prevent accidents at work and reduce occupational hazards.

An employer is obligated to sign an indefinite term labor contract with an employee if the employer continues to employ the employee after two consecutive fixed-term labor contracts, with certain exceptions. The employer also has to pay compensation to the employee if the employer terminates an indefinite term labor contract, with certain exceptions. Except where the employer proposes to renew a labor contract by maintaining or raising the conditions of the labor contract and the employee is not agreeable to the renewal, an employer is required to compensate the employee when a definite term labor contract expires. Furthermore, under the Regulations on Paid Annual Leave for Employees issued by the State Council in December 2007 and effective as of January 2008, an employee who has served an employer for more than one year and less than ten years is entitled to a 5-day paid vacation, those whose service period ranges from 10 to 20 years are entitled to a 10-day paid vacation, and those who have served for more than 20 years are entitled to a 15-day paid vacation. An employee who does not use such vacation time at the request of the employer must be compensated at three times their normal salaries for each waived vacation day.

Pursuant to the Regulations on Occupational Injury Insurance effective in 2004, as amended in 2010, and the Interim Measures concerning the Maternity Insurance for Enterprise Employees effective in 1995, PRC companies must pay occupational injury insurance premiums and maternity insurance premiums for their employees. Pursuant to the Interim Regulations on the Collection and Payment of Social Insurance Premiums effective in 1999 and the Interim Measures concerning the Administration of the Registration of Social Insurance effective in 1999, basic pension insurance, medical insurance and unemployment insurance are collectively referred to as social insurance. Both PRC companies and their employees are required to contribute to the social insurance plans. The aforesaid measures are reiterated in the Social Insurance Law of China effective in July 2011, which stipulates the system of social insurance of China, including basic pension insurance, medical insurance, unemployment insurance, occupational injury insurance and maternity insurance. Pursuant to the Regulations on the Administration of Housing Fund effective in 1999, as amended in 2002, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC companies and their employees are required to contribute to the housing funds.

Regulation on PRC Business Tax and Value-Added Tax