Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Switch, Inc. | exhibit991pressreleasedate.htm |

| 8-K - FORM 8-K - Switch, Inc. | swch8-kearningsreleasefor4.htm |

August 2017

®

POWERING THE FUTURE OF THE CONNECTED WORLD®

Investor Presentation

Q4 2017

SAFE HARBOR

This presentation includes forward-looking statements. All statements contained in this presentation other than statements of historical facts, including statements

regarding future results of operations and financial position of Switch, Inc. and Switch, Ltd. (“Switch,” “we,” “us” or “our”), our business strategy and plans and our

objectives for future operations, are forward-looking statements. The words “anticipate,” believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar

expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections

about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, without

limitation, those risks and uncertainties set forth in the “Risk Factors” section of our most recent Annual Report on Form 10-K filed with the Securities and Exchange

Commission for the year ended December 31, 2017.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance, achievements or events and circumstances reflected in the forward-looking statements will occur. We are under no duty to update any of these forward-

looking statements after the date of this presentation to conform these statements to actual results or revised expectations, except as required by law. You should,

therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Moreover, except as

required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements contained in this

presentation.

This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our

industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other

person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation.

In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject

to a high degree of uncertainty and risk.

This presentation contains certain supplemental financial measures that are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”). These

non-GAAP measures are in addition to, and not a substitute or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of

non-GAAP measures to GAAP measures is contained in the appendix to this presentation.

2018

2

3

Switch IS A TECHNOLOGY INFRASTRUCTURE COMPANY

POWERING THE SUSTAINABLE GROWTH OF THE CONNECTED

WORLD

FINANCIAL HIGHLIGHTS 2017

4

• Total revenue of $378.3 million, compared to $318.4 million in 2016, an increase of 19%

• Operating income of $18.8 million, compared to operating income of $51.1 million in 2016. Operating income in 2017

includes the impact of $71.3 million in non-recurring equity-based compensation expense resulting from the

accelerated vesting of certain incentive units of Switch, Ltd. and related awards granted under Switch’s 2017 Incentive

Award Plan in connection with Switch’s initial public offering. Excluding the impact of this non-recurring

compensation expense, operating income would have increased 76.6% from 2016 to 2017.

• Net loss of $8.6 million, compared to net income of $31.4 million in 2016, which includes $84.8 million in equity-based

compensation expense in 2017 compared with $5.9 million in equity-based compensation expense in 2016.

• Adjusted EBITDA of $194.7 million, compared to $153.2 million for 2016, an increase of 27%. Adjusted EBITDA margin

of 51.5%, compared to 48.1% in 2016, an increase of 340 basis points.

• Capital expenditures of $402.6 million, compared to $287.1 million in 2016, an increase of 40% primarily due to

deployment of capital in The Core Campus in response to additional customer demand and density needs along with

additional capital expenditures to build out The Citadel Campus and The Pyramid Campus.

• Churn of 0.6% for the year ended December 31, 2017 compared with 1.1% in 2016.¹

¹ Churn is defined as a reduction in recurring revenue attributed to customer terminations or non-renewal of expired contracts, as a percentage of revenue at the beginning of the period.

FINANCIAL HIGHLIGHTS Q4 2017

5

• Total revenue of $99.3 million, compared to $81.9 million for the same quarter in 2016, an increase of 21%.

• Net loss of $60.3 million, compared to $19.8 million for the same quarter in 2016.

• Adjusted EBITDA of $51.1 million, compared to $41.0 million for the same quarter in 2016, an increase of 25%.

Adjusted EBITDA margin of 51.4%, compared to 50.0% for the same quarter in 2016, an increase of 140 basis

points.

• Capital expenditures of $118.6 million, compared to $96.6 million in the same quarter in 2016, an increase of 23%.

Capital expenditures for Q4 2017 included $23.9 million for the purchase of the Switch Pyramid building and 142

acres of land in The Pyramid Campus.

• Churn of 0.3%, compared to 1.9% for the same quarter in 2016.¹

¹ Churn is defined as a reduction in recurring revenue attributed to customer terminations or non-renewal of expired contracts, as a percentage of revenue at the beginning of the period.

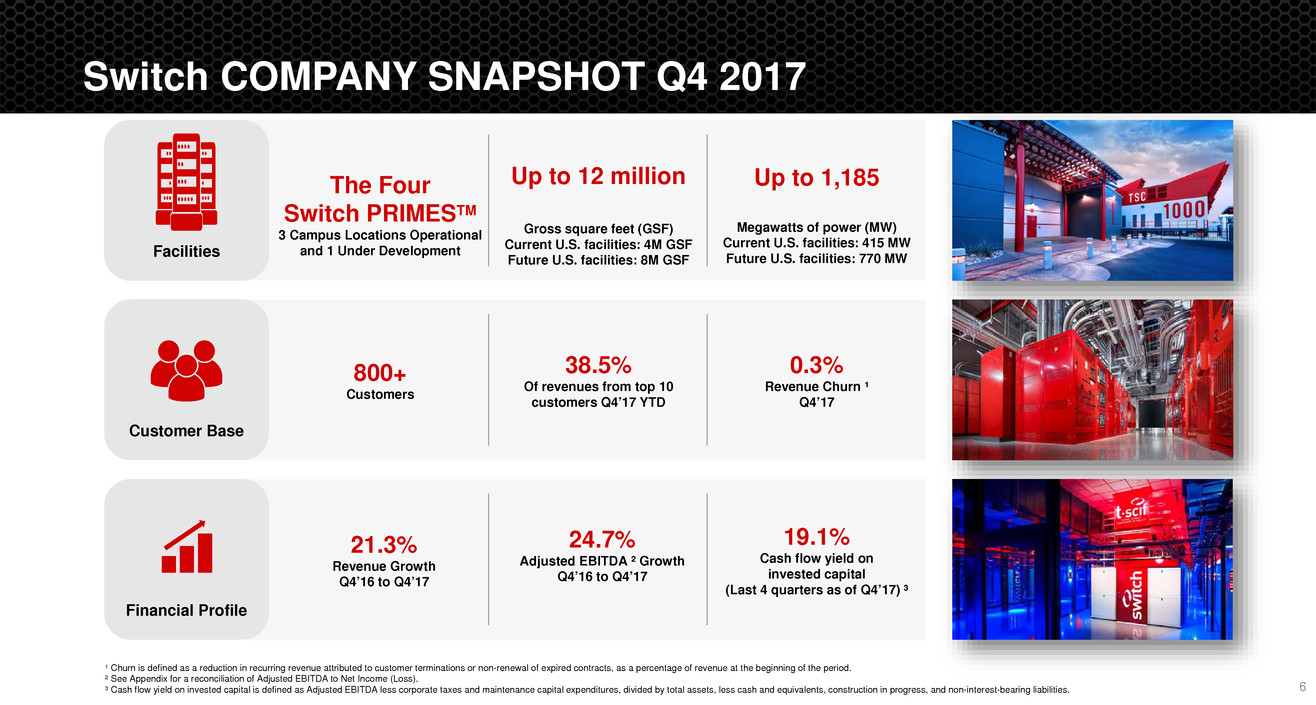

The Four

Switch PRIMESTM

3 Campus Locations Operational

and 1 Under Development

Up to 12 million

Gross square feet (GSF)

Current U.S. facilities: 4M GSF

Future U.S. facilities: 8M GSF

Up to 1,185

Megawatts of power (MW)

Current U.S. facilities: 415 MW

Future U.S. facilities: 770 MW

800+

Customers

38.5%

Of revenues from top 10

customers Q4’17 YTD

0.3%

Revenue Churn ¹

Q4’17

21.3%

Revenue Growth

Q4’16 to Q4’17

24.7%

Adjusted EBITDA ² Growth

Q4’16 to Q4’17

19.1%

Cash flow yield on

invested capital

(Last 4 quarters as of Q4’17) ³

Switch COMPANY SNAPSHOT Q4 2017

¹ Churn is defined as a reduction in recurring revenue attributed to customer terminations or non-renewal of expired contracts, as a percentage of revenue at the beginning of the period.

² See Appendix for a reconciliation of Adjusted EBITDA to Net Income (Loss).

³ Cash flow yield on invested capital is defined as Adjusted EBITDA less corporate taxes and maintenance capital expenditures, divided by total assets, less cash and equivalents, construction in progress, and non-interest-bearing liabilities.

Facilities

Customer Base

Financial Profile

6

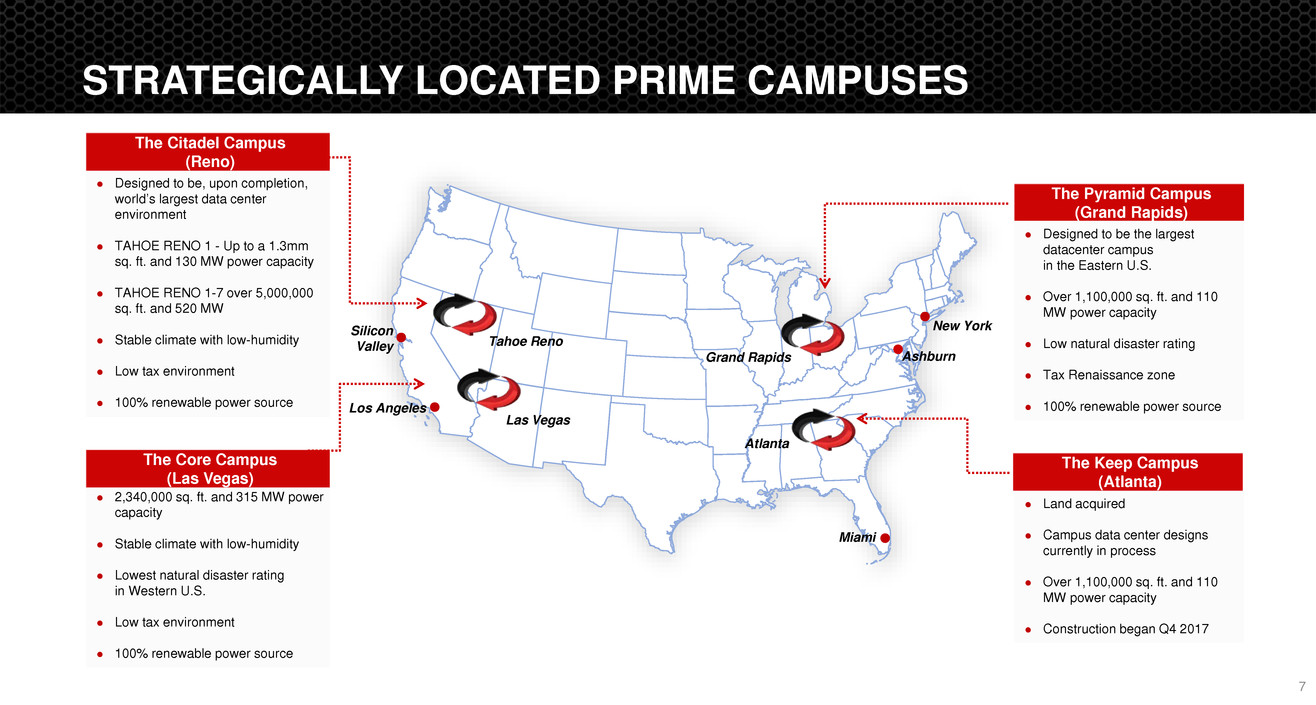

STRATEGICALLY LOCATED PRIME CAMPUSES

7

2,340,000 sq. ft. and 315 MW power

capacity

Stable climate with low-humidity

Lowest natural disaster rating

in Western U.S.

Low tax environment

100% renewable power source

Grand Rapids

Atlanta

Miami

Ashburn

New York

The Pyramid Campus

(Grand Rapids)

Designed to be the largest

datacenter campus

in the Eastern U.S.

Over 1,100,000 sq. ft. and 110

MW power capacity

Low natural disaster rating

Tax Renaissance zone

100% renewable power source

Land acquired

Campus data center designs

currently in process

Over 1,100,000 sq. ft. and 110

MW power capacity

Construction began Q4 2017

Los Angeles

Tahoe Reno

Las Vegas

Silicon

Valley

Designed to be, upon completion,

world’s largest data center

environment

TAHOE RENO 1 - Up to a 1.3mm

sq. ft. and 130 MW power capacity

TAHOE RENO 1-7 over 5,000,000

sq. ft. and 520 MW

Stable climate with low-humidity

Low tax environment

100% renewable power source

The Citadel Campus

(Reno)

The Core Campus

(Las Vegas)

The Keep Campus

(Atlanta)

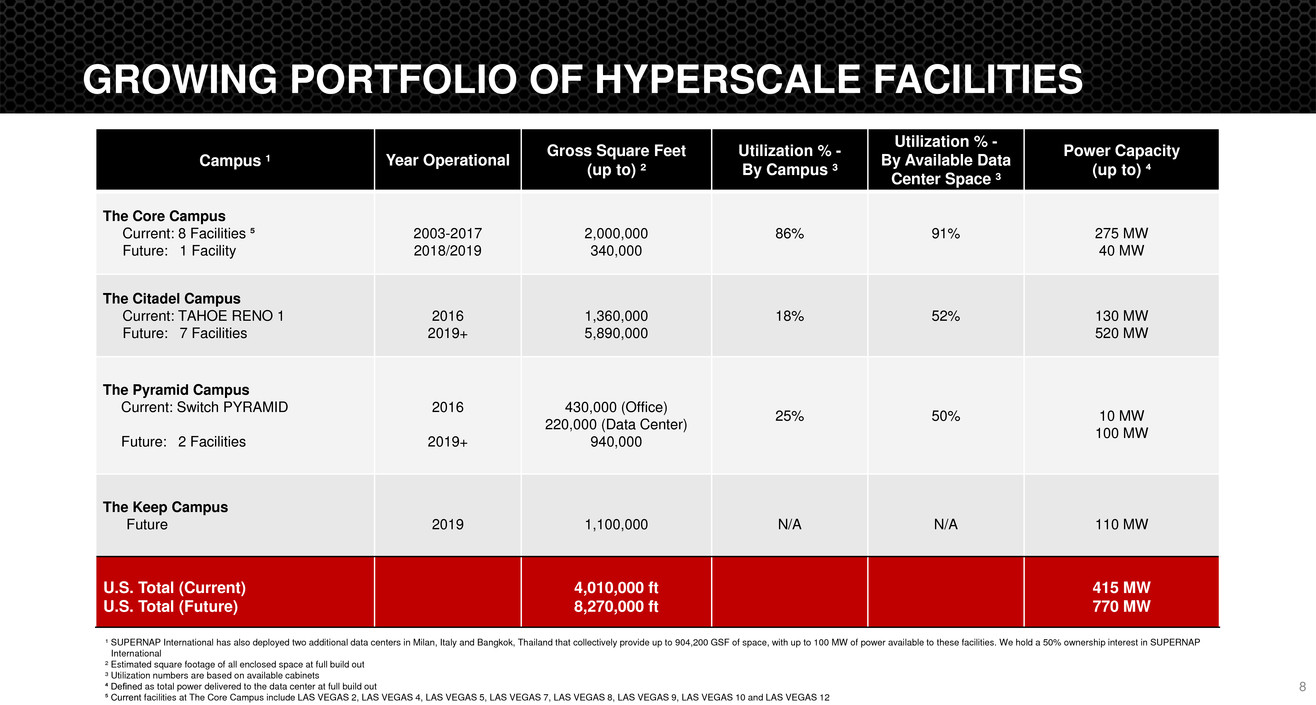

Campus ¹ Year Operational

Gross Square Feet

(up to) ²

Utilization % -

By Campus ³

Utilization % -

By Available Data

Center Space ³

Power Capacity

(up to) ⁴

The Core Campus

Current: 8 Facilities ⁵

Future: 1 Facility

2003-2017

2018/2019

2,000,000

340,000

86% 91% 275 MW

40 MW

The Citadel Campus

Current: TAHOE RENO 1

Future: 7 Facilities

2016

2019+

1,360,000

5,890,000

18% 52% 130 MW

520 MW

The Pyramid Campus

Current: Switch PYRAMID

Future: 2 Facilities

2016

2019+

430,000 (Office)

220,000 (Data Center)

940,000

25% 50% 10 MW

100 MW

The Keep Campus

Future 2019 1,100,000 N/A N/A 110 MW

U.S. Total (Current)

U.S. Total (Future)

4,010,000 ft

8,270,000 ft

415 MW

770 MW

¹ SUPERNAP International has also deployed two additional data centers in Milan, Italy and Bangkok, Thailand that collectively provide up to 904,200 GSF of space, with up to 100 MW of power available to these facilities. We hold a 50% ownership interest in SUPERNAP

International

² Estimated square footage of all enclosed space at full build out

³ Utilization numbers are based on available cabinets

⁴ Defined as total power delivered to the data center at full build out

⁵ Current facilities at The Core Campus include LAS VEGAS 2, LAS VEGAS 4, LAS VEGAS 5, LAS VEGAS 7, LAS VEGAS 8, LAS VEGAS 9, LAS VEGAS 10 and LAS VEGAS 12

GROWING PORTFOLIO OF HYPERSCALE FACILITIES

8

COMPELLING FINANCIAL MODEL

9

Track Record of Organic

Top-Line Growth

84% of the increase in revenue for the year ended December 31, 2017 was attributable to growth

from existing customers, while the remaining 16% of the increase in revenue was attributable to new

customers initiating service after December 31, 2016

Predictable and Recurring

Revenue Stream

Long term licenses (3 to 5 year contracts) with ability to escalate rates

Stable monthly recurring revenue per cabinet

3-year average annual revenue churn of 0.9%

Future Growth and Margin

Expansion Drivers Driving scale provides efficiencies and margin expansion

Capital Efficient Growth

Patent-protected technology enables just-in-time capex deployment and low cost construction

Vertical integration creates additional capex savings

Low maintenance capex – 1.2% of revenue in 2017

Low Capital at Risk Switch MOD® enables the company to build and open new sectors to meet customer demand

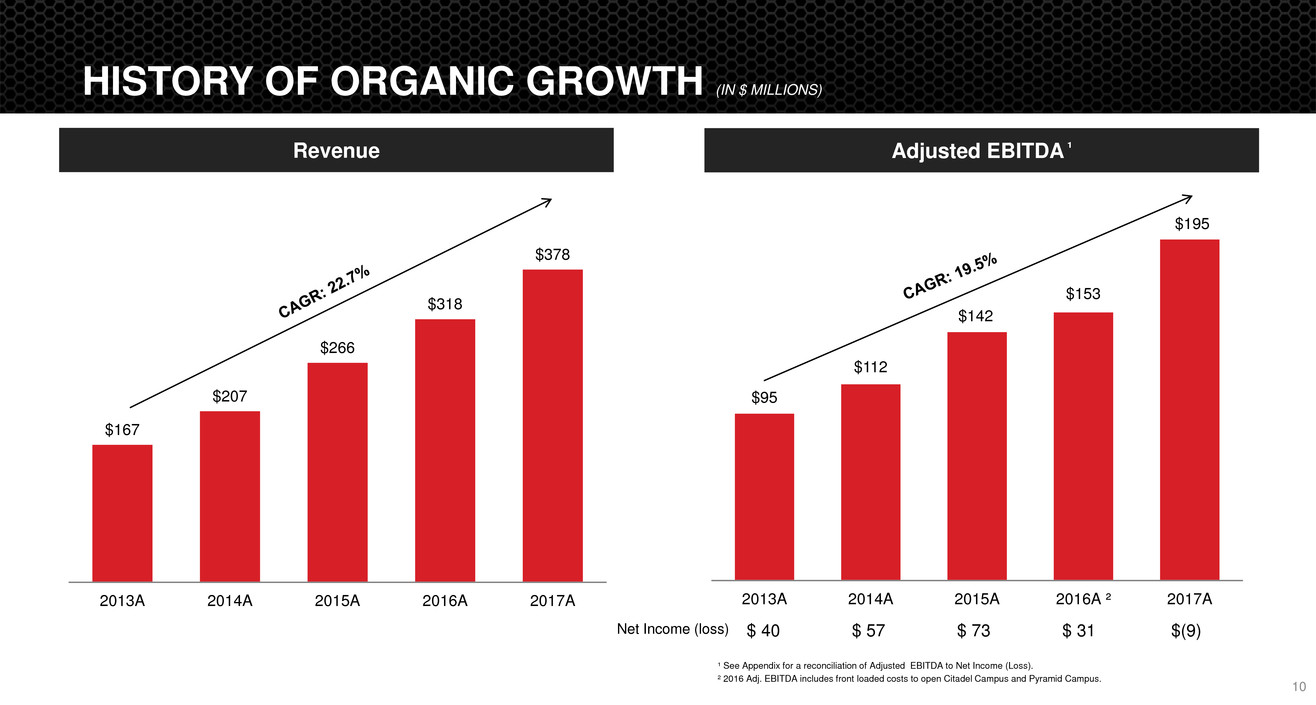

$95

$112

$142

$153

$195

2013A 2014A 2015A 2016A ² 2017A

HISTORY OF ORGANIC GROWTH (IN $ MILLIONS)

¹ See Appendix for a reconciliation of Adjusted EBITDA to Net Income (Loss).

² 2016 Adj. EBITDA includes front loaded costs to open Citadel Campus and Pyramid Campus.

Adjusted EBITDA ¹

$167

$207

$266

$318

$378

2013A 2014A 2015A 2016A 2017A

10

Revenue

$ 40 $ 57 $ 73 $ 31 $(9)Net Income (loss)

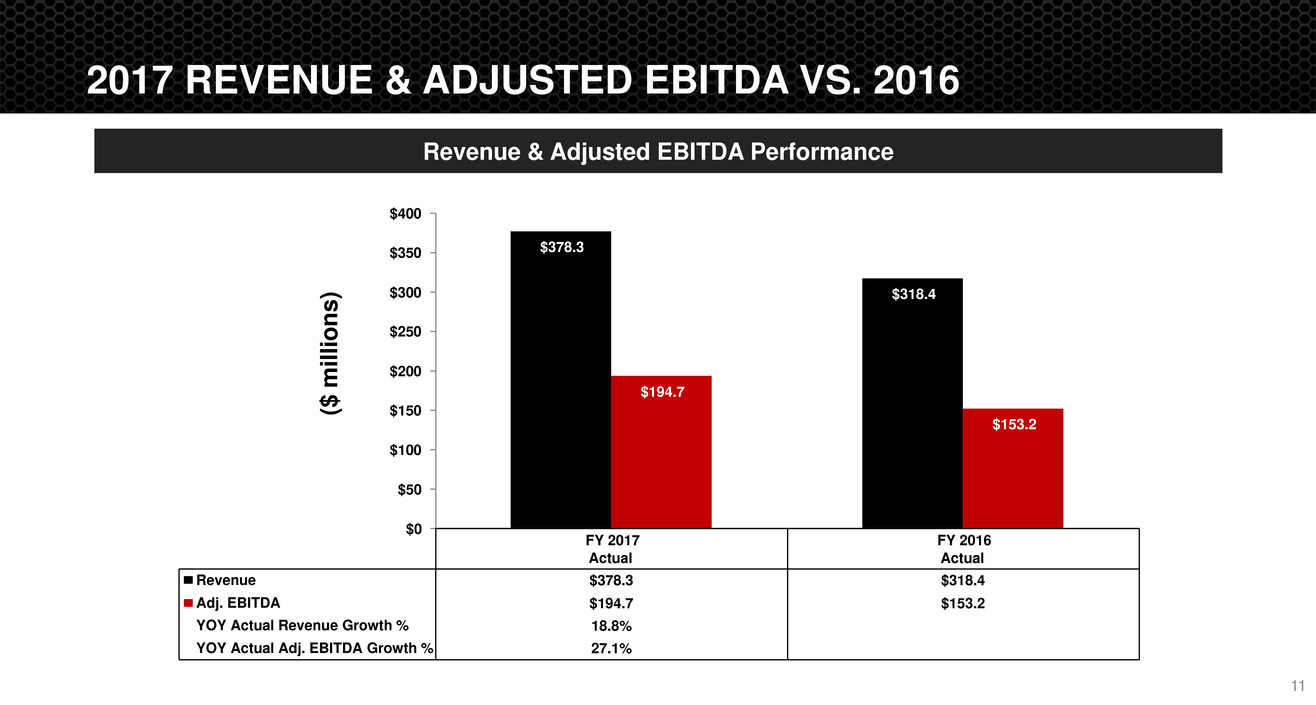

2017 REVENUE & ADJUSTED EBITDA VS. 2016

11

Revenue & Adjusted EBITDA Performance

FY 2017

Actual

FY 2016

Actual

Revenue $378.3 $318.4

Adj. EBITDA $194.7 $153.2

YOY Actual Revenue Growth % 18.8%

YOY Actual Adj. EBITDA Growth % 27.1%

$378.3

$318.4

$194.7

$153.2

$0

$50

$100

$150

$200

$250

$300

$350

$400

($

m

ill

io

ns

)

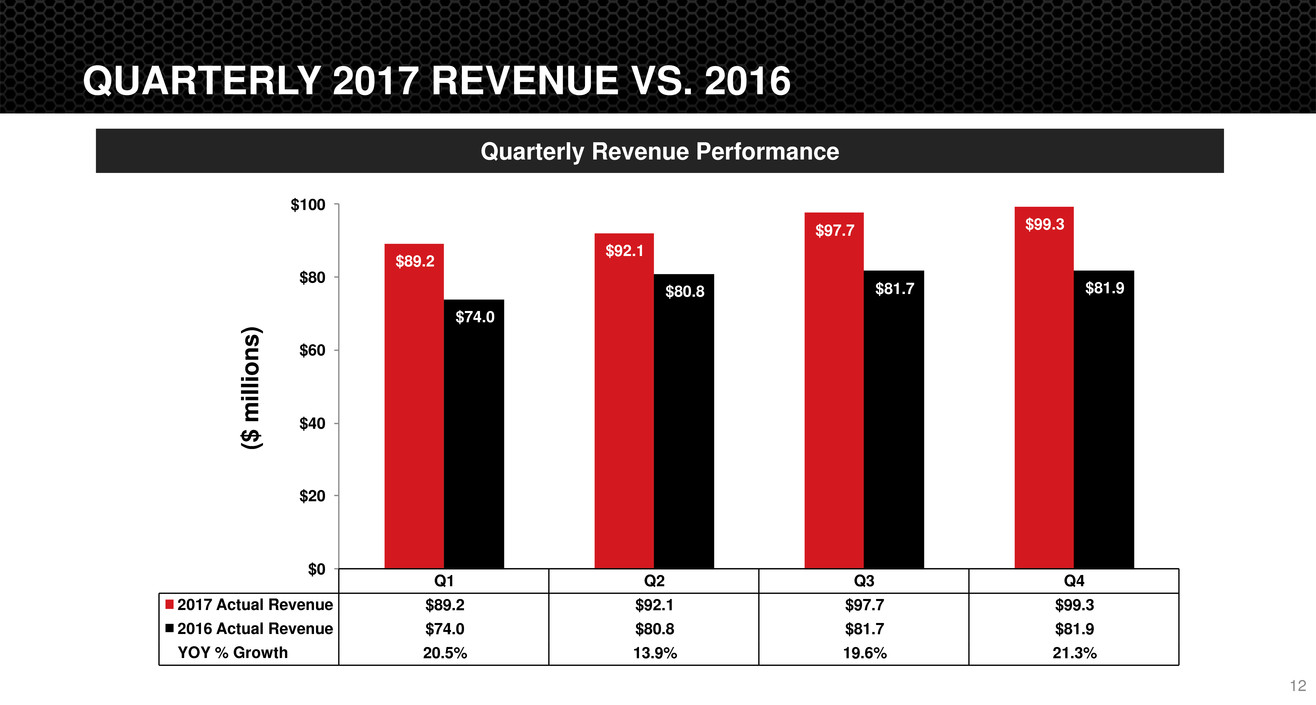

QUARTERLY 2017 REVENUE VS. 2016

12

Quarterly Revenue Performance

Q1 Q2 Q3 Q4

2017 Actual Revenue $89.2 $92.1 $97.7 $99.3

2016 Actual Revenue $74.0 $80.8 $81.7 $81.9

YOY % Growth 20.5% 13.9% 19.6% 21.3%

$89.2

$92.1

$97.7 $99.3

$74.0

$80.8 $81.7 $81.9

$0

$20

$40

$60

$80

$100

($

m

ill

io

ns

)

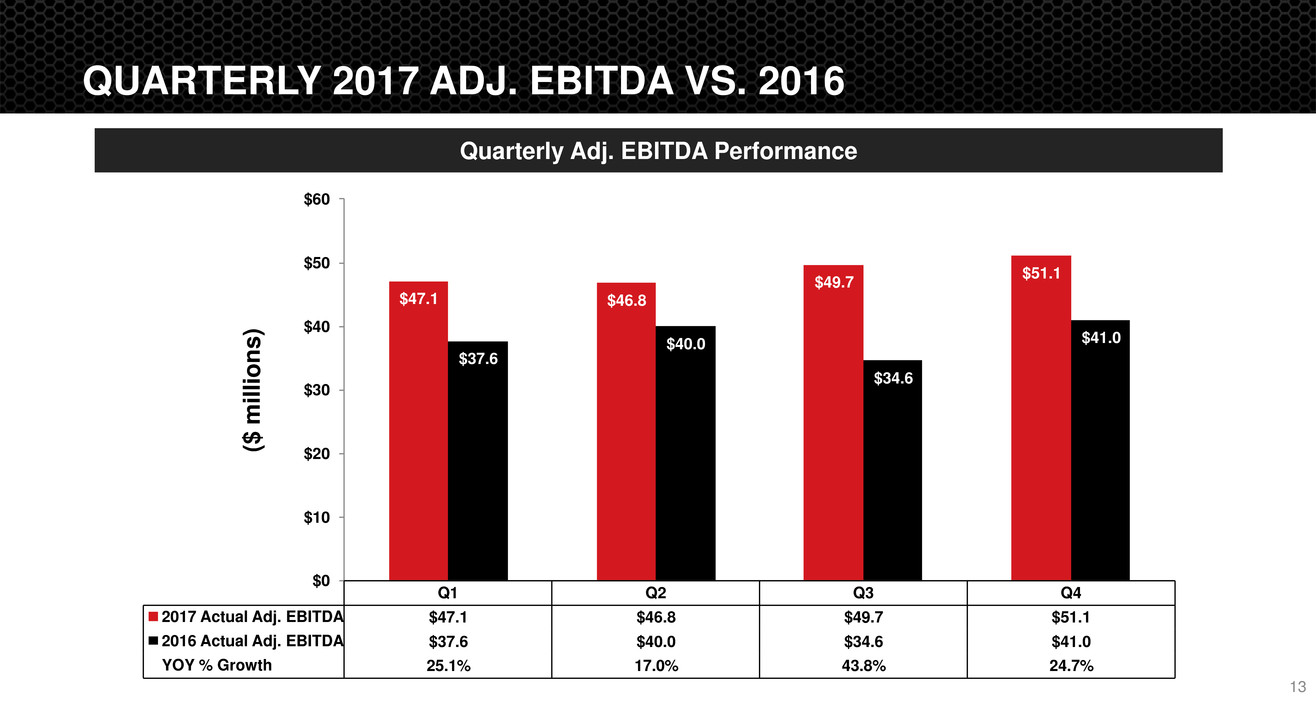

13

Quarterly Adj. EBITDA Performance

QUARTERLY 2017 ADJ. EBITDA VS. 2016

Q1 Q2 Q3 Q4

2017 Actual Adj. EBITDA $47.1 $46.8 $49.7 $51.1

2016 Actual Adj. EBITDA $37.6 $40.0 $34.6 $41.0

YOY % Growth 25.1% 17.0% 43.8% 24.7%

$47.1 $46.8

$49.7 $51.1

$37.6

$40.0

$34.6

$41.0

$0

$10

$20

$30

$40

$50

$60

($

m

ill

io

ns

)

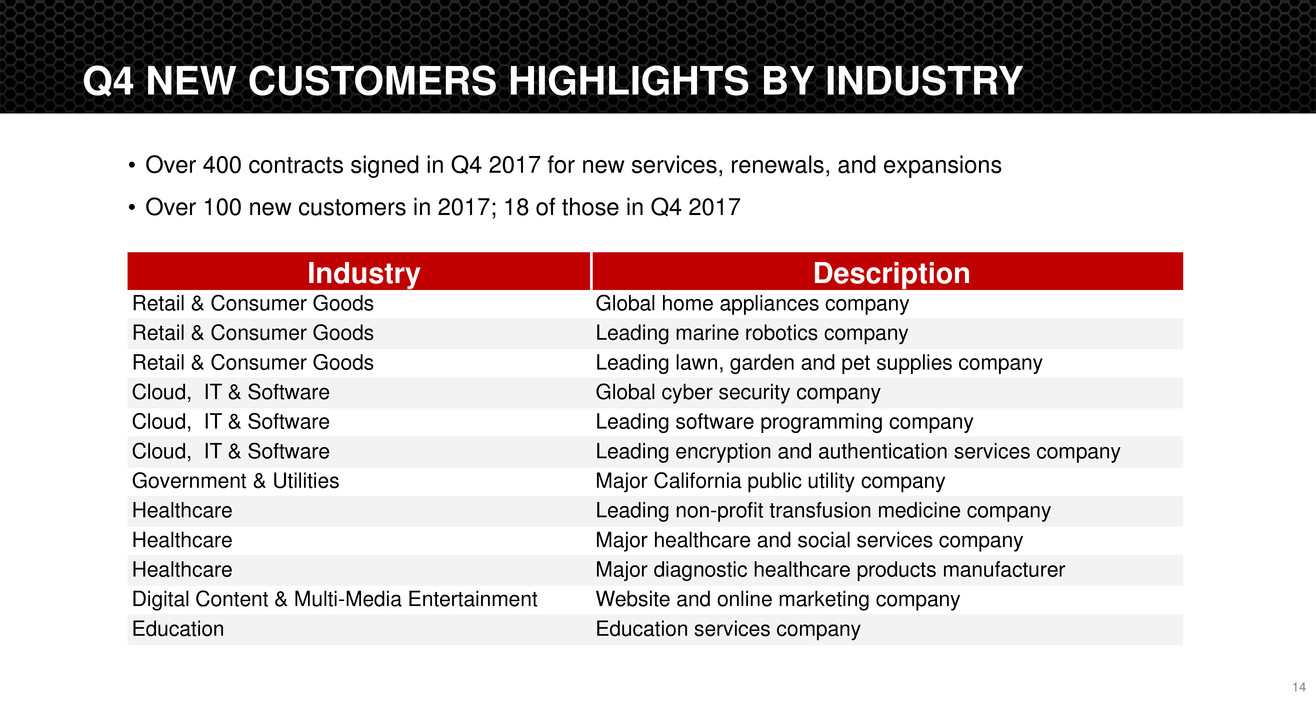

Q4 NEW CUSTOMERS HIGHLIGHTS BY INDUSTRY

14

• Over 400 contracts signed in Q4 2017 for new services, renewals, and expansions

• Over 100 new customers in 2017; 18 of those in Q4 2017

Industry Description

Retail & Consumer Goods Global home appliances company

Retail & Consumer Goods Leading marine robotics company

Retail & Consumer Goods Leading lawn, garden and pet supplies company

Cloud, IT & Software Global cyber security company

Cloud, IT & Software Leading software programming company

Cloud, IT & Software Leading encryption and authentication services company

Government & Utilities Major California public utility company

Healthcare Leading non-profit transfusion medicine company

Healthcare Major healthcare and social services company

Healthcare Major diagnostic healthcare products manufacturer

Digital Content & Multi-Media Entertainment Website and online marketing company

Education Education services company

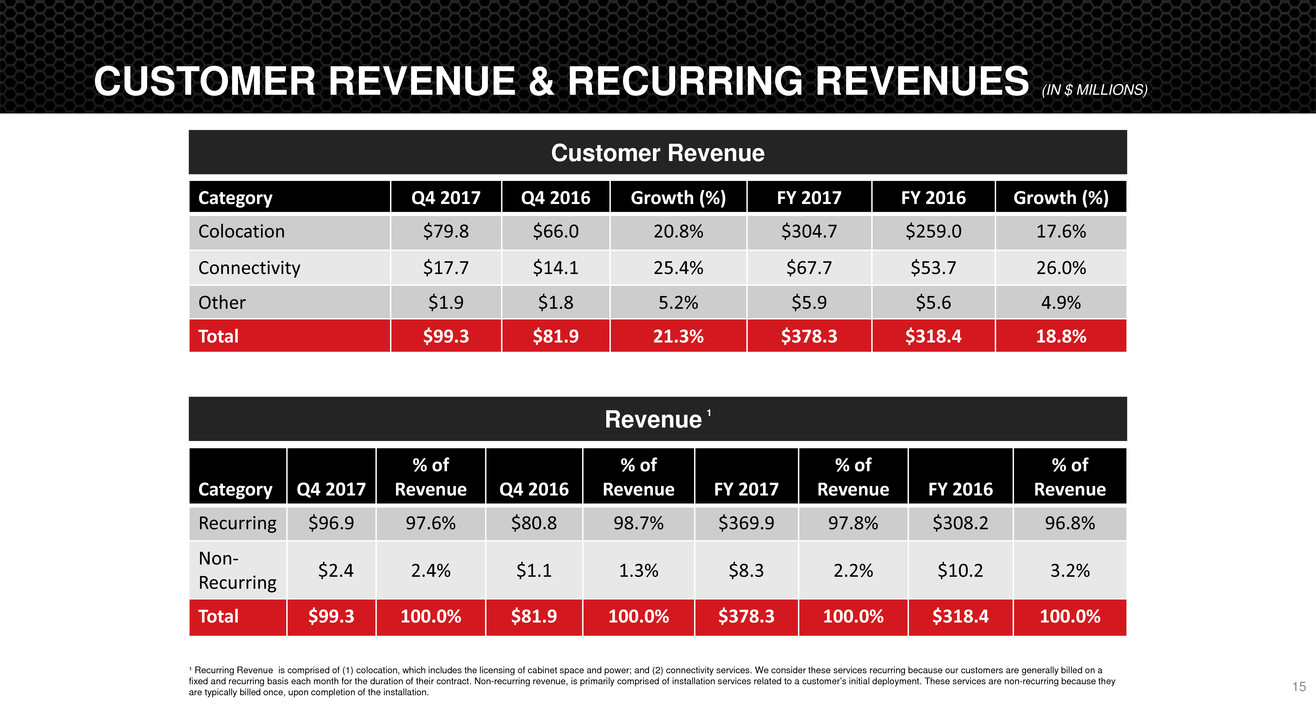

CUSTOMER REVENUE & RECURRING REVENUES (IN $ MILLIONS)

15

¹ Recurring Revenue is comprised of (1) colocation, which includes the licensing of cabinet space and power; and (2) connectivity services. We consider these services recurring because our customers are generally billed on a

fixed and recurring basis each month for the duration of their contract. Non-recurring revenue, is primarily comprised of installation services related to a customer’s initial deployment. These services are non-recurring because they

are typically billed once, upon completion of the installation.

Customer Revenue

Revenue ¹

Category Q4 2017 Q4 2016 Growth (%) FY 2017 FY 2016 Growth (%)

Colocation $79.8 $66.0 20.8% $304.7 $259.0 17.6%

Connectivity $17.7 $14.1 25.4% $67.7 $53.7 26.0%

Other $1.9 $1.8 5.2% $5.9 $5.6 4.9%

Total $99.3 $81.9 21.3% $378.3 $318.4 18.8%

Category Q4 2017

% of

Revenue Q4 2016

% of

Revenue FY 2017

% of

Revenue FY 2016

% of

Revenue

Recurring $96.9 97.6% $80.8 98.7% $369.9 97.8% $308.2 96.8%

Non-

Recurring

$2.4 2.4% $1.1 1.3% $8.3 2.2% $10.2 3.2%

Total $99.3 100.0% $81.9 100.0% $378.3 100.0% $318.4 100.0%

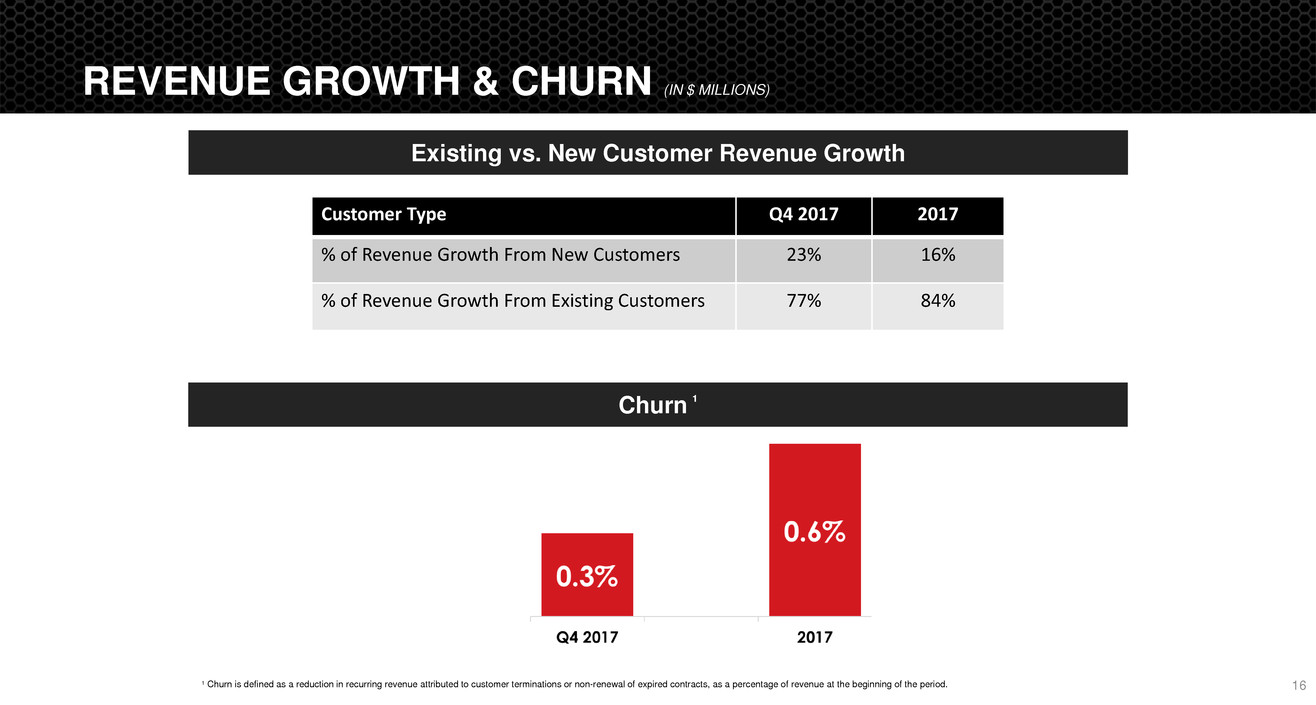

REVENUE GROWTH & CHURN (IN $ MILLIONS)

16¹ Churn is defined as a reduction in recurring revenue attributed to customer terminations or non-renewal of expired contracts, as a percentage of revenue at the beginning of the period.

Existing vs. New Customer Revenue Growth

Customer Type Q4 2017 2017

% of Revenue Growth From New Customers 23% 16%

% of Revenue Growth From Existing Customers 77% 84%

Churn ¹

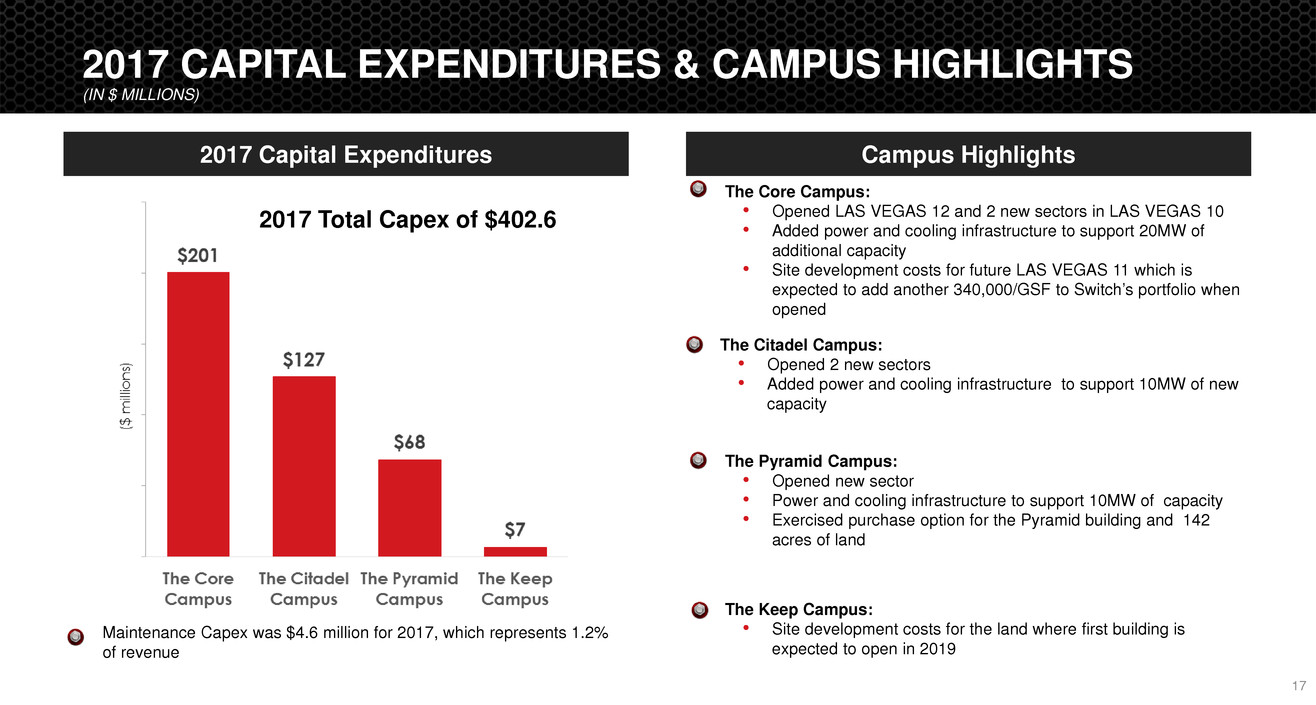

2017 CAPITAL EXPENDITURES & CAMPUS HIGHLIGHTS

(IN $ MILLIONS)

17

• The Core Campus:

• Opened LAS VEGAS 12 and 2 new sectors in LAS VEGAS 10

• Added power and cooling infrastructure to support 20MW of

additional capacity

• Site development costs for future LAS VEGAS 11 which is

expected to add another 340,000/GSF to Switch’s portfolio when

opened

Campus Highlights

• The Pyramid Campus:

• Opened new sector

• Power and cooling infrastructure to support 10MW of capacity

• Exercised purchase option for the Pyramid building and 142

acres of land

• The Keep Campus:

• Site development costs for the land where first building is

expected to open in 2019

• Maintenance Capex was $4.6 million for 2017, which represents 1.2%

of revenue

• The Citadel Campus:

• Opened 2 new sectors

• Added power and cooling infrastructure to support 10MW of new

capacity

2017 Capital Expenditures

2017 Total Capex of $402.6

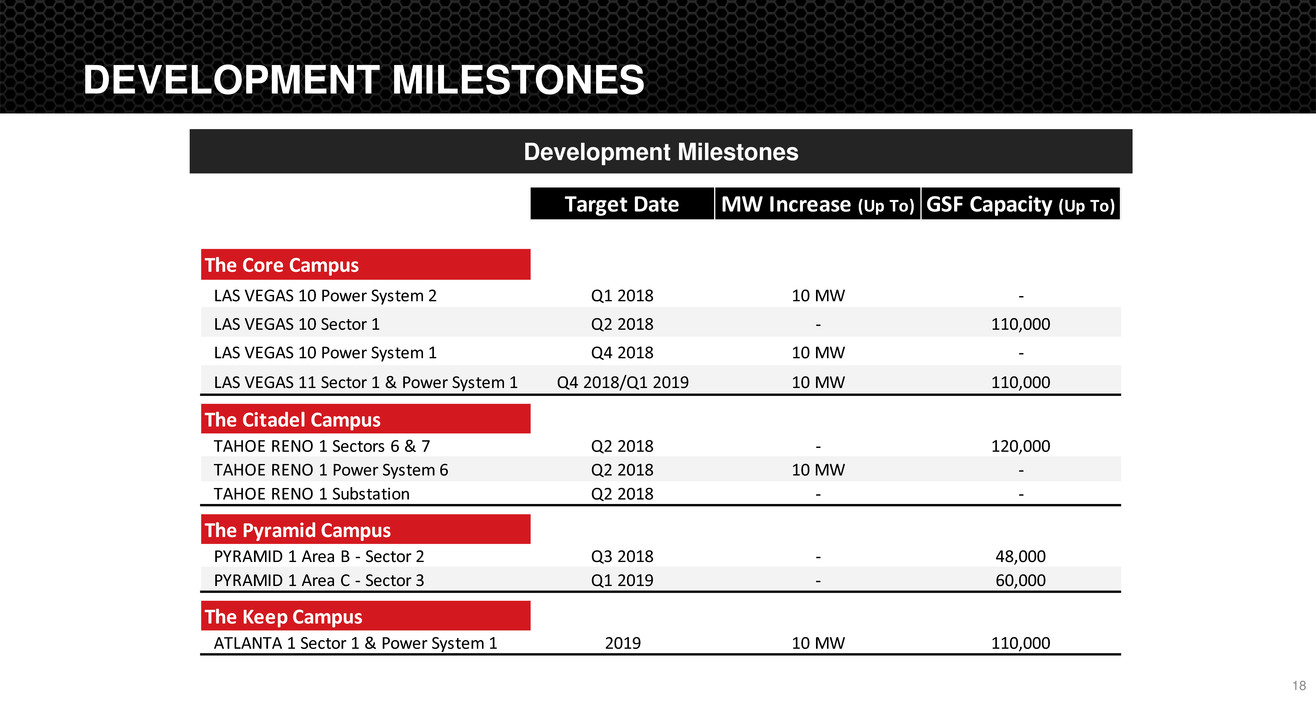

DEVELOPMENT MILESTONES

18

Development Milestones

Target Date MW Increase (Up To) GSF Capacity (Up To)

The Core Campus

LAS VEGAS 10 Power System 2 Q1 2018 10 MW -

LAS VEGAS 10 Sector 1 Q2 2018 - 110,000

LAS VEGAS 10 Power System 1 Q4 2018 10 MW -

LAS VEGAS 11 Sector 1 & Power System 1 Q4 2018/Q1 2019 10 MW 110,000

The Citadel Campus

TAHOE RENO 1 Sectors 6 & 7 Q2 2018 - 120,000

TAHOE RENO 1 Power System 6 Q2 2018 10 MW -

TAHOE RENO 1 Substation Q2 2018 - -

The Pyramid Campus

PYRAMID 1 Area B - Sector 2 Q3 2018 - 48,000

PYRAMID 1 Area C - Sector 3 Q1 2019 - 60,000

The Keep Campus

ATLANTA 1 Sector 1 & Power System 1 2019 10 MW 110,000

DEBT & LIQUIDITY(IN $ MILLIONS)

19¹ Liquidity defined as: Remaining undrawn revolver capacity plus cash & cash equivalents

Debt & Liquidity ¹

12/31/2017

Capital Leases $22

Other Debt $592

Less: Cash & Cash Equivalents ($265)

Net Debt $349

LQA Adjusted EBITDA $204

Net Debt / LQA Adjusted EBITDA 1.7x

Liquidity $765

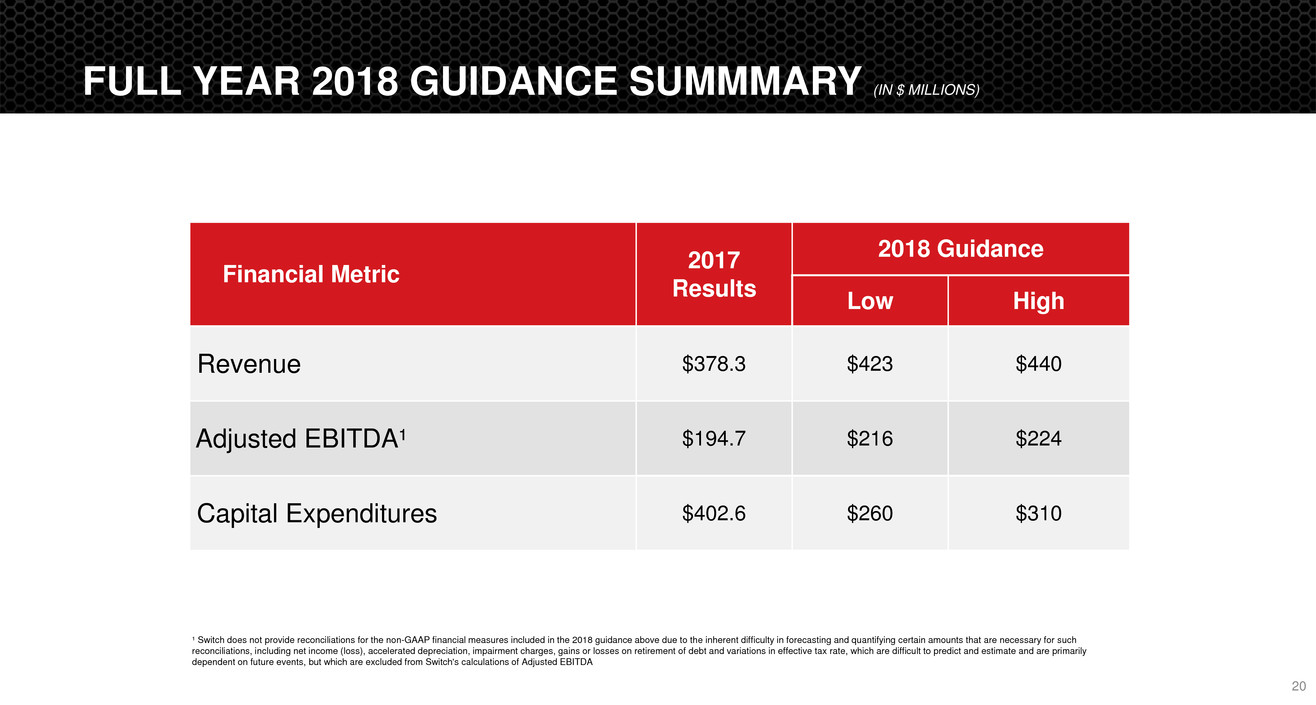

FULL YEAR 2018 GUIDANCE SUMMMARY (IN $ MILLIONS)

20

Financial Metric 2017 Results

2018 Guidance

Low High

Revenue $378.3 $423 $440

Adjusted EBITDA¹ $194.7 $216 $224

Capital Expenditures $402.6 $260 $310

¹ Switch does not provide reconciliations for the non-GAAP financial measures included in the 2018 guidance above due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such

reconciliations, including net income (loss), accelerated depreciation, impairment charges, gains or losses on retirement of debt and variations in effective tax rate, which are difficult to predict and estimate and are primarily

dependent on future events, but which are excluded from Switch's calculations of Adjusted EBITDA

APPENDIX

21

NON-GAAP FINANCIAL MEASURES

22

To supplement Switch’s condensed consolidated financial statements, which are prepared and presented in accordance

with generally accepted accounting principles in the United States (GAAP), Switch uses Adjusted EBITDA, Adjusted

EBITDA margin and recurring revenue, which are non-GAAP measures, in this presentation. Switch defines Adjusted

EBITDA as net income (loss) adjusted for interest expense, interest income, income taxes, depreciation and amortization

and for specific and defined supplemental adjustments to exclude (i) non-cash equity-based compensation expense; (ii)

equity in net earnings (losses) of investments; and (iii) certain other items that Switch believes are not indicative of its

core operating performance. Switch defines Adjusted EBITDA margin as Adjusted EBITDA divided by revenue.

The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or

superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned that there

are material limitations associated with the use of non-GAAP financial measures as an analytical tool. These measures

may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison

purposes. In addition, the non-GAAP measures exclude certain recurring expenses that have been and will continue to be

significant expenses of Switch’s business.

Switch believes these non-GAAP financial measures provide useful information to investors and others in understanding

and evaluating its operating results, enhancing the overall understanding of its past performance and future prospects,

and allowing for greater transparency with respect to key financial metrics used by its management in financial and

operational-decision making.

August 2017

®

POWERING THE FUTURE OF THE CONNECTED WORLD®

Investor Presentation

Q4 2017

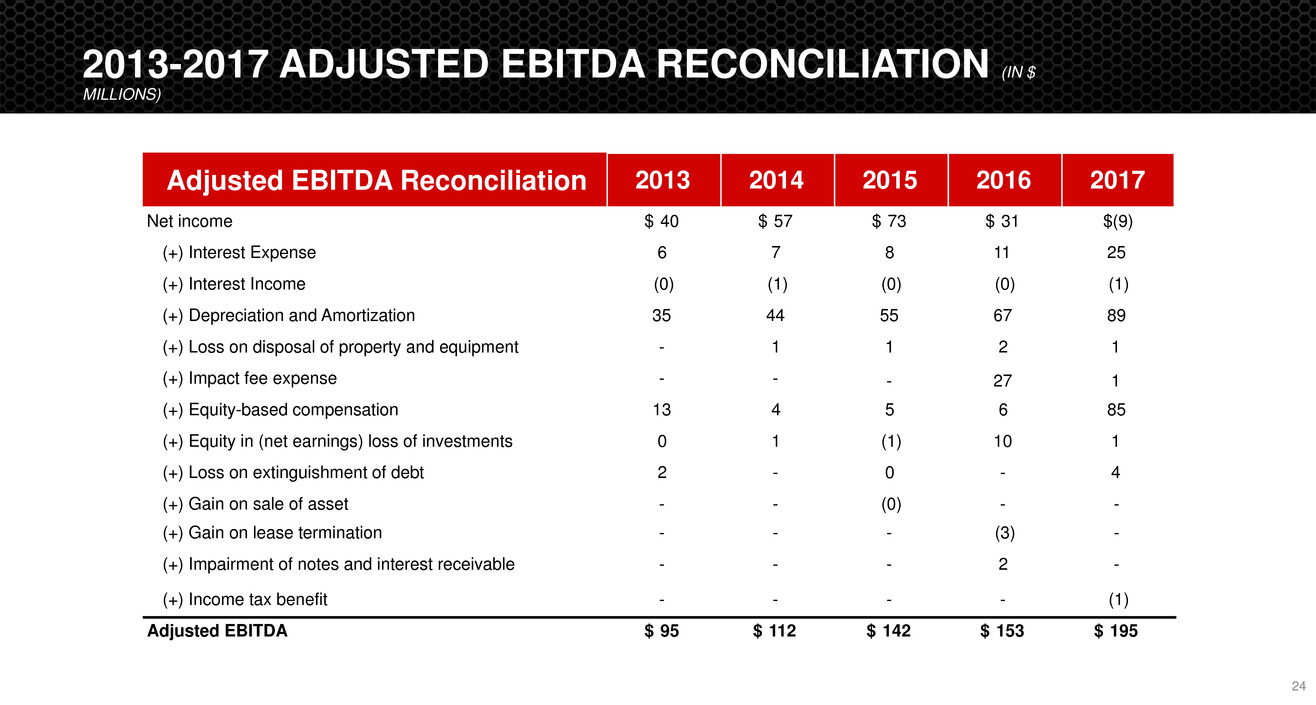

2013-2017 ADJUSTED EBITDA RECONCILIATION (IN $

MILLIONS)

24

Adjusted EBITDA Reconciliation 2013 2014 2015 2016 2017

Net income $ 40 $ 57 $ 73 $ 31 $(9)

(+) Interest Expense 6 7 8 11 25

(+) Interest Income (0) (1) (0) (0) (1)

(+) Depreciation and Amortization 35 44 55 67 89

(+) Loss on disposal of property and equipment - 1 1 2 1

(+) Impact fee expense - - - 27 1

(+) Equity-based compensation 13 4 5 6 85

(+) Equity in (net earnings) loss of investments 0 1 (1) 10 1

(+) Loss on extinguishment of debt 2 - 0 - 4

(+) Gain on sale of asset - - (0) - -

(+) Gain on lease termination - - - (3) -

(+) Impairment of notes and interest receivable - - - 2 -

(+) Income tax benefit - - - - (1)

Adjusted EBITDA $ 95 $ 112 $ 142 $ 153 $ 195

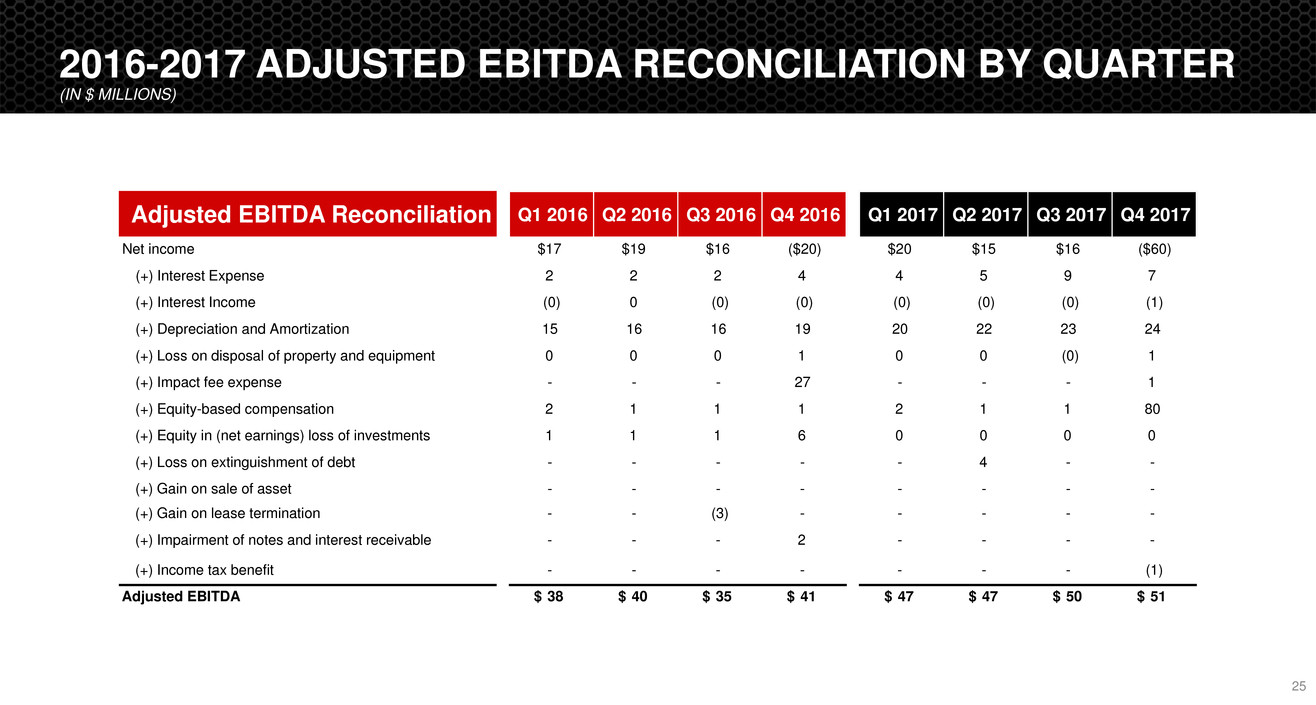

2016-2017 ADJUSTED EBITDA RECONCILIATION BY QUARTER

(IN $ MILLIONS)

25

Adjusted EBITDA Reconciliation Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Net income $17 $19 $16 ($20) $20 $15 $16 ($60)

(+) Interest Expense 2 2 2 4 4 5 9 7

(+) Interest Income (0) 0 (0) (0) (0) (0) (0) (1)

(+) Depreciation and Amortization 15 16 16 19 20 22 23 24

(+) Loss on disposal of property and equipment 0 0 0 1 0 0 (0) 1

(+) Impact fee expense - - - 27 - - - 1

(+) Equity-based compensation 2 1 1 1 2 1 1 80

(+) Equity in (net earnings) loss of investments 1 1 1 6 0 0 0 0

(+) Loss on extinguishment of debt - - - - - 4 - -

(+) Gain on sale of asset - - - - - - - -

(+) Gain on lease termination - - (3) - - - - -

(+) Impairment of notes and interest receivable - - - 2 - - - -

(+) Income tax benefit - - - - - - - (1)

Adjusted EBITDA $ 38 $ 40 $ 35 $ 41 $ 47 $ 47 $ 50 $ 51