Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Northern Power Systems Corp. | exh_321.htm |

| EX-31.2 - EXHIBIT 31.2 - Northern Power Systems Corp. | exh_312.htm |

| EX-31.1 - EXHIBIT 31.1 - Northern Power Systems Corp. | exh_311.htm |

| EX-23.1 - EXHIBIT 23.1 - Northern Power Systems Corp. | exh_231.htm |

| EX-21.1 - EXHIBIT 21.1 - Northern Power Systems Corp. | exh_211.htm |

| EX-10.24 - EXHIBIT 10.24 - Northern Power Systems Corp. | exh_1024.htm |

| EX-10.22 - EXHIBIT 10.22 - Northern Power Systems Corp. | exh_1022.htm |

| EX-10.21 - EXHIBIT 10.21 - Northern Power Systems Corp. | exh_1021.htm |

| 10-K - FORM 10-K - Northern Power Systems Corp. | f10k_033018p.htm |

Exhibit 10.23

AMENDMENT NO. 3 TO MASTER REVOLVING NOTE

This Amendment No. 3 to Master Revolving Note (“Amendment”) dated as of December 6, 2017, is made between Northern Power Systems, Inc. a Delaware corporation (“Borrower”) and Comerica Bank, a Texas banking association (“Bank”) in order to amend the terms of the $6,000,000.00 Master Revolving Note dated June 30, 2014, made by Borrower to Bank (the “Note”).

1. Amendment to Note. The Note is amended as follows:

(a) The principal amount of the Note is hereby increased to $2,500,000 and each reference in the Note to “$2,000,000” and “Two Million Dollars” is amended and restated as “$2,500,000” and “Two Million Five Hundred Thousand Dollars” respectively.

(b) The Maturity Date is extended from December 31, 2017 to June 30, 2019.

2. Defined Terms. Initially capitalized terms used and not defined in this Amendment have the meanings given to them in the Note.

3. Payment Application. Borrower acknowledges that one or more Guaranties have been entered into which guarantee a portion of the Indebtedness under the Note. Upon partial satisfaction of the Indebtedness, Borrower expressly waives any right to designate the portion of the Indebtedness that is satisfied by such payment.

4. Legal Effect. Except as specifically modified hereby, all of the terms and conditions of the Note remain in full force and effect, provided that in the event of any conflict between the terms of this Amendment and the terms of the Note, this Amendment shall control.

5. No Further Amendment. This Amendment is not an agreement to any further or other amendment of the Note. Borrower expressly acknowledges and agrees that except as expressly amended in this Amendment, the Note, as amended, remains in full force and effect and is ratified and confirmed. The execution of this Amendment shall not be deemed to be a waiver of any Default or Event of Default.

6. Waiver. Borrower waives, discharges, and forever releases Bank, Bank’s employees, officers, directors, attorneys, stockholders, and their successors and assigns, from and of any and all claims, causes of action, allegations or assertions that Borrower has or may have had at any time up through and including the date of this Amendment, against any or all of the foregoing, regardless of whether any such claims, causes of action, allegations or assertions are known to Borrower or whether any such claims, causes of action, allegations or assertions arose as result of Bank’s actions or omissions in connection with the Note, or any amendments, extensions or modifications thereto, or Bank’s administration of the debt governed by the Note or otherwise.

7. Costs. Borrower is responsible for all costs incurred by Bank, including without limit reasonable attorney fees, with regard to the preparation and execution of this Amendment.

8. Counterparts. This Amendment may be executed in one or more counterparts, and by separate parties on separate counterparts, all of which shall constitute one and the same agreement. Facsimile copies of signatures or copies of signatures sent by electronic mail (as a “pdf” or “tif” attachment) shall be treated as manually signed originals for the purposes of this Amendment and the documents to be delivered pursuant to Section 4. Any party delivering an executed counterpart of this Amendment by facsimile or electronic mail also shall deliver a manually executed counterpart of this Amendment, but the failure to deliver a manually executed counterpart shall not affect the validity, enforceability, and binding effect of this Amendment.

[Signature Page Follows]

- 2 -

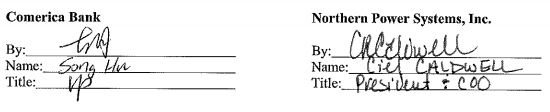

This Amendment No. 3 to Master Revolving Note is executed and delivered as of the date set forth above.