Attached files

| file | filename |

|---|---|

| EX-32.2 - Boxlight Corp | ex32-2.htm |

| EX-32.1 - Boxlight Corp | ex32-1.htm |

| EX-31.2 - Boxlight Corp | ex31-2.htm |

| EX-31.1 - Boxlight Corp | ex31-1.htm |

| EX-21 - Boxlight Corp | ex21.htm |

| EX-10.19 - Boxlight Corp | ex10-19.htm |

| EX-10.7 - Boxlight Corp | ex10-7.htm |

| EX-10.6 - Boxlight Corp | ex10-6.htm |

| EX-10.5 - Boxlight Corp | ex10-5.htm |

| EX-10.4 - Boxlight Corp | ex10-4.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | annual Report UNDER Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2017

OR

| [ ] | Transition Report UNDER Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ______________ to ______________

Commission file number: 001-37564

BOXLIGHT CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 8211 | 46-4116523 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

BOXLIGHT CORPORATION

1045 Progress Circle

Lawrenceville, Georgia 30043

Phone: (678) 367-0809

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | NASDAQ Capital Market |

Securities registered pursuant to section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $_________

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The number of shares outstanding of the registrant’s common stock on March 28, 2018 was 9,648,198.

DOCUMENTS INCORPORATED BY REFERENCE

None

BOXLIGHT CORPORATION

TABLE OF CONTENTS

| 2 |

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis and Results of Operation) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements include statements concerning the following:

| ● | our possible or assumed future results of operations; | |

| ● | our business strategies; | |

| ● | our ability to attract and retain customers; | |

| ● | our ability to sell additional products and services to customers; | |

| ● | our cash needs and financing plans; | |

| ● | our competitive position; | |

| ● | our industry environment; | |

| ● | our potential growth opportunities; | |

| ● | expected technological advances by us or by third parties and our ability to leverage them; | |

| ● | the effects of future regulation; and | |

| ● | our ability to protect or monetize our intellectual property. |

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements, because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the reports we file with the SEC. Actual events or results may vary significantly from those implied or projected by the forward-looking statements due to these risk factors. No forward-looking statement is a guarantee of future performance. You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed as exhibits thereto with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results and circumstances may be materially different from what we expect.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Unless the context otherwise requires, the terms “the Company,” “we,” “us,” and “our” in this report refer to Boxlight Corporation and its consolidated subsidiaries.

| 3 |

ITEM 1. DESCRIPTION OF BUSINESS

We are a global leading distributor of interactive projectors, high definition interactive LED flat panels, and integrated classroom accessory products. We believe we offer the most comprehensive and integrated line of interactive display solutions, audio products, peripherals and accessories for schools and enterprises. Our products are backed by nearly 30 years of research and development. We introduced the world’s first interactive projector in 2007 and received patents in 2010. We focus on developing easy-to-use solutions combining interactive displays with robust software to enhance the educational environment, ease the teacher technology burden, and focus on improving student outcomes.

Advances in technology and new options for introduction into the classroom have forced school districts to look for solutions that allow teachers and students to bring their own devices into the classroom, provide school district information technology departments with the means to access data with or without internet access, handle the demand for video, and control cloud and data storage challenges. Our design teams are able to quickly customize systems and configurations to serve the needs of clients so that existing hardware and software platforms can communicate with one another. We have created plug-ins for annotative software that make existing and legacy hardware interactive and allows interactivity with or without wires through our MimioTeach product. Our goal is to become a single source solution to satisfy the needs of educators around the globe and provide a wholistic approach to the modern classroom.

We pride ourselves in providing industry-leading service and support and have received numerous product awards. Our STEM product, Labdisc, won the BETT Awards 2018 in the tools for teaching, learning and assessment category. In 2017, our MimioStudio with MimioMobile was a BETT Awards finalist in the tools for teaching, learning and assessment area. Our Labdisc product was named Best of BETT 2017 for the Tech & Learning award. In 2017 our Labdisc product won Best In Show at TCEA. Our P12 Projector Series won the Tech & Learning best in show award at ISTE in 2017. Our MimioMobile App with Mimio Studio Classroom Software won the 2016 Cool Tool Award. We received the 2016 Award of Excellence for our MimioTeach at the 34th Tech & Learning Awards of Excellence program honoring new and upgraded software.

Since the Company launched its patented interactive projectors in 2007, we have sold them to public schools in the United States and in 49 other countries, as well as to the Department of Defense International Schools, and in approximately 3,000 classrooms in 20 countries, the Job Corp, the Library of Congress, the Center for Disease Control, the Federal Emergency Management Agency, nine foreign governments and the City of Moscow and numerous Fortune 500 companies, including Verizon, GE Healthcare, Pepsico, First Energy, ADT, Motorola, First Data and Transocean and custom built 4,000 projectors for the Israeli Defense Forces.

Our Company

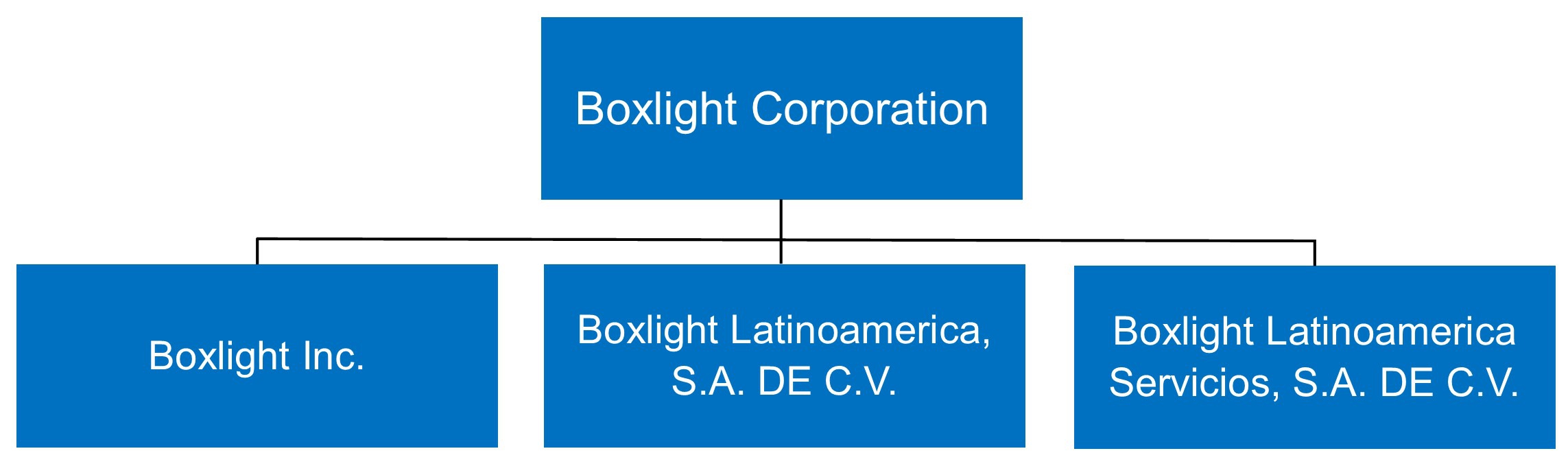

Boxlight Corporation was incorporated in Nevada on September 18, 2014 for the purpose of acquiring technology companies that sell interactive products into the education market. As of the date of this Annual Report, we have three subsidiaries, consisting of Boxlight, Inc., Boxlight Latinoamerica, S.A. DE C.V. and Boxlight Latinamerica Servicios, S.A. DE C.V.

Effective April 1, 2016, Boxlight Corporation acquired Mimio LLC (“Mimio”). Mimio designs, produces and distributes a broad range of Interactive Classroom Technology products primarily targeted at the global K-12 education market. Mimio’s core products include interactive projectors, interactive flat panel displays, interactive touch projectors, touchboards and MimioTeach, which can turn any whiteboard interactive within 30 seconds. Mimio’s product line also includes an accessory document camera, teacher pad for remote control and an assessment system. Mimio was founded on July 11, 2013 and maintained its headquarters in Boston, Massachusetts. Manufacturing is by ODM’s and OEM’s in Taiwan and China. Mimio products have been deployed in over 600,000 classrooms in dozens of countries. Mimio’s software is provided in over 30 languages. Effective October 1, 2016 Mimio LLC was merged into Boxlight Inc.

| 4 |

Effective May 9, 2016, Boxlight Corporation acquired Genesis Collaboration LLC (“Genesis”). Genesis is a value added reseller of interactive learning technologies, selling into the K-12 education market in Georgia, Alabama, South Carolina, northern Florida, western North Carolina and eastern Tennessee. Genesis also sells our interactive solutions into the business and government markets in the United States. Effective August 1, 2016, Genesis was merged into Boxlight Inc.

Effective July 18, 2016, Boxlight Corporation acquired Boxlight, Inc., Boxlight Latinoamerica, S.A. DE C.V. (“BLA”) and Boxlight Latinoamerica Servicios, S.A. DE C.V. (“BLS”) (together, “Boxlight Group”). The Boxlight Group sells and distributes a suite of patented, award-winning interactive projectors that offer a wide variety of features and specifications to suit the varying needs of instructors, teachers and presenters. With an interactive projector, any wall, whiteboard or other flat surface becomes interactive. A teacher, moderator or student can use the included pens or their fingers as a mouse to write or draw images displayed on the surface. As with interactive whiteboards, interactive projectors accommodate multiple users simultaneously. Images that have been created through the projected interactive surface can be saved as computer files. The new Company’s new ProjectoWrite 12 series, launched in February 2016, allows the simultaneous use of up to ten simultaneous points of touch.

We are a leading technology company that focuses on the education and learning industry. We produce and distribute products including interactive projectors, 65”-98” ultra hi-resolution interactive LED panels, integrated STEM (Science, Technology, Engineering, & Mathematics) data logging products, and develop new products utilizing a combination of technologies utilizing Boxlight’s intellectual property portfolio. We invest in significant research and development, leverage our international manufacturing capabilities, and utilize an established global reseller network. Our goal is to become a single source, world-leading innovator, manufacturer and integrator of interactive products for schools and universities, as well as for training and instruction for business and governmental agencies.

The organizational structure of our companies is as follows:

| 5 |

Our Markets

In the United States, which is our primary market, we sell and distribute interactive educational products for K-12 to both public and private schools, the K-12 education sector represents one of the largest industry segments. In addition to its size, the U.S. K-12 education market is highly decentralized and is characterized by complex content adoption processes. The sector is comprised of approximately 15,600 public school districts across the 50 states and 132,000 public and private elementary and secondary schools. We believe this market structure underscores the importance of scale and industry relationships and the need for broad, diverse coverage across states, districts and schools. Even while we believe certain initiatives in the education sector, such as the Common Core State Standards, a set of shared math and literacy standards benchmarked to international standards, have increased standardization in K-12 education content, we believe significant state standard specific customization still exists, and we believe the need to address customization provides an ongoing need for companies in the sector to maintain relationships with individual state and district policymakers and expertise in state-varying academic standards.

U.S. K-12 education has come under significant political scrutiny in recent years, due to the recognition of its importance to U.S. society at large and concern over the perceived decline in U.S. student competitiveness relative to international peers. An independent task force report published in March 2012 by the Council on Foreign Relations, a non-partisan membership organization and think tank, observed that American students rank far behind global leaders in international tests of literacy, math and science, concluding that the current state of U.S. education severely impairs the United States’ economic, military and diplomatic security as well as broader components of America’s global leadership. Also, the Executive Office of the President Council of Economic Advisors, in a report titled Unleashing the Potential of Educational Technology, stated that “many observers are concerned about declines in the relative quality of U.S. primary and secondary education, and improving performance of our schools has become a national priority.” We believe that the customization of learning programs could enhance innovative and growth strategies geared towards student performance in our nation’s schools.

The global education industry is undergoing a significant transition, as primary and secondary school districts, colleges and universities, as well as governments, corporations and individuals around the world are increasingly recognizing the importance of using technology to more effectively provide information to educate students and other users.

According to “All Global Market Education & Learning”, an industry publication, the market for hardware products is growing due to increases in the use of interactive whiteboards and simulation-based learning hardware. Educational institutions have become more receptive to the implementation of hi-tech learning tools. The advent of technology in the classroom has enabled multi-modal training and varying curricula. In general, technology based tools help develop student performance when integrated with the curriculum. The constant progression of technology in education has helped educators to create classroom experiences that are interactive, developed and collaborative.

According to market research report “Markets and Markets Interactive Projector Market” 2016 research report, the interactive projector market was valued at $670 million in 2015 and is expected to reach $2,602 million by 2022, growing at a CAGR of 21.5% between 2016 and 2022. The increasing adoption of interactive projectors in the education segment, the low cost of interactive projectors compared to interactive whiteboards, and significant advantages of interactive projectors over conventional projectors are some of the factors that are driving the growth of the interactive market. Low awareness of the consumers regarding interactive projectors in developing countries restrains the growth of the market in those areas. The major players in the interactive projector market include Seiko Epson Corp. (Japan), BenQ Corp. (Taiwan), Boxlight (U.S.), Dell Technologies Inc. (U.S.), Panasonic Corp. (Japan), CASIO COMPUTER Co., Ltd. (Japan), NEC Display Solutions, Ltd. (Japan), Optoma Technology Inc. (U.S.), Touchjet Inc. (Singapore), and Delta Electronics Inc. (Taiwan).

| 6 |

Our Opportunity

We believe that our patented product portfolios and the software and products we intend to develop either alone or in collaboration with other technology companies positions us to be a leading manufacturer and provider of interactive educational products in the global educational and learning market. We believe that increased consumer spending driven by the close connection between levels of educational attainment, evolving standards in curriculum, personal career prospects and economic growth will increase the demand for our interactive educational products. Some of the factors that we believe will impact our opportunity include:

Growth in U.S. K-12 Market Expenditures

Significant resources are being devoted to primary and secondary education, both in the United States and abroad. As set forth in the Executive Office of the President, Council of Economic Advisers report, U.S. education expenditure has been estimated at approximately $1.3 trillion, with K-12 education accounting for close to half ($625 billion) of this spending. Global spending is roughly triple U.S. spending for K-12 education.

While the market has historically grown above the pace of inflation, averaging 7.2% growth annually since 1969, as expenditures by school districts and educational institutions are largely dependent upon state and local funding, the world-wide economic recession caused many states and school districts to defer spending on educational materials, which materially and adversely affected our historical revenues as well as those of many of our competitors. However, expenditures and growth in the U.S. K-12 market for educational content and services now appears to be rebounding in the wake of the U.S. economic recovery. Although, the economic recovery has been slower than anticipated, and there is no assurance that any further improvement will be significant, nonetheless, states such as Florida, California and Texas were all scheduled to adopt interactive educational materials for certain subjects, including reading and math, by 2016.

International Catalysts Driving Adoption of Learning Technology

According to Ambient Insights 2012 Snapshot of the Worldwide and US Academic Digital Learning Market, substantial growth in revenues for e-learning products in the academic market segment are anticipated throughout the world due to several convergent catalysts, including population demographics such as significant growth in numbers of 15-17 year old students and women in education in emerging markets; government-funded education policies mandating country-wide deployment of digital learning infrastructures; large scale digitization efforts in government and academic markets; significant increases in the amount of digital learning content; migration to digital formats by major educational publishers and content providers; mass purchases of personal learning devices and strong demand for learning platforms, content and technology services; and rapid growth of part-time and fulltime online student enrollments.

Rising Global Demand

We expect to profit from the rising global demand for technology based learning products by offering our interactive product hardware and software in the United States and expanding into foreign countries. In recent years, the global education sector has seen movement towards the adoption of interactive learning devices. As examples:

| 7 |

| ● | In 2010, the Peruvian government spent $3.0 billion for an education technology rollout to provide all teachers and students with individual tablet computers and network infrastructure and classroom displays; | |

| ● | In August 2011, the Russian government announced a plan to deploy tablets, “on a massive scale” in the Russian educational system, to replace printed textbooks; | |

| ● | In October 2011, the Indian government launched its heavily subsidized school-designed tablet called Aakash; and | |

| ● | In July 2011, the Thailand government announced that it intends to give every child in grades 1-6 a tablet starting with first grade students in the 2012 school year. The multi-year program is expected to equip over 5.0 million primary students with handheld devices. |

Growth in the E-learning Market

According to the “E-learning Market – Global Outlook and Forecast 2018-2023”

The introduction of technology-enabled learning that helps organizations train human resource is driving the growth of the global e-learning market. These training modules offer continuous and effective learning at an optimal cost and provide customized course content that meets the specific requirements of end-users. The advent of cloud infrastructure, peer-to-peer problem solving, and open content creation will help to expand business opportunities for service providers in the global e-learning market.

Vendors are also focusing on offering choices on the course content at competitive prices to gain the share in the global e-learning market. The exponential growth in the number of smartphone users and internet connectivity across emerging markets is driving the e-learning market in these regions. The introduction of cloud-based learning and AR/VR mobile-based learning is likely to revolutionize the e-learning market during the forecast period.

Major vendors are introducing technology-enabled tools that can facilitate the user engagement, motivate learners, and help in collaborations, thereby increasing the market share and attracting new consumers to the market. The growing popularity of blended learning that enhances the efficiency of learners will drive the growth of the e-learning market. The e-learning market is expected to generate revenue of $65.41 billion by 2023, growing at a CAGR of 7.07% during the forecast period.

Trends in Tech-Savvy Education

While industries from manufacturing to health care have adopted technology to improve their results, according to Stanford Business School, in its Trends in Tech-Savvy Education, the education field remains heavily reliant on “chalk and talk” instruction conducted in traditional settings; however, that is changing as schools and colleges adopt virtual classrooms, data analysis, online games, highly customized coursework, and other cutting-edge tools to help students learn.

Demand for Interactive Projectors is on the Rise

The interactive projector market was valued at $670.3 million in 2015 and is expected to reach $2.602M by 2022, growing at a CAGR of 21.5% between 2016 and 2022. The factors which are driving the growth of market include significant advantages of interactive projectors over conventional projectors, increased adoption of interactive projectors in the education segment, and the low cost of projectors compared to interactive whiteboards.

Additional Technologies

The delivery of digital education content is also driving a substantial shift in the education market. In addition to whiteboards, interactive projectors and interactive flat panels, other technologies are being adapted for educational uses on the Internet, mobile devices and through cloud-computing, which permits the sharing of digital files and programs among multiple computers or other devices at the same time through a virtual network. We intend to be a leader in the development and implementation of these additional technologies to create effective digital learning environments.

Handheld Device Adoption

Handheld devices, including smartphones, tablets, e-readers and digital video technologies, are now fundamental to the way students communicate. A 2010 FCC survey provides evidence that the rates of handheld use will increase dramatically. It reported that while 50% of respondents currently use handhelds for administrative purposes, 14% of schools and 24% of districts use such devices for academic or educational purposes. Furthermore, 45% of respondents plan to start using such devices for academic and educational purposes within the next 2 to 3 years. The survey stated that, “The use of digital video technologies to support curriculum is becoming increasingly popular as a way to improve student engagement.”

Natural User Interfaces (NUIs)

Tablets and the new class of “smart TVs” are part of a growing list of other devices built with natural user interfaces that accept input in the form of taps, swipes, and other ways of touching; hand and arm motions; body movement; and increasingly, natural language. Natural user interfaces allow users to engage in virtual activities with movements similar to what they would use in the real world, manipulating content intuitively. The idea of being able to have a completely natural interaction with a device is not new, but neither has its full potential been realized. For example, medical students increasingly rely on simulators employing natural user interfaces to practice precise manipulations, such as catheter insertions, that would be far less productive if they had to try to simulate sensitive movements with a mouse and keyboard. NUIs make devices seem easier to use and more accessible, and interactions are far more intuitive, which promotes exploration and engagement. (NMC Horizon Project Technology Outlook STEM+ Education 2012-2017).

| 8 |

The Business and Government Market

The business and government market for interactive displays represents an attractive growth opportunity for us because of the desire of organizations to improve the quality of training, development and collaboration.

In meeting rooms, our solutions help achieve the following:

| ● | Enhance brainstorming and collaboration by providing a real-time focal point upon which participants can share their ideas with the entire group of attendees, including those in remote locations; | |

| ● | Add a tangible, interactive dimension to conferencing that enables attendees to visualize a situation or concept and make decisions based on that visualization; | |

| ● | Save time and enhance productivity by enabling users to save and distribute their collective work product from a meeting without the inconsistencies and subjectivity that may result from individual note taking; | |

| ● | Realize cost savings not only by reducing travel needs, but also by improving internal communication and team building; and | |

| ● | Enable participants to access digital files and use applications in real time. |

In training centers, we believe that our solutions help to enhance achievement levels with multi-modality (visual, auditory and kinesthetic) learning capabilities, improved interactivity and engagement and real-time assessment and feedback. Our solutions may also help improve an enterprise’s return on investment by providing better trained employees reducing training time and getting employees back to their jobs, reduced travel expenses, improved customers service from well-trained employees and reduced employee turnover.

Federal and State Funding According to “State of the K-12 Market Reports 2016”

New Student Support and Academic Enrichment Grant (SSAEG) dollars will likely begin to expand the market somewhat in the 2017-2018 school year. SSAEG is a new funding mechanism that provides flexible funding focused on efforts to promote a well-rounded education, create safe and healthy learning environments for students, and support the effective use of technology. Congress initially authorized SSAEG at $1.6 billion.

Despite the attention paid to the federal education budget, school funding continues to come primarily from state and local sources. For the 2014-2015 school year, state funding provided nearly half (46%) of total funding for K-12 schools, with local funding providing 44% of K-12 funding. The federal contribution was an average of 10%. Overall funding for all public and private K-12 education in the United States is currently about $665 billion.

States spend a significant amount of their overall budgets to support education. According to the National Association of State Budget Officers, states devote 20% of their overall spending to K-12 education. In FY2016, 41 states enacted spending increases for K-12 education resulting in a net increase of $14.7 billion, up from an $11.1 billion increase in FY2015. Thirty-five states also enacted spending increases for higher education. Only four states—Alaska, Hawaii, West Virginia, and Wisconsin—cut K-12 spending in FY2016.

Governors in 43 states called for higher spending in their FY2017 budget recommendations. As has been true for several years, governors’ proposed budgets direct most additional dollars to K-12 funding and Medicaid, the two largest areas of state general fund expenditures.

The Fiscal Survey of States, Spring 2016 confirms that state budgets continue to show moderate growth and stability. FY2016 (July 1, 2015 to June 30, 2016) marked the first time that aggregate spending levels surpassed the pre-recession peak level of FY2008, adjusted for inflation. For the most part, states have been able to close budget gaps and minimize mid-year budget cuts. Unemployment rates are going down, rainy day funds are growing, and states are focused on resolving issues around unfunded pension programs, ongoing health care and education costs, and pent-up infrastructure demand. Enacted 2016 budgets showed state revenues reaching $798 billion, an increase of 4%, compared with the 3% gain in fiscal 2015, when revenues stood at $748 billion. Revenue growth was widespread: 43 states enacted spending increases in FY2016, compared with 2015 levels. A small number of states face revenue shortfalls brought on by the decline in oil and natural gas prices.

Technology Budget Outlook Per “State of the K-12 Market Reports 2016”

The outlook for district technology budgets in the 2016-2017 school year continues the improvement seen last year, confirming schools’ emergence from the long shadow of the recession. Tech directors generally have quite positive expectations about their 2016-2017 budget. Compared with the prior two years, the 2016-2017 outlook is generally strong. Clearly technology directors are making some trade-offs from year to year, increasing spending in one category and balancing that increase by holding steady or slightly decreasing other categories.

Even in the schools’ worst recession years of 2010-2011 through 2012-2013, hardware and teacher training were most likely to see the largest percentage of districts planning to increase spending. The implementation of Common Core assessments likely drove some of this investment in hardware and teacher training in the past; however, the desire to increase overall student access to technology also plays a role. Districts may not be saying that one-to-one is their goal, but they continue to move in that direction. Their budget plans also reflect a clear awareness that teacher training is an essential element of any expansion of technology use.

District characteristics (size, metropolitan status, and region) are sometimes associated with differences in plans for technology spending. While no significant differences are seen by metropolitan status of region, looking at projected increases by district size reveals a difference in budget plans for hardware purchases. Medium-size districts are significantly more likely than their smaller counterparts to be planning increases in hardware budgets.

| 9 |

Our Current Products

We currently offer the following products:

MimioStudio Interactive Instructional Software

MimioStudio Interactive Instructional Software enables the creation, editing, and presentation of interactive instructional lessons and activities. These lessons and activities can be presented and managed from the front of the classroom using any of Boxlight’s front of classroom display systems including MimioTeach + our non-interactive projectors, ProColor Interactive LED panels, MimioBoard Touch + our non-interactive projectors, MimioFrame + our non-interactive projectors or ProjectoWrite “P” Series interactive projectors in either pen or touch controlled versions. MimioStudio can also be operated using MimioPad as a full-featured remote control or a mobile device such as an iPad or tablet which includes a display screen that fully replicates the front-of-classroom display generated by MimioStudio. Operation with a mobile device is enabled via the three-user license for MimioMobile, see next, provided with the MimioStudio license that accompanies all front-of-classroom devices from Mimio.

MimioMobile Collaboration and Assessment Application

The introduction of MimioMobile, a software accessory for MimioStudio, in 2014 introduced a new era of fully interactive student activities that are able to be directly and immediately displayed on the front-of-classroom interactive displays through MimioStudio.

MimioMobile allows fully interactive activities to be pushed to student classroom devices. The students can manipulate objects within the activities, annotate “on top” of them, and even create completely new content on their own handheld devices. MimioMobile also enables assessment using the mobile devices. The teacher can create multiple choice, true\false, yes\no, and text entry assessment questions. The students can respond at their own speed and their answers are stored within MimioStudio from which the teacher can display graphs showing student results. This “continuous assessment” allows formative assessment that can help guide the teacher as to whether to re-teach the material if understanding is low or move forward in the lesson. We believe that this interactive and student dependent instructional model can dramatically enhance student outcomes.

Boxlight Front-of-Classroom Interactive Displays

Boxlight offers the broadest line of interactive displays, each of which provides large image size and interactive technology that complements the capabilities of MimioStudio and MimioMobile.

Boxlight Interactive Projectors

We offer a suite of patented, award-winning interactive projectors with a wide variety of features and specifications to suit the varying needs of instructors, teachers and presenters around the world. With an interactive projector any wall , whiteboard or other flat surface can become an interactive surface and enable computer control. A user can utilize a pen stylus or finger as a mouse or to write or draw images displayed on the screen. As with interactive whiteboards, the interactive projector accommodates multiple users simultaneously. Images that have been created through the projectors can be saved as computer files. Except for the ProjectorWrite 12 series, all the Boxlight Group interactive projectors use LCD or DLP technology.

| 10 |

We offer interactive projectors using lamp and laser illumination technologies. Each ultra-short throw model is available with pen-based interactivity using infra-red emitting pens or touch-based technology using an emitter that generates a laser curtain over the entire surface of an associated whiteboard.

The pen versions of these interactive projectors can display images as large as 130” diagonally in 16:10 aspect ratio. The touch-based versions can display images as large as 100” in the same 16:10 aspect ratio. All models support up to ten simultaneous interactions meaning multiple students can simultaneously work. The projectors come with high quality audio and appropriate wall mounting hardware.

The ProjectoWrite 9 series provides wired interactivity and features 60 frames per second. These projectors have built-in storage of up to 1.5 GB for on-the-go display; a USB or EZ WiFi LAN connection from the PC, Mac or mobile device to the interactive projector is required for interactivity with the projected images. The ProjectoWrite 9 interactive projector series allows for a maximum of ten interactive pens working simultaneously. Utilizing its patented embedded interactive CMOS camera at 60 frames per second, response time is less than 12 ms., and accuracy is within 3 pixels.

The ProjectoWrite 12 series is first in the Boxlight Group’s line of patented finger-touch interactive projectors to offer a driverless installation. With the addition of a laser module, a moderator or student can use a finger, or any solid object, to interact and control the computer at the projected image. With 10-point touch, a user can capitalize on the new touch features of Microsoft Windows 10, emulating a tablet computer.

Boxlight ProColor Interactive Flat Panel Displays

Our ProColor series of interactive LED panels are available in five sizes of Interactive Flat Panel Displays – 55”, 65”, 70”, 75”, and 86” measured diagonally. Each offers a 4K resolution, and an optional PC Module slot for embedded Windows 10 and also include embedded Android computing capability for control, applications, and annotation that produce extraordinarily sharp images suitable for a range of classroom sizes. ProColor Interactive LED panels utilize infrared touch tracking technology, offering 10 points of touch for simultaneous interaction of multiple users. ProColor’s built-in speakers add room filling sound to the display’s vivid colors. The interactive LED panels feature Korean glass with optical coatings that are highly scratch resistant and improve viewing angles and ambient light interference.

ProColor Display 490 Interactive Touch Table

The ProColor Display 490 Interactive Touch Table enables up to four students to work collaboratively or individually on a horizontal surface particularly well-suited to younger students or those with motor skill limitations. The height of the table can be adjusted electrically to accommodate a wide range of student ages and even wheelchairs.

| 11 |

Boxlight’s MimioBoard Interactive Touch Boards

Boxlight’s Interactive Touch Boards are available in 78” 4:3 aspect ratio and 87” 16:10 aspect ratio. These boards provide sophisticated interactivity with any projector because the touch interactivity is built into the board. Unlike many competitive products, Boxlight’s touch boards are suited for use with dry erase markers. Many competitive products advise against using dry erase markers because their boards stain. Boxlight’s touch boards use a porcelain-on-steel surface for durability and dry erase compatibility.

Boxlight’s MimioTeach Interactive Whiteboard

Boxlight’s MimioTeach is one of the company’s best known and longest-lived products. Hundreds of thousands of MimioTeach interactive whiteboards and its predecessor models are used in classrooms around the world. MimioTeach can turn any whiteboard (retrofit) into an interactive whiteboard in as little as 30 seconds. This portable product fits into a tote bag with room for a small desktop projector, which is attractive to teachers who move from classroom to classroom. For schools where “change is our normal,” MimioTeach eliminates the high cost of moving fixed-mount implementations

Boxlight’s MimioFrame retro-fittable Touch Board

Boxlight’s MimioFrame can turn a conventional whiteboard into a touchboard in 10-15 minutes. Millions of classrooms already have a conventional whiteboard and a non-interactive projector. MimioFrame user infrared (IR) technology embedded in the four sides of the frame to turn that non-interactive combination into a modern 10-touch-interactive Digital Classroom. No drilling or cutting is required, MimioFrame easily and quickly attaches with industrial-strength double-sided tape.

Boxlight’s MimioSpace ultra-wide 135” TouchBoard System

MimioSpace combines a, eleven-foot-wide 32-touch interactive whiteboard with a 16:6 aspect ratio ultra-wide projector to produce an extraordinary combination of digital classroom technology and the extremely wide working surface of classical blackboard-based classrooms.

Peripherals and accessories

We offer a line of peripherals and accessories, including amplified speaker systems, mobile carts, installation accessories and adjustable wall-mount accessories that complement its entire line of interactive projectors, LED flat panels and standard projectors. The height and tilt adjustable DeskBoard mobile cart, which won the Best of ISTE in June 2014 for Best Hardware product, can be used as an interactive screen or interactive desktop with the ProjectoWrite 8 ultra-short throw interactive projectors.

Boxlight’s MimioVote Student Assessment System

Boxlight’s MimioVote is a handheld “clicker” that enables student assessment with essentially zero training. MimioVote is so simple it genuinely qualifies as intuitive, an elusive and often proclaimed attribute that is actually merited by MimioVote. MimioVote fully integrates into the MimioMobile environment and offers everything from attendance to fully immersive and on-the-fly student assessment. The MimioVote was specifically designed to survive the rigors of even kindergarten and elementary classrooms where being dropped, stepped on, and kicked are all part of a normal day. The handset’s non-slip coating helps keep it from sliding off desktops or out of little hands. Should they take wing, the rugged construction keeps them working.

| 12 |

Boxlight’s MimioPad wireless pen tablet

MimioPad is a lightweight, rechargeable, wireless tablet used as a remote control for the MimioStudio running on a teacher’s Windows, Mac, or Linux computer. MimioPad enables the teacher to roam the classroom which significantly aids classroom management. MimioPad is a classroom management tool which can be handed off to enable a student to be part of the interactive experience – all without getting up and going to the front of the room.

Boxlight’s MimioView document camera

Boxlight’s MimioView is a document camera that is integrated with MimioStudio to make the combination easy to use with a single cable connection that carries power, video, and control. MimioView is fully integrated into our MimioStudio software solution and is controlled through the applications menu of the quick menu. With 2 clicks, the teacher or user can turn on, auto-focus, and illuminate the included LED lights for smooth high-definition images.

Audio Solutions

We offer SoundLite audio solutions as an affordable and easy-to-install amplified speaker system for use with all of our projectors. The 30 watt SoundLite product is available with a wireless RF microphone. This device produces quality stereo sound in any room.

Features in future SoundLite models will have a security-enabled system and IP addressable audio classroom solution allowing point-to-point address as well as a network wide area address. A panic switch on the wireless transmitters will enable live broadcast of classroom audio and simultaneously trigger predetermined alerts. This feature is designed to work over a school’s existing network infrastructure.

Non-Interactive projectors

We distribute a full line of standard, non-interactive projectors. The Cambridge Series features embedded wireless display functions and is available in short and standard throw options. Offering brightness from 2,700 to 4,000 lumens, we furnish projectors for small classrooms to large classrooms with the Cambridge platform. This series is available in both XGA and WXGA resolutions to replace projectors on existing interactive whiteboards in classrooms operating on limited budgets. The Boxlight Group has designed this platform to provide easy user maintenance with side-changing lamps and filters and developed HEPA filtration systems for harsh environments.

Over the past several years, we have together with strategic allies, provided customized products that fit specific needs of customers, such as the Israeli Ministry of Defense. Working with Nextel Systems, the Boxlight Group delivered approximately 4,000 projectors, with special kitting performance, asset tagging, custom start up screens, operating defaults appropriate for harsh environments, and other unique product specifications. the Boxlight Group also met requirements that each projector contain at least 51% U.S. content and be assembled in the United States. A service center was appointed in Israel to provide warranty service and support. The US Army in connection with the Israeli Defense Forces found the Boxlight Group to be the only manufacturer able to meet the stringent requirements, leading not only to the original multi-year contract, but to extensions for favorable execution and performance.

| 13 |

Integration Strategy

We have centralized our business management for all acquisitions through an enterprise resource planning system. We have streamlined the process to drive front-line sales forecasting to factory production. Through the enterprise resource planning system, we have synchronized five separate accounting and customer relationship management systems through a cloud-based interface to improve inter-company information sharing and allow management at the Company to have immediate access to snapshots of the performance of each of our subsidiaries. As we grow, organically or through acquisition, we plan to move to a multi-currency model of our enterprise resource planning system.

Logistics; Suppliers

Logistics is currently provided by our Lawrenceville, Georgia facility. Contract manufacturing for Boxlight’s products are through ODM and OEM partners according to specific engineering specifications and utilizing IP developed and owned by Boxlight. Boxlight’s factories for ODM and OEM are located in Taiwan, China and Germany.

Technical Support and Service

The Company currently has its technical support and service centers located near Seattle, WA and in Atlanta, GA. Additionally, the Company’s technical support division is responsible for the repair and closing of customer service cases, resulting in more than 60% of the Company’s customer service calls ending in immediate closure of the applicable service case. We accomplish this as a result of the familiarity between our products and the customer service technician.

Sales and Marketing

Our sales force consists of nine regional account managers in the US, two in Latin America, three in Europe, two sales support staff and one Vice President of Sales. Our marketing team consists of one Vice President of Global Marketing, One Vice President of Marketing Communications and Public Relations, one Marketing Coordinator and four contractors. Our sales force and marketing teams primarily drive sales of interactive flat panels, interactive whiteboards, interactive projectors, interactive touch table, education software, STEM data logging products and related peripherals and accessories to school districts, throughout North, Central and South America, Europe, the Middle East and Asia. In addition, we go to market through an indirect channel distribution model and utilize traditional value-added resellers and support them with training to become knowledgeable about the products we sell. We currently have approximately 800 resellers.

We believe Boxlight offers the most comprehensive product portfolio in today’s education technology industry, along with best-in-class service and technical support. Boxlight’s award-winning, interactive classroom technology and easy to use line of classroom hardware and software solutions provide schools and districts with the most complete line of progressive, integrated classroom technologies available worldwide.

Competition

In the interactive education industry, we face substantial competition from developers, manufacturers and distributers of interactive learning products and solutions. The industry is highly competitive and characterized by frequent product introductions and rapid technological advances that have substantially increased the capabilities and use of interactive projectors and interactive whiteboards. We face increased competition from companies with strong positions in certain markets we serve, and in new markets and regions we may enter. These companies manufacture and/or distribute new, disruptive or substitute products that compete for the pool of available funds that previously could have been spent on interactive displays and associated products. Our ability to integrate our technologies and remain innovative and develop new technologies desired by our current and potential new contract manufacturing customers will determine our ability to grow our contract manufacturing divisions.

The Company competes with other developers, manufacturers and distributors of interactive projectors and personal computer technologies, tablets, television screens, smart phones. Interactive whiteboards, since first introduced, have evolved from a high-cost technology that involves multiple components, requiring professional installers, to a one-piece technology that is available at increasingly reduced price points and affords simple installations. With lowered technology entry barriers, we face heated competition from other interactive whiteboard developers, manufacturers and distributors. However, the market presents new opportunities in responding to demands to replace outdated and failing interactive whiteboards with more affordable and simpler solution interactive whiteboards. In addition, the Company has begun to see expansion in the market to sales of complementary products that work in conjunction with the interactive technology, including software, audio solutions, data capture, and tablets.

Employees

As of December 31, 2017, we had approximately 43 employees, of whom 4 are executives, 5 employees are engaged in product development, engineering and research and development, 16 employees are engaged in sales and marketing, 9 employees are engaged in administrative and clerical services and 9 employees are engaged in service and production. In addition, a total of approximately 8 individuals provide sales agency services to us as independent contractors.

None of our employees are represented by labor organizations. We consider our relationship with our employees to be excellent. A majority of our employees have entered into non-disclosure and non-competition agreements with us or our operating subsidiaries.

As a “smaller reporting company,” this item is not required.

| 14 |

RISKS RELATED TO OUR BUSINESS

Our corporate headquarters is located at 1045 Progress Circle, Lawrenceville, Georgia 30043, in a building of approximately 48,000 square feet, for which we pay approximately $20,000 per month as rent through March 2019. Our corporate headquarters house our administrative offices as well as distribution operations and assembly for the Boxlight brand.

We also maintain an office in Poulsbo, Washington, for sales, marketing, technical support and service staff.

Not applicable.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock commenced trading on the NASDAQ Capital Market, or NASDAQ, under the symbol “BOXL” on November 30, 2017. Prior to that time, our common stock was not traded on any exchange or quoted on any over the counter market. The prices set forth below reflect the quarterly high and low sales prices per share for our common stock, as reported by the NASDAQ:

| 15 |

| High | Low | |||||||

| 2018 | ||||||||

| First Quarter (through March 9) | $ | 6.97 | $ | 4.00 | ||||

| 2017 | ||||||||

| First Quarter | $ | N/A | $ | N/A | ||||

| Second Quarter | $ | N/A | $ | N/A | ||||

| Third Quarter | $ | N/A | $ | N/A | ||||

| Fourth Quarter | $ | 7.98 | $ | 5.74 | ||||

| 2016 | ||||||||

| First Quarter | $ | N/A | $ | N/A | ||||

| Second Quarter | $ | N/A | $ | N/A | ||||

| Third Quarter | $ | N/A | $ | N/A | ||||

| Fourth Quarter | $ | N/A | $ | N/A | ||||

Holders

As of March 22, 2018, we have 407 holders of record of our common stock.

Dividends

We have never paid cash dividends on our common stock. Holders of our common stock are entitled to receive dividends, if any, declared and paid from time to time by the Board of Directors out of funds legally available. We intend to retain any earnings for the operation and expansion of our business and do not anticipate paying cash dividends on our common stock in the foreseeable future. Any future determination as to the payment of cash dividends will depend upon future earnings, results of operations, capital requirements, our financial condition and other factors that our Board of Directors may consider.

Equity Compensation Plans

Adoption of the 2014 Stock Option Plan

On September 19, 2014, prior to the listing of our common stock on NASDAQ, the Board approved the Company’s 2014 Stock Option Plan. The total number of underlying shares of the Company’s Class A common stock available for grant to directors, officers, key employees, and consultants of the Company or a subsidiary of the Company under the plan is 2,390,438 shares.

The following table provides information as of December 31, 2017 about our equity compensation plans and arrangements.

| Plan category | Number

of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average

exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans | |||||||||

| Equity compensation plans approved by security holders | 812,574 | $ | 3.01 | 1,577,864 | ||||||||

| Equity compensation plans not approved by security holders | 870,717 | $ | 7.70 | - | ||||||||

| Total | ||||||||||||

| 16 |

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

None.

Use of Proceeds

On January 30, 2017, a Registration Statement on Form S-1 (Reg. No. 333-204811) was declared effective with the Securities and Exchange Commission. A Post-Effective Amendment to the Registration Statement was declared effective on August 29, 2017, for the sale of up to 1,000,000 shares of Class A common stock of the Company at an initial offering price of $7.00 per share. The offering was consummated on November 30, 2017 by the Company with Aegis Capital Corp, as the lead placement agent on a “best efforts” basis, without a firm commitment by Aegis, who had no obligation or commitment to purchase any of the Company’s shares. The Company received gross proceeds in the amount of $7,000,000.

From the effective date of the Registration Statement to December 31, 2017, we incurred actual expenses in the amount of approximately $1,034,000. We had net proceeds from the offering in the amount of $5,678,609 and converted accounts payable into common stock on IPO of $287,119.

We have used approximately $3,500,000 of the net proceeds as of December 31, 2017. The net proceeds were used to pay the Skyview Note, purchase inventory and for general working capital requirements.

ITEM 6. SELECTED FINANCIAL DATA

Not required for smaller reporting companies.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis should be read in conjunction with our financial statements and the related notes thereto included elsewhere herein. The Management’s Discussion and Analysis contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements in this form. Our actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors including, but not limited to, those noted under “Risk Factors” of the reports filed with the Securities and Exchange Commission.

We do not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this transition report.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) contains certain forward-looking statements. Historical results may not indicate future performance. Our forward-looking statements reflect our current views about future events, are based on assumptions and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those contemplated by these statements. Factors that may cause differences between actual results and those contemplated by forward-looking statements include, but are not limited to, those discussed in “Risk Factors.” We undertake no obligation to publicly update or revise any forward-looking statements, including any changes that might result from any facts, events, or circumstances after the date hereof that may bear upon forward-looking statements. Furthermore, we cannot guarantee future results, events, levels of activity, performance, or achievements.

| 17 |

Overview

We are a visual display technology company that is seeking to become a world leading innovator, and integrator of interactive products for schools, as well as for business and government conferencing. We currently design, produce and distribute interactive projectors and distribute interactive LED flat panels in the education market. We also distribute science, technology, engineering and math (or “STEM”) data logging products to the educational market.

To date, we have generated substantially all of our revenue from the sale of our software and expanding product line of projectors, LED panels, interactive whiteboards and display devices to the educational market.

In addition, we have implemented a comprehensive plan to reach profitability for our business acquisitions. Highlights of this plan include:

| ● | We have integrated products of the acquisition companies and cross trained our sales reps to increase their offerings. The combination of products and cross training has already resulted in increased sales. The synergy we have found between the products of Boxlight and Mimio are adding opportunities to resellers for both companies to increase their sales. | |

| ● | Recently hired new sales representatives with significant education technology sales experience in their respective territories and our current pipeline has reached a record high level. | |

| ● | We are seeing increased demand in the US market for technology sales and have the products and infrastructure in place to handle our expected growth. |

Acquisition Strategy and Challenges

Our growth strategy includes acquiring assets and technologies of companies that have products, technologies, industry specializations or geographic coverage that extend or complement our existing business. The process to undertake a potential acquisition is time-consuming and costly. We expect to expend significant resources to undertake business, financial and legal due diligence on our potential acquisition targets, and there is no guarantee that we will complete any acquisition that we pursue.

We believe we can achieve significant cost-savings by merging the operations of the companies we acquire and after their acquisition leverage the opportunity to reduce costs through the following methods:

| ● | Staff reductions – consolidating resources, such as accounting, marketing and human resources. | |

| ● | Economies of scale – improved purchasing power with a greater ability to negotiate prices with suppliers. | |

| ● | Improved market reach and industry visibility – increase in customer base and entry into new markets. |

As a result, we believe that an analysis of the historical costs and expenses of our Target Sellers prior to their acquisition will not provide guidance as to the anticipated results after acquisition. We anticipate that we will be able to achieve significant reductions in our costs of revenue and selling, general and administrative expenses from the levels currently incurred by the Target Sellers operating independently, thereby increasing our EBITDA and cash flows.

| 18 |

Components of our Results of Operations and Financial Condition

Revenue

Our revenue is comprised of product revenue, software revenue, installation revenue and professional development revenue.

| ● | Product revenue. Product revenue is derived from the sale of our interactive projectors, flat panels, peripherals and accessories, along with other third party products, directly to our customers, as well as through our network of domestic and international distributors. | |

| ● | Installation and professional development. We receive revenue from installation and professional development that we outsource to third parties. |

Cost of revenue

Our cost of revenue is comprised of the following:

| ● | third-party logistics costs; | |

| ● | costs to purchase components and finished goods directly; | |

| ● | inbound and outbound freight costs and duties; | |

| ● | costs associated with the repair of products under warranty; and | |

| ● | write-downs of inventory carrying value to adjust for excess and obsolete inventory and periodic physical inventory counts. |

We outsource some of our warehouse operations and order fulfillment and purchase products from related and third parties. Our product costs will vary directly with volume and based on the costs of underlying product components as well as the prices we are able to negotiate with our contract manufacturers. Shipping costs fluctuate with volume as well as with the method of shipping chosen in order to meet customer demand. As a global company with suppliers centered in Asia and customers located worldwide, we have used, and may in the future use, air shipping to deliver our products directly to our customers. Air shipping is more costly than sea or ground shipping or other delivery options. We primarily use air shipping to meet the demand of our products during peak seasons and new product launches.

Gross profit and gross profit margin

Our gross profit and gross profit margin have been, and may in the future be, influenced by several factors including: product, channel and geographical revenue mix; changes in product costs related to the release of projector models; component, contract manufacturing and supplier pricing and foreign currency exchange. As we primarily procure our product components and manufacture our products in Asia, our suppliers incur many costs, including labor costs, in other currencies. To the extent that exchange rates move unfavorably for our suppliers, they may seek to pass these additional costs on to us, which could have a material impact on our future average selling prices and unit costs. Gross profit and gross profit margin may fluctuate over time based on the factors described above.

Operating expenses

We classify our operating expenses into two categories: research and development and general and administrative.

Research and development. Research and development expense consists primarily of personnel related costs, prototype and sample costs, design costs and global product certifications mostly for wireless certifications.

| 19 |

General and administrative. General and administrative expense consists of personnel related costs, which include salaries, as well as the costs of professional services, such as accounting and legal, facilities, information technology, depreciation and amortization and other administrative expenses. We expect our general and administrative expense to increase in absolute dollars following the completion of our initial public offering due to the anticipated growth of our business and related infrastructure as well as accounting, insurance, investor relations and other costs associated with becoming a public company. General and administrative expense may fluctuate as a percentage of revenue, notably in the second and third quarters of our fiscal year when we have historically experienced our highest levels of revenue.

Other income (expense), net

Other income (expense), net consists of interest expense associated with our debt financing arrangements and interest income earned on our cash. We do not utilize derivatives to hedge our foreign exchange risk, as we believe the risk to be immaterial to our results of operations.

Income tax expense

We are subject to income taxes in the United States and Mexico in which we do business. Mexico has a statutory tax rate different from those in the United States. Additionally, certain of our international earnings are also taxable in the United States. Accordingly, our effective tax rates will vary depending on the relative proportion of foreign to U.S. income, the absorption of foreign tax credits, changes in the valuation of our deferred tax assets and liabilities and changes in tax laws. We regularly assess the likelihood of adverse outcomes resulting from the examination of our tax returns by the U.S. Internal Revenue Service, or IRS, and other tax authorities to determine the adequacy of our income tax reserves and expense. Should actual events or results differ from our current expectations, charges or credits to our income tax expense may become necessary. Any such adjustments could have a significant impact on our results of operations.

Operating Results – Boxlight Corporation (Retrospectively adjusted for the acquisitions of Mimio and Genesis)

For the years ended December 31, 2017 and 2016

Revenues. Total revenues for the year ended December 31, 2017 were $25,743,612 as compared to $20,371,826 for the year ended December 31, 2016. Revenues consist of product revenue, software revenue, installation and professional development. For the year ended December 31, 2016, Boxlight Group’s operating results were only included in the balances from their acquisition date on July 18, 2016 through December 31, 2016. Accordingly, the increase in revenues in 2017 is primarily attributable to the inclusion of Boxlight Group’s revenues for a full year in 2017.

Cost of Revenues. Cost of revenues for the year ended December 31, 2017 was $19,329,831 as compared to $12,959,749 for the year ended December 31, 2016. Cost of revenues consists primarily of product cost, freight expenses and inventory write-downs. Cost of revenues increased due to the increase in revenues. Another factor resulting in an increase in cost of revenues was the Company sold product in some instances at a lower margin in exchange for improved payment terms. Freight expenses as a component of cost of revenues increased approximately $1.7 million in 2017 due to alternative freight arrangements. Prior to the completion of our IPO, we had restrictive credit terms with existing freight vendors due to cash restrictions. These costs are expected to be significantly reduced in 2018.

Gross Profit. Gross profit for the year ended December 31, 2017 was $6,413,781 as compared to $7,412,077 for the year ended December 31, 2016 due to the sale of some products at lower margins to increase cash flow and increased freight costs in the amount of approximately $1.7 million.

General and Administrative Expense. General and administrative expense for the year ended December 31, 2017 was $13,086,120 as compared to $7,689,898 for the year ended December 31, 2016. The increase resulted from the inclusion of a full year of Boxlight Group’s operating expenses included for the year ended December 31, 2017, along with $4 million of non-cash stock compensation expense.

Research and Development Expense. Research and development expense was $465,940 and $1,008,433 for the years ended December 31, 2017 and 2016, respectively. Research and development expense primarily consists of costs associated with Mimio’s development of proprietary technology. The decrease was due to the company’s decision to decrease research and development expenditures in 2017. The R&D investments are cyclical and we had limited major enhancements to our software products or new hardware launches. A significant portion of our research and development is now paid for by several of our contract manufacturers.

Other income (expense), net. Other expense for the year ended December 31, 2017 was $158,830 as compared to $775,729 for the year ended December 31, 2016. During 2017, the Company settled debt and other liabilities with a net gain of $276,026. In 2016, the Company amended a note payable agreement that resulted in $350,000 of additional interest expense in August, which resulted in a significant increase in interest expense. Additionally, the Company issued additional notes to acquire Mimio and Boxlight Group during 2016 resulting in an increase in interest expense.

| 20 |

Net loss. Net loss was $7,297,109 and $2,061,983 for the years ended December 31, 2017 and 2016, respectively. There were some major contributing factors to the increase in net loss in 2017, including expense incurred in the amount of $4 million for non-cash stock compensation expense and approximately $1.7 million in additional freight expense.

To provide investors with additional insight and allow for a more comprehensive understanding of the information used by management in its financial and decision-making surrounding operations, we supplement our consolidated financial statements presented on a basis consistent with U.S. generally accepted accounting principles and EBITDA and Adjusted EBITDA, both non-GAAP financial measures of earnings.

EBITDA represents net income before income tax expense, interest income, interest expense, depreciation and amortization. Adjusted EBITDA represents EBITDA, plus stock compensation expense and non-recurring expenses. Our management uses EBITDA and Adjusted EBITDA as financial measures to evaluate the profitability and efficiency of our business model. We use these non-GAAP financial measures to assess the strength of the underlying operations of our business. These adjustments, and the non-GAAP financial measure that is derived from them, provide supplemental information to analyze our operations between periods and over time. We find this especially useful when reviewing results of operations, which include large non-cash amortizations of intangibles assets from acquisitions. Investors should consider our non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP.

The following table contains reconciliations of net losses to EBITDA for the periods presented.

Reconciliation of net loss for the year ended

December 31, 2017 and 2016 to EBITDA

| (in thousands) | 2017 | 2016 | ||||||

| Net loss | $ | (7,297 | ) | $ | (2,062 | ) | ||

| Depreciation and amortization | 747 | 353 | ||||||

| Interest expense | 635 | 818 | ||||||

| EBITDA | $ | (5,915 | ) | $ | (891 | ) | ||

The following table contains reconciliations of net losses to adjusted EBITDA for the periods presented.

Reconciliation of net loss for the year ended

December 31, 2017 and 2016 to Adjusted EBITDA

| (in thousands) | 2017 | 2016 | ||||||

| Net income (loss) | $ | (7,297 | ) | $ | (2,062 | ) | ||

| Depreciation and amortization | 747 | 353 | ||||||

| Interest expense | 635 | 818 | ||||||

| Stock compensation expense | 4,240 | 464 | ||||||

| Non-recurring IPO expenses | - | 528 | ||||||

| Adjusted EBITDA | $ | (1,675 | ) | $ | 101 | |||

| 21 |

Discussion of Effect of Seasonality on Financial Condition

Certain accounts on our balance sheets are subject to seasonal fluctuations. As our business and revenues grow, we expect these seasonal trends to be reduced. The bulk of our products are shipped to our educational customers prior to the beginning of the school year, usually in July, August or September. To prepare for the upcoming school year, we generally build up inventories during the second quarter of the year. Therefore, inventories tend to be at the highest levels at that point in time. In the first quarter of the year, inventories tend to decline significantly as products are delivered to customers and we do not need the same inventory levels during the first quarter. Accounts receivable balances tend to be at the highest levels in the third quarter, in which we record the highest level of sales.

We have been very proactive, and will continue to be proactive, in obtaining contracts during the fourth and first quarters that will help offset the seasonality of our business.

Liquidity and Capital Resources

In 2017, the Company struggled with liquidity issues due to credit limitations and the added expenses necessary to fund the initial public offering. The liquidity issues led to a significant increase in freight costs to enable us to meet shipping demands of our customers. We also sold product, in some instances, at lower margins in exchange for improved payment terms.

Our liquidity and capital resources were significantly improved through funding from our initial public offering in November 2017, along with our ability to close on a lending agreement in August 2017 that allows us to borrow using our accounts receivable as collateral.

The Company made great strides in 2017 improving our balance sheet through debt repayments and debt conversions. Our total short-term and long-term debt was decreased from $7,778,917 at December 31, 2016 to $856,449 at December 31, 2017.

As of December 31, 2017, we had cash and cash equivalents of $2,010,325. We financed our operations and our capital expenditures during the year ended December 31, 2017 primarily through our initial public offering and a financing agreement entered into with a lender.

The Company’s initial public offering was completed on November 30, 2017. The Company raised the maximum amount offered of 1,000,000 shares and received net proceeds through the offering of $5,678,609.

On August 15, 2017, the Company entered into a $6,000,000 accounts receivable sale and purchase agreement with Sallyport Commercial Finance, LLC (“Sallyport”). Pursuant to the agreement, Sallyport agreed to purchase 85% of the eligible accounts receivable of the Company with the right of recourse.