Attached files

| file | filename |

|---|---|

| EX-99.2 - US VR Global.com Inc. | ex99-2.htm |

| EX-99.1 - US VR Global.com Inc. | ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 2)

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2018

| US VR GLOBAL.COM INC. | ||

| Exact name of registrant as specified in its charter |

| Delaware | 000-50413 | 98-0407797 | ||

| (State

or other jurisdiction of incorporation) |

(Commission |

(IRS

Employer Identification No.) |

Lot A-2-10, Galeria Hartamas Jalan 26A/70A, Desa Sri Hartamas 50480 Kuala Lumpur, Malaysia |

50480 | |

| (Address of principal executive offices) | (Zip Code) |

| 603 6201 0069 |

(Registrant’s telephone number, including area code)

| Boly Group Holdings, Corp. | ||

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

EXPLANATORY NOTE

This Amendment No. 2 Current Report on Form 8-K/A is being filed for the purpose of (i) filing the audited financial statements for US VR Global Inc. for the fiscal year ended December 31, 2017 as an exhibit to the Current Report on Form 8-K of US VR Global.com Inc. (the “Company”), which was filed with the Securities and Exchange Commission (the “Commission”) on February 13, 2018 (the “Original Filing”) (ii) filing the Company’s pro forma condensed combined financial statements for the period ended December 31, 2017 and the year ended December 31, 2017 as an exhibit to the Original Filing (iii) updating Item 1.01 for grammatical errors (iv) updating the “Management’s Discussion and Analysis Of Financial Condition And Results Of Operations” section to apply to the US VR Global Inc. financial statements for the fiscal year ended December 31, 2017, and (v) updating the disclosures in the following sections of Item 2.01: “Description of the Business,” “Risk Factors,” “Security Ownership of Certain Beneficial Owners and Management,” “Directors and Executive Officers,” “Certain Relationships and Related Transactions, and Director Independence,” “Description of Our Capital Stock,” “Market Price and Dividends On Our Common Equity And Related Stockholder Matters,” to reflect the most current information as reported by the Company in its Form 10-K filed with the Commission on March 29, 2018. Except as set forth herein and as set forth in the Company’s Form 8-K/A Amendment No. 1 to the Original Filing made with the Commission on February 23, 2018, the Company has not updated its disclosures contained in the Original Filing.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K/A (this “Form 8-K/A”) contains certain “forward-looking statements”, which statements involve substantial risks and uncertainties. In some cases, it is possible to identify forward-looking statements because they contain words such as “anticipates,” believes,” “contemplates,” “continue,” “could,” “estimates,” “expects,” “future,” “intends,” “likely,” “may,” “plans,” “potential,” “predicts,” “projects,” “seek,” “should,” “target” or “will,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Many factors could cause our actual operations or results to differ materially from the operations and results anticipated in forward-looking statements. These factors include, but are not limited to, those set forth under “Risk Factors” including, but not limited to, risks relating to:

| ● | the early stage of development of our company; | |

| ● | the timing, cost or results of our development efforts | |

| ● | our need for substantial additional funds and uncertainties regarding our ability to raise such funds on acceptable terms, if at all; | |

| ● | our ability to negotiate and execute favorable lease and site agreements in desirable areas where our theme parks and theme facilities may draw substantial attendance and may financially flourish; | |

| ● | our ability to negotiate and procure, on favorable terms to us, third party licenses for popular intellectual property content for use in our theme parks and games, as well as our ability to develop such content on our own; | |

| ● | uncertainties related to consumer acceptance of our augmented reality and virtual reality theme parks; | |

| ● | general uncertainties regarding economic fluctuation, consumer discretionary spending capacity, inflation, cost of labor, taxes, costs of material, equipment and insurance. |

See “Risk Factors.”

Item 1.01 Entry into a Material Definitive Agreement.

On February 6, 2018, US VR Global.com Inc. (formerly known as Boly Group Holdings Corp.) (the “Company”), US VR Global Inc. (“US VR Sub”), each of the shareholders of US VR Sub who either executed a counterpart signature to the Share Exchange Agreement dated February 6, 2018 (the “Exchange Agreement”) or who executed a joinder agreement to the Exchange Agreement following the effective date of the Exchange Agreement but prior to the First Closing (as hereinafter defined) (such shareholders, the “US VR Sub Shareholders”), and Lai Chee Mei (Amanda) as representative of the US VR Sub Shareholders entered into the Exchange Agreement. Pursuant to the terms of the Exchange Agreement, (i) the Company agreed to acquire from the US VR Sub Shareholders all of the shares of common stock of US VR Sub held by such US VR Sub Shareholders in exchange for the issuance by the Company to the US VR Sub Shareholders of shares of the Company’s common stock and shares of the Company’s Series A preferred stock, and (ii) US VR Sub will become a wholly owned subsidiary of the Company.

Pursuant to the terms of the Exchange Agreement, at the first closing (the “First Closing”), each US VR Sub Shareholder agreed to exchange 51% of such US VR Sub Shareholder’s common stock of US VR Sub, with any partial shares resulting from such calculation being rounded to the nearest whole share, for shares of Company common stock, on the basis of one share of Company common stock for each three shares of US VR Sub common stock being exchanged at the First Closing, with any partial shares of Company common stock resulting from such calculation being rounded to the nearest whole share (the “Exchange Common Shares”). The First Closing occurred on February 6, 2018. As a result, at the First Closing, the US VR Sub Shareholders exchanged an aggregate of 378,000,124 shares of US VR Sub common stock, representing 51% of US VR Sub’s common stock, for 126,000,041 shares of Company common stock, representing 99.7% of the Company’s common stock, and US VR Sub became a majority owned subsidiary of the Company.

Pursuant to the terms of the Exchange Agreement, at the second closing (the “Second Closing”), each US VR Sub Shareholder agreed to exchange the balance of such US VR Sub Shareholder’s common stock of US VR Sub for shares of Company Series A preferred stock, on the basis of one share of Company Series A preferred stock for each three shares of US VR Sub common stock being exchanged at the Second Closing, with any partial shares of Series A preferred stock resulting from such calculation being rounded to the nearest whole share. (the “Exchange Preferred Shares” and together with the Exchange Common Shares, the “Exchange Shares”). The exchanges set forth above are together referred to herein as the “Share Exchange.” The Second Closing is expected to occur during the fiscal quarter ending June 30, 2018. We expect following the Second Closing, US VR Sub will be a wholly owned subsidiary of the Company.

The Exchange Agreement contains customary representations, warranties, covenants and conditions for a transaction of this type for the benefit of the parties.

For federal income tax purposes, it is intended that the Share Exchange qualify as a reorganization under the provisions of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”).

Series A Preferred Designation and Issuance to US VR Sub Shareholders

Pursuant to the Exchange Agreement, following the First Closing, the Company’s Board of Directors intends to designate 121,058,863 shares of the Company’s Series A Preferred Stock, par value $0.0001 per share, specified below (the “Company Series A Preferred Stock”).

Per the designation, each share of Company Series A Preferred Stock shall (i) have a stated value of $2.79 per share (the “Stated Value”); (ii) be entitled to be paid cash dividends as authorized by the Certificate of Designation, whether or not declared by the Board of Directors, of (1) 1% of the Stated Value, to be paid on the second anniversary of the Second Closing, (2) 2% of the Stated Value, to be paid on the third anniversary of the Second Closing, (3) 2% of the Stated Value, to be paid on the fourth anniversary of the Second Closing, and (4) 2% of the Stated Value, to be paid on the fifth anniversary of the Second Closing; and (iii) be convertible into shares of Company Common Stock on a one-for-one basis, subject to automatic adjustment in the event of any forward split or reverse split of the Company Common Stock, at the election of the holder thereof at any time after the one year anniversary of the issuance thereof and prior to the five year anniversary of the issuance thereof and automatically on the date that is the fifth anniversary of the issuance thereof to the extent not previously converted, and having other terms as determined by the Company.

Once the designation for Series A Preferred Stock has become effective as a designation amendment to the Company’s certificate with the state of Delaware, the Company will issue such Series A Preferred Stock to the US VR Sub stockholders at a 3 for 1 basis (three shares of US VR Sub stock for one share of the Company’s Series A Preferred Stock stock). Such US VR Sub stockholders will thereby hold 121,058,863 shares of Series A Preferred Stock, or a total of 100%, of the outstanding Series A Preferred Stock.

Name Change

The Board of Directors of the Company has amended its certificate of incorporation in order to change the name of the Company to US VR Global.com Inc. Pursuant to Delaware law, no stockholder approval was required for this action.

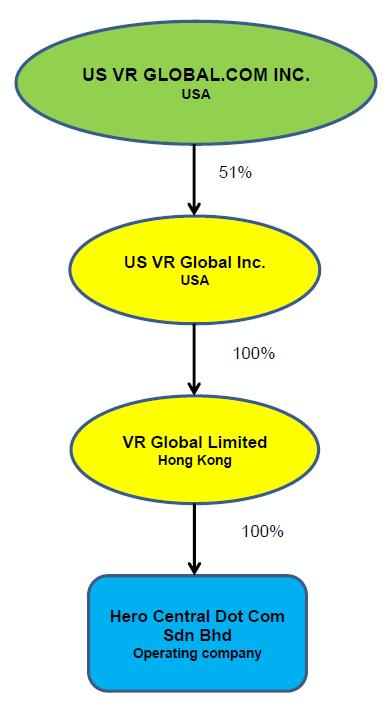

Subsidiaries of the Company

Following the First Closing, the Company holds a 51% interest in US VR Sub. US VR Sub has three subsidiaries, one of which (Hero Central Dot Com Sdn Bhd) is an operating subsidiary. The following chart shows the Company’s current corporate structure.

Accounting Treatment of Share Exchange

The Share Exchange is treated as a reverse acquisition of the Company for financial accounting and reporting purposes. As such, US VR Sub is treated as the acquirer for accounting and financial reporting purposes while the Company is treated as the acquired entity for accounting and financial reporting purposes. Further, as a result, the financial statements for periods prior to the Share Exchange that will be reflected in the Company’s future financial statements filed with the Securities and Exchange Commission (the “SEC”) will be those of US VR Sub, and the Company’s assets, liabilities and results of operations for periods after the Share Exchange will be the consolidated assets, liabilities and results of operations of US VR Sub and the Company.

Independent Accountant

Prior to the First Closing, the Company’s independent accountant was Weinberg & Company, P.A. (“Weinberg”) and US VR Sub’s independent accountant was Total Asia Associates. Going forward, the Company intends to use Weinberg as its independent accountant.

Smaller Reporting Company

Following the closing of the Share Exchange, the Company continues to be a “smaller reporting company,” as defined in Regulation S-K promulgated under the Securities Exchange Act of 1934 (“Exchange Act”).

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the Exchange Agreement filed as Exhibit 10.2 hereto and incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

Immediately prior to the Share Exchange described in detail below, the Company was a “shell company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Item 2.01(f) of Form 8-K states that if the registrant was a “shell” company, such as the Company was immediately before the Share Exchange, then the registrant must disclose on a Current Report on Form 8-K the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, this report includes all of the information that would be included in a Form 10. Please note that unless indicated otherwise, the information provided below relates to the Company after the Share Exchange. Information relating to periods prior to the Share Exchange relate only to the party specifically indicated.

EXCHANGE AGREEMENT AND TRANSACTION

As described in Item 1.01 above, on February 6, 2018, the Company completed its acquisition of 51% of US VR Sub’s outstanding shares pursuant to the Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein US VR Sub is considered the acquirer for accounting and financial reporting purposes.

DESCRIPTION OF THE BUSINESS

The disclosure in this “Description of the Business” section relates primarily to US VR Sub, an operating company that became a subsidiary of the Company at the time of the Share Exchange.

Overview

Company History

The Company was incorporated in the State of Delaware in 2003 and was a shell company immediately prior to the Share Exchange. The Company had no assets or operations prior to the Share Exchange.

US VR Sub was incorporated in the State of Delaware on February 27, 2017 and commenced operations at that time.

Executive Summary

As discussed further below, the main focus of our business will be establishing our Hero Central theme parks, which are new generation playgrounds that use virtual reality (“VR”) and augmented reality (“AR”) technologies to provide interactive and immersive rides, games and attractions. They are also planned to have conventional rides, games and attractions, as well as sports-entertainment facilities for those who enjoy an active lifestyle. The Company is a provider of cutting-edge VR and AR enhanced leisure and entertainment activities. We are creating our Hero Central Digital Platform as an online enabler and integrated platform for our businesses:

| ● | Hero Central theme parks, a chain of next generation indoor shopping mall-based VR and AR enhanced theme parks and arcades; | |

| ● | Publishing AR Trading Card Game Applications; and | |

| ● | Collaborating with Hero Makers, our brand and IP partners and application developers to develop content. |

In addition, we are developing Hero Central Theme Parks as a multi-level platform with intellectual property (“IP”) developed by us and by third party interested IP owners and developers, who we refer to as “Hero Makers.” We can select from a variety of IP to create the best guest experience, and are not limited to any single brand, theme or Hero Maker. We intend our flagship Hero Central theme park will cover approximately170,000 square feet of high-energy space at Empire City Damansara, in Malaysia. This is a mixed development in Damansara Perdana, which is in Malaysia’s Greater Kuala Lumpur metropolis.

The global theme park industry is large and has enjoyed good growth. In Malaysia, the leading water amusement parks grew attendance 16% in 2016 over attendance rates in 2015, and the Themed Entertainment Association’s 2016 Global Attraction’s Attendance Report forecasts steady growth for most of Asia through 2020.

We believe that the VR and AR industry is new and poised for explosive growth. VR can provide an immersive experience in a digital environment for a user, typically through the use of devices such as goggles or visors that can block out the room and transpose the user to the perception of a unique environment. It can be deployed successfully in entertainment situations, such as simulating a roller coaster ride, concert, cartoon or outdoor adventure. AR places digital content on top of the physical world you see around you. AR works by adding two-dimensional (“2D”) or three-dimensional (“3D”) layered content on top of real world objects or locations, allowing the user to unlock additional information, virtual toys, gadgets or “pop up” experiences.

We are in the process, through documentation, of seeking to establish the “first use” of our tradename and the originality of our copyright, so our intellectual property can be protected in Malaysia. The Company has submitted an application to trademark the following logo:

The application was submitted to the Intellectual Property Corporation of Malaysia Trademark Registry on August 11, 2017, under the application number 2017065449, and if granted the trademark will have a duration of 10 years with renewal options after 10 years for subsequent periods. We believe that once our logo has trademark protection in Malaysia, it will consequently then have the protections of the international Berne Convention Treaties, which covers 175 countries, including China, the United States, Canada, Singapore, Japan, and other major nations around the world. In the latest publication of the US Chamber of Commerce’s International Intellectual Property Index, Malaysia has been ranked second among the Association of Southeast Asian Nations in terms of intellectual property protection.

We have a flexible expansion model that we believe is highly modular and scalable for our Hero Central Theme Parks. We plan to create locations that range in size from a VR theme park, to arcades that fit in retail lots. Each theme park and arcade are planned to be tied together by our Hero Central Digital Platform and operated with common management systems. To support our Hero Central Theme Park expansion plan, we plan to develop a licensing program for third party licensees. Under this planned program, licensees will be provided with access to our content, online platform, management system and other back-office systems. Licensees will be responsible for the initial capital investment and daily operations.

We are also developing our own AR-enhanced trading card game application that is enabled and driven by our Hero Central Digital Platform. We plan to publish applications to users in Malaysia and globally. The trading card will be a physical card with printed codes such that a smartphone or tablet will be able to read the codes to create 3D images overlaid on the viewer’s existing environment. The 3D image will be displayed on the viewer’s device. The viewer may also interact with the created 3D image using the device.

VR and AR Explained

What is VR?

Virtual reality uses a combination of technologies to create a 3D environment and present it to the user in a manner that makes the user feel as if he or she is actually immersed in that environment. Current VR systems consist of at least two components, the processor and head mounted display (“HMD”). The processor may be a computer or laptop, smartphone, game console or some other device. Its function is to run the VR application content, gather feedback from the HMD and sensors, and render the virtual 3D environment for the user. A powerful processor is needed to render a convincing environment quickly enough to avoid lag and visual stuttering. The HMD contains the screens that display the immersive visual 3D environment to the user, and headphones to deliver audio content. It is equipped with sensors to detect the user’s head movement to control his field of view in the virtual environment. At a minimum, VR immersion usually involves:

| ● | Vision: The HMD is usually a visor or helmet that filters out the user’s peripheral vision. Visual content is presented to the user with high-definition screens. Equipment manufacturers currently use a number of techniques to achieve 3D images, including dual displays on single or double screens, and stereoscopic display with lenses. Screen refresh rate must be at least 60 frames per second (“fps”) to avoid vision stuttering and user disorientation. Contemporary HMDs commonly have refresh rates of 90 fps and 120 fps. | |

| ● | Sound: Headphones with active and passive noise cancelling are used to block out external sounds. To enhance realism the sound fed to the user is modulated to create the impression that it originates from a particular direction and point in the distance. | |

| ● | Head Tracking: The HMD has a number of sensors to track the movement of the user’s head so that his view of the virtual environment can be updated accordingly. To achieve an even higher level of realism some HMD have infra-red cameras and other sensors to track the user’s eye movement. |

Using more interactive features on top of these minimum requirements can make the VR experience more immersive and realistic:

| ● | Customized Control: Some VR systems and games use a set of wireless controls that are designed to make the user feel as if they are using their own hands in the VR environment. For example, users squeeze on a hand trigger on their controller to fire a gun in a VR application. | |

| ● | Customized Set: The user’s immediate surroundings can be outfitted to resemble a vehicle or other environment that matches their VR world. This concept is usually paired with customized controls. For example, the user of an advanced flight simulator may be strapped into a simulated cockpit, and control his VR aircraft with a joystick, throttle and foot pedals. | |

| ● | Movement: Equipment such as moving platforms and 6-degree-of-freedom seats equipped with force feedback systems can be used to create a realistic sense of motion that matches the user’s movement through the VR environment. |

What is AR?

With augmented reality, users perceive the real world with the addition of computer-generated images that are overlaid on specific objects. Unlike an immersive VR experience, users are aware that they are in the real world. Users employ a device that is equipped with a camera, such as a smartphone or a tablet. The camera scans the environment, feeding the application’s image recognition capability. The application’s AR content is triggered when specific images are recognized, such as QR codes, borders, faces, locations and names. Location-based AR works in a similar manner, using devices equipped with a global position system or other location sensors. Bringing the device to a specific location or area triggers the application’s AR content.

Industry and Market Assessment

Overview

The VR and AR industry is still in its infancy, with many companies investing heavily in research and development. While there are many forecasts and estimates on the future market size of this industry, the one thing that many industry experts agree on is that the industry will experience rapid growth over the next few years.

We expect that hardware will be the main driver of growth for the VR and AR industry. Even now, there are numerous HMDs available which are used primarily for video games, such as the Oculus Rift and HTC Vive. However, the adoption rate is still low as prices of these headsets are costly, not taking into account the high-end processors needed to run the games smoothly to provide players with a satisfactory experience. In the near future, prices of hardware are expected to fall to more affordable levels, on the back of technological improvements in components such as display technology and graphics card, competition among manufacturers as well as the effect of economies of scale on the industry.

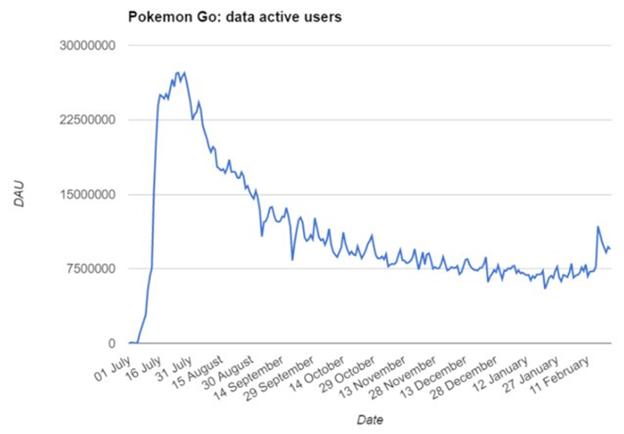

Case Study – Pokémon Go

Pokémon Go is an AR mobile phone game which was released by Niantic Labs in July 2016. The game was an immediate hit upon launching and got many people to go outdoors in search of Pokémon, flooding places such as parks and landmarks in many countries. Pokémon Go’s first day revenue was between $3.9 million and $4.9 million. By August 2016 the mobile app had achieved 100 million downloads worldwide; as of March 2017 the total number is approximately 650 million downloads. At the height of its popularity, the game had 22.5 million active daily users.

The game, which is free-to-play, generates revenue by offering players optional in-application purchases such as PokéBalls, lures and other virtual goods which enhance a player’s gaming experience. Additionally, Pokémon Go derives revenues from businesses who want to increase pedestrian traffic at their locations. In general, the business pays Niantic a sum of money to increase spawn rates of rare Pokémon in their area, or create a game checkpoint such as a PokéStop or PokéGym at their location.

(Source: Wandera)

App Annie, a mobile analytics firm, estimated that Pokémon Go had earned approximately $950 million in revenue in 2016 alone, and breached the $1 billion barrier in January 2017. While the number of daily active users has dropped, it still averaged 7.5 million daily active users in January 2017. There was a small surge in user activity in February 2017 following the release of a collection of new Pokémon, indicating that players are still interested enough to play if there are new developments. Within the first few days of Pokémon Go’s release, the market capitalization of Japanese game maker Nintendo more than doubled to reach a high of $42.5 billion.

Aside from its surreal business success, Pokémon Go was able to promote the concept of AR to a vast number of consumers worldwide better than any other software or hardware at the time. More importantly, it also gave corporations a preview of the potential impact of AR technology on their businesses.

Theme Parks and Attractions

As discussed further below, the main focus of our business will be our Hero Central theme parks, which are new generation playgrounds that use VR and AR technologies to provide interactive and immersive rides, games and attractions. They will also have conventional rides, games and attractions, as well as sports-entertainment facilities for those who enjoy an active lifestyle.

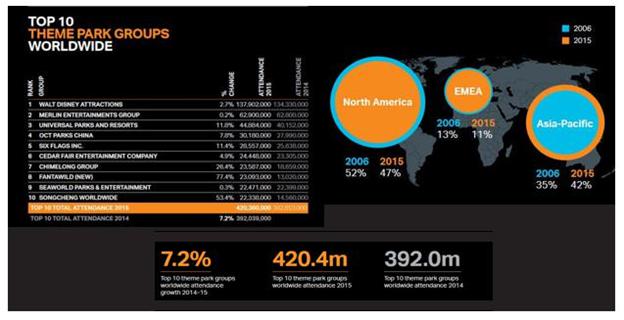

The global theme park industry is large and had enjoyed good growth.

EMEA = Europe, Middle East and Africa

Source: Themed Entertainment Association and AECOM

From 2006 and 2015, market growth was toward Asia-Pacific, where it increased its market share from 35% to 42%, respectively.

Competitive Analysis Home VR and AR

We believe that VR and AR theme parks have various advantages over home-based gaming systems. In general, VR and AR games that run on home computers or consoles require gamers to own high end HMD such as the Oculus and HTC Vive that on its own, can cost approximately $600 in order to enjoy the full experience. Computer gamers will need to spend more money to make sure that their systems have the right amount of processing power needed to run the game smoothly.

In short, setting up a proper home-based VR system may prove to be out of reach of the vast majority of consumers at this point in time. AR and VR theme parks will be able to offer gamers a significantly cheaper alternative through a pay-per-use system. Furthermore, the availability of a wide range of games in the theme park will give gamers the opportunity to play a range of games without having to purchase the game itself. VR and AR theme parks in Malaysia could provide a lower cost alternative to VR and AR gaming enthusiasts who do not have the capacity to purchase a system of their own.

Home-based systems will also likely not be able to duplicate free-roam VR experiences that can be achieved in VR and AR theme parks. Free-roam VR is a concept which uses a tracking system to detect movements of players across a large area. It allows players to move freely while inside a virtual world. The tracking system can coordinate more than one player at a time, which allows gamers to share their virtual environment with friends. We believe that this increases the immersion factor of the game and makes the game more memorable as they are able to share the same virtual experience with friends.

Conventional Theme Parks

The table below shows the number of visitor arrivals to selected Malaysian theme parks from 2013 to 2015 .

Selected Malaysian Theme Park Attendance

| Year | 2013 | 2014 | 2015 | |||||||||

| Sunway Lagoon, Kuala Lumpur (‘000) | 1,100 | 1,100 | 1,077 | |||||||||

| Growth (%) | n.a. | 0.0 | % | -2.1 | % | |||||||

| Sunway Lost World of Tambun, Perak (‘000) | 500 | 700 | 859 | |||||||||

| Growth (%) | n.a. | 40.0 | % | 22.7 | % | |||||||

| Legoland

Water Park, Johor (‘000) | n.a. | 630 | 700 | |||||||||

| Growth (%) | n.a. | n.a. | 11.1 | % | ||||||||

(Source: International Association-Amusement Parks and Attractions)

According to Sentoria Group Berhad’s 2016 annual report, between 2011 and 2015, Bukit Gambang Resort City’s theme park in Pahang serviced an average of 592,000 visitors a year. In 2012, KidZania KL commenced operations and attracted over 400,000 visitors in its first full year of operations. In 2015, Khazanah Nasional Berhad, the co-owner of KidZania KL, reported that it had over two million visitors since its launch. It estimated that 500,000 people visited KidZania in 2015.

Just as VR and AR technologies are disrupting various industries across the globe, VR and AR theme parks could potentially outperform their traditional counterparts due to the various advantages and unique value propositions. A major business advantage that VR and AR theme parks have over conventional theme parks is that they require significantly fewer resources to setup and operate. This is because VR and AR theme parks do not need large structures requiring large space and incurring high capital cost. Instead, VR and AR theme parks can be opened in malls with exciting interior decorations and minor structures requiring relatively lower initial capital outlay. VR and AR theme parks can also easily upgrade or change their content regularly to provide visitors with fresh and new experiences. We believe that this will encourage recurrent visits. This is unlike conventional theme parks, where rides and attractions stay the same for many years.

Business Model

Overview

We are providers of cutting-edge VR and AR enhanced leisure and entertainment activities. We are creating our Hero Central Digital Platform as an online enabler of the key business areas that we are seeking to develop:

| ● | Operating a chain of next generation indoor shopping mall-based VR and AR enhanced theme parks; and | |

| ● | Publishing AR game applications. |

Our business model is based on developing our own content and applications, as well as collaborating with local and international IP owners to develop engaging VR and AR enhanced leisure and educational activities.

Our Integrated Platform Business Model

Our business model is premised on all our activities being linked and integrated to our Hero Central Digital Platform. Our current proposed business activities include VR and AR theme parks and arcades, which we name Hero Central Theme Parks, and AR Trading Card Game Applications.

Hero Central Digital Platform

The Hero Central Digital Platform is planned to be the online platform that unifies all our various business areas. Users, whom we like to call “Hero Lovers”, are expected to be able to create a single profile for all of their online and offline experiences and purchases from us. Regardless of where they start, their profile will follow them as they immerse themselves in any of our theme parks and arcades, and AR trading card games.

Our Hero Central Digital Platform is planned to host a centralized database, collecting and mapping all our Hero Lovers’ activities across all our locations, games and applications. Over time, with sufficient data points, we believe that we will be able to undertake meaningful analytics and proactively suggest new experiences to our Hero Lovers based on their likes, preferences and habits. In addition, we plan to use such analytics for joint marketing with external parties to create new revenue streams for our business.

Our Hero Central Digital Platform is also planned to be a multi-level platform for Hero Makers, our brand and IP partners and application developers, to collaboratively create new and innovative games, rides and applications.

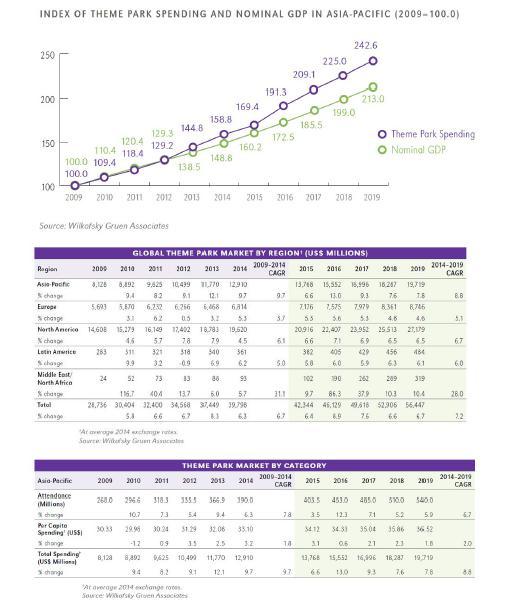

Global Theme Park and Attractions Statistics

The main focus of our business will be our Hero Central theme parks – which are planned to be new generation playgrounds that use VR and AR technologies to provide interactive and immersive rides, games and attractions. They are planned to be designed to have conventional rides, games and attractions, as well as sports-entertainment facilities for those who enjoy an active lifestyle. The theme park industry in general is experiencing excellent growth and we believe provide a fertile ground for the Company to introduce its products and services, as shown in the charts below.

(Source: Wilkofsky Gruen Associates as published by The International Association of Amusement Parks and Attractions)

Source: Wilkofsky Gruen Associates as published by The International Association of Amusement Parks and Attractions

Asia-Pacific and Malaysia Theme Park and Attractions Statistics

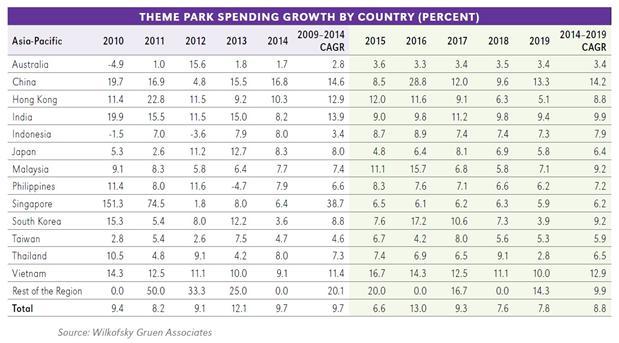

(Source: Wilkofsky Gruen Associates as published by The International Association of Amusement Parks and Attractions)

Theme parks and attractions in Asia-Pacific countries are generally forecasted to grow at compound annual growth rate of 8.8% between 2014 and 2019.

Hero Central Theme Parks and Arcades

Overview

The main focus of our business will be our Hero Central theme parks. Our Hero Central theme parks are planned to be new generation playgrounds that use VR and AR technologies to provide interactive and immersive rides, games and attractions. They are also planned to have conventional rides, games and attractions, as well as sports-entertainment facilities for those who enjoy an active lifestyle.

The key difference of our Hero Central theme parks as opposed to most other theme parks is that they are planned to be established in shopping malls. We believe that this approach will enable us to benefit from each mall’s strategic location as well as tapping on their regular visitor traffic flow. More importantly, we believe that the set-up cost is significantly reduced as we will be using the mall’s infrastructure including the building, parking facilities, security and the ready availability of utilities, amenities and facilities. Since we plan to have most of our theme parks located in indoor malls, we believe that we have a significant advantage over outdoor based theme parks whose attendance can be significantly affected by bad weather.

We plan to adopt three operating models for our theme park and arcade business comprising:

| ● | Grand VR Park, a flagship theme park with over 100,000 square feet of space; | |

| ● | VR Park, a typical theme park with 30,000 square feet to 50,000 square feet of space; | |

| ● | Arcades, with between 500 square feet and 15,000 square feet of space. |

Our business concept is designed to be flexible, modular and scalable. This will allow us to open new theme parks and arcades that are of the proper size to fit their locations, and with the best content to suit economic, social and cultural needs. We aim to establish a chain of Hero Central theme parks and arcades in Malaysia and Asian countries together with our licensees.

Multiple IP at Each Location

Hero Central theme parks and arcades are planned to employ an all-inclusive multi-level platform IP strategy. For example, our theme parks could include VR or AR enhanced games modelled after popular video games, adventure rides through a Jurassic forest or interactive activities with a popular character. This approach means our theme parks are not tied to one brand or IP. In our flagship Hero Central Grand VR Park, we could have up to 100 different IP rides, games, attractions and contents. We will develop our own content as well as collaborate with interested IP owners and developers, or “Hero Makers”, to bring in multiple, interesting and popular content for our theme parks. Each Hero Maker is planned to be able to set up an entire themed zone at our theme parks and arcades or participate at a smaller scale by placing one or a few rides, games and attractions.

We plan to collaborate with Malaysian, regional and global Hero Makers to bring their content and IP into our theme parks and arcades. We believe that this will give our locations a diverse multi-cultural atmosphere that is exciting and new. Our customers, whom we call Hero Lovers, will have an opportunity to interact with their favorite characters, and also discover and enjoy new characters and virtual worlds.

This multi-level platform approach will also mean that each Hero Central theme park and arcade can have a different mix of themed zones and attractions, so that no two are the same. This will enable us to open multiple theme parks and arcades in a particular area and encourage guests to visit different ones.

Fun for Everyone

Our Hero Central theme park and arcade concept is designed to appeal to a wide range of age groups – from toddlers to adults. We expect that it will have five zones:

| ● | Hero Kids will appeal to young children from 3 to 7 years old, and their parents; | |

| ● | Hero Power will excite children from 8 to 12 years old, teenagers and young adults; | |

| ● | Hero Rides are for people of all ages; | |

| ● | Hero Challenge is for families, friends and corporate groups looking for active challenges. | |

| ● | Hero Education dedicated edutainment area filled with digital learning experience, child-size replica of real city and more. |

Grand VR Park – Our Flagship Hero Central Theme Park

Grand VR Park, which is planned to be our flagship Hero Central theme park is planned to be at the Empire City Damansara Shopping Mall. It is planned to have approximately 170,000 square feet of space and we believe it will be the shopping mall’s main attraction. The flagship is planned to have gated Hero Kids, Hero Power, Hero Rides and Hero Challenge zones, and a Central Square with themed retail and food and beverage outlets that is open to the public. We expect the Grand VR Park to commence operations in the fourth fiscal quarter of 2018, although there can be no assurance that this can be completed as planned or at all.

VR Park – Our Typical Theme Park

Hero Central VR Parks are planned cover between 30,000 square feet and 50,000 square feet of space. They are planned to follow the template what we will set out at our flagship Grand VR Park, with a Central Square and five Hero zones. Hero Lovers will get to enjoy the full Hero Central experience at these theme parks. Hero Central theme parks are going to be designed so that they are a shopping mall’s star attraction, creating win-win partnerships with property owners.

Hero Central Arcades

Hero Central arcades are planned to have a smaller footprint of between 500 square feet and 15,000 square feet. They are designed to operate comfortably in a shopping mall’s retail lot and are designed to complement the mall’s other attractions. Arcades are planned to have Hero Power and Hero Ride zones, and generally have fewer rides and games compared to full-fledged theme parks. Entry to our arcades is expected to be free, but Hero Lovers will have to purchase points to play some of the rides and games. Some retail and food and beverage options are planned to be available, although they will not be as extensive as our theme parks.

We believe that Hero Central arcades will help to introduce our brand and experience to a wider audience. They can also help us launch new content and IP partners before we commit to setting up full-fledged theme park. We believe that their smaller size and set-up cost will also appeal to potential licensees with a good operational track record but have fewer financial resources.

Common Standard Operating Procedure

We also plan to develop a common standard operating procedure (“SOP”) that will be adopted at all Hero Central theme parks and arcades. The SOP will cover all aspects of day-to-day operations including integration with the Hero Central Digital Platform; guest relations and dispute resolution; point-of-sales, inventory and procurement; staff training program; food and beverage and retail outlet management; maintenance of equipment and facilities; and upgrades and renovations. Adopting a common SOP across all locations will help to ensure that Hero Lovers will receive the same service regardless of where they play.

The SOP are planned to be an integral part of our licensing program as it will be the basis of how our licensees will operate their locations. We believe that it will help to streamline the process of setting up new theme parks and arcades.

Moving forward, we expect to benefit from economies of scale due to the use of SOP for theme park and arcade management.

Licensing Program

We plan to execute our Hero Central theme park and arcade expansion program through a combination of setting up and operating new locations ourselves, and also through a licensing program.

We plan to develop the licensing program to identify, train and manage suitable licensees to set up and operate new Hero Central theme parks and arcades at carefully selected locations in target countries. We will provide licensees with access to our SOP, management system and staff training program, Hero Central Digital Platform, relevant VR and AR rides, games and attractions, and IP content. Moving forward, we will help suitable licenses that have demonstrated their capability to set up and operate multiple locations.

Licensees will be responsible for funding the capital investment required to set up the new locations. They are then responsible for day-to-day operations when their theme parks or arcades open. Licensees will pay us scheduled licensing fees and a share of their profit, subject to final agreement to be executed between us and such Licensees.

Advanced Technology Launch Pad

We plan to use our flagship Hero Central theme park as our launch pad for advanced next-generation rides and games that we and our Hero Maker collaborators are developing. VR and AR enhanced rides and games that we are developing will be deployed at the theme park for guests to use under real-world conditions.

We believe that this will allow us to quickly identify and resolve any performance and guest experience issues that may arise from actual usage. We will collect feedback directly from Hero Lovers who try these games and use it to enhance guest experience.

We believe that this process also gives visitors to our theme parks and arcades the opportunity to be the first in the world to enjoy these new experiences.

Revenue Streams

We expect our Hero Central theme parks and arcades to benefit from their ability to generate multiple revenue streams, including from our Hero Lovers and guests, Hero Makers and licensees. Hero Lovers purchase a regular entry or fast track ticket to enter the gated Hero zones where most of the more exciting attractions are located. Fast track ticket holders are given priority when lining up for games and rides. The ticket contains points as part of the purchase price, and these points are used to play games and rides. Once these points are used up, Hero Lovers purchase top-up points at automated kiosks located throughout the theme parks and arcades.

It is planned that all ticket and point purchases will be linked to the Hero Lover’s profile on the Hero Central Digital Platform. This is our method to collect profiles and transactional activities of all our paying customers.

Guests will also be able to purchase merchandise and food and beverage items from outlets inside the Hero Zones and at the non-gated Central Square. Guests who purchase promotional items or who spend a certain amount on merchandise and food and beverage items are planned to receive bonus points as an incentive to stay and play more games.

Some of our Hero Maker collaborators are planned to set up themed zones at our theme parks and arcades. They will place their rides and games at these zones and may also operate their own retail and food and beverage outlets. In such situations, we will undertake a profit sharing model with Hero Makers.

We expect that the licensing program will result in a stream of licensing fees, as well as profit sharing with licensees, although there can be no assurance of this.

Our Flagship Hero Central Theme Park

Overview of the Empire City Damansara Shopping Mall

We expect that our flagship Hero Central theme park will be in Empire City Damansara (“Empire City”), which is a mixed development in the Damansara Perdana area, part of the Greater Kuala Lumpur metropolis in Malaysia. The shopping mall is currently under construction and is expected to complete construction in the middle of 2018. Depending on the outcome of our present Regulation 506(c) and Regulation S private placement raises, we expect to open our doors to the public by the fourth quarter of 2018. We intend our flagship Hero Central theme park to cover approximately 170,000 square feet of high-energy space spread out over two levels. Our subsidiary, Hero Central Dot Com Sdn Bhd, has executed two offer letters, one dated March 23, 2017, and one dated May 11, 2017 with Empire City, for a three-year renewable lease for approximately 170,000 square feet of retail space in Empire City, with customary terms and conditions. Once construction of Empire City is completed, it is planned that Hero Central Dot Com Sdn Bhd will execute a lease agreement for this space and that the lease of the space will become binding and commence upon the handover of the space to Hero Central Dot Com Sdn Bhd.

Attractions

Overview

Our flagship Hero Central theme park design is planned to be able to accommodate up to 100 games, rides and attractions. It is planned to be divided into two main sections, the un-gated Central Square open to the public, and gated section with four inter-connected Hero zones, Hero Kids, Hero Power, Hero Rides and Hero Challenge.

Hero Kids

The Hero Kids zone is planned to be a dedicated “park within a park” focused on appealing to young children aged between three and seven years, and their parents. We believe that the VR and AR enhanced games and rides will have a strong education and play element to delight our young Hero Lovers and their families. These include an AR coloring game and a virtual-aquarium. Hero Kids will also feature conventional attractions such as a playground, kiddie rides, sand boxes, and games with fishing and planting themes.

Hero Power

The Hero Power zone is planned to have a large open area featuring table games, VR simulators and signature VR robotic rides. The zone will also have conventional rides and games. This high-excitement zone is designed for older aged groups including children aged between eight and 12 years, teenagers and young adults.

Hero Rides

The Hero Rides zone is planned to be for Hero Lovers of all ages, with signature rides that are based on our Hero Maker’s IP. Some of these rides will have VR and AR enhanced features to create an immersive experience. For example, it could be a virtual ride through a Jurassic forest, under water, through space and a tour through Mars. The rides will be on movable platforms that will synchronize with the travel through the virtual world.

Hero Education

In Hero Education, it is planned that children embark on a journey of early childhood development via a unique informal platform inspired by the need to create a fun-loving process for education, one that opens the mind’s creativity and brings a new delight to the process of learning. We intend to partner with industry leading play facility providers to be featured in Hero Education such as Funtory House from Korea and several other award-winning providers trusted for their reliability with proven track records in providing quality learning experiences for children of all ages.

Hero Challenge

Hero Challenge is planned to be an active playground where guests of all ages can work up a sweat while having fun. It will have facilities for new and conventional physical activities, as well as VR simulators. This zone is for groups including families, friends and corporate groups. The sports-entertainment facilities include trampoline arena, rock climbing wall and ninja park for guests to compete and test their physical limits. There will be male and female locker rooms and showers for our guests to freshen up after their adventures. The VR simulators will run sports-based content, such as car racing, cycling and aircraft racing simulators.

Central Square

Our Central Square is planned to be designed as the grand entrance to our theme park. It will be an open exposition area featuring front desk interface facilities to welcome guests. We intend to have two Hero Café food and beverage outlets at Central Square where guests can have quick snacks or full meals. The Hero Cafes will feature themed interior decorations and menus to create iconic meal dining experiences for our guests.

Retail Outlets

We expect to allocate space for themed retail outlets and gift shops at each of the Hero Zones. Hero Lovers can buy branded and other merchandise to bring home memories of their visit. We expect to also set up kiosks and other retail space at the gated Hero Zones. We expect that these outlets will be themed after our Hero Maker’s IP.

VR and AR Enhanced Activities

Our expectation is that our Hero Central Theme Parks will be new generation playgrounds that are equipped with cutting-edge VR and AR enhanced rides, games and activities. The immersive nature of these VR and AR enhanced activities will let our guests experience new ways of playing and learning. We expect to be among the first in the region to employ these new technologies for leisure activities at such a scale.

Shopping Mall-Based Theme Park

Hero Central Theme Parks are intended to be located in shopping malls, with the intention of the first at the Empire City Damansara Shopping Mall in Greater Kuala Lumpur, Malaysia.

Our Hero Central Theme Parks are expected to be quicker and less capital intensive to set up compared to a conventional theme park. This is because most of the physical infrastructure will have already been developed as part of the host shopping mall. In addition, large Hero Central Theme Parks can be anchor tenants that receive beneficial rental rates and other privileges. Property owners will benefit from our ability to attract visitors to their shopping malls, while we also benefit from visitor traffic created by other shopping mall tenants.

Our Hero Central Theme Parks are also not materially affected by the weather, which will help improve utilization rates and reduce operational disruptions. Our guests are also kept comfortable in an air- conditioned environment, which should help extend average stay and spending.

Multi-Level Platform

We are developing Hero Central Theme Parks as a multi-level platform where IP developed by Hero Makers is planned to be used to create themes for zones, rides, games and activities. We will not be restricted to any single brand, theme or Hero Maker, and can make selections from a variety of third party owned intellectual property licenses (IP) for the best guest experience. It also gives us the flexibility to change and upgrade theme park content from time to time, which helps to encourage repeat visits. The multi-level platform also allows Hero Makers the opportunity to test new concepts and new markets before making large investment commitments. We can work together with Hero Makers to develop ideas and quickly test new concepts.

Flexible Expansion Model

The VR and AR enabled theme park concept that we are developing uses a flexible expansion model that we believe can be replicated in other regions not only in construction but with respect to the use of IPs. Construction is highly modular as it is easy to add zones, rides, games and attractions to create locations that range in size from a VR theme park that is between 30,000 square feet and 50,000 square feet in size, to arcades that fit in retail lots. Our multi- level platform approach also means that content can be easily adapted to fit local conditions and preferences. Each theme park and arcade will use our online platform as well as common management system, SOP, payment system, staff training program and other back-office systems. All of them will be tied together by our Hero Central Digital Platform.

VR theme parks are planned to have multiple VR and AR enhanced rides and games in multiple Hero Maker zones to give guests the full experience. The arcades will focus on one or a small number of Hero Makers and have fewer rides and games.

We believe that these characteristics will help enable rapid expansion in Malaysia and throughout Asia, however there can be no assurance of this.

Strategic Global Collaboration

We intend to license or buy intellectual property and AR and VR equipment from leading makers and developers.

The diversity of marketplace leaders in the entertainment industry is the backbone of Hero Central’s thrust, e.g. Iconix, Rainbow and many more are behind the award-winning content providers and IP owners. An enthralling immersive experience using VR, AR, the new dimension of Mixed Reality, Holograms & 4D motion arenas is provided to thrill visitors. “4D” refers to outside stimuli such as water splashes, etc., in addition to the 3D electronic presentation.

We anticipate that Hero Central will feature the 3D flying theatre experience with advanced technology motion seats and converges simulation with ear shattering sounds coming from the walls that echo in the air as the earth shakes and rumbles beneath.

AR-Enhanced Trading Cards

We are currently developing our own AR-enhanced trading card game application. We are also building our application publishing business for applications and related products that are developed by us and our Hero Maker collaborators. This business will be enabled and driven by our Hero Central Digital Platform. We plan to publish applications to users in Malaysia and globally.

We expect that our application publishing will involve active marketing and promotions to build brand awareness and user engagement. In addition to promoting our own applications to our target markets, we will actively extend the same service to our Hero Maker collaborators. This will enable them to focus on their key competencies of developing applications and creating IP. We can also collaborate with retail and food and beverage operators to hold joint promotion campaigns, product tie-ins and brand placement.

Using the Hero Central Digital Platform has the benefit of reaching a large user base with potentially rich data. We can easily communicate with Hero Lovers through online media. Hero Makers that collaborate with us will gain access to the large Hero Central Digital Platform user base.

AR Enhanced Game Application

We are currently developing AR enhanced games where we will co-own the rights to these games. We plan to publish them on our Hero Central Digital Platform publishing platform, where users who want to play the game must have an existing profile or create new user profiles. The AR enhanced games are played through applications installed on a compatible smartphone or tablet device, paired with corresponding AR enhanced trading cards that we produce. The trading cards vary in terms of the power of the hero, in-game resources, attribute or ability that they represent. Cards are sold in randomized packs and players can trade with one another to customize their card decks.

Each trading card contains information related to the game, along with a proprietary code. Players scan the code with their device’s camera to trigger the card’s AR content. Players view and interact with the AR hero and characters through their devices’ screens.

Hero Makers

We intend to help our Hero Maker collaborators grow their businesses. We will extend our marketing and promotional expertise and effort to help popularize the game applications and IP’s that they develop. This support may be particularly valuable to start-up Hero Makers who have excellent technical skills and are developing cutting-edge applications, but lack the resources, marketing skills and platform needed to distribute them widely.

We believe that our application publishing expertise can also help Hero Makers with popular applications to bring them to the next level. We can work with Hero Makers to expand their brands by creating physical experiences at our Hero Central theme parks. These can include creating VR and AR enhanced rides and games and developing associated merchandise and food and beverage experiences.

Revenue Streams

The potential revenue streams from our application publishing business include:

| ● | Revenue from application users in the form of initial download purchases (for non-free applications) and in-application purchases; | |

| ● | Revenue from the sale of physical accessories such as AR trading cards, 3D cubes and AR business cards; | |

| ● | Shared revenue, licensing and other fees from Hero Makers that use our application publication business to market and promote their applications, including related physical accessories; | |

| ● | Shared revenue, marketing and other fees from retail and food and beverage operators for joint promotion, product tie-in, brand and product placement campaigns. |

Application Publishing

We are developing a platform to publish and distribute applications that we develop, as well as those developed by our Hero Maker collaborators. We will publish and distribute game and other applications, and related physical accessories such as AR trading cards, 3D cubes, AR business cards, AR promotional material and other AR titles and applications. The applications that we publish will target users globally.

Maintaining control over application publication allows us to control brand development and marketing. The brand development and marketing activities that we plan to employ include:

| ● | Develop and execute marketing campaigns; | |

| ● | Host live events such as meet-and-greet, road shows and application launches at our Hero Central theme parks and arcades, and other locations; | |

| ● | Manage the production and distribution of merchandise and other related physical accessories; | |

| ● | Collaborate with retail and food and beverage operators to hold joint promotion campaigns and product tie-ins; | |

| ● | Promote new applications through our Hero Central Digital Platform, and other online media; | |

| ● | Product placement for companies that wish to create brand awareness among our Hero Lovers and guests. We intend to use relevant data from Hero Lovers’ profiles to create targeted both online and real-world marketing and promotion campaigns for greater efficiency. Once we have established our own collection of well- known applications and brands, we can use these to promote our other new applications as and when they are launched. |

Hero Central Digital Platform

Our Hero Central Digital Platform is planned to be the integrator for all our business activities. It is also planned to be the main online interface with our Hero Lovers. The first-time guests make purchases, for example buying tickets for our theme parks and arcades, they will need to register through our Hero Central Digital Platform. We will then have profiles of all our Hero Lovers. Each time Hero Lovers make additional purchases, they will interface with our Hero Central Digital Platform. In this manner, we believe that our Hero Central Digital Platform can build a database of all the transactions undertaken by every Hero Lover. With sufficient data points, we will be able to undertake analytics to know every Hero Lover’s location of visits, frequency of visits, preference levels for various games and rides, and other likes and habits.

We believe that a rich database of all our Hero Lovers will be a very useful marketing tool for our business. Among others, this will include the following:

| ● | We will be able to suggest additional purchases of our products and services; | |

| ● | We can send them updates of new locations, rides and games, and other marketing materials; | |

| ● | We can conduct joint marketing with Hero Makers; | |

| ● | It can serve as a marketing platform for companies that want to reach out to a certain profile of our Hero Lovers. |

Our Hero Central Digital Platform is planned to serve as an e-commerce platform where we will be able to make sales of VR and AR related products as well as any of our thematic merchandise. It will also serve as a publishing platform for applications and AR trading cards. In addition to serving as an interface with Hero Lovers, our Hero Central Digital Platform will provide and integrate all the backroom functions including ticketing, top-ups, downloads, purchasing, and payment system.

Key Differentiation Factors For Hero Central

Currently there are no large-scale mall-based VR and AR theme parks in Malaysia. Nevertheless, there is at least one company in Malaysia that has launched a VR theme park in June of 2017. There are also existing VR arcades in Malaysia. However, we expect that most of these theme parks and arcades in Malaysia are anticipated to be small compared to our planned flagship Hero Central Theme Park. We believe that this creates a unique opening for us to dominate this new market. We aim to take full advantage of this window of opportunity, starting in Malaysia and subsequently expanding to other parts of Asia.

Forefront of New Technologies

All of our businesses are enabled by new and emerging VR and AR technologies. Many of our Hero Central Theme Park guests and AR game players are planned to use these technologies for the first time, leading to an exciting eye-opening experience. We believe that this use of new and emerging technologies to create new user experiences will help attract guests to our theme parks and arcades, and players to play our AR game application.

Developing our Own Content

We are currently developing our own content for our Hero Central theme parks and arcades, and our own AR enhanced trading card game applications. In addition, we are developing our own application publishing business and Hero Central Digital Platform. The ability to develop our own content, publishing business and online platform will enable us to independently grow and develop our business. Our plan includes expansion in Malaysia and on a regional scale throughout Asia.

Competitive Advantages Modular and Scalable Business Model

Our business model for Hero Central theme parks and arcades is highly modular and scalable. All locations are planned to be tied together by our Hero Central Digital Platform, and their operations are planned to be based on a common management system, SOP, payment system, staff training program and other back-office systems.

It is easy to add and change the layout of zones at each location. In addition, our multi-level platform approach allows the mix of VR, AR and conventional rides, games and attractions in each zone to be customized to suit each location’s specific social, economic and cultural conditions.

The business model works equally well for arcades that are between 500 square feet and 15,000 square feet in size, to theme parks between 30,000 square feet and 50,000 square feet, all the way up to our approximately 170,000 square feet flagship theme park. We believe that this flexibility will make it easier for us to quickly conceptualize, design and set up new Hero Central theme parks and arcades to execute our expansion plans.

Licensing for Rapid Regional Expansion

We believe that our licensing program will enable us to leverage the financial and operational capabilities of our licensees to set up and operate new Hero Central theme parks and arcades. We believe that licensees are highly motivated to achieve a high level of operational performance as they share directly in the success of their theme parks and arcades. In addition, the fact that successful licensees are normally given priority in allocating new locations creates an incentive to perform well. We believe that these factors will help to support us in executing our overall regional expansion plan.

Licensees in other countries may also have local knowledge and contacts that may take too long for us to establish. Working with them will allow us to access their local contacts and knowledge to operate to expand our business regionally.

Multi-Level Platform for Wide Range of Content

Our multi-level platform means that we are not tied to a single IP owner and developer to provide content for our Hero Central theme parks and arcades, and AR games applications. We are free to develop our own content, as well as collaborate with Hero Makers around the world to develop content and applications. We can thus offer Hero Lovers and game players a wide variety of experiences and gameplay options.

We will also have more flexibility in designing our Hero Central theme parks and arcades. We can make each location unique by varying their themes and content, which will not be possible if we are tied to a single IP or brand owner and developer. We believe that this will help encourage repeat visits to our theme parks and arcades, and also enable us to open several locations in a single area. In addition, we envision that ardent fans may also visit our future Hero Central theme parks and arcades in other countries when those parks are developed.

Online Platform for User Data Analytics

The user profiles on our Hero Central Digital Platform may contain interesting information and data as each Hero Lover creates and uses a single profile for all of their engagement with us. This includes purchasing tickets and points for theme parks and arcades, downloading and playing game applications, and purchasing in-application items. As a result, the profiles may contain information on their online habits, online search priorities, where they prefer to shop, what games they like to play and their willingness to spend money, all of which is linked to their personal information.

We believe that this will make the Hero Central Digital Platform useful to us in enabling cross-selling theme park experiences, games applications and other services branded with our own and Hero Maker’s IP and content. We can tailor promotions and discounts based on events such as birthdays, anniversaries and festivities. It also creates a potential for us to conduct joint marketing campaigns, product tie-ins and brand placement with other businesses, such as retail, food and beverage leisure and entertainment operators.

Economies of Scale for Cost Efficient Operations

We believe that our theme park and games application business will benefit from economies of scale. Once the common online platform, management system, SOP, payment system, staff training program and other back-office systems are in place, the level of management required for the theme park and arcade operations at the headquarters level is likely to remain relatively flat even if the number of Hero Central theme parks and arcades, and Hero Lovers increase.

Similarly, we anticipate the cost of operating the Hero Central Digital Platform is likely to remain relatively stable even as the number of Hero Lover profiles, game application titles and players increase. The main server/machine will be managed by the Company, and the Company will have a technical team supporting the flagship and the rest of the parks.

As a result, there is potential for our operating margins to improve as our revenue increase as the number of Hero Central locations, Hero Lovers, game applications and players grow, while our operating costs remain relatively flat.

Value Proposition

Theme Park Expansion Strategy for Business and Financial Growth

Our Hero Central Theme Park concept is flexible, modular and thus highly scalable. Parks can be designed to fit practically most locations. Our planned licensing program will support the expansion program by bringing in licensees who contribute capital to set up new locations. Our modular concept means that each new location can be created to match the licensees’ ability to invest capital.

This high scalability and planned license program means that we are in a good position to implement our expansion strategy for our Hero Central Theme Parks in Malaysia and Asia. We believe that this will, in turn, helps us to achieve our financial growth projections and targets.

Involved in VR and AR Industry Experiencing Explosive Growth

The VR and AR industry is still in its infancy, with many operators conducting R&D to develop processors, HMDs, controllers and other accessories. In general, standards have not been established yet, and there is a lot of potential for growth. Digi Capital estimated that between 2016 and 2021, the revenue generated by the VR and AR industry worldwide will almost double every year to reach $108 billion.

We are committed to opening our flagship Hero Central theme park in Malaysia by the fourth quarter of 2018, presuming the success of our Offerings and our successful negotiation of necessary contracts. We hope to dominate the market by executing our expansion plan in Malaysia and Asia.

Successful AR Games can be Lucrative- The Pokemon Go Example

The Pokémon Go AR game application was launched in July 2016, and it quickly became one of the most successful mobile applications to date. It was downloaded 100 million times in its first month and generated approximately $10 million of in- application purchases per day during this period. Within the first few days of the game’s release market sentiment associating Nintendo with the game doubled its market capitalization to $42.5 billion, even though Pokémon Go is actually published by Niantic Lab.

While Pokemon is not affiliated with our Company, we believe that this example shows that engaging AR game applications can, over time and with proper marketing and investment, become extremely successful and lucrative. It also suggests that financial markets appreciate the value of successful AR game applications.

Opportunity to Invest in a New Technology Sector at an Early Stage

We are presenting prospective investors with an opportunity to participate in a new technology at an early stage. To the best of our knowledge, we are planning to set up one of the first large scale VR and AR theme park in Malaysia. We are also actively working to develop this business into a chain of theme parks and arcades in Asia. In addition, we believe our AR enabled trading card game will be one of the first of its kind when it is published. In management’s view, we are entering the VR and AR industry on the “ground floor” at a very early stage of its development.

Future Plans and Strategies

Our future plans and strategies include the following:

Hero Central Theme Park Expansion

Once we have set up our first flagship Hero Central Theme Park at Empire City Damansara shopping mall in Malaysia, we intend to expand our theme parks and arcades to a regional level. We planned that this will be comprised of VR theme parks and arcades.

Licensing

We intend to also launch our licensing program once we have established ourselves in the Malaysian market as well as developed and fine-tuned our SOP and staff training program. Licensing will be our key strategy in being one of the first operators to launch VR and AR theme parks and arcades in Asia.

Develop AR Game Applications

We are currently developing a series of AR enhanced trading card game applications. We plan to publish the game through our publishing platform within the online Hero Central Digital Platform. We plan to grow this business by developing a range of AR game applications by ourselves, and with our Hero Maker collaborators. It is planned that these game applications will feature heroes and characters set in a variety of different worlds and settings. Our publishing platform is planned to be global enabling it to reach a large market of potential users.

Possible Conflict of Interest

Mr. Ramli, our President, Chief Executive Officer and Chairman, is a minority shareholder in MAPS Perak (Movie Animation Park Studio of Perak), a theme park in Ipoh, Perak, Malaysia which was created from a joint venture between Perak Corporation Berhad and the Sanderson Group. The theme park, which opened in June 2017, is the first fully animation-based theme park in Asia and contains attractions based on animations such as DreamWorks Animation and The Smurfs. Mr. Ramli is also acting as developer on another integrated theme park attraction in Melaka, Malaysia, which will be operated by the R-Segari Group. Mr. Ramli is not part of the R-Segari Group management team.

MAPS can be considered a competitor to the VR and AR parks which the Company is aiming to develop in Malaysia. However, Mr. Ramli’s involvement with MAPS has facilitated introductions with major animation intellectual property developers. Mr. Ramli is essentially a passive investor in MAPS, and he does not have management or control responsibilities. Similarly, Mr. Ramli’s involvement with the Melaka project is that of passive investor. As a board member, Mr. Ramli owes a fiduciary duty to our stockholders and must act in good faith and in a manner he reasonably believes to be in the best interests of our stockholders.

Competition

EXA Global Sdn Bhd

EXA Global Sdn Bhd is a wholly owned subsidiary of Havson Group Berhad. The company was incorporated in June 2016. It launched its flagship VR theme park, EXA VR Park, in Greater Kuala Lumpur in June of 2017. As there are currently no VR theme parks in Malaysia, EXA VR Park envisaged that its theme park will be the first of its kind in the country. Games offered in the park will revolve around the free- roam VR concept. The company is said to be developing its own unique games and hardware in-house with the help of its subsidiaries. In addition to gaming rooms, the theme park is expected to have a VR museum to showcase the company’s development in VR.

Zero Latency, Melbourne

Zero Latency is an Australian based company which is the pioneer in free-roam, warehouse-scale, multi-player, VR games. Approximately 10 months after its commencement in August 2015 the company’s first VR facility in Melbourne serviced close to 10,000 visitors and added that they were on track to generate close to $2 million in revenue in its first full year of operations. Customers are charged a fee of AUD88 per person for around 45 minutes of game time and are able to select from a list of four different types of games. To date, Zero Latency has expanded to countries such as US, Japan and Spain through partnerships with venues who buy a license to run the games. Locations of these facilities are as follows:

| ● | Joypolis amusement park, Tokyo, Japan; | |

| ● | 7Fun Centre, Madrid, Spain; | |

| ● | Main Event Entertainment Centre, Orlando, Florida, United States; | |

| ● | Kalahari Resorts, Pocono Mountains, Pennsylvania, United States; | |

| ● | Kalahari Resorts, Wisconsin Dells, Wisconsin, United States. |

In 2016, Zero Latency won the People’s Choice Award at the annual International Association of Amusement Parks and Attractions (IAAPA) Expo.

Shanda Group

Shanda Group is a privately-owned investment group that invests in a wide variety of asset classes, focusing on financial services, technology and healthcare sectors. The company which was incorporated in 1999 started off as an online games company which eventually grew to become one of the leading online game platform operators in China at the time. In 2016, Shanda announced its plans to build a VR theme park in China. The company which is in the process of shifting its strategy away from online games to the VR market pledged to invest $350 million to build the VR facility with the help of The Void, a US-based entertainment company that specializes in VR. Apart from the founders, Shanda is the sole investor of The Void.

Landmark Entertainment Group