Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Four Corners Property Trust, Inc. | form8-kinvestorpresentation.htm |

| FCPT | APRIL 20181

INVESTOR PRESENTATION | APRIL 2018 www.fcpt .com

FOUR CORNERS PROPERTY TRUST

N YS E : F C P T

| FCPT | APRIL 20182

FORWARD LOOKING STATEMENTS

AND DISCLAIMERS

Cautionary Note Regarding Forward-Looking Statements:

This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all

statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations, including, but not limited

to, statements regarding: operating and financial performance; and expectations regarding the making of distributions and the payment of

dividends. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and

similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak

only as of the date on which such statements are made and, except in the normal course of the Company’s public disclosure obligations, the

Company expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any

change in the Company’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking

statements are based on management’s current expectations and beliefs and the Company can give no assurance that its expectations or the

events described will occur as described. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual

results to differ materially from those set forth in or implied by such forward-looking statements. For a further discussion of these and other

factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk

Factors” in the Company’s most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the Company

from time to time with the Securities and Exchange Commission.

Notice Regarding Non-GAAP Financial Measures:

The information in this communication contains and refer to certain non-GAAP financial measures, including FFO and AFFO. These non-GAAP

financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP.

These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP

financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes

these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the investor

relations section of our website at www.fcpt.com.

| FCPT | APRIL 20183

AGENDA

Company Overview and Update Page 3

Diversification and Acquisition Strategy Page 16

Financial Update & Key Credit Strengths Page 25

Key Investment Highlights Page 11

| FCPT | APRIL 20184

SENIOR MANAGEMENT TEAM

William Lenehan

President and CEO

Gerald Morgan

CFO

Former Board member and Chair of the Finance and Real Estate Committee at Darden Restaurants, Inc.

Private investor in net lease retail real estate

Member of the Board of Directors of Macy’s, Inc.

Former Board member and Chairman of the Investment Committee at Gramercy Property Trust, Inc.

Former CEO of Granite REIT, an investment grade single-tenant, triple-net REIT listed on the TSX

Ten years at Farallon Capital Management

B.A. from Claremont McKenna College

Former CFO of Amstar, served on Amstar’s Executive and Investment Committees

Former Managing Director of Financial Strategy & Planning at Prologis, Inc.

Former President and CFO of American Residential Communities

Served as a Senior Officer with Archstone prior to the company’s sale

Former consultant at Bain & Co.

B.S. in Mechanical Engineering and MBA from Stanford University

James Brat

General Counsel

Former Partner in the real estate department at the law firm of Pircher, Nichols & Meeks where he had

practiced since 1998

B.A. from Macalester College

Juris Doctorate from the UCLA School of Law

| FCPT | APRIL 20185

OVERVIEW OF FCPT

Four Corners Property Trust (“FCPT”) is an investment grade rated REIT primarily engaged in the

ownership, acquisition, and leasing of restaurant properties

527 properties, diversified by geography and brand, 415 of which are leased to Darden under long-

term triple-net leases

▪ 5 Restaurant Brands at Spin-Off from Darden:

Olive Garden, LongHorn Steakhouse, Bahama Breeze, Seasons 52, Wildfish Seafood Grille

▪ 23 Additional Brands Acquired:

Arby’s, BJ’s Restaurant, Bob Evans, Buffalo Wild Wings, Burger King, Chick-Fil-A, Chili’s, Del

Taco, Denny’s, Fazoli’s, Hardee’s, KFC, McAlister’s Deli, McDonald’s, MOD Pizza, Panda

Express, Pizza Hut, Red Lobster, Starbucks, Steak ‘n Shake, Taco Bell, Wendy’s, Zaxby’s

▪ Portfolio tenants are principally investment grade (87%) with positive operating trends, fulsome

public disclosure, and strong rent coverage (EBITDAR / rent of 4.6x1)

Strategy to grow and diversify portfolio through acquisitions and sale leasebacks

Low leverage and flexible unsecured capital structure to support diversification strategy

Sufficient platform scale with equity market capitalization of $1.4 billion and a total market

capitalization of $2.0 billion2

__________________________

Figures as of 3/31/2018, unless otherwise stated.

1. Figure as of 12/31/2017

2. Based on a share price of $23.09 as of 3/29/2018

| FCPT | APRIL 20186

2017 YEAR IN REVIEW & RECENT UPDATES

• Announced an increase in the annual dividend to $1.10 per share (over 13% increase from prior dividend)

• Active acquisitions & portfolio management program focused on high credit quality operators:

• Announced a strategic agreement to acquire 41 properties for $67 million from Washington Prime Group at a 6.7%

cap rate in September 2017, closed on the first 10 properties for $14 million in January 2018

• Total dispositions of $41 million since inception of 5 properties at highly attractive cap rates (4.8% weighted

average)

• Diversifying and strengthening capital markets access

- December 2016: Initiated At-The-Market (“ATM”) equity program, capitalizing on sector-best equity multiple to raise

$33.5 million in cumulative equity since inception

- January 2017: Obtained Investment Grade rating from Fitch (BBB-) to gain access to unsecured debt market

- June 2017: Issued $125 million of 7-year and 10-year unsecured notes via private placement, extending debt maturity

schedule

- October 2017: Recast and extended bank credit facility with lower interest rates, realizing $1.8 million in annual cash savings

Figures as of 3/31/2018, unless otherwise stated.

Since the spin-off was completed in late 2015, FCPT has made significant

progress on portfolio diversification and improving access to capital markets

Property

Count

Volume

($mm)

Initial Cash

Yield

Term

(Years)

2016 (Q3, Q4) 59 $94.0 6.6% 17.0

2017 (Full year) 43 $98.6 6.8% 18.6

2018 (Q1) 12 $20.4 6.6% 9.5

Total Q3'16 - Q1'18 114 $213.0 6.7% 17.0

| FCPT | APRIL 20187

CASE STUDY:

FCPT AND WASHINGTON PRIME

• On September 20, 2017, FCPT announced the acquisition of 41 restaurant properties from Washington Prime Group (“WPG”) for a purchase price

of approximately $67 million (6.7% initial cash yield) with a weighted average remaining 8 year lease term

- Attractive Anchors: Approximately 83% of the net operating income is from properties on out-lots to either open-air properties or WPG’s

“Tier One Enclosed” properties

- Unencumbered Sites: All properties are outparcel to malls / shopping centers unencumbered by property level debt

- Diverse Portfolio: 22 different restaurant brands across 12 states (CT, CO, FL, IA, IL, IN, MD, NJ, OH, PA, TX, VA)

• The first 10 properties / $14 million closed in January 2018. Tranche two is expected to close in late Q2 / early Q3 2018

__________________________

Figures as of 3/31/2018, unless otherwise stated.

22 Portfolio Brands

| FCPT | APRIL 20188

FCPT CLOSED ACQUISIT IONS

Note: Figures updated as of 3/31/2018.

Tenant Location

# of

Properties Operator / Guarantor Information

Purchase

Price ($mm)

Initial Cash

Yield

Term

(yrs)

Annualized Rent

Bumps Announced

Pizza Hut IL, IN 6 40-unit sub. of 150-unit operator $5.7 7.2% 20 1.5% 7/18/2016

Wendy's TX 1 2-unit operator $2.1 6.5% 10 1.2% 8/2/2016

Arby's NC 2 24-unit operator $3.5 6.6% 18 1.0% 9/6/2016

KFC MI 4 360-unit operator $3.9 7.1% 20 1.4% 9/14/2016

Buffalo Wild Wings IL, IA 3 7-unit operator (assigned to 40-unit operator) $7.9 6.5% 12 CPI 9/15/2016

Dairy Queen OK 1 76-unit operator $2.6 6.6% 18 1.3% 10/20/2016

Burger King VA, NC, MS, AL 5 98-unit operator $11.5 6.5% 20 1.5% 10/28/2016

Arby's VA, NC 2 24-unit operator $4.3 6.6% 18 1.0% 11/4/2016

USRP Portfolio: Tranche 1

(7 concepts)

MI, KY, OH, IN,

IL, FL, CO, GA

10 Mix of corporate and strong franchisees $15.6 6.6% 10

Various (some

CPI & % rent)

11/9/2016

KFC IN, MI, WI 16 130-unit operator $21.1 6.5% 20 1.5% 11/10/2016

Taco Bell IN 1 85-unit sub. of 250-unit operator $1.3 6.7% 5 NA 11/15/2016

Hardee's AL & GA 4 35-unit operator $6.9 6.5% 20 1.5% 12/15/2016

Burger King TN 4 115-unit operator $7.7 6.5% 20 1.5% 12/28/2016

USRP Portfolio: Tranche 2

(3 concepts)

AL, IN, NY, TN 4 Mix of corporate and strong franchisees $5.8 6.5% 12

Various (some

CPI & % rent)

1/12/2017

Taco Bell SC 1 60-unit sub. of 250-unit operator $2.4 6.5% 12 1.5% 1/13/2017

McAlister's TX 4 40-unit operator $8.9 6.7% 15 1.5% 3/17/2017

Bob Evans

DE, IN, MD, MI, NY,

OH, PA, VA, WV

16 524-unit operator $35.1 7.1% 20 2.0% 5/1/2017

Burger King MS, TN 7 115-unit operator $16.0 6.7% 20 2.0% 6/30/2017

Taco Bell IN 2 270-unit operator $3.4 6.5% 20 0.5% 7/26/2017

MOD Pizza/Del Taco MI 1 5-unit sub. of 90-unit operator $2.7 7.4% 10 2.0% 9/15/2017

Red Lobster OH, MI, PA, GA 5 700-unit operator $19.4 6.7% 21 2.0% 11/2/2017

LongHorn Steakhouse SC 1 490-unit sub. of 1,695-unit operator $1.5 6.6% 10 2.5% 12/7/2017

Burger King MS 2 115 unit operator $3.3 6.7% 20 1.5% 12/19/2017

Buffalo Wild Wings IL 2 65 unit sub of 200+ unit operator $6.6 6.6% 14 2.0% 1/10/2018

WPG Portfolio: Tranche 1

(10 concepts)

FL, IL, IA, OH 10 8 corporate and 2 franchisees $13.8 6.6% 7

Various (some

CPI & % rent)

1/12/2018

Total / Wtd. Avg. 114 $213.0 6.7% 17 1.7%

| FCPT | APRIL 20189

FCPT CLOSED DISPOSIT IONS

Note: Figures updated as of 3/31/2018.

FCPT remains a net acquirer of real estate

While the company receives many unsolicited offers to sell properties, only opportunistic and

attractive cap rate offers are considered

All proceeds from sales exchanged accretively into new investments via 1031 exchange mechanism

Tenant Location

# of

Properties Operator / Guarantor Information

Sale

Price ($mm)

Initial Cash

Yield

Term

(yrs)

Annualized Rent

Bumps Announced

Bahama Breeze Tampa, FL 1 Bahama Breeze Holdings, LLC $18.5 4.8% 12 1.5% 10/24/2016

Olive Garden

Pembroke Pines,

FL

1 Darden Restaurants, Inc. $6.3 4.8% 16 1.5% 10/24/2016

Olive Garden Lakeland, FL 1 Darden Restaurants, Inc. $5.2 5.1% 15 1.5% 5/17/2017

Olive Garden Fairfax, VA 1 Darden Restaurants, Inc. $5.9 4.7% 16 1.5% 9/13/2017

Olive Garden Pinellas Park, FL 1 Darden Restaurants, Inc. $5.1 4.7% 16 1.5% 11/24/2017

Total / Wtd. Avg. 5 $41.0 4.8% 14 1.5%

| FCPT | APRIL 201810

527 Properties

44 States

28 Brands

3.7 million sq ft

NATIONAL FOOTPRINT WITH INCREASING

BRAND DIVERSIF ICATION

Portfolio at Inception Acquired Properties

MN

SD

NJ

OH

INIL

VT NHID

AL

AZ

AR

CA

CO

CT

DE

FL

GA

IA

KS

KY

LA

ME

MD

MA

MI

MS

MO

MT

NE

NV

NM

NY

NC

ND

OK

OR

PA

RI

SC

TN

TX

UT

VA

WA

WV

WI

WY

__________________________

Note: Figures in this presentation are as of 3/31/2018 unless otherwise stated.

Map is based on Current scheduled minimum contractual rent as of 3/31/2018; Excludes six owned / ground leased in the Kerrow Restaurant Operating Business.

| FCPT | APRIL 201811

AGENDA

Company Overview and Update Page 3

Diversification and Acquisition Strategy Page 16

Financial Update & Key Credit Strengths Page 25

Key Investment Highlights Page 11

| FCPT | APRIL 201812

HIGH QUALITY PORTFOLIO

Properties:

• 527 Properties

• 87% Investment grade tenancy

• 28 brands – 16 Quick Service & Fast Casual / 12 Casual, Family & Fine Dining

Geography:

• 44 states

• Only Florida (10.8%) and Texas (10.6%) are above 10% of NOI

Term Remaining:

• 12.7 years

• Less than 1.5% of NOI expiring before 2027

Contractual Rent

(Cash):

$109.4 million

EBITDAR / Rent

Coverage:

4.6x1

Annual Rent

Escalation:

1.5% average fixed annualized rent increase

Lease Structure:

Net leases with tenant responsible for repair and maintenance costs, property tax,

insurance and building restoration

Predominantly individual leases to allow landlord flexibility

FCPT Portfolio Summary

__________________________

Figures as of 3/31/2018 unless stated otherwise

1. Figure as of 12/31/2017

Casual,

Family

& Fine

Dining

Quick

Service

& Fast

Casual

| FCPT | APRIL 201813

PORTFOLIO DIVERSIF ICATION

___________________________

1. Current scheduled minimum contractual rent as of 3/31/2018.

Brand Breakdown by Annual Base Rent (ABR)

18%

105 units

4%

13 units

13%

112 units

65%

297 units

74%

20%

6%

Initial Portfolio:

Rental Revenue of $94.4 million

(ABR at spin)

Today:

Rental Revenue of $109.4 million1

(ABR at 3/31/2018)

104 units

300 units

14 units

| FCPT | APRIL 201814

LEASE MATURITY SCHEDULE

___________________________

1. Current scheduled minimum contractual rent as of 3/31/2018

2. Calculated by square feet

Note: Excludes renewal options.

0.0% 0.0% 0.2% 0.2%

0.3% 0.3% 0.1% 0.1% 0.2%

15.2%

15.8%

14.1%

13.7%

12.8%

9.6%

8.6%

0.7%

0.0%

3.6% 3.7%

0.0%

0.9%

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039

Weighted average lease term of

12.7 years

Lease Maturity Schedule by % Annual Base Rent1 (ABR)

Less than 1.5% of rental income

matures prior to 2027

99.9% occupied as of 3/31/20182

# Properties - - 3 2 3 4 1 1 2 74 74 70 67 62 46 40 5 - 41 27 - 4

Cash ABR ($000s)

(1) 179 171 298 3 6 85 1 7 234 16,621 17,273 15,417 14,936 14,012 10,452 9, 38 787 3,965 4,011 1,021

Total SF (000s) 15 8 12 18 2 4 7 535 539 3 518 93 363 346 21 118 123 31

| FCPT | APRIL 201815

N/A N/A

2.1x

2.6x

2.8x

3.6x

4.6x

ADC VEREIT Spirit STORE Realty National Retail FCPT

54%

64%

81%

85%

100% 100% 100%

STOR VER O SRC ADC NNN FCPT

20%

24%

37% 40%

44% 46%

87%

STOR NNN SRC VER ADC O FCPT

___________________________

Sources: FCPT figures as of 3/31/2018, except EBITDAR / Rent coverage as of 12/31/2017; peer data based on public filings as of 12/31/2017 and Green Street Advisors.

1. Uses 4-Wall / Unit-Level Coverage where available.

2. Based on annualized base rent. Information for peers per company filings (O, ADC and VER) and Green Street Advisors (STOR, SRC and NNN). FCPT classifies investment grade tenants as a tenant with at least one

investment grade rating from Moody’s, S&P or Fitch.

3. Based on annualized base rent.

4. Includes retail, restaurant, movie theaters, health clubs, automotive and consumer goods rental.

FCPT’S PORTFOLIO COMPARES

FAVORABLY ACROSS MAJOR METRICS

EBITDAR Coverage1 % Investment Grade Tenants2

Weighted Average Lease Term % Retail Properties3

9.5 9.5

10.0 10.2

11.5

~14

12.7

VER O SRC ADC NNN STOR FCPT

(In years)

Peer Average: 2.8x

Peer Average: 81%

Peer Average: 35%

Peer Average: 10.8 years

(4)

41% 98%25% 100% 81%% Tenants

included:

| FCPT | APRIL 201816

AGENDA

Company Overview and Update Page 3

Diversification and Acquisition Strategy Page 16

Financial Update & Key Credit Strengths Page 25

Key Investment Highlights Page 11

| FCPT | APRIL 201817

BUSINESS PLAN AND

DIVERSIF ICATION STRATEGY

FCPT has a core portfolio that provides stable cash flow, as well as a strong

balance sheet to support diversification growth objectives

Start with 100% concentration in casual dining, but an extremely strong tenant with an investment grade

credit rating

Seek to grow and diversify with an initial focus on the quick service subsector in order to move portfolio

closer to reflecting national restaurant landscape

Become a preferred partner and capital source for leading restaurant operators and franchisees, capitalizing

on the current industry trends pushing operator consolidation and an “asset light” business model

Maintain conservative and flexible balance sheet

− Continue to improve access to equity and debt capital

− Low leveraged balance sheet with substantial liquidity

− Unencumbered properties

− Conservative payout ratio of approximately 80% of AFFO

− UPREIT structure offering compelling OP unit option

− Capital recycling through selective dispositions

1

2

3

4

| FCPT | APRIL 201818

FCPT ACQUISIT ION PHILOSOPHY

AND UNDERWRITING CRITERIA

Acquisition Philosophy

• Acquire nationally recognized branded restaurants that are well located with creditworthy lease guarantors

• Purchase assets only when accretive to cost of capital

• Increase diversification by targeting different brands, meal price-points, cuisine types, and geographies

Underwriting Criteria

• Acquisition criteria is approximately split 50% / 50% between credit and real estate metrics

• Acquisition decisions are informed by a property scorecard based on these metrics, but ultimately rely on

human judgement

Real Estate Criteria (~50%):

− Location

− Re-use potential

− Lease structure

− Absolute rent

− Rent growth

Credit Criteria (~50%):

− Guarantor credit

− Brand durability

− Store performance

− Rent-to-sales

− Lease term

| FCPT | APRIL 201819

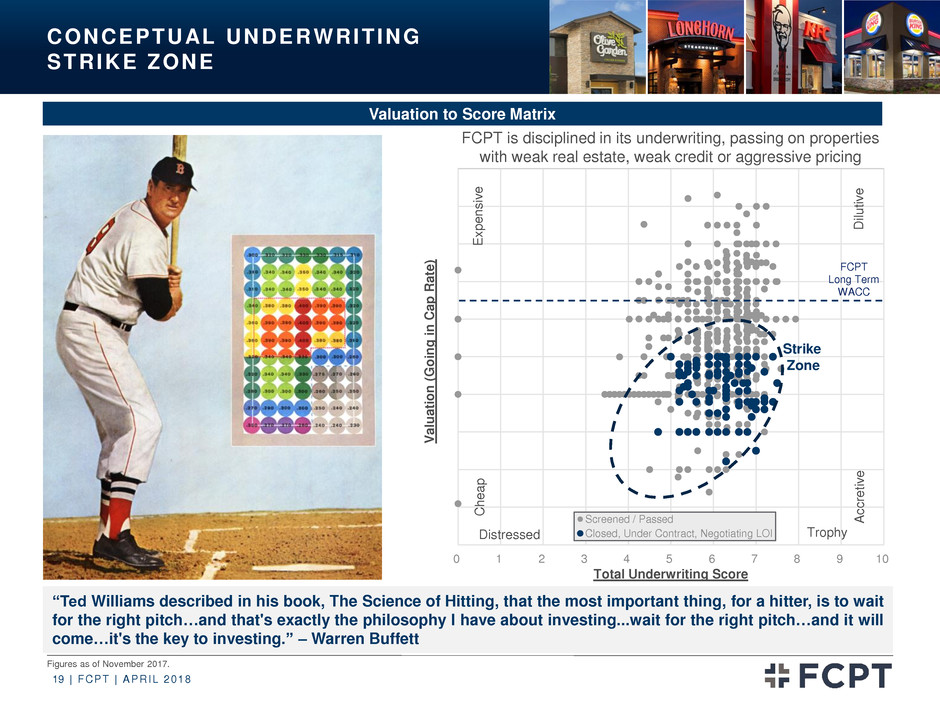

0 1 2 3 4 5 6 7 8 9 10

Screened / Passed

Closed, Under Contract, Negotiating LOI

“TedWilliams described in his book, The Science of Hitting, that the most important thing, for a hitter, is to wait

for the right pitch…and that's exactly the philosophy I have about investing...wait for the right pitch…and it will

come…it's the key to investing.” –Warren Buffett

CONCEPTUAL UNDERWRITING

STRIKE ZONE

E

x

p

e

n

s

iv

e

Che

a

p

A

c

c

ret

iv

e

D

ilut

iv

e

Distressed Trophy

Strike

Zone

Valuation to Score Matrix

FCPT

Long Term

WACC

FCPT is disciplined in its underwriting, passing on properties

with weak real estate, weak credit or aggressive pricing

V

alua

tio

n

(

G

o

in

g

in

Cap

Ra

te

)

Total Underwriting Score

Figures as of November 2017.

| FCPT | APRIL 201820

VAST ADDRESSABLE MARKET WITHIN

RESTAURANT INDUSTRY SUBSECTORS

✓~✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓✓ ✓~

Source: Census Bureau, Bureau of Economic Analysis, Wall Street Research as of March 2017; Data as of December 2015.

Retail Sales

$4.85T

Net Exports

-$0.5T

US GDP – $17.9 Trillion

Food Services

(13.6% of Retail Sales, $620bn)

Consumption

$12.3T

Investment

$3.0T

Government

$3.3T

Quick Service

$255bn

Casual Dining

$177bn

Fine

Dining

$19bn

Non-

Restaurant

$128bn

Hamburger

$80bn

Pizza

$38bn

Sand-

wich

$30bn

Coffee

$25bn

Chicken

$23bn

Mex-

ican

$22bn

Other

$37bn

Varied

Menu

$56bn

Asian

$22bn

Steak

$19bn

Italian

$18bn

Mex-

ican

$13bn

Sea-

food

$12bn

Other

$36bn

FCPT

Target ~ ~

Family

/ Buffet

$41bn

| FCPT | APRIL 201821

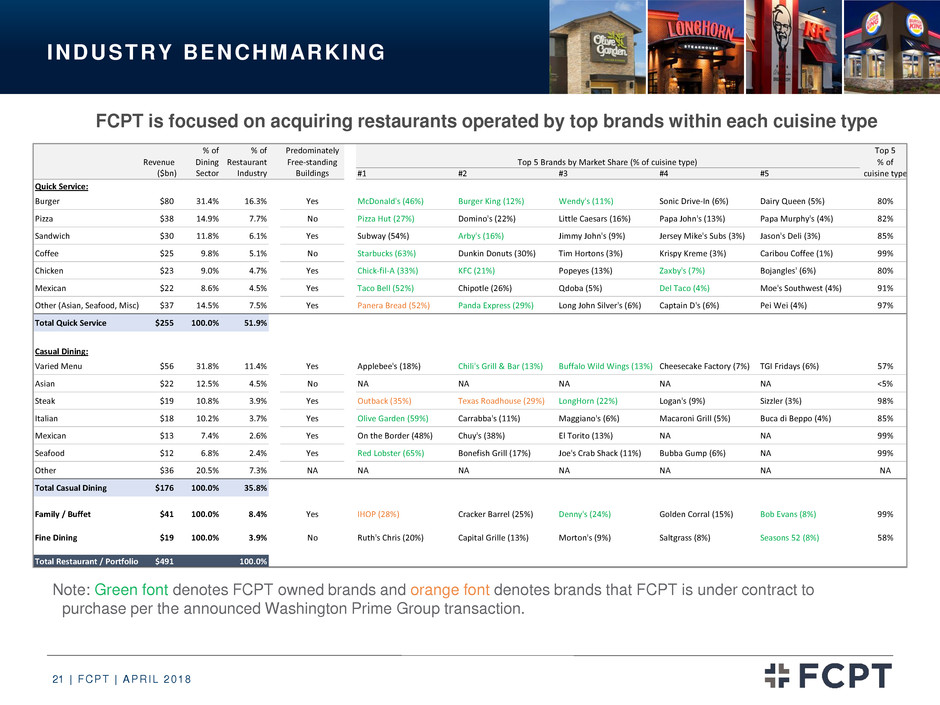

INDUSTRY BENCHMARKING

Note: Green font denotes FCPT owned brands and orange font denotes brands that FCPT is under contract to

purchase per the announced Washington Prime Group transaction.

FCPT is focused on acquiring restaurants operated by top brands within each cuisine type

% of % of Predominately Top 5

Revenue Dining Restaurant Free-standing Top 5 Brands by Market Share (% of cuisine type) % of

($bn) Sector Industry Buildings #1 #2 #3 #4 #5 cuisine type

Quick Service:

Burger $80 31.4% 16.3% Yes McDonald's (46%) Burger King (12%) Wendy's (11%) Sonic Drive-In (6%) Dairy Queen (5%) 80%

Pizza $38 14.9% 7.7% No Pizza Hut (27%) Domino's (22%) Little Caesars (16%) Papa John's (13%) Papa Murphy's (4%) 82%

Sandwich $30 11.8% 6.1% Yes Subway (54%) Arby's (16%) Jimmy John's (9%) Jersey Mike's Subs (3%) Jason's Deli (3%) 85%

Coffee $25 9.8% 5.1% No Starbucks (63%) Dunkin Donuts (30%) Tim Hortons (3%) Krispy Kreme (3%) Caribou Coffee (1%) 99%

Chicken $23 9.0% 4.7% Yes Chick-fil-A (33%) KFC (21%) Popeyes (13%) Zaxby's (7%) Bojangles' (6%) 80%

Mexican $22 8.6% 4.5% Yes Taco Bell (52%) Chipotle (26%) Qdoba (5%) Del Taco (4%) Moe's Southwest (4%) 91%

Other (Asian, Seafood, Misc) $37 14.5% 7.5% Yes Panera Bread (52%) Panda Express (29%) Long John Silver's (6%) Captain D's (6%) Pei Wei (4%) 97%

Total Quick Service $255 100.0% 51.9%

Casual Dining:

Varied Menu $56 31.8% 11.4% Yes Applebee's (18%) Chili's Grill & Bar (13%) Buffalo Wild Wings (13%) Cheesecake Factory (7%) TGI Fridays (6%) 57%

Asian $22 12.5% 4.5% No NA NA NA NA NA <5%

Steak $19 10.8% 3.9% Yes Outback (35%) Texas Roadhouse (29%) LongHorn (22%) Logan's (9%) Sizzler (3%) 98%

Italian $18 10.2% 3.7% Yes Olive Garden (59%) Carrabba's (11%) Maggiano's (6%) Macaroni Grill (5%) Buca di Beppo (4%) 85%

Mexican $13 7.4% 2.6% Yes On the Border (48%) Chuy's (38%) El Torito (13%) NA NA 99%

Seafood $12 6.8% 2.4% Yes Red Lobster (65%) Bonefish Grill (17%) Joe's Crab Shack (11%) Bubba Gump (6%) NA 99%

Other $36 20.5% 7.3% NA NA NA NA NA NA NA

Total Casual Dining $176 100.0% 35.8%

Family / Buffet $41 100.0% 8.4% Yes IHOP (28%) Cracker Barrel (25%) Denny's (24%) Golden Corral (15%) Bob Evans (8%) 99%

Fine Dining $19 100.0% 3.9% No Ruth's Chris (20%) Capital Grille (13%) Morton's (9%) Saltgrass (8%) Seasons 52 (8%) 58%

Total Restaurant / Portfolio $491 100.0%

| FCPT | APRIL 201822

US eCommerce Penetration by Retail Category (2016)

46.7%

31.8%

16.4%

14.8%

11.1% 11.0% 10.5%

7.3%

2.8%

0.9%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Consumer

Electronics

Books &

Magazines

Toys & Hobbies Apparel &

Accessories

Health &

Personal Care

Jewelry &

Watches

Sports & Fitness

(ex apparel)

Furniture &

Home

(incl appliances)

Total

Grocery

Food &

Beverage1 1

Source: ComScore, Census Bureau, BEA, Internet Retailer, Wall Street Research

1 Calculated using estimated online sales

Online / digital sales penetration has remained low within restaurants

FOOD & BEVERAGE SEEMS TO BE

MOST RESIL IENT TO E -COMMERCE

| FCPT | APRIL 201823

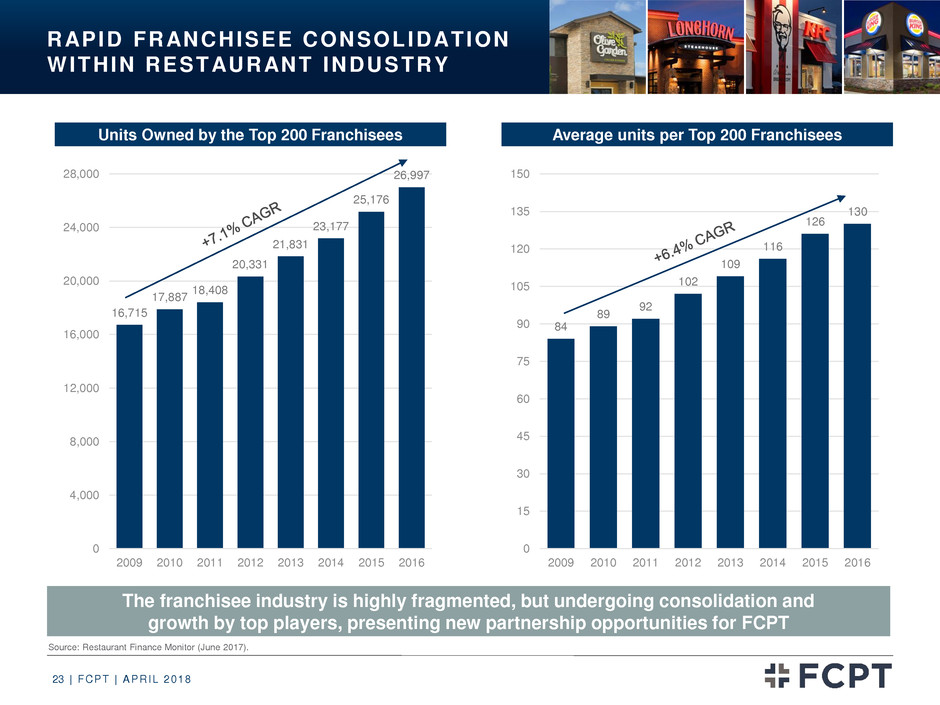

RAPID FRANCHISEE CONSOLIDATION

WITHIN RESTAURANT INDUSTRY

Units Owned by the Top 200 Franchisees Average units per Top 200 Franchisees

16,715

17,887

18,408

20,331

21,831

23,177

25,176

26,997

0

4,000

8,000

12,000

16,000

20,000

24,000

28,000

2009 2010 2011 2012 2013 2014 2015 2016

84

89

92

102

109

116

126

130

0

15

30

45

60

75

90

105

120

135

150

2009 2010 2011 2012 2013 2014 2015 2016

Source: Restaurant Finance Monitor (June 2017).

The franchisee industry is highly fragmented, but undergoing consolidation and

growth by top players, presenting new partnership opportunities for FCPT

| FCPT | APRIL 201824

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Brands with mid-range sales have more

options for re-tenanting in case of vacancy

THOUGHTFUL BRAND SELECTION

AIMED AT PROTECTING CASH FLOW

Casual

Dining

Fast

Casual

Quick

Service

___________________________

Source: Brand average sales per Nation’s Restaurant News Top 200 (2017 edition, uses 2016 financials).

$10,909

Brand Average Sales

Volume ($000s)

| FCPT | APRIL 201825

AGENDA

Company Overview and Update Page 3

Diversification and Acquisition Strategy Page 16

Financial Update & Key Credit Strengths Page 25

Key Investment Highlights Page 11

| FCPT | APRIL 201826

Current Capitalization Current Trading Metrics

($ million, except per share) Cash NOI ($ million)

3 $109.4

Share price (3/29/2018) $23.09 Implied Cap Rate 5.7%

Shares and OP units outstanding (millions) 61.8 Consensus AFFO per share (12 month forward) $1.37

Equity value $1,427 Price / AFFO Multiple 16.9x

Debt: Quarterly Dividend per share $0.2750

Bank term debt $400 Annualized Dividend per share $1.10

Revolving credit facility $0 Dividend Yield 4.8%

Unsecured private notes $125

Total market capitalization $1,952

Cash1 ($24)

Implied enterprise value $1,928

EBITDA (cash, Last Quarter Annualized)2 $98

EBITDA (GAAP, Last Quarter Annualized)2 $104

Credit Metrics Current

Total debt to total market capitalization 26.9%

Fixed charge coverage (per Q4 2017 covenant compliance) 5.7x

Net debt to EBITDA (cash, Last Quarter Annualized)2 5.1x

Net debt to EBITDA (GAAP, Last Quarter Annualized)2 4.8x

___________________________

Note: Figures as of 12/31/2017, unless otherwise stated.

1. Approximate, unaudited cash balance as of 3/31/2018, adjusted for unpaid dividends.

2. EBITDA and leverage metric calculations based on last quarter annualized.

3. Current scheduled minimum contractual rent as of 3/31/2018.

4. Peers are calculated based on Q4 2017 filings, pro forma for announced capital transactions.

SUMMARY CAPITALIZATION AND

F INANCIALS

4.8x

4.3x

5.5x

4.8x

6.0x 6.3x 5.7x

1.2x

0.3x

1.0x

4.8x

4.3x

5.5x

6.0x 6.0x

6.6x 6.7x

FCPT ADC O NNN STOR SRC VER

Net Debt/EBITDA

Net Debt + Pfd./EBITDA

GAAP Leverage Relative to Net Lease Peers4

| FCPT | APRIL 201827

FCPT DEBT MATURITY SCHEDULE

___________________________

Figures as of 3/31/2018.

1. Excludes undrawn revolver

Current Debt Maturity Schedule1

$0 $0 $0

$250

$400

$0

$50

$0 $0

$75

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

Unsecured Notes

Undrawn Revolver Capacity

Drawn Revolver

Unsecured Term Loan

Weighted average

maturity of 5.4 years1

| FCPT | APRIL 201828

High Quality

Portfolio

Diversified by

Geography and

Brand

Well-located assets diversified geographically across 44 states in the U.S.

Darden property-level revenue ~50% above casual dining peers

Sales of Darden branded assets demonstrate strong underlying value and liquidity

Strong acquisition platform with 114 restaurant properties / $213 million in acquisitions

volume since July 2016

Strong, Stable

and Growing

Cash Flow

12.7 year average lease term with < 1.5% of leases expiring before 2027

Annualized rent escalators of 1.5%

Focus on sustainable tenant rents with EBITDAR / rent coverage of 4.6x1 – best-in-class

within net lease sector

Investment

Grade Credit

Profile

FCPT received BBB- investment grade rating from Fitch in January 2017

FCPT’s largest tenant, Darden, who also provides a corporate guarantee on its leases,

is rated BBB/BBB/Baa2 and continues to perform well and increase market share

Conservative

Financial

Position

Financially disciplined acquisition strategy

Current leverage of 4.8x Net Debt / EBITDA (GAAP), with no near-term maturities

100% unencumbered asset base

Conservative dividend payout ratio of ~80% of AFFO

Strong liquidity profile with $250 million fully undrawn revolver

Strong institutional shareholder support

Experienced

Management

and Board

Highly regarded leadership with extensive retail net lease and public market REIT

experience

Board with significant restaurant and real estate experience and a strong track record

Members of management and board are meaningfully invested in FCPT; interests are

aligned with shareholders

Best-in-class corporate governance

FCPT KEY INVESTMENT HIGHLIGHTS

__________________________

Figures as of 3/31/2018 unless otherwise stated

1. Figure as of 12/31/2017

| FCPT | APRIL 201829

FOUR CORNERS PROPERTY TRUST

N YS E : F C P T