Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Victory Capital Holdings, Inc. | a2234849zex-32_2.htm |

| EX-32.1 - EX-32.1 - Victory Capital Holdings, Inc. | a2234849zex-32_1.htm |

| EX-31.2 - EX-31.2 - Victory Capital Holdings, Inc. | a2234849zex-31_2.htm |

| EX-31.1 - EX-31.1 - Victory Capital Holdings, Inc. | a2234849zex-31_1.htm |

| EX-23.1 - EX-23.1 - Victory Capital Holdings, Inc. | a2234849zex-23_1.htm |

| EX-21.1 - EX-21.1 - Victory Capital Holdings, Inc. | a2234849zex-21_1.htm |

| EX-4.4 - EX-4.4 - Victory Capital Holdings, Inc. | a2234849zex-4_4.htm |

| EX-4.3 - EX-4.3 - Victory Capital Holdings, Inc. | a2234849zex-4_3.htm |

| EX-3.2 - EX-3.2 - Victory Capital Holdings, Inc. | a2234849zex-3_2.htm |

| EX-3.1 - EX-3.1 - Victory Capital Holdings, Inc. | a2234849zex-3_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE TRANSITION PERIOD FROM TO |

||

Commission file number: 001-38388

Victory Capital Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

32-0402956 (I.R.S. Employer Identification No.) |

|

4900 Tiedeman Road 4th Floor Brooklyn, OH (Address of principal executive offices) |

44144 (Zip Code) |

(216) 898-2400

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Class A Common Stock, $0.01 par value | The NASDAQ Stock Market LLC | |

|---|---|---|

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2017, the last business day of the registrant's most recently completed second quarter, there was no public market for the registrant's Class A common stock. The registrant's Class A common stock began trading on the NASDAQ Stock Market LLC on February 8, 2018.

The number of outstanding shares of the registrant's Class A common stock, par value $0.01 per share and Class B common stock, par value $0.01 per share, as of March 13, 2018 were 12,899,315 and 55,046,787, respectively.

Our design logos and the marks "Victory Capital," "Victory Capital Management," "Victory Capital Advisers," "Victory Funds," "VictoryShares," "Victory Connect," "CEMP," "CEMP Volatility Weighted Indexes," "Diversified," "Diversified Equity Management," "Expedition Investment Partners," "INCORE Capital Management," "Integrity," "Integrity Asset Management," "Munder," "Munder Capital Management," "The Munder Funds," "NewBridge," "NewBridge Asset

2

Management," "RS Funds," "RS Investments," "Sophus Capital," "Sycamore Capital" and "Trivalent Investments," are owned by us or one of our subsidiaries. All other trademarks, service marks and trade names appearing in this report are the property of their respective owners.

In this report, when we refer to:

- •

- "CEMP," we are referring to Compass Efficient Model Portfolios, LLC;

- •

- the "CEMP Acquisition," we are referring to our acquisition of the CEMP business in 2015;

- •

- "Cerebellum Capital," we are referring to Cerebellum Capital, LLC;

- •

- "Crestview," we are referring to Crestview Advisors, L.L.C.;

- •

- "Crestview GP," we are referring to Crestview Partners II GP, L.P.;

- •

- "Crestview Victory," we are referring to Crestview Victory, L.P.;

- •

- "ETFs," we are referring to exchange-traded funds;

- •

- "IPO," we are referring to the initial public offering of shares of 12,899,315 Class A common stock of Victory Capital

Holdings, Inc.;

- •

- "Munder," we are referring to our Munder Capital Management Franchise;

- •

- the "Munder Acquisition," we are referring to our acquisition of Munder Capital in 2014;

- •

- "Munder Capital," we are referring to Munder Capital Management;

- •

- "Reverence Capital," we are referring to Reverence Capital Partners;

- •

- the "RS Acquisition," we are referring to our acquisition of RS Investments in 2016;

- •

- "RS Investments," we are referring to RS Investment Management Co. LLC;

- •

- "Victory," the "Company," "we," "our" or "us," we are referring to Victory Capital Holdings, Inc. and its consolidated subsidiaries,

except where otherwise stated or where it is clear that the term means only Victory Capital Holdings, Inc. exclusive of its subsidiaries;

- •

- "VCM," we are referring to Victory Capital Management Inc., our wholly owned registered investment adviser; and

- •

- "VCA" we are referring to Victory Capital Advisers, Inc., our broker-dealer subsidiary registered with the Securities and Exchange Commission.

In this report, we rely on and refer to certain market and industry data and forecasts related thereto. We obtained this information and these statistics from sources other than us, which we have supplemented where necessary with information from publicly available sources and our own internal estimates. We use these sources and estimates and believe them to be reliable, but we cannot give any assurance that any of the projected results will be achieved.

3

Forward-Looking Statements

This report includes forward-looking statements, including in the sections entitled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business." These forward-looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals and expectations concerning our market position, future operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion, the words "may," "believes," "intends," "seeks," "anticipates," "plans," "estimates," "expects," "should," "assumes," "continues," "could," "will," "future" and the negative of these or similar terms and phrases are intended to identify forward-looking statements in this report.

Forward-looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Although we believe the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that these expectations will prove to have been correct. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from our expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others, the following:

- •

- reductions in AUM based on investment performance, client withdrawals, difficult market conditions and other factors;

- •

- the nature of our contracts and investment advisory agreements;

- •

- our ability to maintain historical returns and sustain our historical growth;

- •

- our dependence on third parties to market our strategies and provide products or services for the operation of our business;

- •

- our ability to retain key investment professionals or members of our senior management team;

- •

- our reliance on the technology systems supporting our operations;

- •

- our ability to successfully acquire and integrate new companies;

- •

- the concentration of our investments in long only small- and mid-cap equity and U.S. clients;

- •

- risks and uncertainties associated with non-U.S. investments;

- •

- our efforts to establish and develop new teams and strategies;

- •

- the ability of our investment teams to identify appropriate investment opportunities;

- •

- our ability to limit employee misconduct;

- •

- our ability to meet the guidelines set by our clients;

- •

- our exposure to potential litigation (including administrative or tax proceedings) or regulatory actions;

- •

- our ability to implement effective information and cyber security policies, procedures and capabilities;

- •

- our substantial indebtedness;

- •

- the potential impairment of our goodwill and intangible assets;

- •

- disruption to the operations of third parties whose functions are integral to our ETF platform;

4

- •

- our determination that we are not required to register as an "investment company" under the 1940 Act;

- •

- the fluctuation of our expenses;

- •

- our ability to respond to recent trends in the investment management industry;

- •

- the level of regulation on investment management firms and our ability to respond to regulatory developments;

- •

- the competitiveness of the investment management industry;

- •

- the dual class structure of our common stock;

- •

- the level of control over us retained by Crestview GP;

- •

- our status as an emerging growth company and a controlled company; and

- •

- other risks and factors listed under "Risk Factors" and elsewhere in this report.

In light of these risks, uncertainties and other factors, the forward-looking statements contained in this report might not prove to be accurate. All forward-looking statements speak only as of the date made and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

This report contains "non-GAAP financial measures" that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States, or GAAP. Specifically, we make use of the non-GAAP financial measures "Adjusted EBITDA" and "Adjusted Net Income."

Adjustments we make to GAAP net income to calculate Adjusted EBITDA are:

- •

- We add back interest paid on debt net of interest income;

- •

- We add back depreciation on property and equipment;

- •

- We add back other business taxes;

- •

- We add back GAAP amortization of acquisition-related intangibles;

- •

- We add back the expense associated with stock-based compensation associated with equity issued from pools that were created in connection with

our management-led buyout with Crestview GP from KeyCorp, the Munder Acquisition and the RS Acquisition and as a result of any equity grants related to our initial public offering, or IPO;

- •

- We add back direct incremental costs of acquisitions and IPO, including expenses associated with third-party advisors, proxy solicitations of

mutual fund shareholders for transaction consents, vendor contract early termination costs, impairment of receivables recorded in connection with an acquisition and severance, retention and

transaction incentive compensation;

- •

- We add back debt issuance costs;

- •

- We add back pre-IPO governance expenses paid to Crestview and Reverence Capital (which payments terminated as of the completion of the IPO);

- •

- We adjust for earnings/losses on equity method investments; and

5

- •

- We add back annual incentive compensation paid in excess of expected levels due to acquisitions.

Adjustments we make to GAAP net income to calculate Adjusted Net Income are:

- •

- We add back other business taxes;

- •

- We add back GAAP amortization of acquisition-related intangibles;

- •

- We add back the expense associated with stock-based compensation associated with equity issued from pools that were created in connection with

our management-led buyout with Crestview GP from KeyCorp, the Munder Acquisition and the RS Acquisition and as a result of any equity grants related to the IPO;

- •

- We add back direct incremental costs of acquisitions and IPO, including expenses associated with third-party advisors, proxy solicitations of

mutual fund shareholders for transaction consents, vendor contract early termination costs, impairment of receivables recorded in connection with an acquisition and severance, retention and

transaction incentive compensation;

- •

- We add back debt issuance costs;

- •

- We add back pre-IPO governance expenses paid to Crestview and Reverence Capital (which payments terminated as of the completion of the IPO);

- •

- We add back annual incentive compensation paid in excess of expected levels due to acquisitions;

- •

- We subtract an estimate of income tax expense on the adjustments; and

- •

- We subtract the impact of re-measuring our U.S. net deferred taxes under the Tax Cuts and Jobs Act enacted on December 22, 2017.

Adjusted EBITDA and Adjusted Net Income are not recognized terms under GAAP and do not purport to be alternatives to net income (loss) attributable to us as a measure of operating performance. Non-GAAP financial measures are used to supplement GAAP results to provide a more complete understanding of the factors and trends affecting our business than GAAP results alone.

Our management uses these non-GAAP performance measures to evaluate the underlying operations of our business. Due to our acquisitive nature, there are a number of acquisition and restructuring related expenses included in GAAP measures that we believe distort the economic value of our organization and we believe that many investors use this information when assessing the financial performance of companies in the investment management industry. We have included these non-GAAP measures to provide investors with the same financial metrics used by management to assess the operating performance of our Company.

Non-GAAP measures should be considered in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP. Our non-GAAP measures may differ from similar measures at other companies, even if similar terms are used to identify these measures.

6

Overview

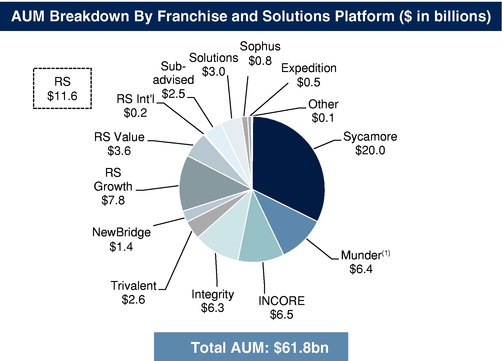

We are an independent investment management firm operating a next generation, integrated multi-boutique model with $61.8 billion in AUM as of December 31, 2017. Our differentiated model features a scalable operating platform that provides centralized distribution, marketing and operations infrastructure to our Franchises and Solutions Platform. As of December 31, 2017, our Franchises and our Solutions Platform collectively managed a diversified set of 65 investment strategies for a wide range of institutional and retail clients.

Our Franchises are operationally integrated, but are separately branded and make investment decisions independently from one another within guidelines established by their respective investment mandates. Our integrated multi-boutique model creates a supportive environment in which our investment professionals, largely unencumbered by administrative and operational responsibilities, can focus on their pursuit of investment excellence. VCM employs all of our U.S. investment professionals across our Franchises, which are not separate legal entities.

Our Solutions Platform consists of multi-Franchise and customized solutions strategies that are primarily rules-based. We offer our Solutions Platform through a variety of vehicles, including separate accounts, mutual funds and VictoryShares which is our ETF brand. Like our Franchises, our Solutions Platform is operationally integrated and supported by our centralized distribution, marketing and operational support functions.

Our centralized key functions include distribution, marketing, trading, middle- and back-office administration, legal, compliance and finance. Our integrated model aims to "centralize, not standardize." We believe by providing our Franchises with control over their portfolio management tools, risk analytics and other investment-related functions, we can minimize disruptions to their investment process and ensure that they are able to invest in the fashion that they find most optimal.

In addition to our integrated multi-boutique business model, we believe there are four main attributes that differentiate us from other publicly traded investment management firms:

- •

- We have constructed a set of distinct investment approaches in specialized asset classes where we believe active managers are well positioned

to generate alpha over a full market cycle through security selection and portfolio construction. We believe our strategies in these specialized asset classes, which we refer to as our current focus

asset classes, will drive our future growth. These strategies have experienced less fee compression than strategies in more commoditized asset classes, and we believe demand for them typically exceeds

capacity. For the year ended December 31, 2017, we had an AUM-weighted average fee rate of 71 basis points. From 2013 through the end of 2017, our AUM-weighted average fee rate has increased

due to a shift to higher fee products as we positioned our business to focus on higher-fee asset classes. We attribute part of our ability to attract flows and drive revenue growth—in the

face of significant headwinds for active managers—to our selection of specialized asset classes and to the quality of our Franchises.

- •

- We have a track record of successfully sourcing, executing and integrating sizable acquisitions and making these acquisitions financially

attractive by extracting significant synergies. We believe our differentiated platform combining scale and boutique-like qualities is appealing to investment professionals, making us an attractive

acquirer to firms looking for a strategic partner.

- •

- We have a diversified business that offers a suite of active products and hybrid rules-based products through our proprietary ETF brand, VictoryShares, across a wide range of asset classes and distinct investment approaches, to a broad and diverse group of institutional and retail

7

- •

- We foster a culture that encourages long-term thinking through promoting meaningful employee ownership. We have a high degree of employee ownership, with over 70% of our employees beneficially owning approximately 27% of our shares as of January 29, 2018. Many of such employees have purchased their equity interests in our firm. In addition, as of December 31, 2017 our employees have collectively invested approximately $100 million in products we manage, directly aligning their investment outcomes with those of our clients.

clients. We offer our 65 investment strategies through nine Franchises and our Solutions Platform, with no Franchise accounting for more than 32% of total AUM as of December 31, 2017. Each of our Franchises employs a different investment approach, which we believe leads to diversification in investment return streams among Franchises, even when asset classes overlap. These factors also mitigate key man risk.

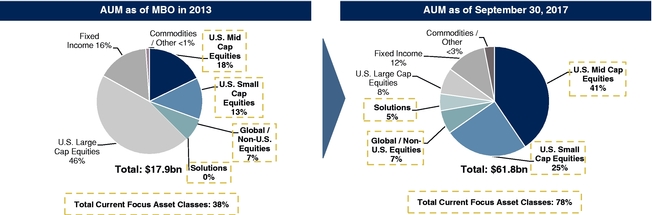

Since our management-led buyout with Crestview GP from KeyCorp in August 2013, we have completed three acquisitions and a strategic minority investment and grown our AUM from $17.9 billion to $61.8 billion as of December 31, 2017. We regularly evaluate potential acquisition candidates and maintain a strong network of industry participants and advisors that provide opportunities to establish potential target relationships and source transactions. Our management leads and participates in our acquisition strategy, leveraging their many years of experience actively operating our Company on a day-to-day basis towards successfully sourcing, executing and integrating sizable acquisitions. We are seeking to make acquisitions that will add high quality investment teams, that enhance our growth and financial profile, improve our diversification by asset class and investment strategy, achieve our integration and synergy expectations, expand our distribution capabilities and optimize our operating platform.

We believe, based on our acquisition experience, that there is a significant opportunity for us to grow through additional acquisitions. We believe the universe of potential acquisition targets has grown as a result of the evolution of the distribution landscape, the increasing cost of regulatory compliance, management fee compression and outflows from actively managed funds to passive products. In the United States, as of December 31, 2017, investment management firms with up to $100 billion of AUM collectively manage approximately $9.3 trillion total AUM. We intend to focus our acquisition efforts on firms with $10 billion to $75 billion in AUM, a size range in which we have successfully executed two transactions—the Munder Acquisition and the RS Acquisition—and in which investment management firms in the United States collectively manage approximately $5.8 trillion of AUM.

Through our acquisitions to date, we have added Franchises we believe can outperform the market, and where we have a strong understanding of the core business's ability to drive growth for those Franchises and our Company as a whole. These acquisitions have shifted our AUM mix from 38% in our current focus asset classes at the time of our management-led buyout in 2013 to 78% in our current focus asset classes as of December 31, 2017. We believe our deliberate repositioning of our

8

business through acquisitions has equipped us with stronger investment strategies in more compelling asset classes, providing us with a next generation investment management platform.

We offer our clients an array of equity and fixed income strategies that encompass a diverse spectrum of market capitalization segments, investment styles and approaches. Our current focus asset classes—which consist of U.S. small- and mid-cap equities, global/non-U.S. equities and solutions—collectively comprised 78% of our AUM as of December 31, 2017. We believe strategies in these asset classes are better positioned to attract positive net flows and maintain stable fee rates over the long term. Furthermore, we believe we are generally able to meet investor demand in these asset classes; as of December 31, 2017, we estimate we had approximately $110 billion of total excess capacity in our four- and five-star funds in these asset classes that were open to new investors (of which approximately $63 billion is in our Solutions Platform).

9

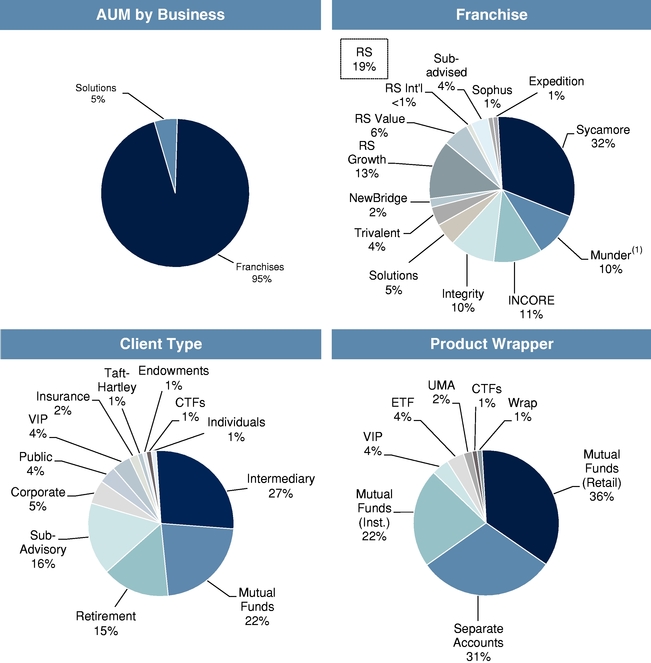

As outlined below, our business is diversified on multiple fronts, including by business, Franchise and Solutions Platform, client type and product wrapper.

Data as of December 31, 2017.

- (1)

- Includes assets managed by Diversified, which were transferred to Munder on May 15, 2017. See "—Our Franchises—Munder Capital Management."

Within individual asset classes, our Franchises employ different investment approaches. This diversification reduces the correlation between return streams generated by multiple Franchises investing within the same asset class. For example, we have three Franchises focused on Emerging Markets within global/non-U.S. equity, each with a different investment approach. Trivalent's investment team is one of the longest industry practitioners of small cap investing and primarily focuses on quantitative analysis for stock selection. Sophus employs a front-end quantitative screen balanced to

10

first rank stocks, then further applies fundamental research to make investment decisions. Expedition pursues a fundamental bottoms-up approach, with an investment team that travels extensively for on-site due diligence. Due to the differences in investment approaches, each Franchise has a different return profile for investors in different market environments while having exposure to their desired asset classes. In this manner, we purposefully manage our Franchises to ensure that each has a distinct approach within its respective asset classes.

Data as of December 31, 2017.

- (1)

- Includes assets managed by Diversified, which were transferred to Munder on May 15, 2017. See "—Our Franchises—Munder Capital Management."

Our multi-channel distribution capabilities provide another degree of diversification, with approximately 58% of our AUM from institutional clients and 42% from retail clients as of December 31, 2017. We believe this client diversification has a stabilizing effect on our revenue, as institutional and retail investors have shown to exhibit different demand patterns and respond to trends in different ways.

We believe we have created a strong alignment of interests through employee ownership, our Franchise revenue share structure and employee investments in Victory products. Notably, the majority of our employee stockholders acquired their equity in connection with the management-led buyout with Crestview GP from KeyCorp, as well as in connection with the Munder Acquisition and the RS Acquisition. We believe the opportunity to own equity in a well-diversified company is attractive, both to existing employees and those who join as part of acquisitions. We principally compensate our investment professionals through a revenue share program, which we believe further incentivizes our investment professionals to focus on investment performance, while simultaneously minimizing potential distractions from the expense allocation process that would be involved in a profit-sharing program. In addition, as of December 31, 2017, our employees collectively have invested approximately $100 million in products we manage, directly aligning their investment outcomes with those of our clients. We believe the combination of these mechanisms has promoted long-term thinking, an enhanced client experience and ultimately the creation of value for our stockholders.

11

Our senior management team has an average of over 20 years of experience in the sector, each bringing significant expertise to his or her role. Our CEO and COO have been with us (and our predecessor) for 13 and 12 years, respectively, overseeing the transformation of the business from a bank subsidiary to an independent investment management firm. Our Franchises' CIOs are highly experienced, having an average of approximately 26 years of experience. Our sales leaders have had significant tenures, with an average of approximately 28 years of experience with us or a predecessor firm.

Competitive Strengths

We believe we have significant competitive strengths that position us for sustained growth over the long term.

Integrated Multi-Boutique Model Providing Investment Autonomy, Centralized Distribution, Marketing and Support Functions to Investment Franchises

We believe our integrated multi-boutique model allows us to achieve the benefits from both the scale of large managers and the focus of smaller managers. Our Franchises retain investment autonomy while benefiting from our centralized middle- and back-office functions. We have demonstrated an ability to integrate our Franchises onto our flexible infrastructure without significantly increasing incremental fixed costs, which is a key component to the scalability of our model. Our structure enables our Franchises to focus their efforts on the investment process, providing them the platform to enhance their investment performance and consequently their growth prospects. Our centralized operations allow our Franchises to customize their desired investment support functions in ways that are best suited for their investment workflow. Through our centralized distribution platform, our Franchises are able to sell their products to institutional investors, retirement plans, brokerages and wealth managers to which it is challenging for smaller managers to gain access.

Within our model, each Franchise retains its own brand and logo, which it has built over time. Unlike other models with unified branding, there is no requirement for newly acquired Franchises to adjust their product set due to pre-existing products on our platform; they are simply marketed under their own brand as they were previously. Because of this dynamic, we have the flexibility to add new Franchises either to gain greater exposure to certain asset classes or increase capacity in places where we already have exposure.

Proven Acquirer with Compelling Proposition

We believe our platform will allow us to continue to be a consolidator within the investment management industry, providing us with an opportunity to further grow and scale our business. Through several transactions, we have demonstrated an ability to successfully source, execute and integrate new Franchises.

We believe our integrated multi-boutique model is compelling for potential Franchises with entrepreneurial leaders. Under our model, Franchises retain the brands they have built as well as autonomy over their investment decisions, while simultaneously benefiting from the ability to leverage our centralized distribution, marketing and operations platform. Our model further relieves our Franchises of much of their administrative burdens and allows them instead to focus on the investment process, which we believe provides them a platform to enhance their performance. By offering a platform on which Franchises can focus on their core competencies, grow their own brand faster and participate in a revenue share program focused on investment performance rather than expense allocation, we believe we are providing an attractive proposition. Furthermore, we believe Victory equity is attractive to Franchise investment personnel, as these personnel receive the advantage of sharing in the potential upside of the entirety of our diversified investment management business.

12

Because we integrate a significant portion of each Franchise's distribution, operational and administrative functions, we have been able to extract significant expense synergies from our acquisitions, enabling us to create greater value from transactions. As of December 31, 2017, we had generated net annualized expense synergies of approximately $76 million from our three acquisitions. In our most recent acquisition of RS Investments, we successfully achieved net annual expense synergies of $52 million, which represents over 45% of RS Investments' expenses in the year prior to the acquisition. We incurred $9.9 million in total one-time expenses as of December 31, 2017 to achieve those synergies.

As a disciplined acquirer, we will seek to continue to augment our next generation investment management platform by focusing on acquisition candidates that provide capabilities that are complementary to achieve our integration and synergy expectations, expand our distribution capabilities and optimize our operating platform. Since our management-led buyout with Crestview GP, our strategy of enhancing our capabilities within our current focus asset classes has driven strong organic growth within these asset classes and for our Company overall. Furthermore, the distribution channels obtained through acquisitions have enhanced our flows.

Portfolio of Specialized Asset Classes with Potential for Outperformance

In assembling our portfolio of Franchises, we have selected investment managers offering strategies in specialized asset classes where active managers have shown an established track record of outperformance relative to benchmarks through security selection and portfolio construction. We continue to build our platform to address the needs of clients who would like exposure to asset classes that have potential for alpha generation. We find that larger industry trends of flows moving from actively managed strategies to passive ones are not as pronounced in our current focus asset classes.

Diversified Platform Across Investment Strategies, Franchises and Client Type

We have strategically built an investment platform that is diversified by investment strategy, Franchise and client type. Within each asset class, Franchises with overlapping investment mandates still contribute to our diversification by pursuing different investment philosophies and/or processes. For example, U.S. small cap equities, which accounted for approximately 25% of our AUM as of December 31, 2017, consists of four Franchises, each following a different investment strategy. We believe the diversity in investment styles reduces the correlation between the return profiles of strategies within the same asset class, and consequently provides an additional layer of diversification and AUM and revenue stability.

We believe our AUM is well diversified at the Franchise level, with no Franchise accounting for more than 32% of AUM, and the median Franchise comprising 8% of AUM, as of December 31, 2017. Furthermore, we believe our Franchises' brand independence reduces the impact of each individual Franchise's performance on clients' perceptions of the other Franchises. The distribution of AUM by Franchise, as well as succession planning, mitigates the level of key man risk typically associated with investment management businesses.

We believe our client base serves as another important diversifying element, as different client segments have shown to have distinct characteristics, including asset class and product preferences, sales and redemptions trends, and exposure to secular trends. We strive to maintain a balance between institutional and retail clients, with 58% and 42% of our AUM as of December 31, 2017 in each of these channels, respectively. We also have the capability to deliver our strategies in product wrappers designed to meet the needs and preferences of investors in each channel. These product wrappers include mutual funds with channel-specific share classes, institutional separate accounts, SMA/UMA/CTF products and ETFs. If a strategy is currently not offered in the wrapper of choice for a client, we have the infrastructure and ability to create a new product wrapper, which helps our Franchises further diversify their investor bases.

13

Attractive Financial Profile

Our revenues have shown to be recurring in nature, as they are based on the level of client assets we manage. The fees we earn have remained high relative to industry averages, as the majority of our strategies are in asset classes that are in higher demand and typically command higher fee rates. From 2013 through December 31, 2017, our AUM-weighted average fee rate increased by seven basis points, primarily due to changes in asset class, product and client mix as we repositioned our business to focus on higher-fee asset classes. We would note that with the growth of our Solutions Platform, our average fee rate is likely to decline as that business continues to grow. In addition, our fee revenue is generated from strategies with differing return profiles, thus diversifying our revenue stream.

Because we largely outsource our middle- and back-office functions, as well as technology support, we have relatively minimal capital expenditure requirements. Approximately two-thirds of our expenses are variable in nature, consisting of the incentive compensation pool for employees, sales commissions, third-party distribution costs, sub-advising and the fees we pay to certain of our vendors.

We have identified three primary net income growth drivers. Firstly, we grow our AUM organically through inflows into our strategies and the market appreciation of those strategies. Secondly, we have a proven ability to grow through synergistic acquisitions. Thirdly, we have constructed a scalable platform; as our AUM increases, we expect margins to expand.

Economic and Structural Alignment of Interests Promotes Owner-Centric Culture

Through our revenue share compensation model and broad employee ownership, we have structurally aligned our employees' interests with those of our clients and other stockholders and have created an owner-centric culture that encourages employees to act in the best interests of clients and our Company, as well as to think long term. Additionally, our employees invest in products managed by our Franchises and Solutions Platform, providing direct alignment with the interests of our clients.

We directly align the compensation paid to our investment teams with the performance of their respective Franchises by structuring formula-based revenue sharing on the products they manage. We believe that compensation based on revenue rather than profits encourages investment professionals to focus their attention on investment performance, while encouraging them to provide good client service, focus on client retention and attract new flows. We believe the formula-based, client-aligned nature of our revenue sharing fosters a culture of transparency where Franchises understand how and on what terms they are being measured to earn compensation.

We believe both the high percentage of employee ownership and employees' purchase of a significant percentage of their equity creates a collective alignment with our success. Further, we believe granting equity is attractive to potential new employees and is a retentive mechanism for current employees. As of January 29, 2018, our employees beneficially owned approximately 27% of our shares, having purchased approximately 40% of this equity. In addition to being aligned with our financial success through their equity ownership, our employees collectively have invested approximately $100 million in products we manage.

Our Growth Strategy

We have a purposeful strategy aimed to achieve continued growth and success for our Company and our Franchises. The growth we pursue is both organic and inorganic. We seek to grow organically by offering our clients strategies with strong performance track records in specialized asset classes. We intend to continue to supplement our growth through disciplined acquisitions. We primarily seek to acquire investment management firms that will add high quality investment teams, that enhance our growth and financial profile, improve our diversification by asset class and investment strategy, achieve our integration and synergy expectations, expand our distribution capabilities and optimize our

14

operating platform. We believe one of our key advantages in a competitive sales process is our ability to provide access to new distribution channels. We believe that our centralized distribution and marketing platform drives organic growth at our acquired Franchises both by opening new distribution channels to them and providing them with the support of our sales and marketing professionals while allowing them to focus on investment performance.

Organic Growth

A key driver of our growth strategy lies in enhancing the strength of each of our existing Franchises. We primarily do this by providing them with access to our centralized distribution, marketing and operations platform. Largely unencumbered by the burdens of administrative and operational tasks, our investment professionals can focus on delivering investment excellence and maintaining strong client relationships, thus driving net flows. We also expect to help our Franchises through fund and share class launches and product development. We believe we are well positioned to help our Franchises grow their product offerings and diversify their investor base, with the ability to offer their strategies in multiple product wrappers to meet clients' needs.

Our platform provides significant operating leverage to our Franchises and is a key factor in our continued success. As we continue to grow and expand, we will continue to look for ways to invest in our operations, in order to achieve greater economies of scale and provide better products to our Franchises. We continue to expand our distribution capabilities as well, demonstrated by our entry in 2016 into an exclusive distribution agreement with an independent investment management firm in Japan, as well as our launch during the first quarter of 2017 of two emerging market UCITS funds with a global financial advisory firm.

We continually look to the future, and as a result, our infrastructure investments can range from the immediate to the long term. As an example, we have acquired a minority interest in Cerebellum Capital, an investment management firm that specializes in machine learning. Cerebellum Capital's techniques help to design, execute and improve investment programs and the firm is working with a number of our Franchises to help them optimize their investment processes. We believe investments like these provide tools that can provide enhancements to our Franchises' investment processes, give our Franchises access to proprietary technology that can give them an advantage and help position our Franchises for the future.

Certain of our Franchise strategies have or may have capacity constraints, and we may choose to limit access to new or existing investors in these strategies. We have generally closed to new investors two Sycamore mutual funds with an aggregate of $16.0 billion in AUM as of December 31, 2017.

We believe there is significant growth potential in solutions products, most notably in ETFs. Through our VictoryShares brand, we offer ETFs that seek to improve the risk, return and diversification profile of client portfolios. Our approach furthers our commitment to rules-based investing and includes single-and multi-factor strategies designed to provide a variety of outcomes, including maximum diversification, dividend income, downside mitigation, minimum volatility and targeted factor exposure. VictoryShares is designed to provide investors with rules-based solutions that bridge the gap between the active and passive elements of their portfolios.

Since the CEMP Acquisition in 2015, our ETF products have grown by over 1000% to approximately $2.2 billion in AUM as of December 31, 2017. As of December 31, 2017, we ranked among the top 30 U.S. ETF issuers by net sales for the preceding 12 months as a percentage of beginning of period assets and ranked in the top quartile for annual growth for the preceding 12 months. Since December 31, 2017, we have launched three new ETFs that track volatility weighted indexes developed in partnership with NASDAQ.

15

Growth through Acquisitions

We intend to continue to accelerate growth through disciplined acquisitions. We regularly evaluate potential acquisition candidates and maintain a strong network among industry participants and advisers that provide opportunities to establish potential target relationships and source transactions. We primarily seek investment management firms that will add high quality investment teams, that enhance our growth and financial profile, improve our diversification by asset class and investment strategy, achieve our integration and synergy expectations, expand our distribution capabilities and optimize our operating platform. We have a preference for investing in asset classes where we have knowledge, provided that further acquisitions must continue to diversify our portfolio in terms of investment strategy. Our focus is not only on U.S. investment managers but also on investment styles that have an international or emerging market presence.

We believe the universe of potential acquisition targets has grown as a result of the evolution of the distribution landscape, the increasing cost of regulatory compliance, management fee compression and outflows from actively managed funds to passive products. We believe our integrated multi-boutique model makes us an attractive acquirer. Further, our centralized distribution, marketing and operations platform allows us to achieve synergies.

Our Franchises

As of December 31, 2017, seven of our nine Franchises managed over $1 billion in AUM, providing us with diversification across investment approaches, with no Franchise accounting for more than 32% of our AUM. Our Franchises are independent from one another from an investment perspective, maintain their own separate brands and logos, which they have built over time, and are led by dedicated CIOs. We customize each Franchise's interactions with our centralized platform and the formula for its respective revenue share.

Our Franchises are:

Expedition Investment Partners

Expedition Investment Partners applies a fundamental growth-oriented approach to investing in secular changes occurring in the small-capitalization companies of emerging and frontier classified countries. Expedition's team has diverse backgrounds, is fluent in multiple languages and travels extensively for on-site due diligence at opportunistic and lesser known companies in the emerging and frontier market areas. Expedition is based in New York, NY and managed $0.5 billion in AUM as of December 31, 2017. Expedition's investment team consists of eight professionals with an average industry experience of approximately 17 years.

INCORE Capital Management

INCORE Capital Management uses niche and customized fixed income strategies focusing on exploiting structural inefficiencies in the U.S. fixed income markets. INCORE conducts extensive research that includes identifying slower prepayment rates on mortgages, market inefficiencies along particular areas of the yield curve, and proprietary quantitative credit quality modeling. INCORE is based in Birmingham, MI and Brooklyn, OH and managed $6.5 billion in AUM as of December 31, 2017. INCORE's investment team consists of 14 professionals with an average industry experience of approximately 19 years.

Integrity Asset Management

Integrity Asset Management utilizes a dynamic value-oriented approach to U.S. mid- and small-capitalization companies. Integrity conducts fundamental stock research to find attractive companies

16

that have compelling discounts to the prevailing market conditions. Integrity is based in Rocky River, OH, and managed $6.3 billion in AUM as of December 31, 2017. Integrity's investment team consists of eleven professionals with an average industry experience of approximately 18 years.

Munder Capital Management

Munder Capital Management has an experienced team utilizing a "Growth-at-a-Reasonable-Price" strategy in the U.S. equity markets designed to generate consistently strong performance over a market cycle. Munder performs extensive fundamental research in order to find attractive growth companies that it expects will exceed market expectations. Of the companies with independently determined growth attributes, valuation is applied to find the most inexpensive growth companies. Munder is based in Birmingham, MI, and managed $6.4 billion in AUM (including assets formerly managed by Diversified) as of December 31, 2017. Munder's investment team consists of eight professionals with an average industry experience of approximately 25 years.

NewBridge Asset Management

NewBridge Asset Management applies a high conviction growth-oriented strategy focusing on U.S. large-capitalization companies experiencing superior long-term growth rates with strong management teams. Most of NewBridge's team has worked together since 1996 doing fundamental research on high growth companies. NewBridge usually holds between 25 and 35 securities. NewBridge is based in New York, NY and managed $1.4 billion in AUM as of December 31, 2017. NewBridge's investment team consists of six professionals with an average industry experience of approximately 23 years.

RS Investments

RS Investments is made up of three investment teams: RS Value; RS Growth; and RS International. RS Value and RS Growth apply an original and proprietary fundamental approach to investing in value and growth-oriented U.S. equity strategies. The RS Value and RS Growth teams conduct hundreds of company research meetings each year. RS International utilizes a highly disciplined quantitative approach to managing core-oriented global and international equity strategies. RS Investments is based in San Francisco, CA and managed $11.6 billion in AUM as of December 31, 2017. RS Investments' three investment teams consist of 17 professionals with an average industry experience of approximately 18 years.

Sophus Capital

Sophus Capital utilizes a disciplined quantitative process that accesses market conditions in emerging equity markets and rank orders attractive companies that are further researched from a fundamental basis. Sophus' team members travel to companies to conduct fundamental research. Sophus is based in Des Moines, IA, with offices in London, Hong Kong and Singapore, and managed $0.8 billion in AUM as of December 31, 2017. Sophus' investment team consists of ten professionals with an average industry experience of approximately 15 years.

Sycamore Capital

Sycamore Capital applies a quality value-oriented approach to U.S. mid- and small- capitalization companies. Sycamore conducts fundamental research to find companies with strong high-quality balance sheets that are undervalued versus comparable high quality companies. Sycamore is based in Cincinnati, OH and managed $20.0 billion in AUM as of December 31, 2017, which includes two mutual funds with an aggregate of $16.0 billion in AUM that we have generally closed to new investors. Sycamore's investment team consists of eight professionals with an average industry experience of approximately 16 years.

17

Trivalent Investments

Trivalent Investments utilizes a disciplined approach to stock selection across large to small companies in the international and emerging markets space. Trivalent is one of the longest standing practitioners of international small-capitalization investing in the industry. Trivalent's investment strategy is primarily a proprietary quantitative process that drives stock selection across various countries. Trivalent frequently conducts reviews of stock selection rankings within a portfolio construction and risk management context in order to isolate performance to stock selection. Trivalent is based in Boston, MA, and managed $2.6 billion in AUM as of December 31, 2017. Trivalent's investment team consists of six professionals with an average industry experience of approximately 23 years.

Non-Franchise/Subadvisory Relationships

Park Avenue

Park Avenue Institutional Advisers LLC, a unit of New York-based Guardian Life Insurance Company of America, subadvises five of our fixed income funds: the Victory Floating Rate, High Yield, Strategic Income, Tax-Exempt, and High Income Municipal Bond funds. Guardian was the controlling shareholder of RS Investments prior to the RS Acquisition. Park Avenue and VCM have entered into a written sub-advisory agreement, pursuant to which Park Avenue provides sub-advisory services with respect to those fixed income funds, subject to the general oversight of VCM and the board of trustees of the Victory Funds.

Under the sub-advisory agreement, VCM pays Park Avenue monthly fees for each sub-advised fund based on a percentage of the fees due from such fund to VCM for such month.

Park Avenue employs a fundamental value approach to investing that gauges value relative to risk, rather than simply reaching for yield. Investment decisions are based on rigorous, independent research into each investment's credit quality, structure and collateral. Park Avenue is based in New York, NY, and managed $1.0 billion in AUM for the Company as of December 31, 2017. Park Avenue's investment team consists of 25 analysts and portfolio managers with an average industry experience of approximately 26 years.

SailingStone

SailingStone Capital Partners is an independent investment advisory firm focused exclusively on providing investment solutions in the global natural resource sector. SailingStone manages concentrated, long-only natural resource equity portfolios for investors and subadvises our Victory Global Natural Resources Fund. SailingStone was formed in 2014 by members of the RS Investments global natural resources, or GNR, team, pursuant to a written agreement between RS Investments and the GNR team to spin off the GNR business into an independent specialized investment management firm. RS Investments assigned all of its rights in the agreement to VCM in the RS Acquisition. SailingStone's sub-advisory services are subject to the general oversight of VCM and the board of trustees of the Victory Funds.

Under the sub-advisory agreement, VCM pays SailingStone a monthly fee, based on the Victory Global Natural Resource Fund's assets.

In addition, through December 31, 2018, we are entitled to a declining percentage of the revenue of SailingStone from certain separate account clients that were transferred in January 2014.

SailingStone is based in San Francisco, CA, and managed $1.4 billion in AUM for the Company as of December 31, 2017. SailingStone's investment team consists of five professionals with an average industry experience of approximately 21 years.

18

Solutions Platform

Our Solutions Platform consists of multi-Franchise and customized solutions strategies that are primarily rules-based. We offer our Solutions Platform through a variety of vehicles, including separate accounts, mutual funds and VictoryShares, which is our ETF brand. Like our Franchises, our Solutions Platform is operationally integrated and supported by our centralized distribution, marketing and operational support functions. As of December 31, 2017, VictoryShares' investment management fees were generally between 30 and 45 basis points.

Our Products and Investment Performance

As of December 31, 2017, our nine Franchises and Solutions Platform offered 65 investment strategies with the majority in our current focus asset classes, consisting of U.S. small- and mid-cap equities, global/non-U.S. equities and solutions. These asset classes collectively comprised 78% of our $61.8 billion AUM as of December 31, 2017.

Product Mix

Our investment strategies are offered through open-end mutual funds, SMAs, UMAs, ETFs, CTFs and wrap separate account programs. Our product mix is expanding, as we have the ability to add product wrappers to any strategy that is offered by our Franchises.

Each individual asset class is diversified through the investment strategies of our Franchises, which each employ different investment approaches. Due to the differences in investment approaches, each of our Franchises has different return profiles for investors in different market environments while having exposure to their desired asset classes.

We have repositioned our business to focus on higher-fee asset classes, resulting in increased average fees. From 2013 through the year ended December 31, 2017, our AUM-weighted average fee rate increased by seven basis points, primarily due to changes in asset class, product and client mix. We would note that with the growth of our Solutions Platform, our average fee rate is likely to decline as that business continues to grow. Our ability to sustain this level of fee rates depends on future growth in specific asset classes and distribution channels.

We believe we are well-positioned for the phased implementation of the DOL's final regulation defining what constitutes investment advice. Among other things, the DOL's final rules restrict investment advisors from selling to ERISA plans and IRAs investment products that generate direct or indirect commissions payable by the holders thereof, unless an exemption applies. The DOL's final rule applies only to sales after June 9, 2017, and there is an exception, generally, for existing assets. In addition, certain provisions of relevant exemptions under the DOL's final rule will not be applicable until July 1, 2019. We believe we offer a wide range of products to investors covered by the DOL's final rules, and we believe the phased implementation of the DOL Rule and related exemptions will not impair our competitiveness with respect to sales from retirement investors.

Investment Performance

Our Franchises have established a long track record of benchmark-relative outperformance, including prior to their acquisition by us. As of December 31, 2017, 80% of our strategies by AUM had returns in excess of their respective benchmarks over a ten-year period, 84% over a five-year period and 84% over a three-year period. On an equal-weighted basis, 75% of our strategies have outperformed their benchmarks over a ten-year period, 77% over a five-year period and 72% over a three-year period. We consider both the AUM-weighted and equal-weighted metrics in evaluating our investment performance. The advantage of the AUM-weighted metric is that it reflects the investment performance of our Company as a whole, indicating whether we tend to outperform our benchmarks

19

for the assets we manage. The disadvantage is that the metric fails to capture the overall effectiveness of our individual investment strategies; it does not capture whether most of our strategies tend to outperform their respective benchmarks. Conversely, the Equal-weighted metric reflects the overall effectiveness of our individual investment strategies, but fails to capture the investment performance of our Company as a whole.

The table below sets forth our 10 largest strategies by AUM as of December 31, 2017 and their average annual total returns compared to their respective benchmark index over the one-, three-, five- and 10-year periods ended December 31, 2017. These strategies represented approximately 64% of our total AUM as of December 31, 2017.

Strategy/Benchmark Index

|

1 year | 3 years | 5 years | 10 years | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Sycamore Mid Cap Value(1) |

16.74 | % | 13.12 | % | 17.41 | % | 11.86 | % | |||||

Russell Midcap Value |

13.34 | % | 9.00 | % | 14.68 | % | 9.10 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

3.40 | % | 4.12 | % | 2.73 | % | 2.76 | % | |||||

Sycamore Small Cap Value(1) |

12.92 | % | 14.24 | % | 16.71 | % | 11.90 | % | |||||

Russell 2000 Value |

7.84 | % | 9.55 | % | 13.01 | % | 8.17 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

5.08 | % | 4.69 | % | 3.70 | % | 3.73 | % | |||||

Munder Mid-Cap Core Growth |

25.73 | % | 9.66 | % | 14.68 | % | 8.55 | % | |||||

Russell Midcap |

18.52 | % | 9.58 | % | 14.96 | % | 9.11 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

7.21 | % | 0.08 | % | –0.28 | % | –0.56 | % | |||||

Integrity Small Cap Value Equity |

13.60 | % | 10.51 | % | 15.95 | % | 11.39 | % | |||||

Russell 2000 Value |

7.84 | % | 9.55 | % | 13.01 | % | 8.17 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

5.76 | % | 0.96 | % | 2.94 | % | 3.22 | % | |||||

RS Mid Cap Growth |

22.42 | % | 9.91 | % | 15.98 | % | 8.11 | % | |||||

Russell Midcap Growth |

25.27 | % | 10.30 | % | 15.30 | % | 9.10 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

–2.85 | % | –0.39 | % | 0.68 | % | –0.99 | % | |||||

RS Small Cap Growth |

38.72 | % | 12.94 | % | 19.27 | % | 11.36 | % | |||||

Russell 2000 Growth |

22.17 | % | 10.28 | % | 15.21 | % | 9.19 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

16.55 | % | 2.66 | % | 4.06 | % | 2.17 | % | |||||

Trivalent International Small-Cap Equity |

38.21 | % | 14.77 | % | 15.77 | % | 6.88 | % | |||||

S&P Developed ex-U.S. SmallCap |

32.37 | % | 13.32 | % | 12.12 | % | 5.22 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

5.84 | % | 1.45 | % | 3.65 | % | 1.66 | % | |||||

RS Large Cap Value |

19.31 | % | 8.87 | % | 15.48 | % | N/A | ||||||

Russell 1000 Value |

13.66 | % | 8.65 | % | 14.04 | % | 7.10 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

5.65 | % | 0.22 | % | 1.44 | % | N/A | ||||||

RS Small Cap Value |

15.77 | % | 9.46 | % | 13.05 | % | 9.45 | % | |||||

Russell 2000 Value |

7.84 | % | 9.55 | % | 13.01 | % | 8.17 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

7.93 | % | –0.09 | % | 0.04 | % | 1.28 | % | |||||

Integrity Small/Mid Cap Value Equity |

19.62 | % | 11.13 | % | 15.24 | % | 10.22 | % | |||||

Russell 2500 Value |

10.36 | % | 9.30 | % | 13.27 | % | 8.82 | % | |||||

| | | | | | | | | | | | | | |

Excess Return |

9.26 | % | 1.83 | % | 1.97 | % | 1.40 | % | |||||

- (1)

- Includes two mutual funds with an aggregate of $16.0 billion in AUM as of December 31, 2017 that we have generally closed to new investors.

20

For each period shown, performance statistics include only strategies that existed during that entire period (including prior to our acquisition of the strategies).

Our products have consistently won awards for performance, with four consecutive years of ranking in Barron's Top Fund Families ratings, coming in at #10, #21, #25 and #15 overall for 2017, 2016, 2015 and 2014, respectively.

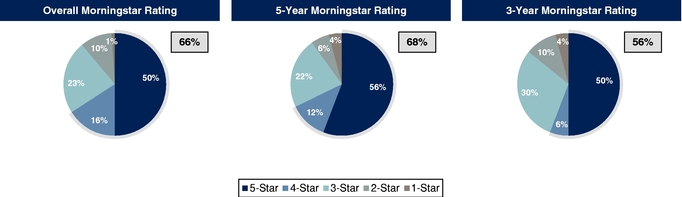

In addition, a significant percentage of our mutual fund assets have high Morningstar ratings. As of December 31, 2017, 24 Victory Funds and ETFs had four or five star overall ratings. On an AUM-weighted basis, 66% of our fund AUM had an overall rating of four or five stars by Morningstar. Over a five-year and three-year basis, 68% and 56% of our fund AUM achieved four or five star ratings, respectively.

Morningstar data as of December 31, 2017.

Integrated Distribution, Marketing and Operations

The centralization of our distribution, marketing and operational functions is a key component in our model, allowing our Franchises to focus on their core competencies of security selection and portfolio construction. In addition, we believe it provides our Franchises with the benefits of operating at scale, providing them with access to larger clients as well as a more streamlined cost structure. As of December 31, 2017, we had 59 employees in management and support functions, 96 sales and marketing professionals and 112 investment professionals.

Our centralized distribution and marketing functions lead the sales effort for both our institutional and retail channels. Our sales teams are staffed with accomplished professionals that are given specific training on how to position each of our strategies. Partially due to our background in the institutional

21

market, our teams have focused on developing relationships with institutional consultants and retail intermediaries. These relationships can enhance our platform's overall reach and allow our Franchises and Solutions Platform to access larger clients that typically would not be willing to spend time with smaller investment management firms.

To ensure high levels of client service, our sales teams liaise regularly with product specialists at our Franchises. The specialists are tasked with responding to institutional client and retail inquiries on product performance and also educating prospective investors and retail partners in coordination with the relevant internal sales team members. Our distribution and marketing professionals collaborate closely with our Franchises' product specialists in order to attract new clients while also servicing and generating additional sales from existing clients.

Institutional Sales: Our institutional sales team attracts and builds relationships with institutional clients, the largest institutional consultants and mutual fund complexes and other organizations seeking sub-advisers. Our institutional clientele includes corporations, public funds, non-profit organizations, Taft-Hartley plans, sub-advisory clients, international clients and insurance companies. Our institutional sales and client-service professionals manage existing client relationships, serve consultants and prospects and/or focus on specific segments. They have extensive experience and a comprehensive understanding of our investment activities. On average, each of our client-facing institutional sales professionals has over 20 years of industry tenure.

Retail Sales: Our retail sales team is split among regional external wholesalers, retirement specialists and national account specialists, all of whom are supported by an internal calling desk. In the retail channel, we focus on gathering assets through intermediaries, such as banks, broker-dealers, wirehouses, retirement platforms and RIA networks. As of December 31, 2017, 65% of our retail AUM was through intermediaries, while 35% was through retirement platforms. We offer mutual funds and separately managed wrap and unified managed accounts on intermediary and retirement platforms. We have agreements with many of the largest platforms in our retail channel, which has provided an opportunity to place our retail products on those platforms. Further, to enhance our presence on large distribution platforms, we have focused our efforts on servicing intermediary home offices and research departments. These efforts have led to strong growth in platform penetration, as measured by investment products on approved and recommended lists, as well as our inclusion in model portfolios. This penetration provides the opportunity for us to sell more products through distribution platforms. As of December 31, 2017, we had at least two and as many as 13 products on the research recommended/model portfolios of the top ten U.S. intermediary platforms by AUM. These top intermediary platforms included Morgan Stanley, Wells Fargo, Merrill Lynch and Raymond James. We also have agreements with all of the top 20 retirement platforms by AUM, including Fidelity, Vanguard, Voya and Merrill Lynch. As of December 31, 2017, we had at least one and as many as eight approved products on the recommended list of each of those top 20 retirement platforms that have recommended lists.

Marketing: Our distribution efforts are supplemented by our marketing function, which is primarily responsible for enhancing the visibility and quality of our portfolio of brands. They are specifically tasked with managing corporate, Franchise and Solutions Platform branding efforts, database management, the development of marketing materials, website design and the publishing of white papers. They are also a key component in our responses to requests for proposals sent over by prospective clients. The success of their efforts can be seen by our eVestment #1 ranking for Institutional Brand Awareness among asset managers with between $25 billion and $50 billion in AUM in 2015 and our #4 ranking among asset managers with between $50 billion and $100 billion in AUM in both 2016 and 2017.

Operations: Our centralized operations functions provide our Franchises and Solutions Platform with the support they need so that they can focus on their investment processes. Our centralized

22

functions include distribution, marketing, trading platforms, risk and compliance, middle- and back-office support, finance, human resources, accounting and legal. Although our operations are centralized, we do allow our Franchises a degree of customization with respect to their desired investment support functions, which we believe helps them maintain their individualized investment processes and minimize undue disruptions.

We outsource certain middle- and back-office activities, such as trade settlement, portfolio analytics, custodian reconciliation, portfolio accounting, corporate action processing, performance calculation and client reporting, to scaled, recognized service providers, who provide their services to us on a variable-cost basis. Systems and processes are customized as necessary to support our investment processes and operations. We maintain relationships with multiple vendors for the majority of our outsourced functions, which we believe mitigates vendor-specific risk. We also have information security, business continuity and data privacy programs in place to help mitigate risk.

Outsourcing these functions enables us to grow our AUM, both organically and through acquisitions, without the incremental capital expenditures and working capital that would typically be needed. Under our direction and oversight, our outsourced model enhances our ability to integrate our acquisitions, as we are experienced in working with our vendors to efficiently bring additional Franchises onto our platform in a cost-efficient manner.

We believe both the scalability of our business and our cost structure, in which approximately two-thirds of our expenses are variable, should drive increasing margins and facilitate free cash flow conversion. Additionally, we believe having a majority of our expenses tied to AUM and the number of client accounts provides downside margin protection should there be sustained net outflows or adverse market conditions.

Competition

We compete in various markets, asset classes and structured vehicles. We sell our investment products in the traditional institutional segments and intermediary and retirement distribution channels, which include mutual funds, wrap accounts, UMAs and ETFs. We face competition in attracting and retaining assets from other investment management firms. Additionally, we compete with other acquirers of investment management firms, including independent, fully integrated investment management firms and multi-boutique businesses, insurance companies, banks, private equity firms and other financial institutions.

We compete with other managers offering similar strategies. Some of these organizations have greater financial resources and capabilities than we are able to offer and have had strong performance track records. We compete with other investment management firms for client assets based on the following primary factors:

- •

- our investment performance track record of delivering alpha;

- •

- the specialized nature of our investment strategies;

- •

- fees charged;

- •

- access to distribution channels;

- •

- client service; and

- •

- our employees' alignment of interests with investors.

We compete with other potential acquirers of investment management firms primarily on the basis of the following factors:

- •

- the strength of our distribution relationships;

23

- •

- the value we add through centralized distribution, marketing and operations platforms;

- •

- the investment autonomy Franchises retain post acquisition;

- •

- the tenure and continuity of our management and investment professionals; and

- •

- the value that can be delivered to the seller through realization of synergies created by the combination of the businesses.

Our ability to continue to compete effectively will also depend upon our ability to retain our current investment professionals and employees and to attract highly qualified new investment professionals and employees. For additional information concerning the competitive risks that we face, see "Risk Factors—Risks Related to Our Industry—The investment management industry is intensely competitive."

Employees

As of December 31, 2017, we had approximately 267 employees. We are not subject to any collective bargaining agreement and have never been subject to a work stoppage. We believe we have maintained satisfactory relationships with our employees.

Business Organization

Victory Capital Holdings, Inc. was formed in 2013 for the purpose of acquiring VCM and VCA from KeyCorp. VCM is a registered investment adviser managing assets through open-end mutual funds, separately managed accounts, unified management accounts, ETFs, collective trust funds, wrap separate account programs and UCITs. VCM also provides mutual fund administrative services for the Victory Portfolios, Victory Variable Insurance Funds, Victory Institutional Funds and the mutual fund series of Victory Portfolios II, a family of open-end mutual funds, collectively, the Victory Funds. VCM additionally employs all of our U.S. investment professionals across our Franchises and Solutions Platform, which are not separate legal entities. VCA is registered with the SEC as an introducing broker-dealer and serves as distributor and underwriter for the Victory Funds.

Initial Public Offering and Debt Repayment

On February 12, 2018, we issued 11,700,000 shares of Class A common stock in the IPO at a price of $13.00 per share. On March 13, 2018, the Company issued an additional 1,110,860 shares of Class A common stock pursuant to the underwriters' exercise of their option. The net proceeds totaled $156.5 million: $143.0 million received at the closing of the IPO and $13.5 million received at the subsequent closing of the underwriters' exercise of their option, after deducting in each case underwriting discounts.

Net proceeds received from the IPO and the Credit Agreement of $143.0 million and $355.9 million, respectively, were used concurrent with the closing of the IPO, together with $0.8 million of cash on hand, to repay the $499.7 million of outstanding term loans under the 2014 Credit Agreement. On February 21, 2018, the Company repaid $10.0 million of outstanding term loans under the Credit Agreement, and on March 19, 2018, the Company used the net proceeds from the underwriters' exercise of their option and cash on hand to repay an additional $27.0 million of the outstanding term loans under the Credit Agreement. See Note 20 of our audited financial statements included elsewhere in this report.

Regulatory Environment and Compliance

Our business is subject to extensive regulation in the United States at the federal level and, to a lesser extent, the state level, as well as regulation by self-regulatory organizations and outside the

24

United States. Under these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines.

SEC Investment Adviser and Investment Company Registration/Regulation