Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - RSP Permian, Inc. | d752710dex991.htm |

| 8-K - FORM 8-K - RSP Permian, Inc. | d752710d8k.htm |

| Exhibit 99.2

|

Exhibit 99.2

Permian Basin Consolidation

March 28, 2018

|

Forward-Looking Statements and Other Disclaimers

No Offer or Solicitation

This communication relates to a proposed business

combination transaction (the “Transaction”) between RSP Permian, Inc. (“RSP”) and Concho Resources Inc. (“Concho”). This communication is for informational purposes only and does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in

this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where to Find It

In connection with the Transaction, Concho will

file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, that will include a joint proxy statement of RSP and Concho that also constitutes a prospectus of

Concho. RSP and Concho may also file other documents with the SEC regarding the Transaction. The definitive joint proxy statement/prospectus will be sent to the stockholders of Concho and RSP. This document is not a substitute for the registration

statement and joint proxy statement/prospectus that will be filed with the SEC or any other documents that Concho or RSP may file with the SEC or send to stockholders of Concho or RSP in connection with the Transaction. INVESTORS AND SECURITY

HOLDERS OF

RSP AND CONCHO ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR

WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS.

Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and all other documents

filed or that will be filed with the SEC by Concho or RSP through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by RSP will be made available free of charge on RSP’s website at

http://www.rsppermian.com under the heading “SEC Filings” or by contacting RSP’s Investor Relations Department by phone at 214-252-2790. Copies of

documents filed with the SEC by Concho will be made available free of charge on Concho’s website at http://www.concho.com/investors or by contacting Concho’s Investor Relations Department by phone at 432-221-0477.

Participants in Solicitation

Concho, RSP and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Concho’s common stock and

RSP’s common stock in respect to the Transaction. Information regarding RSP’s directors and executive officers is contained in the proxy statement for RSP’s 2017 Annual Meeting of Stockholders filed with the SEC on April 28, 2017

and in the other documents filed after the date thereof by RSP with the SEC. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing RSP’s website at http://www.rsppermian.com. Information regarding

Concho’s executive officers and directors is contained in the proxy statement for Concho’s 2017 Annual Meeting of Stockholders filed with the SEC on April 5, 2017 and in the other documents filed after the date thereof by Concho with

the SEC. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing Concho’s website at http://www.concho.com/investors.

Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Transaction by reading the joint proxy

statement/prospectus regarding the Transaction when it becomes available. You may obtain free copies of this document as described above.

Forward-Looking

Statements and Cautionary Statements

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Concho or RSP expects, believes or

anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,”

“create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,”

“assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any

discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to,

statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties

that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and

conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any

event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Concho may not approve the issuance of new shares of common stock in the Transaction or that stockholders of

RSP may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the

Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of Concho’s common stock or RSP’s common stock, the risk that the Transaction and its announcement could have an

adverse effect on the ability of Concho and RSP to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending

Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as

effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ

materially from those projected.

2

|

Forward-Looking Statements and Cautionary Statements

(cont.)

All such factors are difficult to predict and are beyond Concho’s or RSP’s control, including those detailed in Concho’s annual reports on

Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at

http://www.concho.com and on the SEC’s website at http://www.sec.gov, and those detailed in RSP’s annual reports on Form 10-K, quarterly reports on Form 10-Q

and current reports on Form 8-K that are available on RSP’s website at http://www.rsppermian.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on

assumptions that Concho or RSP believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and Concho and RSP undertake no obligation to correct or update

any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the

date hereof.

Cautionary Statements Regarding Resource

Concho may use the term

“resource potential” and similar phrases to describe estimates of potentially recoverable hydrocarbons that SEC rules prohibit from being included in filings with the SEC. These are based on analogy to Concho’s existing models applied

to additional acres, additional zones and tighter spacing and are Concho’s internal estimates of hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery

techniques. These quantities may not constitute “reserves” within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or SEC rules. Such estimates and identified drilling locations have not been

fully risked by Concho management and are inherently more speculative than proved reserves estimates. Actual locations drilled and quantities that may be ultimately recovered from Concho’s interests could differ substantially from these

estimates. There is no commitment by Concho to drill all of the drilling locations that have been attributed to these quantities. Factors affecting ultimate recovery include the scope of Concho’s ongoing drilling program, which will be directly

affected by the availability of capital, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations, transportation constraints, regulatory approvals, actual drilling results, including

geological and mechanical factors affecting recovery rates, and other factors. Such estimates may change significantly as development of Concho’s oil and natural gas assets provide additional data. Concho’s production forecasts and

expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity

price declines or drilling cost increases or other factors that are beyond Concho’s control. Concho’s use of the term “premium resource” refers to assets with the capacity to produce at an internal rate of return that is greater

than thirty-five percent based on fifty-five dollar oil and three dollar gas.

3

|

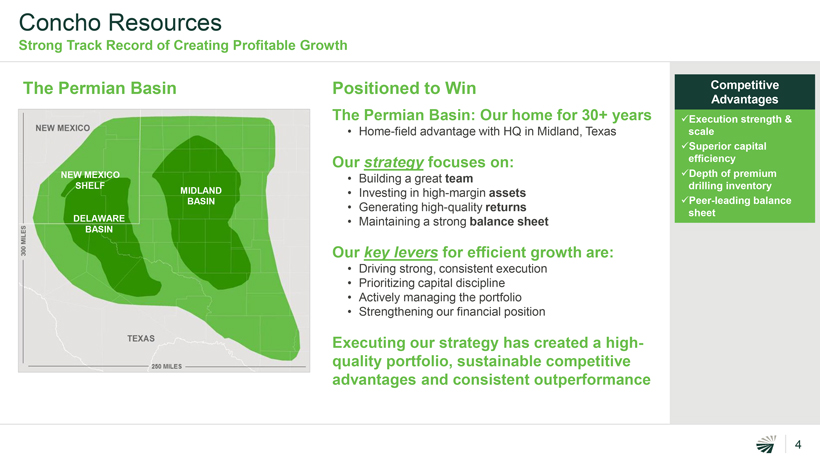

Concho Resources

Strong Track Record of Creating Profitable Growth

The Permian Basin

NEW MEXICO SHELF

MIDLAND BASIN

DELAWARE BASIN

Positioned to Win

The Permian Basin: Our home for 30+ years

• Home-field advantage with HQ in Midland,

Texas

Our strategy focuses on:

• Building a great team

• Investing in high-margin assets

• Generating high-quality returns

• Maintaining a strong balance sheet

Our key levers for efficient growth are:

• Driving strong, consistent execution

• Prioritizing capital discipline

• Actively managing the portfolio

• Strengthening our financial position

Executing our strategy has created a high-quality portfolio, sustainable competitive advantages and consistent outperformance

Competitive Advantages

Execution strength & scale

Superior capital efficiency Depth of premium drilling inventory

Peer-leading balance sheet

4

|

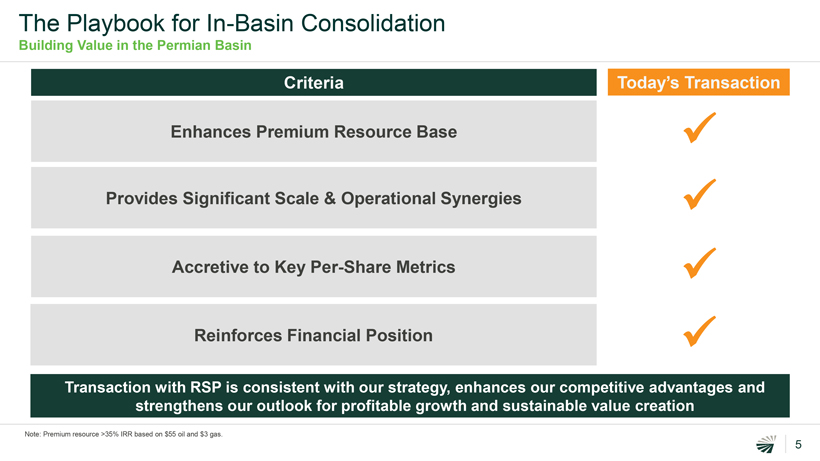

The Playbook for

In-Basin Consolidation

Building Value in the Permian Basin

Criteria

Enhances Premium Resource Base

Provides Significant Scale & Operational Synergies Accretive to Key Per-Share Metrics Reinforces Financial Position

Today’s Transaction

Transaction with RSP is consistent with our strategy, enhances our

competitive advantages and strengthens our outlook for profitable growth and sustainable value creation

Note: Premium resource >35% IRR based on $55 oil and $3

gas.

5

|

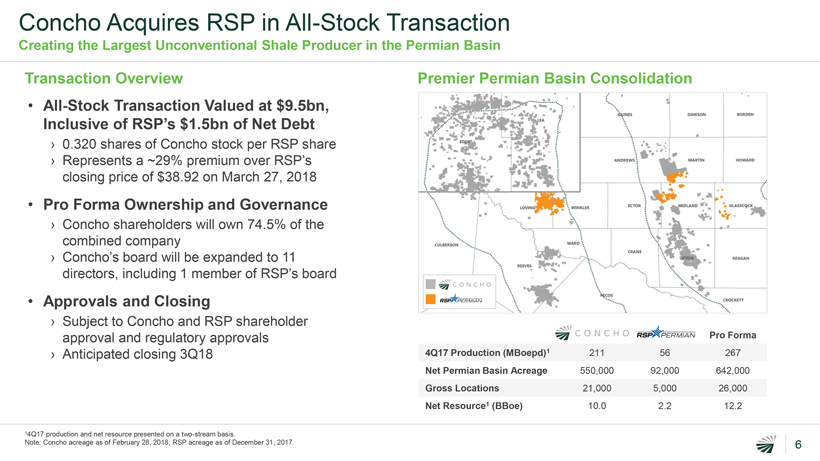

Concho Acquires RSP in All-Stock Transaction

Creating the Largest Unconventional Shale Producer in the Permian Basin

Transaction Overview

• All-Stock Transaction

Valued at $9.5bn,

Inclusive of RSP’s $1.5bn of Net Debt

› 0.320

shares of Concho stock per RSP share

› Represents a ~29% premium over RSP’s closing price of $38.92 on March 27, 2018

• Pro Forma Ownership and Governance

› Concho shareholders will own 74.5% of the

combined company

› Concho’s board will be expanded to 11 directors, including 1 member of RSP’s board

• Approvals and Closing

› Subject to Concho and RSP shareholder approval and

regulatory approvals

› Anticipated closing 3Q18

14Q17 production and net

resource presented on a two-stream basis.

Note: Concho acreage as of February 28, 2018; RSP acreage as of

December 31, 2017.

Premier Permian Basin Consolidation

Pro Forma

4Q17 Production (MBoepd)1 211 56267

Net Permian Basin Acreage 550,000 92,000642,000

Gross

Locations 21,000 5,00026,000

Net Resource1 (BBoe) 10.0 2.212.2

6

|

Transaction Highlights

Extending Concho’s Track Record of Highly-Complementary Consolidation

Focus on

1

The Core

Continue to

2 Prudently Enhance Scale

Drive Corporate

3 & Operational Synergies

Financially

4 Attractive Combination

Premier asset base

Expands premium inventory Enhances capital allocation

Creates the premier Permian pure-play company

Leverages execution strength and greater

economies of scale Peer-leading drilling program

Combines exceptional technical teams with similar execution-focused cultures

Meaningful corporate level and operational synergies identified Realization expected to occur in the first year and over time

Growth within cash flow approach unchanged

Transaction neutral to balance sheet and accretive

to credit profile Immediately accretive on a per share basis Enhances margins and capital efficiency

7

|

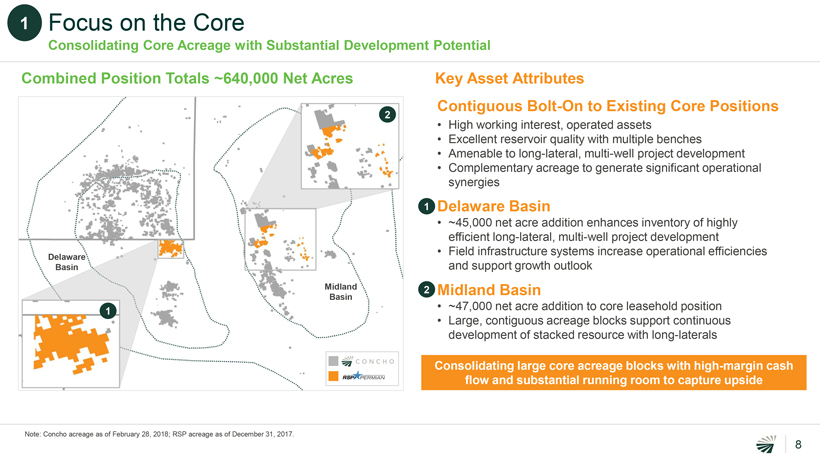

1 Focus on the Core

Consolidating Core Acreage with Substantial Development Potential

Combined Position Totals

~640,000 Net Acres

2

Delaware Basin

Midland Basin

1

Key Asset Attributes

Contiguous Bolt-On to Existing

Core Positions

• High working interest, operated assets

• Excellent

reservoir quality with multiple benches

• Amenable to long-lateral, multi-well project development

• Complementary acreage to generate significant operational synergies

1 Delaware Basin

• ~45,000 net acre addition enhances inventory of highly efficient long-lateral, multi-well project development

• Field infrastructure systems increase operational efficiencies and support growth outlook

2 Midland Basin

• ~47,000 net acre addition to core leasehold position

• Large, contiguous acreage blocks support continuous development of stacked resource with long-laterals

Consolidating large core acreage blocks with high-margin cash flow and substantial running room to capture upside

Note: Concho acreage as of February 28, 2018; RSP acreage as of December 31, 2017.

8

|

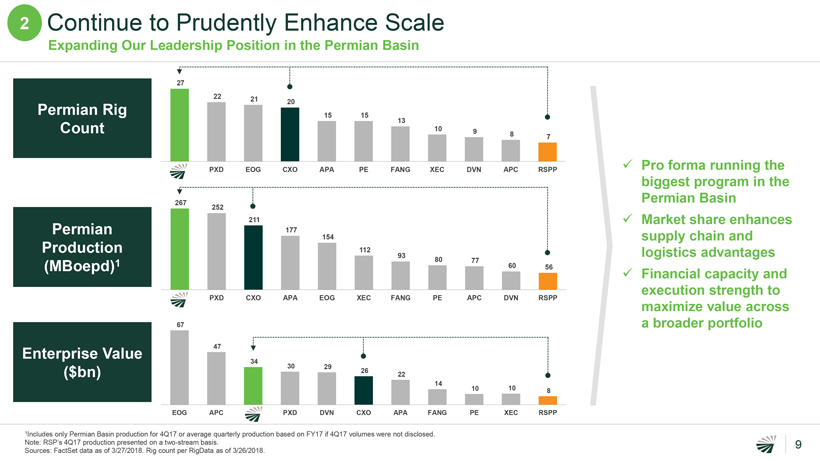

2 Continue to Prudently Enhance Scale

Expanding Our Leadership Position in the Permian Basin

27

22

2120

Permian Rig 1515

13

Count 109

87

PXD EOGCXOAPAPEFANGXECDVNAPCRSPP

267

252

211

Permian 177

154

Production 112

938077

(MBoepd)1 6056

PXD CXOAPAEOGXECFANGPEAPCDVNRSPP

67

Enterprise Value 47

34

3029

($bn) 2622

14

10108

EOG APC PXDDVNCXOAPAFANGPEXECRSPP

1Includes only Permian Basin production for 4Q17 or average quarterly production based on FY17 if 4Q17 volumes were not disclosed.

Note: RSP’s 4Q17 production presented on a two-stream basis.

Sources: FactSet data as of 3/27/2018. Rig count per RigData as of 3/26/2018.

Pro forma

running the biggest program in the Permian Basin

Market share enhances supply chain and logistics advantages

Financial capacity and execution strength to maximize value across a broader portfolio

9

|

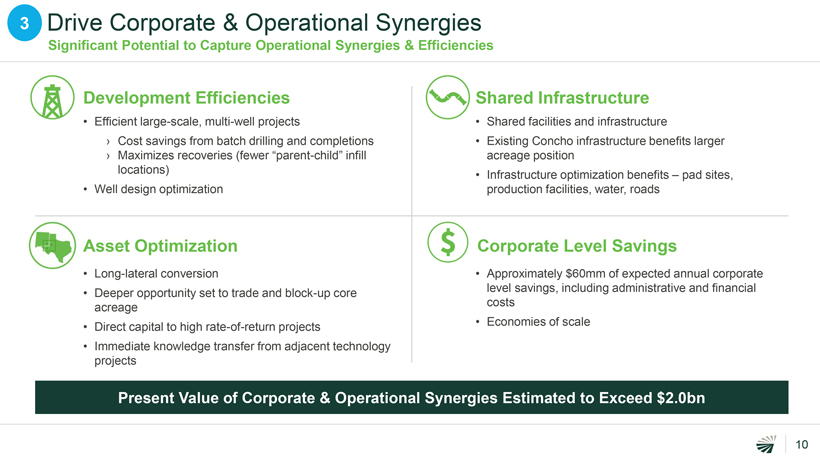

3 Drive Corporate & Operational Synergies

Significant Potential to Capture Operational Synergies & Efficiencies

Development Efficiencies

• Efficient large-scale, multi-well projects

› Cost savings from batch drilling and completions

› Maximizes

recoveries (fewer “parent-child” infill locations)

• Well design optimization

Asset Optimization

• Long-lateral conversion

• Deeper opportunity set to trade and block-up core acreage

• Direct capital to high rate-of-return projects

• Immediate knowledge transfer from adjacent technology projects

Shared Infrastructure

• Shared facilities and infrastructure

• Existing Concho

infrastructure benefits larger acreage position

• Infrastructure optimization benefits – pad sites, production facilities, water, roads

Corporate Level Savings

• Approximately $60mm of expected annual corporate level savings,

including administrative and financial costs

• Economies of scale

Present Value of Corporate & Operational Synergies Estimated to Exceed $2.0bn

10

|

4 Financially Attractive Combination

Reinforcing Financial Strength & Profitability

Balance sheet neutral and credit

accretive

› Maintains target leverage ratio

› Significantly

enhances scale

Lowers cost of capital

Enhances

3-year production growth plan

› Growth within cash flow consistent

Margin and capital efficiency improvement

Immediately Accretive

• Immediately accretive to key per-share metrics (before operational synergies)

Earnings Cash flow

Debt-adjusted production and cash flow

growth Net asset value

11

|

Key Messages

Extending Concho’s Track Record of Highly-Complementary Consolidation

Focuses on the core

Enhances scale advantage and leverages Concho’s execution strength to extract greater value from properties

Drives significant corporate level and operational synergies Accretive to key per-share

metrics Maintains financial strength Delivers meaningful shareholder value

12