Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Breitburn Energy Partners LP | a20180326form8-k.htm |

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

--------------------------------------------------------x

:

In re : Chapter 11

:

BREITBURN ENERGY : Case No. 16-11390 (SMB)

PARTNERS LP, et al., :

: (Jointly Administered)

Debtors.1 :

:

--------------------------------------------------------x

ORDER CONFIRMING DEBTORS’ THIRD AMENDED JOINT

CHAPTER 11 PLAN (WITH TECHNICAL MODIFICATIONS)

WHEREAS Breitburn Energy Partners LP and its affiliated debtors in the above-captioned chapter 11 cases (collectively, the “Debtors”), as “proponents of the plan” within the meaning of section 1129 of title 11 of the United States Code (the “Bankruptcy Code”), on December 1, 2017 filed the Debtors’ Third Amended Joint Chapter 11 Plan (such plan, as transmitted to parties in interest being the “Amended Plan”, ECF No. 1889);2 and

WHEREAS on December 1, 2017, the Bankruptcy Court entered an order (the “Solicitation Order”, ECF No. 1885) which, among other things, (a) approved the Disclosure Statement for Debtors’ Third Amended Joint Chapter 11 Plan (as amended, supplemented, or modified, the “Disclosure Statement”, ECF No. 1890), (b) established January 11, 2018 as the

_________________________

1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable, are: Breitburn Energy Partners LP (9953); Breitburn GP LLC (9948); Breitburn Operating LP (5529); Breitburn Operating GP LLC (5525); Breitburn Management Company LLC (2858); Breitburn Finance Corporation (2548); Alamitos Company (9156); Beaver Creek Pipeline, L.L.C. (7887); Breitburn Florida LLC (7424); Breitburn Oklahoma LLC (4714); Breitburn Sawtelle LLC (7661); Breitburn Transpetco GP LLC (7222); Breitburn Transpetco LP LLC (7188); GTG Pipeline LLC (3760); Mercury Michigan Company, LLC (3380); Phoenix Production Company (1427); QR Energy, LP (3069); QRE GP, LLC (2855); QRE Operating, LLC (9097); Terra Energy Company LLC (9616); Terra Pipeline Company LLC (3146); and Transpetco Pipeline Company, L.P. (2620). The Debtors’ mailing address is 707 Wilshire Boulevard, Suite 4600, Los Angeles, California 90017.

2 Capitalized terms used herein not otherwise defined have the meanings given to them in the Debtors’ Third Amended Joint Chapter 11 Plan (with Technical Modifications), dated March 13, 2018 (ECF No. 2329), a copy of which is annexed hereto as Exhibit A (as amended and as may be further amended and as defined below, the “Plan”).

date for the commencement of the hearing to consider confirmation of the Amended Plan, (c) approved the form and method of notice of the Confirmation Hearing (the “Confirmation Hearing Notice”), and (d) established certain procedures for soliciting and tabulating votes with respect to the Amended Plan; and

WHEREAS the Debtors transmitted or caused to be transmitted the solicitation materials or appropriate notices to all applicable parties in accordance with the Solicitation Order, as evidenced by the Affidavit of Service of Solicitation Material sworn to on December 12, 2017 (ECF No. 1918), the Affidavit of Service sworn to on December 13, 2017 (ECF No. 1923), and the Supplemental Affidavit of Service sworn to on December 15, 2017 (ECF No. 1947), and such service was adequate as provided by Bankruptcy Rule 3017(d); and

WHEREAS the Debtors transmitted or caused to be transmitted the Rights Offering Procedures and related forms and materials in accordance with the Solicitation Order, as evidenced by the Affidavit of Service sworn to on December 7, 2017 (ECF No. 1908); and

WHEREAS the Debtors caused to be published the Confirmation Hearing Notice in the national edition of USA Today and The Wall Street Journal in accordance with the Solicitation Order, as evidenced by the Affidavit of Publication sworn to on December 11, 2017 (ECF No. 1913); and

WHEREAS on December 11, 2017 the Debtors filed the Plan Supplement with respect to the Amended Plan (ECF No. 1914), an amendment thereto on December 29, 2017 (ECF No. 2010), and a further amendment thereto on January 10, 2018 (ECF No. 2101) (collectively, as the documents contained therein may have been or may be further amended or supplemented, the “Plan Supplement”); and

2

WHEREAS the Debtors transmitted or caused to be transmitted notices of the treatment of executory contracts and unexpired leases under the Amended Plan to all known parties in interest, as evidenced by the Affidavit of Service sworn to on December 29, 2017 (ECF No. 2009); and

WHEREAS the Declaration of Christina Pullo of Prime Clerk LLC Regarding the Solicitation of Votes and Tabulation of Ballots Cast on the Debtors’ Third Amended Joint Chapter 11 Plan, sworn to on January 8, 2018 (the “Voting Report”, ECF No. 2066), was filed attesting and certifying the method and results of the tabulation of votes on the Amended Plan for the Classes of Claims in Class 3 (Revolving Credit Facility Claims), Class 4 (Secured Notes Claims), Class 5A and Class 5B (Unsecured Notes Claims), and Class 6 (General Unsecured Claims); and

WHEREAS by Memorandum Decision and Order Denying Confirmation of the Debtors’ Third Amended Plan (the “Decision”, ECF Nos. 2312 and 2324), the Bankruptcy Court denied confirmation of the Amended Plan. In the Decision, the Bankruptcy Court determined that the Amended Plan satisfied all of the requirements for confirmation under the Bankruptcy Code other than “proving that the Plan does not unfairly discriminate against Class 5B”; and

WHEREAS on March 13, 2018, the Debtors filed the Debtors’ Third Amended Joint Chapter 11 Plan (with Technical Modifications) (as amended and as may be further amended, the “Plan”, ECF No. 2329). The Plan contains amendments to address the issue of unfair discrimination referred to in the immediately preceding paragraph; and

WHEREAS, by Order dated March 14, 2018 (ECF No. 2333), the Bankruptcy Court scheduled a further Confirmation Hearing for March 23, 2018 to consider confirmation of the Plan, and such hearing was held before the Bankruptcy Court on such date; and

3

WHEREAS at the hearing held before the Bankruptcy Court on March 23, 2018, the Bankruptcy Court determined that, based on the amendments and modifications contained in the Plan, the Plan does not unfairly discriminate against Class 5B and, therefore, the Plan complies with all of the requirements for confirmation under the Bankruptcy Code.

NOW, THEREFORE, the Court having considered the record in these chapter 11 cases, the compromises and settlements embodied in and contemplated by the Plan, the briefs and arguments regarding confirmation of the Plan, the evidence regarding confirmation of the Plan, and a hearing on confirmation of the Plan having been held on January 11, 2018 and continued on January 12, 2018, January 16, 2018, January 22, 2018, and March 23, 2018, IT IS HEREBY ORDERED, ADJUDGED, AND DECREED THAT:

1. Confirmation. The Plan is confirmed under section 1129 of the Bankruptcy Code. The terms of the Plan, all exhibits thereto, the Plan Documents, and the Plan Supplement are incorporated by reference into, are an integral part of the Plan and this Confirmation Order, and shall be effective and binding as of the Effective Date. The failure to specifically include or refer to any particular article, section, or provision of the Plan, the Plan Documents, the Plan Supplement, or any related document in this Confirmation Order does not diminish or impair the effectiveness of such article, section, or provision.

2. Plan Supplement and Exhibits and Schedules to the Plan. The documents, substantially in the form contained in the Plan Supplement, the Exhibits and Schedules to the Plan, and any amendments, modifications, and supplements thereto, and the execution, delivery, and performance thereof by the Debtors or the Reorganized Debtors, as applicable, are authorized and approved.

4

3. Compromises and Settlements. The compromises and settlements set forth in the Plan are approved, and will be effective immediately and binding on all parties in interest on the Effective Date.

4. Objections. All objections or reservations that have not been withdrawn, waived, settled, or deferred, and all reservations of rights pertaining to confirmation of the Plan, are overruled on the merits for the reasons stated on the record of the Confirmation Hearing and in the Decision.

5. Releases, Exculpation, and Injunctions. Pursuant to Bankruptcy Rule 3020(c)(1), the following provisions in the Plan are hereby approved and will be effective immediately on the Effective Date without further Order or action by the Bankruptcy Court, any of the parties to such releases, or any other Entity: (a) releases by the Debtors (Section 10.9(a) of the Plan), (b) releases by holders of Claims and Interests (Section 10.9(b) of the Plan), (c) exculpation of each Exculpated Party (Section 10.8 of the Plan), and (d) injunctions related to releases and exculpation (Section 10.10 of the Plan).

6. Exemptions from Securities Laws. The issuance of and the distribution under the Plan of (a) the LegacyCo Units issued pursuant to Section 4.4(b) of the Plan, and (b) the New Permian Corp. Shares (i) comprising the Put Option Premium and (ii) pursuant to Sections 4.5(c) or 4.6 of the Plan, shall be exempt from registration under the Securities Act and any other applicable securities laws to the fullest extent permitted by section 1145 of the Bankruptcy Code. These Securities may be resold without registration under the Securities Act or other federal securities laws pursuant to the exemption provided by section 4(a)(1) of the Securities Act, unless the holder is an “underwriter” with respect to such Securities, as that term is defined in section 1145(b) of the Bankruptcy Code. In addition, such section 1145 exempt Securities generally may

5

be resold without registration under state securities laws pursuant to various exemptions provided by the respective laws of the several states. The availability of the exemption under section 1145 of the Bankruptcy Code or any other applicable securities laws shall not be a condition to the occurrence of the Effective Date. [SMB: 3/26/18]

The issuance and sale, as applicable, of the New Permian Corp. Shares pursuant to the Rights Offering and to the Backstop Parties under the Backstop Commitment Agreement (including the New Permian Corp. Shares issued pursuant to the Minimum Allocation Rights) were made in reliance on the exemption from registration set forth in section 4(a)(2) of the Securities Act and Regulation D thereunder. Such Securities will be considered “restricted securities” and may not be transferred except pursuant to an effective registration statement or under an available exemption from the registration requirements of the Securities Act, such as, under certain conditions, the resale provisions of Rule 144 of the Securities Act. [SMB: 3/26/18]

New Permian Corp. Shares issued to holders of Allowed General Unsecured Claims shall be issued through the facilities, and in accordance with any applicable procedures of, the DTC and the Debtors may require recipients thereof to identify themselves through the provision of information reasonably requested by the Debtors or Reorganized Debtors. New Permian Corp. will reflect the ownership of such New Permian Corp. Shares through the facilities of the DTC, and New Permian Corp. shall not be required to provide any further evidence other than the Plan or Confirmation Order with respect to the treatment of such applicable portion of the New Permian Corp. Shares under applicable securities laws, and such Plan or Confirmation Order shall be deemed to be legal and binding obligations of the Reorganized Debtors in all respects. The DTC shall be required to accept and conclusively rely upon the Plan and this Confirmation Order in lieu of a legal opinion regarding whether the New Permian Corp. Shares are exempt from registration

6

and/or eligible for DTC book-entry delivery, settlement, and depository services. Notwithstanding anything to the contrary in the Plan, no entity (including, for the avoidance of doubt, the DTC) may require a legal opinion regarding the validity of any transaction contemplated by the Plan, including, for the avoidance of doubt, whether the New Permian Corp. Shares are exempt from registration and/or eligible for DTC book entry delivery, settlement, and depository services. [SMB: 3/26/18]

7. Exit Facility.

(a) On the Effective Date, each Reorganized Debtor (other than New Permian Corp. and New Permian LLC) shall enter into the Exit Facility.

(b) The terms of the Exit Facility are fair and reasonable, and the Exit Facility was negotiated in good faith and at arm’s-length by the Debtors, the Second Lien Group, the Exit Facility Agent, and the Exit Facility Lenders.

(c) The Exit Facility is hereby approved (including, without limitation, the transactions contemplated thereby, and all actions to be taken, undertakings to be made, and obligations to be incurred and the fees paid by Reorganized Debtors (other than New Permian Corp. and New Permian LLC)), and each Reorganized Debtor (other than New Permian Corp. and New Permian LLC) is authorized to execute and deliver the Exit Facility Documents without further notice to or order of the Bankruptcy Court, act, or action under applicable law, regulation, order, or rule or vote, consent, authorization, or approval of any Person, subject to such modifications as the Reorganized Debtors (other than New Permian Corp. and New Permian LLC) may deem to be necessary to consummate the Exit Facility.

(d) On the Effective Date, all existing Liens (as defined in the Exit Facility Credit Agreement) and other security interests, including, without limitation, all Liens granted in

7

connection with the Revolving Credit Facility and DIP Facility that are hereby assumed by and assigned to the Exit Facility Agent, and any other Liens or security interests to be granted in accordance with the Exit Facility Documents (i) shall be legal, binding, and enforceable Liens on, and security interests in, the Collateral (as defined in the Exit Facility Credit Agreement) granted thereunder in accordance with the terms of the Exit Facility Documents, (ii) shall be deemed automatically attached and perfected (or deemed continuing to be attached and perfected) on the Effective Date, and (iii) shall not be subject to avoidance, recharacterization, or subordination (including equitable subordination) for any purposes whatsoever and shall not constitute preferential transfers, fraudulent conveyances, or other voidable transfers under the Bankruptcy Code or any applicable non-bankruptcy law.

(e) Each Reorganized Debtor that is a party to the Exit Facility is authorized to make all filings and recordings, and to obtain all governmental approvals and consents necessary to establish, attach, and perfect such Liens and security interests under the provisions of the applicable state, provincial, federal, or other law (it being understood that perfection shall occur automatically by virtue of the entry of this Confirmation Order, and any such filings, recordings, approvals, notices, and consents shall not be required), and will thereafter cooperate to make all other filings and recordings that otherwise would be necessary under applicable law or desirable, in the reasonable discretion of the Exit Facility Agent, to give notice of such Liens and security interests to third parties.

(f) On the Effective Date, all of the Liens (as defined in the Exit Facility Credit Agreement) and other security interests granted to the Revolving Credit Facility Agent and the DIP Facility Agent by the Reorganized Debtors (other than New Permian Corp. and New Permian LLC), respectively (including, without limitation, those mortgages and deeds of trust described in

8

the schedules attached to the Perfection Notice (as defined below) and made a part hereof) shall remain in full force and effect (subject to any agreed upon amendments and modifications thereto) and shall be deemed to be assigned by the Revolving Credit Facility Agent and the DIP Facility Agent to the Exit Facility Agent and duly assumed by the Exit Facility Agent and shall constitute Collateral (as such term is defined in the Exit Facility Credit Agreement) of each Reorganized Debtor that is a party to the Exit Facility Credit Agreement and (i) shall be legal, binding, and enforceable Liens on, and security interests in, the Collateral, and (ii) shall be deemed automatically attached and perfected on the Effective Date, subject only to such other Liens and security interests as may be permitted under the Exit Facility Documents.

(g) On the Effective Date, all existing Revolving Credit Facility Obligations and DIP Facility Obligations, including, without limitation (i) Existing Letters of Credit (as defined in the Exit Facility Credit Agreement), (ii) Swap Obligations (as defined in the Exit Facility Credit Agreement) existing as of the Effective Date, and (iii) other remaining Obligations, including, without limitation, indemnification and with respect to Revolving Credit Facility Indemnified Taxes and DIP Facility Indemnified Taxes (as defined in the Revolving Credit Facility and DIP Facility, respectively) shall remain in full force and effect and shall be deemed to be Obligations (as defined in the Exit Facility Credit Agreement) of each Reorganized Debtor that is a party to the Exit Facility Credit Agreement.

(h) Notwithstanding that no filings, recordings, approvals, notices, or consents of any kind are required for the Liens and security interests granted in accordance with the Exit Facility Documents to be attached and perfected as of the Effective Date, at the discretion of the Exit Facility Agent, a notice substantially in the form to be filed by the Exit Facility Agent (the “Perfection Notice”) may be filed and recorded in any federal, state or county filing agency or

9

recordation bureau that the Exit Facility Agent deems appropriate, and such notice shall constitute sufficient notice of the entry of the Confirmation Order to filing and recording officers.

(i) On the Effective Date, all Exit Facility Documents (other than certain documents that will be agreed upon after the Effective Date) shall become effective, binding, and enforceable upon the parties thereto in accordance with their respective terms and conditions. With respect to any party, including, without limitation, any Exit Facility Lender, that refuses to execute any Exit Facility Document required to be executed, the provisions of section 1142 of the Bankruptcy Code and Rule 70 of the Federal Rules of Civil Procedure, made applicable by Bankruptcy Rule 7070, are specifically made applicable for such a situation, the refusing Exit Facility Lender is directed to execute such Exit Facility Document, and regardless of whether the Exit Facility Lender ultimately executes such Exit Facility Document, the Exit Facility Agent may execute such document on behalf of such Exit Facility Lender and such document will have the same effect as if executed by such Exit Facility Lender.

8. Cure Disputes.

(a) Any monetary defaults under an assumed or assumed and assigned executory contract or unexpired lease relating to the period before the Petition Date shall be satisfied, pursuant to section 365(b)(1) of the Bankruptcy Code, by payment of the default amount, as reflected in the applicable cure notice, in Cash on the Effective Date, subject to the limitations described in Section 8.2 of the Plan, or on such other terms as the parties to such executory contracts or unexpired leases and the Debtors may otherwise agree. Any person that failed to timely file and serve an objection to the assumption and assignment of any contract, lease, or agreement listed in a schedule included in the Plan Supplement or otherwise to be assigned to New Permian LLC pursuant to the Permian Contribution Agreement (the “Assigned Agreements”)

10

shall be deemed to consent to and approve of the assumption, transfer, and assignment to the Reorganized Debtors of such Assigned Agreements and the Debtors’ right, title and interest in, to and under the properties covered thereby, free and clear of all liens, encumbrances, claims and other interests except as otherwise set forth in the Plan.

(b) Any amounts due or payable under an assumed or assumed and assigned executory contract or unexpired lease relating to goods delivered or services rendered during the period from and after the Petition Date shall be treated as an ordinary course administrative expense subject to Section 2.1 of the Plan.

9. Provisions Relating to Exxon.

Notwithstanding anything in either the Plan or this Confirmation Order, the following provisions shall apply to the “Exxon Contracts” (as defined below):

(a) The term “Exxon” shall collectively include Exxon Mobil Corporation, XTO Energy Inc., Exxon Corporation, ExxonMobil Oil Corp. (formerly known as Mobil Oil Corp.), Mobil Exploration & Producing U.S., Inc. and Exxon Pipeline Company, and each of their parents, subsidiaries and affiliated entities.

(b) The term “Exxon Contracts” shall include all contracts and leases among Exxon and any of the Debtors which are not rejected pursuant to the Plan.

(c) Exxon and each of the Reorganized Debtors, LegacyCo and New Permian LLC, as applicable, shall continue to perform their respective obligations and duties under each of the Exxon Contracts in the ordinary course of business in accordance with the terms of, and subject to the conditions of, the applicable agreement.

(d) Nothing in either the Plan or this Confirmation Order shall impair, prejudice, alter, or release any rights, duties, obligations, claims, defenses or remedies (either legal

11

or equitable) which either Exxon or either of the Reorganized Debtors, LegacyCo or New Permian LLC, as applicable, may have under any of the Exxon Contracts. Without limiting the generality of the foregoing, nothing contained in the Plan or this Confirmation Order shall impair, prejudice, alter, or release (i) any Lien in favor of Exxon, whether granted pursuant to any of the Exxon Contracts or arising pursuant to applicable law, or (ii) any right by Exxon of offset or recoupment pursuant to, or in relation to, any of the Exxon Contracts.

(e) Nothing in the Plan or this Confirmation Order shall alter, release, or otherwise affect any rights, obligations, claims, causes of action, or defenses of Exxon or the Reorganized Debtors, LegacyCo and New Permian LLC, as applicable, arising under or in connection with (i) the Purchase and Sale Agreement dated effective December 1, 2006 between Exxon and Quantum Resources Management, LLC (“Quantum”); (ii) the Abandonment and Remediation Funding Agreement dated December 22, 2006 between Exxon and Quantum; (iii) the Escrow Agreement dated December 22, 2006 by and among Exxon, Quantum, and JPMorgan Chase Bank, N.A. (“Escrow Agent”); (iv) the Assignment and Agreement dated December 22, 2006 by and among Quantum, Black Diamond Resources, LLC, QAB Carried WI, LP, QAC Carried WI, LP, and Quantum Resources A1, LP; (v) the Assignment Agreement dated December 17, 2014 by and among Quantum, Breitburn Operating LP, Exxon, and Escrow Agent; (vi) the Assurance Letter dated December 17, 2014 from Breitburn Energy Partners LP and Breitburn Operating LP to Exxon; (vii) the Carbon Dioxide Supply Agreement dated November 1, 1995 between ExxonMobil Gas & Power Marketing Company, a division of Exxon Mobil Corporation as agent for and on behalf of Mobil Exploration and Producing U.S. Inc., and Breitburn Operating LP, as successor-in-interest to Whiting Oil and Gas Corporation, Celero Energy, L.P. and Mobil Exploration and Producing U.S. Inc. (as amended); (viii) any instruments of financial security in

12

favor of Exxon associated with or relating to any of the foregoing agreements, including without limitation Irrevocable Standby Letter of Credit No. IS0017583U dated December 28, 2012 (as amended) issued by Wells Fargo Bank, N.A. in favor of Exxon Mobil Corporation as beneficiary, Irrevocable Standby Letter of Credit No. IS0059747U dated July 29, 2013 (as amended) issued by Wells Fargo Bank, N.A. in favor of Exxon Mobil Corporation as beneficiary, and any other letters of credit and surety bonds in favor of Exxon; and (ix) any escrowed funds held in favor of Exxon associated with or relating to any of the foregoing agreements, including without limitation all funds escrowed pursuant to the above-referenced Escrow Agreement. Furthermore, nothing in the Plan or this Confirmation Order shall alter, affect, or impair Exxon’s ability to draw or exercise any rights under the foregoing instruments of financial security in accordance with their terms.

(f) Certain amounts may be due and payable as Cure Amounts for production from the Blue Forest Unit 10-30 well and under the following invoices issued under the Exxon Contracts relating to the period before the Petition Date (“Prepetition Amounts”):

Date | JIB Invoice No. |

01/31/2016 | 6736040 |

04/30/2016 | 6923053 |

04/30/2016 | 6923054 |

04/30/2016 | 6923055 |

04/30/2016 | 6923056 |

04/30/2016 | 6923057 |

The Debtors and Exxon shall attempt to resolve such Prepetition Amounts. If they are unable to do so, such dispute will be resolved by the Bankruptcy Court.

(g) Any amounts due or payable under any of the executory Exxon Contracts relating to the period from and after the Petition Date (“Postpetition Amounts”) shall be treated as an ordinary course administrative expense subject to Section 2.1 of the Plan. Exxon shall not be required to file any application for payment of any Postpetition Amounts pursuant to any of the

13

executory Exxon Contracts, and the Reorganized Debtors, may pay any such Postpetition Amounts without further order of the Bankruptcy Court. Exxon, the Reorganized Debtors, LegacyCo or New Permian LLC, as applicable, shall each make a good faith effort to reach agreement on the amount of any Postpetition Amounts applicable to any executory Exxon Contract as of the Effective Date of the Plan. If Exxon, the Reorganized Debtors, LegacyCo or New Permian LLC, as applicable, are unable to agree on the Postpetition Amount applicable to any of the executory Exxon Contracts, either Exxon, the Reorganized Debtors, LegacyCo or New Permian LLC, as applicable, may move the Bankruptcy Court to enter a Final Order determining the applicable Postpetition Amount.

(h) If the Debtors, in accordance with Section 8.2(d) of the Plan, elect to reject any executory Exxon Contract which is presently listed as a contract or lease to be assumed, Exxon shall have 30 days from the date the notice of the rejection of such contract or lease is filed with the Bankruptcy Court to file a proof of claim for any rejection damages.

(i) Subject to payment of the Prepetition Amounts in subparagraph (f) above, Exxon consents to the assumption and, if applicable, the assignment of the Exxon Contracts as provided in the Plan and the Plan Supplement and agrees that no prepetition Cure Amounts other than the Prepetition Amounts are owing with respect to any such Exxon Contracts.

10. Employee Obligations. Pursuant to Section 8.6 of the Plan, the Reorganized Debtors (other than New Permian Corp. and New Permian LLC) shall honor all of the Employee Obligations in accordance with the Schedule of Assumed Employee Obligations and all Employee Obligations set forth on the Schedule of Assumed Employee Obligations shall be deemed assumed by the Reorganized Debtors (other than New Permian Corp. and New Permian LLC) pursuant to section 365 of the Bankruptcy Code on and subject to the occurrence of the

14

Effective Date; provided, that (a) the consummation of the transactions contemplated by the Plan shall not, in and of themselves, constitute a “change in control” with respect to any of the Employee Obligations and (b) subject to and in accordance with the Employee Programs Order, the KEIP (as defined in the Employee Programs Order) shall terminate on the Effective Date and the participants in such program shall vest in and be entitled to the payments and compensation as expressly provided under the KEIP. Subject to clause (b) above, to the extent that any of the Employee Obligations constitute executory contracts, pursuant to sections 365 and 1123 of the Bankruptcy Code, each of them will be deemed rejected as of the Effective Date unless identified in the Schedule of Assumed Employee Obligations and shall be treated in accordance with Article VIII of the Plan. [SMB: 3/26/18]

11. Corporation Election. The Second Lien Group confirms that it will not make the Corporation Election (as defined and described in Section 6.9 of the Plan) or cause the Debtors to make the Corporation Election before the second day after the Effective Date. Furthermore, should the LegacyCo Board elect in the future to treat LegacyCo as a corporation for U.S. federal income tax purposes, the LegacyCo Board shall not cause such election to be effective before the second day after the Effective Date.

12. No Reserve for Disallowed or Expunged Claims. No reserves shall be required to be established for Claims (or any portion thereof) that have been disallowed or expunged by order of the Bankruptcy Court notwithstanding any appeal, motion for reconsideration, or similar motion or request for relief that may be filed, absent an order of the Bankruptcy Court expressly directing the establishment of such a reserve. [SMB: 3/26/18]

13. Retention of Causes of Action/Reservation of Rights. In addition to the terms set forth in Section 10.13 of the Plan, neither the Debtors nor the Reorganized Debtors shall

15

preserve, retain, commence, prosecute or otherwise reserve any Claims or Cause of Action against (a) the DIP Facility Agent, (b) the DIP Facility Lenders, (c) the Revolving Credit Facility Agent, (d) the Revolving Credit Facility Lenders, (e) the Creditors’ Committee, (f) any of the forgoing Entities’ respective affiliates, agents, attorneys, advisors, professionals, officers, directors, and employees, or (g) the past and current members of the Creditors’ Committee (solely in their capacity as such), including the Released and Settled Claims.

14. Special Provisions for Governmental Units.

(a) Generally. As to the United States of America, its agencies, departments, or agents (collectively, the “United States”), nothing in the Plan or Confirmation Order shall limit or expand the scope of discharge, release or injunction to which the Debtors or Reorganized Debtors are entitled to under the Bankruptcy Code, if any. The discharge, release and injunction provisions contained in the Plan and Confirmation Order are not intended and shall not be construed to bar the United States from, subsequent to the Confirmation Order, pursuing any police or regulatory action.

Accordingly, notwithstanding anything contained in the Plan or Confirmation Order to the contrary, nothing in the Plan or Confirmation Order shall discharge, release, impair or otherwise preclude: (a) any liability to the United States that is not a “claim” within the meaning of section 101(5) of the Bankruptcy Code; (b) any Claim of the United States arising on or after the Effective Date; (c) any valid right of setoff or recoupment of the United States against any of the Debtors; or (d) any liability of the Debtors or Reorganized Debtors under police or regulatory statutes or regulations to any Governmental Unit (as defined by section 101(27) of the Bankruptcy Code) as the owner, lessor, lessee or operator of property that such entity owns, operates or leases on or after the Effective Date. Nor shall anything in this Confirmation Order or the Plan: (i) enjoin

16

or otherwise bar the United States or any Governmental Unit from asserting or enforcing, outside the Bankruptcy Court, any liability described in the preceding sentence; or (ii) divest any court, commission, or tribunal of jurisdiction to determine whether any liabilities asserted by the United States or any Governmental Unit are discharged or otherwise barred by this Confirmation Order, the Plan, or the Bankruptcy Code. Moreover, nothing in the Confirmation Order or the Plan shall release or exculpate any non-debtor, including any non-Debtor Released Party, from any liability to the United States, including but not limited to any liabilities arising under the Internal Revenue Code, the environmental laws, or the criminal laws against the non-Debtor Released Parties, nor shall anything in this Confirmation Order or the Plan enjoin the United States from bringing any claim, suit, action or other proceeding against the non-Debtor Released Parties for any liability whatsoever; provided, however, that the foregoing sentence shall not (x) limit the scope of discharge granted to the Debtors under sections 524 and 1141 of the Bankruptcy Code or (y) diminish the scope of any exculpation to which any party is entitled under section 1125(e) of the Bankruptcy Code.

Nothing contained in the Plan or Confirmation Order shall be deemed to determine the tax liability of any person or entity, including but not limited to the Debtors and the Reorganized Debtors, nor shall the Plan or Confirmation Order be deemed to have determined the federal tax treatment of any item, distribution, or entity, including the federal tax consequences of the Plan, nor shall anything in the Plan or this Confirmation Order be deemed to have conferred exclusive jurisdiction upon the Bankruptcy Court to make determinations as to federal tax liability and federal tax treatment except as provided under section 505 of the Bankruptcy Code.

(b) FCC. No provision in the Plan or this Confirmation Order relieves a Debtor or Reorganized Debtor that is a holder of a license (a “Licensee”) issued by the Federal

17

Communications Commission (“FCC”) from the obligation to comply with the Communications Act of 1934, as amended, and the rules, regulations and orders promulgated thereunder by the FCC. No transfer of control of the Licensee or transfer of any license or any other federal license or authorization issued by the FCC shall take place without the issuance of FCC regulatory approval for such transfer of control or transfer of license or the grant of authorization pursuant to applicable FCC regulations. The FCC’s rights and powers to take any action pursuant to its regulatory authority, including, but not limited to, imposing any regulatory conditions on such transfers, are fully preserved, and nothing herein shall proscribe or constrain the FCC’s exercise of such power or authority.

(c) ONRR. Any assumption, assignment, and/or transfer of any interests in leases, contracts, covenants, operating rights agreements, rights-of-use and easements, and rights-of-way, or other interests or agreements with the United States or involving (i) federal land or minerals or (ii) lands or minerals held in trust for federally-recognized Indian tribes or Indian individuals (collectively, “Indian Landowners”) or held by such Indian Landowners in fee with federal restriction on alienation (collectively, the “Federal Leases”) will be ineffective absent the consent of the United States. The United States hereby consents to the assumption of the Federal Leases listed on the Schedule of Assumed Executory Contracts and Unexpired Leases, Exhibit C to the Amended Plan Supplement and proofs of claim numbers 2884, 2889, 2317, 2984, 3006, and 3026 submitted by the United States shall be deemed withdrawn. Without limiting the foregoing, for the avoidance of doubt, nothing in this Confirmation Order, the Plan, or implementing Plan Documents shall be interpreted to set cure amounts for any Federal Lease; to release Debtors and/or Reorganized Debtors from any reclamation, plugging and abandonment, or other operational requirement under applicable Federal or Tribal law; to impair audit rights; or to require

18

the United States to novate, approve, or otherwise consent to the assignment and/or transfer of any interests of any Federal Lease. Any and all existing Federal Lease defaults, including any outstanding royalties due under any Federal Lease must be cured or the prospective assignee and/or transferee must provide adequate assurance that the defaults will be promptly cured. Except to the extent already paid by the Debtors, the obligations for the cure amounts owed to the United States, which include without limitation pre-petition and post-petition royalties known to date, are ratified and assumed, and each cure amount shall be paid in full, in cash and after consideration of any and all credits due and owing to the Debtors as described below, as soon as practicable on the later of (x) the Effective Date or (y) when due in the ordinary course, except for amounts owing that are not reflected on the ONRR Statement of Accounts and that are disputed in good faith by the Debtors. If the Debtors and/or their transferee(s) or assignee(s) do not timely pay these amounts, late payment charges will be due on the untimely payment at the rate established at 30 C.F.R. § 1218.54. Nothing in this paragraph shall be construed as an implication or admission that the Debtors have any outstanding obligations or unpaid amounts owed to the United States, including the ONRR (as defined below), in connection with the Federal Leases.

Notwithstanding any provision in the Plan, this Confirmation Order, or implementing Plan Documents, the United States will retain and have the right to audit and/or perform any compliance review and, if appropriate, collect from the Debtors and/or their successor(s) and assign(s) (including Reorganized Debtor parties, if applicable), in full any additional monies owed by the Debtors prior to the assumption of the Federal Leases, including any amounts determined by the Department of the Interior Office of Natural Resources Revenue (“ONRR”) to be owed by the Debtors for pre- and post-petition royalties, including interest accrual through the date(s) of receipt by ONRR of payment on account of any such amount(s), without

19

those rights being adversely affected by these bankruptcy proceedings. Such rights shall be preserved in full as if this bankruptcy had not occurred. The ONRR shall apply any and all credits determined by ONRR to be due and owing to the Debtors, whether arising pre-petition or post-petition, to amounts determined by ONRR to be due and owing by the Debtors to ONRR. The Debtors and the Reorganized Debtors and their successors and assigns, will retain all defenses and/or rights, other than defenses and/or rights arising from the bankruptcy, to challenge any such determination, provided, however, that any such challenge, including any challenge associated with these bankruptcy cases, must be raised in the United States’ administrative review process leading to a final agency determination by the ONRR. The audit and/or compliance review period shall remain open for the full statute of limitations period established by the Federal Oil and Gas Royalty Simplification and Fairness Act of 1996, 30 U.S.C. § 1702, et seq.

In addition, nothing in the Plan, Confirmation Order, or implementing Plan Documents addresses or shall otherwise affect any decommissioning obligations and financial assurance requirements under the Federal Leases, as determined by the United States, that must

be met by the Debtors or their successors and assigns on the Federal Leases going forward. Nor shall anything in this Confirmation Order, the Plan, or implementing Plan Documents nullify the United States’ right to assert, against Debtors and their estates, any decommissioning liability and/or claim arising from the Debtors’ interest in any Federal Lease not assumed by the Debtors.

(d) Michigan. Nothing in the Plan or this Confirmation Order shall authorize the Reorganized Debtors to assign any oil and gas lease or surface use lease or agreement with any Governmental Unit in the State of Michigan without compliance with the terms of such lease or agreement and any applicable state law.

20

15. Governmental Approvals Not Required. Except as otherwise expressly provided in the Plan or this Confirmation Order, this Confirmation Order shall constitute all approvals and consents required, if any, by the laws, rules, or regulations of any state or any other governmental authority with respect to the implementation or consummation of the Plan and any documents, instruments, or agreements, and any amendments or modifications thereto, and any other acts referred to in or contemplated by the Plan, the Disclosure Statement, and any documents, instruments, or agreements, and any amendments or modifications thereto.

Each federal, state, commonwealth, local, foreign, or other governmental agency is directed and authorized to accept the validity of any and all documents, trust agreements, mortgages, and instruments that are necessary or appropriate to effectuate, implement, or consummate the transactions contemplated by the Plan, this Confirmation Order, and any agreements created or contemplated by the Plan, without payment of any stamp tax or similar tax imposed by state or local law to the fullest extent permitted by section 1146 of the Bankruptcy Code.

16. Provisions Relating to LL&E Royalty Trust. The disposition of whether the Debtors’ agreement with LL&E Royalty Trust (the Conveyance of Overriding Royalty Interests) is subject to rejection under section 365 of the Bankruptcy Code shall be deferred, with the rights of all parties reserved, pending a determination of the issues to be adjudicated in the Texas Court as defined in, and as set forth in, the Bankruptcy Court’s Order Granting in Part and Denying in Part LL&E Royalty Trust’s Motion for Relief from the Automatic Stay entered May 2, 2017 (the “Lift Stay Order”, ECF No. 1217). Nothing shall preclude the parties from seeking any relief in the Bankruptcy Court that is not inconsistent with the Lift Stay Order.

21

17. Provisions Relating to Sureties. Notwithstanding anything in the Plan, Plan Supplement, this Confirmation Order or any related documents to the contrary, absent the agreement of American Contractors Indemnity Company and U.S. Specialty Insurance Company (collectively, the “Sureties”), on the Effective Date any outstanding surety bonds issued by the Sureties on behalf of one or more Debtors, or their affiliates, shall be replaced by the Reorganized Debtors, unless renewed or extended by the Sureties, or unless the bond is released by the beneficiary.

18. Unsecured Notes Indenture Trustee Fees. The Reviewing Parties shall have ten (10) Business Days from the receipt of invoices from the Unsecured Notes Indenture Trustee, which invoices were provided prior to the Confirmation Hearing, to review such invoices and raise any objection, in writing, to the reasonableness of the fees and expenses requested therein. If the Unsecured Notes Indenture Trustee and the Reviewing Parties are unable to resolve such an objection on a consensual basis within ten (10) Business Days after such written objection has been submitted to the Unsecured Notes Indenture Trustee, then one or more of the Reviewing Parties may file with the Court such objection and the Court shall adjudicate the matter at the next omnibus hearing date, provided, however, that if the Additional Class 5A/5B Cash Distribution is less than $1,050,000 (for any reason), such excess Cash shall be retained by LegacyCo. Under no circumstances shall the aggregate amount of the fees and expenses sought by the Unsecured Notes Indenture Trustee exceed $1,050,000.

19. Notice of Entry of Confirmation Order and of Effective Date. The Debtors shall cause to be served a notice of the entry of this Confirmation Order and occurrence of the Effective Date (the “Confirmation Notice”) upon (a) all parties listed in the creditor matrix maintained by Prime Clerk LLC and (b) such additional persons and entities as deemed appropriate

22

by the Debtors, no later than ten (10) Business Days after the Effective Date. The Debtors shall cause the Confirmation Notice to be published in The Wall Street Journal and USA Today within ten (10) Business Days after the Effective Date.

20. Immediate Effectiveness; Waiver of Stay. Notwithstanding the possible applicability of Bankruptcy Rules 3020(e), 6004(h), 6006(d), 7062, and 9014, the terms and provisions of this Confirmation Order shall be immediately effective and enforceable upon its entry and the 14-day stay of this Confirmation Order set forth in Bankruptcy Rule 3020(e) shall be waived.

21. Conflicts between Order and Plan. To the extent of any inconsistency between the provisions of the Plan and this Confirmation Order, the terms and provisions contained in this Confirmation Order shall govern. The provisions of this Confirmation Order are integrated with each other and are nonseverable and mutually dependent unless expressly stated by further order of the Bankruptcy Court.

Dated: | March 26, 2018 New York, New York | ||

/s/ Stuart M. Bernstein | |||

STUART M. BERNSTEIN United States Bankruptcy Judge | |||

23

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

--------------------------------------------------------x

:

In re :

: Chapter 11

BREITBURN ENERGY :

PARTNERS LP, et al., : Case No. 16-11390 (SMB)

:

Debtors. : (Jointly Administered)

:

--------------------------------------------------------x

DEBTORS’ THIRD AMENDED JOINT CHAPTER 11 PLAN

(WITH TECHNICAL MODIFICATIONS)

WEIL, GOTSHAL & MANGES LLP

Ray C. Schrock, P.C.

Stephen Karotkin, Esq.

767 Fifth Avenue

New York, New York 10153

(212) 310-8000

Attorneys for Debtors and

Debtors in Possession

Table of Contents

Page

ARTICLE I. | DEFINITIONS, INTERPRETATION AND CONSENTS 1 |

ARTICLE II. | ADMINISTRATIVE EXPENSES AND PRIORITY TAX |

CLAIMS 27

2.1 | Administrative Expenses 27 |

2.2 | Professional Fee Claims 27 |

2.3 | DIP Facility Claims 28 |

2.4 | Priority Tax Claims 29 |

ARTICLE III. | CLASSIFICATION OF CLAIMS AND INTERESTS 29 |

3.1 | Formation of Debtor Groups for Convenience Only 29 |

3.2 | Classification of Claims and Interests 29 |

3.3 | Separate Classification of Other Secured Claims 30 |

3.4 | Nonconsensual Confirmation 30 |

3.5 | Debtors’ Rights in Respect of Unimpaired Claims 30 |

ARTICLE IV. | TREATMENT OF CLAIMS AND INTERESTS 31 |

4.1 | Class 1 - Priority Non-Tax Claims 31 |

4.2 | Class 2 - Other Secured Claims 31 |

4.3 | Class 3 - Revolving Credit Facility Claims 31 |

4.4 | Class 4 - Secured Notes Claim 32 |

4.5 | Class 5A/Class 5B - Unsecured Notes Claims 32 |

4.6 | Class 6 - General Unsecured Claims 34 |

4.7 | Class 7A - Ongoing Trade Claims of LegacyCo 35 |

4.8 | Class 7B - Ongoing Trade Claims of New Permian Corp 35 |

4.9 | Class 8 - Intercompany Claims 35 |

4.10 | Class 9 - Subordinated Claims 35 |

4.11 | Class 10 - Intercompany Interests 36 |

4.12 | Class 11 - Existing BBEP Equity Interests 36 |

ARTICLE V. | PROVISIONS GOVERNING DISTRIBUTIONS 36 |

5.1 | Distributions Generally 36 |

5.2 | Plan Funding 36 |

5.3 | No Postpetition or Default Interest on Claims 36 |

5.4 | Date of Distributions 36 |

5.5 | Distribution Record Date 36 |

5.6 | Disbursing Agent 37 |

5.7 | Delivery of Distributions 37 |

5.8 | Unclaimed Property 38 |

5.9 | Satisfaction of Claims 38 |

5.10 | Manner of Payment under Plan 38 |

5.11 | Fractional Shares and De Minimis Cash Distributions 38 |

5.12 | No Distribution in Excess of Amount of Allowed Claim 39 |

5.13 | Allocation of Distributions Between Principal and Interest 39 |

i

Table of Contents

Page

5.14 | Exemption from Securities Laws 39 |

5.15 | Setoffs and Recoupments 40 |

5.16 | Rights and Powers of Disbursing Agent 41 |

5.17 | Withholding and Reporting Requirements 41 |

ARTICLE VI. | MEANS FOR IMPLEMENTATION AND EXECUTION OF |

THE PLAN 42

6.1 | General Settlement of Claims and Interests 42 |

6.2 | Continued Corporate Existence 42 |

6.3 | Authorization, Issuance, and Delivery of LegacyCo Units and |

New Permian Corp. Shares 43

6.4 | Cancelation of Existing Securities and Agreements 43 |

6.5 | Cancelation of Certain Existing Security Agreements 44 |

6.6 | Rights Offering and Minimum Allocation Rights 45 |

6.7 | New Permian Corp. Certificate of Incorporation 45 |

6.8 | Exit Facility 46 |

6.9 | Restructuring Transactions 46 |

6.10 | Board of Directors 48 |

6.11 | Corporate Action 49 |

6.12 | LegacyCo Management Incentive Plan 49 |

6.13 | New Permian Corp. Management Incentive Plan 50 |

6.14 | Effectuating Documents and Further Transactions 50 |

6.15 | Separability 50 |

6.16 | Director, Officer, Manager, and Employee Liability Insurance 50 |

6.17 | Preservation of Royalty and Working Interests 50 |

6.18 | Hart-Scott-Rodino Antitrust Improvements Act 50 |

6.19 | Post-Effective Date Tax Filings and Audits 51 |

6.20 | AUNC Trust 51 |

ARTICLE VII. | PROCEDURES FOR DISPUTED CLAIMS 52 |

7.1 | Objections to Claims 52 |

7.2 | Resolution of Disputed Administrative Expenses and Disputed |

Claims 52

7.3 | Payments and Distributions with Respect to Disputed Claims 52 |

7.4 | Distributions After Allowance 52 |

7.5 | Disallowance of Claims 52 |

7.6 | Estimation 53 |

7.7 | Interest 54 |

ARTICLE VIII. | EXECUTORY CONTRACTS AND UNEXPIRED LEASES 54 |

8.1 | General Treatment 54 |

8.2 | Determination of Cure Disputes and Deemed Consent 54 |

8.3 | Rejection Damages Claims 56 |

8.4 | Payment of Cure Amounts 56 |

8.5 | Survival of the Debtors’ Indemnification Obligations 56 |

8.6 | Employee Obligations 57 |

ii

Table of Contents

Page

8.7 | Insurance Policies 57 |

8.8 | Reservation of Rights 57 |

8.9 | Modifications, Amendments, Supplements, Restatements, or |

Other Agreements 58

ARTICLE IX. | EFFECTIVENESS OF THE PLAN 58 |

9.1 | Conditions Precedent to Confirmation of the Plan 58 |

9.2 | Conditions Precedent to the Effective Date 59 |

9.3 | Satisfaction of Conditions 60 |

9.4 | Waiver of Conditions 60 |

9.5 | Effect of Non-Occurrence of Effective Date 60 |

ARTICLE X. | EFFECT OF CONFIRMATION 61 |

10.1 | Released and Settled Claims 61 |

10.2 | Binding Effect 61 |

10.3 | Vesting of Assets 61 |

10.4 | Release and Discharge of Debtors 61 |

10.5 | Term of Injunctions or Stays 62 |

10.6 | Injunction Against Interference with Plan 62 |

10.7 | Injunction 62 |

10.8 | Exculpation 62 |

10.9 | Releases 63 |

10.10 | Injunction Related to Releases and Exculpation 65 |

10.11 | Subordinated Claims 66 |

10.12 | Avoidance Actions 66 |

10.13 | Retention of Causes of Action/Reservation of Rights 66 |

10.14 | Preservation of Causes of Action 67 |

10.15 | Special Provisions for Governmental Units 67 |

10.16 | Protections Against Discriminatory Treatment 67 |

10.17 | Document Retention 68 |

ARTICLE XI. | RETENTION OF JURISDICTION 68 |

11.1 | Jurisdiction of Bankruptcy Court 68 |

ARTICLE XII. | MISCELLANEOUS PROVISIONS 70 |

12.1 | Dissolution of Statutory Committees 70 |

12.2 | Substantial Consummation 70 |

12.3 | Exemption from Transfer Taxes 71 |

12.4 | Expedited Tax Determination 71 |

12.5 | Payment of Statutory Fees 71 |

12.6 | Plan Modifications and Amendments 71 |

12.7 | Revocation or Withdrawal of Plan 72 |

12.8 | Courts of Competent Jurisdiction 73 |

12.9 | Severability 73 |

12.10 | Governing Law 73 |

12.11 | Schedules 73 |

iii

Table of Contents

Page

12.12 | Successors and Assigns 73 |

12.13 | Time 74 |

12.14 | Notices 74 |

12.15 | Reservation of Rights 75 |

Exhibit I: Exit Facility Term Sheet

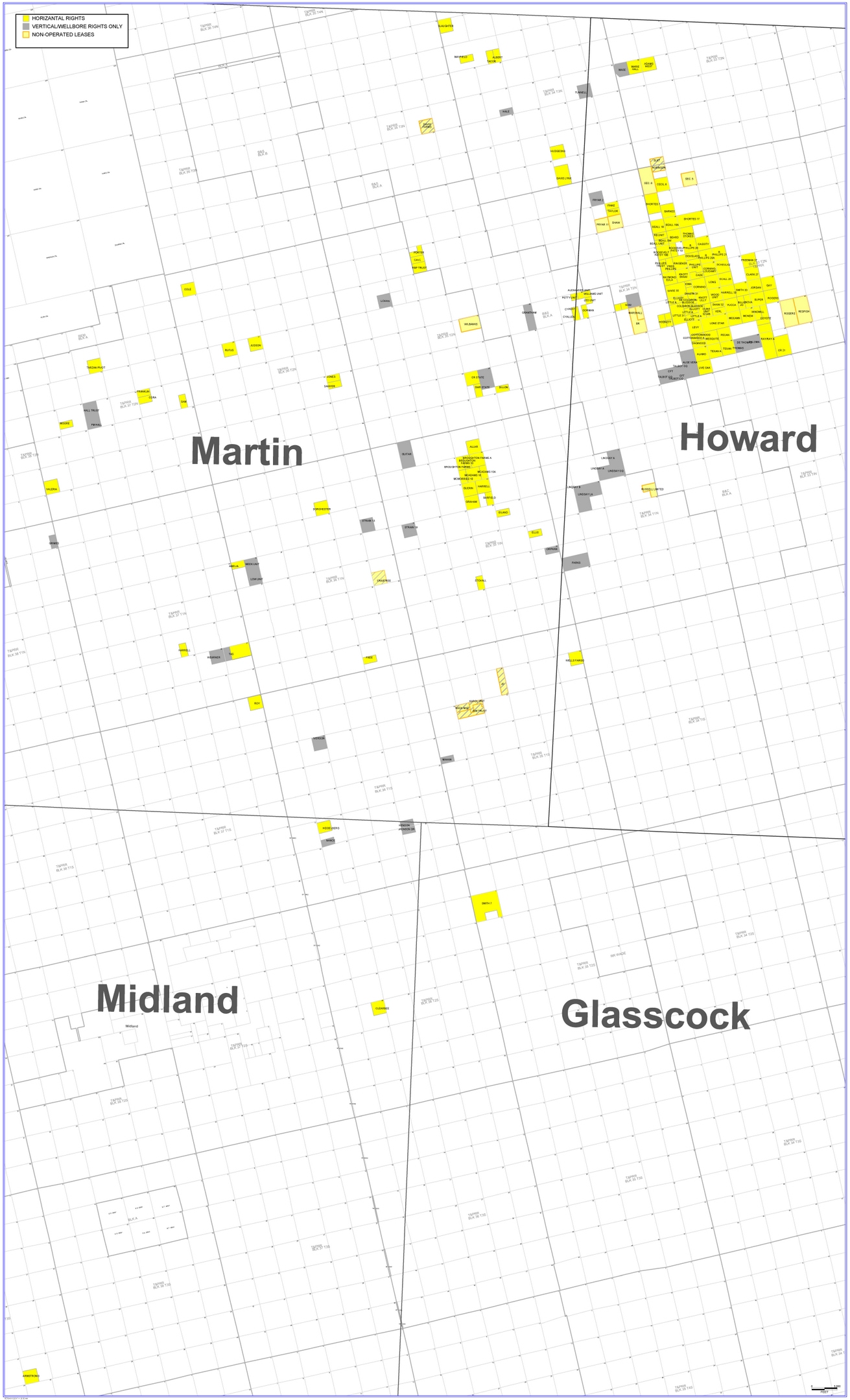

Exhibit II: Permian Assets

iv

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

--------------------------------------------------------x

:

In re :

: Chapter 11

BREITBURN ENERGY :

PARTNERS LP, et al., : Case No. 16-11390 (SMB)

:

Debtors. : (Jointly Administered)

:

--------------------------------------------------------x

DEBTORS’ THIRD AMENDED JOINT CHAPTER 11 PLAN

(WITH TECHNICAL MODIFICATIONS)

Breitburn Energy Partners LP (9953); Breitburn GP LLC (9948); Breitburn Operating LP (5529); Breitburn Operating GP LLC (5525); Breitburn Management Company LLC (2858); Breitburn Finance Corporation (2548); Alamitos Company (9156); Beaver Creek Pipeline, L.L.C. (7887); Breitburn Florida LLC (7424); Breitburn Oklahoma LLC (4714); Breitburn Sawtelle LLC (7661); Breitburn Transpetco GP LLC (7222); Breitburn Transpetco LP LLC (7188); GTG Pipeline LLC (3760); Mercury Michigan Company, LLC (3380); Phoenix Production Company (1427); QR Energy, LP (3069); QRE GP, LLC (2855); QRE Operating, LLC (9097); Terra Energy Company LLC (9616); Terra Pipeline Company LLC (3146); and Transpetco Pipeline Company, L.P. (2620), the above-captioned debtors, as plan proponents, propose the following chapter 11 plan pursuant to section 1121(a) of title 11 of the United States Code.

ALL HOLDERS OF CLAIMS AND INTERESTS, TO THE EXTENT APPLICABLE, ARE ENCOURAGED TO READ THE PLAN AND THE DISCLOSURE STATEMENT IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

ARTICLE I.

DEFINITIONS, INTERPRETATION AND CONSENTS

DEFINITIONS. The following terms used herein shall have the respective meanings defined below (such meanings to be equally applicable to both the singular and plural):

1.1 7.875% Unsecured Notes means the 7.875% Senior Notes due April 15, 2022, issued pursuant to the 7.875% Unsecured Notes Indenture in the aggregate principal amount of Eight Hundred Fifty Million Dollars ($850,000,000).

1.2 7.875% Unsecured Notes Claim means, collectively, all Claims arising under the 7.875% Unsecured Notes, including any guaranty Claims arising on account of the 7.875% Unsecured Notes and the 7.875% Unsecured Notes Indenture.

1.3 7.875% Unsecured Notes Indenture means that certain Indenture, dated as of January 13, 2012, by and among BBEP and Breitburn Finance, as issuers, the guarantors named therein, and the 7.875% Unsecured Notes Indenture Trustee, including all agreements, notes, instruments, and any other documents delivered pursuant thereto or in connection therewith (in each case, as amended, modified, or supplemented from time to time).

1.4 7.875% Unsecured Notes Indenture Trustee means Wilmington Trust Company, solely in its capacity as successor indenture trustee under the 7.875% Unsecured Notes Indenture.

1.5 8.625% Unsecured Notes means the 8.625% Senior Notes due October 15, 2020, issued pursuant to the 8.625% Unsecured Notes Indenture in the aggregate principal amount of Three Hundred Five Million Dollars ($305,000,000).

1.6 8.625% Unsecured Notes Claim means, collectively, all Claims arising under the 8.625% Unsecured Notes, including any guaranty Claims arising on account of the 8.625% Unsecured Notes and the 8.625% Unsecured Notes Indenture.

1.7 8.625% Unsecured Notes Indenture means that certain Indenture, dated as of October 6, 2010, by and among BBEP and Breitburn Finance, as issuers, the guarantors named therein, and the 8.625% Unsecured Notes Indenture Trustee, including all agreements, notes, instruments, and any other documents delivered pursuant thereto or in connection therewith (in each case, as amended, modified, or supplemented from time to time).

1.8 8.625% Unsecured Notes Indenture Trustee means Wilmington Trust Company, solely in its capacity as successor indenture trustee under the 8.625% Unsecured Notes Indenture.

1.9 Administrative Expenses means costs or expenses of administration of any of the Chapter 11 Cases arising on or prior to the Effective Date and allowed under section 503(b) of the Bankruptcy Code and entitled to priority pursuant to section 507(a)(2) and 507(b) of the Bankruptcy Code that have not already been paid by the Debtors, including, any actual and necessary costs and expenses of preserving the Debtors’ estates, any actual and necessary costs and expenses of operating the Debtors’ businesses, any indebtedness or obligations incurred or assumed by the Debtors, as debtors in possession, during the Chapter 11 Cases, including, for the acquisition or lease of property or an

2

interest in property or the performance of services, any compensation and reimbursement of expenses to the extent allowed by Final Order under sections 330 or 503 of the Bankruptcy Code, any indebtedness or obligations arising under the Backstop Commitment Agreement (including the Put Option Premium, the Breakup Premium (as defined in the Backstop Commitment Agreement), the granting of the Minimum Allocation Rights (and the underlying securities), the indemnification provisions of the Backstop Commitment Agreement, and the Expense Reimbursement (as defined in the Backstop Commitment Agreement), all in accordance with the terms of the Backstop Commitment Agreement) and any fees or charges assessed against the estates of the Debtors under section 1930 of chapter 123 of title 28 of the United States Code.

1.10 Allowed means, (a) with reference to any Claim, (i) any Claim against any Debtor that has been listed by such Debtor in the Schedules, as such Schedules may be amended by the Debtors from time to time in accordance with Bankruptcy Rule 1009, as liquidated in amount and not disputed or contingent and for which no contrary proof of Claim has been filed, (ii) any Claim listed on the Schedules or any timely filed proof of Claim, as to which no objection to allowance has been, or subsequently is, interposed in accordance with Section 7.1 hereof or prior to the expiration of such other applicable period of limitation fixed by the Bankruptcy Code, the Bankruptcy Rules, or the Bankruptcy Court, or as to which any objection has been determined by a Final Order to the extent such Final Order is in favor of the respective holder (but solely in the amount as determined in such Final Order), or (iii) any Claim expressly allowed by the Plan or a Final Order of the Bankruptcy Court; and (b) with reference to any Interest, such Interest is reflected as outstanding (other than any such Interest held by any Debtor or any affiliate of a Debtor) in the stock transfer ledger or similar register of the applicable Debtor on the Distribution Record Date.

1.11 Avoidance Action means any action commenced, or that may be commenced, before or after the Effective Date pursuant to chapter 5 of the Bankruptcy Code including sections 544, 545, 547, 548, 549, 550, or 551; provided, that Avoidance Actions do not include Released and Settled Claims.

1.12 Backstop Approval Order means the Order of the Bankruptcy Court entered on December 1, 2017 (ECF No. 1886) approving the Backstop Commitment Agreement, which order shall be in form and substance satisfactory to the Debtors, the Requisite Consenting Second Lien Creditors, and the Requisite Commitment Parties.

1.13 Backstop Commitment Agreement means that certain Amended and Restated Backstop Commitment Agreement, dated as of October 11, 2017, as may be amended or modified from time to time in accordance with the terms thereof and the Backstop Approval Order, pursuant to which the Backstop Parties have agreed to (a) exercise the Minimum Allocation Rights; and (b) backstop the Rights Offering.

3

1.14 Backstop Parties means, the Commitment Parties (as such term is defined in the Backstop Commitment Agreement).

1.15 Ballot means the form(s) distributed to holders of impaired Claims on which is to be indicated the acceptance or rejection of the Plan.

1.16 Bankruptcy Code means title 11 of the United States Code, as amended from time to time, as applicable to the Chapter 11 Cases.

1.17 Bankruptcy Court means the United States Bankruptcy Court for the Southern District of New York, having subject matter jurisdiction over the Chapter 11 Cases and, to the extent of any reference withdrawal made under section 157(d) of title 28 of the United States Code, the District Court having subject matter jurisdiction over the Chapter 11 Cases.

1.18 Bankruptcy Rules means the Federal Rules of Bankruptcy Procedure as promulgated by the United States Supreme Court under section 2075 of title 28 of the United States Code, as amended from time to time, applicable to the Chapter 11 Cases, and any Local Rules of the Bankruptcy Court.

1.19 BBEP means Breitburn Energy Partners LP, a Delaware limited partnership, as debtor or debtor in possession, as the context requires.

1.20 BOLP means Breitburn Operating LP, a Delaware limited partnership, as debtor or debtor in possession, as the context requires.

1.21 Breitburn Finance means Breitburn Finance Corporation, a Delaware corporation, as debtor or debtor in possession, as the context requires.

1.22 Business Day means any day other than a Saturday, a Sunday, or any other day on which banking institutions in New York, New York are required or authorized to close by law or executive order.

1.23 Cash means legal tender of the United States of America.

1.24 Cause of Action means, without limitation, any and all actions, proceedings, causes of action, controversies, liabilities, obligations, rights, rights of setoff, recoupment rights, suits, damages, judgments, accounts, defenses, offsets, powers, privileges, licenses, franchises, Claims, Avoidance Actions, counterclaims, cross-claims, affirmative defenses, and demands of any kind or character whatsoever, whether known or unknown, asserted or unasserted, reduced to judgment or otherwise, liquidated or unliquidated, fixed or contingent, matured or unmatured, disputed or undisputed, secured or unsecured, assertable directly or derivatively, existing or hereafter arising, in contract or in tort, in law, in equity, or otherwise, whether arising under the Bankruptcy Code or any applicable nonbankruptcy law, based in whole or in part upon any act or omission

4

or other event occurring prior to the Petition Date or during the course of the Chapter 11 Cases, including through the Effective Date. Without limiting the generality of the foregoing, when referring to Causes of Action of the Debtors or their estates, Causes of Action shall include (a) all rights of setoff, counterclaim, or recoupment and Claims on contracts or for breaches of duties imposed by law or equity, (b) Claims (including Avoidance Actions) pursuant to section 362, and chapter 5 of the Bankruptcy Code including sections 510, 542, 543, 544 through 550, or 553, and (c) Claims and defenses such as fraud, mistake, duress, usury, and any other defenses set forth in section 558 of the Bankruptcy Code. A nonexclusive list of Causes of Action shall be set forth in the Plan Supplement.

1.25 Certified Holder means any holder of an Allowed Secured Notes Claim that provides a certification to the Debtors or the Disbursing Agent prior to the Distribution Record Date in the form of or substantially in the form of that contained in that certain Noteholder Distribution Certification Form (or as otherwise agreed with the Debtors), which include, without limitation, disclosure of ownership of Existing BBEP Equity Interests by the holder and certain controlling and controlled persons, and verification that such holder (and, in the case such holder is a disregarded entity for U.S. federal income tax purposes, its regarded owner) is and as of the Effective Date will be a “United States person” within the meaning of Section 7701(a)(30) of the Tax Code. For purposes of this definition, (i) a person “controlling or controlled by” a holder includes any individual or entity that controls the holder (such as a general partner, managing member or any other equityholder in a similar managing capacity or that owns controlling voting equity interests or more than 50% of the equity interests in the holder, and in the case of a controlling entity, any person that controls such controlling entity) and any entity controlled (through direct or indirect equity ownership) by the holder, and (ii) the term “Existing BBEP Equity Interests” shall be limited to outstanding Series A Redeemable Preferred Units, Series B Preferred Units and common units of BBEP.

1.26 Chapter 11 Cases means the jointly administered cases under chapter 11 of the Bankruptcy Code commenced by the Debtors on the Petition Date in the Bankruptcy Court and currently styled In re Breitburn Energy Partners LP, Ch. 11 Case No. 16-11390 (SMB) (Jointly Administered).

1.27 Charging Lien means any Lien or other priority in payment to which the Unsecured Notes Indenture Trustee is entitled to under and subject to the terms of the Unsecured Notes Indentures to assert against distributions to be made to holders of Claims under such Unsecured Notes Indentures.

1.28 Claim has the meaning set forth in section 101(5) of the Bankruptcy Code.

1.29 Class means any group of Claims or Interests classified herein pursuant to section 1123(a)(1) of the Bankruptcy Code.

5

1.30 Collateral means any property or interest in property of the estate of any Debtor subject to a lien, charge, or other encumbrance to secure the payment or performance of a Claim, which lien, charge, or other encumbrance is not subject to a Final Order ordering the remedy of avoidance on any such lien, charge, or other encumbrance under the Bankruptcy Code.

1.31 Confirmation Date means the date on which the Clerk of the Bankruptcy Court enters the Confirmation Order.

1.32 Confirmation Hearing means the hearing to be held by the Bankruptcy Court regarding confirmation of the Plan, as such hearing may be adjourned or continued from time to time.

1.33 Confirmation Order means the order of the Bankruptcy Court confirming the Plan pursuant to section 1129 of the Bankruptcy Code and approving the transactions contemplated thereby, which shall be in form and substance acceptable to the Debtors, the Revolving Credit Facility Agent, the Exit Facility Agent, the DIP Facility Agent, the Requisite Consenting Second Lien Creditors, the Requisite Commitment Parties, and to the extent that any provisions of such order affect Classes 5A, 5B, 6, 7A or 7B they shall be acceptable to the Creditors’ Committee and all other provisions of such order shall be reasonably acceptable to the Creditors’ Committee.

1.34 Creditors’ Committee means the statutory committee of unsecured creditors appointed by the U.S. Trustee in the Chapter 11 Cases pursuant to section 1102 of the Bankruptcy Code.

1.35 Cure Amount means the payment of Cash or the distribution of other property (as the parties may agree or the Bankruptcy Court may order) as necessary to (a) cure a monetary default as required by section 365(a) of the Bankruptcy Code by the Debtors in accordance with the terms of an executory contract or unexpired lease of the Debtors and (b) permit the Debtors to assume or assume and assign such executory contract or unexpired lease under section 365(a) of the Bankruptcy Code.

1.36 Debtors means BBEP; Breitburn GP LLC; BOLP; Breitburn Operating GP LLC; Breitburn Management Company LLC; Breitburn Finance; Alamitos Company; Beaver Creek Pipeline, L.L.C.; Breitburn Florida LLC; Breitburn Oklahoma LLC; Breitburn Sawtelle LLC; Breitburn Transpetco GP LLC; Breitburn Transpetco LP LLC; GTG Pipeline LLC; Mercury Michigan Company, LLC; Phoenix Production Company; QR Energy, LP; QRE GP, LLC; QRE Operating, LLC; Terra Energy Company LLC; Terra Pipeline Company LLC; and Transpetco Pipeline Company, L.P.

6

1.37 DIP Facility means the revolving senior secured postpetition credit facility approved in the DIP Facility Order, as the same may be amended through the Effective Date.

1.38 DIP Facility Agent means Wells Fargo Bank, National Association, solely in its capacity as administrative agent under the DIP Facility Documents, its successors, assigns, or any replacement agent appointed pursuant to the terms of the DIP Facility Documents.

1.39 DIP Facility Claims means all Claims held by the DIP Facility Lenders or the DIP Facility Agent arising under or relating to the DIP Facility Documents or the DIP Facility Order, including any and all fees, expenses, and accrued but unpaid interest and fees arising under the DIP Facility Documents.

1.40 DIP Facility Credit Agreement means the Debtor-In-Possession Credit Agreement, dated as of May 19, 2016, by and among BOLP as borrower, BBEP as parent guarantor, certain other Debtor subsidiaries of BBEP as additional guarantors, the DIP Facility Agent, and the DIP Facility Lenders, as the same has been or may be further amended, modified, or supplemented from time to time including, without limitation, the First Amendment to Debtor-In-Possession Credit Agreement effective as of December 15, 2016, the Second Amendment to Debtor-In-Possession Credit Agreement effective as of December 2016, the Third Amendment to Debtor-In-Possession Credit Agreement effective as of May 11, 2017, the Fourth Amendment to Debtor-In-Possession Credit Agreement effective as of July 17, 2017, and the Fifth Amendment to Debtor-In-Possession Credit Agreement effective of as August 24, 2017.

1.41 DIP Facility Documents means, collectively, the DIP Facility Credit Agreement and all other “Loan Documents” (as defined therein), including all other agreements, documents, and instruments delivered or entered into pursuant thereto or entered into in connection therewith (including any guarantee agreements and collateral documentation) (in each case, as amended, restated, modified, or supplemented from time to time).

1.42 DIP Facility Lenders means the lenders party to the DIP Facility Credit Agreement, including any swingline lender, any issuing lender) and any “Lender Derivative Provider” under any “Lender Derivative Contract” (as each such term is defined in the DIP Facility Credit Agreement).

1.43 DIP Facility Order means collectively, the Final Order Pursuant to 11 U.S.C. §§ 105, 361, 362, 363, 364 and 507, Bankruptcy Rules 2002, 4001, 6004 and 9014 and Local Bankruptcy Rule 4001-2 (I) Authorizing the Debtors to Obtain Postpetition Senior Secured Superpriority Financing, (II) Authorizing the Debtors’ Limited Use of Cash Collateral, (III) Granting Adequate Protection to the Prepetition Secured Parties and (IV) Granting Related Relief dated August 19, 2016 (ECF No. 431), as the same has been supplemented from time to time,

7

including, without limitation, pursuant to those orders of the Bankruptcy Court dated December 13, 2016 (ECF No. 837), May 10, 2017 (ECF No. 1252), August 9. 2017 (ECF No. 1496), and August 24, 2017 (ECF No. 1525).

1.44 Disallowed means, with reference to any Claim or a portion of a Claim, any Claim against any Debtor that (a) has been disallowed by a Final Order of the Bankruptcy Court, (b) has been listed by such Debtor in the Schedules, as such Schedules may be amended by the Debtors from time to time in accordance with Bankruptcy Rule 1009, as $0, contingent, disputed, or unliquidated and as to which no proof of Claim has been filed by the applicable deadline or deemed timely filed pursuant to any Final Order of the Bankruptcy Court, (c) has been agreed to by the holder of such Claim and the applicable Debtor to be equal to $0 or to be expunged, or (d) has not been listed by such Debtor on the Schedules and as to which no proof of Claim has been filed by the applicable deadline or deemed timely filed pursuant to any Final Order of the Bankruptcy Court.

1.45 Disbursing Agent means LegacyCo (or such Entity designated by BBEP and the Requisite Consenting Second Lien Creditors and without the need for any further order of the Bankruptcy Court) in its capacity as a disbursing agent pursuant to Section 5.6 hereof.

1.46 Disclosure Statement means the disclosure statement relating to the Plan, including, all exhibits thereto, as approved by the Bankruptcy Court pursuant to section 1125 of the Bankruptcy Code.

1.47 Disputed means, with respect to a Claim, (a) any Claim, proof of which was timely and properly filed, which is disputed under Section 7.1 of this Plan or as to which the Debtors have interposed and not withdrawn an objection or request for estimation (pursuant to Section 7.6 of this Plan or otherwise) that has not been determined by a Final Order, (b) any Claim, proof of which was required to be filed by order of the Bankruptcy Court but as to which a proof of claim was not timely or properly filed, (c) any Claim that is listed in the Schedules as unliquidated, contingent, or disputed, or (d) any Claim that is otherwise disputed by any of the Debtors or the Reorganized Debtors, which dispute has not been withdrawn, resolved, or overruled by a Final Order.

For the avoidance of doubt, if no proof of Claim has been filed by the applicable deadline and the Claim is not listed on the Schedules or has been or hereafter is listed on the Schedules as $0, disputed, contingent, or unliquidated, such Claim shall be Disallowed and shall be disregarded for all purposes.

1.48 Distribution Record Date means for Class 6 the record date for purposes of voting on the Plan, and for all other purposes the Effective Date, unless otherwise provided in the Rights Offering Procedures, the Plan or designated by the Bankruptcy Court; provided, that no Distribution Record Date

8

shall apply to distributions to be made through DTC to holders of publicly held securities unless otherwise specified.

1.49 District Court means the United States District Court for the Southern District of New York having subject matter jurisdiction over the Chapter 11 Cases.

1.50 D&O Liability Insurance Policies means all unexpired directors’, managers’, and officers’ liability insurance policies (including any “tail policy”) of any of the Debtors with respect to directors, managers, officers, and employees of the Debtors.

1.51 DTC means The Depository Trust Company.

1.52 Early Election Procedures means the Early Election Procedures set forth in the Rights Offering Procedures pursuant to which any holder of Senior Unsecured Notes that is not a Backstop Party and that wishes to participate in the “Early Election” as an Eligible Offeree must by December 13, 2017: (a) commit to participate in the Rights Offering and to accept the Plan; (b) certify that they are an Eligible Offeree, were an Eligible Offeree on the Rights Offering Record Date, and are not a Backstop Party; (c) certify and/or covenant, as applicable, that with respect to any Subscription Right that such Eligible Offeree wishes to participate in the Early Election, that the relevant Senior Unsecured Notes have only been held and shall only be held by an Eligible Offeree from and after the Rights Offering Record Date (November 27, 2017) through December 13, 2017; and (d) provide sufficient evidence in the Debtors’ reasonable discretion, in consultation with the Requisite Consenting Second Lien Creditors, the Requisite Commitment Parties, and the Creditors’ Committee, of such Eligible Offeree’s financial wherewithal to consummate its commitment to exercise its Subscription Rights; provided, that, the Early Election Procedures shall not modify the obligations of the Backstop Parties under the Backstop Commitment Agreement.

1.53 Effective Date means a Business Day on or after the Confirmation Date selected by the Debtors, subject to the consent of the Requisite Commitment Parties, the Requisite Consenting Second Lien Creditors, and the Exit Facility Agent and in compliance with the Restructuring Support Agreement, on which the conditions to the effectiveness of the Plan specified in Section 9.2 hereof have been satisfied or otherwise effectively waived in accordance with the terms hereof.

1.54 Eligible Offeree means that such party is an Eligible Offeree as defined under the Rights Offering Procedures; provided, that, with regard to any Subscription Right pursuant to which an Eligible Offeree has opted into the Early Election Procedures, such Eligible Offeree must certify as to the statements set forth in the Early Election Procedures to be considered an Eligible Offeree.

9

1.55 Employee Obligations means any written contracts, agreements, policies, programs and plans for, among other things, compensation, reimbursement, indemnity, health care benefits, disability benefits, deferred compensation benefits, travel benefits, vacation and sick leave benefits, savings, severance benefits, retirement benefits, welfare benefits, relocation programs, life insurance and accidental death and dismemberment insurance, including written contracts, agreements, policies, programs and plans for bonuses and other incentives or compensation for the directors, officers, and employees of any of the Debtors.

1.56 Employee Programs Order means the Bankruptcy Court’s Order Pursuant to 11 U.S.C. §§ 105, 363(b), and 503(c)(3) Approving Debtors’ 2017 Key Employee Retention Program and Key Employee Incentive Program entered on March 6, 2017 (ECF No. 1057).

1.57 Entity shall have the meaning set forth in section 101(15) of the Bankruptcy Code.

1.58 Equity Committee means the official committee of equity security holders appointed by the U.S. Trustee pursuant to section 1102(a)(2) of the Bankruptcy Code.

1.59 Exchange Agreement means that certain agreement, by and among New Permian Corp. and BBEP, substantially in the form included in the Plan Supplement, pursuant to which New Permian Corp. agrees to acquire on the Effective Date all of the New Permian LLC Equity and 7.5% of the LegacyCo Units from BBEP, subject to certain liabilities and obligations, which shall be in form and substance acceptable to the Debtors, the Requisite Consenting Second Lien Creditors, and the Requisite Commitment Parties.