Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | a2018-3x26investorpresenta.htm |

Investor Presentation

March 2018

2

Forward-Looking Statements / Disclaimers

The information contained in this presentation has been prepared to assist you in making your own evaluation of the company and does not purport to contain all of the

information you may consider important. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but

should not be relied upon as an accurate representation of future results. Certain statements, estimates and financial information contained in this presentation

constitute forward-‐looking statements.

Such forward-looking statements involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results

implied or expressed in such forward-‐looking statements. While presented with numerical specificity, certain forward-looking statements are based (1) upon assumptions

that are inherently subject to significant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including,

without limitation, our ability to maintain adequate liquidity, to realize the potential benefit of our net operating loss tax carryforwards, to obtain sufficient debt and

equity financings, our capital costs, well production performance, and operating costs, anticipated commodity pricing, differentials or crack spreads, anticipated or

projected pricing information related to oil, NGLs, and natural gas, realize the potential benefits of our supply and offtake agreements, assumptions inherent in a sum-of-

the-parts valuation of our business, our ability to realize the benefit of our investment in Laramie Energy, LLC, assumptions related to our investment in Laramie Energy, LLC,

including completion activity and projected capital contributions, Laramie Energy, LLC’s financial and operational performance and plans for 2018, the potential uplift of an

MLP, our ability to meet environmental and regulatory requirements, our ability to increase refinery throughput and profitability, estimated production, our ability to

evaluate and pursue strategic and growth opportunities, our estimates of 2018 Adjusted EBITDA, estimates regarding our anticipated diesel hydrotreater project, including

costs, timing, and benefits, anticipated retail store openings in 2018, anticipated throughput, production costs, and on-island sales expectations in Hawaii, anticipated

throughput and distillate yield expectations in Wyoming, our estimates related to the annual gross margin impact of changes in RINs prices, the ability of our refinery in

Wyoming to provide supply in the Pacific Northwest region, and estimates regarding the CHS Inc. retail asset acquisition, including anticipated synergies and other benefits

related to the acquisition, and anticipated financial and operating results of the acquired assets and their effect on the company’s earnings profile, cash flows and

profitability (including Adjusted EBITDA, free cash flow and Adjusted earnings per share), as well as plans for financing the proposed acquisition, the conditions to the closing

of the acquisition and the possibility that the acquisition may not close, and other known and unknown risks (all of which are difficult to predict and many of which are beyond

the company's control), some of which are further discussed in the company’s periodic and other filings with the SEC and (2) upon assumptions with respect to future business

decisions that are subject to change.

There can be no assurance that the results implied or expressed in such forward-looking statements or the underlying assumptions will be realized and that actual results of

operations or future events will not be materially different from the results implied or expressed in such forward-looking statements. Under no circumstances should the

inclusion of the forward-looking statements be regarded as a representation, undertaking, warranty or prediction by the company or any other person with respect to the

accuracy thereof or the accuracy of the underlying assumptions, or that the company will achieve or is likely to achieve any particular results. The forward-looking

statements are made as of the date hereof and the company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements,

whether as a result of new information, future events or otherwise, except as may be required by applicable law. Recipients are cautioned that forward-looking statements

are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements due to the inherent

uncertainty therein.

This presentation contains non-GAAP financial measures, such as Adjusted EBITDA, Adjusted Net Income (loss), and Laramie Energy Adjusted EBITDAX. Please see the

Appendix for the definitions and reconciliations to GAAP of the non-GAAP financial measures that are based on reconcilable historical information.

Cautionary Note

Regarding Hydrocarbon Quantities

The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable, and possible reserve

estimates. We have provided Laramie Energy, LLC (“Laramie”) internally generated estimates for proved and probable reserve estimates (collectively, “2P”) in this

presentation in accordance with SEC guidelines and definitions. The 2P reserve estimates as of December 31, 2017 included in this presentation have been prepared by

Laramie’s internal reserve engineers and have not been reviewed or audited by Laramie’s independent reserve engineers. Actual quantities that may be ultimately

recovered from Laramie’s interests may differ substantially from the estimates in this presentation. Factors affecting ultimate recovery include the scope of Laramie’s

ongoing drilling program, which is directly affected by commodity prices, the availability of capital, drilling and production costs, the availability of drilling services and

equipment, drilling results, lease expirations, transportation constraints, regulatory approvals and other factors; and actual drilling results, including geological and

mechanical factors and recovery rates.

3

Our Business Platforms

Retail

Gasoline and diesel marketed through 91 locations in Hawaii and 33 locations in Idaho and Washington

Exclusive provider of “76” branded outlets in Hawaii

Completed launch of Hele, a local fuel brand in Hawaii

Laramie Energy: A Competitive Natural Gas Producer (2)

Deep inventory of economic drilling locations

Cash operating costs competitive with low cost basins in the U.S.

Access to takeaway capacity to multiple end markets

____________________

(1) As measured by Nelson Complexity rating.

(2) Par Pacific ownership of Laramie Energy decreased from 42.3% to 39.1% upon the closing of a small, in-basin acquisition on 2/28/2018.

Hawaii Refinery

94,000 bpd 5.0 complexity refinery (1)

50% distillate yield configuration

Crudes sourced globally

Wyoming Refinery

18,000 bpd 10.7 complexity refinery (1)

95% light products yield

Tailored for Powder River Basin & Bakken crude

Hawaii Logistics

Storage capacity of 5.4 million barrels with

27 mile pipeline

3 barges deliver products to 8 refined

product terminals

Wyoming Logistics

140 miles of crude oil gathering systems

40 miles of refined products pipeline

Approximately 650 thousand barrels of storage

capacity

Refining

Logistics

Retail

Laramie Energy

4

Corporate Strategy

Grow Existing

Businesses

Bolt-on acquisitions

Selective capital

projects

Continuous business

improvement

Acquire Similar

Businesses

Energy and

infrastructure

business in niche

markets

Maintain Diverse

Earnings Profile

Decrease commodity

price volatility

Enhance credit

profile

Leverage Tax

Attributes

Disciplined Focus on Increasing Adjusted EPS and Free Cash Flow

5

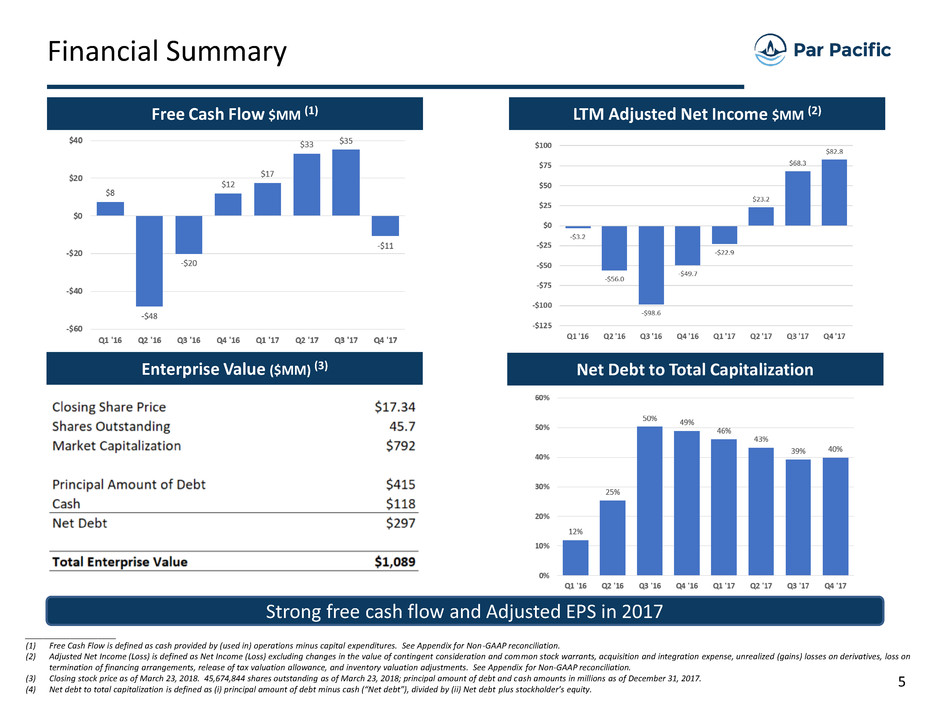

Financial Summary

____________________

(1) Free Cash Flow is defined as cash provided by (used in) operations minus capital expenditures. See Appendix for Non-GAAP reconciliation.

(2) Adjusted Net Income (Loss) is defined as Net Income (Loss) excluding changes in the value of contingent consideration and common stock warrants, acquisition and integration expense, unrealized (gains) losses on derivatives, loss on

termination of financing arrangements, release of tax valuation allowance, and inventory valuation adjustments. See Appendix for Non-GAAP reconciliation.

(3) Closing stock price as of March 23, 2018. 45,674,844 shares outstanding as of March 23, 2018; principal amount of debt and cash amounts in millions as of December 31, 2017.

(4) Net debt to total capitalization is defined as (i) principal amount of debt minus cash (“Net debt”), divided by (ii) Net debt plus stockholder’s equity.

Strong free cash flow and Adjusted EPS in 2017

Free Cash Flow $MM (1) LTM Adjusted Net Income $MM (2)

Enterprise Value ($MM) (3) Net Debt to Total Capitalization

6

Business Segment Profile

____________________

(1) Percentage of total segment Adjusted EBITDA excluding corporate and other.

(2) After adjusting for the February 2018 acquisition

Retail and Logistics contributed 38% of 2017 Adjusted EBITDA (1)

E&P diversification with 39.1% ownership of Laramie Energy

Unrestricted federal tax attributes of $1.6 billion

Targeting EURs of approximately 1.7 Bcfe with drilling

and completion costs of approximately $950,000

Anticipated production growth range of 22% to 28%

for 2018 exit vs. 2017 exit based on 2 rig program (2)

7

Refining Unit Capacity (MBPD)

Crude Unit 94

Vacuum Distillation Unit 40

Hydrocracker 19

Catalytic Reformer 13

Visbreaker 11

Hydrogen Plant (MMCFD) 18

Naphtha Hydrotreater 13

Cogeneration Turbine Unit 20 MW

Hawaii Refinery

Largest and most complex refinery in Hawaii

Distillate yield configured for Hawaii demand

$27MM diesel hydrotreater project anticipated to increase

distillate production 5-7Mbpd; estimated completion 4Q

2019

Asset location and configuration favorably positioned to benefit

from commercial flexibility

Anticipated ability to meet environmental and regulatory

requirements without material capital expenditures

Asset Highlights

Asset Detail

Gasoline

Distillate

HSFO

LSFO

Other

Middle East Africa

North America Asia

2017 Yield Profile 2017 Crude Sourcing

8

At Acquisition: September 2013

60,000 BPD throughput

45,000 BPD on-island sales

35% fuel oil yield

Middle East crude slate

$5.00/bbl production cost

Hawaii Business Strategy

FY 2017:

73,736 MBPD throughput

63,282 MBPD on-island sales

16% fuel oil yield

Balanced opportunistic crude slate

$3.60/bbl production cost

2019 Goals:

83,000 BPD throughput

70,000 BPD on-island sales

15% fuel oil yield

$3.00/bbl production cost

Reduce distillate imports

$27MM distillate

hydrotreater

project

Improved crude

selection

Improved

mechanical

reliability

Aggressive in-state

commercial

strategy

Mid Pac acquisition

increased on-island

sales

Creative working

capital solution

9

Wyoming Refinery

Asset Highlights

Asset Detail

Refining Unit Capacity (MBPD)

Crude Unit 18

Residual Fluid Catalytic Cracker 7

Catalytic Reformer 3

Naphtha Hydrotreater 3

Diesel Hydrotreater 5

Isomerization 5

18,000 bpd refinery in Newcastle, Wyoming

Complex refinery with a Nelson Complexity Index of 10.7

Flexible product yield

Attractive light products yield over 95% during 2017

2017 Crude Sourcing 2017 Yield Profile

Power River Basin

Gasoline Distillate

NGLs Fuel Oil

Bakken

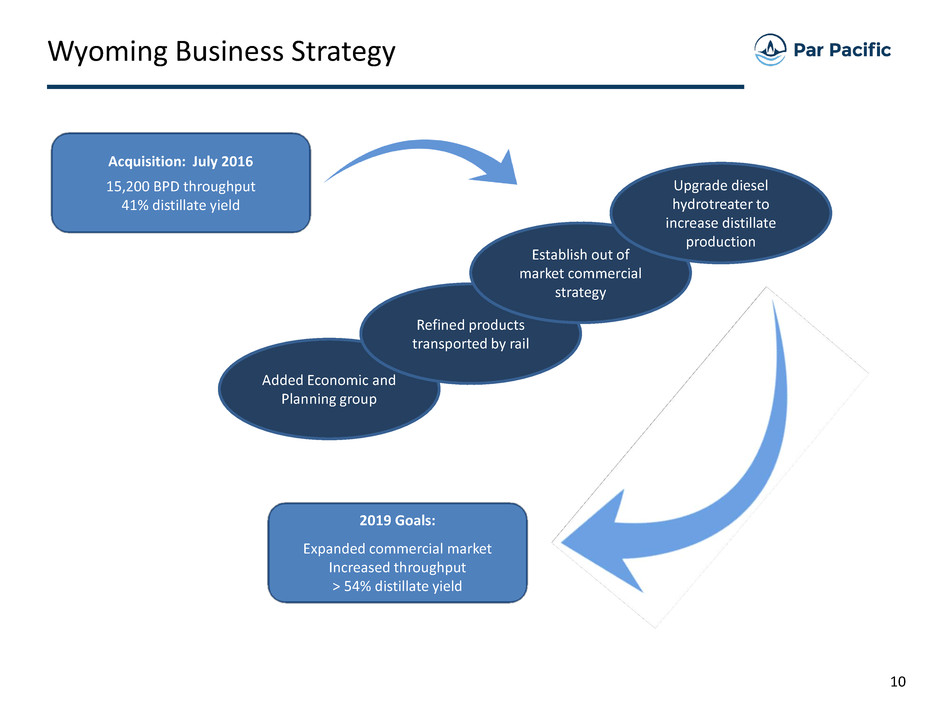

10

Acquisition: July 2016

15,200 BPD throughput

41% distillate yield

Wyoming Business Strategy

2019 Goals:

Expanded commercial market

Increased throughput

> 54% distillate yield

Added Economic and

Planning group

Refined products

transported by rail

Establish out of

market commercial

strategy

Upgrade diesel

hydrotreater to

increase distillate

production

Logistics Segment

12

Hawaii Assets Map Asset Highlights

Hawaii Logistics

Integrated system enhances flexibility and profitability

Difficult to replicate asset base

Multiple advantages from single point mooring

Increased safety and flexibility

Enhanced distribution capability

Latin America

South America

North America

Middle East

Africa

Asia

Logistics network represents a critical component of Hawaii operations

Asset Detail

Number of Terminals 8

Crude Storage Capacity (MMBbls) 2.4

Other Storage Capacity (MMBbls) 3.0

Number of Barges 3

Miles of Pipeline 27

Refinery

Terminal Crude Inflows

Refined Products Outflows

13

Wyoming Logistics

Logistics Assets

Well-positioned to benefit from regional development

____________________

(1) Source: Baker Hughes North American Rig Count as of March 2, 2018.

140-mile crude oil pipeline gathering

system providing direct access to Powder

River Basin crude

40-mile products pipeline feeds into

Magellan Products Line en route to Rapid

City, South Dakota

Jet fuel terminal in Rapid City and

pipeline connecting to the Ellsworth Air

Force Base

650 Mbls of crude and refined product

tankage with expansion opportunities

identified

Truck racks and a loading facility at the

refinery

14 rigs operating in the Powder River

Basin (1)

Retail Segment

15

Hawaii Retail

Highlights

Extensive footprint across four islands in Hawaii

Same-store fuel and non-fuel sales up 2.6% and 2.1%,

respectively, during the fourth quarter 2017 compared

to the same period last year

New location expected to open in 2018

High real estate costs, scarcity of land, and logistics complexity strengthen competitive position

Retail Network

16

Pacific Northwest Retail Acquisition

• 33 Cenex Zip Trip branded convenience stores

• 21 fee-owned sites

• 30 sites recently remodeled / upgraded

• Strategic multi-year fuel supply and Cenex branded

agreements

• Second largest branded retail position in Spokane

region

• Historically robust fuel margins driven by fuel supply

logistics complexities

• Wyoming Refinery well positioned to

opportunistically provide additional supply to the

region

Acquisition further diversifies Par Pacific’s earnings profile

Asset Highlights

Significant Presence in Niche Market

Laramie Energy

18

Asset Highlights

Laramie Energy

____________________

(1) Figures for 100% of Laramie Energy based on 2018 two rig capital plan.

(2) After adjusting for the February 2018 acquisition

(3) 2016 unit costs were $1.72/Mcfe.

Par Pacific owns 39.1% of Laramie Energy, LLC

6,500+ Mesa Verde drilling locations over 150,000

net acres

75% of existing gas production hedged through

December 2018

Targeting EURs of approximately 1.7 Bcfe with drilling

and completion costs of approximately $950,000

Unit Costs Reduction (3) 2018 Plans

Completed small, in-basin acquisition in February

boosting anticipated 2018 production by an

estimated 15 MMcfe/d

Anticipated production growth range of 22% to 28%

for 2018 exit vs. 2017 exit based on 2 rig program (2)

Targeting < 3.0x debt / Adj. EBITDA through 2018

Self-funded two rig program positions Laramie for production growth

Production Profile (1)

Appendix

20

Air Transport

Electric Power

Ground Transport

Industrial

Marine

Commercial

Hawaii Market Fundamentals

Air Travel (2)

____________________

1) Source: EIA data as of May 2017; including military demand per Par Pacific internal estimates.

2) Source: Department of Business, Economic Development and Tourism (“DBEDT”)

Refined Product Demand (1)

Shortage of distillate capacity in Hawaii

Air travel to and from Hawaii projected to continue to grow

Fuel oil utilized for ~70% of electricity generation in Hawaii

Electricity Production by Source and Petroleum Use (2)

MBbl/d Total Production

Total Demand

60 61

70

51

0

8

16

24

32

40

48

56

64

72

80

Other Products Distillate

(number of visitors in millions)

GDP and Employment (2)

Strong year over year economic growth in Hawaii

Petroleum

Coal

Biomass

Other

Geothermal

Hydro Solar

Wind

21

Mid Pacific Crack Spread and Crude Differential

____________________

(1) Company calculation based on a rolling five-year average for the 4-1-2-1 Mid Pacific Crack Spread plus Mid Pacific Crude Differential

Mid Pacific Crude Differential is calculated as follows: Weighted average differentials, excluding shipping costs, of a blend of crudes with an API of 31.98 and sulphur wt% of 0.65% that is indicative of our typical crude mix quality.

Mid Pacific 4.1.2.1 Crack Spread is calculated as follows: Singapore Daily: computed by taking 1 part gasoline (RON 92), 2 parts middle distillates (Sing Jet & Sing Gasoil), and 1 part fuel oil (Sing 180) as created from four barrels

of Brent Crude. San Francisco Daily: computed by taking 1 part gasoline (SF Reg Unl), 2 parts middle distillates (SF Jet 54 & SF ULSD), and 1 part fuel oil (SF 180 Waterborne) as created from four barrels of Brent Crude. Daily:

computed using a weighted average of 80% Singapore and 20% San Francisco. Month (CMA): computed using all available pricing days for each marker. Quarter/Year: computed using calendar day weighted CMAs for each

marker.

5YR Combined

Mid-cycle (1) = $8.27

22

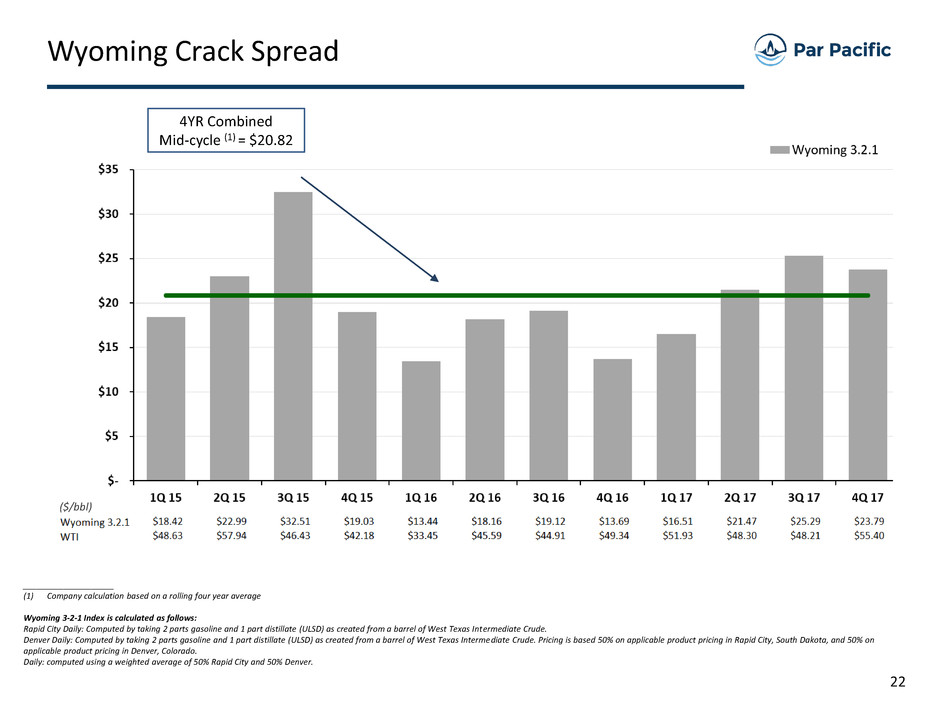

Wyoming Crack Spread

____________________

(1) Company calculation based on a rolling four year average

Wyoming 3-2-1 Index is calculated as follows:

Rapid City Daily: Computed by taking 2 parts gasoline and 1 part distillate (ULSD) as created from a barrel of West Texas Intermediate Crude.

Denver Daily: Computed by taking 2 parts gasoline and 1 part distillate (ULSD) as created from a barrel of West Texas Intermediate Crude. Pricing is based 50% on applicable product pricing in Rapid City, South Dakota, and 50% on

applicable product pricing in Denver, Colorado.

Daily: computed using a weighted average of 50% Rapid City and 50% Denver.

4YR Combined

Mid-cycle (1) = $20.82

($/bbl)

23

Capital Expenditures Summary

Maintenance /

Regulatory

Growth

Turnaround

Annual base maintenance capital expenditures of $25-30MM

2018 estimates include non-recurring maintenance and regulatory capital related to Wyoming

Refinery and Logistics

Distillate hydrotreater project in Hawaii accounts for $15MM of growth capital in 2018

Remaining growth capital allocated towards completion of new retail location in Western

Oahu and debottlenecking projects within the Wyoming Refinery and logistics systems

2016 refinery capex higher due to Wyoming Benzout project

No material turnaround capex expected in 2018

____________________

Note: $ in millions. 2016 excludes the Hawaii turnaround. Maintenance includes $6MM associated with completion of Wyoming Benzout project.

24

Corporate Structure

Par Pacific Holdings Inc.

NYSE: PARR

$115 MM 5% Convertible

Notes due 6/15/2021

Par Hawaii Refining, LLC

Supply and Offtake

Agreement

Par Hawaii, Inc

Hermes Consolidated, LLC

d/b/a Wyoming Refining

Company

____________________

Note: Chart omits intermediate subsidiaries between parent and operating subsidiaries for brevity.

(1) ABL Revolver co-borrowers are Par Petroleum, LLC, a Delaware limited liability company, Mid Pac Petroleum, LLC, a Delaware limited liability company, Hermes Consolidated, LLC (d/b/a Wyoming

Refining Company), a Delaware limited liability company, HIE Retail, LLC, a Hawaii limited liability company, Par Hawaii, Inc., a Hawaii corporation, and Wyoming Pipeline Company LLC, a Wyoming

limited liability company.

(2) Recourse limited to pledge of equity interest of Par Piceance Energy Equity, LLC.

Par Petroleum, LLC

$75 MM ABL Revolver (1)

Due 12/21/2022

$300 MM 7.75% Senior Secured

Notes due 12/15/2025

Laramie Energy, LLC (2)

39.1% Interest

25

Laramie Energy Hedging Program

2018 2019

NYMEX Fixed Price Swap

Hedged Volume (MMBtu/day) 88,415 9,863

Average Floor Price ($/MMBtu) $2.67 $3.09

NYMEX Collar

Hedged Volume (MMBtu/day) 7,500

Collar ($/MMBtu) $2.92 - $3.25

CIG Basis Swap

Hedged Volume (MMBtu/day) 75,072

Average CIG Differential to NYMEX ($0.26)

Northwest Rockies Pipeline Collar

Hedged Volume (MMBtu/day) 2,500

Collar ($/MMBtu) $3.00 - $3.25

NGL Hedges

Pentane (gal/day) 5,434

Pentane ($/gal) $1.39

26

Year End Reserves and PV10 Summary – 100% of Laramie Energy

Laramie Energy Reserves

Strip Pricing Summary

Note: Par Pacific Holdings owned 42.3% of Laramie Energy, LLC as of 12/31/2017. Par Pacific Holdings currently owns 39.1%.

Reserve information based on NSAI’s reserve report

(1) NGLs and Oil converted to gas based on 6:1 ratio

(2) Based on NYMEX strip pricing as of December 31, 2017 held flat after five years also adjusted for NWROX basis of ($0.472). See "Non-GAAP PV10 and PV20 Disclosure" for additional discussion.

(3) Based on North West Wyoming Pool SEC pricing as of December 31, 2017 adjusted for basis of ($0.072). See "Non-GAAP PV10 and PV20 Disclosure" for additional discussion.

(4) All PUD locations conform to SEC standards.

(5) Laramie Energy, LLC internal reserves based on PV10 discounting.

27

Laramie Key Statistics

____________________

(1) Laramie Debt is non-recourse to Par Pacific and solely guaranteed by a Par Pacific subsidiary that owns Laramie Energy units.

(2) Preferred stock balance based on current Liquidation Preference amount.

(3) Par Pacific ownership of Laramie Energy decreased from 42.3% to 39.1% upon the closing a small, in-basin acquisition on 2/28/2018.

(4) Based on two rig capital plan and February 2018 acquisition.

(5) See Appendix for Non-GAAP reconciliation of Laramie Adjusted EBITDAX to the most directly comparable GAAP financial measure.

28

Laramie Energy Adjusted EBITDAX

($ in thousands)

29

Non-GAAP PV10 and PV20 Disclosure

Non-GAAP PV10 and PV20 Disclosure

PV10 and PV20 are considered non-GAAP financial measures under SEC regulations because they do not include the effects of

future income taxes, as is required in computing the standardized measure of discounted future net cash flows. However, our

PV10/PV20 and our standardized measure of discounted future net cash flows are equivalent as we do not project to be taxable

or pay cash income taxes based on our available tax assets and additional tax assets generated in the development of reserves

because the tax basis of our oil and gas properties and NOL carryforwards exceeds the amount of discounted future net

earnings. PV10/PV20 should not be considered a substitute for, or superior to, measures prepared in accordance with U.S.

generally accepted accounting principles. We believe that PV10 and PV20 are important measures that can be used to evaluate

the relative significance of our natural gas and oil properties to other companies and that PV10 and PV20 are widely used by

securities analysts and investors when evaluating oil and gas companies. PV10 and PV20 computed on the same basis as the

standardized measure of discounted future net cash flows but without deducting income taxes.

30

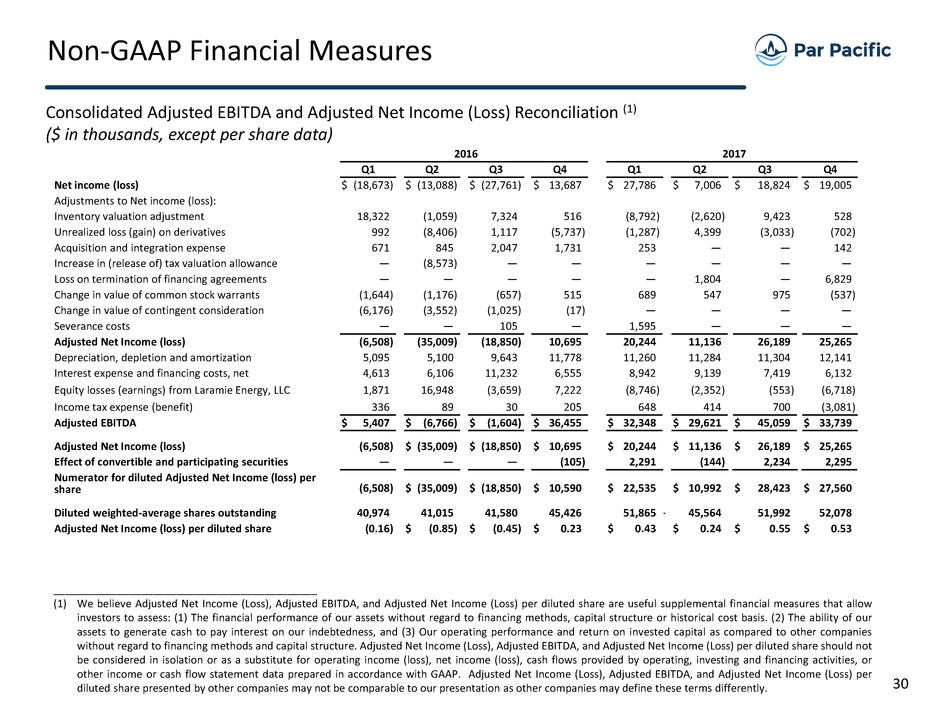

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA and Adjusted Net Income (Loss) Reconciliation (1)

($ in thousands, except per share data)

_____________________________________________

(1) We believe Adjusted Net Income (Loss), Adjusted EBITDA, and Adjusted Net Income (Loss) per diluted share are useful supplemental financial measures that allow

investors to assess: (1) The financial performance of our assets without regard to financing methods, capital structure or historical cost basis. (2) The ability of our

assets to generate cash to pay interest on our indebtedness, and (3) Our operating performance and return on invested capital as compared to other companies

without regard to financing methods and capital structure. Adjusted Net Income (Loss), Adjusted EBITDA, and Adjusted Net Income (Loss) per diluted share should not

be considered in isolation or as a substitute for operating income (loss), net income (loss), cash flows provided by operating, investing and financing activities, or

other income or cash flow statement data prepared in accordance with GAAP. Adjusted Net Income (Loss), Adjusted EBITDA, and Adjusted Net Income (Loss) per

diluted share presented by other companies may not be comparable to our presentation as other companies may define these terms differently.

2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Net income (loss) $ (18,673 ) $ (13,088 ) $ (27,761 ) $ 13,687 $ 27,786 $ 7,006 $ 18,824 $ 19,005

Adjustments to Net income (loss):

Inventory valuation adjustment 18,322 (1,059 ) 7,324 516 (8,792 ) (2,620 ) 9,423 528

Unrealized loss (gain) on derivatives 992 (8,406 ) 1,117 (5,737 ) (1,287 ) 4,399 (3,033 ) (702 )

Acquisition and integration expense 671 845 2,047 1,731 253 — — 142

Increase in (release of) tax valuation allowance — (8,573 ) — — — — — —

Loss on termination of financing agreements — — — — — 1,804 — 6,829

Change in value of common stock warrants (1,644 ) (1,176 ) (657 ) 515 689 547 975 (537 )

Change in value of contingent consideration (6,176 ) (3,552 ) (1,025 ) (17 ) — — — —

Severance costs — — 105 — 1,595 — — —

Adjusted Net Income (loss) (6,508 ) (35,009 ) (18,850 ) 10,695 20,244 11,136 26,189 25,265

Depreciation, depletion and amortization 5,095 5,100 9,643 11,778 11,260 11,284 11,304 12,141

Interest expense and financing costs, net 4,613 6,106 11,232 6,555 8,942 9,139 7,419 6,132

Equity losses (earnings) from Laramie Energy, LLC 1,871 16,948 (3,659 ) 7,222 (8,746 ) (2,352 ) (553 ) (6,718 )

Income tax expense (benefit) 336 89 30 205 648 414 700 (3,081 )

Adjusted EBITDA $ 5,407 $ (6,766 ) $ (1,604 ) $ 36,455 $ 32,348 $ 29,621 $ 45,059 $ 33,739

Adjusted Net Income (loss) (6,508 ) $ (35,009 ) $ (18,850 ) $ 10,695 $ 20,244 $ 11,136 $ 26,189 $ 25,265

Effect of convertible and participating securities — — — (105 ) 2,291 (144 ) 2,234 2,295

Numerator for diluted Adjusted Net Income (loss) per

share (6,508 ) $ (35,009 ) $ (18,850 ) $ 10,590 $ 22,535 $ 10,992 $ 28,423 $ 27,560

Diluted weighted-average shares outstanding 40,974 41,015 41,580 45,426 51,865 — 45,564 51,992 52,078

Adjusted Net Income (loss) per diluted share (0.16 ) $ (0.85 ) $ (0.45 ) $ 0.23 $ 0.43 $ 0.24 $ 0.55 $ 0.53

31

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA and Adjusted Net Income (Loss) Reconciliation (1)

For the twelve months ended December 31, 2017

($ in thousands, except per share data)

_____________________________________________

(1) Refer to description of Adjusted Net Income (Loss), Adjusted EBITDA and Adjusted Net Income (Loss) per diluted share on the previous slide.

Net income $ 72,621

Adjustments to Net income:

Inventory valuation adjustment (1,461 )

Unrealized gain on derivatives (623 )

Acquisition and integration expense 395

Loss on termination of financing agreements 8,633

Change in value of common stock warrants 1,674

Change in value of contingent consideration —

Severance costs 1,595

Adjusted Net Income 82,834

Depreciation, depletion and amortization 45,989

Interest expense and financing costs, net 31,632

Equity losses (earnings) from Laramie Energy, LLC (18,369 )

Income tax expense (1,319 )

Adjusted EBITDA $ 140,767

Adjusted Net Income (loss) $ 82,834

Effect of convertible and participating securities 9,206

Numerator for diluted Adjusted Net Income (loss) per share $ 92,040

Diluted weighted-average shares outstanding 51,972

Adjusted Net Income (loss) per diluted share $ 1.77

32

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA by Segment Reconciliation (1)

For the twelve months ended December 31, 2017

($ in thousands)

Refining Logistics Retail

Corporate,

Eliminations, and

Other

Operating income (loss) $ 86,013 $ 33,993 $ 24,700 $ (49,834 )

Adjustments to operating income (loss):

Unrealized loss (gain) on derivatives (623 ) — — —

Acquisition and integration expense — — — 395

Inventory valuation adjustment (1,461 ) — — —

Depreciation, depletion and amortization 29,753 6,166 6,338 3,732

Severance costs 395 — — 1,200

Adjusted EBITDA $ 114,077 $ 40,159 $ 31,038 $ (44,507 )

_____________________________________________

(1) Adjusted EBITDA by segment is defined as operating income (loss) by segment excluding unrealized (gains) losses on derivatives, inventory valuation

adjustment, acquisition and integration expense, severance costs, and depreciation, depletion and amortization expense. We believe Adjusted EBITDA

by segment is a useful supplemental financial measure to evaluate the economic performance of our segments without regard to financing methods,

capital structure or historical cost basis. Adjusted EBITDA by segment presented by other companies may not be comparable to our presentation as

other companies may define these terms differently.

33

Non-GAAP Financial Measures

Free Cash Flow (1)

($ in thousands)

2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Cash provided by (used in) operations $ 12,029 $ (40,835 ) $ (12,442 ) $ 17,357 $ 24,995 $ 37,202 $ 43,259 $ 1,027

Less: Capital Expenditures 4,476 7,215 7,585 5,557 7,579 4,198 8,111 11,820

Free Cash Flow $ 7,553 $ (48,050 ) $ (20,027 ) $ 11,800 $ 17,416 $ 33,004 $ 35,148 $ (10,793 )

_____________________________________________

(1) Free Cash Flow is defined as cash provided by (used in) operations less capital expenditures. We believe Free Cash Flow is a useful supplemental financial

measure to evaluate our ability to generate cash to repay our indebtedness or make discretionary investments. Free Cash Flow should be considered in

addition to, rather than as a substitute for, net income as a measure of our financial performance and net cash provided by (used in) operations as a measure

of our liquidity. Free Cash Flow presented by other companies may not be comparable to our presentation as other companies may define these terms

differently.