Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kannualmtgslidepresentat.htm |

CITIZENS

COMMUNITY

BANCORP INC

Annual Meeting | March 27, 2018

This presentation includes forward-looking statements about the financial condition, results of operations and business of

Citizens Community Bancorp, Inc. (“Citizens”) and its wholly owned subsidiary, Citizens Community Federal N.A. (“CCFBank”).

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These

statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,”

“intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or other words of similar meaning.

These forward-looking statements are intended to be covered by the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements in this presentation are inherently subject to many uncertainties arising in

CCFBank’s operations and business environment. These uncertainties include conditions in the financial markets and economic

conditions generally; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; the

sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among

depository and other financial institutions; our ability to realize the benefits of net deferred tax assets; our ability to maintain or

increase our market share; acts of terrorism and political or military actions by the United States or other governments;

legislative or regulatory changes or actions, or significant litigation, adversely affecting the CCFBank; increases in FDIC

insurance premiums or special assessments by the FDIC; disintermediation risk; our inability to obtain needed liquidity; our

ability to raise capital needed to fund growth or meet regulatory requirements; the possibility that our internal controls and

procedures could fail or be circumvented; our ability to attract and retain key personnel; our ability to keep pace with

technological change; cybersecurity risks; risks posed by acquisitions and other expansion opportunities; changes in accounting

principles, policies or guidelines and their impact on financial performance; restrictions on our ability to pay dividends; and the

potential volatility of our stock price. Shareholders, potential investors and other readers are urged to consider these factors

carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking

statements. Such uncertainties and other risks that may affect the Company’s performance are discussed further in Part I, Item

1A, “Risk Factors,” in the Company’s Form 10-K, for the year ended September 30, 2017 filed with the Securities and Exchange

Commission ("SEC") on December 13, 2017 and the Company's subsequent filings with the SEC. The Company undertakes no

obligation to make any revisions to the forward-looking statements contained in this presentation or to update them to reflect

events or circumstances occurring after the date hereof.

CAUTIONARY NOTE REGARDING

FORWARD LOOKING STATEMENTS

This presentation contains non-GAAP financial measures, which management believes may be helpful in

understanding the Company's results of operations or financial position and comparing results over different

periods. Non-GAAP measures eliminate the impact of certain one-time expenses such as acquisition and branch

closure costs and related data processing termination fees, legal costs, severance pay, accelerated depreciation

expense and lease termination fees. Merger related charges represent expenses to either satisfy contractual

obligations of acquired entities without any useful benefit to the Company or to convert and consolidate customer

records onto the Company platforms. These costs are unique to each transaction based on the contracts in

existence at the merger date. In addition, non-GAAP financial measures exclude settlement proceeds and the

FHLB prepayment fee. Where non-GAAP financial measures are used, the comparable GAAP financial measure,

as well as the reconciliation to the comparable GAAP financial measure, can be found in this presentation. These

disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor

are they necessarily comparable to non-GAAP performance measures that may be presented by other banks and

financial institutions.

CAUTIONARY NOTE REGARDING

Non-GAAP Financial Measures

Our Leadership Team OUR LEADERSHIP TEAM

President / CEO SVP Chief Technology Officer EVP / CFO SVP Corporate Development

SVP West Region President

Commercial / Ag Banking

SVP Chief Credit Officer VP Human Resources SVP East Region President

Commercial / Ag Banking

Current CZWI Branch Locations

One additional office in

suburban Detroit.

COMPANY PROFILE

FOUNDED IN 1939

Business model changing to Commercial/Ag/Consumer from credit union, thrift legacy

GROWTH ORIENTED

Acquisitions and organic growth driving robust loan and deposit growth since 2016

INCREASED PROFITABILITY

Quality and quantity of earnings improving via balance sheet remixing and efficiency

measures

EMERGING BRAND, MARKET LEVERAGE

Momentum growing from new business model execution, acquisition of key talent and

consolidation of branch network

CZWI FOCUS ITEMS

ENHANCING THE QUANTITY AND QUALITY OF EARNINGS

We are committed to enhancing shareholder value by improving the loan and deposit mix,

deepening customer relationships and strengthening other sources of revenue.

EXPERTISE IN COMMERCIAL & AG BANKING

We take pride in serving small and mid-sized business and Ag operators in our communities

with the best professionals, products and process.

EXPERIENCED & PROVEN STRATEGIC LEADERSHIP TEAM

Our team has over 174 years of banking experience to draw upon with national, regional

and community banks.

ENTERPRISE PRODUCTIVITY & RISK MANAGEMENT

We have embraced technology and workflow improvements to increase profitability as

revenue grows. Our emphasis on prudent risk taking, knowing the client and proactive risk

management has resulted in top quartile asset quality performance.

KEY MARKET DIFFERENTIATORS

BUSINESS

MODEL

• Serving small to mid-sized

entrepreneurs & Ag producers

• Responsive professionals

• Easy to do business with

• Products to compete vs. big

banks, superior to smaller

community banks

CULTURE

CREDIT STRATEGIC

GROWTH

• Experienced, energetic

leadership team

• Accountability for doing the

right thing and getting results

• Entrepreneurial spirit, winning

attitude

• Prudent risk taking

• Process driven , transparent

• Nimble , centralized approval

process

• Proactive risk management

• Loan and deposit growth

through prudent M&A

• Robust

• Quality and quantity of

earnings improving

LOAN PORTFOLIO DETAIL

• Well diversified portfolio

• Portfolio mix has

changed dramatically

• Commercial loan growth

offset by the planned

runoff of 1-4 family and

indirect loan portfolios

Commercial/Ag

RE

39.40%

Commercial/Ag

Non RE

11.20%

Originated

Indirect

10.80%

Purchased

Indirect

3.60%

Other

Consumer Non

RE

2.60%

Residential RE

32.40%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2014 2015 2016 1017 Q1 2018

Growth portfolios as %

of portfolio

Runoff portfolios as % of

portfolio

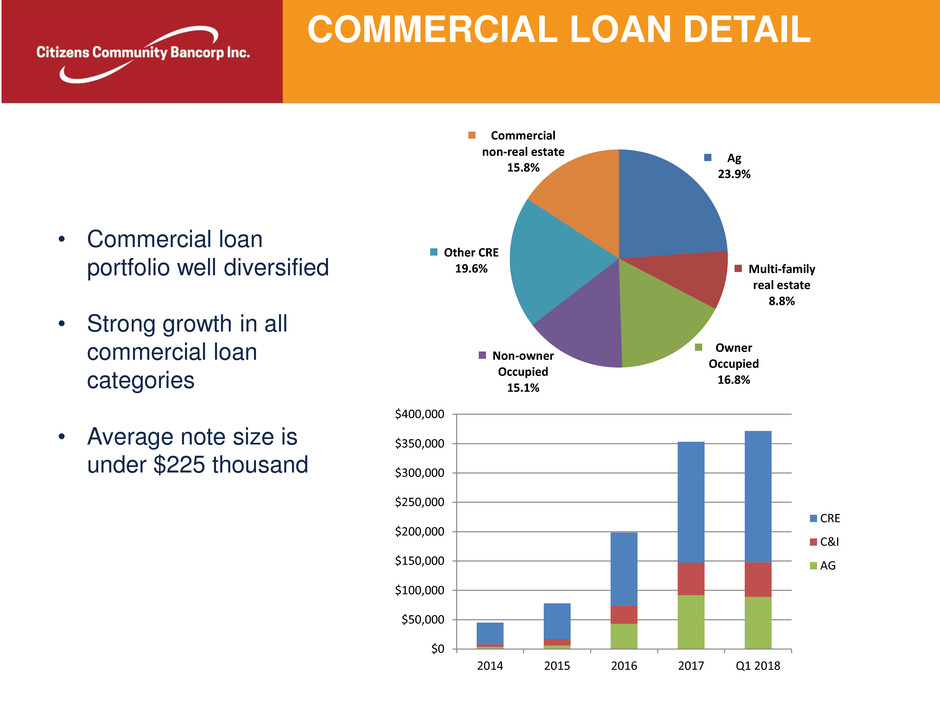

COMMERCIAL LOAN DETAIL

• Commercial loan

portfolio well diversified

• Strong growth in all

commercial loan

categories

• Average note size is

under $225 thousand

Ag

23.9%

Multi-family

real estate

8.8%

Owner

Occupied

16.8%

Non-owner

Occupied

15.1%

Other CRE

19.6%

Commercial

non-real estate

15.8%

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

2014 2015 2016 2017 Q1 2018

CRE

C&I

AG

ASSET QUALITY

• Good asset quality

• CCFBank asset quality

improved in all periods

presented

• Proactive risk

management

• Acquired NPA marked at

time of acquisition

• Low loan charge-off

percentages

NPAs/Total Loans

0.00%

0.10%

0.20%

0.30%

0.40%

9/30/2014 9/30/2015 9/30/2016 9/30/2017 12/31/2017

Sum of Loan NCOs

to Gross Loans

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

Acquired REO %

Acquired Loan %

CCF REO %

CCF Loan %

DEPOSIT MIX

Deposit

Mix/COFs

At December 31,2017

• Planned remix of

deposits to lower cost

non-maturity deposits

from certificates

ongoing

• Consistent growth in

checking and money

market/savings

• This deposit remix

will decrease our cost

of funds and enhance

future profitability

Money

Market

Demand

17.00%

Certificate

Accounts

38.90%

Noninterest

Bearing

Demand

10.60%

Interest

Bearing

Demand

20.10%

Savings

Accounts

13.40%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

0%

20%

40%

60%

80%

100%

2014 2015 2016 2017 Q1 2018

Sum of Checking Sum of Savings/MMDA Sum of CD Sum of COF

NET INCOME AND DILUTED EPS

(In $000’s) (In $)

Core Income and Core EPS are non-GAAP financial measures, which management believes may be helpful in understanding the

Company's results of operations or financial position and comparing results over different periods. Reconciliation of Core Income and

Core EPS to the comparable GAAP financial measure can be found in the final slide to this presentation. These measures should not

be viewed as a substitute for operating results determined in accordance with GAAP.

• Positive earnings trends

• First quarter 2018 shows impact of Wells acquisition

First Qtr. First Qtr. $0.62

$0.54

$0.49

$0.67

$0.46

$0.79

$0.23

$0.30

SHAREHOLDER HIGHLIGHTS

COMMERCIAL/AG BANKING EXPERTISE

PROVEN EXECUTIVES AND SENIOR MANAGERS

SUCCESSFUL M&A ACTIVITY

MICROPOLITAN, METROPOLITAN & RURAL DEMOGRAPHICS

CULTURE OF ACCOUNTABILITY

STRONG CREDIT QUALITY

PROACTIVE RISK MANAGEMENT

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

EXPERTISE IN COMMERCIAL & AG

BANKING

FY2015 FY2016 FY2017 FQ1-18

(Dollars in Thousands, except share data)

GAAP pre-tax earnings $ 4,420 $ 3,859 $ 3,822 $ 2,223

Merger related costs (1) 0 701 1,860 94

Branch closure costs (2) 614 839 951 7

Settlement proceeds (3) 0 0 (283) 0

FHLB borrowings prepayment fee (4) 0 0 104 0

Core earnings before income taxes (5) 5,034 5,399 6,454 2,324

Provision for income tax on core earnings (6) 1,712 1,836 2,194 569

Core earnings after income taxes (5) $ 3,322 $ 3,563 $ 4,260 $ 1,755

GAAP diluted earnings per share, net of tax $ 0.54 $ 0.49 $ 0.46 $ 0.23

Merger related costs, net of tax - 0.09 0.23 0.02

Branch related costs, net of tax 0.08 0.09 0.12 -

Settlement proceeds - - (0.03) -

FHLB borrowings prepayment fee - - 0.01 -

Tax Cuts and Jobs Act of 2017 tax provision (7) - - - 0.05

Core diluted earnings per share, net of tax $ 0.62 $ 0.67 $ 0.79 $ 0.30

Average diluted shares outstanding 5,239,943 5,257,304 5,378,548 5,920,899

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

EXPERTISE IN COMMERCIAL & AG

BANKING

(1) Costs incurred are included as data processing, advertising, marketing and public relations, professional fees and other noninterest

expense in the consolidated statement of operations.

(2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and

lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated

statement of operations. In addition, other non-interest expense includes costs related to the reduction in valuation of the

Ridgeland branch office in the fourth quarter of fiscal 2017.

(3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage Backed Security (RMBS) claim.

This JP Morgan RMBS was previously owned by the Bank and sold in 2011.

(4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in

the consolidated statement of operations.

(5) Core earnings is a non-GAAP measure that management believes enhances investors' ability to better understand the

underlying business performance and trends related to core business activities.

(6) Provision for income tax on core earnings is calculated at 24.5% for the three months ended December 31, 2017 and at 34%

for all quarters in the prior fiscal year, which represents our federal statutory tax rate for each respective period presented.

(7) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $275 in the first quarter of 2018,

which is included in provision for income taxes expense in the consolidated statement of operations.

EXPERTISE IN COMMERCIAL & AG

BANKING

Thank you !